8be012e63d01ed149e7cdca94de83c7a.ppt

- Количество слайдов: 25

e. Forms and XML at NYS Dept of Taxation and Finance Jim Lieb, Director – Common Services NYS Department of Taxation and Finance Emerging Technologies Committee

e. Forms and XML at NYS Dept of Taxation and Finance Jim Lieb, Director – Common Services NYS Department of Taxation and Finance Emerging Technologies Committee

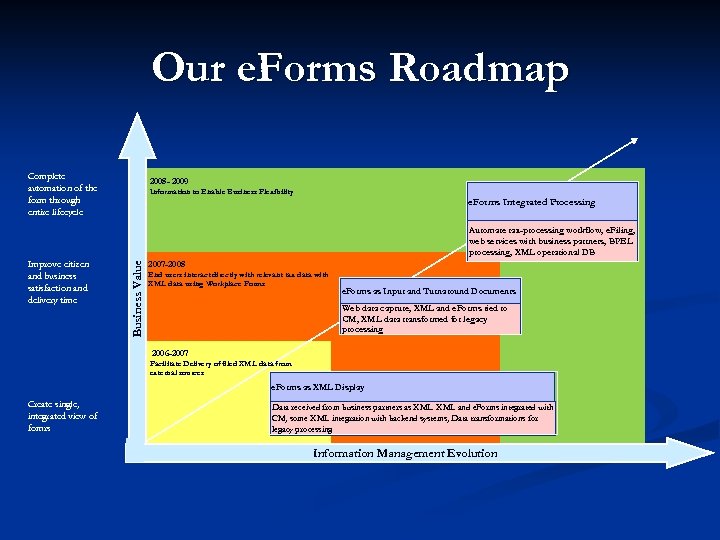

Our e. Forms Roadmap Complete automation of the form through entire lifecycle 2008 - 2009 Information to Enable Business Flexibility e. Forms Integrated Processing Improve citizen and business satisfaction and delivery time Business Value Automate tax-processing workflow, e. Filing, web services with business partners, BPEL processing, XML operational DB 2007 -2008 End users interact directly with relevant tax data with XML data using Workplace Forms e. Forms as Input and Turnaround Documents Web data capture, XML and e. Forms tied to CM, XML data transformed for legacy processing 2006 -2007 Facilitate Delivery of filed XML data from external sources e. Forms as XML Display Create single, integrated view of fomrs Data received from business partners as XML and e. Forms integrated with CM, some XML integration with backend systems, Data transformations for legacy processing Information Management Evolution

Our e. Forms Roadmap Complete automation of the form through entire lifecycle 2008 - 2009 Information to Enable Business Flexibility e. Forms Integrated Processing Improve citizen and business satisfaction and delivery time Business Value Automate tax-processing workflow, e. Filing, web services with business partners, BPEL processing, XML operational DB 2007 -2008 End users interact directly with relevant tax data with XML data using Workplace Forms e. Forms as Input and Turnaround Documents Web data capture, XML and e. Forms tied to CM, XML data transformed for legacy processing 2006 -2007 Facilitate Delivery of filed XML data from external sources e. Forms as XML Display Create single, integrated view of fomrs Data received from business partners as XML and e. Forms integrated with CM, some XML integration with backend systems, Data transformations for legacy processing Information Management Evolution

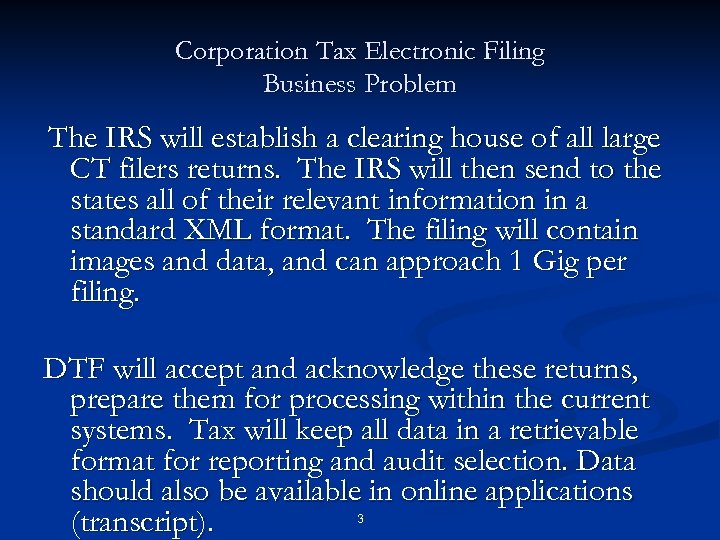

Corporation Tax Electronic Filing Business Problem The IRS will establish a clearing house of all large CT filers returns. The IRS will then send to the states all of their relevant information in a standard XML format. The filing will contain images and data, and can approach 1 Gig per filing. DTF will accept and acknowledge these returns, prepare them for processing within the current systems. Tax will keep all data in a retrievable format for reporting and audit selection. Data should also be available in online applications (transcript). 3

Corporation Tax Electronic Filing Business Problem The IRS will establish a clearing house of all large CT filers returns. The IRS will then send to the states all of their relevant information in a standard XML format. The filing will contain images and data, and can approach 1 Gig per filing. DTF will accept and acknowledge these returns, prepare them for processing within the current systems. Tax will keep all data in a retrievable format for reporting and audit selection. Data should also be available in online applications (transcript). 3

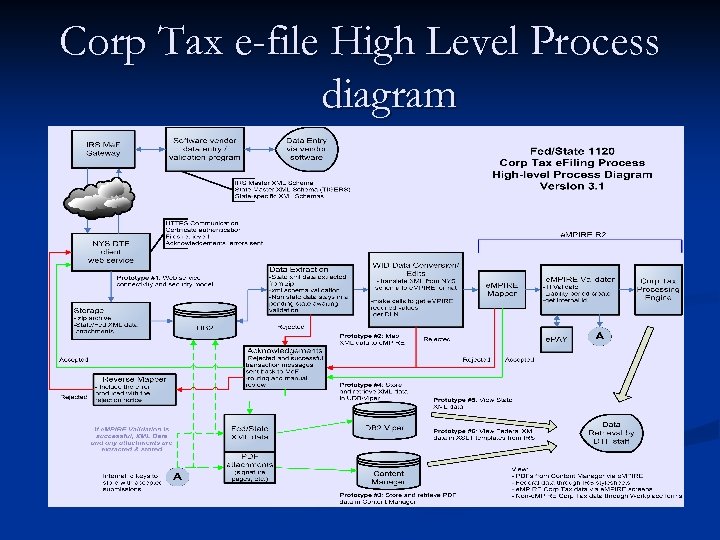

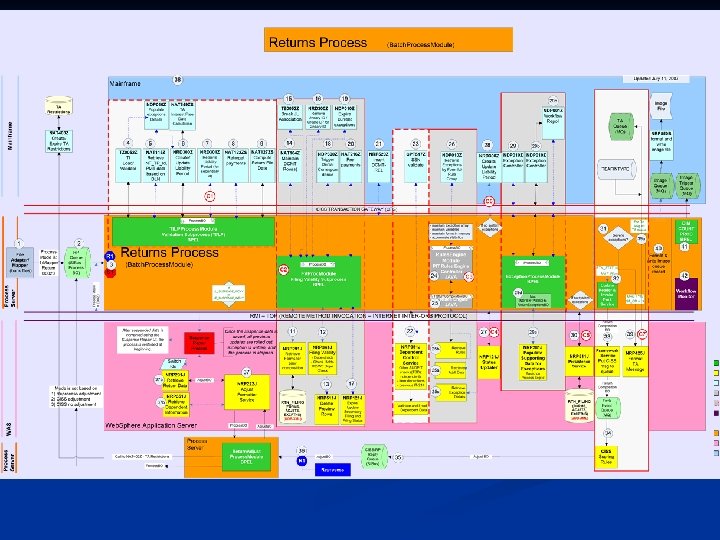

Corp Tax e-file High Level Process diagram

Corp Tax e-file High Level Process diagram

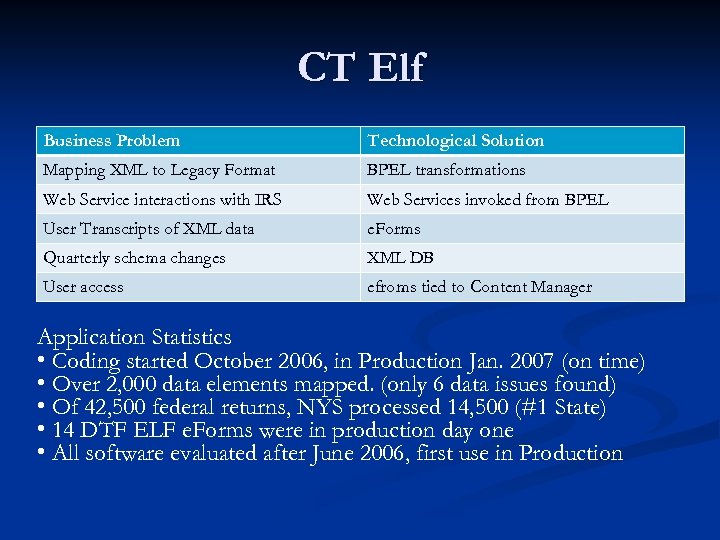

CT Elf Business Problem Technological Solution Mapping XML to Legacy Format BPEL transformations Web Service interactions with IRS Web Services invoked from BPEL User Transcripts of XML data e. Forms Quarterly schema changes XML DB User access efroms tied to Content Manager Application Statistics • Coding started October 2006, in Production Jan. 2007 (on time) • Over 2, 000 data elements mapped. (only 6 data issues found) • Of 42, 500 federal returns, NYS processed 14, 500 (#1 State) • 14 DTF ELF e. Forms were in production day one • All software evaluated after June 2006, first use in Production

CT Elf Business Problem Technological Solution Mapping XML to Legacy Format BPEL transformations Web Service interactions with IRS Web Services invoked from BPEL User Transcripts of XML data e. Forms Quarterly schema changes XML DB User access efroms tied to Content Manager Application Statistics • Coding started October 2006, in Production Jan. 2007 (on time) • Over 2, 000 data elements mapped. (only 6 data issues found) • Of 42, 500 federal returns, NYS processed 14, 500 (#1 State) • 14 DTF ELF e. Forms were in production day one • All software evaluated after June 2006, first use in Production

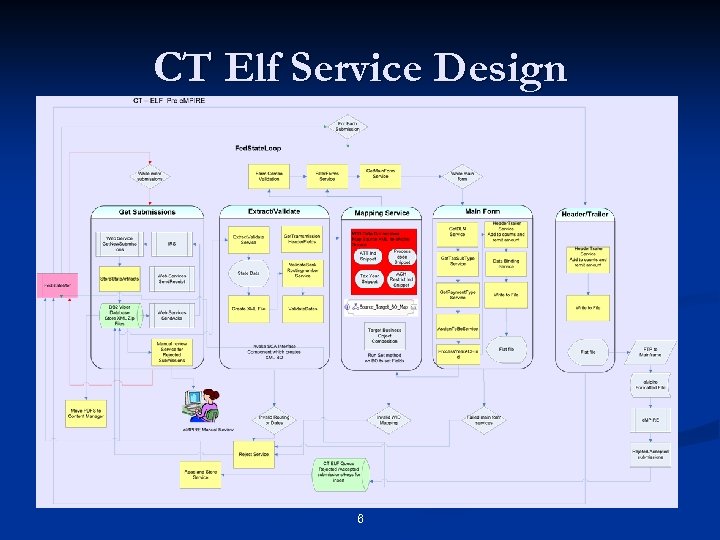

CT Elf Service Design 6

CT Elf Service Design 6

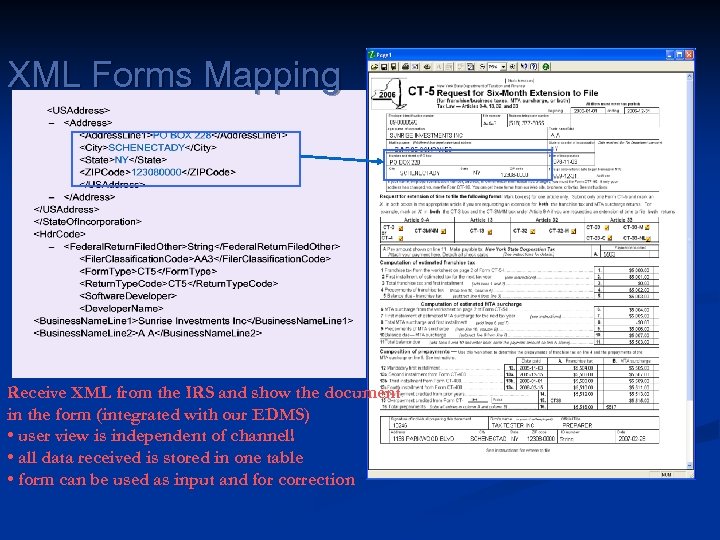

XML Forms Mapping Receive XML from the IRS and show the document in the form (integrated with our EDMS) • user view is independent of channel! • all data received is stored in one table • form can be used as input and for correction

XML Forms Mapping Receive XML from the IRS and show the document in the form (integrated with our EDMS) • user view is independent of channel! • all data received is stored in one table • form can be used as input and for correction

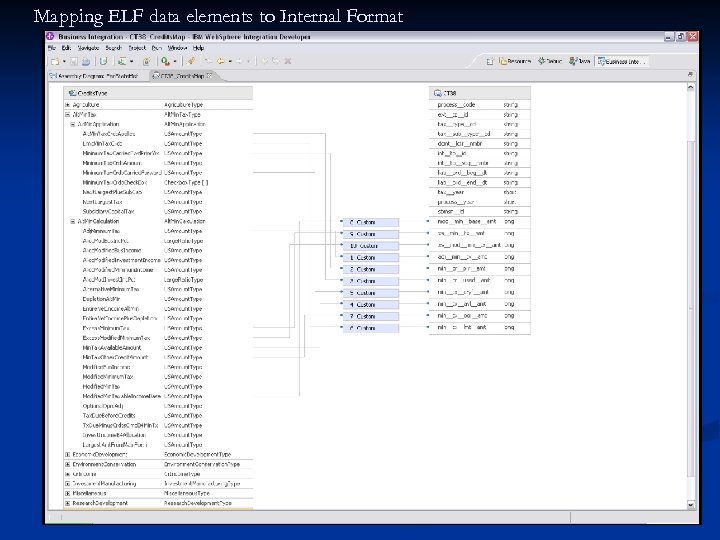

Mapping ELF data elements to Internal Format Mapping ELF to Internal Format

Mapping ELF data elements to Internal Format Mapping ELF to Internal Format

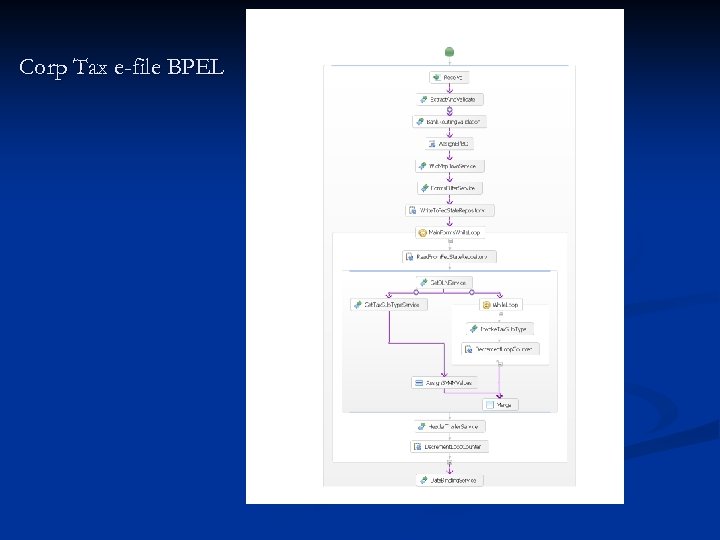

Corp Tax e-file BPEL

Corp Tax e-file BPEL

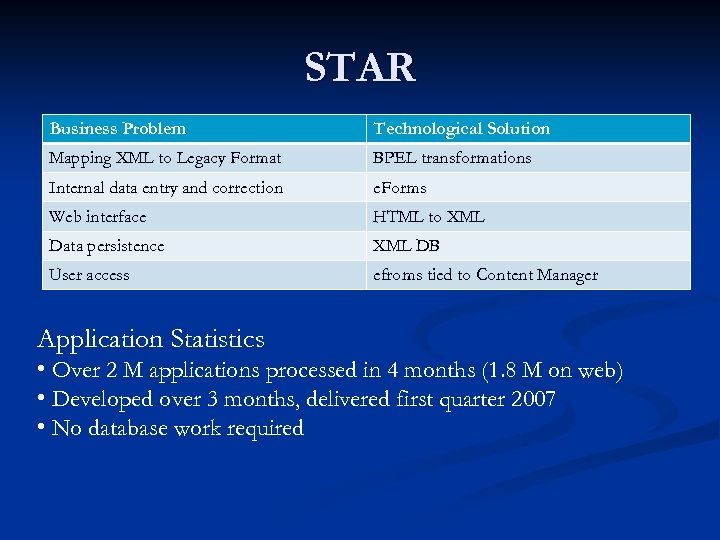

STAR Business Problem Technological Solution Mapping XML to Legacy Format BPEL transformations Internal data entry and correction e. Forms Web interface HTML to XML Data persistence XML DB User access efroms tied to Content Manager Application Statistics • Over 2 M applications processed in 4 months (1. 8 M on web) • Developed over 3 months, delivered first quarter 2007 • No database work required

STAR Business Problem Technological Solution Mapping XML to Legacy Format BPEL transformations Internal data entry and correction e. Forms Web interface HTML to XML Data persistence XML DB User access efroms tied to Content Manager Application Statistics • Over 2 M applications processed in 4 months (1. 8 M on web) • Developed over 3 months, delivered first quarter 2007 • No database work required

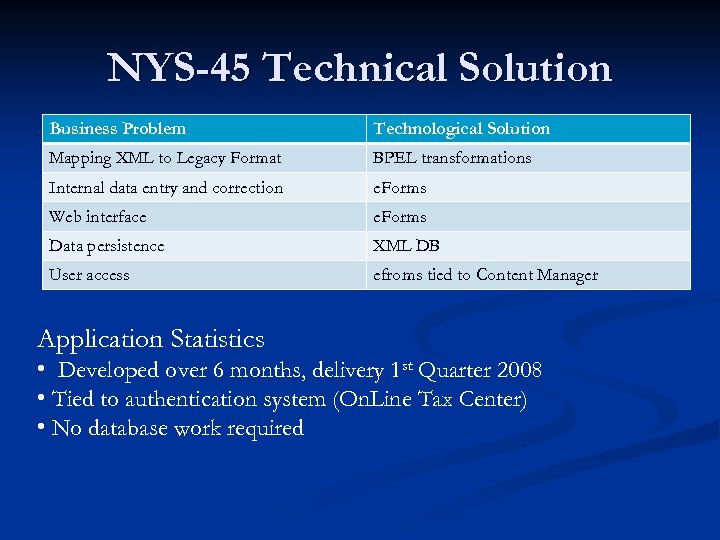

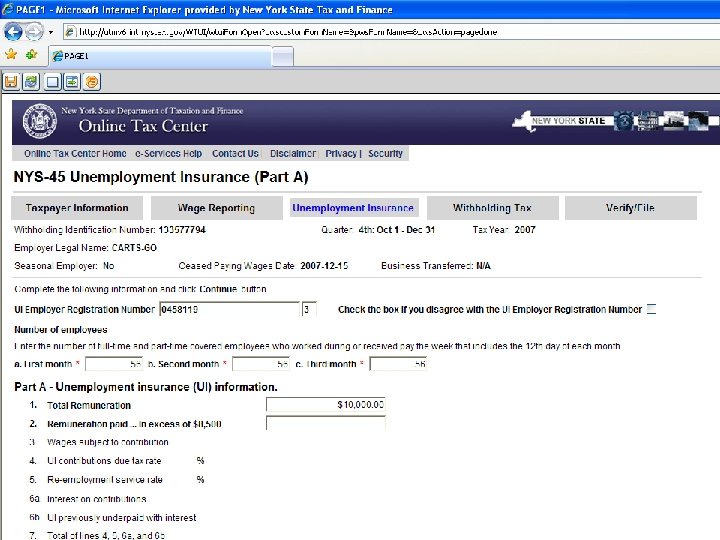

NYS-45 Technical Solution Business Problem Technological Solution Mapping XML to Legacy Format BPEL transformations Internal data entry and correction e. Forms Web interface e. Forms Data persistence XML DB User access efroms tied to Content Manager Application Statistics • Developed over 6 months, delivery 1 st Quarter 2008 • Tied to authentication system (On. Line Tax Center) • No database work required

NYS-45 Technical Solution Business Problem Technological Solution Mapping XML to Legacy Format BPEL transformations Internal data entry and correction e. Forms Web interface e. Forms Data persistence XML DB User access efroms tied to Content Manager Application Statistics • Developed over 6 months, delivery 1 st Quarter 2008 • Tied to authentication system (On. Line Tax Center) • No database work required

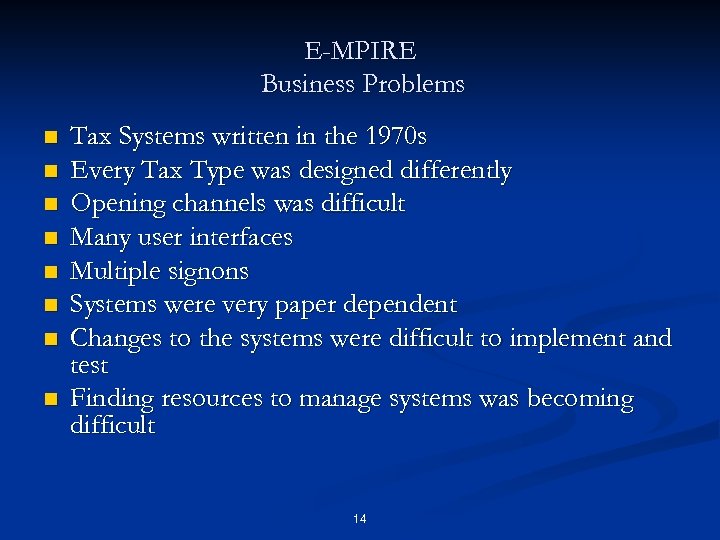

E-MPIRE Business Problems n n n n Tax Systems written in the 1970 s Every Tax Type was designed differently Opening channels was difficult Many user interfaces Multiple signons Systems were very paper dependent Changes to the systems were difficult to implement and test Finding resources to manage systems was becoming difficult 14

E-MPIRE Business Problems n n n n Tax Systems written in the 1970 s Every Tax Type was designed differently Opening channels was difficult Many user interfaces Multiple signons Systems were very paper dependent Changes to the systems were difficult to implement and test Finding resources to manage systems was becoming difficult 14

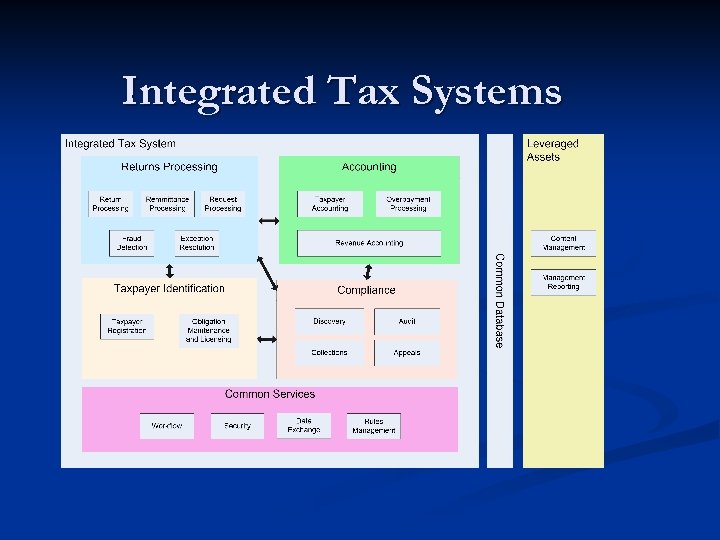

Integrated Tax Systems

Integrated Tax Systems

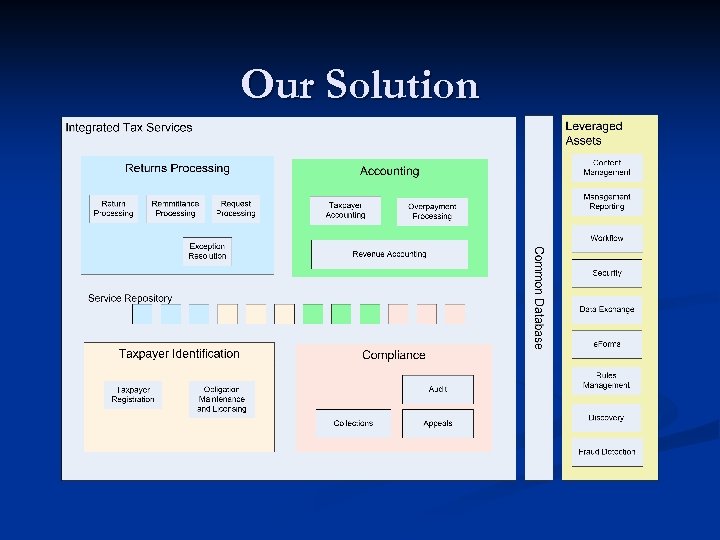

Our Solution

Our Solution

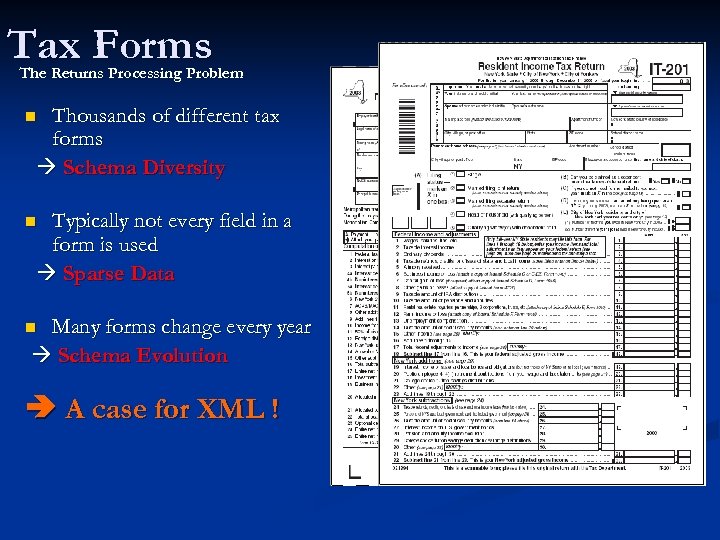

Tax Forms The Returns Processing Problem Thousands of different tax forms Schema Diversity n Typically not every field in a form is used Sparse Data n Many forms change every year Schema Evolution n A case for XML !

Tax Forms The Returns Processing Problem Thousands of different tax forms Schema Diversity n Typically not every field in a form is used Sparse Data n Many forms change every year Schema Evolution n A case for XML !

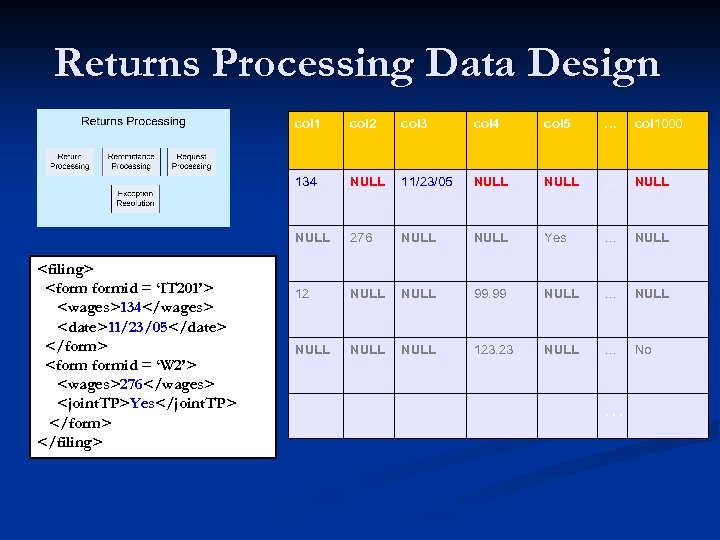

Returns Processing Data Design col 1 col 3 col 4 col 5 … col 1000 134 NULL 11/23/05 NULL … NULL

Returns Processing Data Design col 1 col 3 col 4 col 5 … col 1000 134 NULL 11/23/05 NULL … NULL

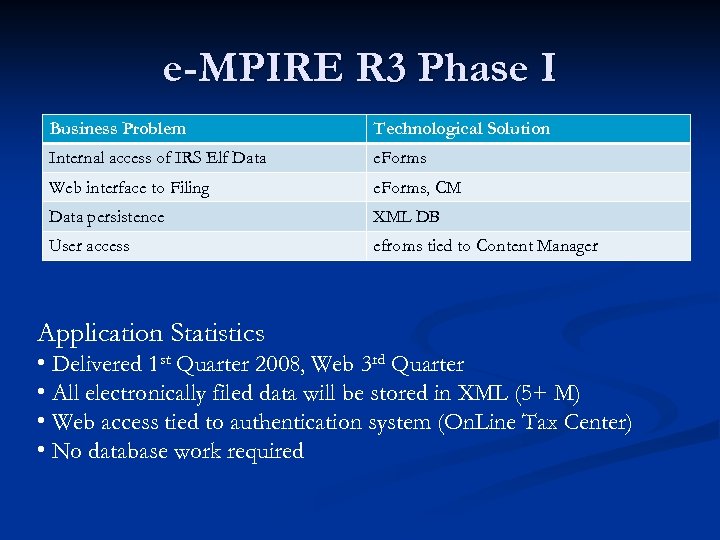

e-MPIRE R 3 Phase I Business Problem Technological Solution Internal access of IRS Elf Data e. Forms Web interface to Filing e. Forms, CM Data persistence XML DB User access efroms tied to Content Manager Application Statistics • Delivered 1 st Quarter 2008, Web 3 rd Quarter • All electronically filed data will be stored in XML (5+ M) • Web access tied to authentication system (On. Line Tax Center) • No database work required

e-MPIRE R 3 Phase I Business Problem Technological Solution Internal access of IRS Elf Data e. Forms Web interface to Filing e. Forms, CM Data persistence XML DB User access efroms tied to Content Manager Application Statistics • Delivered 1 st Quarter 2008, Web 3 rd Quarter • All electronically filed data will be stored in XML (5+ M) • Web access tied to authentication system (On. Line Tax Center) • No database work required

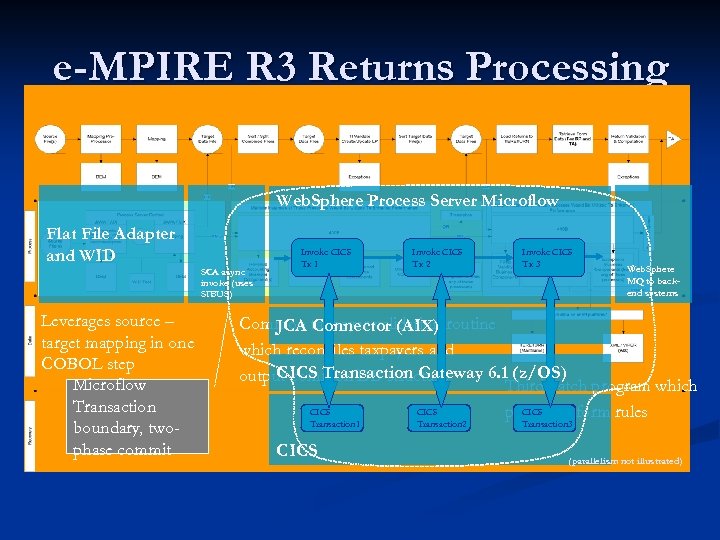

e-MPIRE R 3 Returns Processing Web. Sphere Process Server Microflow Flat File Adapter and WID SCA async invoke (uses SIBUS) Leverages source – target mapping in one COBOL step Microflow Transaction boundary, twophase commit Invoke CICS Tx 1 Invoke CICS Tx 2 Invoke CICS Tx 3 Web. Sphere MQ to backend systems Common taxpayer validation routine JCA Connector (AIX) which reconciles taxpayers and CICS Transaction Gateway 6. 1 (z/OS) output common DB structure Third batch program which CICS processes form rules Transaction 1 CICS Transaction 2 Transaction 3 (parallelism not illustrated)

e-MPIRE R 3 Returns Processing Web. Sphere Process Server Microflow Flat File Adapter and WID SCA async invoke (uses SIBUS) Leverages source – target mapping in one COBOL step Microflow Transaction boundary, twophase commit Invoke CICS Tx 1 Invoke CICS Tx 2 Invoke CICS Tx 3 Web. Sphere MQ to backend systems Common taxpayer validation routine JCA Connector (AIX) which reconciles taxpayers and CICS Transaction Gateway 6. 1 (z/OS) output common DB structure Third batch program which CICS processes form rules Transaction 1 CICS Transaction 2 Transaction 3 (parallelism not illustrated)

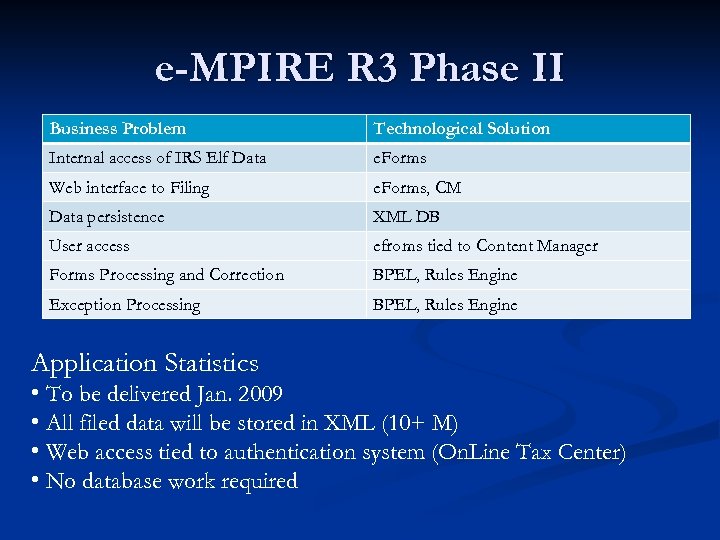

e-MPIRE R 3 Phase II Business Problem Technological Solution Internal access of IRS Elf Data e. Forms Web interface to Filing e. Forms, CM Data persistence XML DB User access efroms tied to Content Manager Forms Processing and Correction BPEL, Rules Engine Exception Processing BPEL, Rules Engine Application Statistics • To be delivered Jan. 2009 • All filed data will be stored in XML (10+ M) • Web access tied to authentication system (On. Line Tax Center) • No database work required

e-MPIRE R 3 Phase II Business Problem Technological Solution Internal access of IRS Elf Data e. Forms Web interface to Filing e. Forms, CM Data persistence XML DB User access efroms tied to Content Manager Forms Processing and Correction BPEL, Rules Engine Exception Processing BPEL, Rules Engine Application Statistics • To be delivered Jan. 2009 • All filed data will be stored in XML (10+ M) • Web access tied to authentication system (On. Line Tax Center) • No database work required

New Web Projects Sales Tax Registration n Sales Tax Re-Registration n Sales Tax e-Filing (NYS-810) n Bill, Return and Account Presentment and Payment n Estimated Tax Payments n Job Applicant n

New Web Projects Sales Tax Registration n Sales Tax Re-Registration n Sales Tax e-Filing (NYS-810) n Bill, Return and Account Presentment and Payment n Estimated Tax Payments n Job Applicant n

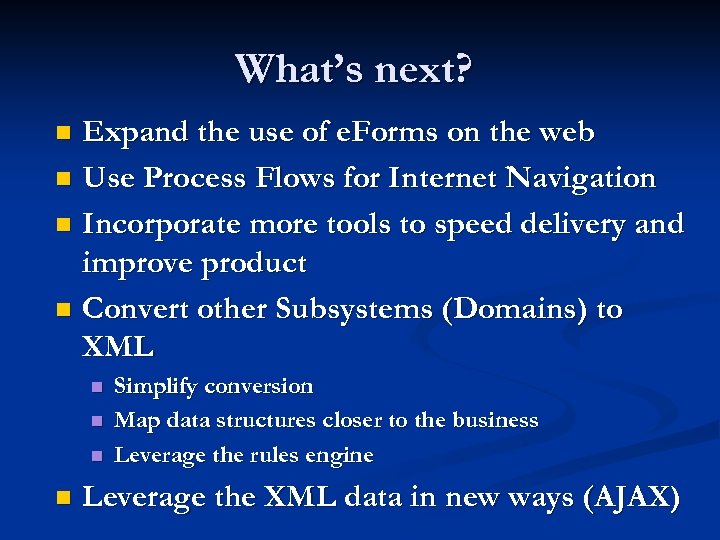

What’s next? Expand the use of e. Forms on the web n Use Process Flows for Internet Navigation n Incorporate more tools to speed delivery and improve product n Convert other Subsystems (Domains) to XML n n n Simplify conversion Map data structures closer to the business Leverage the rules engine Leverage the XML data in new ways (AJAX)

What’s next? Expand the use of e. Forms on the web n Use Process Flows for Internet Navigation n Incorporate more tools to speed delivery and improve product n Convert other Subsystems (Domains) to XML n n n Simplify conversion Map data structures closer to the business Leverage the rules engine Leverage the XML data in new ways (AJAX)

Customer Feedback?

Customer Feedback?