1871683da28aa2a32395771754e7393c.ppt

- Количество слайдов: 41

E-Commerce and Its Effect on Pricing and Strategic Positioning July 30, 2001 216 -792

E-Commerce and Its Effect on Pricing and Strategic Positioning July 30, 2001 216 -792

Impact of E-Commerce u Good news and Bad news!

Impact of E-Commerce u Good news and Bad news!

Smart competitors grow stronger, dumb competitors grow weaker

Smart competitors grow stronger, dumb competitors grow weaker

Past Differences Between Choices Profit Option 1 Option II

Past Differences Between Choices Profit Option 1 Option II

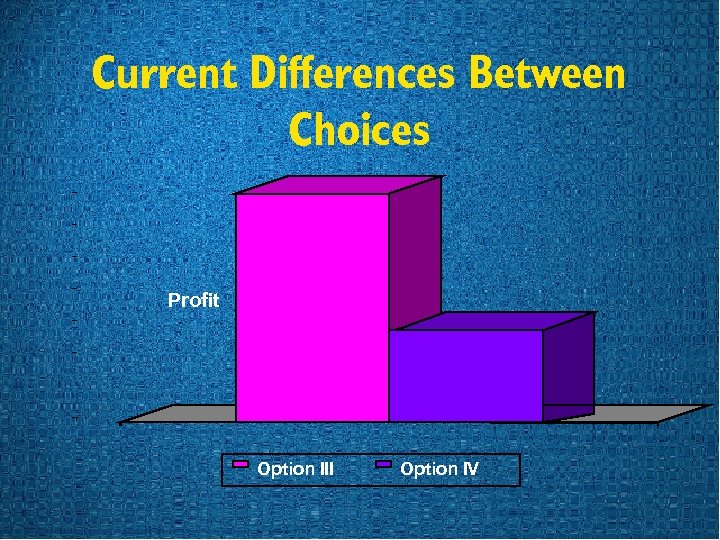

Current Differences Between Choices Profit Option III Option IV

Current Differences Between Choices Profit Option III Option IV

Competition

Competition

Profits will increasingly diverge!

Profits will increasingly diverge!

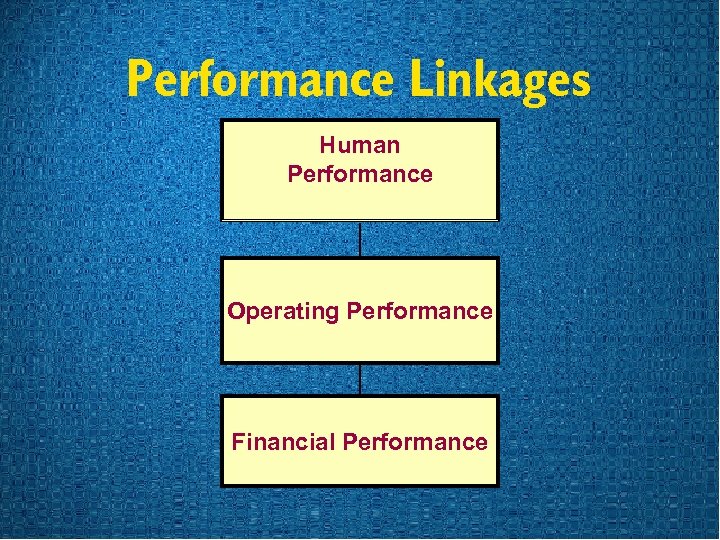

Performance Linkages Human Performance Operating Performance Financial Performance

Performance Linkages Human Performance Operating Performance Financial Performance

Profitability Dispersion

Profitability Dispersion

E-Commerce Impacts u Lower communication costs for sellers u Sometimes lower logistics & service costs for sellers u Lower search & acquisition costs for buyers u More exposure to buyers for sellers u More exposure to sellers for buyers u Less “total friction” in the transaction system

E-Commerce Impacts u Lower communication costs for sellers u Sometimes lower logistics & service costs for sellers u Lower search & acquisition costs for buyers u More exposure to buyers for sellers u More exposure to sellers for buyers u Less “total friction” in the transaction system

Changes in Transportation & Communication Time & Cost u The wheel u Domesticated animals u Sails u Roads u Engines u Rails u Telegraph u Telephone u Electronic media

Changes in Transportation & Communication Time & Cost u The wheel u Domesticated animals u Sails u Roads u Engines u Rails u Telegraph u Telephone u Electronic media

Interesting Examples u Swift replaces Allan’s Butcher Shop u Amazon. com clips Barnes & Noble u Free. Markets On. Linecuts supplier margins 15% u E-mail reduces usage for Post Office

Interesting Examples u Swift replaces Allan’s Butcher Shop u Amazon. com clips Barnes & Noble u Free. Markets On. Linecuts supplier margins 15% u E-mail reduces usage for Post Office

![Transportation & Communication Costs [Past, Present & Future] Transportation & Communication Costs [Past, Present & Future]](https://present5.com/presentation/1871683da28aa2a32395771754e7393c/image-13.jpg) Transportation & Communication Costs [Past, Present & Future]

Transportation & Communication Costs [Past, Present & Future]

Speculation on the E-Commerce Impact u Custom structural steel u Business software upgrades u Pornographic videotapes u Retail landscaping services u Construction services: large commercial buildings u Remote diagnostic services for industrial machinery u Commercial crushed rock u Worldwide travel weather information u Rare stamps for serious collectors u Retail fruits & vegetables

Speculation on the E-Commerce Impact u Custom structural steel u Business software upgrades u Pornographic videotapes u Retail landscaping services u Construction services: large commercial buildings u Remote diagnostic services for industrial machinery u Commercial crushed rock u Worldwide travel weather information u Rare stamps for serious collectors u Retail fruits & vegetables

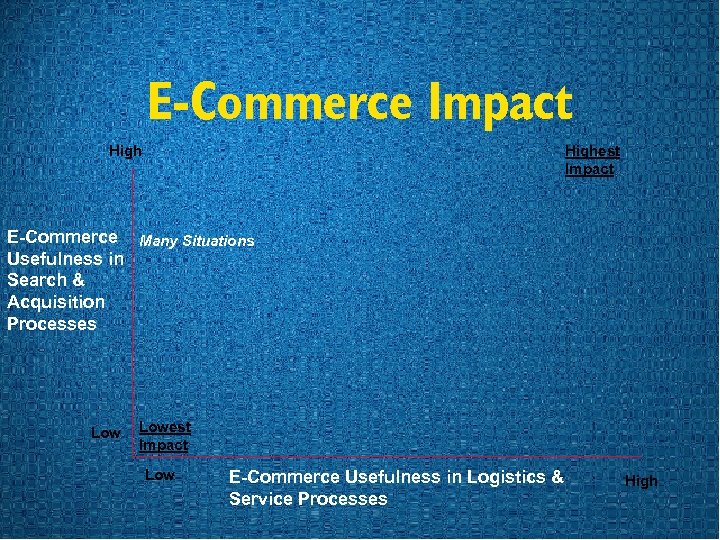

E-Commerce Impact Highest Impact E-Commerce Many Situations Usefulness in Search & Acquisition Processes Lowest Impact Low E-Commerce Usefulness in Logistics & Service Processes High

E-Commerce Impact Highest Impact E-Commerce Many Situations Usefulness in Search & Acquisition Processes Lowest Impact Low E-Commerce Usefulness in Logistics & Service Processes High

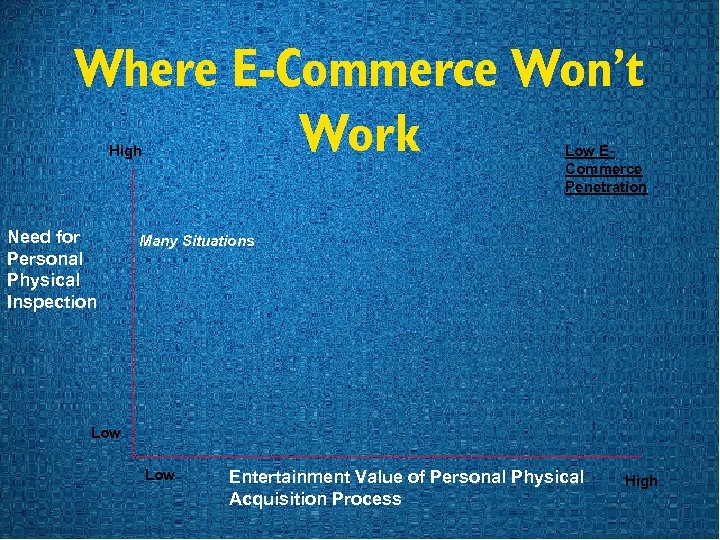

Where E-Commerce Won’t Work High Need for Personal Physical Inspection Low ECommerce Penetration Many Situations Low Entertainment Value of Personal Physical Acquisition Process High

Where E-Commerce Won’t Work High Need for Personal Physical Inspection Low ECommerce Penetration Many Situations Low Entertainment Value of Personal Physical Acquisition Process High

E-Commerce Diagnostic E-Commerce will impact if: u Search & acquisition costs are high. u Search & acquisition personal pleasure is low. u Personal inspection is not necessary. u Internet can improve search & acquisition process. u Internet can provide delivery and/or service. u Sales, delivery and service are not real differentiators. u Product/core service differentiation is low. u Personal relationship adds little real value.

E-Commerce Diagnostic E-Commerce will impact if: u Search & acquisition costs are high. u Search & acquisition personal pleasure is low. u Personal inspection is not necessary. u Internet can improve search & acquisition process. u Internet can provide delivery and/or service. u Sales, delivery and service are not real differentiators. u Product/core service differentiation is low. u Personal relationship adds little real value.

E-Commerce Test Vehicles u Catalogues u Direct Mail u Telemarketing u EDI u Fax

E-Commerce Test Vehicles u Catalogues u Direct Mail u Telemarketing u EDI u Fax

Derivative E-Commerce Impacts u u Sellers of differentiated specialties will be exposed to more buyers at lower costsales and margins will improve Buyers of commodities will be exposed to more sellers at lower cost-margins will decrease

Derivative E-Commerce Impacts u u Sellers of differentiated specialties will be exposed to more buyers at lower costsales and margins will improve Buyers of commodities will be exposed to more sellers at lower cost-margins will decrease

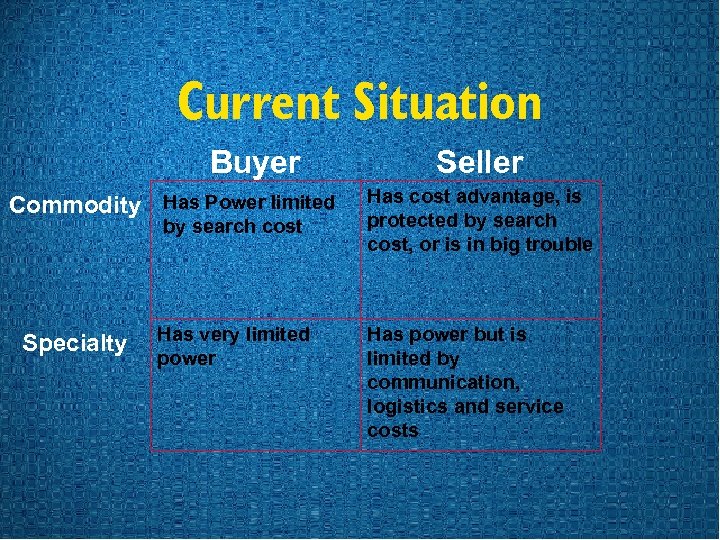

Current Situation Buyer Commodity Has Power limited by search cost Specialty Has very limited power Seller Has cost advantage, is protected by search cost, or is in big trouble Has power but is limited by communication, logistics and service costs

Current Situation Buyer Commodity Has Power limited by search cost Specialty Has very limited power Seller Has cost advantage, is protected by search cost, or is in big trouble Has power but is limited by communication, logistics and service costs

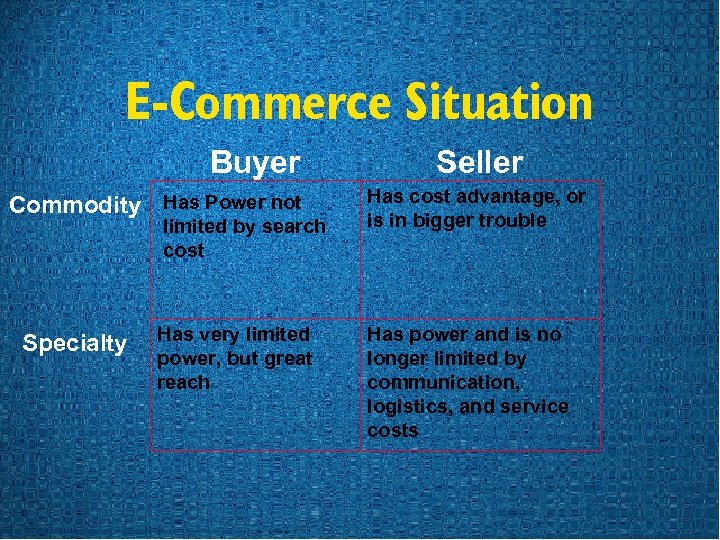

E-Commerce Situation Buyer Commodity Has Power not limited by search cost Specialty Has very limited power, but great reach Seller Has cost advantage, or is in bigger trouble Has power and is no longer limited by communication, logistics, and service costs

E-Commerce Situation Buyer Commodity Has Power not limited by search cost Specialty Has very limited power, but great reach Seller Has cost advantage, or is in bigger trouble Has power and is no longer limited by communication, logistics, and service costs

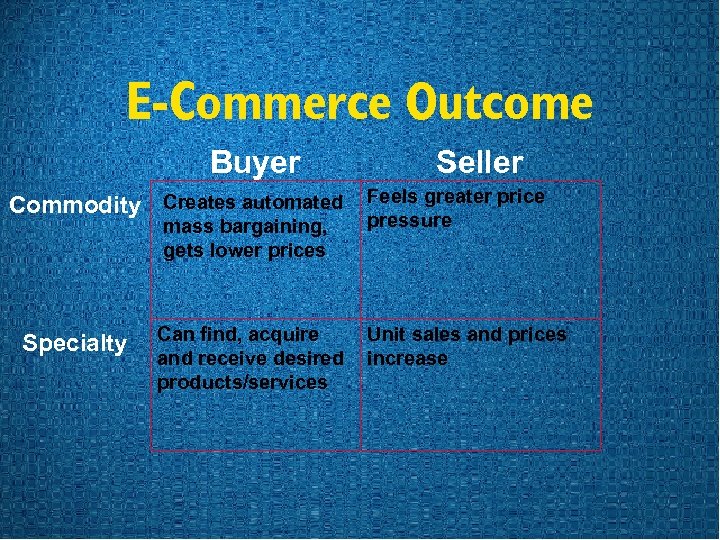

E-Commerce Outcome Buyer Commodity Creates automated mass bargaining, gets lower prices Specialty Can find, acquire and receive desired products/services Seller Feels greater price pressure Unit sales and prices increase

E-Commerce Outcome Buyer Commodity Creates automated mass bargaining, gets lower prices Specialty Can find, acquire and receive desired products/services Seller Feels greater price pressure Unit sales and prices increase

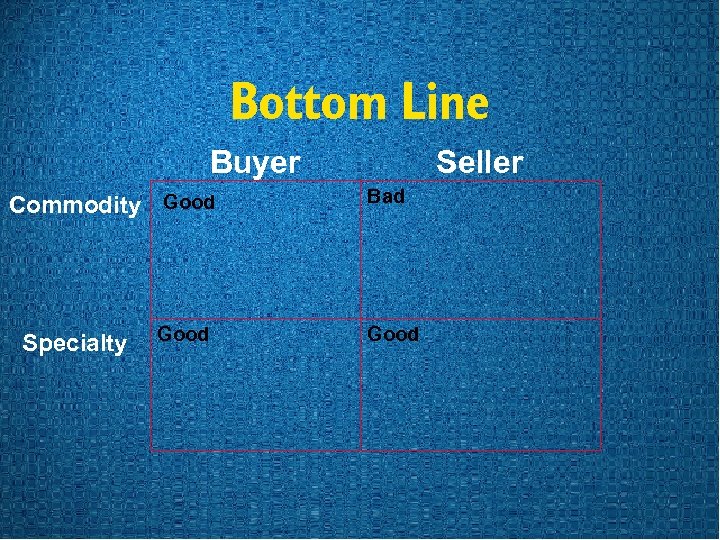

Bottom Line Buyer Commodity Good Specialty Good Seller Bad Good

Bottom Line Buyer Commodity Good Specialty Good Seller Bad Good

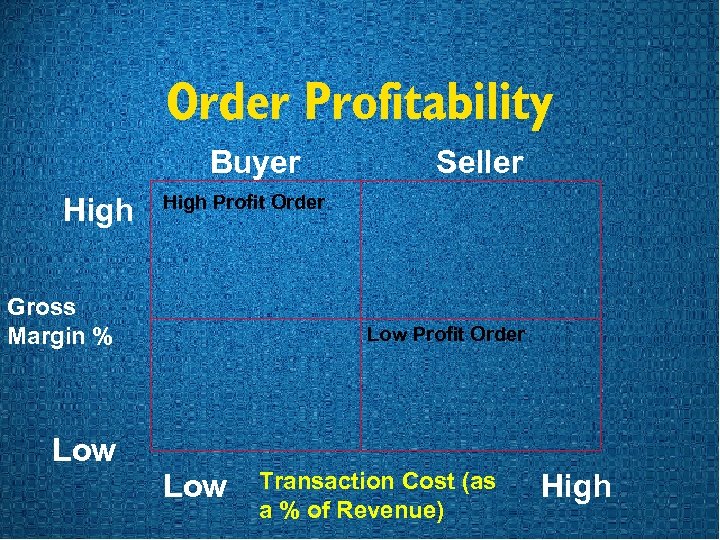

Order Profitability Buyer High Seller High Profit Order Gross Margin % Low Profit Order Low Transaction Cost (as a % of Revenue) High

Order Profitability Buyer High Seller High Profit Order Gross Margin % Low Profit Order Low Transaction Cost (as a % of Revenue) High

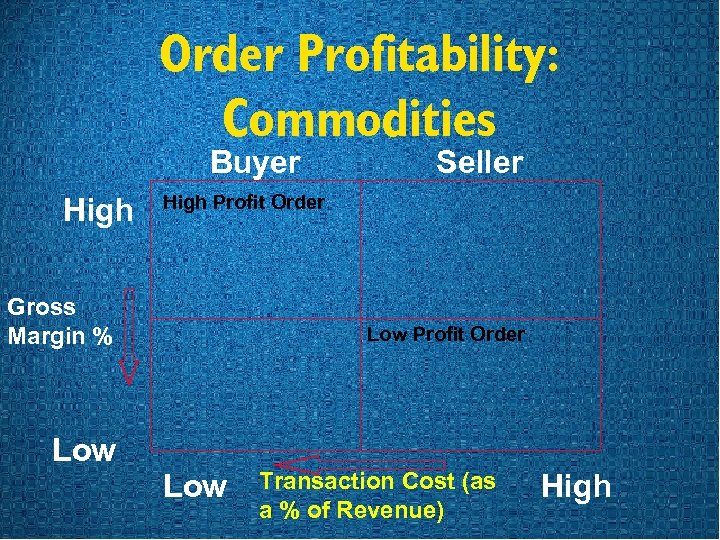

Order Profitability: Commodities Buyer High Seller High Profit Order Gross Margin % Low Profit Order Low Transaction Cost (as a % of Revenue) High

Order Profitability: Commodities Buyer High Seller High Profit Order Gross Margin % Low Profit Order Low Transaction Cost (as a % of Revenue) High

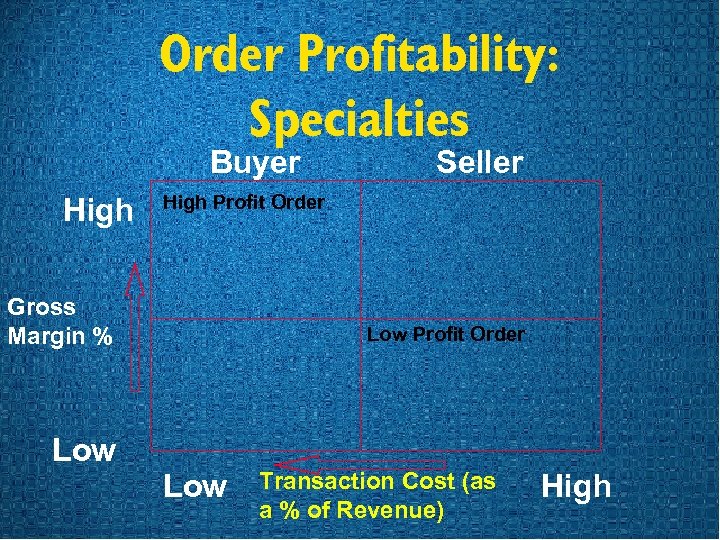

Order Profitability: Specialties Buyer High Seller High Profit Order Gross Margin % Low Profit Order Low Transaction Cost (as a % of Revenue) High

Order Profitability: Specialties Buyer High Seller High Profit Order Gross Margin % Low Profit Order Low Transaction Cost (as a % of Revenue) High

Why are large companies generally doing better than small companies in profit growth, and stock price-to-earnings ratios?

Why are large companies generally doing better than small companies in profit growth, and stock price-to-earnings ratios?

For Commodities Only Buyer Seller Lots of power: gets Has economies of scale Big and scope if they exist concessions Companies Buys at list price Small Companies Is in a difficult position

For Commodities Only Buyer Seller Lots of power: gets Has economies of scale Big and scope if they exist concessions Companies Buys at list price Small Companies Is in a difficult position

Likely Outcome u Specialty sellers make more money: higher unit volume at higher gross margins with lower transaction costs. u Commodity sellers make less money unless they have a cost advantage: lower gross margins but with lower transaction cost. u Low cost commodity sellers prosper : if their increased unit volume and lower transaction costs more than compensate for lower gross margins. High fixed cost structures help.

Likely Outcome u Specialty sellers make more money: higher unit volume at higher gross margins with lower transaction costs. u Commodity sellers make less money unless they have a cost advantage: lower gross margins but with lower transaction cost. u Low cost commodity sellers prosper : if their increased unit volume and lower transaction costs more than compensate for lower gross margins. High fixed cost structures help.

E-Commerce Questions: Offense u Can I use E-Commerce to reach new prospects? u Can I use E-Commerce to manage order flow? u Can I add value to my sales effort (e. g. , customer advice, design, etc. ) with E-Commerce? u Can I deliver products/services with E-Commerce? u Can I provide post sales service with E-Commerce? u Can I support distributors/dealers/salespeople with E-Commerce? u Can I influenceinfluentialswith E-Commerce? u Can I reduce costs with E-Commerce?

E-Commerce Questions: Offense u Can I use E-Commerce to reach new prospects? u Can I use E-Commerce to manage order flow? u Can I add value to my sales effort (e. g. , customer advice, design, etc. ) with E-Commerce? u Can I deliver products/services with E-Commerce? u Can I provide post sales service with E-Commerce? u Can I support distributors/dealers/salespeople with E-Commerce? u Can I influenceinfluentialswith E-Commerce? u Can I reduce costs with E-Commerce?

E-Commerce Questions: Defense u Are my products/services differentiated? u Is my differentiation increasing or decreasing? u What are my competitors doing with E-Commerce? u What are potential competitors doing with ECommerce? u What are my suppliers, customers and distributors doing with E-Commerce? u Will I be “commoditized ”? u Will I be “disintermediated ”?

E-Commerce Questions: Defense u Are my products/services differentiated? u Is my differentiation increasing or decreasing? u What are my competitors doing with E-Commerce? u What are potential competitors doing with ECommerce? u What are my suppliers, customers and distributors doing with E-Commerce? u Will I be “commoditized ”? u Will I be “disintermediated ”?

Some Emerging Traps u Customers price shop u Customers product/service shop u Competitive myopia u Relationship to incumbent distribution channels u Relationship to incumbent sales forces u Relationship to service organizations u Obsolete logistics/support thinking u Customer value & differentiation distraction u Non-system thinking u Ignoring profits

Some Emerging Traps u Customers price shop u Customers product/service shop u Competitive myopia u Relationship to incumbent distribution channels u Relationship to incumbent sales forces u Relationship to service organizations u Obsolete logistics/support thinking u Customer value & differentiation distraction u Non-system thinking u Ignoring profits

Leverage Points u Customer Value u “Go to Market” architecture u Precision Pricing u Jurisdictional Integration u Execution Speed & Precision u Relationship “Equity”

Leverage Points u Customer Value u “Go to Market” architecture u Precision Pricing u Jurisdictional Integration u Execution Speed & Precision u Relationship “Equity”

Customer Value u Convenience u Availability u Function u Relationship u Price

Customer Value u Convenience u Availability u Function u Relationship u Price

Go-to-Market Architecture u Independent distributors u Sales agents u Sales force u Telemarketers u Catalogues u Fulfillers u Logistics services u E-Commerce agents

Go-to-Market Architecture u Independent distributors u Sales agents u Sales force u Telemarketers u Catalogues u Fulfillers u Logistics services u E-Commerce agents

Leverage Points u Customer Value u “Go to Market” architecture u Precision Pricing u Jurisdictional Integration u Execution Speed & Precision u Relationship “Equity”

Leverage Points u Customer Value u “Go to Market” architecture u Precision Pricing u Jurisdictional Integration u Execution Speed & Precision u Relationship “Equity”

Integrating Jurisdictions u Common understanding u Unified, explicit strategy u Organizational structure u Formal management processes u Information technology u Informal social network u People

Integrating Jurisdictions u Common understanding u Unified, explicit strategy u Organizational structure u Formal management processes u Information technology u Informal social network u People

Execution u Speed” The enduring first mover advantage u Precision: Unforgiving customers, influentials partners, , & investors u Patience is dead: it is a Type A world

Execution u Speed” The enduring first mover advantage u Precision: Unforgiving customers, influentials partners, , & investors u Patience is dead: it is a Type A world

Relationship Equity: The Enduring Assets u Customer relationships: “brand” equity u The organization & its people

Relationship Equity: The Enduring Assets u Customer relationships: “brand” equity u The organization & its people

Attention!! Tectonic Changes Ahead u Great Opportunity u Catastrophic Threats

Attention!! Tectonic Changes Ahead u Great Opportunity u Catastrophic Threats

Questions?

Questions?