323775a398d725accbfc2da62c300552.ppt

- Количество слайдов: 19

Dynamic portfolio and mortgage choice for homeowners Otto van Hemert, Frank de Jong Joost Driessen January 23 th, 2006

Dynamic portfolio and mortgage choice for homeowners Otto van Hemert, Frank de Jong Joost Driessen January 23 th, 2006

Dynamic portfolio and mortgage choice for homeowners Research Agenda • For many investors, house is largest asset, and mortgage largest liability • Research questions – How does optimal financial portfolio depend on housing tenure and size? – What mortgage type to finance your house? – How to hedge house price/future housing cost risk? – When to own, when to rent? 1

Dynamic portfolio and mortgage choice for homeowners Research Agenda • For many investors, house is largest asset, and mortgage largest liability • Research questions – How does optimal financial portfolio depend on housing tenure and size? – What mortgage type to finance your house? – How to hedge house price/future housing cost risk? – When to own, when to rent? 1

Dynamic portfolio and mortgage choice for homeowners Main findings this paper • Unconstrained investor: closed-form solution – Mean-variance tangency portfolio – Portfolio hedging real interest rate (/inflation) risk – Portfolio hedging house price risk – Leverage financial positions to get desired risk exposure total (financial + housing) wealth – Weights depend on effective housing wealth • Constrained investor with mortgage choice 2 – ARM alleviates short-sale constraint on cash – FRM alleviates short-sale constraint on 20 y bond – Risk-tolerant homeowner chooses ARM – Risk-averse homeowner chooses FRM (or hybrid)

Dynamic portfolio and mortgage choice for homeowners Main findings this paper • Unconstrained investor: closed-form solution – Mean-variance tangency portfolio – Portfolio hedging real interest rate (/inflation) risk – Portfolio hedging house price risk – Leverage financial positions to get desired risk exposure total (financial + housing) wealth – Weights depend on effective housing wealth • Constrained investor with mortgage choice 2 – ARM alleviates short-sale constraint on cash – FRM alleviates short-sale constraint on 20 y bond – Risk-tolerant homeowner chooses ARM – Risk-averse homeowner chooses FRM (or hybrid)

Dynamic portfolio and mortgage choice for homeowners Two complementing papers • Dynamic portfolio and mortgage choice for homeowners – – Utility from terminal wealth Capitalised labor income No tenure choice Fixed house size • Implicit closed-form solution unrestricted case enhancing intuition restricted case • Interpretation: retired or wealthy investor 3 • Life-cycle housing and portfolio choice with bond markets – – Full-fledged life-cycle model Stochastic labor income Choice renting/owning House size choice • Brute force solution with aid supercomputer • Builds on intuition acquired in other paper

Dynamic portfolio and mortgage choice for homeowners Two complementing papers • Dynamic portfolio and mortgage choice for homeowners – – Utility from terminal wealth Capitalised labor income No tenure choice Fixed house size • Implicit closed-form solution unrestricted case enhancing intuition restricted case • Interpretation: retired or wealthy investor 3 • Life-cycle housing and portfolio choice with bond markets – – Full-fledged life-cycle model Stochastic labor income Choice renting/owning House size choice • Brute force solution with aid supercomputer • Builds on intuition acquired in other paper

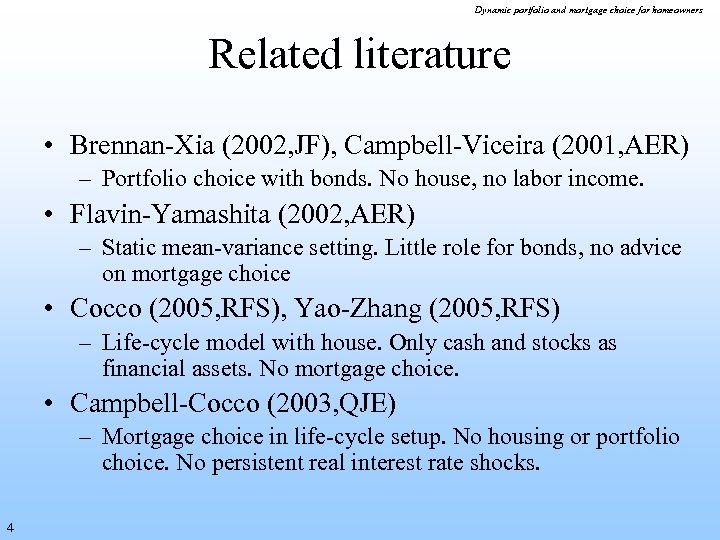

Dynamic portfolio and mortgage choice for homeowners Related literature • Brennan-Xia (2002, JF), Campbell-Viceira (2001, AER) – Portfolio choice with bonds. No house, no labor income. • Flavin-Yamashita (2002, AER) – Static mean-variance setting. Little role for bonds, no advice on mortgage choice • Cocco (2005, RFS), Yao-Zhang (2005, RFS) – Life-cycle model with house. Only cash and stocks as financial assets. No mortgage choice. • Campbell-Cocco (2003, QJE) – Mortgage choice in life-cycle setup. No housing or portfolio choice. No persistent real interest rate shocks. 4

Dynamic portfolio and mortgage choice for homeowners Related literature • Brennan-Xia (2002, JF), Campbell-Viceira (2001, AER) – Portfolio choice with bonds. No house, no labor income. • Flavin-Yamashita (2002, AER) – Static mean-variance setting. Little role for bonds, no advice on mortgage choice • Cocco (2005, RFS), Yao-Zhang (2005, RFS) – Life-cycle model with house. Only cash and stocks as financial assets. No mortgage choice. • Campbell-Cocco (2003, QJE) – Mortgage choice in life-cycle setup. No housing or portfolio choice. No persistent real interest rate shocks. 4

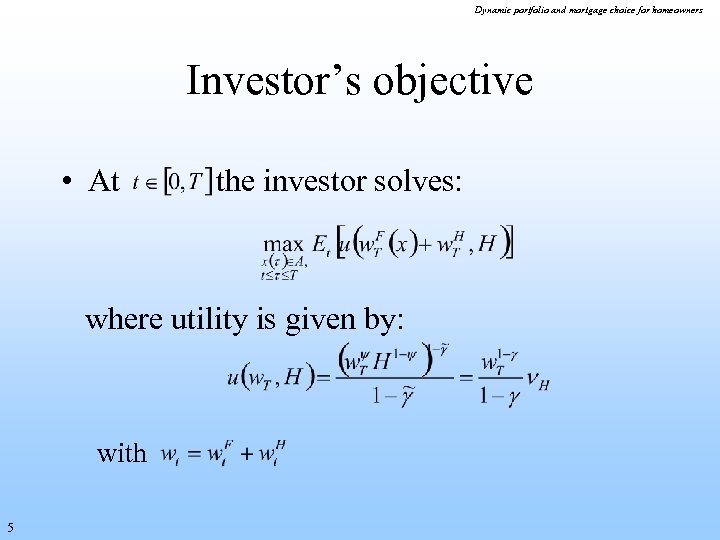

Dynamic portfolio and mortgage choice for homeowners Investor’s objective • At the investor solves: where utility is given by: with 5

Dynamic portfolio and mortgage choice for homeowners Investor’s objective • At the investor solves: where utility is given by: with 5

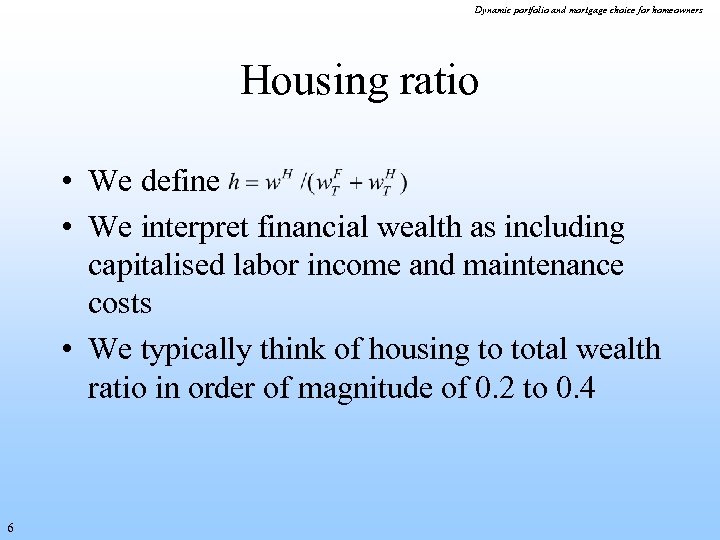

Dynamic portfolio and mortgage choice for homeowners Housing ratio • We define • We interpret financial wealth as including capitalised labor income and maintenance costs • We typically think of housing to total wealth ratio in order of magnitude of 0. 2 to 0. 4 6

Dynamic portfolio and mortgage choice for homeowners Housing ratio • We define • We interpret financial wealth as including capitalised labor income and maintenance costs • We typically think of housing to total wealth ratio in order of magnitude of 0. 2 to 0. 4 6

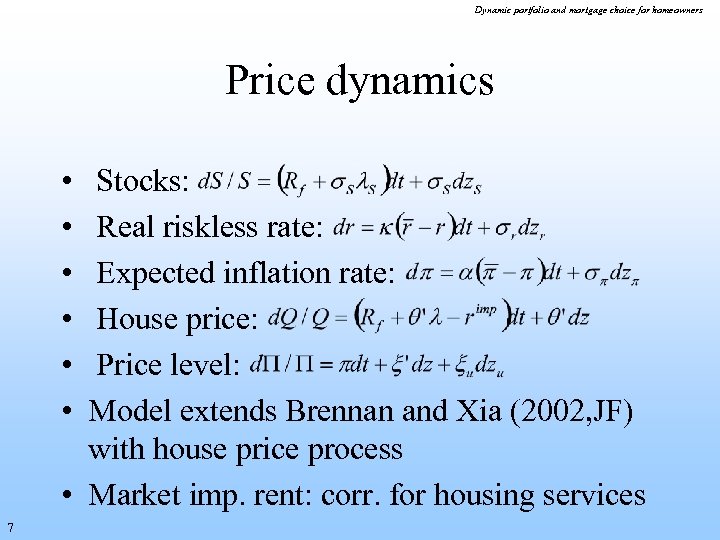

Dynamic portfolio and mortgage choice for homeowners Price dynamics • • • Stocks: Real riskless rate: Expected inflation rate: House price: Price level: Model extends Brennan and Xia (2002, JF) with house price process • Market imp. rent: corr. for housing services 7

Dynamic portfolio and mortgage choice for homeowners Price dynamics • • • Stocks: Real riskless rate: Expected inflation rate: House price: Price level: Model extends Brennan and Xia (2002, JF) with house price process • Market imp. rent: corr. for housing services 7

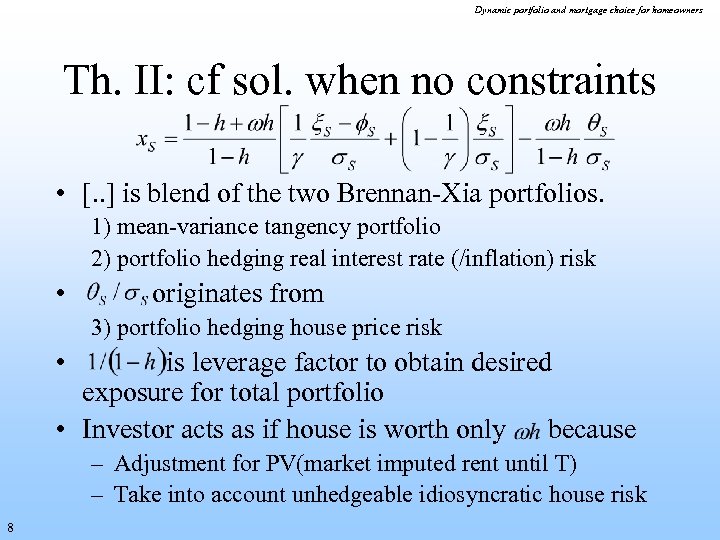

Dynamic portfolio and mortgage choice for homeowners Th. II: cf sol. when no constraints • [. . ] is blend of the two Brennan-Xia portfolios. 1) mean-variance tangency portfolio 2) portfolio hedging real interest rate (/inflation) risk • originates from 3) portfolio hedging house price risk • is leverage factor to obtain desired exposure for total portfolio • Investor acts as if house is worth only because – Adjustment for PV(market imputed rent until T) – Take into account unhedgeable idiosyncratic house risk 8

Dynamic portfolio and mortgage choice for homeowners Th. II: cf sol. when no constraints • [. . ] is blend of the two Brennan-Xia portfolios. 1) mean-variance tangency portfolio 2) portfolio hedging real interest rate (/inflation) risk • originates from 3) portfolio hedging house price risk • is leverage factor to obtain desired exposure for total portfolio • Investor acts as if house is worth only because – Adjustment for PV(market imputed rent until T) – Take into account unhedgeable idiosyncratic house risk 8

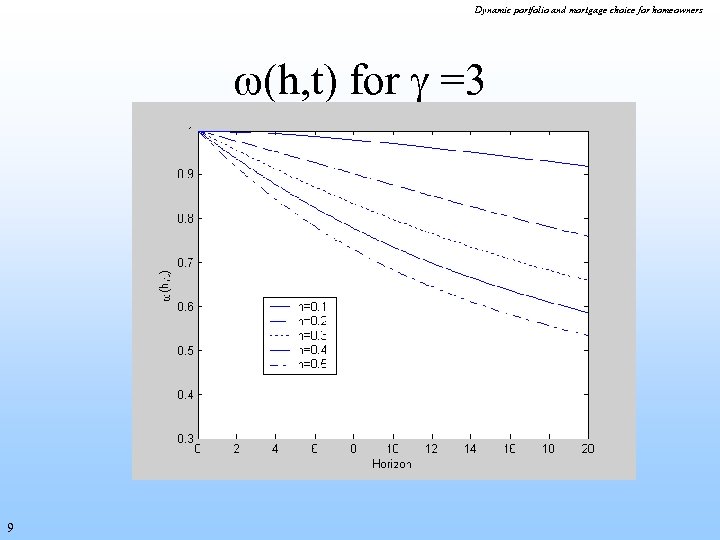

Dynamic portfolio and mortgage choice for homeowners (h, t) for =3 9

Dynamic portfolio and mortgage choice for homeowners (h, t) for =3 9

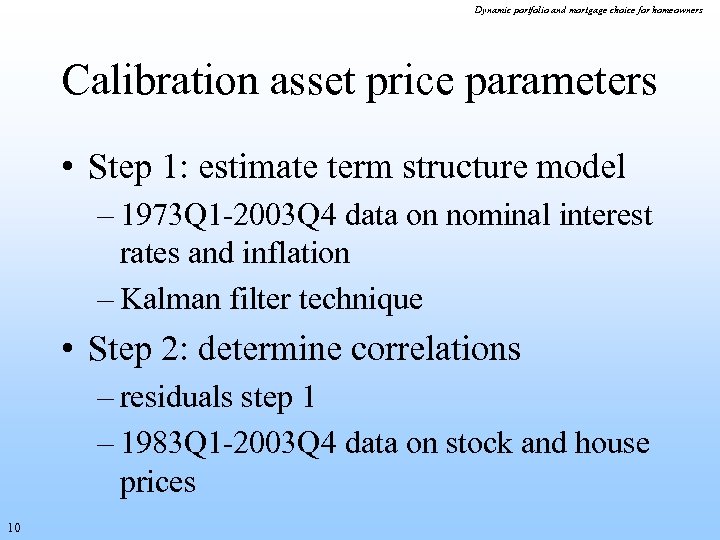

Dynamic portfolio and mortgage choice for homeowners Calibration asset price parameters • Step 1: estimate term structure model – 1973 Q 1 -2003 Q 4 data on nominal interest rates and inflation – Kalman filter technique • Step 2: determine correlations – residuals step 1 – 1983 Q 1 -2003 Q 4 data on stock and house prices 10

Dynamic portfolio and mortgage choice for homeowners Calibration asset price parameters • Step 1: estimate term structure model – 1973 Q 1 -2003 Q 4 data on nominal interest rates and inflation – Kalman filter technique • Step 2: determine correlations – residuals step 1 – 1983 Q 1 -2003 Q 4 data on stock and house prices 10

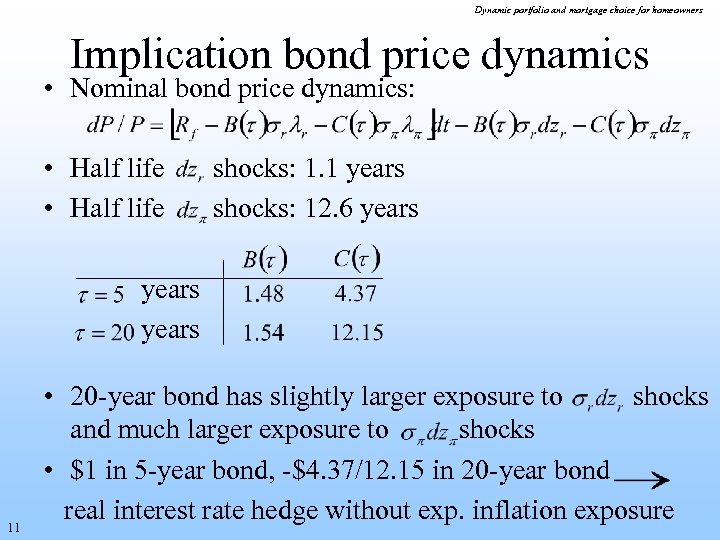

Dynamic portfolio and mortgage choice for homeowners Implication bond price dynamics • Nominal bond price dynamics: • Half life shocks: 1. 1 years shocks: 12. 6 years 11 • 20 -year bond has slightly larger exposure to shocks and much larger exposure to shocks • $1 in 5 -year bond, -$4. 37/12. 15 in 20 -year bond real interest rate hedge without exp. inflation exposure

Dynamic portfolio and mortgage choice for homeowners Implication bond price dynamics • Nominal bond price dynamics: • Half life shocks: 1. 1 years shocks: 12. 6 years 11 • 20 -year bond has slightly larger exposure to shocks and much larger exposure to shocks • $1 in 5 -year bond, -$4. 37/12. 15 in 20 -year bond real interest rate hedge without exp. inflation exposure

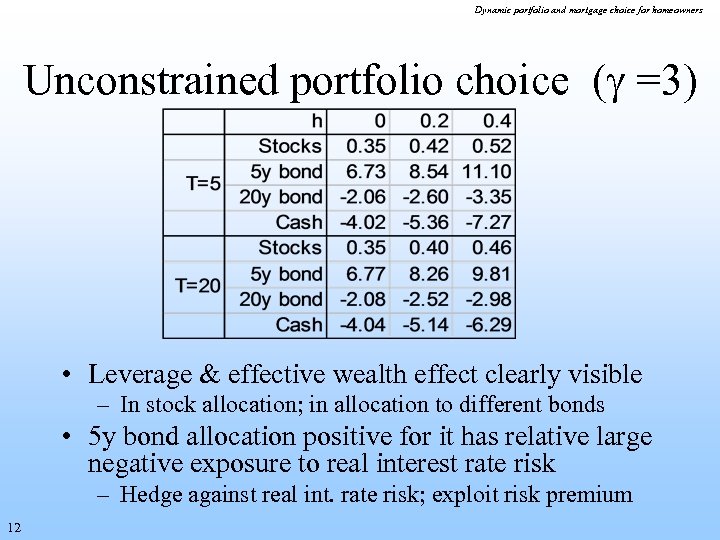

Dynamic portfolio and mortgage choice for homeowners Unconstrained portfolio choice ( =3) • Leverage & effective wealth effect clearly visible – In stock allocation; in allocation to different bonds • 5 y bond allocation positive for it has relative large negative exposure to real interest rate risk – Hedge against real int. rate risk; exploit risk premium 12

Dynamic portfolio and mortgage choice for homeowners Unconstrained portfolio choice ( =3) • Leverage & effective wealth effect clearly visible – In stock allocation; in allocation to different bonds • 5 y bond allocation positive for it has relative large negative exposure to real interest rate risk – Hedge against real int. rate risk; exploit risk premium 12

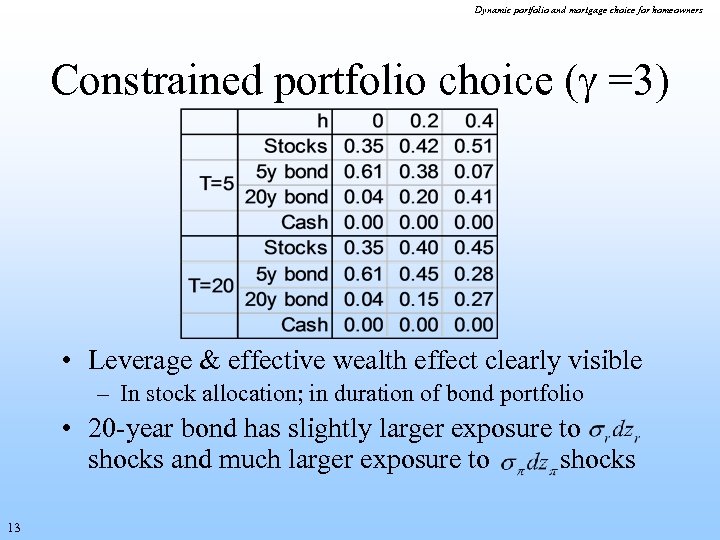

Dynamic portfolio and mortgage choice for homeowners Constrained portfolio choice ( =3) • Leverage & effective wealth effect clearly visible – In stock allocation; in duration of bond portfolio • 20 -year bond has slightly larger exposure to shocks and much larger exposure to shocks 13

Dynamic portfolio and mortgage choice for homeowners Constrained portfolio choice ( =3) • Leverage & effective wealth effect clearly visible – In stock allocation; in duration of bond portfolio • 20 -year bond has slightly larger exposure to shocks and much larger exposure to shocks 13

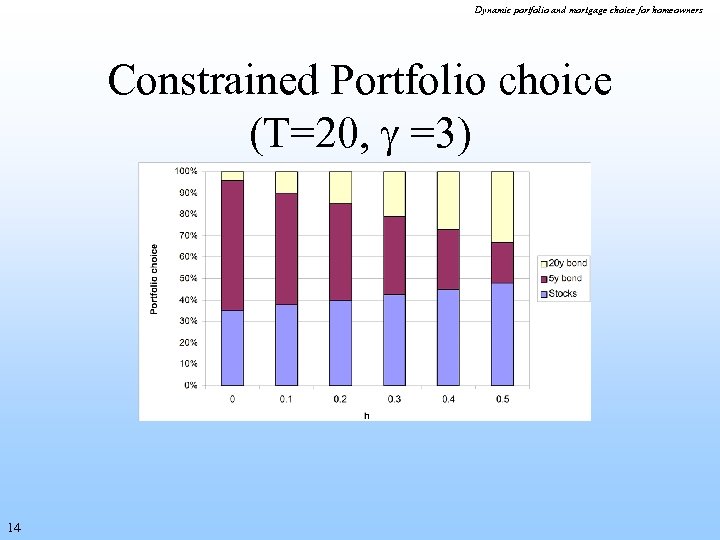

Dynamic portfolio and mortgage choice for homeowners Constrained Portfolio choice (T=20, =3) 14

Dynamic portfolio and mortgage choice for homeowners Constrained Portfolio choice (T=20, =3) 14

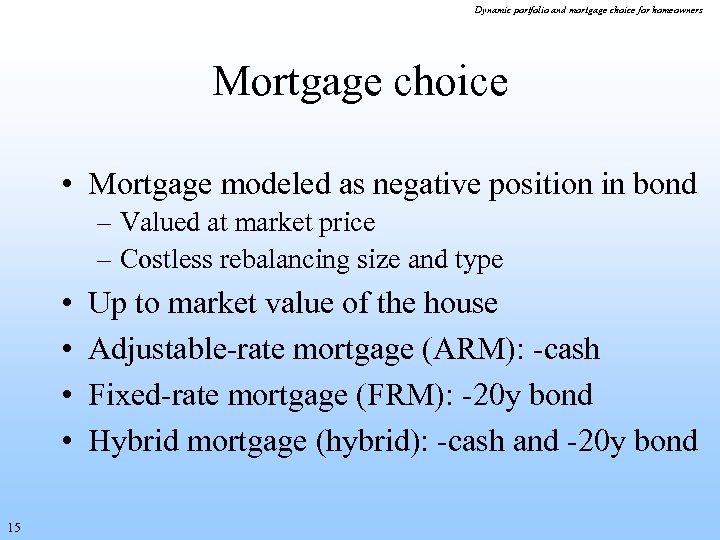

Dynamic portfolio and mortgage choice for homeowners Mortgage choice • Mortgage modeled as negative position in bond – Valued at market price – Costless rebalancing size and type • • 15 Up to market value of the house Adjustable-rate mortgage (ARM): -cash Fixed-rate mortgage (FRM): -20 y bond Hybrid mortgage (hybrid): -cash and -20 y bond

Dynamic portfolio and mortgage choice for homeowners Mortgage choice • Mortgage modeled as negative position in bond – Valued at market price – Costless rebalancing size and type • • 15 Up to market value of the house Adjustable-rate mortgage (ARM): -cash Fixed-rate mortgage (FRM): -20 y bond Hybrid mortgage (hybrid): -cash and -20 y bond

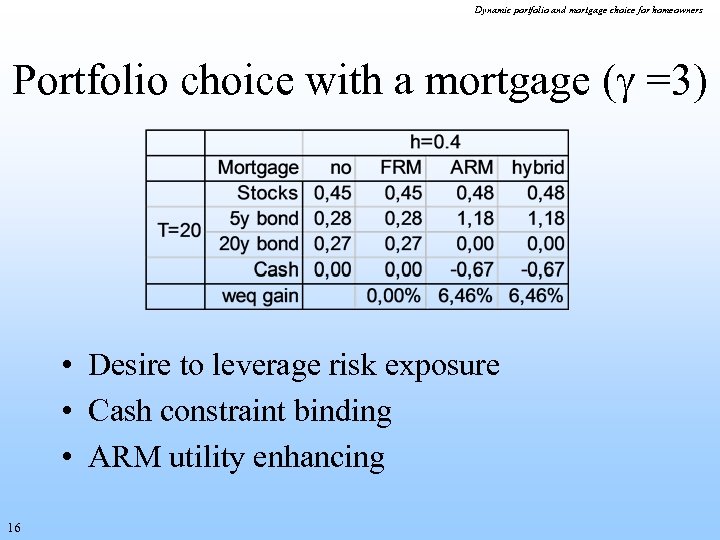

Dynamic portfolio and mortgage choice for homeowners Portfolio choice with a mortgage ( =3) • Desire to leverage risk exposure • Cash constraint binding • ARM utility enhancing 16

Dynamic portfolio and mortgage choice for homeowners Portfolio choice with a mortgage ( =3) • Desire to leverage risk exposure • Cash constraint binding • ARM utility enhancing 16

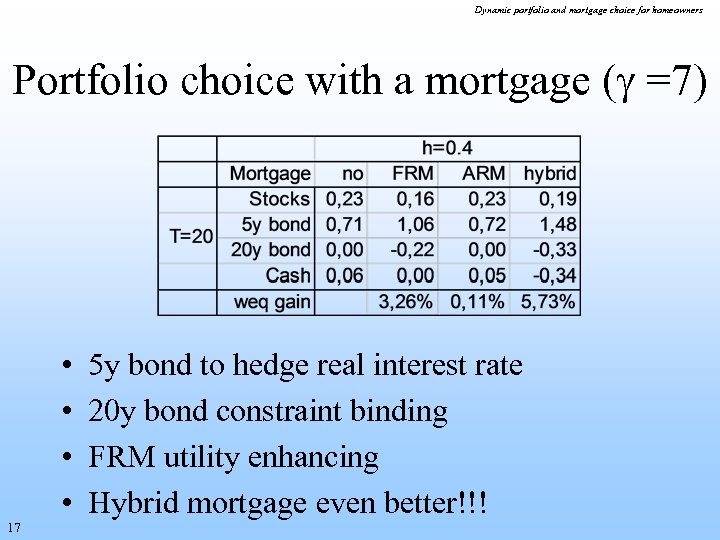

Dynamic portfolio and mortgage choice for homeowners Portfolio choice with a mortgage ( =7) 17 • • 5 y bond to hedge real interest rate 20 y bond constraint binding FRM utility enhancing Hybrid mortgage even better!!!

Dynamic portfolio and mortgage choice for homeowners Portfolio choice with a mortgage ( =7) 17 • • 5 y bond to hedge real interest rate 20 y bond constraint binding FRM utility enhancing Hybrid mortgage even better!!!

Dynamic portfolio and mortgage choice for homeowners Main findings • Unconstrained investor: closed-form solution – Mean-variance tangency portfolio – Portfolio hedging real interest rate (/inflation) risk – Portfolio hedging house price risk – Leverage financial positions to get desired risk exposure total (financial + housing) wealth – Weights depend on effective housing wealth • Constrained investor 18 – ARM alleviates short-sale constraint on cash – FRM alleviates short-sale constraint on 20 y bond – Risk-tolerant homeowner chooses ARM – Risk-averse homeowner chooses FRM (or hybrid)

Dynamic portfolio and mortgage choice for homeowners Main findings • Unconstrained investor: closed-form solution – Mean-variance tangency portfolio – Portfolio hedging real interest rate (/inflation) risk – Portfolio hedging house price risk – Leverage financial positions to get desired risk exposure total (financial + housing) wealth – Weights depend on effective housing wealth • Constrained investor 18 – ARM alleviates short-sale constraint on cash – FRM alleviates short-sale constraint on 20 y bond – Risk-tolerant homeowner chooses ARM – Risk-averse homeowner chooses FRM (or hybrid)