48f6f3faecb2e30ea8f70924f15672b5.ppt

- Количество слайдов: 15

Draft Only Business Advisory Services Financial Transformation Finance Leadership through Management Reporting Alon Levy, Ernst & Young Forum CFO April 07, 2008

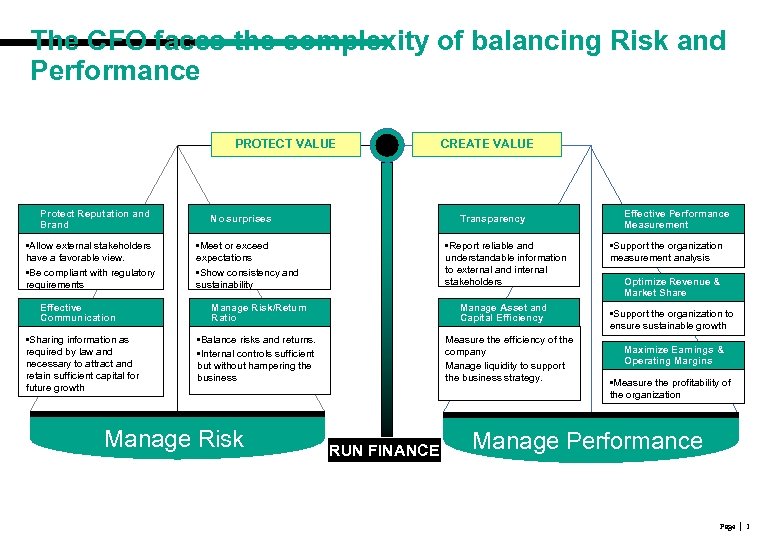

The CFO faces the complexity of balancing Risk and Performance PROTECT VALUE Protect Reputation and Brand • Allow external stakeholders have a favorable view. • Be compliant with regulatory requirements Effective Communication • Sharing information as required by law and necessary to attract and retain sufficient capital for future growth No surprises Transparency • Meet or exceed expectations • Show consistency and sustainability • Report reliable and understandable information to external and internal stakeholders Manage Risk/Return Ratio Manage Asset and Capital Efficiency • Balance risks and returns. • Internal controls sufficient but without hampering the business Manage Risk CREATE VALUE Measure the efficiency of the company Manage liquidity to support the business strategy. RUN FINANCE Effective Performance Measurement • Support the organization measurement analysis Optimize Revenue & Market Share • Support the organization to ensure sustainable growth Maximize Earnings & Operating Margins • Measure the profitability of the organization Manage Performance Page │ 1

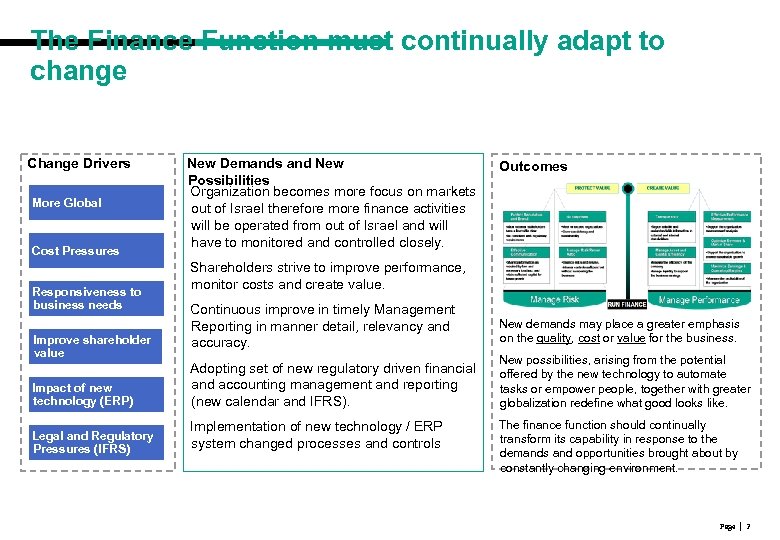

The Finance Function must continually adapt to change Change Drivers More Global Cost Pressures Responsiveness to business needs New Demands and New Possibilities Organization becomes more focus on markets out of Israel therefore more finance activities will be operated from out of Israel and will have to monitored and controlled closely. Outcomes Shareholders strive to improve performance, monitor costs and create value. Continuous improve in timely Management Reporting in manner detail, relevancy and accuracy. New demands may place a greater emphasis on the quality, cost or value for the business. Impact of new technology (ERP) Adopting set of new regulatory driven financial and accounting management and reporting (new calendar and IFRS). New possibilities, arising from the potential offered by the new technology to automate tasks or empower people, together with greater globalization redefine what good looks like. Legal and Regulatory Pressures (IFRS) Implementation of new technology / ERP system changed processes and controls Improve shareholder value The finance function should continually transform its capability in response to the demands and opportunities brought about by constantly changing environment. Page │ 2

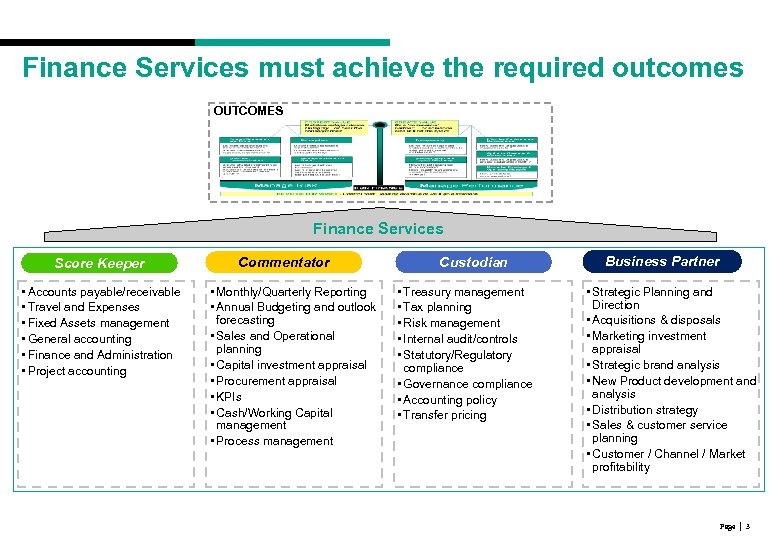

Finance Services must achieve the required outcomes OUTCOMES Finance Services Score Keeper • Accounts payable/receivable • Travel and Expenses • Fixed Assets management • General accounting • Finance and Administration • Project accounting Commentator • Monthly/Quarterly Reporting • Annual Budgeting and outlook forecasting • Sales and Operational planning • Capital investment appraisal • Procurement appraisal • KPIs • Cash/Working Capital management • Process management Custodian • Treasury management • Tax planning • Risk management • Internal audit/controls • Statutory/Regulatory compliance • Governance compliance • Accounting policy • Transfer pricing Business Partner • Strategic Planning and Direction • Acquisitions & disposals • Marketing investment appraisal • Strategic brand analysis • New Product development and analysis • Distribution strategy • Sales & customer service planning • Customer / Channel / Market profitability Page │ 3

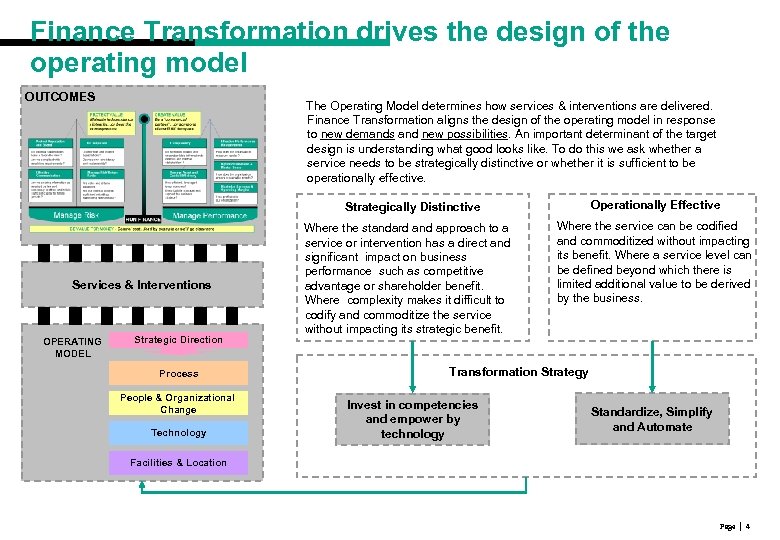

Finance Transformation drives the design of the operating model OUTCOMES The Operating Model determines how services & interventions are delivered. Finance Transformation aligns the design of the operating model in response to new demands and new possibilities. An important determinant of the target design is understanding what good looks like. To do this we ask whether a service needs to be strategically distinctive or whether it is sufficient to be operationally effective. Operationally Effective Strategically Distinctive Services & Interventions OPERATING MODEL Strategic Direction Process People & Organizational Change Technology Where the standard and approach to a service or intervention has a direct and significant impact on business performance such as competitive advantage or shareholder benefit. Where complexity makes it difficult to codify and commoditize the service without impacting its strategic benefit. Where the service can be codified and commoditized without impacting its benefit. Where a service level can be defined beyond which there is limited additional value to be derived by the business. Transformation Strategy Invest in competencies and empower by technology Standardize, Simplify and Automate Facilities & Location Page │ 4

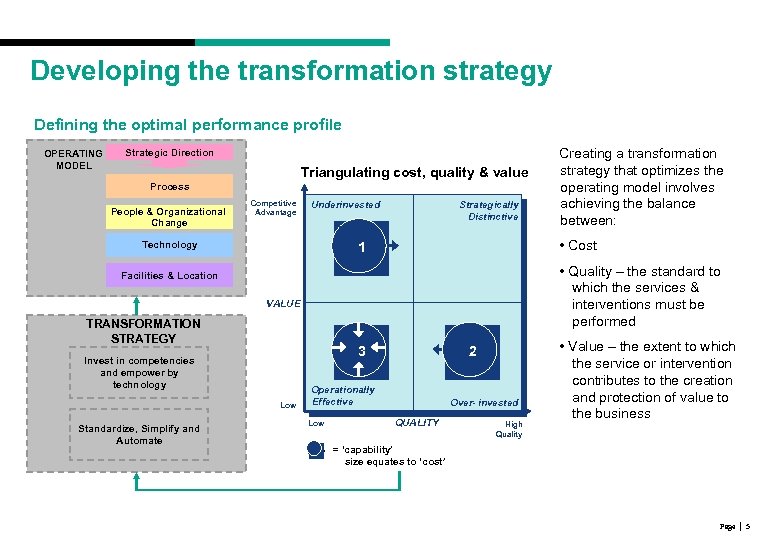

Developing the transformation strategy Defining the optimal performance profile OPERATING MODEL Strategic Direction Triangulating cost, quality & value Process People & Organizational Change Competitive Advantage Underinvested Strategically Distinctive • Cost 1 1 Technology • Quality – the standard to which the services & interventions must be performed Facilities & Location VALUE TRANSFORMATION STRATEGY 3 3 Invest in competencies and empower by technology Low Standardize, Simplify and Automate Creating a transformation strategy that optimizes the operating model involves achieving the balance between: 2 2 Operationally Effective Low Over- invested QUALITY High Quality • Value – the extent to which the service or intervention contributes to the creation and protection of value to the business = ‘capability’ size equates to ‘cost’ Page │ 5

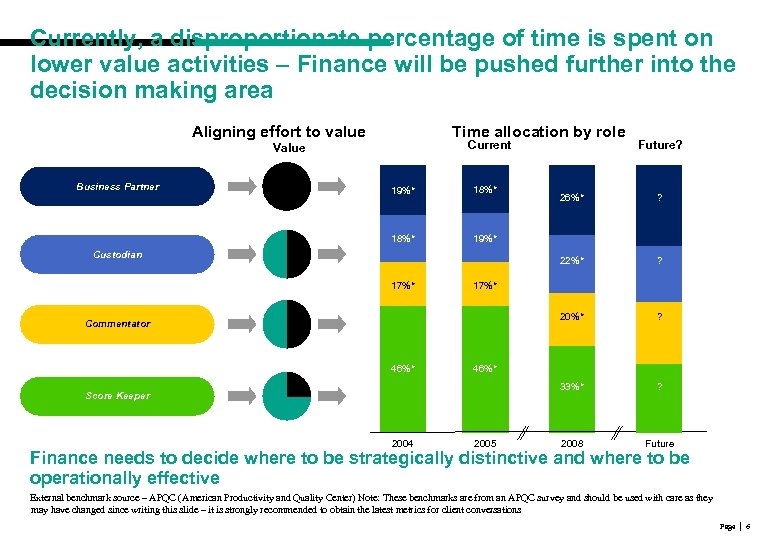

Currently, a disproportionate percentage of time is spent on lower value activities – Finance will be pushed further into the decision making area Aligning effort to value Time allocation by role Current Value Business Partner 19%* 18%* Future? 19%* 33%* ? 2008 Future 46%* Score Keeper 2004 ? 17%* Commentator 46%* ? 20%* 17%* ? 22%* Custodian 26%* 2005 Finance needs to decide where to be strategically distinctive and where to be operationally effective External benchmark source – APQC (American Productivity and Quality Center) Note: These benchmarks are from an APQC survey and should be used with care as they may have changed since writing this slide – it is strongly recommended to obtain the latest metrics for client conversations Page │ 6

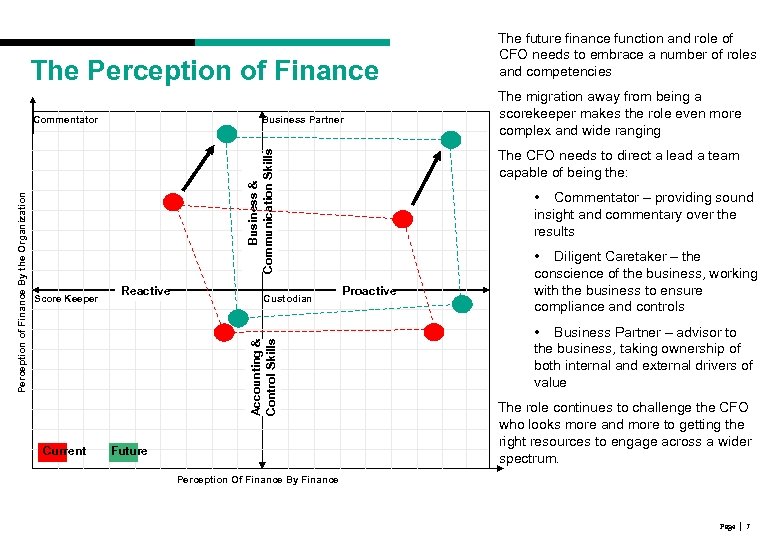

The Perception of Finance Business Partner Reactive Custodian Current Future The migration away from being a scorekeeper makes the role even more complex and wide ranging The CFO needs to direct a lead a team capable of being the: Business & Communication Skills Score Keeper Accounting & Control Skills Perception of Finance By the Organization Commentator The future finance function and role of CFO needs to embrace a number of roles and competencies • Commentator – providing sound insight and commentary over the results Proactive • Diligent Caretaker – the conscience of the business, working with the business to ensure compliance and controls • Business Partner – advisor to the business, taking ownership of both internal and external drivers of value The role continues to challenge the CFO who looks more and more to getting the right resources to engage across a wider spectrum. Perception Of Finance By Finance Page │ 7

The Main Components of the Operating Model • Processes ⁻ For the areas of data collection, data integration, calculations, allocations and data consolidation. • Rules ⁻ How do use the corporate rules in order to simplify processes of collection, integration, calculations, allocations, consolidation and reporting. • Information Technology ⁻ How to change, deploy and rollout information technology in order to assist the processes and the rules. • People ⁻ How to match the skills and experience to the roles and responsibilities of the processes, of the rules applications and the technology. • Organization ⁻ How to make sure that the organization structure of the finance and reporting divisions support the entire structure and systems. Page │ 8

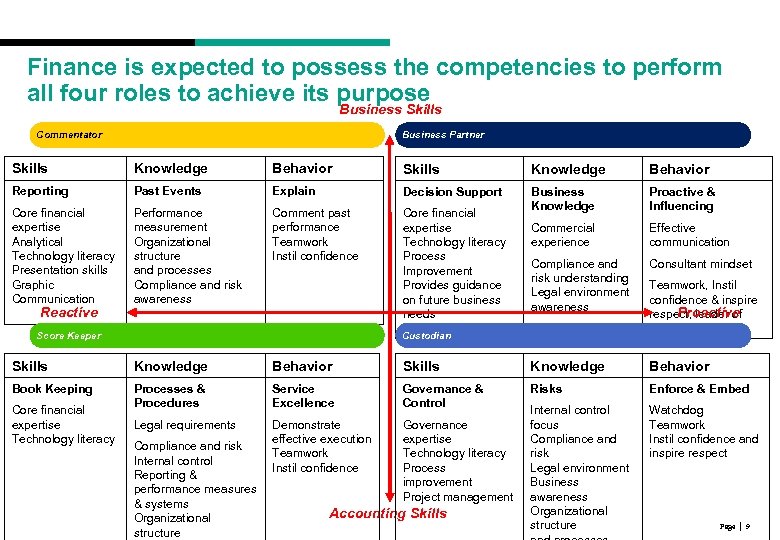

Finance is expected to possess the competencies to perform all four roles to achieve its purpose Business Skills Commentator Business Partner Skills Knowledge Behavior Reporting Past Events Explain Decision Support Core financial expertise Analytical Technology literacy Presentation skills Graphic Communication Performance measurement Organizational structure and processes Compliance and risk awareness Comment past performance Teamwork Instil confidence Core financial expertise Technology literacy Process Improvement Provides guidance on future business needs Project management Business Knowledge Proactive & Influencing Commercial experience Effective communication Compliance and risk understanding Legal environment awareness Consultant mindset Reactive Score Keeper Custodian Teamwork, Instil confidence & inspire Proactive respect, leader of change Skills Knowledge Behavior Book Keeping Processes & Procedures Service Excellence Governance & Control Risks Enforce & Embed Legal requirements Demonstrate effective execution Teamwork Instil confidence Governance expertise Technology literacy Process improvement Project management Internal control focus Compliance and risk Legal environment Business awareness Organizational structure Watchdog Teamwork Instil confidence and inspire respect Core financial expertise Technology literacy Compliance and risk Internal control Reporting & performance measures & systems Organizational structure Accounting Skills Page │ 9

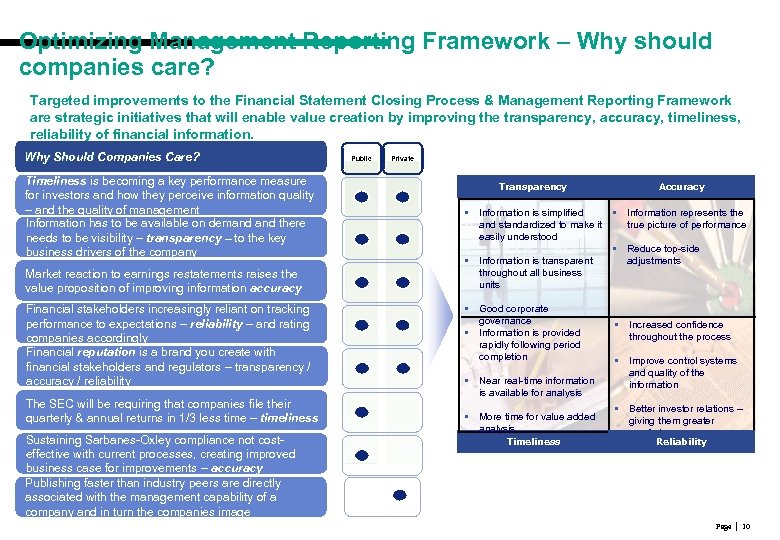

Optimizing Management Reporting Framework – Why should companies care? Targeted improvements to the Financial Statement Closing Process & Management Reporting Framework are strategic initiatives that will enable value creation by improving the transparency, accuracy, timeliness, reliability of financial information. Why Should Companies Care? Timeliness is becoming a key performance measure for investors and how they perceive information quality – and the quality of management Information has to be available on demand there needs to be visibility – transparency – to the key business drivers of the company Market reaction to earnings restatements raises the value proposition of improving information accuracy Financial stakeholders increasingly reliant on tracking performance to expectations – reliability – and rating companies accordingly Financial reputation is a brand you create with financial stakeholders and regulators – transparency / accuracy / reliability The SEC will be requiring that companies file their quarterly & annual returns in 1/3 less time – timeliness Sustaining Sarbanes-Oxley compliance not costeffective with current processes, creating improved business case for improvements – accuracy Publishing faster than industry peers are directly associated with the management capability of a company and in turn the companies image Public Private Transparency Accuracy • Information is simplified and standardized to make it easily understood • Information represents the true picture of performance • Information is transparent throughout all business units • Good corporate governance • Information is provided rapidly following period completion • Near real-time information is available for analysis • More time for value added analysis Timeliness • Reduce top-side adjustments • Increased confidence throughout the process • Improve control systems and quality of the information • Better investor relations – giving them greater comfort Reliability Page │ 10

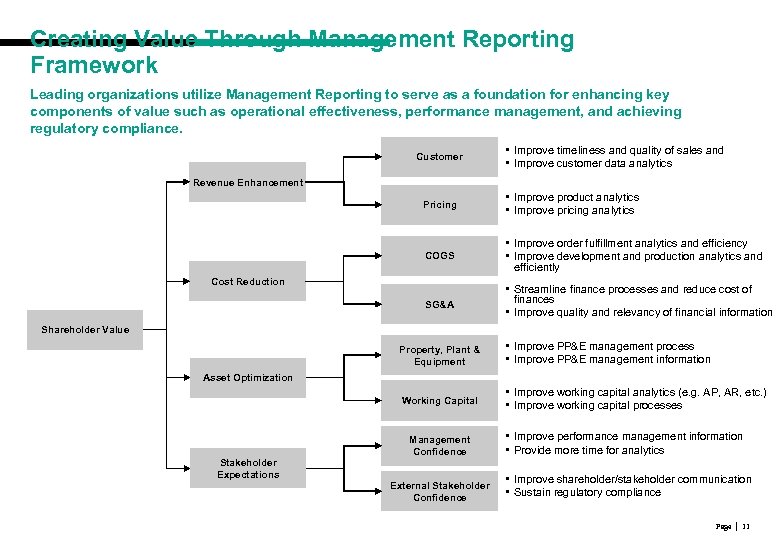

Creating Value Through Management Reporting Framework Leading organizations utilize Management Reporting to serve as a foundation for enhancing key components of value such as operational effectiveness, performance management, and achieving regulatory compliance. Customer • Improve timeliness and quality of sales and • Improve customer data analytics Revenue Enhancement Pricing • Improve product analytics • Improve pricing analytics COGS • Improve order fulfillment analytics and efficiency • Improve development and production analytics and efficiently SG&A • Streamline finance processes and reduce cost of finances • Improve quality and relevancy of financial information Cost Reduction Shareholder Value Property, Plant & Equipment • Improve PP&E management process • Improve PP&E management information Working Capital • Improve working capital analytics (e. g. AP, AR, etc. ) • Improve working capital processes Asset Optimization Stakeholder Expectations Management Confidence External Stakeholder Confidence • Improve performance management information • Provide more time for analytics • Improve shareholder/stakeholder communication • Sustain regulatory compliance Page │ 11

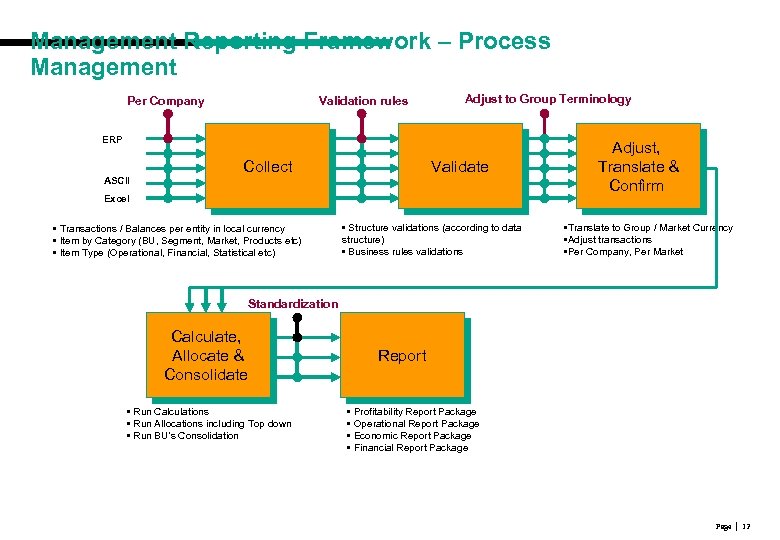

Management Reporting Framework – Process Management Per Company Validation rules Adjust to Group Terminology ERP ASCII Collect Validate Excel • Transactions / Balances per entity in local currency • Item by Category (BU, Segment, Market, Products etc) • Item Type (Operational, Financial, Statistical etc) • Structure validations (according to data structure) • Business rules validations Adjust, Translate & Confirm • Translate to Group / Market Currency • Adjust transactions • Per Company, Per Market Standardization Calculate, Allocate & Consolidate • Run Calculations • Run Allocations including Top down • Run BU’s Consolidation Report • Profitability Report Package • Operational Report Package • Economic Report Package • Financial Report Package Page │ 12

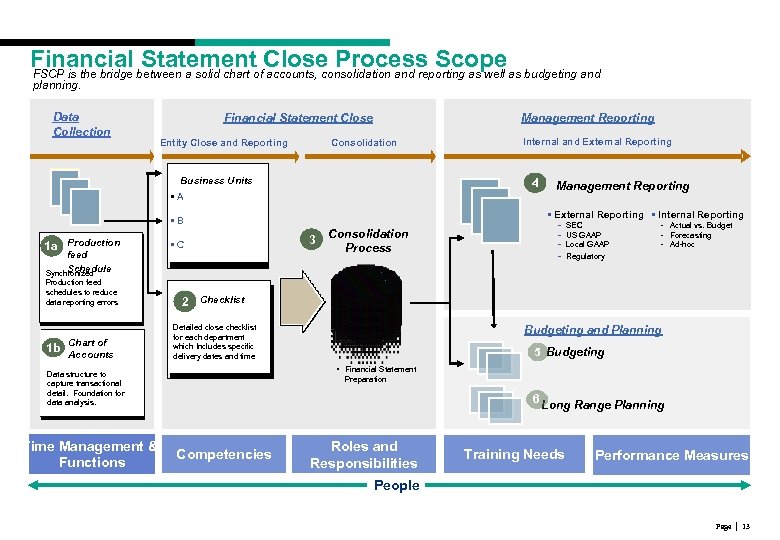

Financial between a solid chart of. Close Process Scope as budgeting and Statement accounts, consolidation and reporting as well FSCP is the bridge planning. Business Data Processes Collection Stable Production Feed Schedule Financial Statement Close Entity Close. Check. Reporting Close and Lists Management Reporting Consolidation Business Units 4 • § A A Production feed Synchronized schedules to reduce data production feed reporting errors schedules to minimize data reporting errors 1 b 1 b Chart of of Chart Accounts Data structure to capture transactional capture detail. Foundation for transactional data analysis. Consolidation 3 3 Process • § C C §D Statutory Reporting SEC US GAAP Reporting Regulatory - Local GAAP § Tax - Regulatory §§- - Actual vs. Budget - Forecasting - Ad-hoc §E • 2 Checklist Detailed closefor each checklist for each department which Includes specific includes specific delivery dates and time Consolidated Financial Information • Financial Statement Preparation • Financial Statement Preparation Budgeting and Planning 5 Budgeting 6 Long Range Planning detail. Foundation for data analysis Time Management & Functions 4 Management Reporting § • External Reporting • Internal Reporting • § B B 1 a Production feed Schedule schedule Synchronized Internal and External Reporting Competencies Roles and Responsibilities Training Needs Performance Measures People Page │ 13

ERNST & YOUNG © 2007 Ernst & Young All Rights Reserved.

48f6f3faecb2e30ea8f70924f15672b5.ppt