a2c3890908edf84a18cb0fc3396bb7e5.ppt

- Количество слайдов: 59

DRAFT NATIONAL PORT MASTERPLAN 2011 - 2030 Progress and Ideas – 09 August 2011

DRAFT NATIONAL PORT MASTERPLAN 2011 - 2030 Progress and Ideas – 09 August 2011

DRAFT MOT MINISTER REGULATION ON A NATIONAL PORT MASTER PLAN (NPMP) CONSIDERING THAT: a. Article 71, Shipping Law No. 17 the year of 2008 and Article 7, 8, and 9 of Government Regulation No 61, the year of 2009 regarding Ports provide that NPMP shall be formulated b. Based on Article 71 para (4) of the Shipping Law, NPMP shall be decided by the Minister c. Taking into consideration to the statements as described in a and b above, the NPMP is needed to be stipulated in Minister of Transport Regulation REFERRING TO: 1. Shipping Law No. 17 the year of 2008 2. Government Regulation No. 61 the year of 2009 regarding Ports 3. President Regulation No 47 the Year of 2009 regarding Establishment and Organization of State Ministers 4. Minister of Transport Regulation No KM 43 the Year of 2005 regarding Organization, and Working Arrangement of the Ministry of Transport as ammended with Minister of Transport Regulation No 20 the yaer of 2008 Has decided to stipulate: Minister of Transport Regulation regarding NMPM Article 1 NPMP containing National Port Policy and Port Location Plan and Port Hiearchy is an intergrated part of National Port System Article 2 NPMP provides guidance for stipulating port location, construction, operation and development, and arrangement of a Port Master Plan The NPMP is developed with consideration of: National Spatial Plan, Provincial Spatial Plan, and Local Spatial Plan Potential for regional economic and socio economic development Potential for natural resource development Development of the strategic environment, either domestic or international Article 3 The NPMP is stipulated for a period of 20 years and should be reviewed and updated every 5 years If there is a change in the strategic environment, the NPMP may be reviewed more than once every years Revision of the NPMP may be made based on the five years evaluation The contain of NPMP is elaborated as described in the Attachment Article 4 Director General of Sea Transport shall supervise and take further action needed to implement the NPMP Article 5 This Regulation shall take into effect as the date of enactment. To promulgate this law to the public, it is hereby ordered to announce the enactment of this Minister of Transport Regulation by placing it in the State Gazette of the Republic Indonesia Stipulated in Jakarta on the dated of . . . 2011 Minister of Transport Freddy Numberi 2

DRAFT MOT MINISTER REGULATION ON A NATIONAL PORT MASTER PLAN (NPMP) CONSIDERING THAT: a. Article 71, Shipping Law No. 17 the year of 2008 and Article 7, 8, and 9 of Government Regulation No 61, the year of 2009 regarding Ports provide that NPMP shall be formulated b. Based on Article 71 para (4) of the Shipping Law, NPMP shall be decided by the Minister c. Taking into consideration to the statements as described in a and b above, the NPMP is needed to be stipulated in Minister of Transport Regulation REFERRING TO: 1. Shipping Law No. 17 the year of 2008 2. Government Regulation No. 61 the year of 2009 regarding Ports 3. President Regulation No 47 the Year of 2009 regarding Establishment and Organization of State Ministers 4. Minister of Transport Regulation No KM 43 the Year of 2005 regarding Organization, and Working Arrangement of the Ministry of Transport as ammended with Minister of Transport Regulation No 20 the yaer of 2008 Has decided to stipulate: Minister of Transport Regulation regarding NMPM Article 1 NPMP containing National Port Policy and Port Location Plan and Port Hiearchy is an intergrated part of National Port System Article 2 NPMP provides guidance for stipulating port location, construction, operation and development, and arrangement of a Port Master Plan The NPMP is developed with consideration of: National Spatial Plan, Provincial Spatial Plan, and Local Spatial Plan Potential for regional economic and socio economic development Potential for natural resource development Development of the strategic environment, either domestic or international Article 3 The NPMP is stipulated for a period of 20 years and should be reviewed and updated every 5 years If there is a change in the strategic environment, the NPMP may be reviewed more than once every years Revision of the NPMP may be made based on the five years evaluation The contain of NPMP is elaborated as described in the Attachment Article 4 Director General of Sea Transport shall supervise and take further action needed to implement the NPMP Article 5 This Regulation shall take into effect as the date of enactment. To promulgate this law to the public, it is hereby ordered to announce the enactment of this Minister of Transport Regulation by placing it in the State Gazette of the Republic Indonesia Stipulated in Jakarta on the dated of . . . 2011 Minister of Transport Freddy Numberi 2

Draft Outline Attachment: REGULATION OF MOT MINISTER ON A NATIONAL PORT MASTER PLAN LAMPIRAN : PERMENHUB NO ---- NOPEMBER 2011 PERATURAN MENTERI PERHUBUNGAN TENTANG: RENCANA INDUK PELABUHAN NASIONAL 1. INTRODUCTION 1. 1. Vision of National Port Master plan 1. 2. Target 2030 2. PRESENT/CURRENT PORT CONDITIONS 2. 1. Policy Framework 2. 2. Port Traffic, Facilities and Operations 3

Draft Outline Attachment: REGULATION OF MOT MINISTER ON A NATIONAL PORT MASTER PLAN LAMPIRAN : PERMENHUB NO ---- NOPEMBER 2011 PERATURAN MENTERI PERHUBUNGAN TENTANG: RENCANA INDUK PELABUHAN NASIONAL 1. INTRODUCTION 1. 1. Vision of National Port Master plan 1. 2. Target 2030 2. PRESENT/CURRENT PORT CONDITIONS 2. 1. Policy Framework 2. 2. Port Traffic, Facilities and Operations 3

(2) LAMPIRAN : PERMENHUB 3. NATIONAL PORT POLICY 4. FUTURE PORT DEVELOPMENT 4. 1. Strategic Environment 4. 2. Forecast of Indonesia Port Traffic 4

(2) LAMPIRAN : PERMENHUB 3. NATIONAL PORT POLICY 4. FUTURE PORT DEVELOPMENT 4. 1. Strategic Environment 4. 2. Forecast of Indonesia Port Traffic 4

(3) LAMPIRAN : PERMENHUB 5. PORT DEVELOPMENT IMPLEMENTATION PLAN 5. 1. National Port Development Implementation Plan 5. 2. Collector and Feeder Port Implementation Plan 5. 3. Human Resources and Institutional Development 5. 4. Technology Development for Port Management and Operation 5. 5. Port Development Investments 6. CLOSING STATEMENT 5

(3) LAMPIRAN : PERMENHUB 5. PORT DEVELOPMENT IMPLEMENTATION PLAN 5. 1. National Port Development Implementation Plan 5. 2. Collector and Feeder Port Implementation Plan 5. 3. Human Resources and Institutional Development 5. 4. Technology Development for Port Management and Operation 5. 5. Port Development Investments 6. CLOSING STATEMENT 5

CHAPTER 1 : INTRODUCTION 1. 1. Vision of National Port Master plan 1. 2. Target 2030 6

CHAPTER 1 : INTRODUCTION 1. 1. Vision of National Port Master plan 1. 2. Target 2030 6

Vision of NPMP The vision is to create a strong economic base that provides port planning and development, in particular as regards with connecting reinventing of port management in Indonesia including empowering port authorities competencies, clear direction and strengthen the main economic drivers and diversify into new sectors /main commodities, inclusive connect more developed regions to lagging regions and achieve sustainable development and targeted economic and social development measures. 7

Vision of NPMP The vision is to create a strong economic base that provides port planning and development, in particular as regards with connecting reinventing of port management in Indonesia including empowering port authorities competencies, clear direction and strengthen the main economic drivers and diversify into new sectors /main commodities, inclusive connect more developed regions to lagging regions and achieve sustainable development and targeted economic and social development measures. 7

Target 2030 The 2030 vision encompasses “. . . a national port system that will contribute to consistently reducing international and domestic transport costs” by: – Being able to accommodate the ships that will provide the lowest seafreight costs – Serving ships promptly and effectively without causing undue delay – Ensuring high levels of cargo handling productivity – Optimizing the cost of port service delivery” By 2030, 16 of Indonesia’s main container ports will need to provide additional capacity. This includes accommodation for 9. 4 million TEU at Tanjung Priok, 4. 3 million TEU at Tanjung Perak, 1. 9 million TEU at Belawan/Kuala Tanjung and 0. 9 million TEU at Makassar. 8

Target 2030 The 2030 vision encompasses “. . . a national port system that will contribute to consistently reducing international and domestic transport costs” by: – Being able to accommodate the ships that will provide the lowest seafreight costs – Serving ships promptly and effectively without causing undue delay – Ensuring high levels of cargo handling productivity – Optimizing the cost of port service delivery” By 2030, 16 of Indonesia’s main container ports will need to provide additional capacity. This includes accommodation for 9. 4 million TEU at Tanjung Priok, 4. 3 million TEU at Tanjung Perak, 1. 9 million TEU at Belawan/Kuala Tanjung and 0. 9 million TEU at Makassar. 8

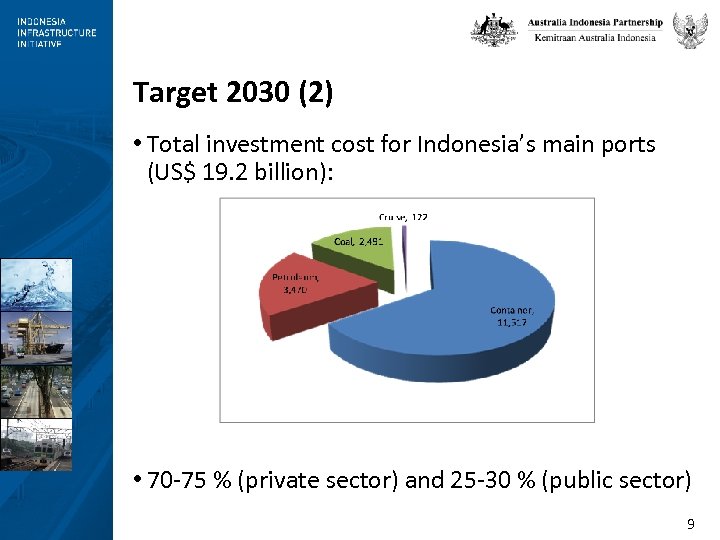

Target 2030 (2) • Total investment cost for Indonesia’s main ports (US$ 19. 2 billion): • 70 -75 % (private sector) and 25 -30 % (public sector) 9

Target 2030 (2) • Total investment cost for Indonesia’s main ports (US$ 19. 2 billion): • 70 -75 % (private sector) and 25 -30 % (public sector) 9

CHAPTER 2 : PRESENT/CURRENT PORT CONDITIONS 2. 1. Policy Framework 2. 2. Port Traffic, Facilities and Operations 10

CHAPTER 2 : PRESENT/CURRENT PORT CONDITIONS 2. 1. Policy Framework 2. 2. Port Traffic, Facilities and Operations 10

Policy Framework • Shipping Law No. 17/2008 and GR 61/2009 • Masterplan of acceleration and expansion of Indonesia economic development/ Indonesia economic corridor (MP 3 EI) • National Transportation System (SISTRANAS) • Blueprint of Intermoda/Multimoda Transport KM 15/2010 • Blueprint National Logistics System (Draft) • National Spatial Plan Act No. 26/2008 • Economic Zone of Industries (KEK) Act. No. 39/2009 • Investment of Capital Act. No. 25/2007 • Fairness of Competation Act. No. 5/1999 • Regional Government Act. No. 32/2004 • National Development Planning (RPJM, RPJP) • Presidential Regulation No. 67/2005 and 13/2010 (PPP) • International Conventions related to port affair 11

Policy Framework • Shipping Law No. 17/2008 and GR 61/2009 • Masterplan of acceleration and expansion of Indonesia economic development/ Indonesia economic corridor (MP 3 EI) • National Transportation System (SISTRANAS) • Blueprint of Intermoda/Multimoda Transport KM 15/2010 • Blueprint National Logistics System (Draft) • National Spatial Plan Act No. 26/2008 • Economic Zone of Industries (KEK) Act. No. 39/2009 • Investment of Capital Act. No. 25/2007 • Fairness of Competation Act. No. 5/1999 • Regional Government Act. No. 32/2004 • National Development Planning (RPJM, RPJP) • Presidential Regulation No. 67/2005 and 13/2010 (PPP) • International Conventions related to port affair 11

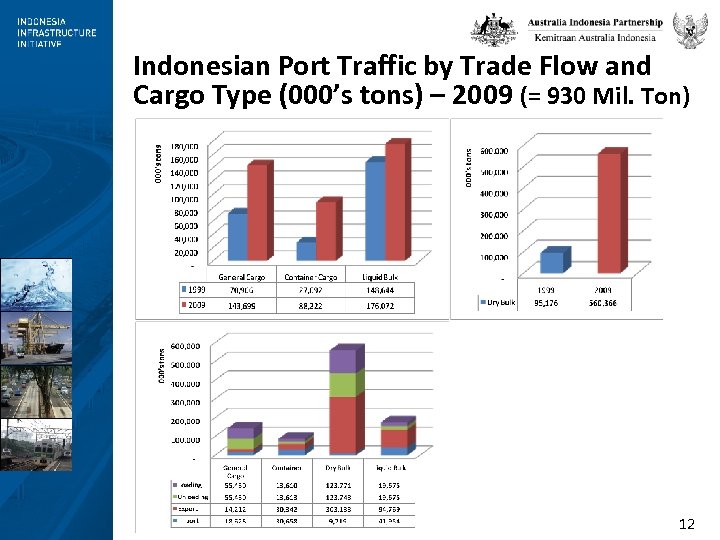

Indonesian Port Traffic by Trade Flow and Cargo Type (000’s tons) – 2009 (= 930 Mil. Ton) 12

Indonesian Port Traffic by Trade Flow and Cargo Type (000’s tons) – 2009 (= 930 Mil. Ton) 12

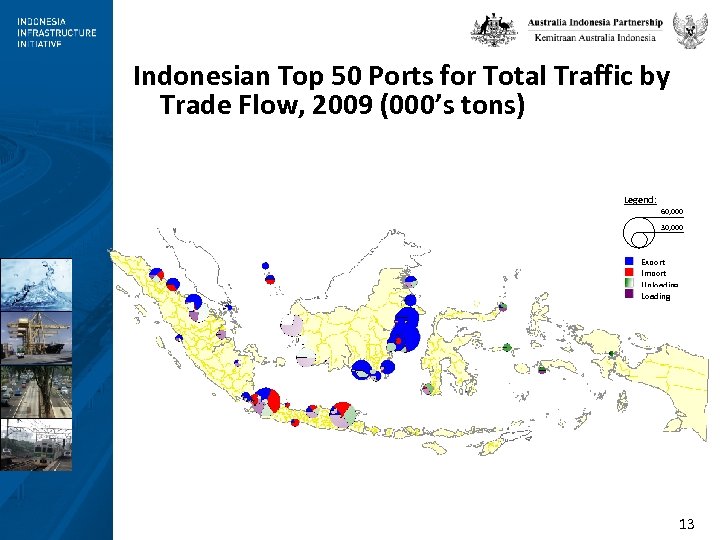

Indonesian Top 50 Ports for Total Traffic by Trade Flow, 2009 (000’s tons) Legend: 60, 000 30, 000 Export Import Unloading Loading 13

Indonesian Top 50 Ports for Total Traffic by Trade Flow, 2009 (000’s tons) Legend: 60, 000 30, 000 Export Import Unloading Loading 13

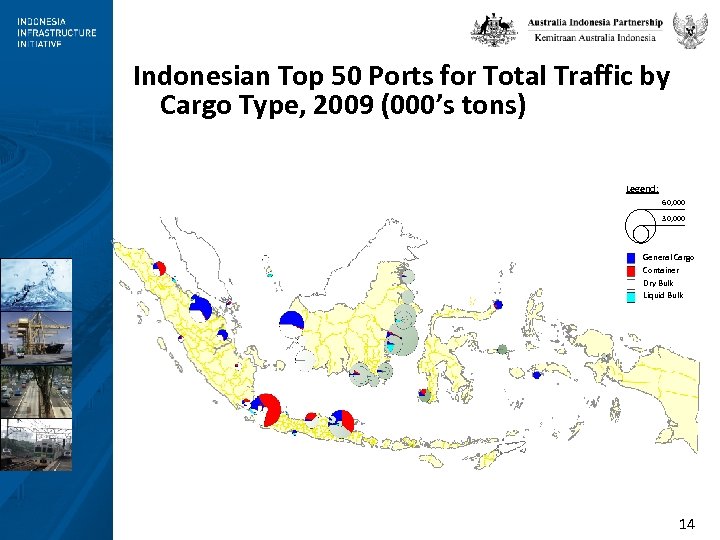

Indonesian Top 50 Ports for Total Traffic by Cargo Type, 2009 (000’s tons) Legend: 60, 000 30, 000 General Cargo Container Dry Bulk Liquid Bulk 14

Indonesian Top 50 Ports for Total Traffic by Cargo Type, 2009 (000’s tons) Legend: 60, 000 30, 000 General Cargo Container Dry Bulk Liquid Bulk 14

CHAPTER 3 : NATIONAL PORT POLICY 15

CHAPTER 3 : NATIONAL PORT POLICY 15

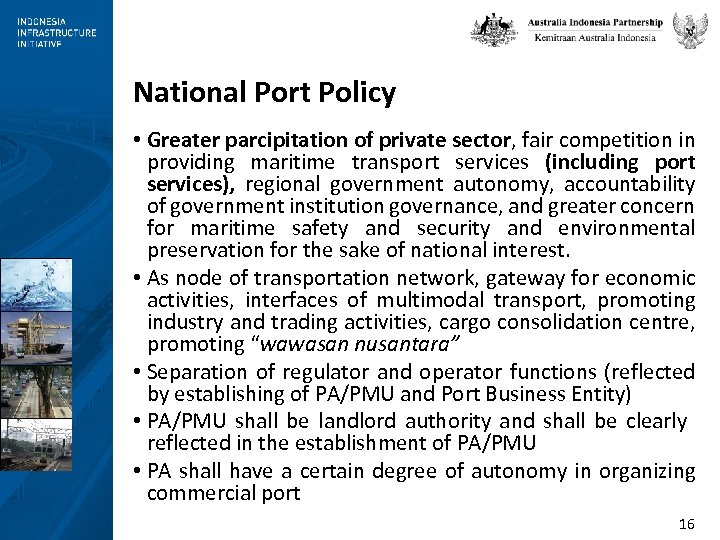

National Port Policy • Greater parcipitation of private sector, fair competition in providing maritime transport services (including port services), regional government autonomy, accountability of government institution governance, and greater concern for maritime safety and security and environmental preservation for the sake of national interest. • As node of transportation network, gateway for economic activities, interfaces of multimodal transport, promoting industry and trading activities, cargo consolidation centre, promoting “wawasan nusantara” • Separation of regulator and operator functions (reflected by establishing of PA/PMU and Port Business Entity) • PA/PMU shall be landlord authority and shall be clearly reflected in the establishment of PA/PMU • PA shall have a certain degree of autonomy in organizing commercial port 16

National Port Policy • Greater parcipitation of private sector, fair competition in providing maritime transport services (including port services), regional government autonomy, accountability of government institution governance, and greater concern for maritime safety and security and environmental preservation for the sake of national interest. • As node of transportation network, gateway for economic activities, interfaces of multimodal transport, promoting industry and trading activities, cargo consolidation centre, promoting “wawasan nusantara” • Separation of regulator and operator functions (reflected by establishing of PA/PMU and Port Business Entity) • PA/PMU shall be landlord authority and shall be clearly reflected in the establishment of PA/PMU • PA shall have a certain degree of autonomy in organizing commercial port 16

National Port Policy (2) • Increasing PSP under fair competition environment • PSP could be in term of PPP through concession agreement or other form of cooperation with PA/PMU • Restructure the status of Pelindo versus the role of PA landlord organisations and as regulators • Clear guidelines on the formulation of operational regulations by PA/PMU • The Ministry develops port policies related to: – Planning and development of basic infrastructure including port entrances, lighthouses, aid to navigation, port basin, and breakwater – Planning and development of ports (location, function, type of management – Planning and development of port hinterland connection • Procedure of new port development (greenfield) and new public terminal shall be clearly formulated 17

National Port Policy (2) • Increasing PSP under fair competition environment • PSP could be in term of PPP through concession agreement or other form of cooperation with PA/PMU • Restructure the status of Pelindo versus the role of PA landlord organisations and as regulators • Clear guidelines on the formulation of operational regulations by PA/PMU • The Ministry develops port policies related to: – Planning and development of basic infrastructure including port entrances, lighthouses, aid to navigation, port basin, and breakwater – Planning and development of ports (location, function, type of management – Planning and development of port hinterland connection • Procedure of new port development (greenfield) and new public terminal shall be clearly formulated 17

CHAPTER 4 : FUTURE PORT DEVELOPMENT 4. 1. Strategic Environment 4. 2. Forecast of Indonesia Port Traffic 18

CHAPTER 4 : FUTURE PORT DEVELOPMENT 4. 1. Strategic Environment 4. 2. Forecast of Indonesia Port Traffic 18

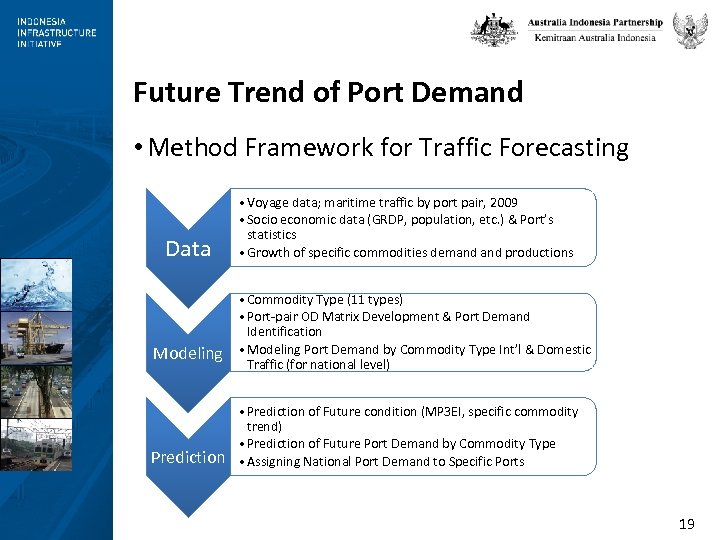

Future Trend of Port Demand • Method Framework for Traffic Forecasting Data Modeling Prediction • Voyage data; maritime traffic by port pair, 2009 • Socio economic data (GRDP, population, etc. ) & Port’s statistics • Growth of specific commodities demand productions • Commodity Type (11 types) • Port-pair OD Matrix Development & Port Demand Identification • Modeling Port Demand by Commodity Type Int’l & Domestic Traffic (for national level) • Prediction of Future condition (MP 3 EI, specific commodity trend) • Prediction of Future Port Demand by Commodity Type • Assigning National Port Demand to Specific Ports 19

Future Trend of Port Demand • Method Framework for Traffic Forecasting Data Modeling Prediction • Voyage data; maritime traffic by port pair, 2009 • Socio economic data (GRDP, population, etc. ) & Port’s statistics • Growth of specific commodities demand productions • Commodity Type (11 types) • Port-pair OD Matrix Development & Port Demand Identification • Modeling Port Demand by Commodity Type Int’l & Domestic Traffic (for national level) • Prediction of Future condition (MP 3 EI, specific commodity trend) • Prediction of Future Port Demand by Commodity Type • Assigning National Port Demand to Specific Ports 19

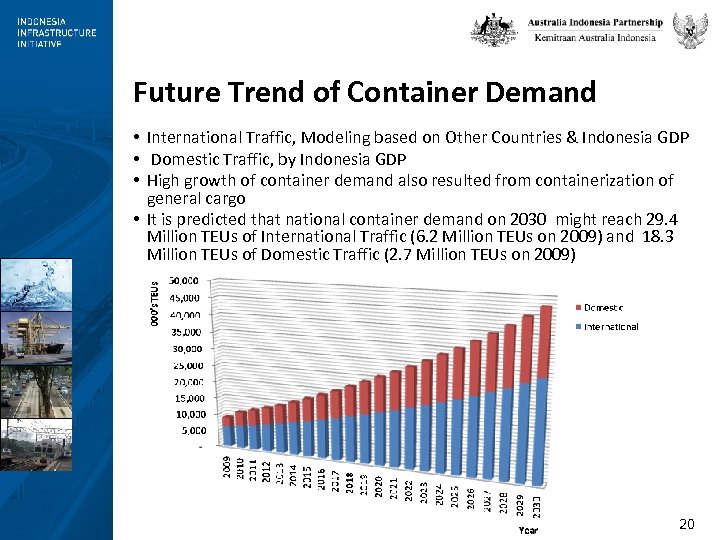

Future Trend of Container Demand • International Traffic, Modeling based on Other Countries & Indonesia GDP • Domestic Traffic, by Indonesia GDP • High growth of container demand also resulted from containerization of general cargo • It is predicted that national container demand on 2030 might reach 29. 4 Million TEUs of International Traffic (6. 2 Million TEUs on 2009) and 18. 3 Million TEUs of Domestic Traffic (2. 7 Million TEUs on 2009) 20

Future Trend of Container Demand • International Traffic, Modeling based on Other Countries & Indonesia GDP • Domestic Traffic, by Indonesia GDP • High growth of container demand also resulted from containerization of general cargo • It is predicted that national container demand on 2030 might reach 29. 4 Million TEUs of International Traffic (6. 2 Million TEUs on 2009) and 18. 3 Million TEUs of Domestic Traffic (2. 7 Million TEUs on 2009) 20

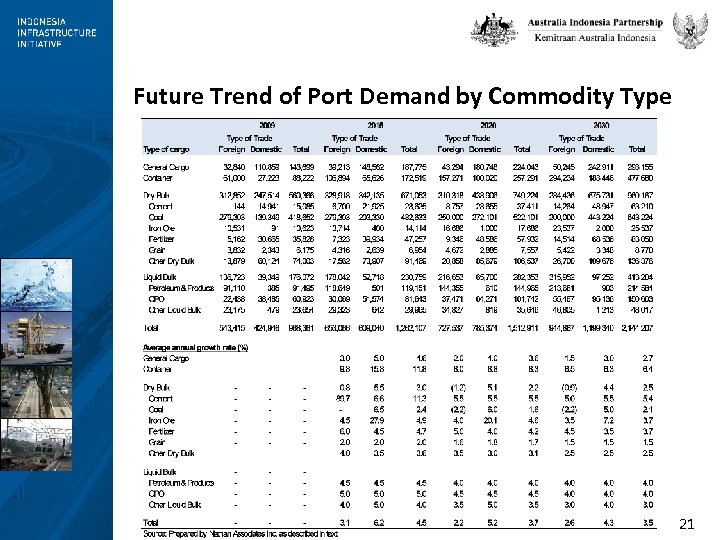

Future Trend of Port Demand by Commodity Type 21

Future Trend of Port Demand by Commodity Type 21

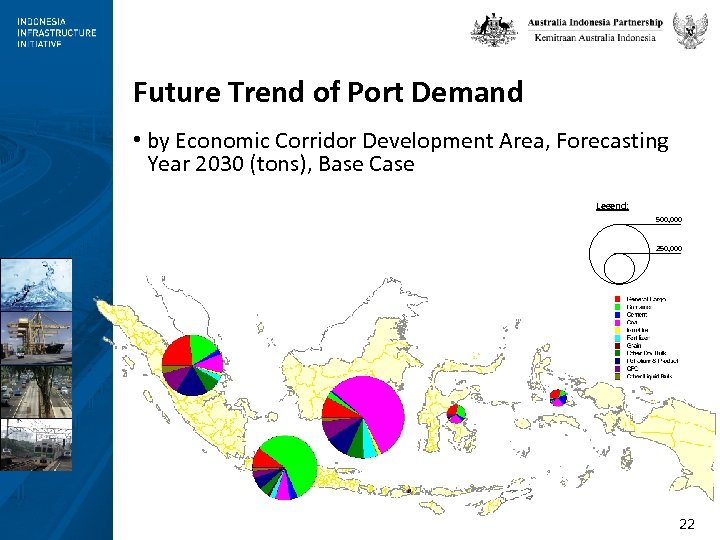

Future Trend of Port Demand • by Economic Corridor Development Area, Forecasting Year 2030 (tons), Base Case Legend: 500, 000 250, 000 22

Future Trend of Port Demand • by Economic Corridor Development Area, Forecasting Year 2030 (tons), Base Case Legend: 500, 000 250, 000 22

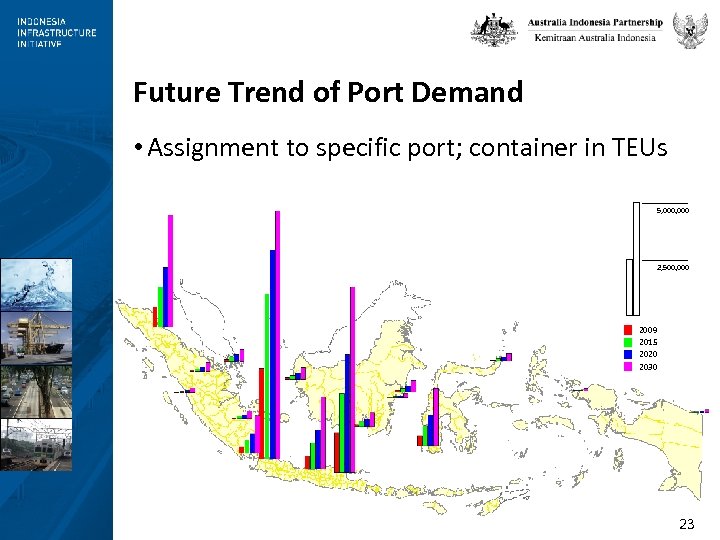

Future Trend of Port Demand • Assignment to specific port; container in TEUs 5, 000 2, 500, 000 2009 2015 2020 2030 23

Future Trend of Port Demand • Assignment to specific port; container in TEUs 5, 000 2, 500, 000 2009 2015 2020 2030 23

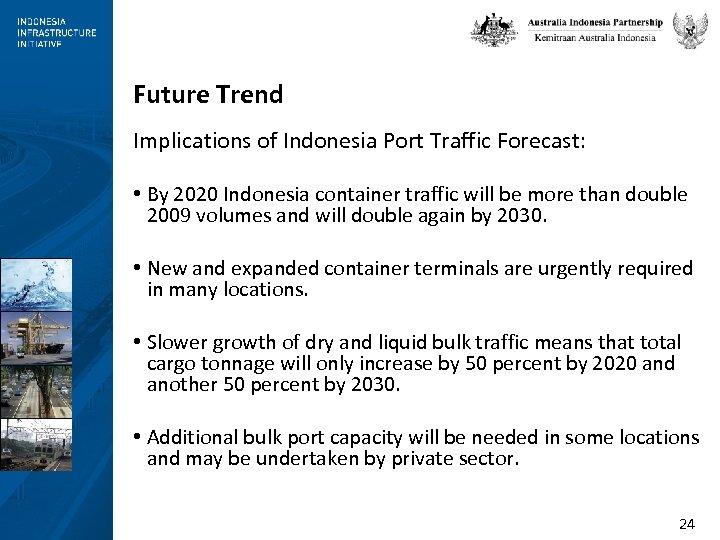

Future Trend Implications of Indonesia Port Traffic Forecast: • By 2020 Indonesia container traffic will be more than double 2009 volumes and will double again by 2030. • New and expanded container terminals are urgently required in many locations. • Slower growth of dry and liquid bulk traffic means that total cargo tonnage will only increase by 50 percent by 2020 and another 50 percent by 2030. • Additional bulk port capacity will be needed in some locations and may be undertaken by private sector. 24

Future Trend Implications of Indonesia Port Traffic Forecast: • By 2020 Indonesia container traffic will be more than double 2009 volumes and will double again by 2030. • New and expanded container terminals are urgently required in many locations. • Slower growth of dry and liquid bulk traffic means that total cargo tonnage will only increase by 50 percent by 2020 and another 50 percent by 2030. • Additional bulk port capacity will be needed in some locations and may be undertaken by private sector. 24

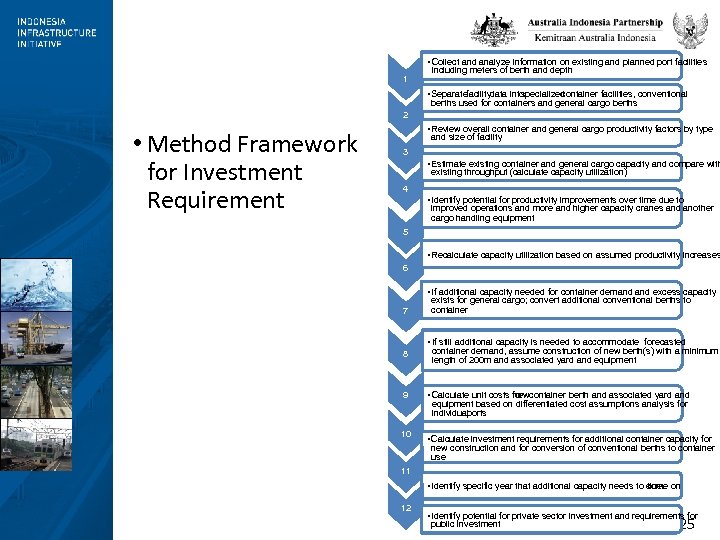

1 • Collect and analyze information on existing and planned port facilities including meters of berth and depth • Separatefacilitydata into specialized container facilities, conventional berths used for containers and general cargo berths 2 • Method Framework for Investment Requirement • Review overall container and general cargo productivity factors by type and size of facility 3 • Estimate existing container and general cargo capacity and compare with existing throughput (calculate capacity utilization) 4 • Identify potential for productivity improvements over time due to improved operations and more and higher capacity cranes and another cargo handling equipment 5 • Recalculate capacity utilization based on assumed productivity increases 6 7 8 9 10 • If additional capacity needed for container demand excess capacity exists for general cargo; convert additional conventional berths to container • If still additional capacity is needed to accommodate forecasted container demand, assume construction of new berth(s) with a minimum length of 200 m and associated yard and equipment • Calculate unit costs for container berth and associated yard and new equipment based on differentiated cost assumptions analysis for individual ports • Calculate investment requirements for additional container capacity for new construction and for conversion of conventional berths to container use 11 • Identify specific year that additional capacity needs to -line. on come 12 • Identify potential for private sector investment and requirements for public investment 25

1 • Collect and analyze information on existing and planned port facilities including meters of berth and depth • Separatefacilitydata into specialized container facilities, conventional berths used for containers and general cargo berths 2 • Method Framework for Investment Requirement • Review overall container and general cargo productivity factors by type and size of facility 3 • Estimate existing container and general cargo capacity and compare with existing throughput (calculate capacity utilization) 4 • Identify potential for productivity improvements over time due to improved operations and more and higher capacity cranes and another cargo handling equipment 5 • Recalculate capacity utilization based on assumed productivity increases 6 7 8 9 10 • If additional capacity needed for container demand excess capacity exists for general cargo; convert additional conventional berths to container • If still additional capacity is needed to accommodate forecasted container demand, assume construction of new berth(s) with a minimum length of 200 m and associated yard and equipment • Calculate unit costs for container berth and associated yard and new equipment based on differentiated cost assumptions analysis for individual ports • Calculate investment requirements for additional container capacity for new construction and for conversion of conventional berths to container use 11 • Identify specific year that additional capacity needs to -line. on come 12 • Identify potential for private sector investment and requirements for public investment 25

CHAPTER 5 : PORT DEVELOPMENT IMPLEMENTATION PLAN 5. 1. 5. 2. 5. 3. 5. 4. 5. 5. National Port Development Implementation Plan Collector and Feeder Port Implementation Plan Human Resources (Implementation Strategy for Continuous and Sustainable Training Program on Port Sector) and Institutional Development Technology Development for Port Management and Operation Port Development Investments (Investment Plan Direction) 26

CHAPTER 5 : PORT DEVELOPMENT IMPLEMENTATION PLAN 5. 1. 5. 2. 5. 3. 5. 4. 5. 5. National Port Development Implementation Plan Collector and Feeder Port Implementation Plan Human Resources (Implementation Strategy for Continuous and Sustainable Training Program on Port Sector) and Institutional Development Technology Development for Port Management and Operation Port Development Investments (Investment Plan Direction) 26

National Port Development Implementation Plan • Port Location and Development Needs in 2030 • Prioritized Actions for Connectivity and Port Infrastructure Development to Support the Program of Indonesia Economic Corridor 2030 a. Port Development Stage in the Short Term b. Port Development Stage in the Middle Term c. Port Development Stage in the Long Term 27

National Port Development Implementation Plan • Port Location and Development Needs in 2030 • Prioritized Actions for Connectivity and Port Infrastructure Development to Support the Program of Indonesia Economic Corridor 2030 a. Port Development Stage in the Short Term b. Port Development Stage in the Middle Term c. Port Development Stage in the Long Term 27

Collector and Feeder Port Development Implementation Plan The Divestiture Policy Implementation: • Port management capacity building (PMU, Local Government, DGST) • Funding capital repair and improvement by central government • Long term liabilities (maintenance including dredging) 28

Collector and Feeder Port Development Implementation Plan The Divestiture Policy Implementation: • Port management capacity building (PMU, Local Government, DGST) • Funding capital repair and improvement by central government • Long term liabilities (maintenance including dredging) 28

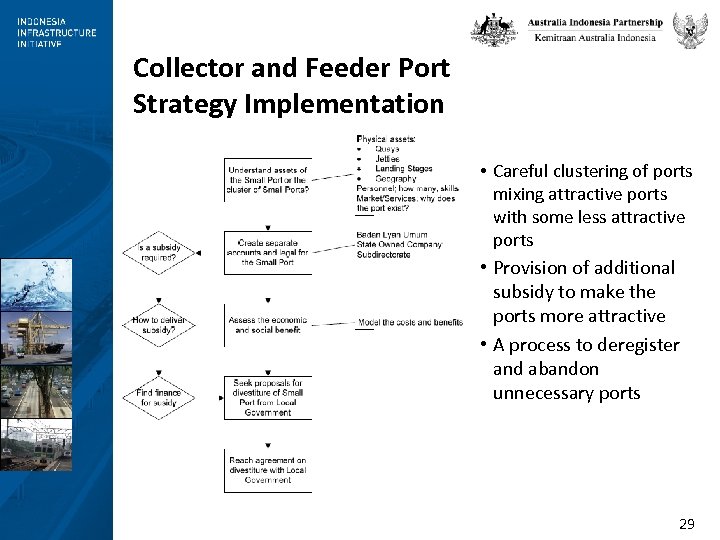

Collector and Feeder Port Strategy Implementation • Careful clustering of ports mixing attractive ports with some less attractive ports • Provision of additional subsidy to make the ports more attractive • A process to deregister and abandon unnecessary ports 29

Collector and Feeder Port Strategy Implementation • Careful clustering of ports mixing attractive ports with some less attractive ports • Provision of additional subsidy to make the ports more attractive • A process to deregister and abandon unnecessary ports 29

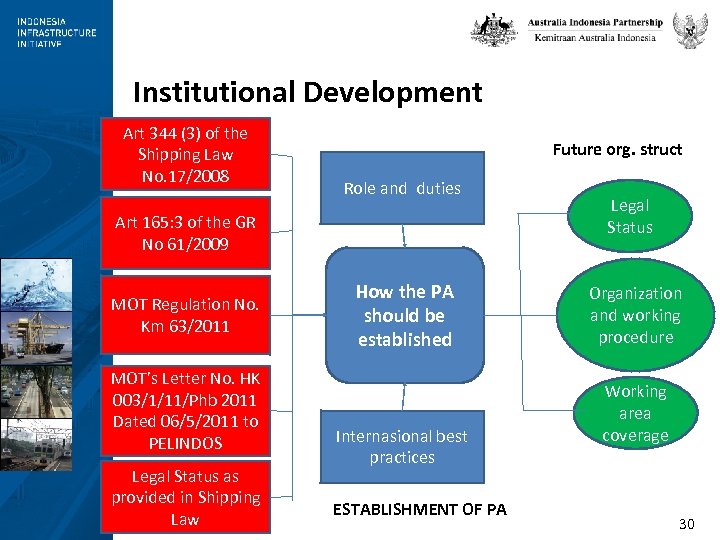

Institutional Development Art 344 (3) of the Shipping Law No. 17/2008 Future org. struct Role and duties Art 165: 3 of the GR No 61/2009 MOT Regulation No. Km 63/2011 MOT’s Letter No. HK 003/1/11/Phb 2011 Dated 06/5/2011 to PELINDOS Legal Status as provided in Shipping Law How the PA should be established Internasional best practices ESTABLISHMENT OF PA Legal Status Organization and working procedure Working area coverage 30

Institutional Development Art 344 (3) of the Shipping Law No. 17/2008 Future org. struct Role and duties Art 165: 3 of the GR No 61/2009 MOT Regulation No. Km 63/2011 MOT’s Letter No. HK 003/1/11/Phb 2011 Dated 06/5/2011 to PELINDOS Legal Status as provided in Shipping Law How the PA should be established Internasional best practices ESTABLISHMENT OF PA Legal Status Organization and working procedure Working area coverage 30

International Best Practices for Port Authority Organisation PA is characterized by creating automous PA which should be: • Financially independent • Have their own personnel scheme • Have a management that is responsible for and held accountable performance by board 31

International Best Practices for Port Authority Organisation PA is characterized by creating automous PA which should be: • Financially independent • Have their own personnel scheme • Have a management that is responsible for and held accountable performance by board 31

Legal Status of PA (as Provided in the Shipping Law) • Full Government Agency (Line agency operating port) • Its responsibilities directly goes to the Transport Minister • Its personnels are civil servant (PNS) • Its income serves as state income • Its Organization structure based on MENPAN Regulation PA/PMU as a landlord authority shall be clearly reflected in the establishment of PA/PMU 32

Legal Status of PA (as Provided in the Shipping Law) • Full Government Agency (Line agency operating port) • Its responsibilities directly goes to the Transport Minister • Its personnels are civil servant (PNS) • Its income serves as state income • Its Organization structure based on MENPAN Regulation PA/PMU as a landlord authority shall be clearly reflected in the establishment of PA/PMU 32

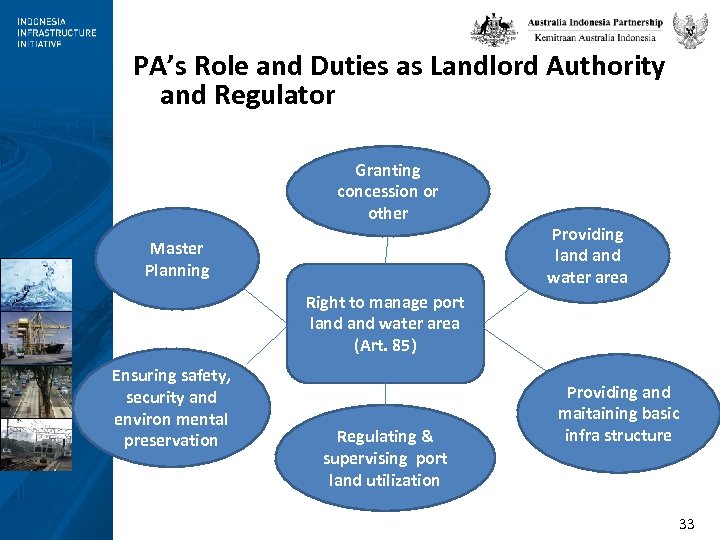

PA’s Role and Duties as Landlord Authority and Regulator Granting concession or other Master Planning Providing land water area Right to manage port land water area (Art. 85) Ensuring safety, security and environ mental preservation Regulating & supervising port land utilization Providing and maitaining basic infra structure 33

PA’s Role and Duties as Landlord Authority and Regulator Granting concession or other Master Planning Providing land water area Right to manage port land water area (Art. 85) Ensuring safety, security and environ mental preservation Regulating & supervising port land utilization Providing and maitaining basic infra structure 33

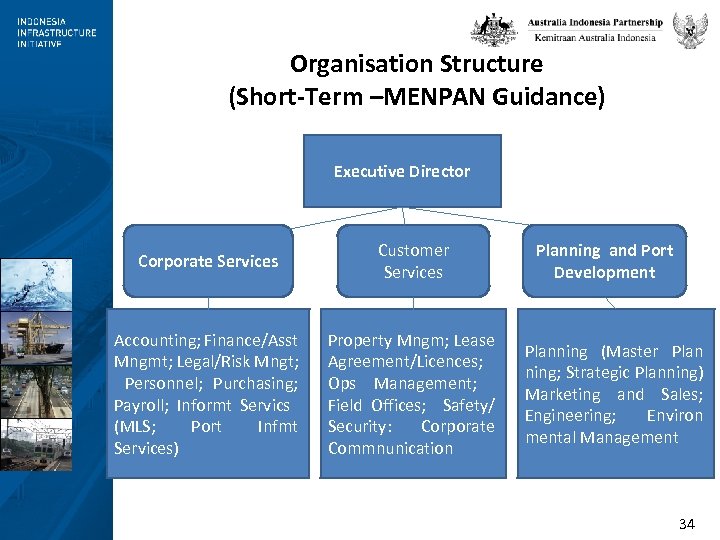

Organisation Structure (Short-Term –MENPAN Guidance) Executive Director Corporate Services Customer Services Accounting; Finance/Asst Mngmt; Legal/Risk Mngt; Personnel; Purchasing; Payroll; Informt Servics (MLS; Port Infmt Services) Property Mngm; Lease Agreement/Licences; Ops Management; Field Offices; Safety/ Security: Corporate Commnunication Planning and Port Development Planning (Master Plan ning; Strategic Planning) Marketing and Sales; Engineering; Environ mental Management 34

Organisation Structure (Short-Term –MENPAN Guidance) Executive Director Corporate Services Customer Services Accounting; Finance/Asst Mngmt; Legal/Risk Mngt; Personnel; Purchasing; Payroll; Informt Servics (MLS; Port Infmt Services) Property Mngm; Lease Agreement/Licences; Ops Management; Field Offices; Safety/ Security: Corporate Commnunication Planning and Port Development Planning (Master Plan ning; Strategic Planning) Marketing and Sales; Engineering; Environ mental Management 34

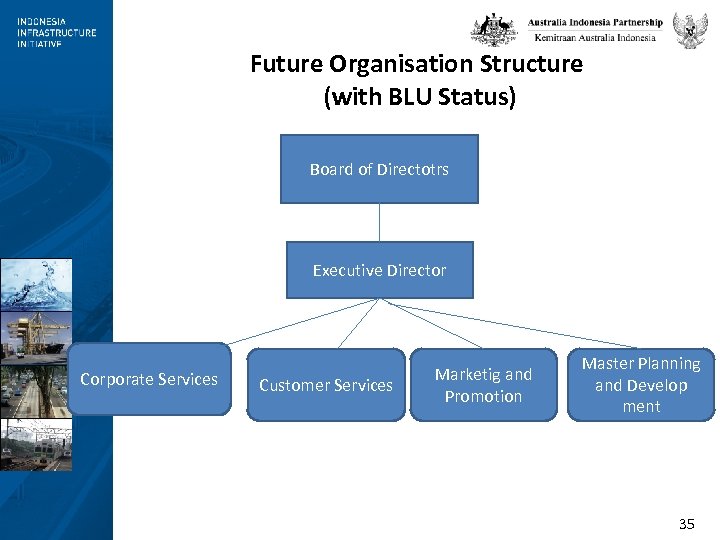

Future Organisation Structure (with BLU Status) Board of Directotrs Executive Director Corporate Services Customer Services Marketig and Promotion Master Planning and Develop ment 35

Future Organisation Structure (with BLU Status) Board of Directotrs Executive Director Corporate Services Customer Services Marketig and Promotion Master Planning and Develop ment 35

Technology Development for Port Management and Operation • Adopting International best practices: – Providing modern infrastructure – Highly efficient services level (one stop total services, distribution and logistics consolidation center). – Technology Information Communication (TIC), including NSW, CITOS, CIMOS, PORTNET, EDI, VTIS, etc. 36

Technology Development for Port Management and Operation • Adopting International best practices: – Providing modern infrastructure – Highly efficient services level (one stop total services, distribution and logistics consolidation center). – Technology Information Communication (TIC), including NSW, CITOS, CIMOS, PORTNET, EDI, VTIS, etc. 36

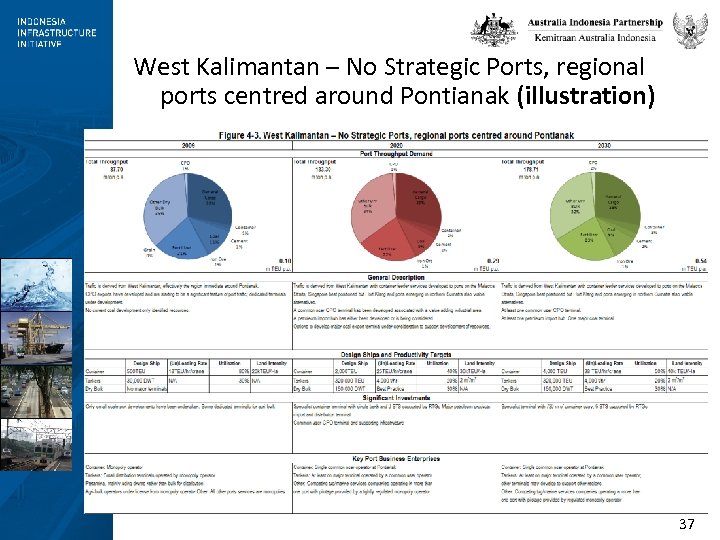

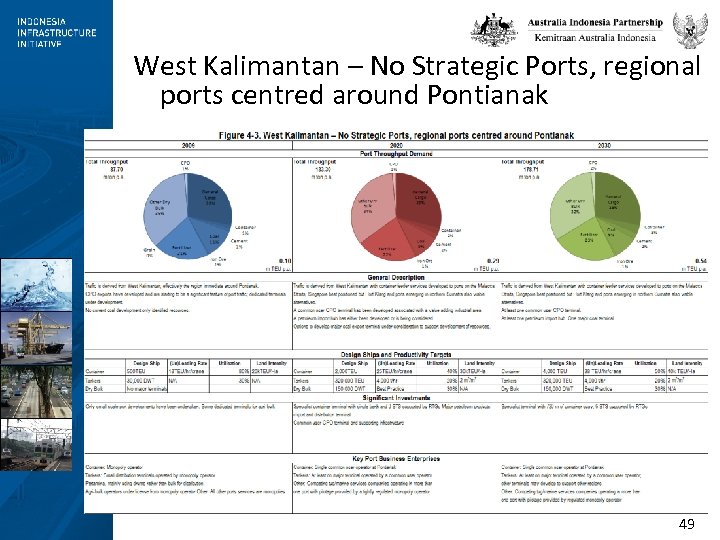

West Kalimantan – No Strategic Ports, regional ports centred around Pontianak (illustration) 37

West Kalimantan – No Strategic Ports, regional ports centred around Pontianak (illustration) 37

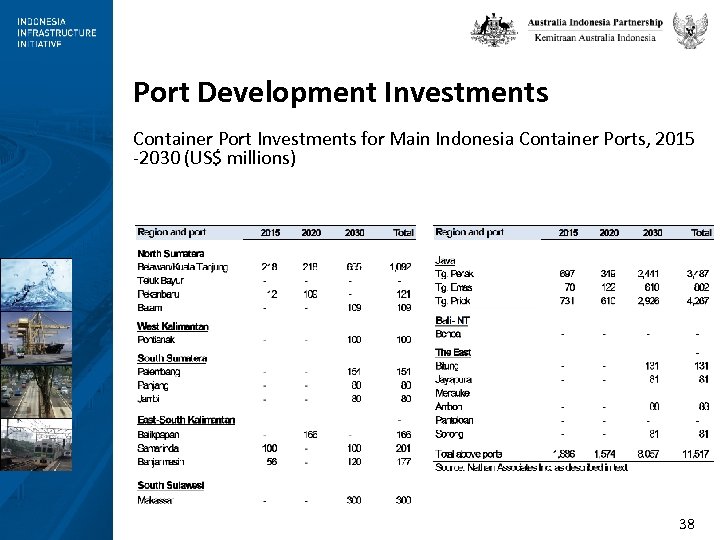

Port Development Investments Container Port Investments for Main Indonesia Container Ports, 2015 -2030 (US$ millions) 38

Port Development Investments Container Port Investments for Main Indonesia Container Ports, 2015 -2030 (US$ millions) 38

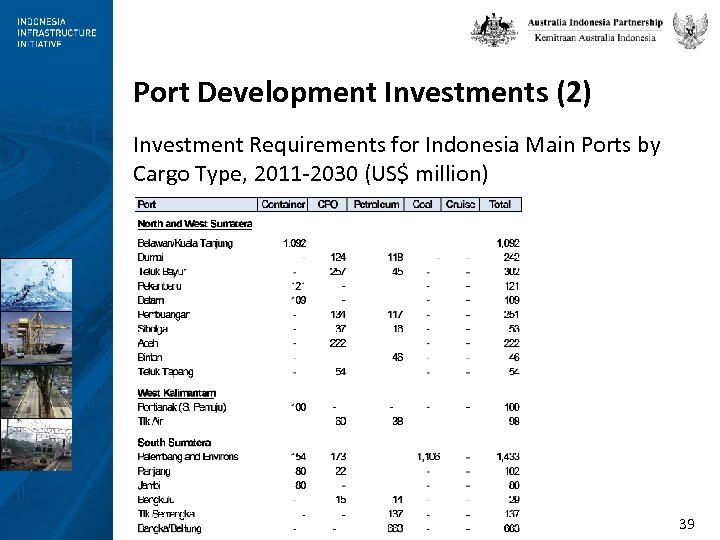

Port Development Investments (2) Investment Requirements for Indonesia Main Ports by Cargo Type, 2011 -2030 (US$ million) 39

Port Development Investments (2) Investment Requirements for Indonesia Main Ports by Cargo Type, 2011 -2030 (US$ million) 39

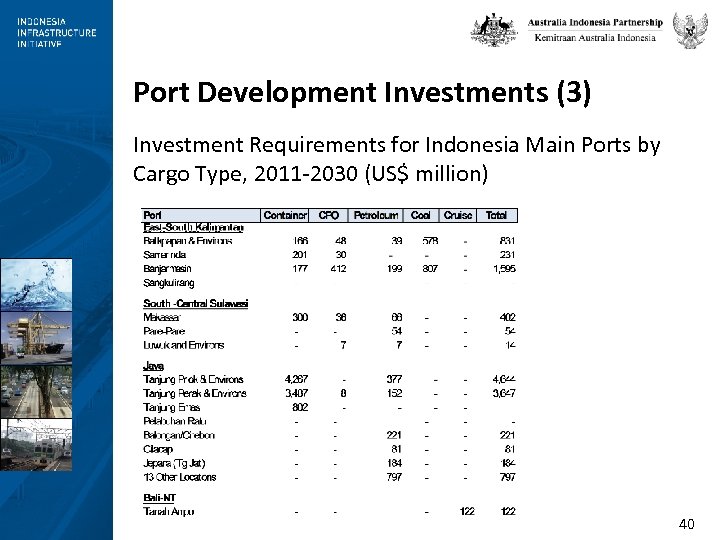

Port Development Investments (3) Investment Requirements for Indonesia Main Ports by Cargo Type, 2011 -2030 (US$ million) 40

Port Development Investments (3) Investment Requirements for Indonesia Main Ports by Cargo Type, 2011 -2030 (US$ million) 40

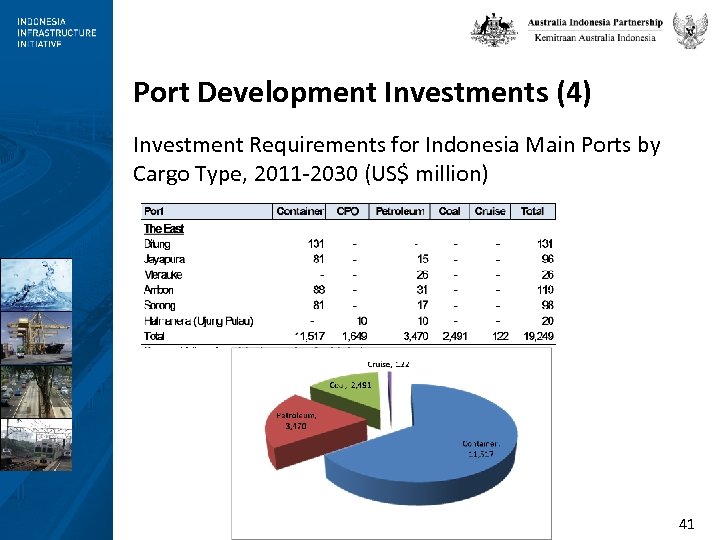

Port Development Investments (4) Investment Requirements for Indonesia Main Ports by Cargo Type, 2011 -2030 (US$ million) 41

Port Development Investments (4) Investment Requirements for Indonesia Main Ports by Cargo Type, 2011 -2030 (US$ million) 41

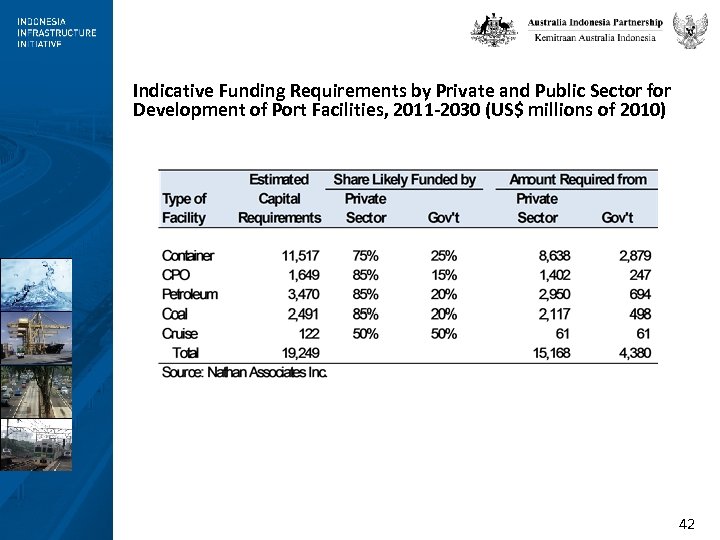

Indicative Funding Requirements by Private and Public Sector for Development of Port Facilities, 2011 -2030 (US$ millions of 2010) 42

Indicative Funding Requirements by Private and Public Sector for Development of Port Facilities, 2011 -2030 (US$ millions of 2010) 42

TERIMA KASIH 43

TERIMA KASIH 43

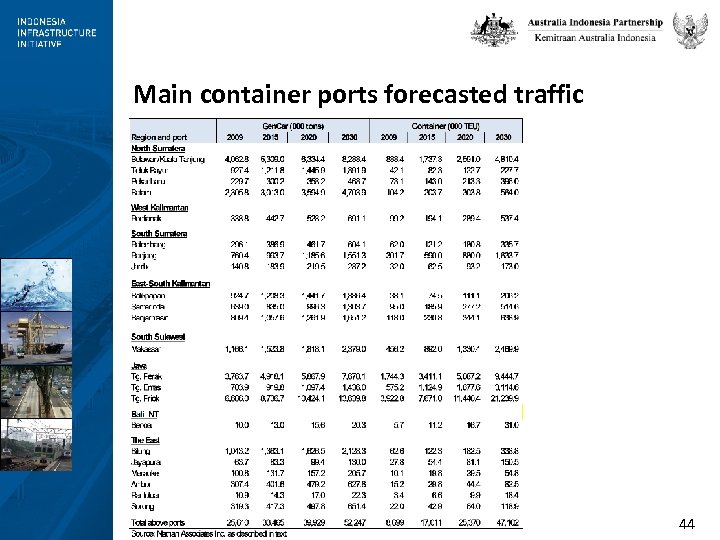

Main container ports forecasted traffic 44

Main container ports forecasted traffic 44

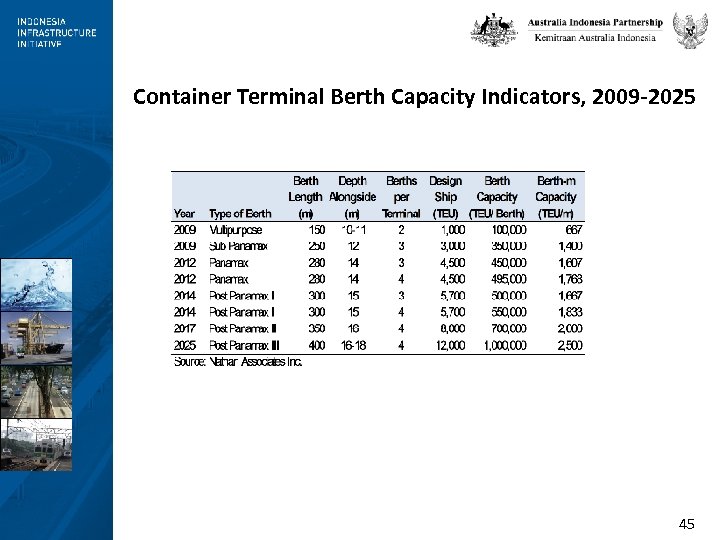

Container Terminal Berth Capacity Indicators, 2009 -2025 45

Container Terminal Berth Capacity Indicators, 2009 -2025 45

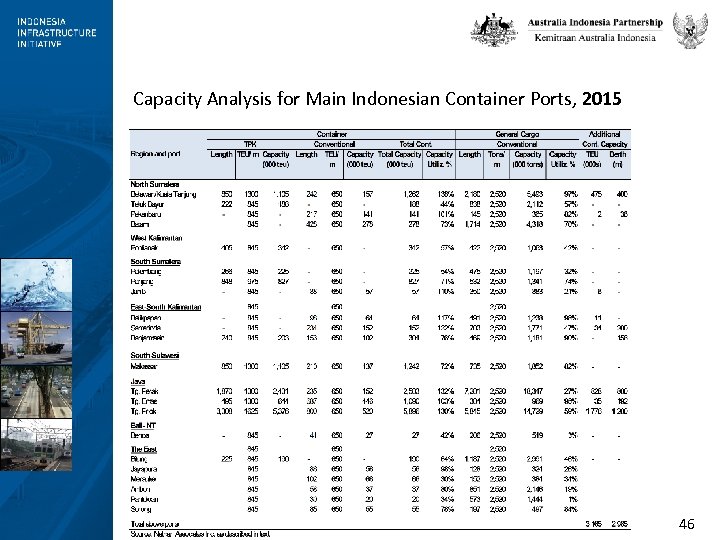

Capacity Analysis for Main Indonesian Container Ports, 2015 46

Capacity Analysis for Main Indonesian Container Ports, 2015 46

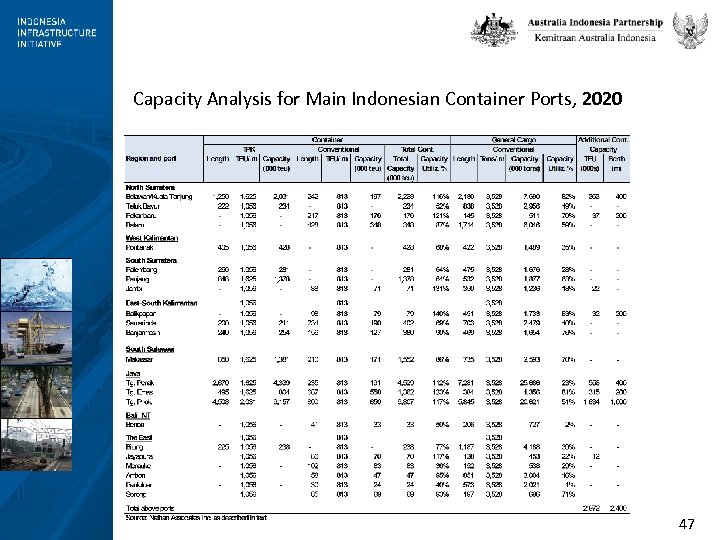

Capacity Analysis for Main Indonesian Container Ports, 2020 47

Capacity Analysis for Main Indonesian Container Ports, 2020 47

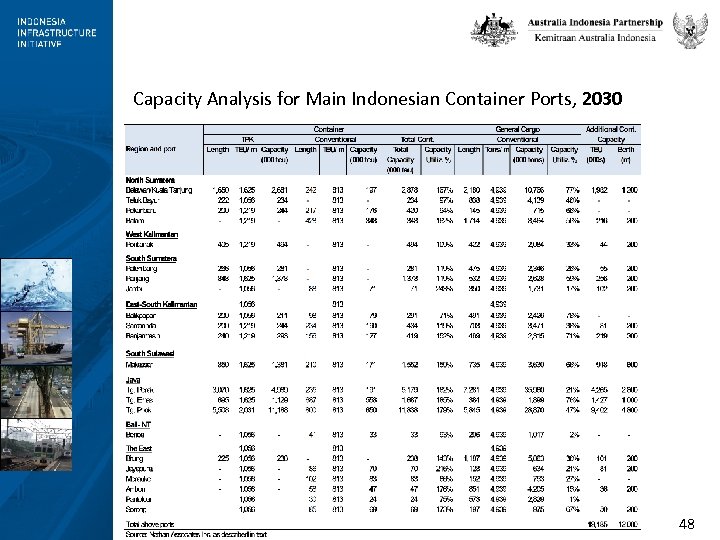

Capacity Analysis for Main Indonesian Container Ports, 2030 48

Capacity Analysis for Main Indonesian Container Ports, 2030 48

West Kalimantan – No Strategic Ports, regional ports centred around Pontianak 49

West Kalimantan – No Strategic Ports, regional ports centred around Pontianak 49

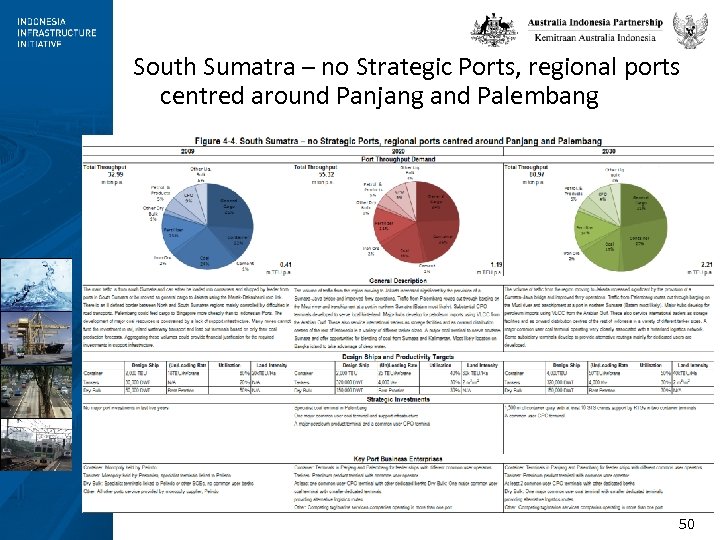

South Sumatra – no Strategic Ports, regional ports centred around Panjang and Palembang 50

South Sumatra – no Strategic Ports, regional ports centred around Panjang and Palembang 50

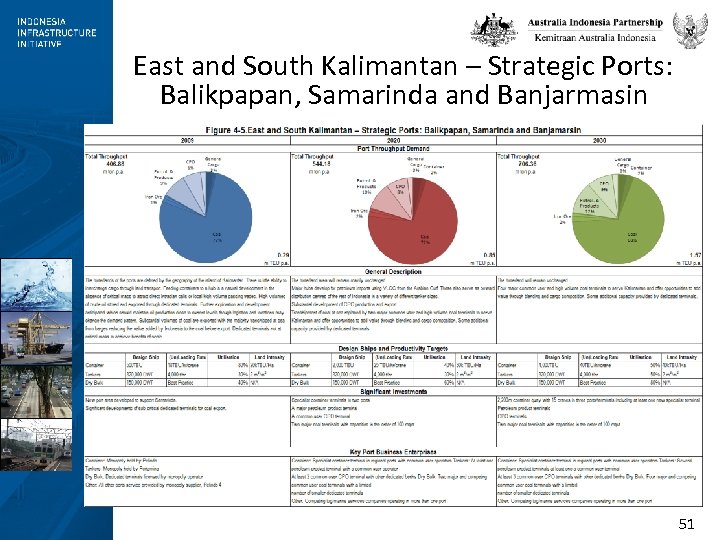

East and South Kalimantan – Strategic Ports: Balikpapan, Samarinda and Banjarmasin 51

East and South Kalimantan – Strategic Ports: Balikpapan, Samarinda and Banjarmasin 51

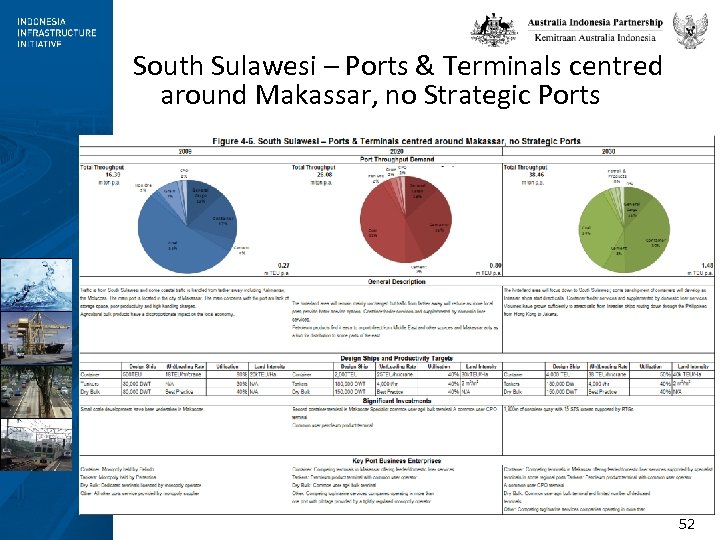

South Sulawesi – Ports & Terminals centred around Makassar, no Strategic Ports 52

South Sulawesi – Ports & Terminals centred around Makassar, no Strategic Ports 52

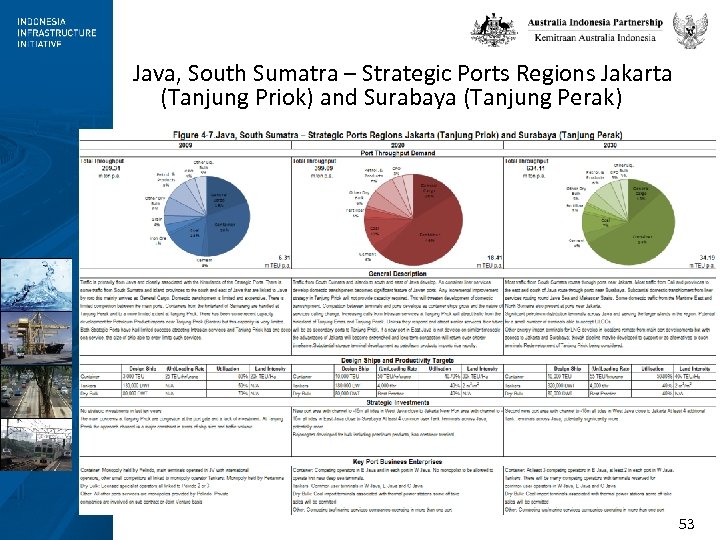

Java, South Sumatra – Strategic Ports Regions Jakarta (Tanjung Priok) and Surabaya (Tanjung Perak) 53

Java, South Sumatra – Strategic Ports Regions Jakarta (Tanjung Priok) and Surabaya (Tanjung Perak) 53

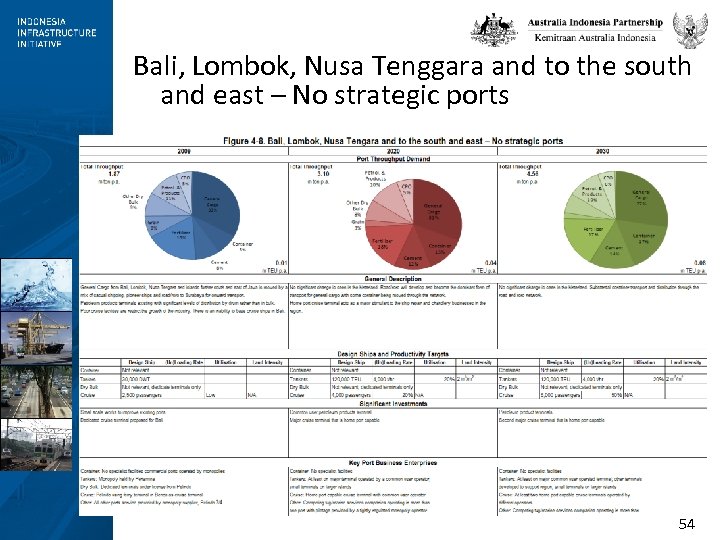

Bali, Lombok, Nusa Tenggara and to the south and east – No strategic ports 54

Bali, Lombok, Nusa Tenggara and to the south and east – No strategic ports 54

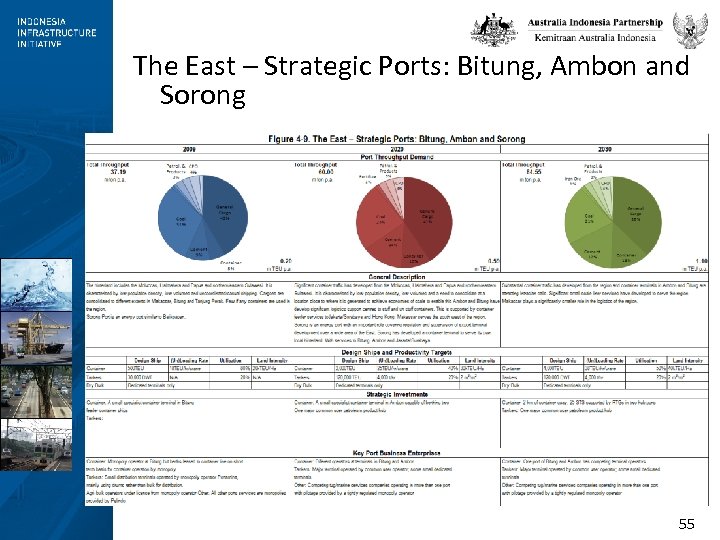

The East – Strategic Ports: Bitung, Ambon and Sorong 55

The East – Strategic Ports: Bitung, Ambon and Sorong 55

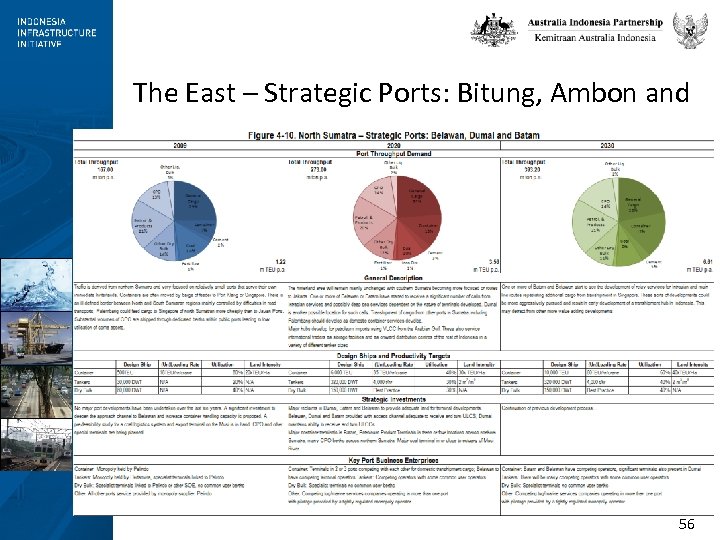

The East – Strategic Ports: Bitung, Ambon and 56

The East – Strategic Ports: Bitung, Ambon and 56

Assumed Indonesian Port Productivity Factors by Type of Facility, 2009 -2030 57

Assumed Indonesian Port Productivity Factors by Type of Facility, 2009 -2030 57

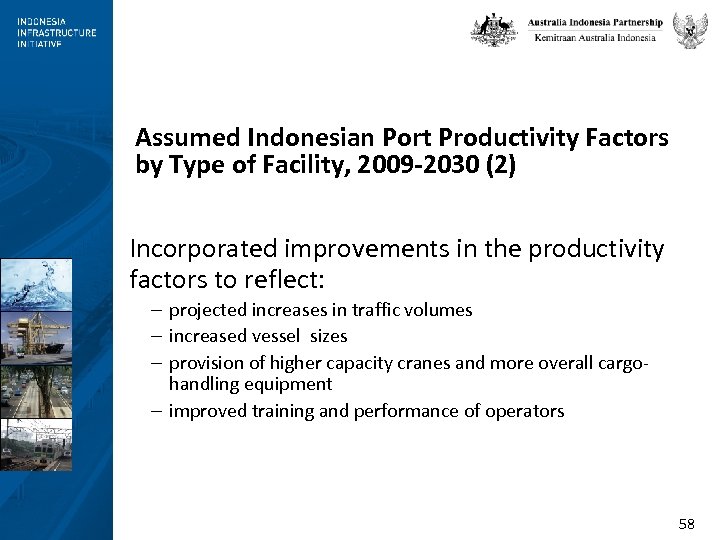

Assumed Indonesian Port Productivity Factors by Type of Facility, 2009 -2030 (2) Incorporated improvements in the productivity factors to reflect: – projected increases in traffic volumes – increased vessel sizes – provision of higher capacity cranes and more overall cargohandling equipment – improved training and performance of operators 58

Assumed Indonesian Port Productivity Factors by Type of Facility, 2009 -2030 (2) Incorporated improvements in the productivity factors to reflect: – projected increases in traffic volumes – increased vessel sizes – provision of higher capacity cranes and more overall cargohandling equipment – improved training and performance of operators 58

Assumed Indonesian Port Productivity Factors by Type of Facility, 2009 -2030 (3) Productivity is assumed to improve : – Container : 30 % ( 2009 - 2015) ; 25 % 2015 - 2020. – General cargo : 40 % (2009 through 2030. This is due to factors cited above, plus the greater use of unitized or palletized cargo handling in place of individual bags for break-bulk cargo. • The rate of general cargo handling per meter of berth is only 4. 9 thousand tons in 2030, • The handling of containerized cargo at conventional terminals of 8. 1 thousand tons per meter of berth (assuming an average of 10 tons per TEU). • Cargo at a specialized container terminal has an assumed productivity in 2030 of over 20 thousand tons per meter of berth. 59

Assumed Indonesian Port Productivity Factors by Type of Facility, 2009 -2030 (3) Productivity is assumed to improve : – Container : 30 % ( 2009 - 2015) ; 25 % 2015 - 2020. – General cargo : 40 % (2009 through 2030. This is due to factors cited above, plus the greater use of unitized or palletized cargo handling in place of individual bags for break-bulk cargo. • The rate of general cargo handling per meter of berth is only 4. 9 thousand tons in 2030, • The handling of containerized cargo at conventional terminals of 8. 1 thousand tons per meter of berth (assuming an average of 10 tons per TEU). • Cargo at a specialized container terminal has an assumed productivity in 2030 of over 20 thousand tons per meter of berth. 59