5b127b60e39dc57241d409cd9ff0c388.ppt

- Количество слайдов: 83

![[DRAFT] Mid Range Plan Fiscal Years 2009 – 2012 August 2008 [DRAFT] Mid Range Plan Fiscal Years 2009 – 2012 August 2008](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-1.jpg) [DRAFT] Mid Range Plan Fiscal Years 2009 – 2012 August 2008

[DRAFT] Mid Range Plan Fiscal Years 2009 – 2012 August 2008

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 2

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 2

![Television Market Update [Discuss overall status of the TV market] • What areas are Television Market Update [Discuss overall status of the TV market] • What areas are](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-3.jpg) Television Market Update [Discuss overall status of the TV market] • What areas are flat? What areas are growing? • Where is competition increasing? • What are the trends in – Viewership (fragmentation of audiences / networks) – Advertising (CPMs, ad units, DVRs) – Programming (growth in reality) 3

Television Market Update [Discuss overall status of the TV market] • What areas are flat? What areas are growing? • Where is competition increasing? • What are the trends in – Viewership (fragmentation of audiences / networks) – Advertising (CPMs, ad units, DVRs) – Programming (growth in reality) 3

Impact of Market Trends on SPT Mid-Range Plan [Discuss why market trends mean we must take certain actions] • With local stations in decline, new shows need strong brands in order to be worth a risk (e. g. , Dr. Oz) • Programming shifts require investment in reality • Advertising landscape requires seeking new inventory (e. g. , 3 rd party, DR, Sony Ad Network) • Fragmentation requires careful rights management, dual windowing, addition of digital rights 4

Impact of Market Trends on SPT Mid-Range Plan [Discuss why market trends mean we must take certain actions] • With local stations in decline, new shows need strong brands in order to be worth a risk (e. g. , Dr. Oz) • Programming shifts require investment in reality • Advertising landscape requires seeking new inventory (e. g. , 3 rd party, DR, Sony Ad Network) • Fragmentation requires careful rights management, dual windowing, addition of digital rights 4

![Executive Summary [Prior pages would be an alternative to this] Core Programs Programming Digital Executive Summary [Prior pages would be an alternative to this] Core Programs Programming Digital](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-5.jpg) Executive Summary [Prior pages would be an alternative to this] Core Programs Programming Digital Networks Strategic Investments Distribution & Licensing Ad Sales • Expand Harpo partnership to drive growth in our first run syndication business • Introduce our core programs to a new generation of viewers • Partner with networks to ensure strong marketing support for our shows • Build our reality / format business through the acquisition of Embassy Row • Continue to grow and monetize digital networks across distribution partners • Further integrate Crackle into the overall studio • Secure carriage of a linear FEARnet channel in order to reach scale • Launch new shows targeted at core GSN demo and integrate skill-based gaming to increase interactivity and multiplatform opportunities • Manage increasingly complex rights and windowing strategy • Balance needs of traditional partners with emerging digital/mobile distributors • Use Dr. Oz to expand client base to include additional network affiliates • Continue to pursue third party representation of emerging networks • Aggressively expand our digital ad sales business • Leverage our content and ad sales assets to build a cross-platform Sony ad network 5

Executive Summary [Prior pages would be an alternative to this] Core Programs Programming Digital Networks Strategic Investments Distribution & Licensing Ad Sales • Expand Harpo partnership to drive growth in our first run syndication business • Introduce our core programs to a new generation of viewers • Partner with networks to ensure strong marketing support for our shows • Build our reality / format business through the acquisition of Embassy Row • Continue to grow and monetize digital networks across distribution partners • Further integrate Crackle into the overall studio • Secure carriage of a linear FEARnet channel in order to reach scale • Launch new shows targeted at core GSN demo and integrate skill-based gaming to increase interactivity and multiplatform opportunities • Manage increasingly complex rights and windowing strategy • Balance needs of traditional partners with emerging digital/mobile distributors • Use Dr. Oz to expand client base to include additional network affiliates • Continue to pursue third party representation of emerging networks • Aggressively expand our digital ad sales business • Leverage our content and ad sales assets to build a cross-platform Sony ad network 5

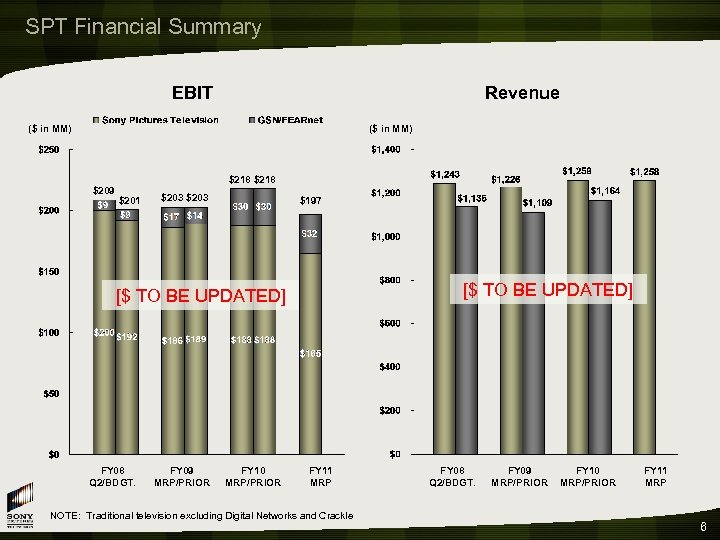

SPT Financial Summary EBIT Revenue ($ in MM) $209 $218 $201 $203 $197 [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP NOTE: Traditional television excluding Digital Networks and Crackle FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 6

SPT Financial Summary EBIT Revenue ($ in MM) $209 $218 $201 $203 $197 [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP NOTE: Traditional television excluding Digital Networks and Crackle FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 6

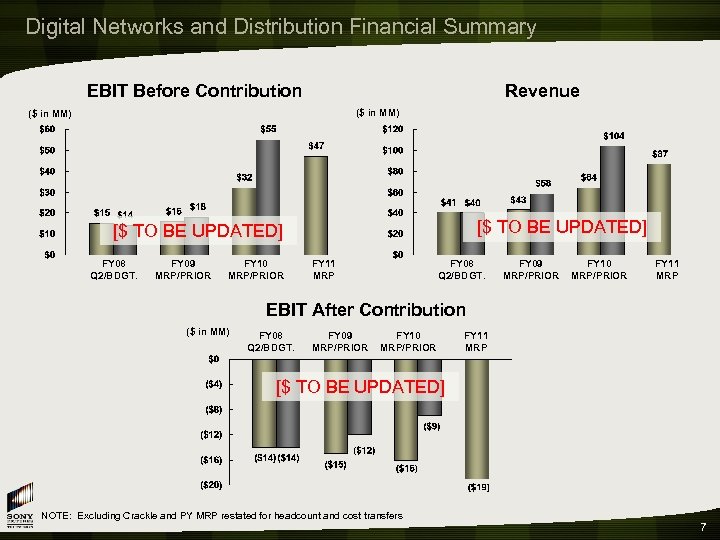

Digital Networks and Distribution Financial Summary EBIT Before Contribution Revenue ($ in MM) [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 08 Q 2/BDGT. FY 11 MRP FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP EBIT After Contribution ($ in MM) FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP [$ TO BE UPDATED] NOTE: Excluding Crackle and PY MRP restated for headcount and cost transfers 7

Digital Networks and Distribution Financial Summary EBIT Before Contribution Revenue ($ in MM) [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 08 Q 2/BDGT. FY 11 MRP FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP EBIT After Contribution ($ in MM) FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP [$ TO BE UPDATED] NOTE: Excluding Crackle and PY MRP restated for headcount and cost transfers 7

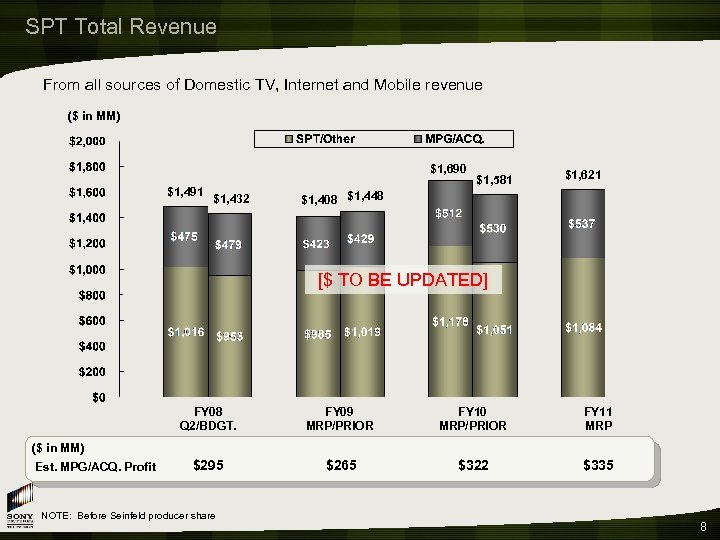

SPT Total Revenue From all sources of Domestic TV, Internet and Mobile revenue ($ in MM) $1, 690 $1, 491 $1, 432 $1, 581 $1, 621 $1, 408 $1, 448 [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP $295 $265 $322 $335 ($ in MM) Est. MPG/ACQ. Profit NOTE: Before Seinfeld producer share 8

SPT Total Revenue From all sources of Domestic TV, Internet and Mobile revenue ($ in MM) $1, 690 $1, 491 $1, 432 $1, 581 $1, 621 $1, 408 $1, 448 [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP $295 $265 $322 $335 ($ in MM) Est. MPG/ACQ. Profit NOTE: Before Seinfeld producer share 8

![Net G&A Expenses & Headcount Net G&A Headcount [$ TO BE UPDATED] (1) PY Net G&A Expenses & Headcount Net G&A Headcount [$ TO BE UPDATED] (1) PY](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-9.jpg) Net G&A Expenses & Headcount Net G&A Headcount [$ TO BE UPDATED] (1) PY MRP G&A & headcount restated for headcount included in SPHE/SPD which has since been transferred to DSD ($3. 7 M / 7 HC in PY 09 and $4 M / 7 HC in PY 10) 9

Net G&A Expenses & Headcount Net G&A Headcount [$ TO BE UPDATED] (1) PY MRP G&A & headcount restated for headcount included in SPHE/SPD which has since been transferred to DSD ($3. 7 M / 7 HC in PY 09 and $4 M / 7 HC in PY 10) 9

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 10

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 10

Core Programs Strategy • Launch Dr. Oz as the anchor to our first run syndication business – Grow partnership with Harpo to include additional shows • Adjust timing of Seinfeld sale to approach broadcast partners under more favorable market conditions • Introduce innovative marketing programs to keep shows top-of-mind and expose them to a new generation of viewers • Create new multi-platform extensions of our game shows to increase interactivity and drive viewership • Continue to aggressively sell SPT library product – Leverage new windows, rights, and assets to generate additional sales opportunities 11

Core Programs Strategy • Launch Dr. Oz as the anchor to our first run syndication business – Grow partnership with Harpo to include additional shows • Adjust timing of Seinfeld sale to approach broadcast partners under more favorable market conditions • Introduce innovative marketing programs to keep shows top-of-mind and expose them to a new generation of viewers • Create new multi-platform extensions of our game shows to increase interactivity and drive viewership • Continue to aggressively sell SPT library product – Leverage new windows, rights, and assets to generate additional sales opportunities 11

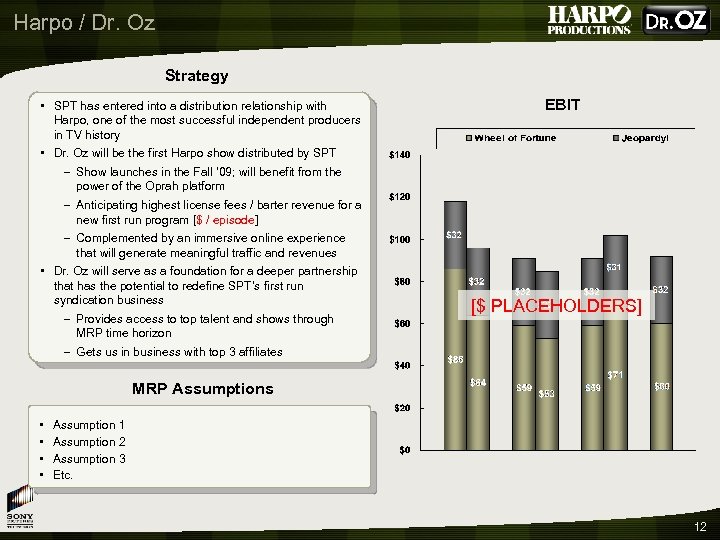

Harpo / Dr. Oz Strategy • SPT has entered into a distribution relationship with Harpo, one of the most successful independent producers in TV history • Dr. Oz will be the first Harpo show distributed by SPT – Show launches in the Fall ’ 09; will benefit from the power of the Oprah platform – Anticipating highest license fees / barter revenue for a new first run program [$ / episode] – Complemented by an immersive online experience that will generate meaningful traffic and revenues • Dr. Oz will serve as a foundation for a deeper partnership that has the potential to redefine SPT’s first run syndication business – Provides access to top talent and shows through MRP time horizon – Gets us in business with top 3 affiliates EBIT [$ PLACEHOLDERS] MRP Assumptions • • Assumption 1 Assumption 2 Assumption 3 Etc. 12

Harpo / Dr. Oz Strategy • SPT has entered into a distribution relationship with Harpo, one of the most successful independent producers in TV history • Dr. Oz will be the first Harpo show distributed by SPT – Show launches in the Fall ’ 09; will benefit from the power of the Oprah platform – Anticipating highest license fees / barter revenue for a new first run program [$ / episode] – Complemented by an immersive online experience that will generate meaningful traffic and revenues • Dr. Oz will serve as a foundation for a deeper partnership that has the potential to redefine SPT’s first run syndication business – Provides access to top talent and shows through MRP time horizon – Gets us in business with top 3 affiliates EBIT [$ PLACEHOLDERS] MRP Assumptions • • Assumption 1 Assumption 2 Assumption 3 Etc. 12

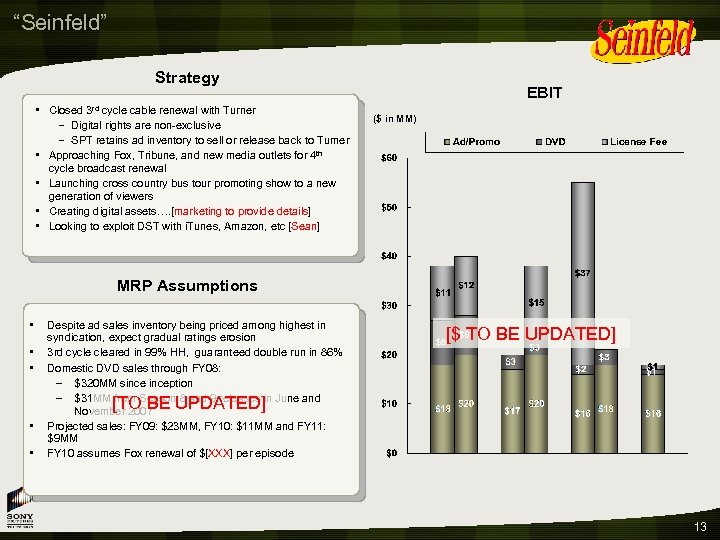

“Seinfeld” Strategy • Closed cycle cable renewal with Turner – Digital rights are non-exclusive – SPT retains ad inventory to sell or release back to Turner • Approaching Fox, Tribune, and new media outlets for 4 th cycle broadcast renewal • Launching cross country bus tour promoting show to a new generation of viewers • Creating digital assets…. [marketing to provide details] • Looking to exploit DST with i. Tunes, Amazon, etc [Sean] 3 rd EBIT ($ in MM) MRP Assumptions • • • Despite ad sales inventory being priced among highest in syndication, expect gradual ratings erosion 3 rd cycle cleared in 99% HH, guaranteed double run in 86% Domestic DVD sales through FY 08: – $320 MM sinception – $31 MM from Season 8 and 9 releases in June and November 2007 Projected sales: FY 09: $23 MM, FY 10: $11 MM and FY 11: $9 MM FY 10 assumes Fox renewal of $[XXX] per episode [$ TO BE UPDATED] [TO BE UPDATED] • • 13

“Seinfeld” Strategy • Closed cycle cable renewal with Turner – Digital rights are non-exclusive – SPT retains ad inventory to sell or release back to Turner • Approaching Fox, Tribune, and new media outlets for 4 th cycle broadcast renewal • Launching cross country bus tour promoting show to a new generation of viewers • Creating digital assets…. [marketing to provide details] • Looking to exploit DST with i. Tunes, Amazon, etc [Sean] 3 rd EBIT ($ in MM) MRP Assumptions • • • Despite ad sales inventory being priced among highest in syndication, expect gradual ratings erosion 3 rd cycle cleared in 99% HH, guaranteed double run in 86% Domestic DVD sales through FY 08: – $320 MM sinception – $31 MM from Season 8 and 9 releases in June and November 2007 Projected sales: FY 09: $23 MM, FY 10: $11 MM and FY 11: $9 MM FY 10 assumes Fox renewal of $[XXX] per episode [$ TO BE UPDATED] [TO BE UPDATED] • • 13

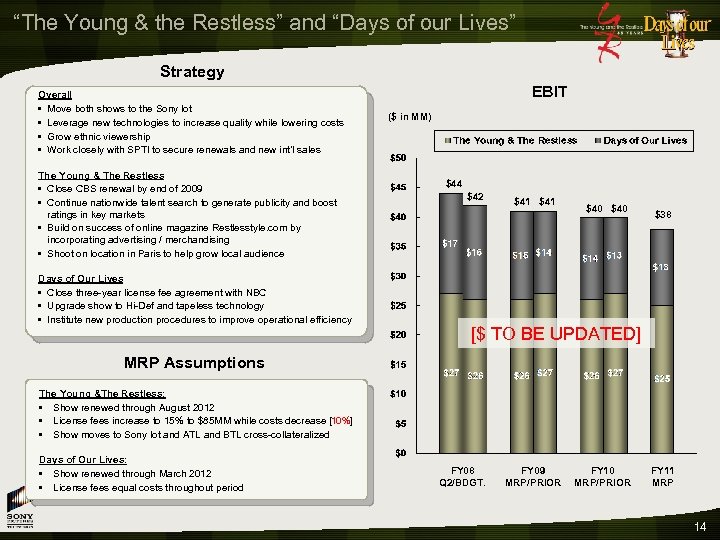

“The Young & the Restless” and “Days of our Lives” Strategy Overall • Move both shows to the Sony lot • Leverage new technologies to increase quality while lowering costs • Grow ethnic viewership • Work closely with SPTI to secure renewals and new int’l sales The Young & The Restless • Close CBS renewal by end of 2009 • Continue nationwide talent search to generate publicity and boost ratings in key markets • Build on success of online magazine Restlesstyle. com by incorporating advertising / merchandising • Shoot on location in Paris to help grow local audience Days of Our Lives • Close three-year license fee agreement with NBC • Upgrade show to Hi-Def and tapeless technology • Institute new production procedures to improve operational efficiency EBIT ($ in MM) $44 $42 $41 $40 $38 [$ TO BE UPDATED] MRP Assumptions The Young &The Restless: • Show renewed through August 2012 • License fees increase to 15% to $85 MM while costs decrease [10%] • Show moves to Sony lot and ATL and BTL cross-collateralized Days of Our Lives: • Show renewed through March 2012 • License fees equal costs throughout period FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 14

“The Young & the Restless” and “Days of our Lives” Strategy Overall • Move both shows to the Sony lot • Leverage new technologies to increase quality while lowering costs • Grow ethnic viewership • Work closely with SPTI to secure renewals and new int’l sales The Young & The Restless • Close CBS renewal by end of 2009 • Continue nationwide talent search to generate publicity and boost ratings in key markets • Build on success of online magazine Restlesstyle. com by incorporating advertising / merchandising • Shoot on location in Paris to help grow local audience Days of Our Lives • Close three-year license fee agreement with NBC • Upgrade show to Hi-Def and tapeless technology • Institute new production procedures to improve operational efficiency EBIT ($ in MM) $44 $42 $41 $40 $38 [$ TO BE UPDATED] MRP Assumptions The Young &The Restless: • Show renewed through August 2012 • License fees increase to 15% to $85 MM while costs decrease [10%] • Show moves to Sony lot and ATL and BTL cross-collateralized Days of Our Lives: • Show renewed through March 2012 • License fees equal costs throughout period FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 14

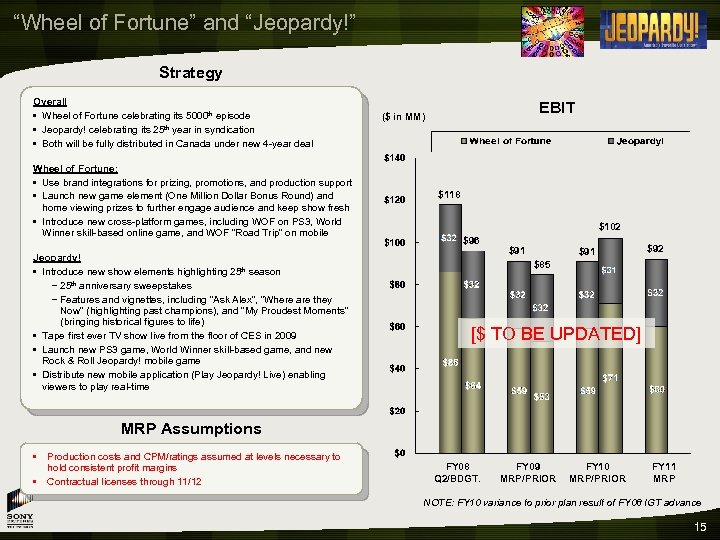

“Wheel of Fortune” and “Jeopardy!” Strategy Overall • Wheel of Fortune celebrating its 5000 th episode • Jeopardy! celebrating its 25 th year in syndication • Both will be fully distributed in Canada under new 4 -year deal Wheel of Fortune: • Use brand integrations for prizing, promotions, and production support • Launch new game element (One Million Dollar Bonus Round) and home viewing prizes to further engage audience and keep show fresh • Introduce new cross-platform games, including WOF on PS 3, World Winner skill-based online game, and WOF “Road Trip” on mobile Jeopardy! • Introduce new show elements highlighting 25 th season – 25 th anniversary sweepstakes – Features and vignettes, including “Ask Alex”, “Where are they Now” (highlighting past champions), and “My Proudest Moments” (bringing historical figures to life) • Tape first ever TV show live from the floor of CES in 2009 • Launch new PS 3 game, World Winner skill-based game, and new Rock & Roll Jeopardy! mobile game • Distribute new mobile application (Play Jeopardy! Live) enabling viewers to play real-time EBIT ($ in MM) $118 $102 $96 $91 $92 $85 [$ TO BE UPDATED] MRP Assumptions • Production costs and CPM/ratings assumed at levels necessary to hold consistent profit margins • Contractual licenses through 11/12 FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP NOTE: FY 10 variance to prior plan result of FY 08 IGT advance 15

“Wheel of Fortune” and “Jeopardy!” Strategy Overall • Wheel of Fortune celebrating its 5000 th episode • Jeopardy! celebrating its 25 th year in syndication • Both will be fully distributed in Canada under new 4 -year deal Wheel of Fortune: • Use brand integrations for prizing, promotions, and production support • Launch new game element (One Million Dollar Bonus Round) and home viewing prizes to further engage audience and keep show fresh • Introduce new cross-platform games, including WOF on PS 3, World Winner skill-based online game, and WOF “Road Trip” on mobile Jeopardy! • Introduce new show elements highlighting 25 th season – 25 th anniversary sweepstakes – Features and vignettes, including “Ask Alex”, “Where are they Now” (highlighting past champions), and “My Proudest Moments” (bringing historical figures to life) • Tape first ever TV show live from the floor of CES in 2009 • Launch new PS 3 game, World Winner skill-based game, and new Rock & Roll Jeopardy! mobile game • Distribute new mobile application (Play Jeopardy! Live) enabling viewers to play real-time EBIT ($ in MM) $118 $102 $96 $91 $92 $85 [$ TO BE UPDATED] MRP Assumptions • Production costs and CPM/ratings assumed at levels necessary to hold consistent profit margins • Contractual licenses through 11/12 FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP NOTE: FY 10 variance to prior plan result of FY 08 IGT advance 15

![SPT Library Revenue EBIT [$ TO BE UPDATED] Budget/ Prior MRP $178 $204 $186 SPT Library Revenue EBIT [$ TO BE UPDATED] Budget/ Prior MRP $178 $204 $186](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-16.jpg) SPT Library Revenue EBIT [$ TO BE UPDATED] Budget/ Prior MRP $178 $204 $186 Budget/ Prior MRP Variance ($9) ($20) ($32) Variance • • • $72 $85 $74 ($13) ($1) ($6) Coordinating with other SPE divisions to identify additional opportunities to sell SPT Library product Initiating discussions with new partners to expand distribution of library product (e. g. , Shout! Factory) Assuming no demand for TV product on Blu-ray 16

SPT Library Revenue EBIT [$ TO BE UPDATED] Budget/ Prior MRP $178 $204 $186 Budget/ Prior MRP Variance ($9) ($20) ($32) Variance • • • $72 $85 $74 ($13) ($1) ($6) Coordinating with other SPE divisions to identify additional opportunities to sell SPT Library product Initiating discussions with new partners to expand distribution of library product (e. g. , Shout! Factory) Assuming no demand for TV product on Blu-ray 16

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 17

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 17

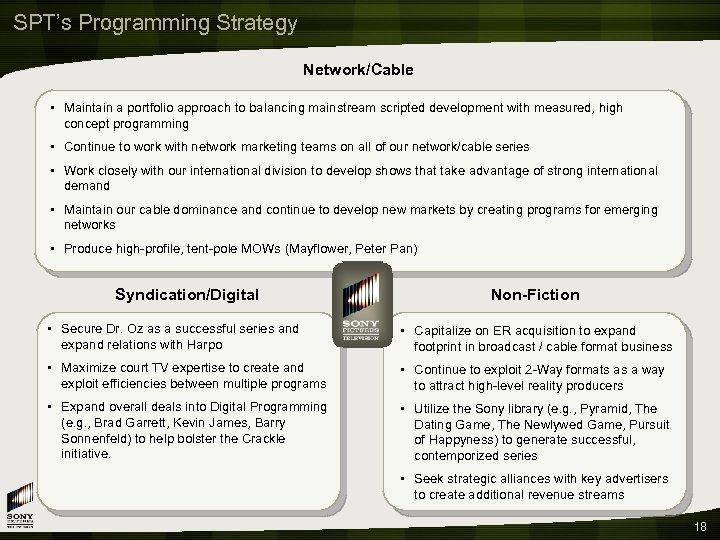

SPT’s Programming Strategy Network/Cable • Maintain a portfolio approach to balancing mainstream scripted development with measured, high concept programming • Continue to work with network marketing teams on all of our network/cable series • Work closely with our international division to develop shows that take advantage of strong international demand • Maintain our cable dominance and continue to develop new markets by creating programs for emerging networks • Produce high-profile, tent-pole MOWs (Mayflower, Peter Pan) Syndication/Digital Non-Fiction • Secure Dr. Oz as a successful series and expand relations with Harpo • Capitalize on ER acquisition to expand footprint in broadcast / cable format business • Maximize court TV expertise to create and exploit efficiencies between multiple programs • Continue to exploit 2 -Way formats as a way to attract high-level reality producers • Expand overall deals into Digital Programming (e. g. , Brad Garrett, Kevin James, Barry Sonnenfeld) to help bolster the Crackle initiative. • Utilize the Sony library (e. g. , Pyramid, The Dating Game, The Newlywed Game, Pursuit of Happyness) to generate successful, contemporized series • Seek strategic alliances with key advertisers to create additional revenue streams 18

SPT’s Programming Strategy Network/Cable • Maintain a portfolio approach to balancing mainstream scripted development with measured, high concept programming • Continue to work with network marketing teams on all of our network/cable series • Work closely with our international division to develop shows that take advantage of strong international demand • Maintain our cable dominance and continue to develop new markets by creating programs for emerging networks • Produce high-profile, tent-pole MOWs (Mayflower, Peter Pan) Syndication/Digital Non-Fiction • Secure Dr. Oz as a successful series and expand relations with Harpo • Capitalize on ER acquisition to expand footprint in broadcast / cable format business • Maximize court TV expertise to create and exploit efficiencies between multiple programs • Continue to exploit 2 -Way formats as a way to attract high-level reality producers • Expand overall deals into Digital Programming (e. g. , Brad Garrett, Kevin James, Barry Sonnenfeld) to help bolster the Crackle initiative. • Utilize the Sony library (e. g. , Pyramid, The Dating Game, The Newlywed Game, Pursuit of Happyness) to generate successful, contemporized series • Seek strategic alliances with key advertisers to create additional revenue streams 18

SPT’s Current Program Lineup The Unusuals (pilot) Raisin in the Sun (mini) Mayflower (MOW) Peter Pan (mini) Days of Our Lives [Lost in the 80’s (pilot)] ‘Til Death Sit Down Shut Up Young & The Restless Rules of Engagement Can Openers (pilot) Jesse Stone: Thin Ice (MOW) Comanche Moon (mini) Stone Cold 6 (MOW) Syndication Boondocks Breaking Bad The Gong Show S. I. S. (pilot/mow) Gay Robot (presentation) Drop Dead Diva (pilot) The Gathering (mini) Living Proof (MOW) The 10 th Circle (MOW) The Memory Keeper’s Daughter (MOW) Sex & Lies in Sin City (MOW) Flirting with Forty (MOW) Spectacular Spider-Man Dragon Tales 10 Items or Less My Boys Dave Caplan Project (pilot) Gifted Hands (mow) Time Heals (pilot) The Shield Rescue Me Damages Wheel of Fortune Jeopardy! Dr. Oz Judge Hatchett Judge David Young Judge Karen The Beast Danny Fricke (pilot) 19

SPT’s Current Program Lineup The Unusuals (pilot) Raisin in the Sun (mini) Mayflower (MOW) Peter Pan (mini) Days of Our Lives [Lost in the 80’s (pilot)] ‘Til Death Sit Down Shut Up Young & The Restless Rules of Engagement Can Openers (pilot) Jesse Stone: Thin Ice (MOW) Comanche Moon (mini) Stone Cold 6 (MOW) Syndication Boondocks Breaking Bad The Gong Show S. I. S. (pilot/mow) Gay Robot (presentation) Drop Dead Diva (pilot) The Gathering (mini) Living Proof (MOW) The 10 th Circle (MOW) The Memory Keeper’s Daughter (MOW) Sex & Lies in Sin City (MOW) Flirting with Forty (MOW) Spectacular Spider-Man Dragon Tales 10 Items or Less My Boys Dave Caplan Project (pilot) Gifted Hands (mow) Time Heals (pilot) The Shield Rescue Me Damages Wheel of Fortune Jeopardy! Dr. Oz Judge Hatchett Judge David Young Judge Karen The Beast Danny Fricke (pilot) 19

2008/2009 Development Snapshot Writer/Producer Current In Development End Date Tantamount § Sit Down, Shut Up § Ab Fab § Lost in the 80’s § Untitled Rob Pearlstein/Laird Hamilton Surfing Project 06/14/10 Michael Davies § N/A § § 01/01/09 Happy Madison § Rules of Engagement § Gong Show § Gay Robot § Joe Dirt § Untitled Adam Goldberg Project 08/07/11 Timberman/Beverly Productions § N/A § Untitled Steinfelds Project § Untitled Wallace & Wolfe Project § Black List, Hitman 06/08/09 Barry Sonnenfeld § N/A § Los Simuladores § Things a Man Should Never Do Past 30 § Untitled Chelsea Handler Project 03/31/09 Neal Moritz § N/A § Untitled Dave Caplan Project § Vantage Point 02/06/10 Fanfare (Jamie Tarses) § My Boys § Time Heals § Eva Adams § Slummy Mummy 05/03/10 The Dating Game The Newlywed Game American Bandstand All-Star Mr. & Mrs. 20

2008/2009 Development Snapshot Writer/Producer Current In Development End Date Tantamount § Sit Down, Shut Up § Ab Fab § Lost in the 80’s § Untitled Rob Pearlstein/Laird Hamilton Surfing Project 06/14/10 Michael Davies § N/A § § 01/01/09 Happy Madison § Rules of Engagement § Gong Show § Gay Robot § Joe Dirt § Untitled Adam Goldberg Project 08/07/11 Timberman/Beverly Productions § N/A § Untitled Steinfelds Project § Untitled Wallace & Wolfe Project § Black List, Hitman 06/08/09 Barry Sonnenfeld § N/A § Los Simuladores § Things a Man Should Never Do Past 30 § Untitled Chelsea Handler Project 03/31/09 Neal Moritz § N/A § Untitled Dave Caplan Project § Vantage Point 02/06/10 Fanfare (Jamie Tarses) § My Boys § Time Heals § Eva Adams § Slummy Mummy 05/03/10 The Dating Game The Newlywed Game American Bandstand All-Star Mr. & Mrs. 20

![Overall Term Deal Financials # of Term Deals [$ TO BE UPDATED] NOTE: Deals Overall Term Deal Financials # of Term Deals [$ TO BE UPDATED] NOTE: Deals](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-21.jpg) Overall Term Deal Financials # of Term Deals [$ TO BE UPDATED] NOTE: Deals with total gross commitments of $1 MM or more Net Cost Per Year [$ TO BE UPDATED] 21

Overall Term Deal Financials # of Term Deals [$ TO BE UPDATED] NOTE: Deals with total gross commitments of $1 MM or more Net Cost Per Year [$ TO BE UPDATED] 21

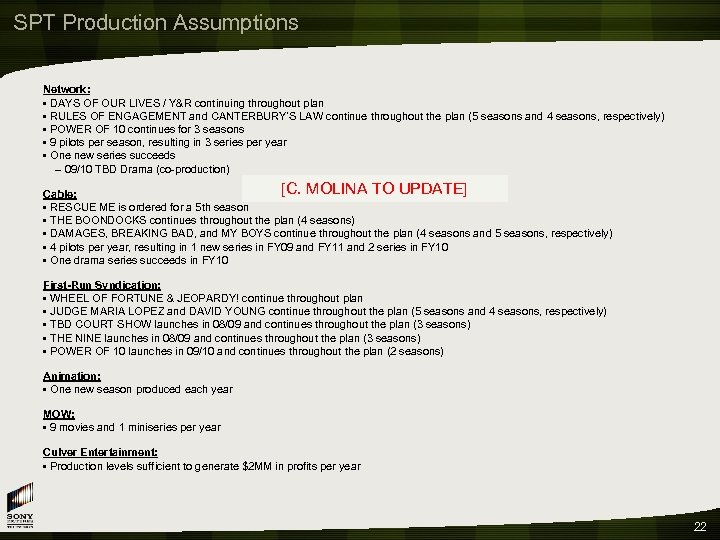

SPT Production Assumptions Network: • DAYS OF OUR LIVES / Y&R continuing throughout plan • RULES OF ENGAGEMENT and CANTERBURY’S LAW continue throughout the plan (5 seasons and 4 seasons, respectively) • POWER OF 10 continues for 3 seasons • 9 pilots per season, resulting in 3 series per year • One new series succeeds – 09/10 TBD Drama (co-production) [C. MOLINA TO UPDATE] Cable: • RESCUE ME is ordered for a 5 th season • THE BOONDOCKS continues throughout the plan (4 seasons) • DAMAGES, BREAKING BAD, and MY BOYS continue throughout the plan (4 seasons and 5 seasons, respectively) • 4 pilots per year, resulting in 1 new series in FY 09 and FY 11 and 2 series in FY 10 • One drama series succeeds in FY 10 First-Run Syndication: • WHEEL OF FORTUNE & JEOPARDY! continue throughout plan • JUDGE MARIA LOPEZ and DAVID YOUNG continue throughout the plan (5 seasons and 4 seasons, respectively) • TBD COURT SHOW launches in 08/09 and continues throughout the plan (3 seasons) • THE NINE launches in 08/09 and continues throughout the plan (3 seasons) • POWER OF 10 launches in 09/10 and continues throughout the plan (2 seasons) Animation: • One new season produced each year MOW: • 9 movies and 1 miniseries per year Culver Entertainment: • Production levels sufficient to generate $2 MM in profits per year 22

SPT Production Assumptions Network: • DAYS OF OUR LIVES / Y&R continuing throughout plan • RULES OF ENGAGEMENT and CANTERBURY’S LAW continue throughout the plan (5 seasons and 4 seasons, respectively) • POWER OF 10 continues for 3 seasons • 9 pilots per season, resulting in 3 series per year • One new series succeeds – 09/10 TBD Drama (co-production) [C. MOLINA TO UPDATE] Cable: • RESCUE ME is ordered for a 5 th season • THE BOONDOCKS continues throughout the plan (4 seasons) • DAMAGES, BREAKING BAD, and MY BOYS continue throughout the plan (4 seasons and 5 seasons, respectively) • 4 pilots per year, resulting in 1 new series in FY 09 and FY 11 and 2 series in FY 10 • One drama series succeeds in FY 10 First-Run Syndication: • WHEEL OF FORTUNE & JEOPARDY! continue throughout plan • JUDGE MARIA LOPEZ and DAVID YOUNG continue throughout the plan (5 seasons and 4 seasons, respectively) • TBD COURT SHOW launches in 08/09 and continues throughout the plan (3 seasons) • THE NINE launches in 08/09 and continues throughout the plan (3 seasons) • POWER OF 10 launches in 09/10 and continues throughout the plan (2 seasons) Animation: • One new season produced each year MOW: • 9 movies and 1 miniseries per year Culver Entertainment: • Production levels sufficient to generate $2 MM in profits per year 22

![Programming – New Series Investment & Development ($100) ($95) [$ TO BE UPDATED] Budget/Prior Programming – New Series Investment & Development ($100) ($95) [$ TO BE UPDATED] Budget/Prior](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-23.jpg) Programming – New Series Investment & Development ($100) ($95) [$ TO BE UPDATED] Budget/Prior MRP ($90) ($82) ($83) Variance ($10) ($13) ($12) 23

Programming – New Series Investment & Development ($100) ($95) [$ TO BE UPDATED] Budget/Prior MRP ($90) ($82) ($83) Variance ($10) ($13) ($12) 23

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 24

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 24

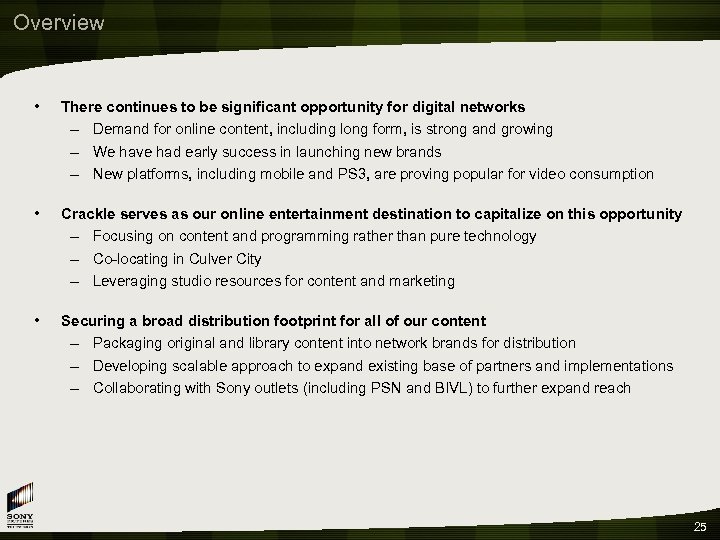

Overview • There continues to be significant opportunity for digital networks – Demand for online content, including long form, is strong and growing – We have had early success in launching new brands – New platforms, including mobile and PS 3, are proving popular for video consumption • Crackle serves as our online entertainment destination to capitalize on this opportunity – Focusing on content and programming rather than pure technology – Co-locating in Culver City – Leveraging studio resources for content and marketing • Securing a broad distribution footprint for all of our content – Packaging original and library content into network brands for distribution – Developing scalable approach to expand existing base of partners and implementations – Collaborating with Sony outlets (including PSN and BIVL) to further expand reach 25

Overview • There continues to be significant opportunity for digital networks – Demand for online content, including long form, is strong and growing – We have had early success in launching new brands – New platforms, including mobile and PS 3, are proving popular for video consumption • Crackle serves as our online entertainment destination to capitalize on this opportunity – Focusing on content and programming rather than pure technology – Co-locating in Culver City – Leveraging studio resources for content and marketing • Securing a broad distribution footprint for all of our content – Packaging original and library content into network brands for distribution – Developing scalable approach to expand existing base of partners and implementations – Collaborating with Sony outlets (including PSN and BIVL) to further expand reach 25

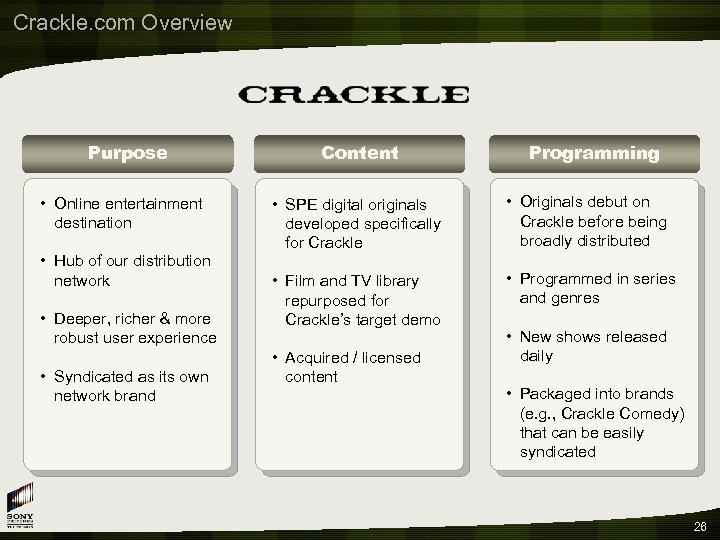

Crackle. com Overview Purpose • Online entertainment destination • Hub of our distribution network • Deeper, richer & more robust user experience • Syndicated as its own network brand Content Programming • SPE digital originals developed specifically for Crackle • Originals debut on Crackle before being broadly distributed • Film and TV library repurposed for Crackle’s target demo • Programmed in series and genres • Acquired / licensed content • New shows released daily • Packaged into brands (e. g. , Crackle Comedy) that can be easily syndicated 26

Crackle. com Overview Purpose • Online entertainment destination • Hub of our distribution network • Deeper, richer & more robust user experience • Syndicated as its own network brand Content Programming • SPE digital originals developed specifically for Crackle • Originals debut on Crackle before being broadly distributed • Film and TV library repurposed for Crackle’s target demo • Programmed in series and genres • Acquired / licensed content • New shows released daily • Packaged into brands (e. g. , Crackle Comedy) that can be easily syndicated 26

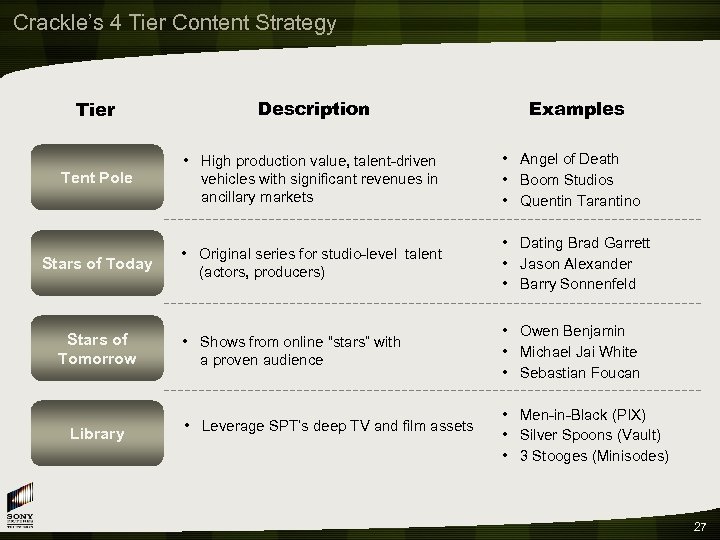

Crackle’s 4 Tier Content Strategy Examples Tier Description Tent Pole • High production value, talent-driven vehicles with significant revenues in ancillary markets • Angel of Death • Boom Studios • Quentin Tarantino Stars of Today • Original series for studio-level talent (actors, producers) • Dating Brad Garrett • Jason Alexander • Barry Sonnenfeld • Shows from online “stars” with a proven audience • Owen Benjamin • Michael Jai White • Sebastian Foucan Stars of Tomorrow Library • Leverage SPT’s deep TV and film assets • Men-in-Black (PIX) • Silver Spoons (Vault) • 3 Stooges (Minisodes) 27

Crackle’s 4 Tier Content Strategy Examples Tier Description Tent Pole • High production value, talent-driven vehicles with significant revenues in ancillary markets • Angel of Death • Boom Studios • Quentin Tarantino Stars of Today • Original series for studio-level talent (actors, producers) • Dating Brad Garrett • Jason Alexander • Barry Sonnenfeld • Shows from online “stars” with a proven audience • Owen Benjamin • Michael Jai White • Sebastian Foucan Stars of Tomorrow Library • Leverage SPT’s deep TV and film assets • Men-in-Black (PIX) • Silver Spoons (Vault) • 3 Stooges (Minisodes) 27

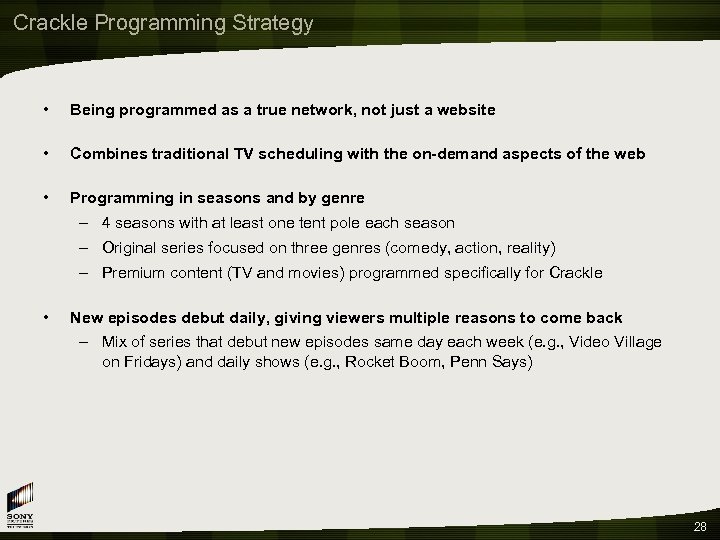

Crackle Programming Strategy • Being programmed as a true network, not just a website • Combines traditional TV scheduling with the on-demand aspects of the web • Programming in seasons and by genre – 4 seasons with at least one tent pole each season – Original series focused on three genres (comedy, action, reality) – Premium content (TV and movies) programmed specifically for Crackle • New episodes debut daily, giving viewers multiple reasons to come back – Mix of series that debut new episodes same day each week (e. g. , Video Village on Fridays) and daily shows (e. g. , Rocket Boom, Penn Says) 28

Crackle Programming Strategy • Being programmed as a true network, not just a website • Combines traditional TV scheduling with the on-demand aspects of the web • Programming in seasons and by genre – 4 seasons with at least one tent pole each season – Original series focused on three genres (comedy, action, reality) – Premium content (TV and movies) programmed specifically for Crackle • New episodes debut daily, giving viewers multiple reasons to come back – Mix of series that debut new episodes same day each week (e. g. , Video Village on Fridays) and daily shows (e. g. , Rocket Boom, Penn Says) 28

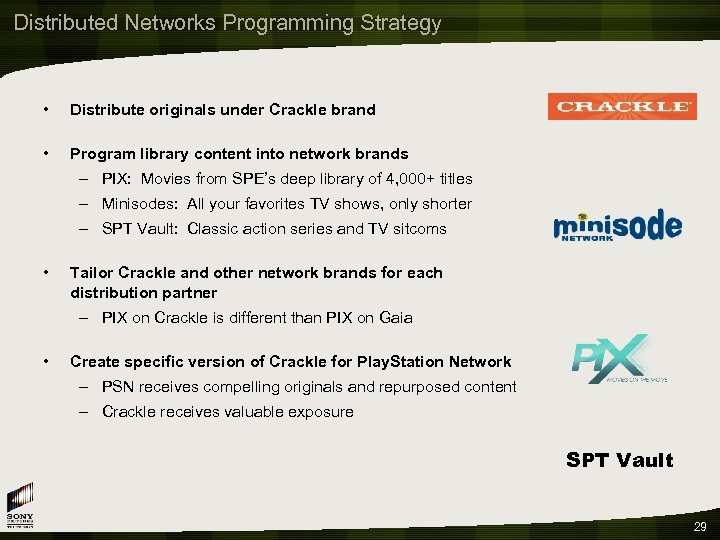

Distributed Networks Programming Strategy • Distribute originals under Crackle brand • Program library content into network brands – PIX: Movies from SPE’s deep library of 4, 000+ titles – Minisodes: All your favorites TV shows, only shorter – SPT Vault: Classic action series and TV sitcoms • Tailor Crackle and other network brands for each distribution partner – PIX on Crackle is different than PIX on Gaia • Create specific version of Crackle for Play. Station Network – PSN receives compelling originals and repurposed content – Crackle receives valuable exposure SPT Vault 29

Distributed Networks Programming Strategy • Distribute originals under Crackle brand • Program library content into network brands – PIX: Movies from SPE’s deep library of 4, 000+ titles – Minisodes: All your favorites TV shows, only shorter – SPT Vault: Classic action series and TV sitcoms • Tailor Crackle and other network brands for each distribution partner – PIX on Crackle is different than PIX on Gaia • Create specific version of Crackle for Play. Station Network – PSN receives compelling originals and repurposed content – Crackle receives valuable exposure SPT Vault 29

![Distribution of our Networks [PRELIMINARY] Goals • Further expansion with Tier II and Tier Distribution of our Networks [PRELIMINARY] Goals • Further expansion with Tier II and Tier](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-30.jpg) Distribution of our Networks [PRELIMINARY] Goals • Further expansion with Tier II and Tier III partners requires a scalable solution – Coordinating with corporate technology and WPF Show logos or all major distribution partners by network for large sites Show logos of existing and potential future smaller scale but high growth partner sites Growth • Majority of partners are “Tier 1” today Tier II • 38 live implementations with 16 partners Tier III Show logos of smaller sites that, once aggregated, create meaningful distribution Size 30

Distribution of our Networks [PRELIMINARY] Goals • Further expansion with Tier II and Tier III partners requires a scalable solution – Coordinating with corporate technology and WPF Show logos or all major distribution partners by network for large sites Show logos of existing and potential future smaller scale but high growth partner sites Growth • Majority of partners are “Tier 1” today Tier II • 38 live implementations with 16 partners Tier III Show logos of smaller sites that, once aggregated, create meaningful distribution Size 30

![Distribution Example • [PLACEHOLDER] Show the content / experience differs for original programming on Distribution Example • [PLACEHOLDER] Show the content / experience differs for original programming on](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-31.jpg) Distribution Example • [PLACEHOLDER] Show the content / experience differs for original programming on Crackle versus the same content distributed to our partner sites (e. g. , Video Village on Crackle vs. Video Village on You. Tube) 31

Distribution Example • [PLACEHOLDER] Show the content / experience differs for original programming on Crackle versus the same content distributed to our partner sites (e. g. , Video Village on Crackle vs. Video Village on You. Tube) 31

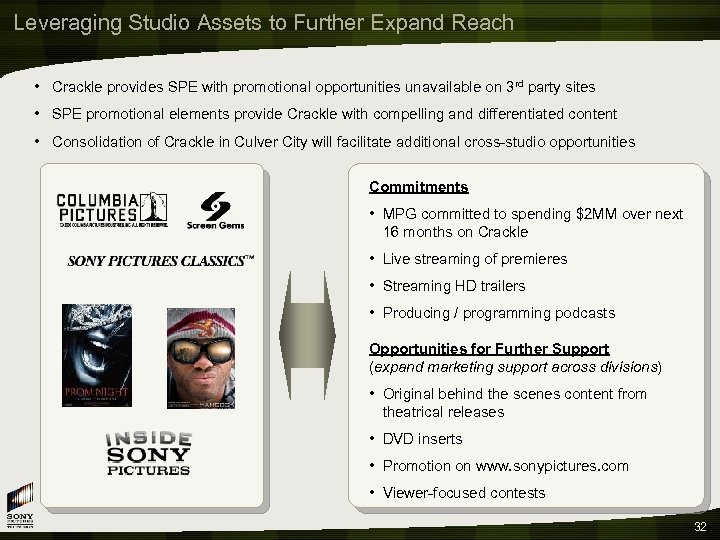

Leveraging Studio Assets to Further Expand Reach • Crackle provides SPE with promotional opportunities unavailable on 3 rd party sites • SPE promotional elements provide Crackle with compelling and differentiated content • Consolidation of Crackle in Culver City will facilitate additional cross-studio opportunities Commitments • MPG committed to spending $2 MM over next 16 months on Crackle • Live streaming of premieres • Streaming HD trailers • Producing / programming podcasts Opportunities for Further Support (expand marketing support across divisions) • Original behind the scenes content from theatrical releases • DVD inserts • Promotion on www. sonypictures. com • Viewer-focused contests 32

Leveraging Studio Assets to Further Expand Reach • Crackle provides SPE with promotional opportunities unavailable on 3 rd party sites • SPE promotional elements provide Crackle with compelling and differentiated content • Consolidation of Crackle in Culver City will facilitate additional cross-studio opportunities Commitments • MPG committed to spending $2 MM over next 16 months on Crackle • Live streaming of premieres • Streaming HD trailers • Producing / programming podcasts Opportunities for Further Support (expand marketing support across divisions) • Original behind the scenes content from theatrical releases • DVD inserts • Promotion on www. sonypictures. com • Viewer-focused contests 32

![Traffic Forecasts [PLACEHOLDER] Monthly Figures for the Last Month of the Fiscal Year (MM) Traffic Forecasts [PLACEHOLDER] Monthly Figures for the Last Month of the Fiscal Year (MM)](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-33.jpg) Traffic Forecasts [PLACEHOLDER] Monthly Figures for the Last Month of the Fiscal Year (MM) July ‘ 08 Actuals FY 09 FY 10 FY 11 FY 12 Crackle. com Unique Users Streams Network Streams Total Streams 33

Traffic Forecasts [PLACEHOLDER] Monthly Figures for the Last Month of the Fiscal Year (MM) July ‘ 08 Actuals FY 09 FY 10 FY 11 FY 12 Crackle. com Unique Users Streams Network Streams Total Streams 33

![Revenue Plan for Digital Networks [CARNEY / COUPER TO PROVIDE] 34 Revenue Plan for Digital Networks [CARNEY / COUPER TO PROVIDE] 34](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-34.jpg) Revenue Plan for Digital Networks [CARNEY / COUPER TO PROVIDE] 34

Revenue Plan for Digital Networks [CARNEY / COUPER TO PROVIDE] 34

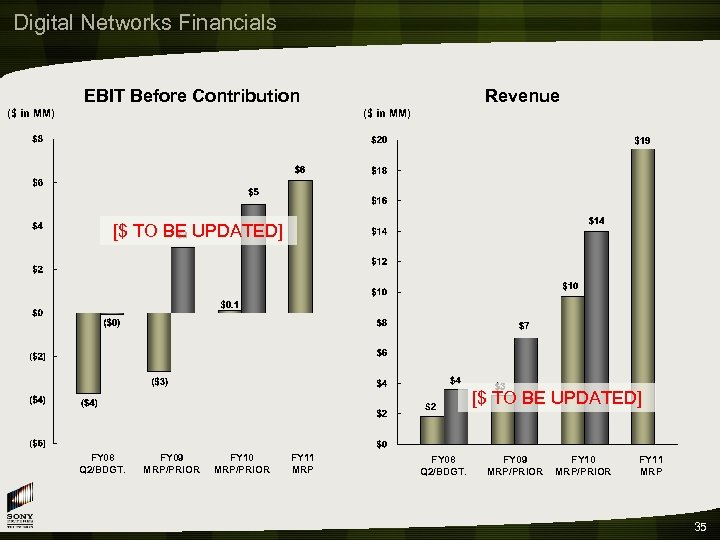

Digital Networks Financials EBIT Before Contribution ($ in MM) Revenue ($ in MM) [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 35

Digital Networks Financials EBIT Before Contribution ($ in MM) Revenue ($ in MM) [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 35

![Crackle Financial Summary EBIT Revenue ($ in MM) [$ TO BE UPDATED] FY 08 Crackle Financial Summary EBIT Revenue ($ in MM) [$ TO BE UPDATED] FY 08](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-36.jpg) Crackle Financial Summary EBIT Revenue ($ in MM) [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 36

Crackle Financial Summary EBIT Revenue ($ in MM) [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 36

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 37

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 37

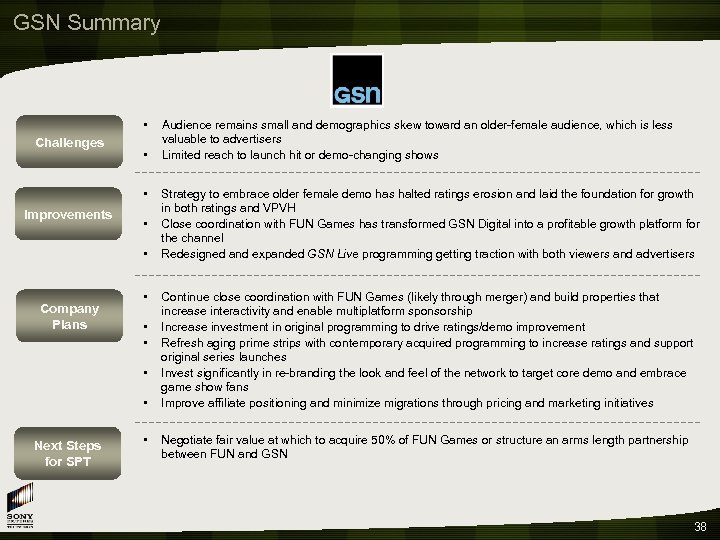

GSN Summary • Challenges • • Improvements • • Company Plans • • • Next Steps for SPT • Audience remains small and demographics skew toward an older-female audience, which is less valuable to advertisers Limited reach to launch hit or demo-changing shows Strategy to embrace older female demo has halted ratings erosion and laid the foundation for growth in both ratings and VPVH Close coordination with FUN Games has transformed GSN Digital into a profitable growth platform for the channel Redesigned and expanded GSN Live programming getting traction with both viewers and advertisers Continue close coordination with FUN Games (likely through merger) and build properties that increase interactivity and enable multiplatform sponsorship Increase investment in original programming to drive ratings/demo improvement Refresh aging prime strips with contemporary acquired programming to increase ratings and support original series launches Invest significantly in re-branding the look and feel of the network to target core demo and embrace game show fans Improve affiliate positioning and minimize migrations through pricing and marketing initiatives Negotiate fair value at which to acquire 50% of FUN Games or structure an arms length partnership between FUN and GSN 38

GSN Summary • Challenges • • Improvements • • Company Plans • • • Next Steps for SPT • Audience remains small and demographics skew toward an older-female audience, which is less valuable to advertisers Limited reach to launch hit or demo-changing shows Strategy to embrace older female demo has halted ratings erosion and laid the foundation for growth in both ratings and VPVH Close coordination with FUN Games has transformed GSN Digital into a profitable growth platform for the channel Redesigned and expanded GSN Live programming getting traction with both viewers and advertisers Continue close coordination with FUN Games (likely through merger) and build properties that increase interactivity and enable multiplatform sponsorship Increase investment in original programming to drive ratings/demo improvement Refresh aging prime strips with contemporary acquired programming to increase ratings and support original series launches Invest significantly in re-branding the look and feel of the network to target core demo and embrace game show fans Improve affiliate positioning and minimize migrations through pricing and marketing initiatives Negotiate fair value at which to acquire 50% of FUN Games or structure an arms length partnership between FUN and GSN 38

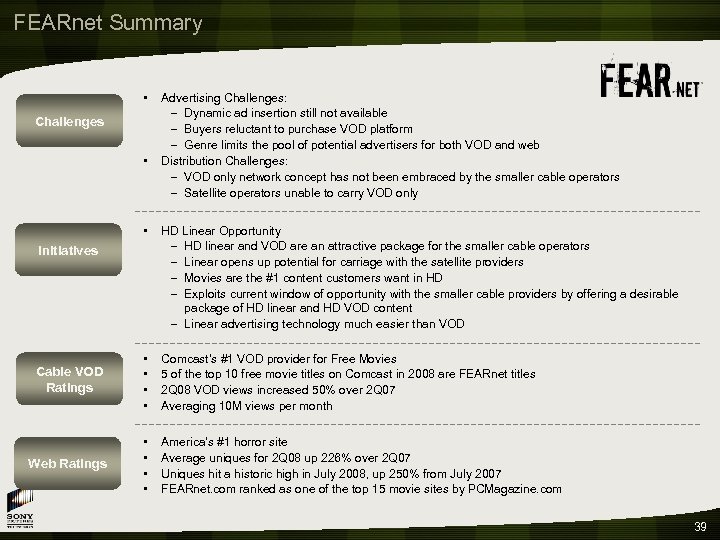

FEARnet Summary • Challenges • Advertising Challenges: – Dynamic ad insertion still not available – Buyers reluctant to purchase VOD platform – Genre limits the pool of potential advertisers for both VOD and web Distribution Challenges: – VOD only network concept has not been embraced by the smaller cable operators – Satellite operators unable to carry VOD only • HD Linear Opportunity – HD linear and VOD are an attractive package for the smaller cable operators – Linear opens up potential for carriage with the satellite providers – Movies are the #1 content customers want in HD – Exploits current window of opportunity with the smaller cable providers by offering a desirable package of HD linear and HD VOD content – Linear advertising technology much easier than VOD Cable VOD Ratings • • Comcast’s #1 VOD provider for Free Movies 5 of the top 10 free movie titles on Comcast in 2008 are FEARnet titles 2 Q 08 VOD views increased 50% over 2 Q 07 Averaging 10 M views per month Web Ratings • • America’s #1 horror site Average uniques for 2 Q 08 up 226% over 2 Q 07 Uniques hit a historic high in July 2008, up 250% from July 2007 FEARnet. com ranked as one of the top 15 movie sites by PCMagazine. com Initiatives 39

FEARnet Summary • Challenges • Advertising Challenges: – Dynamic ad insertion still not available – Buyers reluctant to purchase VOD platform – Genre limits the pool of potential advertisers for both VOD and web Distribution Challenges: – VOD only network concept has not been embraced by the smaller cable operators – Satellite operators unable to carry VOD only • HD Linear Opportunity – HD linear and VOD are an attractive package for the smaller cable operators – Linear opens up potential for carriage with the satellite providers – Movies are the #1 content customers want in HD – Exploits current window of opportunity with the smaller cable providers by offering a desirable package of HD linear and HD VOD content – Linear advertising technology much easier than VOD Cable VOD Ratings • • Comcast’s #1 VOD provider for Free Movies 5 of the top 10 free movie titles on Comcast in 2008 are FEARnet titles 2 Q 08 VOD views increased 50% over 2 Q 07 Averaging 10 M views per month Web Ratings • • America’s #1 horror site Average uniques for 2 Q 08 up 226% over 2 Q 07 Uniques hit a historic high in July 2008, up 250% from July 2007 FEARnet. com ranked as one of the top 15 movie sites by PCMagazine. com Initiatives 39

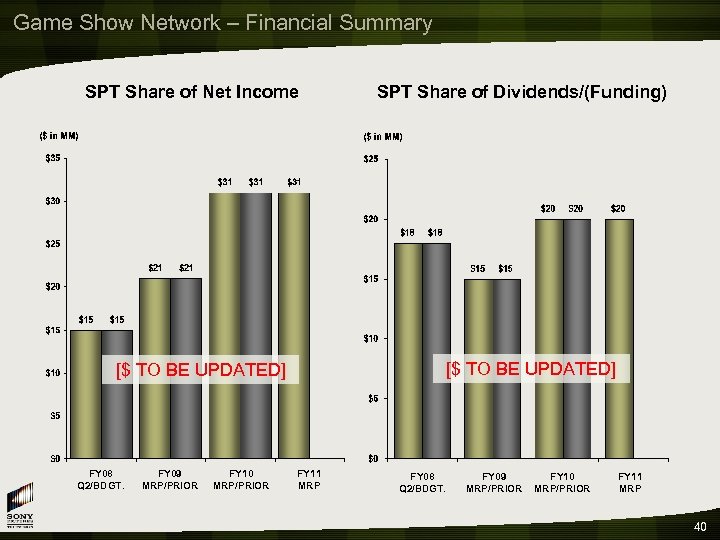

Game Show Network – Financial Summary SPT Share of Net Income SPT Share of Dividends/(Funding) [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 40

Game Show Network – Financial Summary SPT Share of Net Income SPT Share of Dividends/(Funding) [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 40

![FEARnet Financial Summary SPT Share of Net Loss/Income [$ TO BE UPDATED] FY 08 FEARnet Financial Summary SPT Share of Net Loss/Income [$ TO BE UPDATED] FY 08](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-41.jpg) FEARnet Financial Summary SPT Share of Net Loss/Income [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR SPT Share of Cash Funding FY 11 MRP FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 41

FEARnet Financial Summary SPT Share of Net Loss/Income [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR SPT Share of Cash Funding FY 11 MRP FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 41

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 42

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 42

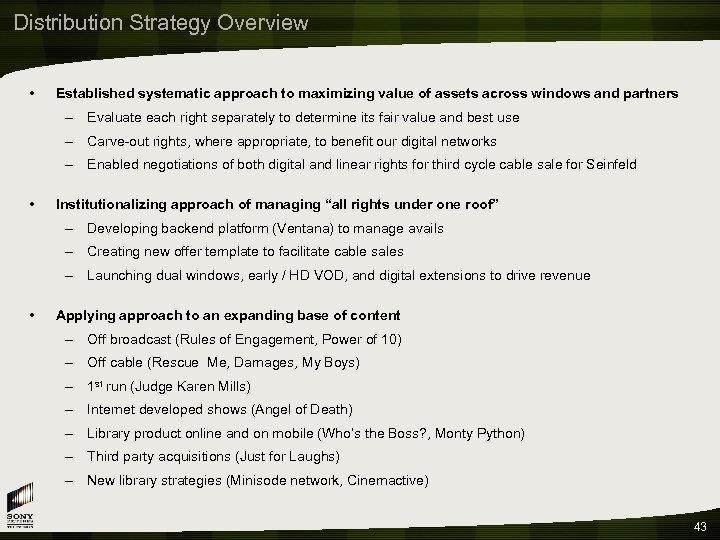

Distribution Strategy Overview • Established systematic approach to maximizing value of assets across windows and partners – Evaluate each right separately to determine its fair value and best use – Carve-out rights, where appropriate, to benefit our digital networks – Enabled negotiations of both digital and linear rights for third cycle cable sale for Seinfeld • Institutionalizing approach of managing “all rights under one roof” – Developing backend platform (Ventana) to manage avails – Creating new offer template to facilitate cable sales – Launching dual windows, early / HD VOD, and digital extensions to drive revenue • Applying approach to an expanding base of content – Off broadcast (Rules of Engagement, Power of 10) – Off cable (Rescue Me, Damages, My Boys) – 1 st run (Judge Karen Mills) – Internet developed shows (Angel of Death) – Library product online and on mobile (Who’s the Boss? , Monty Python) – Third party acquisitions (Just for Laughs) – New library strategies (Minisode network, Cinemactive) 43

Distribution Strategy Overview • Established systematic approach to maximizing value of assets across windows and partners – Evaluate each right separately to determine its fair value and best use – Carve-out rights, where appropriate, to benefit our digital networks – Enabled negotiations of both digital and linear rights for third cycle cable sale for Seinfeld • Institutionalizing approach of managing “all rights under one roof” – Developing backend platform (Ventana) to manage avails – Creating new offer template to facilitate cable sales – Launching dual windows, early / HD VOD, and digital extensions to drive revenue • Applying approach to an expanding base of content – Off broadcast (Rules of Engagement, Power of 10) – Off cable (Rescue Me, Damages, My Boys) – 1 st run (Judge Karen Mills) – Internet developed shows (Angel of Death) – Library product online and on mobile (Who’s the Boss? , Monty Python) – Third party acquisitions (Just for Laughs) – New library strategies (Minisode network, Cinemactive) 43

![Distribution Sales – Total Licensing Revenue SPT will generate [$745] million in total current Distribution Sales – Total Licensing Revenue SPT will generate [$745] million in total current](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-44.jpg) Distribution Sales – Total Licensing Revenue SPT will generate [$745] million in total current and library sales for SPE ($ in MM) $937 $745 $748 $799 $751 $793 $680 [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 44

Distribution Sales – Total Licensing Revenue SPT will generate [$745] million in total current and library sales for SPE ($ in MM) $937 $745 $748 $799 $751 $793 $680 [$ TO BE UPDATED] FY 08 Q 2/BDGT. FY 09 MRP/PRIOR FY 10 MRP/PRIOR FY 11 MRP 44

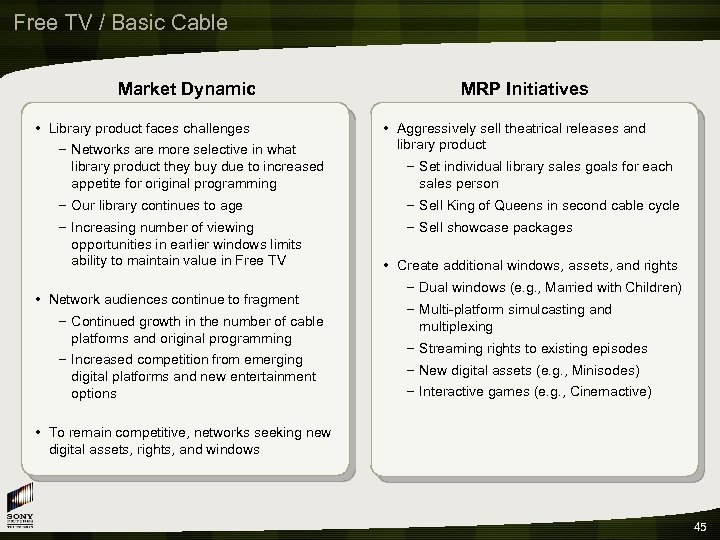

Free TV / Basic Cable Market Dynamic • Library product faces challenges – Networks are more selective in what library product they buy due to increased appetite for original programming MRP Initiatives • Aggressively sell theatrical releases and library product – Set individual library sales goals for each sales person – Our library continues to age – Sell King of Queens in second cable cycle – Increasing number of viewing opportunities in earlier windows limits ability to maintain value in Free TV – Sell showcase packages • Network audiences continue to fragment – Continued growth in the number of cable platforms and original programming – Increased competition from emerging digital platforms and new entertainment options • Create additional windows, assets, and rights – Dual windows (e. g. , Married with Children) – Multi-platform simulcasting and multiplexing – Streaming rights to existing episodes – New digital assets (e. g. , Minisodes) – Interactive games (e. g. , Cinemactive) • To remain competitive, networks seeking new digital assets, rights, and windows 45

Free TV / Basic Cable Market Dynamic • Library product faces challenges – Networks are more selective in what library product they buy due to increased appetite for original programming MRP Initiatives • Aggressively sell theatrical releases and library product – Set individual library sales goals for each sales person – Our library continues to age – Sell King of Queens in second cable cycle – Increasing number of viewing opportunities in earlier windows limits ability to maintain value in Free TV – Sell showcase packages • Network audiences continue to fragment – Continued growth in the number of cable platforms and original programming – Increased competition from emerging digital platforms and new entertainment options • Create additional windows, assets, and rights – Dual windows (e. g. , Married with Children) – Multi-platform simulcasting and multiplexing – Streaming rights to existing episodes – New digital assets (e. g. , Minisodes) – Interactive games (e. g. , Cinemactive) • To remain competitive, networks seeking new digital assets, rights, and windows 45

![Free TV / Basic Cable - Revenues ($ in MM) [$ TO BE UPDATED] Free TV / Basic Cable - Revenues ($ in MM) [$ TO BE UPDATED]](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-46.jpg) Free TV / Basic Cable - Revenues ($ in MM) [$ TO BE UPDATED] 46

Free TV / Basic Cable - Revenues ($ in MM) [$ TO BE UPDATED] 46

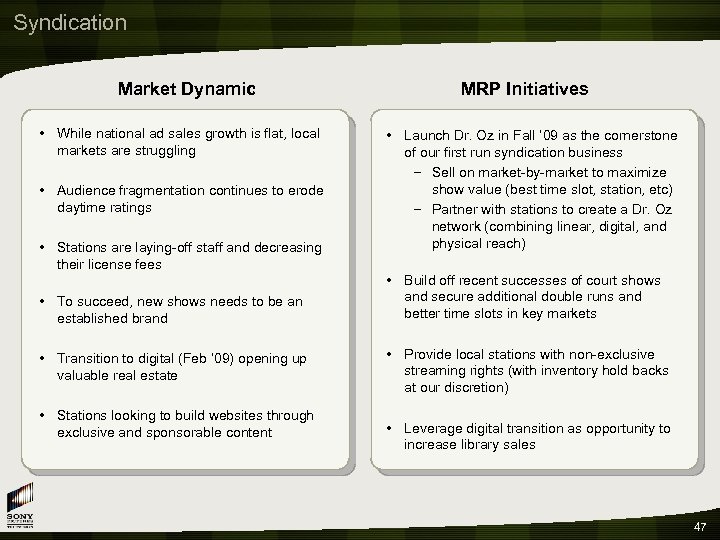

Syndication Market Dynamic • While national ad sales growth is flat, local markets are struggling • Audience fragmentation continues to erode daytime ratings • Stations are laying-off staff and decreasing their license fees • To succeed, new shows needs to be an established brand • Transition to digital (Feb ’ 09) opening up valuable real estate • Stations looking to build websites through exclusive and sponsorable content MRP Initiatives • Launch Dr. Oz in Fall ’ 09 as the cornerstone of our first run syndication business – Sell on market-by-market to maximize show value (best time slot, station, etc) – Partner with stations to create a Dr. Oz network (combining linear, digital, and physical reach) • Build off recent successes of court shows and secure additional double runs and better time slots in key markets • Provide local stations with non-exclusive streaming rights (with inventory hold backs at our discretion) • Leverage digital transition as opportunity to increase library sales 47

Syndication Market Dynamic • While national ad sales growth is flat, local markets are struggling • Audience fragmentation continues to erode daytime ratings • Stations are laying-off staff and decreasing their license fees • To succeed, new shows needs to be an established brand • Transition to digital (Feb ’ 09) opening up valuable real estate • Stations looking to build websites through exclusive and sponsorable content MRP Initiatives • Launch Dr. Oz in Fall ’ 09 as the cornerstone of our first run syndication business – Sell on market-by-market to maximize show value (best time slot, station, etc) – Partner with stations to create a Dr. Oz network (combining linear, digital, and physical reach) • Build off recent successes of court shows and secure additional double runs and better time slots in key markets • Provide local stations with non-exclusive streaming rights (with inventory hold backs at our discretion) • Leverage digital transition as opportunity to increase library sales 47

![Syndication - Revenues ($ in MM) [$ TO BE UPDATED] 48 Syndication - Revenues ($ in MM) [$ TO BE UPDATED] 48](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-48.jpg) Syndication - Revenues ($ in MM) [$ TO BE UPDATED] 48

Syndication - Revenues ($ in MM) [$ TO BE UPDATED] 48

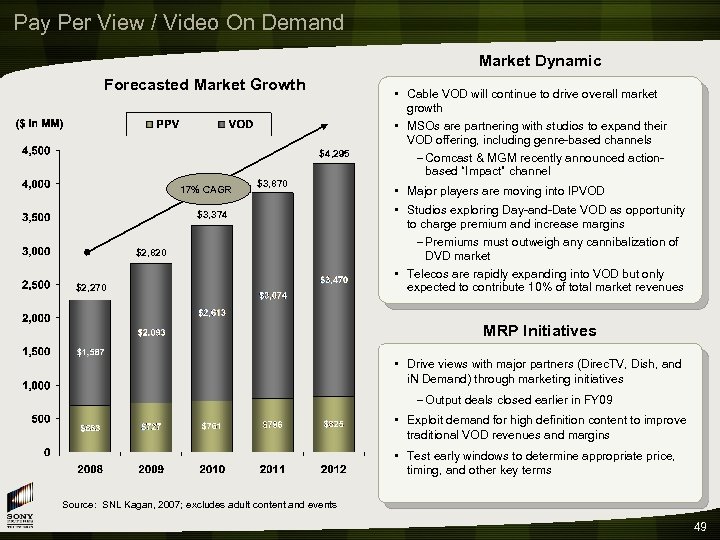

Pay Per View / Video On Demand Market Dynamic Forecasted Market Growth $4, 295 17% CAGR $3, 870 $3, 374 $2, 820 $2, 270 • Cable VOD will continue to drive overall market growth • MSOs are partnering with studios to expand their VOD offering, including genre-based channels – Comcast & MGM recently announced actionbased “Impact” channel • Major players are moving into IPVOD • Studios exploring Day-and-Date VOD as opportunity to charge premium and increase margins – Premiums must outweigh any cannibalization of DVD market • Telecos are rapidly expanding into VOD but only expected to contribute 10% of total market revenues MRP Initiatives • Drive views with major partners (Direc. TV, Dish, and i. N Demand) through marketing initiatives – Output deals closed earlier in FY 09 • Exploit demand for high definition content to improve traditional VOD revenues and margins • Test early windows to determine appropriate price, timing, and other key terms Source: SNL Kagan, 2007; excludes adult content and events 49

Pay Per View / Video On Demand Market Dynamic Forecasted Market Growth $4, 295 17% CAGR $3, 870 $3, 374 $2, 820 $2, 270 • Cable VOD will continue to drive overall market growth • MSOs are partnering with studios to expand their VOD offering, including genre-based channels – Comcast & MGM recently announced actionbased “Impact” channel • Major players are moving into IPVOD • Studios exploring Day-and-Date VOD as opportunity to charge premium and increase margins – Premiums must outweigh any cannibalization of DVD market • Telecos are rapidly expanding into VOD but only expected to contribute 10% of total market revenues MRP Initiatives • Drive views with major partners (Direc. TV, Dish, and i. N Demand) through marketing initiatives – Output deals closed earlier in FY 09 • Exploit demand for high definition content to improve traditional VOD revenues and margins • Test early windows to determine appropriate price, timing, and other key terms Source: SNL Kagan, 2007; excludes adult content and events 49

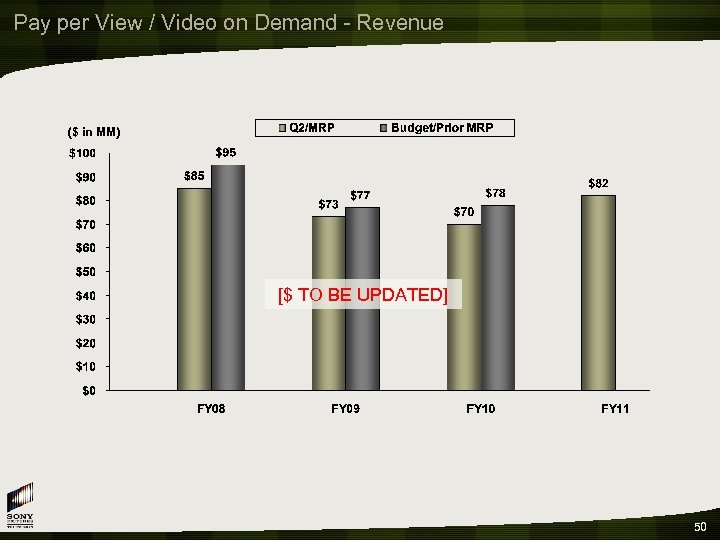

Pay per View / Video on Demand - Revenue ($ in MM) [$ TO BE UPDATED] 50

Pay per View / Video on Demand - Revenue ($ in MM) [$ TO BE UPDATED] 50

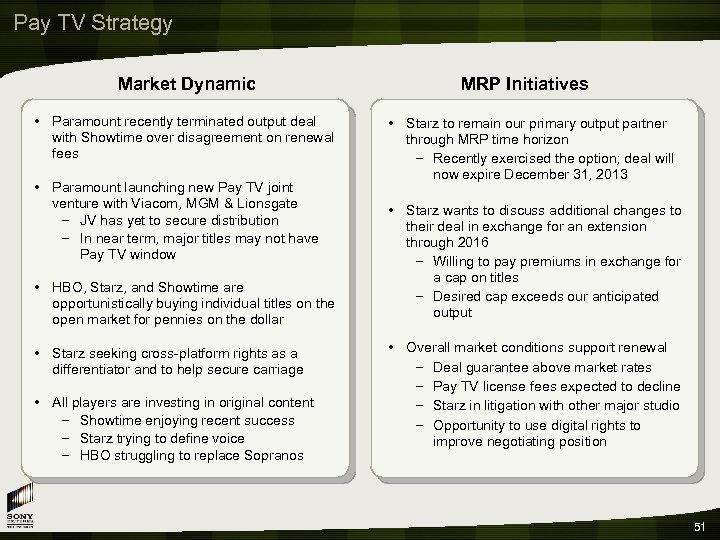

Pay TV Strategy Market Dynamic • Paramount recently terminated output deal with Showtime over disagreement on renewal fees • Paramount launching new Pay TV joint venture with Viacom, MGM & Lionsgate – JV has yet to secure distribution – In near term, major titles may not have Pay TV window • HBO, Starz, and Showtime are opportunistically buying individual titles on the open market for pennies on the dollar • Starz seeking cross-platform rights as a differentiator and to help secure carriage • All players are investing in original content – Showtime enjoying recent success – Starz trying to define voice – HBO struggling to replace Sopranos MRP Initiatives • Starz to remain our primary output partner through MRP time horizon – Recently exercised the option; deal will now expire December 31, 2013 • Starz wants to discuss additional changes to their deal in exchange for an extension through 2016 – Willing to pay premiums in exchange for a cap on titles – Desired cap exceeds our anticipated output • Overall market conditions support renewal – Deal guarantee above market rates – Pay TV license fees expected to decline – Starz in litigation with other major studio – Opportunity to use digital rights to improve negotiating position 51

Pay TV Strategy Market Dynamic • Paramount recently terminated output deal with Showtime over disagreement on renewal fees • Paramount launching new Pay TV joint venture with Viacom, MGM & Lionsgate – JV has yet to secure distribution – In near term, major titles may not have Pay TV window • HBO, Starz, and Showtime are opportunistically buying individual titles on the open market for pennies on the dollar • Starz seeking cross-platform rights as a differentiator and to help secure carriage • All players are investing in original content – Showtime enjoying recent success – Starz trying to define voice – HBO struggling to replace Sopranos MRP Initiatives • Starz to remain our primary output partner through MRP time horizon – Recently exercised the option; deal will now expire December 31, 2013 • Starz wants to discuss additional changes to their deal in exchange for an extension through 2016 – Willing to pay premiums in exchange for a cap on titles – Desired cap exceeds our anticipated output • Overall market conditions support renewal – Deal guarantee above market rates – Pay TV license fees expected to decline – Starz in litigation with other major studio – Opportunity to use digital rights to improve negotiating position 51

![Pay TV - Revenues ($ in MM) [$ TO BE UPDATED] 52 Pay TV - Revenues ($ in MM) [$ TO BE UPDATED] 52](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-52.jpg) Pay TV - Revenues ($ in MM) [$ TO BE UPDATED] 52

Pay TV - Revenues ($ in MM) [$ TO BE UPDATED] 52

![Library Sales Targets by Market $113 $99 $90 $87 [$ TO BE UPDATED] In-House Library Sales Targets by Market $113 $99 $90 $87 [$ TO BE UPDATED] In-House](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-53.jpg) Library Sales Targets by Market $113 $99 $90 $87 [$ TO BE UPDATED] In-House $38 MM • 3 year annual average of $101 MM in FY 08 -FY 10, and $100 MM in FY 09 -FY 11 • 4 year annual average of $97 MM 53

Library Sales Targets by Market $113 $99 $90 $87 [$ TO BE UPDATED] In-House $38 MM • 3 year annual average of $101 MM in FY 08 -FY 10, and $100 MM in FY 09 -FY 11 • 4 year annual average of $97 MM 53

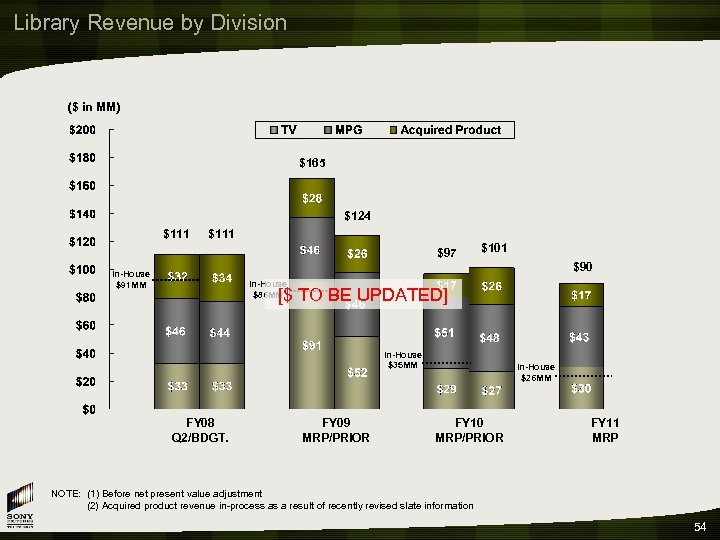

Library Revenue by Division ($ in MM) $165 $124 $111 $97 $101 $90 In-House $91 MM In-House $86 MM [$ TO BE UPDATED] In-House $35 MM FY 08 Q 2/BDGT. FY 09 MRP/PRIOR In-House $26 MM FY 10 MRP/PRIOR FY 11 MRP NOTE: (1) Before net present value adjustment (2) Acquired product revenue in-process as a result of recently revised slate information 54

Library Revenue by Division ($ in MM) $165 $124 $111 $97 $101 $90 In-House $91 MM In-House $86 MM [$ TO BE UPDATED] In-House $35 MM FY 08 Q 2/BDGT. FY 09 MRP/PRIOR In-House $26 MM FY 10 MRP/PRIOR FY 11 MRP NOTE: (1) Before net present value adjustment (2) Acquired product revenue in-process as a result of recently revised slate information 54

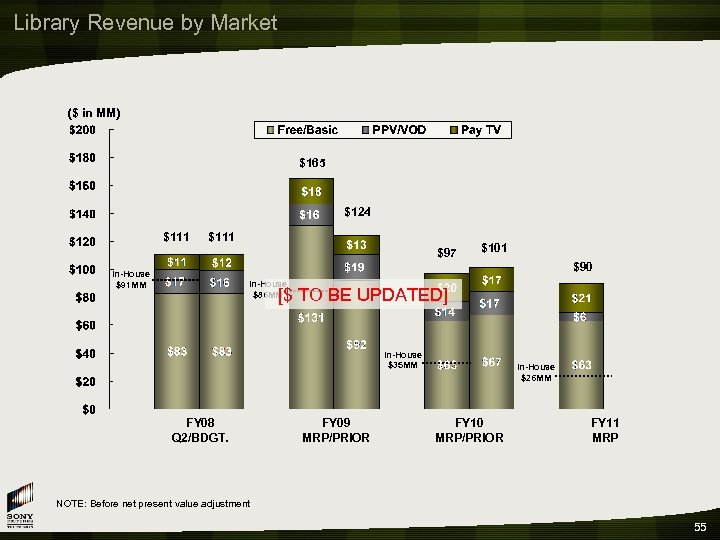

Library Revenue by Market ($ in MM) $165 $124 $111 $97 $101 $90 In-House $91 MM In-House $86 MM [$ TO BE UPDATED] In-House $35 MM FY 08 Q 2/BDGT. FY 09 MRP/PRIOR In-House $26 MM FY 10 MRP/PRIOR FY 11 MRP NOTE: Before net present value adjustment 55

Library Revenue by Market ($ in MM) $165 $124 $111 $97 $101 $90 In-House $91 MM In-House $86 MM [$ TO BE UPDATED] In-House $35 MM FY 08 Q 2/BDGT. FY 09 MRP/PRIOR In-House $26 MM FY 10 MRP/PRIOR FY 11 MRP NOTE: Before net present value adjustment 55

![Distribution Sales – FY 10 Slate [TO BE UPDATED] SPT will generate over [$451] Distribution Sales – FY 10 Slate [TO BE UPDATED] SPT will generate over [$451]](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-56.jpg) Distribution Sales – FY 10 Slate [TO BE UPDATED] SPT will generate over [$451] million in sales from the FY 10 slate 56

Distribution Sales – FY 10 Slate [TO BE UPDATED] SPT will generate over [$451] million in sales from the FY 10 slate 56

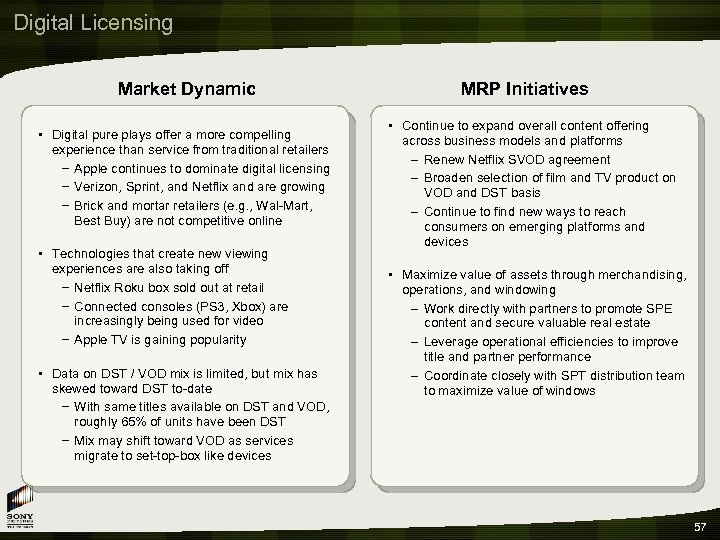

Digital Licensing Market Dynamic • Digital pure plays offer a more compelling experience than service from traditional retailers – Apple continues to dominate digital licensing – Verizon, Sprint, and Netflix and are growing – Brick and mortar retailers (e. g. , Wal-Mart, Best Buy) are not competitive online • Technologies that create new viewing experiences are also taking off – Netflix Roku box sold out at retail – Connected consoles (PS 3, Xbox) are increasingly being used for video – Apple TV is gaining popularity • Data on DST / VOD mix is limited, but mix has skewed toward DST to-date – With same titles available on DST and VOD, roughly 65% of units have been DST – Mix may shift toward VOD as services migrate to set-top-box like devices MRP Initiatives • Continue to expand overall content offering across business models and platforms – Renew Netflix SVOD agreement – Broaden selection of film and TV product on VOD and DST basis – Continue to find new ways to reach consumers on emerging platforms and devices • Maximize value of assets through merchandising, operations, and windowing – Work directly with partners to promote SPE content and secure valuable real estate – Leverage operational efficiencies to improve title and partner performance – Coordinate closely with SPT distribution team to maximize value of windows 57

Digital Licensing Market Dynamic • Digital pure plays offer a more compelling experience than service from traditional retailers – Apple continues to dominate digital licensing – Verizon, Sprint, and Netflix and are growing – Brick and mortar retailers (e. g. , Wal-Mart, Best Buy) are not competitive online • Technologies that create new viewing experiences are also taking off – Netflix Roku box sold out at retail – Connected consoles (PS 3, Xbox) are increasingly being used for video – Apple TV is gaining popularity • Data on DST / VOD mix is limited, but mix has skewed toward DST to-date – With same titles available on DST and VOD, roughly 65% of units have been DST – Mix may shift toward VOD as services migrate to set-top-box like devices MRP Initiatives • Continue to expand overall content offering across business models and platforms – Renew Netflix SVOD agreement – Broaden selection of film and TV product on VOD and DST basis – Continue to find new ways to reach consumers on emerging platforms and devices • Maximize value of assets through merchandising, operations, and windowing – Work directly with partners to promote SPE content and secure valuable real estate – Leverage operational efficiencies to improve title and partner performance – Coordinate closely with SPT distribution team to maximize value of windows 57

![Digital Licensing Revenues ($ in MM) [$ TO BE UPDATED] • Variance to PY Digital Licensing Revenues ($ in MM) [$ TO BE UPDATED] • Variance to PY](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-58.jpg) Digital Licensing Revenues ($ in MM) [$ TO BE UPDATED] • Variance to PY MRP is the result of key DST partners not entering the business (Best Buy, Target, Google, Yahoo) and higher than anticipated Apple/Microsoft market share ($ in MM) Apple/Microsoft Opp. $10 $40 $60 $80 58

Digital Licensing Revenues ($ in MM) [$ TO BE UPDATED] • Variance to PY MRP is the result of key DST partners not entering the business (Best Buy, Target, Google, Yahoo) and higher than anticipated Apple/Microsoft market share ($ in MM) Apple/Microsoft Opp. $10 $40 $60 $80 58

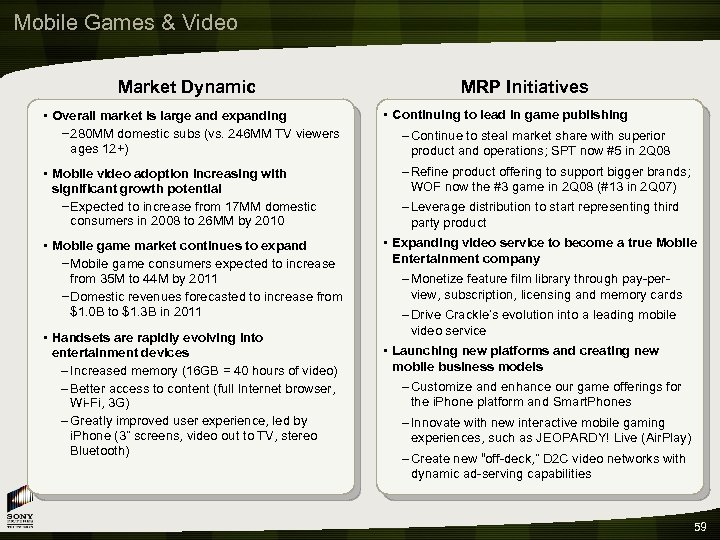

Mobile Games & Video Market Dynamic • Overall market is large and expanding – 280 MM domestic subs (vs. 246 MM TV viewers ages 12+) • Mobile video adoption increasing with significant growth potential – Expected to increase from 17 MM domestic consumers in 2008 to 26 MM by 2010 • Mobile game market continues to expand – Mobile game consumers expected to increase from 35 M to 44 M by 2011 – Domestic revenues forecasted to increase from $1. 0 B to $1. 3 B in 2011 • Handsets are rapidly evolving into entertainment devices – Increased memory (16 GB = 40 hours of video) – Better access to content (full Internet browser, Wi-Fi, 3 G) – Greatly improved user experience, led by i. Phone (3” screens, video out to TV, stereo Bluetooth) MRP Initiatives • Continuing to lead in game publishing – Continue to steal market share with superior product and operations; SPT now #5 in 2 Q 08 – Refine product offering to support bigger brands; WOF now the #3 game in 2 Q 08 (#13 in 2 Q 07) – Leverage distribution to start representing third party product • Expanding video service to become a true Mobile Entertainment company – Monetize feature film library through pay-perview, subscription, licensing and memory cards – Drive Crackle’s evolution into a leading mobile video service • Launching new platforms and creating new mobile business models – Customize and enhance our game offerings for the i. Phone platform and Smart. Phones – Innovate with new interactive mobile gaming experiences, such as JEOPARDY! Live (Air. Play) – Create new “off-deck, ” D 2 C video networks with dynamic ad-serving capabilities 59

Mobile Games & Video Market Dynamic • Overall market is large and expanding – 280 MM domestic subs (vs. 246 MM TV viewers ages 12+) • Mobile video adoption increasing with significant growth potential – Expected to increase from 17 MM domestic consumers in 2008 to 26 MM by 2010 • Mobile game market continues to expand – Mobile game consumers expected to increase from 35 M to 44 M by 2011 – Domestic revenues forecasted to increase from $1. 0 B to $1. 3 B in 2011 • Handsets are rapidly evolving into entertainment devices – Increased memory (16 GB = 40 hours of video) – Better access to content (full Internet browser, Wi-Fi, 3 G) – Greatly improved user experience, led by i. Phone (3” screens, video out to TV, stereo Bluetooth) MRP Initiatives • Continuing to lead in game publishing – Continue to steal market share with superior product and operations; SPT now #5 in 2 Q 08 – Refine product offering to support bigger brands; WOF now the #3 game in 2 Q 08 (#13 in 2 Q 07) – Leverage distribution to start representing third party product • Expanding video service to become a true Mobile Entertainment company – Monetize feature film library through pay-perview, subscription, licensing and memory cards – Drive Crackle’s evolution into a leading mobile video service • Launching new platforms and creating new mobile business models – Customize and enhance our game offerings for the i. Phone platform and Smart. Phones – Innovate with new interactive mobile gaming experiences, such as JEOPARDY! Live (Air. Play) – Create new “off-deck, ” D 2 C video networks with dynamic ad-serving capabilities 59

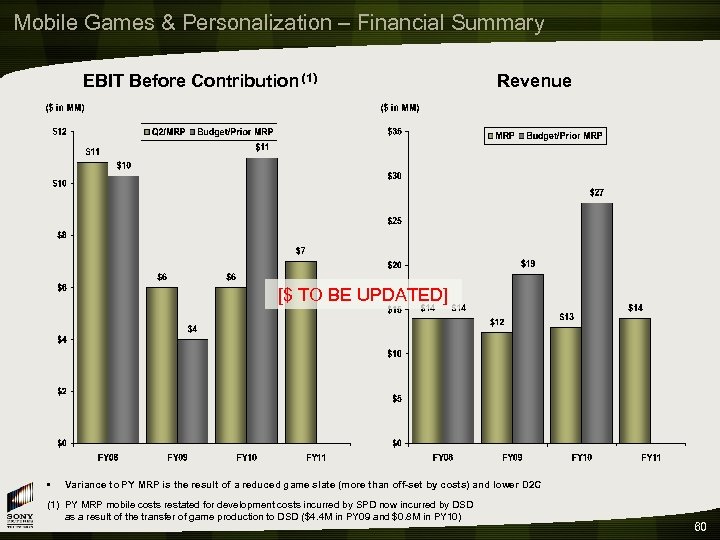

Mobile Games & Personalization – Financial Summary EBIT Before Contribution (1) Revenue [$ TO BE UPDATED] • Variance to PY MRP is the result of a reduced game slate (more than off-set by costs) and lower D 2 C (1) PY MRP mobile costs restated for development costs incurred by SPD now incurred by DSD as a result of the transfer of game production to DSD ($4. 4 M in PY 09 and $0. 8 M in PY 10) 60

Mobile Games & Personalization – Financial Summary EBIT Before Contribution (1) Revenue [$ TO BE UPDATED] • Variance to PY MRP is the result of a reduced game slate (more than off-set by costs) and lower D 2 C (1) PY MRP mobile costs restated for development costs incurred by SPD now incurred by DSD as a result of the transfer of game production to DSD ($4. 4 M in PY 09 and $0. 8 M in PY 10) 60

![VOD vs. DVD [PLACEHOLDER] Physical Digital Sale Rental New Release $ $ $ $ VOD vs. DVD [PLACEHOLDER] Physical Digital Sale Rental New Release $ $ $ $](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-61.jpg) VOD vs. DVD [PLACEHOLDER] Physical Digital Sale Rental New Release $ $ $ $ Library $ $ $ $ New Release % % % % Library % % % % Revenue Titles 61

VOD vs. DVD [PLACEHOLDER] Physical Digital Sale Rental New Release $ $ $ $ Library $ $ $ $ New Release % % % % Library % % % % Revenue Titles 61

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 62

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 62

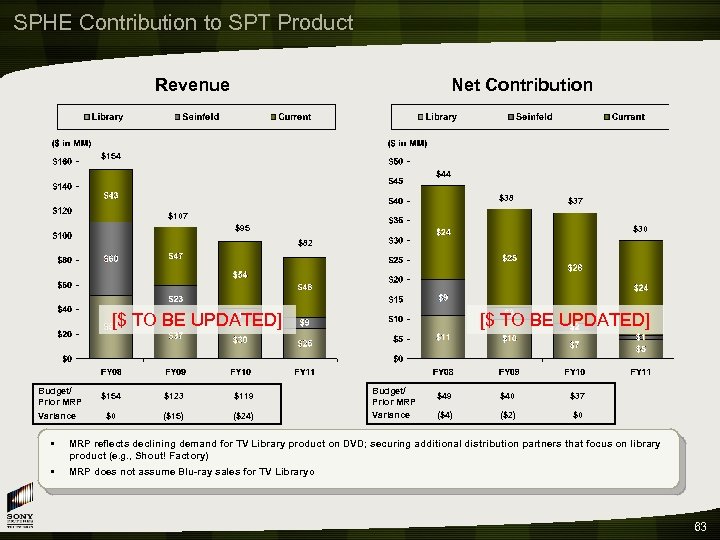

SPHE Contribution to SPT Product Revenue Net Contribution $154 $44 $38 $37 $107 $95 $30 $82 [$ TO BE UPDATED] Budget/ Prior MRP Variance [$ TO BE UPDATED] $154 $123 $119 Budget/ Prior MRP $49 $40 $37 $0 ($15) ($24) Variance ($4) ($2) $0 • MRP reflects declining demand for TV Library product on DVD; securing additional distribution partners that focus on library product (e. g. , Shout! Factory) • MRP does not assume Blu-ray sales for TV Library 0 63

SPHE Contribution to SPT Product Revenue Net Contribution $154 $44 $38 $37 $107 $95 $30 $82 [$ TO BE UPDATED] Budget/ Prior MRP Variance [$ TO BE UPDATED] $154 $123 $119 Budget/ Prior MRP $49 $40 $37 $0 ($15) ($24) Variance ($4) ($2) $0 • MRP reflects declining demand for TV Library product on DVD; securing additional distribution partners that focus on library product (e. g. , Shout! Factory) • MRP does not assume Blu-ray sales for TV Library 0 63

![SPTI Contribution to SPT Product Revenue Net Contribution [$ TO BE UPDATED] Budget/ Prior SPTI Contribution to SPT Product Revenue Net Contribution [$ TO BE UPDATED] Budget/ Prior](https://present5.com/presentation/5b127b60e39dc57241d409cd9ff0c388/image-64.jpg) SPTI Contribution to SPT Product Revenue Net Contribution [$ TO BE UPDATED] Budget/ Prior MRP $200 $174 $183 Budget/ Prior MRP $167 $146 $152 Variance $31 $46 $42 Variance $30 $39 $37 64

SPTI Contribution to SPT Product Revenue Net Contribution [$ TO BE UPDATED] Budget/ Prior MRP $200 $174 $183 Budget/ Prior MRP $167 $146 $152 Variance $31 $46 $42 Variance $30 $39 $37 64

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 65

1. Executive Summary 2. Core Programs 3. Programming 4. Digital Networks 5. Strategic Investments 6. Distribution & Licensing 7. SPHE & SPTI Contribution to SPT Product 8. Ad Sales 9. Appendix 65

Expanding SPT’s Advertising Footprint Current Business Lines Syndication : 10 Spot Cable / Satellite Emerging Opportunities Digital / Mobile Direct Response Play. Station Sony Ad Network PS. com Online Games Wireless Sony Electronics 66

Expanding SPT’s Advertising Footprint Current Business Lines Syndication : 10 Spot Cable / Satellite Emerging Opportunities Digital / Mobile Direct Response Play. Station Sony Ad Network PS. com Online Games Wireless Sony Electronics 66

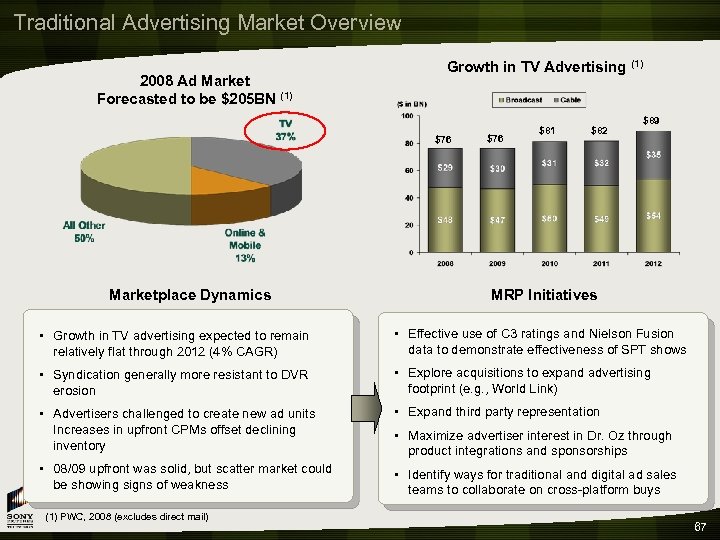

Traditional Advertising Market Overview 2008 Ad Market Forecasted to be $205 BN (1) Growth in TV Advertising (1) $76 Marketplace Dynamics $76 $81 $82 $89 MRP Initiatives • Growth in TV advertising expected to remain relatively flat through 2012 (4% CAGR) • Effective use of C 3 ratings and Nielson Fusion data to demonstrate effectiveness of SPT shows • Syndication generally more resistant to DVR erosion • Explore acquisitions to expand advertising footprint (e. g. , World Link) • Advertisers challenged to create new ad units Increases in upfront CPMs offset declining inventory • Expand third party representation • 08/09 upfront was solid, but scatter market could be showing signs of weakness • Identify ways for traditional and digital ad sales teams to collaborate on cross-platform buys (1) PWC, 2008 (excludes direct mail) • Maximize advertiser interest in Dr. Oz through product integrations and sponsorships 67

Traditional Advertising Market Overview 2008 Ad Market Forecasted to be $205 BN (1) Growth in TV Advertising (1) $76 Marketplace Dynamics $76 $81 $82 $89 MRP Initiatives • Growth in TV advertising expected to remain relatively flat through 2012 (4% CAGR) • Effective use of C 3 ratings and Nielson Fusion data to demonstrate effectiveness of SPT shows • Syndication generally more resistant to DVR erosion • Explore acquisitions to expand advertising footprint (e. g. , World Link) • Advertisers challenged to create new ad units Increases in upfront CPMs offset declining inventory • Expand third party representation • 08/09 upfront was solid, but scatter market could be showing signs of weakness • Identify ways for traditional and digital ad sales teams to collaborate on cross-platform buys (1) PWC, 2008 (excludes direct mail) • Maximize advertiser interest in Dr. Oz through product integrations and sponsorships 67

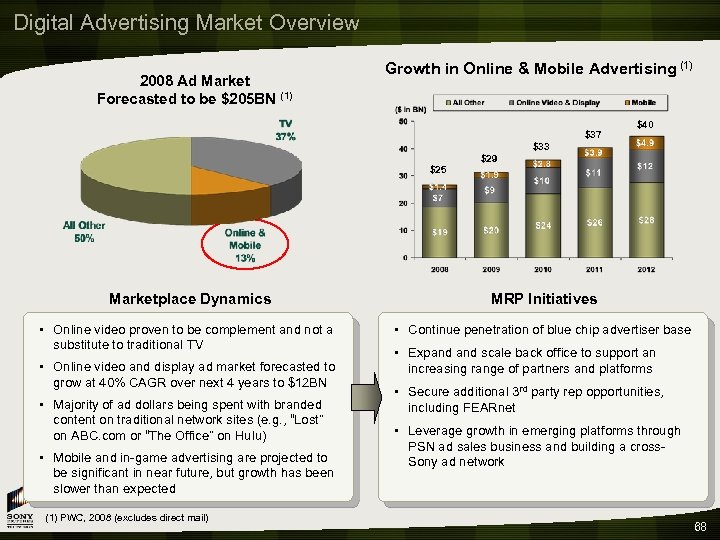

Digital Advertising Market Overview 2008 Ad Market Forecasted to be $205 BN (1) Growth in Online & Mobile Advertising (1) $37 $40 $33 $29 $25 Marketplace Dynamics MRP Initiatives • Online video proven to be complement and not a substitute to traditional TV • Continue penetration of blue chip advertiser base • Online video and display ad market forecasted to grow at 40% CAGR over next 4 years to $12 BN • Majority of ad dollars being spent with branded content on traditional network sites (e. g. , “Lost” on ABC. com or “The Office” on Hulu) • Mobile and in-game advertising are projected to be significant in near future, but growth has been slower than expected (1) PWC, 2008 (excludes direct mail) • Expand scale back office to support an increasing range of partners and platforms • Secure additional 3 rd party rep opportunities, including FEARnet • Leverage growth in emerging platforms through PSN ad sales business and building a cross. Sony ad network 68

Digital Advertising Market Overview 2008 Ad Market Forecasted to be $205 BN (1) Growth in Online & Mobile Advertising (1) $37 $40 $33 $29 $25 Marketplace Dynamics MRP Initiatives • Online video proven to be complement and not a substitute to traditional TV • Continue penetration of blue chip advertiser base • Online video and display ad market forecasted to grow at 40% CAGR over next 4 years to $12 BN • Majority of ad dollars being spent with branded content on traditional network sites (e. g. , “Lost” on ABC. com or “The Office” on Hulu) • Mobile and in-game advertising are projected to be significant in near future, but growth has been slower than expected (1) PWC, 2008 (excludes direct mail) • Expand scale back office to support an increasing range of partners and platforms • Secure additional 3 rd party rep opportunities, including FEARnet • Leverage growth in emerging platforms through PSN ad sales business and building a cross. Sony ad network 68

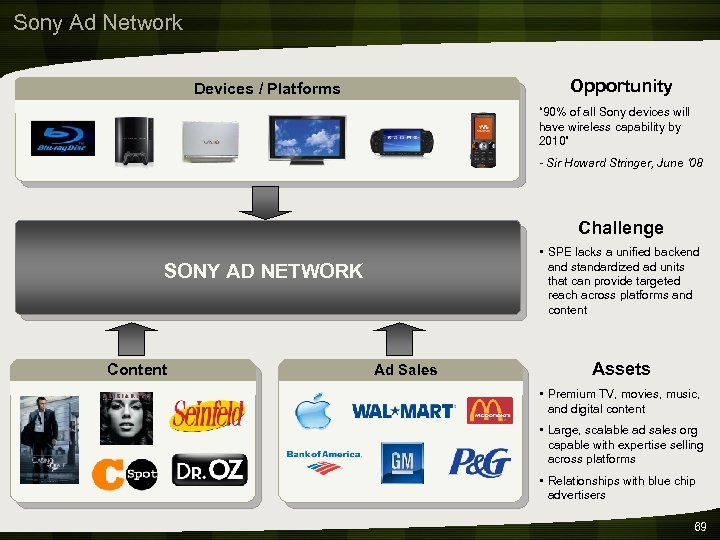

Sony Ad Network Opportunity Devices / Platforms “ 90% of all Sony devices will have wireless capability by 2010” - Sir Howard Stringer, June ‘ 08 Challenge • SPE lacks a unified backend and standardized ad units that can provide targeted reach across platforms and content SONY AD NETWORK Content Ad Sales Assets • Premium TV, movies, music, and digital content • Large, scalable ad sales org capable with expertise selling across platforms • Relationships with blue chip advertisers 69

Sony Ad Network Opportunity Devices / Platforms “ 90% of all Sony devices will have wireless capability by 2010” - Sir Howard Stringer, June ‘ 08 Challenge • SPE lacks a unified backend and standardized ad units that can provide targeted reach across platforms and content SONY AD NETWORK Content Ad Sales Assets • Premium TV, movies, music, and digital content • Large, scalable ad sales org capable with expertise selling across platforms • Relationships with blue chip advertisers 69