e6ef306aec1d7004498c808801bab76d.ppt

- Количество слайдов: 43

Draft decisions 2011 -16 Access Arrangements for APT Allgas and Envestra (Qld) Warwick Anderson General Manager, Network Regulation 1 March 2011 Public forum

Draft decisions 2011 -16 Access Arrangements for APT Allgas and Envestra (Qld) Warwick Anderson General Manager, Network Regulation 1 March 2011 Public forum

Housekeeping matters • Please sign the attendance sheet • A record of this meeting will be made 2

Housekeeping matters • Please sign the attendance sheet • A record of this meeting will be made 2

Purpose of the forum • Present the main features of the AER’s draft decision on the access arrangement proposals submitted by APT Allgas and Envestra • Inform parties intending to make submissions on the AER’s draft decision 3

Purpose of the forum • Present the main features of the AER’s draft decision on the access arrangement proposals submitted by APT Allgas and Envestra • Inform parties intending to make submissions on the AER’s draft decision 3

Submissions • Submissions on the AER’s draft decision can be sent to QLDSAgas@aer. gov. au, until 21 April • The AER’s access arrangement guideline provides guidance on making submissions – available at www. AER. gov. au • Timeframes under the NGL and NGR limit the AER’s ability to accept late submissions 4

Submissions • Submissions on the AER’s draft decision can be sent to QLDSAgas@aer. gov. au, until 21 April • The AER’s access arrangement guideline provides guidance on making submissions – available at www. AER. gov. au • Timeframes under the NGL and NGR limit the AER’s ability to accept late submissions 4

Revenues & Prices - APT Allgas • The AER has determined lower revenues & prices than those proposed by APT Allgas. • The main reductions are to the proposed WACC, forecast opex and tax allowance. • Tariffs for haulage services are expected to rise in real terms by about 3. 6 per cent per annum (on average) over the AA period. • The tariffs for ancillary services were revised and will increase each year only by the rate of change in CPI. 5

Revenues & Prices - APT Allgas • The AER has determined lower revenues & prices than those proposed by APT Allgas. • The main reductions are to the proposed WACC, forecast opex and tax allowance. • Tariffs for haulage services are expected to rise in real terms by about 3. 6 per cent per annum (on average) over the AA period. • The tariffs for ancillary services were revised and will increase each year only by the rate of change in CPI. 5

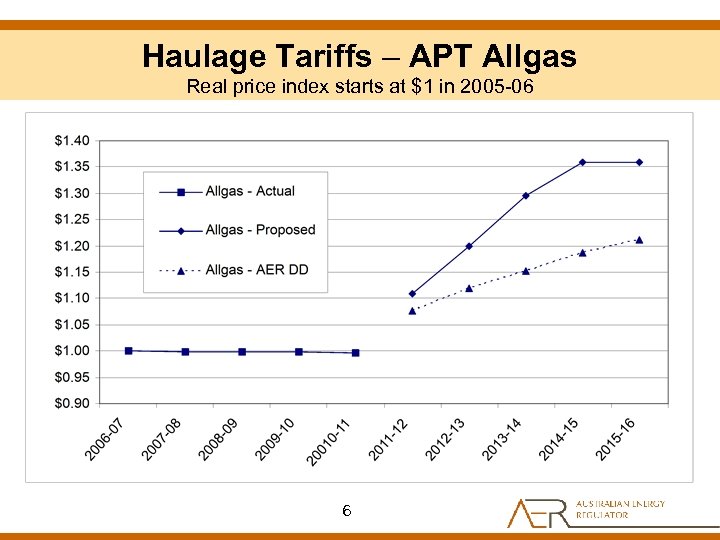

Haulage Tariffs – APT Allgas Real price index starts at $1 in 2005 -06 6

Haulage Tariffs – APT Allgas Real price index starts at $1 in 2005 -06 6

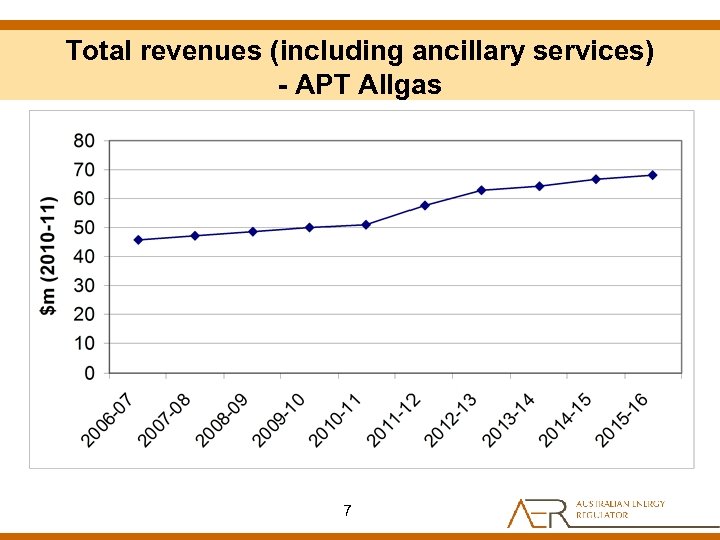

Total revenues (including ancillary services) - APT Allgas 7

Total revenues (including ancillary services) - APT Allgas 7

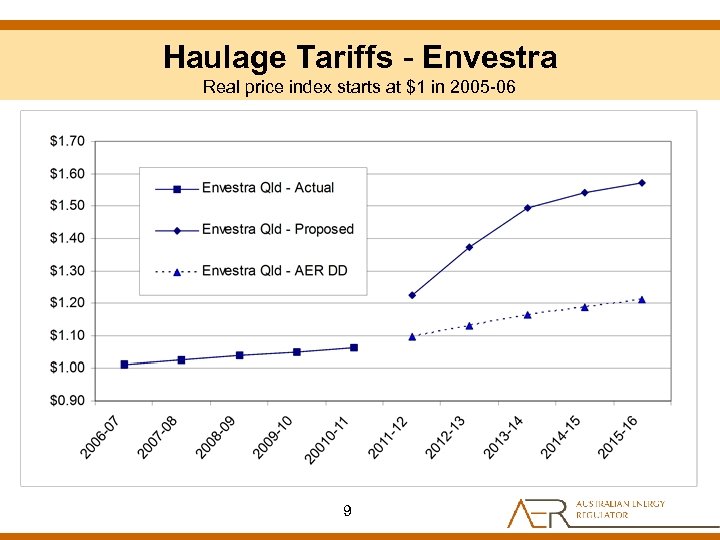

Revenues & Prices - Envestra • The AER has determined lower revenues & prices than those proposed by Envestra. • The main reductions are to Envestra’s proposed WACC, forecast capex and forecast opex. • Tariffs for haulage services are expected to rise in real terms by about 2. 6 per cent per annum (on average) over the AA period. • The tariffs for ancillary services were revised and will increase each year only by the rate of change in CPI. 8

Revenues & Prices - Envestra • The AER has determined lower revenues & prices than those proposed by Envestra. • The main reductions are to Envestra’s proposed WACC, forecast capex and forecast opex. • Tariffs for haulage services are expected to rise in real terms by about 2. 6 per cent per annum (on average) over the AA period. • The tariffs for ancillary services were revised and will increase each year only by the rate of change in CPI. 8

Haulage Tariffs - Envestra Real price index starts at $1 in 2005 -06 9

Haulage Tariffs - Envestra Real price index starts at $1 in 2005 -06 9

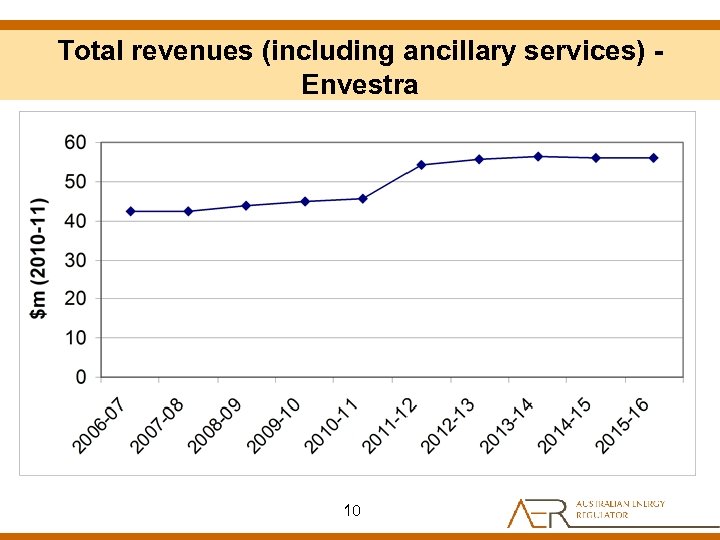

Total revenues (including ancillary services) Envestra 10

Total revenues (including ancillary services) Envestra 10

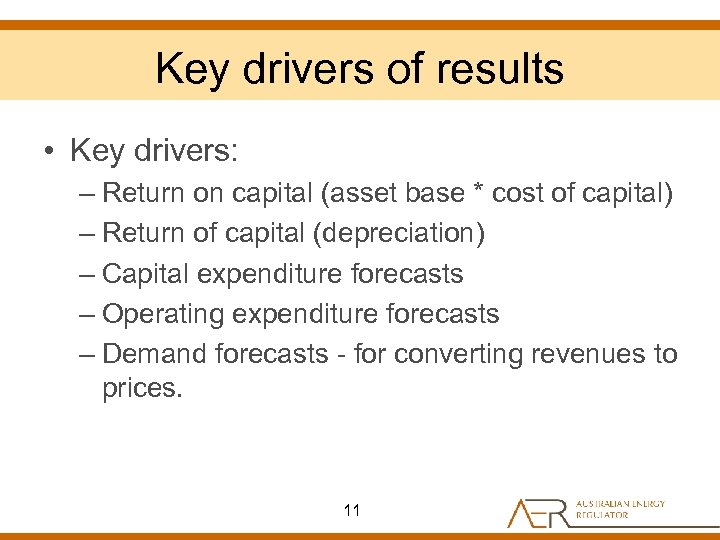

Key drivers of results • Key drivers: – Return on capital (asset base * cost of capital) – Return of capital (depreciation) – Capital expenditure forecasts – Operating expenditure forecasts – Demand forecasts - for converting revenues to prices. 11

Key drivers of results • Key drivers: – Return on capital (asset base * cost of capital) – Return of capital (depreciation) – Capital expenditure forecasts – Operating expenditure forecasts – Demand forecasts - for converting revenues to prices. 11

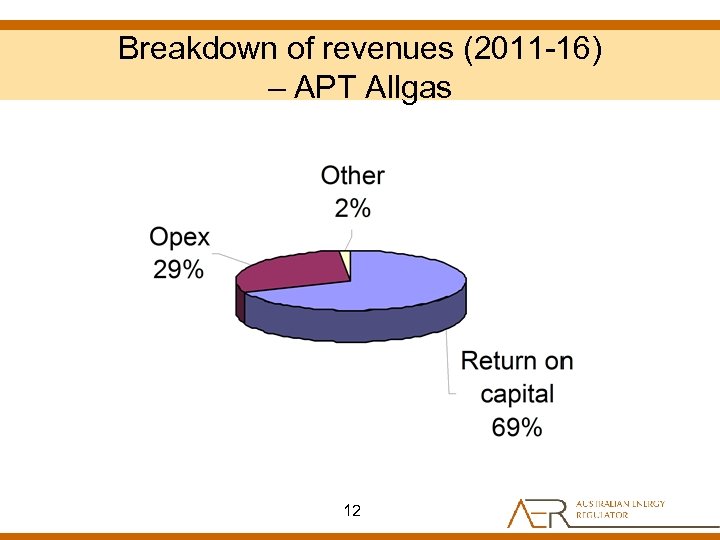

Breakdown of revenues (2011 -16) – APT Allgas 12

Breakdown of revenues (2011 -16) – APT Allgas 12

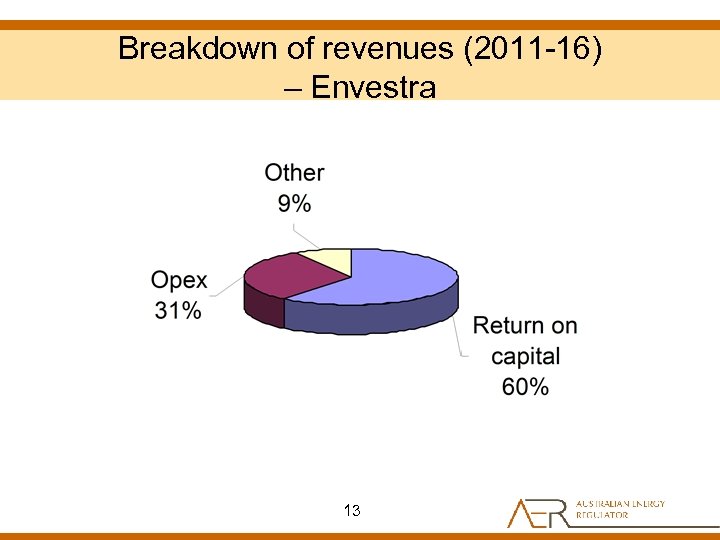

Breakdown of revenues (2011 -16) – Envestra 13

Breakdown of revenues (2011 -16) – Envestra 13

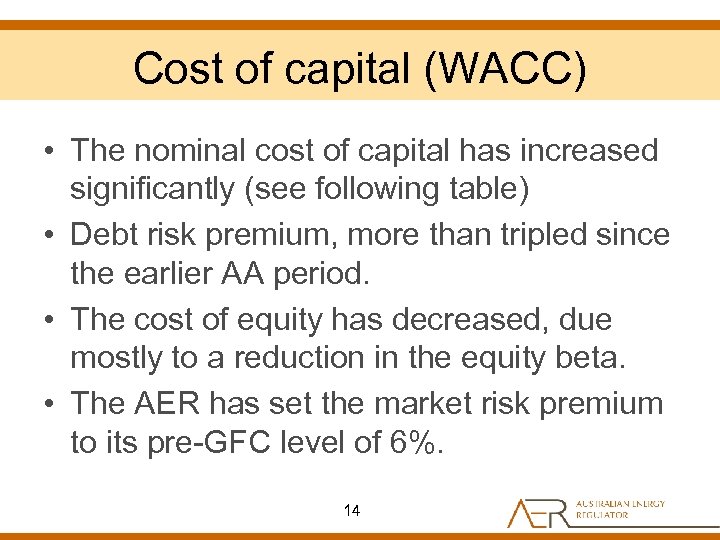

Cost of capital (WACC) • The nominal cost of capital has increased significantly (see following table) • Debt risk premium, more than tripled since the earlier AA period. • The cost of equity has decreased, due mostly to a reduction in the equity beta. • The AER has set the market risk premium to its pre-GFC level of 6%. 14

Cost of capital (WACC) • The nominal cost of capital has increased significantly (see following table) • Debt risk premium, more than tripled since the earlier AA period. • The cost of equity has decreased, due mostly to a reduction in the equity beta. • The AER has set the market risk premium to its pre-GFC level of 6%. 14

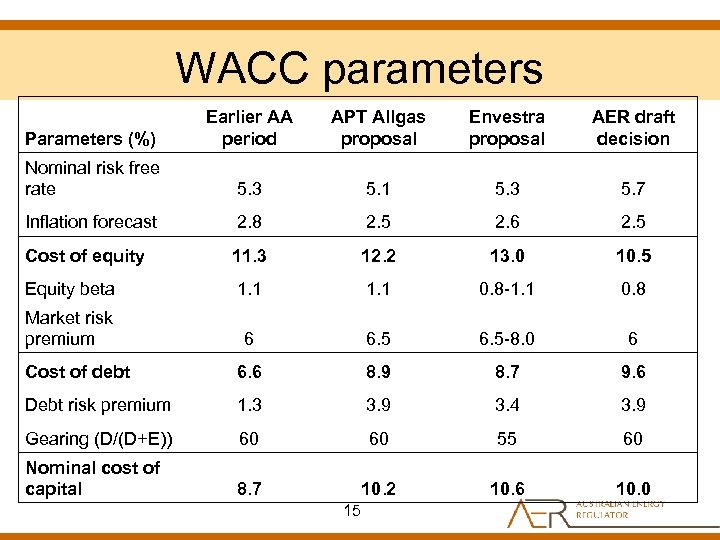

WACC parameters Parameters (%) Earlier AA period APT Allgas proposal Envestra proposal AER draft decision Nominal risk free rate 5. 3 5. 1 5. 3 5. 7 Inflation forecast 2. 8 2. 5 2. 6 2. 5 Cost of equity 11. 3 12. 2 13. 0 10. 5 Equity beta 1. 1 0. 8 -1. 1 0. 8 Market risk premium 6 6. 5 -8. 0 6 Cost of debt 6. 6 8. 9 8. 7 9. 6 Debt risk premium 1. 3 3. 9 3. 4 3. 9 Gearing (D/(D+E)) 60 60 55 60 Nominal cost of capital 8. 7 10. 2 10. 6 10. 0 15

WACC parameters Parameters (%) Earlier AA period APT Allgas proposal Envestra proposal AER draft decision Nominal risk free rate 5. 3 5. 1 5. 3 5. 7 Inflation forecast 2. 8 2. 5 2. 6 2. 5 Cost of equity 11. 3 12. 2 13. 0 10. 5 Equity beta 1. 1 0. 8 -1. 1 0. 8 Market risk premium 6 6. 5 -8. 0 6 Cost of debt 6. 6 8. 9 8. 7 9. 6 Debt risk premium 1. 3 3. 9 3. 4 3. 9 Gearing (D/(D+E)) 60 60 55 60 Nominal cost of capital 8. 7 10. 2 10. 6 10. 0 15

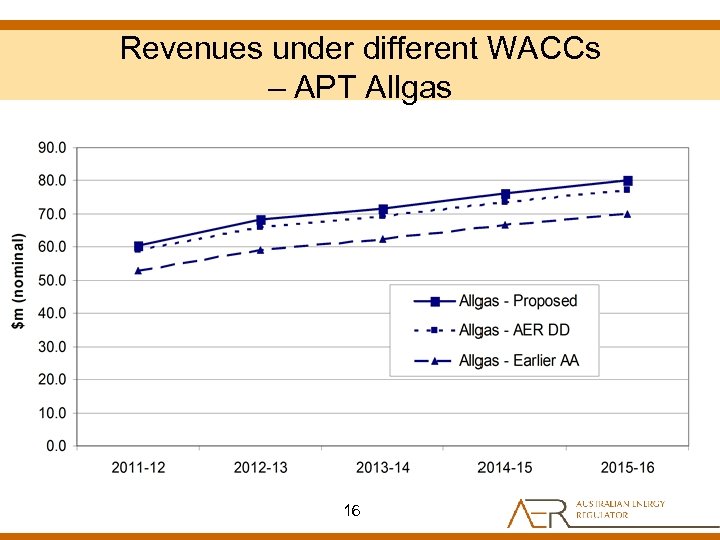

Revenues under different WACCs – APT Allgas 16

Revenues under different WACCs – APT Allgas 16

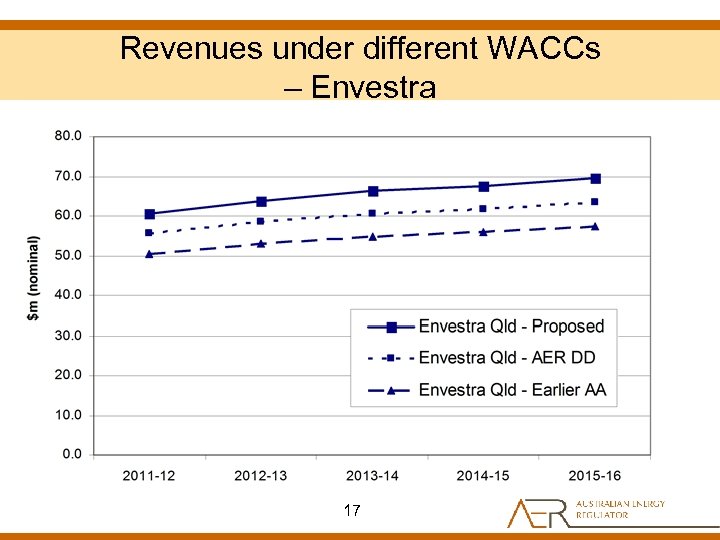

Revenues under different WACCs – Envestra 17

Revenues under different WACCs – Envestra 17

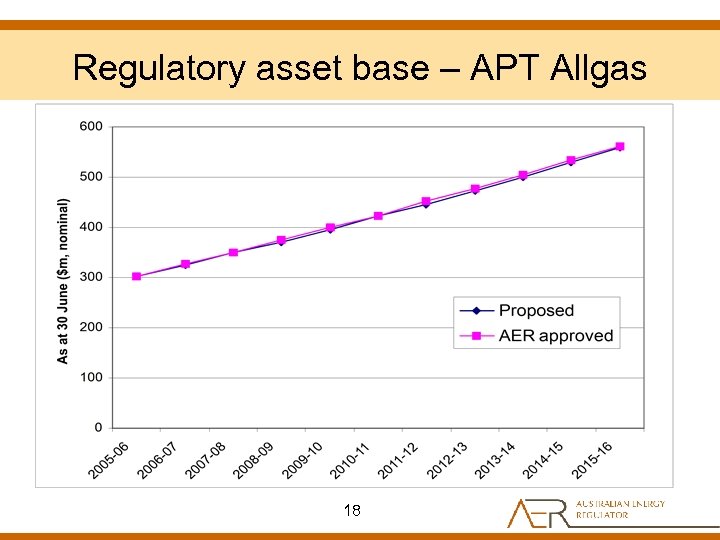

Regulatory asset base – APT Allgas 18

Regulatory asset base – APT Allgas 18

Capital expenditure – APT Allgas • AER accepted APT Allgas’s proposed capex. • AER identified a few issues with APT Allgas’s capex proposal. But the impact was not material. 19

Capital expenditure – APT Allgas • AER accepted APT Allgas’s proposed capex. • AER identified a few issues with APT Allgas’s capex proposal. But the impact was not material. 19

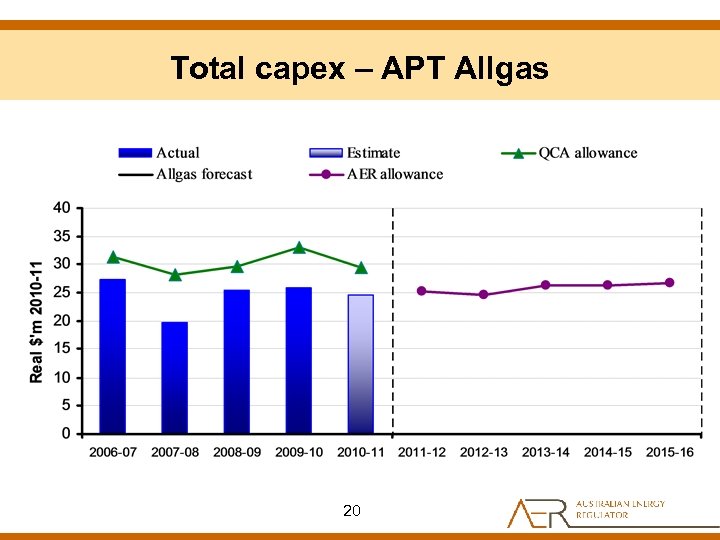

Total capex – APT Allgas 20

Total capex – APT Allgas 20

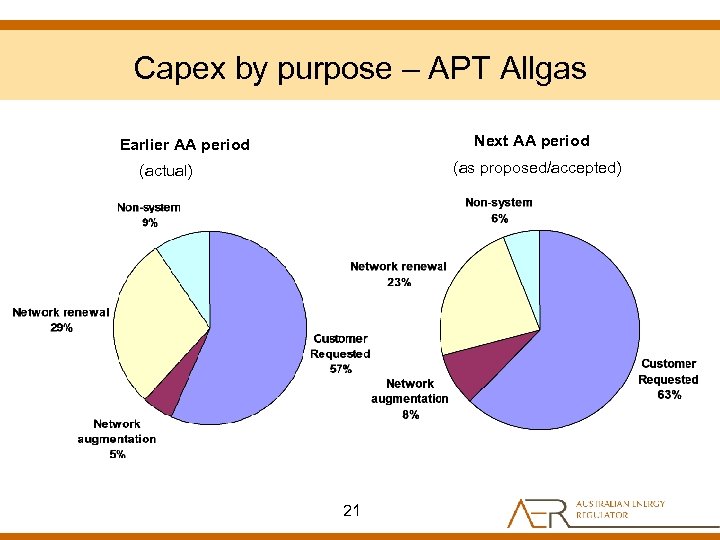

Capex by purpose – APT Allgas Next AA period Earlier AA period (as proposed/accepted) (actual) 21

Capex by purpose – APT Allgas Next AA period Earlier AA period (as proposed/accepted) (actual) 21

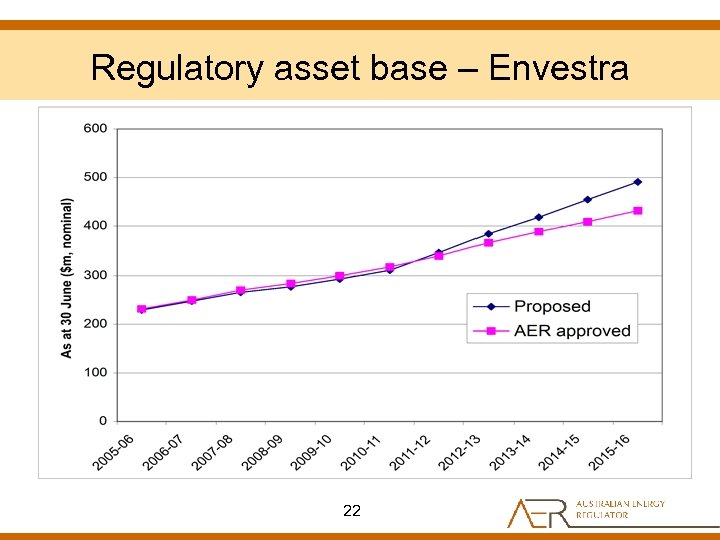

Regulatory asset base – Envestra 22

Regulatory asset base – Envestra 22

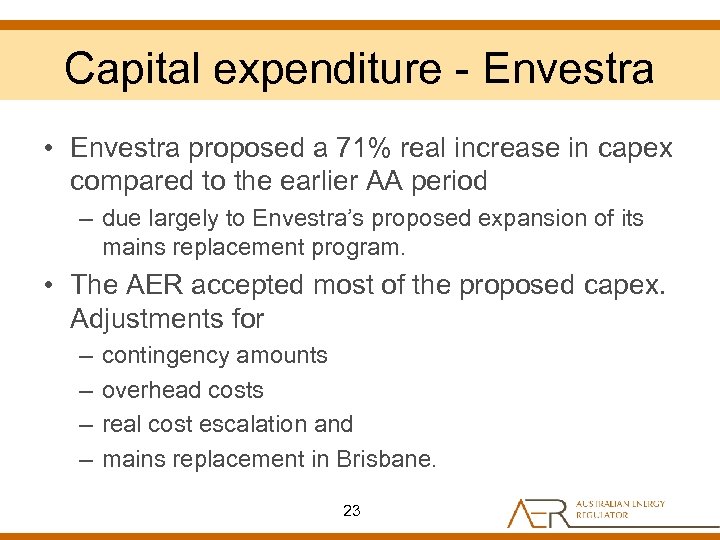

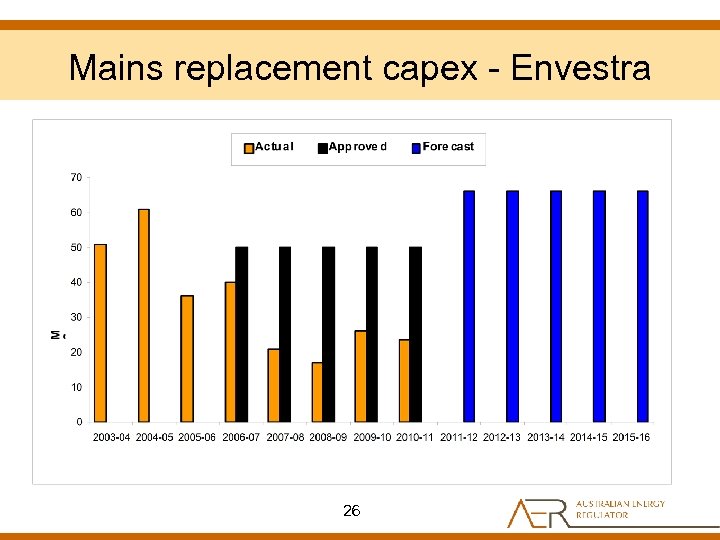

Capital expenditure - Envestra • Envestra proposed a 71% real increase in capex compared to the earlier AA period – due largely to Envestra’s proposed expansion of its mains replacement program. • The AER accepted most of the proposed capex. Adjustments for – – contingency amounts overhead costs real cost escalation and mains replacement in Brisbane. 23

Capital expenditure - Envestra • Envestra proposed a 71% real increase in capex compared to the earlier AA period – due largely to Envestra’s proposed expansion of its mains replacement program. • The AER accepted most of the proposed capex. Adjustments for – – contingency amounts overhead costs real cost escalation and mains replacement in Brisbane. 23

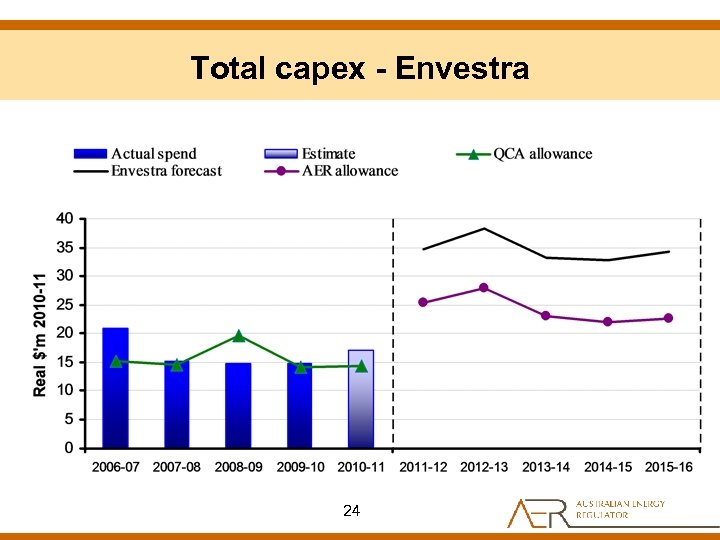

Total capex - Envestra 24

Total capex - Envestra 24

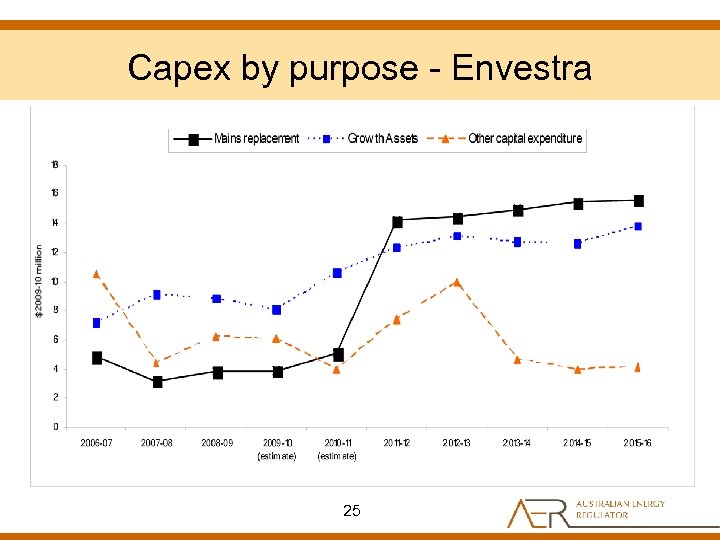

Capex by purpose - Envestra 25

Capex by purpose - Envestra 25

Mains replacement capex - Envestra 26

Mains replacement capex - Envestra 26

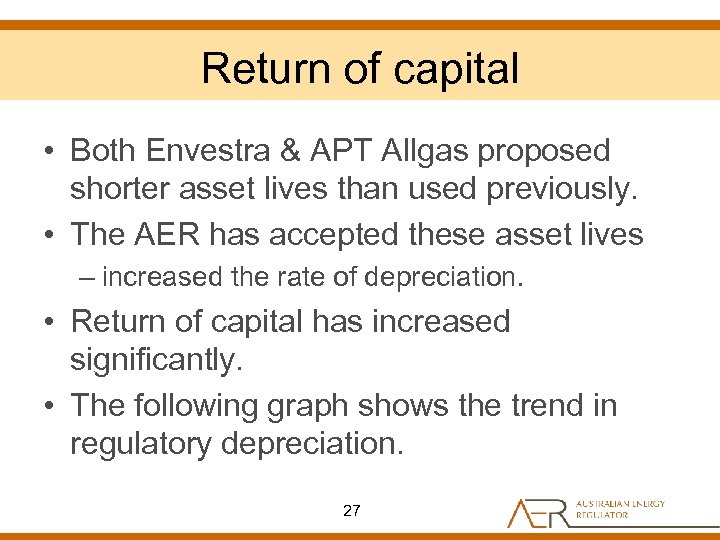

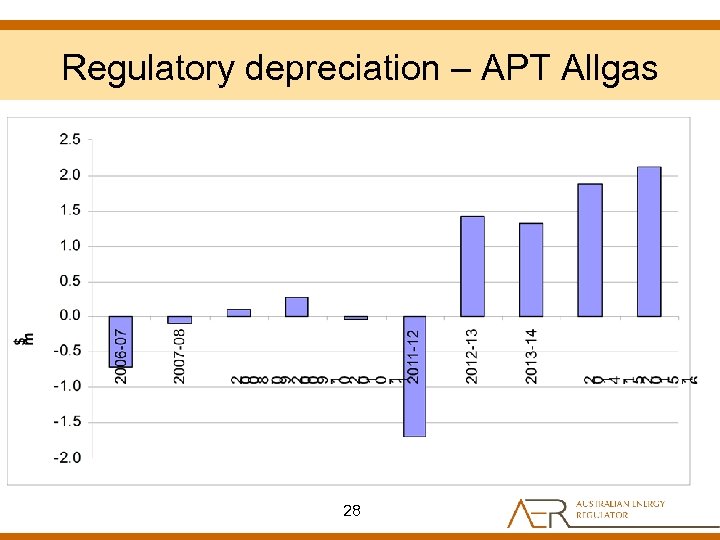

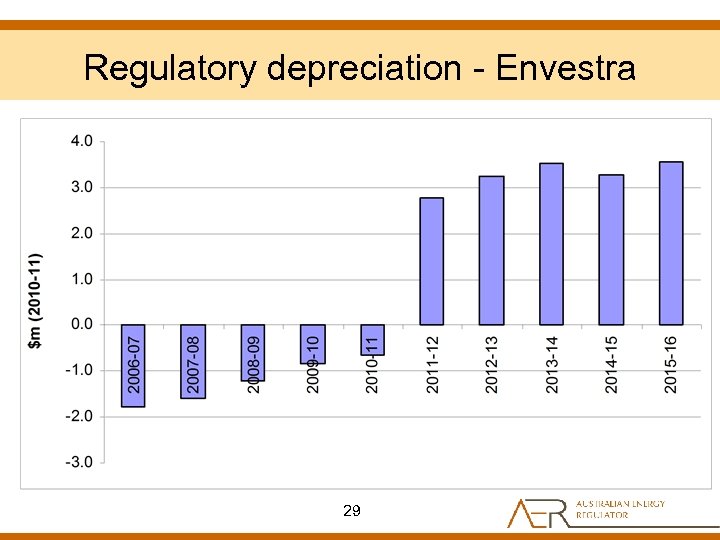

Return of capital • Both Envestra & APT Allgas proposed shorter asset lives than used previously. • The AER has accepted these asset lives – increased the rate of depreciation. • Return of capital has increased significantly. • The following graph shows the trend in regulatory depreciation. 27

Return of capital • Both Envestra & APT Allgas proposed shorter asset lives than used previously. • The AER has accepted these asset lives – increased the rate of depreciation. • Return of capital has increased significantly. • The following graph shows the trend in regulatory depreciation. 27

Regulatory depreciation – APT Allgas 28

Regulatory depreciation – APT Allgas 28

Regulatory depreciation - Envestra 29

Regulatory depreciation - Envestra 29

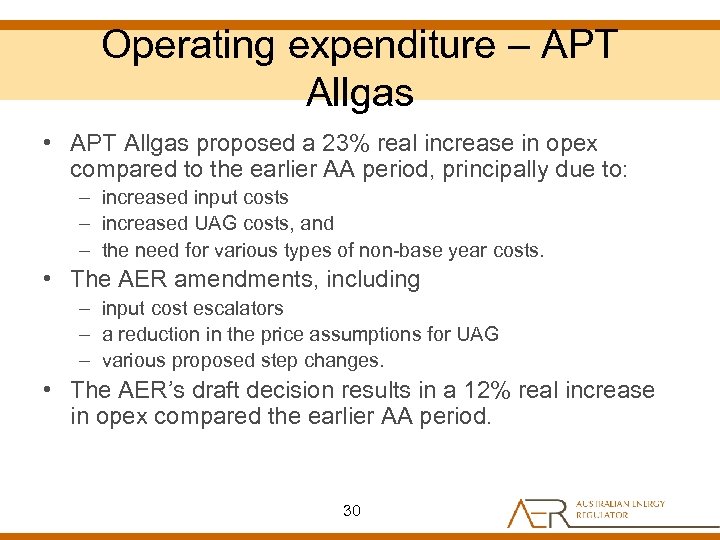

Operating expenditure – APT Allgas • APT Allgas proposed a 23% real increase in opex compared to the earlier AA period, principally due to: – increased input costs – increased UAG costs, and – the need for various types of non-base year costs. • The AER amendments, including – input cost escalators – a reduction in the price assumptions for UAG – various proposed step changes. • The AER’s draft decision results in a 12% real increase in opex compared the earlier AA period. 30

Operating expenditure – APT Allgas • APT Allgas proposed a 23% real increase in opex compared to the earlier AA period, principally due to: – increased input costs – increased UAG costs, and – the need for various types of non-base year costs. • The AER amendments, including – input cost escalators – a reduction in the price assumptions for UAG – various proposed step changes. • The AER’s draft decision results in a 12% real increase in opex compared the earlier AA period. 30

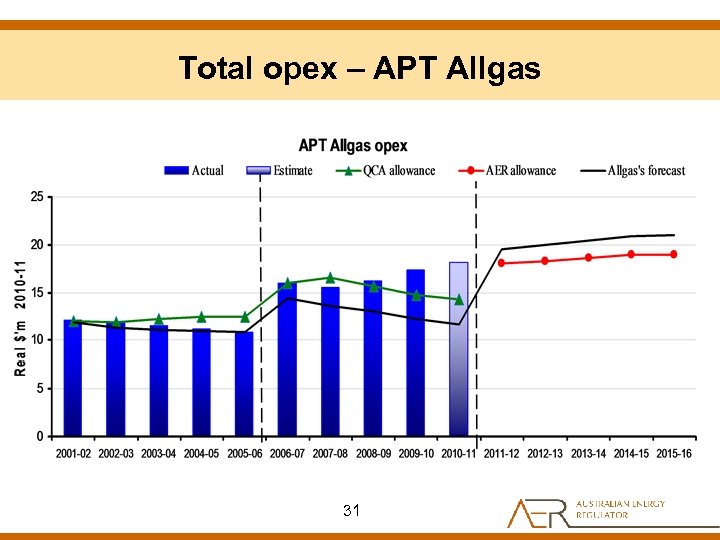

Total opex – APT Allgas 31

Total opex – APT Allgas 31

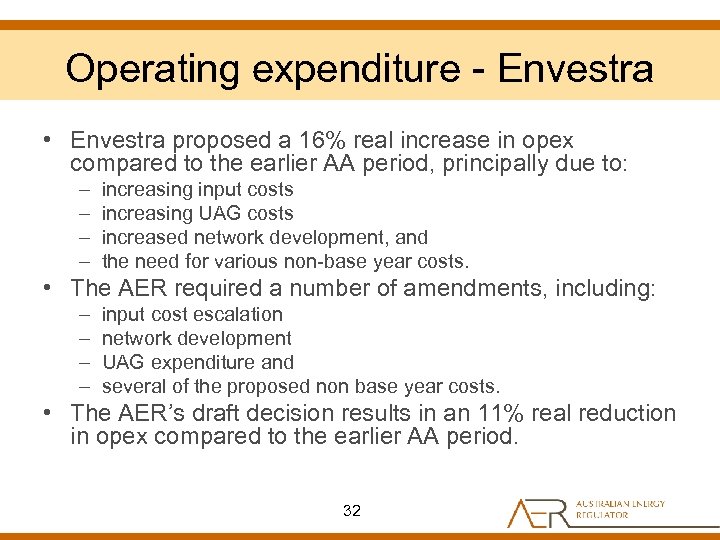

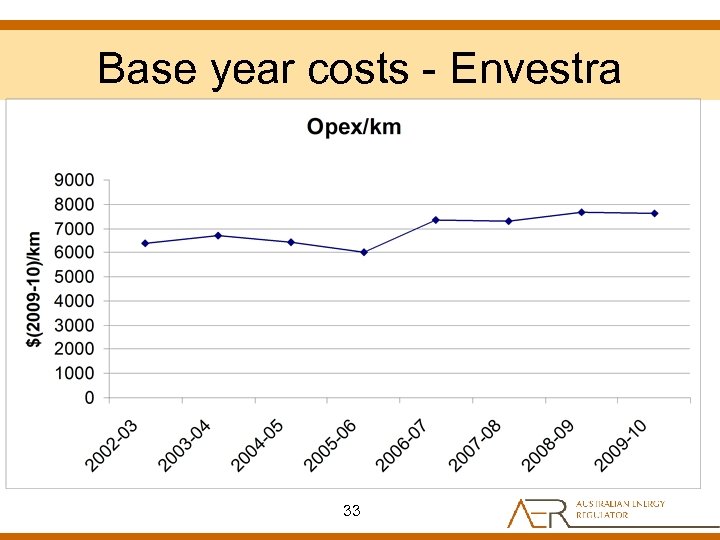

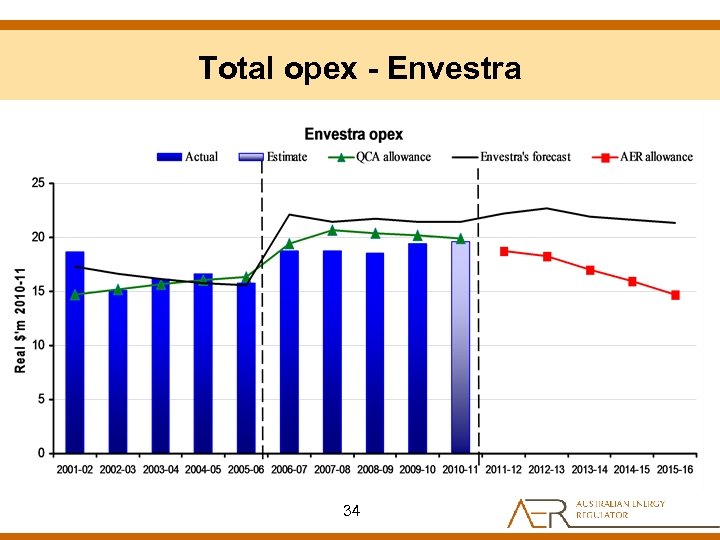

Operating expenditure - Envestra • Envestra proposed a 16% real increase in opex compared to the earlier AA period, principally due to: – – increasing input costs increasing UAG costs increased network development, and the need for various non-base year costs. • The AER required a number of amendments, including: – – input cost escalation network development UAG expenditure and several of the proposed non base year costs. • The AER’s draft decision results in an 11% real reduction in opex compared to the earlier AA period. 32

Operating expenditure - Envestra • Envestra proposed a 16% real increase in opex compared to the earlier AA period, principally due to: – – increasing input costs increasing UAG costs increased network development, and the need for various non-base year costs. • The AER required a number of amendments, including: – – input cost escalation network development UAG expenditure and several of the proposed non base year costs. • The AER’s draft decision results in an 11% real reduction in opex compared to the earlier AA period. 32

Base year costs - Envestra 33

Base year costs - Envestra 33

Total opex - Envestra 34

Total opex - Envestra 34

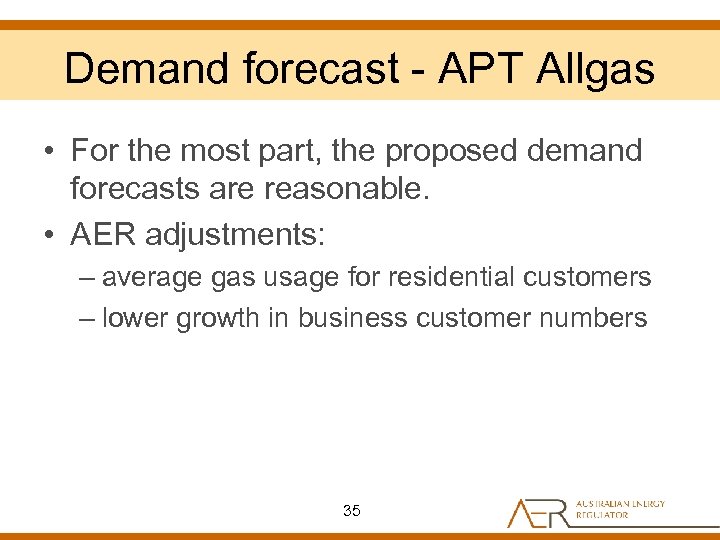

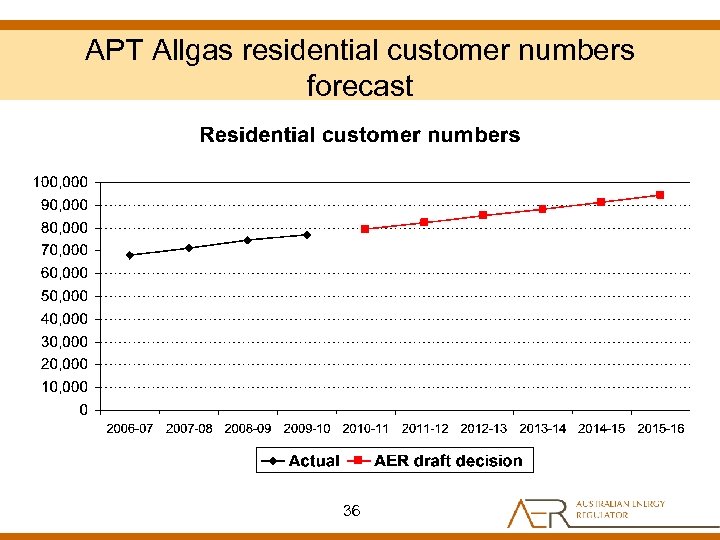

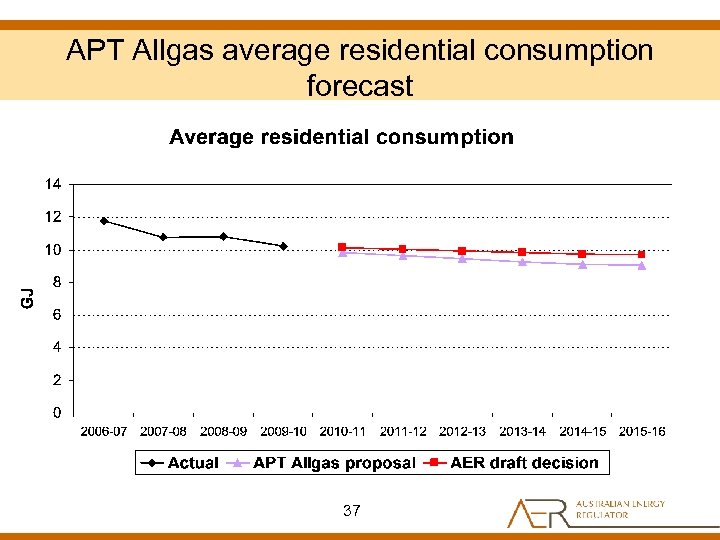

Demand forecast - APT Allgas • For the most part, the proposed demand forecasts are reasonable. • AER adjustments: – average gas usage for residential customers – lower growth in business customer numbers 35

Demand forecast - APT Allgas • For the most part, the proposed demand forecasts are reasonable. • AER adjustments: – average gas usage for residential customers – lower growth in business customer numbers 35

APT Allgas residential customer numbers forecast 36

APT Allgas residential customer numbers forecast 36

APT Allgas average residential consumption forecast 37

APT Allgas average residential consumption forecast 37

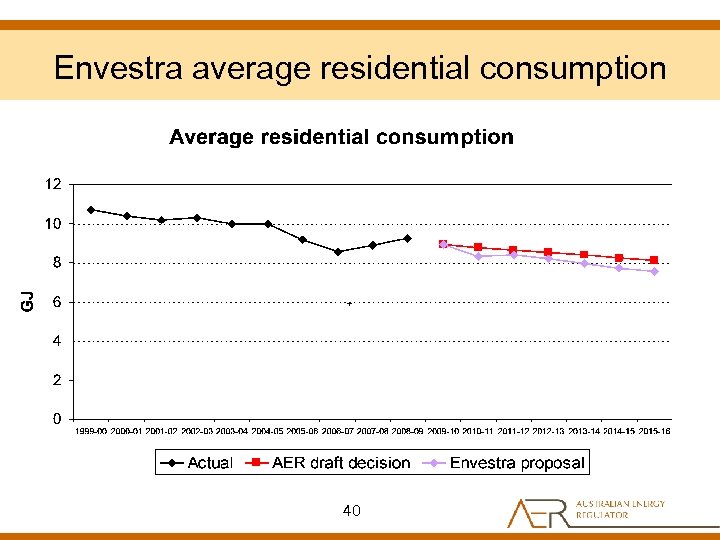

Demand forecast - Envestra • For the most part, the proposed demand forecasts are reasonable. • AER adjustments: – average gas usage for residential customers 38

Demand forecast - Envestra • For the most part, the proposed demand forecasts are reasonable. • AER adjustments: – average gas usage for residential customers 38

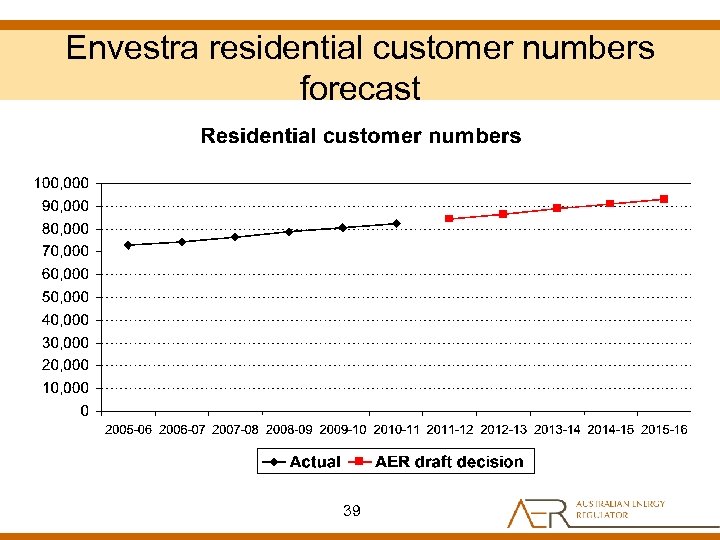

Envestra residential customer numbers forecast 39

Envestra residential customer numbers forecast 39

Envestra average residential consumption 40

Envestra average residential consumption 40

Terms and conditions • Submissions: – overall terms and conditions were weighted too much in favour of the service providers. • The AER accepts most of the proposed terms and conditions for both service providers. • However, changes are required to provide a better balance between the service providers and customers 41

Terms and conditions • Submissions: – overall terms and conditions were weighted too much in favour of the service providers. • The AER accepts most of the proposed terms and conditions for both service providers. • However, changes are required to provide a better balance between the service providers and customers 41

Consultant advice • • Cost of capital: Professor Kevin Davis Opex and capex forecasts: Wilson Cook Labour cost growth: Access Economics Demand forecasts: ACIL Tasman 42

Consultant advice • • Cost of capital: Professor Kevin Davis Opex and capex forecasts: Wilson Cook Labour cost growth: Access Economics Demand forecasts: ACIL Tasman 42

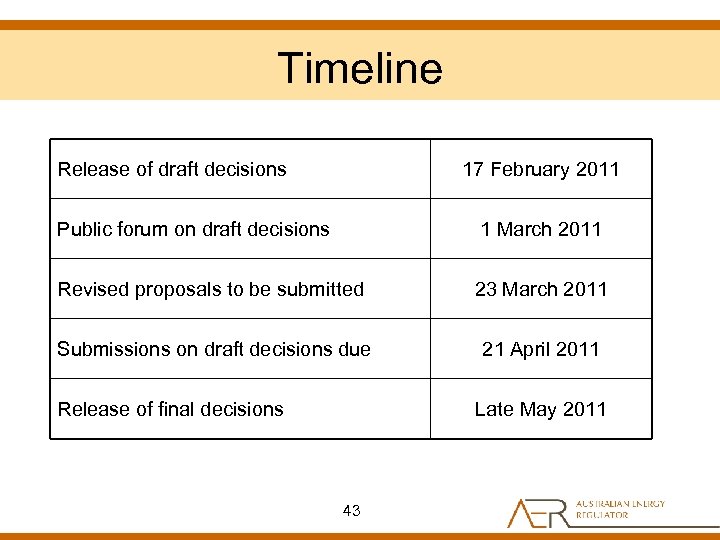

Timeline Release of draft decisions 17 February 2011 Public forum on draft decisions 1 March 2011 Revised proposals to be submitted 23 March 2011 Submissions on draft decisions due 21 April 2011 Release of final decisions Late May 2011 43

Timeline Release of draft decisions 17 February 2011 Public forum on draft decisions 1 March 2011 Revised proposals to be submitted 23 March 2011 Submissions on draft decisions due 21 April 2011 Release of final decisions Late May 2011 43