75a7f6ba0a689f6dc09c795c43662c34.ppt

- Количество слайдов: 31

Dr. Reddy’s Laboratories November 17, 2006 Globalization Strategies of Indian Pharmaceutical Industry 1

Presentation Flow Indian Pharmaceutical Industry - The evolution - Vital Statistics - Services offered - Key Success Factors - Growth Drivers - Indigenous Success Stories - Challenges for the Future 2

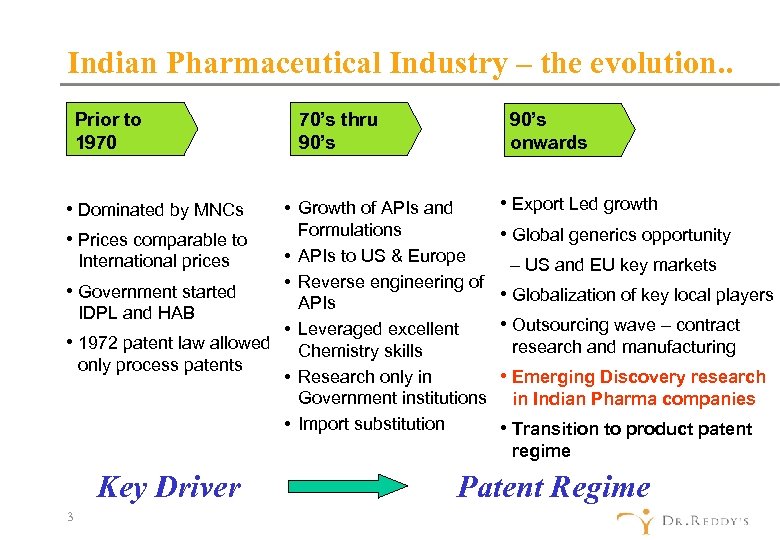

Indian Pharmaceutical Industry – the evolution. . Prior to 1970 • Dominated by MNCs • Prices comparable to 70’s thru 90’s onwards • Growth of APIs and Formulations • APIs to US & Europe International prices • Reverse engineering of • Government started APIs IDPL and HAB • Leveraged excellent • 1972 patent law allowed Chemistry skills only process patents • Research only in Government institutions • Import substitution • Export Led growth • Global generics opportunity – US and EU key markets • Globalization of key local players • Outsourcing wave – contract research and manufacturing • Emerging Discovery research in Indian Pharma companies • Transition to product patent regime Key Driver 3 Patent Regime

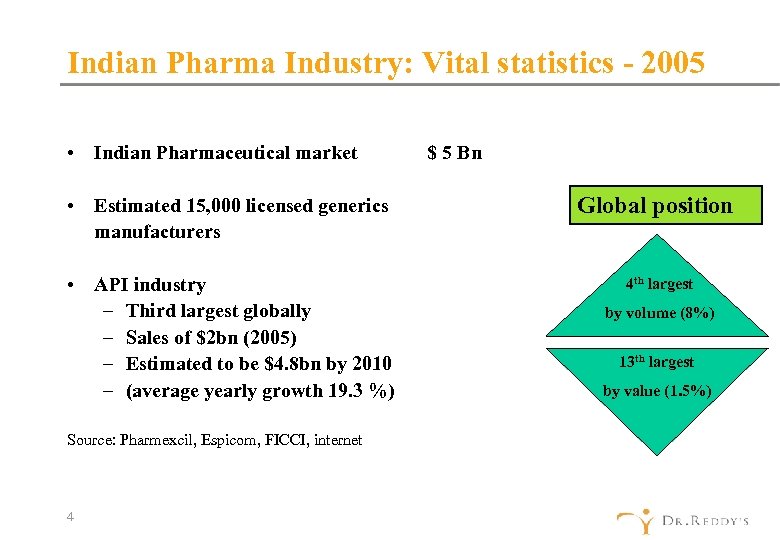

Indian Pharma Industry: Vital statistics - 2005 • Indian Pharmaceutical market • Estimated 15, 000 licensed generics manufacturers • API industry – Third largest globally – Sales of $2 bn (2005) – Estimated to be $4. 8 bn by 2010 – (average yearly growth 19. 3 %) Source: Pharmexcil, Espicom, FICCI, internet 4 $ 5 Bn Global position 4 th largest by volume (8%) 13 th largest by value (1. 5%)

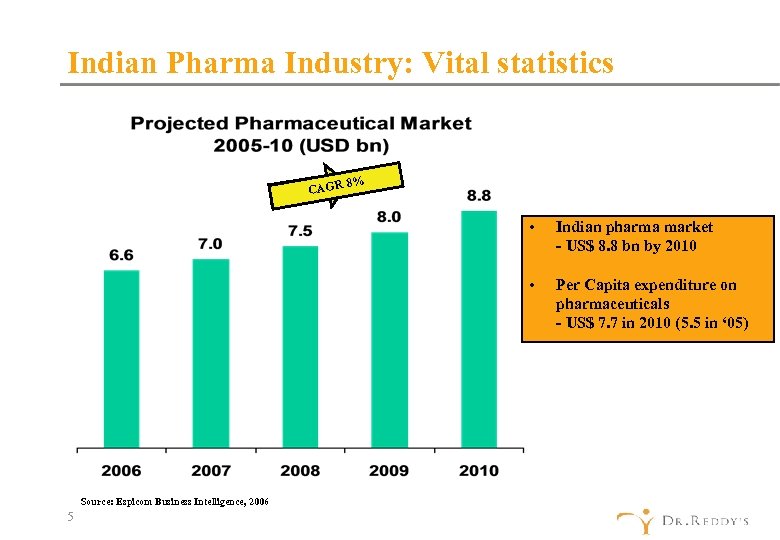

Indian Pharma Industry: Vital statistics 8% CAGR • • Source: Espicom Business Intelligence, 2006 5 Indian pharma market - US$ 8. 8 bn by 2010 Per Capita expenditure on pharmaceuticals - US$ 7. 7 in 2010 (5. 5 in ‘ 05)

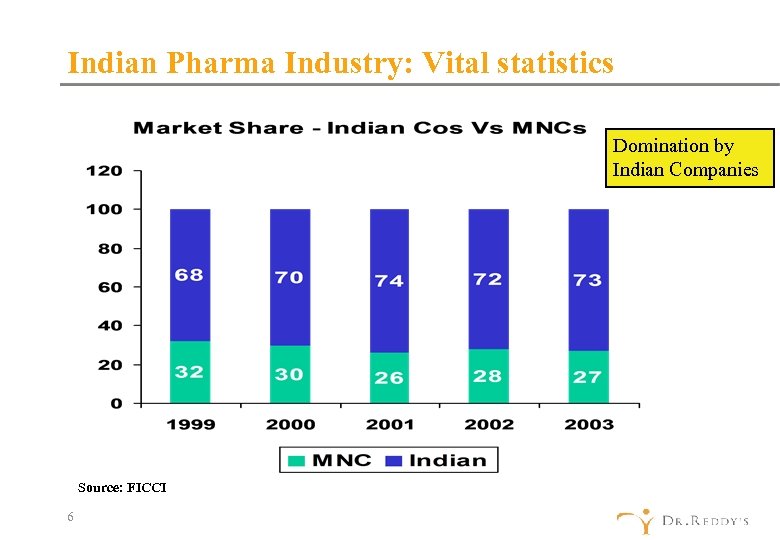

Indian Pharma Industry: Vital statistics Domination by Indian Companies Source: FICCI 6

In Globalization of the Pharmaceutical Industry, what the World witnessed… 7

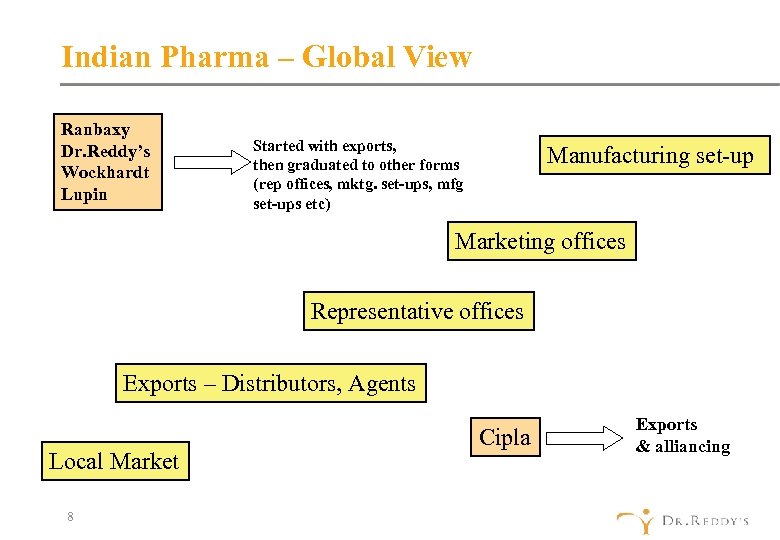

Indian Pharma – Global View Ranbaxy Dr. Reddy’s Wockhardt Lupin Started with exports, then graduated to other forms (rep offices, mktg. set-ups, mfg set-ups etc) Manufacturing set-up Marketing offices Representative offices Exports – Distributors, Agents Local Market 8 Cipla Exports & alliancing

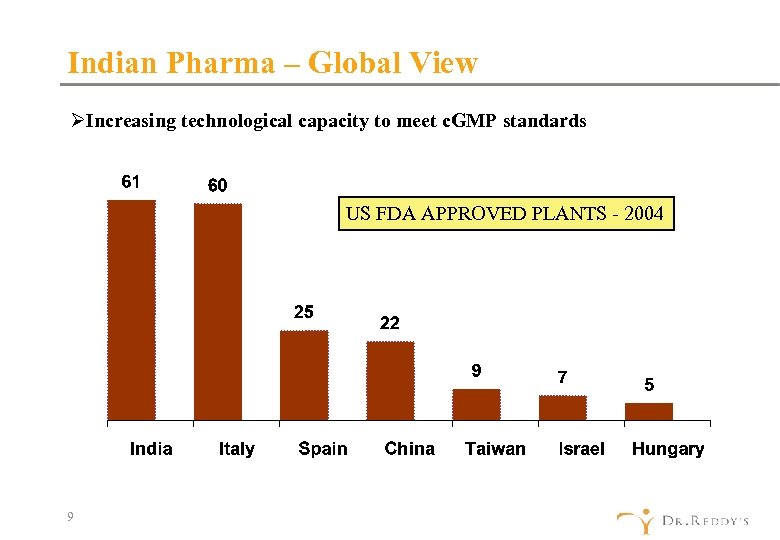

Indian Pharma – Global View ØIncreasing technological capacity to meet c. GMP standards US FDA APPROVED PLANTS - 2004 9

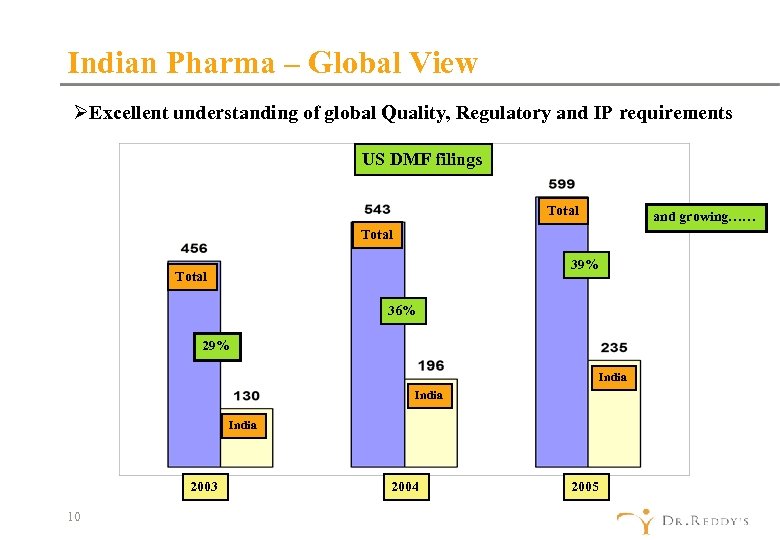

Indian Pharma – Global View ØExcellent understanding of global Quality, Regulatory and IP requirements US DMF filings Total and growing…… Total 39% Total 36% 29% India 2003 10 2004 2005

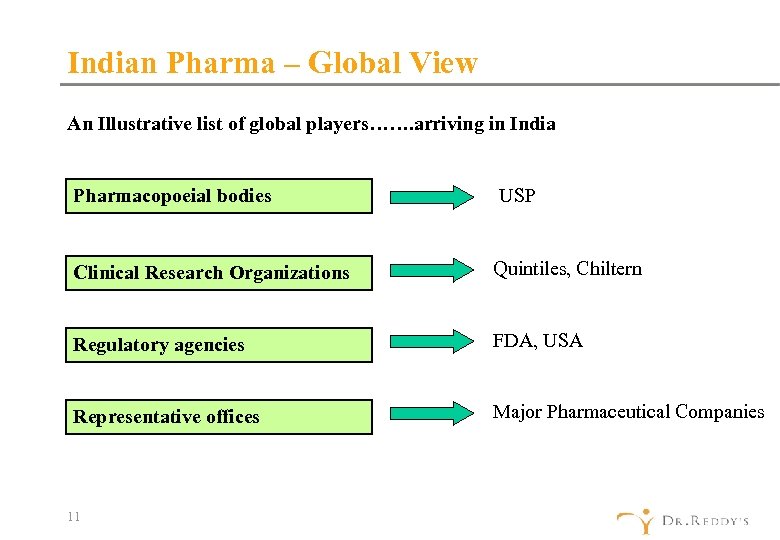

Indian Pharma – Global View An Illustrative list of global players……. arriving in India Pharmacopoeial bodies USP Clinical Research Organizations Quintiles, Chiltern Regulatory agencies FDA, USA Representative offices Major Pharmaceutical Companies 11

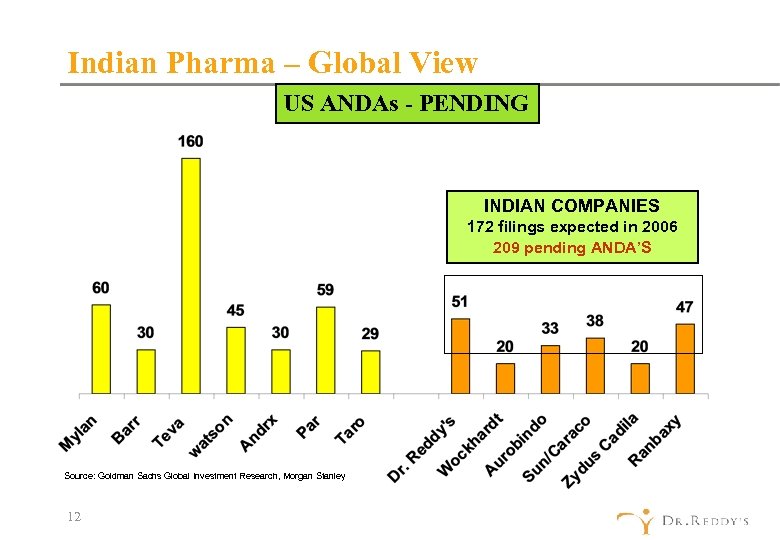

Indian Pharma – Global View US ANDAs - PENDING INDIAN COMPANIES 172 filings expected in 2006 209 pending ANDA’S Source: Goldman Sachs Global Investment Research, Morgan Stanley 12

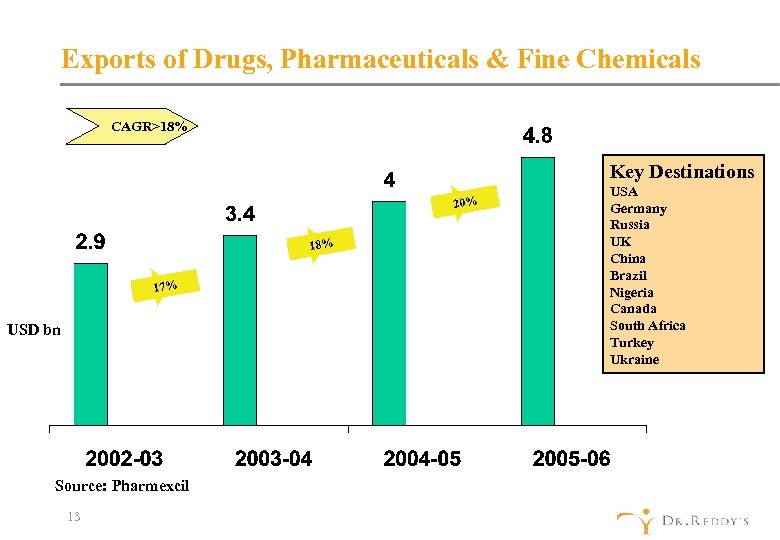

Exports of Drugs, Pharmaceuticals & Fine Chemicals CAGR>18% Key Destinations 20% 18% 17% USD bn Source: Pharmexcil 13 USA Germany Russia UK China Brazil Nigeria Canada South Africa Turkey Ukraine

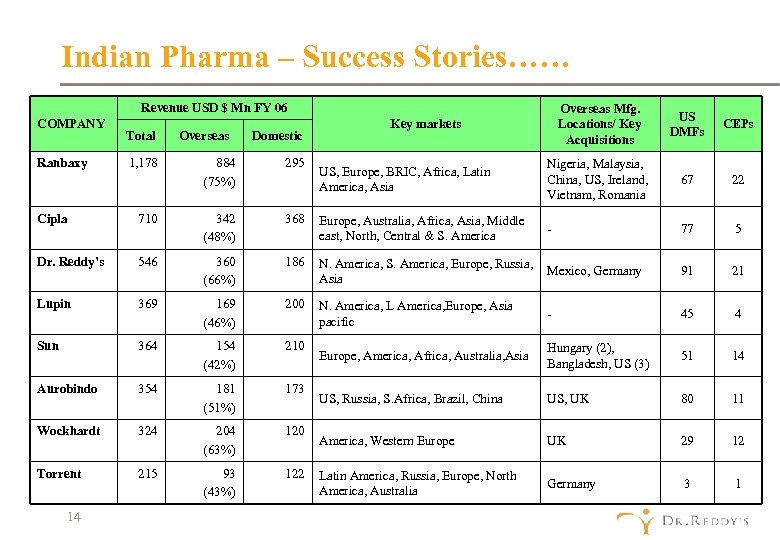

Indian Pharma – Success Stories…… Revenue USD $ Mn FY 06 COMPANY Ranbaxy Total 1, 178 Overseas Domestic 884 (75%) 295 Overseas Mfg. Locations/ Key Acquisitions US DMFs CEPs US, Europe, BRIC, Africa, Latin America, Asia Nigeria, Malaysia, China, US, Ireland, Vietnam, Romania 67 22 - 77 5 Key markets Cipla 710 342 (48%) 368 Europe, Australia, Africa, Asia, Middle east, North, Central & S. America Dr. Reddy’s 546 360 (66%) 186 N. America, S. America, Europe, Russia, Mexico, Germany Asia 91 21 Lupin 369 169 (46%) 200 N. America, L America, Europe, Asia pacific - 45 4 Sun 364 154 (42%) 210 Europe, America, Africa, Australia, Asia Hungary (2), Bangladesh, US (3) 51 14 Aurobindo 354 181 (51%) 173 US, Russia, S. Africa, Brazil, China US, UK 80 11 Wockhardt 324 204 (63%) 120 America, Western Europe UK 29 12 Torrent 215 93 (43%) 122 Latin America, Russia, Europe, North America, Australia Germany 3 1 14

Key Success Factors 15

Indian Pharma – Key Success Factors ØEntrepreneurship ØMature Financial Markets & well established Legal Framework ØGood Corporate Governance ØHuge Captive Market ØFavourable Cost of Capital (Equipment, Intellectual & Finance) ØGood Local Education standards; Large pool of competent Manpower ØInformation & Technology ØCommunication Skills ØStrong Focus on export markets ØGovernment Support 16

Route to Globalization…… 17

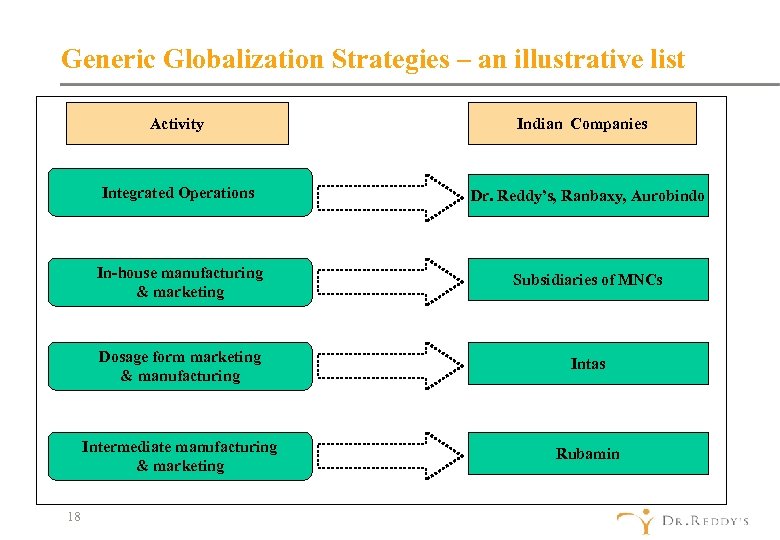

Generic Globalization Strategies – an illustrative list Activity Indian Companies Integrated Operations In-house manufacturing & marketing Subsidiaries of MNCs Dosage form marketing & manufacturing Intas Intermediate manufacturing & marketing 18 Dr. Reddy’s, Ranbaxy, Aurobindo Rubamin

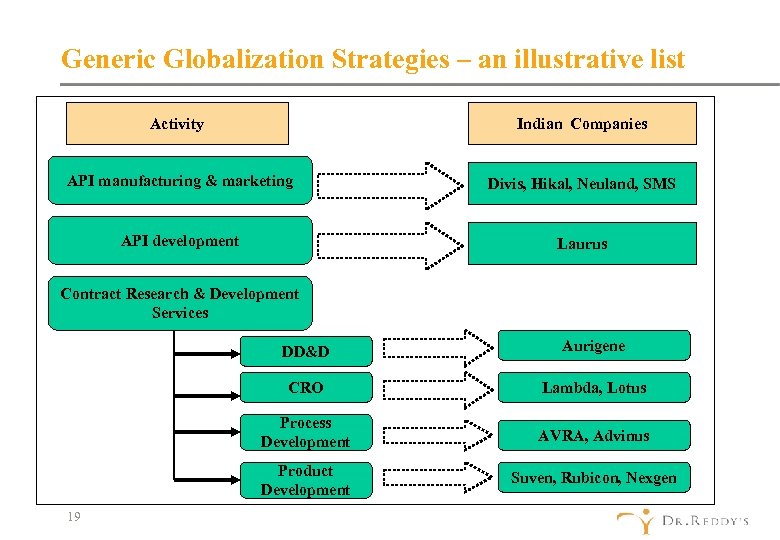

Generic Globalization Strategies – an illustrative list Activity Indian Companies API manufacturing & marketing Divis, Hikal, Neuland, SMS API development Laurus Contract Research & Development Services DD&D CRO Lambda, Lotus Process Development AVRA, Advinus Product Development 19 Aurigene Suven, Rubicon, Nexgen

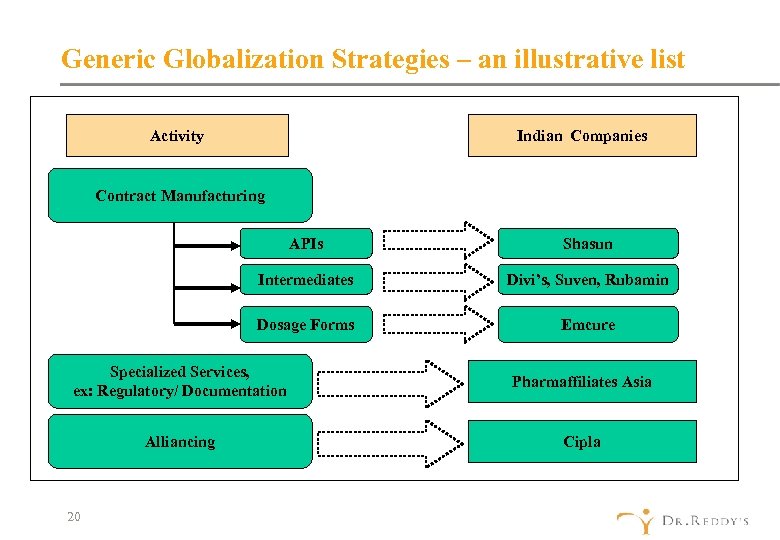

Generic Globalization Strategies – an illustrative list Activity Indian Companies Contract Manufacturing APIs Shasun Intermediates Divi’s, Suven, Rubamin Dosage Forms Emcure Specialized Services, ex: Regulatory/ Documentation Pharmaffiliates Asia Alliancing Cipla 20

Some Good Stories……. 21

Indian Pharma – Leading Global Players Globalization Path of Ranbaxy Laboratories Limited (inc. 1961, public 1973, turnover 2005 USD 1. 2 bn, 75% intl. mkts) Mfg operations in 8 countries, ground presence in 49 countries and products in over 125 countries. ~ over 10, 000 strong multicultural workforce Present in 23 of the Top 25 pharma markets of the world. - 21 of the 25 EU countries 1977: 1993: 1994: 1995: 2000: 2001: 2003: 2005: 2006: JV set up in Nigeria JV in 1993 in China Regional HQs set-up in USA, UK Acquisition of Ohm Laboratories (Mfg unit), USA Forays into Brazil, acquires Bayer’s Generics business in Germany Sets up mfg unit in Vietnam Acquires RPG Aventis in France Launches operations in Canada, acquires generic portfolio of Eframes (Spain), JV in Japan Acquires Terapia (Romania), GSKs unbranded business (Italy, Spain) Besides the above, the company entered into a large number of strategic alliances with small, mid and large size pharma companies (ORCs/ Generics) in various geographies to qugment its product portfolio (Eli Lilly, Glaxo, Ferring, Mallinckrodt, Knoll (Abbott), Schwarz, Debiopharm, Gilead…) 22

Indian Pharma – Leading Global Players Cipla – Strong Export Focus………. (inc 1931, turnover 2005 USD 0. 6 bn, 48% intl. mkts) 1946: First product exported to USA 1980: Wins Chemexcil award for excellence in exports Over the years, sets up manufacturing facilities in India Products exported to over 160 countries worldwide October 2006: Sets up a wholly owned subsidiary 'Cipla FZE' at Jebel Ali Free Zone, Dubai, UAE Subsidiary formed to aid logistics and explore new export opportunities. Globalization through exports & Alliancing……. . Strategic Alliances with Morton Grove, Pentech, Akorn, Watson, Neolabs etc - Entered into partnerships for over 120 products in USA - Filed over 170 registrations in Europe - Has approvals for over 4000 formulations in emerging markets 23

Indian Pharma – Leading Global Players DRL – the late entrant………. (inc 1984, turnover 2005: 0. 55 bn, 66% intl. mkts) Direct presence in over 40 geographies - 12 subsidiaries, 32 rep offices, 2 joint ventures, 2 manufacturing locations outside India Products marketed in over 100 countries The globalization journey…… 1984 - Established with an initial capital outlay of Rs. 25 lakhs (USD 56, 000/- at current exchange rates) 1986 - Goes public - Enters international markets with exports of Methyldopa 1987 - Obtains its first USFDA approval for Ibuprofen API - Starts its formulations operations 24

Indian Pharma – Leading Global Players 1990 - Dr. Reddy’s, for the first time in India, exports Norfloxacin & Ciprofloxacin to Europe & Far East 1991 - First formulation exports to Russia commence 1993 - Dr. Reddy's Research Foundation established. The company drug discovery programme starts 1994 - Makes a GDR issue of USD 48 million - Foundation stone laid for finished dosage facility to cater to Regulated markets 1995 - Sets up a Joint Venture in Russia. 1997 - Licenses anti-diabetic molecule, DRF 2593 to Novo Nordisk - Becomes first Indian pharmaceutical company to out-license an original molecule. - First ANDA filed with US Food and Drug Administration for Ranitidine 25

Indian Pharma – Leading Global Players 1998 - Licenses anti-diabetic molecule, DRF 2725 (Ragaglitazar), to Novo Nordisk 2000 - Becomes India's third largest pharmaceutical company - Reddy US Therapeutics, established at Atlanta, US to conduct target based drug discovery 2001 - Becomes first Asia Pacific pharmaceutical company, outside Japan, to list on NYSE - Out-licenses DRF 4158 to Novartis for up to US $55 million upfront payment - Launches its first generic product, Ranitidine, in the US market - Becomes first Indian pharmaceutical company to obtain 180 -day EMR (Fluoxetine) in USA 2002 - Conducts its first overseas acquisition – BMS Laboratories Limited and Meridian Healthcare in UK 2003 - 15 -year exclusive product development & marketing agreement for OTC drugs with Leiner, USA - Launches Ibuprofen, first generic product to be marketed under the “Dr. Reddy’s” label in the US 26

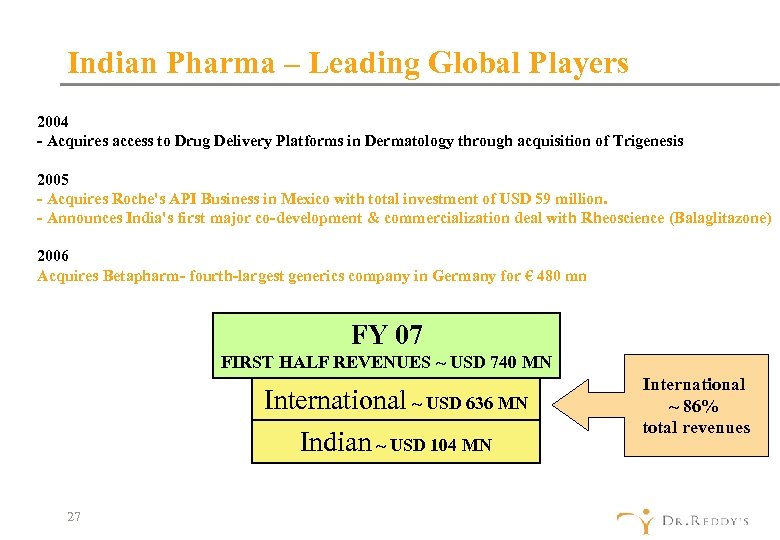

Indian Pharma – Leading Global Players 2004 - Acquires access to Drug Delivery Platforms in Dermatology through acquisition of Trigenesis 2005 - Acquires Roche's API Business in Mexico with total investment of USD 59 million. - Announces India's first major co-development & commercialization deal with Rheoscience (Balaglitazone) 2006 Acquires Betapharm- fourth-largest generics company in Germany for € 480 mn FY 07 FIRST HALF REVENUES ~ USD 740 MN International ~ USD 636 MN Indian ~ USD 104 MN 27 International ~ 86% total revenues

Indian Pharma – Challenges Sustain & grow domestic business - Entry/ reemergence of MNCs Increase international business - New markets: regulated, unregulated Maintain cost competitiveness - Products, services Innovate – products & services 28

Indian Pharma – Useful Links INDUSTRY ASSOCIATIONS GOVERNMENT http: //www. bdm-assn. org http: //chemicals. nic. in http: //www. idma-assn. org http: //commerce. nic. in http: //www. indiaoppi. com http: //mohfw. nic. in http: //www. pharmexcil. com http: //indianmedicine. nic. in http: //www. ciionline. org http: //www. fieo. com http: //www. ficci. com http: //www. assocham. org http: //www. fapcci. org http: //www. scrfi. org 29 http: //commerce. nic. in/ http: //www. patentoffice. nic. in http: //www. cdriindia. org http: //www. csir. res. in/ http: //www. niper. nic. in http: //www. cbec. gov. in

Indian Pharma – Useful Links GOVERNMENT http: //www. cbec. gov. in http: //commerce. nic. in http: //eouindia. com PORTALS http: //sezindia. nic. in http: //commerce. nic. in http: //164. 100. 9. 245/exim/2000/cir/indexc. htm http: //164. 100. 9. 245/exim/2000/download 05. htm http: //www. pharmabiz. com http: //www. expresspharmapulse. com http: //www. dgftcom. nic. in http: //commerce. nic. in http: //www. nppaindia. nic. in http: //www. gs 1 india. org http: //www. meaindia. nic. in 30 http: //www. itcot. com

Thank You Arun Sawhney sarun@drreddys. com 31

75a7f6ba0a689f6dc09c795c43662c34.ppt