c6e4487385fd91ebc49fae30541797d2.ppt

- Количество слайдов: 24

Double Entry System 2 DR CR

The Accounting System to record transactions Click me!

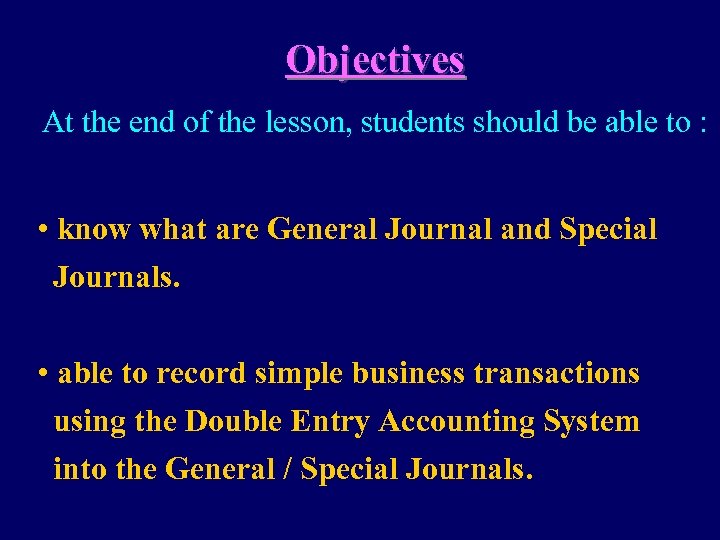

Objectives At the end of the lesson, students should be able to : • know what are General Journal and Special Journals. • able to record simple business transactions using the Double Entry Accounting System into the General / Special Journals.

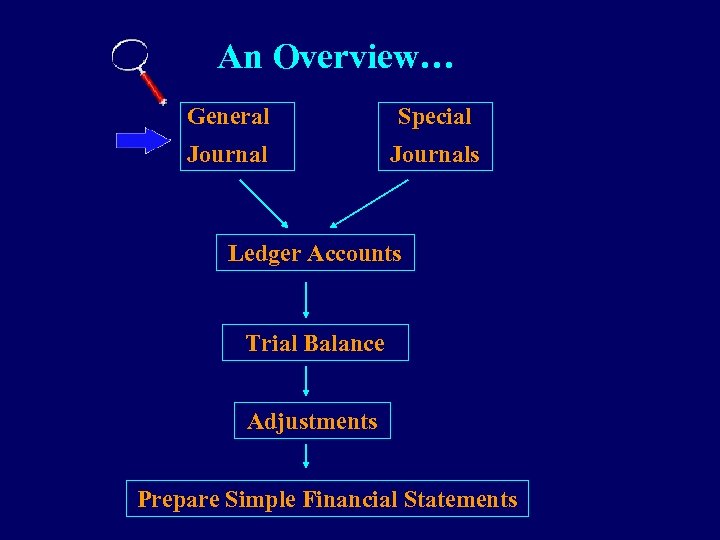

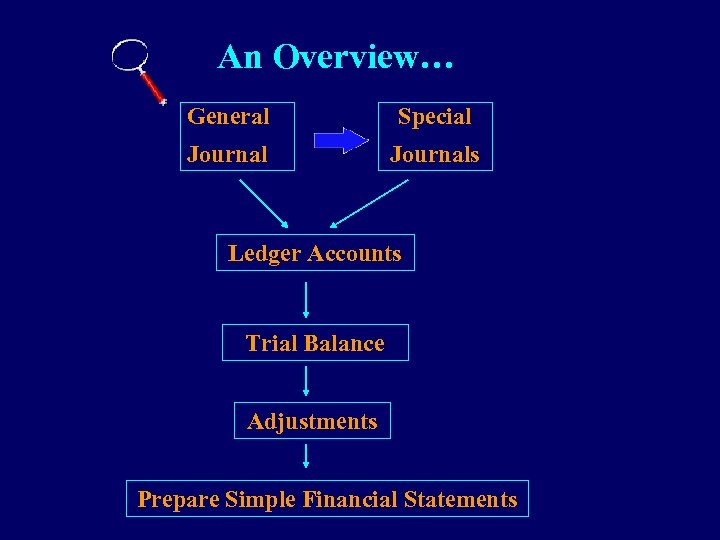

An Overview… General Special Journals Ledger Accounts Trial Balance Adjustments Prepare Simple Financial Statements

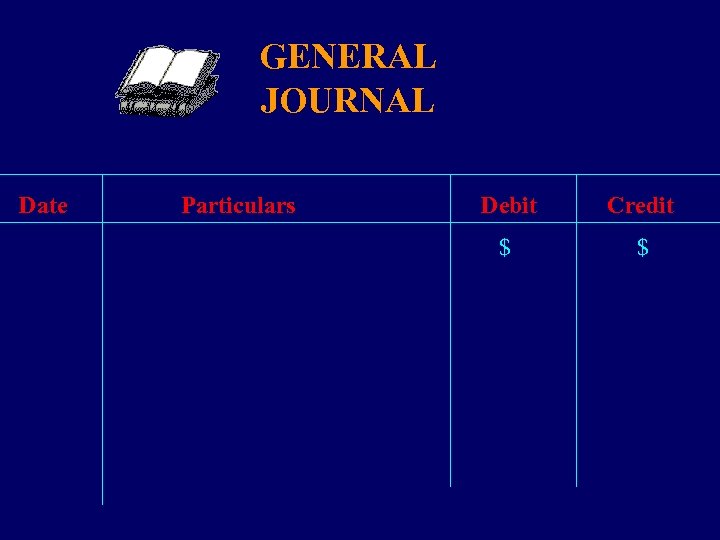

GENERAL JOURNAL Date Particulars Debit Credit $ $

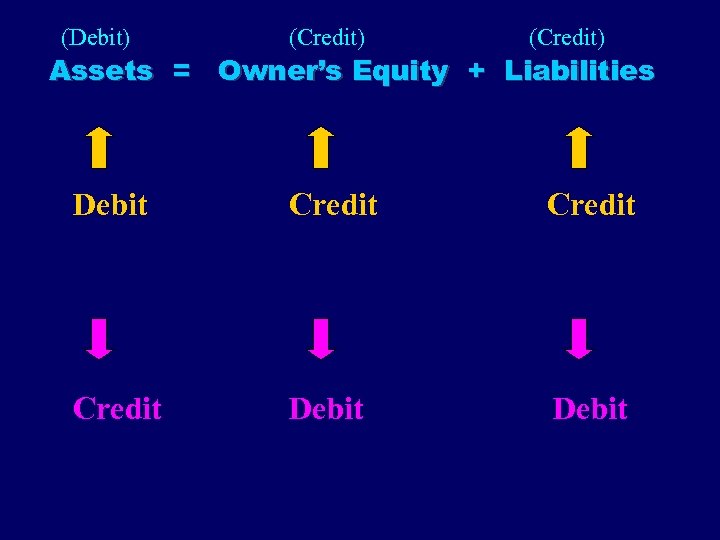

(Debit) (Credit) Assets = Owner’s Equity + Liabilities Debit Credit Debit

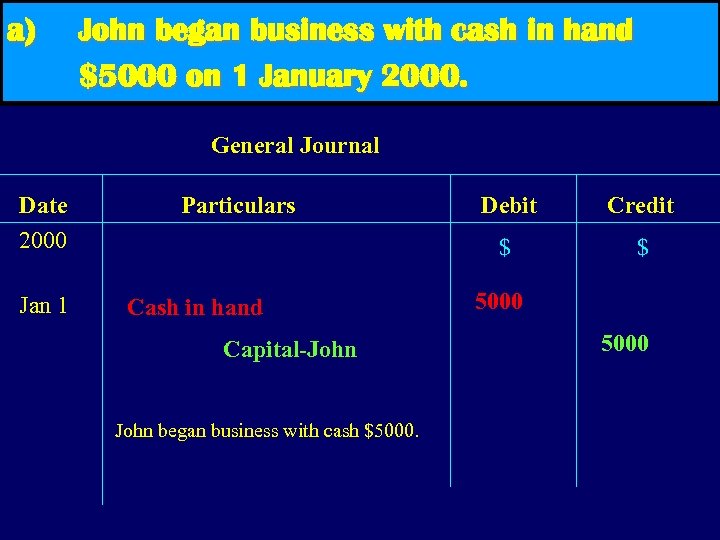

a) John began business with cash in hand $5000 on 1 January 2000. General Journal Date 2000 Jan 1 Particulars Capital-John began business with cash $5000. Credit $ Cash in hand Debit $ 5000

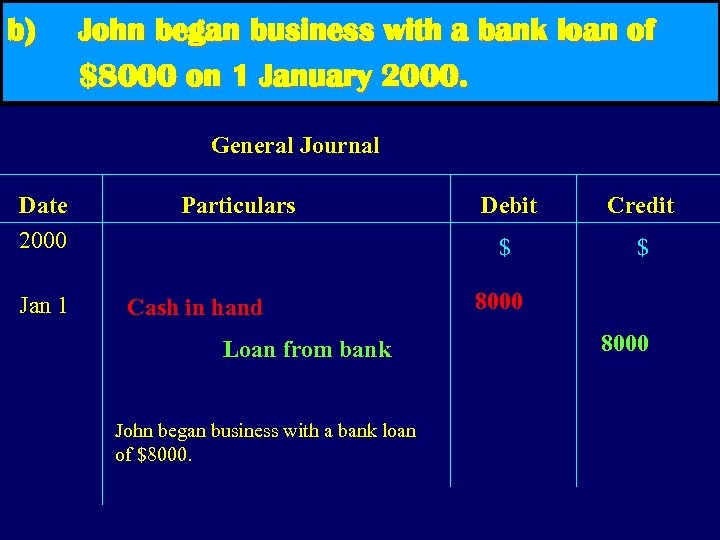

b) John began business with a bank loan of $8000 on 1 January 2000. General Journal Date 2000 Jan 1 Particulars Loan from bank John began business with a bank loan of $8000. Credit $ Cash in hand Debit $ 8000

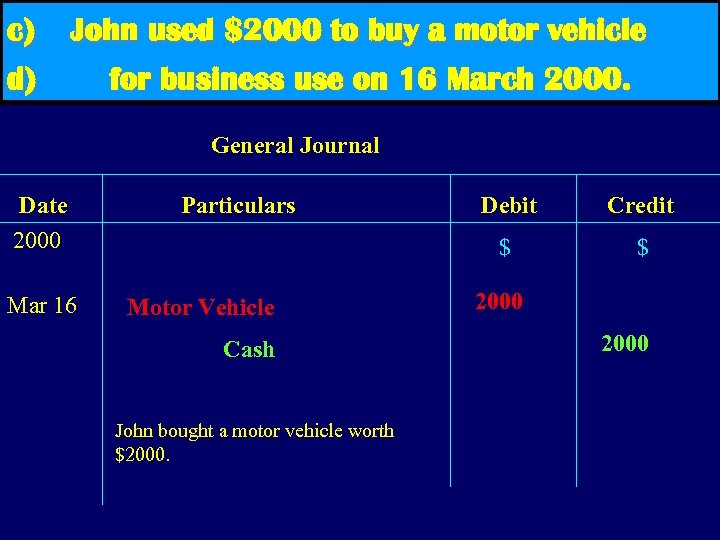

c) d) John used $2000 to buy a motor vehicle for business use on 16 March 2000. General Journal Date 2000 Mar 16 Particulars Cash John bought a motor vehicle worth $2000. Credit $ Motor Vehicle Debit $ 2000

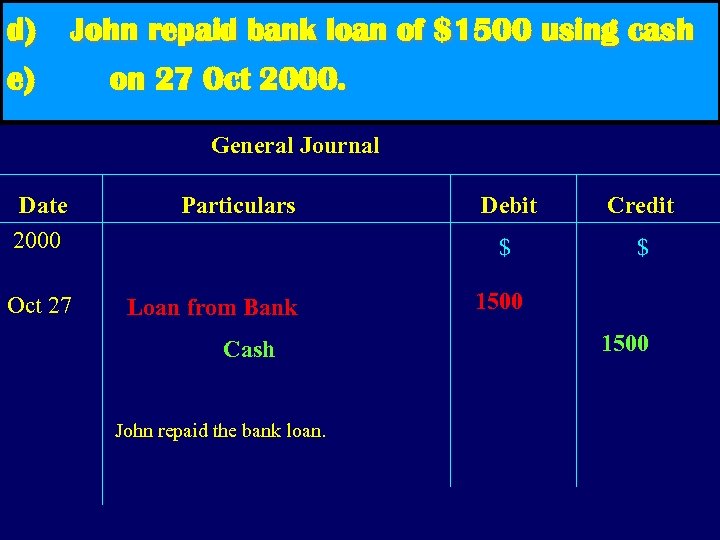

d) e) John repaid bank loan of $1500 using cash on 27 Oct 2000. General Journal Date 2000 Particulars Oct 27 Loan from Bank John repaid the bank loan. Credit $ Cash Debit $ 1500

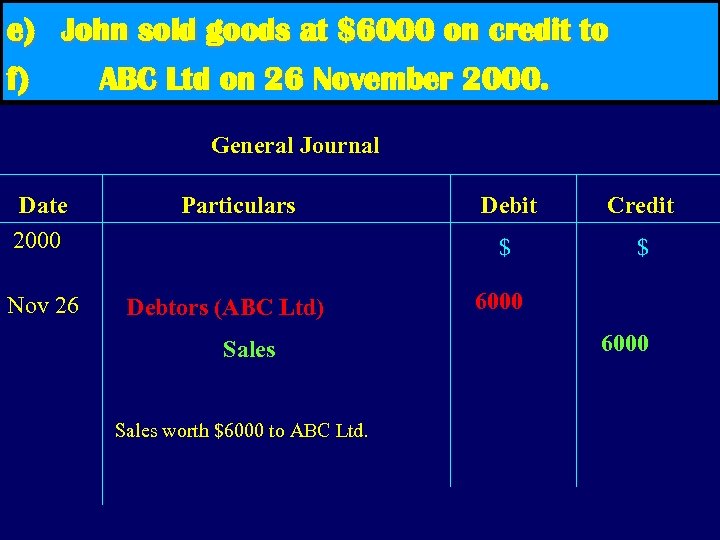

e) John sold goods at $6000 on credit to f) ABC Ltd on 26 November 2000. General Journal Date 2000 Nov 26 Particulars Sales worth $6000 to ABC Ltd. Credit $ Debtors (ABC Ltd) Debit $ 6000

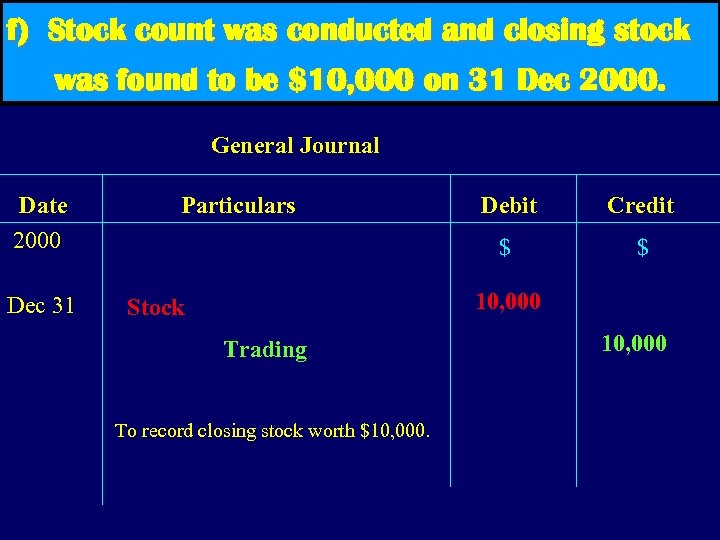

f) Stock count was conducted and closing stock was found to be $10, 000 on 31 Dec 2000. General Journal Date 2000 Dec 31 Particulars Debit Credit $ $ 10, 000 Stock Trading To record closing stock worth $10, 000. 10, 000

It is common for the owner to draw money or goods from the firm for personal use anytime. According to the Accounting Entity concept, we must record the event even though he is the owner of the firm. What do you call this? Click me!

It is common for the owner to draw money or goods from the firm for personal use anytime. According to the Accounting Entity concept, we must record the event even though he is the owner of the firm. DRAWINGS

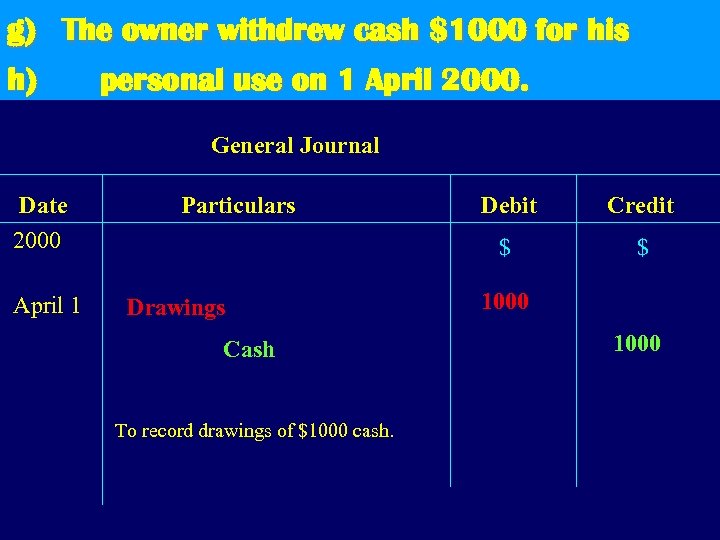

g) The owner withdrew cash $1000 for his h) personal use on 1 April 2000. General Journal Date 2000 April 1 Particulars Cash To record drawings of $1000 cash. Credit $ Drawings Debit $ 1000

An Overview… General Special Journals Ledger Accounts Trial Balance Adjustments Prepare Simple Financial Statements

4 SPECIAL JOURNALS Purchases Journal Returns Outwards Journal Sales Journal Returns Inwards Journal

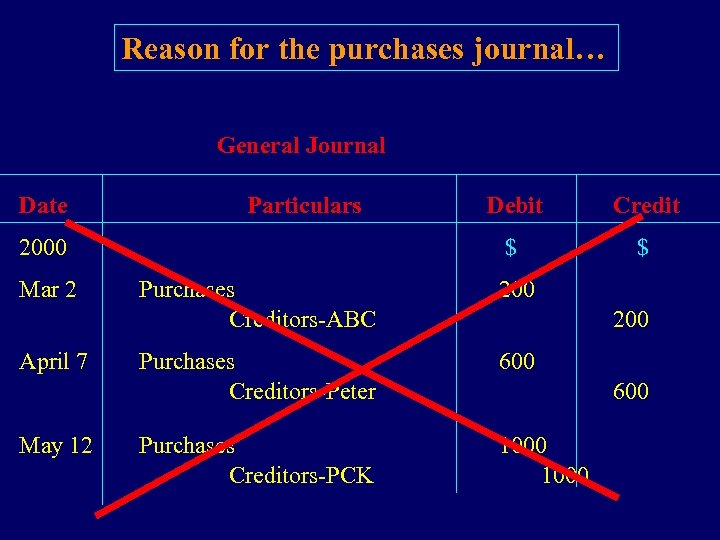

Reason for the purchases journal… General Journal Date Particulars Mar 2 April 7 May 12 Credit $ 2000 Debit $ Purchases Creditors-ABC 200 Purchases Creditors-Peter 600 Purchases Creditors-PCK 1000 200 600

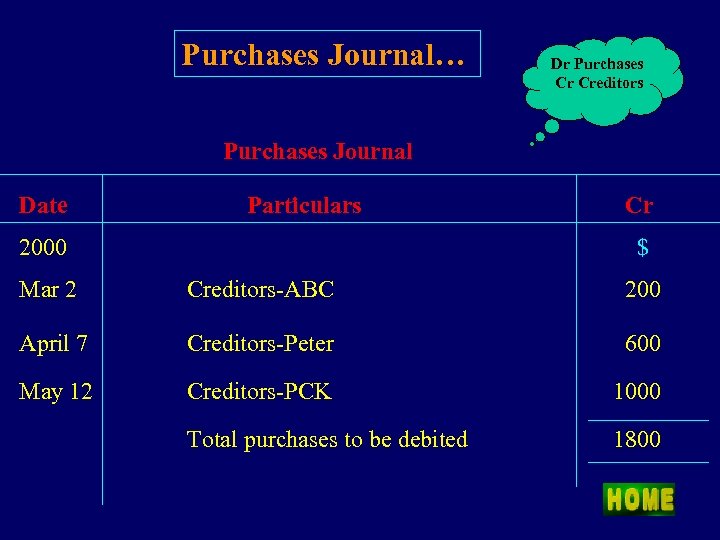

Purchases Journal… Dr Purchases Cr Creditors Purchases Journal Date Particulars Cr $ 2000 Mar 2 Creditors-ABC April 7 Creditors-Peter 600 May 12 Creditors-PCK 1000 Total purchases to be debited 200 1800

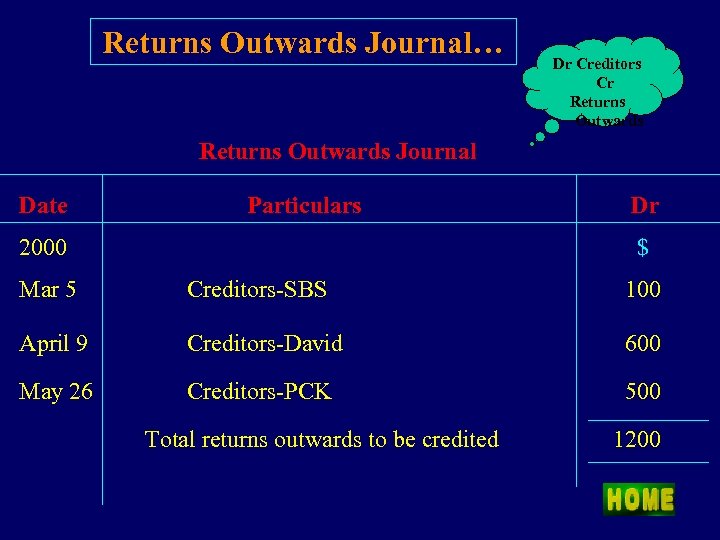

Returns Outwards Journal… Dr Creditors Cr Returns Outwards Journal Date Particulars Dr $ 2000 Mar 5 Creditors-SBS April 9 Creditors-David 600 May 26 Creditors-PCK 500 Total returns outwards to be credited 100 1200

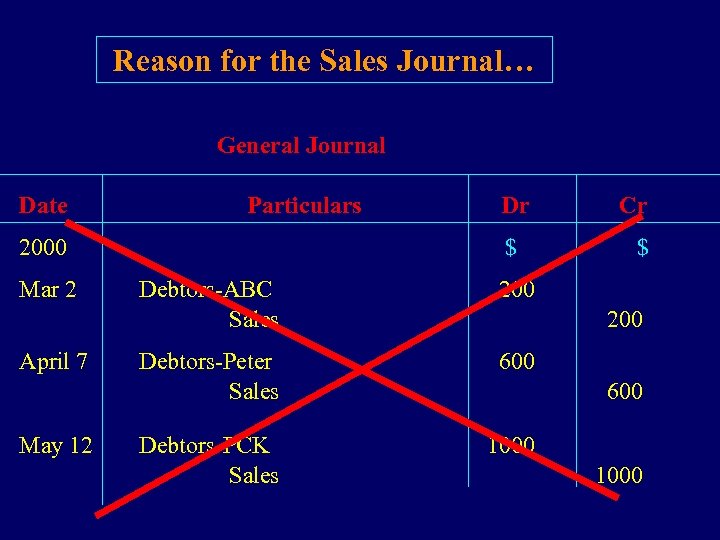

Reason for the Sales Journal… General Journal Date Particulars Dr 2000 $ Mar 2 Debtors-ABC Sales April 7 Debtors-Peter Sales May 12 Debtors-PCK Sales Cr $ 200 200 600 1000 1000

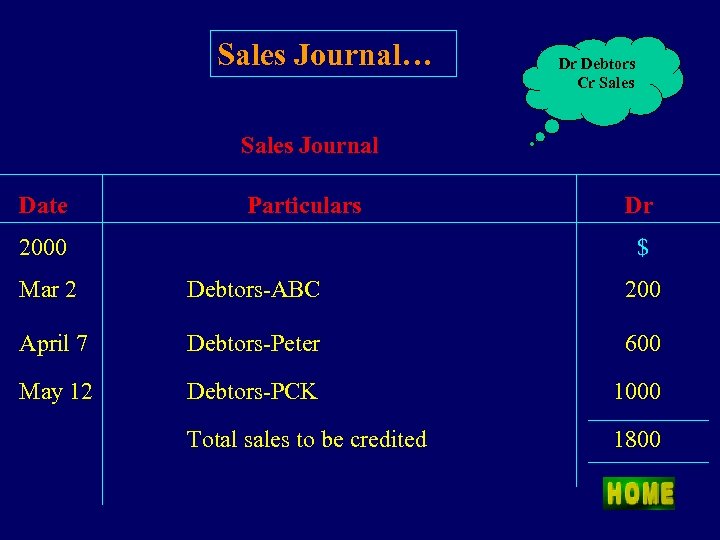

Sales Journal… Dr Debtors Cr Sales Journal Date Particulars Dr $ 2000 Mar 2 Debtors-ABC April 7 Debtors-Peter 600 May 12 Debtors-PCK 1000 Total sales to be credited 200 1800

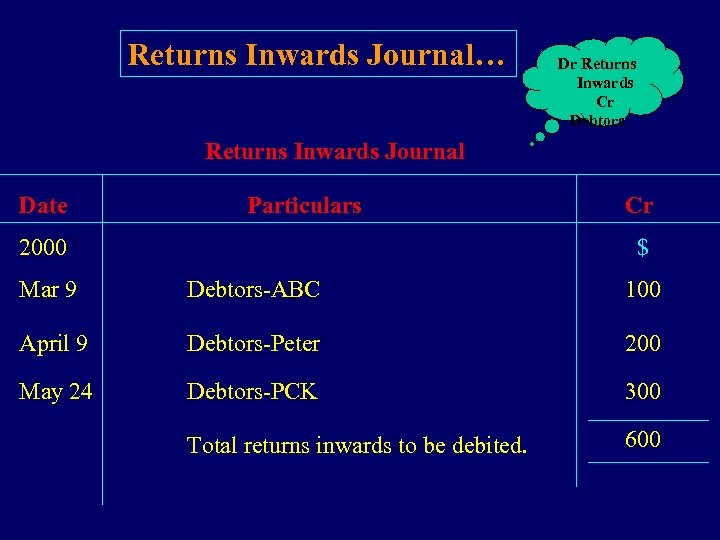

Returns Inwards Journal… Dr Returns Inwards Cr Debtors Returns Inwards Journal Date Particulars Cr $ 2000 Mar 9 Debtors-ABC April 9 Debtors-Peter 200 May 24 Debtors-PCK 300 Total returns inwards to be debited. 100 600

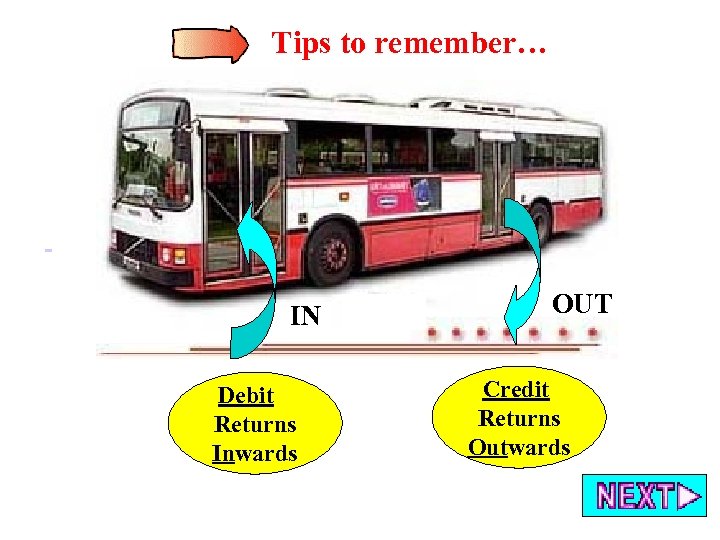

Tips to remember… IN Debit Returns Inwards OUT Credit Returns Outwards

c6e4487385fd91ebc49fae30541797d2.ppt