f7beff41a30e3f72cd4386b8edc862af.ppt

- Количество слайдов: 41

Don Kennedy Managing Director IDG Communications

Obstacles & Opportunities The Whitebox Channel Goes Home Don Kennedy Managing Director IDG Communications ANZ

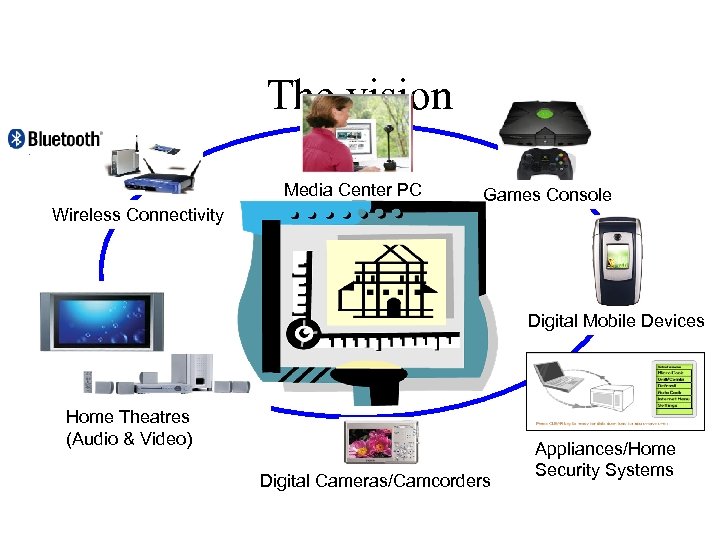

The vision Media Center PC Games Console Wireless Connectivity Digital Mobile Devices Home Theatres (Audio & Video) Digital Cameras/Camcorders Appliances/Home Security Systems

Where we are – the pluses • Consumer acceptance of many types of digital products – Cameras/camcorders – Multimedia mobile phones – DVD players – MP 3 – Micro-storage devices – LCD and plasma screens

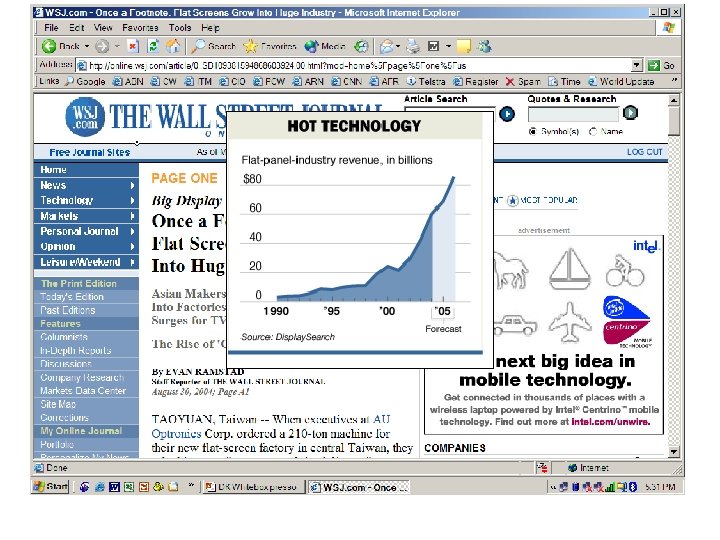

Where we are – the pluses • Consumer acceptance of many types of digital products – – – Cameras/camcorders Multimedia mobile phones DVD players MP 3 Micro-storage devices LCD and plasma screens • The Digital Living Network Alliance

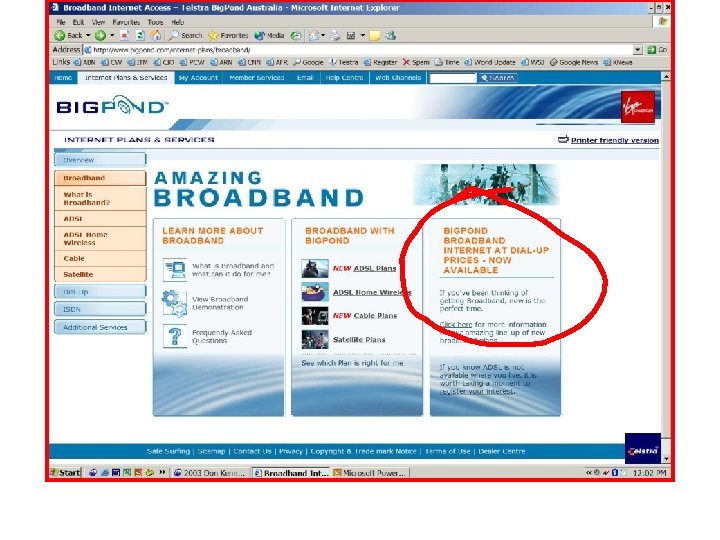

Where we are – the obstacles • Market – Weak broadband uptake in Australia

Broadband growth August 31, 2004 Broadband hits the million subscriber mark in Australia, but higher speeds – not lower prices – will drive future growth A. T. Kearney report predicts a “quiet revolution” for 2005 in entertainment, voice and data applications AROUND 15% of Australian households and 30% of small to medium enterprises will have broadband by year’s end, with subscriber numbers doubling to one

Digital TV growth The number of pay TV subscribers. . . rose 8. 3% in 2003 -4

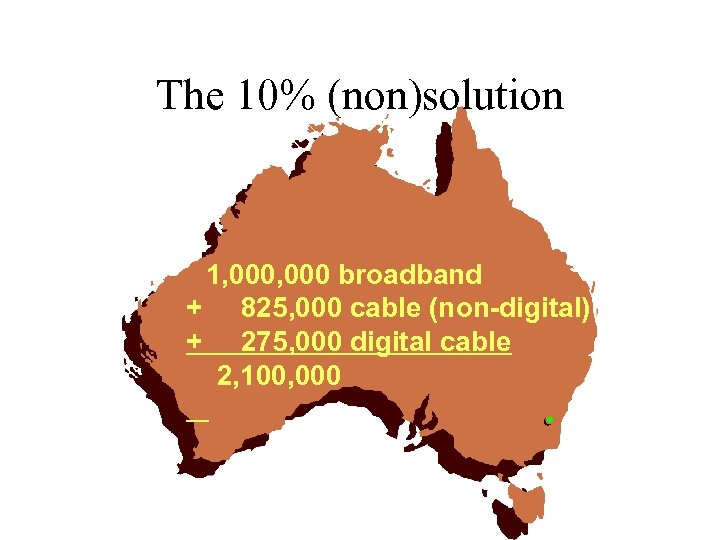

The 10% (non)solution 1, 000 broadband + 825, 000 cable (non-digital) + 275, 000 digital cable 2, 100, 000

Where we are – the obstacles • Market – Weak home PC network uptake – Early adopters (only) for digital home networks – – Security issues Legacy investments Ease of use issues Where’s. net? • Technology – Standards and technologies are not all here yet (802. 11 e, Ultrawideband, Home. Plug, IPv 6)

Even more issues in Australians are missing out on a TV program recording service that has cult status in the United States because of a lack of co-operation between broadcasters on technical standards

Where we are – the obstacles • No compelling case for consumers at the mass market level

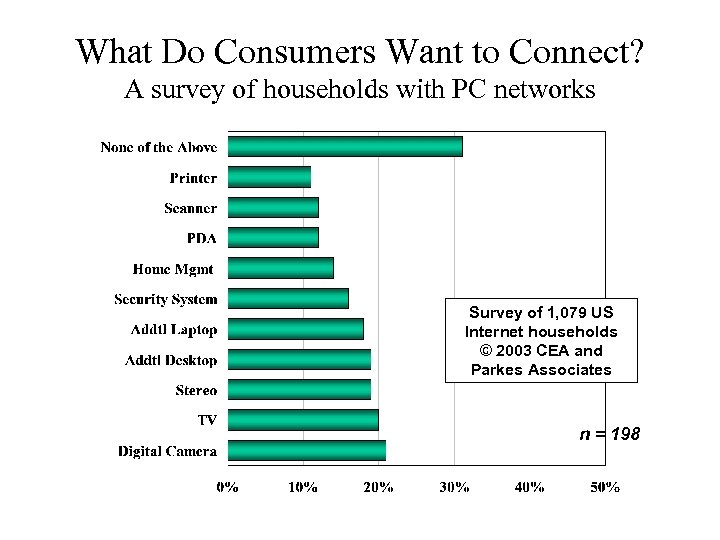

What Do Consumers Want to Connect? A survey of households with PC networks Survey of 1, 079 US Internet households © 2003 CEA and Parkes Associates n = 198

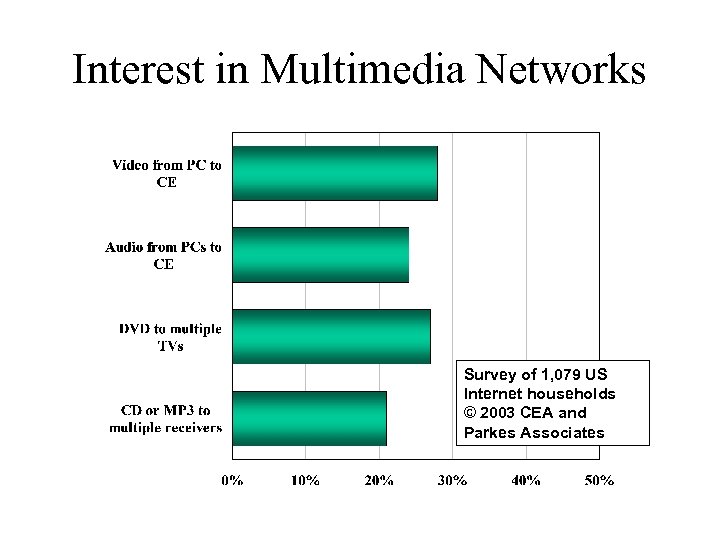

Interest in Multimedia Networks Survey of 1, 079 US Internet households © 2003 CEA and Parkes Associates

What consumers want • Digital home products should be easy to instal, provide obvious value and be affordable • Products must interoperate with each other and with existing consumer electronic devices like TVs and stereos • Device communication and collaboration with each other must be simple and seamless Source: DHWG Working Paper

Consumer Value Propositions • Greater convenience and ease of use • More flexibility in selecting a range of products from different vendors • Content in the home can go mobile (and mobile content can come home) • Confidence purchases will work together Source: DHWG Working Paper and are future proof

What the industry needs • Adapters that bridge the CE, mobile and PC worlds and support consumer’s existing home devices • CE, mobile and PC vendors must routinely deliver new and exciting digital home products that meet consumer needs for functionality, reliability, performance and simplicity

What the industry really, really needs • The widespread adoption of multimedia networking components is contingent upon the availability of compelling entertainment content – the kind end users will want to access, download, store and stream

Should the Channel Go Fishing in the Home Pond?

Value Chain of Home Networks • Digital Content – Audio/video (including interactive) – Games – User-created pictures, movies • Access – ISPs, Cable/Satellite, Digital Free-to-Air, Multimedia Phone Services • Platforms – Products – Service, support, installation, help desk

DIGITAL CONTENT

DIGITAL ACCESS

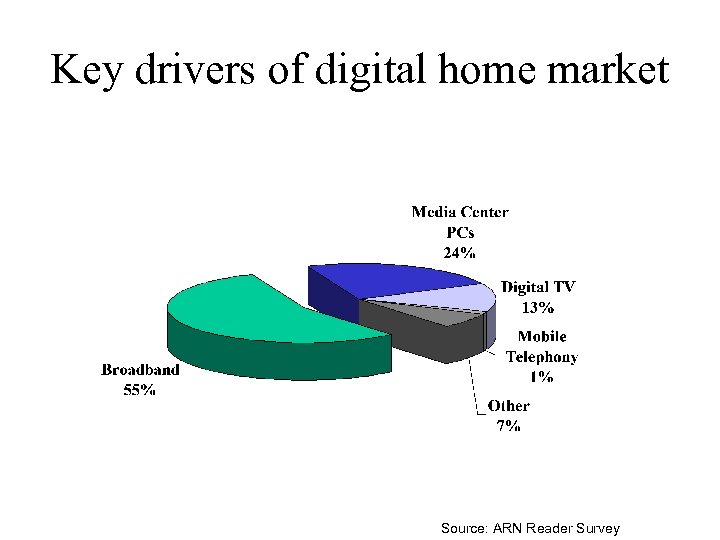

Key drivers of digital home market Source: ARN Reader Survey

DIGITAL PLATFORMS

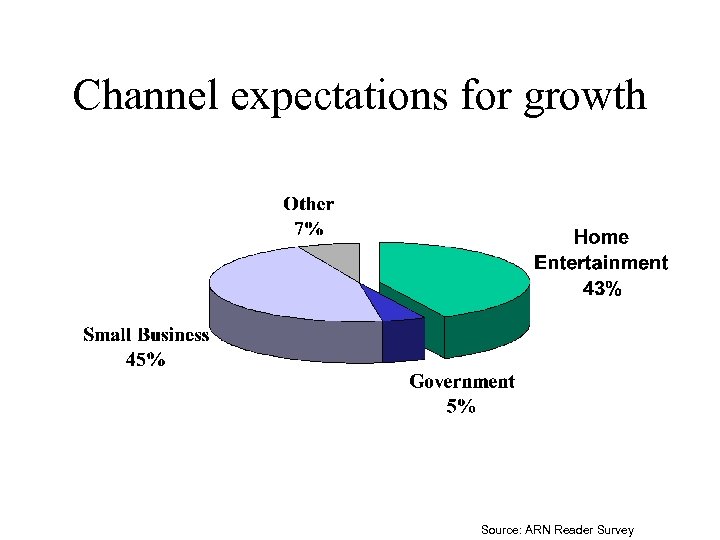

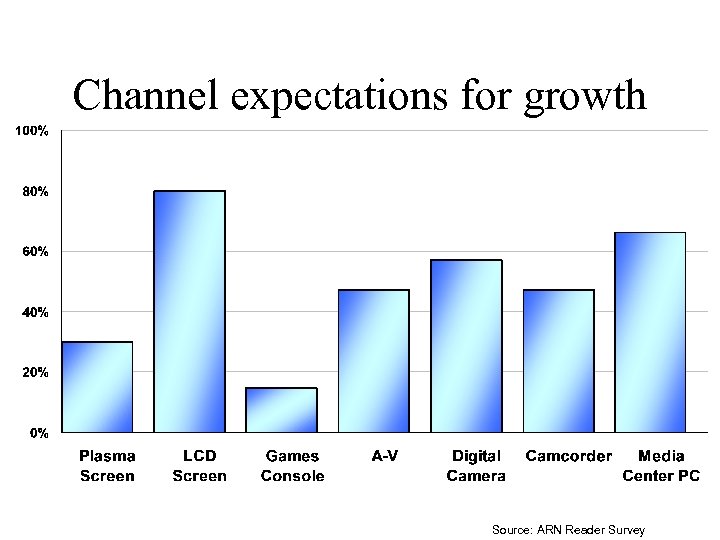

Channel expectations for growth Source: ARN Reader Survey

Channel expectations for growth Source: ARN Reader Survey

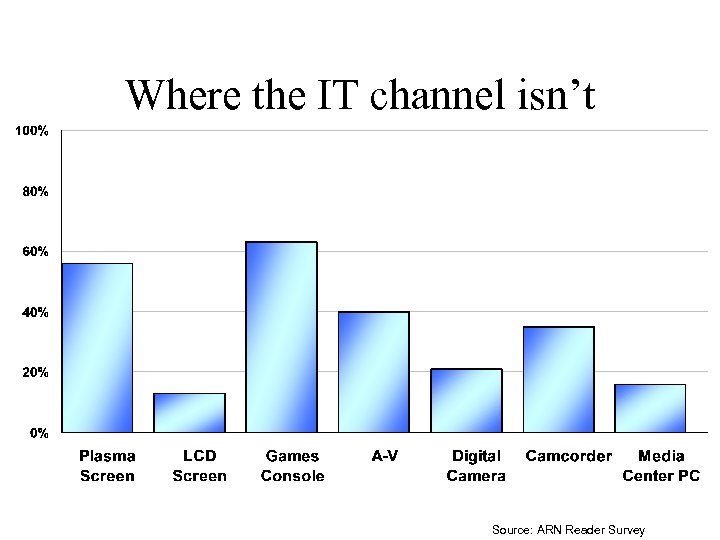

Where the IT channel isn’t Source: ARN Reader Survey

The changing landscape • The new competition from white goods distributors • New business models moving into mass market products • New products and services to sell

Convergence diverges • A-V VARs – Early adopters and gadget lovers pay premium for new features and improvements – Sophisticated users require installation, service and support • Infrastructure specialists – Convergence technology a minor percentage of total cost (e. g. , of a home) – Price is king and brand loyalty unlikely

And some not so new threats

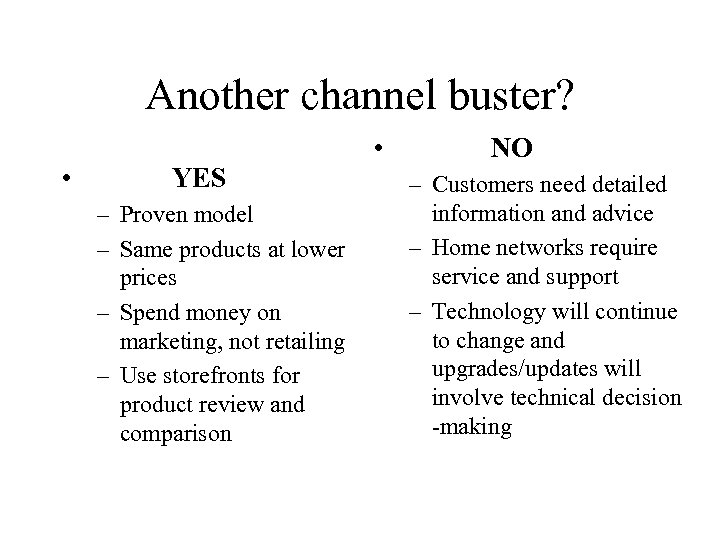

Another channel buster? • YES – Proven model – Same products at lower prices – Spend money on marketing, not retailing – Use storefronts for product review and comparison • NO – Customers need detailed information and advice – Home networks require service and support – Technology will continue to change and upgrades/updates will involve technical decision -making

The opportunities • Begin selling digital convergence products NOW and expand to include traditional CE products • Broaden your solution offerings to include integrated entertainment networks • Develop expertise in-house to become an early player in the architecture and building space. This is a long-term investment

Action Items • Educate your company about digital convergence • Stay on top of new trends in digital home products – Interactive gaming – Tivo – Photo sharing

Obstacles & Opportunities The Whitebox Channel Goes Home Don Kennedy Managing Director IDG Communications ANZ

f7beff41a30e3f72cd4386b8edc862af.ppt