M&ALecture.ppt

- Количество слайдов: 38

Domestic and Cross-border Mergers and Acquisitions Bruce A. Blonigen Knight Professor of Social Science, Department of Economics, University of Oregon Research Associate, National Bureau of Economic Research

Definitions • MERGERS and ACQUISTIONS (M&As) are transactions where one party sells part or all of their productive assets to another party • ACQUIROR is the party buying the assets • TARGET is the party being purchased • CROSS-BORDER M&As are where the two parties are located in different countries

Why should we care? • World M&A activity was around US$2. 7 trillion in 2011 • Cross-border M&A is the main way in which foreign investors gain control of productive domestic assets • The banking sector is a major source of financing M&A activity • The banking sector sees significant M&A activity in developed economies (8% in US)

What motivates M&A activity • Greater efficiency through ECONOMIES OF SCALE OR SCOPE – Example of SCALE: When Chase and Chemical banks merged they predicted that costs would fall by 16% from consolidating activities and reducing redundancies – Example of SCOPE: Google buys Picasa, a firm that has developed web software to store and share photos

What motivates M&A activity • Increase in MARKET POWER – ability to increase prices above marginal cost – Concern of antitrust authorities, so difficult to find firms saying this will happen due to M&A – Example? : British Petroleum acquisition of U. S. Amoco

What motivates M&A activity • Pairing of complementary assets – SYNERGIES – Example: Disney and Pixar – Example: “For example, when Renault took a one third share of Nissan, it had not been contemplating building a Renault factory in Japan. There was no intention of shifting production of Renault models to Japanese factories. Instead, Renault installed one of its star managers, Carlos Ghosn, as the Nissan CEO. He proceeded to restructure the Japanese company, restoring it to profitability” --- Head & Ries, J. of Int’l Econ, 2008

What motivates M&A activity • VERTICAL INTEGRATION – firm purchasing an upstream supplier (or vice versa) – EX: Auto manufacturer purchases an automobile parts supplier

Financing of M&As • Two main ways to finance an acquisition – Cash – Stock – provide the shareholders of the other company with shares in your acquiring firm • Over the past decade, cash accounts for about 60% of all deals according to Dealogic

Banks and Financing of M&As • When a cash offer, this may often be financed through bank lending • This means the bank must also evaluate whether the acquisition is a good business decision and allow repayment of the loan • Results suggest that bank debt performs an important certification and monitoring role for acquirers in tender offers – M&A financed by banks generally are more successul

Are M&As Good Business Decisions? • Merging assets of two companies is a very complex task – can take years to complete • Many examples of failed M&As – EX: e. Bay and Skype – e. Bay customers prefer email – EX: AOL and Time Warner – bad timing – end of dotcom bubble; culture clash – EX: Daimer and Chrysler – culture clash

Are M&As Good Business Decisions? • At best, only half of all M&As have been shown to create shareholder value.

Are M&As Good Business Decisions? • Evidence is that target shareholders see significant gains, but acquiring firms’ shareholders do not? • Why do they fail? – Overestimated net benefits – CEO incentives wrong. Hubris?

Bank financing and M&As • Again, results suggest that bank debt performs an important certification and monitoring role for acquirers in tender offers. • Third party can be an important check on whether the decision makes sense and is not too risky

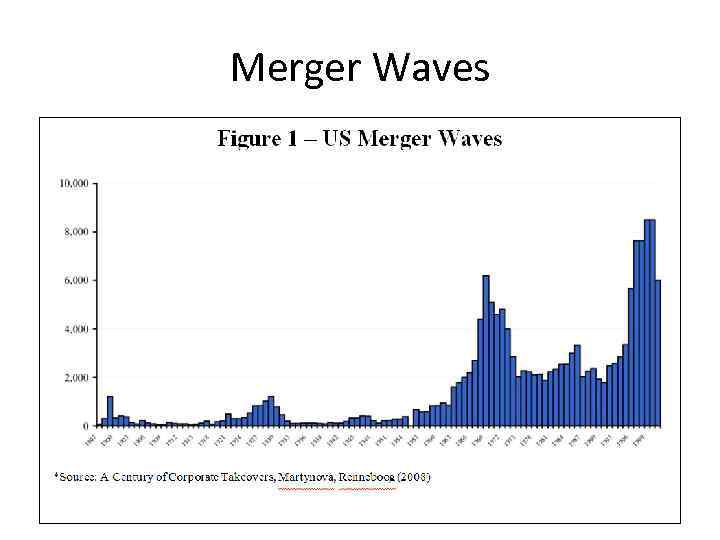

Merger Waves

Merger Waves • Debate about why these occur – Regulations – Technology – Stock market and increased firm equity valuations • Best explanation – combination – Regulations and technology provide motive for M&A, but need stock market valuations necessary to provide the preferred financing

Cross-border M&A activity • Why should we care? • Represents foreign acquirers buying domestic assets or vice versa • Firms that engage in this activity are • Large • Unusually productive and efficient • Have access to many markets for capital and consumers

Cross-border M&A activity • Why should we care? • Evidence is that these firms bring net benefits generally • Typically pay higher wages than average domestic firm • Will work with local suppliers to make them more productive and efficient • May provide other spillovers in terms of greater overall productivity and competition in the marketplace • As a result, governments often offer financial packages and other incentives to attract foreign investors

Cross-border M&A activity • Why should we care? • There are possible negative effects • May not care as much about the local environment • May be more likely to move • May drive out local firms

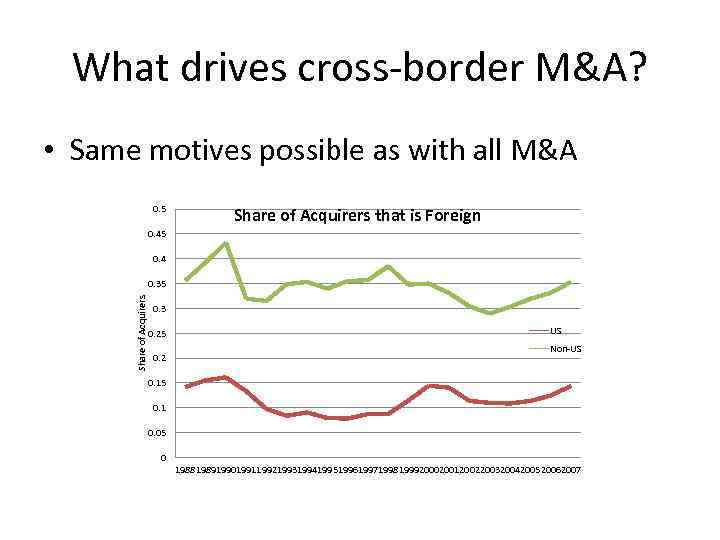

What drives cross-border M&A? • Same motives possible as with all M&A 0. 5 Share of Acquirers that is Foreign 0. 45 0. 4 Share of Acquirers 0. 35 0. 3 0. 25 0. 2 US Non-US 0. 15 0. 1 0. 05 0 19881989199019911992199319941995199619971998199920002001200220032004200520062007

What drives cross-border M&A? • But also additional motives for cross-border M&A • Access to new international markets – HORIZONTAL foreign direct investment (FDI) • Access to lower wages – VERTICAL FDI • RESOURCE FDI • Seeking source of resource not in own country • Example: Oil!

What drives cross-border M&A? • Additional frictions for cross-border M&A • Political and economic uncertainty can matter much more for firms crossing borders • Cultural differences matter • Often greater regulations foreign investors

What drives cross-border M&A? • Example: Regulations in Russia (as of 2008) • Currency controls to some extent • Investment restrictions in some industries • Foreign ownership max of 11% in natural resources • Foreign ownership max of 12% in banking • Foreign ownership max of 25% in aerospace and power • Foreign investors need prior approval for • Ventures with more than 50% of ownership • Projects related to defense and natural resources

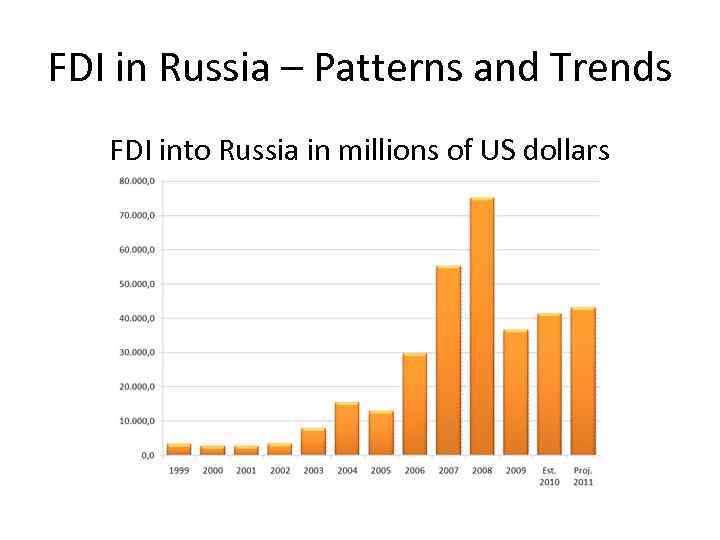

FDI in Russia – Patterns and Trends FDI into Russia in millions of US dollars

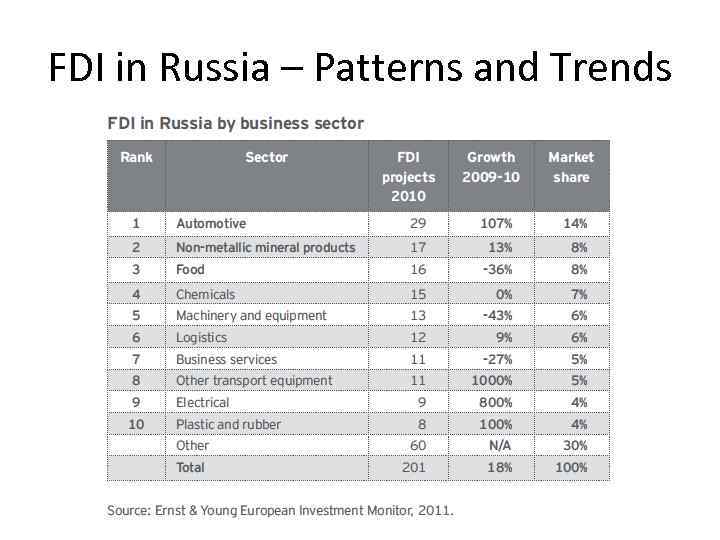

FDI in Russia – Patterns and Trends FDI into Russia by sectors

FDI in Russia – Patterns and Trends

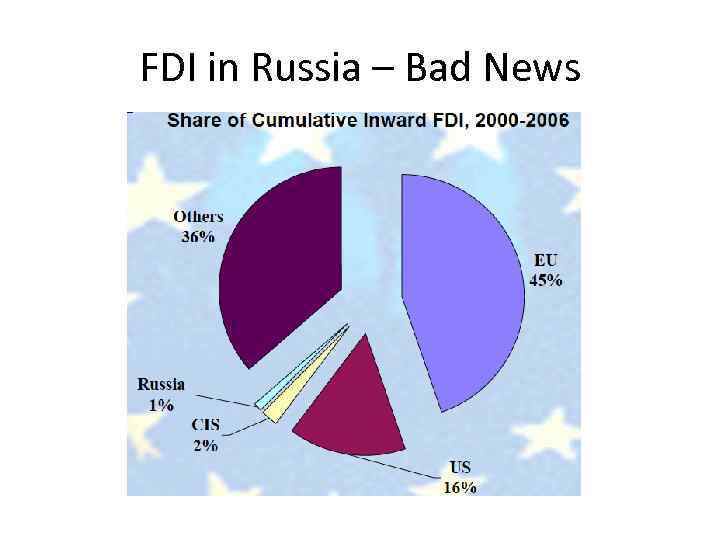

FDI in Russia – Bad News

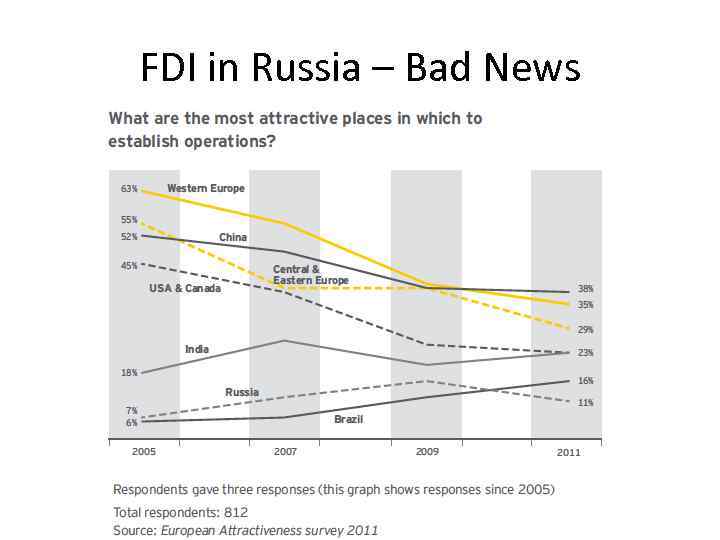

FDI in Russia – Bad News

FDI in Russia – Bad News • Reasons? – Currency controls and regulations – Political environment and corruption – Not as close to western European markets as many of the former Soviet bloc countries

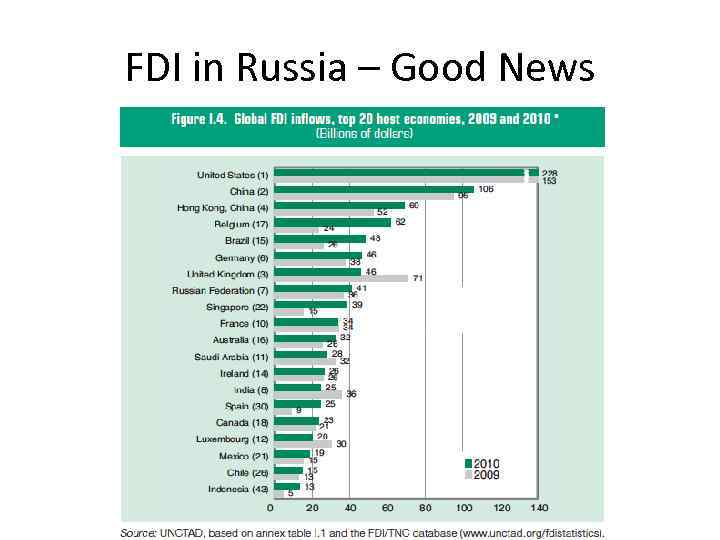

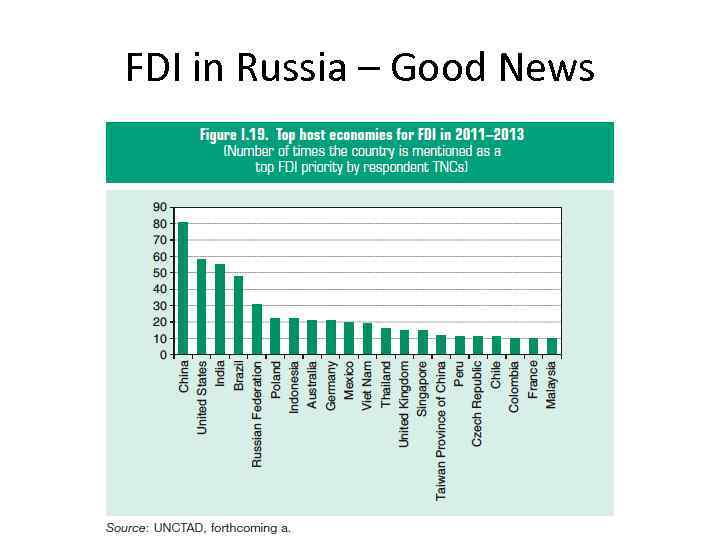

FDI in Russia – Good News • Russia has a number of natural advantages – Low tax rates – Highly skilled population – Relatively large market – almost 150 million – Decent infrastructure • This has led to some promising trends …

FDI in Russia – Good News

FDI in Russia – Good News

FDI in Russia – Good News

FDI in Russia – Good News “Russia needs to bolster the positive trend of foreign direct investment growth in Russia, Prime Minister and President-elect Vladimir Putin said on Wednesday” (May 2, 2012, RIA Novasti) “The commission foreign investment has examined over 140 requests from foreign investors in the four years of its work and approved 94 percent of them, Putin said. ” “Plans to loosen restrictions in the future and encourage more foreign investment”

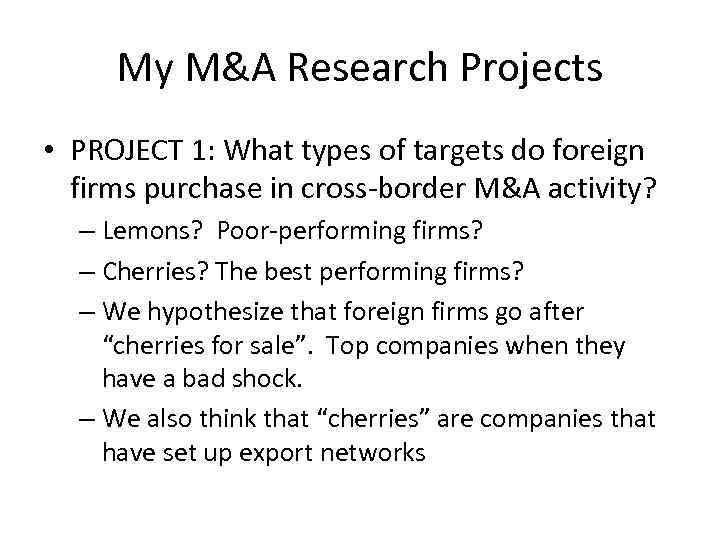

My M&A Research Projects • PROJECT 1: What types of targets do foreign firms purchase in cross-border M&A activity? – Lemons? Poor-performing firms? – Cherries? The best performing firms? – We hypothesize that foreign firms go after “cherries for sale”. Top companies when they have a bad shock. – We also think that “cherries” are companies that have set up export networks

My M&A Research Projects • PROJECT 1: What types of targets do foreign firms purchase in cross-border M&A activity? – Theory: 3 -Stage Game • Stage 1 – Good domestic company sets up export networks and sells a lot on the network • Stage 2 – Domestic company has a negative shock and no longer sells very well on its network. • Stage 3 – Foreign firm finds the export network valuable because different from its own and purchases the domestic firm that received the shock

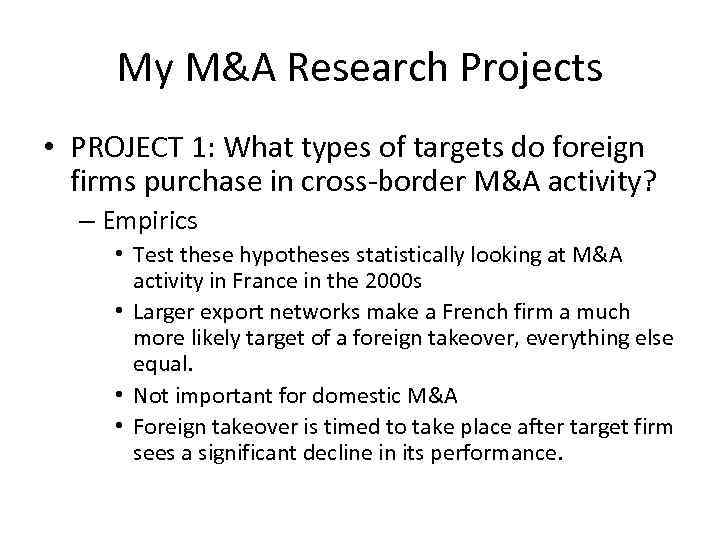

My M&A Research Projects • PROJECT 1: What types of targets do foreign firms purchase in cross-border M&A activity? – Empirics • Test these hypotheses statistically looking at M&A activity in France in the 2000 s • Larger export networks make a French firm a much more likely target of a foreign takeover, everything else equal. • Not important for domestic M&A • Foreign takeover is timed to take place after target firm sees a significant decline in its performance.

My M&A Research Projects • PROJECT 2: How do M&A frictions vary across sectors? Why are half of cross-border M&A transactions in manufacturing, when this sector is a much lower share of world GDP? – Statistically estimate the impact of various frictions on M&A activity by sector • Physical distance • Cultural distance • Tradeability

My M&A Research Projects • PROJECT 2: How do M&A frictions vary across sectors? – Very preliminary results at this point • Cultural distance between countries has a negative effect on M&A activity in financial sectors that is TWICE as large as in manufacturing sectors • Regulation and FDI restrictions are much larger in financial sectors than in manufacturing, which also significantly lowers cross-border M&A

M&ALecture.ppt