e1aab3f23286c50b7229c347525ec419.ppt

- Количество слайдов: 22

Does your company have a PPA strategy? Pension Protection Act of 2006 Playing by the Rules for DB Mike Walton & Vin Grillo Products & Advisory Services Webcast: November 1, 2006 For Plan Sponsor Use Only 1

Does your company have a PPA strategy? Pension Protection Act of 2006 Playing by the Rules for DB Mike Walton & Vin Grillo Products & Advisory Services Webcast: November 1, 2006 For Plan Sponsor Use Only 1

Does your company have a PPA strategy? Outline p The New Rule Book – Pension Protection Act of 2006 p The Game within the Game – Accounting Reform Phase I & II p No Mercy Rule – Sample Illustrations under PPA For Plan Sponsor Use Only 2

Does your company have a PPA strategy? Outline p The New Rule Book – Pension Protection Act of 2006 p The Game within the Game – Accounting Reform Phase I & II p No Mercy Rule – Sample Illustrations under PPA For Plan Sponsor Use Only 2

Does your company have a PPA strategy? Pension Protection Act of 2006 p Generally effective for 2008 Plan Years p New funding rules p Potential lump sum restrictions (includes cash balance plans) p Potential restrictions for plan amendments, payment forms and funding of executive deferred compensation p And more… For Plan Sponsor Use Only 3

Does your company have a PPA strategy? Pension Protection Act of 2006 p Generally effective for 2008 Plan Years p New funding rules p Potential lump sum restrictions (includes cash balance plans) p Potential restrictions for plan amendments, payment forms and funding of executive deferred compensation p And more… For Plan Sponsor Use Only 3

Does your company have a PPA strategy? Pension Protection Act of 2006 p Funding Target Attainment Percentage (FTAP) – Actuarial Value of Assets / Targeted Liability – Trigger percentage for the new rules impacts Funding requirements o Benefit administration o Benefit delivery o For Plan Sponsor Use Only 4

Does your company have a PPA strategy? Pension Protection Act of 2006 p Funding Target Attainment Percentage (FTAP) – Actuarial Value of Assets / Targeted Liability – Trigger percentage for the new rules impacts Funding requirements o Benefit administration o Benefit delivery o For Plan Sponsor Use Only 4

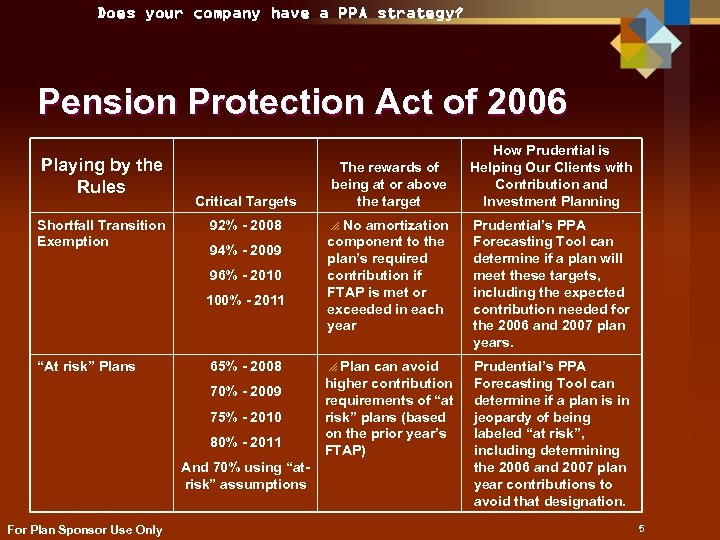

Does your company have a PPA strategy? Pension Protection Act of 2006 Playing by the Rules Shortfall Transition Exemption Critical Targets The rewards of being at or above the target 92% - 2008 p No amortization 94% - 2009 96% - 2010 100% - 2011 “At risk” Plans 65% - 2008 70% - 2009 75% - 2010 80% - 2011 And 70% using “atrisk” assumptions For Plan Sponsor Use Only component to the plan’s required contribution if FTAP is met or exceeded in each year p Plan can avoid higher contribution requirements of “at risk” plans (based on the prior year’s FTAP) How Prudential is Helping Our Clients with Contribution and Investment Planning Prudential’s PPA Forecasting Tool can determine if a plan will meet these targets, including the expected contribution needed for the 2006 and 2007 plan years. Prudential’s PPA Forecasting Tool can determine if a plan is in jeopardy of being labeled “at risk”, including determining the 2006 and 2007 plan year contributions to avoid that designation. 5

Does your company have a PPA strategy? Pension Protection Act of 2006 Playing by the Rules Shortfall Transition Exemption Critical Targets The rewards of being at or above the target 92% - 2008 p No amortization 94% - 2009 96% - 2010 100% - 2011 “At risk” Plans 65% - 2008 70% - 2009 75% - 2010 80% - 2011 And 70% using “atrisk” assumptions For Plan Sponsor Use Only component to the plan’s required contribution if FTAP is met or exceeded in each year p Plan can avoid higher contribution requirements of “at risk” plans (based on the prior year’s FTAP) How Prudential is Helping Our Clients with Contribution and Investment Planning Prudential’s PPA Forecasting Tool can determine if a plan will meet these targets, including the expected contribution needed for the 2006 and 2007 plan years. Prudential’s PPA Forecasting Tool can determine if a plan is in jeopardy of being labeled “at risk”, including determining the 2006 and 2007 plan year contributions to avoid that designation. 5

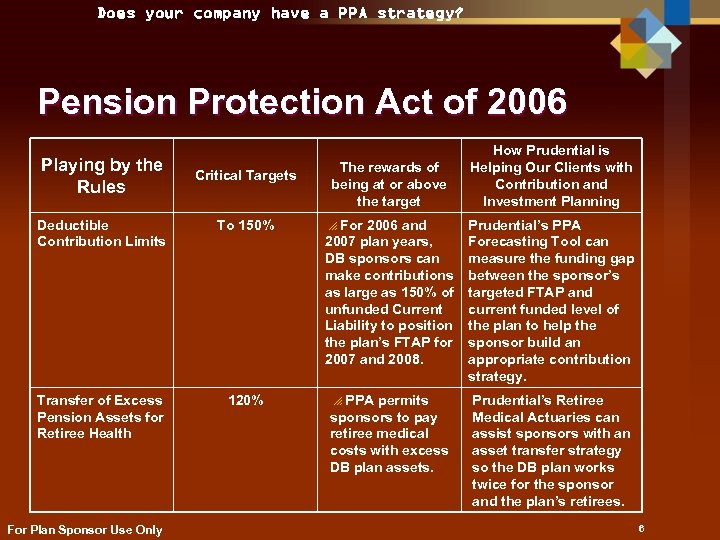

Does your company have a PPA strategy? Pension Protection Act of 2006 Playing by the Rules Critical Targets Deductible Contribution Limits To 150% Transfer of Excess Pension Assets for Retiree Health 120% For Plan Sponsor Use Only The rewards of being at or above the target p For 2006 and 2007 plan years, DB sponsors can make contributions as large as 150% of unfunded Current Liability to position the plan’s FTAP for 2007 and 2008. p PPA permits sponsors to pay retiree medical costs with excess DB plan assets. How Prudential is Helping Our Clients with Contribution and Investment Planning Prudential’s PPA Forecasting Tool can measure the funding gap between the sponsor’s targeted FTAP and current funded level of the plan to help the sponsor build an appropriate contribution strategy. Prudential’s Retiree Medical Actuaries can assist sponsors with an asset transfer strategy so the DB plan works twice for the sponsor and the plan’s retirees. 6

Does your company have a PPA strategy? Pension Protection Act of 2006 Playing by the Rules Critical Targets Deductible Contribution Limits To 150% Transfer of Excess Pension Assets for Retiree Health 120% For Plan Sponsor Use Only The rewards of being at or above the target p For 2006 and 2007 plan years, DB sponsors can make contributions as large as 150% of unfunded Current Liability to position the plan’s FTAP for 2007 and 2008. p PPA permits sponsors to pay retiree medical costs with excess DB plan assets. How Prudential is Helping Our Clients with Contribution and Investment Planning Prudential’s PPA Forecasting Tool can measure the funding gap between the sponsor’s targeted FTAP and current funded level of the plan to help the sponsor build an appropriate contribution strategy. Prudential’s Retiree Medical Actuaries can assist sponsors with an asset transfer strategy so the DB plan works twice for the sponsor and the plan’s retirees. 6

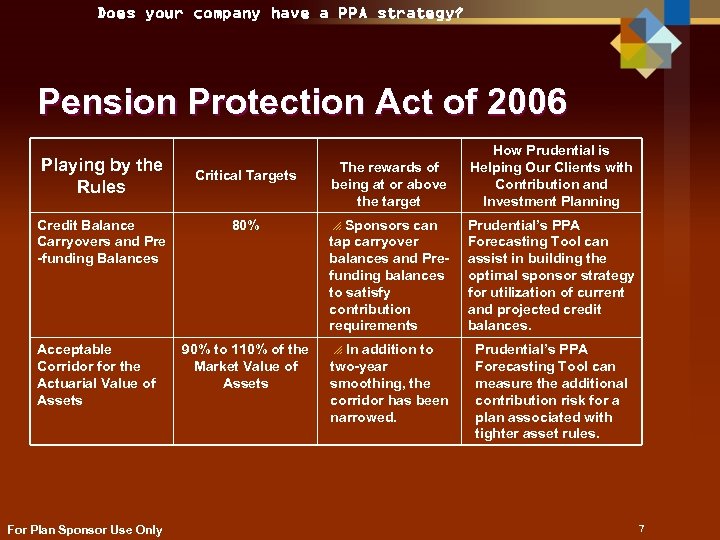

Does your company have a PPA strategy? Pension Protection Act of 2006 Playing by the Rules Credit Balance Carryovers and Pre -funding Balances Acceptable Corridor for the Actuarial Value of Assets For Plan Sponsor Use Only Critical Targets 80% The rewards of being at or above the target p Sponsors can tap carryover balances and Prefunding balances to satisfy contribution requirements 90% to 110% of the Market Value of Assets p In addition to two-year smoothing, the corridor has been narrowed. How Prudential is Helping Our Clients with Contribution and Investment Planning Prudential’s PPA Forecasting Tool can assist in building the optimal sponsor strategy for utilization of current and projected credit balances. Prudential’s PPA Forecasting Tool can measure the additional contribution risk for a plan associated with tighter asset rules. 7

Does your company have a PPA strategy? Pension Protection Act of 2006 Playing by the Rules Credit Balance Carryovers and Pre -funding Balances Acceptable Corridor for the Actuarial Value of Assets For Plan Sponsor Use Only Critical Targets 80% The rewards of being at or above the target p Sponsors can tap carryover balances and Prefunding balances to satisfy contribution requirements 90% to 110% of the Market Value of Assets p In addition to two-year smoothing, the corridor has been narrowed. How Prudential is Helping Our Clients with Contribution and Investment Planning Prudential’s PPA Forecasting Tool can assist in building the optimal sponsor strategy for utilization of current and projected credit balances. Prudential’s PPA Forecasting Tool can measure the additional contribution risk for a plan associated with tighter asset rules. 7

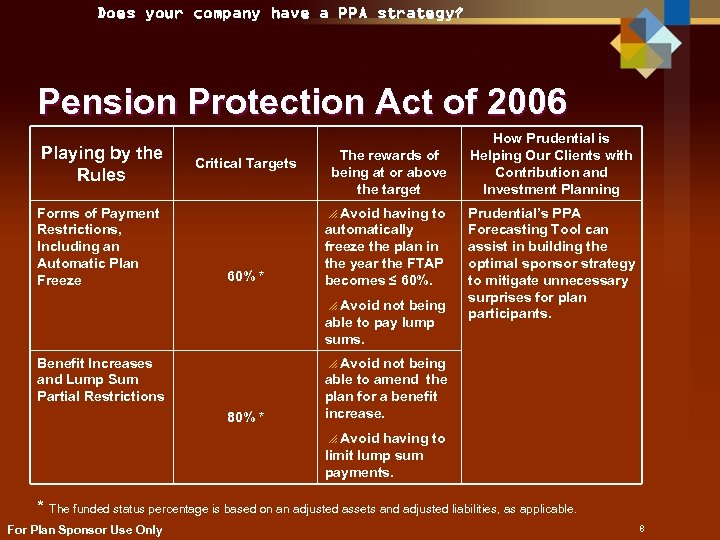

Does your company have a PPA strategy? Pension Protection Act of 2006 Playing by the Rules Forms of Payment Restrictions, Including an Automatic Plan Freeze Critical Targets The rewards of being at or above the target p Avoid having to 60% * automatically freeze the plan in the year the FTAP becomes ≤ 60%. p Avoid not being able to pay lump sums. Benefit Increases and Lump Sum Partial Restrictions How Prudential is Helping Our Clients with Contribution and Investment Planning Prudential’s PPA Forecasting Tool can assist in building the optimal sponsor strategy to mitigate unnecessary surprises for plan participants. p Avoid not being 80% * able to amend the plan for a benefit increase. p Avoid having to limit lump sum payments. * The funded status percentage is based on an adjusted assets and adjusted liabilities, as applicable. For Plan Sponsor Use Only 8

Does your company have a PPA strategy? Pension Protection Act of 2006 Playing by the Rules Forms of Payment Restrictions, Including an Automatic Plan Freeze Critical Targets The rewards of being at or above the target p Avoid having to 60% * automatically freeze the plan in the year the FTAP becomes ≤ 60%. p Avoid not being able to pay lump sums. Benefit Increases and Lump Sum Partial Restrictions How Prudential is Helping Our Clients with Contribution and Investment Planning Prudential’s PPA Forecasting Tool can assist in building the optimal sponsor strategy to mitigate unnecessary surprises for plan participants. p Avoid not being 80% * able to amend the plan for a benefit increase. p Avoid having to limit lump sum payments. * The funded status percentage is based on an adjusted assets and adjusted liabilities, as applicable. For Plan Sponsor Use Only 8

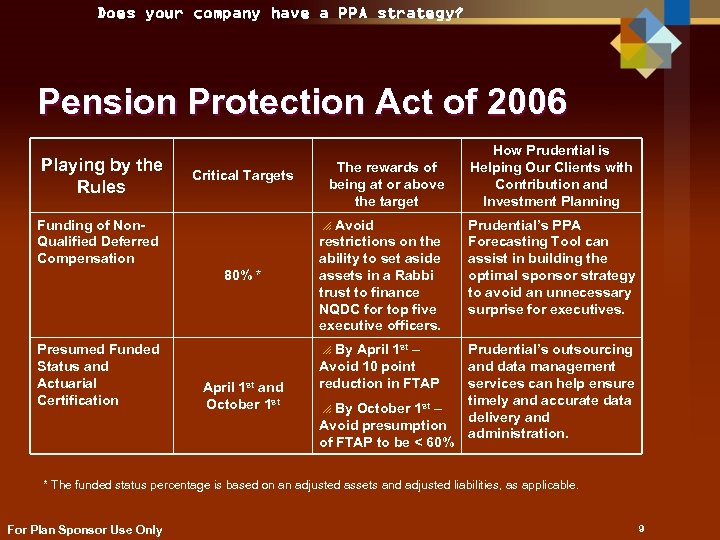

Does your company have a PPA strategy? Pension Protection Act of 2006 Playing by the Rules Critical Targets Funding of Non. Qualified Deferred Compensation p Avoid 80% * Presumed Funded Status and Actuarial Certification The rewards of being at or above the target restrictions on the ability to set aside assets in a Rabbi trust to finance NQDC for top five executive officers. p By April 1 st – April 1 st and October 1 st Avoid 10 point reduction in FTAP p By October 1 st – Avoid presumption of FTAP to be < 60% How Prudential is Helping Our Clients with Contribution and Investment Planning Prudential’s PPA Forecasting Tool can assist in building the optimal sponsor strategy to avoid an unnecessary surprise for executives. Prudential’s outsourcing and data management services can help ensure timely and accurate data delivery and administration. * The funded status percentage is based on an adjusted assets and adjusted liabilities, as applicable. For Plan Sponsor Use Only 9

Does your company have a PPA strategy? Pension Protection Act of 2006 Playing by the Rules Critical Targets Funding of Non. Qualified Deferred Compensation p Avoid 80% * Presumed Funded Status and Actuarial Certification The rewards of being at or above the target restrictions on the ability to set aside assets in a Rabbi trust to finance NQDC for top five executive officers. p By April 1 st – April 1 st and October 1 st Avoid 10 point reduction in FTAP p By October 1 st – Avoid presumption of FTAP to be < 60% How Prudential is Helping Our Clients with Contribution and Investment Planning Prudential’s PPA Forecasting Tool can assist in building the optimal sponsor strategy to avoid an unnecessary surprise for executives. Prudential’s outsourcing and data management services can help ensure timely and accurate data delivery and administration. * The funded status percentage is based on an adjusted assets and adjusted liabilities, as applicable. For Plan Sponsor Use Only 9

Does your company have a PPA strategy? Pension Protection Act of 2006 Newsflash: FTAP is more than determining which DB plans are underfunded. The new rules will significantly impact your plan administration and participants. For Plan Sponsor Use Only 10

Does your company have a PPA strategy? Pension Protection Act of 2006 Newsflash: FTAP is more than determining which DB plans are underfunded. The new rules will significantly impact your plan administration and participants. For Plan Sponsor Use Only 10

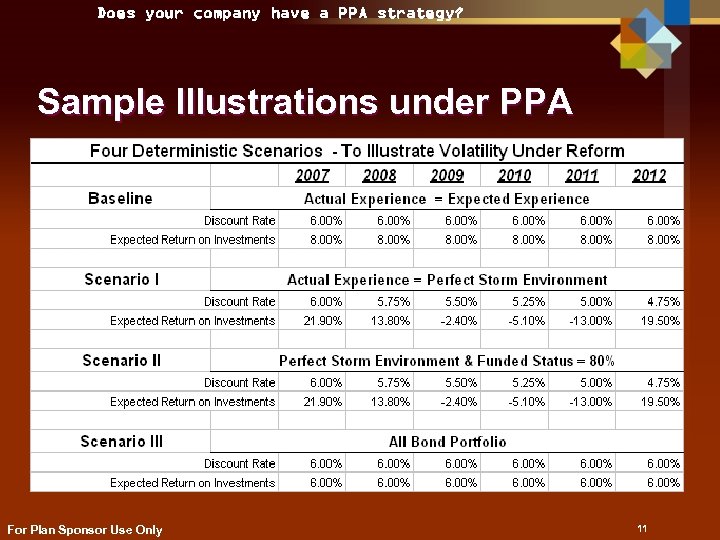

Does your company have a PPA strategy? Sample Illustrations under PPA For Plan Sponsor Use Only 11

Does your company have a PPA strategy? Sample Illustrations under PPA For Plan Sponsor Use Only 11

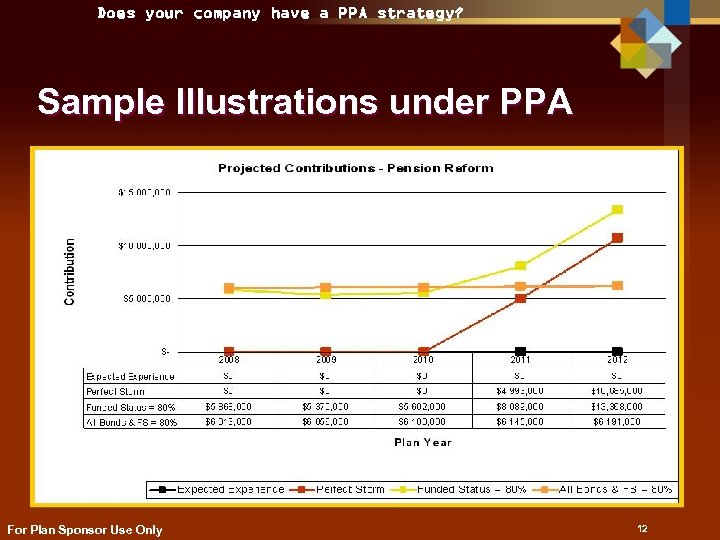

Does your company have a PPA strategy? Sample Illustrations under PPA For Plan Sponsor Use Only 12

Does your company have a PPA strategy? Sample Illustrations under PPA For Plan Sponsor Use Only 12

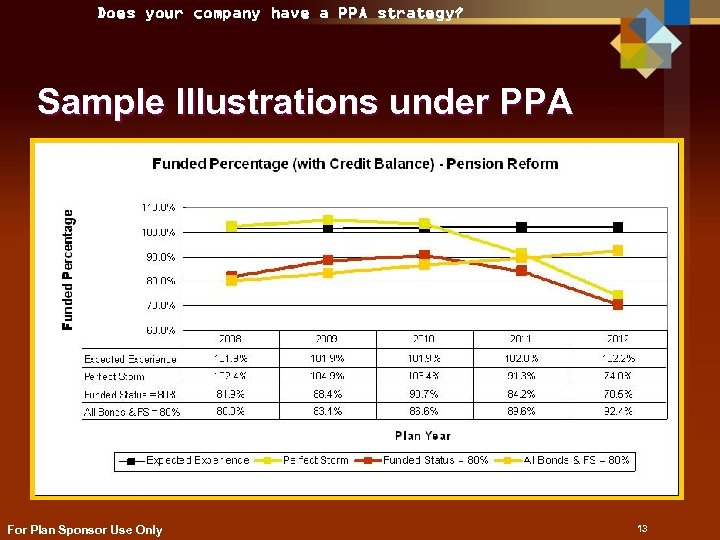

Does your company have a PPA strategy? Sample Illustrations under PPA For Plan Sponsor Use Only 13

Does your company have a PPA strategy? Sample Illustrations under PPA For Plan Sponsor Use Only 13

Does your company have a PPA strategy? Impact for DB Sponsors Volatility! For Plan Sponsor Use Only 14

Does your company have a PPA strategy? Impact for DB Sponsors Volatility! For Plan Sponsor Use Only 14

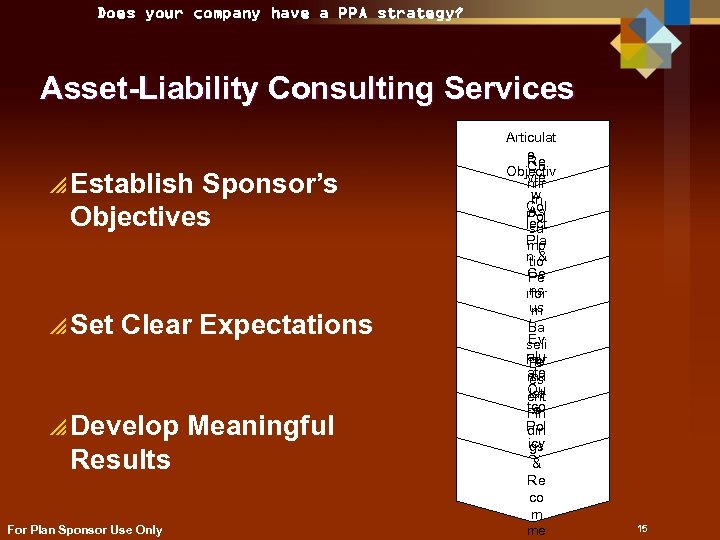

Does your company have a PPA strategy? Asset-Liability Consulting Services p Establish Sponsor’s Objectives p Set Clear Expectations p Develop Results For Plan Sponsor Use Only Meaningful Articulat e Re Co Objectiv vie nfir es w m Col As Pol lect su icie Pla mp ns& tio Ce Pe ns ns rfor & us m Me Inf Ba tho Ev or seli ds alu ma For ne Pr ate tio mu For es Ou n lat ec ent tco e ast Fin me Pol din s icy gs Ch & an Re ge co s m me 15

Does your company have a PPA strategy? Asset-Liability Consulting Services p Establish Sponsor’s Objectives p Set Clear Expectations p Develop Results For Plan Sponsor Use Only Meaningful Articulat e Re Co Objectiv vie nfir es w m Col As Pol lect su icie Pla mp ns& tio Ce Pe ns ns rfor & us m Me Inf Ba tho Ev or seli ds alu ma For ne Pr ate tio mu For es Ou n lat ec ent tco e ast Fin me Pol din s icy gs Ch & an Re ge co s m me 15

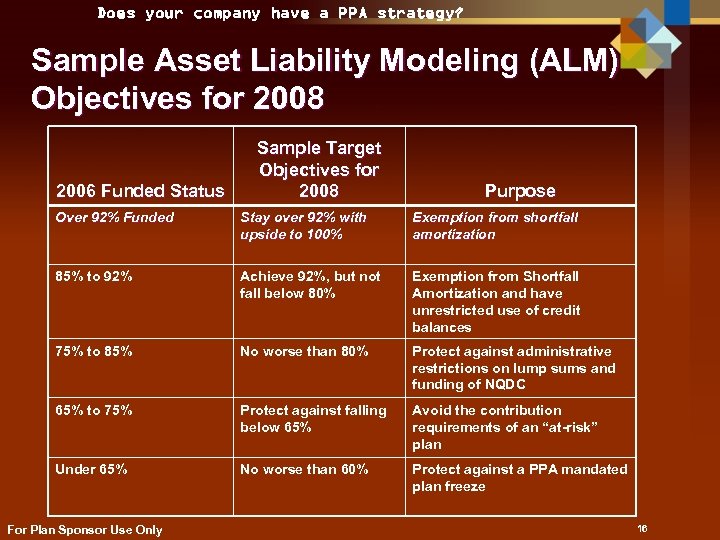

Does your company have a PPA strategy? Sample Asset Liability Modeling (ALM) Objectives for 2008 2006 Funded Status Sample Target Objectives for 2008 Purpose Over 92% Funded Stay over 92% with upside to 100% Exemption from shortfall amortization 85% to 92% Achieve 92%, but not fall below 80% Exemption from Shortfall Amortization and have unrestricted use of credit balances 75% to 85% No worse than 80% Protect against administrative restrictions on lump sums and funding of NQDC 65% to 75% Protect against falling below 65% Avoid the contribution requirements of an “at-risk” plan Under 65% No worse than 60% Protect against a PPA mandated plan freeze For Plan Sponsor Use Only 16

Does your company have a PPA strategy? Sample Asset Liability Modeling (ALM) Objectives for 2008 2006 Funded Status Sample Target Objectives for 2008 Purpose Over 92% Funded Stay over 92% with upside to 100% Exemption from shortfall amortization 85% to 92% Achieve 92%, but not fall below 80% Exemption from Shortfall Amortization and have unrestricted use of credit balances 75% to 85% No worse than 80% Protect against administrative restrictions on lump sums and funding of NQDC 65% to 75% Protect against falling below 65% Avoid the contribution requirements of an “at-risk” plan Under 65% No worse than 60% Protect against a PPA mandated plan freeze For Plan Sponsor Use Only 16

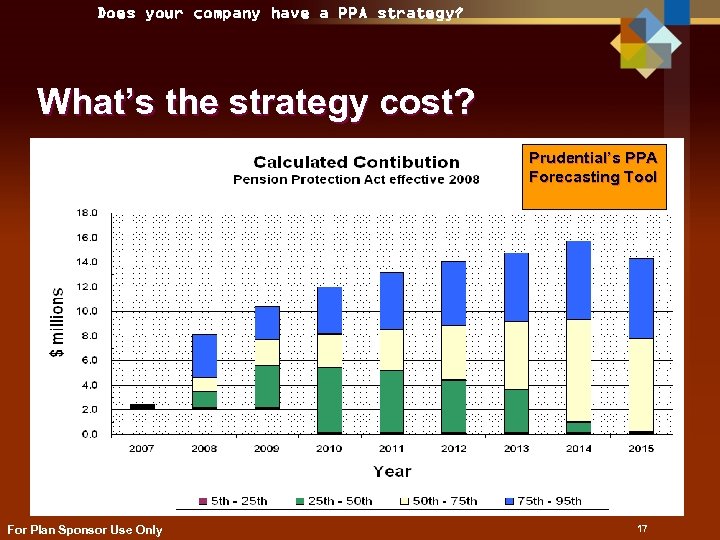

Does your company have a PPA strategy? What’s the strategy cost? Prudential’s PPA Forecasting Tool For Plan Sponsor Use Only 17

Does your company have a PPA strategy? What’s the strategy cost? Prudential’s PPA Forecasting Tool For Plan Sponsor Use Only 17

Does your company have a PPA strategy? Accounting Reform Phase I and II p Pension and Other Post Employment Benefits (OPEB) p Phase I: Balance Sheet – Effective for FYE > 12/15/2006 for public entities, and for FYE > 6/15/2007 for privately held corporations. – Requires the difference between assets and liabilities, including future salary increases, to be recorded on the balance sheet. – Year over year adjustments flow through Other Comprehensive Income (OCI) and impact net worth of the Company (i. e. equity). For Plan Sponsor Use Only 18

Does your company have a PPA strategy? Accounting Reform Phase I and II p Pension and Other Post Employment Benefits (OPEB) p Phase I: Balance Sheet – Effective for FYE > 12/15/2006 for public entities, and for FYE > 6/15/2007 for privately held corporations. – Requires the difference between assets and liabilities, including future salary increases, to be recorded on the balance sheet. – Year over year adjustments flow through Other Comprehensive Income (OCI) and impact net worth of the Company (i. e. equity). For Plan Sponsor Use Only 18

Does your company have a PPA strategy? Accounting Reform Phase I and II p Phase II: Income Statement – Phase II is expected to take several years to complete. – FASB will review all accounting standards for pension and post-employment benefits. – Directionally toward international accounting standards, which are more closely marked to market. – FASB could distinguish between total pension cost and operational pension cost to mitigate income statement volatility. For Plan Sponsor Use Only 19

Does your company have a PPA strategy? Accounting Reform Phase I and II p Phase II: Income Statement – Phase II is expected to take several years to complete. – FASB will review all accounting standards for pension and post-employment benefits. – Directionally toward international accounting standards, which are more closely marked to market. – FASB could distinguish between total pension cost and operational pension cost to mitigate income statement volatility. For Plan Sponsor Use Only 19

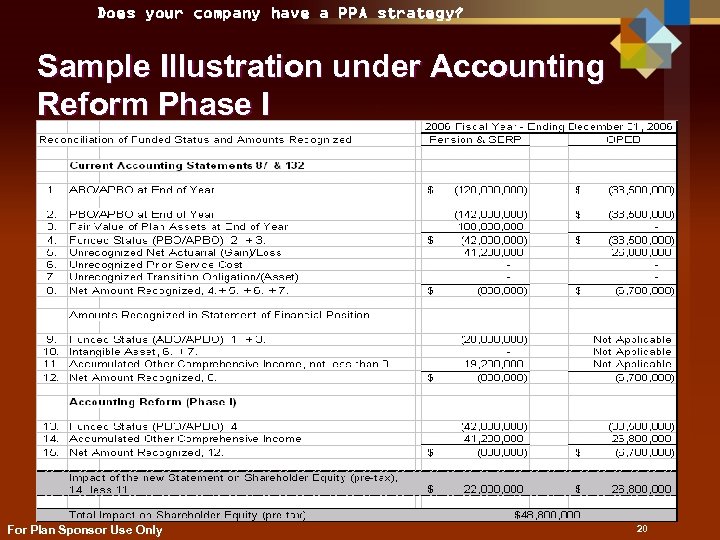

Does your company have a PPA strategy? Sample Illustration under Accounting Reform Phase I For Plan Sponsor Use Only 20

Does your company have a PPA strategy? Sample Illustration under Accounting Reform Phase I For Plan Sponsor Use Only 20

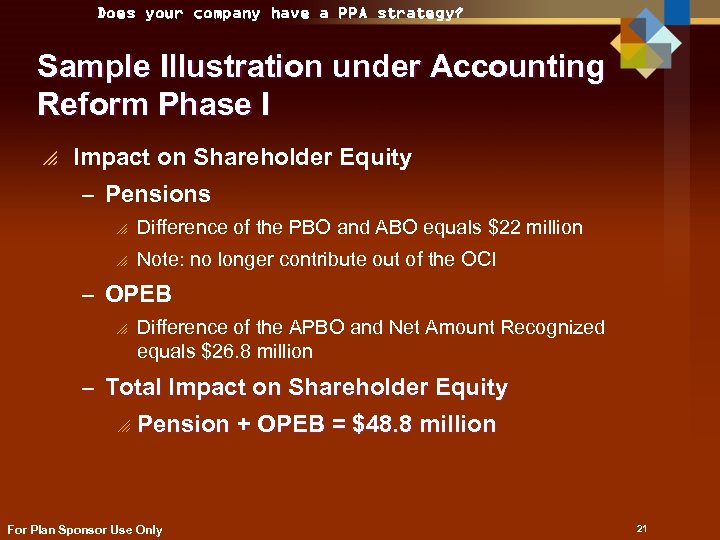

Does your company have a PPA strategy? Sample Illustration under Accounting Reform Phase I p Impact on Shareholder Equity – Pensions o Difference of the PBO and ABO equals $22 million o Note: no longer contribute out of the OCI – OPEB o Difference of the APBO and Net Amount Recognized equals $26. 8 million – Total Impact on Shareholder Equity o Pension + OPEB = $48. 8 million For Plan Sponsor Use Only 21

Does your company have a PPA strategy? Sample Illustration under Accounting Reform Phase I p Impact on Shareholder Equity – Pensions o Difference of the PBO and ABO equals $22 million o Note: no longer contribute out of the OCI – OPEB o Difference of the APBO and Net Amount Recognized equals $26. 8 million – Total Impact on Shareholder Equity o Pension + OPEB = $48. 8 million For Plan Sponsor Use Only 21

Does your company have a PPA strategy? Questions Prudential Retirement and Prudential Financial are registered service marks of The Prudential Insurance Company of America, Newark, NJ and its affiliates. Prudential Retirement is a Prudential Financial business. Prudential Financial is a service mark of The Prudential Insurance Company of America, Newark, NJ and its affiliates. For Plan Sponsor Use Only 22

Does your company have a PPA strategy? Questions Prudential Retirement and Prudential Financial are registered service marks of The Prudential Insurance Company of America, Newark, NJ and its affiliates. Prudential Retirement is a Prudential Financial business. Prudential Financial is a service mark of The Prudential Insurance Company of America, Newark, NJ and its affiliates. For Plan Sponsor Use Only 22