6224483bca3801c3cf7ec8060f832027.ppt

- Количество слайдов: 21

Document Classification: OFFICIAL February 2016 Establishing a UK Presence

Document Classification: OFFICIAL Options for Establishing a UK Business Entity § There are two main options in the UK when establishing a business entity to do business in the UK. These are a branch, or some form of limited company. § The following slides give definitions of these options and what they offer. § Using an agent or distributor is also mentioned as a possible, initial presence in the UK but only when you are doing business WITH the UK, not doing business IN the UK. 2

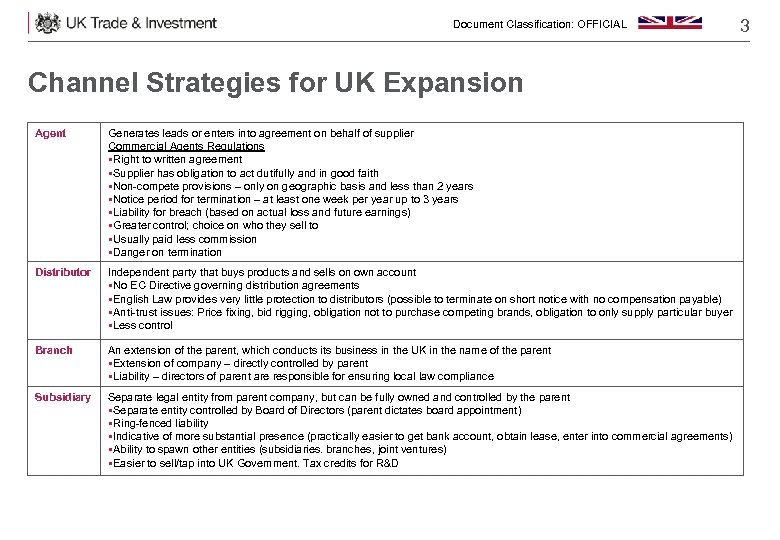

Document Classification: OFFICIAL Channel Strategies for UK Expansion Agent Generates leads or enters into agreement on behalf of supplier Commercial Agents Regulations §Right to written agreement §Supplier has obligation to act dutifully and in good faith §Non-compete provisions – only on geographic basis and less than 2 years §Notice period for termination – at least one week per year up to 3 years §Liability for breach (based on actual loss and future earnings) §Greater control; choice on who they sell to §Usually paid less commission §Danger on termination Distributor Independent party that buys products and sells on own account §No EC Directive governing distribution agreements §English Law provides very little protection to distributors (possible to terminate on short notice with no compensation payable) §Anti-trust issues: Price fixing, bid rigging, obligation not to purchase competing brands, obligation to only supply particular buyer §Less control Branch An extension of the parent, which conducts its business in the UK in the name of the parent §Extension of company – directly controlled by parent §Liability – directors of parent are responsible for ensuring local law compliance Subsidiary Separate legal entity from parent company, but can be fully owned and controlled by the parent §Separate entity controlled by Board of Directors (parent dictates board appointment) §Ring-fenced liability §Indicative of more substantial presence (practically easier to get bank account, obtain lease, enter into commercial agreements) §Ability to spawn other entities (subsidiaries. branches, joint ventures) §Easier to sell/tap into UK Government. Tax credits for R&D 3

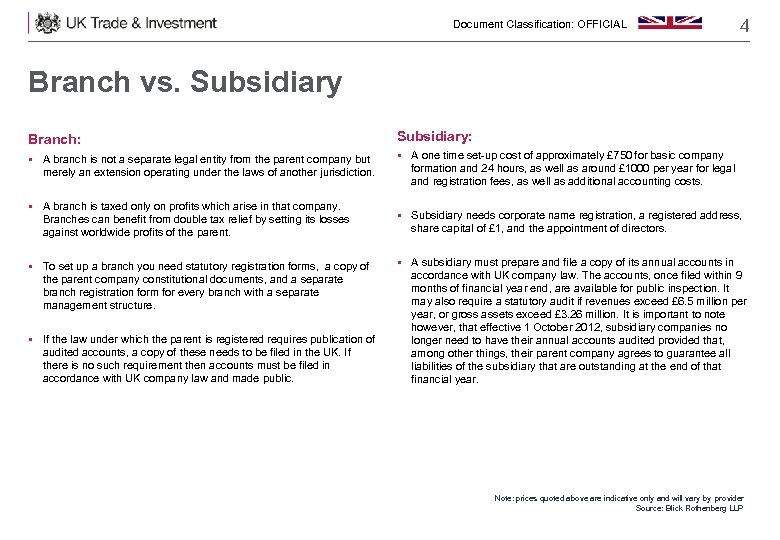

Document Classification: OFFICIAL 4 Branch vs. Subsidiary Branch: Subsidiary: § A branch is not a separate legal entity from the parent company but merely an extension operating under the laws of another jurisdiction. § A one time set-up cost of approximately £ 750 for basic company formation and 24 hours, as well as around £ 1000 per year for legal and registration fees, as well as additional accounting costs. § A branch is taxed only on profits which arise in that company. Branches can benefit from double tax relief by setting its losses against worldwide profits of the parent. § Subsidiary needs corporate name registration, a registered address, share capital of £ 1, and the appointment of directors. § To set up a branch you need statutory registration forms, a copy of the parent company constitutional documents, and a separate branch registration form for every branch with a separate management structure. § If the law under which the parent is registered requires publication of audited accounts, a copy of these needs to be filed in the UK. If there is no such requirement then accounts must be filed in accordance with UK company law and made public. § A subsidiary must prepare and file a copy of its annual accounts in accordance with UK company law. The accounts, once filed within 9 months of financial year end, are available for public inspection. It may also require a statutory audit if revenues exceed £ 6. 5 million per year, or gross assets exceed £ 3. 26 million. It is important to note however, that effective 1 October 2012, subsidiary companies no longer need to have their annual accounts audited provided that, among other things, their parent company agrees to guarantee all liabilities of the subsidiary that are outstanding at the end of that financial year. Note: prices quoted above are indicative only and will vary by provider Source: Blick Rothenberg LLP

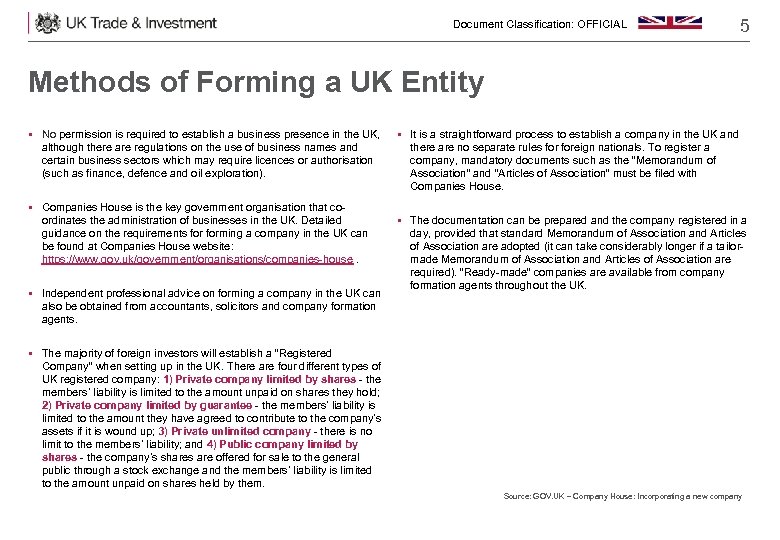

Document Classification: OFFICIAL 5 Methods of Forming a UK Entity § No permission is required to establish a business presence in the UK, although there are regulations on the use of business names and certain business sectors which may require licences or authorisation (such as finance, defence and oil exploration). § Companies House is the key government organisation that coordinates the administration of businesses in the UK. Detailed guidance on the requirements forming a company in the UK can be found at Companies House website: https: //www. gov. uk/government/organisations/companies-house. § Independent professional advice on forming a company in the UK can also be obtained from accountants, solicitors and company formation agents. § It is a straightforward process to establish a company in the UK and there are no separate rules foreign nationals. To register a company, mandatory documents such as the “Memorandum of Association” and “Articles of Association” must be filed with Companies House. § The documentation can be prepared and the company registered in a day, provided that standard Memorandum of Association and Articles of Association are adopted (it can take considerably longer if a tailormade Memorandum of Association and Articles of Association are required). “Ready-made” companies are available from company formation agents throughout the UK. § The majority of foreign investors will establish a “Registered Company” when setting up in the UK. There are four different types of UK registered company: 1) Private company limited by shares - the members’ liability is limited to the amount unpaid on shares they hold; 2) Private company limited by guarantee - the members’ liability is limited to the amount they have agreed to contribute to the company’s assets if it is wound up; 3) Private unlimited company - there is no limit to the members’ liability; and 4) Public company limited by shares - the company’s shares are offered for sale to the general public through a stock exchange and the members’ liability is limited to the amount unpaid on shares held by them. Source: GOV. UK – Company House: Incorporating a new company

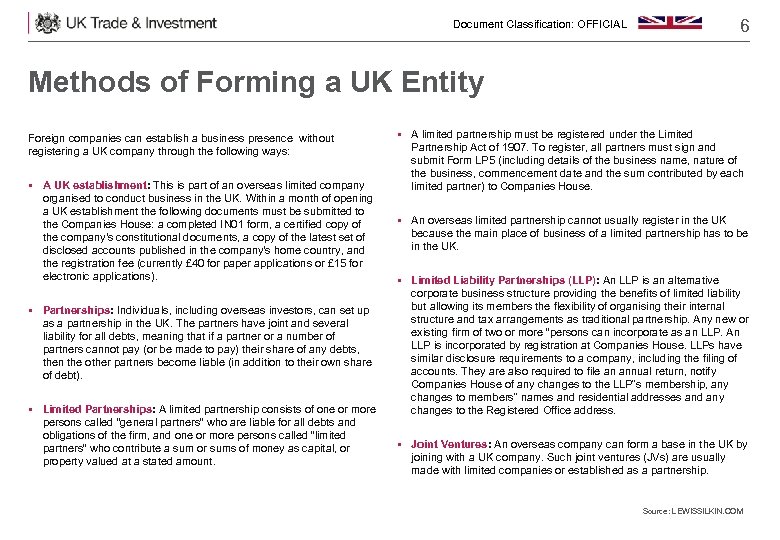

Document Classification: OFFICIAL 6 Methods of Forming a UK Entity Foreign companies can establish a business presence without registering a UK company through the following ways: § A UK establishment: This is part of an overseas limited company organised to conduct business in the UK. Within a month of opening a UK establishment the following documents must be submitted to the Companies House: a completed IN 01 form, a certified copy of the company's constitutional documents, a copy of the latest set of disclosed accounts published in the company's home country, and the registration fee (currently £ 40 for paper applications or £ 15 for electronic applications). § Partnerships: Individuals, including overseas investors, can set up as a partnership in the UK. The partners have joint and several liability for all debts, meaning that if a partner or a number of partners cannot pay (or be made to pay) their share of any debts, then the other partners become liable (in addition to their own share of debt). § Limited Partnerships: A limited partnership consists of one or more persons called “general partners” who are liable for all debts and obligations of the firm, and one or more persons called “limited partners” who contribute a sum or sums of money as capital, or property valued at a stated amount. § A limited partnership must be registered under the Limited Partnership Act of 1907. To register, all partners must sign and submit Form LP 5 (including details of the business name, nature of the business, commencement date and the sum contributed by each limited partner) to Companies House. § An overseas limited partnership cannot usually register in the UK because the main place of business of a limited partnership has to be in the UK. § Limited Liability Partnerships (LLP): An LLP is an alternative corporate business structure providing the benefits of limited liability but allowing its members the flexibility of organising their internal structure and tax arrangements as traditional partnership. Any new or existing firm of two or more “persons can incorporate as an LLP. An LLP is incorporated by registration at Companies House. LLPs have similar disclosure requirements to a company, including the filing of accounts. They are also required to file an annual return, notify Companies House of any changes to the LLP‟s membership, any changes to members‟ names and residential addresses and any changes to the Registered Office address. § Joint Ventures: An overseas company can form a base in the UK by joining with a UK company. Such joint ventures (JVs) are usually made with limited companies or established as a partnership. Source: LEWISSILKIN. COM

Document Classification: OFFICIAL 7 Methods of Forming a UK Entity § European Public Limited Company: European Union legislation allows overseas companies to establish a European public limited company (also known as a “Societas Europaea” or “SE”) in the UK. An SE can be registered in any country within the European Economic Area although the registered office and head office must be in the same country. § There a number of ways to form an SE: By merger; as a holding company; as a subsidiary; or by a plc transforming into an SE. § Choosing a Company Name: Regulations restrict the choice of a company name. A company name cannot be chosen if it is the same as an existing registered company or uses certain words regarded as sensitive. § Before applying to set up a company, or doing anything to change its name, it is recommended that a search of the company name index is undertaken. § An SE must have share capital and shareholders whose liability is limited in a similar manner to that of a plc. As with a plc, an SE registered in the UK may denominate its share capital in any currency it chooses, provided that at least £ 50, 000 is denominated in sterling or € 57, 100 is denominated in Euros. § The major benefit of an SE is that the registered office can be transferred to another European country without a loss of legal status. Source: GOV. UK – The European Company: Societas Europaea (SE ); GOV. UK – Company House: Incorporating a new company

Document Classification: OFFICIAL 8 Corporate Structure Options Place of Business (POB) Subsidiary § The process of registering a POB is fairly simple. The overseas company needs to complete a form which requires it to give details of the parent company, shareholders and directors and attach to this a copy of its bylaws. These need to be certified as being true copies of the original. § A subsidiary is also very easy to establish. There are no statutory consents that need to be obtained prior to setting up the company. A company can be formed by submitting a form providing the consent of at least one person who is prepared to act as a director. There is no longer a requirement to formally appoint a company secretary although there is still the requirement for the functions of a company secretary to be undertaken. This function is normally outsourced. Branch § The process of establishing a branch is fairly similar to that of establishing a POB. The overseas company needs to file a form giving details of its shareholders and directors. It also needs to submit with the form, a certified copy of its Memorandum and Articles of Association (company bylaws or equivalent). § The form needs to provide details of the UK address from which business is going to be conducted. The process of establishing a branch can take up to three weeks but can be less if the documents mentioned are readily available. § It is normal for a company to have at least two directors to allow for greater efficiency in managing the company, should one director be absent. There is no requirement for the company to have a minimum amount of issued share capital. Such a company is normally formed with one £ 1 issued ordinary share. Authorised and paid up capital can be increased at the time that the company is formed or later, depending on commercial requirements. § The government offers a free service called GOV. UK which advises on all regulations for all types of business, in addition to providing general advice – www. gov. uk § Registration, by an overseas company, of an establishment in the UK is governed by a single set of rules and not the two sets (POB and branch) that once existed. Source: Blick Rothenberg LLP; GOV. UK

Document Classification: OFFICIAL 9 Indicative Setup and Maintenance Initial Set-up Costs: Back Office Support: § An average of £ 750 (including company registration, VAT registration, corporate tax registration, PAYE registration). § Payroll Services – an average of £ 1000 per annum for up to 5 employees. Reporting: § Employee Benefits Management – an average of £ 100 per employee per annum. § Annual Reports and Filing - Preparation of Year End Statutory Accounts – an average of £ 1000 (average base rate - can increase depending upon the complexity and nature of transactions to be disclosed). § Bookkeeping and Invoicing (with VAT) – from £ 200 per month (can increase dependent on number of transactions). § Corporate Tax Return (preparation of CT 600) – an average of £ 750 per annum. § Audit (UK companies with a group turnover - inclusive of all parent and subsidiary companies - greater than £ 6. 5 million may require an audit) – from £ 2000 per annum (dependent on records maintained and volume of transactions). § VAT returns from £ 400 per annum (paid quarterly) dependent on number of transactions. § Company Secretarial Support (all annual statutory compliance duties) – an average of £ 150 per annum. Additional Services: § International Tax Planning Advice - the tax impact of the overall structure of your worldwide group. § Transfer Price Policy Setting - international sales between group companies will be subject to scrutiny by both the UK and parent country's tax authorities. Note: prices quoted above are indicative only and will vary by provider

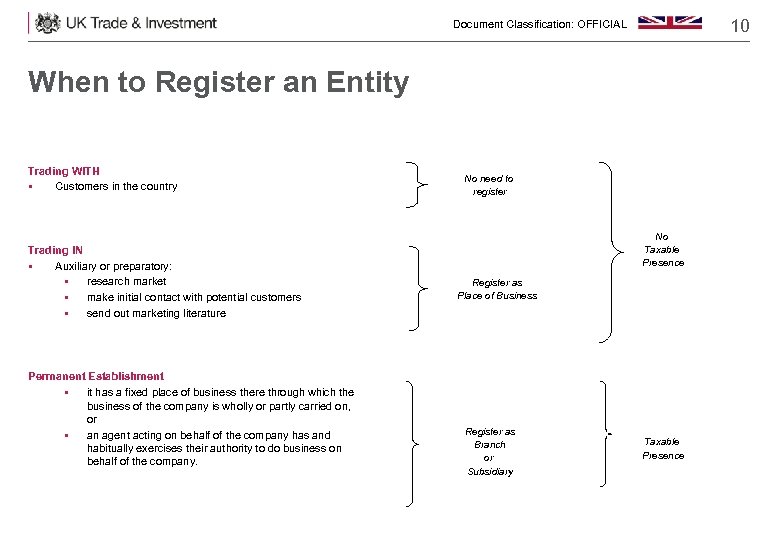

10 Document Classification: OFFICIAL When to Register an Entity Trading WITH § Customers in the country Trading IN § Auxiliary or preparatory: § research market § make initial contact with potential customers § send out marketing literature Permanent Establishment § it has a fixed place of business there through which the business of the company is wholly or partly carried on, or § an agent acting on behalf of the company has and habitually exercises their authority to do business on behalf of the company. No need to register No Taxable Presence Register as Place of Business Register as Branch or Subsidiary Taxable Presence

Document Classification: OFFICIAL 11 Corporation Tax § The UK is an internationally competitive location for tax, with several key advantages for businesses and individuals including one of the lowest main corporate tax rates in the European Union, generous tax allowances (such as the availability of research and development tax credits) and no local taxes on profits or surpluses, the most extensive network of double taxation treaties in the world, and competitive personal taxes and low social welfare contributions. § The “standard” or “main” rate of corporation tax in the UK is currently 20%, effective 1 April 2015, and applies to both resident and nonresident companies. In April 2015, the standard tax rate became unified with the small companies tax rate of 20%. § The UK has the largest network of treaties globally. An important feature of many treaties is a reduced rate for withholding tax on the payment of dividends, interest and royalties. The majority of UKbased companies also benefit from an exemption from corporation tax on any foreign dividends that they receive. § The UK also has an extensive range of capital allowances that allow the costs of capital assets to be written off against taxable profits. § Research and development (R&D) tax credits are available for large corporations and SMEs investing in R&D. § National Insurance contributions (NICs) are payable by employees at rates of 12 per cent on weekly income between £ 155 and £ 770 and two per cent on income above this limit. Employers also pay NICs on the earnings of their employees above £ 156 per week at 13. 8 per cent, including benefits in kind. There is no upper cap on employers’ NICs. From April 2014, businesses and charities are eligible for a new £ 2, 000 Employment Allowance. § As part of the Autumn Statement 2013, the government announced that they will make it cheaper for businesses to employ young people by abolishing employer National Insurance contributions for under-21 year olds on earnings up to £ 815 per week, equivalent to the point at which higher rate tax is charged. § All UK tax is administered by one body called HM Revenue and Customs. (HMRC). Source: GOV. UK – Business Tax: Corporation Tax

Document Classification: OFFICIAL 12 Value Added Tax (VAT) § VAT is a sales tax. It is chargeable by businesses if they are making supplies (sales) above a certain threshold. The current threshold for registering for VAT is £ 82, 000 per annum. § If the threshold is exceeded or expected to be exceeded in the near future, the business must notify the authorities and register itself to be able to charge VAT on the supply of goods and services. § The current rate at which VAT is charged is 20%. When a business is registered for VAT it must charge VAT at the appropriate rate on the value of all sales of goods and services made in the UK, unless they are specifically zero-rated or exempt. § Where a business is registered for VAT, the charge to it on purchase of goods or services is not a cost. This is because it is able to recover this VAT from the Government. At the end of every calendar quarter, the business calculates the amount of VAT it has charged to its customers as well as that which it has paid to its suppliers. The net amount, depending on whether more has been collected or paid, is either paid to the authorities or claimed back from them. VAT is ultimately only a cost to individuals and businesses which are not registered for VAT or make exempt supplies. 1. Goods and services supplied to a parent company based outside the EU - if the UK entity established by the parent sells goods to the parent, there is no VAT chargeable as this is classed as an export. If the subsidiary provides services such as consultancy, technical support and marketing, these are not subject to VAT. However, the provision of general management services would be subject to VAT. 2. Services supplied to the UK - an overseas company, not having its own permanent establishment in the UK (its taxable establishment or subsidiary in the UK, for these purposes, is treated as a separate entity) does not have to register for or charge VAT as long as it is making those supplies from outside the UK. 3. Goods supplied to the UK - an overseas company, not having a permanent establishment in the UK, does not have to register for and charge VAT. This is as long as the UK customer is importing the goods into the UK. If the customer is expecting to take delivery of the goods only after they reach its premises, the overseas company may have to register for VAT in order to first recover the VAT paid at the border on importation of the goods and then charge VAT on its invoices. This is even if it is raised by the overseas company as the goods will now be deemed to have been physically supplied in the UK. § There a number of issues that overseas companies need to be aware of when setting up a business in the UK: Source: GOV. UK – Business Tax: VAT

Document Classification: OFFICIAL 13 UK Payroll Principles § If you have employees in the UK, you are required by law to operate a payroll. Employees’ income tax and National Insurance Contributions (NICs) are deducted (usually on a monthly basis) from their pay at the end of each month. The deductions are then paid over to HM Revenue & Customs (HMRC) on or before the 19 th day of the following month, together with NIC from the employer. This method of collection is known as “Pay As You Earn” (“PAYE”). § Currently in the UK, the basic rate of tax is 20% (for those employees earning up to £ 31, 785 per annum) and the top rate is 40% (for those earning over £ 31, 785 per annum). For individuals earning more than £ 150, 000 per year the basic tax rate is 45%, effective 1 April 2015. Also worth noting is from April 2015 onwards, the income tax personal allowance increased to £ 10, 600. § At present, employee National Insurance is at a rate of 12% and employer National Insurance is at 13. 8%. § Generally it is normal to pay employees their salary monthly, although other payment periods can be used. Salary payments are usually made electronically, directly into the employee’s bank account. Should an employee start late in one month; it is generally acceptable for payment to be included within the first full months pay. Payday can be any day; however most employers choose to pay employees on the last working day of the month, or at least between the 25 th day of the month and month end. § Loans are often provided to assist with travel costs and are repayable over 12 months. Stock options and ESPP would go through the payroll to account for tax and NIC. Any voluntary payment or deduction needs to be appropriately authorised by both the employee and employer. § Payslips are generally provided in hard copy; however companies are moving towards using secure electronic payslips, or e. Payslips, as they are known. § It is normal for an employee to belong to a Pension Plan and for the employer to contribute. Many employers will also provide Private Medical Insurance (PMI) of some description. § Personal Pension contributions (assuming part of the employers’ Group Pension Plan) can be processed through payroll net of basic rate tax i. e. 20%. If the employee is required to make a contribution towards PMI provision, then this deduction will also be made through payroll. Source: GOV. UK – Business Tax: PAYE; GOV. UK – Business Tax: Pension Scheme Administration

Document Classification: OFFICIAL 14 Bank Accounts Do you need a UK bank account? § If you are intending to trade in the UK, then a UK bank account will be needed, and expected. Not only does it give your business credibility in the UK, but if you have numerous transactions it will be cheaper to handle these locally, rather than through overseas bank transfers which are invariably costly. In addition (should you need to be VAT registered), having a UK bank account expedites the process. Alternatively, you can specify pounds sterling (£) when setting up a bank account in your home country, which in some circumstances (i. e. trading directly from overseas with a single, large customer) may be appropriate. How do you open a UK bank account? § Due to money laundering legislation the identity (and sometimes the source of the funds) used to open the bank account must be traceable. In order to identify you, a UK bank will require an original passport, and one or possibly two utility bills (less than 3 months old, showing your current home address – this need not be in the UK). Can I get my home country bank to open an account through one of their branches in the UK? § Your existing bank relationships can help, but in reality few banks are truly global. Experience has shown that your own relationships can smooth the process. Other things to consider: § Use a small balance (<£ 1, 000) to open the account to avoid additional money laundering checks. Simplicity is best in terms of the initial structure when setting up your UK entity (e. g. a single director who is sole share holder) as additional directors and shareholders can be added to the account once it is in place. Use advisor connections to ensure good bank service. § The best way to open a UK bank account is to get your accountant to arrange a meeting with a commercial bank manager, so you can meet, explain your business, and go through and sign all the forms together. Source: GOV. UK

Document Classification: OFFICIAL Employment Law

Document Classification: OFFICIAL 16 UK Employment Law § The UK has one of the least restrictive and most flexible systems of employment law anywhere in the developed world. This is because employment law is still largely based on the contract – the principle that whatever two competent parties agree will be enforced by the courts. § Generally, the employer is free to hire whatever staff it wants, how it wants. Employees must be given a written statement of the terms of their contract of employment within two months of starting work. Draft contracts of employment which comply with the law are readily available from commercial suppliers. § The national minimum wage is a minimum amount per hour that most workers in the UK are entitled to be paid, depending on age and if apprenticeship applies. The current minimum rate of wage for an employee over 21 years of age is £ 6. 70 per hour. More information on the minimum wage can be found at: https: //www. gov. uk/rates-and-thresholds-for-employers-2015 -to 2016 § The hours of work are a matter for negotiation, though there are some restrictions. An employee cannot be required to work more than 48 hours a week, though there are exceptions to this rule. These comply with European law, and are not onerous. An employee may be paid a higher overtime rate if this is agreed in the contract of employment. Some employers will offer time off in lieu instead of overtime pay, where the employee will be entitled to extra hours/days off work for any overtime worked. § There are strict health and safety laws. These laws have generally been in place for over 20 years, so their provisions are well known. They are not generally considered unreasonable or onerous. UK criminal law has many provisions which can be relevant in employment. For example, there are public law offences which curtail many strikers’ activities. Source: GOV. UK: Working, jobs and pensions

Document Classification: OFFICIAL 17 UK Employment Law Protection § Under UK employment law, UK employees are entitled to a range of statutory protections and benefits. § An employee must receive a UK-compliant statement of terms and conditions of employment within 2 months of beginning work in the UK (or risk liability of up to 4 weeks pay per employee). A statement of terms and conditions of employment is very basic and offers almost no company protection. Full contracts of employment should be put in place to properly protect the company. § Certain provisions of UK employment law will apply immediately, including minimum notice periods (one week for every year of service); maximum working hours (cannot be required to work more than 48 hours per week averaged over a 17 week rolling period); and protection from discrimination and minimum holiday entitlement (28 paid days for full time employees, which includes bank and public holidays). Further information on Employment Law Protection can be found at: https: //ico. org. uk/for-organisations/guide-todata-protection/employment/ § There is no concept of "at will" employment. Employees are entitled to a statutory period of notice of termination of their employment, one week for the first two years of employment, and after that it is one week per complete year of service up to a maximum of 12 weeks after 12 years service. § In practice most employees are entitled to a notice period of at least one month, rising to 3 months for more senior employees. § An employee with more than 24 months continuous service will acquire UK protection against unfair dismissal. This means that if either (a) the employee is dismissed for a reason which is held to be unfair and/or (b) the procedures followed for the dismissal process are unfair, an unfair dismissal award could be made. There are two parts to the award: § The first is calculated by reference to the employee's length of service and age and is capped at £ 13, 920. § The second part is capped at £ 78, 335 and is intended to compensate the employee for loss of earnings. Source: GOV. UK: Working, jobs and pensions

Document Classification: OFFICIAL 18 UK Employment Law Benefits Group Pension Disability § ‘Stakeholder’ pension must be provided by all employers with 5+ employees. § Employer must inform all employees about the ‘stakeholder’ plan and enable access to the advisers for the program. § Employer must allow employees to make personal contributions via payroll and to remit contributions to the pension provider within set timescales. § Accepts both employer and employee contributions. § ‘Vesting’ in the UK means when the plan pays out, i. e. on retirement. Contributions are invested immediately on being paid by employer, so if an employee leaves after only 1 year then there is no refund of contributions and all monies remain in the plan. § Known as PHI (Permanent Health Insurance) when written individually. § Maximum cover available – 75% salary less single persons incapacity benefit. § Typical deferred period – 13 or 26 weeks, i. e. period before benefits start. § Corporates/group terms available for 4+ employees. § Short Term Disability available, however most employers self insure. Death In Service § It is usual for a multiple of salary to be provided – up to 4 x which is the maximum allowable under HMRC guidelines. § Employees can nominate beneficiaries (tax efficient). § Corporates/group terms available for 3+ employees. § Paid for by employer. § Cover generally set at 3 or 4 x salary. Source: GOV. UK: Working, jobs and pensions Healthcare/Private Medical Insurance § § § Supplements rather than replaces NHS. Enables ‘queue jumping’, i. e. can speed up treatment/consultation. Employer contributions are taxed, i. e. a ‘benefit in kind’. Corporates/group terms available for 3+ employees. This benefit should be made available within 30 days of joining the company to enable transfer of terms from existing arrangements. Dental/Vision/Critical Illness § Dental schemes often provided as an ‘added benefit’ to Healthcare. § Vision cover is available for 20+ employees. It may be appropriate to self insure for up to this number (wording for staff handbook can be provided). § Critical Illness is not often provided and is expensive, but in some circumstances, can be made available for senior positions.

19 Document Classification: OFFICIAL Auto-Enrolment What is Auto-Enrolment? UK employers have to automatically enrol their staff into a workplace pension if they meet certain criteria. The law on workplace pensions has now changed and every employer must comply. Key Points § Automatic enrolment affects all employers with staff in the UK. § You must enrol certain staff into a pension scheme. § Your staging date is the date your automatic enrolment duties come into effect for you. You must be prepared for this date. There are several tasks you'll need to complete before your staging date to be ready to comply with your duties – for example, choosing a pension scheme. § You must start doing this from your staging date, though there is an option to postpone automatic enrolment for up to three months. § You must write to all your staff to tell them how they’ve been affected. Who do I need to put into a pension scheme? You must automatically enrol all staff who are: § Aged 22 to state pension age § Working in the UK § Earning over £ 10, 000 a year. Some staff who don’t meet the criteria above are able to opt in to the pension scheme you’re using for automatic enrolment. You must put them in if they ask. You’ll have to pay a minimum employer contribution for all staff you put into this scheme. Certain other staff can ask to join a pension scheme. You must put these staff in a scheme, but the rules are different and there’s no requirement for you to pay an employer contribution. It’s the age and earnings of a member of staff that determines what ‘type’ of worker they are and therefore what duties you’ll have for them. For more information go to know your workforce. What else needs to be done? You’ll need to write to each member of staff individually to tell them how they’ve personally been affected by automatic enrolment. The information you’ll need to tell them is different depending on their rights and the duties you have for them. You must also provide certain information to the regulator about how you’ve complied with your duties. Find out more about reporting and regulatory duties. Source; GOV. UK

Document Classification: OFFICIAL For more information on Automatic Enrolment, please visit: http: //www. thepensionsregulator. gov. uk/automatic-enrolment. aspx Tools The Pension Regulator have created four interactive tools to assist with automatic enrolment: 1. Find out your staging date 2. Your employee duties 3. How to automatically enrol your staff 4. Your minimum employer contribution Please click on the image to open the document 20

Document Classification: OFFICIAL www. gov. uk/ukti This presentation is based upon materials either compiled by us through independent research, or supplied to us by third parties. Property particulars are for information only, and to give a general idea of the property. Whereas every effort has been made to ensure that the information given in this document is accurate, neither UK Trade & Investment nor its parent Departments (the Department for Business, Innovation and Skills, and the Foreign & Commonwealth Office), accept liability for any errors, omissions or misleading statements, and no warranty is given or responsibility accepted as to the standing of any individual, firm, company or other organisation mentioned. © Crown copyright 2016

6224483bca3801c3cf7ec8060f832027.ppt