b77e521d1309381e2cc80ecb20a0df64.ppt

- Количество слайдов: 6

Doctoral Program and Advanced Degree in Sustainable Energy Systems Doctoral Program in Mechanical Engineering Ecological Economics Week 1 Tiago Domingos Assistant Professor Environment and Energy Section Department of Mechanical Engineering

Overview • Consumer theory – consumers choose the best bundles of goods • Two parts to theory – “can afford” — budget constraint – “best” — according to consumers’ preferences • How much is actually consumed?

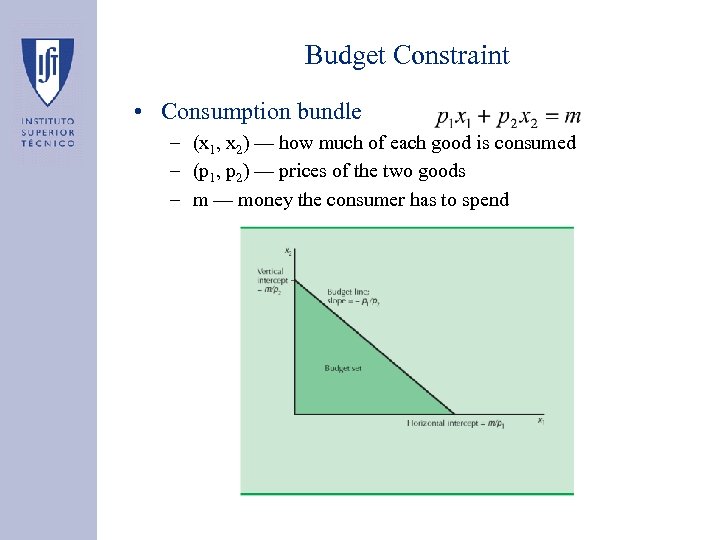

Budget Constraint • Consumption bundle – (x 1, x 2) — how much of each good is consumed – (p 1, p 2) — prices of the two goods – m — money the consumer has to spend

Budget Constraint • Taxes, subsidies, and rationing – 1. quantity tax — tax levied on units bought (ex. Car taxes) : p 1 + t – 2. value tax— tax levied on dollars spent (IVA): p 1+τp 1. Also known as ad valorem tax – 3. subsidies — opposite of a tax a) p 1 − s b) (1 − σ)p 1 – 4. lump sum tax or subsidy — amount of tax or subsidy is independent of the consumer’s choices. Also called a head tax or a poll tax – 5. rationing — can’t consume more than a certain amount of some good • Example — food stamps – 1. before 1979 was an ad valorem subsidy on food – a) paid a certain amount of money to get food stamps which were worth more than they cost – b) some rationing component — could only buy a maximum amount of food stamps – 2. after 1979 got a straight lump-sum grant of food coupons. Not the same as a pure lump-sum grant since could only spend the coupons on food.

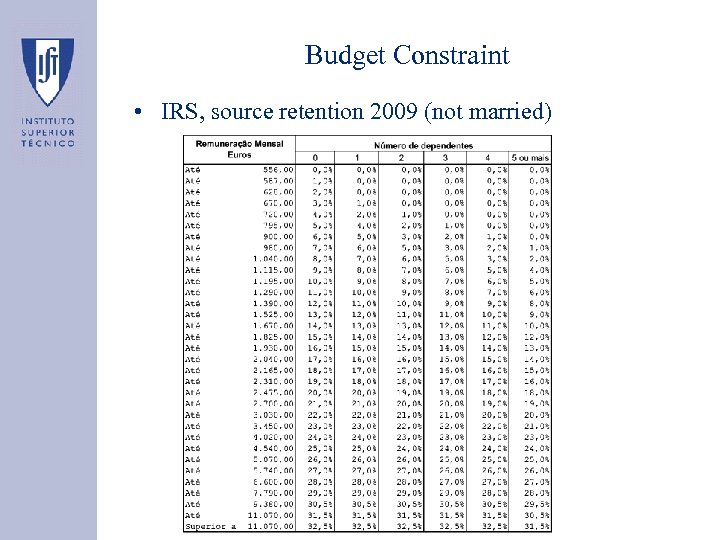

Budget Constraint • IRS, source retention 2009 (not married)

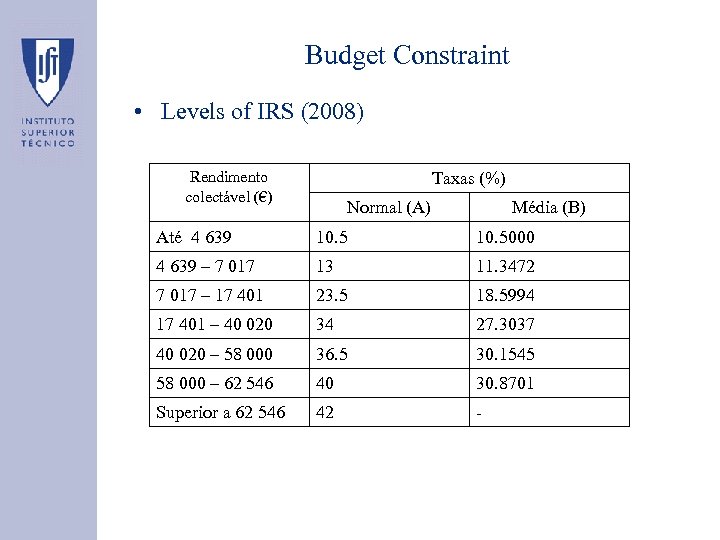

Budget Constraint • Levels of IRS (2008) Rendimento colectável (€) Taxas (%) Normal (A) Média (B) Até 4 639 10. 5000 4 639 – 7 017 13 11. 3472 7 017 – 17 401 23. 5 18. 5994 17 401 – 40 020 34 27. 3037 40 020 – 58 000 36. 5 30. 1545 58 000 – 62 546 40 30. 8701 Superior a 62 546 42 -

b77e521d1309381e2cc80ecb20a0df64.ppt