f6d87c78f3efaeb23322c03f3e6aa58d.ppt

- Количество слайдов: 13

Do We Need Money? Money: anything that is generally accepted in payment for goods, services & debts. Economies can function without money. Barter is a exchange system with direct trade of goods and services, it prevailed in the early stages of econ development but is inefficient. Four main sources of inefficiency in a barter economy: 1. A double coincidence of wants increases the transactions costs (time or other resources required for agreeing and carrying out an exchange) 2. Each good has many prices. When there are N items: Number of prices = N(N – 1)/2. 3. A lack of standardization exists for goods and services. 4. It is difficult to accumulate wealth.

Do We Need Money? Money: anything that is generally accepted in payment for goods, services & debts. Economies can function without money. Barter is a exchange system with direct trade of goods and services, it prevailed in the early stages of econ development but is inefficient. Four main sources of inefficiency in a barter economy: 1. A double coincidence of wants increases the transactions costs (time or other resources required for agreeing and carrying out an exchange) 2. Each good has many prices. When there are N items: Number of prices = N(N – 1)/2. 3. A lack of standardization exists for goods and services. 4. It is difficult to accumulate wealth.

The Invention of Money and Its Functions To improve barter people identified product that most people accept in an exchange. Commodity money is a good used as $ with value independent of its use as $. Money allows people to specialize, (produce goods or services for which they have competitive advantages) so they become more productive, and earn higher incomes. Money serves four key functions in the economy: 1. Medium of exchange: something that is generally accepted as payment. 2. Unit of account: measuring value in an economy in terms of money. . 3. Standard of deferred payment: money can facilitate exchange over time. 4. Store of value: accumulation of wealth by holding $ or other assets that can buy goods and services in the future. Even though other assets offer a greater return as a store of value, people hold money because it is perfectly liquid.

The Invention of Money and Its Functions To improve barter people identified product that most people accept in an exchange. Commodity money is a good used as $ with value independent of its use as $. Money allows people to specialize, (produce goods or services for which they have competitive advantages) so they become more productive, and earn higher incomes. Money serves four key functions in the economy: 1. Medium of exchange: something that is generally accepted as payment. 2. Unit of account: measuring value in an economy in terms of money. . 3. Standard of deferred payment: money can facilitate exchange over time. 4. Store of value: accumulation of wealth by holding $ or other assets that can buy goods and services in the future. Even though other assets offer a greater return as a store of value, people hold money because it is perfectly liquid.

What Can Serve as Money? An asset is suitable to use as a medium of exchange if it is: • Acceptable to most people • Standardized in terms of quality • Durable • Valuable relative to its weight • Divisible U. S. paper currency—Federal Reserve Notes—meet all these criteria. Fiat money has no value apart from its use as money, e. g. , paper currency. People accept paper currency as money partly because it is legal tender (government designation that currency is accepted for payment of taxes and people must accept it in payment of debts). Our society’s willingness to use Federal Reserve Notes as money makes them an acceptable medium of exchange.

What Can Serve as Money? An asset is suitable to use as a medium of exchange if it is: • Acceptable to most people • Standardized in terms of quality • Durable • Valuable relative to its weight • Divisible U. S. paper currency—Federal Reserve Notes—meet all these criteria. Fiat money has no value apart from its use as money, e. g. , paper currency. People accept paper currency as money partly because it is legal tender (government designation that currency is accepted for payment of taxes and people must accept it in payment of debts). Our society’s willingness to use Federal Reserve Notes as money makes them an acceptable medium of exchange.

The Payments System Mechanism for conducting transactions in the economy. The Transition from Commodity Money to Fiat Money • Gold and silver coins are cumbersome. • Early banks stored gold coins in safes and issue paper certificates (paper currency). • Today the central bank issues paper currency (not convertible into gold). The Importance of Checks • Promises to pay on demand $ deposited with a bank or other financial institutions. • Checks avoid drawbacks of paper money but require more trust from the seller.

The Payments System Mechanism for conducting transactions in the economy. The Transition from Commodity Money to Fiat Money • Gold and silver coins are cumbersome. • Early banks stored gold coins in safes and issue paper certificates (paper currency). • Today the central bank issues paper currency (not convertible into gold). The Importance of Checks • Promises to pay on demand $ deposited with a bank or other financial institutions. • Checks avoid drawbacks of paper money but require more trust from the seller.

Electronic Funds and Electronic Cash • Electronic funds transfer systems are computerized payment-clearing devices. • Debit cards allow stores to instantly credit the store’s account, thus eliminating the problem of trust. • Automated Clearing House (ACH) transactions are direct deposits of checks and electronic transfers, which reduce transactions costs. • Automated teller machines (ATMs) allow you to withdraw funds from your bank anytime, or the another bank. • E-money (electronic money) is digital cash people use to buy goods and services over the Internet. )

Electronic Funds and Electronic Cash • Electronic funds transfer systems are computerized payment-clearing devices. • Debit cards allow stores to instantly credit the store’s account, thus eliminating the problem of trust. • Automated Clearing House (ACH) transactions are direct deposits of checks and electronic transfers, which reduce transactions costs. • Automated teller machines (ATMs) allow you to withdraw funds from your bank anytime, or the another bank. • E-money (electronic money) is digital cash people use to buy goods and services over the Internet. )

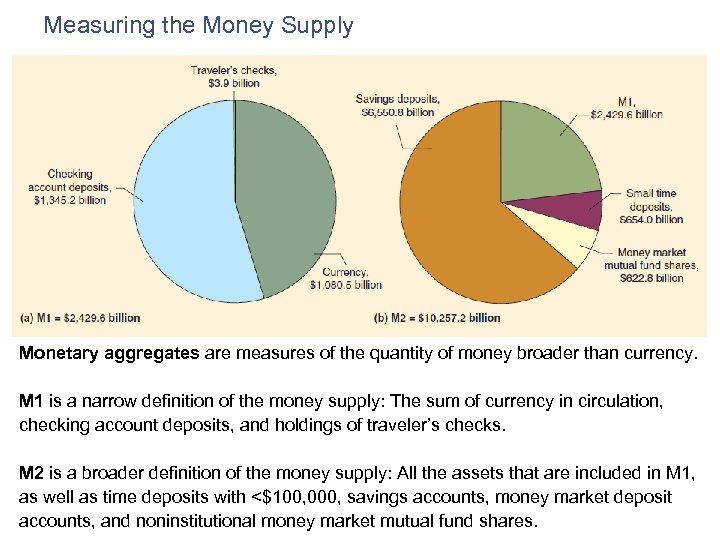

Measuring the Money Supply Monetary aggregates are measures of the quantity of money broader than currency. M 1 is a narrow definition of the money supply: The sum of currency in circulation, checking account deposits, and holdings of traveler’s checks. M 2 is a broader definition of the money supply: All the assets that are included in M 1, as well as time deposits with <$100, 000, savings accounts, money market deposit accounts, and noninstitutional money market mutual fund shares.

Measuring the Money Supply Monetary aggregates are measures of the quantity of money broader than currency. M 1 is a narrow definition of the money supply: The sum of currency in circulation, checking account deposits, and holdings of traveler’s checks. M 2 is a broader definition of the money supply: All the assets that are included in M 1, as well as time deposits with <$100, 000, savings accounts, money market deposit accounts, and noninstitutional money market mutual fund shares.

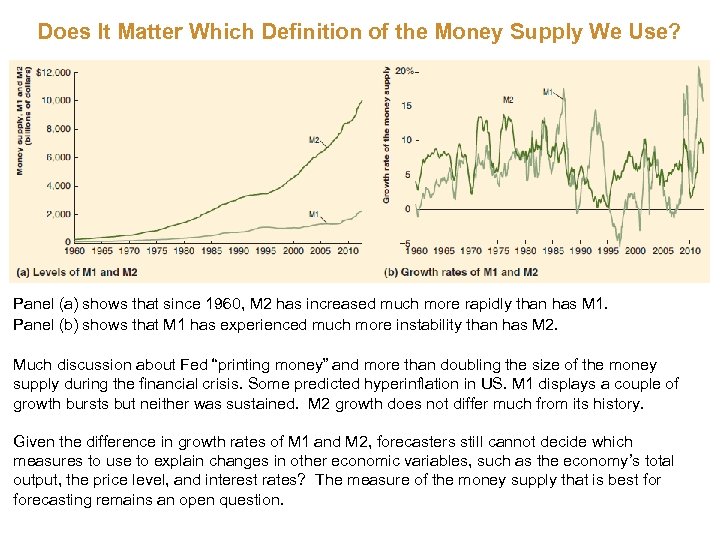

Does It Matter Which Definition of the Money Supply We Use? Panel (a) shows that since 1960, M 2 has increased much more rapidly than has M 1. Panel (b) shows that M 1 has experienced much more instability than has M 2. Much discussion about Fed “printing money” and more than doubling the size of the money supply during the financial crisis. Some predicted hyperinflation in US. M 1 displays a couple of growth bursts but neither was sustained. M 2 growth does not differ much from its history. Given the difference in growth rates of M 1 and M 2, forecasters still cannot decide which measures to use to explain changes in other economic variables, such as the economy’s total output, the price level, and interest rates? The measure of the money supply that is best forecasting remains an open question.

Does It Matter Which Definition of the Money Supply We Use? Panel (a) shows that since 1960, M 2 has increased much more rapidly than has M 1. Panel (b) shows that M 1 has experienced much more instability than has M 2. Much discussion about Fed “printing money” and more than doubling the size of the money supply during the financial crisis. Some predicted hyperinflation in US. M 1 displays a couple of growth bursts but neither was sustained. M 2 growth does not differ much from its history. Given the difference in growth rates of M 1 and M 2, forecasters still cannot decide which measures to use to explain changes in other economic variables, such as the economy’s total output, the price level, and interest rates? The measure of the money supply that is best forecasting remains an open question.

The Quantity Theory of Money: A First Look at the Link Between Money and Prices Irving Fisher and the Equation of Exchange • The quantity of money (M) multiplied by the velocity of money (V), equals the price level (P) multiplied by the level of real GDP (Y). M V = P Y • PY equals nominal GDP, so V = PY/M • Irving Fisher asserted that V is constant and turned the equation of exchange (an identity) into the quantity theory of money (theory about the connection between money and prices that assumes that the velocity of money is constant). The Quantity Theory Explanation of Inflation • Use the quantity equation expressed in percentage changes: % Δ M + % Δ V = % Δ P + % Δ Y. • % Δ P is inflation and since % Δ V = 0 => % Δ P = % Δ M – % Δ Y

The Quantity Theory of Money: A First Look at the Link Between Money and Prices Irving Fisher and the Equation of Exchange • The quantity of money (M) multiplied by the velocity of money (V), equals the price level (P) multiplied by the level of real GDP (Y). M V = P Y • PY equals nominal GDP, so V = PY/M • Irving Fisher asserted that V is constant and turned the equation of exchange (an identity) into the quantity theory of money (theory about the connection between money and prices that assumes that the velocity of money is constant). The Quantity Theory Explanation of Inflation • Use the quantity equation expressed in percentage changes: % Δ M + % Δ V = % Δ P + % Δ Y. • % Δ P is inflation and since % Δ V = 0 => % Δ P = % Δ M – % Δ Y

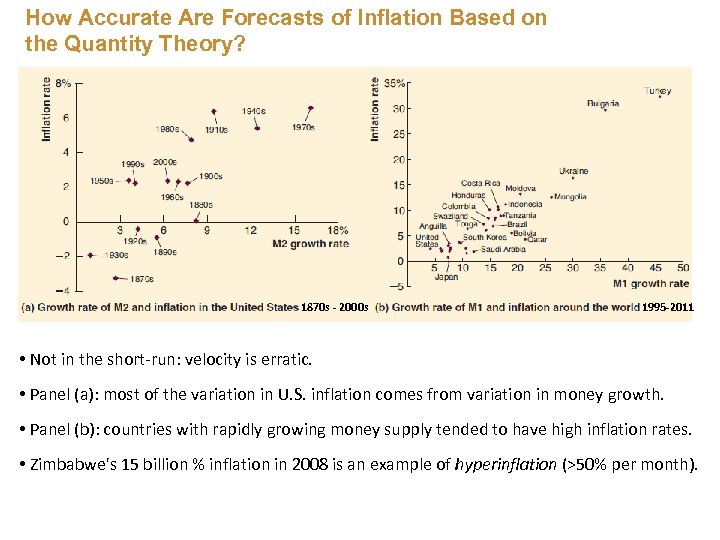

How Accurate Are Forecasts of Inflation Based on the Quantity Theory? 1870 s - 2000 s 1995 -2011 • Not in the short-run: velocity is erratic. • Panel (a): most of the variation in U. S. inflation comes from variation in money growth. • Panel (b): countries with rapidly growing money supply tended to have high inflation rates. • Zimbabwe's 15 billion % inflation in 2008 is an example of hyperinflation (>50% per month).

How Accurate Are Forecasts of Inflation Based on the Quantity Theory? 1870 s - 2000 s 1995 -2011 • Not in the short-run: velocity is erratic. • Panel (a): most of the variation in U. S. inflation comes from variation in money growth. • Panel (b): countries with rapidly growing money supply tended to have high inflation rates. • Zimbabwe's 15 billion % inflation in 2008 is an example of hyperinflation (>50% per month).

The Hazards of Hyperinflation • Examples: US Civil War, Germany in early 1920 s, Argentina in 1990 s, Zimbabwe. • With hyperinflation, loans repaid in money lose most of their values. • The total number of German marks in circulation: 115 million in January 1922, 1. 3 billion in January 1923, and 497 quintillion in December 1923. • The German price index rose to 126, 160, 000, 000 in December 1923. • In response, Deutsche Bank would make loans only to borrowers who would repay them in either foreign currencies or commodities. • Prices rise so rapidly that $ buys fewer and fewer goods and services each day. • Households and firms responded by refusing to accept money, contracting econ activity and soaring unemployment. • The quantity theory indicates that hyperinflation is caused by the money supply (M) rising more rapidly than real output (Y). • Hyperinflation usually when governments spend more than they collect in taxes. • Government’s debt can be monetized by forcing central bank to print money.

The Hazards of Hyperinflation • Examples: US Civil War, Germany in early 1920 s, Argentina in 1990 s, Zimbabwe. • With hyperinflation, loans repaid in money lose most of their values. • The total number of German marks in circulation: 115 million in January 1922, 1. 3 billion in January 1923, and 497 quintillion in December 1923. • The German price index rose to 126, 160, 000, 000 in December 1923. • In response, Deutsche Bank would make loans only to borrowers who would repay them in either foreign currencies or commodities. • Prices rise so rapidly that $ buys fewer and fewer goods and services each day. • Households and firms responded by refusing to accept money, contracting econ activity and soaring unemployment. • The quantity theory indicates that hyperinflation is caused by the money supply (M) rising more rapidly than real output (Y). • Hyperinflation usually when governments spend more than they collect in taxes. • Government’s debt can be monetized by forcing central bank to print money.

Distinguishing Among Money, Income, and Wealth • Money is part of wealth, which is the sum of the value of a person’s assets minus the value of the person’s liabilities. • Only if an asset serves as a medium of exchange can we call it money. • A person’s income is his or her earnings over a period of time. • So, a person typically has considerably less money than income or wealth. • The Relationship between Money and Income Do you agree with this statement: “It is not possible for the total value of production to increase unless the money supply also increases. After all, how can the value of the goods and services being bought and sold increase unless there is more money available? ” The total value of production (PY) is the right side of the equation of exchange, so for it to increase, the left side (MV) must also increase. If V increases, NGDP can increase with the money supply remaining constant.

Distinguishing Among Money, Income, and Wealth • Money is part of wealth, which is the sum of the value of a person’s assets minus the value of the person’s liabilities. • Only if an asset serves as a medium of exchange can we call it money. • A person’s income is his or her earnings over a period of time. • So, a person typically has considerably less money than income or wealth. • The Relationship between Money and Income Do you agree with this statement: “It is not possible for the total value of production to increase unless the money supply also increases. After all, how can the value of the goods and services being bought and sold increase unless there is more money available? ” The total value of production (PY) is the right side of the equation of exchange, so for it to increase, the left side (MV) must also increase. If V increases, NGDP can increase with the money supply remaining constant.

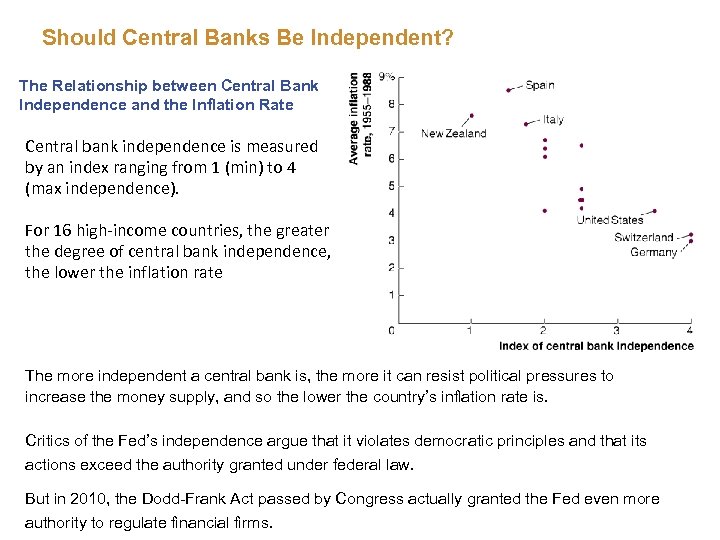

Should Central Banks Be Independent? The Relationship between Central Bank Independence and the Inflation Rate Central bank independence is measured by an index ranging from 1 (min) to 4 (max independence). For 16 high-income countries, the greater the degree of central bank independence, the lower the inflation rate The more independent a central bank is, the more it can resist political pressures to increase the money supply, and so the lower the country’s inflation rate is. Critics of the Fed’s independence argue that it violates democratic principles and that its actions exceed the authority granted under federal law. But in 2010, the Dodd-Frank Act passed by Congress actually granted the Fed even more authority to regulate financial firms.

Should Central Banks Be Independent? The Relationship between Central Bank Independence and the Inflation Rate Central bank independence is measured by an index ranging from 1 (min) to 4 (max independence). For 16 high-income countries, the greater the degree of central bank independence, the lower the inflation rate The more independent a central bank is, the more it can resist political pressures to increase the money supply, and so the lower the country’s inflation rate is. Critics of the Fed’s independence argue that it violates democratic principles and that its actions exceed the authority granted under federal law. But in 2010, the Dodd-Frank Act passed by Congress actually granted the Fed even more authority to regulate financial firms.