c01c33cb90050c8d072863061560403d.ppt

- Количество слайдов: 31

![Division of Revenue Bill 2004 [B 4 -2004] Portfolio Committee on Finance Ismail Momoniat Division of Revenue Bill 2004 [B 4 -2004] Portfolio Committee on Finance Ismail Momoniat](https://present5.com/presentation/c01c33cb90050c8d072863061560403d/image-1.jpg)

Division of Revenue Bill 2004 [B 4 -2004] Portfolio Committee on Finance Ismail Momoniat 20 February 2004

Intergovernmental Fiscal System • Section 214 of Constitution and IGFR Act – Requires an annual Division of Revenue Bill – Section 10(5) of the Intergovernmental Fiscal Relations Act gives effect to Constitution • Consultation processes for allocations • Explanatory memorandum (Annexure E) – Budget Council and Budget Forum – FFC • Extended Cabinet with provincial Premiers and chairperson of SALGA 2

2004 Division of Revenue Bill • Section 76(4) Bill and has to start in NA – Most important Budget Bill, not a s 75 money bill! • • Clauses 1 -35 of the Bill Schedules 1 -7 divides revenue bet 3 spheres Memo on the objectives of bill Explanatory attachments – Annexure E (also part of Budget Review) – Appendix E 1 & E 2: Frameworks on all conditional grants (provincial and local) – Appendix E 3 to E 6: LG allocations by municipality for both national & municipal financial year – Appendix E 7 Demographic data for Local Government Equitable share and Municipal Infrastructure Grant 3

DOR: Schedules • Schedules 1 to 7 – Equitable Share allocations (Schedules 1 -3) • Schedule 1 divides eq share between 3 spheres • Schedules 2 divides provincial equitable share between 9 provinces • Schedule 3 divides local equitable share between 284 municipalities – Conditional Grant allocations (Schedules 4 -6) • Schedules 4 and 5 on provincial grants, by province • Schedules 6 on LG grants (no division by muni) – Allocations by municipality in explanatory attachments – Allocations-in-kind (Schedules 7) 4

Fiscal framework 5

Division of revenue 6

Response of National Govt to FFC Proposals Part 1 of Annexure E

Key Proposals on Do. R • Census 2001 results released in 2003 • Update formulae with new data for 2004 • Comprehensive review of formula for provincial and LG equitable share grants for 2005 MTEF • Review of all conditional grants • Review of LG Fiscal Framework – Restructuring of electricity distribution – Division of functions 3 Jan 2003 – Review of RSC and municipal service levy 8

Process to consider FFC proposals • FFC Submission: Do. R 2004/05 – Focus is on two main sets of issues – First set deals with DOR issues pertaining to each sphere of government – Second set focus on the intergovernmental system • Response should be viewed against the review of LG and Provincial fiscal review • Budget Council considered prov proposals • Budget Forum considered LG proposal • Premiers invited at Extended Cabinet • Cabinet decides on div of revenue thereafter 9

FFC Provincial Recommendations • HIV and Aids funding and health conditional grants • Equitable share formula – Education component – Health component – Welfare component • The FFC also made overall proposals regarding the equitable share formula • Framework for Comprehensive Social Security Reform 10

Response of N Govt to FFC provincial proposals • Governments current approach to HIV and Aids funding is largely in line with FFC recommendations – The proposal to consolidate all HIV and Aids grants will be explored during the review of provincial fiscal framework – It is difficult to evaluate ES spending on HIV and Aids • On health conditional grant proposals – national Departments of Health and Education and the National Treasury review the funding of academic and tertiary hospitals – PSNP to be administered by education in 2004/05 11

Response of N Govt to FFC provincial proposals • Health component of ES formula – Regular updates not possible due to lack of updated data – Replacement of current datasets used in component with alternative data being explored • Education component of ES formula – ‘out-of-school’ enrollment retained as stabiliser – ECD phase into ES formula by adjusting the age co-hort to 5 -17 – ABET proposal will form part of the broader review • On welfare component of ES formula – Should be viewed against current developments pertaining to the shifting of social security function – Two Bills before parliament – Increasing the weight of welfare component will not address FFC concerns as other areas of spending are crowded out 12

FFC proposals on LG • • Revenue capacity and the ES formula Municipal institutional capacity Financing development nodes Differentiated approach to municipalities 13

Response of NG to FFC on LG • On the revenue capacity of LG and the ES formula – Government supports the FFC proposals – Recognise the need for a review of LG fiscal framework • On I-element – Will form part of the broader LG fiscal framework review • Capacity building CG – Will form part of LG fiscal review and steps are to be taken to minimise the number of CG in system – Grants will be assessed in terms of outputs and outcomes 14

Response of NG to FFC on LG • On financing development nodes – FFC is raising valid issues on ISRDS and URP – The current ES transfers still fund transitional programmes and can only be phased out in a few years time – Funding for nodes will be explored with the fiscal framework review – Gov agrees that the programmes be evaluated • On the differentiated approach to municiaplities – Legislation provides for a differentiated approach – Consideration is being given to a differentiated approach based on capapcity 15

FFC proposals on intergov system • Bulk of proposals are work-in-progress • Proposals related to CBS, expenditure assignment, costednorms, performance management, building institutional capacity, funding instruments for poverty-alleviation • Gov response just an initial response • Gov welcomes the emphasis on the need for certainty in functions • Expenditure assignment is complex and calls for greater cooperation • Re-assignment of social grants underway • CBS taken account of in vertical and horizontal DOR 16

Provincial Allocations Part 4 of Annexure E

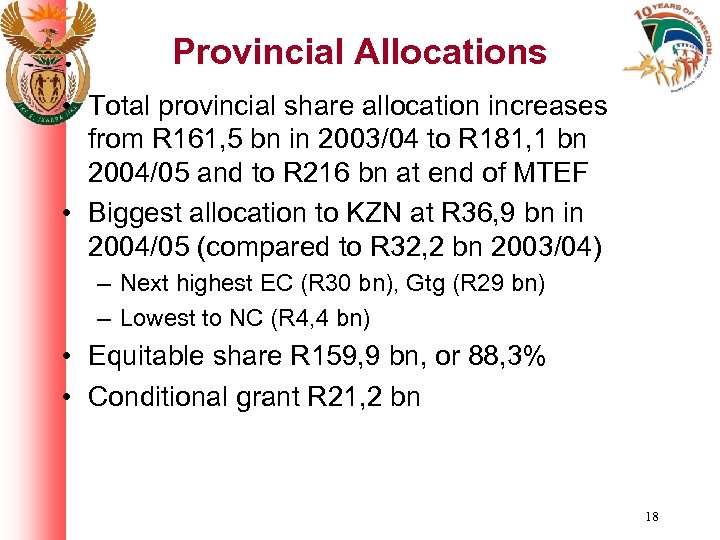

Provincial Allocations • Total provincial share allocation increases from R 161, 5 bn in 2003/04 to R 181, 1 bn 2004/05 and to R 216 bn at end of MTEF • Biggest allocation to KZN at R 36, 9 bn in 2004/05 (compared to R 32, 2 bn 2003/04) – Next highest EC (R 30 bn), Gtg (R 29 bn) – Lowest to NC (R 4, 4 bn) • Equitable share R 159, 9 bn, or 88, 3% • Conditional grant R 21, 2 bn 18

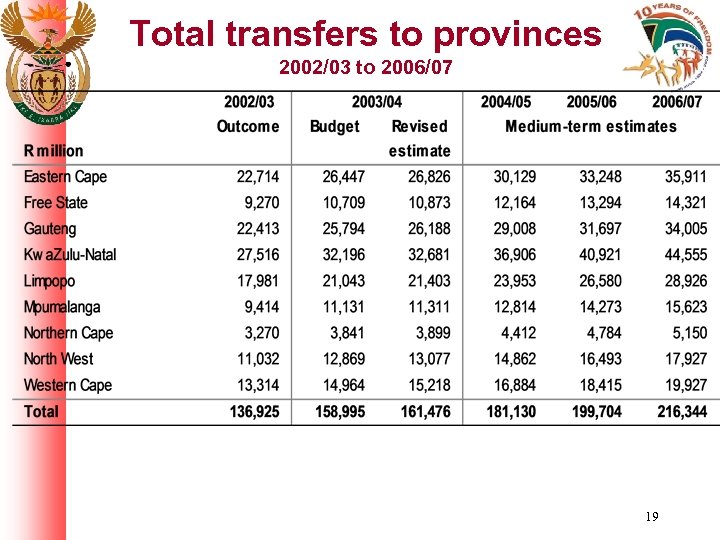

Total transfers to provinces 2002/03 to 2006/07 19

National transfers to provinces(1) • National transfers make up 97% of total provincial revenue in 2004/05 • Equitable share makes up 88, 3% of national transfers to provinces – Rises from R 144, 7 bn in 2003/04 to R 159, 9 bn in 2004/05 and will peak at R 186, 4 bn by 2005/06 – R 19, 7 bn added to ES over the next three years, a growth rate of 8, 8 % 20

National transfers to provinces(2) • Conditonal grants grow from R 16, 7 bn in 2003/04 to R 21, 2 bn in 2004/05, and will rise to R 30 bn by 2006/07 • Growth in CGs largely linked to – Child support extension grant • R 3, 7 bn, R 6, 9 bn and R 9, 3 bn – Food relief of R 388 m each MTEF year – HIV and Aids in health • R 782 million, R 1, 1 bn and R 1, 7 bn – R 750 million for CASP – Growing infrastructure grants • 19 Conditional grants • 2002/03 Audit concerns 21

Local Government Allocations Part 5 of Annexure E

Local Government priorities • Bulk of pro-poor spending is in provinces and local government – Accelerate the rollout of free basic services • Electricity, water and sanitation, refuse removal – Municipal infrastructure development • MIG to provide the infrastructure to rollout free basic services • Contributing to job creation • Capacity building grants to support MIG implementation – MFMA implementation • Building in-house capacity in planning, budgeting and financial management 23

Local Government Allocations • National allocations an important and growing source of revenue for municipalities – Comprise about 14, 4 per cent of total LG budgets, but can be as high as 90 per cent in some municipalities • Increases by R 3, 9 bn over the next 3 years • Total allocations grows to R 17, 1 billion in 2006/07 from R 12, 4 billion in 2003/04 • Equitable share is most significant comprising 55 per cent of allocations – allowing greater discretion at local level • Equitable share increase to R 9, 4 billion in 2006/07 from R 6, 4 billion in 2003/04 24

LG Allocations (continued) • R 21, 6 billion earmarked transfers made to LG over the MTEF – Infrastructure grants also receive a major boost to address backlogs • Grow to R 6, 0 bn in 2006/07 from R 4, 1 bn in 2003/04 – R 1, 7 bn increase over baseline – Capacity building and restructuring grants are allocated R 2, 2 bn over the three years • Mainly to support the implementation of MIG and the MFMA • Support municipal restructuring 25

Clauses in the Bill

Division of Revenue Bill 2004 • Bill largely same as 2003 DOR Act • Substantive changes: – New clauses to align the Bill with MFMA (additional definitions, 1(2 and 3), 14(3), 16(3), 18(3)) – 3 additional clauses in section 8 to strengthen the regulation of provision of municipal services through public entities – 4 new sub-clauses in section 11 to facilitate the phasing in of infrastructure grants to MIG, facilitate better planning and reporting on 27 performance

Division of Revenue Bill, 2004 • Substantive changes – additional clause in sections 23 and 26 to restrict reallocation of grants between municipalities – additional clause in section 23 as interim measure to deal with uncertainties regarding possible take up of additional funds to HIV/Aids for roll out of ARV treatment plan – New section 35 to deal with underspending of capital grants 28

Analysis of transfers

Analysis of Provincial Formula • Formula updated education, population and economic data (2001 Census) • Weighting for social grants is 18%, but provinces will spend 29, 3% of eq share I 2003/04, and rising • Allocations are redistributive, as can be seen in Table E 21 in Annexure E – Gauteng, W Cape and to a lesser extent KZN get less than per capital average 30

Local Government Transfers • As reflected in tables E 17, E 22 and E 23 in annexure E – Total transfers as percentage of municipal budgets average 13, 7% country wide • as high as 55, 2% in Limpopo municipalities, • as low as 4, 0% in Gauteng municipalities – Total transfers as percentage of budgets for sample municipalities • only 3, 0% in Cape Town • only 3, 2% in Johannesburg • as high as 92, 1% in Bohlabela (Bushbuckridge) 31

c01c33cb90050c8d072863061560403d.ppt