5442b03a6ab12eea2f0d16f785dca6ac.ppt

- Количество слайдов: 16

Dividend policy Concepts and exemplification

Objective Understand the role of dividend policy in the context of the firm’s overall financial policy.

Outline • Types of dividends • The dividend time line • Stock price reaction • Dividend policy irrelevance • Theories explaining dividend policy

Dividends come in many forms: · Regular cash dividend · Extra dividends · Liquidating dividends · Shares repurchases • Stock dividends

Dividend time Line • Declaration date • Cum-dividend date • Ex-dividend date • Record date • Payment date

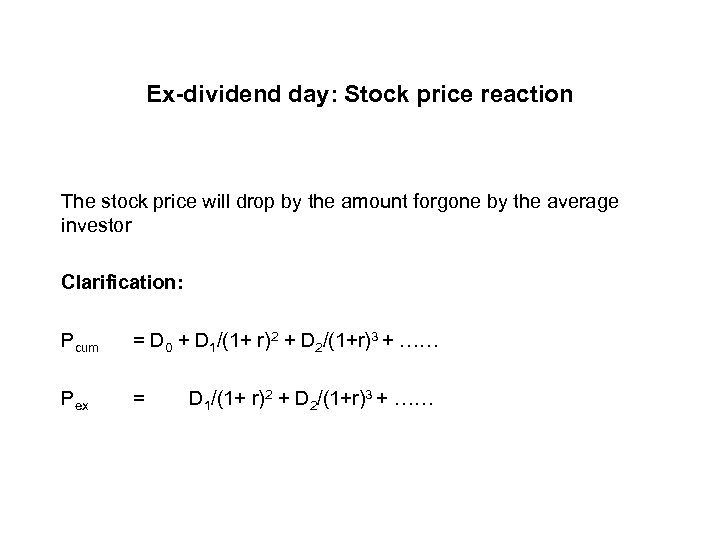

Ex-dividend day: Stock price reaction The stock price will drop by the amount forgone by the average investor Clarification: Pcum = D 0 + D 1/(1+ r)2 + D 2/(1+r)3 + …… Pex = D 1/(1+ r)2 + D 2/(1+r)3 + ……

Stock price reaction (con't) With taxes, the price drop ~ D(1 -Td)/(1 -Tcg) Td = tax on dividend (average investor) Tcg = tax on capital gain (average investor)

Dividend Policy: Does it matter? Is there an optimal dividend policy? If no, focus on the investment decision If yes, what is the optimal policy?

View # 1: Dividend policy is irrelevant Shareholders are able to undo firm's dividend policy. M&M: firm value is independent of the dividend decision.

View # 1: Dividend policy is relevant Bird-in-hand story A $1 in dividend now is worth more than $2 in dividend later on. Signaling Dividend increase = Good times ahead The free cash-flow hypothesis $1 in dividend is $1 less to spend on M&A

View # 1: Dividend policy is relevant (cont’d) Clientele effect Some want dividends while others want capital gains Tax effect

Tax effect REC Company has $1, 000 in extra cash. It can invest this cash in a 5 year T-bill at 8%, or it can pay the cash to the shareholders as a dividend. Shareholders can also invest in T-bills. Assume a 44% corporate tax, a 40% individual tax on interest, and 30% individual tax on dividend income. If dividend is paid now, shareholders get 1000(1 -0. 3)[1+ (0. 08)(1 -0. 4)]5=$884. 9 If dividend is invested, shareholders get 1000[1+ (0. 08)(1 -0. 44)]5(1 -0. 3) =$871. 5 Shareholders would be indifferent between receiving the dividend now as opposed to receiving it later if and only if: (1 -TE)[1+r(1 -TP)] = [1+r(1 -TC)](1 -TE)

Tax effect (cont’d) Investors would like a dividend according to their tax preferences: • Tax-exempt investors, investors in low tax brackets, etc. prefer high current dividend • Investors in high tax brackets prefer capital gains

Agency costs explanation of dividends Paying dividends can result in a need for external financing. Raising equity and/or debt more often intensifies market’s scrutiny of the company.

Reality check • Earnings increase one year before dividend initiation. • Earnings decrease one year before dividend omission. • Following dividend initiation, earnings increases appear to be permanent. • Following dividend omission, earnings decreases appear to be temporary. • Weak reaction to earnings changes following dividend changes.

Overview of financial policy: Why is it important? Capital structure policy, long-term financing policy, dividend policy, etc. …do have some impact on market valuation. Remember, however: Capital budgeting is the bread and butter of wealth maximization. Financial policy is only fine-tuning.

5442b03a6ab12eea2f0d16f785dca6ac.ppt