6389b6ed7edf4b09b8a06a6c2a07badb.ppt

- Количество слайдов: 52

Diversifying with Commodities The Revenge of the Old Economy Goldman Sachs International October 2004 Stefan Weiser, CFA stefan. weiser@gs. com +44 20 7774 6232

Diversifying with Commodities The Revenge of the Old Economy Goldman Sachs International October 2004 Stefan Weiser, CFA stefan. weiser@gs. com +44 20 7774 6232

Commodities: A Separate Asset Class Goldman Sachs recommends an investment in a broadly diversified basket of commodities to hedge macroeconomic risk, decrease portfolio volatility and enhance portfolio returns § Commodities have historically yielded high, equity-like returns § Commodities correlate negatively with financial assets. Commodities typically perform best when bonds and equities suffer their worst losses § No asset manager required. Investments are long-only and passive § Very good liquidity – Unlike other ‘alternative assets’ most major commodity markets are deep and liquid Positive Tactical Outlook for another 5 – 10 years § Significant lack of investment in commodity infrastructure has resulted in severe capacity constraints across commodity sectors § We expect commodity investment returns to remain above historic averages for as long as there is a lack of ability to supply, deliver and store commodities

Commodities: A Separate Asset Class Goldman Sachs recommends an investment in a broadly diversified basket of commodities to hedge macroeconomic risk, decrease portfolio volatility and enhance portfolio returns § Commodities have historically yielded high, equity-like returns § Commodities correlate negatively with financial assets. Commodities typically perform best when bonds and equities suffer their worst losses § No asset manager required. Investments are long-only and passive § Very good liquidity – Unlike other ‘alternative assets’ most major commodity markets are deep and liquid Positive Tactical Outlook for another 5 – 10 years § Significant lack of investment in commodity infrastructure has resulted in severe capacity constraints across commodity sectors § We expect commodity investment returns to remain above historic averages for as long as there is a lack of ability to supply, deliver and store commodities

How to Invest in Commodities Physical? Resource Stocks? § § § § Buying commodities and storing Cumbersome and expensive Prices tend to mean-revert Broad equity market exposure Business risk Discounted cash flows Tend to under-perform especially when commodity prices are volatile Commodity Futures? Commodity Index? § § Requires monthly rolls Operational risks Admin Intensive § § § Most investments are made via the Goldman Sachs Commodity Index Long-only passive index Tracks performance of a diversified basket of commodity futures Transparent, liquid, freely licensed

How to Invest in Commodities Physical? Resource Stocks? § § § § Buying commodities and storing Cumbersome and expensive Prices tend to mean-revert Broad equity market exposure Business risk Discounted cash flows Tend to under-perform especially when commodity prices are volatile Commodity Futures? Commodity Index? § § Requires monthly rolls Operational risks Admin Intensive § § § Most investments are made via the Goldman Sachs Commodity Index Long-only passive index Tracks performance of a diversified basket of commodity futures Transparent, liquid, freely licensed

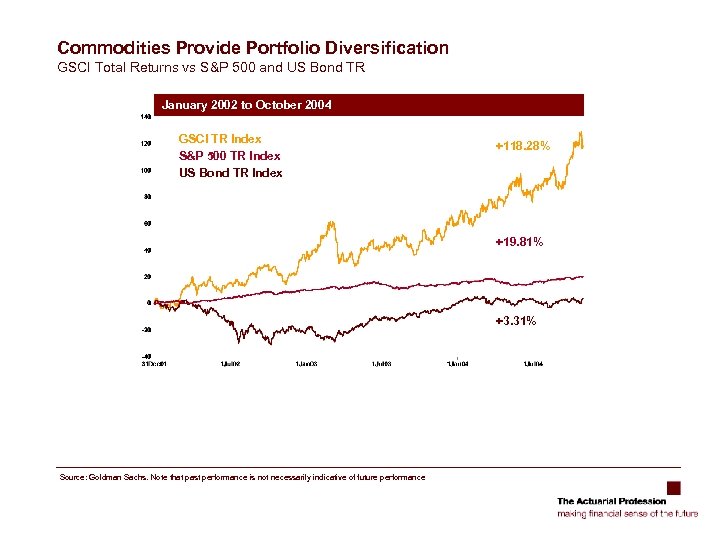

Commodities Provide Portfolio Diversification GSCI Total Returns vs S&P 500 and US Bond TR January 2002 to October 2004 GSCI TR Index S&P 500 TR Index US Bond TR Index +118. 28% +19. 81% +3. 31% Source: Goldman Sachs. Note that past performance is not necessarily indicative of future performance

Commodities Provide Portfolio Diversification GSCI Total Returns vs S&P 500 and US Bond TR January 2002 to October 2004 GSCI TR Index S&P 500 TR Index US Bond TR Index +118. 28% +19. 81% +3. 31% Source: Goldman Sachs. Note that past performance is not necessarily indicative of future performance

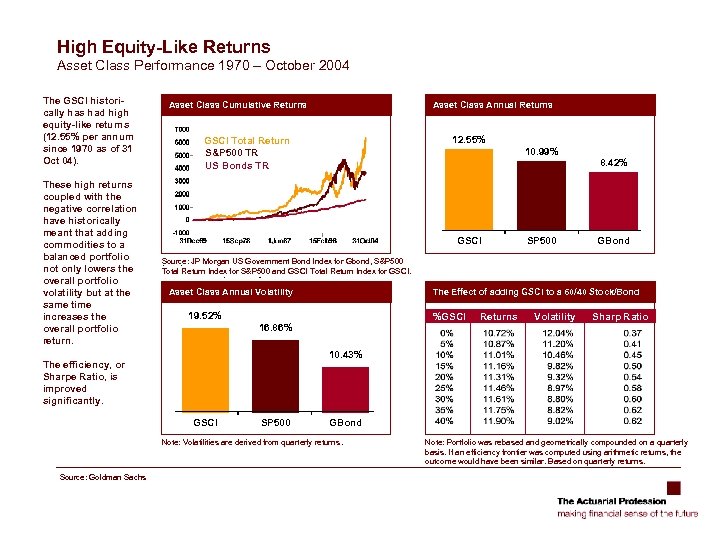

High Equity-Like Returns Asset Class Performance 1970 – October 2004 The GSCI historically has had high equity-like returns (12. 55% per annum since 1970 as of 31 Oct 04). These high returns coupled with the negative correlation have historically meant that adding commodities to a balanced portfolio not only lowers the overall portfolio volatility but at the same time increases the overall portfolio return. Asset Class Cumulative Returns Asset Class Annual Returns 12. 55% GSCI Total Return S&P 500 TR US Bonds TR 10. 99% GSCI GBond Source: JP Morgan US Government Bond Index for Gbond, S&P 500 Total Return Index for S&P 500 and GSCI Total Return Index for GSCI. Asset Class Annual Volatility The Effect of adding GSCI to a 60/40 Stock/Bond 19. 52% %GSCI Returns Volatility Sharp Ratio 16. 86% 10. 43% The efficiency, or Sharpe Ratio, is improved significantly. GSCI SP 500 GBond Note: Volatilities are derived from quarterly returns. Source: Goldman Sachs SP 500 8. 42% Note: Portfolio was rebased and geometrically compounded on a quarterly basis. If an efficiency frontier was computed using arithmetic returns, the outcome would have been similar. Based on quarterly returns.

High Equity-Like Returns Asset Class Performance 1970 – October 2004 The GSCI historically has had high equity-like returns (12. 55% per annum since 1970 as of 31 Oct 04). These high returns coupled with the negative correlation have historically meant that adding commodities to a balanced portfolio not only lowers the overall portfolio volatility but at the same time increases the overall portfolio return. Asset Class Cumulative Returns Asset Class Annual Returns 12. 55% GSCI Total Return S&P 500 TR US Bonds TR 10. 99% GSCI GBond Source: JP Morgan US Government Bond Index for Gbond, S&P 500 Total Return Index for S&P 500 and GSCI Total Return Index for GSCI. Asset Class Annual Volatility The Effect of adding GSCI to a 60/40 Stock/Bond 19. 52% %GSCI Returns Volatility Sharp Ratio 16. 86% 10. 43% The efficiency, or Sharpe Ratio, is improved significantly. GSCI SP 500 GBond Note: Volatilities are derived from quarterly returns. Source: Goldman Sachs SP 500 8. 42% Note: Portfolio was rebased and geometrically compounded on a quarterly basis. If an efficiency frontier was computed using arithmetic returns, the outcome would have been similar. Based on quarterly returns.

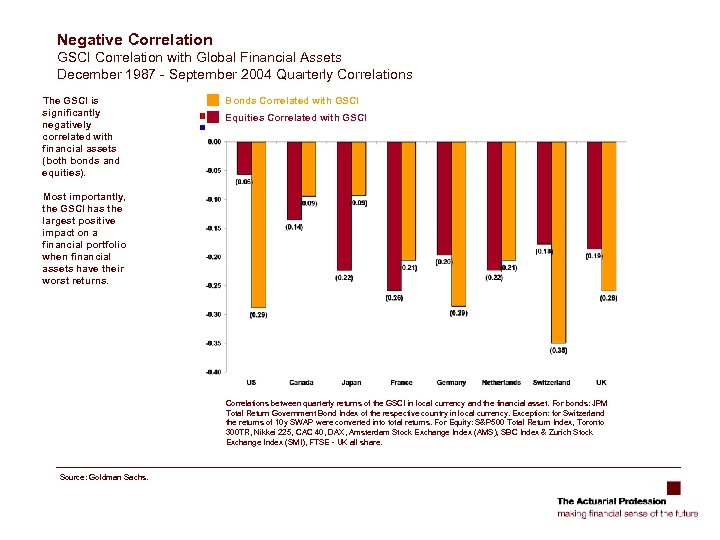

Negative Correlation GSCI Correlation with Global Financial Assets December 1987 - September 2004 Quarterly Correlations The GSCI is significantly negatively correlated with financial assets (both bonds and equities). Bonds Correlated with GSCI Equities Correlated with GSCI Most importantly, the GSCI has the largest positive impact on a financial portfolio when financial assets have their worst returns. Correlations between quarterly returns of the GSCI in local currency and the financial asset. For bonds: JPM Total Return Government Bond Index of the respective country in local currency. Exception: for Switzerland the returns of 10 y SWAP were converted into total returns. For Equity: S&P 500 Total Return Index, Toronto 300 TR, Nikkei 225, CAC 40, DAX, Amsterdam Stock Exchange Index (AMS), SBC Index & Zurich Stock Exchange Index (SMI), FTSE - UK all share. Source: Goldman Sachs.

Negative Correlation GSCI Correlation with Global Financial Assets December 1987 - September 2004 Quarterly Correlations The GSCI is significantly negatively correlated with financial assets (both bonds and equities). Bonds Correlated with GSCI Equities Correlated with GSCI Most importantly, the GSCI has the largest positive impact on a financial portfolio when financial assets have their worst returns. Correlations between quarterly returns of the GSCI in local currency and the financial asset. For bonds: JPM Total Return Government Bond Index of the respective country in local currency. Exception: for Switzerland the returns of 10 y SWAP were converted into total returns. For Equity: S&P 500 Total Return Index, Toronto 300 TR, Nikkei 225, CAC 40, DAX, Amsterdam Stock Exchange Index (AMS), SBC Index & Zurich Stock Exchange Index (SMI), FTSE - UK all share. Source: Goldman Sachs.

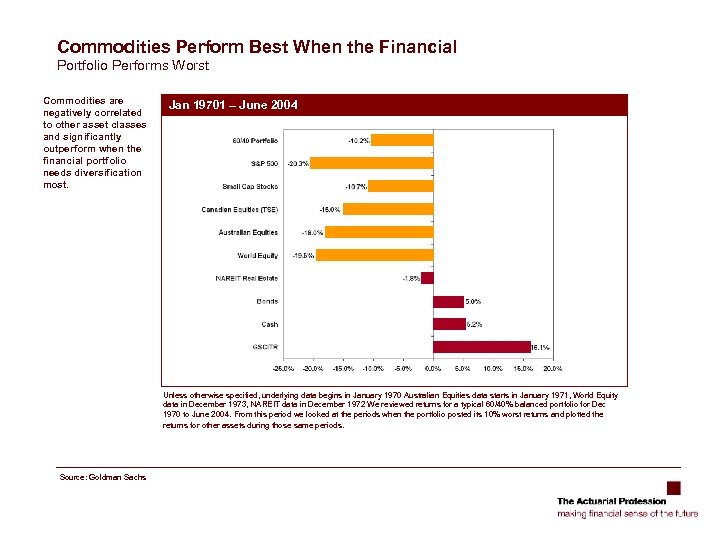

Commodities Perform Best When the Financial Portfolio Performs Worst Commodities are negatively correlated to other asset classes and significantly outperform when the financial portfolio needs diversification most. Jan 19701 – June 2004 Unless otherwise specified, underlying data begins in January 1970 Australian Equities data starts in January 1971, World Equity data in December 1973, NAREIT data in December 1972 We reviewed returns for a typical 60/40% balanced portfolio for Dec 1970 to June 2004. From this period we looked at the periods when the portfolio posted its 10% worst returns and plotted the returns for other assets during those same periods. Source: Goldman Sachs

Commodities Perform Best When the Financial Portfolio Performs Worst Commodities are negatively correlated to other asset classes and significantly outperform when the financial portfolio needs diversification most. Jan 19701 – June 2004 Unless otherwise specified, underlying data begins in January 1970 Australian Equities data starts in January 1971, World Equity data in December 1973, NAREIT data in December 1972 We reviewed returns for a typical 60/40% balanced portfolio for Dec 1970 to June 2004. From this period we looked at the periods when the portfolio posted its 10% worst returns and plotted the returns for other assets during those same periods. Source: Goldman Sachs

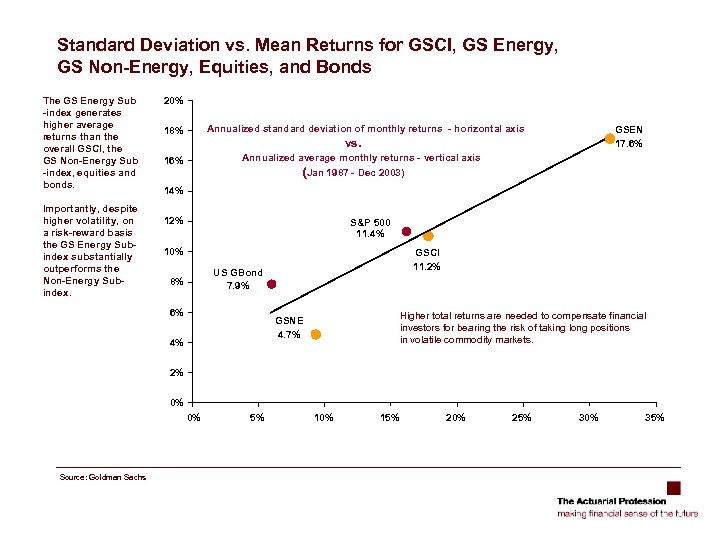

Standard Deviation vs. Mean Returns for GSCI, GS Energy, GS Non-Energy, Equities, and Bonds The GS Energy Sub -index generates higher average returns than the overall GSCI, the GS Non-Energy Sub -index, equities and bonds. Importantly, despite higher volatility, on a risk-reward basis the GS Energy Subindex substantially outperforms the Non-Energy Subindex. 20% Annualized standard deviation of monthly returns - horizontal axis 18% GSEN 17. 6% vs. Annualized average monthly returns - vertical axis 16% (Jan 1987 - Dec 2003) 14% 12% S&P 500 11. 4% 10% GSCI 11. 2% US GBond 7. 9% 8% 6% Higher total returns are needed to compensate financial investors for bearing the risk of taking long positions in volatile commodity markets. GSNE 4. 7% 4% 2% 0% 0% Source: Goldman Sachs 5% 10% 15% 20% 25% 30% 35%

Standard Deviation vs. Mean Returns for GSCI, GS Energy, GS Non-Energy, Equities, and Bonds The GS Energy Sub -index generates higher average returns than the overall GSCI, the GS Non-Energy Sub -index, equities and bonds. Importantly, despite higher volatility, on a risk-reward basis the GS Energy Subindex substantially outperforms the Non-Energy Subindex. 20% Annualized standard deviation of monthly returns - horizontal axis 18% GSEN 17. 6% vs. Annualized average monthly returns - vertical axis 16% (Jan 1987 - Dec 2003) 14% 12% S&P 500 11. 4% 10% GSCI 11. 2% US GBond 7. 9% 8% 6% Higher total returns are needed to compensate financial investors for bearing the risk of taking long positions in volatile commodity markets. GSNE 4. 7% 4% 2% 0% 0% Source: Goldman Sachs 5% 10% 15% 20% 25% 30% 35%

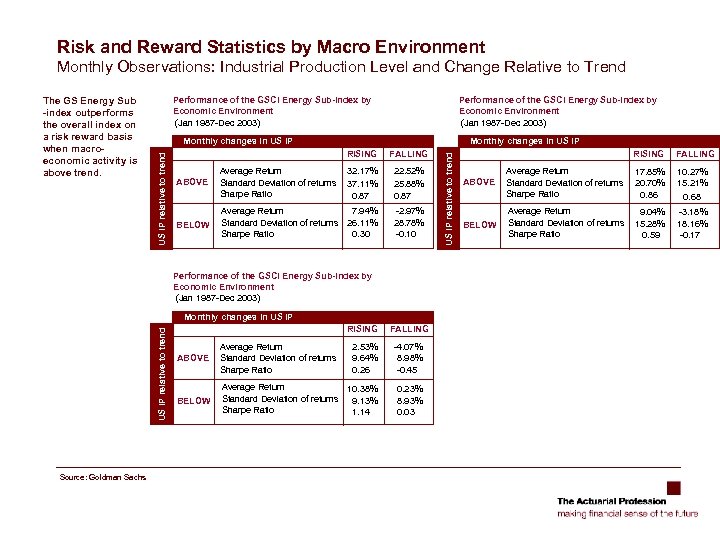

Risk and Reward Statistics by Macro Environment Monthly Observations: Industrial Production Level and Change Relative to Trend Performance of the GSCI Energy Sub-Index by Economic Environment (Jan 1987 -Dec 2003) Monthly changes in US IP RISING FALLING ABOVE Average Return Standard Deviation of returns Sharpe Ratio 32. 17% 37. 11% 0. 87 22. 52% 25. 88% 0. 87 BELOW Average Return 7. 94% Standard Deviation of returns 26. 11% Sharpe Ratio 0. 30 -2. 97% 28. 78% -0. 10 Performance of the GSCI Energy Sub-Index by Economic Environment (Jan 1987 -Dec 2003) US IP relative to trend Monthly changes in US IP Source: Goldman Sachs RISING FALLING ABOVE Average Return Standard Deviation of returns Sharpe Ratio 2. 53% 9. 64% 0. 26 -4. 07% 8. 98% -0. 45 BELOW Average Return 10. 38% Standard Deviation of returns 9. 13% Sharpe Ratio 1. 14 0. 23% 8. 93% 0. 03 US IP relative to trend Monthly changes in US IP relative to trend The GS Energy Sub -index outperforms the overall index on a risk reward basis when macroeconomic activity is above trend. RISING FALLING ABOVE Average Return Standard Deviation of returns Sharpe Ratio 17. 85% 20. 70% 0. 86 10. 27% 15. 21% 0. 68 BELOW Average Return Standard Deviation of returns Sharpe Ratio 9. 04% 15. 28% 0. 59 -3. 18% 18. 16% -0. 17

Risk and Reward Statistics by Macro Environment Monthly Observations: Industrial Production Level and Change Relative to Trend Performance of the GSCI Energy Sub-Index by Economic Environment (Jan 1987 -Dec 2003) Monthly changes in US IP RISING FALLING ABOVE Average Return Standard Deviation of returns Sharpe Ratio 32. 17% 37. 11% 0. 87 22. 52% 25. 88% 0. 87 BELOW Average Return 7. 94% Standard Deviation of returns 26. 11% Sharpe Ratio 0. 30 -2. 97% 28. 78% -0. 10 Performance of the GSCI Energy Sub-Index by Economic Environment (Jan 1987 -Dec 2003) US IP relative to trend Monthly changes in US IP Source: Goldman Sachs RISING FALLING ABOVE Average Return Standard Deviation of returns Sharpe Ratio 2. 53% 9. 64% 0. 26 -4. 07% 8. 98% -0. 45 BELOW Average Return 10. 38% Standard Deviation of returns 9. 13% Sharpe Ratio 1. 14 0. 23% 8. 93% 0. 03 US IP relative to trend Monthly changes in US IP relative to trend The GS Energy Sub -index outperforms the overall index on a risk reward basis when macroeconomic activity is above trend. RISING FALLING ABOVE Average Return Standard Deviation of returns Sharpe Ratio 17. 85% 20. 70% 0. 86 10. 27% 15. 21% 0. 68 BELOW Average Return Standard Deviation of returns Sharpe Ratio 9. 04% 15. 28% 0. 59 -3. 18% 18. 16% -0. 17

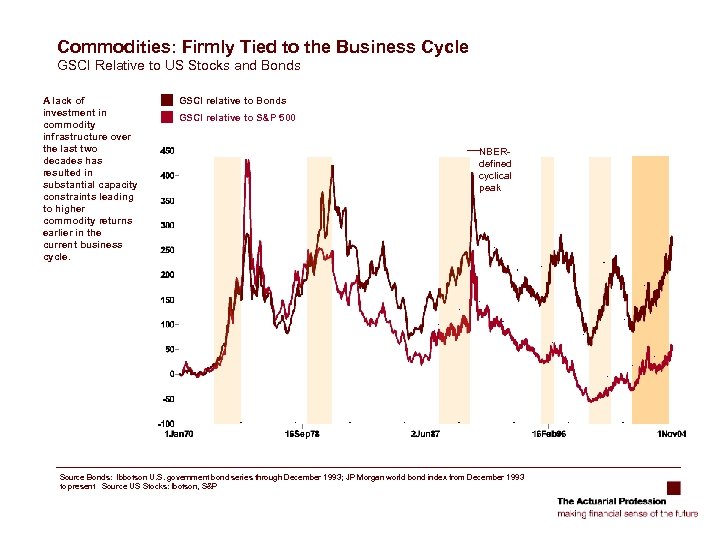

Commodities: Firmly Tied to the Business Cycle GSCI Relative to US Stocks and Bonds A lack of investment in commodity infrastructure over the last two decades has resulted in substantial capacity constraints leading to higher commodity returns earlier in the current business cycle. GSCI relative to Bonds GSCI relative to S&P 500 NBERdefined cyclical peak Source Bonds: Ibbotson U. S. government bond series through December 1993; JP Morgan world bond index from December 1993 to present Source US Stocks: Ibotson, S&P

Commodities: Firmly Tied to the Business Cycle GSCI Relative to US Stocks and Bonds A lack of investment in commodity infrastructure over the last two decades has resulted in substantial capacity constraints leading to higher commodity returns earlier in the current business cycle. GSCI relative to Bonds GSCI relative to S&P 500 NBERdefined cyclical peak Source Bonds: Ibbotson U. S. government bond series through December 1993; JP Morgan world bond index from December 1993 to present Source US Stocks: Ibotson, S&P

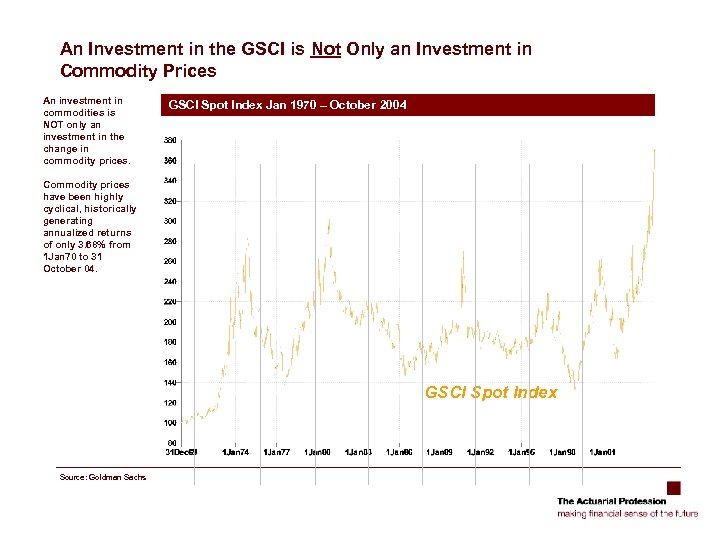

An Investment in the GSCI is Not Only an Investment in Commodity Prices An investment in commodities is NOT only an investment in the change in commodity prices. GSCI Spot Index Jan 1970 – October 2004 Commodity prices have been highly cyclical, historically generating annualized returns of only 3. 68% from 1 Jan 70 to 31 October 04. GSCI Spot Index Source: Goldman Sachs

An Investment in the GSCI is Not Only an Investment in Commodity Prices An investment in commodities is NOT only an investment in the change in commodity prices. GSCI Spot Index Jan 1970 – October 2004 Commodity prices have been highly cyclical, historically generating annualized returns of only 3. 68% from 1 Jan 70 to 31 October 04. GSCI Spot Index Source: Goldman Sachs

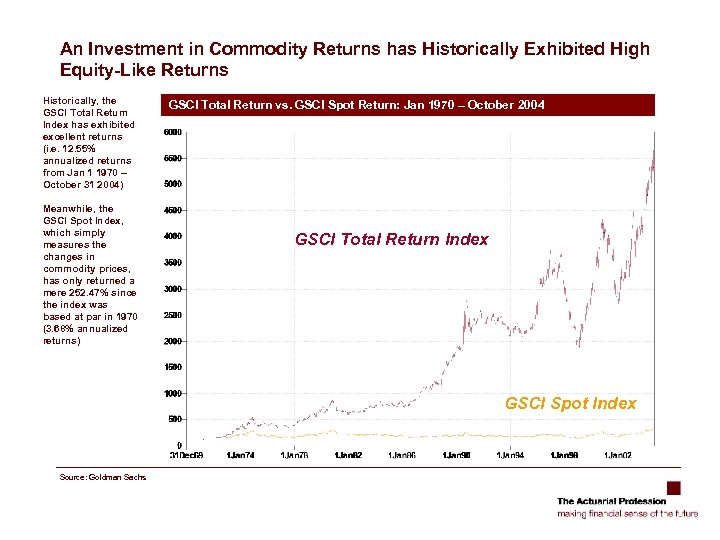

An Investment in Commodity Returns has Historically Exhibited High Equity-Like Returns Historically, the GSCI Total Return Index has exhibited excellent returns (i. e. 12. 55% annualized returns from Jan 1 1970 – October 31 2004) Meanwhile, the GSCI Spot Index, which simply measures the changes in commodity prices, has only returned a mere 252. 47% since the index was based at par in 1970 (3. 68% annualized returns) GSCI Total Return vs. GSCI Spot Return: Jan 1970 – October 2004 GSCI Total Return Index GSCI Spot Index Source: Goldman Sachs

An Investment in Commodity Returns has Historically Exhibited High Equity-Like Returns Historically, the GSCI Total Return Index has exhibited excellent returns (i. e. 12. 55% annualized returns from Jan 1 1970 – October 31 2004) Meanwhile, the GSCI Spot Index, which simply measures the changes in commodity prices, has only returned a mere 252. 47% since the index was based at par in 1970 (3. 68% annualized returns) GSCI Total Return vs. GSCI Spot Return: Jan 1970 – October 2004 GSCI Total Return Index GSCI Spot Index Source: Goldman Sachs

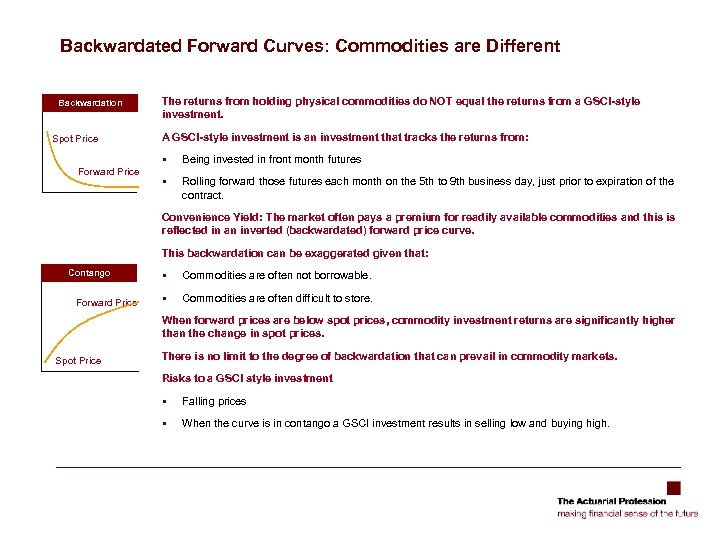

Backwardated Forward Curves: Commodities are Different Backwardation Spot Price The returns from holding physical commodities do NOT equal the returns from a GSCI-style investment. A GSCI-style investment is an investment that tracks the returns from: § Forward Price Being invested in front month futures § Rolling forward those futures each month on the 5 th to 9 th business day, just prior to expiration of the contract. Convenience Yield: The market often pays a premium for readily available commodities and this is reflected in an inverted (backwardated) forward price curve. This backwardation can be exaggerated given that: Contango Forward Price § Commodities are often not borrowable. § Commodities are often difficult to store. When forward prices are below spot prices, commodity investment returns are significantly higher than the change in spot prices. Spot Price There is no limit to the degree of backwardation that can prevail in commodity markets. Risks to a GSCI style investment § Falling prices § When the curve is in contango a GSCI investment results in selling low and buying high.

Backwardated Forward Curves: Commodities are Different Backwardation Spot Price The returns from holding physical commodities do NOT equal the returns from a GSCI-style investment. A GSCI-style investment is an investment that tracks the returns from: § Forward Price Being invested in front month futures § Rolling forward those futures each month on the 5 th to 9 th business day, just prior to expiration of the contract. Convenience Yield: The market often pays a premium for readily available commodities and this is reflected in an inverted (backwardated) forward price curve. This backwardation can be exaggerated given that: Contango Forward Price § Commodities are often not borrowable. § Commodities are often difficult to store. When forward prices are below spot prices, commodity investment returns are significantly higher than the change in spot prices. Spot Price There is no limit to the degree of backwardation that can prevail in commodity markets. Risks to a GSCI style investment § Falling prices § When the curve is in contango a GSCI investment results in selling low and buying high.

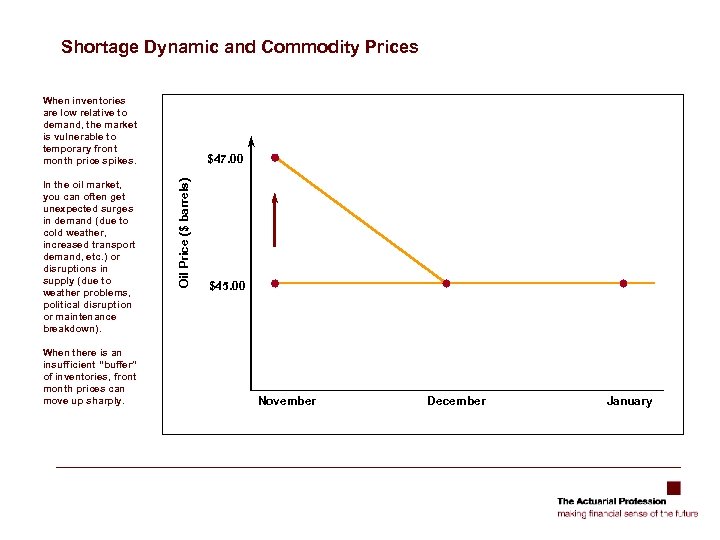

Shortage Dynamic and Commodity Prices When inventories are low relative to demand, the market is vulnerable to temporary front month price spikes. When there is an insufficient “buffer” of inventories, front month prices can move up sharply. Oil Price ($ barrels) In the oil market, you can often get unexpected surges in demand (due to cold weather, increased transport demand, etc. ) or disruptions in supply (due to weather problems, political disruption or maintenance breakdown). $47. 00 $45. 00 November December January

Shortage Dynamic and Commodity Prices When inventories are low relative to demand, the market is vulnerable to temporary front month price spikes. When there is an insufficient “buffer” of inventories, front month prices can move up sharply. Oil Price ($ barrels) In the oil market, you can often get unexpected surges in demand (due to cold weather, increased transport demand, etc. ) or disruptions in supply (due to weather problems, political disruption or maintenance breakdown). $47. 00 $45. 00 November December January

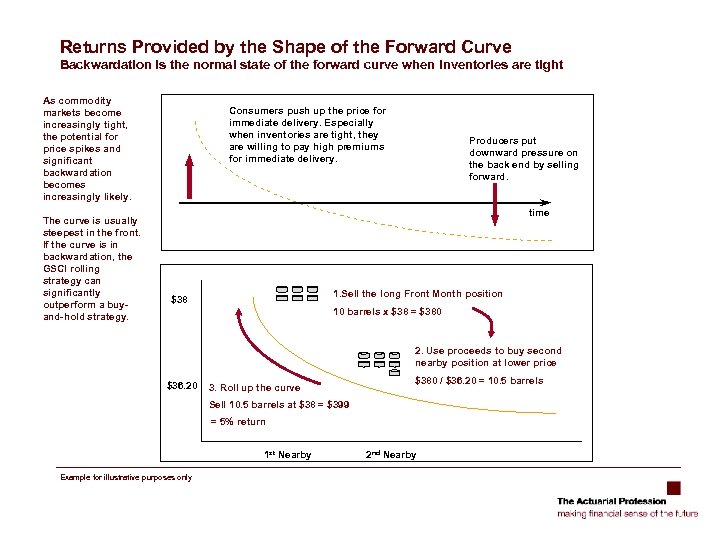

Returns Provided by the Shape of the Forward Curve Backwardation is the normal state of the forward curve when inventories are tight As commodity markets become increasingly tight, the potential for price spikes and significant backwardation becomes increasingly likely. The curve is usually steepest in the front. If the curve is in backwardation, the GSCI rolling strategy can significantly outperform a buyand-hold strategy. Consumers push up the price for immediate delivery. Especially when inventories are tight, they are willing to pay high premiums for immediate delivery. Producers put downward pressure on the back end by selling forward. time 1. Sell the long Front Month position $38 10 barrels x $38 = $380 2. Use proceeds to buy second nearby position at lower price $36. 20 3. Roll up the curve $380 / $36. 20 = 10. 5 barrels Sell 10. 5 barrels at $38 = $399 = 5% return 1 st Nearby Example for illustrative purposes only 2 nd Nearby

Returns Provided by the Shape of the Forward Curve Backwardation is the normal state of the forward curve when inventories are tight As commodity markets become increasingly tight, the potential for price spikes and significant backwardation becomes increasingly likely. The curve is usually steepest in the front. If the curve is in backwardation, the GSCI rolling strategy can significantly outperform a buyand-hold strategy. Consumers push up the price for immediate delivery. Especially when inventories are tight, they are willing to pay high premiums for immediate delivery. Producers put downward pressure on the back end by selling forward. time 1. Sell the long Front Month position $38 10 barrels x $38 = $380 2. Use proceeds to buy second nearby position at lower price $36. 20 3. Roll up the curve $380 / $36. 20 = 10. 5 barrels Sell 10. 5 barrels at $38 = $399 = 5% return 1 st Nearby Example for illustrative purposes only 2 nd Nearby

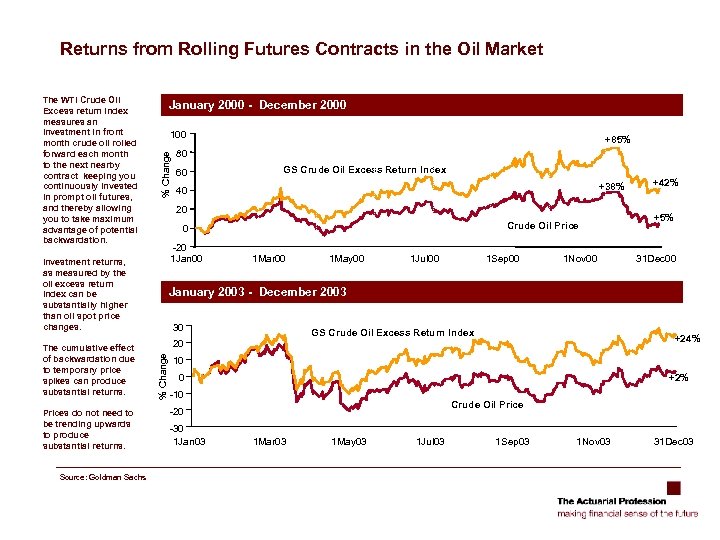

Returns from Rolling Futures Contracts in the Oil Market January 2000 - December 2000 100 % Change The WTI Crude Oil Excess return index measures an investment in front month crude oil rolled forward each month to the next nearby contract keeping you continuously invested in prompt oil futures, and thereby allowing you to take maximum advantage of potential backwardation. Prices do not need to be trending upwards to produce substantial returns. Source: Goldman Sachs 80 60 GS Crude Oil Excess Return Index +38% 40 20 Crude Oil Price 0 -20 1 Jan 00 Investment returns, as measured by the oil excess return index can be substantially higher than oil spot price changes. 1 Mar 00 1 May 00 1 Jul 00 1 Sep 00 1 Nov 00 +42% +5% 31 Dec 00 January 2003 - December 2003 30 GS Crude Oil Excess Return Index +24% 20 % Change The cumulative effect of backwardation due to temporary price spikes can produce substantial returns. +85% 10 +2% 0 -10 Crude Oil Price -20 -30 1 Jan 03 1 Mar 03 1 May 03 1 Jul 03 1 Sep 03 1 Nov 03 31 Dec 03

Returns from Rolling Futures Contracts in the Oil Market January 2000 - December 2000 100 % Change The WTI Crude Oil Excess return index measures an investment in front month crude oil rolled forward each month to the next nearby contract keeping you continuously invested in prompt oil futures, and thereby allowing you to take maximum advantage of potential backwardation. Prices do not need to be trending upwards to produce substantial returns. Source: Goldman Sachs 80 60 GS Crude Oil Excess Return Index +38% 40 20 Crude Oil Price 0 -20 1 Jan 00 Investment returns, as measured by the oil excess return index can be substantially higher than oil spot price changes. 1 Mar 00 1 May 00 1 Jul 00 1 Sep 00 1 Nov 00 +42% +5% 31 Dec 00 January 2003 - December 2003 30 GS Crude Oil Excess Return Index +24% 20 % Change The cumulative effect of backwardation due to temporary price spikes can produce substantial returns. +85% 10 +2% 0 -10 Crude Oil Price -20 -30 1 Jan 03 1 Mar 03 1 May 03 1 Jul 03 1 Sep 03 1 Nov 03 31 Dec 03

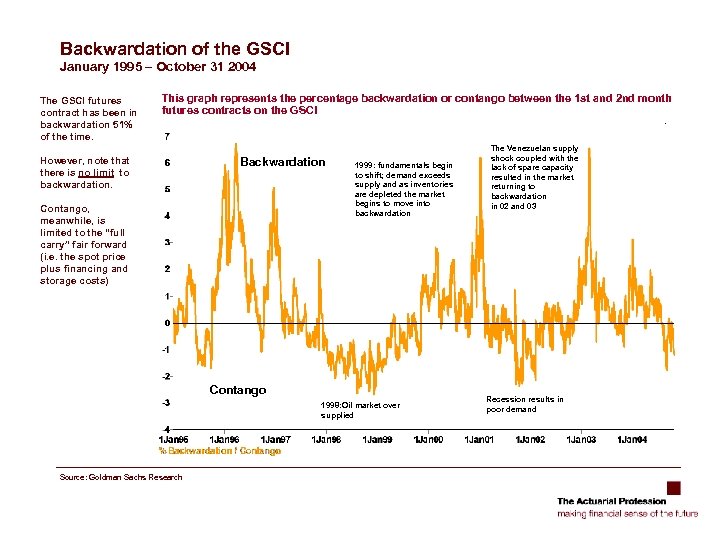

Backwardation of the GSCI January 1995 – October 31 2004 The GSCI futures contract has been in backwardation 51% of the time. This graph represents the percentage backwardation or contango between the 1 st and 2 nd month futures contracts on the GSCI However, note that there is no limit to backwardation. Backwardation Contango, meanwhile, is limited to the “full carry” fair forward (i. e. the spot price plus financing and storage costs) 1999: fundamentals begin to shift; demand exceeds supply and as inventories are depleted the market begins to move into backwardation Contango 1998: Oil market over supplied Source: Goldman Sachs Research The Venezuelan supply shock coupled with the lack of spare capacity resulted in the market returning to backwardation in 02 and 03 Recession results in poor demand

Backwardation of the GSCI January 1995 – October 31 2004 The GSCI futures contract has been in backwardation 51% of the time. This graph represents the percentage backwardation or contango between the 1 st and 2 nd month futures contracts on the GSCI However, note that there is no limit to backwardation. Backwardation Contango, meanwhile, is limited to the “full carry” fair forward (i. e. the spot price plus financing and storage costs) 1999: fundamentals begin to shift; demand exceeds supply and as inventories are depleted the market begins to move into backwardation Contango 1998: Oil market over supplied Source: Goldman Sachs Research The Venezuelan supply shock coupled with the lack of spare capacity resulted in the market returning to backwardation in 02 and 03 Recession results in poor demand

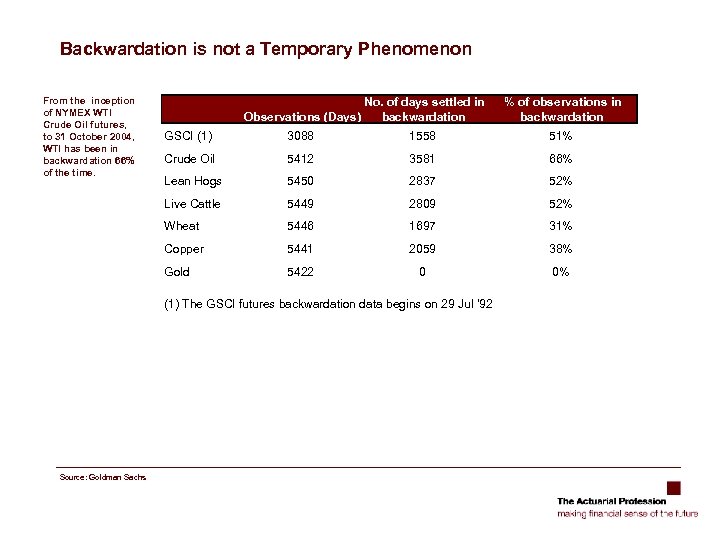

Backwardation is not a Temporary Phenomenon From the inception of NYMEX WTI Crude Oil futures, to 31 October 2004, WTI has been in backwardation 66% of the time. No. of days settled in Observations (Days) backwardation % of observations in backwardation GSCI (1) 3088 1558 51% Crude Oil 5412 3581 66% Lean Hogs 5450 2837 52% Live Cattle 5449 2809 52% Wheat 5446 1697 31% Copper 5441 2059 38% Gold 5422 0 0% (1) The GSCI futures backwardation data begins on 29 Jul '92 Source: Goldman Sachs

Backwardation is not a Temporary Phenomenon From the inception of NYMEX WTI Crude Oil futures, to 31 October 2004, WTI has been in backwardation 66% of the time. No. of days settled in Observations (Days) backwardation % of observations in backwardation GSCI (1) 3088 1558 51% Crude Oil 5412 3581 66% Lean Hogs 5450 2837 52% Live Cattle 5449 2809 52% Wheat 5446 1697 31% Copper 5441 2059 38% Gold 5422 0 0% (1) The GSCI futures backwardation data begins on 29 Jul '92 Source: Goldman Sachs

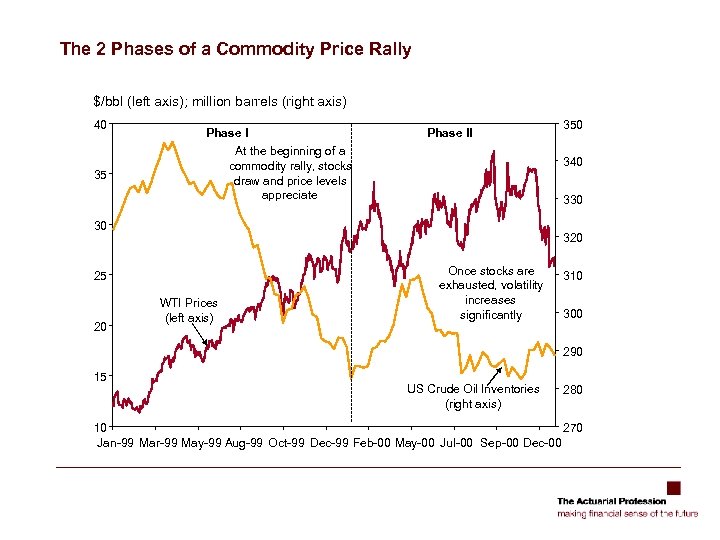

The 2 Phases of a Commodity Price Rally $/bbl (left axis); million barrels (right axis) 40 Phase II At the beginning of a commodity rally, stocks draw and price levels appreciate 35 340 330 30 320 25 20 350 WTI Prices (left axis) Once stocks are exhausted, volatility increases significantly 310 300 290 15 US Crude Oil Inventories (right axis) 280 10 270 Jan-99 Mar-99 May-99 Aug-99 Oct-99 Dec-99 Feb-00 May-00 Jul-00 Sep-00 Dec-00

The 2 Phases of a Commodity Price Rally $/bbl (left axis); million barrels (right axis) 40 Phase II At the beginning of a commodity rally, stocks draw and price levels appreciate 35 340 330 30 320 25 20 350 WTI Prices (left axis) Once stocks are exhausted, volatility increases significantly 310 300 290 15 US Crude Oil Inventories (right axis) 280 10 270 Jan-99 Mar-99 May-99 Aug-99 Oct-99 Dec-99 Feb-00 May-00 Jul-00 Sep-00 Dec-00

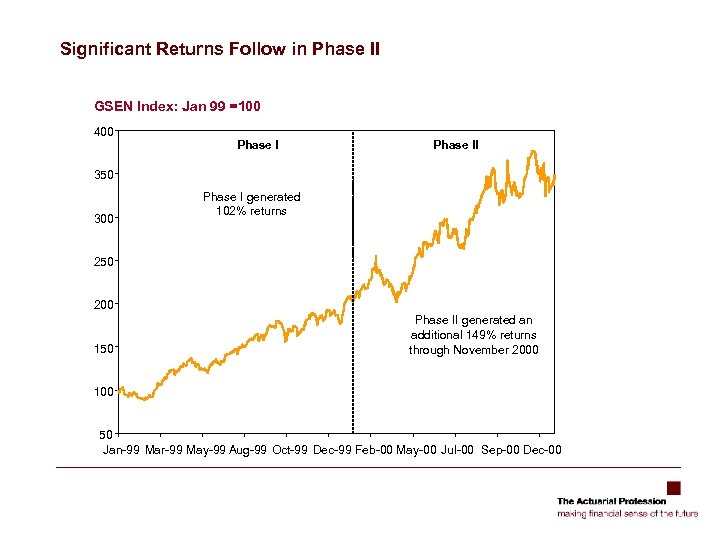

Significant Returns Follow in Phase II GSEN Index: Jan 99 =100 400 Phase II 350 300 Phase I generated 102% returns 250 200 150 Phase II generated an additional 149% returns through November 2000 100 50 Jan-99 Mar-99 May-99 Aug-99 Oct-99 Dec-99 Feb-00 May-00 Jul-00 Sep-00 Dec-00

Significant Returns Follow in Phase II GSEN Index: Jan 99 =100 400 Phase II 350 300 Phase I generated 102% returns 250 200 150 Phase II generated an additional 149% returns through November 2000 100 50 Jan-99 Mar-99 May-99 Aug-99 Oct-99 Dec-99 Feb-00 May-00 Jul-00 Sep-00 Dec-00

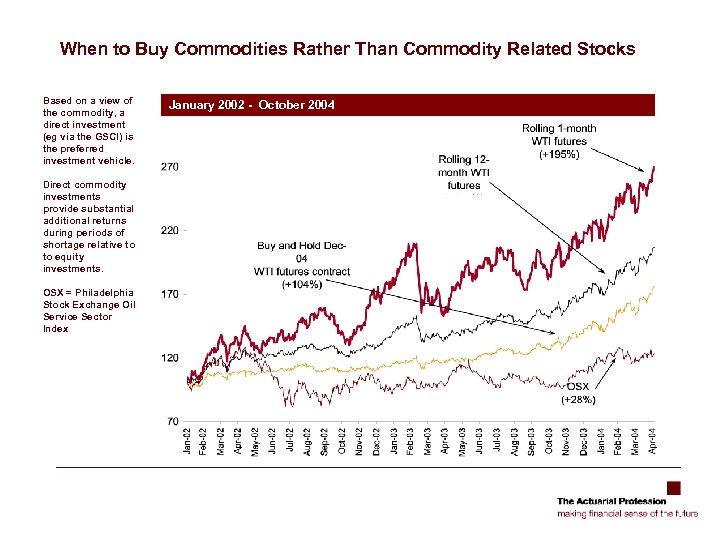

When to Buy Commodities Rather Than Commodity Related Stocks Based on a view of the commodity, a direct investment (eg via the GSCI) is the preferred investment vehicle. Direct commodity investments provide substantial additional returns during periods of shortage relative to to equity investments. OSX = Philadelphia Stock Exchange Oil Service Sector Index January 2002 - October 2004

When to Buy Commodities Rather Than Commodity Related Stocks Based on a view of the commodity, a direct investment (eg via the GSCI) is the preferred investment vehicle. Direct commodity investments provide substantial additional returns during periods of shortage relative to to equity investments. OSX = Philadelphia Stock Exchange Oil Service Sector Index January 2002 - October 2004

Inadequate investment in commodity industries will likely continue to support returns from commodities throughout the remainder of the current investment phase

Inadequate investment in commodity industries will likely continue to support returns from commodities throughout the remainder of the current investment phase

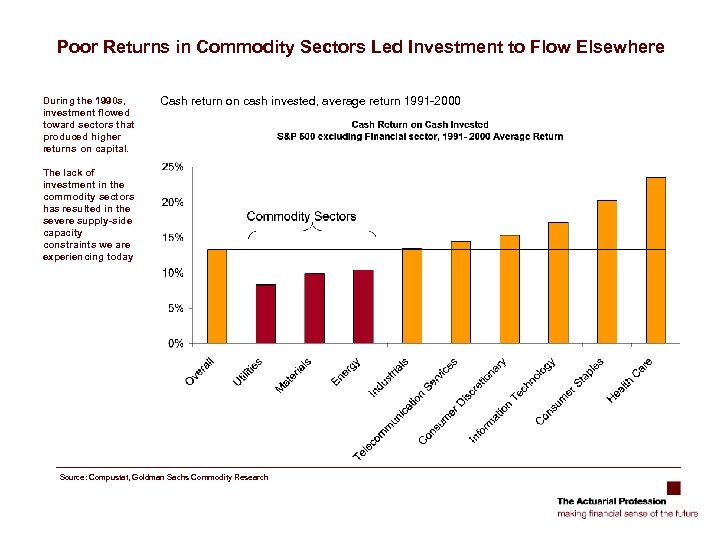

Poor Returns in Commodity Sectors Led Investment to Flow Elsewhere During the 1990 s, investment flowed toward sectors that produced higher returns on capital. Cash return on cash invested, average return 1991 -2000 The lack of investment in the commodity sectors has resulted in the severe supply-side capacity constraints we are experiencing today Source: Compustat, Goldman Sachs Commodity Research

Poor Returns in Commodity Sectors Led Investment to Flow Elsewhere During the 1990 s, investment flowed toward sectors that produced higher returns on capital. Cash return on cash invested, average return 1991 -2000 The lack of investment in the commodity sectors has resulted in the severe supply-side capacity constraints we are experiencing today Source: Compustat, Goldman Sachs Commodity Research

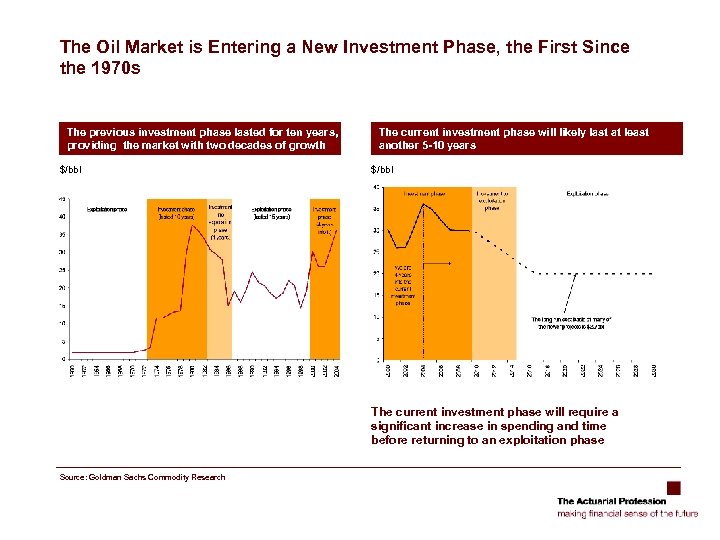

The Oil Market is Entering a New Investment Phase, the First Since the 1970 s The previous investment phase lasted for ten years, providing the market with two decades of growth $/bbl The current investment phase will likely last at least another 5 -10 years $/bbl The current investment phase will require a significant increase in spending and time before returning to an exploitation phase Source: Goldman Sachs Commodity Research

The Oil Market is Entering a New Investment Phase, the First Since the 1970 s The previous investment phase lasted for ten years, providing the market with two decades of growth $/bbl The current investment phase will likely last at least another 5 -10 years $/bbl The current investment phase will require a significant increase in spending and time before returning to an exploitation phase Source: Goldman Sachs Commodity Research

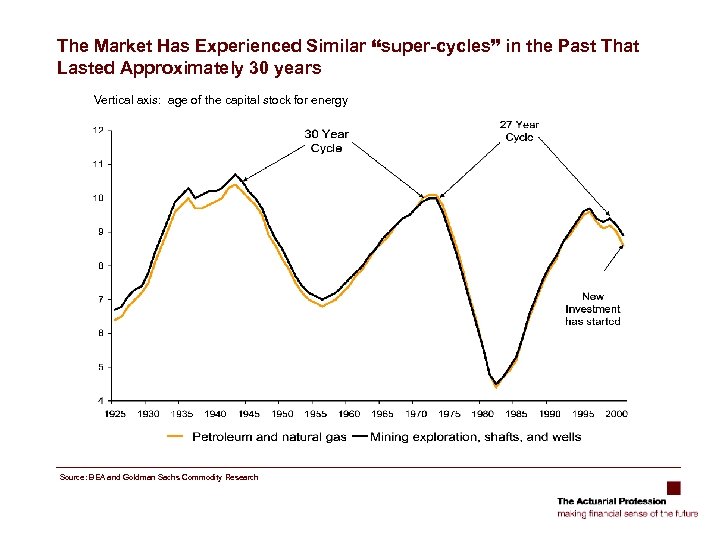

The Market Has Experienced Similar “super-cycles” in the Past That Lasted Approximately 30 years Vertical axis: age of the capital stock for energy Source: BEA and Goldman Sachs Commodity Research

The Market Has Experienced Similar “super-cycles” in the Past That Lasted Approximately 30 years Vertical axis: age of the capital stock for energy Source: BEA and Goldman Sachs Commodity Research

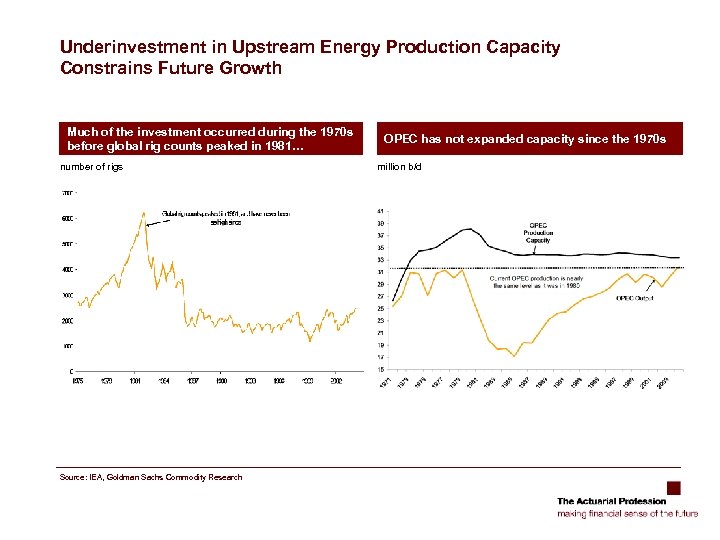

Underinvestment in Upstream Energy Production Capacity Constrains Future Growth Much of the investment occurred during the 1970 s before global rig counts peaked in 1981… number of rigs Source: IEA, Goldman Sachs Commodity Research OPEC has not expanded capacity since the 1970 s million b/d

Underinvestment in Upstream Energy Production Capacity Constrains Future Growth Much of the investment occurred during the 1970 s before global rig counts peaked in 1981… number of rigs Source: IEA, Goldman Sachs Commodity Research OPEC has not expanded capacity since the 1970 s million b/d

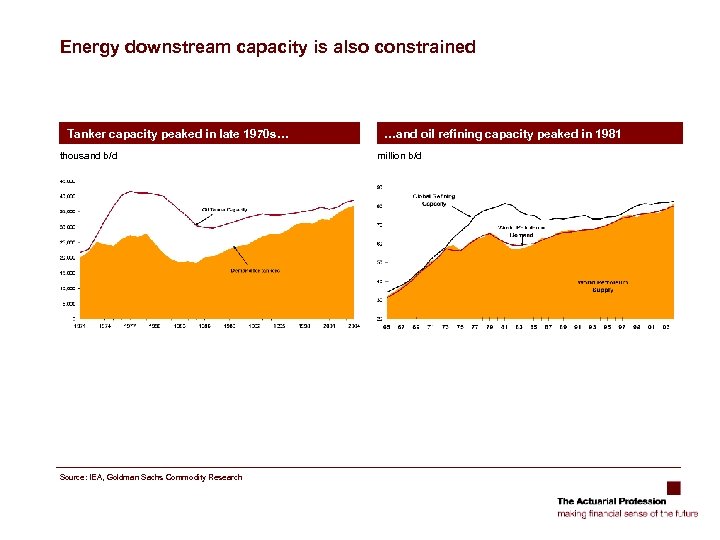

Energy downstream capacity is also constrained Tanker capacity peaked in late 1970 s… thousand b/d Source: IEA, Goldman Sachs Commodity Research …and oil refining capacity peaked in 1981 million b/d

Energy downstream capacity is also constrained Tanker capacity peaked in late 1970 s… thousand b/d Source: IEA, Goldman Sachs Commodity Research …and oil refining capacity peaked in 1981 million b/d

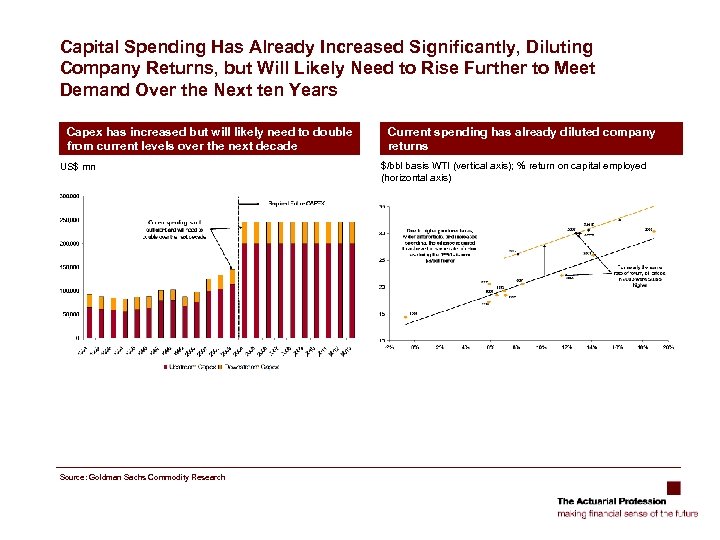

Capital Spending Has Already Increased Significantly, Diluting Company Returns, but Will Likely Need to Rise Further to Meet Demand Over the Next ten Years Capex has increased but will likely need to double from current levels over the next decade US$ mn Source: Goldman Sachs Commodity Research Current spending has already diluted company returns $/bbl basis WTI (vertical axis); % return on capital employed (horizontal axis)

Capital Spending Has Already Increased Significantly, Diluting Company Returns, but Will Likely Need to Rise Further to Meet Demand Over the Next ten Years Capex has increased but will likely need to double from current levels over the next decade US$ mn Source: Goldman Sachs Commodity Research Current spending has already diluted company returns $/bbl basis WTI (vertical axis); % return on capital employed (horizontal axis)

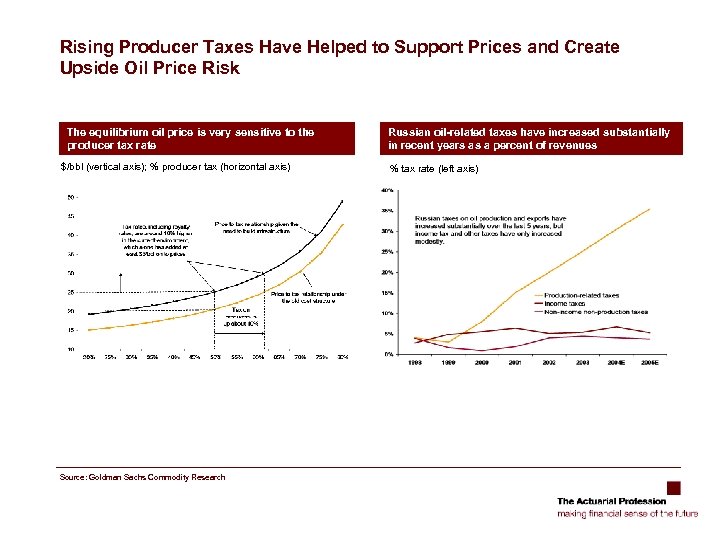

Rising Producer Taxes Have Helped to Support Prices and Create Upside Oil Price Risk The equilibrium oil price is very sensitive to the producer tax rate $/bbl (vertical axis); % producer tax (horizontal axis) Source: Goldman Sachs Commodity Research Russian oil-related taxes have increased substantially in recent years as a percent of revenues % tax rate (left axis)

Rising Producer Taxes Have Helped to Support Prices and Create Upside Oil Price Risk The equilibrium oil price is very sensitive to the producer tax rate $/bbl (vertical axis); % producer tax (horizontal axis) Source: Goldman Sachs Commodity Research Russian oil-related taxes have increased substantially in recent years as a percent of revenues % tax rate (left axis)

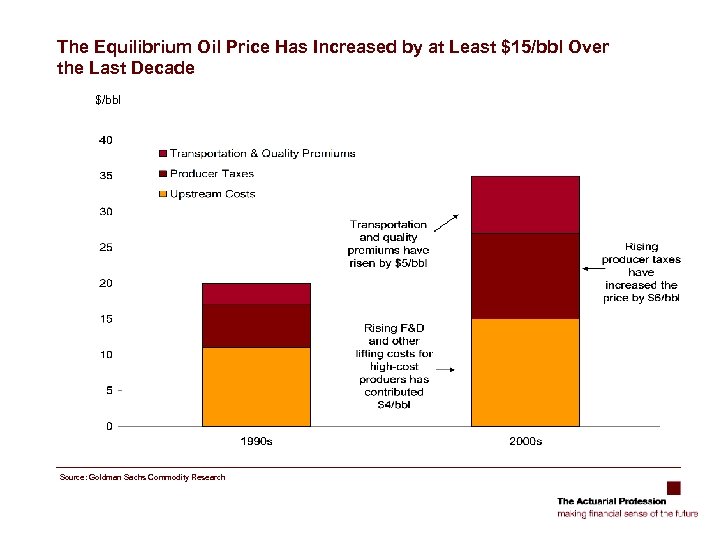

The Equilibrium Oil Price Has Increased by at Least $15/bbl Over the Last Decade $/bbl Source: Goldman Sachs Commodity Research

The Equilibrium Oil Price Has Increased by at Least $15/bbl Over the Last Decade $/bbl Source: Goldman Sachs Commodity Research

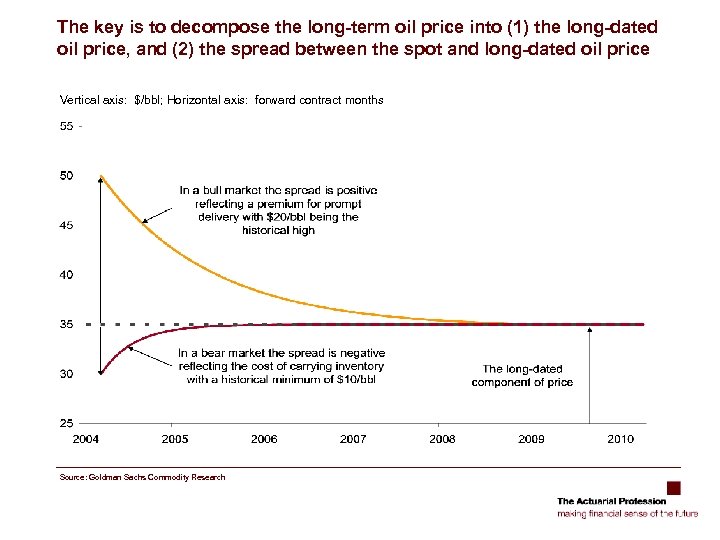

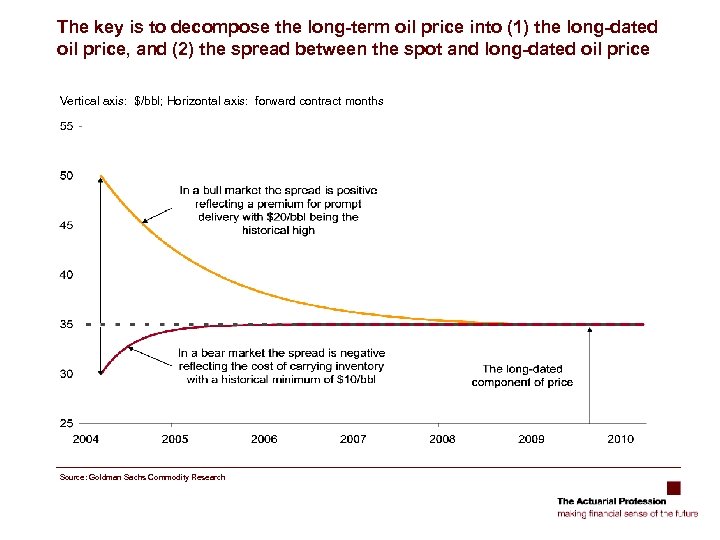

The key is to decompose the long-term oil price into (1) the long-dated oil price, and (2) the spread between the spot and long-dated oil price Vertical axis: $/bbl; Horizontal axis: forward contract months Source: Goldman Sachs Commodity Research

The key is to decompose the long-term oil price into (1) the long-dated oil price, and (2) the spread between the spot and long-dated oil price Vertical axis: $/bbl; Horizontal axis: forward contract months Source: Goldman Sachs Commodity Research

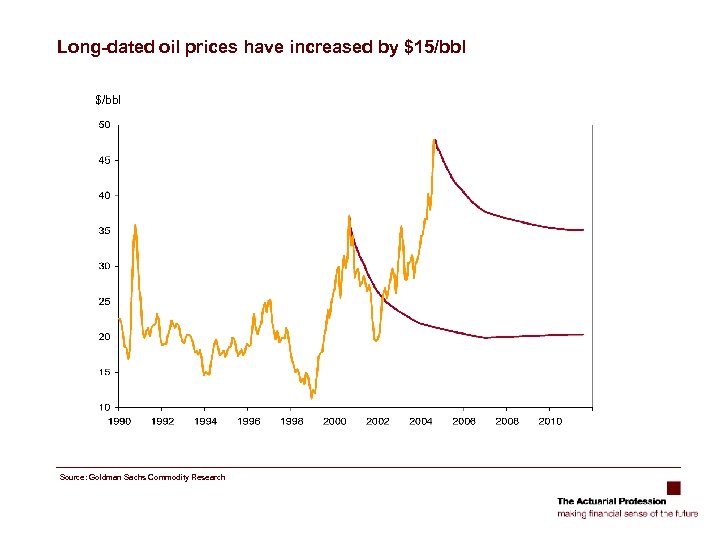

Long-dated oil prices have increased by $15/bbl $/bbl Source: Goldman Sachs Commodity Research

Long-dated oil prices have increased by $15/bbl $/bbl Source: Goldman Sachs Commodity Research

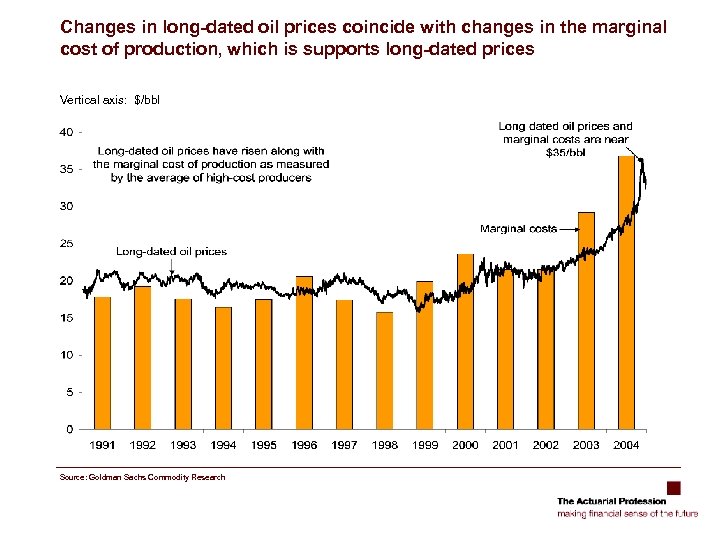

Changes in long-dated oil prices coincide with changes in the marginal cost of production, which is supports long-dated prices Vertical axis: $/bbl Source: Goldman Sachs Commodity Research

Changes in long-dated oil prices coincide with changes in the marginal cost of production, which is supports long-dated prices Vertical axis: $/bbl Source: Goldman Sachs Commodity Research

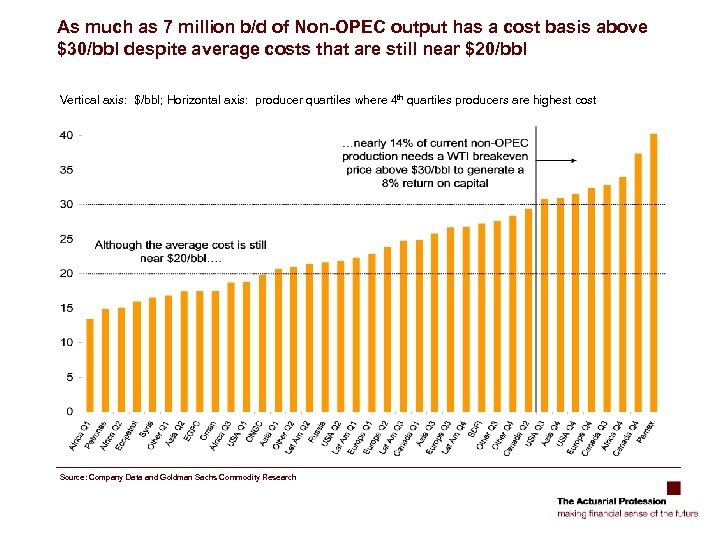

As much as 7 million b/d of Non-OPEC output has a cost basis above $30/bbl despite average costs that are still near $20/bbl Vertical axis: $/bbl; Horizontal axis: producer quartiles where 4 th quartiles producers are highest cost Source: Company Data and Goldman Sachs Commodity Research

As much as 7 million b/d of Non-OPEC output has a cost basis above $30/bbl despite average costs that are still near $20/bbl Vertical axis: $/bbl; Horizontal axis: producer quartiles where 4 th quartiles producers are highest cost Source: Company Data and Goldman Sachs Commodity Research

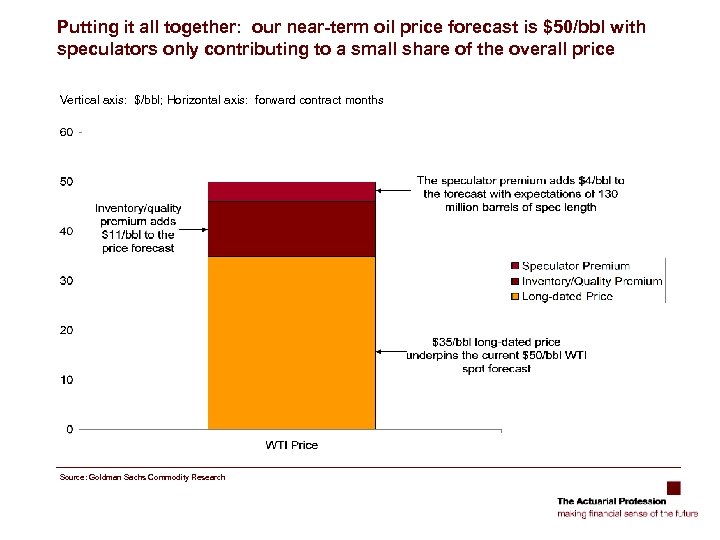

Putting it all together: our near-term oil price forecast is $50/bbl with speculators only contributing to a small share of the overall price Vertical axis: $/bbl; Horizontal axis: forward contract months Source: Goldman Sachs Commodity Research

Putting it all together: our near-term oil price forecast is $50/bbl with speculators only contributing to a small share of the overall price Vertical axis: $/bbl; Horizontal axis: forward contract months Source: Goldman Sachs Commodity Research

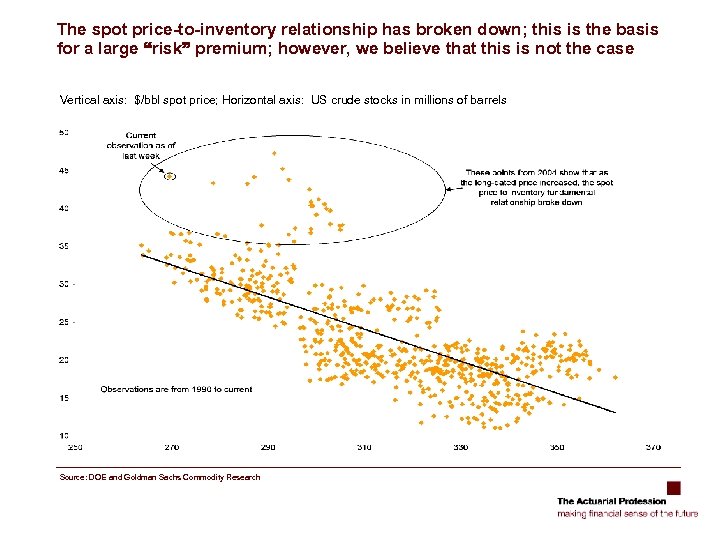

The spot price-to-inventory relationship has broken down; this is the basis for a large “risk” premium; however, we believe that this is not the case Vertical axis: $/bbl spot price; Horizontal axis: US crude stocks in millions of barrels Source: DOE and Goldman Sachs Commodity Research

The spot price-to-inventory relationship has broken down; this is the basis for a large “risk” premium; however, we believe that this is not the case Vertical axis: $/bbl spot price; Horizontal axis: US crude stocks in millions of barrels Source: DOE and Goldman Sachs Commodity Research

The key is to decompose the long-term oil price into (1) the long-dated oil price, and (2) the spread between the spot and long-dated oil price Vertical axis: $/bbl; Horizontal axis: forward contract months Source: Goldman Sachs Commodity Research

The key is to decompose the long-term oil price into (1) the long-dated oil price, and (2) the spread between the spot and long-dated oil price Vertical axis: $/bbl; Horizontal axis: forward contract months Source: Goldman Sachs Commodity Research

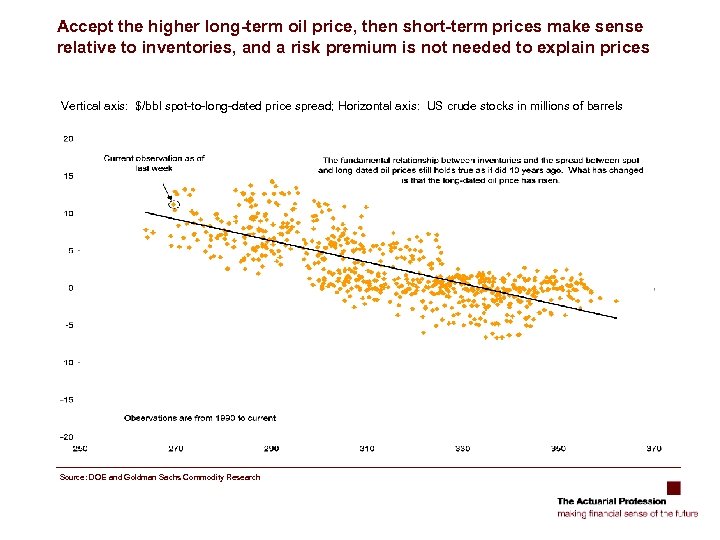

Accept the higher long-term oil price, then short-term prices make sense relative to inventories, and a risk premium is not needed to explain prices Vertical axis: $/bbl spot-to-long-dated price spread; Horizontal axis: US crude stocks in millions of barrels Source: DOE and Goldman Sachs Commodity Research

Accept the higher long-term oil price, then short-term prices make sense relative to inventories, and a risk premium is not needed to explain prices Vertical axis: $/bbl spot-to-long-dated price spread; Horizontal axis: US crude stocks in millions of barrels Source: DOE and Goldman Sachs Commodity Research

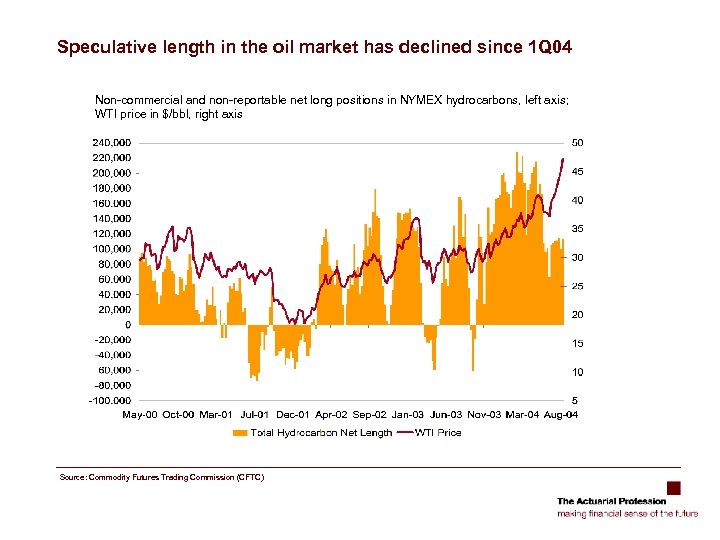

Speculative length in the oil market has declined since 1 Q 04 Non-commercial and non-reportable net long positions in NYMEX hydrocarbons, left axis; WTI price in $/bbl, right axis Source: Commodity Futures Trading Commission (CFTC)

Speculative length in the oil market has declined since 1 Q 04 Non-commercial and non-reportable net long positions in NYMEX hydrocarbons, left axis; WTI price in $/bbl, right axis Source: Commodity Futures Trading Commission (CFTC)

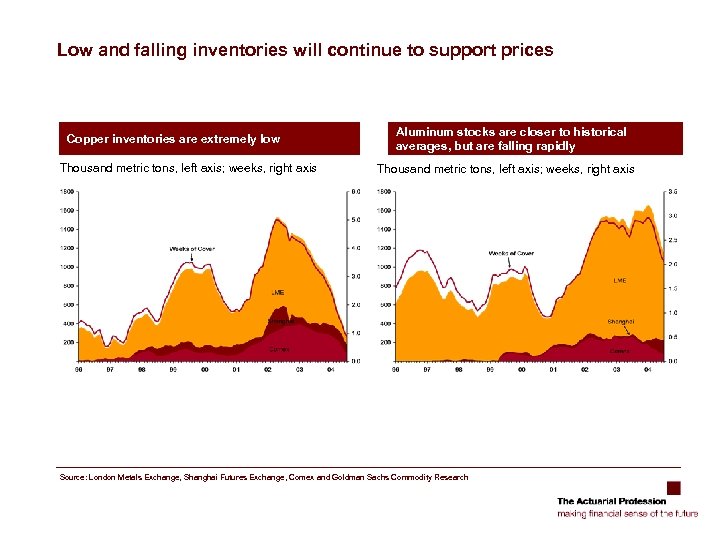

Low and falling inventories will continue to support prices Copper inventories are extremely low Thousand metric tons, left axis; weeks, right axis Aluminum stocks are closer to historical averages, but are falling rapidly Thousand metric tons, left axis; weeks, right axis Source: London Metals Exchange, Shanghai Futures Exchange, Comex and Goldman Sachs Commodity Research

Low and falling inventories will continue to support prices Copper inventories are extremely low Thousand metric tons, left axis; weeks, right axis Aluminum stocks are closer to historical averages, but are falling rapidly Thousand metric tons, left axis; weeks, right axis Source: London Metals Exchange, Shanghai Futures Exchange, Comex and Goldman Sachs Commodity Research

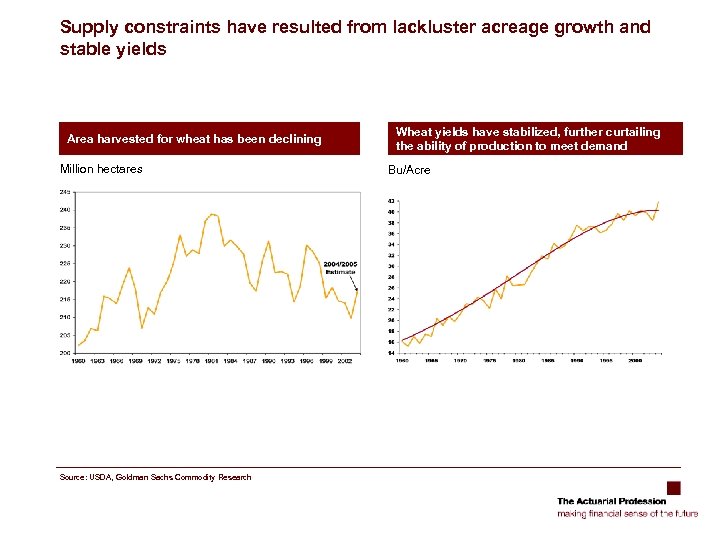

Supply constraints have resulted from lackluster acreage growth and stable yields Area harvested for wheat has been declining Million hectares Source: USDA, Goldman Sachs Commodity Research Wheat yields have stabilized, further curtailing the ability of production to meet demand Bu/Acre

Supply constraints have resulted from lackluster acreage growth and stable yields Area harvested for wheat has been declining Million hectares Source: USDA, Goldman Sachs Commodity Research Wheat yields have stabilized, further curtailing the ability of production to meet demand Bu/Acre

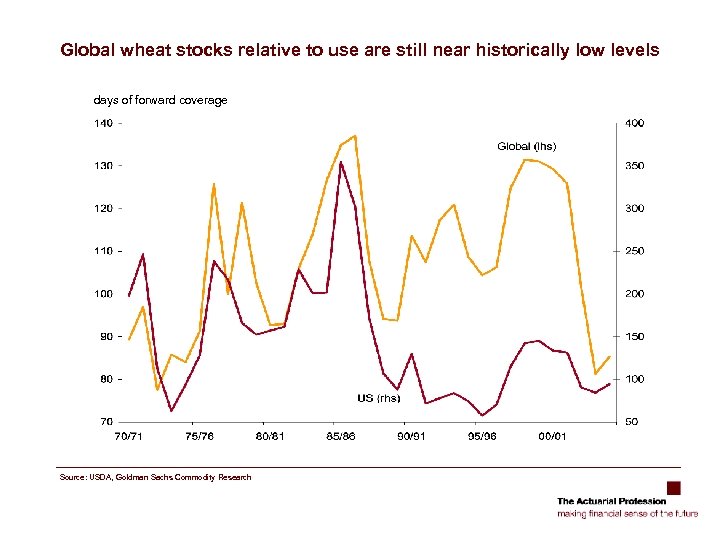

Global wheat stocks relative to use are still near historically low levels days of forward coverage Source: USDA, Goldman Sachs Commodity Research

Global wheat stocks relative to use are still near historically low levels days of forward coverage Source: USDA, Goldman Sachs Commodity Research

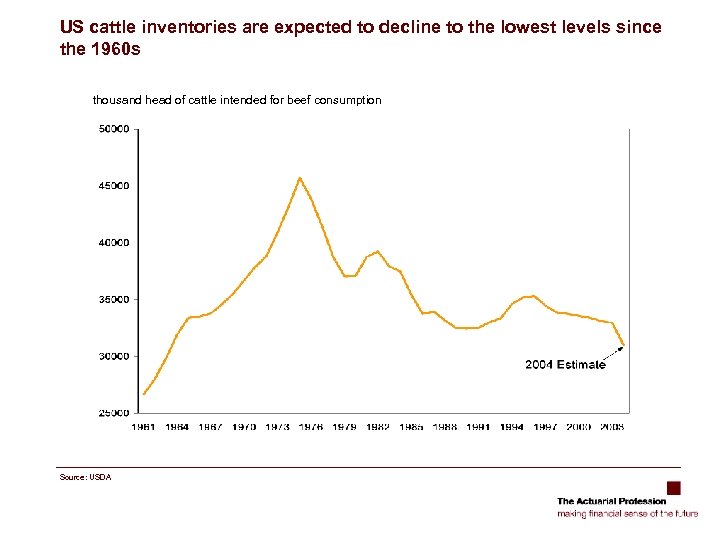

US cattle inventories are expected to decline to the lowest levels since the 1960 s thousand head of cattle intended for beef consumption Source: USDA

US cattle inventories are expected to decline to the lowest levels since the 1960 s thousand head of cattle intended for beef consumption Source: USDA

How to Invest

How to Invest

Many Ways to Invest For institutional investors there are various ways of implementing a GSCI investment. Swaps have proven to be most popular. § The GSCI is very liquid and you can invest large amounts with minimal slippage. § There a variety of ways for investors to get exposure to the GSCI, including: – Swaps – Certificates – Structured Notes and Options – GSCI Futures Contract – Third Party Asset Managers § Swaps and certificates remain the most popular methods of implementation for institutional clients – providing direct exposure to the GSCI with fixed slippage § The GSCI Futures contract is the most cost efficient method of getting exposure to the GSCI via the futures markets as opposed to the underlying futures markets.

Many Ways to Invest For institutional investors there are various ways of implementing a GSCI investment. Swaps have proven to be most popular. § The GSCI is very liquid and you can invest large amounts with minimal slippage. § There a variety of ways for investors to get exposure to the GSCI, including: – Swaps – Certificates – Structured Notes and Options – GSCI Futures Contract – Third Party Asset Managers § Swaps and certificates remain the most popular methods of implementation for institutional clients – providing direct exposure to the GSCI with fixed slippage § The GSCI Futures contract is the most cost efficient method of getting exposure to the GSCI via the futures markets as opposed to the underlying futures markets.

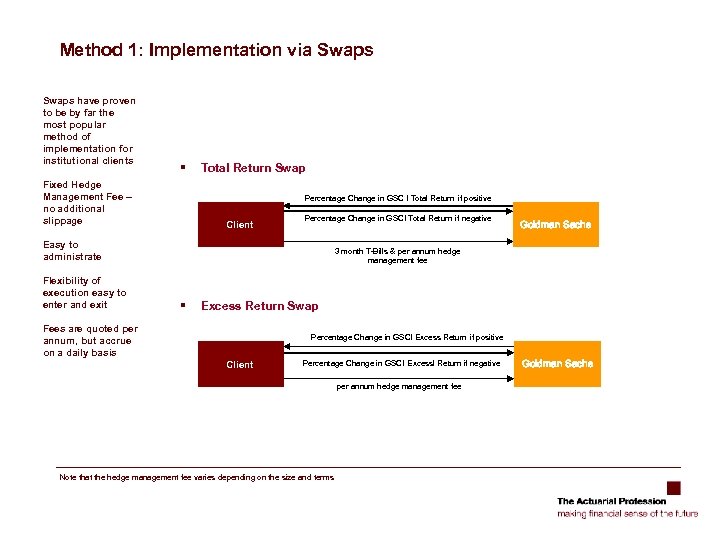

Method 1: Implementation via Swaps have proven to be by far the most popular method of implementation for institutional clients § Fixed Hedge Management Fee – no additional slippage Total Return Swap Percentage Change in GSC I Total Return if positive Client Percentage Change in GSCI Total Return if negative Easy to administrate Flexibility of execution easy to enter and exit Goldman Sachs 3 month T-Bills & per annum hedge management fee § Excess Return Swap Fees are quoted per annum, but accrue on a daily basis Percentage Change in GSCI Excess Return if positive Client Percentage Change in GSCI Excessl Return if negative per annum hedge management fee Note that the hedge management fee varies depending on the size and terms Goldman Sachs

Method 1: Implementation via Swaps have proven to be by far the most popular method of implementation for institutional clients § Fixed Hedge Management Fee – no additional slippage Total Return Swap Percentage Change in GSC I Total Return if positive Client Percentage Change in GSCI Total Return if negative Easy to administrate Flexibility of execution easy to enter and exit Goldman Sachs 3 month T-Bills & per annum hedge management fee § Excess Return Swap Fees are quoted per annum, but accrue on a daily basis Percentage Change in GSCI Excess Return if positive Client Percentage Change in GSCI Excessl Return if negative per annum hedge management fee Note that the hedge management fee varies depending on the size and terms Goldman Sachs

2: Implementation via Certificates provide investors with an unleveraged position in commodities which measures the return from a passive, fully collateralized and long-only position in the 24 underlying commodities. What they are: Certificates are securities that track the value of an underlying commodity index (GSCI, sub indices or individual commodity indices) § The index assumes investment in nearby futures contracts. It is calculated by rolling forward the first nearby contracts into the next nearby contracts mechanically on the 5 th-9 th business day of each month using the official closing futures prices. § Commodity Index Certificates are the simplest way for a financial investor to gain direct exposure to commodity markets on an unleveraged (but non-principal protected) basis. How they work: Provide investors with direct exposure to the relevant commodity price or index of prices by: § Directly tracking the price movements of the underlying commodities; § Liquidity - trade them during market open hours or leave orders to be executed at the close; § Transparency - track both the underlying index and the bid/ask price of the security on Reuters and Bloomberg Fees: We charge a per annum hedge management fee, reflecting the bid/ask spread we incur when rolling the futures contracts each month. This fee is accrued on a daily basis. Thus, investors only pay the hedge management fee on a pro rata basis for the period that the certificate is held.

2: Implementation via Certificates provide investors with an unleveraged position in commodities which measures the return from a passive, fully collateralized and long-only position in the 24 underlying commodities. What they are: Certificates are securities that track the value of an underlying commodity index (GSCI, sub indices or individual commodity indices) § The index assumes investment in nearby futures contracts. It is calculated by rolling forward the first nearby contracts into the next nearby contracts mechanically on the 5 th-9 th business day of each month using the official closing futures prices. § Commodity Index Certificates are the simplest way for a financial investor to gain direct exposure to commodity markets on an unleveraged (but non-principal protected) basis. How they work: Provide investors with direct exposure to the relevant commodity price or index of prices by: § Directly tracking the price movements of the underlying commodities; § Liquidity - trade them during market open hours or leave orders to be executed at the close; § Transparency - track both the underlying index and the bid/ask price of the security on Reuters and Bloomberg Fees: We charge a per annum hedge management fee, reflecting the bid/ask spread we incur when rolling the futures contracts each month. This fee is accrued on a daily basis. Thus, investors only pay the hedge management fee on a pro rata basis for the period that the certificate is held.

3: Buying and Rolling the 24 Underlying Commodity Futures Contracts Buying and rolling the 24 underlying commodity futures is a timely and costly exercise Implementation Method § Buy 24 commodity futures contracts on the various commodity exchanges § Roll forward all 24 contracts on 5 th to 9 th business day of each month, 20% per day § Manage the underlying cash collateral Comment § Less than 5% of known GSCI investors and asset managers use this method. Most GSCI investors find it costly and inefficient compared to trading the GSCI futures contract or GSCI swaps § This is particularly true if they do not have any natural commodity business

3: Buying and Rolling the 24 Underlying Commodity Futures Contracts Buying and rolling the 24 underlying commodity futures is a timely and costly exercise Implementation Method § Buy 24 commodity futures contracts on the various commodity exchanges § Roll forward all 24 contracts on 5 th to 9 th business day of each month, 20% per day § Manage the underlying cash collateral Comment § Less than 5% of known GSCI investors and asset managers use this method. Most GSCI investors find it costly and inefficient compared to trading the GSCI futures contract or GSCI swaps § This is particularly true if they do not have any natural commodity business

4: Buying and Rolling the GSCI Futures Contract The GSCI futures contract provides an efficient way to replicate the index Liquidity is not impacted by the level of GSCI open interest due to the fact that true liquidity is determined by the underlying 24 futures’ markets liquidity. Implementation Method § Buy GSCI futures contract on the Chicago Mercantile Exchange § Roll forward on 5 th to 9 th business day of each month, 20% per day § Manage the underlying cash collateral Comment: § Perfectly arbitrageable versus the 24 underlying markets. § Arbitraged by various competitors in the CME pit - resulting in a highly efficient market § Most-favoured method of implementation by largest asset managers and clients who use futures

4: Buying and Rolling the GSCI Futures Contract The GSCI futures contract provides an efficient way to replicate the index Liquidity is not impacted by the level of GSCI open interest due to the fact that true liquidity is determined by the underlying 24 futures’ markets liquidity. Implementation Method § Buy GSCI futures contract on the Chicago Mercantile Exchange § Roll forward on 5 th to 9 th business day of each month, 20% per day § Manage the underlying cash collateral Comment: § Perfectly arbitrageable versus the 24 underlying markets. § Arbitraged by various competitors in the CME pit - resulting in a highly efficient market § Most-favoured method of implementation by largest asset managers and clients who use futures

5: Third Party Asset Managers The GSCI futures contract on the CME is the primary investment vehicle for achieving exposure to the GSCI Index § Manage a semi-passive portfolio which will create exposure to commodities through the purchase of GSCI futures contracts traded on the Chicago Mercantile Exchange (CME) § Actively manage cash in a short-duration fixed income portfolio to create excess return. § Maintain the production weightings of the commodities in the GSCI so as not to impair its intrinsic inflation hedging characteristic § Tactically decide to take and manage tracking error in order to reduce transaction costs. § Periodically, purchase individual commodity contracts in a different month than that represented in the GSCI.

5: Third Party Asset Managers The GSCI futures contract on the CME is the primary investment vehicle for achieving exposure to the GSCI Index § Manage a semi-passive portfolio which will create exposure to commodities through the purchase of GSCI futures contracts traded on the Chicago Mercantile Exchange (CME) § Actively manage cash in a short-duration fixed income portfolio to create excess return. § Maintain the production weightings of the commodities in the GSCI so as not to impair its intrinsic inflation hedging characteristic § Tactically decide to take and manage tracking error in order to reduce transaction costs. § Periodically, purchase individual commodity contracts in a different month than that represented in the GSCI.

6: Implementation via Structured Notes Structured notes are a way to gain commodity exposure but at the same time to limit your downside risk § GSCI linked notes are bonds issued by third parties where the returns of the bond are linked to the performance of the GSCI Excess Return Index (notes can be created on any of the individual sub-components of the GSCI) § Most structured notes are principal protected between 90% and 100% depending on the client’s preferences § Notes can also be structured to provide customers with a more specific risk profile by averaging observations or adding upside leverage to the payout formula § Issuers are highly rated institutions (e. g. AA or better) § Note that pricing will fluctuate with interest rates and volatility § Minimum of $5 million notional is required to issue a new note, although smaller individual orders may be aggregated to reach the necessary threshold

6: Implementation via Structured Notes Structured notes are a way to gain commodity exposure but at the same time to limit your downside risk § GSCI linked notes are bonds issued by third parties where the returns of the bond are linked to the performance of the GSCI Excess Return Index (notes can be created on any of the individual sub-components of the GSCI) § Most structured notes are principal protected between 90% and 100% depending on the client’s preferences § Notes can also be structured to provide customers with a more specific risk profile by averaging observations or adding upside leverage to the payout formula § Issuers are highly rated institutions (e. g. AA or better) § Note that pricing will fluctuate with interest rates and volatility § Minimum of $5 million notional is required to issue a new note, although smaller individual orders may be aggregated to reach the necessary threshold

Disclaimer This document contains historical information. Past performance of investments and the commodities markets cannot be used to predict future performance. There are many changing factors which influence prices, which can go down as well as up. Derivative products should only be executed by investors who have a full understanding of the complexity and risks involved in trading derivatives. This material has been prepared and issued by one of the Trading Departments of Goldman, Sachs & Co. and/or one of its affiliates; it is not a product of the Research Department. This material is for your private information, and we are not soliciting any action based upon it. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Opinions expressed are our current opinions as of the date appearing on this material only. We and our affiliates, officers, directors and employees, including persons involved in the preparation or issuance of this material may, from time to time, have long or short positions in, and buy or sell, any of the commodities, futures, securities, or other instruments and investments mentioned herein, or derivatives (including options) on any of the same. We make no representations and have given you no advice, including advice concerning the appropriate accounting treatment or possible tax consequences of the indicative transactions. You are authorised, subject to applicable law, to disclose any and all aspects of a potential transaction that are necessary to support any U. S. federal income tax benefits expected to be claimed with respect to the transaction, without Goldman Sachs imposing any limitation of any kind. Our authorisation to you does not override, however, any rule of law, such as securities laws, that might otherwise require you to keep some or all aspects of the transaction confidential. This material has been issued or approved by J. Aron & Company (U. K. ) or Goldman Sachs International, which are authorised and regulated by The Financial Services Authority, in connection with its distribution in the United Kingdom. Further information on any investmentioned in this material may be obtained upon request.

Disclaimer This document contains historical information. Past performance of investments and the commodities markets cannot be used to predict future performance. There are many changing factors which influence prices, which can go down as well as up. Derivative products should only be executed by investors who have a full understanding of the complexity and risks involved in trading derivatives. This material has been prepared and issued by one of the Trading Departments of Goldman, Sachs & Co. and/or one of its affiliates; it is not a product of the Research Department. This material is for your private information, and we are not soliciting any action based upon it. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Opinions expressed are our current opinions as of the date appearing on this material only. We and our affiliates, officers, directors and employees, including persons involved in the preparation or issuance of this material may, from time to time, have long or short positions in, and buy or sell, any of the commodities, futures, securities, or other instruments and investments mentioned herein, or derivatives (including options) on any of the same. We make no representations and have given you no advice, including advice concerning the appropriate accounting treatment or possible tax consequences of the indicative transactions. You are authorised, subject to applicable law, to disclose any and all aspects of a potential transaction that are necessary to support any U. S. federal income tax benefits expected to be claimed with respect to the transaction, without Goldman Sachs imposing any limitation of any kind. Our authorisation to you does not override, however, any rule of law, such as securities laws, that might otherwise require you to keep some or all aspects of the transaction confidential. This material has been issued or approved by J. Aron & Company (U. K. ) or Goldman Sachs International, which are authorised and regulated by The Financial Services Authority, in connection with its distribution in the United Kingdom. Further information on any investmentioned in this material may be obtained upon request.