f323047fde7537817e7b68e9459400de.ppt

- Количество слайдов: 19

Diversification: Key to Economic Development 1. ECONOMY 2. INVESTMENT 3. STRATEGY OF ECONOMIC GROWTH 4. SISTEMA CASE STUDY 5. Q&A April 2004 Russian Economic Forum London

Diversification: Key to Economic Development 1. ECONOMY 2. INVESTMENT 3. STRATEGY OF ECONOMIC GROWTH 4. SISTEMA CASE STUDY 5. Q&A April 2004 Russian Economic Forum London

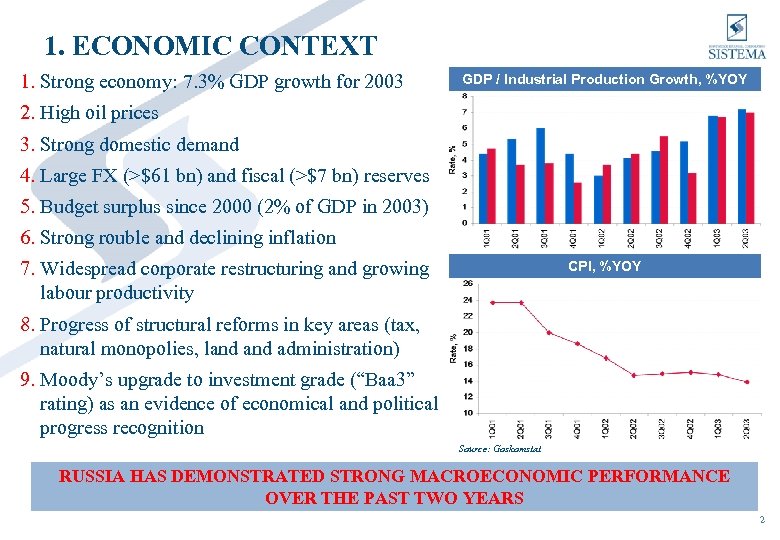

1. ECONOMIC CONTEXT 1. Strong economy: 7. 3% GDP growth for 2003 GDP / Industrial Production Growth, %YOY 2. High oil prices 3. Strong domestic demand 4. Large FX (>$61 bn) and fiscal (>$7 bn) reserves 5. Budget surplus since 2000 (2% of GDP in 2003) 6. Strong rouble and declining inflation 7. Widespread corporate restructuring and growing labour productivity CPI, %YOY 8. Progress of structural reforms in key areas (tax, natural monopolies, land administration) 9. Moody’s upgrade to investment grade (“Baa 3” rating) as an evidence of economical and political progress recognition Source: Goskomstat RUSSIA HAS DEMONSTRATED STRONG MACROECONOMIC PERFORMANCE OVER THE PAST TWO YEARS 2

1. ECONOMIC CONTEXT 1. Strong economy: 7. 3% GDP growth for 2003 GDP / Industrial Production Growth, %YOY 2. High oil prices 3. Strong domestic demand 4. Large FX (>$61 bn) and fiscal (>$7 bn) reserves 5. Budget surplus since 2000 (2% of GDP in 2003) 6. Strong rouble and declining inflation 7. Widespread corporate restructuring and growing labour productivity CPI, %YOY 8. Progress of structural reforms in key areas (tax, natural monopolies, land administration) 9. Moody’s upgrade to investment grade (“Baa 3” rating) as an evidence of economical and political progress recognition Source: Goskomstat RUSSIA HAS DEMONSTRATED STRONG MACROECONOMIC PERFORMANCE OVER THE PAST TWO YEARS 2

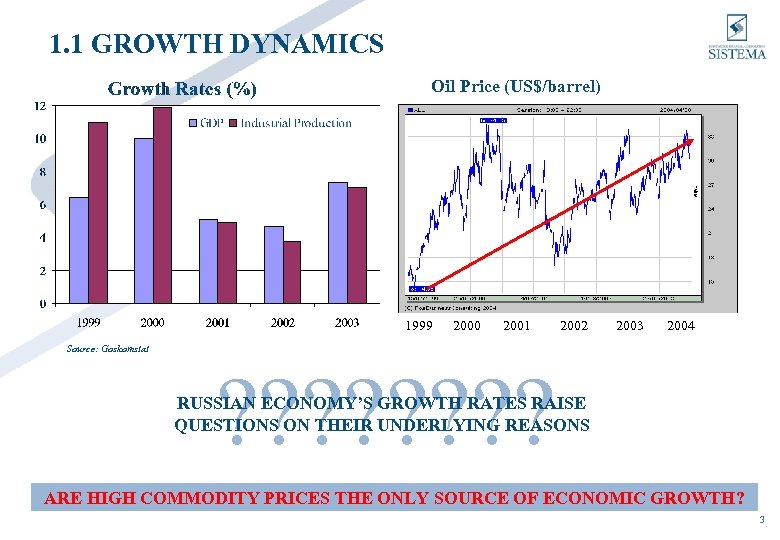

1. 1 GROWTH DYNAMICS Oil Price (US$/barrel) 1999 2000 2001 2002 2003 2004 Source: Goskomstat ? ? ? ? RUSSIAN ECONOMY’S GROWTH RATES RAISE QUESTIONS ON THEIR UNDERLYING REASONS ARE HIGH COMMODITY PRICES THE ONLY SOURCE OF ECONOMIC GROWTH? 3

1. 1 GROWTH DYNAMICS Oil Price (US$/barrel) 1999 2000 2001 2002 2003 2004 Source: Goskomstat ? ? ? ? RUSSIAN ECONOMY’S GROWTH RATES RAISE QUESTIONS ON THEIR UNDERLYING REASONS ARE HIGH COMMODITY PRICES THE ONLY SOURCE OF ECONOMIC GROWTH? 3

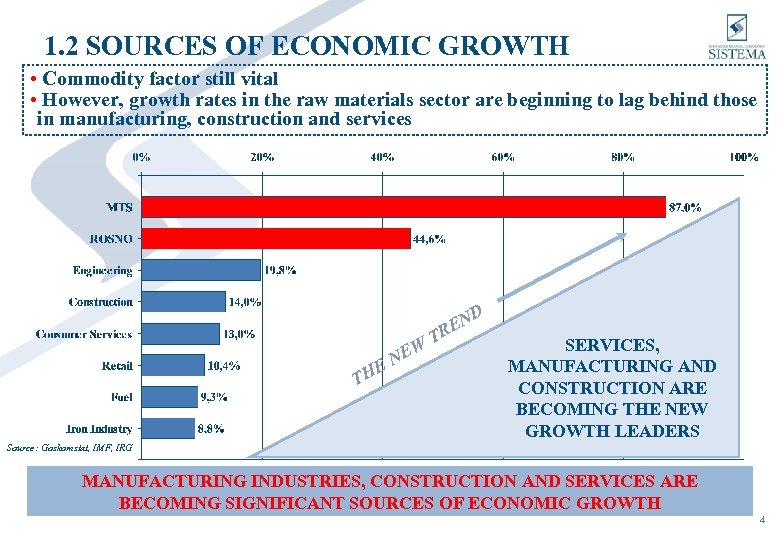

1. 2 SOURCES OF ECONOMIC GROWTH • Commodity factor still vital • However, growth rates in the raw materials sector are beginning to lag behind those in manufacturing, construction and services D EW EN H T T N RE SERVICES, MANUFACTURING AND CONSTRUCTION ARE BECOMING THE NEW GROWTH LEADERS Source: Goskomstat, IMF, IRG MANUFACTURING INDUSTRIES, CONSTRUCTION AND SERVICES ARE BECOMING SIGNIFICANT SOURCES OF ECONOMIC GROWTH 4

1. 2 SOURCES OF ECONOMIC GROWTH • Commodity factor still vital • However, growth rates in the raw materials sector are beginning to lag behind those in manufacturing, construction and services D EW EN H T T N RE SERVICES, MANUFACTURING AND CONSTRUCTION ARE BECOMING THE NEW GROWTH LEADERS Source: Goskomstat, IMF, IRG MANUFACTURING INDUSTRIES, CONSTRUCTION AND SERVICES ARE BECOMING SIGNIFICANT SOURCES OF ECONOMIC GROWTH 4

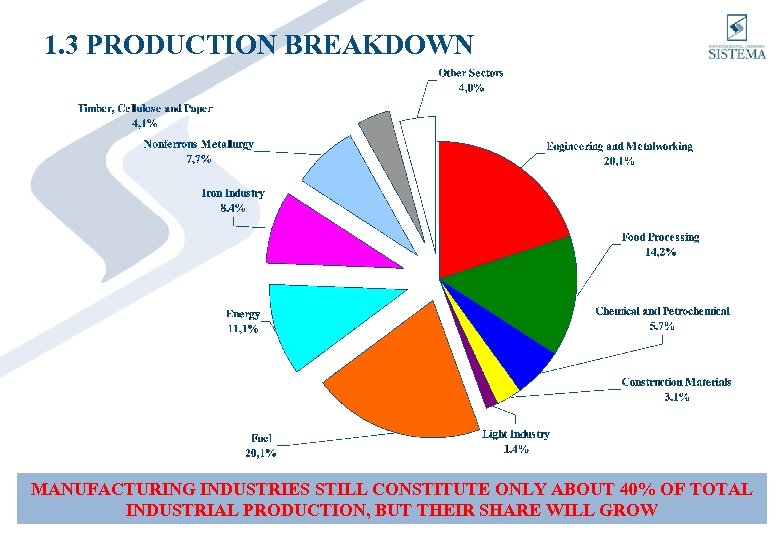

1. 3 PRODUCTION BREAKDOWN MANUFACTURING INDUSTRIES STILL CONSTITUTE ONLY ABOUT 40% OF TOTAL INDUSTRIAL PRODUCTION, BUT THEIR SHARE WILL GROW 5

1. 3 PRODUCTION BREAKDOWN MANUFACTURING INDUSTRIES STILL CONSTITUTE ONLY ABOUT 40% OF TOTAL INDUSTRIAL PRODUCTION, BUT THEIR SHARE WILL GROW 5

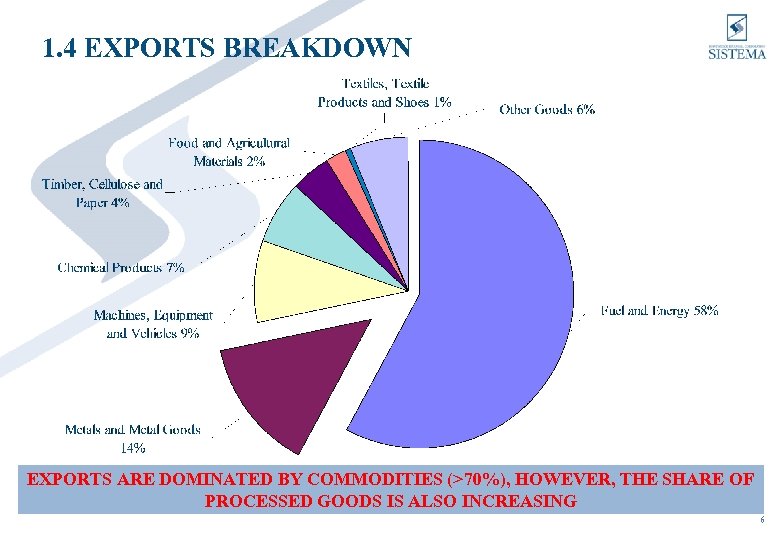

1. 4 EXPORTS BREAKDOWN EXPORTS ARE DOMINATED BY COMMODITIES (>70%), HOWEVER, THE SHARE OF PROCESSED GOODS IS ALSO INCREASING 6

1. 4 EXPORTS BREAKDOWN EXPORTS ARE DOMINATED BY COMMODITIES (>70%), HOWEVER, THE SHARE OF PROCESSED GOODS IS ALSO INCREASING 6

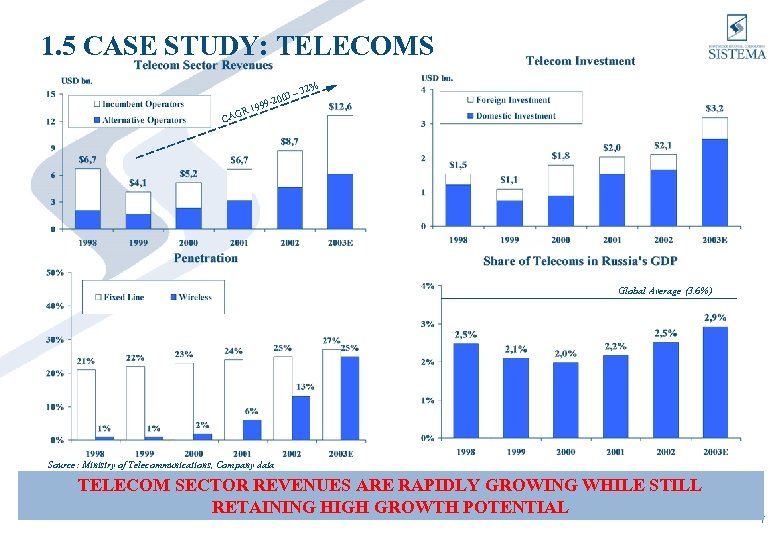

1. 5 CASE STUDY: TELECOMS 3– -200 999 32% R 1 CAG Global Average (3. 6%) Source: Ministry of Telecommunications, Company data TELECOM SECTOR REVENUES ARE RAPIDLY GROWING WHILE STILL RETAINING HIGH GROWTH POTENTIAL 7

1. 5 CASE STUDY: TELECOMS 3– -200 999 32% R 1 CAG Global Average (3. 6%) Source: Ministry of Telecommunications, Company data TELECOM SECTOR REVENUES ARE RAPIDLY GROWING WHILE STILL RETAINING HIGH GROWTH POTENTIAL 7

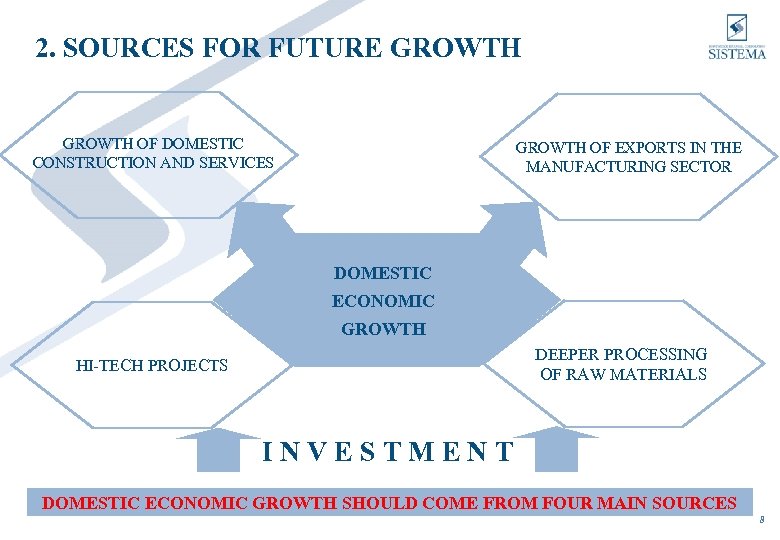

2. SOURCES FOR FUTURE GROWTH OF DOMESTIC CONSTRUCTION AND SERVICES GROWTH OF EXPORTS IN THE MANUFACTURING SECTOR DOMESTIC ECONOMIC GROWTH DEEPER PROCESSING OF RAW MATERIALS HI-TECH PROJECTS INVESTMENT DOMESTIC ECONOMIC GROWTH SHOULD COME FROM FOUR MAIN SOURCES 8

2. SOURCES FOR FUTURE GROWTH OF DOMESTIC CONSTRUCTION AND SERVICES GROWTH OF EXPORTS IN THE MANUFACTURING SECTOR DOMESTIC ECONOMIC GROWTH DEEPER PROCESSING OF RAW MATERIALS HI-TECH PROJECTS INVESTMENT DOMESTIC ECONOMIC GROWTH SHOULD COME FROM FOUR MAIN SOURCES 8

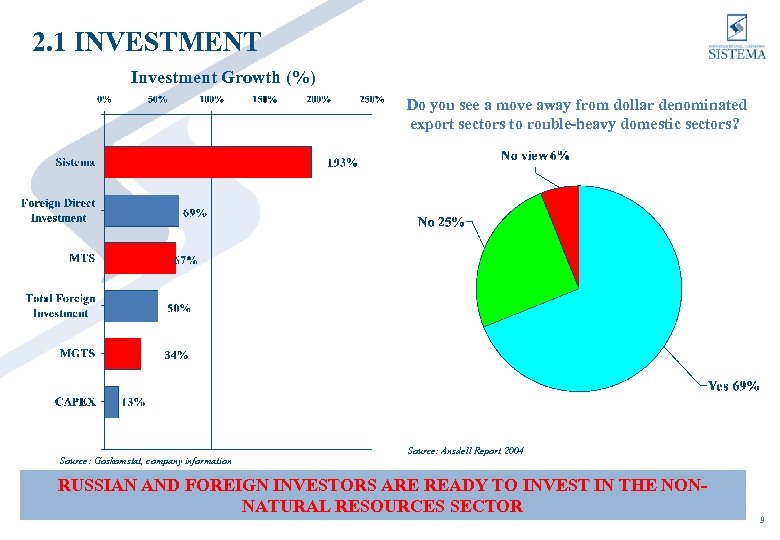

2. 1 INVESTMENT Investment Growth (%) Do you see a move away from dollar denominated export sectors to rouble-heavy domestic sectors? Source: Goskomstat, company information Source: Ansdell Report 2004 RUSSIAN AND FOREIGN INVESTORS ARE READY TO INVEST IN THE NONNATURAL RESOURCES SECTOR 9

2. 1 INVESTMENT Investment Growth (%) Do you see a move away from dollar denominated export sectors to rouble-heavy domestic sectors? Source: Goskomstat, company information Source: Ansdell Report 2004 RUSSIAN AND FOREIGN INVESTORS ARE READY TO INVEST IN THE NONNATURAL RESOURCES SECTOR 9

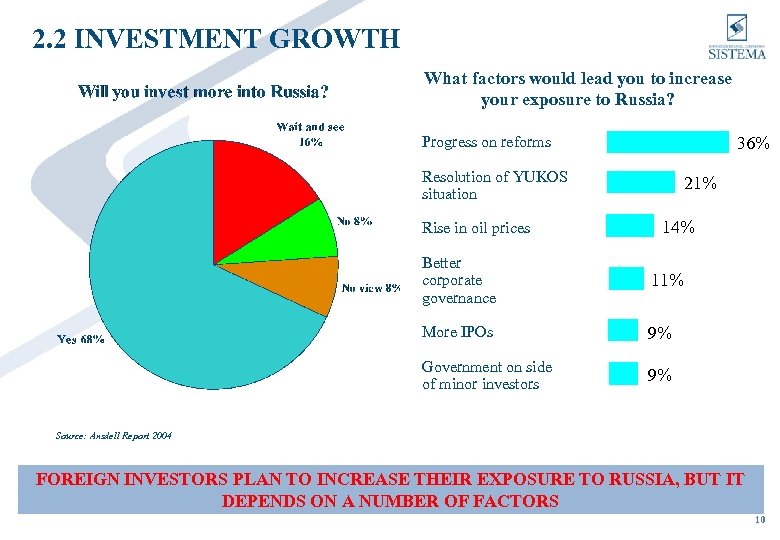

2. 2 INVESTMENT GROWTH What factors would lead you to increase your exposure to Russia? Progress on reforms 36% Resolution of YUKOS situation Rise in oil prices 21% 14% Better corporate governance 11% More IPOs 9% Government on side of minor investors 9% Source: Ansdell Report 2004 FOREIGN INVESTORS PLAN TO INCREASE THEIR EXPOSURE TO RUSSIA, BUT IT DEPENDS ON A NUMBER OF FACTORS 10

2. 2 INVESTMENT GROWTH What factors would lead you to increase your exposure to Russia? Progress on reforms 36% Resolution of YUKOS situation Rise in oil prices 21% 14% Better corporate governance 11% More IPOs 9% Government on side of minor investors 9% Source: Ansdell Report 2004 FOREIGN INVESTORS PLAN TO INCREASE THEIR EXPOSURE TO RUSSIA, BUT IT DEPENDS ON A NUMBER OF FACTORS 10

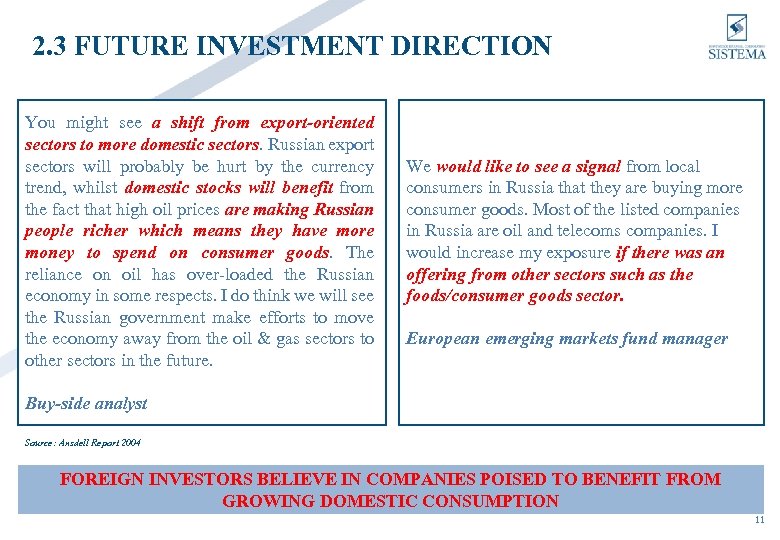

2. 3 FUTURE INVESTMENT DIRECTION You might see a shift from export-oriented sectors to more domestic sectors. Russian export sectors will probably be hurt by the currency trend, whilst domestic stocks will benefit from the fact that high oil prices are making Russian people richer which means they have more money to spend on consumer goods. The reliance on oil has over-loaded the Russian economy in some respects. I do think we will see the Russian government make efforts to move the economy away from the oil & gas sectors to other sectors in the future. We would like to see a signal from local consumers in Russia that they are buying more consumer goods. Most of the listed companies in Russia are oil and telecoms companies. I would increase my exposure if there was an offering from other sectors such as the foods/consumer goods sector. European emerging markets fund manager Buy-side analyst Source: Ansdell Report 2004 FOREIGN INVESTORS BELIEVE IN COMPANIES POISED TO BENEFIT FROM GROWING DOMESTIC CONSUMPTION 11

2. 3 FUTURE INVESTMENT DIRECTION You might see a shift from export-oriented sectors to more domestic sectors. Russian export sectors will probably be hurt by the currency trend, whilst domestic stocks will benefit from the fact that high oil prices are making Russian people richer which means they have more money to spend on consumer goods. The reliance on oil has over-loaded the Russian economy in some respects. I do think we will see the Russian government make efforts to move the economy away from the oil & gas sectors to other sectors in the future. We would like to see a signal from local consumers in Russia that they are buying more consumer goods. Most of the listed companies in Russia are oil and telecoms companies. I would increase my exposure if there was an offering from other sectors such as the foods/consumer goods sector. European emerging markets fund manager Buy-side analyst Source: Ansdell Report 2004 FOREIGN INVESTORS BELIEVE IN COMPANIES POISED TO BENEFIT FROM GROWING DOMESTIC CONSUMPTION 11

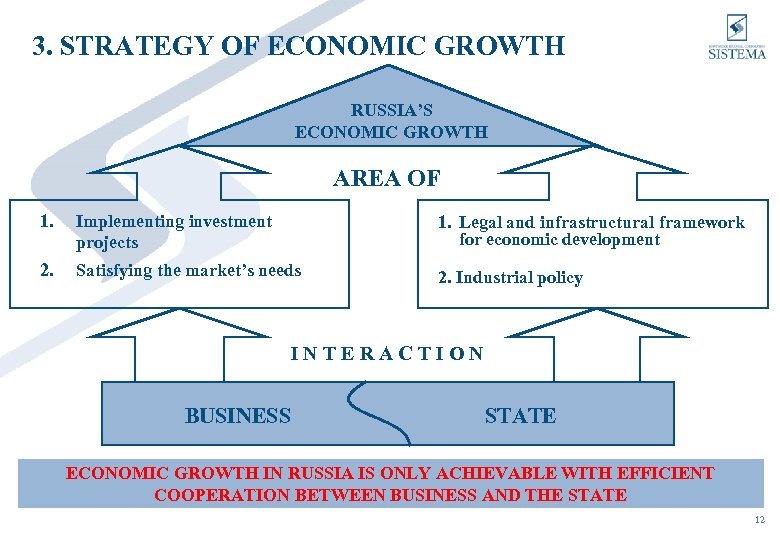

3. STRATEGY OF ECONOMIC GROWTH RUSSIA’S ECONOMIC GROWTH AREA OF 1. Implementing investment projects 1. Legal and infrastructural framework for economic development 2. Satisfying the market’s needs 2. Industrial policy INTERACTION BUSINESS STATE ECONOMIC GROWTH IN RUSSIA IS ONLY ACHIEVABLE WITH EFFICIENT COOPERATION BETWEEN BUSINESS AND THE STATE 12

3. STRATEGY OF ECONOMIC GROWTH RUSSIA’S ECONOMIC GROWTH AREA OF 1. Implementing investment projects 1. Legal and infrastructural framework for economic development 2. Satisfying the market’s needs 2. Industrial policy INTERACTION BUSINESS STATE ECONOMIC GROWTH IN RUSSIA IS ONLY ACHIEVABLE WITH EFFICIENT COOPERATION BETWEEN BUSINESS AND THE STATE 12

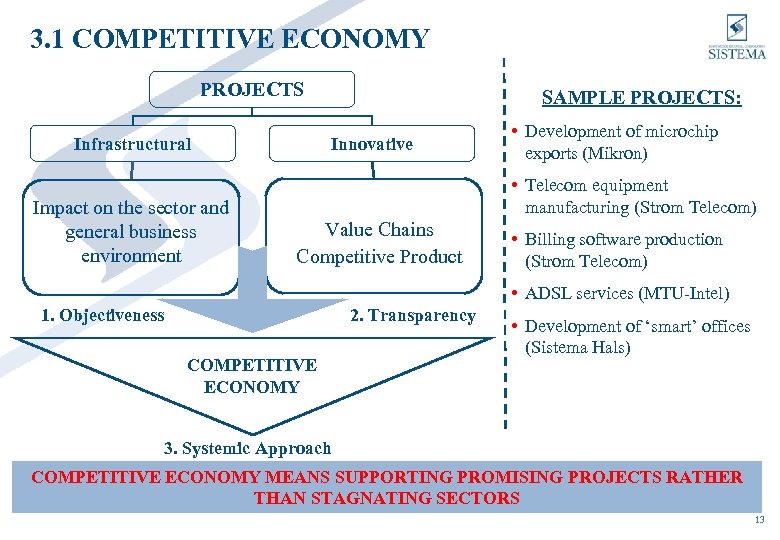

3. 1 COMPETITIVE ECONOMY PROJECTS Infrastructural Impact on the sector and general business environment SAMPLE PROJECTS: Innovative • Development of microchip exports (Mikron) • Telecom equipment manufacturing (Strom Telecom) Value Chains Competitive Product • Billing software production (Strom Telecom) • ADSL services (MTU-Intel) 1. Objectiveness 2. Transparency COMPETITIVE ECONOMY • Development of ‘smart’ offices (Sistema Hals) 3. Systemic Approach COMPETITIVE ECONOMY MEANS SUPPORTING PROMISING PROJECTS RATHER THAN STAGNATING SECTORS 13

3. 1 COMPETITIVE ECONOMY PROJECTS Infrastructural Impact on the sector and general business environment SAMPLE PROJECTS: Innovative • Development of microchip exports (Mikron) • Telecom equipment manufacturing (Strom Telecom) Value Chains Competitive Product • Billing software production (Strom Telecom) • ADSL services (MTU-Intel) 1. Objectiveness 2. Transparency COMPETITIVE ECONOMY • Development of ‘smart’ offices (Sistema Hals) 3. Systemic Approach COMPETITIVE ECONOMY MEANS SUPPORTING PROMISING PROJECTS RATHER THAN STAGNATING SECTORS 13

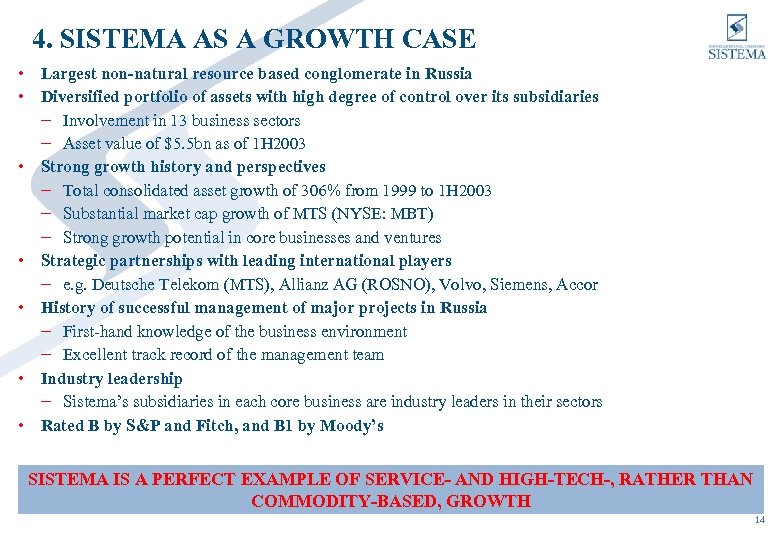

4. SISTEMA AS A GROWTH CASE • Largest non-natural resource based conglomerate in Russia • Diversified portfolio of assets with high degree of control over its subsidiaries − Involvement in 13 business sectors − Asset value of $5. 5 bn as of 1 H 2003 • Strong growth history and perspectives − Total consolidated asset growth of 306% from 1999 to 1 H 2003 − Substantial market cap growth of MTS (NYSE: MBT) − Strong growth potential in core businesses and ventures • Strategic partnerships with leading international players − e. g. Deutsche Telekom (MTS), Allianz AG (ROSNO), Volvo, Siemens, Accor • History of successful management of major projects in Russia − First-hand knowledge of the business environment − Excellent track record of the management team • Industry leadership − Sistema’s subsidiaries in each core business are industry leaders in their sectors • Rated B by S&P and Fitch, and B 1 by Moody’s SISTEMA IS A PERFECT EXAMPLE OF SERVICE- AND HIGH-TECH-, RATHER THAN COMMODITY-BASED, GROWTH 14

4. SISTEMA AS A GROWTH CASE • Largest non-natural resource based conglomerate in Russia • Diversified portfolio of assets with high degree of control over its subsidiaries − Involvement in 13 business sectors − Asset value of $5. 5 bn as of 1 H 2003 • Strong growth history and perspectives − Total consolidated asset growth of 306% from 1999 to 1 H 2003 − Substantial market cap growth of MTS (NYSE: MBT) − Strong growth potential in core businesses and ventures • Strategic partnerships with leading international players − e. g. Deutsche Telekom (MTS), Allianz AG (ROSNO), Volvo, Siemens, Accor • History of successful management of major projects in Russia − First-hand knowledge of the business environment − Excellent track record of the management team • Industry leadership − Sistema’s subsidiaries in each core business are industry leaders in their sectors • Rated B by S&P and Fitch, and B 1 by Moody’s SISTEMA IS A PERFECT EXAMPLE OF SERVICE- AND HIGH-TECH-, RATHER THAN COMMODITY-BASED, GROWTH 14

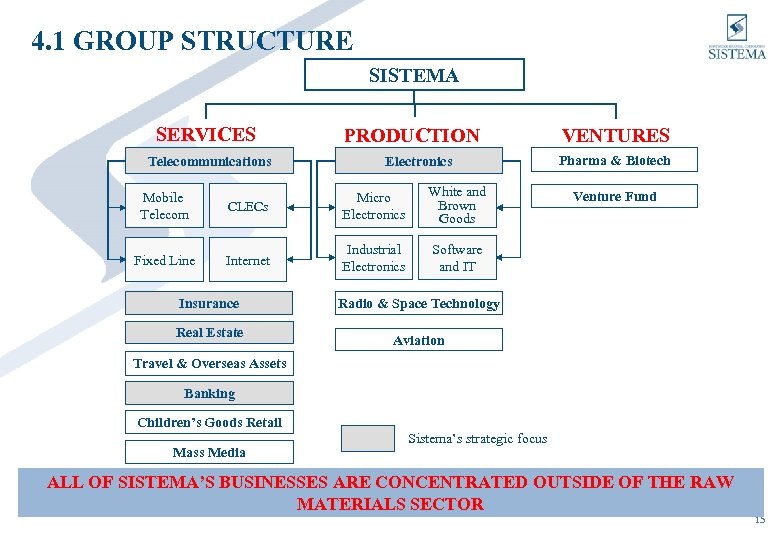

4. 1 GROUP STRUCTURE SISTEMA SERVICES Telecommunications PRODUCTION Electronics Mobile Telecom CLECs Micro Electronics White and Brown Goods Fixed Line Internet Industrial Electronics VENTURES Pharma & Biotech Software and IT Insurance Real Estate Venture Fund Radio & Space Technology Aviation Travel & Overseas Assets Banking Children’s Goods Retail Mass Media Sistema’s strategic focus ALL OF SISTEMA’S BUSINESSES ARE CONCENTRATED OUTSIDE OF THE RAW MATERIALS SECTOR 15

4. 1 GROUP STRUCTURE SISTEMA SERVICES Telecommunications PRODUCTION Electronics Mobile Telecom CLECs Micro Electronics White and Brown Goods Fixed Line Internet Industrial Electronics VENTURES Pharma & Biotech Software and IT Insurance Real Estate Venture Fund Radio & Space Technology Aviation Travel & Overseas Assets Banking Children’s Goods Retail Mass Media Sistema’s strategic focus ALL OF SISTEMA’S BUSINESSES ARE CONCENTRATED OUTSIDE OF THE RAW MATERIALS SECTOR 15

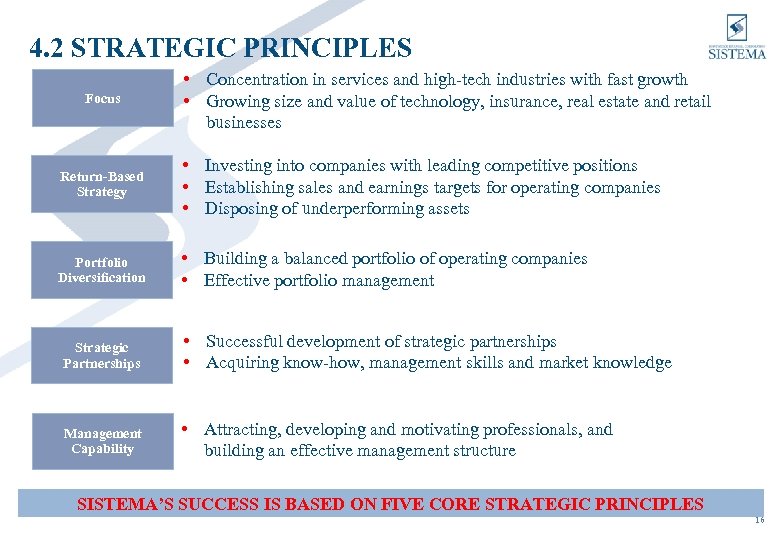

4. 2 STRATEGIC PRINCIPLES Focus • Concentration in services and high-tech industries with fast growth • Growing size and value of technology, insurance, real estate and retail businesses Return-Based Strategy • Investing into companies with leading competitive positions • Establishing sales and earnings targets for operating companies • Disposing of underperforming assets Portfolio Diversification • Building a balanced portfolio of operating companies • Effective portfolio management Strategic Partnerships • Successful development of strategic partnerships • Acquiring know-how, management skills and market knowledge Management Capability • Attracting, developing and motivating professionals, and building an effective management structure SISTEMA’S SUCCESS IS BASED ON FIVE CORE STRATEGIC PRINCIPLES 16

4. 2 STRATEGIC PRINCIPLES Focus • Concentration in services and high-tech industries with fast growth • Growing size and value of technology, insurance, real estate and retail businesses Return-Based Strategy • Investing into companies with leading competitive positions • Establishing sales and earnings targets for operating companies • Disposing of underperforming assets Portfolio Diversification • Building a balanced portfolio of operating companies • Effective portfolio management Strategic Partnerships • Successful development of strategic partnerships • Acquiring know-how, management skills and market knowledge Management Capability • Attracting, developing and motivating professionals, and building an effective management structure SISTEMA’S SUCCESS IS BASED ON FIVE CORE STRATEGIC PRINCIPLES 16

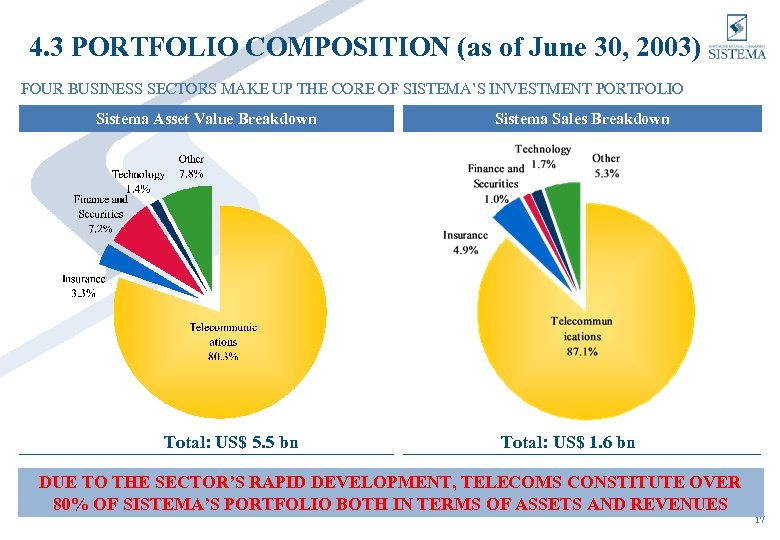

4. 3 PORTFOLIO COMPOSITION (as of June 30, 2003) FOUR BUSINESS SECTORS MAKE UP THE CORE OF SISTEMA’S INVESTMENT PORTFOLIO Sistema Asset Value Breakdown Total: US$ 5. 5 bn Sistema Sales Breakdown Total: US$ 1. 6 bn DUE TO THE SECTOR’S RAPID DEVELOPMENT, TELECOMS CONSTITUTE OVER 80% OF SISTEMA’S PORTFOLIO BOTH IN TERMS OF ASSETS AND REVENUES 17

4. 3 PORTFOLIO COMPOSITION (as of June 30, 2003) FOUR BUSINESS SECTORS MAKE UP THE CORE OF SISTEMA’S INVESTMENT PORTFOLIO Sistema Asset Value Breakdown Total: US$ 5. 5 bn Sistema Sales Breakdown Total: US$ 1. 6 bn DUE TO THE SECTOR’S RAPID DEVELOPMENT, TELECOMS CONSTITUTE OVER 80% OF SISTEMA’S PORTFOLIO BOTH IN TERMS OF ASSETS AND REVENUES 17

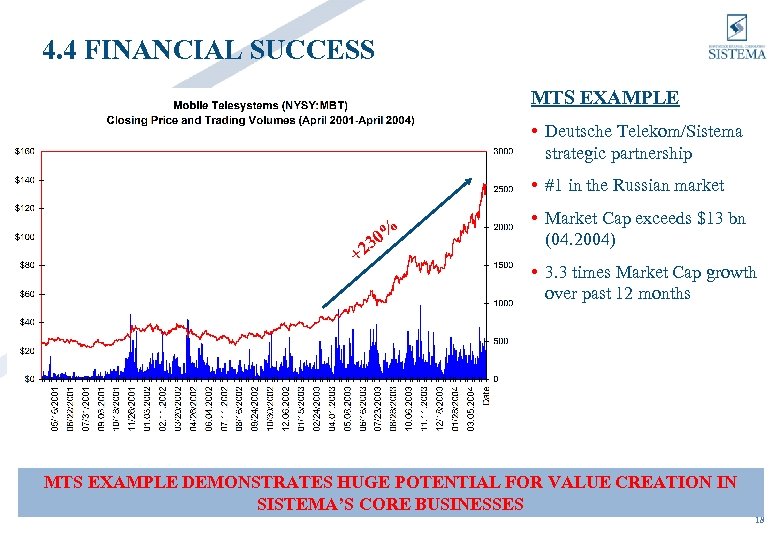

4. 4 FINANCIAL SUCCESS MTS EXAMPLE • Deutsche Telekom/Sistema strategic partnership • #1 in the Russian market % 0 23 + • Market Cap exceeds $13 bn (04. 2004) • 3. 3 times Market Cap growth over past 12 months MTS EXAMPLE DEMONSTRATES HUGE POTENTIAL FOR VALUE CREATION IN SISTEMA’S CORE BUSINESSES 18

4. 4 FINANCIAL SUCCESS MTS EXAMPLE • Deutsche Telekom/Sistema strategic partnership • #1 in the Russian market % 0 23 + • Market Cap exceeds $13 bn (04. 2004) • 3. 3 times Market Cap growth over past 12 months MTS EXAMPLE DEMONSTRATES HUGE POTENTIAL FOR VALUE CREATION IN SISTEMA’S CORE BUSINESSES 18

5. Q&A 1………………………. 2………………………. 3………………………. 4………………………. 5………………………. ? THANK YOU FOR YOUR ATTENTION 19

5. Q&A 1………………………. 2………………………. 3………………………. 4………………………. 5………………………. ? THANK YOU FOR YOUR ATTENTION 19