effc04935003dd7610836a6e8483c9ad.ppt

- Количество слайдов: 19

Diver Acquisition Project - Phase I Profile of the Most Active Divers in the US; Lifestyle and Demographic Study

Diver Acquisition Project - Phase I Profile of the Most Active Divers in the US; Lifestyle and Demographic Study

Project Methodology • Part of the study used actual diving customer lists to determine their lifestyles and certain demographic characteristics. The “N” totaled more than 300, 000 divers which were geo-coded to determine their US Census block. • From this information, DEMA determined Lifestyle (ie: attitudes and beliefs) and some demographic information (ie: income and marriage status) FROM THIRD PARTY SOURCES (No customers were contacted directly in this part of the study) • In addition, diver activity levels were determined using a web-based activity survey with more than 3, 000 responding divers. These were also compared for lifestyle, demographics, and diving activity level.

Project Methodology • Part of the study used actual diving customer lists to determine their lifestyles and certain demographic characteristics. The “N” totaled more than 300, 000 divers which were geo-coded to determine their US Census block. • From this information, DEMA determined Lifestyle (ie: attitudes and beliefs) and some demographic information (ie: income and marriage status) FROM THIRD PARTY SOURCES (No customers were contacted directly in this part of the study) • In addition, diver activity levels were determined using a web-based activity survey with more than 3, 000 responding divers. These were also compared for lifestyle, demographics, and diving activity level.

Data Obtained • Self-reported data: Age, Gender, Geographic Location (using postal code), Diver Activity • Appended Demographic Characteristics – These were NOT reported by the individual but were determined from third party, verifiable databases (used name and postal code identifier): – – – Household Income Occupation Home ownership Mortgage amount Marital Status Presence and age of children

Data Obtained • Self-reported data: Age, Gender, Geographic Location (using postal code), Diver Activity • Appended Demographic Characteristics – These were NOT reported by the individual but were determined from third party, verifiable databases (used name and postal code identifier): – – – Household Income Occupation Home ownership Mortgage amount Marital Status Presence and age of children

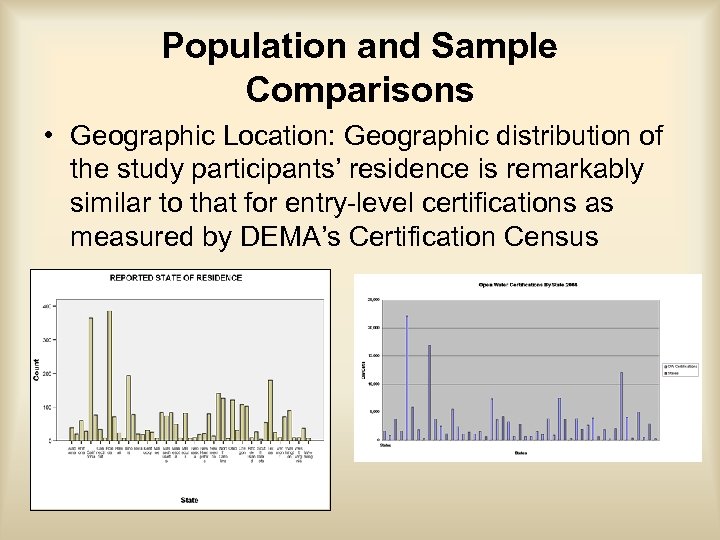

Population and Sample Comparisons • Geographic Location: Geographic distribution of the study participants’ residence is remarkably similar to that for entry-level certifications as measured by DEMA’s Certification Census

Population and Sample Comparisons • Geographic Location: Geographic distribution of the study participants’ residence is remarkably similar to that for entry-level certifications as measured by DEMA’s Certification Census

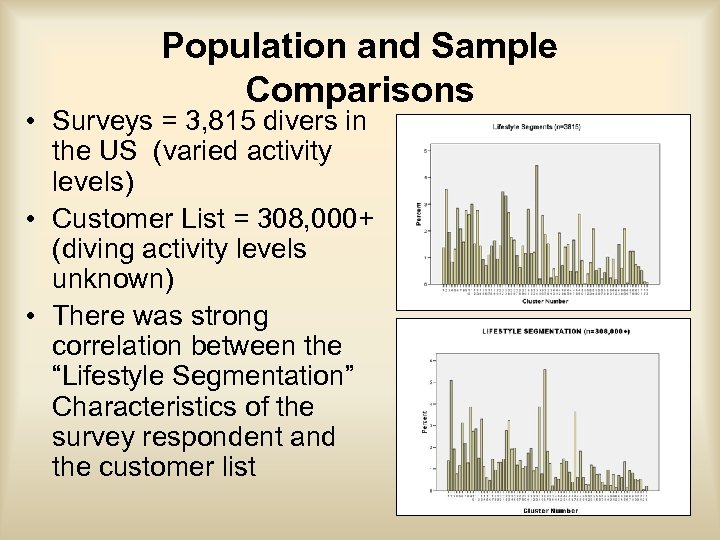

Population and Sample Comparisons • Surveys = 3, 815 divers in the US (varied activity levels) • Customer List = 308, 000+ (diving activity levels unknown) • There was strong correlation between the “Lifestyle Segmentation” Characteristics of the survey respondent and the customer list

Population and Sample Comparisons • Surveys = 3, 815 divers in the US (varied activity levels) • Customer List = 308, 000+ (diving activity levels unknown) • There was strong correlation between the “Lifestyle Segmentation” Characteristics of the survey respondent and the customer list

Characteristics of Active Diver From The Study • Age – Between 38 & 53 years old – Mean: 45 Median: 46 • 76% are male • Household Income – 56% make between $75, 000 and $100, 000 • Occupation – 80% are White Collar/ Professional/ Technical/ Management • Home ownership – 93% own their own home • Mortgage amount – Median of $148, 000 • Marital Status – 71% married • Presence and age of children – 17% have kids under 18

Characteristics of Active Diver From The Study • Age – Between 38 & 53 years old – Mean: 45 Median: 46 • 76% are male • Household Income – 56% make between $75, 000 and $100, 000 • Occupation – 80% are White Collar/ Professional/ Technical/ Management • Home ownership – 93% own their own home • Mortgage amount – Median of $148, 000 • Marital Status – 71% married • Presence and age of children – 17% have kids under 18

Measuring “Lifestyle” • Lifestyles: attitudes, beliefs as measured by their purchase and other pertinent behavior (psychographics). DEMA used a methodology involving “Lifestyle Clusters” which reflect actual purchase behavior • Two variables were used to determine which customer lifestyle “clusters” should be approached for the most valuable “micro-target”: – Activity level of the diver – Median House Hold Income – Gives the greatest potential “value” of the customer to the industry

Measuring “Lifestyle” • Lifestyles: attitudes, beliefs as measured by their purchase and other pertinent behavior (psychographics). DEMA used a methodology involving “Lifestyle Clusters” which reflect actual purchase behavior • Two variables were used to determine which customer lifestyle “clusters” should be approached for the most valuable “micro-target”: – Activity level of the diver – Median House Hold Income – Gives the greatest potential “value” of the customer to the industry

Active US Diver: Diving Activity Level • DEMA’s recent US marketing study shows: – No one single activity causes a diver to remain active – By definition an “active diver” participates in a SERIES of activities which varies with the customer – Nine different diving activities help determine the MOST active among those in the survey

Active US Diver: Diving Activity Level • DEMA’s recent US marketing study shows: – No one single activity causes a diver to remain active – By definition an “active diver” participates in a SERIES of activities which varies with the customer – Nine different diving activities help determine the MOST active among those in the survey

Active Divers: Activity Types 1. Number of additional certification courses after initial certification 2. Number of overnight dive trips made in the 12 months preceding taking the survey 3. Number of days spent on most recent dive trip 4. Number of dive trips (no overnight stay) made in the 12 months preceding taking the survey 5. Number of lifetime international dive trips 6. Number of scuba dives made in 2005 and 2006 7. Number of visits to local dive store made in the 12 months preceding taking the survey 8. Amount spent on scuba equipment in diving lifetime 9. Amount spent on scuba equipment in the 12 months preceding taking the survey

Active Divers: Activity Types 1. Number of additional certification courses after initial certification 2. Number of overnight dive trips made in the 12 months preceding taking the survey 3. Number of days spent on most recent dive trip 4. Number of dive trips (no overnight stay) made in the 12 months preceding taking the survey 5. Number of lifetime international dive trips 6. Number of scuba dives made in 2005 and 2006 7. Number of visits to local dive store made in the 12 months preceding taking the survey 8. Amount spent on scuba equipment in diving lifetime 9. Amount spent on scuba equipment in the 12 months preceding taking the survey

Understanding the Customer’s Expectations: Using Income + Lifestyle • DEMA used median income to indicate customer value in combination with lifestyle (attitudes and beliefs); this provides the best possibilities for potential buying power • Top Five Lifestyle Clusters: Using Most Active PLUS Highest Median Income: – – – Cluster 9: “Suburban Wave” - US$76, 499 Cluster 13: “Sierra Snuggle” - US$72, 952 Cluster 2: “Executive Domain” - US$124, 295 Cluster 6: “Balancing Acts” - US$91, 612 Cluster 3 “Nouveau Manors” - US$97, 584 • These five clusters collectively represent about 10% of the US population and 18% of survey respondents

Understanding the Customer’s Expectations: Using Income + Lifestyle • DEMA used median income to indicate customer value in combination with lifestyle (attitudes and beliefs); this provides the best possibilities for potential buying power • Top Five Lifestyle Clusters: Using Most Active PLUS Highest Median Income: – – – Cluster 9: “Suburban Wave” - US$76, 499 Cluster 13: “Sierra Snuggle” - US$72, 952 Cluster 2: “Executive Domain” - US$124, 295 Cluster 6: “Balancing Acts” - US$91, 612 Cluster 3 “Nouveau Manors” - US$97, 584 • These five clusters collectively represent about 10% of the US population and 18% of survey respondents

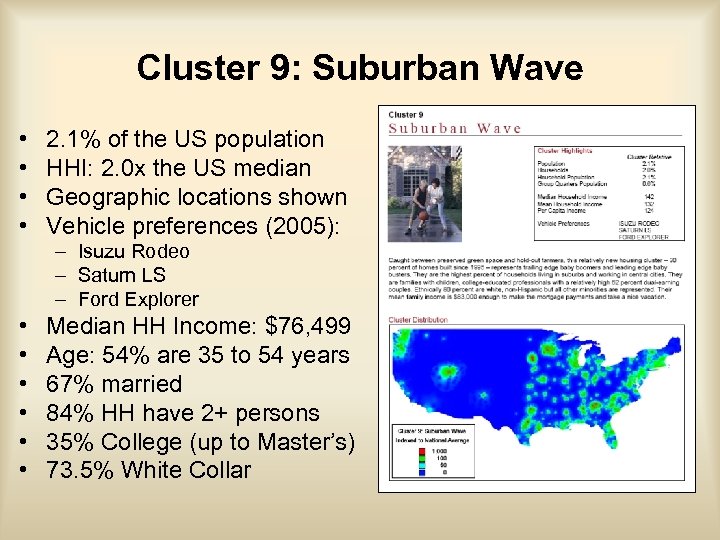

Cluster 9: Suburban Wave • • 2. 1% of the US population HHI: 2. 0 x the US median Geographic locations shown Vehicle preferences (2005): – Isuzu Rodeo – Saturn LS – Ford Explorer • • • Median HH Income: $76, 499 Age: 54% are 35 to 54 years 67% married 84% HH have 2+ persons 35% College (up to Master’s) 73. 5% White Collar

Cluster 9: Suburban Wave • • 2. 1% of the US population HHI: 2. 0 x the US median Geographic locations shown Vehicle preferences (2005): – Isuzu Rodeo – Saturn LS – Ford Explorer • • • Median HH Income: $76, 499 Age: 54% are 35 to 54 years 67% married 84% HH have 2+ persons 35% College (up to Master’s) 73. 5% White Collar

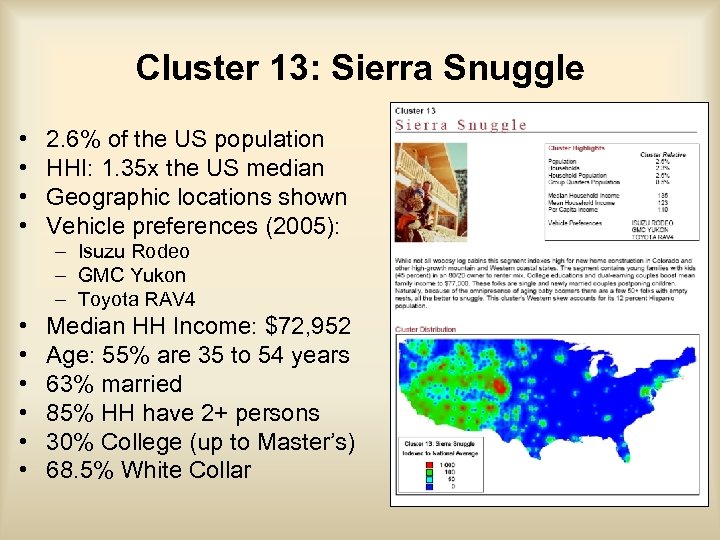

Cluster 13: Sierra Snuggle • • 2. 6% of the US population HHI: 1. 35 x the US median Geographic locations shown Vehicle preferences (2005): – Isuzu Rodeo – GMC Yukon – Toyota RAV 4 • • • Median HH Income: $72, 952 Age: 55% are 35 to 54 years 63% married 85% HH have 2+ persons 30% College (up to Master’s) 68. 5% White Collar

Cluster 13: Sierra Snuggle • • 2. 6% of the US population HHI: 1. 35 x the US median Geographic locations shown Vehicle preferences (2005): – Isuzu Rodeo – GMC Yukon – Toyota RAV 4 • • • Median HH Income: $72, 952 Age: 55% are 35 to 54 years 63% married 85% HH have 2+ persons 30% College (up to Master’s) 68. 5% White Collar

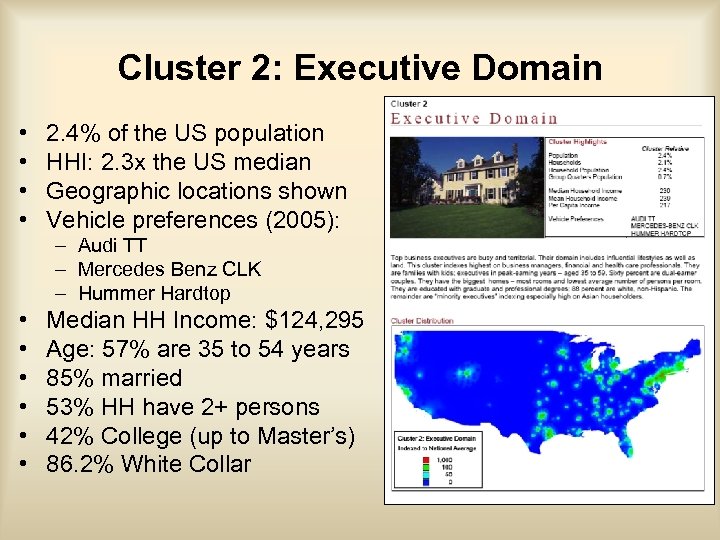

Cluster 2: Executive Domain • • 2. 4% of the US population HHI: 2. 3 x the US median Geographic locations shown Vehicle preferences (2005): – Audi TT – Mercedes Benz CLK – Hummer Hardtop • • • Median HH Income: $124, 295 Age: 57% are 35 to 54 years 85% married 53% HH have 2+ persons 42% College (up to Master’s) 86. 2% White Collar

Cluster 2: Executive Domain • • 2. 4% of the US population HHI: 2. 3 x the US median Geographic locations shown Vehicle preferences (2005): – Audi TT – Mercedes Benz CLK – Hummer Hardtop • • • Median HH Income: $124, 295 Age: 57% are 35 to 54 years 85% married 53% HH have 2+ persons 42% College (up to Master’s) 86. 2% White Collar

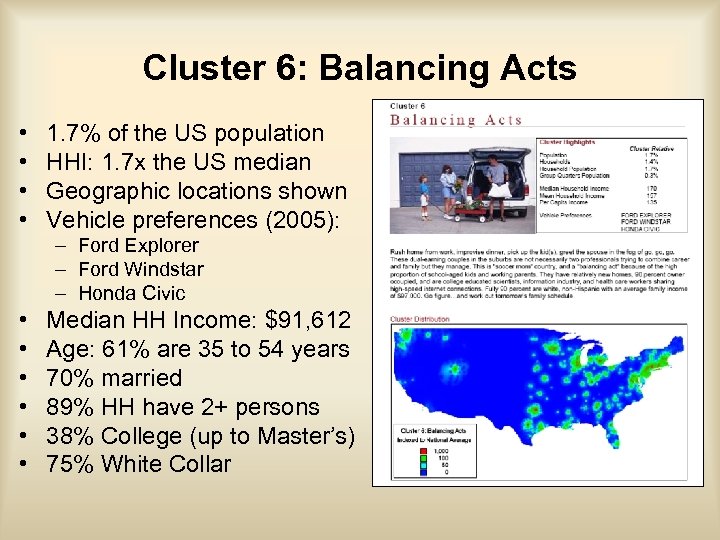

Cluster 6: Balancing Acts • • 1. 7% of the US population HHI: 1. 7 x the US median Geographic locations shown Vehicle preferences (2005): – Ford Explorer – Ford Windstar – Honda Civic • • • Median HH Income: $91, 612 Age: 61% are 35 to 54 years 70% married 89% HH have 2+ persons 38% College (up to Master’s) 75% White Collar

Cluster 6: Balancing Acts • • 1. 7% of the US population HHI: 1. 7 x the US median Geographic locations shown Vehicle preferences (2005): – Ford Explorer – Ford Windstar – Honda Civic • • • Median HH Income: $91, 612 Age: 61% are 35 to 54 years 70% married 89% HH have 2+ persons 38% College (up to Master’s) 75% White Collar

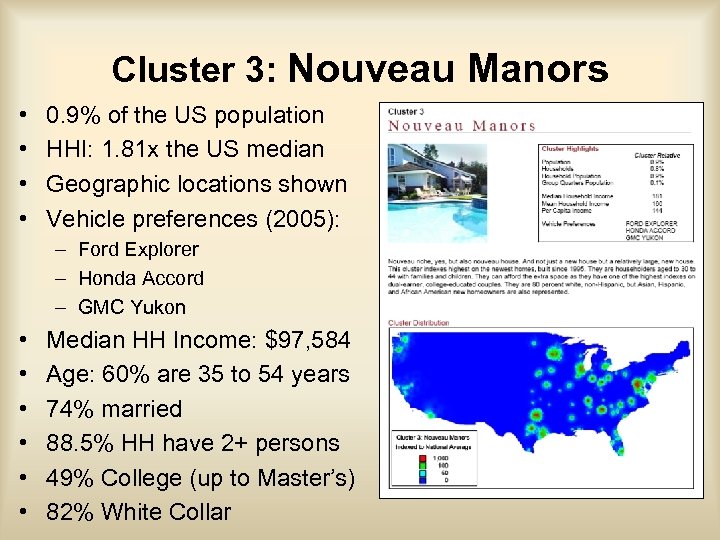

Cluster 3: Nouveau Manors • • 0. 9% of the US population HHI: 1. 81 x the US median Geographic locations shown Vehicle preferences (2005): – Ford Explorer – Honda Accord – GMC Yukon • • • Median HH Income: $97, 584 Age: 60% are 35 to 54 years 74% married 88. 5% HH have 2+ persons 49% College (up to Master’s) 82% White Collar

Cluster 3: Nouveau Manors • • 0. 9% of the US population HHI: 1. 81 x the US median Geographic locations shown Vehicle preferences (2005): – Ford Explorer – Honda Accord – GMC Yukon • • • Median HH Income: $97, 584 Age: 60% are 35 to 54 years 74% married 88. 5% HH have 2+ persons 49% College (up to Master’s) 82% White Collar

Notes on the Lifestyle Results • Each lifestyle cluster requires different tone and type of communication (ie: NY Times is appropriate in the Northeast, but wouldn’t necessarily work for Illinois) • The message can be relatively consistent across all within the lifestyle segment – across the US • The message will generally only be effective within the cluster itself. Neighborhoods with different lifestyles (even those next to each other) will not be likely to respond to the same message or media vehicle

Notes on the Lifestyle Results • Each lifestyle cluster requires different tone and type of communication (ie: NY Times is appropriate in the Northeast, but wouldn’t necessarily work for Illinois) • The message can be relatively consistent across all within the lifestyle segment – across the US • The message will generally only be effective within the cluster itself. Neighborhoods with different lifestyles (even those next to each other) will not be likely to respond to the same message or media vehicle

Notes on the Lifestyle Results • The benefit of clustering is that it can provide the opportunity to focus marketing on neighborhoods with similar lifestyles (microtargeting) – down to 500 households. • More effective targeting will eventually help the industry use limited resources more efficiently

Notes on the Lifestyle Results • The benefit of clustering is that it can provide the opportunity to focus marketing on neighborhoods with similar lifestyles (microtargeting) – down to 500 households. • More effective targeting will eventually help the industry use limited resources more efficiently

Analysis – Who is the Most Active Diver? • This is the Baby Boomer: An individual with an extremely high value set and corresponding high expectations. • This individual is highly sought after by all marketers, but especially marketers of luxury products in search of individuals with high disposable income. • This target is comfortable with and demands the trappings of wealth and luxury consistent with his/her profile. • From a destination and lifestyle experience perspective, this is the same target sought after by Four Seasons and W Hotels alike.

Analysis – Who is the Most Active Diver? • This is the Baby Boomer: An individual with an extremely high value set and corresponding high expectations. • This individual is highly sought after by all marketers, but especially marketers of luxury products in search of individuals with high disposable income. • This target is comfortable with and demands the trappings of wealth and luxury consistent with his/her profile. • From a destination and lifestyle experience perspective, this is the same target sought after by Four Seasons and W Hotels alike.

Diver Acquisition Project - Phase I Profile of the Most Active Divers in the US; Lifestyle and Demographic Study

Diver Acquisition Project - Phase I Profile of the Most Active Divers in the US; Lifestyle and Demographic Study