d262d41ed1d8f1f3b6059102415c1431.ppt

- Количество слайдов: 18

DISTRIBUTION

Market Update and Strategy Overview • The marketplace has evolved past traditional delivery platforms, creating new opportunities for SPT – Emerging platforms (VOD/Internet/Mobile) and non-traditional competition (Comcast, Google, Verizon) are now buying content and rights – To remain competitive, established platforms are diversifying the ways they deliver programming, requiring them to buy more rights • As more companies buy more content and rights; SPT is uniquely positioned to sell to all of them – Taking an “all rights under one roof” approach, including broadcast, cable, satellite and digital – Coordinating strategic approach to customers multi-faceted business objectives – Licensing more rights and creating innovative deal structures to position our content to be relevant to viewers and advertisers • As a result, we are distributing shows from more sources now than ever before: – Off broadcast (Rules of Engagement, Power of 10) – Off cable (Rescue Me, Damages) – 1 st run (Judge David Young) – Internet developed shows (The 9) – 3 rd party acquisitions (G. B. B. , Just for Laughs) – New library strategies (Minisode network) 2

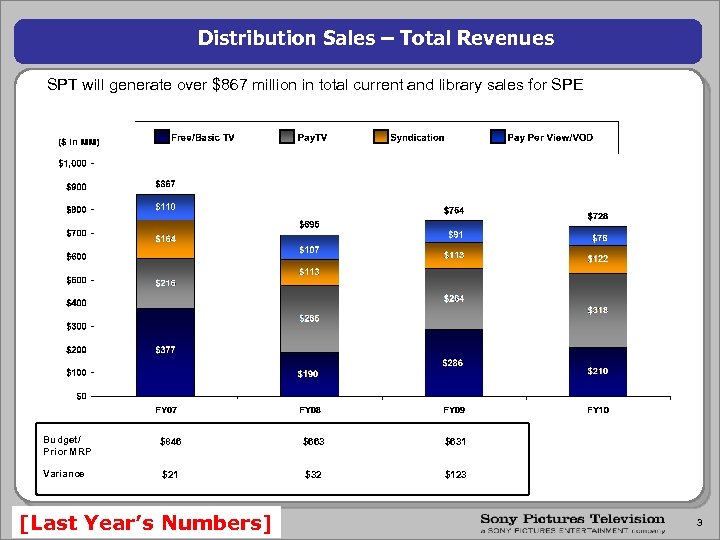

Distribution Sales – Total Revenues SPT will generate over $867 million in total current and library sales for SPE Budget/ Prior MRP $846 $663 $631 Variance $21 $32 $123 [Last Year’s Numbers] 3

Free / Basic TV Market Dynamic • Cable networks growing appetite for original programming is coming at the direct expense of acquisition budgets • For movies and TV shows, SPT is employing new strategic initiatives and licensing new rights – New internal ratings systems – Shorter and dual windowing – Inclusion of barter – Repurposing – Network VOD/SVOD – Network branded MSO VOD – EST MRP Initiatives • Increase revenue by 2 to 3% by increasing sales of non-linear digital rights across platforms • Increase library film sales by 5% by utilizing newly developed ratings and competitive database • Increase library film sales by 2 -3% by converting “event” movie buyers into ongoing buyers (e. g. , Hallmark, G 4, and E!) • Increase library sales by 1 -2% by converting non-buyers (e. g. , TV Land, Nick @ Nite, and Soap. Net) into at least occasional buyers 4

![Free / Basic TV – Revenues [Last Year’s Numbers] 5 Free / Basic TV – Revenues [Last Year’s Numbers] 5](https://present5.com/presentation/d262d41ed1d8f1f3b6059102415c1431/image-5.jpg)

Free / Basic TV – Revenues [Last Year’s Numbers] 5

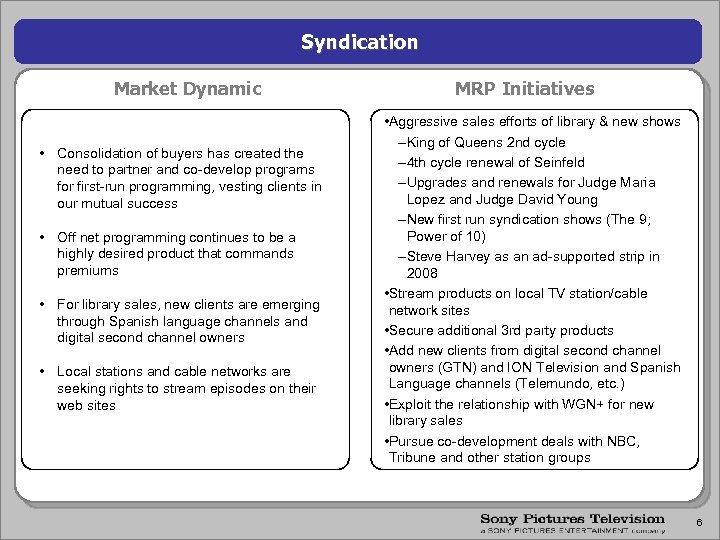

Syndication Market Dynamic • Consolidation of buyers has created the need to partner and co-develop programs for first-run programming, vesting clients in our mutual success • Off net programming continues to be a highly desired product that commands premiums • For library sales, new clients are emerging through Spanish language channels and digital second channel owners • Local stations and cable networks are seeking rights to stream episodes on their web sites MRP Initiatives • Aggressive sales efforts of library & new shows – King of Queens 2 nd cycle – 4 th cycle renewal of Seinfeld – Upgrades and renewals for Judge Maria Lopez and Judge David Young – New first run syndication shows (The 9; Power of 10) – Steve Harvey as an ad-supported strip in 2008 • Stream products on local TV station/cable network sites • Secure additional 3 rd party products • Add new clients from digital second channel owners (GTN) and ION Television and Spanish Language channels (Telemundo, etc. ) • Exploit the relationship with WGN+ for new library sales • Pursue co-development deals with NBC, Tribune and other station groups 6

![Syndication – Revenues [Last Year’s Numbers] 7 Syndication – Revenues [Last Year’s Numbers] 7](https://present5.com/presentation/d262d41ed1d8f1f3b6059102415c1431/image-7.jpg)

Syndication – Revenues [Last Year’s Numbers] 7

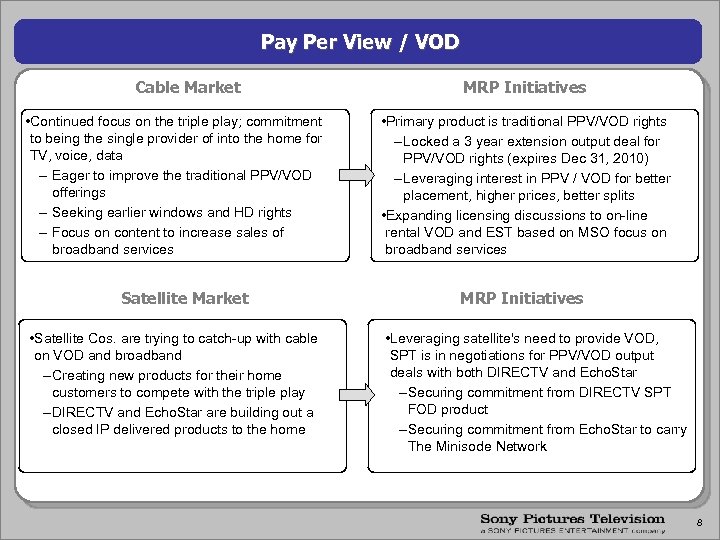

Pay Per View / VOD Cable Market • Continued focus on the triple play; commitment to being the single provider of into the home for TV, voice, data – Eager to improve the traditional PPV/VOD offerings – Seeking earlier windows and HD rights – Focus on content to increase sales of broadband services Satellite Market • Satellite Cos. are trying to catch-up with cable on VOD and broadband – Creating new products for their home customers to compete with the triple play – DIRECTV and Echo. Star are building out a closed IP delivered products to the home MRP Initiatives • Primary product is traditional PPV/VOD rights – Locked a 3 year extension output deal for PPV/VOD rights (expires Dec 31, 2010) – Leveraging interest in PPV / VOD for better placement, higher prices, better splits • Expanding licensing discussions to on-line rental VOD and EST based on MSO focus on broadband services MRP Initiatives • Leveraging satellite's need to provide VOD, SPT is in negotiations for PPV/VOD output deals with both DIRECTV and Echo. Star – Securing commitment from DIRECTV SPT FOD product – Securing commitment from Echo. Star to carry The Minisode Network 8

![Pay Per View / VOD – Revenues [Last Year’s Numbers] 9 Pay Per View / VOD – Revenues [Last Year’s Numbers] 9](https://present5.com/presentation/d262d41ed1d8f1f3b6059102415c1431/image-9.jpg)

Pay Per View / VOD – Revenues [Last Year’s Numbers] 9

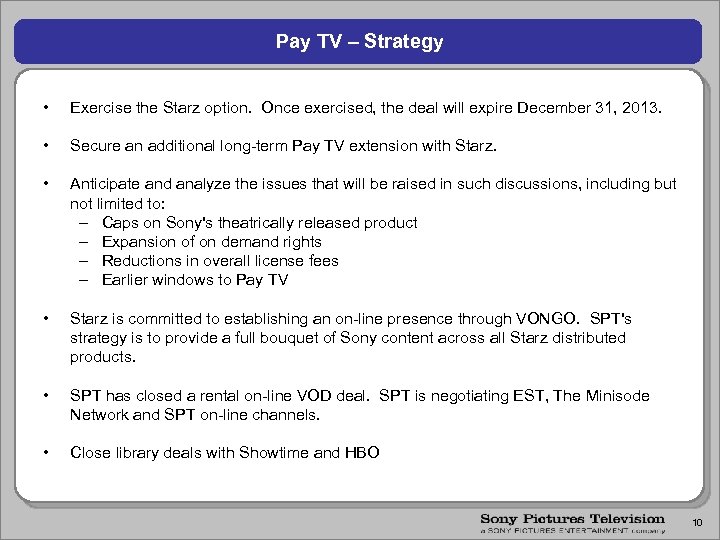

Pay TV – Strategy • Exercise the Starz option. Once exercised, the deal will expire December 31, 2013. • Secure an additional long-term Pay TV extension with Starz. • Anticipate and analyze the issues that will be raised in such discussions, including but not limited to: – Caps on Sony's theatrically released product – Expansion of on demand rights – Reductions in overall license fees – Earlier windows to Pay TV • Starz is committed to establishing an on-line presence through VONGO. SPT's strategy is to provide a full bouquet of Sony content across all Starz distributed products. • SPT has closed a rental on-line VOD deal. SPT is negotiating EST, The Minisode Network and SPT on-line channels. • Close library deals with Showtime and HBO 10

![Pay TV – Revenues [Last Year’s Numbers] 11 Pay TV – Revenues [Last Year’s Numbers] 11](https://present5.com/presentation/d262d41ed1d8f1f3b6059102415c1431/image-11.jpg)

Pay TV – Revenues [Last Year’s Numbers] 11

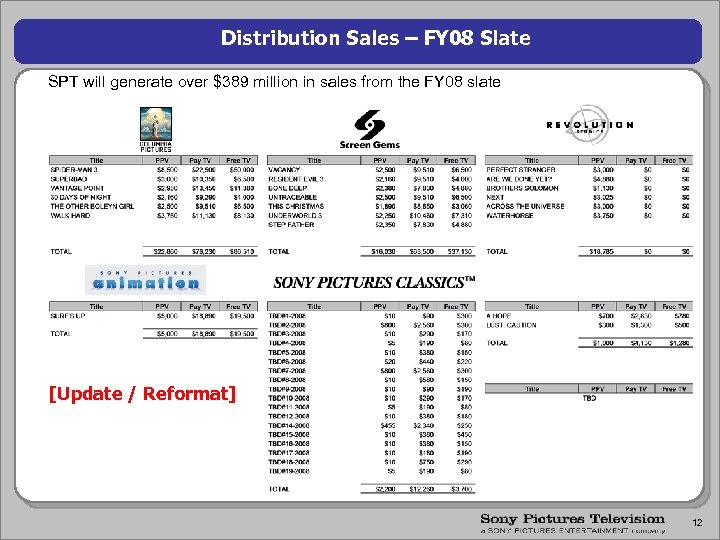

Distribution Sales – FY 08 Slate SPT will generate over $389 million in sales from the FY 08 slate [Update / Reformat] 12

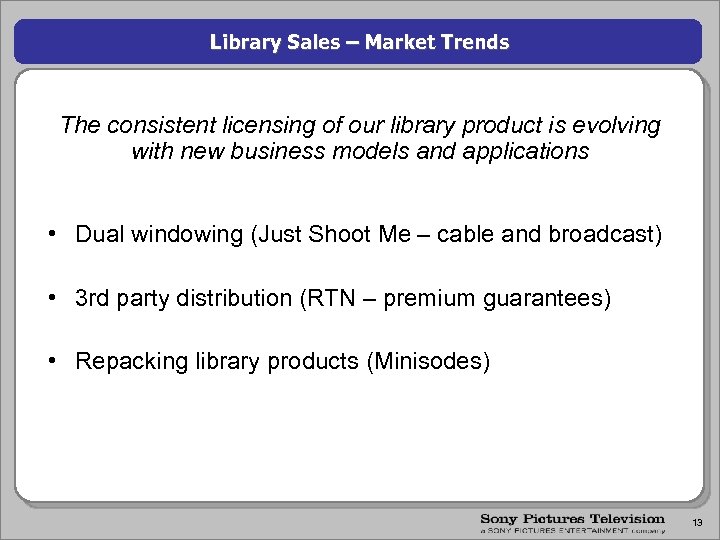

Library Sales – Market Trends The consistent licensing of our library product is evolving with new business models and applications • Dual windowing (Just Shoot Me – cable and broadcast) • 3 rd party distribution (RTN – premium guarantees) • Repacking library products (Minisodes) 13

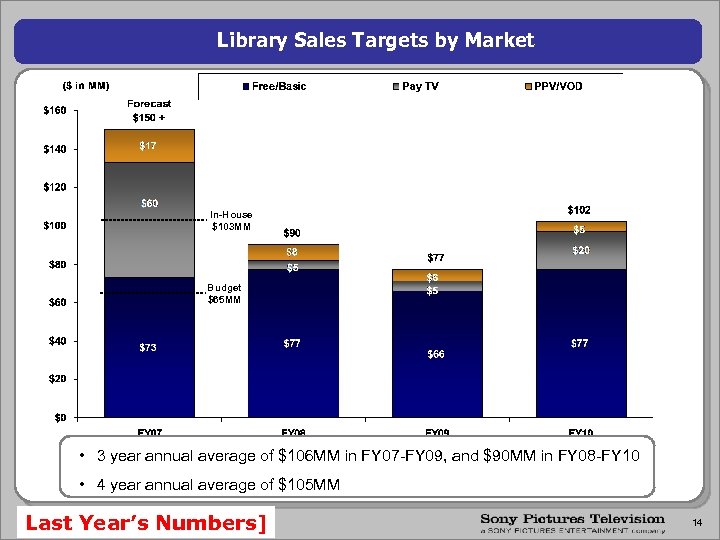

Library Sales Targets by Market In-House $103 MM Budget $65 MM • 3 year annual average of $106 MM in FY 07 -FY 09, and $90 MM in FY 08 -FY 10 • 4 year annual average of $105 MM Last Year’s Numbers] 14

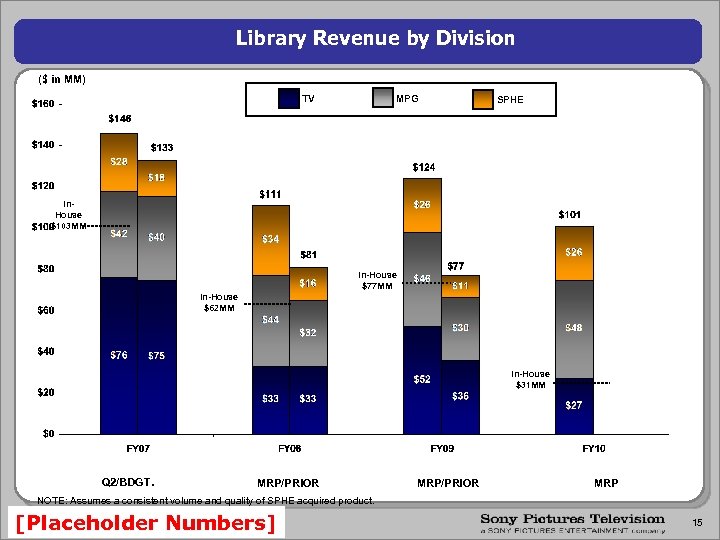

Library Revenue by Division ($ in MM) MPG TV SPHE In. House $103 MM In-House $77 MM In-House $62 MM In-House $31 MM Q 2/BDGT. MRP/PRIOR MRP NOTE: Assumes a consistent volume and quality of SPHE acquired product. [Placeholder Numbers] 15

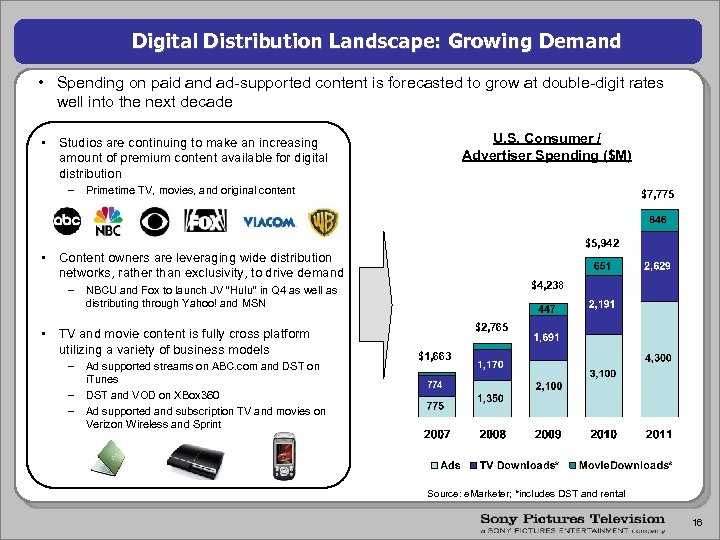

Digital Distribution Landscape: Growing Demand • Spending on paid and ad-supported content is forecasted to grow at double-digit rates well into the next decade • U. S. Consumer / Advertiser Spending ($M) Studios are continuing to make an increasing amount of premium content available for digital distribution – Primetime TV, movies, and original content $7, 775 $5, 942 • Content owners are leveraging wide distribution networks, rather than exclusivity, to drive demand $4, 238 – NBCU and Fox to launch JV “Hulu” in Q 4 as well as distributing through Yahoo! and MSN • TV and movie content is fully cross platform utilizing a variety of business models – Ad supported streams on ABC. com and DST on i. Tunes – DST and VOD on XBox 360 – Ad supported and subscription TV and movies on Verizon Wireless and Sprint $2, 765 $1, 663 Source: e. Marketer; *includes DST and rental 16

Digital Distribution SPT Strategy & Financials • Aggressively build the distribution network – • Continue to expand the overall content offering – – • Broaden selection of film and TV product Introduce the most compelling short-form/original content into the offering Continue to lead the market in innovating the digital product offering and usage models – • Strike partnerships across the complete spectrum of traditional and on-line players Focus on Digital Sell-Through as foundational/core product Build a strong, retail-focused organization – – Create innovative marketing and promotional programs Continue to lead the industry with respect to asset delivery and digital operations Total Revenue 17

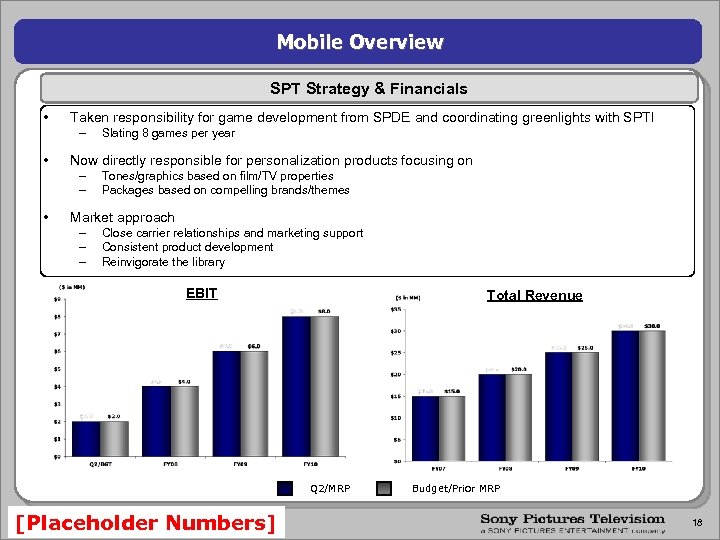

Mobile Overview SPT Strategy & Financials • Taken responsibility for game development from SPDE and coordinating greenlights with SPTI – • Now directly responsible for personalization products focusing on – – • Slating 8 games per year Tones/graphics based on film/TV properties Packages based on compelling brands/themes Market approach – – – Close carrier relationships and marketing support Consistent product development Reinvigorate the library EBIT Total Revenue Q 2/MRP [Placeholder Numbers] Budget/Prior MRP 18

d262d41ed1d8f1f3b6059102415c1431.ppt