c0c5fb77ebf4c71646896a2ccc7d49f9.ppt

- Количество слайдов: 26

DISTRIBUTION AUTOMATION Scott Ware Product Manager - Automation Smart Grid and Lazer DA Strategy Competition Resources 1

Smart Grid and Lazer 2

Drivers 3

Customer Value of Automating • Increase reliability and uptime • Improved performance metrics for rates (SAIDI, SAIFI, CAIDI…) • Reduces human error • Reduces humans • Reduces need for emergency dispatches and time to find faults • Performance Based Rates 4

DISTRIBUTION AUTOMATION • Two or more G&W devices communicating and doing something – Switchgear or reclosers – Relays – Communication – Packaged • Up to full SCADA package 5

Specific Value to You • • • 6 Customer future is automation Stimulus money Helps lock in our products Helps break commodity pricing Expand your value to the customer More $ in automated products than non -automated products

Automation Up Sell • There is more money in automation – Two Viper ST’s - $40 K – Two Viper ST’s communicating in an auto transfer scheme - $55 K – Two Vipers communicating to existing Vipers in an FDIR scheme - $100 K • 4 way SF 6 or Trident – Normal product - $55 k – Lazer Ready package - $75 k

Strategy 8

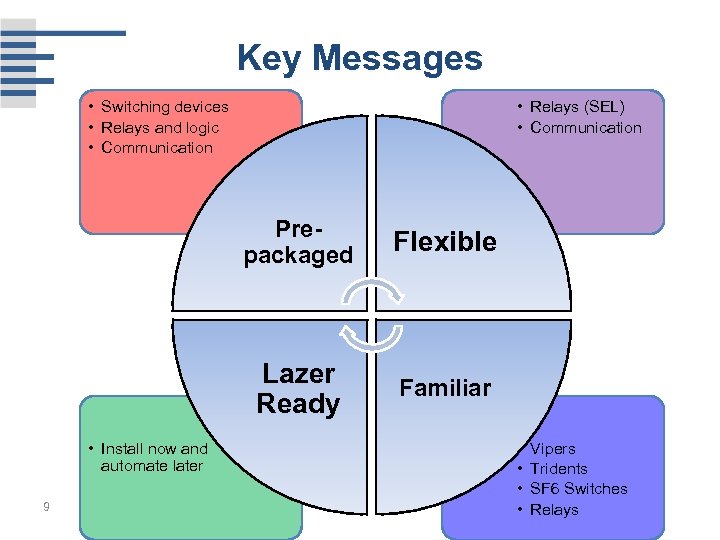

Key Messages • Switching devices • Relays and logic • Communication • Relays (SEL) • Communication Prepackaged Lazer Ready • Install now and automate later 9 Flexible Familiar • • Vipers Tridents SF 6 Switches Relays

North America – C&I Market and Coops / Munis Promote packaged solutions as individual products: • No engineering department required • Familiar products with flexibility • Short start up time • Examples – Kauai Electric, Camp Humphreys, Woodstock, Brantford Power, City of Newnan, UNC, Purdue, San Diego Airport • Primary offering as SEL but open to others C&I Potential Customers • Hospitals and universities • Manufacturers requiring reliable power • Engineering firms, EPC’s, and developers • Military installations 10

North America – Major Utilities, IOU’s 1. Lazer Ready products as primary offering 2. High speed automated loops as secondary offering for specific areas Benefits: • Products work with existing system • Familiarity of SEL relays • Open protocols • Co-selling with SEL 1. Build a Smart Grid one smart product at a time 2. Examples – AEP, PSE&G 11

International • C&I market - reliable power – US Military Bases in particular • Major utilities (independent or government owned) – – Look for partners Intelligent components Experience and reliability Help promote their Smart Grid initiatives with US reliability • Products – Submersible or other demanding applications where RMU’s won’t work. – Trident solutions where greenhouse gas emissions are an issue. 12

Competition 13

Competition • Primary Competitor – S&C Electric • Secondary Competitors – Cooper, ABB, • Third Tier Competitors – Siemens, Powell, GE, Schneider, Eaton, Noja, Lucy 14

Intelliteam • • • Will push their own relays / controllers Can offer SEL as alternative More experience and bigger installed base Want engineering + design work too Other products that we do not offer (distribution level UPS, static VAR compensator…) • Larger company - more resources.

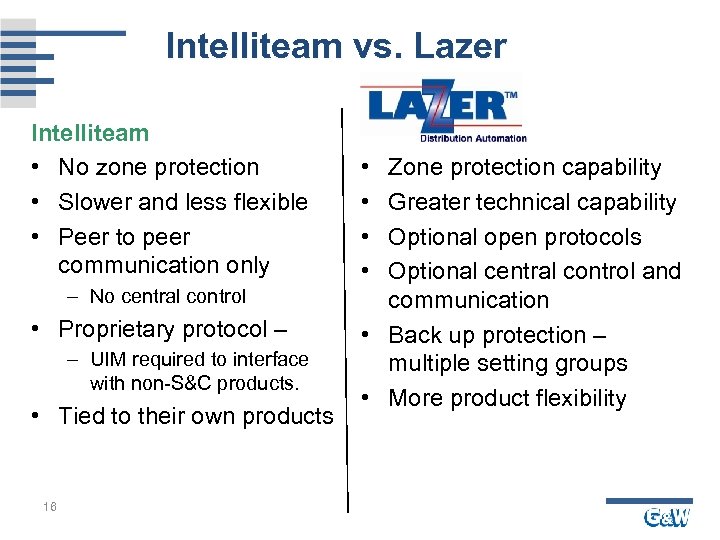

Intelliteam vs. Lazer Intelliteam • No zone protection • Slower and less flexible • Peer to peer communication only – No central control • Proprietary protocol – – UIM required to interface with non-S&C products. • Tied to their own products 16 • • Zone protection capability Greater technical capability Optional open protocols Optional central control and communication • Back up protection – multiple setting groups • More product flexibility

• Uses their own relays and protocols • 4 tier marketing from independent products to peer-to-peer communication • Market leading recloser • EAS group, Cannon PLC, Cyme • Big company service • Will only use their own relays (inflexible) 17

• • • 18 Systems and packages Transmission leader True global company Not as interested in smaller projects Will only use their own relays Few distribution installations

Others – Third Tier Competitors Switchgear Manufacturers / Multi-Nationals Product Manufacturers • Siemens • General Electric • Schneider / Square D • Eaton / Cutler Hammer • Powell • Noja • Lucy • Whipp & Bourne • Koreans Generally not interested in smaller projects and / or don’t have the products to do it. 19 Haven’t shown and interest or competence in this yet.

Resources 20

Marketing Development • More Lazer ads – Individual – As part of other product ads • Application guides – Currently 5 – More added as new projects come • Tradeshow promotion – Distributech – IEEE 21

Marketing Resources • Standard FAT document to send with quote on request (May 2010) • Standard designs – System / functionality templates – Drawings • Webinars in 2010 (Dates coming) • Updated website with more resources • New catalog (June) 22

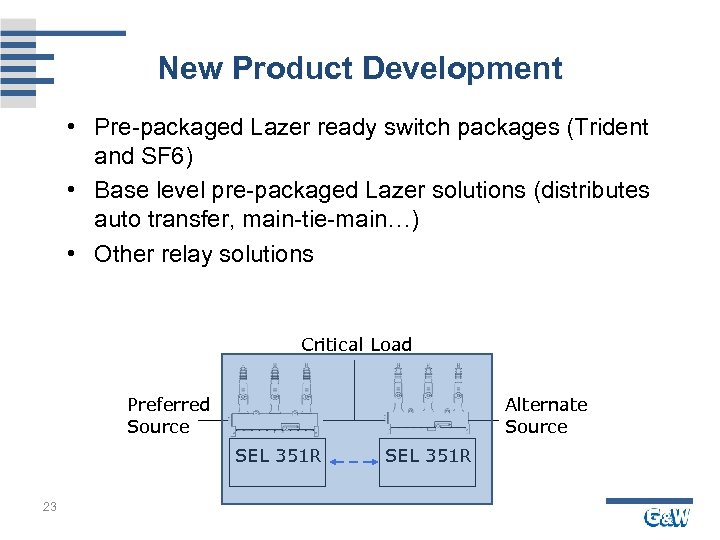

New Product Development • Pre-packaged Lazer ready switch packages (Trident and SF 6) • Base level pre-packaged Lazer solutions (distributes auto transfer, main-tie-main…) • Other relay solutions Critical Load Preferred Source Alternate Source SEL 351 R 23 SEL 351 R

Services and Commissioning F. A. T. Training Field Service

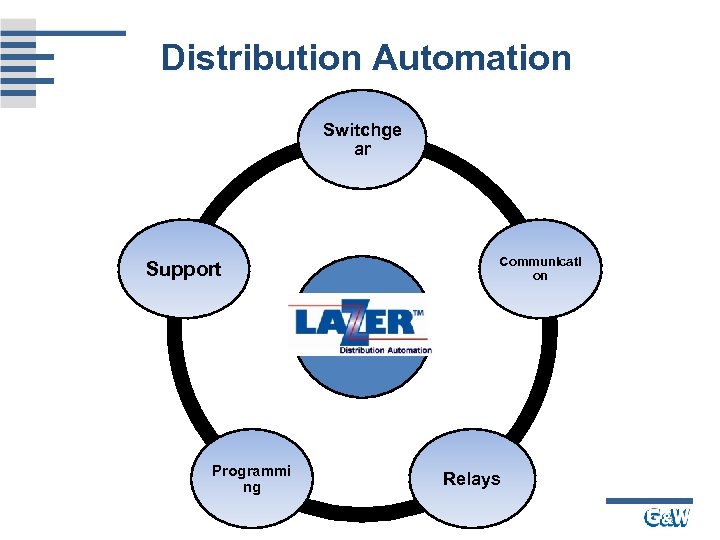

Distribution Automation Switchge ar Support Programmi ng Communicati on Relays

Can G&W Do It? Yes we can!

c0c5fb77ebf4c71646896a2ccc7d49f9.ppt