de958438fbac0af6c24c6716f92883ef.ppt

- Количество слайдов: 28

Distressed M&A Transactions June 16, 2009 1: 30 -3: 00 PM Eastern Time Dorsey & Whitney LLP Bryan S. Gadol, Michael Foreman & Wendy R. Kottmeier

Distressed M&A Transactions June 16, 2009 1: 30 -3: 00 PM Eastern Time Dorsey & Whitney LLP Bryan S. Gadol, Michael Foreman & Wendy R. Kottmeier

Part 1: Out-of-Court Transaction Issues • Fraudulent Transfer – Beware of having a transaction unwound after it closes • Successor Liability – Heightened concern due to less effective indemnification protections • Fiduciary Duties of Directors – Not only the seller’s concern

Part 1: Out-of-Court Transaction Issues • Fraudulent Transfer – Beware of having a transaction unwound after it closes • Successor Liability – Heightened concern due to less effective indemnification protections • Fiduciary Duties of Directors – Not only the seller’s concern

Fraudulent Transfer • Actual fraudulent transfer vs. constructive fraudulent transfer - Actual fraud – intent to defraud, hinder or delay creditors - Constructive fraud – (1) debtor is insolvent at the time of the sale (or becomes insolvent as a result of the sale), and (2) doesn’t receive “reasonably equivalent value” in exchange for the transferred assets • Risk to buyers is that the sale may be unwound after the fact - claims can be asserted months or even years after the sale - a successful claim results in forced return by the buyer of the purchased assets (or the value thereof) - buyer is left with an unsecured claim against an insolvent seller • Buyers need to evaluate distressed assets/targets with “reasonably equivalent value” in mind - marketability of assets, level of interest from other buyers - third party appraisal, if time permits - not the same as fair market value – the law permits a sale at a discount – how much?

Fraudulent Transfer • Actual fraudulent transfer vs. constructive fraudulent transfer - Actual fraud – intent to defraud, hinder or delay creditors - Constructive fraud – (1) debtor is insolvent at the time of the sale (or becomes insolvent as a result of the sale), and (2) doesn’t receive “reasonably equivalent value” in exchange for the transferred assets • Risk to buyers is that the sale may be unwound after the fact - claims can be asserted months or even years after the sale - a successful claim results in forced return by the buyer of the purchased assets (or the value thereof) - buyer is left with an unsecured claim against an insolvent seller • Buyers need to evaluate distressed assets/targets with “reasonably equivalent value” in mind - marketability of assets, level of interest from other buyers - third party appraisal, if time permits - not the same as fair market value – the law permits a sale at a discount – how much?

Successor Liability • General Rule: acquiring company in a purchase of assets is generally not liable for the debts or liabilities of the selling company, unless specifically assumed/agreed upon • Four traditional exceptions: 1) the successor expressly or impliedly assumes the predecessor's liabilities; 2) there is an actual or de facto consolidation or merger of the seller and the purchaser; 3) the purchasing company is a mere continuation of the seller; or 4) the transaction is entered into fraudulently to escape liability • Areas where exceptions may be found: - environmental liabilities - products liability - tax - employee benefits - labor and employment • Creditors of an insolvent seller will be looking for someone to satisfy claims • Indemnification provisions in sale contract likely to be ineffective if seller is insolvent • Due diligence to uncover potential successor liability claims

Successor Liability • General Rule: acquiring company in a purchase of assets is generally not liable for the debts or liabilities of the selling company, unless specifically assumed/agreed upon • Four traditional exceptions: 1) the successor expressly or impliedly assumes the predecessor's liabilities; 2) there is an actual or de facto consolidation or merger of the seller and the purchaser; 3) the purchasing company is a mere continuation of the seller; or 4) the transaction is entered into fraudulently to escape liability • Areas where exceptions may be found: - environmental liabilities - products liability - tax - employee benefits - labor and employment • Creditors of an insolvent seller will be looking for someone to satisfy claims • Indemnification provisions in sale contract likely to be ineffective if seller is insolvent • Due diligence to uncover potential successor liability claims

Fiduciary Duties of Directors • Fiduciary duties of directors of a solvent corporation: duty of care and duty of loyalty to the corporation and its stockholders • Fiduciary duties of directors of an insolvent corporation: directors have fiduciary duties to the creditors as well • When does the duty shift? - under U. S. law there at least three tests for determining when a corporation is insolvent: (1) unable to pay debts as they become due (2) liabilities exceed reasonable value of assets (3) when a transaction leaves a corporation with too little capital to conduct its ongoing business * determining the precise moment of insolvency is not practical, even possible • The “zone of insolvency” and “deepening insolvency” theories; recent Delaware cases • Fairness Opinions & Solvency Opinions

Fiduciary Duties of Directors • Fiduciary duties of directors of a solvent corporation: duty of care and duty of loyalty to the corporation and its stockholders • Fiduciary duties of directors of an insolvent corporation: directors have fiduciary duties to the creditors as well • When does the duty shift? - under U. S. law there at least three tests for determining when a corporation is insolvent: (1) unable to pay debts as they become due (2) liabilities exceed reasonable value of assets (3) when a transaction leaves a corporation with too little capital to conduct its ongoing business * determining the precise moment of insolvency is not practical, even possible • The “zone of insolvency” and “deepening insolvency” theories; recent Delaware cases • Fairness Opinions & Solvency Opinions

Part II: Bankruptcy Transaction Issues • Pre-packaged Chapter 11 Plan v. Pre-Arranged Chapter 11 transaction – When does one make sense over the other? • Bidding Procedures – Stalking Horse Benefits, Protections and Risks • DIP Financing and First Day Motions • The Lehman Bros. , Chrysler & GM Experiences – Unique deals for unique circumstances or harbingers for the next wave?

Part II: Bankruptcy Transaction Issues • Pre-packaged Chapter 11 Plan v. Pre-Arranged Chapter 11 transaction – When does one make sense over the other? • Bidding Procedures – Stalking Horse Benefits, Protections and Risks • DIP Financing and First Day Motions • The Lehman Bros. , Chrysler & GM Experiences – Unique deals for unique circumstances or harbingers for the next wave?

Pre-Packaged and Pre-Negotiated Chapter 11’s • “Pre-Pack”: the sale terms are negotiated before the bankruptcy filing and the Chapter 11 plan, which incorporates those terms, is filed simultaneously with the bankruptcy petition • Section 363 Sale: sale resulting from bidding procedures and auction authorized by bankruptcy court, and subject to approval of bankruptcy court as highest and best bid - Sale of business as going concern or liquidation / going out of business - Free and clear of liens and claims • Chapter 11 Plan: sale, merger or recapitalization of target through plan of reorganization voted on by creditors and approved (confirmed) by bankruptcy court

Pre-Packaged and Pre-Negotiated Chapter 11’s • “Pre-Pack”: the sale terms are negotiated before the bankruptcy filing and the Chapter 11 plan, which incorporates those terms, is filed simultaneously with the bankruptcy petition • Section 363 Sale: sale resulting from bidding procedures and auction authorized by bankruptcy court, and subject to approval of bankruptcy court as highest and best bid - Sale of business as going concern or liquidation / going out of business - Free and clear of liens and claims • Chapter 11 Plan: sale, merger or recapitalization of target through plan of reorganization voted on by creditors and approved (confirmed) by bankruptcy court

Significant Elements of Chapter 11 Plan Confirmation Process • Disclosure statement – must contain “adequate information” that would enable a hypothetical investor to make an informed judgment about the proposed plan • Confirmation hearing – Feasibility of plan – Ability to “cramdown” plan on non-consenting junior creditors – Creditor acceptance v. cram down, provided compliance with Bankruptcy Code and one impaired class votes for plan • Common plan disputes: enterprise valuation; feasibility • Class voting: class approves if plan accepted by creditors holding at least 2/3 rds of the claims in the class and constituting more than half of the number of creditors • Absolute priority rule – new value exception and debt for equity swaps

Significant Elements of Chapter 11 Plan Confirmation Process • Disclosure statement – must contain “adequate information” that would enable a hypothetical investor to make an informed judgment about the proposed plan • Confirmation hearing – Feasibility of plan – Ability to “cramdown” plan on non-consenting junior creditors – Creditor acceptance v. cram down, provided compliance with Bankruptcy Code and one impaired class votes for plan • Common plan disputes: enterprise valuation; feasibility • Class voting: class approves if plan accepted by creditors holding at least 2/3 rds of the claims in the class and constituting more than half of the number of creditors • Absolute priority rule – new value exception and debt for equity swaps

Pre-Packaged Chapter 11 Plan of Reorganization • Solicit acceptances of reorganization plan prior to filing Chapter 11 petition, schedules, statement of affairs, disclosure statement and plan • Solicitation may require SEC registration, but can be combined with an SEC registered exchange offer • Restructuring documents negotiated with ad hoc bondholders committee or creditors holding a controlling class position • If high enough percentage accept, issuer may complete the exchange offer. If only 2/3 of amount and half in number accept, issuer may proceed with a prepackaged plan • Disclosure statement approval hearing and confirmation hearing scheduled at time Chapter 11 petition is filed, and may be combined into a single hearing • Restructuring will be transparent to trade and other “ordinary course” creditors

Pre-Packaged Chapter 11 Plan of Reorganization • Solicit acceptances of reorganization plan prior to filing Chapter 11 petition, schedules, statement of affairs, disclosure statement and plan • Solicitation may require SEC registration, but can be combined with an SEC registered exchange offer • Restructuring documents negotiated with ad hoc bondholders committee or creditors holding a controlling class position • If high enough percentage accept, issuer may complete the exchange offer. If only 2/3 of amount and half in number accept, issuer may proceed with a prepackaged plan • Disclosure statement approval hearing and confirmation hearing scheduled at time Chapter 11 petition is filed, and may be combined into a single hearing • Restructuring will be transparent to trade and other “ordinary course” creditors

Pre-Negotiated Chapter 11 Plan • Plan term sheet or definitive documents negotiated with ad hoc bondholders committee or creditors holding a controlling class position • Chapter 11 petition is filed, together with disclosure statement, plan and other restructuring documents (including DIP financing and/or cash collateral stipulation) • Acceptances are solicited after bankruptcy court approval of disclosure statement (minimum 25 days notice required for each of disclosure statement approval and plan confirmation hearings) • Lock-up and plan support agreements: creditor can agree to support plan and oppose any competing plan, but cannot agree to vote for plan

Pre-Negotiated Chapter 11 Plan • Plan term sheet or definitive documents negotiated with ad hoc bondholders committee or creditors holding a controlling class position • Chapter 11 petition is filed, together with disclosure statement, plan and other restructuring documents (including DIP financing and/or cash collateral stipulation) • Acceptances are solicited after bankruptcy court approval of disclosure statement (minimum 25 days notice required for each of disclosure statement approval and plan confirmation hearings) • Lock-up and plan support agreements: creditor can agree to support plan and oppose any competing plan, but cannot agree to vote for plan

Impact of Chapter 11 Under Section 363 Sale • All actions by debtor outside ordinary course of business require bankruptcy court approval – Asset sales conducted through Section 363(b) auction process – Asset sales free and clear of all liens, claims and encumbrances • Executory contracts may be assumed, assumed and assigned (free of most assignment restrictions), or rejected – Time to assume, reject or assume and assign commercial leases cannot be extended beyond first 210 days without landlord consent – Assumption conditioned on cure of pre-petition defaults – Rejection creates pre-petition unsecured damage claims encumbrances • Automatic stay enjoins all actions against debtor and its assets – Any action against collateral (including escrowed funds) requires bankruptcy court approval – Likely prevents any action against multi-national debtor in a foreign proceeding

Impact of Chapter 11 Under Section 363 Sale • All actions by debtor outside ordinary course of business require bankruptcy court approval – Asset sales conducted through Section 363(b) auction process – Asset sales free and clear of all liens, claims and encumbrances • Executory contracts may be assumed, assumed and assigned (free of most assignment restrictions), or rejected – Time to assume, reject or assume and assign commercial leases cannot be extended beyond first 210 days without landlord consent – Assumption conditioned on cure of pre-petition defaults – Rejection creates pre-petition unsecured damage claims encumbrances • Automatic stay enjoins all actions against debtor and its assets – Any action against collateral (including escrowed funds) requires bankruptcy court approval – Likely prevents any action against multi-national debtor in a foreign proceeding

Pre-Negotiated Section 363 Sale • Asset sale negotiated with stalking horse bidder, consented to by senior creditors and/or ad hoc bondholders committee • Motions for approval of bidding procedures and sale filed with Chapter 11 petition • Sales not permitted within 20 days of bankruptcy filing unless necessary to avoid immediate and irreparable harm (Bankruptcy Rule 6003) • Distribution of net sale proceeds subject to further bankruptcy court order or confirmation of Chapter 11 plan: senior creditor can “gift” distribution to junior creditors

Pre-Negotiated Section 363 Sale • Asset sale negotiated with stalking horse bidder, consented to by senior creditors and/or ad hoc bondholders committee • Motions for approval of bidding procedures and sale filed with Chapter 11 petition • Sales not permitted within 20 days of bankruptcy filing unless necessary to avoid immediate and irreparable harm (Bankruptcy Rule 6003) • Distribution of net sale proceeds subject to further bankruptcy court order or confirmation of Chapter 11 plan: senior creditor can “gift” distribution to junior creditors

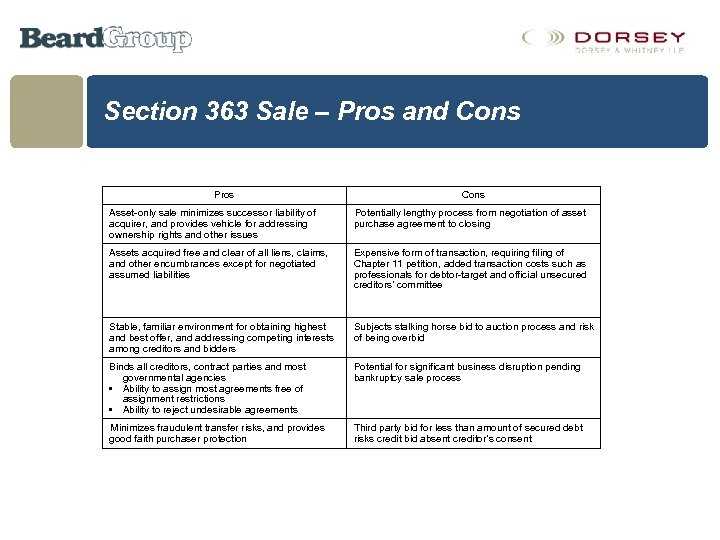

Section 363 Sale – Pros and Cons Pros Cons Asset-only sale minimizes successor liability of acquirer, and provides vehicle for addressing ownership rights and other issues Potentially lengthy process from negotiation of asset purchase agreement to closing Assets acquired free and clear of all liens, claims, and other encumbrances except for negotiated assumed liabilities Expensive form of transaction, requiring filing of Chapter 11 petition, added transaction costs such as professionals for debtor-target and official unsecured creditors’ committee Stable, familiar environment for obtaining highest and best offer, and addressing competing interests among creditors and bidders Subjects stalking horse bid to auction process and risk of being overbid Binds all creditors, contract parties and most governmental agencies • Ability to assign most agreements free of assignment restrictions • Ability to reject undesirable agreements Potential for significant business disruption pending bankruptcy sale process Minimizes fraudulent transfer risks, and provides good faith purchaser protection Third party bid for less than amount of secured debt risks credit bid absent creditor’s consent

Section 363 Sale – Pros and Cons Pros Cons Asset-only sale minimizes successor liability of acquirer, and provides vehicle for addressing ownership rights and other issues Potentially lengthy process from negotiation of asset purchase agreement to closing Assets acquired free and clear of all liens, claims, and other encumbrances except for negotiated assumed liabilities Expensive form of transaction, requiring filing of Chapter 11 petition, added transaction costs such as professionals for debtor-target and official unsecured creditors’ committee Stable, familiar environment for obtaining highest and best offer, and addressing competing interests among creditors and bidders Subjects stalking horse bid to auction process and risk of being overbid Binds all creditors, contract parties and most governmental agencies • Ability to assign most agreements free of assignment restrictions • Ability to reject undesirable agreements Potential for significant business disruption pending bankruptcy sale process Minimizes fraudulent transfer risks, and provides good faith purchaser protection Third party bid for less than amount of secured debt risks credit bid absent creditor’s consent

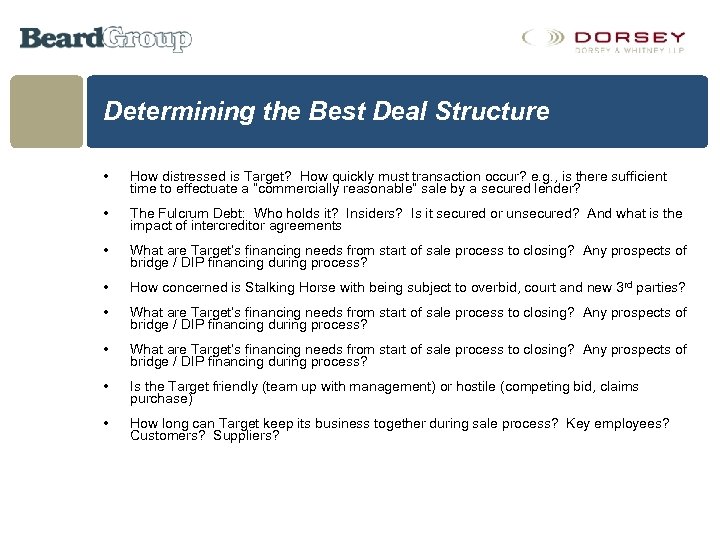

Determining the Best Deal Structure • How distressed is Target? How quickly must transaction occur? e. g. , is there sufficient time to effectuate a “commercially reasonable” sale by a secured lender? • The Fulcrum Debt: Who holds it? Insiders? Is it secured or unsecured? And what is the impact of intercreditor agreements • What are Target’s financing needs from start of sale process to closing? Any prospects of bridge / DIP financing during process? • How concerned is Stalking Horse with being subject to overbid, court and new 3 rd parties? • What are Target’s financing needs from start of sale process to closing? Any prospects of bridge / DIP financing during process? • Is the Target friendly (team up with management) or hostile (competing bid, claims purchase) • How long can Target keep its business together during sale process? Key employees? Customers? Suppliers?

Determining the Best Deal Structure • How distressed is Target? How quickly must transaction occur? e. g. , is there sufficient time to effectuate a “commercially reasonable” sale by a secured lender? • The Fulcrum Debt: Who holds it? Insiders? Is it secured or unsecured? And what is the impact of intercreditor agreements • What are Target’s financing needs from start of sale process to closing? Any prospects of bridge / DIP financing during process? • How concerned is Stalking Horse with being subject to overbid, court and new 3 rd parties? • What are Target’s financing needs from start of sale process to closing? Any prospects of bridge / DIP financing during process? • Is the Target friendly (team up with management) or hostile (competing bid, claims purchase) • How long can Target keep its business together during sale process? Key employees? Customers? Suppliers?

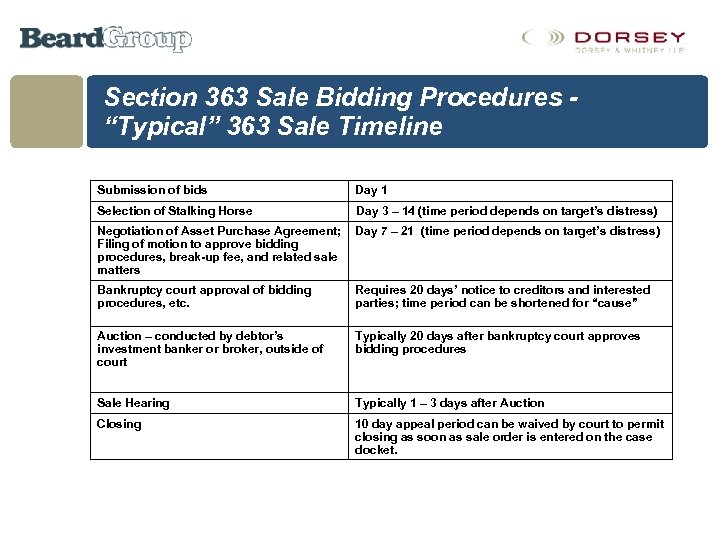

Section 363 Sale Bidding Procedures “Typical” 363 Sale Timeline Submission of bids Day 1 Selection of Stalking Horse Day 3 – 14 (time period depends on target’s distress) Negotiation of Asset Purchase Agreement; Filing of motion to approve bidding procedures, break-up fee, and related sale matters Day 7 – 21 (time period depends on target’s distress) Bankruptcy court approval of bidding procedures, etc. Requires 20 days’ notice to creditors and interested parties; time period can be shortened for “cause” Auction – conducted by debtor’s investment banker or broker, outside of court Typically 20 days after bankruptcy court approves bidding procedures Sale Hearing Typically 1 – 3 days after Auction Closing 10 day appeal period can be waived by court to permit closing as soon as sale order is entered on the case docket.

Section 363 Sale Bidding Procedures “Typical” 363 Sale Timeline Submission of bids Day 1 Selection of Stalking Horse Day 3 – 14 (time period depends on target’s distress) Negotiation of Asset Purchase Agreement; Filing of motion to approve bidding procedures, break-up fee, and related sale matters Day 7 – 21 (time period depends on target’s distress) Bankruptcy court approval of bidding procedures, etc. Requires 20 days’ notice to creditors and interested parties; time period can be shortened for “cause” Auction – conducted by debtor’s investment banker or broker, outside of court Typically 20 days after bankruptcy court approves bidding procedures Sale Hearing Typically 1 – 3 days after Auction Closing 10 day appeal period can be waived by court to permit closing as soon as sale order is entered on the case docket.

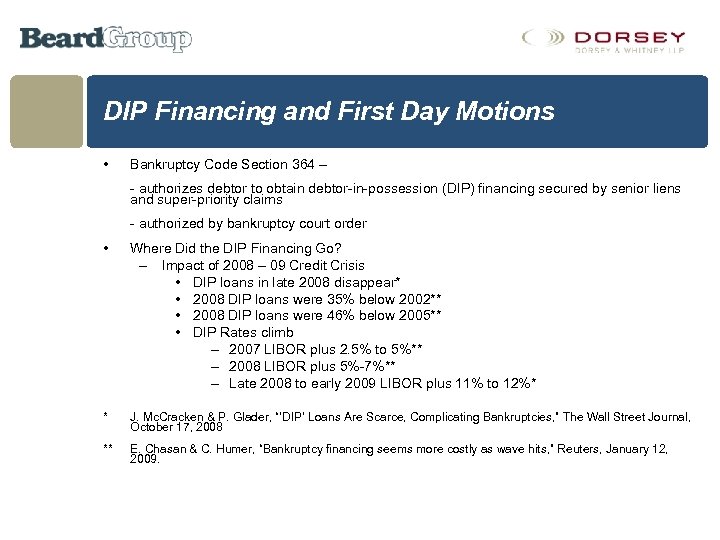

DIP Financing and First Day Motions • Bankruptcy Code Section 364 – - authorizes debtor to obtain debtor-in-possession (DIP) financing secured by senior liens and super-priority claims - authorized by bankruptcy court order • Where Did the DIP Financing Go? – Impact of 2008 – 09 Credit Crisis • DIP loans in late 2008 disappear* • 2008 DIP loans were 35% below 2002** • 2008 DIP loans were 46% below 2005** • DIP Rates climb – 2007 LIBOR plus 2. 5% to 5%** – 2008 LIBOR plus 5%-7%** – Late 2008 to early 2009 LIBOR plus 11% to 12%* * J. Mc. Cracken & P. Glader, “’DIP’ Loans Are Scarce, Complicating Bankruptcies, ” The Wall Street Journal, October 17, 2008 ** E. Chasan & C. Humer, “Bankruptcy financing seems more costly as wave hits, ” Reuters, January 12, 2009.

DIP Financing and First Day Motions • Bankruptcy Code Section 364 – - authorizes debtor to obtain debtor-in-possession (DIP) financing secured by senior liens and super-priority claims - authorized by bankruptcy court order • Where Did the DIP Financing Go? – Impact of 2008 – 09 Credit Crisis • DIP loans in late 2008 disappear* • 2008 DIP loans were 35% below 2002** • 2008 DIP loans were 46% below 2005** • DIP Rates climb – 2007 LIBOR plus 2. 5% to 5%** – 2008 LIBOR plus 5%-7%** – Late 2008 to early 2009 LIBOR plus 11% to 12%* * J. Mc. Cracken & P. Glader, “’DIP’ Loans Are Scarce, Complicating Bankruptcies, ” The Wall Street Journal, October 17, 2008 ** E. Chasan & C. Humer, “Bankruptcy financing seems more costly as wave hits, ” Reuters, January 12, 2009.

First Day Motions / Orders • Continuing Customer Programs • Payment of Certain Essential Suppliers • Payment of Employee Wages, Compensation and Employee Benefits • Payment of Prepetition Obligations Owed to Certain Foreign Creditors • Granting Administrative Expense Status to Debtor's Undisputed Obligations to Vendors Arising from Postpetition Delivery of Goods Ordered Prepetition and Authorizing Payment of Such Obligations in Ordinary Course of Business • Continuing the Workers' Compensation Program and its Liability, Product and Other Insurance Programs and Pay All Prepetition Obligations in Respect Thereof • Authorizing Payment of Prepetition Customs Duties, Broker's Fees and Freight Forward Charges, and Prepetition Common Carrier, Warehouse and Product Servicers • Continuing Existing Cash Management System and Maintaining Bank Accounts and Business Forms • Prohibiting Utilities from Discontinuing Service and Deeming Utilities Adequately Assured of Future Performance

First Day Motions / Orders • Continuing Customer Programs • Payment of Certain Essential Suppliers • Payment of Employee Wages, Compensation and Employee Benefits • Payment of Prepetition Obligations Owed to Certain Foreign Creditors • Granting Administrative Expense Status to Debtor's Undisputed Obligations to Vendors Arising from Postpetition Delivery of Goods Ordered Prepetition and Authorizing Payment of Such Obligations in Ordinary Course of Business • Continuing the Workers' Compensation Program and its Liability, Product and Other Insurance Programs and Pay All Prepetition Obligations in Respect Thereof • Authorizing Payment of Prepetition Customs Duties, Broker's Fees and Freight Forward Charges, and Prepetition Common Carrier, Warehouse and Product Servicers • Continuing Existing Cash Management System and Maintaining Bank Accounts and Business Forms • Prohibiting Utilities from Discontinuing Service and Deeming Utilities Adequately Assured of Future Performance

Chrysler Chapter 11 Bankruptcy • Filed Chapter 11 petition April 30, 2009 • $4. 1 billion DIP Financing provided by U. S. Treasury & Export Development Canada – $400 million use of cash collateral agreed to by pre-petition lenders – DIP Budget contemplated $4. 6 billion of disbursements over 9 weeks • Section 363 with New Chrysler / Fiat – Sale hearing May 27 – 29; Sale approved May 31 – Indiana Pensioners’ objections and appeal – Rejection of Dealer Agreements • Supreme Court - June 9; denied application for stay of sale • Closing - June 10

Chrysler Chapter 11 Bankruptcy • Filed Chapter 11 petition April 30, 2009 • $4. 1 billion DIP Financing provided by U. S. Treasury & Export Development Canada – $400 million use of cash collateral agreed to by pre-petition lenders – DIP Budget contemplated $4. 6 billion of disbursements over 9 weeks • Section 363 with New Chrysler / Fiat – Sale hearing May 27 – 29; Sale approved May 31 – Indiana Pensioners’ objections and appeal – Rejection of Dealer Agreements • Supreme Court - June 9; denied application for stay of sale • Closing - June 10

General Motors Chapter 11 Bankruptcy • Filed Chapter 11 petition June 1, 2009 • $33. 3 billion DIP Financing provided by U. S. Treasury & Export Development Canada – $15 billion interim DIP approved June 1 – “Wind-down” loan expected to be $950 million • Section 363 Sale with “New GM” – Sale hearing June 30, 2009 – June 3 –Official Unsecured Creditors Committee formed – Appointment of Al Koch as Chief Restructuring Officer – First-Day Motions / Orders re Customers, Suppliers, Employees

General Motors Chapter 11 Bankruptcy • Filed Chapter 11 petition June 1, 2009 • $33. 3 billion DIP Financing provided by U. S. Treasury & Export Development Canada – $15 billion interim DIP approved June 1 – “Wind-down” loan expected to be $950 million • Section 363 Sale with “New GM” – Sale hearing June 30, 2009 – June 3 –Official Unsecured Creditors Committee formed – Appointment of Al Koch as Chief Restructuring Officer – First-Day Motions / Orders re Customers, Suppliers, Employees

Thank you for joining us! Bryan S. Gadol gadol. bryan@dorsey. com (949) 932 -3669 Michael Foreman foreman. michael@dorsey. com (212) 415 -9243 Wendy R. Kottmeier kottmeier. wendy@dorsey. com (949) 932 -3648

Thank you for joining us! Bryan S. Gadol gadol. bryan@dorsey. com (949) 932 -3669 Michael Foreman foreman. michael@dorsey. com (212) 415 -9243 Wendy R. Kottmeier kottmeier. wendy@dorsey. com (949) 932 -3648

Bryan S. Gadol Experience Bryan S. Gadol is a partner in Dorsey's Corporate group. Mr. Gadol has extensive experience in mergers and acquisitions, joint ventures, public and private securities offerings, private equity and venture capital transactions, SEC reporting and corporate governance. Mr. Gadol also provides general corporate advice to emerging growth and middle market companies and investors operating or investing in a wide variety of industries through all stages of the business and investment lifecycle. Admissions • California • U. S. District Court for the Central District of California Education Chapman University School of Law J. D. , 1998 cum laude Tax Emphasis Program; Law Review Member University of California, Santa Barbara B. A. , Law and Society 1994 Beta Theta Pi Fraternity, Vice-President Professional Activities • Member, Corporations Committee, State Bar of California • Member, Mergers and Acquisitions Committee, American Bar Association • Member, Private Equity and Venture Capital Committee, American Bar Association • Member, Angel Venture Capital Committee, American Bar Association • Civic and Community Activities • Member, Dean's Council and Tax Law Institute Board of Governors, Chapman University School of Law • Member, Board of Directors, Canyon Acres Children and Family Services • Member, Tax and Law Institute Board of Governors, Chapman University School of Law Presentations • "Exits and Recapitalizations, " Los Angeles Venture Association (LAVA) Investment Capital Conference, Los Angeles, CA, May 2008 • "Overview of Corporate and Securities Laws, " Chapman University School of Law, Orange, CA, April 2007 • "Everything You Always Wanted to Know About Selling Your Business, " B. Riley Co. , Merrill Lynch, Singer Lewak Greenbaum & Goldstein and Greenberg Traurig, Riverside, CA, October 2006 • "How and When Do I Sell My Business? " Citigroup/Smith Barney, Beverly Hills, CA, June 2006 • "Overview of the M&A Market - How to Value Your Company, " Deutsche Bank, Costa Mesa, CA, May 2006

Bryan S. Gadol Experience Bryan S. Gadol is a partner in Dorsey's Corporate group. Mr. Gadol has extensive experience in mergers and acquisitions, joint ventures, public and private securities offerings, private equity and venture capital transactions, SEC reporting and corporate governance. Mr. Gadol also provides general corporate advice to emerging growth and middle market companies and investors operating or investing in a wide variety of industries through all stages of the business and investment lifecycle. Admissions • California • U. S. District Court for the Central District of California Education Chapman University School of Law J. D. , 1998 cum laude Tax Emphasis Program; Law Review Member University of California, Santa Barbara B. A. , Law and Society 1994 Beta Theta Pi Fraternity, Vice-President Professional Activities • Member, Corporations Committee, State Bar of California • Member, Mergers and Acquisitions Committee, American Bar Association • Member, Private Equity and Venture Capital Committee, American Bar Association • Member, Angel Venture Capital Committee, American Bar Association • Civic and Community Activities • Member, Dean's Council and Tax Law Institute Board of Governors, Chapman University School of Law • Member, Board of Directors, Canyon Acres Children and Family Services • Member, Tax and Law Institute Board of Governors, Chapman University School of Law Presentations • "Exits and Recapitalizations, " Los Angeles Venture Association (LAVA) Investment Capital Conference, Los Angeles, CA, May 2008 • "Overview of Corporate and Securities Laws, " Chapman University School of Law, Orange, CA, April 2007 • "Everything You Always Wanted to Know About Selling Your Business, " B. Riley Co. , Merrill Lynch, Singer Lewak Greenbaum & Goldstein and Greenberg Traurig, Riverside, CA, October 2006 • "How and When Do I Sell My Business? " Citigroup/Smith Barney, Beverly Hills, CA, June 2006 • "Overview of the M&A Market - How to Value Your Company, " Deutsche Bank, Costa Mesa, CA, May 2006

Bryan S. Gadol (cont’d) Attorney Articles • "Key Considerations in Distressed M&A Transactions, " VC Experts, Inc. , March 2009 • "Key Considerations in Distressed M&A Transactions, " Corporations Committee E-Bulletin (Business Law Section of the State Bar of California), March 2009 • "Key Considerations in Distressed M&A Transactions, " Association for Corporate Growth (ACG), February 2009 • "Key Considerations in Distressed M&A Transactions, " Orange County Business Journal, January 19, 2009 • "Updates to Form D, " co-author, E-Bulletin Legislative Alert from the California State Bar Business Law Section’s Corporations Committee, July 24, 2008 • "Traps for the Unwary Seller, " Orange County Business Journal, August 27, 2007

Bryan S. Gadol (cont’d) Attorney Articles • "Key Considerations in Distressed M&A Transactions, " VC Experts, Inc. , March 2009 • "Key Considerations in Distressed M&A Transactions, " Corporations Committee E-Bulletin (Business Law Section of the State Bar of California), March 2009 • "Key Considerations in Distressed M&A Transactions, " Association for Corporate Growth (ACG), February 2009 • "Key Considerations in Distressed M&A Transactions, " Orange County Business Journal, January 19, 2009 • "Updates to Form D, " co-author, E-Bulletin Legislative Alert from the California State Bar Business Law Section’s Corporations Committee, July 24, 2008 • "Traps for the Unwary Seller, " Orange County Business Journal, August 27, 2007

Michael Foreman Experience Michael Foreman is a partner in the Financial Restructuring and Bankruptcy practice. He represents secured and unsecured lenders and creditors, acquirers of and investors in distressed assets, and reorganizing and financially distressed companies, in many of the nation's largest and most complex restructurings under Chapter 11 of the federal bankruptcy code. Michael also represents lenders, other creditors, investors and companies in out-of-court and cross-border restructurings, and regularly advises clients in mergers and acquisitions, corporate finance transactions, and internal investigations on corporate governance, accounting and insolvency-related matters. In addition, he provides bankruptcy counseling in the areas of structured financing and securitization. Admissions • New York • U. S. District Court for the Southern and Eastern Districts of New York Education Hofstra University Law School J. D. , 1985 Cornell University New York State School of Industrial and Labor Relations B. S. , 1982 Representative Transactions Significant Creditor Representations • U. S. Bank, National Association: indenture trustee of securitization trusts organized by American Home Mortgage, having an aggregate principal balance in excess of $500 million. • U. S. Bank, National Association: collateral agent and trustee for Second Secured Lien Notes having an aggregate principal amount at maturity in excess of $145 million. • Alcatel: development contract creditor in Global Crossing, 360 Networks and Flag Telecom cases • Bank of America N. A. : lender in Brooklyn Hospital, Jillian's Entertainment, Far & Wide Corporation cases • Qwest Communications: contract creditor in Touch America case; potential bidder in Cable & Wireless case • Multicanal: bondholders' objection to Section 304 ancillary case • MBIA Insurance Corporation: credit insurance creditor in Student Finance case • Reckson Associates: pre-petition lender in Front. Line Corporation case • Sun Capital Healthcare: DIP lender in Med Diversified case, replacement lender in National Century Finance case • Learning. Express LLC: publisher creditor in Publishers Group West case • Carl Icahn & affiliates: creditor and ERISA control group member in Trans World Airlines case

Michael Foreman Experience Michael Foreman is a partner in the Financial Restructuring and Bankruptcy practice. He represents secured and unsecured lenders and creditors, acquirers of and investors in distressed assets, and reorganizing and financially distressed companies, in many of the nation's largest and most complex restructurings under Chapter 11 of the federal bankruptcy code. Michael also represents lenders, other creditors, investors and companies in out-of-court and cross-border restructurings, and regularly advises clients in mergers and acquisitions, corporate finance transactions, and internal investigations on corporate governance, accounting and insolvency-related matters. In addition, he provides bankruptcy counseling in the areas of structured financing and securitization. Admissions • New York • U. S. District Court for the Southern and Eastern Districts of New York Education Hofstra University Law School J. D. , 1985 Cornell University New York State School of Industrial and Labor Relations B. S. , 1982 Representative Transactions Significant Creditor Representations • U. S. Bank, National Association: indenture trustee of securitization trusts organized by American Home Mortgage, having an aggregate principal balance in excess of $500 million. • U. S. Bank, National Association: collateral agent and trustee for Second Secured Lien Notes having an aggregate principal amount at maturity in excess of $145 million. • Alcatel: development contract creditor in Global Crossing, 360 Networks and Flag Telecom cases • Bank of America N. A. : lender in Brooklyn Hospital, Jillian's Entertainment, Far & Wide Corporation cases • Qwest Communications: contract creditor in Touch America case; potential bidder in Cable & Wireless case • Multicanal: bondholders' objection to Section 304 ancillary case • MBIA Insurance Corporation: credit insurance creditor in Student Finance case • Reckson Associates: pre-petition lender in Front. Line Corporation case • Sun Capital Healthcare: DIP lender in Med Diversified case, replacement lender in National Century Finance case • Learning. Express LLC: publisher creditor in Publishers Group West case • Carl Icahn & affiliates: creditor and ERISA control group member in Trans World Airlines case

Michael Foreman (cont’d) Representative Transactions (cont’d) Significant Distressed M&A Transactions • Metalforming Technologies, Inc. : automotive parts supplier; $150 million debt • Gray Television Inc. : $250 million Chapter 11 prepackaged plan acquisition of Benedek Communications • DLJ Real Estate Capital Partners: $150 million acquisition of the San Juan Ritz Carlton Hotel, Spa & Casino and related mortgage debt • Delaware North Companies: $100 million acquisition of riverboat business of American Classic Voyages • MFN Global: $10 million acquisition of government telecom business of Metromedia Fiber Networks • Right Track Recording Investors LLC: $10 million acquisition of secured claims against Right Track Recording Studios • Buster Brown Apparel, Inc. : clothing manufacturer; $150 million debt • Rose's Stores, Inc. : discount retailer; $300 million debt • LJ Hooker Corporation Inc. (including B. Altman, Bonwit Teller, Sakowitz, Parisian and Merksamer Jewelers): retailers, real estate developments, homebuilding, real estate brokerage; $1 billion debt • Savin Corporation: office equipment manufacturer; $150 million debt Other Significant Chapter 11 and Out of Court Representations • Monitor Oil Plc: developer of oil and gas production support service projects; $275 million debt • Perry Mandarino, Examiner of Polaroid Corp. : examination into allegations of accounting improprieties in $500 million restructuring • Superior Telecom, Inc. : $1 billion restructuring of telecom equipment manufacturer • William J. Scharffenberger, Chapter 11 Trustee of Allegheny Health, Education and Research Foundation: not-for-profit health-care system; $1. 2 billion debt • Millbrook Distributors: $8 million acquisition of Paskert Distribution Company • U. S. Industries: $1 billion debt restructuring of multiindustry holding company • Cronos Containers: $200 million debt restructuring of shipping container company • The Alpine Group, Inc. : $125 million debt restructuring of multi-industry holding company • Maxcom Telecomunicacio: $200 million debt restructuring of Mexican telecom company • Supercanal: $150 million restructuring of Argentine cable television system • 1515 Broadway Associates: $500 million restructuring of Manhattan premium office building • Golden Books Family Entertainment: $250 million restructuring of book publisher and video distributor; • Reeves Industries: $200 million restructuring of textile and automotive parts supplier

Michael Foreman (cont’d) Representative Transactions (cont’d) Significant Distressed M&A Transactions • Metalforming Technologies, Inc. : automotive parts supplier; $150 million debt • Gray Television Inc. : $250 million Chapter 11 prepackaged plan acquisition of Benedek Communications • DLJ Real Estate Capital Partners: $150 million acquisition of the San Juan Ritz Carlton Hotel, Spa & Casino and related mortgage debt • Delaware North Companies: $100 million acquisition of riverboat business of American Classic Voyages • MFN Global: $10 million acquisition of government telecom business of Metromedia Fiber Networks • Right Track Recording Investors LLC: $10 million acquisition of secured claims against Right Track Recording Studios • Buster Brown Apparel, Inc. : clothing manufacturer; $150 million debt • Rose's Stores, Inc. : discount retailer; $300 million debt • LJ Hooker Corporation Inc. (including B. Altman, Bonwit Teller, Sakowitz, Parisian and Merksamer Jewelers): retailers, real estate developments, homebuilding, real estate brokerage; $1 billion debt • Savin Corporation: office equipment manufacturer; $150 million debt Other Significant Chapter 11 and Out of Court Representations • Monitor Oil Plc: developer of oil and gas production support service projects; $275 million debt • Perry Mandarino, Examiner of Polaroid Corp. : examination into allegations of accounting improprieties in $500 million restructuring • Superior Telecom, Inc. : $1 billion restructuring of telecom equipment manufacturer • William J. Scharffenberger, Chapter 11 Trustee of Allegheny Health, Education and Research Foundation: not-for-profit health-care system; $1. 2 billion debt • Millbrook Distributors: $8 million acquisition of Paskert Distribution Company • U. S. Industries: $1 billion debt restructuring of multiindustry holding company • Cronos Containers: $200 million debt restructuring of shipping container company • The Alpine Group, Inc. : $125 million debt restructuring of multi-industry holding company • Maxcom Telecomunicacio: $200 million debt restructuring of Mexican telecom company • Supercanal: $150 million restructuring of Argentine cable television system • 1515 Broadway Associates: $500 million restructuring of Manhattan premium office building • Golden Books Family Entertainment: $250 million restructuring of book publisher and video distributor; • Reeves Industries: $200 million restructuring of textile and automotive parts supplier

Michael Foreman (cont’d) Representative Transactions (cont’d) Other Significant Chapter 11 and Out of Court Representations • Bower & Gardner: $75 million dissolution of law firm • Al Copeland Enterprises, Inc. (d/b/a Popeye's and Church's Fried Chicken): $750 million restructuring of owner and franchisor of fast-food restaurants • Lechter's, Inc. : $100 million restructuring of homewares retailer • Dispatch Management Services: $50 million cross-border restructuring / asset dispositions of delivery service businesses • Johnston Industries: $75 million debt restructuring of textile manufacturer • Alcott & Andrews: $50 million debt restructuring of clothing retailer • Paul Harris Stores: $50 million debt restructuring of clothing retailer • Berkey, Inc. : $50 million debt restructuring of photo technology retailer • A. Tarricone, Inc. : $75 million debt restructuring of fuel supplier Professional Activities • Member, International Bar Association (Insolvency, Restructuring and Creditors' Rights Section) • Member, American Bar Association (Business Law Section) • Member, New York State Bar Association • Member, Association of the Bar of the City of New York • Member, American Bankruptcy Institute, 1995 – present • Member, Turnaround Management Association, 2002 – present • Member, Next Generation Committee, Bankruptcy Lawyers Division Civic and Community Activities • Member, Program Committee, The Educational Alliance • Member, Next Generation Committee, Bankruptcy Lawyers' Division, UJA Federation of New York Presentations • Sponsored by Dorsey & Whitney, New York City Symposium for Corporate Leaders, Breakout Session panelist, "When the Going Gets Tough, the Tough Start Suing: Director and Officer Liability in a Challenging Economy and Practical Advice on What to Do About It, " May 7, 2009

Michael Foreman (cont’d) Representative Transactions (cont’d) Other Significant Chapter 11 and Out of Court Representations • Bower & Gardner: $75 million dissolution of law firm • Al Copeland Enterprises, Inc. (d/b/a Popeye's and Church's Fried Chicken): $750 million restructuring of owner and franchisor of fast-food restaurants • Lechter's, Inc. : $100 million restructuring of homewares retailer • Dispatch Management Services: $50 million cross-border restructuring / asset dispositions of delivery service businesses • Johnston Industries: $75 million debt restructuring of textile manufacturer • Alcott & Andrews: $50 million debt restructuring of clothing retailer • Paul Harris Stores: $50 million debt restructuring of clothing retailer • Berkey, Inc. : $50 million debt restructuring of photo technology retailer • A. Tarricone, Inc. : $75 million debt restructuring of fuel supplier Professional Activities • Member, International Bar Association (Insolvency, Restructuring and Creditors' Rights Section) • Member, American Bar Association (Business Law Section) • Member, New York State Bar Association • Member, Association of the Bar of the City of New York • Member, American Bankruptcy Institute, 1995 – present • Member, Turnaround Management Association, 2002 – present • Member, Next Generation Committee, Bankruptcy Lawyers Division Civic and Community Activities • Member, Program Committee, The Educational Alliance • Member, Next Generation Committee, Bankruptcy Lawyers' Division, UJA Federation of New York Presentations • Sponsored by Dorsey & Whitney, New York City Symposium for Corporate Leaders, Breakout Session panelist, "When the Going Gets Tough, the Tough Start Suing: Director and Officer Liability in a Challenging Economy and Practical Advice on What to Do About It, " May 7, 2009

Michael Foreman (cont’d) Presentations (cont’d) • Sponsored by the Legal Publishing Group of Strafford Publications - CLE Tele. Conference - "D&O Duties When a Company Faces Insolvency Teleconference: Strategies for Avoiding and Defending Direct and Derivative Lawsuits, " October 15, 2008, January 28, 2009, April 28, 2009 • Sponsored by Association of Corporate Counsel-Greater New York, Dorsey & Whitney LLP joint CLE seminar: Bankruptcy and Restructuring for the In-House Lawyer: "A Discussion of Common Topics When The Other Side of a Transaction or a Competitor Files for Bankruptcy, " October 16, 2008 • Sponsored by the Legal Publishing Group of Strafford Publications - CLE Tele. Conference "Distressed M&A: Buying and Selling Businesses Facing Financial Trouble, " October 29, 2008 • Sponsored by the New York State Bar Association: "2008 Practical Skills Program on Basic of Bankruptcy Practice, " October 30, 2008 • Speaker, The Secured Debt Conference, Panel on Distressed Debt and DIP Financing, March 2006 • Speaker, 7 th Annual New York City Bankruptcy Conference, Panel on Property of the Estate and Substantive Consolidation, May 2005 Attorney Articles • "Buying a Troubled Business: Bankruptcy and Other Options, " Private Equity Focus, June 26, 2008 • "In the Zone: New Insolvency Rules, " (co-author) The Corporate Board, May/June 2008 • "Corporate Restructuring: Valuation Litigation is Key Process, " (co-author) National Law Journal, March 5, 2007 • "Radnor Holdings: Delaware Bankruptcy Court Upholds Lenders' Actions, " (co-author) Metropolitan Corporate Counsel, January 2007 • "Bankruptcy and Corporate Reorganization: Proposed Chapter 15, " (co-author) New York Law Journal, August 26, 2002 Other Articles • Appearance: "GM Inches Closer to Bankruptcy, " Reuters' Breaking News video, May 29, 2009 • Quoted in "GM's ‘Main Street' Bondholders Would Be Losers, Lawyer Says, " Bloomberg. May 28, 2009 • Quoted in "Speedy Chrysler Ch. 11 A Pipe Dream: Experts, " Law 360. May 1, 2009 • Quoted in "Dried-Up DIP Financing to Intensify Ch. 11 Sell -Offs, " Law 360. October 20, 2008.

Michael Foreman (cont’d) Presentations (cont’d) • Sponsored by the Legal Publishing Group of Strafford Publications - CLE Tele. Conference - "D&O Duties When a Company Faces Insolvency Teleconference: Strategies for Avoiding and Defending Direct and Derivative Lawsuits, " October 15, 2008, January 28, 2009, April 28, 2009 • Sponsored by Association of Corporate Counsel-Greater New York, Dorsey & Whitney LLP joint CLE seminar: Bankruptcy and Restructuring for the In-House Lawyer: "A Discussion of Common Topics When The Other Side of a Transaction or a Competitor Files for Bankruptcy, " October 16, 2008 • Sponsored by the Legal Publishing Group of Strafford Publications - CLE Tele. Conference "Distressed M&A: Buying and Selling Businesses Facing Financial Trouble, " October 29, 2008 • Sponsored by the New York State Bar Association: "2008 Practical Skills Program on Basic of Bankruptcy Practice, " October 30, 2008 • Speaker, The Secured Debt Conference, Panel on Distressed Debt and DIP Financing, March 2006 • Speaker, 7 th Annual New York City Bankruptcy Conference, Panel on Property of the Estate and Substantive Consolidation, May 2005 Attorney Articles • "Buying a Troubled Business: Bankruptcy and Other Options, " Private Equity Focus, June 26, 2008 • "In the Zone: New Insolvency Rules, " (co-author) The Corporate Board, May/June 2008 • "Corporate Restructuring: Valuation Litigation is Key Process, " (co-author) National Law Journal, March 5, 2007 • "Radnor Holdings: Delaware Bankruptcy Court Upholds Lenders' Actions, " (co-author) Metropolitan Corporate Counsel, January 2007 • "Bankruptcy and Corporate Reorganization: Proposed Chapter 15, " (co-author) New York Law Journal, August 26, 2002 Other Articles • Appearance: "GM Inches Closer to Bankruptcy, " Reuters' Breaking News video, May 29, 2009 • Quoted in "GM's ‘Main Street' Bondholders Would Be Losers, Lawyer Says, " Bloomberg. May 28, 2009 • Quoted in "Speedy Chrysler Ch. 11 A Pipe Dream: Experts, " Law 360. May 1, 2009 • Quoted in "Dried-Up DIP Financing to Intensify Ch. 11 Sell -Offs, " Law 360. October 20, 2008.

Wendy R. Kottmeier Experience Wendy R. Kottmeier is an attorney in Dorsey's Corporate group. She represents clients in general corporate and securities matters, including mergers and acquisitions, public and private offerings of securities, private equity and venture capital transactions, securities law compliance and reporting and corporate governance. She also has experience in technology licensing transactions, including software, trademark and patent licensing, distribution and joint venture transactions and research and development transactions. Ms. Kottmeier has drafted and negotiated a variety of technology-related professional service agreements, manufacturing and supply agreements, and other commercial contracts. Admissions • California Education U. C. Hastings College of the Law J. D. , 2001 magna cum laude, Order of the Coif University of Redlands B. A. , 1996, Phi Beta Kappa, Proudian Interdisciplinary Honors Attorney Articles • "Key Considerations in Distressed M&A Transactions, " VC Experts, Inc. , March 2009 • "Key Considerations in Distressed M&A Transactions, " Association for Corporate Growth (ACG), February 2009 • "Key Considerations in Distressed M&A Transactions, " Orange County Business Journal, January 19, 2009

Wendy R. Kottmeier Experience Wendy R. Kottmeier is an attorney in Dorsey's Corporate group. She represents clients in general corporate and securities matters, including mergers and acquisitions, public and private offerings of securities, private equity and venture capital transactions, securities law compliance and reporting and corporate governance. She also has experience in technology licensing transactions, including software, trademark and patent licensing, distribution and joint venture transactions and research and development transactions. Ms. Kottmeier has drafted and negotiated a variety of technology-related professional service agreements, manufacturing and supply agreements, and other commercial contracts. Admissions • California Education U. C. Hastings College of the Law J. D. , 2001 magna cum laude, Order of the Coif University of Redlands B. A. , 1996, Phi Beta Kappa, Proudian Interdisciplinary Honors Attorney Articles • "Key Considerations in Distressed M&A Transactions, " VC Experts, Inc. , March 2009 • "Key Considerations in Distressed M&A Transactions, " Association for Corporate Growth (ACG), February 2009 • "Key Considerations in Distressed M&A Transactions, " Orange County Business Journal, January 19, 2009

About Dorsey & Whitney LLP Clients have relied on Dorsey since 1912 as a valued business partner. With more than 650 lawyers in 18 locations in the United States, Asia, Australia, Canada and Europe, Dorsey provides an integrated, proactive approach to its clients' legal and business needs. Dorsey represents a number of the world's most successful Fortune 500 companies from a broad range of disciplines, including leaders in the financial services, investment banking, life sciences, securities, technology and energy sectors, as well as nonprofit and government entities. Dorsey lawyers in the Southern California office practice in the areas of corporate law, securities and corporate finance, intellectual property, labor and employment, general business litigation, including securities litigation and compliance advice, and corporate trust. More information about the firm can be found at www. dorsey. com.

About Dorsey & Whitney LLP Clients have relied on Dorsey since 1912 as a valued business partner. With more than 650 lawyers in 18 locations in the United States, Asia, Australia, Canada and Europe, Dorsey provides an integrated, proactive approach to its clients' legal and business needs. Dorsey represents a number of the world's most successful Fortune 500 companies from a broad range of disciplines, including leaders in the financial services, investment banking, life sciences, securities, technology and energy sectors, as well as nonprofit and government entities. Dorsey lawyers in the Southern California office practice in the areas of corporate law, securities and corporate finance, intellectual property, labor and employment, general business litigation, including securities litigation and compliance advice, and corporate trust. More information about the firm can be found at www. dorsey. com.