f74c8879c343a9310b3713c8a133ae6f.ppt

- Количество слайдов: 156

Distant but close: The Impact of Immigrant Remittances on Latin America Manuel Orozco, Inter-American Dialogue May 30 th 2005

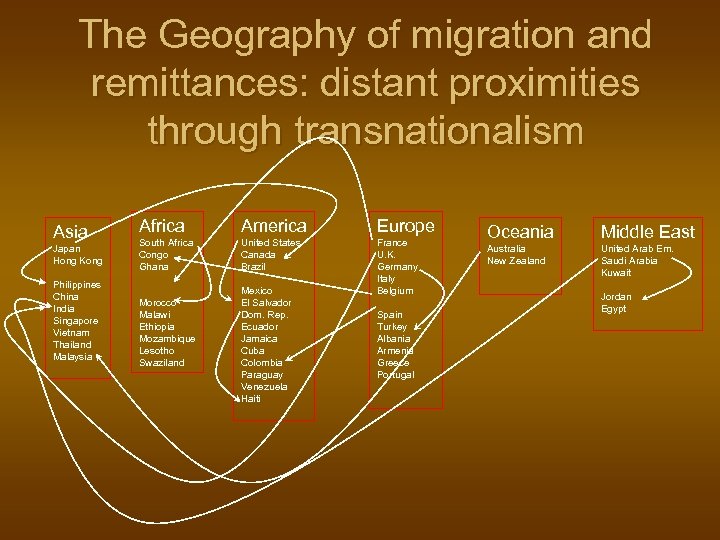

The Geography of migration and remittances: distant proximities through transnationalism Asia Japan Hong Kong Philippines China India Singapore Vietnam Thailand Malaysia Africa America Europe South Africa Congo Ghana United States Canada Brazil France U. K. Germany Italy Belgium Morocco Malawi Ethiopia Mozambique Lesotho Swaziland Mexico El Salvador Dom. Rep. Ecuador Jamaica Cuba Colombia Paraguay Venezuela Haiti Spain Turkey Albania Armenia Greece Portugal Oceania Middle East Australia New Zealand United Arab Em. Saudi Arabia Kuwait Jordan Egypt

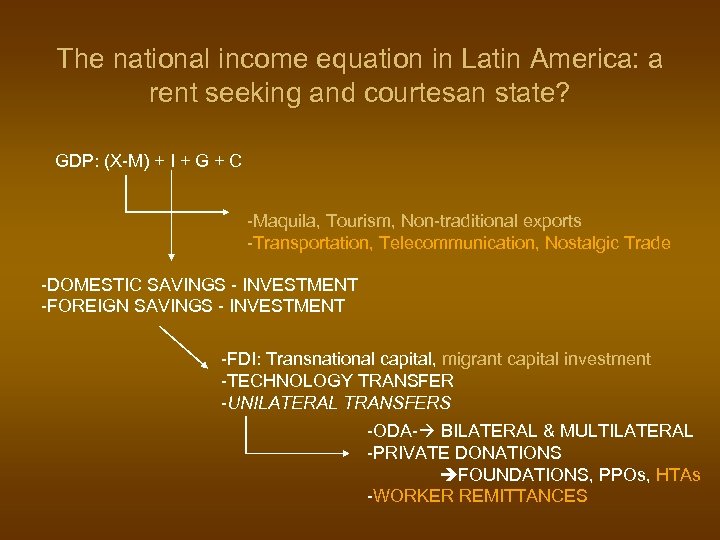

The national income equation in Latin America: a rent seeking and courtesan state? GDP: (X-M) + I + G + C -Maquila, Tourism, Non-traditional exports -Transportation, Telecommunication, Nostalgic Trade -DOMESTIC SAVINGS - INVESTMENT -FOREIGN SAVINGS - INVESTMENT -FDI: Transnational capital, migrant capital investment -TECHNOLOGY TRANSFER -UNILATERAL TRANSFERS -ODA- BILATERAL & MULTILATERAL -PRIVATE DONATIONS FOUNDATIONS, PPOs, HTAs -WORKER REMITTANCES

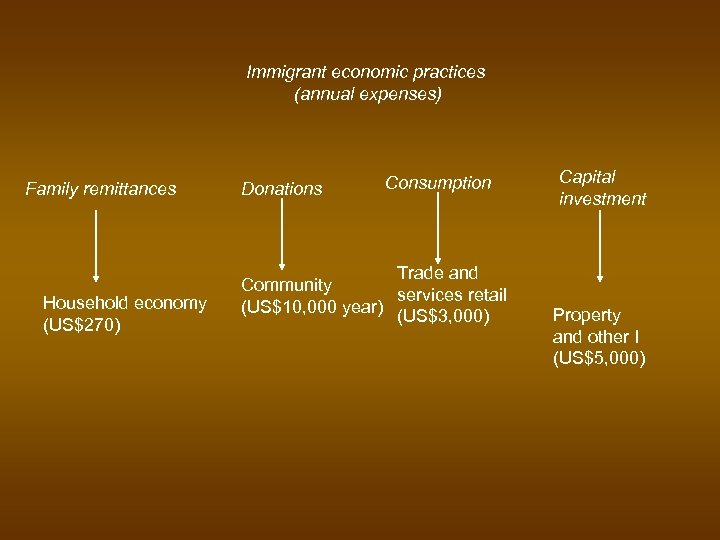

Immigrant economic practices (annual expenses) Family remittances Household economy (US$270) Donations Consumption Trade and Community services retail (US$10, 000 year) (US$3, 000) Capital investment Property and other I (US$5, 000)

Main remittance recipient countries worldwide

Remittances per capita (2001)

The Latin American context The level of engagement The 5 Ts

Remittances to Latin America and the Caribbean by Region (%) US$ 45. 2 billion

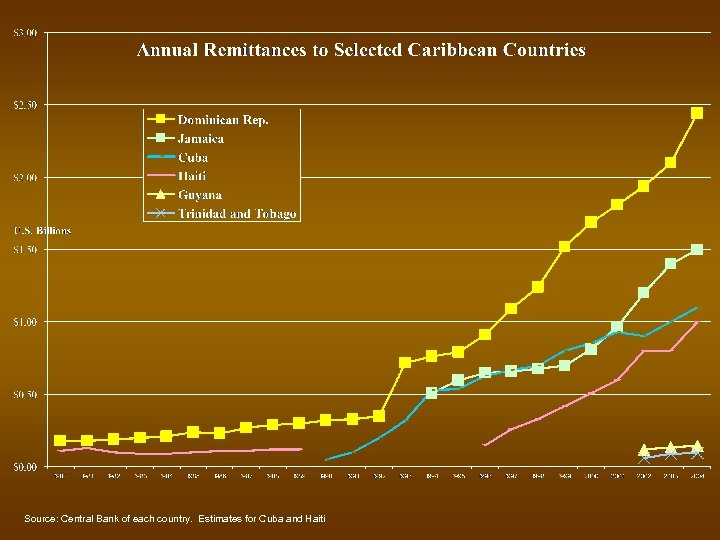

Source: Central Bank of each country. Estimates for Cuba and Haiti

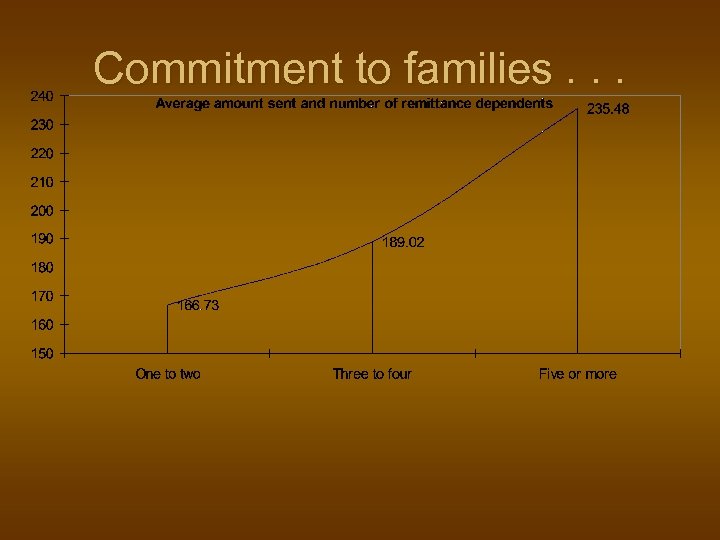

Commitment to families. . .

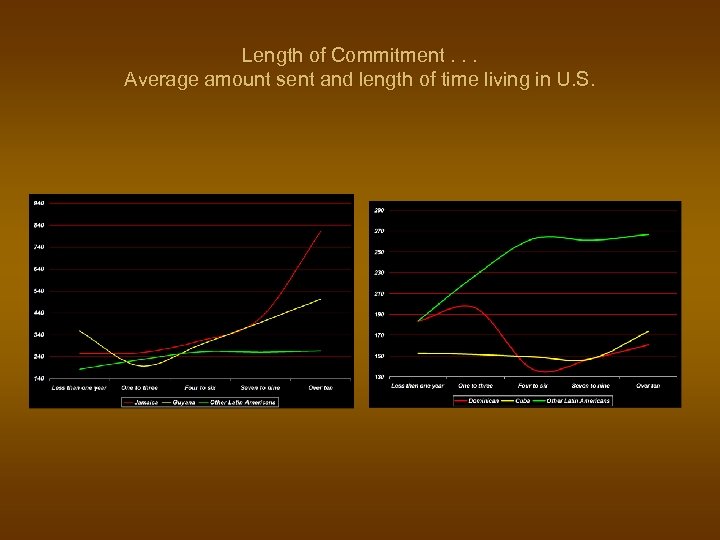

Length of Commitment. . . Average amount sent and length of time living in U. S.

Percent of remittance senders who. . . Jamaicans: younger with formal education, Bank accounts, higher income and live in smaller households

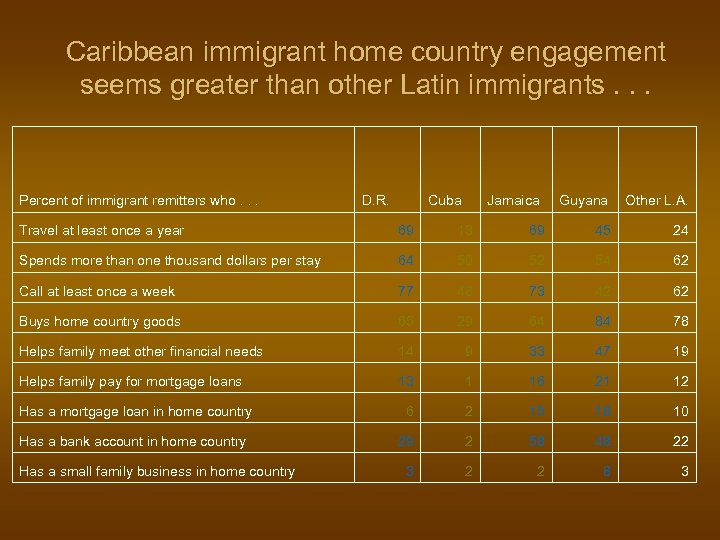

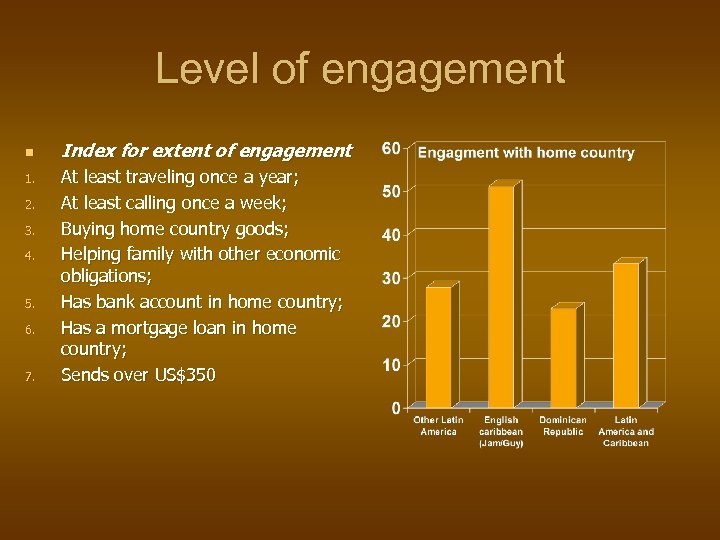

Caribbean immigrant home country engagement seems greater than other Latin immigrants. . . Percent of immigrant remitters who. . . D. R. Cuba Jamaica Guyana Other L. A. Travel at least once a year 69 13 69 45 24 Spends more than one thousand dollars per stay 64 50 52 54 62 Call at least once a week 77 48 73 42 62 Buys home country goods 65 29 64 84 78 Helps family meet other financial needs 14 9 33 47 19 Helps family pay for mortgage loans 13 1 16 21 12 Has a mortgage loan in home country 6 2 15 18 10 Has a bank account in home country 29 2 58 48 22 3 2 2 8 3 Has a small family business in home country

Effects and trends in home country

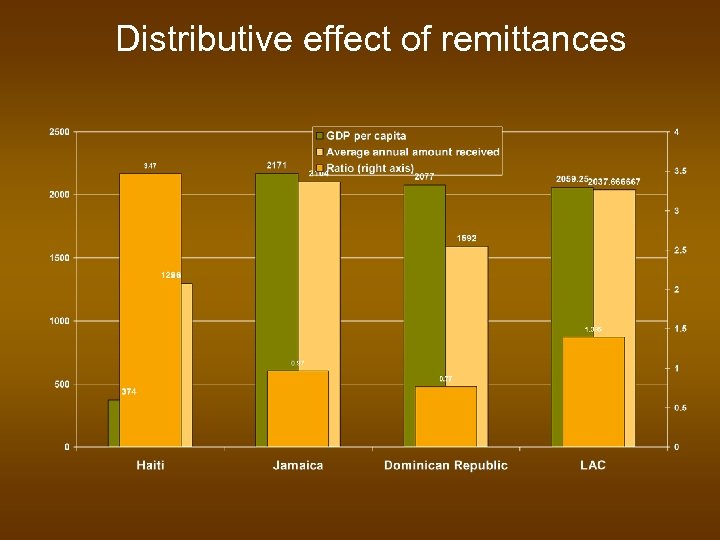

Distributive effect of remittances

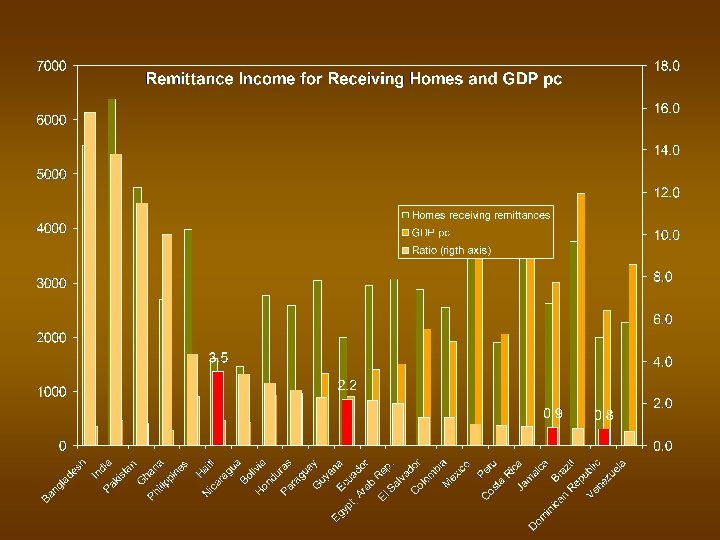

Remittance recipient households Source: El Salvador, Honduras and Guatemala: Bendixen and Associates survey; Dominican Republic: Emmanuel Sylvestre & Associates survey (commissioned out by the author); Guyana: Laparkan Trading survey (commissioned out by the author); Ecuador: Mauricio Orbe (Pulso. Ecuador); Mexico: El Colegio de la Frontera Norte. “Problemas y Perspectivas de las Remesas de los Mexicanos y Centroamericanos en Estados Unidos, ” El Colegio de la Frontera Norte: Departamento de Estudios Económicos. Mexico: 2002, p. 30.

Female remittance recipients (%)

Remittance recipient (relationship)

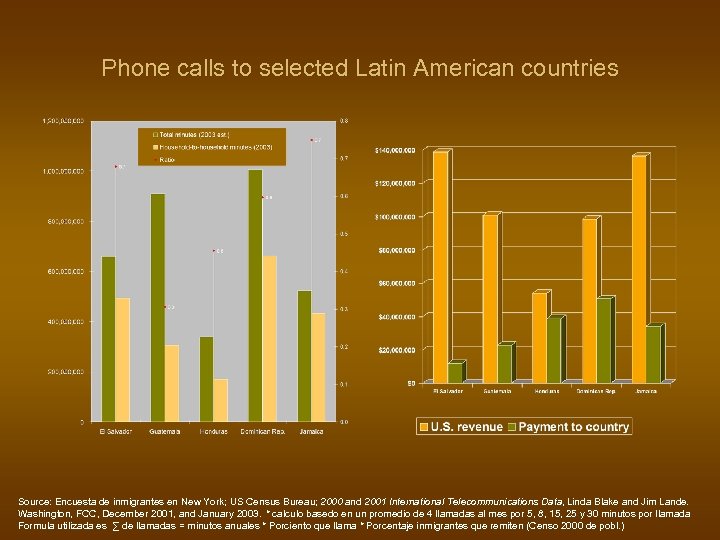

Phone calls to selected Latin American countries Source: Encuesta de inmigrantes en New York; US Census Bureau; 2000 and 2001 International Telecommunications Data, Linda Blake and Jim Lande. Washington, FCC, December 2001, and January 2003. * calculo basedo en un promedio de 4 llamadas al mes por 5, 8, 15, 25 y 30 minutos por llamada Formula utilizada es ∑ de llamadas = minutos anuales * Porciento que llama * Porcentaje inmigrantes que remiten (Censo 2000 de pobl. )

Goods bought by Guyanese diaspora

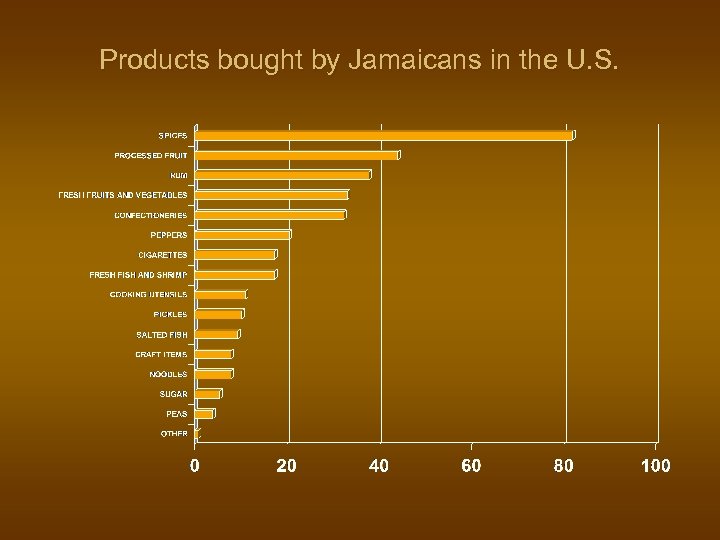

Products bought by Jamaicans in the U. S.

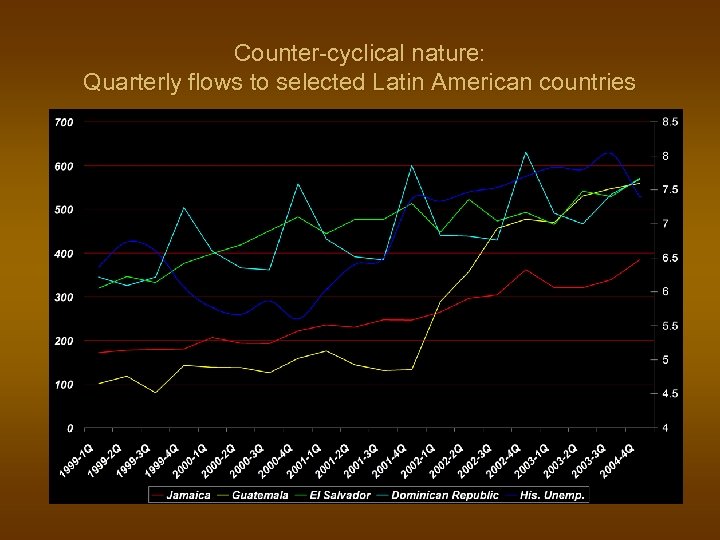

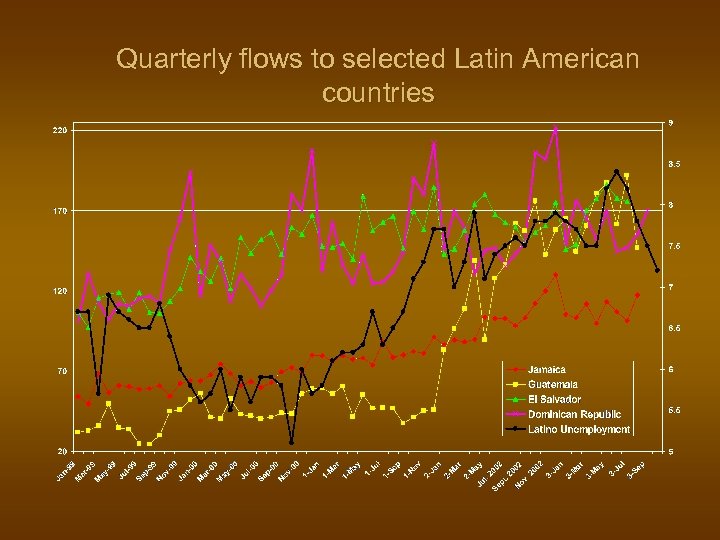

Counter-cyclical nature: Quarterly flows to selected Latin American countries

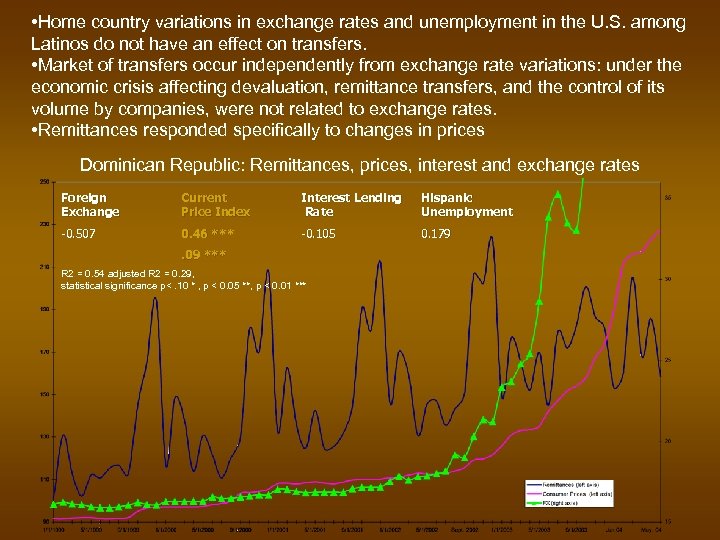

• Home country variations in exchange rates and unemployment in the U. S. among Latinos do not have an effect on transfers. • Market of transfers occur independently from exchange rate variations: under the economic crisis affecting devaluation, remittance transfers, and the control of its volume by companies, were not related to exchange rates. • Remittances responded specifically to changes in prices Dominican Republic: Remittances, prices, interest and exchange rates Foreign Exchange Current Price Index Interest Lending Rate Hispanic Unemployment -0. 507 0. 46 *** -0. 105 0. 179 . 09 *** R 2 = 0. 54 adjusted R 2 = 0. 29, statistical significance p<. 10 * , p < 0. 05 **, p < 0. 01 ***

Jamaica: Macroeconomic determinants

Jamaica and GDP: Remittances, Tourism and Non-Traditional Exports

Levels and determinants of Engagement Comparisons among Latin American and Caribbean immigrants in the U. S.

Level of engagement n 1. 2. 3. 4. 5. 6. 7. Index for extent of engagement At least traveling once a year; At least calling once a week; Buying home country goods; Helping family with other economic obligations; Has bank account in home country; Has a mortgage loan in home country; Sends over US$350

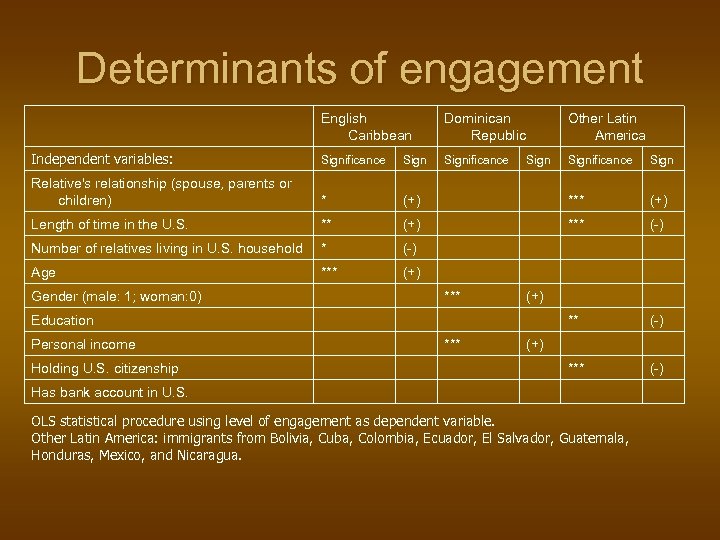

Determinants of engagement English Caribbean Dominican Republic Independent variables: Significance Relative's relationship (spouse, parents or children) * Length of time in the U. S. Other Latin America Significance Sign (+) *** (-) Number of relatives living in U. S. household * (-) Age *** (+) ** (-) *** (-) Gender (male: 1; woman: 0) *** Sign (+) Education Personal income Holding U. S. citizenship *** (+) Has bank account in U. S. OLS statistical procedure using level of engagement as dependent variable. Other Latin America: immigrants from Bolivia, Cuba, Colombia, Ecuador, El Salvador, Guatemala, Honduras, Mexico, and Nicaragua.

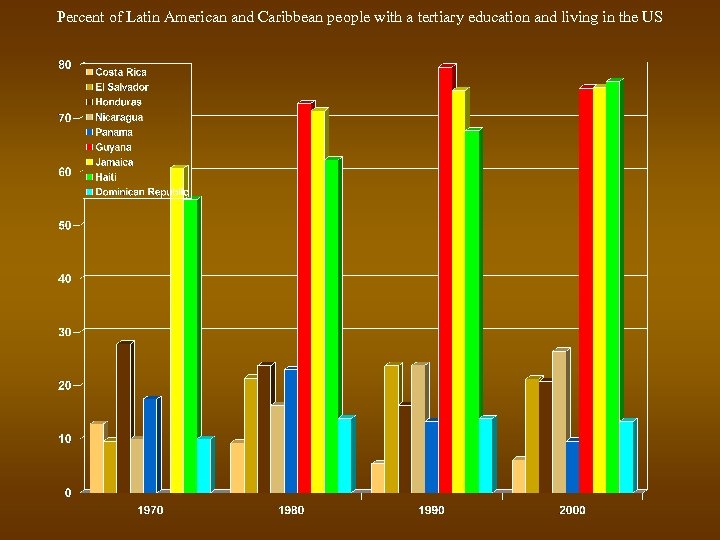

Percent of Latin American and Caribbean people with a tertiary education and living in the US

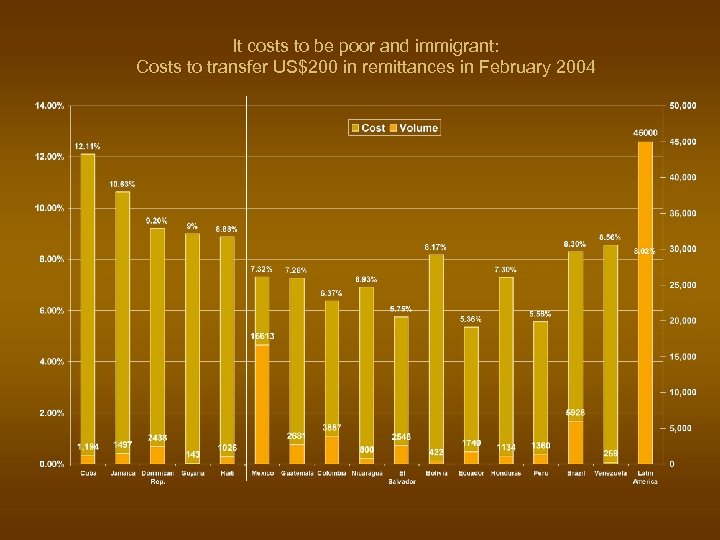

It costs to be poor and immigrant: Costs to transfer US$200 in remittances in February 2004

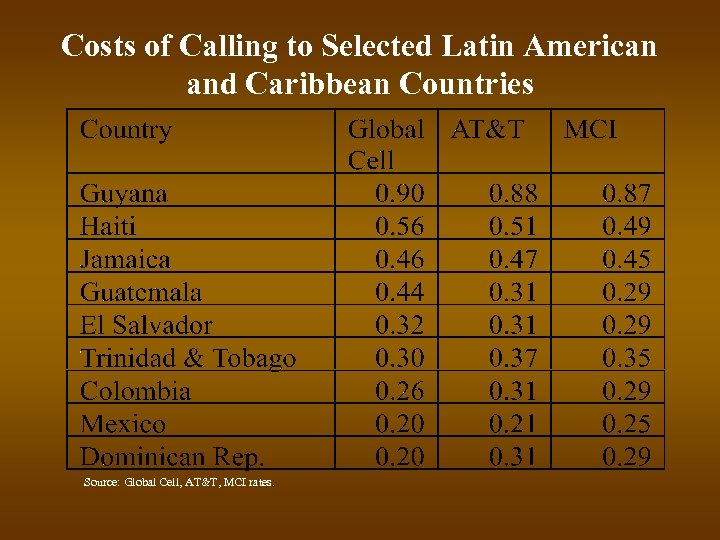

Costs of Calling to Selected Latin American and Caribbean Countries Source: Global Cell, AT&T, MCI rates.

Diaspora organizing Hometown associations in Latin America

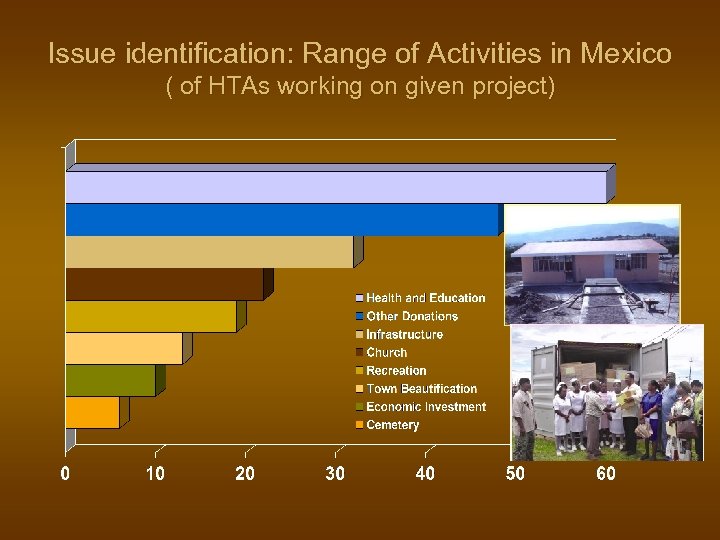

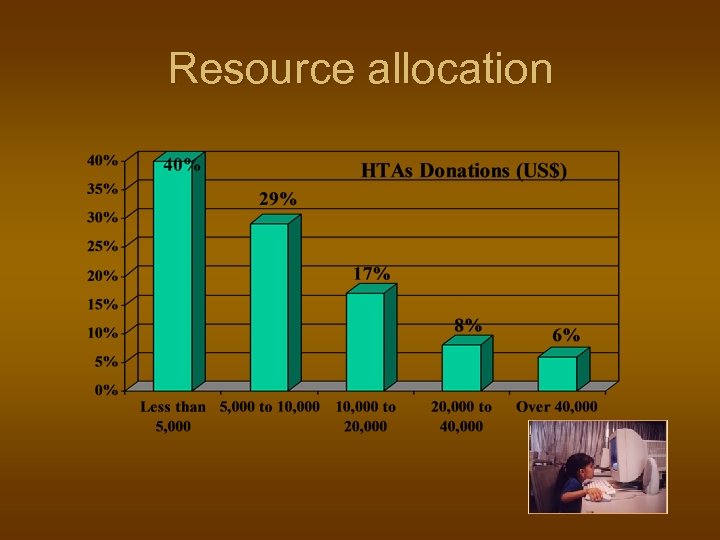

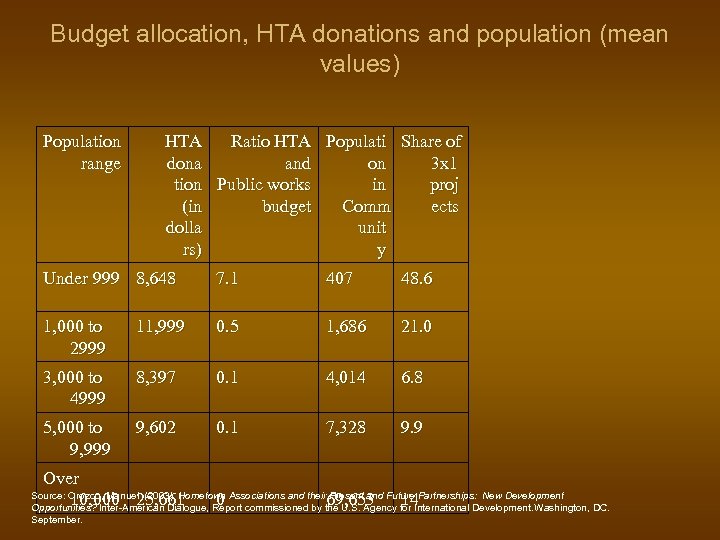

Philanthropy for the homeland • HTAs are small voluntary philanthropic organizations; • Their organizational structure is commensurate to the groups’ proposed goals; • The activities focus on basic health, education and public infrastructure; • The resources raised are relatively small in volume (US$10, 000); • Donations are significant however in rural recipient localities; • Partnership with governments enhance development goals. Source: Orozco, Manuel (2003), Hometown Associations and their Present and Future Partnerships: New Development Opportunities? Inter-American Dialogue, Report commissioned by the U. S. Agency for International Development. Washington, DC. September.

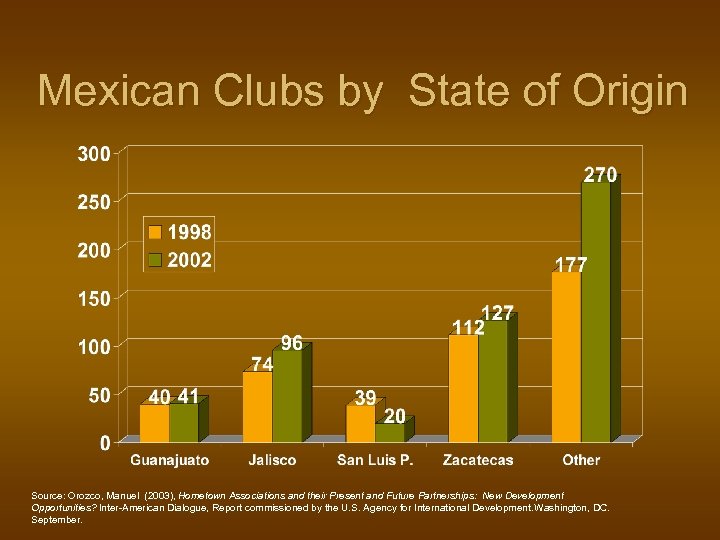

Mexican Clubs by State of Origin Source: Orozco, Manuel (2003), Hometown Associations and their Present and Future Partnerships: New Development Opportunities? Inter-American Dialogue, Report commissioned by the U. S. Agency for International Development. Washington, DC. September.

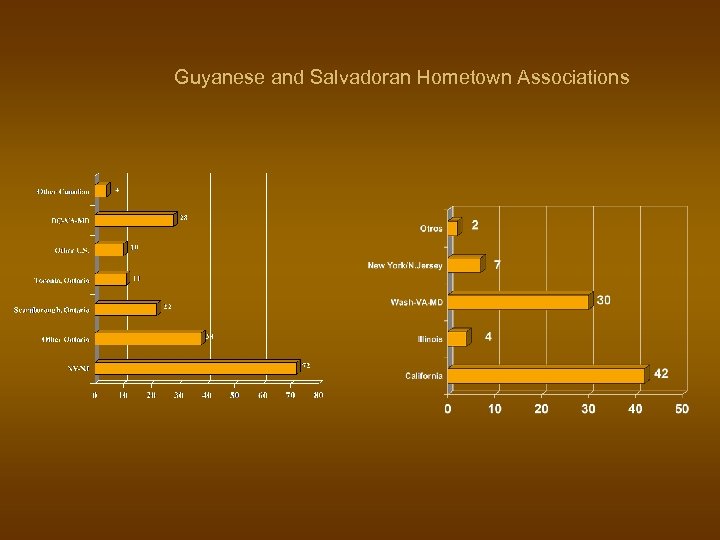

Guyanese and Salvadoran Hometown Associations

Issue identification: Range of Activities in Mexico ( of HTAs working on given project)

Resource allocation

Budget allocation, HTA donations and population (mean values) Population range HTA Ratio HTA Populati Share of dona and on 3 x 1 tion Public works in proj (in budget Comm ects dolla unit rs) y Under 999 8, 648 7. 1 407 48. 6 1, 000 to 2999 11, 999 0. 5 1, 686 21. 0 3, 000 to 4999 8, 397 0. 1 4, 014 6. 8 5, 000 to 9, 999 9, 602 0. 1 7, 328 9. 9 Over Source: Orozco, Manuel (2003), Hometown Associations and their Present and Future Partnerships: New Development 10, 000 25, 661 0 69, 653 14 Opportunities? Inter-American Dialogue, Report commissioned by the U. S. Agency for International Development. Washington, DC. September.

The reality of transnational families Is poverty out of the picture with transnational migration?

Remittance Sender n n n n A person who represents two thirds of immigrants; Sends regularly, at least seven times a year; Has an income below $30, 000 (65); Has a basic education below high school (70); Sends about $3, 000 annually; Has a longstanding commitment with their relatives (at least 5 years); Uses intermediaries to send money (70); Does not have a bank account (56)

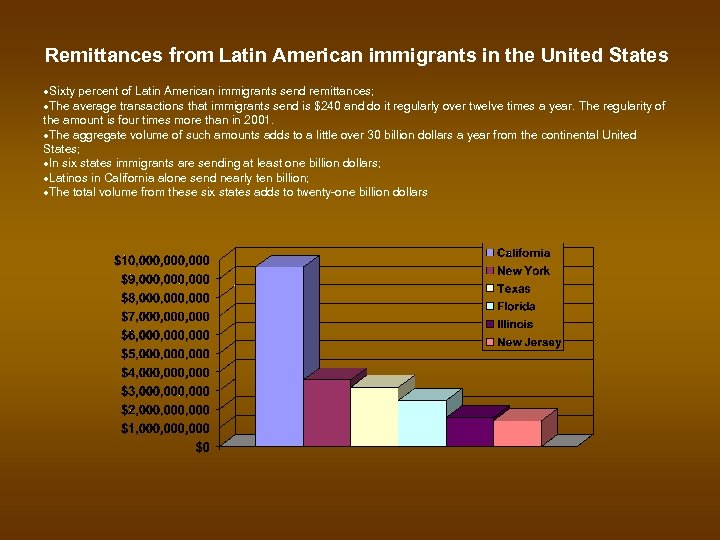

Remittances from Latin American immigrants in the United States Sixty percent of Latin American immigrants send remittances; The average transactions that immigrants send is $240 and do it regularly over twelve times a year. The regularity of the amount is four times more than in 2001. The aggregate volume of such amounts adds to a little over 30 billion dollars a year from the continental United States; In six states immigrants are sending at least one billion dollars; Latinos in California alone send nearly ten billion; The total volume from these six states adds to twenty-one billion dollars

Personal Income and Years living in U. S.

Remittance senders without bank accounts

Dominican Republic remittance receiving households: Income and years receiving remittances

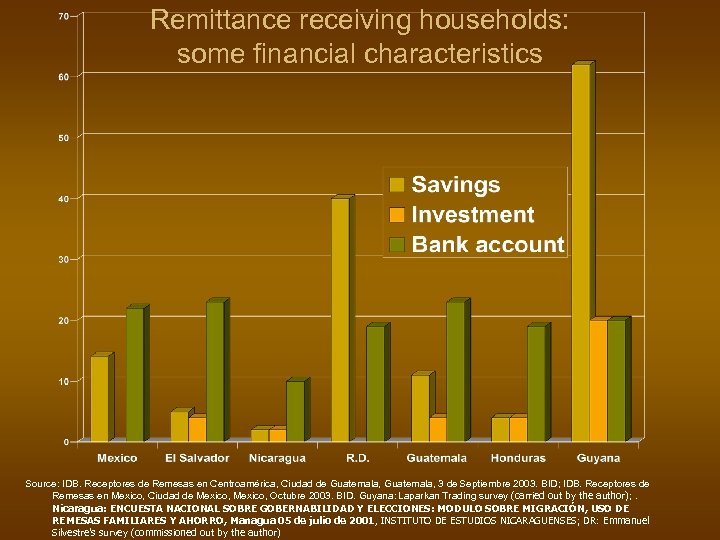

Remittance receiving households: some financial characteristics Source: IDB. Receptores de Remesas en Centroamérica, Ciudad de Guatemala, 3 de Septiembre 2003. BID; IDB. Receptores de Centroamérica, IDB. Remesas en Mexico, Ciudad de Mexico, Octubre 2003. BID. Guyana: Laparkan Trading survey (carried out by the author); . Mexico, (carried out by the author); Nicaragua: ENCUESTA NACIONAL SOBRE GOBERNABILIDAD Y ELECCIONES: MODULO SOBRE MIGRACIÓN, USO DE REMESAS FAMILIARES Y AHORRO, Managua 05 de julio de 2001, INSTITUTO DE ESTUDIOS NICARAGUENSES; DR: Emmanuel Silvestre’s survey (commissioned out by the author)

Remittances as Institutions of Development

Opportunities for development i. iii. iv. vi. Reduce Costs Savings, Credit and Banking Link with hometown associations Promote nostalgic markets and tourism Create institutional ties with the diaspora Link remittances and technology

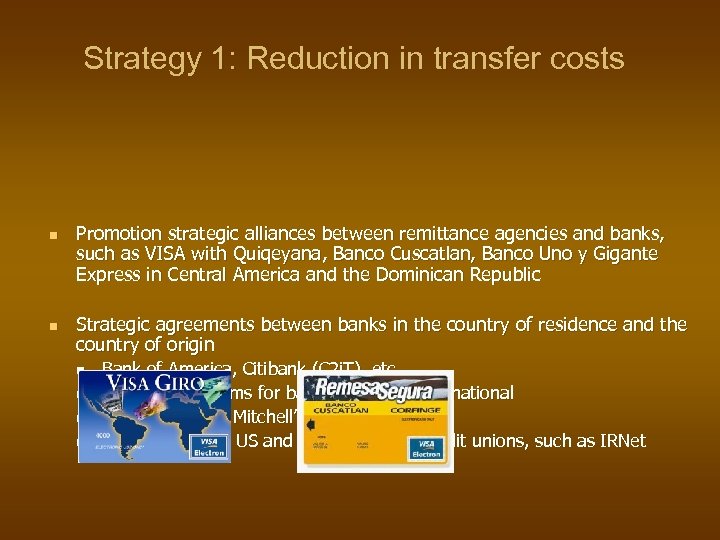

Strategy 1: Reduction in transfer costs n n Promotion strategic alliances between remittance agencies and banks, such as VISA with Quiqeyana, Banco Cuscatlan, Banco Uno y Gigante Express in Central America and the Dominican Republic Strategic agreements between banks in the country of residence and the country of origin n n Bank of America, Citibank (C 2 i. T), etc. Software Platforms for banks: Mastrex International ATMs and MAC: Mitchell’s Bank Alliances among US and Latin American credit unions, such as IRNet

Total cost of remittance transfer by industry sector

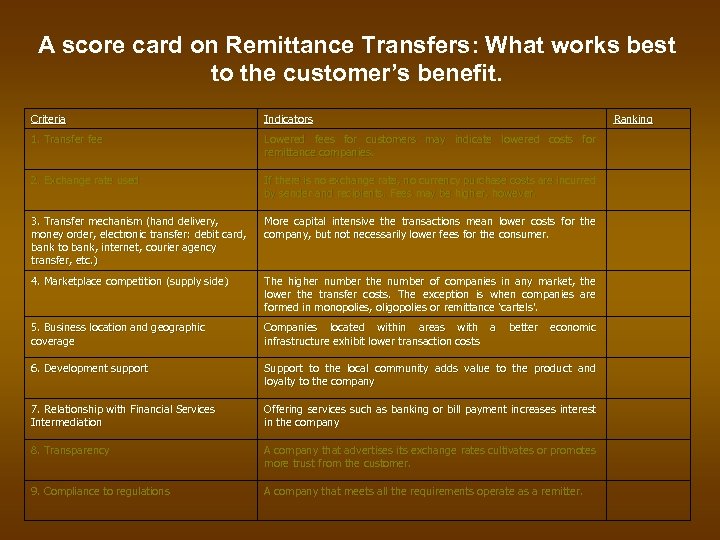

A score card on Remittance Transfers: What works best to the customer’s benefit. Criteria Indicators 1. Transfer fee Lowered fees for customers may indicate lowered costs for remittance companies. 2. Exchange rate used If there is no exchange rate, no currency purchase costs are incurred by sender and recipients. Fees may be higher, however. 3. Transfer mechanism (hand delivery, money order, electronic transfer: debit card, bank to bank, internet, courier agency transfer, etc. ) More capital intensive the transactions mean lower costs for the company, but not necessarily lower fees for the consumer. 4. Marketplace competition (supply side) The higher number the number of companies in any market, the lower the transfer costs. The exception is when companies are formed in monopolies, oligopolies or remittance ‘cartels’. 5. Business location and geographic coverage Companies located within areas with a better economic infrastructure exhibit lower transaction costs 6. Development support Support to the local community adds value to the product and loyalty to the company 7. Relationship with Financial Services Intermediation Offering services such as banking or bill payment increases interest Offering services such as banking bill payment increases interest in the company 8. Transparency A company that advertises its exchange rates cultivates or promotes more trust from the customer. 9. Compliance to regulations A company that meets all the requirements operate as a remitter. Ranking

Score for Fee, FX and total cost 4 5 6 Dominican Rep. Company 0. 996 0 0. 498 0 0. 279 1 0. 120 2 0. 101 2 Giromex 0. 057 3 Uno Money 0. 003 3 -0. 012 3 Dinero Seguro (USPS) 0. 014 3 Moneygram Below 30% of Avg 0 Vigo Below 20% of Avg 1. 433 Bank of America Below 10% of Avg 0 Western Union Same as avg. 0. 405 Dinero Express Above 10% of Avg. 3 TTL%-score Park Federal Savings Bank Above 20% of Avg. 2 TTL% mto vs. overall mean Harris Bank Above 30% of Avg. 1 Company Mexico Express Score = MTOa / All MTOa 0 Mexico 0. 073 3 Orlandi Valuta Orlandi TTL% mto vs. overall mean TTL%score Western Union 0. 527 0 Wells Fargo -0. 001 3 BHD 0. 467 0 Order Express -0. 118 4 Hemisferio Pronto Envios 0. 467 0 Sigue -0. 123 4 Remesas Quisqueyanas Remesas 0. 467 0 Intermex -0. 169 4 Girosol 0. 321 0 Delgado Travel -0. 171 4 Cibao 0. 167 2 Rapid Money -0. 101 4 Vigo 0. 167 2 Bancomer Transfer Services -0. 249 5 Moneygram 0. 029 3 Transfast -0. 365 6 La Nacional -0. 121 4 Second Federal Savings -0. 324 6 Remesas Pujols Remesas -0. 271 5 Barri International -0. 396 6 Ria -0. 271 5 Ria -0. 353 6 Viamericas -0. 271 5 Servimex -0. 438 6 Transfast -0. 416 6 US Money Express -0. 352 6 Mateo Express -0. 580 6 Maniflo -0. 391 6 Dolex Dollar Express -0. 304 6

Remittance Market Composition in Latin America Mature Composition of market share, Efficiency of transactions (use of modern technology, extended networks nation wide, safe transfers), Compliance to regulatory environment, Tradition of transferring money, Multiple new and old players(MTOs, banks, MFIs), Costs to customers are lower than average, Information and transparency, Investment accessible None Consolidating Mexico, El Salvador, Dominican Republic, Ecuador, Jamaica Incipient Colombia Honduras Peru Guyana Haiti Cuba Nicaragua Argentina Venezuela

Strategy II: Savings, Credit and Remittances a. b. c. d. e. Monitoring transfers, especially the exchange rate Motivate savings and credit institutions to attract remittance senders and recipients Bring low cost banking centers where there is a high concentration of families who receive remittances Offer incentives to households that receive remittances; Allow micro-finance and credit unions to become agents of remittances and savings institutions

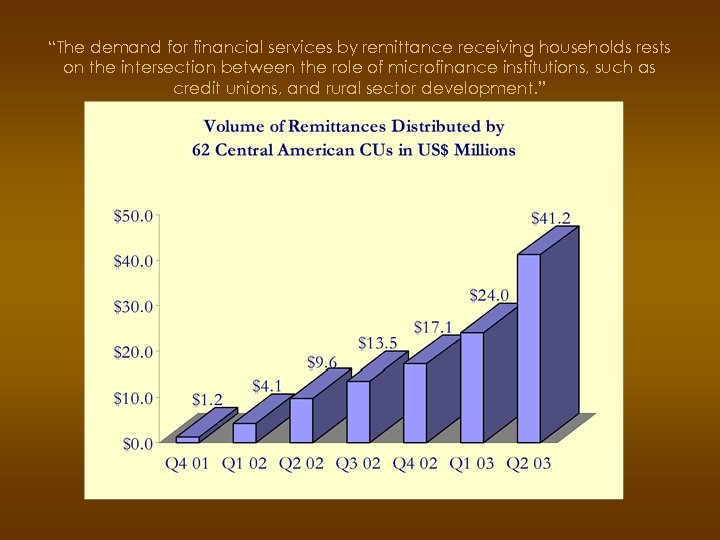

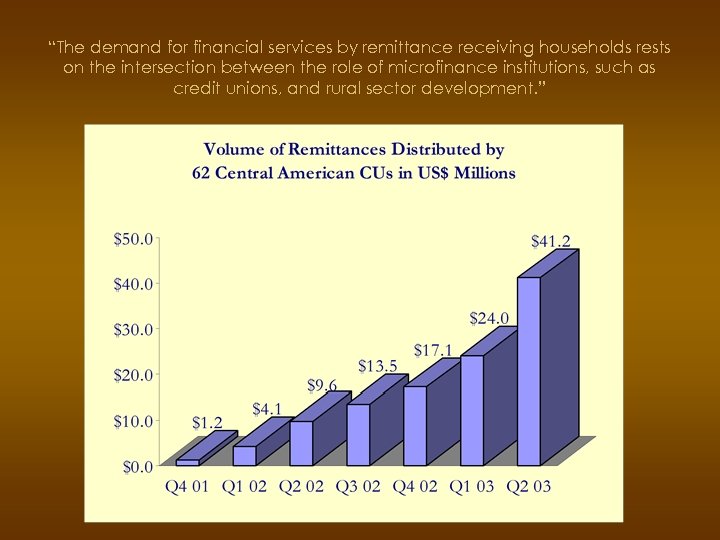

“The demand for financial services by remittance receiving households rests on the intersection between the role of microfinance institutions, such as credit unions, and rural sector development. ”

Mexico: Remittances to rural households 15 recibe US$250 al mes, siete veces al año.

People with bank accounts (remittance recipients and non-recipients) Source: Multilateral Investment Fund-Inter-American Development Bank, Receptores de Remesas en Mexico, Octubre 2003; Receptores de remesas en Guatemala, El Salvador y Honduras, Septiembre 2003; Receptores de Remesas en Ecuador, Mayo 2003. Washington, DC: MIFIADB/FOMIN-BID.

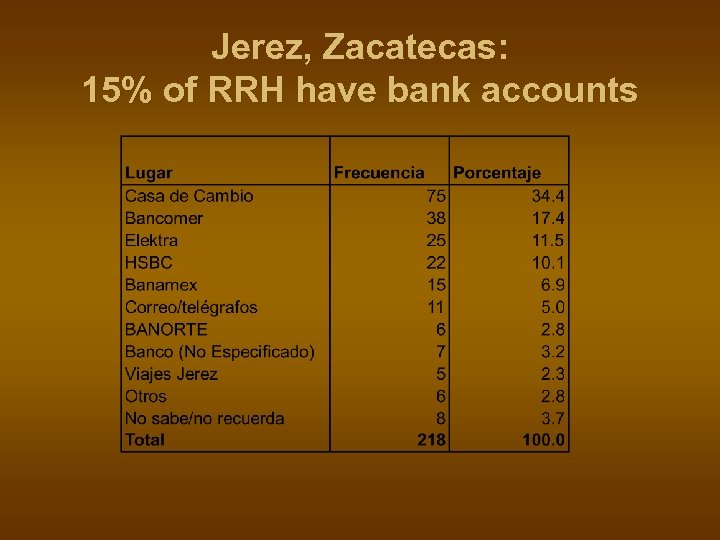

MFI Relevance: Zacatecas Municipalities (pop. ) Banks Credit Unions MTOs Jerez (55, 000) Bancomer, Banamex, Bital, Banorte Caja Popular Mexicana Thirteen money transfer ‘centros de cambio’ Tlatenango (24, 000) Bancomer, Bital, Banorte Caja Popular Mexicana Five Tepechitlan (5, 000) Banorte FINRURAL Tepetongo (5, 000) One Momax One Jalpa (20, 000) Bancomer, Bital, Banorte Juchipila Bancomer, Bital, Banorte Caja Popular Mexicana Three

Jerez, Zacatecas: 15% of RRH have bank accounts

Remittances and microfinance 1. Competitive position: The institution. . . a. has offered remittances since ____ b. offers money transfers on its own, through partnership or in a network c. has experienced growth in the transfers (number of transactions; market share) d. offers a competitive fee and enjoys profit margins e. has a competitive foreign exchange f. has a remittance marketing tool 2. Financial intermediation: The institution a. offers remittance distribution to members b. opens bank accounts to remittance recipient households in the institution’s vicinity; c. Has a crosselling marketing tool d. Provides range of financial services e. Provides credit for productive investment [mobilizes savings from remittance transfers] f. Remittance senders has a financial relationship with institution 3. Regulatory environment: The institution. . . a. Has awareness of regulatory issues in money transfers b. Report its activities to partner money transfer company c. Report its activities to government agencies 4. Technological applications a. The money transfer occurs through mainstream but modern platforms b. Innovative technologies are implemented (cards, wifi, online transfers, bundled softwares). 5. Data Management: The institution. . . a. Systematizes flows b. Performs market research and client analysis 6. External assistance: The institution. . . a. Donors or investors provide technical assistance for remittance transfer incorporation or innovation (equipment, regulatory compliance, training, market research, etc. ) b. Donors or investors provide working capital for remittance operation 7. Institutional efforts: The institution. . . a. Has invested resources to compete in the market b. Business is generating non-negligible revenue c. Relationship to local economy d. Relationship to local community

Minimum indicators leveraging the relationship between financial intermediation and remittances n Remittance market service coverage: The institution provides remittance transfer operations to its clients or members, as well as to the communities where its branches operate. Indicator: Coverage where there is competition (MFI branches / Competitor branches) n Effective market presence: As a minimum, market presence is achieved through a combination of partnership with money transfer companies, offer of a low cost remittance transaction and a distribution capacity. Indicators: Transfer volume (transfers / month, rate of transactions per institution’s branch), transaction cost (institution’s transfer cost / market average), number of branches, . n n Accessible financial services: The institution markets, designs and provides recipients with an array of various product options, including savings, credit, insurance, pension funds. Indicator: financial services (number of remittance recipients that are clients). Information management and adaptation: Institutional awareness and management of the market composition of recipients, adoption of adequate technologies linking MFI systems with remittance transfers. Indicator:

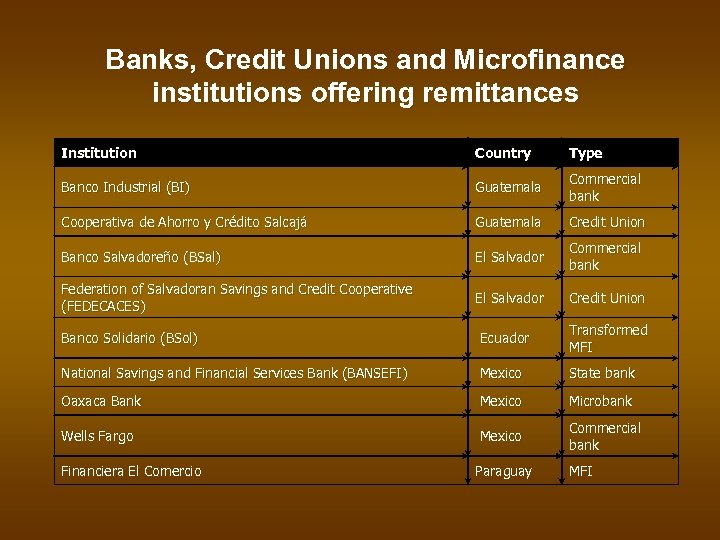

Banks, Credit Unions and Microfinance institutions offering remittances Institution Country Type Banco Industrial (BI) Guatemala Commercial bank Cooperativa de Ahorro y Crédito Salcajá Guatemala Credit Union Banco Salvadoreño (BSal) El Salvador Commercial bank Federation of Salvadoran Savings and Credit Cooperative (FEDECACES) El Salvador Credit Union Banco Solidario (BSol) Ecuador Transformed MFI National Savings and Financial Services Bank (BANSEFI) Mexico State bank Oaxaca Bank Mexico Microbank Wells Fargo Mexico Commercial bank Financiera El Comercio Paraguay MFI

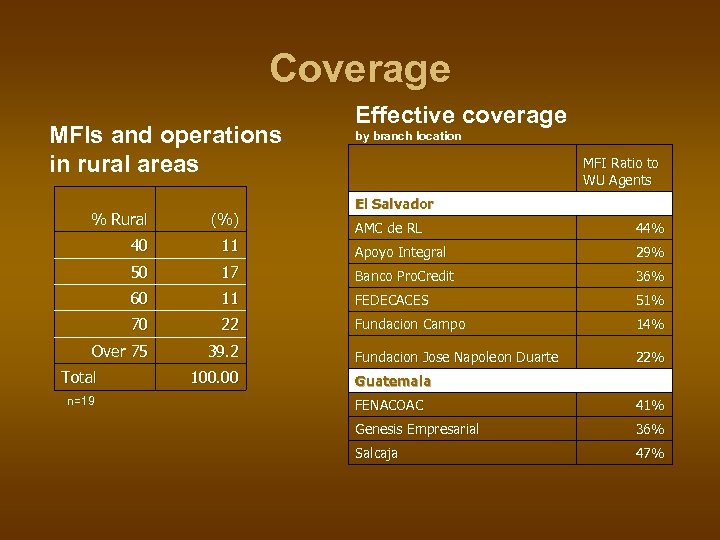

Coverage MFIs and operations in rural areas % Rural (%) 40 11 50 Effective coverage by branch location MFI Ratio to WU Agents El Salvador AMC de RL 44% Apoyo Integral 29% 17 Banco Pro. Credit 36% 60 11 FEDECACES 51% 70 22 Fundacion Campo 14% Over 75 39. 2 Fundacion Jose Napoleon Duarte 22% Total n=19 100. 00 Guatemala FENACOAC 41% Genesis Empresarial 36% Salcaja 47%

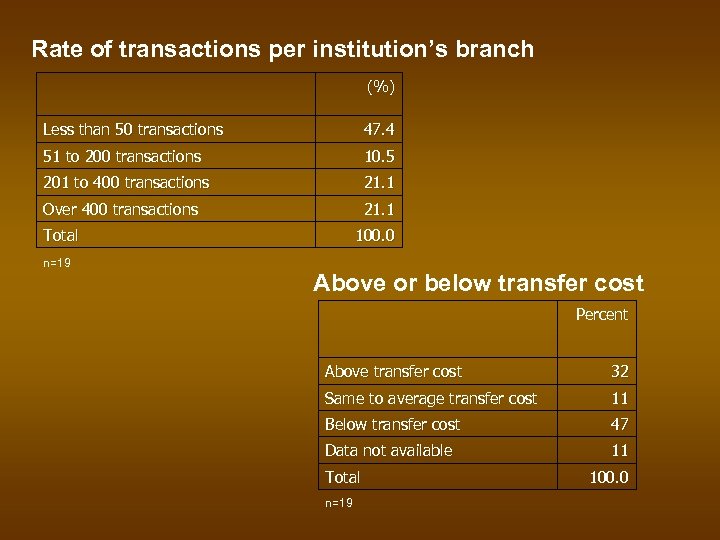

Rate of transactions per institution’s branch (%) Less than 50 transactions 47. 4 51 to 200 transactions 10. 5 201 to 400 transactions 21. 1 Over 400 transactions 21. 1 Total n=19 100. 0 Above or below transfer cost Percent Above transfer cost 32 Same to average transfer cost 11 Below transfer cost 47 Data not available 11 Total n=19 100. 0

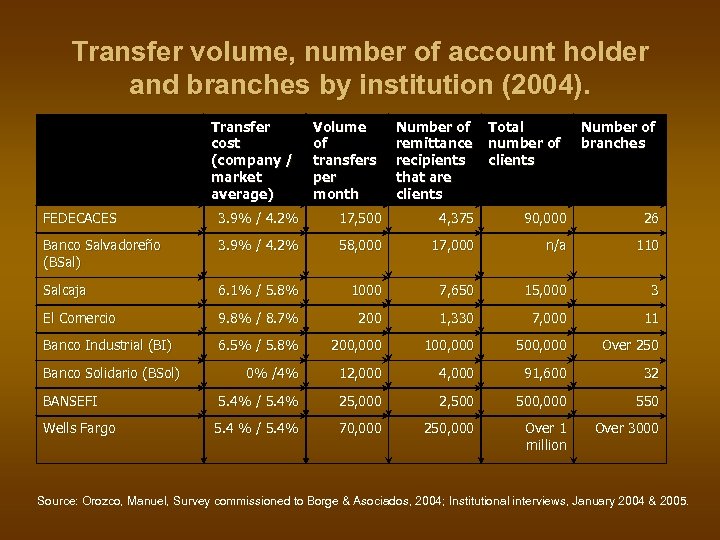

Transfer volume, number of account holder and branches by institution (2004). Transfer cost (company / market average) Volume of transfers per month Number of remittance recipients that are clients Total number of clients Number of branches 4, 375 90, 000 26 Transfer volume, number of account holder and branches by institution (2004). FEDECACES 3. 9% / 4. 2% 17, 500 Banco Salvadoreño (BSal) 3. 9% / 4. 2% 58, 000 17, 000 n/a 110 Salcaja 6. 1% / 5. 8% 1000 7, 650 15, 000 3 El Comercio 9. 8% / 8. 7% 200 1, 330 7, 000 11 Banco Industrial (BI) 6. 5% / 5. 8% 200, 000 100, 000 500, 000 Over 250 12, 000 4, 000 91, 600 32 5. 4% / 5. 4% 25, 000 2, 500, 000 550 5. 4 % / 5. 4% 70, 000 250, 000 Banco Solidario (BSol) BANSEFI Wells Fargo 0% /4% Over 1 million Over 3000 Source: Orozco, Manuel, Survey commissioned to Borge & Asociados, 2004; Institutional interviews, January 2004 & 2005.

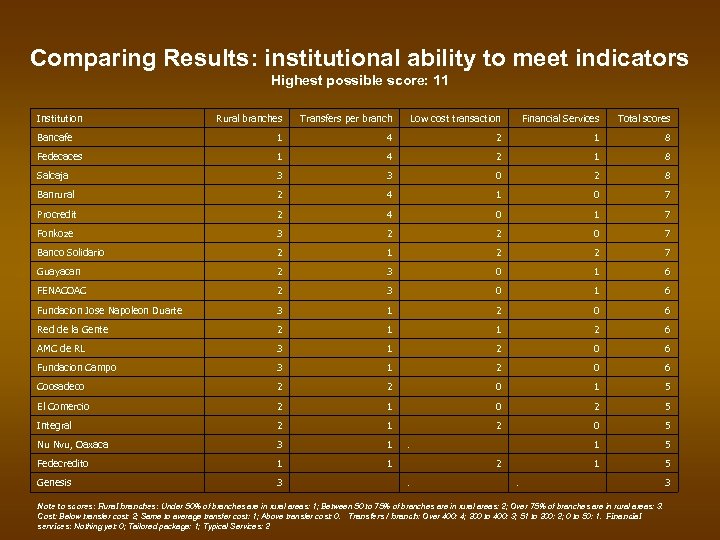

Comparing Results: institutional ability to meet indicators Highest possible score: 11 Institution Rural branches Transfers per branch Low cost transaction Financial Services Total scores Bancafe 1 4 2 1 8 Fedecaces 1 4 2 1 8 Salcaja 3 3 0 2 8 Banrural 2 4 1 0 7 Procredit 2 4 0 1 7 Fonkoze 3 2 2 0 7 Banco Solidario 2 1 2 2 7 Guayacan 2 3 0 1 6 FENACOAC 2 3 0 1 6 Fundacion Jose Napoleon Duarte 3 1 2 0 6 Red de la Gente 2 1 1 2 6 AMC de RL 3 1 2 0 6 Fundacion Campo 3 1 2 0 6 Coosadeco 2 2 0 1 5 El Comercio 2 1 0 2 5 Integral 2 1 2 0 5 Nu Nvu, Oaxaca 3 1 1 5 Fedecredito 1 1 1 5 Genesis 3 . 2. . Note to scores: Rural branches: Under 50% of branches are in rural areas: 1; Between 50 to 75% of branches are in rural areas: 2; Over 75% of branches are in rural areas: 3. Cost: Below transfer cost: 2; Same to average transfer cost: 1; Above transfer cost: 0. Transfers / branch: Over 400: 4; 200 to 400: 3; 51 to 200: 2; 0 to 50: 1. Financial services: Nothing yet: 0; Tailored package: 1; Typical Services: 2 3

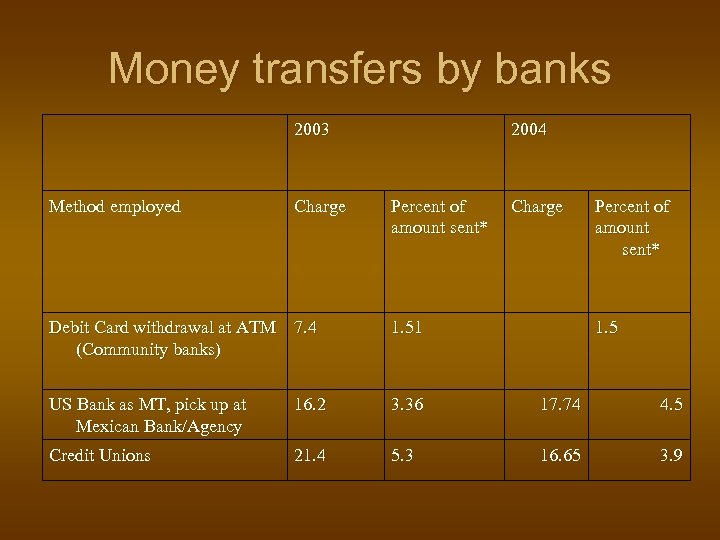

Money transfers by banks 2003 Method employed Charge 2004 Percent of amount sent* Charge Percent of amount sent* Debit Card withdrawal at ATM 7. 4 (Community banks) 1. 51 1. 5 US Bank as MT, pick up at Mexican Bank/Agency 16. 2 3. 36 17. 74 4. 5 Credit Unions 21. 4 5. 3 16. 65 3. 9

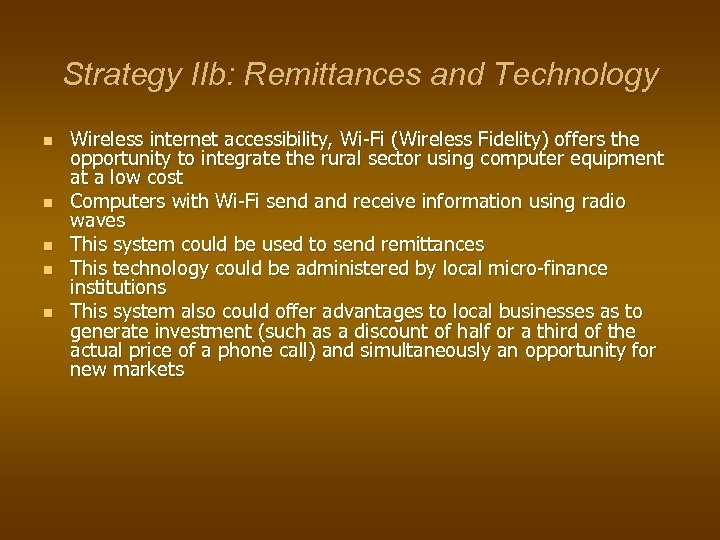

Strategy IIb: Remittances and Technology n n n Wireless internet accessibility, Wi-Fi (Wireless Fidelity) offers the opportunity to integrate the rural sector using computer equipment at a low cost Computers with Wi-Fi send and receive information using radio waves This system could be used to send remittances This technology could be administered by local micro-finance institutions This system also could offer advantages to local businesses as to generate investment (such as a discount of half or a third of the actual price of a phone call) and simultaneously an opportunity for new markets

Strategy III: Alliances with Home Town Associations n n Seek communication and dialogue with HTAs; Social development n Donor technical assistance for project identification; n Support of a transnational community radio; n Donor support on governance and democratic participation; n Donor partnerships in social (health and education) and infrastructural projects Economic development n Government incentives to attract private sector involvement; n Government support in investment feasibility analysis; Financial infrastructure n Support education on financial services; n Support to link technology to education, communication and remittances in the rural areas.

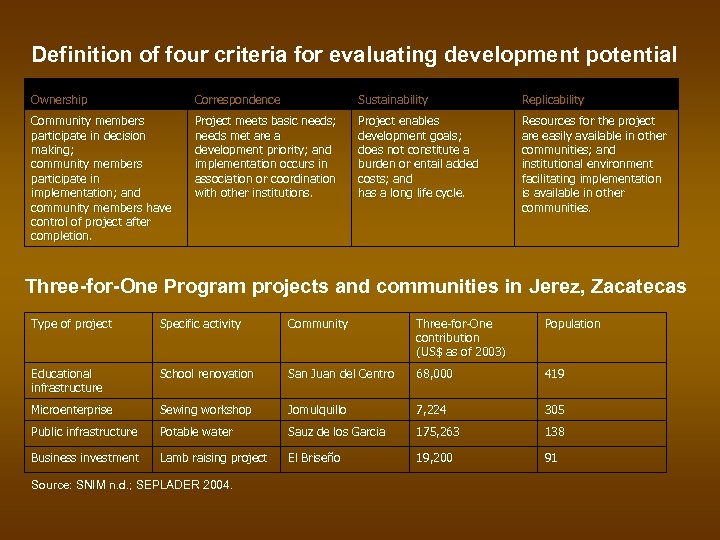

Definition of four criteria for evaluating development potential Ownership Correspondence Sustainability Replicability Community members participate in decision making; community members participate in implementation; and community members have control of project after completion. Project meets basic needs; needs met are a development priority; and implementation occurs in association or coordination with other institutions. Project enables development goals; does not constitute a burden or entail added costs; and has a long life cycle. Resources for the project are easily available in other communities; and institutional environment facilitating implementation is available in other communities. Three-for-One Program projects and communities in Jerez, Zacatecas Type of project Specific activity Community Three-for-One contribution (US$ as of 2003) Population Educational infrastructure School renovation San Juan del Centro 68, 000 419 Microenterprise Sewing workshop Jomulquillo 7, 224 305 Public infrastructure Potable water Sauz de los Garcia 175, 263 138 Business investment Lamb raising project El Briseño 19, 200 91 Source: SNIM n. d. ; SEPLADER 2004.

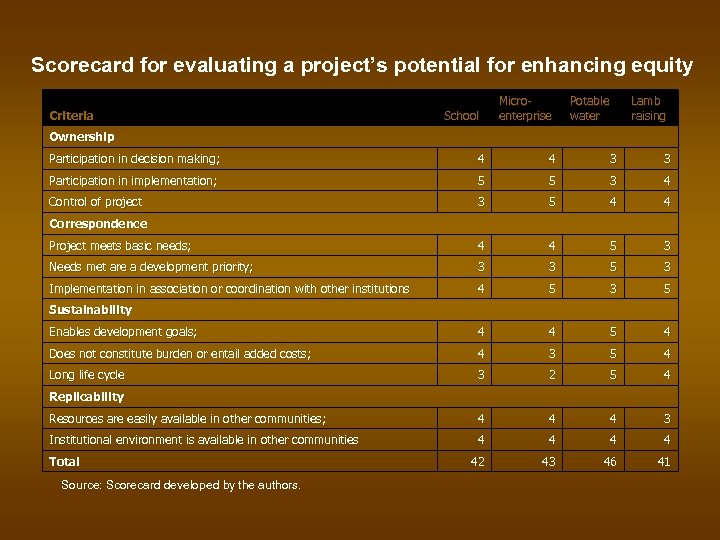

Scorecard for evaluating a project’s potential for enhancing equity Criteria School Microenterprise Potable water Lamb raising Ownership Participation in decision making; 4 4 3 3 Participation in implementation; 5 5 3 4 Control of project 3 5 4 4 Project meets basic needs; 4 4 5 3 Needs met are a development priority; 3 3 5 3 Implementation in association or coordination with other institutions 4 5 3 5 Enables development goals; 4 4 5 4 Does not constitute burden or entail added costs; 4 3 5 4 Long life cycle 3 2 5 4 Resources are easily available in other communities; 4 4 4 3 Institutional environment is available in other communities 4 4 42 43 46 41 Correspondence Sustainability Replicability Total Source: Scorecard developed by the authors.

Strategy IV: Expansion of Financial Investment

Strategy IVa: Promotion of the nostalgic market a. b. c. d. Risk and investment analysis Build partnerships between the private sector and the immigrant community; Financing small investment projects within rural sectors Involve home town associations and NGOs with strategies to invest

Strategy IVb: Tourism and Migration Establish travel packages to traditional places n Establish new and innovative products for tourists n Create new investment strategies to promote tourism n

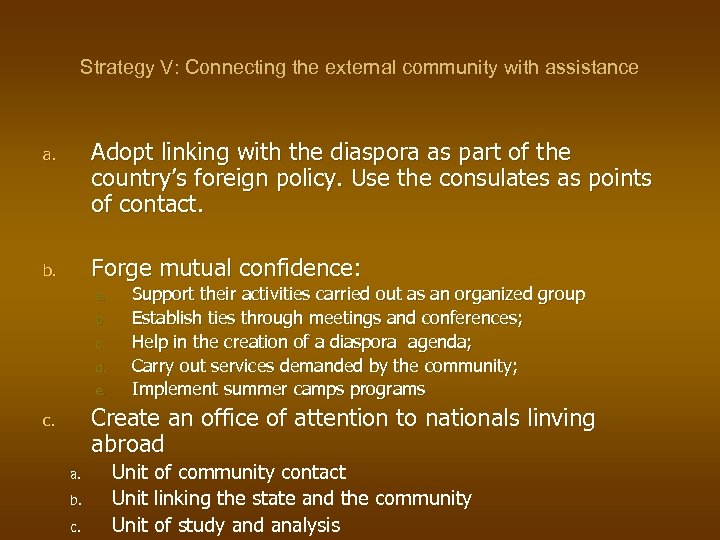

Strategy V: Connecting the external community with assistance a. Adopt linking with the diaspora as part of the country’s foreign policy. Use the consulates as points of contact. b. Forge mutual confidence: a. b. c. d. e. Support their activities carried out as an organized group Establish ties through meetings and conferences; Help in the creation of a diaspora agenda; Carry out services demanded by the community; Implement summer camps programs Create an office of attention to nationals linving abroad c. a. b. c. Unit of community contact Unit linking the state and the community Unit of study and analysis

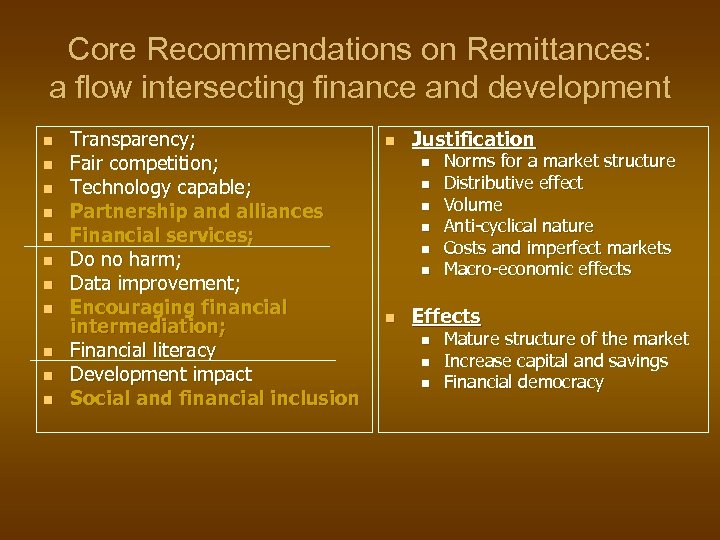

Core Recommendations on Remittances: a flow intersecting finance and development n n n Transparency; Fair competition; Technology capable; Partnership and alliances Financial services; Do no harm; Data improvement; Encouraging financial intermediation; Financial literacy Development impact Social and financial inclusion n Justification n n n Norms for a market structure Distributive effect Volume Anti-cyclical nature Costs and imperfect markets Macro-economic effects Effects n n n Mature structure of the market Increase capital and savings Financial democracy

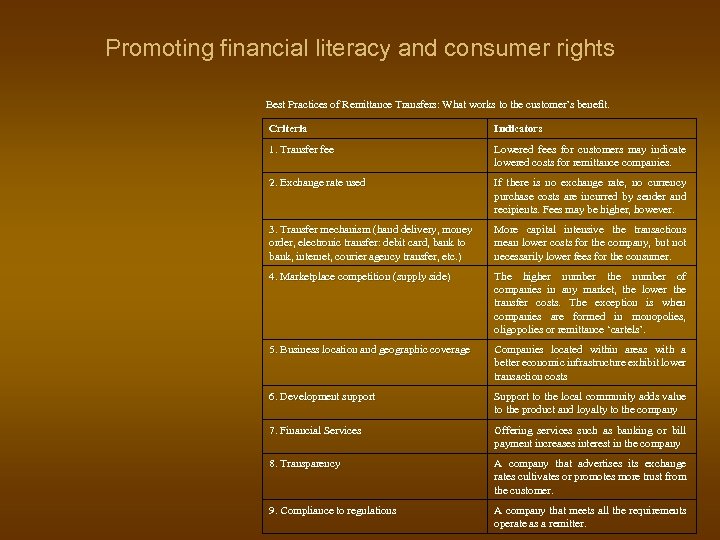

Promoting financial literacy and consumer rights Best Practices of Remittance Transfers: What works to the customer’s benefit. Criteria Indicators 1. Transfer fee Lowered fees for customers may indicate lowered costs for remittance companies. 2. Exchange rate used If there is no exchange rate, no currency purchase costs are incurred by sender and recipients. Fees may be higher, however. 3. Transfer mechanism (hand delivery, money order, electronic transfer: debit card, bank to bank, internet, courier agency transfer, etc. ) More capital intensive the transactions mean lower costs for the company, but not necessarily lower fees for the consumer. 4. Marketplace competition (supply side) The higher number the number of companies in any market, the lower the transfer costs. The exception is when companies are formed in monopolies, oligopolies or remittance ‘cartels’. 5. Business location and geographic coverage Companies located within areas with a better economic infrastructure exhibit lower transaction costs 6. Development support Support to the local community adds value to the product and loyalty to the company 7. Financial Services Offering services such as banking or bill payment increases interest in the company 8. Transparency A company that advertises its exchange rates cultivates or promotes more trust from the customer. 9. Compliance to regulations A company that meets all the requirements operate as a remitter.

Financial Institution Assets Remittances, banks and new accounts Approx # of accts. Opened via Remittances Type of Remittance <50, 000 Citibank Accounts Introduction of a checkless account to send money Access account / Affinity card <70, 000 20 of new accounts within the last year come from the Hispanic segment Safe. Send - ATM card N/A ACH - $20 Bank of America $736 billion Bank of Belton N/A Central Bank of Kansas City $7, 333, 646 <5, 000 Over the last six months until 1/04, about 25 of new accounts opened had Spanish-sounding surnames. Stored-value card Commercial Federal Bank $12. 2 billion N/A Standard WT and cash cards First National Bank of Omaha $626. 7 million <10, 000 At least 40 of bank clients use remittances. Standard WT and secondary ATM Harris Bank/Bank of Montreal $197 billion <50, 000 Growth in remittances has been double digit since the service began in 1999. Standard WT Mitchell Bank $74. 9 million <500 125 remittance accounts International Transfer Acct. with dual ATM card Northshore Bank $1. 59 billion <500 400 remittance accounts Standard WT Dual ATM and debit card for Mexico N/A Standard WT Security Savings Bank $761, 058, 304 United Americas Bank $89. 4 million US Bank $189 billion Wells Fargo $388 billion <1000 12 overall increase in market share of Hispanics since the 2001 launch of its Hispanic initiative. Since its launch, 56 of all non-account holders have converted into regular customers <250, 000 Secure Money Transfer (SMT) at the ATM and Secure Money Transfer with the People’s Network Above average cross-sales levels for border transaction customers. WF’s cross-sell ratio exceeds the banks’ average. Intercuenta Express, an accountto-account wire transfer service. Dinero al Instante, similar WT

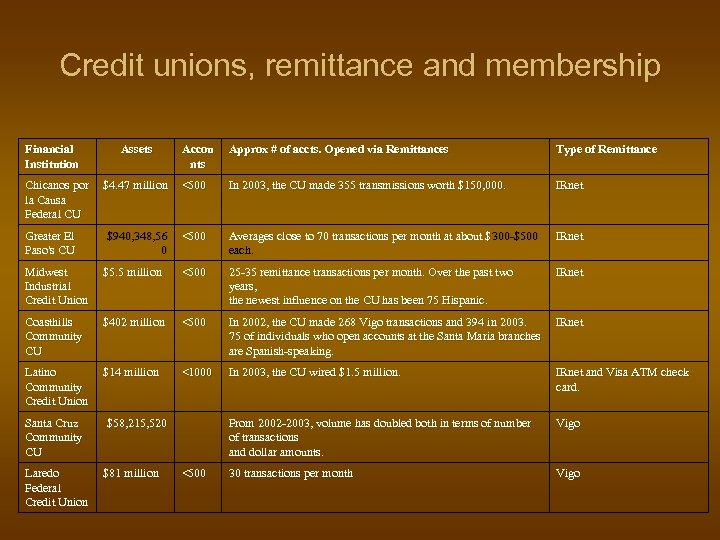

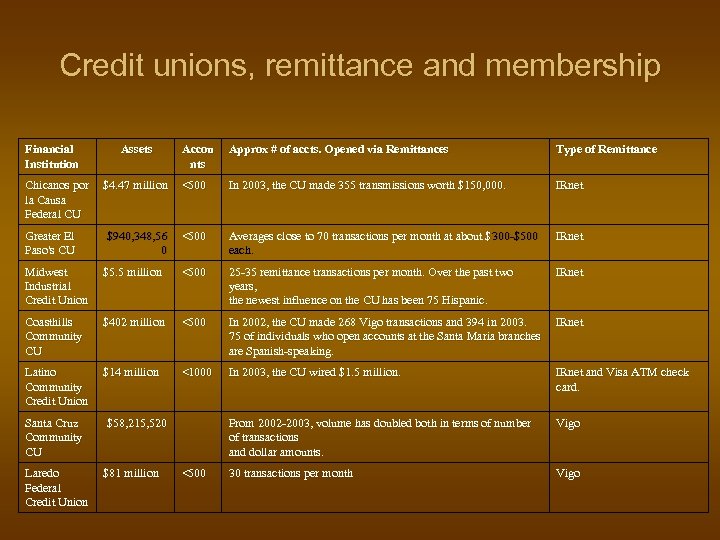

Credit unions, remittance and membership Financial Institution Assets Chicanos por $4. 47 million la Causa Federal CU Greater El Paso's CU Accou nts Approx # of accts. Opened via Remittances Type of Remittance <500 In 2003, the CU made 355 transmissions worth $150, 000. IRnet Averages close to 70 transactions per month at about $ 300 -$500 each. IRnet $940, 348, 56 <500 0 Midwest Industrial Credit Union $5. 5 million <500 25 -35 remittance transactions per month. Over the past two years, the newest influence on the CU has been 75 Hispanic. Coasthills Community CU $402 million <500 In 2002, the CU made 268 Vigo transactions and 394 in 2003. IRnet 75 of individuals who open accounts at the Santa Maria branches are Spanish-speaking. Latino Community Credit Union $14 million <1000 In 2003, the CU wired $1. 5 million. IRnet and Visa ATM check card. From 2002 -2003, volume has doubled both in terms of number of transactions and dollar amounts. Vigo 30 transactions per month Vigo Santa Cruz Community CU Laredo Federal Credit Union $58, 215, 520 $81 million <500

“The demand for financial services by remittance receiving households rests on the intersection between the role of microfinance institutions, such as credit unions, and rural sector development. ”

Mexico: Remittances to rural households 15 recibe US$250 al mes, siete veces al año.

Strategy IIb: Remittances and Technology n n n Wireless internet accessibility, Wi-Fi (Wireless Fidelity) offers the opportunity to integrate the rural sector using computer equipment at a low cost Computers with Wi-Fi send and receive information using radio waves This system could be used to send remittances This technology could be administered by local micro-finance institutions This system also could offer advantages to local businesses as to generate investment (such as a discount of half or a third of the actual price of a phone call) and simultaneously an opportunity for new markets

Volume and Price in Latin America Manuel Orozco

Quarterly flows to selected Latin American countries

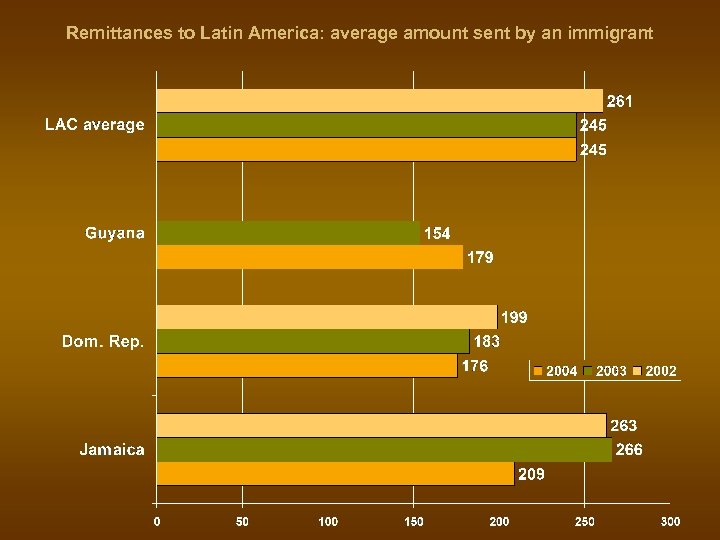

Remittances to Latin America: average amount sent by an immigrant

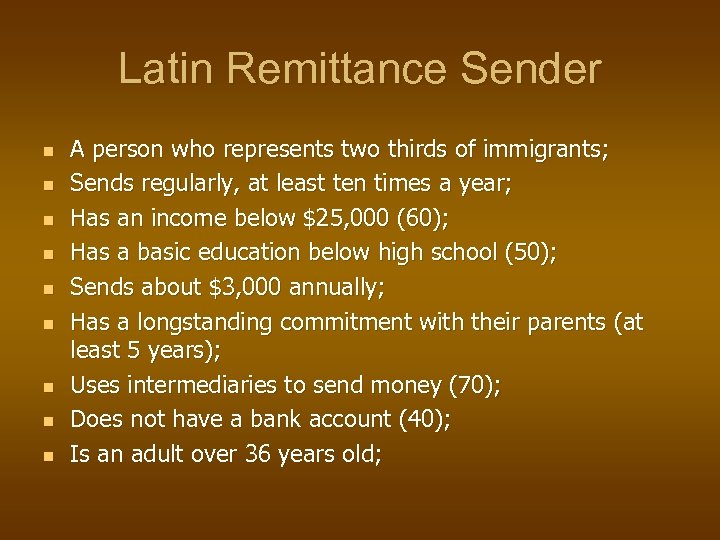

Latin Remittance Sender n n n n n A person who represents two thirds of immigrants; Sends regularly, at least ten times a year; Has an income below $25, 000 (60); Has a basic education below high school (50); Sends about $3, 000 annually; Has a longstanding commitment with their parents (at least 5 years); Uses intermediaries to send money (70); Does not have a bank account (40); Is an adult over 36 years old;

Average amount sent and length of time living in the U. S.

Immigrants and bank accounts

Why doesn’t have a bank account?

Do you have debit, credit card, or both

Do you have financial obligations (loans)?

Personal Income and Years living in U. S.

Remittances and the Market Some features and trends

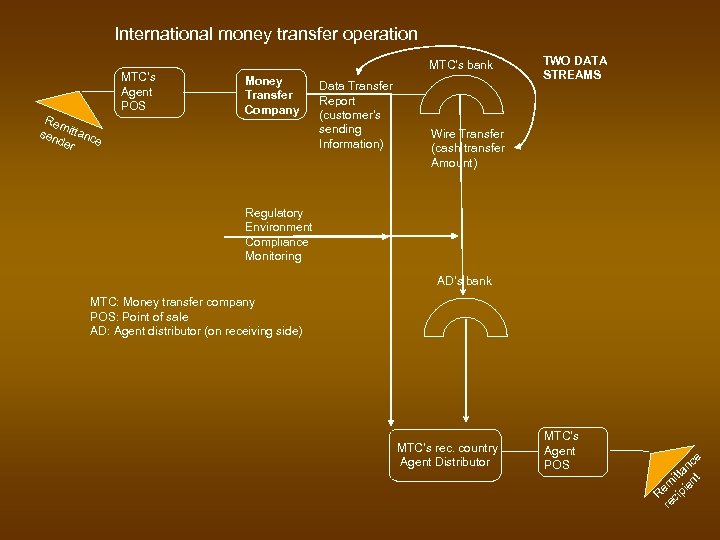

International money transfer operation MTC’s Agent POS Rem sen ittanc e der MTC’s bank Money Transfer Company Data Transfer Report (customer’s sending Information) TWO DATA STREAMS Wire Transfer (cash transfer Amount) Regulatory Environment Compliance Monitoring AD’s bank MTC: Money transfer company POS: Point of sale AD: Agent distributor (on receiving side) MTC’s rec. country Agent Distributor MTC’s Agent POS ce an t itt m ien Re cip re

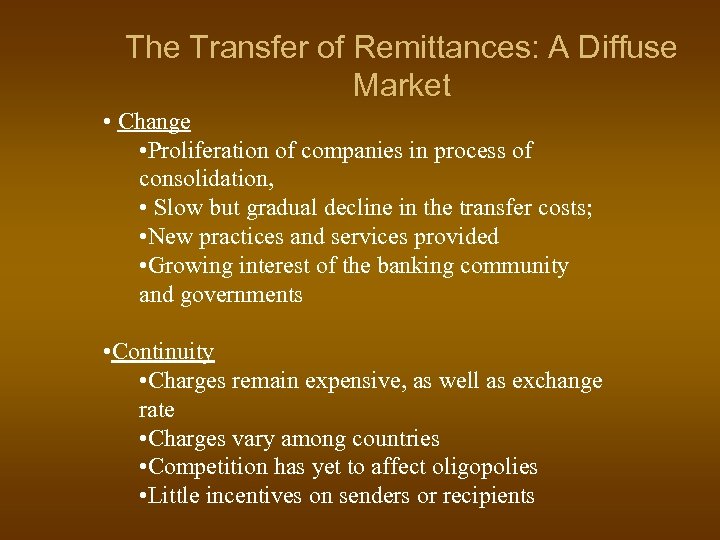

The Transfer of Remittances: A Diffuse Market • Change • Proliferation of companies in process of consolidation, • Slow but gradual decline in the transfer costs; • New practices and services provided • Growing interest of the banking community and governments • Continuity • Charges remain expensive, as well as exchange rate • Charges vary among countries • Competition has yet to affect oligopolies • Little incentives on senders or recipients

Competition among major remittance recipients Number of money transfer companies holding 50 or more of market share Cost of sending money to selected countries (as percent of principal sent)

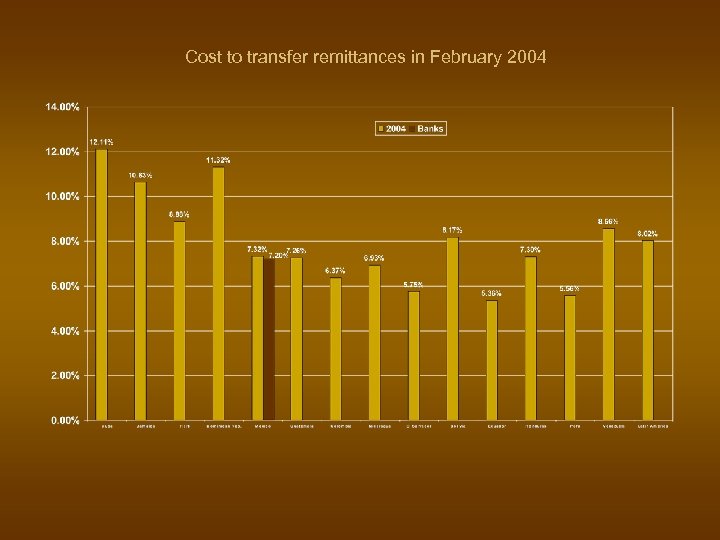

Cost to transfer remittances in February 2004

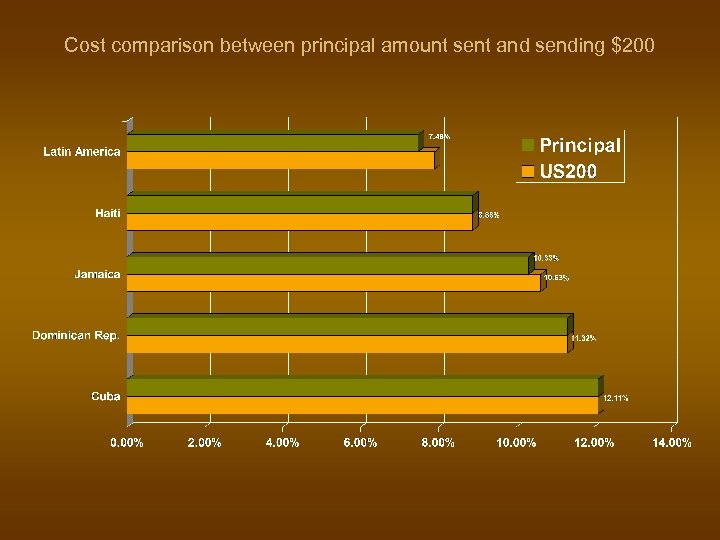

Cost comparison between principal amount sent and sending $200

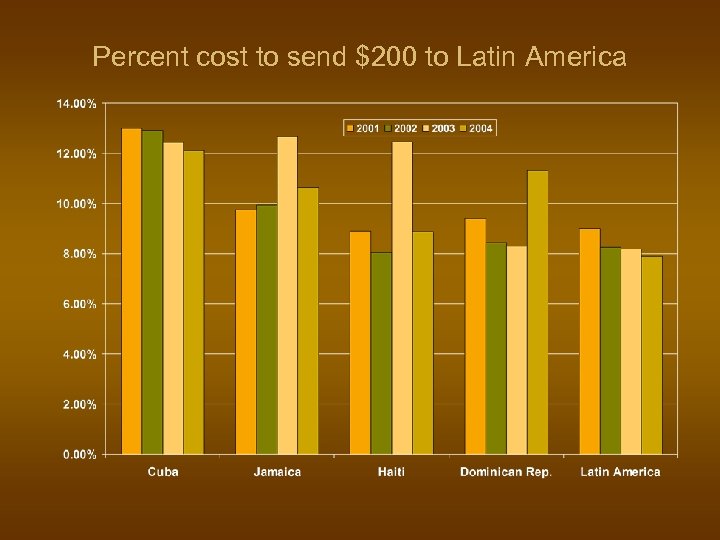

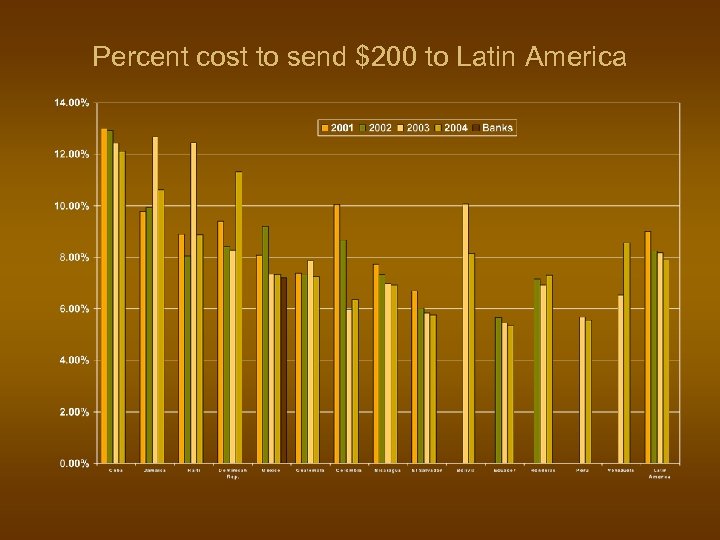

Percent cost to send $200 to Latin America

Changes over time in costs to send principal amount

Percent cost to send $200

Remittances Via ATM/Debit Cards and Resulting Fees for Sending $300 to Mexico Subject to Average Company Withdrawal Fees additional withdraw fees from Mexican ATM Number of ATM/Debit Cards issued with account Exchange Rate of Two Major Mexican Banks[1] Interbank Exchange Rate 30 -Jan-03[2] Exchange Charge Plus Fee Charge First Bank of the Americas, Quickcash $1. 50 for first 4 withdrawals /month ($1. 50 extra after 4 withdrawals in a month) X 2 10. 78 10. 86 $3. 85 Banco Popular, Acceso Popular $1. 00 (2 free Banco Popular ATM withdrawals per month) X 2 10. 78 10. 86 $3. 35 Fifth Third Bank $3. 00 X 1 10. 78 10. 86 $2. 35 Michell Bank $2. 50 X 2 10. 78 10. 86 $4. 85 Citibank, $5 Not at Banamex 1 10. 78 10. 86 $10. 30 Elgin State Bank $1. 50 X 2 10. 78 10. 86 Other Fees $5. 35 $3 to open a cash deposit only account $10. 00 per transfer ($15 if $12 to open account; not Bof. A Bank of $3 fee if ATM cardholder); $3 withdrawal is used America, x 2 10. 78 10. 86 $12. 35 per withdrawal, Safe Send[3] more than once per Safe Send[3] and one free [1] Average Exchange rate of Bancomer and Banamex for 30 -Jan-03. The bank that owns the ATM usually applies the exchange rate at the time of ATM withdrawal. Therefore, this average transfer withdrawal per approximates exchange rate received by a customer accessing his remittances through an ATM. [2] Banco Central de Mexico Official Exchange Rate. transfer [3] Other fees that apply: A US$4. 00 Representative Assisted Fee will be charged each time You or the Recipient talk directly with a person. This fee will be waived for the first 4 such calls each

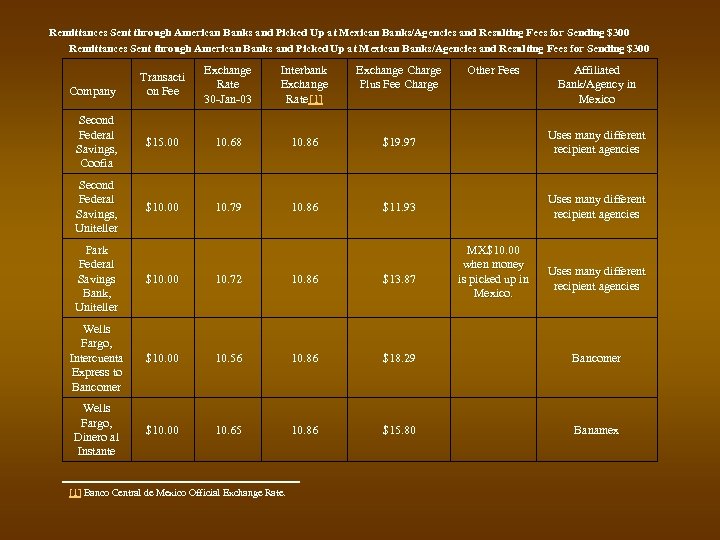

Remittances Sent through American Banks and Picked Up at Mexican Banks/Agencies and Resulting Fees for Sending $300 Transacti on Fee Exchange Rate 30 -Jan-03 Interbank Exchange Rate[1] Exchange Charge Plus Fee Charge Second Federal Savings, Coofia $15. 00 10. 68 10. 86 $19. 97 Uses many different recipient agencies Second Federal Savings, Uniteller $10. 00 10. 79 10. 86 $11. 93 Uses many different recipient agencies Company Other Fees Park Federal Savings Bank, Uniteller $10. 00 10. 72 10. 86 $13. 87 Wells Fargo, Intercuenta Express to Bancomer $10. 00 10. 56 10. 86 $18. 29 Bancomer Wells Fargo, Dinero al Instante $10. 00 10. 65 10. 86 $15. 80 Banamex [1] Banco Central de Mexico Official Exchange Rate. MX$10. 00 when money is picked up in Mexico. Affiliated Bank/Agency in Mexico Uses many different recipient agencies

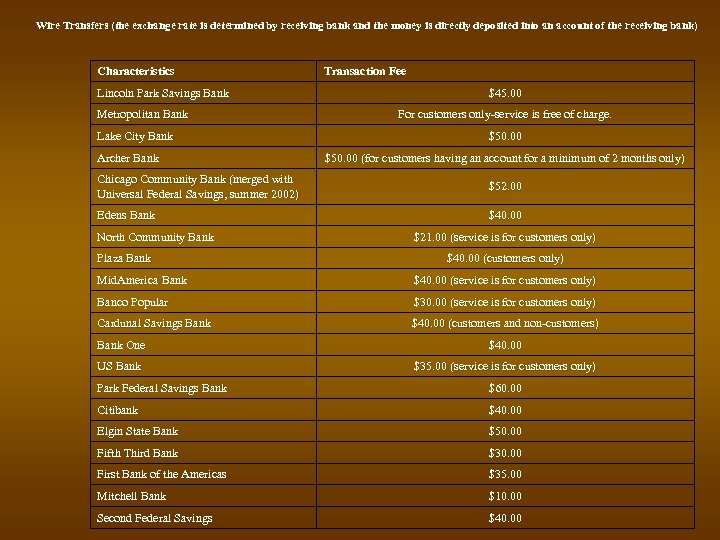

Wire Transfers (the exchange rate is determined by receiving bank and the money is directly deposited into an account of the receiving bank) Characteristics Lincoln Park Savings Bank Metropolitan Bank Lake City Bank Archer Bank Transaction Fee $45. 00 For customers only-service is free of charge. $50. 00 (for customers having an account for a minimum of 2 months only) Chicago Community Bank (merged with Universal Federal Savings, summer 2002) $52. 00 Edens Bank $40. 00 North Community Bank Plaza Bank $21. 00 (service is for customers only) $40. 00 (customers only) Mid. America Bank $40. 00 (service is for customers only) Banco Popular $30. 00 (service is for customers only) Cardunal Savings Bank $40. 00 (customers and non-customers) Bank One $40. 00 US Bank $35. 00 (service is for customers only) Park Federal Savings Bank $60. 00 Citibank $40. 00 Elgin State Bank $50. 00 Fifth Third Bank $30. 00 First Bank of the Americas $35. 00 Mitchell Bank $10. 00 Second Federal Savings $40. 00

Financial Institution Assets Remittances, banks and new accounts Approx # of accts. Opened via Remittances Type of Remittance <50, 000 Citibank Accounts Introduction of a checkless account to send money Access account / Affinity card <70, 000 20 of new accounts within the last year come from the Hispanic segment Safe. Send - ATM card N/A ACH - $20 Bank of America $736 billion Bank of Belton N/A Central Bank of Kansas City $7, 333, 646 <5, 000 Over the last six months until 1/04, about 25 of new accounts opened had Spanish-sounding surnames. Stored-value card Commercial Federal Bank $12. 2 billion N/A Standard WT and cash cards First National Bank of Omaha $626. 7 million <10, 000 At least 40 of bank clients use remittances. Standard WT and secondary ATM Harris Bank/Bank of Montreal $197 billion <50, 000 Growth in remittances has been double digit since the service began in 1999. Standard WT Mitchell Bank $74. 9 million <500 125 remittance accounts International Transfer Acct. with dual ATM card Northshore Bank $1. 59 billion <500 400 remittance accounts Standard WT Dual ATM and debit card for Mexico N/A Standard WT Security Savings Bank $761, 058, 304 United Americas Bank $89. 4 million US Bank $189 billion Wells Fargo $388 billion <1000 12 overall increase in market share of Hispanics since the 2001 launch of its Hispanic initiative. Since its launch, 56 of all non-account holders have converted into regular customers <250, 000 Secure Money Transfer (SMT) at the ATM and Secure Money Transfer with the People’s Network Above average cross-sales levels for border transaction customers. WF’s cross-sell ratio exceeds the banks’ average. Intercuenta Express, an accountto-account wire transfer service. Dinero al Instante, similar WT

Credit unions, remittance and membership Financial Institution Assets Chicanos por $4. 47 million la Causa Federal CU Greater El Paso's CU Accou nts Approx # of accts. Opened via Remittances Type of Remittance <500 In 2003, the CU made 355 transmissions worth $150, 000. IRnet Averages close to 70 transactions per month at about $ 300 -$500 each. IRnet $940, 348, 56 <500 0 Midwest Industrial Credit Union $5. 5 million <500 25 -35 remittance transactions per month. Over the past two years, the newest influence on the CU has been 75 Hispanic. Coasthills Community CU $402 million <500 In 2002, the CU made 268 Vigo transactions and 394 in 2003. IRnet 75 of individuals who open accounts at the Santa Maria branches are Spanish-speaking. Latino Community Credit Union $14 million <1000 In 2003, the CU wired $1. 5 million. IRnet and Visa ATM check card. From 2002 -2003, volume has doubled both in terms of number of transactions and dollar amounts. Vigo 30 transactions per month Vigo Santa Cruz Community CU Laredo Federal Credit Union $58, 215, 520 $81 million <500

Remittances and costs to Cuba

Jamaica

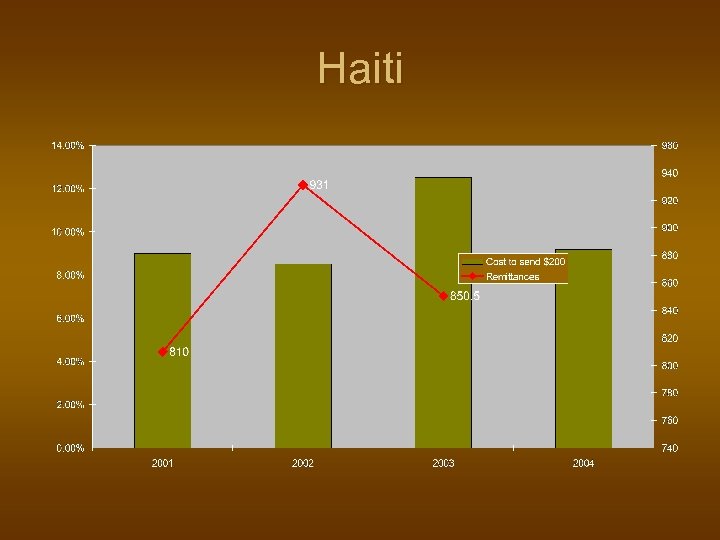

Haiti

Dominican Republic

Mexico

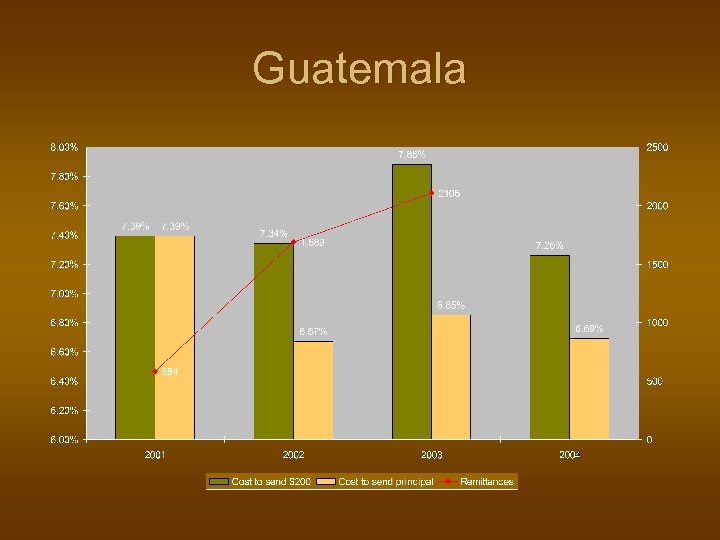

Guatemala

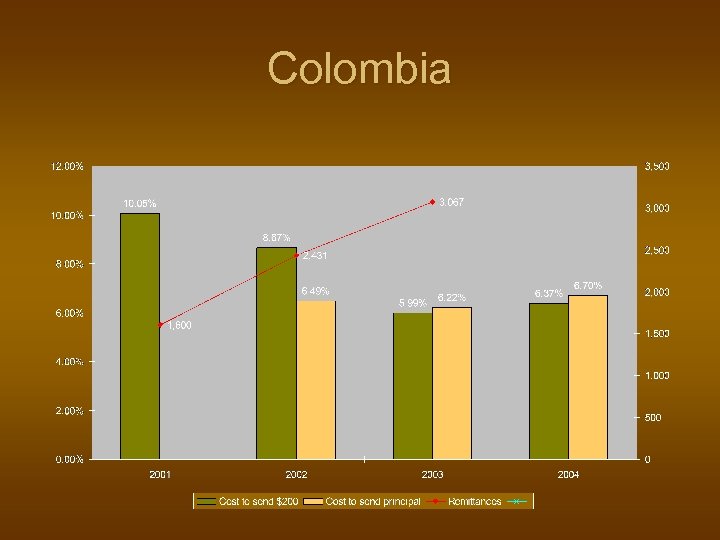

Colombia

Nicaragua

El Salvador

Bolivia

Ecuador

Honduras

Peru

Venezuela

Guyana

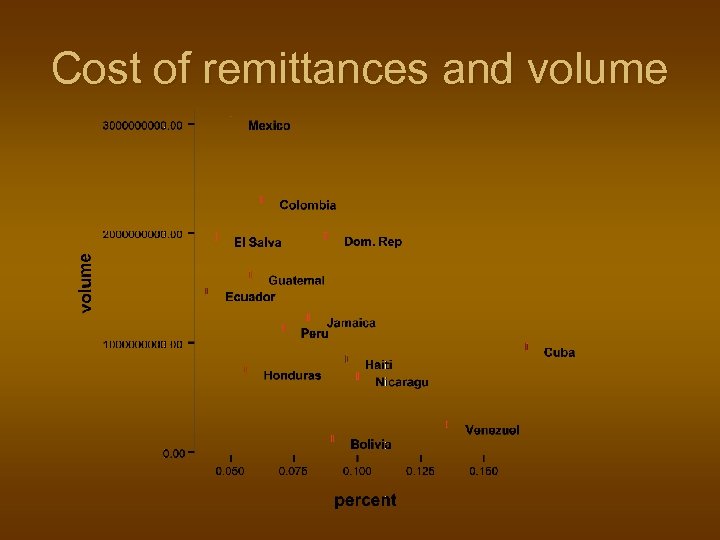

Cost of remittances and volume

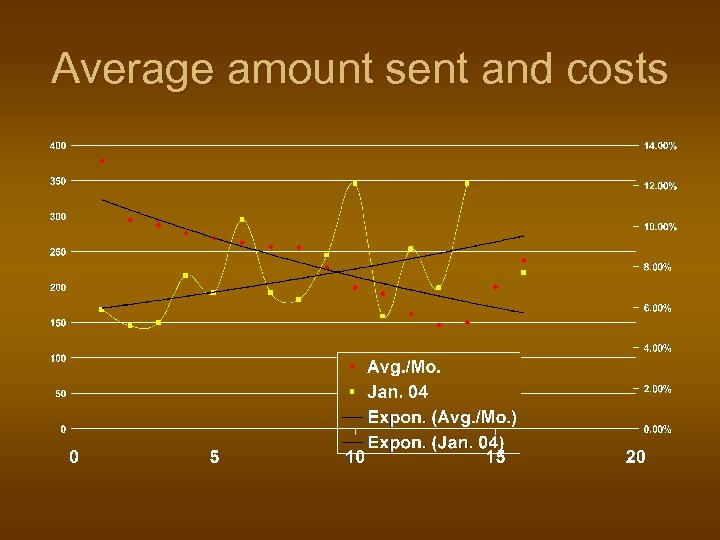

Average amount sent and costs

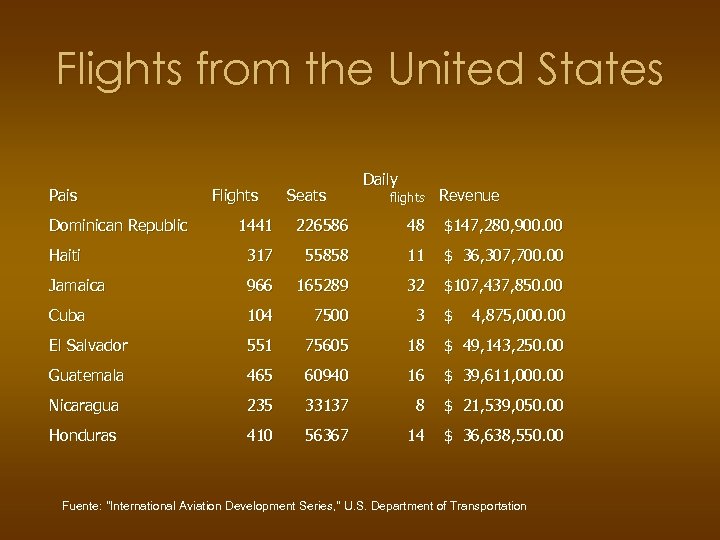

Flights from the United States Pais Dominican Republic Flights Seats Daily flights Revenue 1441 226586 48 $147, 280, 900. 00 Haiti 317 55858 11 $ 36, 307, 700. 00 Jamaica 966 165289 32 $107, 437, 850. 00 Cuba 104 7500 3 $ 4, 875, 000. 00 El Salvador 551 75605 18 $ 49, 143, 250. 00 Guatemala 465 60940 16 $ 39, 611, 000. 00 Nicaragua 235 33137 8 $ 21, 539, 050. 00 Honduras 410 56367 14 $ 36, 638, 550. 00 Fuente: "International Aviation Development Series, " U. S. Department of Transportation

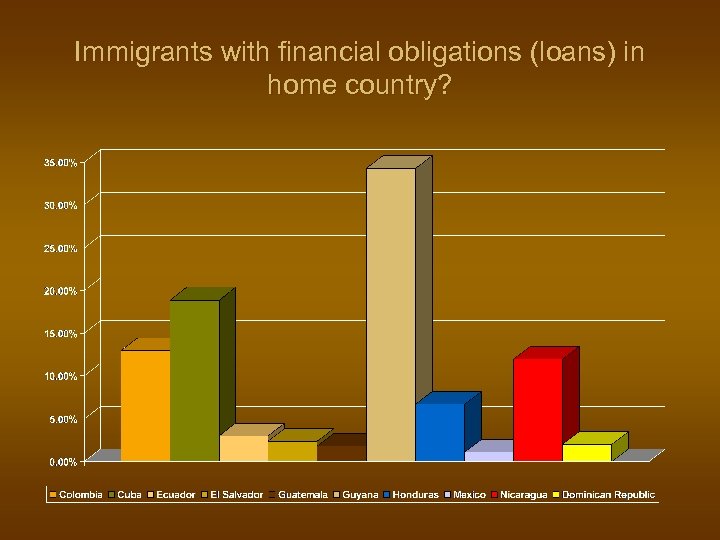

Immigrants with financial obligations (loans) in home country?

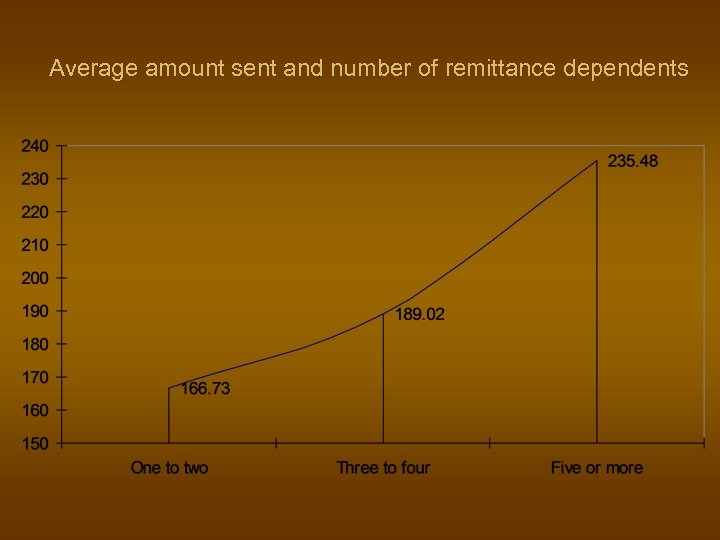

Average amount sent and number of remittance dependents

Dynamics of migration and development n n n n Migration from Latin America to the U. S. A global pattern The level of engagement: the 5 Ts Impacts in Latin America Sender and recipient profiles Hometown associations Policy issues

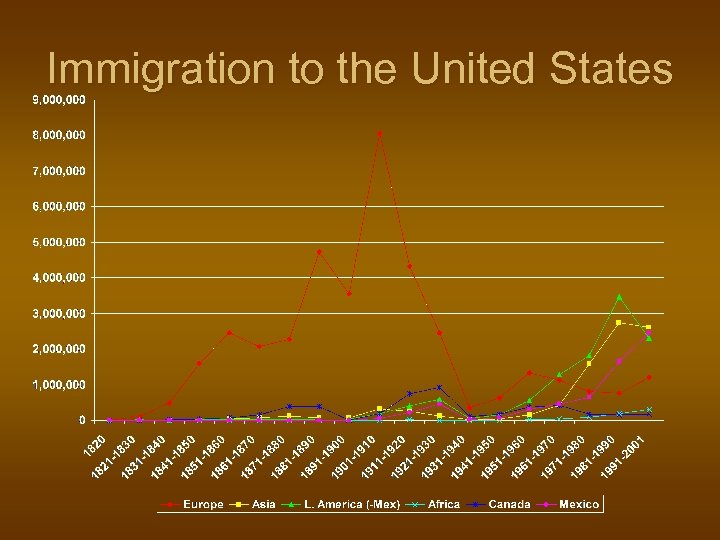

Immigration to the United States

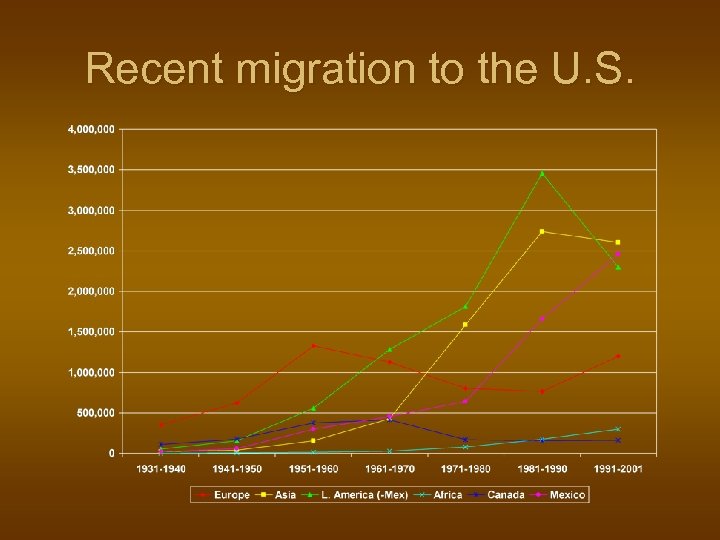

Recent migration to the U. S.

Latin American migration

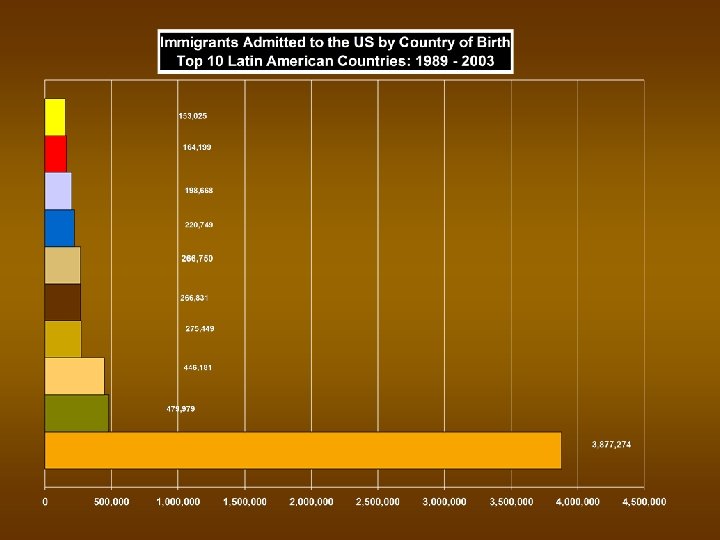

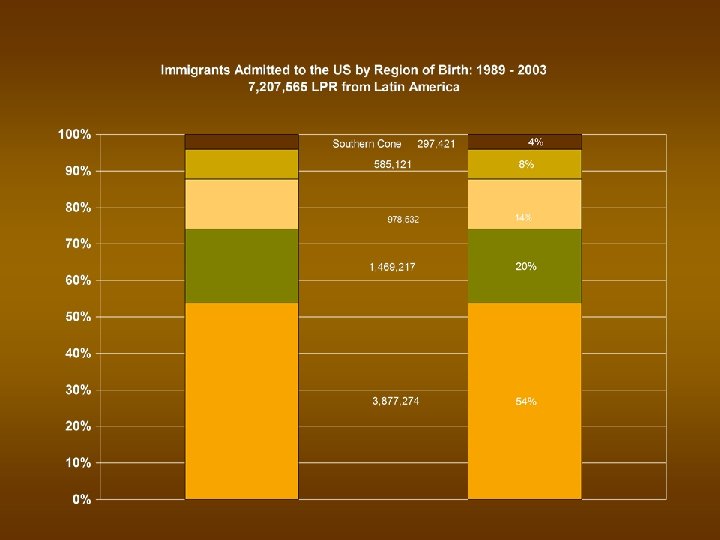

Main Latin American migration in the U. S. by country of origin

Latin American immigrants in the U. S. (2000)

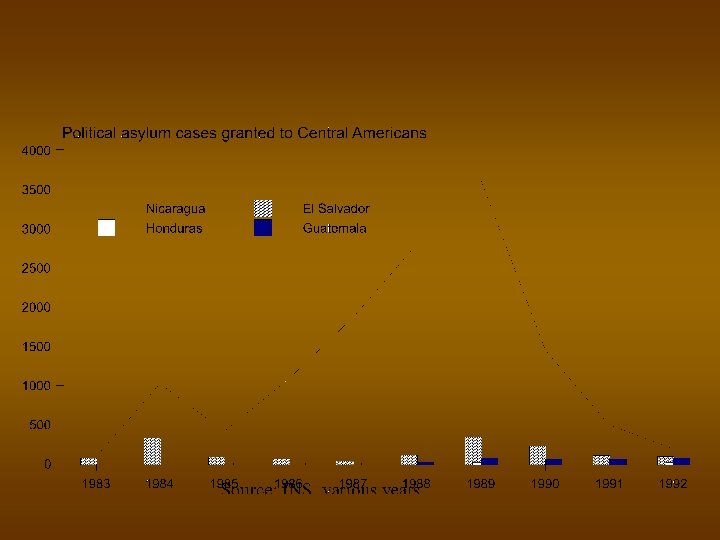

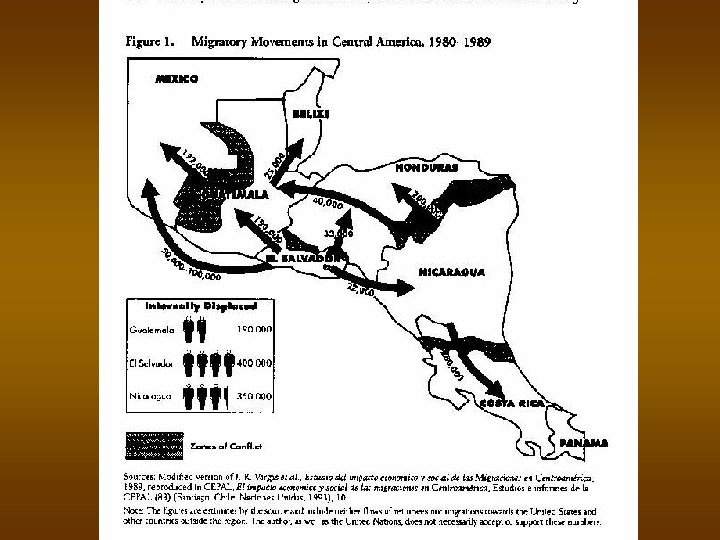

Escaping bullets and repression

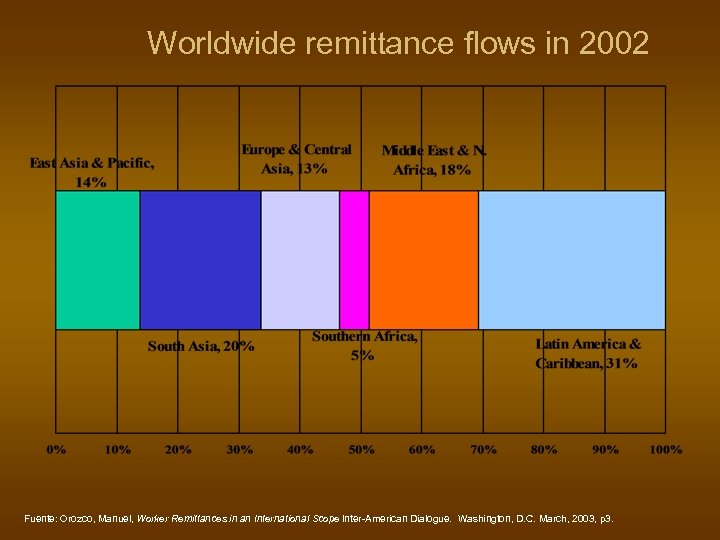

Worldwide remittance flows in 2002 Fuente: Orozco, Manuel, Worker Remittances in an International Scope Inter-American Dialogue. Washington, D. C. March, 2003, p 3.

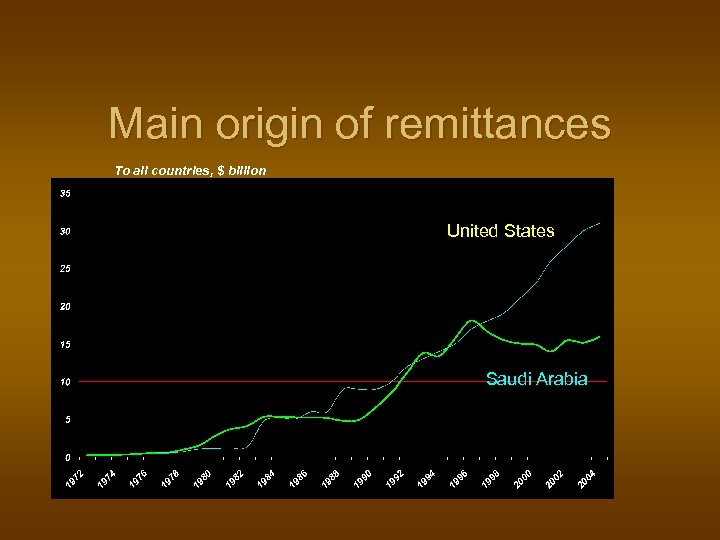

Main origin of remittances To all countries, $ billion United States Saudi Arabia

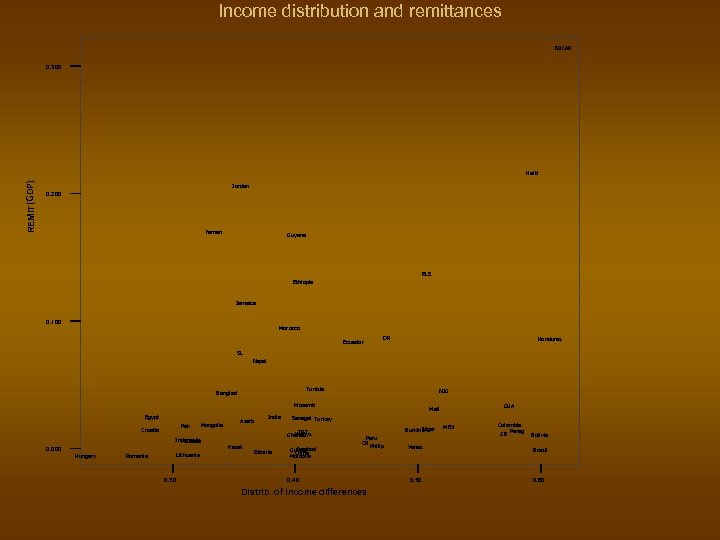

Income distribution and remittances NICAR 0. 300 REMIT(GDP) Haiti Jordan 0. 200 Yemen Guyana ELS Ethiopia Jamaica 0. 100 Morocco Ecuador DR Honduras SL Nepal Tunisia Banglad NIG Mozamb Egypt Pak Croatia Mongolia Indonesia Latvia Poland 0. 000 Hungary Lithuania Romania 0. 30 Azerb India Senegal Turkey T&T Kyrgyz Ghana Kazak Estonia GUA Mali Cambod Guinea China Moldova Niger Burkina Peru CR Philip 0. 40 Distrib. of Income differences Venez 0. 50 MEX Colombia Parag GB Bolivia Brazil 0. 60

Percent cost to send $200 to Latin America

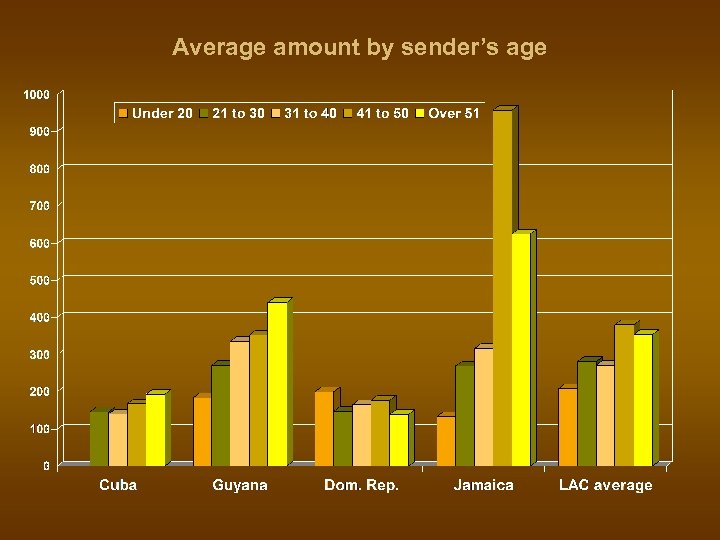

Average amount by sender’s age

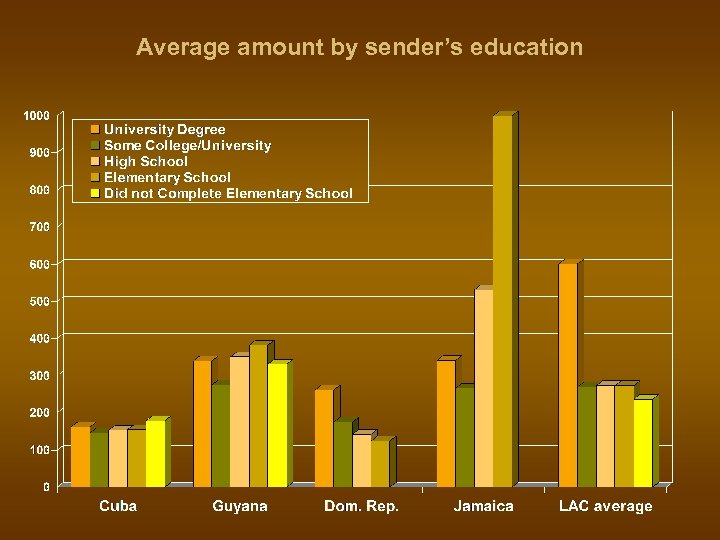

Average amount by sender’s education

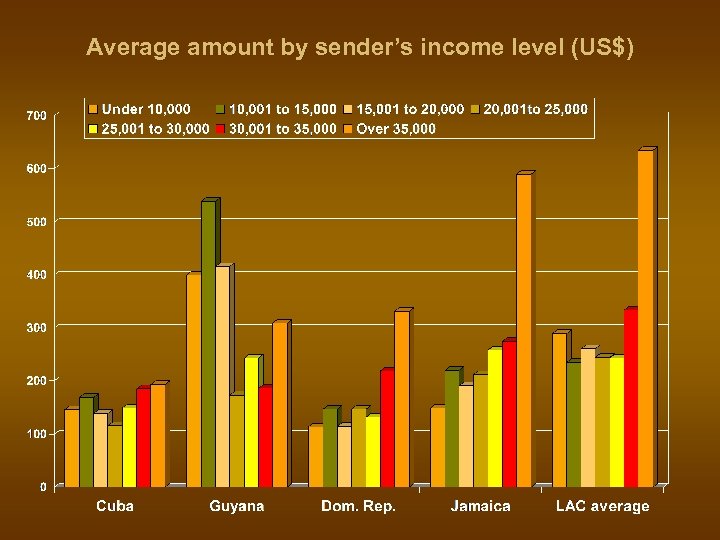

Average amount by sender’s income level (US$)

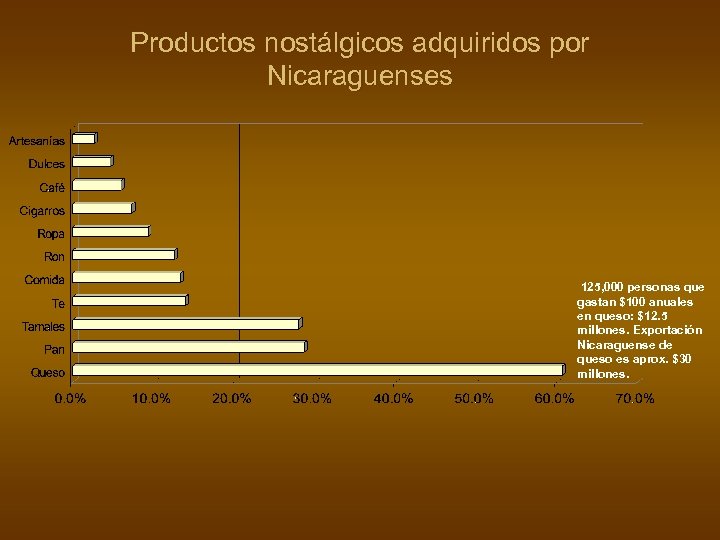

Productos nostálgicos adquiridos por Nicaraguenses 125, 000 personas que gastan $100 anuales en queso: $12. 5 millones. Exportación Nicaraguense de queso es aprox. $30 millones.

Remittances to Latin America: average amount sent by an immigrant

Frequency in traveling back to home country (%)

Frequency of phone calls to relatives () Datos recogidos de la encuesta e inmigrantes en. New York conducida por el autor, administrada por Emmanuel Sylvestre& Assoc. Resultados presentados en Orozco, Manuel (2004), Distant but close: Guyanese transnational communities and their remittances from the United States Inter. American Dialogue, Informe encargado por la U. S. Agency for International Development. Washington, DC. Enero. .

Percent buying home country goods and types Data reported from survey of immigrants in New York conducted out by the author, administered by Emmanuel Sylvestre and Assoc. Results reported in Orozco, Manuel (2004), Distant but close: Guyanese transnational communities and their remittances from the United States Inter-American Dialogue, Report commissioned by the U. S. Agency for International Development. Washington, DC. January. .

f74c8879c343a9310b3713c8a133ae6f.ppt