8c1386492143e1a51b73464d91d80929.ppt

- Количество слайдов: 19

Distance and Information Asymmetries in Lending Decisions Sumit Agarwal Federal Reserve Bank of Chicago Robert Hauswald American University FDIC-CFR Fall Workshop Washington, DC, October 2006 The views do not represent those of the Federal Reserve Bank of Chicago.

Distance and Information Asymmetries in Lending Decisions Sumit Agarwal Federal Reserve Bank of Chicago Robert Hauswald American University FDIC-CFR Fall Workshop Washington, DC, October 2006 The views do not represent those of the Federal Reserve Bank of Chicago.

Motivation • “Information drives financial intermediation” but – anecdotal and recent empirical evidence suggest that other factors might be important: geographic distance – “changing geography: ” banks lend over longer distances while also contesting local markets more vigorously • Current work on distance in lending is inconclusive – what is the economic role of borrower proximity? – nature of discrimination in credit pricing and availability – how does information production affect credit markets? • There exists a large theoretical literature but little empirical evidence on bank-borrower interaction 3/19/2018 Distance and Information Asymmetries 2

Motivation • “Information drives financial intermediation” but – anecdotal and recent empirical evidence suggest that other factors might be important: geographic distance – “changing geography: ” banks lend over longer distances while also contesting local markets more vigorously • Current work on distance in lending is inconclusive – what is the economic role of borrower proximity? – nature of discrimination in credit pricing and availability – how does information production affect credit markets? • There exists a large theoretical literature but little empirical evidence on bank-borrower interaction 3/19/2018 Distance and Information Asymmetries 2

Results • Loan rates and the likelihood of granting credit – decrease (increase) in firm – bank (competitor) distance – consistent with both informational and spatial models • However, once we include a proxy for the bank’s private information the effects become insignificant – strong evidence: distance is a proxy for private information • Higher rate or credit score, or more distant: applicant more likely to decline loan offer and to switch lender – consistent with informational capture: rent extraction – evidence in favor of asymmetric-information models • Does the bank’s type II error increases in distance? 3/19/2018 Distance and Information Asymmetries 3

Results • Loan rates and the likelihood of granting credit – decrease (increase) in firm – bank (competitor) distance – consistent with both informational and spatial models • However, once we include a proxy for the bank’s private information the effects become insignificant – strong evidence: distance is a proxy for private information • Higher rate or credit score, or more distant: applicant more likely to decline loan offer and to switch lender – consistent with informational capture: rent extraction – evidence in favor of asymmetric-information models • Does the bank’s type II error increases in distance? 3/19/2018 Distance and Information Asymmetries 3

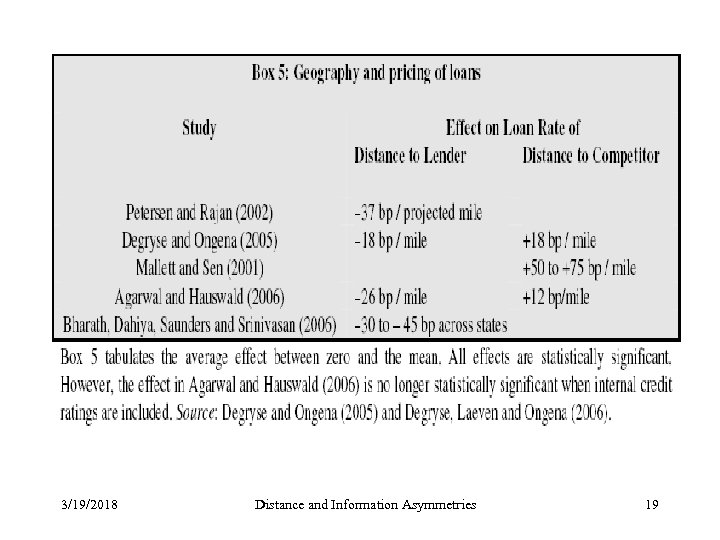

Related Literature • Petersen and Rajan (2002): NSSBF survey – “local-information” hypothesis: the “soft” information crucial in this market – borrower proximity matters for risk assessment – find increase in bank-borrower distance: technology presumably allows banks to overcome rising risks outside local core markets • Degryse and Ongena (2005): Belgian loan data – loan rates decrease (increase) in distance to bank (competitor) – relationship variables insignificant: transportation costs seem to play a large(r) role in Belgian loan transaction (economic geography? ) • Hauswald and Marquez (2006): quality of bank’s information decreases in distance between bank and loan applicant – adverse selection constrains competition (captive markets): loan rates (competition) decrease (increases) in firm-bank distance – same prediction as transportation-cost models: no pricing-based test ) use declined loan offers to test the different model classes 3/19/2018 Distance and Information Asymmetries 4

Related Literature • Petersen and Rajan (2002): NSSBF survey – “local-information” hypothesis: the “soft” information crucial in this market – borrower proximity matters for risk assessment – find increase in bank-borrower distance: technology presumably allows banks to overcome rising risks outside local core markets • Degryse and Ongena (2005): Belgian loan data – loan rates decrease (increase) in distance to bank (competitor) – relationship variables insignificant: transportation costs seem to play a large(r) role in Belgian loan transaction (economic geography? ) • Hauswald and Marquez (2006): quality of bank’s information decreases in distance between bank and loan applicant – adverse selection constrains competition (captive markets): loan rates (competition) decrease (increases) in firm-bank distance – same prediction as transportation-cost models: no pricing-based test ) use declined loan offers to test the different model classes 3/19/2018 Distance and Information Asymmetries 4

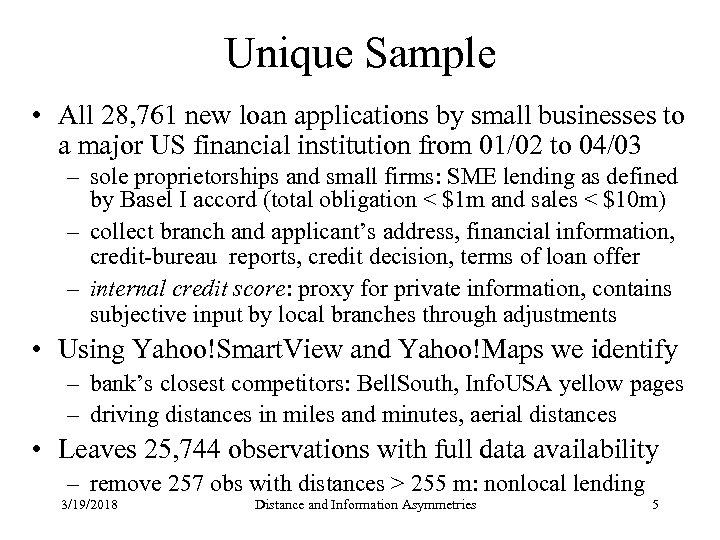

Unique Sample • All 28, 761 new loan applications by small businesses to a major US financial institution from 01/02 to 04/03 – sole proprietorships and small firms: SME lending as defined by Basel I accord (total obligation < $1 m and sales < $10 m) – collect branch and applicant’s address, financial information, credit-bureau reports, credit decision, terms of loan offer – internal credit score: proxy for private information, contains subjective input by local branches through adjustments • Using Yahoo!Smart. View and Yahoo!Maps we identify – bank’s closest competitors: Bell. South, Info. USA yellow pages – driving distances in miles and minutes, aerial distances • Leaves 25, 744 observations with full data availability – remove 257 obs with distances > 255 m: nonlocal lending 3/19/2018 Distance and Information Asymmetries 5

Unique Sample • All 28, 761 new loan applications by small businesses to a major US financial institution from 01/02 to 04/03 – sole proprietorships and small firms: SME lending as defined by Basel I accord (total obligation < $1 m and sales < $10 m) – collect branch and applicant’s address, financial information, credit-bureau reports, credit decision, terms of loan offer – internal credit score: proxy for private information, contains subjective input by local branches through adjustments • Using Yahoo!Smart. View and Yahoo!Maps we identify – bank’s closest competitors: Bell. South, Info. USA yellow pages – driving distances in miles and minutes, aerial distances • Leaves 25, 744 observations with full data availability – remove 257 obs with distances > 255 m: nonlocal lending 3/19/2018 Distance and Information Asymmetries 5

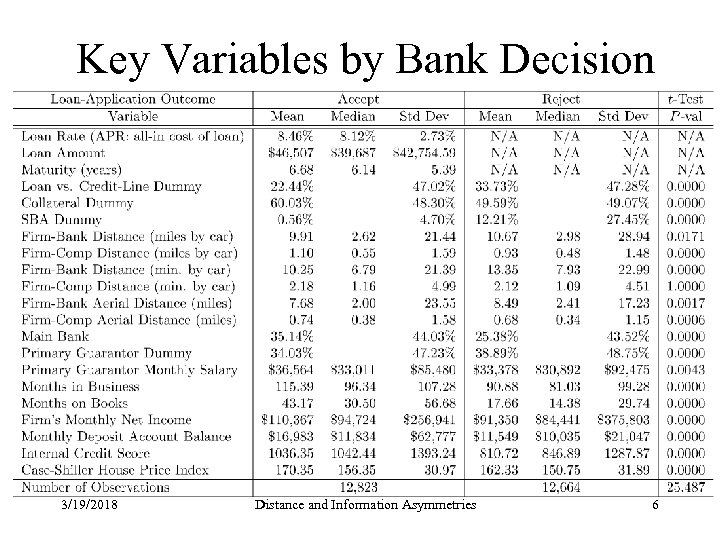

Key Variables by Bank Decision 3/19/2018 Distance and Information Asymmetries 6

Key Variables by Bank Decision 3/19/2018 Distance and Information Asymmetries 6

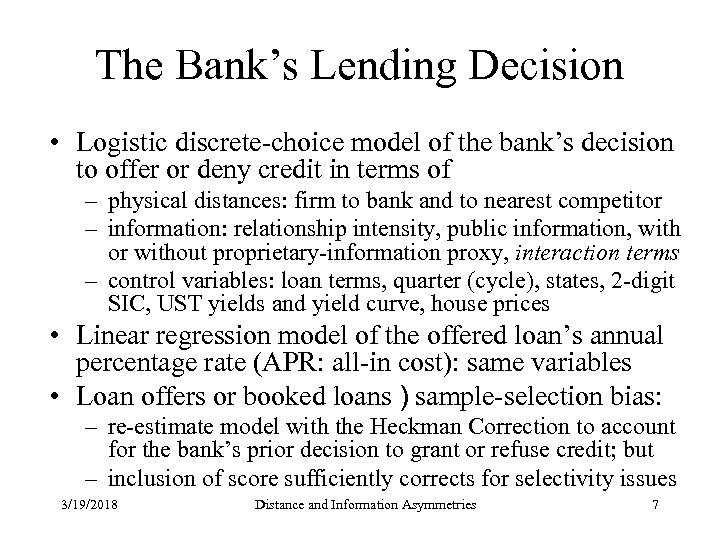

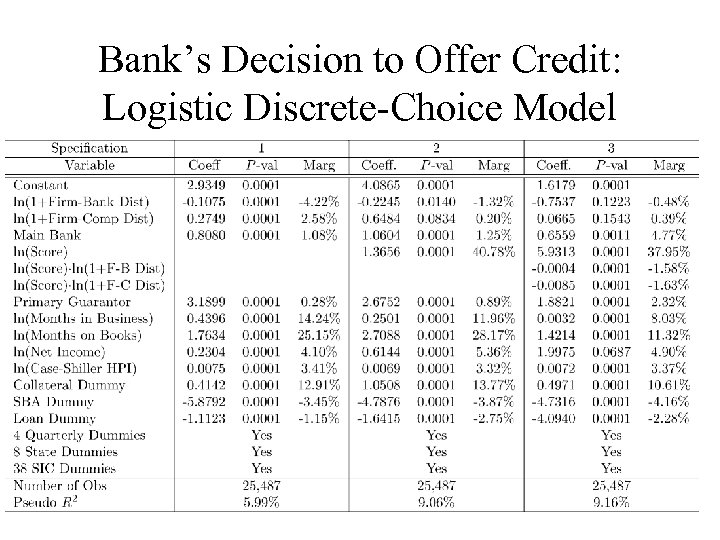

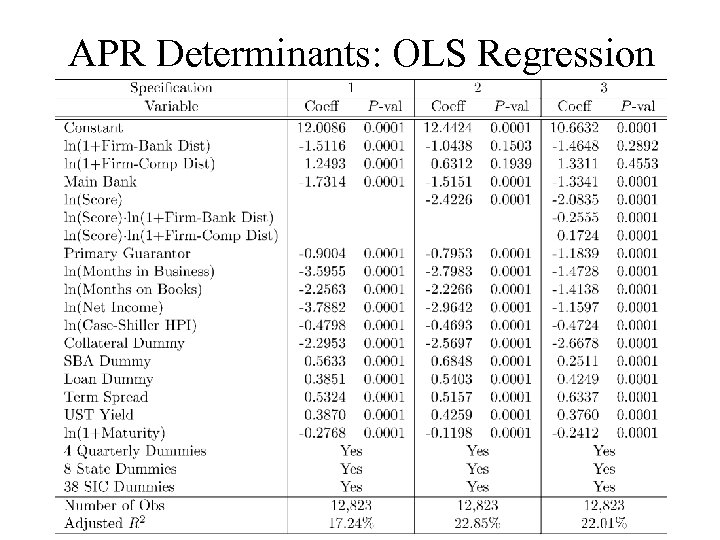

The Bank’s Lending Decision • Logistic discrete-choice model of the bank’s decision to offer or deny credit in terms of – physical distances: firm to bank and to nearest competitor – information: relationship intensity, public information, with or without proprietary-information proxy, interaction terms – control variables: loan terms, quarter (cycle), states, 2 -digit SIC, UST yields and yield curve, house prices • Linear regression model of the offered loan’s annual percentage rate (APR: all-in cost): same variables • Loan offers or booked loans ) sample-selection bias: – re-estimate model with the Heckman Correction to account for the bank’s prior decision to grant or refuse credit; but – inclusion of score sufficiently corrects for selectivity issues 3/19/2018 Distance and Information Asymmetries 7

The Bank’s Lending Decision • Logistic discrete-choice model of the bank’s decision to offer or deny credit in terms of – physical distances: firm to bank and to nearest competitor – information: relationship intensity, public information, with or without proprietary-information proxy, interaction terms – control variables: loan terms, quarter (cycle), states, 2 -digit SIC, UST yields and yield curve, house prices • Linear regression model of the offered loan’s annual percentage rate (APR: all-in cost): same variables • Loan offers or booked loans ) sample-selection bias: – re-estimate model with the Heckman Correction to account for the bank’s prior decision to grant or refuse credit; but – inclusion of score sufficiently corrects for selectivity issues 3/19/2018 Distance and Information Asymmetries 7

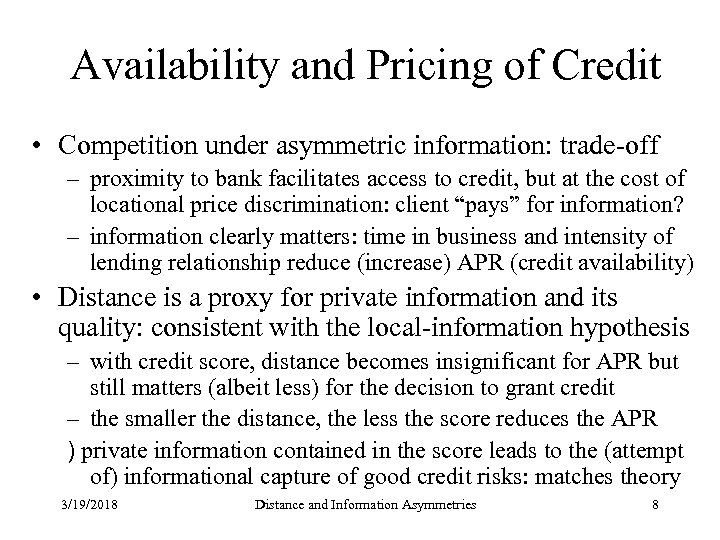

Availability and Pricing of Credit • Competition under asymmetric information: trade-off – proximity to bank facilitates access to credit, but at the cost of locational price discrimination: client “pays” for information? – information clearly matters: time in business and intensity of lending relationship reduce (increase) APR (credit availability) • Distance is a proxy for private information and its quality: consistent with the local-information hypothesis – with credit score, distance becomes insignificant for APR but still matters (albeit less) for the decision to grant credit – the smaller the distance, the less the score reduces the APR ) private information contained in the score leads to the (attempt of) informational capture of good credit risks: matches theory 3/19/2018 Distance and Information Asymmetries 8

Availability and Pricing of Credit • Competition under asymmetric information: trade-off – proximity to bank facilitates access to credit, but at the cost of locational price discrimination: client “pays” for information? – information clearly matters: time in business and intensity of lending relationship reduce (increase) APR (credit availability) • Distance is a proxy for private information and its quality: consistent with the local-information hypothesis – with credit score, distance becomes insignificant for APR but still matters (albeit less) for the decision to grant credit – the smaller the distance, the less the score reduces the APR ) private information contained in the score leads to the (attempt of) informational capture of good credit risks: matches theory 3/19/2018 Distance and Information Asymmetries 8

Bank’s Decision to Offer Credit: Logistic Discrete-Choice Model 3/19/2018 Distance and Information Asymmetries 9

Bank’s Decision to Offer Credit: Logistic Discrete-Choice Model 3/19/2018 Distance and Information Asymmetries 9

APR Determinants: OLS Regression 3/19/2018 Distance and Information Asymmetries 10

APR Determinants: OLS Regression 3/19/2018 Distance and Information Asymmetries 10

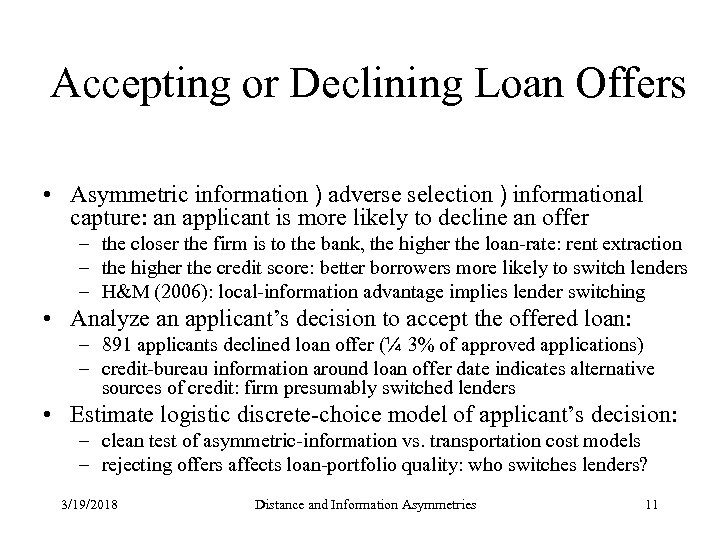

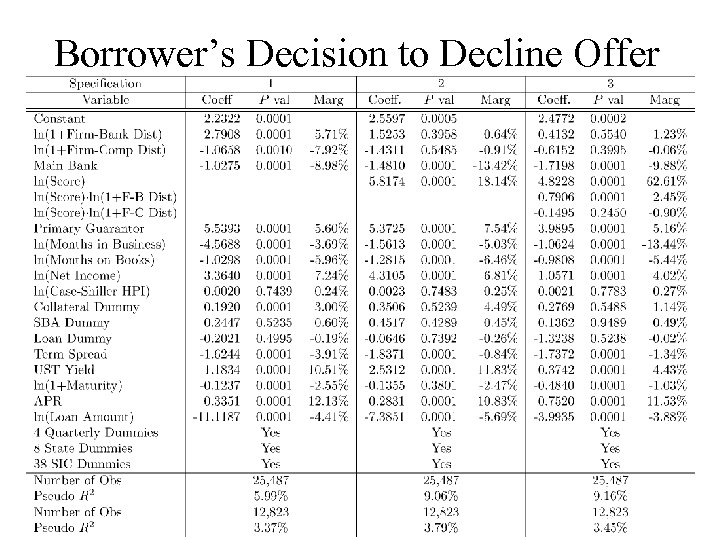

Accepting or Declining Loan Offers • Asymmetric information ) adverse selection ) informational capture: an applicant is more likely to decline an offer – the closer the firm is to the bank, the higher the loan-rate: rent extraction – the higher the credit score: better borrowers more likely to switch lenders – H&M (2006): local-information advantage implies lender switching • Analyze an applicant’s decision to accept the offered loan: – 891 applicants declined loan offer (¼ 3% of approved applications) – credit-bureau information around loan offer date indicates alternative sources of credit: firm presumably switched lenders • Estimate logistic discrete-choice model of applicant’s decision: – clean test of asymmetric-information vs. transportation cost models – rejecting offers affects loan-portfolio quality: who switches lenders? 3/19/2018 Distance and Information Asymmetries 11

Accepting or Declining Loan Offers • Asymmetric information ) adverse selection ) informational capture: an applicant is more likely to decline an offer – the closer the firm is to the bank, the higher the loan-rate: rent extraction – the higher the credit score: better borrowers more likely to switch lenders – H&M (2006): local-information advantage implies lender switching • Analyze an applicant’s decision to accept the offered loan: – 891 applicants declined loan offer (¼ 3% of approved applications) – credit-bureau information around loan offer date indicates alternative sources of credit: firm presumably switched lenders • Estimate logistic discrete-choice model of applicant’s decision: – clean test of asymmetric-information vs. transportation cost models – rejecting offers affects loan-portfolio quality: who switches lenders? 3/19/2018 Distance and Information Asymmetries 11

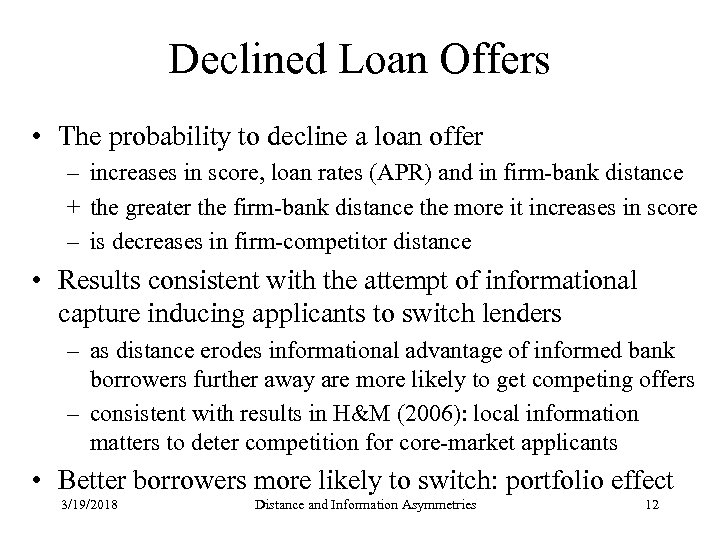

Declined Loan Offers • The probability to decline a loan offer – increases in score, loan rates (APR) and in firm-bank distance + the greater the firm-bank distance the more it increases in score – is decreases in firm-competitor distance • Results consistent with the attempt of informational capture inducing applicants to switch lenders – as distance erodes informational advantage of informed bank borrowers further away are more likely to get competing offers – consistent with results in H&M (2006): local information matters to deter competition for core-market applicants • Better borrowers more likely to switch: portfolio effect 3/19/2018 Distance and Information Asymmetries 12

Declined Loan Offers • The probability to decline a loan offer – increases in score, loan rates (APR) and in firm-bank distance + the greater the firm-bank distance the more it increases in score – is decreases in firm-competitor distance • Results consistent with the attempt of informational capture inducing applicants to switch lenders – as distance erodes informational advantage of informed bank borrowers further away are more likely to get competing offers – consistent with results in H&M (2006): local information matters to deter competition for core-market applicants • Better borrowers more likely to switch: portfolio effect 3/19/2018 Distance and Information Asymmetries 12

Borrower’s Decision to Decline Offer 3/19/2018 Distance and Information Asymmetries 13

Borrower’s Decision to Decline Offer 3/19/2018 Distance and Information Asymmetries 13

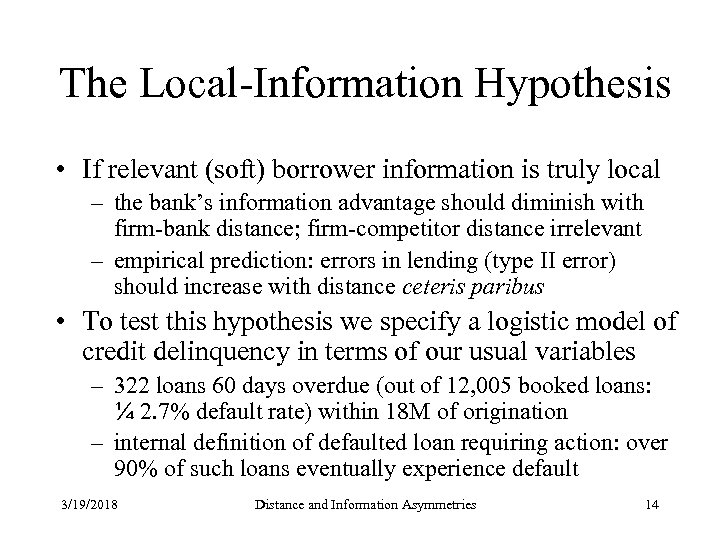

The Local-Information Hypothesis • If relevant (soft) borrower information is truly local – the bank’s information advantage should diminish with firm-bank distance; firm-competitor distance irrelevant – empirical prediction: errors in lending (type II error) should increase with distance ceteris paribus • To test this hypothesis we specify a logistic model of credit delinquency in terms of our usual variables – 322 loans 60 days overdue (out of 12, 005 booked loans: ¼ 2. 7% default rate) within 18 M of origination – internal definition of defaulted loan requiring action: over 90% of such loans eventually experience default 3/19/2018 Distance and Information Asymmetries 14

The Local-Information Hypothesis • If relevant (soft) borrower information is truly local – the bank’s information advantage should diminish with firm-bank distance; firm-competitor distance irrelevant – empirical prediction: errors in lending (type II error) should increase with distance ceteris paribus • To test this hypothesis we specify a logistic model of credit delinquency in terms of our usual variables – 322 loans 60 days overdue (out of 12, 005 booked loans: ¼ 2. 7% default rate) within 18 M of origination – internal definition of defaulted loan requiring action: over 90% of such loans eventually experience default 3/19/2018 Distance and Information Asymmetries 14

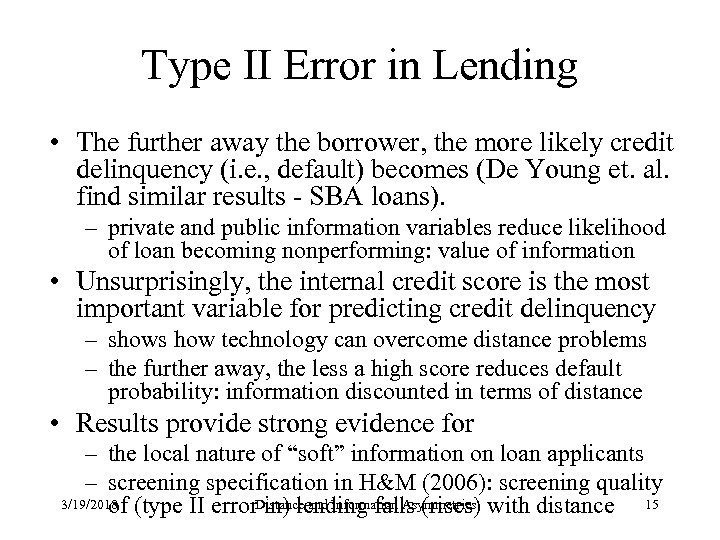

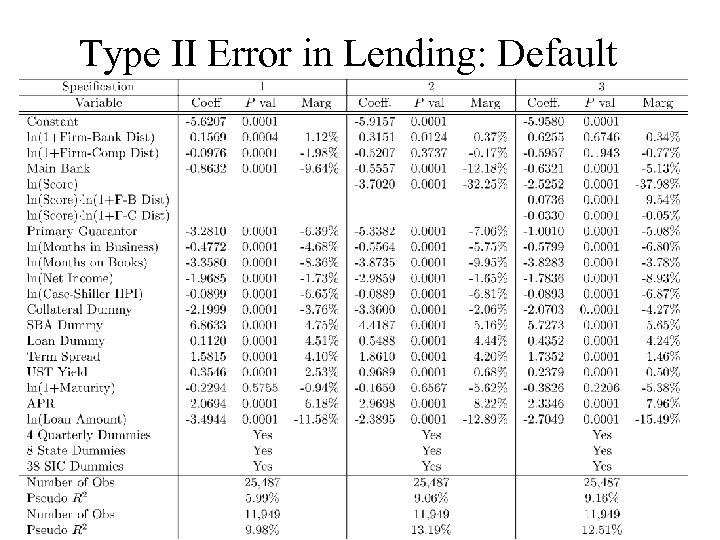

Type II Error in Lending • The further away the borrower, the more likely credit delinquency (i. e. , default) becomes (De Young et. al. find similar results - SBA loans). – private and public information variables reduce likelihood of loan becoming nonperforming: value of information • Unsurprisingly, the internal credit score is the most important variable for predicting credit delinquency – shows how technology can overcome distance problems – the further away, the less a high score reduces default probability: information discounted in terms of distance • Results provide strong evidence for – the local nature of “soft” information on loan applicants – screening specification in H&M (2006): screening quality 3/19/2018 (type II error. Distance and Information Asymmetries with distance 15 of in) lending falls (rises)

Type II Error in Lending • The further away the borrower, the more likely credit delinquency (i. e. , default) becomes (De Young et. al. find similar results - SBA loans). – private and public information variables reduce likelihood of loan becoming nonperforming: value of information • Unsurprisingly, the internal credit score is the most important variable for predicting credit delinquency – shows how technology can overcome distance problems – the further away, the less a high score reduces default probability: information discounted in terms of distance • Results provide strong evidence for – the local nature of “soft” information on loan applicants – screening specification in H&M (2006): screening quality 3/19/2018 (type II error. Distance and Information Asymmetries with distance 15 of in) lending falls (rises)

Type II Error in Lending: Default 3/19/2018 Distance and Information Asymmetries 16

Type II Error in Lending: Default 3/19/2018 Distance and Information Asymmetries 16

The Nature of Soft Information and the Effect of Competition • Relationship content of credit assessments: interact the score and lending-relationship variables – relationship variables increase the score’s marginal effect in all specifications: improvement in risk assessment – soft information is (i) local, (ii) gathered over time – partial hardening of soft information through technology • The incidence of industry structure: number of branches or competitors, HHI for deposit shares – more competition reduces both loan offers and rates – again, trade-off between pricing and availability of credit 3/19/2018 Distance and Information Asymmetries 17

The Nature of Soft Information and the Effect of Competition • Relationship content of credit assessments: interact the score and lending-relationship variables – relationship variables increase the score’s marginal effect in all specifications: improvement in risk assessment – soft information is (i) local, (ii) gathered over time – partial hardening of soft information through technology • The incidence of industry structure: number of branches or competitors, HHI for deposit shares – more competition reduces both loan offers and rates – again, trade-off between pricing and availability of credit 3/19/2018 Distance and Information Asymmetries 17

Conclusion • We investigate the dual hypotheses that – private information is local and implies an – informational advantage to deter competition • Technology increases the reach of local information: banks “harden” soft proprietary information + to extend the geographic reach of their markets by overcoming threats of adverse selection due to distance • Hence, distance still limits the size of local markets – bank discounts own intelligence in function of distance that acts as a proxy for the quality of information 3/19/2018 Distance and Information Asymmetries 18

Conclusion • We investigate the dual hypotheses that – private information is local and implies an – informational advantage to deter competition • Technology increases the reach of local information: banks “harden” soft proprietary information + to extend the geographic reach of their markets by overcoming threats of adverse selection due to distance • Hence, distance still limits the size of local markets – bank discounts own intelligence in function of distance that acts as a proxy for the quality of information 3/19/2018 Distance and Information Asymmetries 18

3/19/2018 Distance and Information Asymmetries 19

3/19/2018 Distance and Information Asymmetries 19