4f1dc347abb70e388fdd2730fd2c611e.ppt

- Количество слайдов: 9

Discussion – Session 1 B Housing and business cycles Cross-country analysis Conference on Macroeconomics of Housing Markets Banque de France 3 -4 December 2009 Christophe ANDRÉ OECD Economics Department

3 complementary papers • Housing cycles in the major euro area countries (Álvarez et al. ): focus on the growth cycle. • Common business and housing market cycles in the Euro area from a multivariate decomposition (Ferrara and Koopman): identification of short and long cycles. • The international transmission of house price shocks (de Bandt et al. ): focus on contagion.

General issues • Trend-cycle decomposition. • The latest housing expansion (≈1995 -2007) has been exceptional. • Country sample: Germany is an outlier. • Time span: the common currency period corresponds to a global housing boom. • Convergence in euro area house prices.

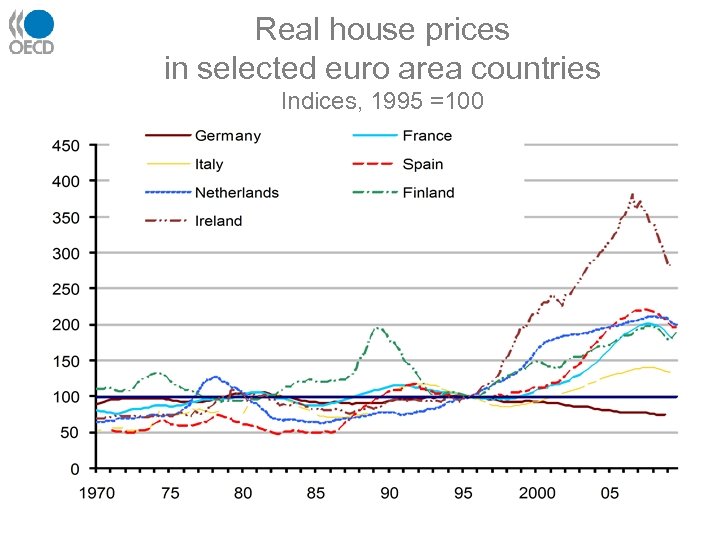

Real house prices in selected euro area countries Indices, 1995 =100

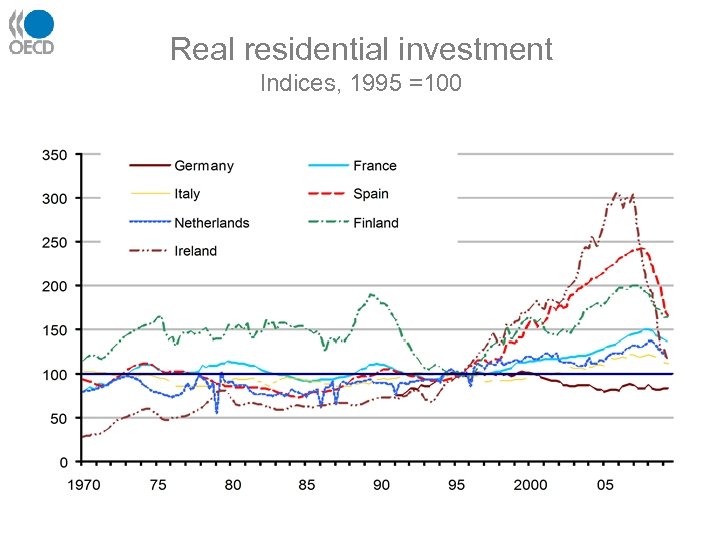

Real residential investment Indices, 1995 =100

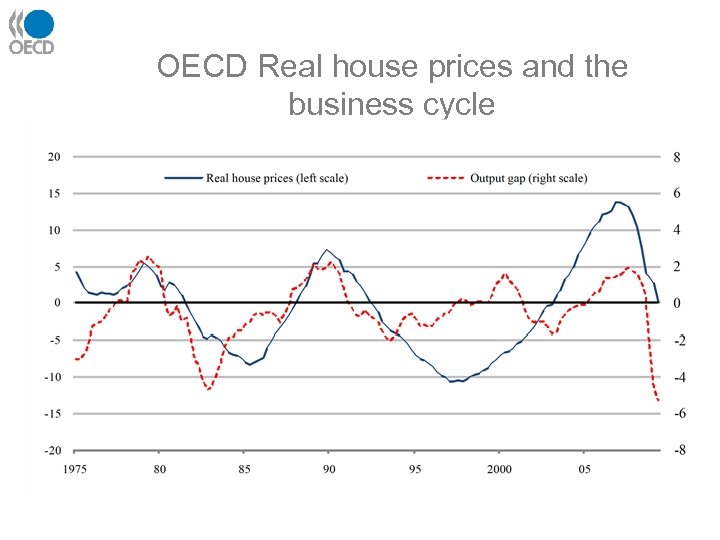

OECD Real house prices and the business cycle

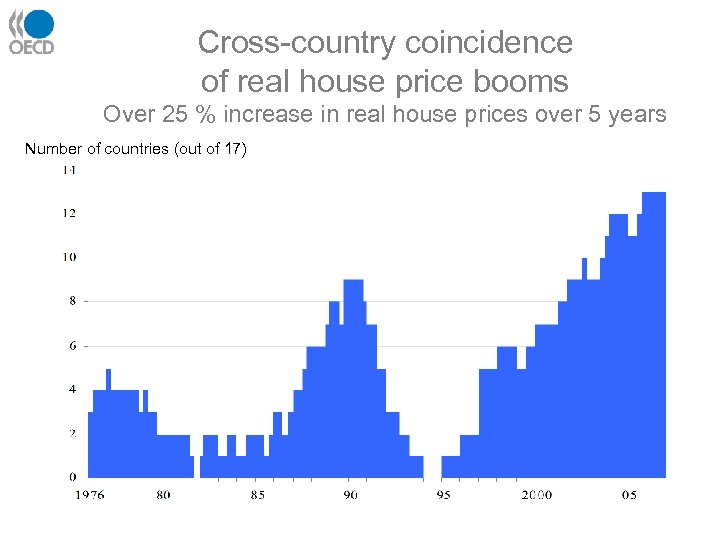

Cross-country coincidence of real house price booms Over 25 % increase in real house prices over 5 years Number of countries (out of 17)

What is behind the global housing factor ? Some candidates: • • • Acquisitions by residents of neighbouring countries Role of international property investors Shift in preferences towards housing News House price expectations Omitted fundamentals captured by the global factor • Role of international lenders

Thank you !

4f1dc347abb70e388fdd2730fd2c611e.ppt