544c2da92290ef1e12c260c6fe3f247e.ppt

- Количество слайдов: 13

Discussion Of Stock Selection Methods Used By Investment Professionals, Corporate Governance, And Investor Activism Douglas S. Phillips, CFA Retired President, CEO, and CIO Trusco Capital Management, Inc. Georgia State University Corporate Governance And Performance Analysis October 23, 2007 1

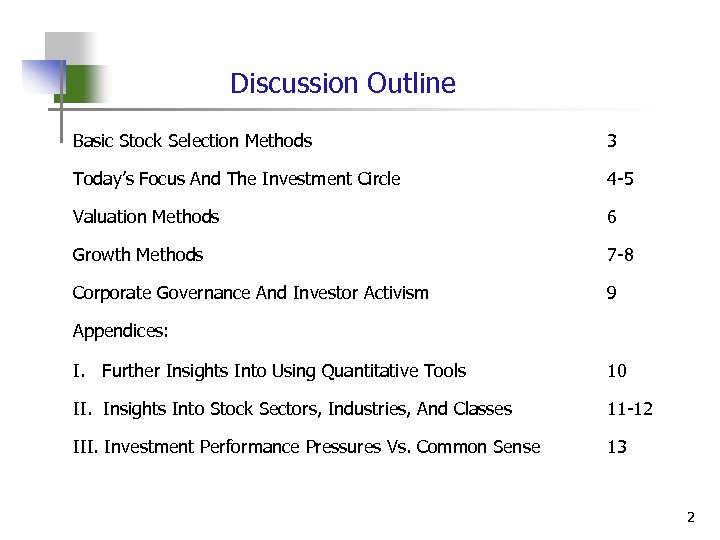

Discussion Outline Basic Stock Selection Methods 3 Today’s Focus And The Investment Circle 4 -5 Valuation Methods 6 Growth Methods 7 -8 Corporate Governance And Investor Activism 9 Appendices: I. Further Insights Into Using Quantitative Tools 10 II. Insights Into Stock Sectors, Industries, And Classes 11 -12 III. Investment Performance Pressures Vs. Common Sense 13 2

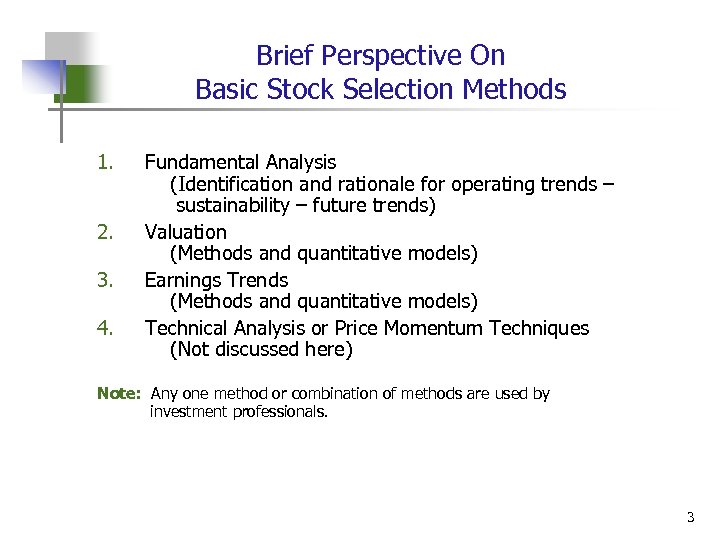

Brief Perspective On Basic Stock Selection Methods 1. 2. 3. 4. Fundamental Analysis (Identification and rationale for operating trends – sustainability – future trends) Valuation (Methods and quantitative models) Earnings Trends (Methods and quantitative models) Technical Analysis or Price Momentum Techniques (Not discussed here) Note: Any one method or combination of methods are used by investment professionals. 3

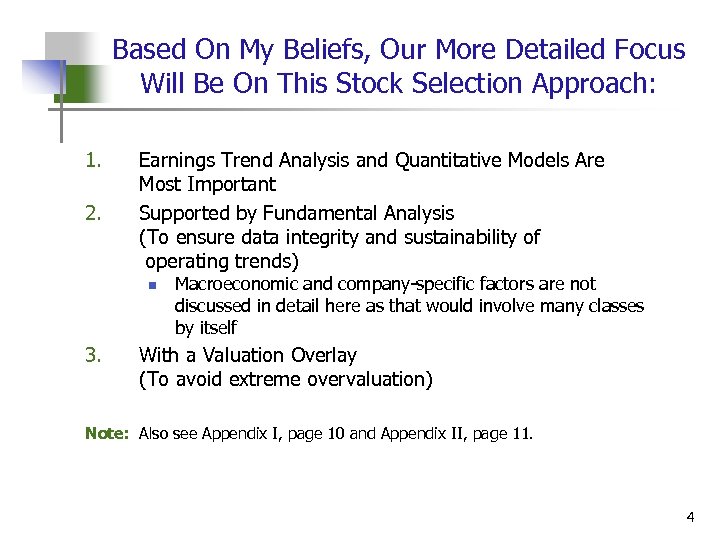

Based On My Beliefs, Our More Detailed Focus Will Be On This Stock Selection Approach: 1. 2. Earnings Trend Analysis and Quantitative Models Are Most Important Supported by Fundamental Analysis (To ensure data integrity and sustainability of operating trends) n 3. Macroeconomic and company-specific factors are not discussed in detail here as that would involve many classes by itself With a Valuation Overlay (To avoid extreme overvaluation) Note: Also see Appendix I, page 10 and Appendix II, page 11. 4

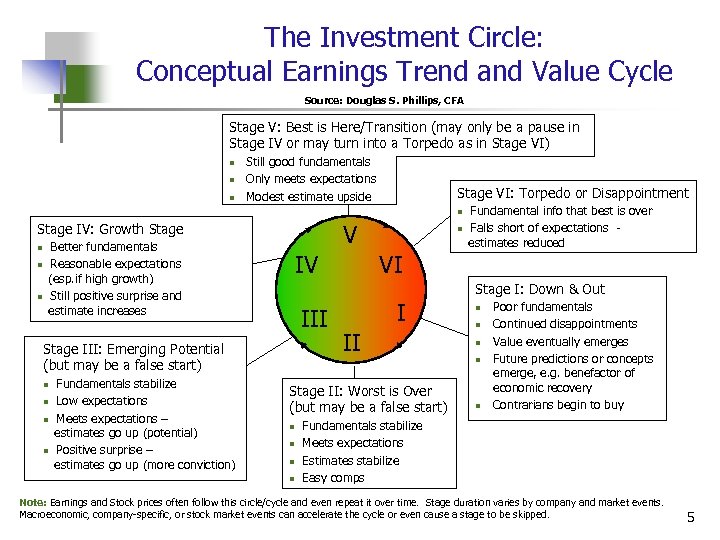

The Investment Circle: Conceptual Earnings Trend and Value Cycle Source: Douglas S. Phillips, CFA Stage V: Best is Here/Transition (may only be a pause in Stage IV or may turn into a Torpedo as in Stage VI) n n n Still good fundamentals Only meets expectations Modest estimate upside Stage VI: Torpedo or Disappointment n V Stage IV: Growth Stage n n n Better fundamentals Reasonable expectations (esp. if high growth) Still positive surprise and estimate increases IV n n n Fundamentals stabilize Low expectations Meets expectations – estimates go up (potential) Positive surprise – estimates go up (more conviction) VI Stage I: Down & Out III Stage III: Emerging Potential (but may be a false start) n n Fundamental info that best is over Falls short of expectations estimates reduced I II Stage II: Worst is Over (but may be a false start) n n n n n Poor fundamentals Continued disappointments Value eventually emerges Future predictions or concepts emerge, e. g. benefactor of economic recovery Contrarians begin to buy Fundamentals stabilize Meets expectations Estimates stabilize Easy comps Note: Earnings and Stock prices often follow this circle/cycle and even repeat it over time. Stage duration varies by company and market events. Macroeconomic, company-specific, or stock market events can accelerate the cycle or even cause a stage to be skipped. 5

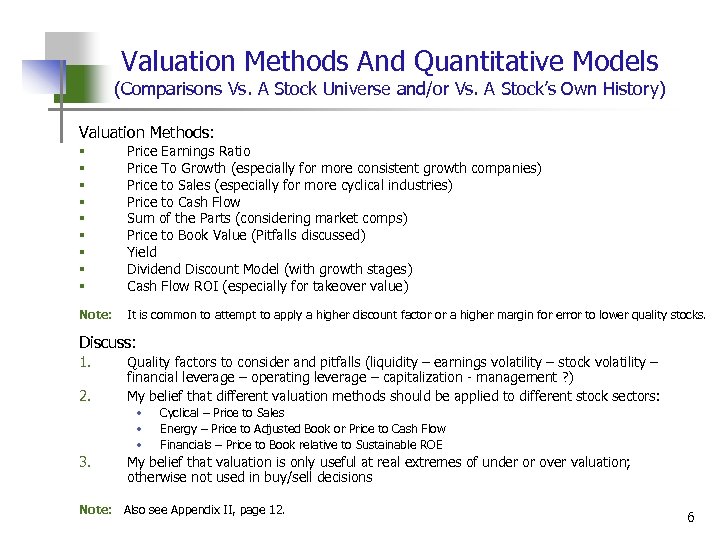

Valuation Methods And Quantitative Models (Comparisons Vs. A Stock Universe and/or Vs. A Stock’s Own History) Valuation Methods: § § § § § Price Earnings Ratio Price To Growth (especially for more consistent growth companies) Price to Sales (especially for more cyclical industries) Price to Cash Flow Sum of the Parts (considering market comps) Price to Book Value (Pitfalls discussed) Yield Dividend Discount Model (with growth stages) Cash Flow ROI (especially for takeover value) Note: It is common to attempt to apply a higher discount factor or a higher margin for error to lower quality stocks. Discuss: 1. 2. Quality factors to consider and pitfalls (liquidity – earnings volatility – stock volatility – financial leverage – operating leverage – capitalization - management ? ) My belief that different valuation methods should be applied to different stock sectors: • • • 3. Cyclical – Price to Sales Energy – Price to Adjusted Book or Price to Cash Flow Financials – Price to Book relative to Sustainable ROE My belief that valuation is only useful at real extremes of under or over valuation; otherwise not used in buy/sell decisions Note: Also see Appendix II, page 12. 6

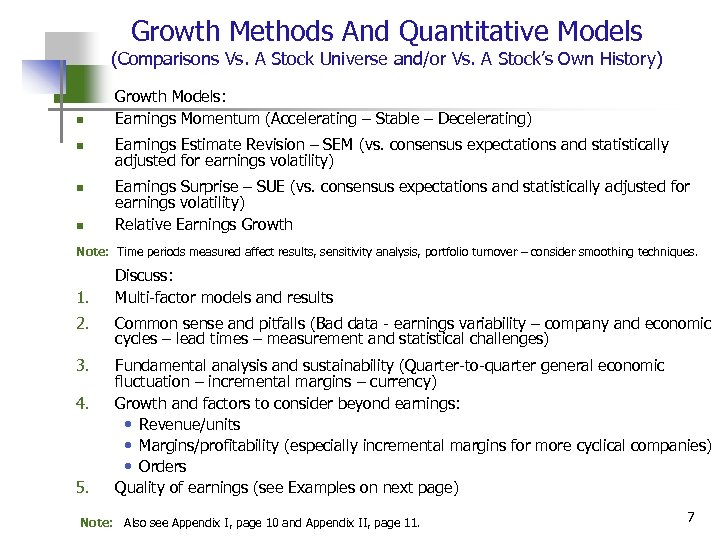

Growth Methods And Quantitative Models (Comparisons Vs. A Stock Universe and/or Vs. A Stock’s Own History) n n Growth Models: Earnings Momentum (Accelerating – Stable – Decelerating) Earnings Estimate Revision – SEM (vs. consensus expectations and statistically adjusted for earnings volatility) Earnings Surprise – SUE (vs. consensus expectations and statistically adjusted for earnings volatility) Relative Earnings Growth Note: Time periods measured affect results, sensitivity analysis, portfolio turnover – consider smoothing techniques. 1. Discuss: Multi-factor models and results 2. Common sense and pitfalls (Bad data - earnings variability – company and economic cycles – lead times – measurement and statistical challenges) 3. Fundamental analysis and sustainability (Quarter-to-quarter general economic fluctuation – incremental margins – currency) Growth and factors to consider beyond earnings: • Revenue/units • Margins/profitability (especially incremental margins for more cyclical companies) • Orders Quality of earnings (see Examples on next page) 4. 5. Note: Also see Appendix I, page 10 and Appendix II, page 11. 7

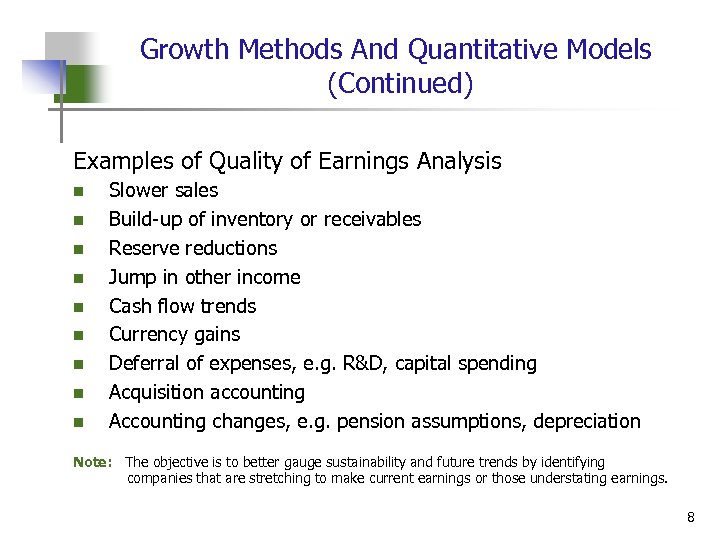

Growth Methods And Quantitative Models (Continued) Examples of Quality of Earnings Analysis n n n n n Slower sales Build-up of inventory or receivables Reserve reductions Jump in other income Cash flow trends Currency gains Deferral of expenses, e. g. R&D, capital spending Acquisition accounting Accounting changes, e. g. pension assumptions, depreciation Note: The objective is to better gauge sustainability and future trends by identifying companies that are stretching to make current earnings or those understating earnings. 8

Thoughts On Corporate Governance And Investor Activism n Mutual Fund Trustees/Boards n n Corporate Boards n n Board Members (Composition - Pct. Independent – Independent Chairman – Designate A Lead Independent Director) Proxy Policies (Internal Vs. External Voting – Conflict of Interest – Union Plans) Selecting Investment Managers (Any External Managers? ) Board Membership Roles, Terms, And Cross-directorships Management Compensation Including Options Challenge Of Balancing Short-Term And Long-Term Operating Results, Stock Performance, And Management Compensation Investors n n Activism - Fixed Income Investors Vs. Equity Investors Timeframe And Almost Sole Focus On Stock Performance Overemphasis On Past Trends And Consensus Thinking Vs. Foresight When Evaluating Other Management Factors Key Role Of Who You Manage Money For (Not-For-Profit Organization – Corporations – Union – Public Entity – Individual) EXAMPLES TO BE DISCUSSED 9

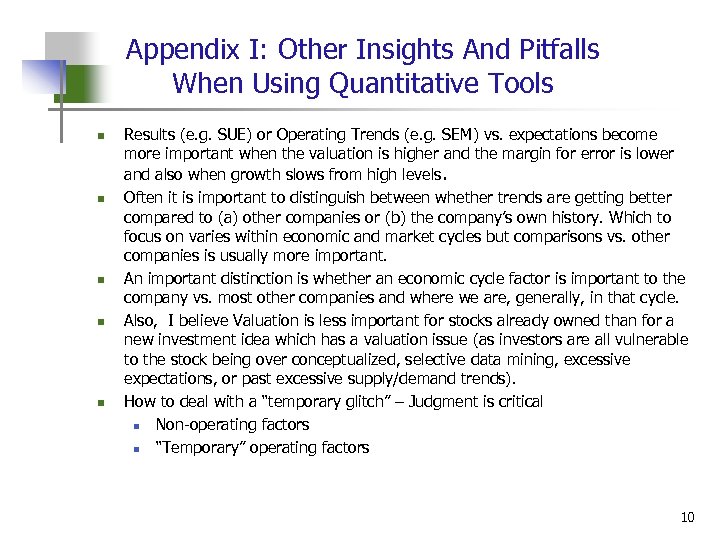

Appendix I: Other Insights And Pitfalls When Using Quantitative Tools n n n Results (e. g. SUE) or Operating Trends (e. g. SEM) vs. expectations become more important when the valuation is higher and the margin for error is lower and also when growth slows from high levels. Often it is important to distinguish between whether trends are getting better compared to (a) other companies or (b) the company’s own history. Which to focus on varies within economic and market cycles but comparisons vs. other companies is usually more important. An important distinction is whether an economic cycle factor is important to the company vs. most other companies and where we are, generally, in that cycle. Also, I believe Valuation is less important for stocks already owned than for a new investment idea which has a valuation issue (as investors are all vulnerable to the stock being over conceptualized, selective data mining, excessive expectations, or past excessive supply/demand trends). How to deal with a “temporary glitch” – Judgment is critical n Non-operating factors n “Temporary” operating factors 10

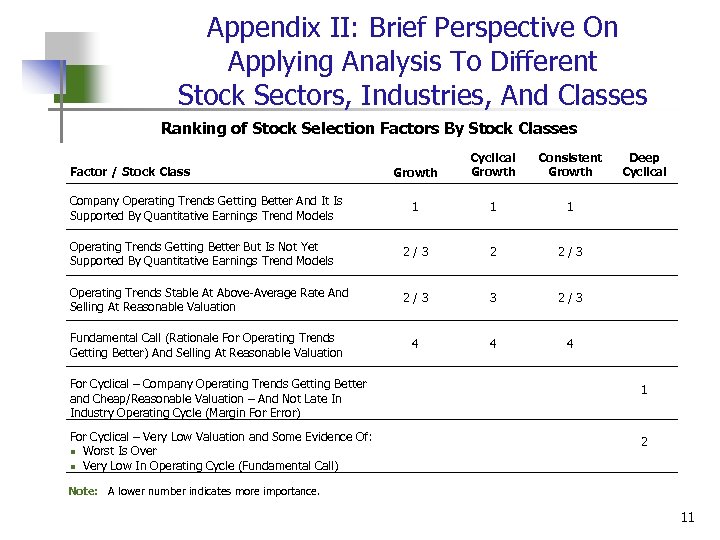

Appendix II: Brief Perspective On Applying Analysis To Different Stock Sectors, Industries, And Classes Ranking of Stock Selection Factors By Stock Classes Growth Cyclical Growth Consistent Growth 1 1 1 Operating Trends Getting Better But Is Not Yet Supported By Quantitative Earnings Trend Models 2/3 2 2/3 Operating Trends Stable At Above-Average Rate And Selling At Reasonable Valuation 2/3 3 2/3 Fundamental Call (Rationale For Operating Trends Getting Better) And Selling At Reasonable Valuation 4 4 4 Factor / Stock Class Company Operating Trends Getting Better And It Is Supported By Quantitative Earnings Trend Models Deep Cyclical For Cyclical – Company Operating Trends Getting Better and Cheap/Reasonable Valuation – And Not Late In Industry Operating Cycle (Margin For Error) 1 For Cyclical – Very Low Valuation and Some Evidence Of: n Worst Is Over n Very Low In Operating Cycle (Fundamental Call) 2 Note: A lower number indicates more importance. 11

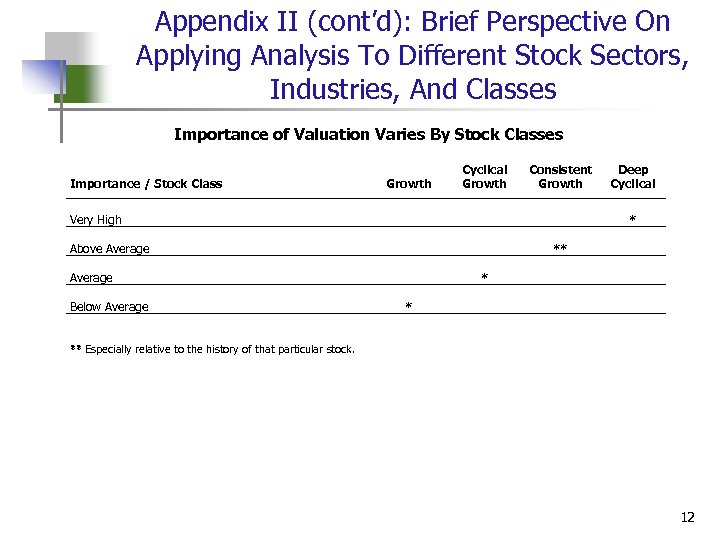

Appendix II (cont’d): Brief Perspective On Applying Analysis To Different Stock Sectors, Industries, And Classes Importance of Valuation Varies By Stock Classes Importance / Stock Class Growth Cyclical Growth Consistent Growth Very High * Above Average ** Average Below Average Deep Cyclical * * ** Especially relative to the history of that particular stock. 12

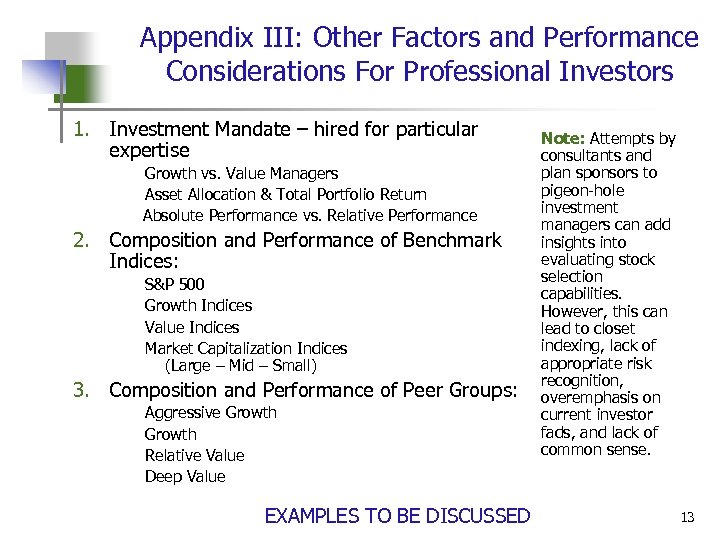

Appendix III: Other Factors and Performance Considerations For Professional Investors 1. Investment Mandate – hired for particular expertise Growth vs. Value Managers Asset Allocation & Total Portfolio Return Absolute Performance vs. Relative Performance 2. Composition and Performance of Benchmark Indices: S&P 500 Growth Indices Value Indices Market Capitalization Indices (Large – Mid – Small) 3. Composition and Performance of Peer Groups: Aggressive Growth Relative Value Deep Value EXAMPLES TO BE DISCUSSED Note: Attempts by consultants and plan sponsors to pigeon-hole investment managers can add insights into evaluating stock selection capabilities. However, this can lead to closet indexing, lack of appropriate risk recognition, overemphasis on current investor fads, and lack of common sense. 13

544c2da92290ef1e12c260c6fe3f247e.ppt