78a271d482c1da6e58d18faeef43bd08.ppt

- Количество слайдов: 16

Discussion of: Housing Cycles in the Major Euro Area Countries Common Business and Housing Market Cycles in the Euro area from a Multivariate Decomposition The International Transmission of House Price Stocks Gabriel Pérez-Quirós, Bank of Spain International Research Conference “The Macroeconomics of Housing Markets” Paris, 3 -4 December 2009 DG ECONOMICS, RESEARCH, AND STATISTICS

Discussion of: Housing Cycles in the Major Euro Area Countries Common Business and Housing Market Cycles in the Euro area from a Multivariate Decomposition The International Transmission of House Price Stocks Gabriel Pérez-Quirós, Bank of Spain International Research Conference “The Macroeconomics of Housing Markets” Paris, 3 -4 December 2009 DG ECONOMICS, RESEARCH, AND STATISTICS

1. General Impression Three good papers : § Very timely. They do not need to justify their interest § State of the art econometric techniques. I prefer some to others but they are all well done. § Big effort in constructing comparable datasets § Even though it is a big task what you asked me to do here, I enjoyed reading all of them …. . and most of the authors are friends and that helps § I expected similar conclusions…. DG ECONOMICS, RESEARCH, AND STATISTICS 2

1. General Impression Three good papers : § Very timely. They do not need to justify their interest § State of the art econometric techniques. I prefer some to others but they are all well done. § Big effort in constructing comparable datasets § Even though it is a big task what you asked me to do here, I enjoyed reading all of them …. . and most of the authors are friends and that helps § I expected similar conclusions…. DG ECONOMICS, RESEARCH, AND STATISTICS 2

1. General Impression However, they should read each other (this is supposed to be a joint effort) : One doctor, cure, two doctors doubt, three doctors, sure death § Alvarez, Bulligan, Cabrero, Ferrara and Stahl (ABCFS) and Ferrara and Koopman (FK) conclude: “Housing prices are not synchronized across countries” § De Brandt, Barhoumi and Bruneau (BBB) conclude: “The US real house price unidirectionally causes the international house price factor, which in turn causes the domestic real house price growth for each country” § But even ABCFS and FK do not always send the same message: “In Housing Prices there is a strong relation between Germany and Spain” “Germany and Spain are strongly but negatively correlated” DG ECONOMICS, RESEARCH, AND STATISTICS 3

1. General Impression However, they should read each other (this is supposed to be a joint effort) : One doctor, cure, two doctors doubt, three doctors, sure death § Alvarez, Bulligan, Cabrero, Ferrara and Stahl (ABCFS) and Ferrara and Koopman (FK) conclude: “Housing prices are not synchronized across countries” § De Brandt, Barhoumi and Bruneau (BBB) conclude: “The US real house price unidirectionally causes the international house price factor, which in turn causes the domestic real house price growth for each country” § But even ABCFS and FK do not always send the same message: “In Housing Prices there is a strong relation between Germany and Spain” “Germany and Spain are strongly but negatively correlated” DG ECONOMICS, RESEARCH, AND STATISTICS 3

2. General concerns (Some papers more than others) § Lack of robustness of the results. Some specifications produce some results and others produce others. Value of p in ABCFS, trend specification in KF or the FAVAR specification in BBB. §Out of sample forecasting exercise? § Lack of standard errors- There is no standard errors in any of the three papers! § Lack of focus. The papers analyze comovements across economies and comovements between sectors in the economies, (FK), comovements across economies and leading and lagging behaviors of a big set of variables (ABCFS), non linearities, causal relations and different types of propragations(BBB) …. One paper is one message DG ECONOMICS, RESEARCH, AND STATISTICS 4

2. General concerns (Some papers more than others) § Lack of robustness of the results. Some specifications produce some results and others produce others. Value of p in ABCFS, trend specification in KF or the FAVAR specification in BBB. §Out of sample forecasting exercise? § Lack of standard errors- There is no standard errors in any of the three papers! § Lack of focus. The papers analyze comovements across economies and comovements between sectors in the economies, (FK), comovements across economies and leading and lagging behaviors of a big set of variables (ABCFS), non linearities, causal relations and different types of propragations(BBB) …. One paper is one message DG ECONOMICS, RESEARCH, AND STATISTICS 4

2. General concerns § Lack of a message with policy implications. Just an example: We find that, in the four major euro area countries, GDP cycles show a high degree of comovement, most likely due to trade linkages, although idiosyncratic factors play a larger role in Germany than in the other countries. Cross country comovements are mostly contemporaneous, but developments in Spain tend to lead those in Germany, Italy and France by 1 or 2 quarters. In contrast, comovements are substantially weaker for housing market cycles, where country-specific or local variables, [. . ] Again, residential investment developments in Spain precede those in the other countries. Nominal prices are weakly related across countries, but developments in France tend lead those in the other countries. DG ECONOMICS, RESEARCH, AND STATISTICS 5

2. General concerns § Lack of a message with policy implications. Just an example: We find that, in the four major euro area countries, GDP cycles show a high degree of comovement, most likely due to trade linkages, although idiosyncratic factors play a larger role in Germany than in the other countries. Cross country comovements are mostly contemporaneous, but developments in Spain tend to lead those in Germany, Italy and France by 1 or 2 quarters. In contrast, comovements are substantially weaker for housing market cycles, where country-specific or local variables, [. . ] Again, residential investment developments in Spain precede those in the other countries. Nominal prices are weakly related across countries, but developments in France tend lead those in the other countries. DG ECONOMICS, RESEARCH, AND STATISTICS 5

2. General concerns § Lack of a similar exercise that we can use as a baseline Correlation between prices and output is not new in the literature (Den Haan, Cooley and Ohanian, etc…. ) At the end of the day, this is the exercise that the three papers try to do. I would have liked to see first the exercise of GDP-Inflation and then, with the same specification, GDP-Housing prices. DG ECONOMICS, RESEARCH, AND STATISTICS 6

2. General concerns § Lack of a similar exercise that we can use as a baseline Correlation between prices and output is not new in the literature (Den Haan, Cooley and Ohanian, etc…. ) At the end of the day, this is the exercise that the three papers try to do. I would have liked to see first the exercise of GDP-Inflation and then, with the same specification, GDP-Housing prices. DG ECONOMICS, RESEARCH, AND STATISTICS 6

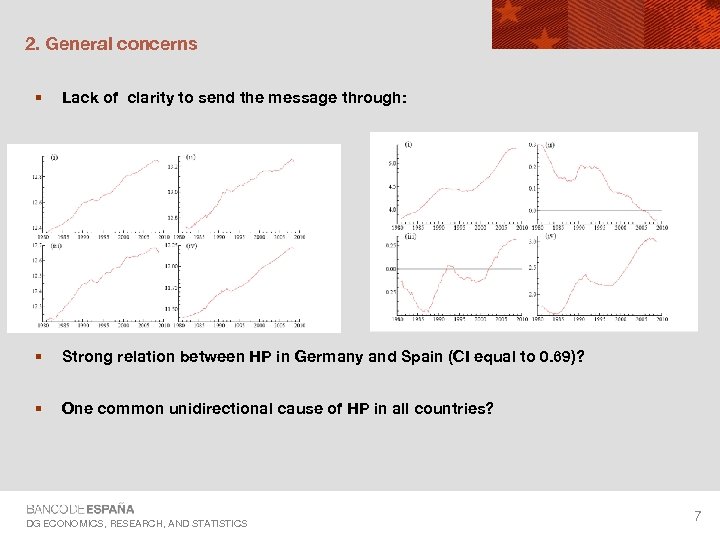

2. General concerns § Lack of clarity to send the message through: § Strong relation between HP in Germany and Spain (CI equal to 0. 69)? § One common unidirectional cause of HP in all countries? DG ECONOMICS, RESEARCH, AND STATISTICS 7

2. General concerns § Lack of clarity to send the message through: § Strong relation between HP in Germany and Spain (CI equal to 0. 69)? § One common unidirectional cause of HP in all countries? DG ECONOMICS, RESEARCH, AND STATISTICS 7

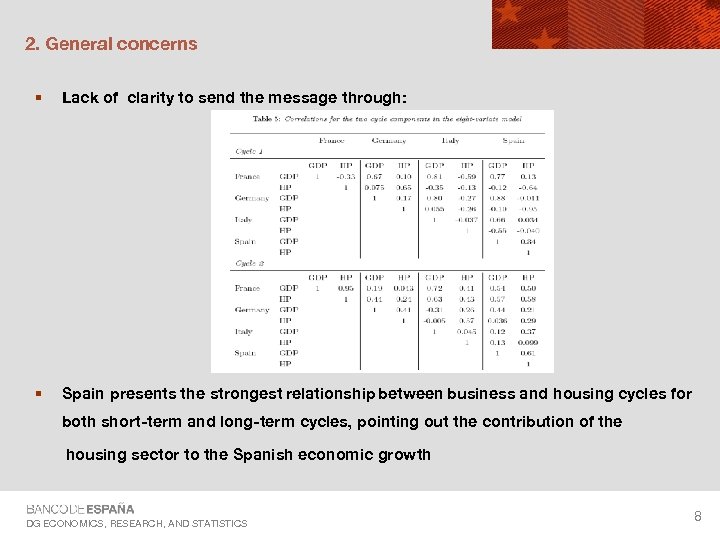

2. General concerns § Lack of clarity to send the message through: § Spain presents the strongest relationship between business and housing cycles for both short-term and long-term cycles, pointing out the contribution of the housing sector to the Spanish economic growth DG ECONOMICS, RESEARCH, AND STATISTICS 8

2. General concerns § Lack of clarity to send the message through: § Spain presents the strongest relationship between business and housing cycles for both short-term and long-term cycles, pointing out the contribution of the housing sector to the Spanish economic growth DG ECONOMICS, RESEARCH, AND STATISTICS 8

3. Detailed comments On ABCFS: § Why do you filter the data? Growth ratesor den Haan (2000) are easier to interpret § § Or if you need to filter, filter based on models as in FK. How much your results depend on the value of “p”? Why this should be equal for all variables and all countries? § What is the gain of using the statistic proposed by Peña and Rodriguez ? § Combine measures and produce just one table of summary of the results § Why Spain leads Germany in GDP ? § Leading and lagging behavior of filtered data is misleading § Concordance analysis misleading. When low number of recession, positively biased. Parametric measures have advantages. DG ECONOMICS, RESEARCH, AND STATISTICS 9

3. Detailed comments On ABCFS: § Why do you filter the data? Growth ratesor den Haan (2000) are easier to interpret § § Or if you need to filter, filter based on models as in FK. How much your results depend on the value of “p”? Why this should be equal for all variables and all countries? § What is the gain of using the statistic proposed by Peña and Rodriguez ? § Combine measures and produce just one table of summary of the results § Why Spain leads Germany in GDP ? § Leading and lagging behavior of filtered data is misleading § Concordance analysis misleading. When low number of recession, positively biased. Parametric measures have advantages. DG ECONOMICS, RESEARCH, AND STATISTICS 9

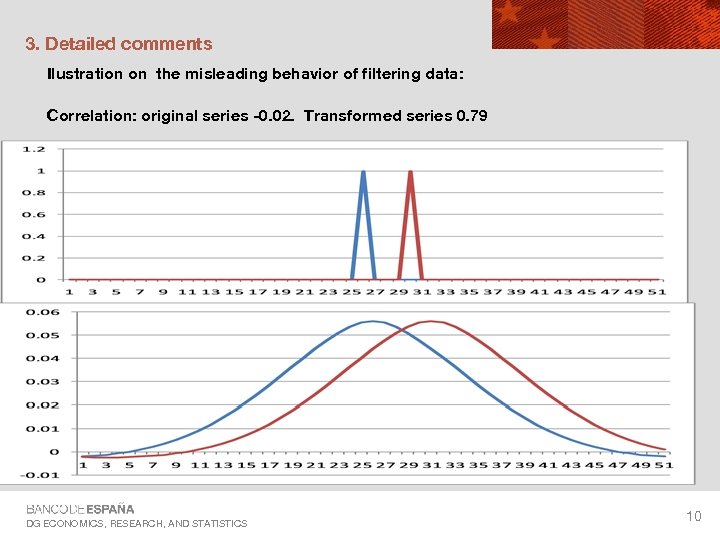

3. Detailed comments Ilustration on the misleading behavior of filtering data: Correlation: original series -0. 02. Transformed series 0. 79 Series, 0. 79 DG ECONOMICS, RESEARCH, AND STATISTICS 10

3. Detailed comments Ilustration on the misleading behavior of filtering data: Correlation: original series -0. 02. Transformed series 0. 79 Series, 0. 79 DG ECONOMICS, RESEARCH, AND STATISTICS 10

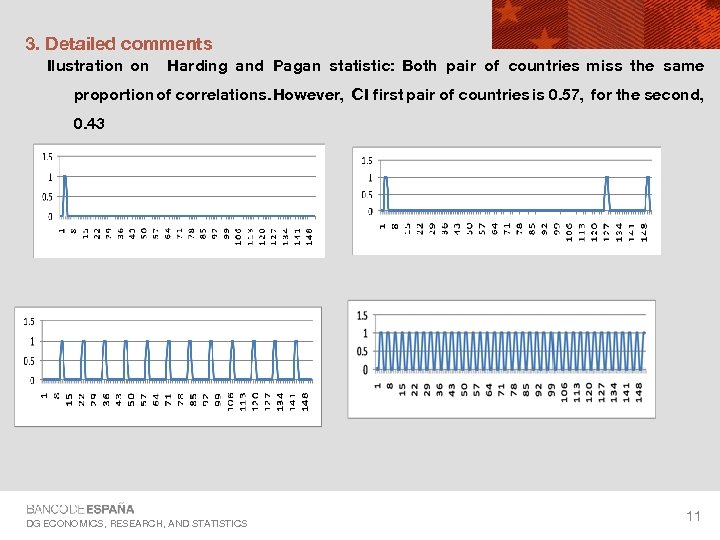

3. Detailed comments Ilustration on Harding and Pagan statistic: Both pair of countries miss the same proportion of correlations. However, CI first pair of countries is 0. 57, for the second, 0. 43 DG ECONOMICS, RESEARCH, AND STATISTICS 11

3. Detailed comments Ilustration on Harding and Pagan statistic: Both pair of countries miss the same proportion of correlations. However, CI first pair of countries is 0. 57, for the second, 0. 43 DG ECONOMICS, RESEARCH, AND STATISTICS 11

3. Detailed comments On FK: § Why do you need to enforce the restrictions for the value of the parameters? Why the same restrictions to all series and countries? § Why GDP and HP are much more correlated in Germany than in Italy while the picture gives a totally different impression? § How robust are your results to different trends (although I like your trend)? § Is your trend compatible with ABCFS specification? § Timing of things…. this morning we learnt that prices in France lead GDP and the leading nature of housing in Spain! § I miss the covariancerank reduction analysis that you propose at the beginning. DG ECONOMICS, RESEARCH, AND STATISTICS 12

3. Detailed comments On FK: § Why do you need to enforce the restrictions for the value of the parameters? Why the same restrictions to all series and countries? § Why GDP and HP are much more correlated in Germany than in Italy while the picture gives a totally different impression? § How robust are your results to different trends (although I like your trend)? § Is your trend compatible with ABCFS specification? § Timing of things…. this morning we learnt that prices in France lead GDP and the leading nature of housing in Spain! § I miss the covariancerank reduction analysis that you propose at the beginning. DG ECONOMICS, RESEARCH, AND STATISTICS 12

3. Detailed comments On BBB: § Two definitions of contagion. One is “contagion occurs when the transmission is different, (more pronounced) in crisis events”. Not clear, but the testing procedures, “dummy for recessions” and LSTAR are seriously misleading. § § Why do you change the number of countries in the non-linear model? The second approach, the contagion effect, more standard. However serious lack of robustness. First, Australia, Spain and UK, later Autralia, UK and France, § The strategy used by Grocer should be more carefully explained § From the reading of the text, I was not able to figure out how do you get the conclusion that it is the market in the US what cause all the movements in markets in Europe DG ECONOMICS, RESEARCH, AND STATISTICS 13

3. Detailed comments On BBB: § Two definitions of contagion. One is “contagion occurs when the transmission is different, (more pronounced) in crisis events”. Not clear, but the testing procedures, “dummy for recessions” and LSTAR are seriously misleading. § § Why do you change the number of countries in the non-linear model? The second approach, the contagion effect, more standard. However serious lack of robustness. First, Australia, Spain and UK, later Autralia, UK and France, § The strategy used by Grocer should be more carefully explained § From the reading of the text, I was not able to figure out how do you get the conclusion that it is the market in the US what cause all the movements in markets in Europe DG ECONOMICS, RESEARCH, AND STATISTICS 13

4. To sum up From my point of view, three interesting papers that try to put some light on the relation between housing prices and GDP but… DG ECONOMICS, RESEARCH, AND STATISTICS 14

4. To sum up From my point of view, three interesting papers that try to put some light on the relation between housing prices and GDP but… DG ECONOMICS, RESEARCH, AND STATISTICS 14

4. To sum up From my point of view, three interesting papers that try to put some light on the relation between housing prices and GDP but… …. . still to messy to send a clear message that can go through (in some papers more than in others) DG ECONOMICS, RESEARCH, AND STATISTICS 15

4. To sum up From my point of view, three interesting papers that try to put some light on the relation between housing prices and GDP but… …. . still to messy to send a clear message that can go through (in some papers more than in others) DG ECONOMICS, RESEARCH, AND STATISTICS 15

4. To sum up From my point of view, three interesting papers that try to put some light on the relation between housing prices and GDP but… …. . still to messy to send a clear message that can go through (in some papers more than in others) …. more research is needed. I do not sympathize with the message that housing prices move on their own. My own experience with soft indicators and lessons that we have learnt from oil prices have shown us that the design of the filter is key to identify comovements DG ECONOMICS, RESEARCH, AND STATISTICS 16

4. To sum up From my point of view, three interesting papers that try to put some light on the relation between housing prices and GDP but… …. . still to messy to send a clear message that can go through (in some papers more than in others) …. more research is needed. I do not sympathize with the message that housing prices move on their own. My own experience with soft indicators and lessons that we have learnt from oil prices have shown us that the design of the filter is key to identify comovements DG ECONOMICS, RESEARCH, AND STATISTICS 16