b1ecc17e4070f43566626139565ca301.ppt

- Количество слайдов: 57

Discussion Materials October 4, 2007

Summary • Very undesirable audience from a TV perspective • Limited reach to launch hit or demo-changing shows • Incremental improvements more difficult due to: declining ratings, fragmentation, return of game shows to broadcast, affiliate pressures • Ambitious re-orientation of business proposed to capitalize on growth of casual games off TV • Seek genuine multi-platform games biz model: packaging, online ad sales, online fees, formats, mobile • Key issue: can Game Show Network broaden to attract similar, but not identical, audience with similar but not identical consumer experience?

Current Situation

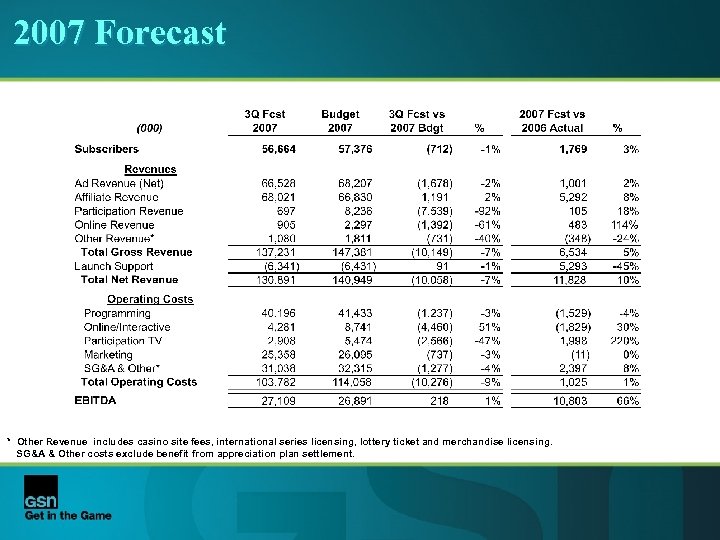

2007 Forecast * Other Revenue includes casino site fees, international series licensing, lottery ticket and merchandise licensing. SG&A & Other costs exclude benefit from appreciation plan settlement.

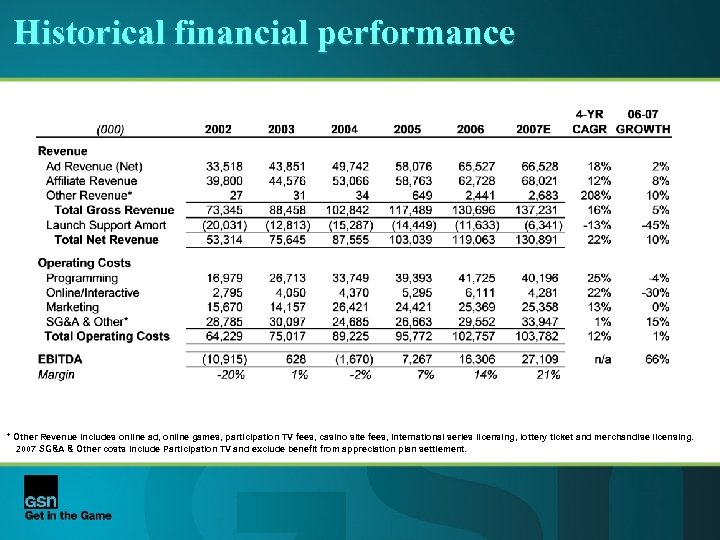

Historical financial performance * Other Revenue includes online ad, online games, participation TV fees, casino site fees, international series licensing, lottery ticket and merchandise licensing. 2007 SG&A & Other costs include Participation TV and exclude benefit from appreciation plan settlement.

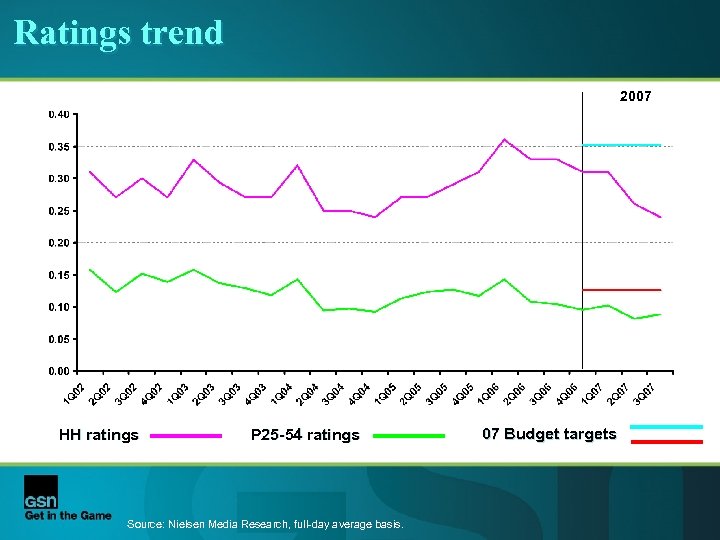

Ratings trend 2007 HH ratings P 25 -54 ratings Source: Nielsen Media Research, full-day average basis. 07 Budget targets

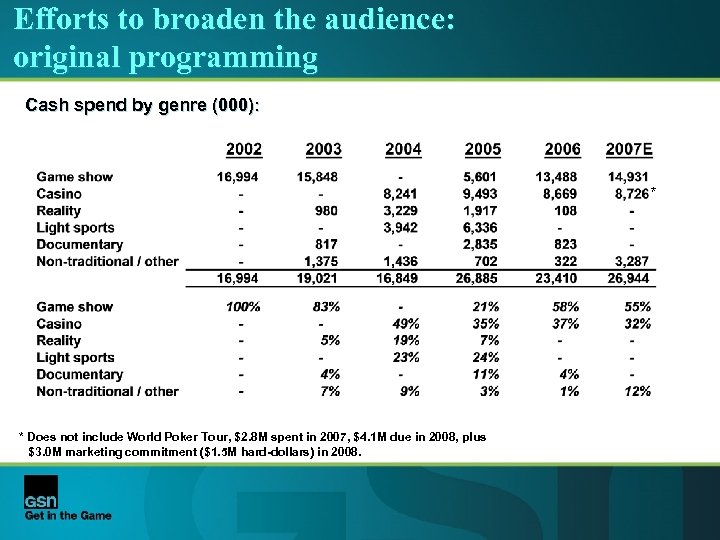

Efforts to broaden the audience: original programming Cash spend by genre (000): * * Does not include World Poker Tour, $2. 8 M spent in 2007, $4. 1 M due in 2008, plus $3. 0 M marketing commitment ($1. 5 M hard-dollars) in 2008.

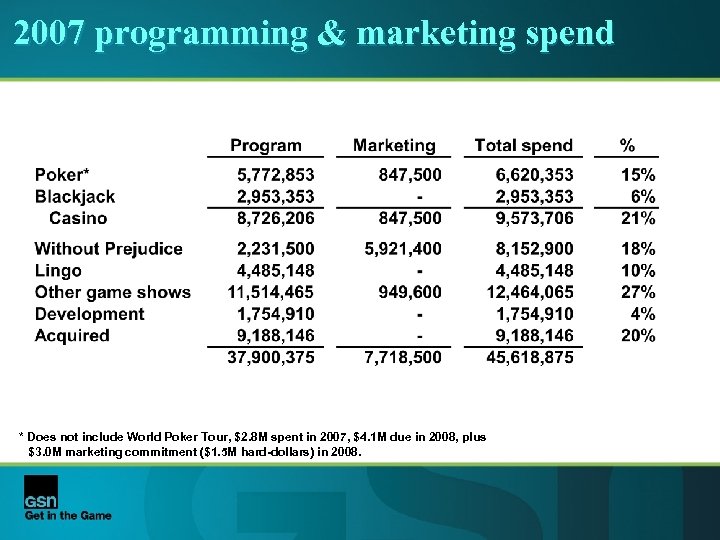

2007 programming & marketing spend * Does not include World Poker Tour, $2. 8 M spent in 2007, $4. 1 M due in 2008, plus $3. 0 M marketing commitment ($1. 5 M hard-dollars) in 2008.

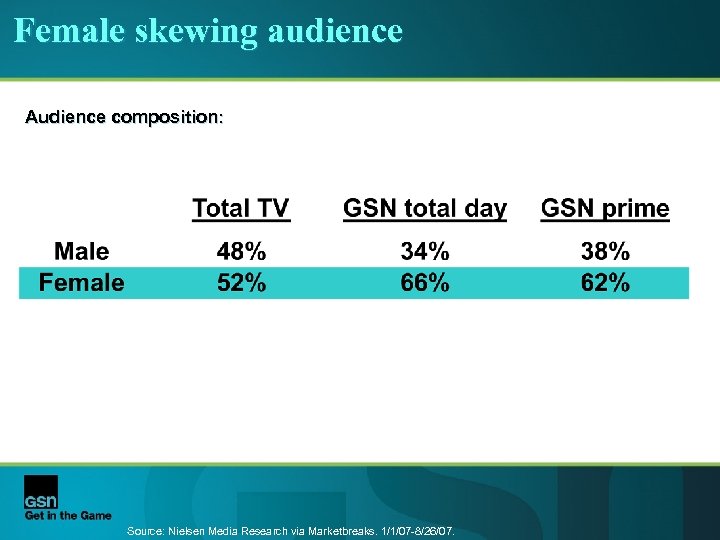

Female skewing audience Audience composition: Source: Nielsen Media Research via Marketbreaks. 1/1/07 -8/26/07.

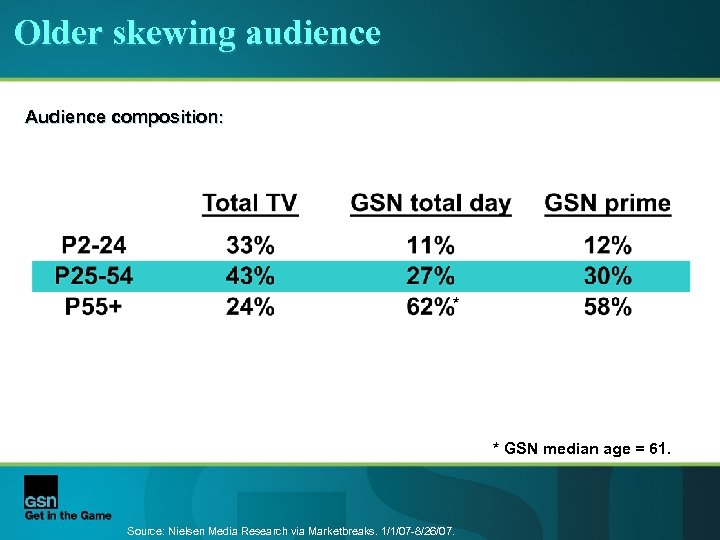

Older skewing audience Audience composition: * * GSN median age = 61. Source: Nielsen Media Research via Marketbreaks. 1/1/07 -8/26/07.

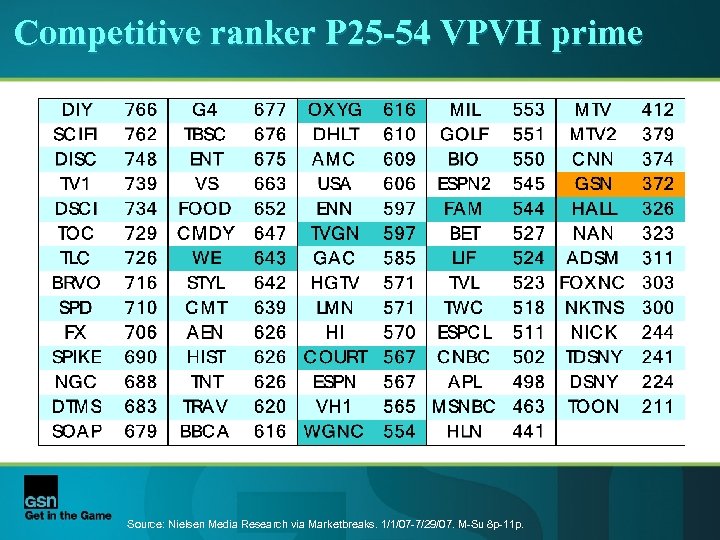

Competitive ranker P 25 -54 VPVH prime Source: Nielsen Media Research via Marketbreaks. 1/1/07 -7/29/07. M-Su 8 p-11 p.

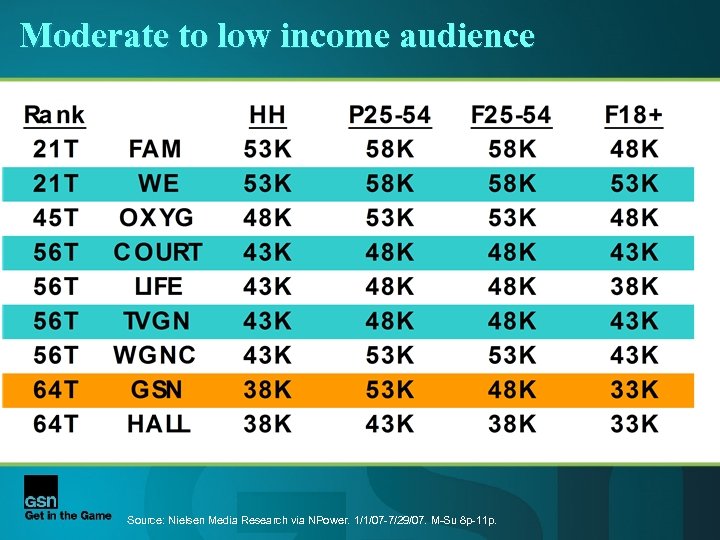

Moderate to low income audience Source: Nielsen Media Research via NPower. 1/1/07 -7/29/07. M-Su 8 p-11 p.

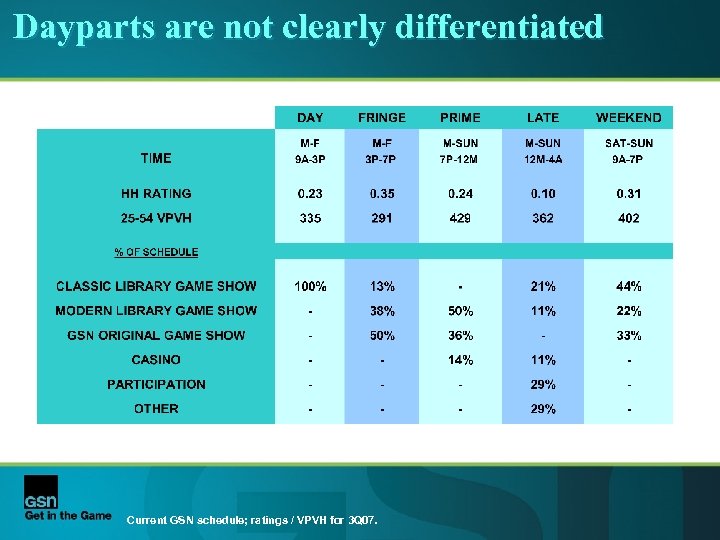

Dayparts are not clearly differentiated Current GSN schedule; ratings / VPVH for 3 Q 07.

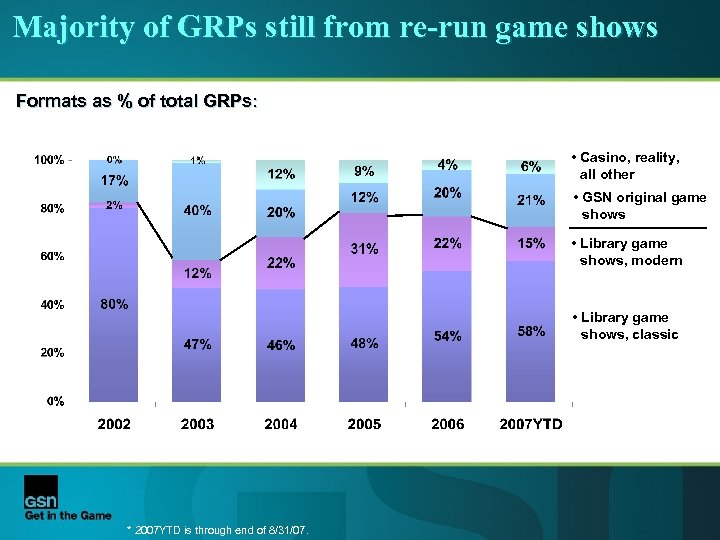

Majority of GRPs still from re-run game shows Formats as % of total GRPs: • Casino, reality, all other • GSN original game shows • Library game shows, modern • Library game shows, classic * 2007 YTD is through end of 8/31/07.

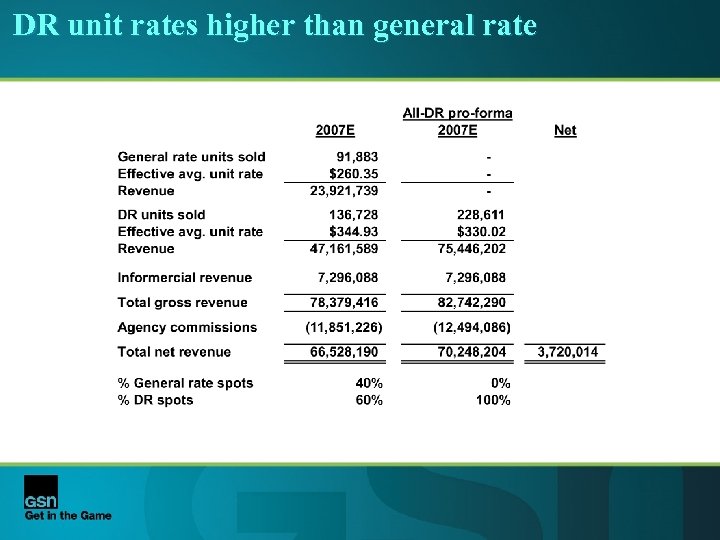

DR unit rates higher than general rate

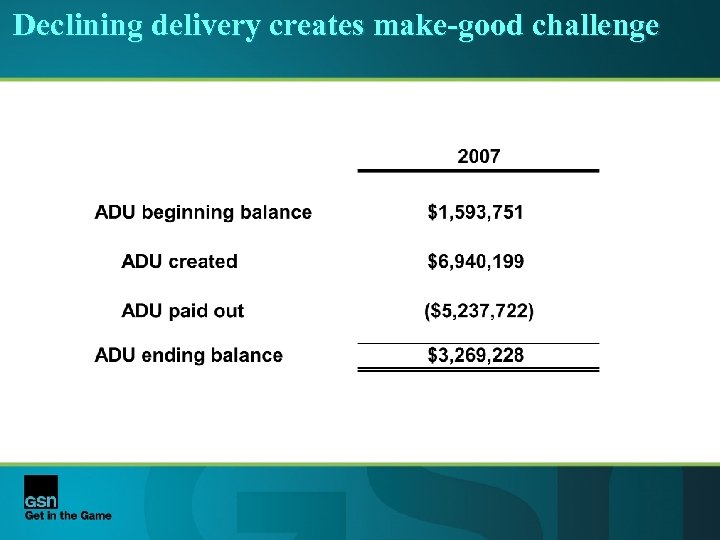

Declining delivery creates make-good challenge

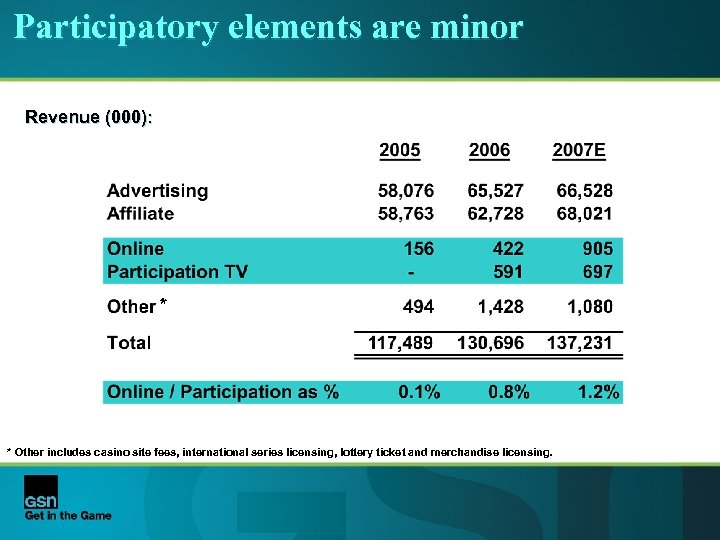

Participatory elements are minor Revenue (000): * * Other includes casino site fees, international series licensing, lottery ticket and merchandise licensing.

Online business still small Source: Rank out of 125 listed games sites; Com. Score, My Metrix, July 2007

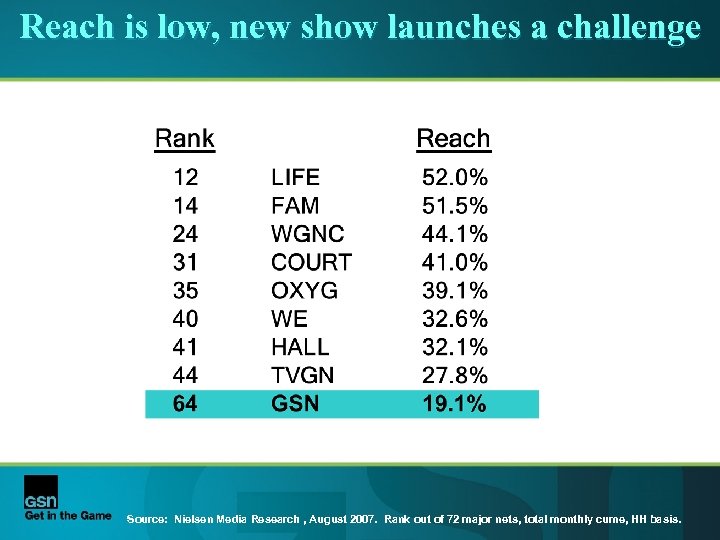

Reach is low, new show launches a challenge Source: Nielsen Media Research , August 2007. Rank out of 72 major nets, total monthly cume, HH basis.

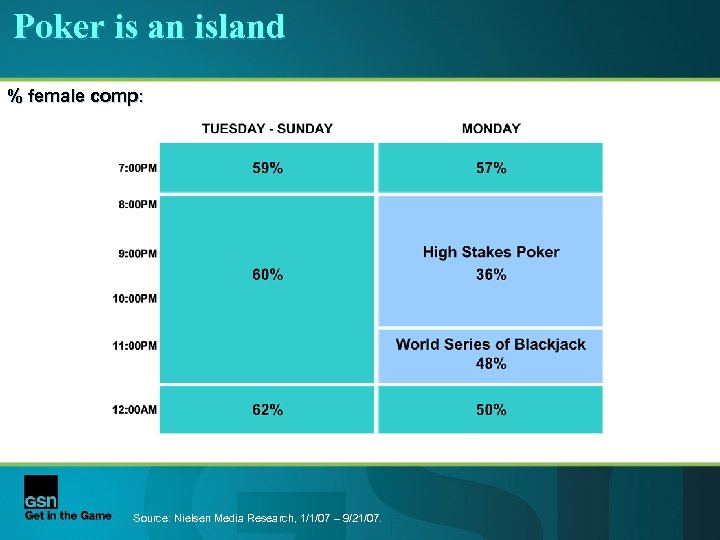

Poker is an island % female comp: Source: Nielsen Media Research, 1/1/07 – 9/21/07.

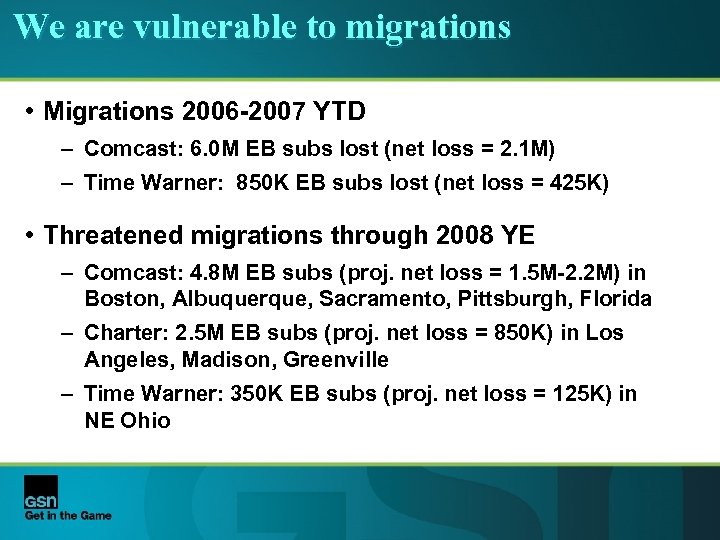

We are vulnerable to migrations • Migrations 2006 -2007 YTD – Comcast: 6. 0 M EB subs lost (net loss = 2. 1 M) – Time Warner: 850 K EB subs lost (net loss = 425 K) • Threatened migrations through 2008 YE – Comcast: 4. 8 M EB subs (proj. net loss = 1. 5 M-2. 2 M) in Boston, Albuquerque, Sacramento, Pittsburgh, Florida – Charter: 2. 5 M EB subs (proj. net loss = 850 K) in Los Angeles, Madison, Greenville – Time Warner: 350 K EB subs (proj. net loss = 125 K) in NE Ohio

GSN’s strategic advantages • The only network in this space – 66. 4 million Nielsen UE • Solid household core • Audience is highly engaged • Audience over-indexes on computer / internet usage • Casual games space has exploded • GSN demographic a plausible fit with casual games

Opportunity

Casual games opportunity • 55 million online casual gamers in the U. S. • The #2 activity on AOL, behind only email / IM • The “stickiest” form of online entertainment • Heavily female • Older than typical internet audience • Multiple but modest-sized revenue streams (ad, subscription, download, cash games, etc. )

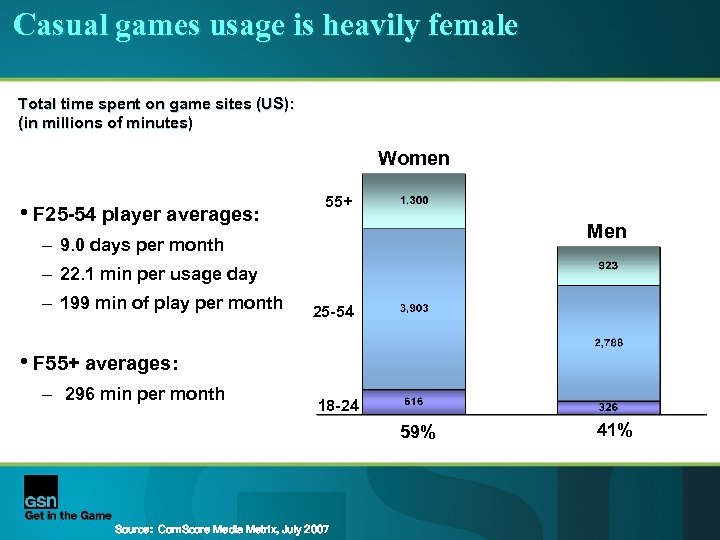

Casual games usage is heavily female Total time spent on game sites (US): (in millions of minutes) Women • F 25 -54 player averages: 55+ Men – 9. 0 days per month – 22. 1 min per usage day – 199 min of play per month 25 -54 • F 55+ averages: – 296 min per month 18 -24 59% Source: Com. Score Media Metrix, July 2007 41%

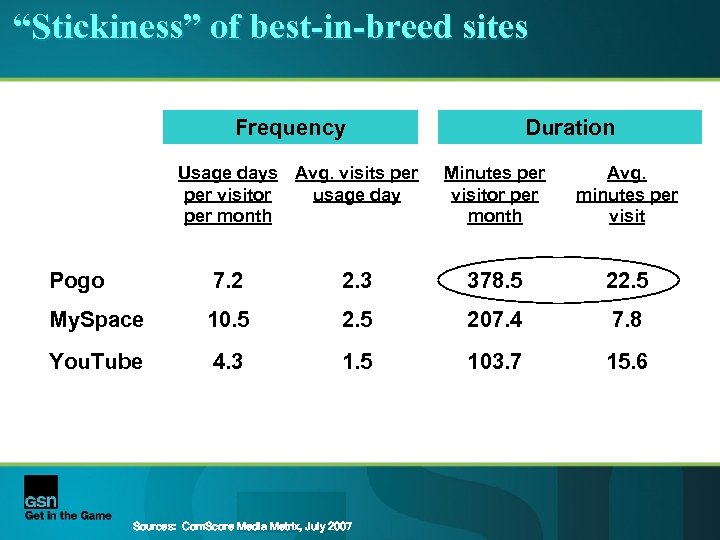

“Stickiness” of best-in-breed sites Frequency Usage days Avg. visits per visitor usage day per month Duration Minutes per visitor per month Avg. minutes per visit Pogo 7. 2 2. 3 378. 5 22. 5 My. Space 10. 5 207. 4 7. 8 You. Tube 4. 3 1. 5 103. 7 15. 6 Sources: Com. Score Media Metrix, July 2007

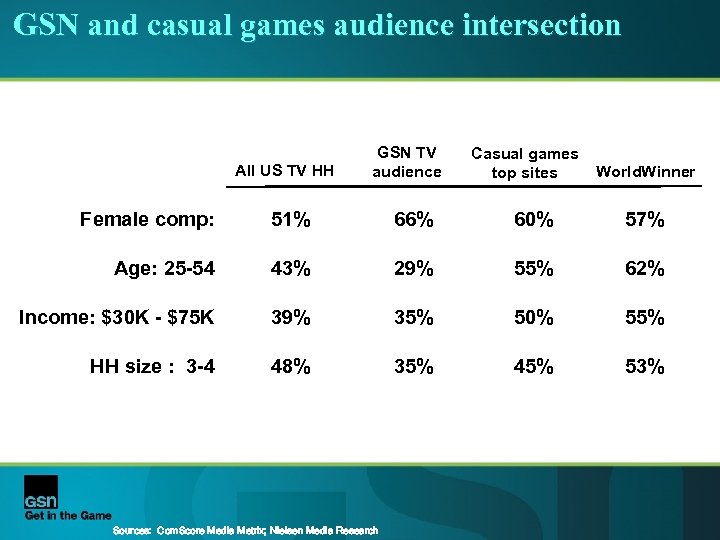

GSN and casual games audience intersection All US TV HH GSN TV audience Casual games top sites World. Winner Female comp: 51% 66% 60% 57% Age: 25 -54 43% 29% 55% 62% Income: $30 K - $75 K 39% 35% 50% 55% HH size : 3 -4 48% 35% 45% 53% Sources: Com. Score Media Metrix; Nielsen Media Research

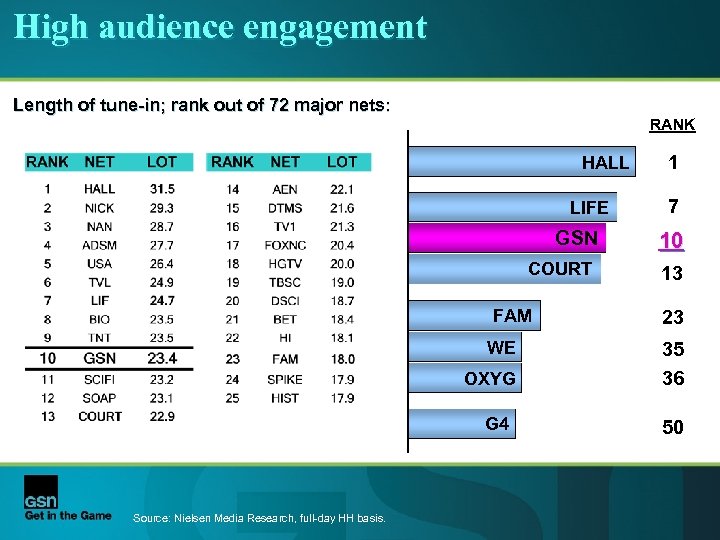

High audience engagement Length of tune-in; rank out of 72 major nets: RANK HALL LIFE GSN COURT FAM WE OXYG G 4 Source: Nielsen Media Research, full-day HH basis. 1 7 10 13 23 35 36 50

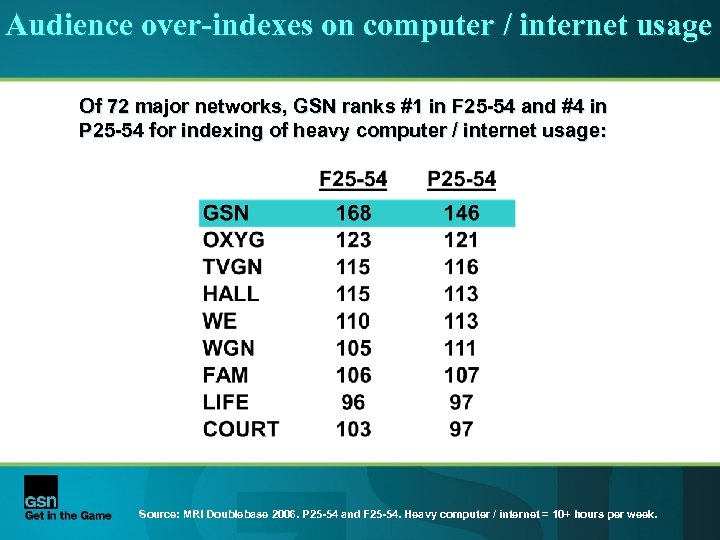

Audience over-indexes on computer / internet usage Of 72 major networks, GSN ranks #1 in F 25 -54 and #4 in P 25 -54 for indexing of heavy computer / internet usage: Source: MRI Doublebase 2006. P 25 -54 and F 25 -54. Heavy computer / internet = 10+ hours per week.

What to do

6 key objectives in building business plan • Accept fundamentally older female demo, gradually seek to get marginally younger • Make play, accessible participation central to all programming • Focus on brand • Market untraditionally • Build multi-platform business models • Own, exploit our own IP

Revitalize air while staying true to core • Game shows remain the workhorse of the schedule • Create sense of “lights on” at network – – – Interstitials Games Same-day promotion • IDEA: Utilize a substantial live-hosted block to establish unique tone, new business models, refresh library programming – – – Current thinking: fringe 4 -7 pm, 6 -8 minutes per hour GSN, online promotion Live games with prizes Tied to programming Major sponsorship vehicle

continued… – Substantial programming / marketing investment • Production costs estimated at $2 million per 13 weeks • Prizes estimated at $0. 5 million per 13 weeks • Lost ad inventory to stay on clock, foregoing $1 million in revenue per 13 weeks • Single feed (some cost recapture) • Build greater differentiation between dayparts – Idea: use varying degrees of participation to define blocks, counter-program broadcast game shows • Poker as an island – Drop or create “male swim”

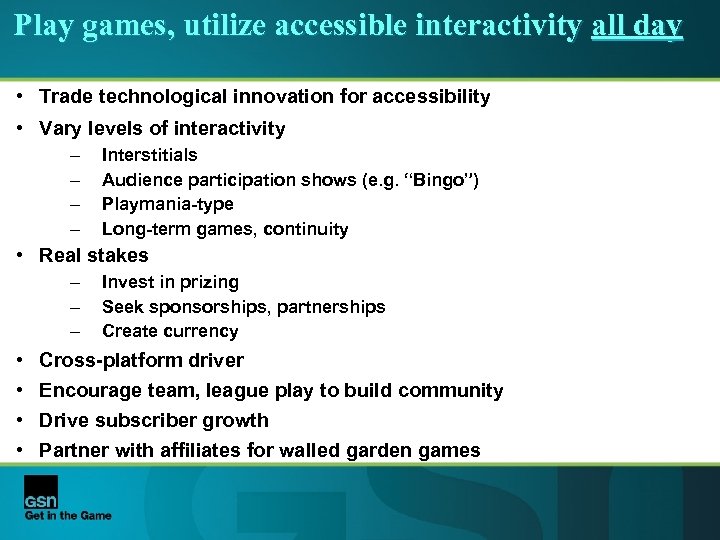

Play games, utilize accessible interactivity all day • Trade technological innovation for accessibility • Vary levels of interactivity – – Interstitials Audience participation shows (e. g. “Bingo”) Playmania-type Long-term games, continuity • Real stakes – – – • • Invest in prizing Seek sponsorships, partnerships Create currency Cross-platform driver Encourage team, league play to build community Drive subscriber growth Partner with affiliates for walled garden games

Build strong well-defined brand, targeting actual core audience • Look and feel of network, programming / marketing choices reflect: – – – – Female Casual Accessible, not edgy Family friendly Competitive but fun Ever-present diversion Participatory but not technology driven • Focus on brand in everything we do • Focus on our community – GSN is “their” network – 4. 9 million registered users • Embrace identity – – Celebrate, don’t run away from classics Tie classics to online games

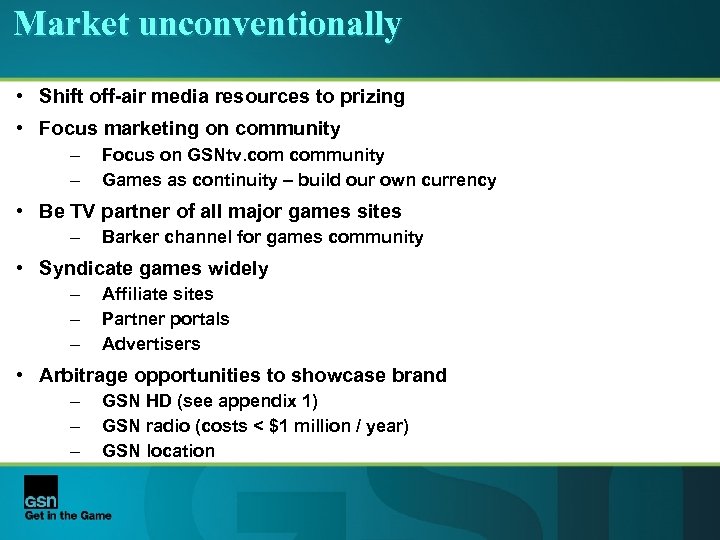

Market unconventionally • Shift off-air media resources to prizing • Focus marketing on community – – Focus on GSNtv. community Games as continuity – build our own currency • Be TV partner of all major games sites – Barker channel for games community • Syndicate games widely – – – Affiliate sites Partner portals Advertisers • Arbitrage opportunities to showcase brand – – – GSN HD (see appendix 1) GSN radio (costs < $1 million / year) GSN location

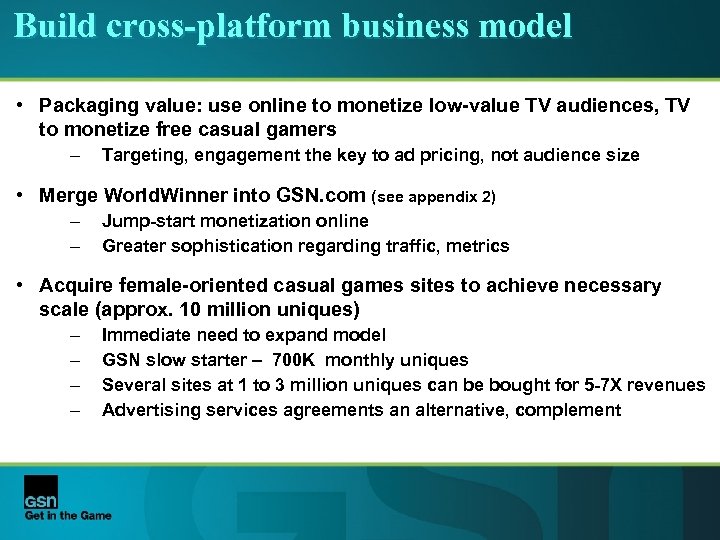

Build cross-platform business model • Packaging value: use online to monetize low-value TV audiences, TV to monetize free casual gamers – Targeting, engagement the key to ad pricing, not audience size • Merge World. Winner into GSN. com (see appendix 2) – – Jump-start monetization online Greater sophistication regarding traffic, metrics • Acquire female-oriented casual games sites to achieve necessary scale (approx. 10 million uniques) – – Immediate need to expand model GSN slow starter – 700 K monthly uniques Several sites at 1 to 3 million uniques can be bought for 5 -7 X revenues Advertising services agreements an alternative, complement

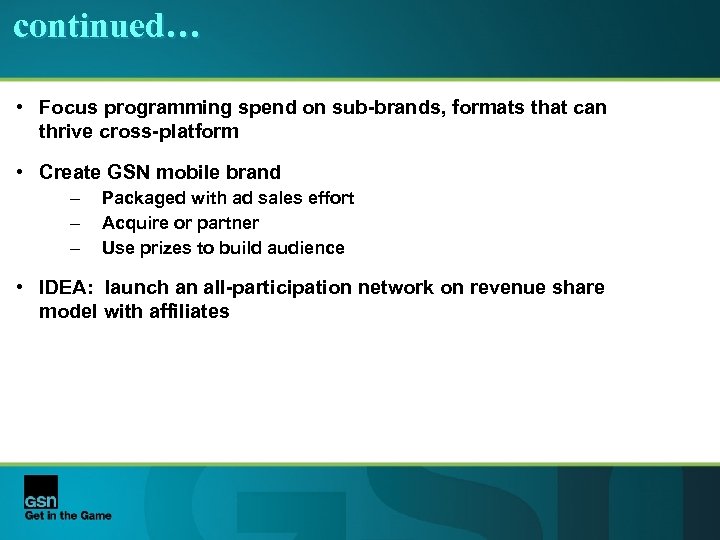

continued… • Focus programming spend on sub-brands, formats that can thrive cross-platform • Create GSN mobile brand – – – Packaged with ad sales effort Acquire or partner Use prizes to build audience • IDEA: launch an all-participation network on revenue share model with affiliates

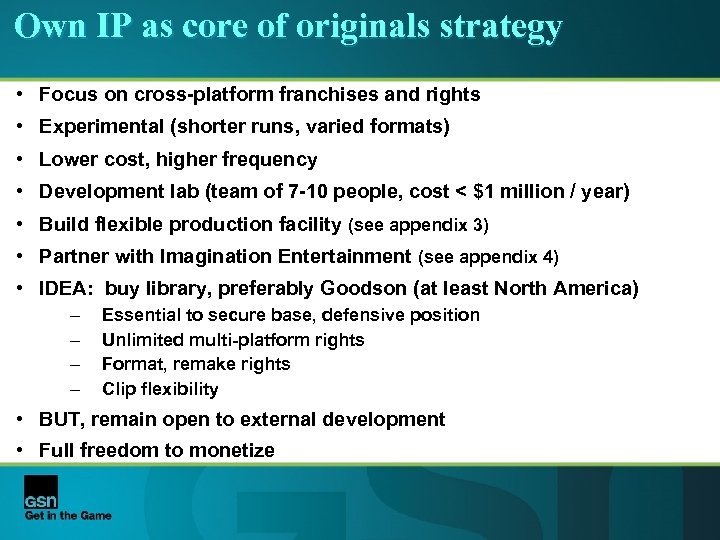

Own IP as core of originals strategy • Focus on cross-platform franchises and rights • Experimental (shorter runs, varied formats) • Lower cost, higher frequency • Development lab (team of 7 -10 people, cost < $1 million / year) • Build flexible production facility (see appendix 3) • Partner with Imagination Entertainment (see appendix 4) • IDEA: buy library, preferably Goodson (at least North America) – – Essential to secure base, defensive position Unlimited multi-platform rights Format, remake rights Clip flexibility • BUT, remain open to external development • Full freedom to monetize

Team

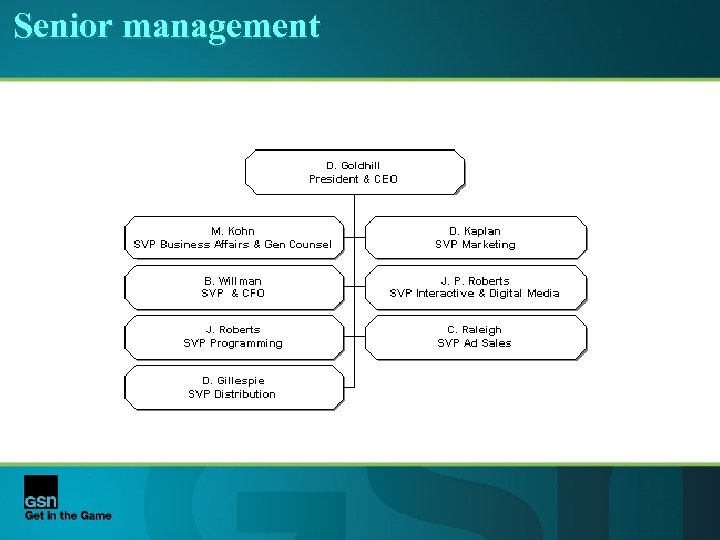

Senior management

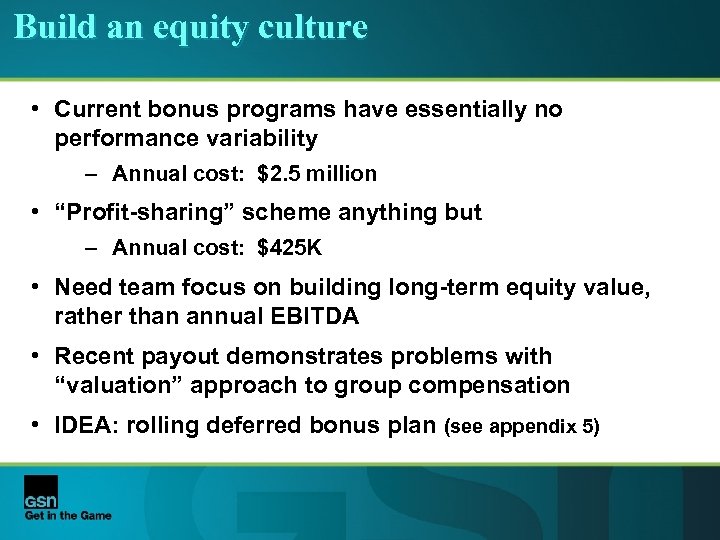

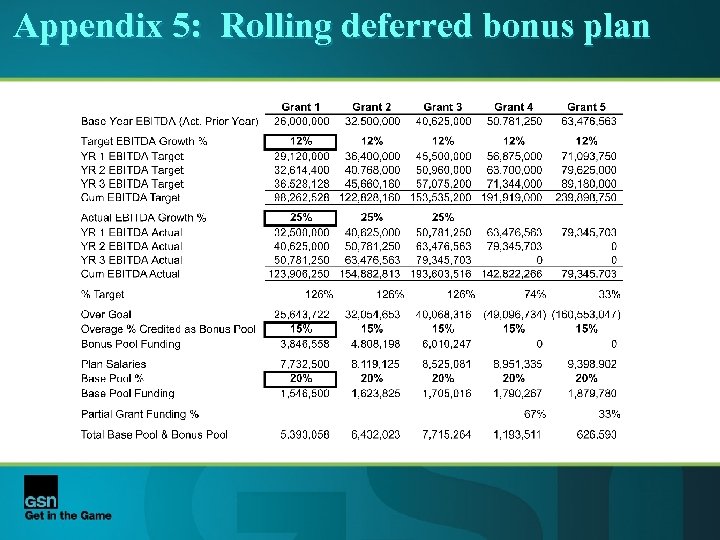

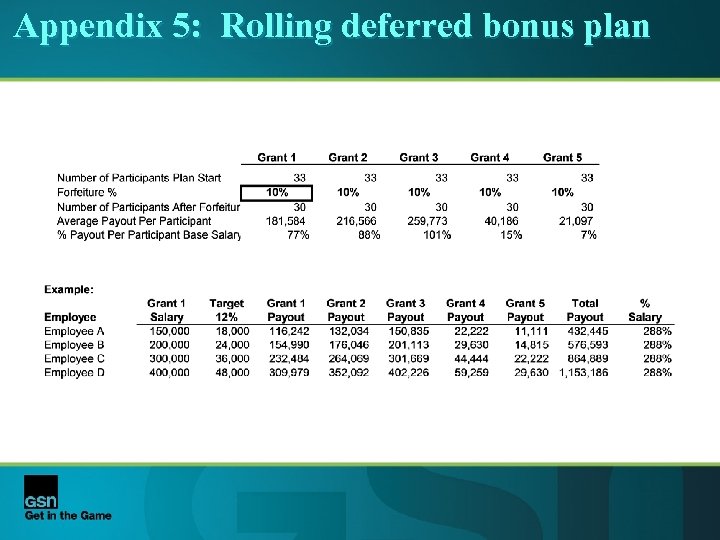

Build an equity culture • Current bonus programs have essentially no performance variability – Annual cost: $2. 5 million • “Profit-sharing” scheme anything but – Annual cost: $425 K • Need team focus on building long-term equity value, rather than annual EBITDA • Recent payout demonstrates problems with “valuation” approach to group compensation • IDEA: rolling deferred bonus plan (see appendix 5)

Governance

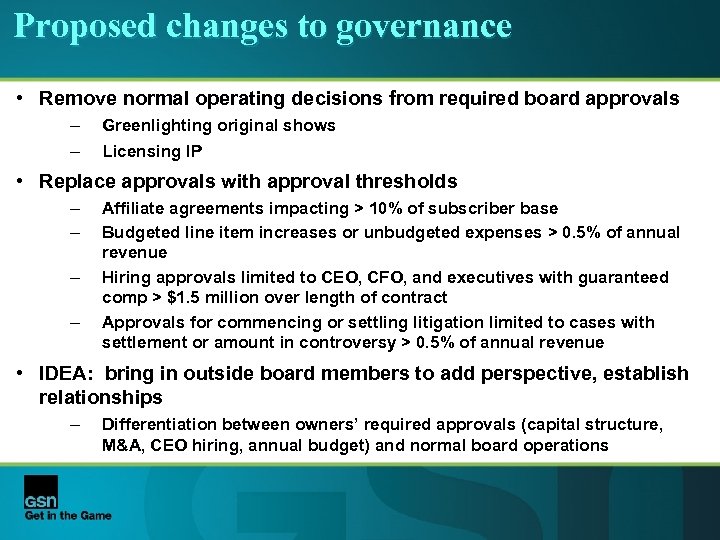

Proposed changes to governance • Remove normal operating decisions from required board approvals – – Greenlighting original shows Licensing IP • Replace approvals with approval thresholds – – Affiliate agreements impacting > 10% of subscriber base Budgeted line item increases or unbudgeted expenses > 0. 5% of annual revenue Hiring approvals limited to CEO, CFO, and executives with guaranteed comp > $1. 5 million over length of contract Approvals for commencing or settling litigation limited to cases with settlement or amount in controversy > 0. 5% of annual revenue • IDEA: bring in outside board members to add perspective, establish relationships – Differentiation between owners’ required approvals (capital structure, M&A, CEO hiring, annual budget) and normal board operations

Appendices

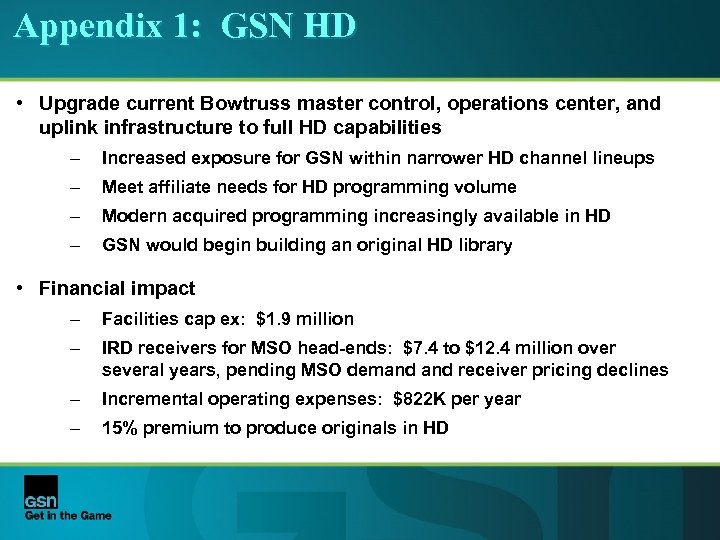

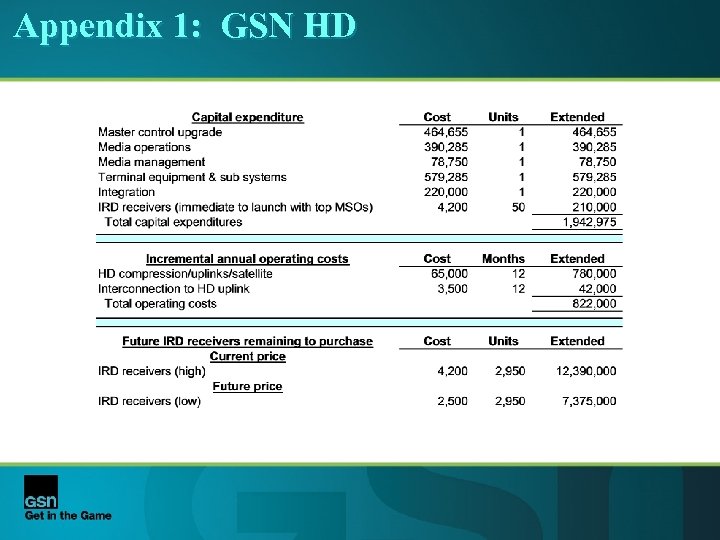

Appendix 1: GSN HD • Upgrade current Bowtruss master control, operations center, and uplink infrastructure to full HD capabilities – Increased exposure for GSN within narrower HD channel lineups – Meet affiliate needs for HD programming volume – Modern acquired programming increasingly available in HD – GSN would begin building an original HD library • Financial impact – Facilities cap ex: $1. 9 million – IRD receivers for MSO head-ends: $7. 4 to $12. 4 million over several years, pending MSO demand receiver pricing declines – Incremental operating expenses: $822 K per year – 15% premium to produce originals in HD

Appendix 1: GSN HD

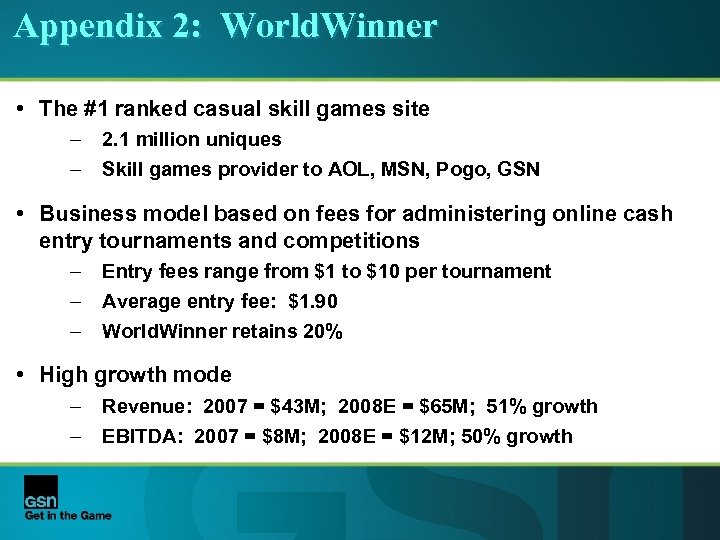

Appendix 2: World. Winner • The #1 ranked casual skill games site – – 2. 1 million uniques Skill games provider to AOL, MSN, Pogo, GSN • Business model based on fees for administering online cash entry tournaments and competitions – – – Entry fees range from $1 to $10 per tournament Average entry fee: $1. 90 World. Winner retains 20% • High growth mode – – Revenue: 2007 = $43 M; 2008 E = $65 M; 51% growth EBITDA: 2007 = $8 M; 2008 E = $12 M; 50% growth

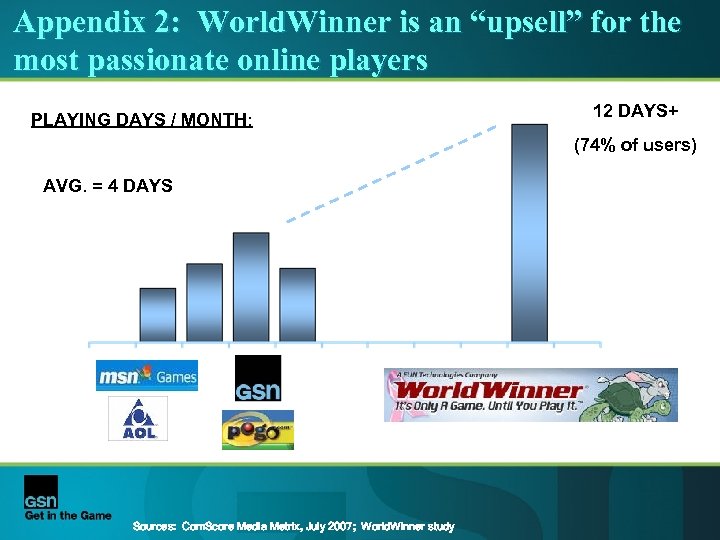

Appendix 2: World. Winner is an “upsell” for the most passionate online players PLAYING DAYS / MONTH: 12 DAYS+ (74% of users) AVG. = 4 DAYS Sources: Com. Score Media Metrix, July 2007; World. Winner study

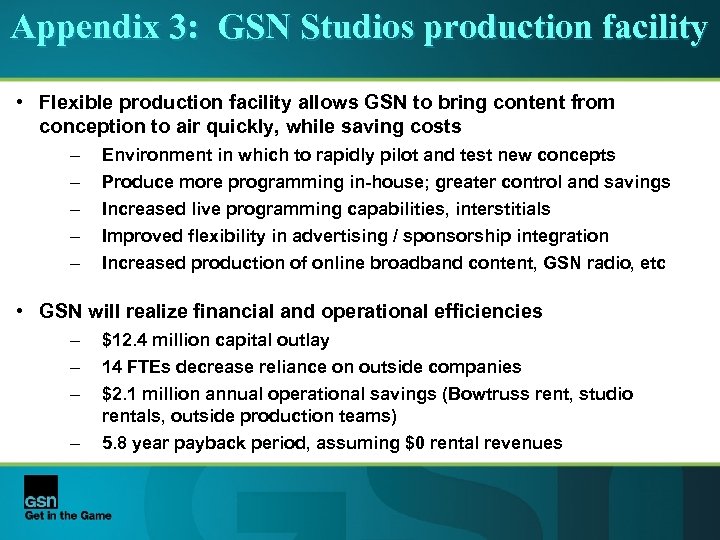

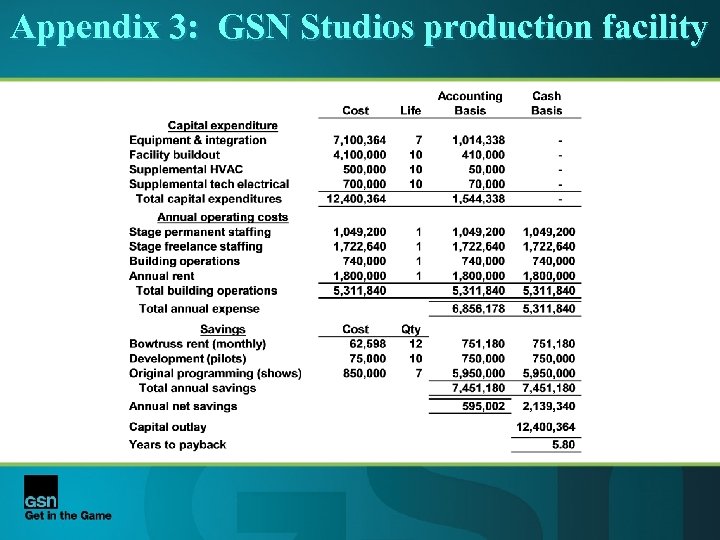

Appendix 3: GSN Studios production facility • Flexible production facility allows GSN to bring content from conception to air quickly, while saving costs – – – Environment in which to rapidly pilot and test new concepts Produce more programming in-house; greater control and savings Increased live programming capabilities, interstitials Improved flexibility in advertising / sponsorship integration Increased production of online broadband content, GSN radio, etc • GSN will realize financial and operational efficiencies – – $12. 4 million capital outlay 14 FTEs decrease reliance on outside companies $2. 1 million annual operational savings (Bowtruss rent, studio rentals, outside production teams) 5. 8 year payback period, assuming $0 rental revenues

Appendix 3: GSN Studios production facility

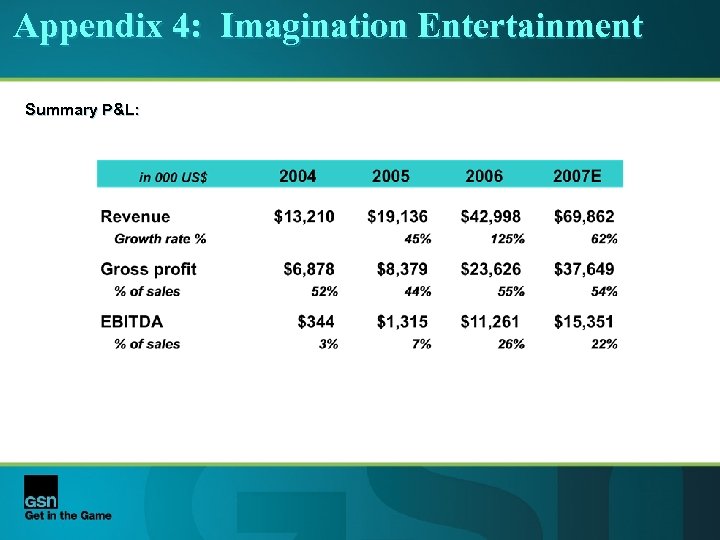

Appendix 4: Imagination Entertainment • A leading multi-platform games company – – – DVD-based games (considered inventor of category) Board games, puzzle books, desktop calendars, toys Produce TV, i. TV, radio, mobile, online, console games • Broad international footprint – – – Distribution to 16, 000 US retail outlets; 69, 000 more in 42 countries 170 employees in US, Europe, Australia 2007 E financials: $70 M revenue, $15 M EBITDA • Current GSN collaborations: – Lingo DVD game, “The Wrong Game” in original programming development, targeted ad buys for game show DVD/board games

Appendix 4: Imagination Entertainment Summary P&L:

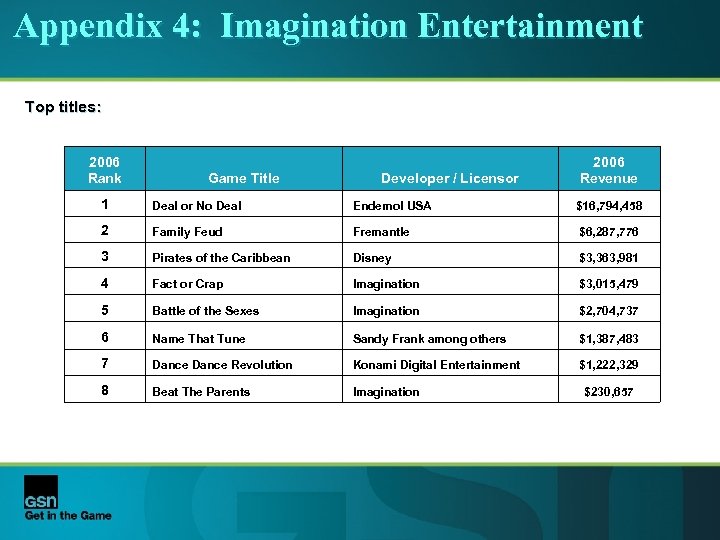

Appendix 4: Imagination Entertainment Top titles: 2006 Rank Game Title Developer / Licensor 2006 Revenue 1 Deal or No Deal Endemol USA $16, 794, 458 2 Family Feud Fremantle $6, 287, 776 3 Pirates of the Caribbean Disney $3, 363, 981 4 Fact or Crap Imagination $3, 015, 479 5 Battle of the Sexes Imagination $2, 704, 737 6 Name That Tune Sandy Frank among others $1, 387, 483 7 Dance Revolution Konami Digital Entertainment $1, 222, 329 8 Beat The Parents Imagination $230, 657

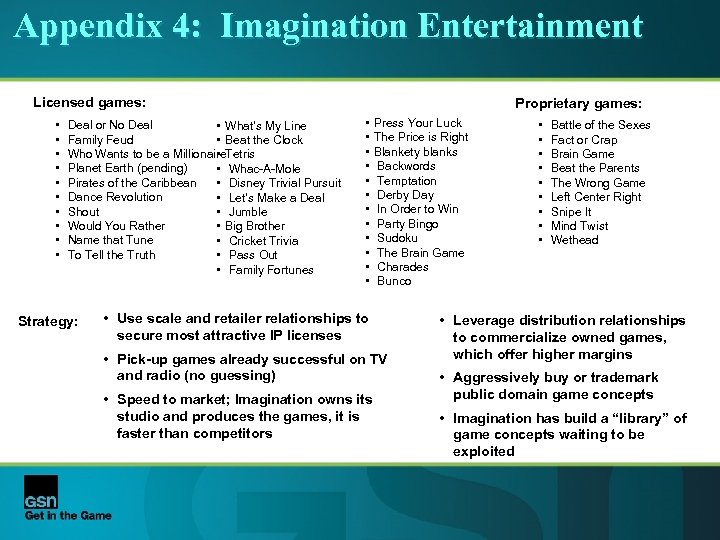

Appendix 4: Imagination Entertainment Licensed games: • • • Deal or No Deal • What’s My Line Family Feud • Beat the Clock Who Wants to be a Millionaire. Tetris • Planet Earth (pending) • Whac-A-Mole Pirates of the Caribbean • Disney Trivial Pursuit Dance Revolution • Let’s Make a Deal Shout • Jumble Would You Rather • Big Brother Name that Tune • Cricket Trivia To Tell the Truth • Pass Out • Family Fortunes Strategy: Proprietary games: • • • Press Your Luck The Price is Right Blankety blanks Backwords Temptation Derby Day In Order to Win Party Bingo Sudoku The Brain Game Charades Bunco • Use scale and retailer relationships to secure most attractive IP licenses • Pick-up games already successful on TV and radio (no guessing) • Speed to market; Imagination owns its studio and produces the games, it is faster than competitors • • • Battle of the Sexes Fact or Crap Brain Game Beat the Parents The Wrong Game Left Center Right Snipe It Mind Twist Wethead • Leverage distribution relationships to commercialize owned games, which offer higher margins • Aggressively buy or trademark public domain game concepts • Imagination has build a “library” of game concepts waiting to be exploited

Appendix 5: Rolling deferred bonus plan

Appendix 5: Rolling deferred bonus plan

b1ecc17e4070f43566626139565ca301.ppt