Heidrive - Pitch.pptx

- Количество слайдов: 46

DISCUSSION MATERIAL March 18, 2015 1

DISCUSSION MATERIAL March 18, 2015 1

Agenda 1 2 3 4 5 6 Introduction Investment case and positioning Preliminary valuation considerations and M&A market dynamics Potential buyers universe Process considerations Appendix 2

Agenda 1 2 3 4 5 6 Introduction Investment case and positioning Preliminary valuation considerations and M&A market dynamics Potential buyers universe Process considerations Appendix 2

Investment case and positioning 1 Heidrive features numerous promising value creation options making it an attractive target for a strategic or financial buyer with an active portfolio management approach Heidrive is a specialized niche player in the European market for servo and fractional horsepower (FHP) motors and with close long-term customer relationships and a clear market proposition 5 Under palero’s ownership, Heidrive was successfully split from its former parent’s systems business and set-up as a cost efficient and growth-oriented standalone operation 2 4 3 Broad portfolio of modular servo motors as well as wide selection of traditional FHP motors allows to cater to the requirements of a variety of niche markets and unique application areas Heidrive is well positioned among relevant niche providers of customizable FHP and servo motors through an advanced special purpose product offering 3

Investment case and positioning 1 Heidrive features numerous promising value creation options making it an attractive target for a strategic or financial buyer with an active portfolio management approach Heidrive is a specialized niche player in the European market for servo and fractional horsepower (FHP) motors and with close long-term customer relationships and a clear market proposition 5 Under palero’s ownership, Heidrive was successfully split from its former parent’s systems business and set-up as a cost efficient and growth-oriented standalone operation 2 4 3 Broad portfolio of modular servo motors as well as wide selection of traditional FHP motors allows to cater to the requirements of a variety of niche markets and unique application areas Heidrive is well positioned among relevant niche providers of customizable FHP and servo motors through an advanced special purpose product offering 3

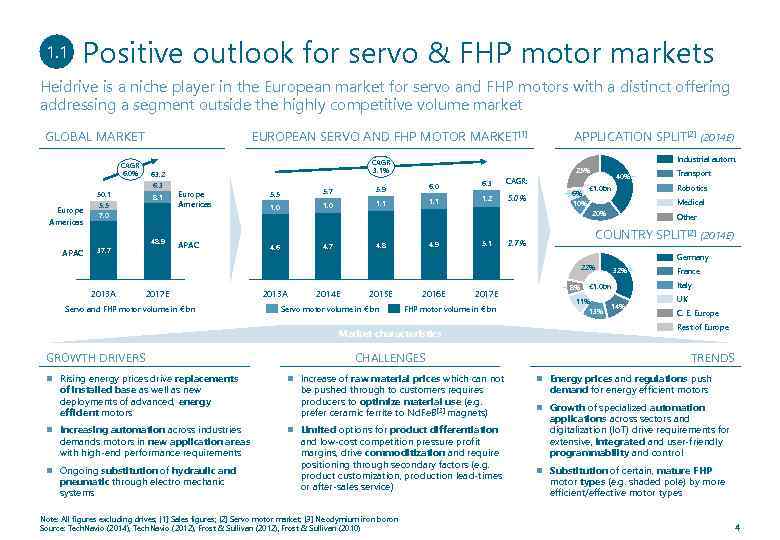

1. 1 Positive outlook for servo & FHP motor markets Heidrive is a niche player in the European market for servo and FHP motors with a distinct offering addressing a segment outside the highly competitive volume market GLOBAL MARKET CAGR 6. 0% 50. 1 Europe Americas APAC 5. 5 7. 0 37. 7 EUROPEAN SERVO AND FHP MOTOR MARKET[1] 6. 3 8. 1 48. 9 Industrial autom. CAGR 3. 1% 63. 2 Europe Americas APAC 25% 5. 5 5. 7 5. 9 6. 0 1. 1 6. 3 CAGR: 1. 2 5. 0% 6% 40% 4. 9 4. 8 5. 1 Medical 10% Other COUNTRY SPLIT[2] (2014 E) 2. 7% Germany 22% 2013 A Transport Robotics € 1. 0 bn 20% 4. 7 4. 6 APPLICATION SPLIT[2] (2014 E) 2017 E Servo and FHP motor volume in € bn 2013 A 2014 E 2015 E Servo motor volume in € bn 2016 E 2017 E FHP motor volume in € bn Market characteristics GROWTH DRIVERS Rising energy prices drive replacements of installed base as well as new deployments of advanced, energy efficient motors Increasing automation across industries demands motors in new application areas with high-end performance requirements Ongoing substitution of hydraulic and pneumatic through electro mechanic systems CHALLENGES Increase of raw material prices which can not be pushed through to customers requires producers to optimize material use (e. g. prefer ceramic ferrite to Nd. Fe. B [3] magnets) Limited options for product differentiation and low-cost competition pressure profit margins, drive commoditization and require positioning through secondary factors (e. g. product customization, production lead-times or after-sales service) Note: All figures excluding drives; [1] Sales figures; [2] Servo motor market; [3] Neodymium iron boron Source: Tech. Navio (2014), Tech. Navio (2012), Frost & Sullivan (2010) 8% 32% € 1. 0 bn 11% 13% 14% France Italy UK C. E. Europe Rest of Europe TRENDS Energy prices and regulations push demand for energy efficient motors Growth of specialized automation applications across sectors and digitalization (Io. T) drive requirements for extensive, integrated and user-friendly programmability and control Substitution of certain, mature FHP motor types (e. g. shaded pole) by more efficient/effective motor types 4

1. 1 Positive outlook for servo & FHP motor markets Heidrive is a niche player in the European market for servo and FHP motors with a distinct offering addressing a segment outside the highly competitive volume market GLOBAL MARKET CAGR 6. 0% 50. 1 Europe Americas APAC 5. 5 7. 0 37. 7 EUROPEAN SERVO AND FHP MOTOR MARKET[1] 6. 3 8. 1 48. 9 Industrial autom. CAGR 3. 1% 63. 2 Europe Americas APAC 25% 5. 5 5. 7 5. 9 6. 0 1. 1 6. 3 CAGR: 1. 2 5. 0% 6% 40% 4. 9 4. 8 5. 1 Medical 10% Other COUNTRY SPLIT[2] (2014 E) 2. 7% Germany 22% 2013 A Transport Robotics € 1. 0 bn 20% 4. 7 4. 6 APPLICATION SPLIT[2] (2014 E) 2017 E Servo and FHP motor volume in € bn 2013 A 2014 E 2015 E Servo motor volume in € bn 2016 E 2017 E FHP motor volume in € bn Market characteristics GROWTH DRIVERS Rising energy prices drive replacements of installed base as well as new deployments of advanced, energy efficient motors Increasing automation across industries demands motors in new application areas with high-end performance requirements Ongoing substitution of hydraulic and pneumatic through electro mechanic systems CHALLENGES Increase of raw material prices which can not be pushed through to customers requires producers to optimize material use (e. g. prefer ceramic ferrite to Nd. Fe. B [3] magnets) Limited options for product differentiation and low-cost competition pressure profit margins, drive commoditization and require positioning through secondary factors (e. g. product customization, production lead-times or after-sales service) Note: All figures excluding drives; [1] Sales figures; [2] Servo motor market; [3] Neodymium iron boron Source: Tech. Navio (2014), Tech. Navio (2012), Frost & Sullivan (2010) 8% 32% € 1. 0 bn 11% 13% 14% France Italy UK C. E. Europe Rest of Europe TRENDS Energy prices and regulations push demand for energy efficient motors Growth of specialized automation applications across sectors and digitalization (Io. T) drive requirements for extensive, integrated and user-friendly programmability and control Substitution of certain, mature FHP motor types (e. g. shaded pole) by more efficient/effective motor types 4

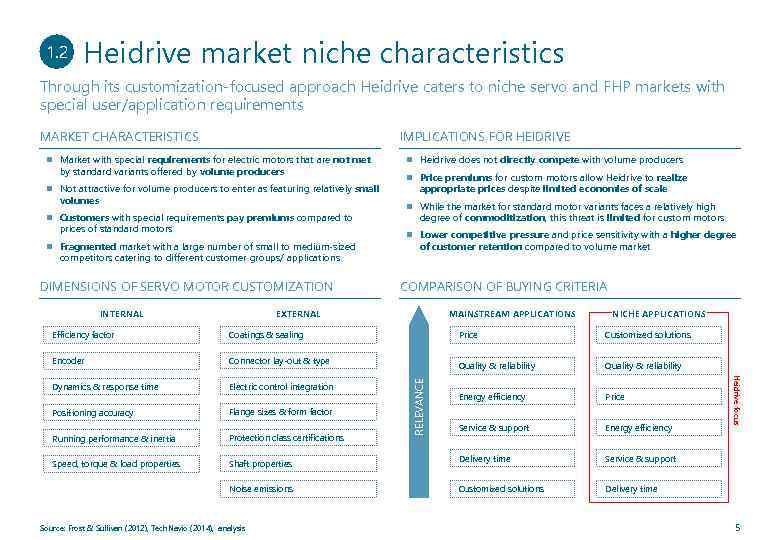

1. 2 Heidrive market niche characteristics Through its customization-focused approach Heidrive caters to niche servo and FHP markets with special user/application requirements MARKET CHARACTERISTICS IMPLICATIONS FOR HEIDRIVE Market with special requirements for electric motors that are not met by standard variants offered by volume producers Not attractive for volume producers to enter as featuring relatively small volumes Customers with special requirements pay premiums compared to prices of standard motors Fragmented market with a large number of small to medium-sized competitors catering to different customer groups/ applications DIMENSIONS OF SERVO MOTOR CUSTOMIZATION INTERNAL Heidrive does not directly compete with volume producers Price premiums for custom motors allow Heidrive to realize appropriate prices despite limited economies of scale While the market for standard motor variants faces a relatively high degree of commoditization, this threat is limited for custom motors Lower competitive pressure and price sensitivity with a higher degree of customer retention compared to volume market COMPARISON OF BUYING CRITERIA EXTERNAL Encoder Connector lay-out & type Dynamics & response time Electric control integration Positioning accuracy Flange sizes & form factor Running performance & inertia Protection class certifications Speed, torque & load properties Shaft properties Noise emissions Source: Frost & Sullivan (2012), Tech. Navio (2014), analysis Price Customized solutions Quality & reliability RELEVANCE Coatings & sealing NICHE APPLICATIONS Quality & reliability Energy efficiency Price Service & support Energy efficiency Delivery time Service & support Customized solutions Delivery time Heidrive focus Efficiency factor MAINSTREAM APPLICATIONS 5

1. 2 Heidrive market niche characteristics Through its customization-focused approach Heidrive caters to niche servo and FHP markets with special user/application requirements MARKET CHARACTERISTICS IMPLICATIONS FOR HEIDRIVE Market with special requirements for electric motors that are not met by standard variants offered by volume producers Not attractive for volume producers to enter as featuring relatively small volumes Customers with special requirements pay premiums compared to prices of standard motors Fragmented market with a large number of small to medium-sized competitors catering to different customer groups/ applications DIMENSIONS OF SERVO MOTOR CUSTOMIZATION INTERNAL Heidrive does not directly compete with volume producers Price premiums for custom motors allow Heidrive to realize appropriate prices despite limited economies of scale While the market for standard motor variants faces a relatively high degree of commoditization, this threat is limited for custom motors Lower competitive pressure and price sensitivity with a higher degree of customer retention compared to volume market COMPARISON OF BUYING CRITERIA EXTERNAL Encoder Connector lay-out & type Dynamics & response time Electric control integration Positioning accuracy Flange sizes & form factor Running performance & inertia Protection class certifications Speed, torque & load properties Shaft properties Noise emissions Source: Frost & Sullivan (2012), Tech. Navio (2014), analysis Price Customized solutions Quality & reliability RELEVANCE Coatings & sealing NICHE APPLICATIONS Quality & reliability Energy efficiency Price Service & support Energy efficiency Delivery time Service & support Customized solutions Delivery time Heidrive focus Efficiency factor MAINSTREAM APPLICATIONS 5

1. 3 Comprehensive application coverage Heidrive addresses – particularly through its newly developed servo motor generation – highly attractive application areas setting the basis for the future growth of the company HEIDRIVE EXPOSURE REQUIREMENTS GROWTH DRIVER APPLICATIONS (Selection) MARKET (2014 E[1]) INDUSTRIAL AUTOMATION Exp. volume: € 405 mn CAGR 2013 -17 E: 5. 1% TRANSPORT Exp. volume: € 205 mn CAGR 2013 -17 E: 5. 0% ROBOTICS Exp. volume: € 98 mn CAGR 2013 -17 E: 5. 0% MEDICAL TECHNOLOGY Exp. volume: € 58 mn CAGR 2013 -17 E: 5. 0% OTHER Exp. volume: € 259 mn CAGR 2013 -17 E: 5. 0% CNC machine tools Aeronautic controls Industrial robots Powered prosthesis Building automation Material handling and lifting Supplemental systems in ground transport Commercial and domestic robots Automated surgical instruments (Renewable) power generation Marine hatch control Increase of industrial output Substitution of hydraulic by electro mechanic systems Complexity of applications Growing adoption of robots Increasing automation of Increasing complexity esp. in Share of automatized tasks Optimized energy efficiency High reliability Rapid and precise reactions High accuracy and reliability High durability under volatile Endurance under high loads Optimized weight & volume High degree of connectivity Rapid and precise control Special corrosion resistance Low inflammableness & Optimized weight Aseptic surfaces/ IP in some applications € 4. 0 mn of € 22. 1 mn in sales in 2014 E (18%) protection certifications € 3. 1 mn of € 22. 1 mn in sales in 2014 E (14%) across application areas IP protection € 5. 3 mn of € 22. 1 mn in sales in 2014 E (24%) medical technology renewable energy production outdoor conditions IP protection certifications protection € 6. 2 mn of € 22. 1 mn in sales in 2014 E (28%) € 3. 3 mn of € 22. 1 mn in sales in 2014 E (15%) Through its diversified customer as well as sector exposure, the company faces relatively low clustered sales risk [1] European market Source: Company information, Bundesanzeiger, Fact. Set, analysis 6

1. 3 Comprehensive application coverage Heidrive addresses – particularly through its newly developed servo motor generation – highly attractive application areas setting the basis for the future growth of the company HEIDRIVE EXPOSURE REQUIREMENTS GROWTH DRIVER APPLICATIONS (Selection) MARKET (2014 E[1]) INDUSTRIAL AUTOMATION Exp. volume: € 405 mn CAGR 2013 -17 E: 5. 1% TRANSPORT Exp. volume: € 205 mn CAGR 2013 -17 E: 5. 0% ROBOTICS Exp. volume: € 98 mn CAGR 2013 -17 E: 5. 0% MEDICAL TECHNOLOGY Exp. volume: € 58 mn CAGR 2013 -17 E: 5. 0% OTHER Exp. volume: € 259 mn CAGR 2013 -17 E: 5. 0% CNC machine tools Aeronautic controls Industrial robots Powered prosthesis Building automation Material handling and lifting Supplemental systems in ground transport Commercial and domestic robots Automated surgical instruments (Renewable) power generation Marine hatch control Increase of industrial output Substitution of hydraulic by electro mechanic systems Complexity of applications Growing adoption of robots Increasing automation of Increasing complexity esp. in Share of automatized tasks Optimized energy efficiency High reliability Rapid and precise reactions High accuracy and reliability High durability under volatile Endurance under high loads Optimized weight & volume High degree of connectivity Rapid and precise control Special corrosion resistance Low inflammableness & Optimized weight Aseptic surfaces/ IP in some applications € 4. 0 mn of € 22. 1 mn in sales in 2014 E (18%) protection certifications € 3. 1 mn of € 22. 1 mn in sales in 2014 E (14%) across application areas IP protection € 5. 3 mn of € 22. 1 mn in sales in 2014 E (24%) medical technology renewable energy production outdoor conditions IP protection certifications protection € 6. 2 mn of € 22. 1 mn in sales in 2014 E (28%) € 3. 3 mn of € 22. 1 mn in sales in 2014 E (15%) Through its diversified customer as well as sector exposure, the company faces relatively low clustered sales risk [1] European market Source: Company information, Bundesanzeiger, Fact. Set, analysis 6

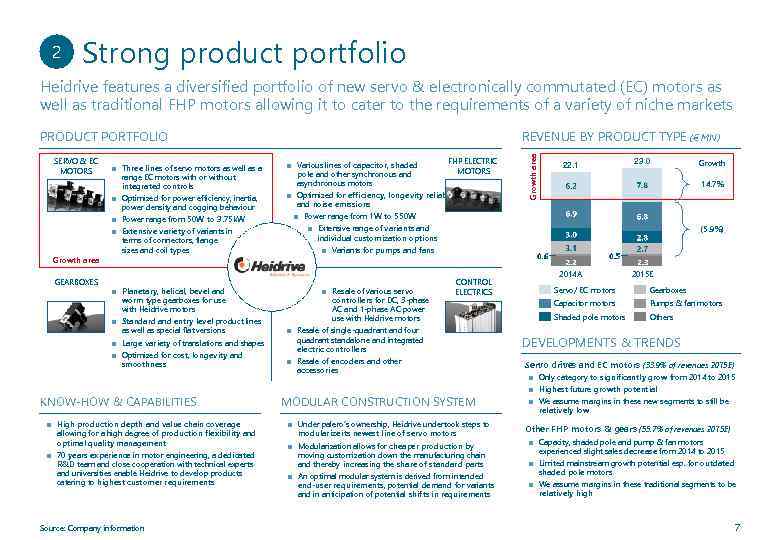

2 Strong product portfolio Heidrive features a diversified portfolio of new servo & electronically commutated (EC) motors as well as traditional FHP motors allowing it to cater to the requirements of a variety of niche markets SERVO & EC MOTORS REVENUE BY PRODUCT TYPE (€ MN) Three lines of servo motors as well as a range EC motors with or without integrated controls Optimized for power efficiency, inertia, power density and cogging behaviour Power range from 50 W to 3. 75 k. W Various lines of capacitor, shaded pole and other synchronous and asynchronous motors Optimized for efficiency, longevity reliability and noise emissions Extensive variety of variants in terms of connectors, flange sizes and coil types FHP ELECTRIC MOTORS Growth area PRODUCT PORTFOLIO 22. 1 23. 0 Growth 14. 7% Power range from 1 W to 550 W Extensive range of variants and individual customization options (5. 9%) Variants for pumps and fans Growth area GEARBOXES Planetary, helical, bevel and worm type gearboxes for use with Heidrive motors Standard and entry level product lines as well as special flat versions Large variety of translations and shapes Optimized for cost, longevity and smoothness Resale of various servo controllers for DC, 3 -phase AC and 1 -phase AC power use with Heidrive motors 2014 A CONTROL ELECTRICS Resale of single-quadrant and four quadrant standalone and integrated electric controllers Resale of encoders and other accessories 2015 E Servo/ EC motors Gearboxes Capacitor motors Pumps & fan motors Shaded pole motors Others DEVELOPMENTS & TRENDS Servo drives and EC motors (33. 9% of revenues 2015 E) High production depth and value chain coverage allowing for a high degree of production flexibility and optimal quality management 70 years experience in motor engineering, a dedicated R&D team and close cooperation with technical experts and universities enable Heidrive to develop products catering to highest customer requirements Source: Company information MODULAR CONSTRUCTION SYSTEM Under palero’s ownership, Heidrive undertook steps to modularize its newest line of servo motors Modularization allows for cheaper production by moving customization down the manufacturing chain and thereby increasing the share of standard parts An optimal modular system is derived from intended end-user requirements, potential demand for variants and in anticipation of potential shifts in requirements Only category to significantly grow from 2014 to 2015 KNOW-HOW & CAPABILITIES Highest future growth potential We assume margins in these new segments to still be relatively low Other FHP motors & gears (55. 7% of revenues 2015 E) Capacity, shaded pole and pump & fan motors experienced slight sales decrease from 2014 to 2015 Limited mainstream growth potential esp. for outdated shaded pole motors We assume margins in these traditional segments to be relatively high 7

2 Strong product portfolio Heidrive features a diversified portfolio of new servo & electronically commutated (EC) motors as well as traditional FHP motors allowing it to cater to the requirements of a variety of niche markets SERVO & EC MOTORS REVENUE BY PRODUCT TYPE (€ MN) Three lines of servo motors as well as a range EC motors with or without integrated controls Optimized for power efficiency, inertia, power density and cogging behaviour Power range from 50 W to 3. 75 k. W Various lines of capacitor, shaded pole and other synchronous and asynchronous motors Optimized for efficiency, longevity reliability and noise emissions Extensive variety of variants in terms of connectors, flange sizes and coil types FHP ELECTRIC MOTORS Growth area PRODUCT PORTFOLIO 22. 1 23. 0 Growth 14. 7% Power range from 1 W to 550 W Extensive range of variants and individual customization options (5. 9%) Variants for pumps and fans Growth area GEARBOXES Planetary, helical, bevel and worm type gearboxes for use with Heidrive motors Standard and entry level product lines as well as special flat versions Large variety of translations and shapes Optimized for cost, longevity and smoothness Resale of various servo controllers for DC, 3 -phase AC and 1 -phase AC power use with Heidrive motors 2014 A CONTROL ELECTRICS Resale of single-quadrant and four quadrant standalone and integrated electric controllers Resale of encoders and other accessories 2015 E Servo/ EC motors Gearboxes Capacitor motors Pumps & fan motors Shaded pole motors Others DEVELOPMENTS & TRENDS Servo drives and EC motors (33. 9% of revenues 2015 E) High production depth and value chain coverage allowing for a high degree of production flexibility and optimal quality management 70 years experience in motor engineering, a dedicated R&D team and close cooperation with technical experts and universities enable Heidrive to develop products catering to highest customer requirements Source: Company information MODULAR CONSTRUCTION SYSTEM Under palero’s ownership, Heidrive undertook steps to modularize its newest line of servo motors Modularization allows for cheaper production by moving customization down the manufacturing chain and thereby increasing the share of standard parts An optimal modular system is derived from intended end-user requirements, potential demand for variants and in anticipation of potential shifts in requirements Only category to significantly grow from 2014 to 2015 KNOW-HOW & CAPABILITIES Highest future growth potential We assume margins in these new segments to still be relatively low Other FHP motors & gears (55. 7% of revenues 2015 E) Capacity, shaded pole and pump & fan motors experienced slight sales decrease from 2014 to 2015 Limited mainstream growth potential esp. for outdated shaded pole motors We assume margins in these traditional segments to be relatively high 7

3 Distinctive competitive positioning Heidrive is positioned as a niche provider of high-end, customized electric servo and FHP motors primarily competing with various European small and medium size motor manufacturers EUROPEAN SERVO AND FHP MOTOR MARKET SEGMENTATION AND HEIDRIVE POSITIONING SERVO MOTORS FHP MOTORS DESCRIPTION 55. 7% of 2015 E revenues CUSTOM MOTORS 33. 9% of 2015 E revenues ■ Small volumes ■ Customizable ■ High-end requirements ■ STANDARD MOTORS LOW-COST MOTORS ■ Large volumes ■ High degree of customizability with active customercollaboration High production flexibility and low batch sizes Motors allowing for especially precise, reliable, quiet or energy efficient operation Customization and specific requirements allow for significant price premiums Variety of small to medium-sized, specialized European firms CHARACTERISTICS Standardized ■ Specialized use DESCRIPTION Source: Company information, analysis CHARACTERISTICS ■ Medium degree of motor customizability through modular variants with limited customer-collaboration Medium to highend requirements Standardization leads to significant cost advantages Price premiums are limited by ongoing commoditization Numerous variants Mostly subsidiaries or divisions of large and diversified multinational groups DESCRIPTION ■ Large volumes ■ Standardized ■ ■ CHARACTERISTICS Limited degree of motor customizability and customer-collaboration Low to medium requirements Mostly independent players from emerging Asia Technology of Asian firms rapidly advancing Limited variants Limited market success in US and Europe due to lack of brand awareness and sales channels 8

3 Distinctive competitive positioning Heidrive is positioned as a niche provider of high-end, customized electric servo and FHP motors primarily competing with various European small and medium size motor manufacturers EUROPEAN SERVO AND FHP MOTOR MARKET SEGMENTATION AND HEIDRIVE POSITIONING SERVO MOTORS FHP MOTORS DESCRIPTION 55. 7% of 2015 E revenues CUSTOM MOTORS 33. 9% of 2015 E revenues ■ Small volumes ■ Customizable ■ High-end requirements ■ STANDARD MOTORS LOW-COST MOTORS ■ Large volumes ■ High degree of customizability with active customercollaboration High production flexibility and low batch sizes Motors allowing for especially precise, reliable, quiet or energy efficient operation Customization and specific requirements allow for significant price premiums Variety of small to medium-sized, specialized European firms CHARACTERISTICS Standardized ■ Specialized use DESCRIPTION Source: Company information, analysis CHARACTERISTICS ■ Medium degree of motor customizability through modular variants with limited customer-collaboration Medium to highend requirements Standardization leads to significant cost advantages Price premiums are limited by ongoing commoditization Numerous variants Mostly subsidiaries or divisions of large and diversified multinational groups DESCRIPTION ■ Large volumes ■ Standardized ■ ■ CHARACTERISTICS Limited degree of motor customizability and customer-collaboration Low to medium requirements Mostly independent players from emerging Asia Technology of Asian firms rapidly advancing Limited variants Limited market success in US and Europe due to lack of brand awareness and sales channels 8

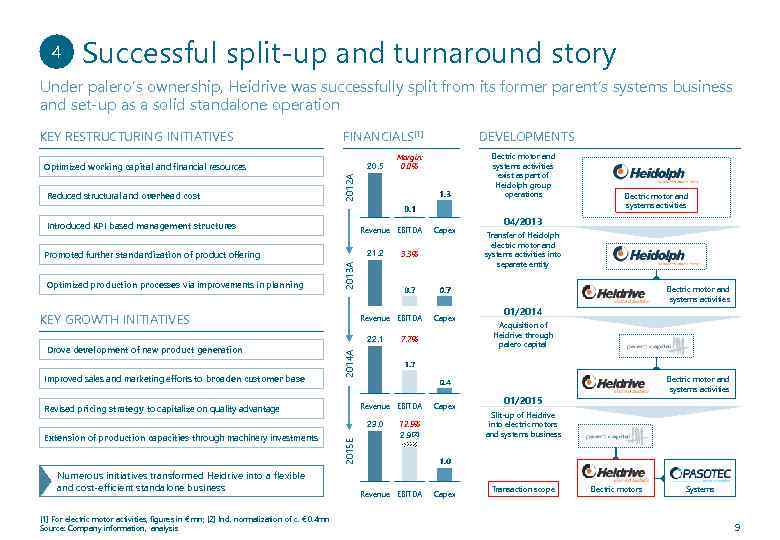

4 Successful split-up and turnaround story Under palero’s ownership, Heidrive was successfully split from its former parent’s systems business and set-up as a solid standalone operation KEY RESTRUCTURING INITIATIVES FINANCIALS[1] Optimized working capital and financial resources Introduced KPI based management structures Revenue EBITDA 21. 2 KEY GROWTH INITIATIVES Improved sales and marketing efforts to broaden customer base 22. 1 [1] For electric motor activities, figures in € mn; [2] Incl. normalization of c. € 0. 4 mn Source: Company information, analysis Capex 7. 7% Revenue EBITDA 2015 E 23. 0 Numerous initiatives transformed Heidrive into a flexible and cost-efficient standalone business 04/2013 Transfer of Heidolph electric motor and systems activities into separate entity Electric motor and systems activities Revenue EBITDA Revised pricing strategy to capitalize on quality advantage Extension of production capacities through machinery investments 3. 3% Electric motor and systems activities 01/2014 Acquisition of Heidrive through palero capital 2014 A Drove development of new product generation Capex 2013 A Promoted further standardization of product offering Optimized production processes via improvements in planning Electric motor and systems activities exist as part of Heidolph group operations Margin: 0. 0% 2012 A Reduced structural and overhead cost 20. 5 DEVELOPMENTS Capex 12. 5% 2. 9[2] Revenue EBITDA Capex Electric motor and systems activities 01/2015 Slit-up of Heidrive into electric motors and systems business Transaction scope Electric motors Systems 9

4 Successful split-up and turnaround story Under palero’s ownership, Heidrive was successfully split from its former parent’s systems business and set-up as a solid standalone operation KEY RESTRUCTURING INITIATIVES FINANCIALS[1] Optimized working capital and financial resources Introduced KPI based management structures Revenue EBITDA 21. 2 KEY GROWTH INITIATIVES Improved sales and marketing efforts to broaden customer base 22. 1 [1] For electric motor activities, figures in € mn; [2] Incl. normalization of c. € 0. 4 mn Source: Company information, analysis Capex 7. 7% Revenue EBITDA 2015 E 23. 0 Numerous initiatives transformed Heidrive into a flexible and cost-efficient standalone business 04/2013 Transfer of Heidolph electric motor and systems activities into separate entity Electric motor and systems activities Revenue EBITDA Revised pricing strategy to capitalize on quality advantage Extension of production capacities through machinery investments 3. 3% Electric motor and systems activities 01/2014 Acquisition of Heidrive through palero capital 2014 A Drove development of new product generation Capex 2013 A Promoted further standardization of product offering Optimized production processes via improvements in planning Electric motor and systems activities exist as part of Heidolph group operations Margin: 0. 0% 2012 A Reduced structural and overhead cost 20. 5 DEVELOPMENTS Capex 12. 5% 2. 9[2] Revenue EBITDA Capex Electric motor and systems activities 01/2015 Slit-up of Heidrive into electric motors and systems business Transaction scope Electric motors Systems 9

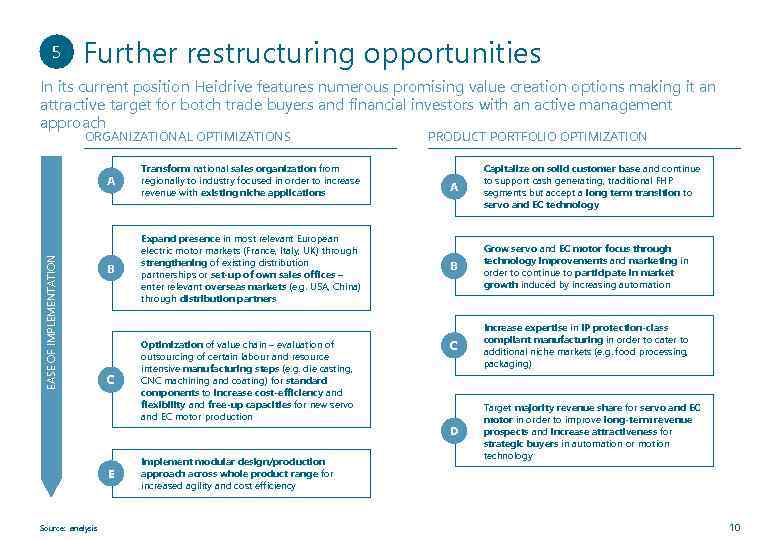

5 Further restructuring opportunities In its current position Heidrive features numerous promising value creation options making it an attractive target for botch trade buyers and financial investors with an active management approach ORGANIZATIONAL OPTIMIZATIONS A Transform national sales organization from regionally to industry focused in order to increase revenue with existing niche applications B Expand presence in most relevant European electric motor markets (France, Italy, UK) through strengthening of existing distribution partnerships or set-up of own sales offices – enter relevant overseas markets (e. g. USA, China) through distribution partners PRODUCT PORTFOLIO OPTIMIZATION EASE OF IMPLEMENTATION E Source: analysis Implement modular design/production approach across whole product range for increased agility and cost efficiency B Grow servo and EC motor focus through technology improvements and marketing in order to continue to participate in market growth induced by increasing automation C Increase expertise in IP protection-class compliant manufacturing in order to cater to additional niche markets (e. g. food processing, packaging) D C Optimization of value chain – evaluation of outsourcing of certain labour and resource intensive manufacturing steps (e. g. die casting, CNC machining and coating) for standard components to increase cost-efficiency and flexibility and free-up capacities for new servo and EC motor production A Capitalize on solid customer base and continue to support cash generating, traditional FHP segments but accept a long term transition to servo and EC technology Target majority revenue share for servo and EC motor in order to improve long-term revenue prospects and increase attractiveness for strategic buyers in automation or motion technology 10

5 Further restructuring opportunities In its current position Heidrive features numerous promising value creation options making it an attractive target for botch trade buyers and financial investors with an active management approach ORGANIZATIONAL OPTIMIZATIONS A Transform national sales organization from regionally to industry focused in order to increase revenue with existing niche applications B Expand presence in most relevant European electric motor markets (France, Italy, UK) through strengthening of existing distribution partnerships or set-up of own sales offices – enter relevant overseas markets (e. g. USA, China) through distribution partners PRODUCT PORTFOLIO OPTIMIZATION EASE OF IMPLEMENTATION E Source: analysis Implement modular design/production approach across whole product range for increased agility and cost efficiency B Grow servo and EC motor focus through technology improvements and marketing in order to continue to participate in market growth induced by increasing automation C Increase expertise in IP protection-class compliant manufacturing in order to cater to additional niche markets (e. g. food processing, packaging) D C Optimization of value chain – evaluation of outsourcing of certain labour and resource intensive manufacturing steps (e. g. die casting, CNC machining and coating) for standard components to increase cost-efficiency and flexibility and free-up capacities for new servo and EC motor production A Capitalize on solid customer base and continue to support cash generating, traditional FHP segments but accept a long term transition to servo and EC technology Target majority revenue share for servo and EC motor in order to improve long-term revenue prospects and increase attractiveness for strategic buyers in automation or motion technology 10

Potential investor concerns and responses In order to sharpen the equity story, we recommend to address potential investor concerns that Heidrive could be exposed to POTENTIAL CONCERNS POTENTIAL MITIGANTS ■ Heidrive’s product portfolio is well-balanced – Featuring an assortment of FHP motors, catering to the special requirements of a long standing customer base as well as servo motors meeting special customer requirements and steadily growing its market presence ■ Heidrive’s value proposition is to provide high quality motors optimized for performance and/or cost depending on customer preferences offering superior value from a TCO perspective through longevity, low maintenance requirements and a high degree of efficiency ■ “Heidrive cannot compete with volume players” Heidrive is a minor player and thus not able to compete with the numerous larger volume producers who feature more efficient manufacturing, R&D and sales operations Heidrive does not directly compete with volume producers of servo and FHP motors as the company is focused on catering to niche-markets that are not attractive for larger players ■ Through a high degree of own development expertise as well as a limited speed/ complexity of technology innovation in the electric motor market, Heidrive is not exposed to significant risk of being left behind larger competitors in terms of technology “Servo motors are becoming commoditized” With limited options for product differentiation, Heidrive is not going to be able to realize attractive margins ■ Commoditization is an issue for volume manufacturers of electric motors to some extent – however, Heidrive caters to niche-applications with custom requirement where commoditization is of limited relevance “Restructuring case with no history” Limited holding period does not provide a sufficient earnings history or proof of effectiveness for standalone business ■ 2014 A figures highlighted the effectiveness of palero’s restructuring initiatives ■ A scheduled signing of the transaction in at the end of 2015 will allow for the provision of current trading performance backing the business plan and successful turnaround story “Limited electric drive and control expertise” Heidrive has limited expertise concerning essential and complementary servo drive and electric control units ■ Unbundled provision of motors and drives is common as these products are largely interoperable and manufacturing requires expertise in two significantly different areas ■ Cooperation between manufacturers of motors and drives allows for realization of crossselling and distribution synergies, successfully implemented by Heidrive with LTi Motion “High capex associated with production depth” Heidrive’s high degree of value chain integration requires high capex in order to expand production capacities ■ High degree of value-chain integration allows for optimal quality control and a high degree of production flexibility which is essential to producing custom drives ■ A new owner still has the option to optimize the level of value chain integration and manufacturing flexibility “Incoherent product portfolio and value proposition” Heidrive’s product portfolio is too broad/not focused and contains outdated products (e. g. shaded pole motors), its value proposition to customers is not consistent Source: analysis 11

Potential investor concerns and responses In order to sharpen the equity story, we recommend to address potential investor concerns that Heidrive could be exposed to POTENTIAL CONCERNS POTENTIAL MITIGANTS ■ Heidrive’s product portfolio is well-balanced – Featuring an assortment of FHP motors, catering to the special requirements of a long standing customer base as well as servo motors meeting special customer requirements and steadily growing its market presence ■ Heidrive’s value proposition is to provide high quality motors optimized for performance and/or cost depending on customer preferences offering superior value from a TCO perspective through longevity, low maintenance requirements and a high degree of efficiency ■ “Heidrive cannot compete with volume players” Heidrive is a minor player and thus not able to compete with the numerous larger volume producers who feature more efficient manufacturing, R&D and sales operations Heidrive does not directly compete with volume producers of servo and FHP motors as the company is focused on catering to niche-markets that are not attractive for larger players ■ Through a high degree of own development expertise as well as a limited speed/ complexity of technology innovation in the electric motor market, Heidrive is not exposed to significant risk of being left behind larger competitors in terms of technology “Servo motors are becoming commoditized” With limited options for product differentiation, Heidrive is not going to be able to realize attractive margins ■ Commoditization is an issue for volume manufacturers of electric motors to some extent – however, Heidrive caters to niche-applications with custom requirement where commoditization is of limited relevance “Restructuring case with no history” Limited holding period does not provide a sufficient earnings history or proof of effectiveness for standalone business ■ 2014 A figures highlighted the effectiveness of palero’s restructuring initiatives ■ A scheduled signing of the transaction in at the end of 2015 will allow for the provision of current trading performance backing the business plan and successful turnaround story “Limited electric drive and control expertise” Heidrive has limited expertise concerning essential and complementary servo drive and electric control units ■ Unbundled provision of motors and drives is common as these products are largely interoperable and manufacturing requires expertise in two significantly different areas ■ Cooperation between manufacturers of motors and drives allows for realization of crossselling and distribution synergies, successfully implemented by Heidrive with LTi Motion “High capex associated with production depth” Heidrive’s high degree of value chain integration requires high capex in order to expand production capacities ■ High degree of value-chain integration allows for optimal quality control and a high degree of production flexibility which is essential to producing custom drives ■ A new owner still has the option to optimize the level of value chain integration and manufacturing flexibility “Incoherent product portfolio and value proposition” Heidrive’s product portfolio is too broad/not focused and contains outdated products (e. g. shaded pole motors), its value proposition to customers is not consistent Source: analysis 11

Agenda 1 2 3 4 5 6 Introduction Investment case and positioning Preliminary valuation considerations and M&A market dynamics Potential buyers universe Process considerations Appendix 12

Agenda 1 2 3 4 5 6 Introduction Investment case and positioning Preliminary valuation considerations and M&A market dynamics Potential buyers universe Process considerations Appendix 12

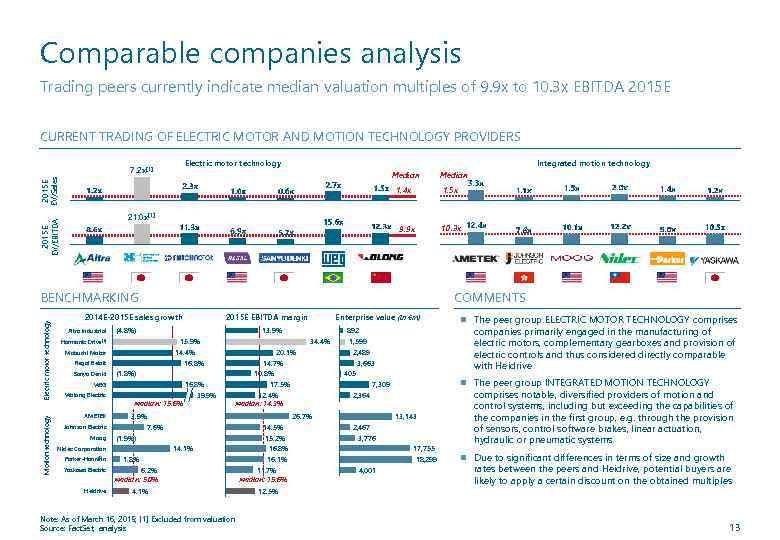

Comparable companies analysis Trading peers currently indicate median valuation multiples of 9. 9 x to 10. 3 x EBITDA 2015 E CURRENT TRADING OF ELECTRIC MOTOR AND MOTION TECHNOLOGY PROVIDERS Electric motor technology 7. 2 x[1] Integrated motion technology 2015 E EV/Sales Median 1. 5 x 1. 4 x 2015 E EV/EBITDA 21. 0 x[1] 10. 3 x 9. 9 x Electric motor technology BENCHMARKING Motion technology Median COMMENTS 2014 E-2015 E sales growth Altra Industrial 14. 4% 16. 8% Regal Beloit 16. 8% Median: 15. 6% Yaskawa Electric Heidrive 1, 599 2, 489 3, 663 405 17. 5% 2, 364 26. 7% 14. 5% (1. 9%) 14. 1% 1. 8% 6. 2% Median: 5. 0% 4. 1% Note: As of March 16, 2015; [1] Excluded from valuation Source: Fact. Set, analysis 15. 2% 16. 8% 16. 1% 11. 7% Median: 15. 6% The peer group INTEGRATED MOTION TECHNOLOGY 7, 309 12. 4% Median: 14. 3% 7. 6% Nidec Corporation Parker-Hannifin 39. 9% 3. 9% Johnson Electric Moog 20. 1% 14. 7% 10. 8% (1. 8%) WEG AMETEK 34. 4% 13, 143 2, 467 3, 776 17, 755 18, 299 4, 001 The peer group ELECTRIC MOTOR TECHNOLOGY comprises companies primarily engaged in the manufacturing of electric motors, complementary gearboxes and provision of electric controls and thus considered directly comparable with Heidrive 892 15. 9% Mabuchi Motor Wolong Electric Enterprise value (in €m) 13. 9% Harmonic Drive[1] Sanyo Denki 2015 E EBITDA margin (4. 8%) comprises notable, diversified providers of motion and control systems, including but exceeding the capabilities of the companies in the first group, e. g. through the provision of sensors, control software brakes, linear actuation, hydraulic or pneumatic systems Due to significant differences in terms of size and growth rates between the peers and Heidrive, potential buyers are likely to apply a certain discount on the obtained multiples 12. 5% 13

Comparable companies analysis Trading peers currently indicate median valuation multiples of 9. 9 x to 10. 3 x EBITDA 2015 E CURRENT TRADING OF ELECTRIC MOTOR AND MOTION TECHNOLOGY PROVIDERS Electric motor technology 7. 2 x[1] Integrated motion technology 2015 E EV/Sales Median 1. 5 x 1. 4 x 2015 E EV/EBITDA 21. 0 x[1] 10. 3 x 9. 9 x Electric motor technology BENCHMARKING Motion technology Median COMMENTS 2014 E-2015 E sales growth Altra Industrial 14. 4% 16. 8% Regal Beloit 16. 8% Median: 15. 6% Yaskawa Electric Heidrive 1, 599 2, 489 3, 663 405 17. 5% 2, 364 26. 7% 14. 5% (1. 9%) 14. 1% 1. 8% 6. 2% Median: 5. 0% 4. 1% Note: As of March 16, 2015; [1] Excluded from valuation Source: Fact. Set, analysis 15. 2% 16. 8% 16. 1% 11. 7% Median: 15. 6% The peer group INTEGRATED MOTION TECHNOLOGY 7, 309 12. 4% Median: 14. 3% 7. 6% Nidec Corporation Parker-Hannifin 39. 9% 3. 9% Johnson Electric Moog 20. 1% 14. 7% 10. 8% (1. 8%) WEG AMETEK 34. 4% 13, 143 2, 467 3, 776 17, 755 18, 299 4, 001 The peer group ELECTRIC MOTOR TECHNOLOGY comprises companies primarily engaged in the manufacturing of electric motors, complementary gearboxes and provision of electric controls and thus considered directly comparable with Heidrive 892 15. 9% Mabuchi Motor Wolong Electric Enterprise value (in €m) 13. 9% Harmonic Drive[1] Sanyo Denki 2015 E EBITDA margin (4. 8%) comprises notable, diversified providers of motion and control systems, including but exceeding the capabilities of the companies in the first group, e. g. through the provision of sensors, control software brakes, linear actuation, hydraulic or pneumatic systems Due to significant differences in terms of size and growth rates between the peers and Heidrive, potential buyers are likely to apply a certain discount on the obtained multiples 12. 5% 13

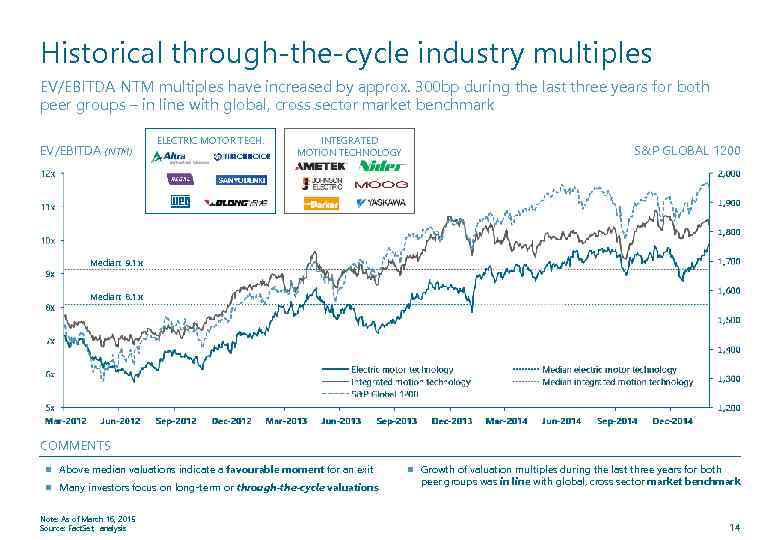

Historical through-the-cycle industry multiples EV/EBITDA NTM multiples have increased by approx. 300 bp during the last three years for both peer groups – in line with global, cross sector market benchmark EV/EBITDA (NTM) ELECTRIC MOTOR TECH. INTEGRATED MOTION TECHNOLOGY S&P GLOBAL 1200 Median: 9. 1 x Median: 8. 1 x COMMENTS Above median valuations indicate a favourable moment for an exit Many investors focus on long-term or through-the-cycle valuations Note: As of March 16, 2015 Source: Fact. Set, analysis Growth of valuation multiples during the last three years for both peer groups was in line with global, cross sector market benchmark 14

Historical through-the-cycle industry multiples EV/EBITDA NTM multiples have increased by approx. 300 bp during the last three years for both peer groups – in line with global, cross sector market benchmark EV/EBITDA (NTM) ELECTRIC MOTOR TECH. INTEGRATED MOTION TECHNOLOGY S&P GLOBAL 1200 Median: 9. 1 x Median: 8. 1 x COMMENTS Above median valuations indicate a favourable moment for an exit Many investors focus on long-term or through-the-cycle valuations Note: As of March 16, 2015 Source: Fact. Set, analysis Growth of valuation multiples during the last three years for both peer groups was in line with global, cross sector market benchmark 14

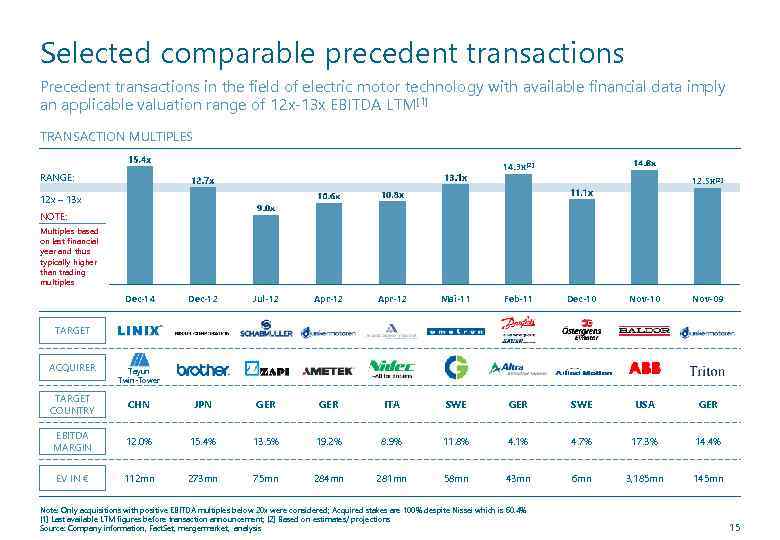

Selected comparable precedent transactions Precedent transactions in the field of electric motor technology with available financial data imply an applicable valuation range of 12 x-13 x EBITDA LTM[1] TRANSACTION MULTIPLES 14. 3 x[2] RANGE: 12. 5 x[2] 12 x – 13 x NOTE: Multiples based on last financial year and thus typically higher than trading multiples Dec-14 Dec-12 Jul-12 Apr-12 Mai-11 Feb-11 Dec-10 Nov-09 TARGET ACQUIRER Tayun Twin-Tower TARGET COUNTRY CHN JPN GER ITA SWE GER SWE USA GER EBITDA MARGIN 12. 0% 15. 4% 13. 5% 19. 2% 8. 9% 11. 8% 4. 1% 4. 7% 17. 3% 14. 4% EV IN € 112 mn 273 mn 75 mn 284 mn 281 mn 58 mn 43 mn 6 mn 3, 185 mn 145 mn Note: Only acquisitions with positive EBITDA multiples below 20 x were considered; Acquired stakes are 100% despite Nissei which is 60. 4% [1] Last available LTM figures before transaction announcement; [2] Based on estimates/ projections Source: Company information, Fact. Set, mergermarket, analysis 15

Selected comparable precedent transactions Precedent transactions in the field of electric motor technology with available financial data imply an applicable valuation range of 12 x-13 x EBITDA LTM[1] TRANSACTION MULTIPLES 14. 3 x[2] RANGE: 12. 5 x[2] 12 x – 13 x NOTE: Multiples based on last financial year and thus typically higher than trading multiples Dec-14 Dec-12 Jul-12 Apr-12 Mai-11 Feb-11 Dec-10 Nov-09 TARGET ACQUIRER Tayun Twin-Tower TARGET COUNTRY CHN JPN GER ITA SWE GER SWE USA GER EBITDA MARGIN 12. 0% 15. 4% 13. 5% 19. 2% 8. 9% 11. 8% 4. 1% 4. 7% 17. 3% 14. 4% EV IN € 112 mn 273 mn 75 mn 284 mn 281 mn 58 mn 43 mn 6 mn 3, 185 mn 145 mn Note: Only acquisitions with positive EBITDA multiples below 20 x were considered; Acquired stakes are 100% despite Nissei which is 60. 4% [1] Last available LTM figures before transaction announcement; [2] Based on estimates/ projections Source: Company information, Fact. Set, mergermarket, analysis 15

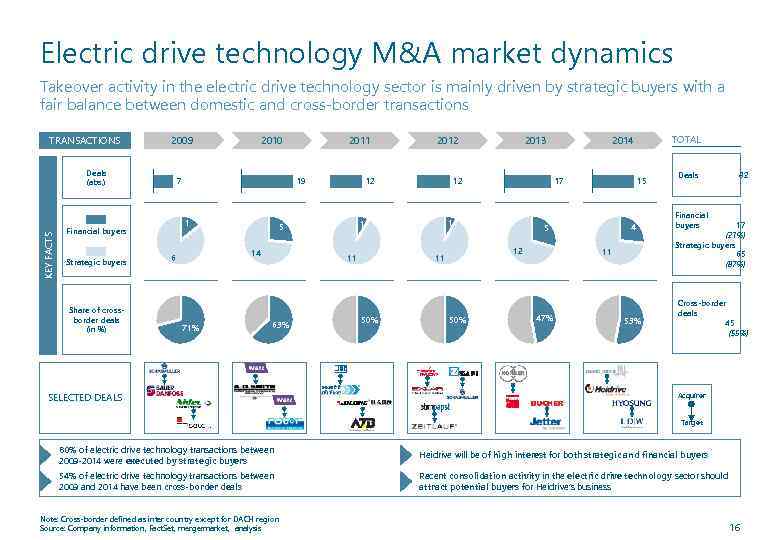

Electric drive technology M&A market dynamics Takeover activity in the electric drive technology sector is mainly driven by strategic buyers with a fair balance between domestic and cross-border transactions TRANSACTIONS 2009 KEY FACTS Deals (abs. ) 7 Share of crossborder deals (in %) 2011 19 1 Financial buyers Strategic buyers 2010 71% 12 11 63% SELECTED DEALS 50% 15 4 5 12 TOTAL 2014 17 1 11 50% 2013 12 1 5 14 6 2012 11 47% 53% Deals 82 Financial buyers 17 (21%) Strategic buyers 65 (87%) Cross-border deals 45 (55%) Acquirer Target 80% of electric drive technology transactions between 2009 -2014 were executed by strategic buyers Heidrive will be of high interest for both strategic and financial buyers 54% of electric drive technology transactions between 2009 and 2014 have been cross-border deals Recent consolidation activity in the electric drive technology sector should attract potential buyers for Heidrive’s business Note: Cross-border defined as inter country except for DACH region Source: Company information, Fact. Set, mergermarket, analysis 16

Electric drive technology M&A market dynamics Takeover activity in the electric drive technology sector is mainly driven by strategic buyers with a fair balance between domestic and cross-border transactions TRANSACTIONS 2009 KEY FACTS Deals (abs. ) 7 Share of crossborder deals (in %) 2011 19 1 Financial buyers Strategic buyers 2010 71% 12 11 63% SELECTED DEALS 50% 15 4 5 12 TOTAL 2014 17 1 11 50% 2013 12 1 5 14 6 2012 11 47% 53% Deals 82 Financial buyers 17 (21%) Strategic buyers 65 (87%) Cross-border deals 45 (55%) Acquirer Target 80% of electric drive technology transactions between 2009 -2014 were executed by strategic buyers Heidrive will be of high interest for both strategic and financial buyers 54% of electric drive technology transactions between 2009 and 2014 have been cross-border deals Recent consolidation activity in the electric drive technology sector should attract potential buyers for Heidrive’s business Note: Cross-border defined as inter country except for DACH region Source: Company information, Fact. Set, mergermarket, analysis 16

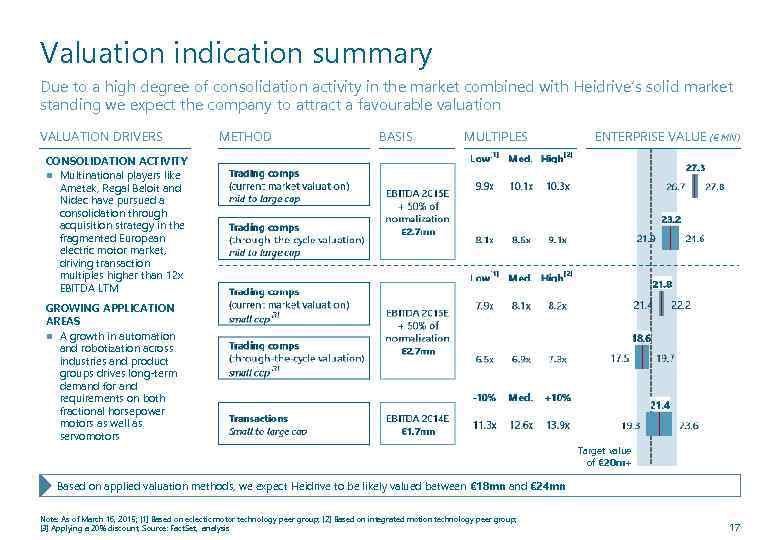

Valuation indication summary Due to a high degree of consolidation activity in the market combined with Heidrive’s solid market standing we expect the company to attract a favourable valuation VALUATION DRIVERS METHOD BASIS MULTIPLES ENTERPRISE VALUE (€ MN) CONSOLIDATION ACTIVITY Multinational players like Ametek, Regal Beloit and Nidec have pursued a consolidation through acquisition strategy in the fragmented European electric motor market, driving transaction multiples higher than 12 x EBITDA LTM GROWING APPLICATION AREAS A growth in automation and robotization across industries and product groups drives long-term demand for and requirements on both fractional horsepower motors as well as servomotors Target value of € 20 m+ Based on applied valuation methods, we expect Heidrive to be likely valued between € 18 mn and € 24 mn Note: As of March 16, 2015; [1] Based on eclectic motor technology peer group; [2] Based on integrated motion technology peer group; [3] Applying a 20% discount; Source: Fact. Set, analysis 17

Valuation indication summary Due to a high degree of consolidation activity in the market combined with Heidrive’s solid market standing we expect the company to attract a favourable valuation VALUATION DRIVERS METHOD BASIS MULTIPLES ENTERPRISE VALUE (€ MN) CONSOLIDATION ACTIVITY Multinational players like Ametek, Regal Beloit and Nidec have pursued a consolidation through acquisition strategy in the fragmented European electric motor market, driving transaction multiples higher than 12 x EBITDA LTM GROWING APPLICATION AREAS A growth in automation and robotization across industries and product groups drives long-term demand for and requirements on both fractional horsepower motors as well as servomotors Target value of € 20 m+ Based on applied valuation methods, we expect Heidrive to be likely valued between € 18 mn and € 24 mn Note: As of March 16, 2015; [1] Based on eclectic motor technology peer group; [2] Based on integrated motion technology peer group; [3] Applying a 20% discount; Source: Fact. Set, analysis 17

Agenda 1 2 3 4 5 6 Introduction Investment case and positioning Preliminary valuation considerations and M&A market dynamics Potential buyers universe Process considerations Appendix 18

Agenda 1 2 3 4 5 6 Introduction Investment case and positioning Preliminary valuation considerations and M&A market dynamics Potential buyers universe Process considerations Appendix 18

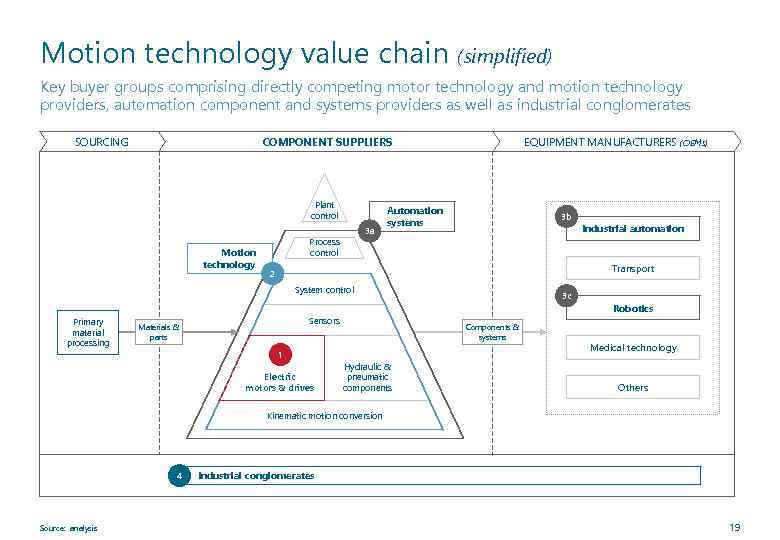

Motion technology value chain (simplified) Key buyer groups comprising directly competing motor technology and motion technology providers, automation component and systems providers as well as industrial conglomerates SOURCING COMPONENT SUPPLIERS Plant control Motion technology 3 a Process control EQUIPMENT MANUFACTURERS (OEMs) Automation systems 3 b Transport 2 System control Primary material processing Industrial automation Sensors Materials & parts 1 Electric motors & drives 3 c Components & systems Hydraulic & pneumatic components Robotics Medical technology Others Kinematic motion conversion 4 Source: analysis Industrial conglomerates 19

Motion technology value chain (simplified) Key buyer groups comprising directly competing motor technology and motion technology providers, automation component and systems providers as well as industrial conglomerates SOURCING COMPONENT SUPPLIERS Plant control Motion technology 3 a Process control EQUIPMENT MANUFACTURERS (OEMs) Automation systems 3 b Transport 2 System control Primary material processing Industrial automation Sensors Materials & parts 1 Electric motors & drives 3 c Components & systems Hydraulic & pneumatic components Robotics Medical technology Others Kinematic motion conversion 4 Source: analysis Industrial conglomerates 19

Selected potential strategic buyers Through its extensive industry network has inroads to some of the most promising buyers for Heidrive 1 ELECTRIC MOTOR TECHNOLOGY Altra Industrial Motion Harmonic Drive Systems Mabuchi Motor Regal Beloit 2 MOTION TECHNOLOGY AMETEK Johnson Electric MOOG Nidec Plant control Custom Sensors & Technologies Parker Hannifin Process control Wolong Electric/ ATB System control Sensors Electric motors & drives Hydraulic & pneumatic components Kinematic motion conversion 3 AUTOMATION COMPONENTS & SYSTEMS 4 INDUSTRIAL CONGLOMERATES Beckhoff Automation Bernecker + Rainer Bucher Industries Danaher Festo Kuka Illinois Tool Works Körber/ LTi 20

Selected potential strategic buyers Through its extensive industry network has inroads to some of the most promising buyers for Heidrive 1 ELECTRIC MOTOR TECHNOLOGY Altra Industrial Motion Harmonic Drive Systems Mabuchi Motor Regal Beloit 2 MOTION TECHNOLOGY AMETEK Johnson Electric MOOG Nidec Plant control Custom Sensors & Technologies Parker Hannifin Process control Wolong Electric/ ATB System control Sensors Electric motors & drives Hydraulic & pneumatic components Kinematic motion conversion 3 AUTOMATION COMPONENTS & SYSTEMS 4 INDUSTRIAL CONGLOMERATES Beckhoff Automation Bernecker + Rainer Bucher Industries Danaher Festo Kuka Illinois Tool Works Körber/ LTi 20

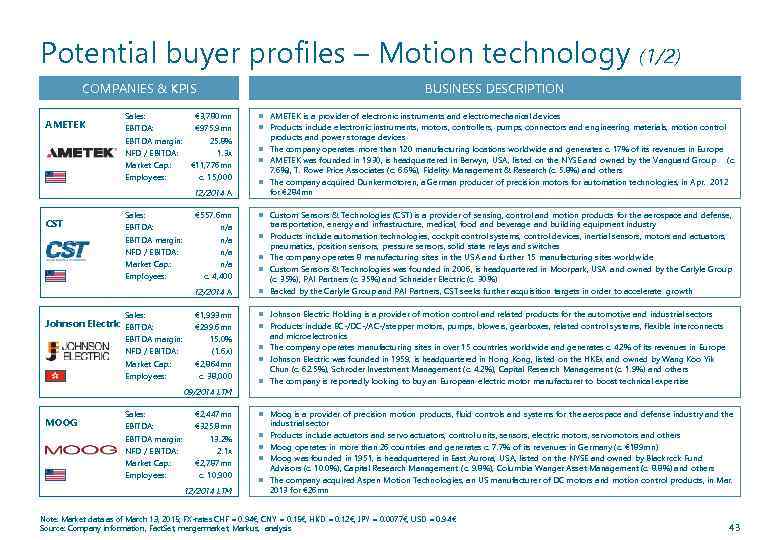

Strategic buyer details (1/2) Selection of bidders is key to maintain an efficient and confidential process 1 Electric motor technology RATIONALE BUYER INTELLIGENCE Acquire technology and International groups like Regal development know-how Acquire process capabilities and production competences Realize sales synergies through existing sales networks/ cross-selling Realize management synergies and cost synergies Gain access to key customers Beloit aim to participate in consolidation of European industrial electric motor market by acquiring smaller players Motion technology OTHER RELEVANT MARKET PARTICIPANTS Players historically focused on large scale propulsion drives e. g. Altra or Wolong seek to enter the market for smaller, precision drives through acquisitions For some, strengthen position in Foreign firms like Harmonic Drive RATIONALE 2 LIKELY BUYERS BUYER INTELLIGENCE Complement product portfolio Motion technology providers like valuable German market Realize sales synergies through existing sales networks/ cross-selling Acquire technology and development know-how Realize management and cost synergies Gain access to key customers Source: analysis or Mabuchi motor seek to use cash reserves for acquiring European know-how Ametek, Moog or Nidec aim to build dominance in the fragmented European industrial electric motor market through acquisitions LIKELY BUYERS OTHER RELEVANT MARKET PARTICIPANTS Emerging market firms like Johnson Electric want to use surplus cash for know-how acquisitions 21

Strategic buyer details (1/2) Selection of bidders is key to maintain an efficient and confidential process 1 Electric motor technology RATIONALE BUYER INTELLIGENCE Acquire technology and International groups like Regal development know-how Acquire process capabilities and production competences Realize sales synergies through existing sales networks/ cross-selling Realize management synergies and cost synergies Gain access to key customers Beloit aim to participate in consolidation of European industrial electric motor market by acquiring smaller players Motion technology OTHER RELEVANT MARKET PARTICIPANTS Players historically focused on large scale propulsion drives e. g. Altra or Wolong seek to enter the market for smaller, precision drives through acquisitions For some, strengthen position in Foreign firms like Harmonic Drive RATIONALE 2 LIKELY BUYERS BUYER INTELLIGENCE Complement product portfolio Motion technology providers like valuable German market Realize sales synergies through existing sales networks/ cross-selling Acquire technology and development know-how Realize management and cost synergies Gain access to key customers Source: analysis or Mabuchi motor seek to use cash reserves for acquiring European know-how Ametek, Moog or Nidec aim to build dominance in the fragmented European industrial electric motor market through acquisitions LIKELY BUYERS OTHER RELEVANT MARKET PARTICIPANTS Emerging market firms like Johnson Electric want to use surplus cash for know-how acquisitions 21

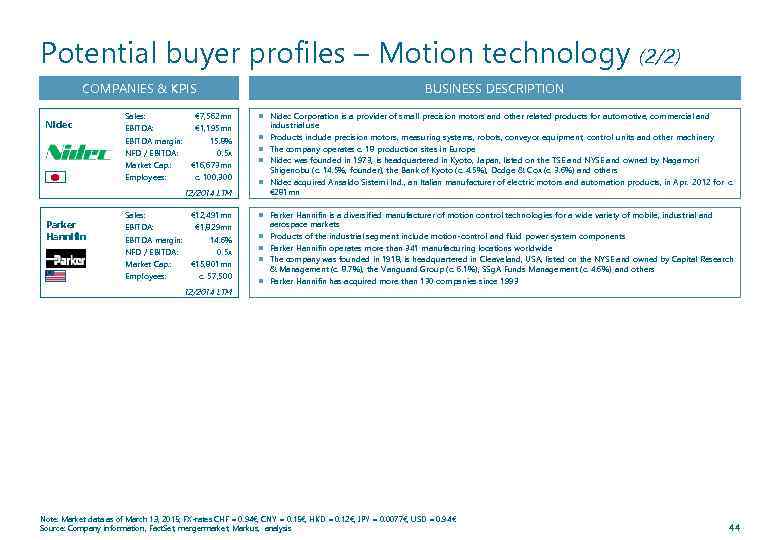

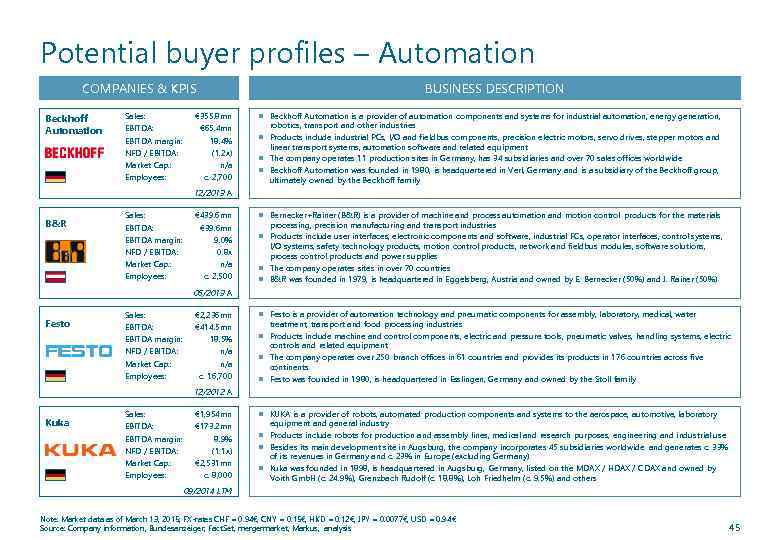

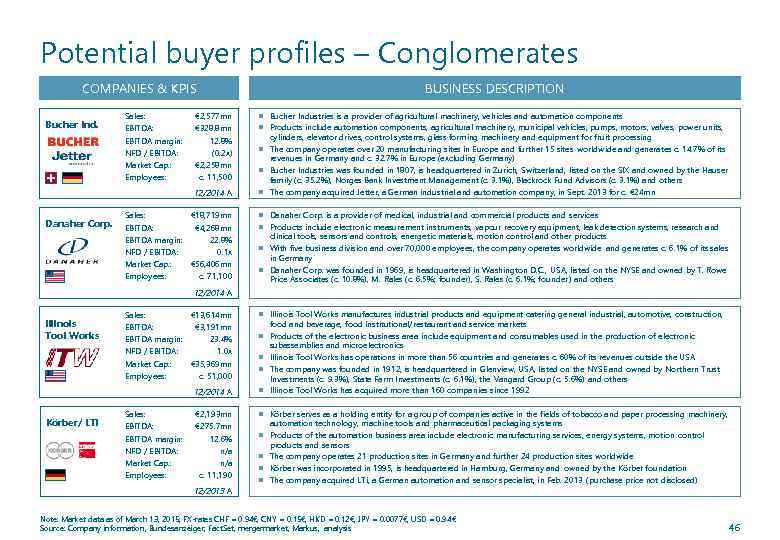

Strategic buyer details (2/2) Selection of bidders is key to maintain an efficient and confidential process Mechatronic & automation components & systems 3 a 3 b c 3 Industrial conglomerates 4 RATIONALE BUYER INTELLIGENCE Complement technology portfolio to Large component suppliers and offer more integrated solutions for automation or motion control Strengthen geographic positioning automation specialists like Festo are open to relatively minor, technology-driven acquisitions LIKELY BUYERS OTHER RELEVANT MARKET PARTICIPANTS of existing drive technology division Realize sales synergies through existing sales networks/ cross-selling Realize management and cost synergies Gain access to key customers RATIONALE BUYER INTELLIGENCE Strengthen positioning and diversify Bucher acquired Jetter, a product offering of industrial automation/ precision drive technology portfolio Complement existing automation or motion technology portfolio Realize sales synergies through existing sales networks/ cross-selling provider of industrial and mobile automation components, in 2013 in order to build a new industrial automation focused division LIKELY BUYERS OTHER RELEVANT MARKET PARTICIPANTS Diversified groups like Danaher have subsidiaries active in the production of electric motors For some, enter precision drive Source: analysis market 22

Strategic buyer details (2/2) Selection of bidders is key to maintain an efficient and confidential process Mechatronic & automation components & systems 3 a 3 b c 3 Industrial conglomerates 4 RATIONALE BUYER INTELLIGENCE Complement technology portfolio to Large component suppliers and offer more integrated solutions for automation or motion control Strengthen geographic positioning automation specialists like Festo are open to relatively minor, technology-driven acquisitions LIKELY BUYERS OTHER RELEVANT MARKET PARTICIPANTS of existing drive technology division Realize sales synergies through existing sales networks/ cross-selling Realize management and cost synergies Gain access to key customers RATIONALE BUYER INTELLIGENCE Strengthen positioning and diversify Bucher acquired Jetter, a product offering of industrial automation/ precision drive technology portfolio Complement existing automation or motion technology portfolio Realize sales synergies through existing sales networks/ cross-selling provider of industrial and mobile automation components, in 2013 in order to build a new industrial automation focused division LIKELY BUYERS OTHER RELEVANT MARKET PARTICIPANTS Diversified groups like Danaher have subsidiaries active in the production of electric motors For some, enter precision drive Source: analysis market 22

Selected overview of financial sponsors Several financial sponsors have gained relevant hands-on expertise by successfully developing similar industrial companies with attractive growth and restructuring opportunities SPONSOR CRITERIA Target EV: Up to € 150 mn Majority equity inv. : € 5 mn - 100 mn Target sales: € 15 mn - 200 mn Majority equity inv. : n/a Target sales: € 10 mn - 100 mn Majority equity inv. : € 10 mn - 30 mn RELEVANT INVESTMENTS ■ ■ ■ SPONSOR CRITERIA Schabmueller[1] Schleicher Electronic[1] Target sales: Larger than € 20 mn Minority equity inv. : Up to € 50 mn IMTRON Messtechnik [1] Martens Elektronik[1] RELEVANT INVESTMENTS ■ Flender Getriebe[1] Henkelhausen Holding[1] Target EV: Up to € 100 mn Majority equity inv. : n/a ■ MBB Fertigungstechnik Spheros[1] mut group[1] Target EV: Larger than € 20 mn Majority equity inv. : n/a ■ RADEMACHER Geräte-Elektronik[1] ■ n/a ■ Target sales: Larger than € 10 m Majority equity inv. : n/a ■ ACTech Target sales: Up to € 100 mn Majority equity inv. : € 5 mn - 20 mn Target EV: € 10 mn - 120 mn Majority equity inv. : n/a ■ RADEMACHER Geräte-Elektronik Target sales: € 20 mn - 100 mn Majority equity inv. : Up to € 20 mn ■ n/a ■ m. G mini. Gears Herzog Target sales: € 20 mn - 500 mn Majority equity inv. : Larger than € 2. 5 mn ■ HAP Georg Kesel Target sales: Larger than € 20 mn Majority equity inv. : € 1. 5 mn - 15 mn ■ WMH Herion Target EV: € 25 mn - 125 mn Majority equity inv. : € 10 mn - 25 mn Target sales: Larger than € 25 mn Majority equity inv. : n/A [1] Former investment Source: company information, analysis ■ ■ 23

Selected overview of financial sponsors Several financial sponsors have gained relevant hands-on expertise by successfully developing similar industrial companies with attractive growth and restructuring opportunities SPONSOR CRITERIA Target EV: Up to € 150 mn Majority equity inv. : € 5 mn - 100 mn Target sales: € 15 mn - 200 mn Majority equity inv. : n/a Target sales: € 10 mn - 100 mn Majority equity inv. : € 10 mn - 30 mn RELEVANT INVESTMENTS ■ ■ ■ SPONSOR CRITERIA Schabmueller[1] Schleicher Electronic[1] Target sales: Larger than € 20 mn Minority equity inv. : Up to € 50 mn IMTRON Messtechnik [1] Martens Elektronik[1] RELEVANT INVESTMENTS ■ Flender Getriebe[1] Henkelhausen Holding[1] Target EV: Up to € 100 mn Majority equity inv. : n/a ■ MBB Fertigungstechnik Spheros[1] mut group[1] Target EV: Larger than € 20 mn Majority equity inv. : n/a ■ RADEMACHER Geräte-Elektronik[1] ■ n/a ■ Target sales: Larger than € 10 m Majority equity inv. : n/a ■ ACTech Target sales: Up to € 100 mn Majority equity inv. : € 5 mn - 20 mn Target EV: € 10 mn - 120 mn Majority equity inv. : n/a ■ RADEMACHER Geräte-Elektronik Target sales: € 20 mn - 100 mn Majority equity inv. : Up to € 20 mn ■ n/a ■ m. G mini. Gears Herzog Target sales: € 20 mn - 500 mn Majority equity inv. : Larger than € 2. 5 mn ■ HAP Georg Kesel Target sales: Larger than € 20 mn Majority equity inv. : € 1. 5 mn - 15 mn ■ WMH Herion Target EV: € 25 mn - 125 mn Majority equity inv. : € 10 mn - 25 mn Target sales: Larger than € 25 mn Majority equity inv. : n/A [1] Former investment Source: company information, analysis ■ ■ 23

Agenda 1 2 3 4 5 6 Introduction Investment case and positioning Preliminary valuation considerations and M&A market dynamics Potential buyers universe Process considerations Appendix 24

Agenda 1 2 3 4 5 6 Introduction Investment case and positioning Preliminary valuation considerations and M&A market dynamics Potential buyers universe Process considerations Appendix 24

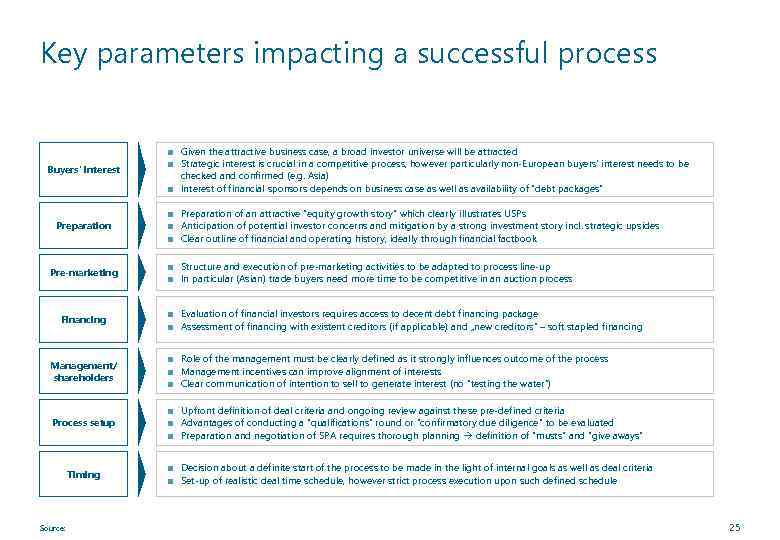

Key parameters impacting a successful process ■ Buyers’ interest ■ ■ Preparation ■ ■ ■ Pre-marketing ■ Financing ■ Management/ shareholders Process setup ■ ■ ■ ■ Timing Source: ■ ■ Given the attractive business case, a broad investor universe will be attracted Strategic interest is crucial in a competitive process, however particularly non-European buyers’ interest needs to be checked and confirmed (e. g. Asia) Interest of financial sponsors depends on business case as well as availability of “debt packages” Preparation of an attractive “equity growth story” which clearly illustrates USPs Anticipation of potential investor concerns and mitigation by a strong investment story incl. strategic upsides Clear outline of financial and operating history, ideally through financial factbook Structure and execution of pre-marketing activities to be adapted to process line-up In particular (Asian) trade buyers need more time to be competitive in an auction process Evaluation of financial investors requires access to decent debt financing package Assessment of financing with existent creditors (if applicable) and „new creditors“ – soft stapled financing Role of the management must be clearly defined as it strongly influences outcome of the process Management incentives can improve alignment of interests Clear communication of intention to sell to generate interest (no “testing the water”) Upfront definition of deal criteria and ongoing review against these pre-defined criteria Advantages of conducting a “qualifications” round or “confirmatory due diligence” to be evaluated Preparation and negotiation of SPA requires thorough planning definition of “musts” and “give aways” Decision about a definite start of the process to be made in the light of internal goals as well as deal criteria Set-up of realistic deal time schedule, however strict process execution upon such defined schedule 25

Key parameters impacting a successful process ■ Buyers’ interest ■ ■ Preparation ■ ■ ■ Pre-marketing ■ Financing ■ Management/ shareholders Process setup ■ ■ ■ ■ Timing Source: ■ ■ Given the attractive business case, a broad investor universe will be attracted Strategic interest is crucial in a competitive process, however particularly non-European buyers’ interest needs to be checked and confirmed (e. g. Asia) Interest of financial sponsors depends on business case as well as availability of “debt packages” Preparation of an attractive “equity growth story” which clearly illustrates USPs Anticipation of potential investor concerns and mitigation by a strong investment story incl. strategic upsides Clear outline of financial and operating history, ideally through financial factbook Structure and execution of pre-marketing activities to be adapted to process line-up In particular (Asian) trade buyers need more time to be competitive in an auction process Evaluation of financial investors requires access to decent debt financing package Assessment of financing with existent creditors (if applicable) and „new creditors“ – soft stapled financing Role of the management must be clearly defined as it strongly influences outcome of the process Management incentives can improve alignment of interests Clear communication of intention to sell to generate interest (no “testing the water”) Upfront definition of deal criteria and ongoing review against these pre-defined criteria Advantages of conducting a “qualifications” round or “confirmatory due diligence” to be evaluated Preparation and negotiation of SPA requires thorough planning definition of “musts” and “give aways” Decision about a definite start of the process to be made in the light of internal goals as well as deal criteria Set-up of realistic deal time schedule, however strict process execution upon such defined schedule 25

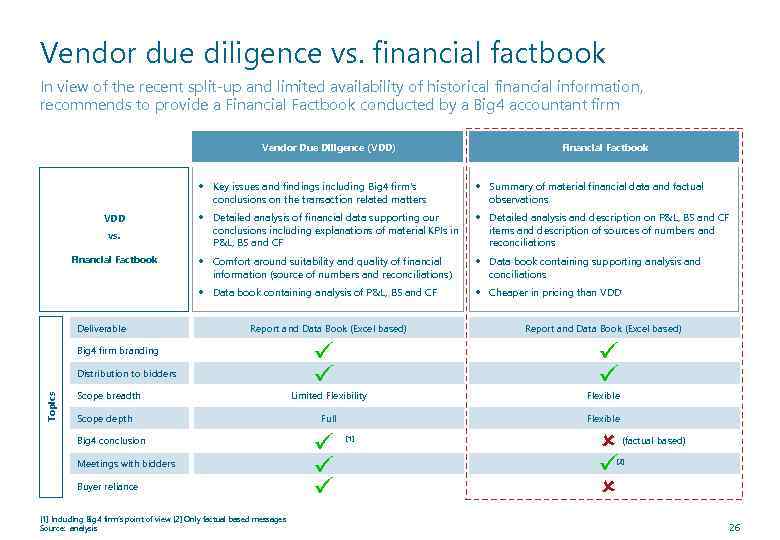

Vendor due diligence vs. financial factbook In view of the recent split-up and limited availability of historical financial information, recommends to provide a Financial Factbook conducted by a Big 4 accountant firm Vendor Due Diligence (VDD) Financial Factbook • Key issues and findings including Big 4 firm’s conclusions on the transaction related matters vs. Financial Factbook Deliverable • Detailed analysis of financial data supporting our conclusions including explanations of material KPIs in P&L, BS and CF • Detailed analysis and description on P&L, BS and CF items and description of sources of numbers and reconciliations • Comfort around suitability and quality of financial information (source of numbers and reconciliations) • Data book containing supporting analysis and conciliations • Data book containing analysis of P&L, BS and CF VDD • Summary of material financial data and factual observations • Cheaper in pricing than VDD Report and Data Book (Excel based) Big 4 firm branding Topics Distribution to bidders Scope breadth Scope depth Big 4 conclusion Meetings with bidders Buyer reliance [1] Including Big 4 firm’s point of view [2] Only factual based messages Source: analysis Report and Data Book (Excel based) Limited Flexibility Flexible Full Flexible [1] (factual based) [2] 26

Vendor due diligence vs. financial factbook In view of the recent split-up and limited availability of historical financial information, recommends to provide a Financial Factbook conducted by a Big 4 accountant firm Vendor Due Diligence (VDD) Financial Factbook • Key issues and findings including Big 4 firm’s conclusions on the transaction related matters vs. Financial Factbook Deliverable • Detailed analysis of financial data supporting our conclusions including explanations of material KPIs in P&L, BS and CF • Detailed analysis and description on P&L, BS and CF items and description of sources of numbers and reconciliations • Comfort around suitability and quality of financial information (source of numbers and reconciliations) • Data book containing supporting analysis and conciliations • Data book containing analysis of P&L, BS and CF VDD • Summary of material financial data and factual observations • Cheaper in pricing than VDD Report and Data Book (Excel based) Big 4 firm branding Topics Distribution to bidders Scope breadth Scope depth Big 4 conclusion Meetings with bidders Buyer reliance [1] Including Big 4 firm’s point of view [2] Only factual based messages Source: analysis Report and Data Book (Excel based) Limited Flexibility Flexible Full Flexible [1] (factual based) [2] 26

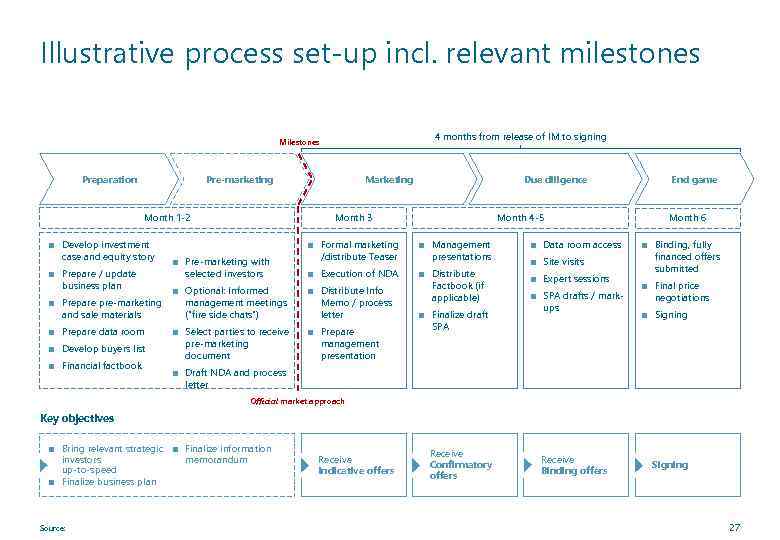

Illustrative process set-up incl. relevant milestones 4 months from release of IM to signing Milestones Preparation Pre-marketing Month 3 Month 1 -2 ■ Develop investment case and equity story ■ Prepare / update business plan ■ Prepare pre-marketing and sale materials ■ Prepare data room ■ Financial factbook Month 4 -5 ■ Formal marketing /distribute Teaser ■ Management presentations ■ Execution of NDA ■ Optional: Informed management meetings (“fire side chats”) ■ Distribute Info Memo / process letter Distribute Factbook (if applicable) ■ Select parties to receive pre-marketing document ■ ■ ■ Pre-marketing with selected investors Prepare management presentation ■ Finalize draft SPA ■ Data room access ■ Site visits ■ Expert sessions ■ SPA drafts / markups Month 6 Draft NDA and process letter ■ Develop buyers list ■ End game Due diligence ■ Binding, fully financed offers submitted ■ Final price negotiations ■ Signing Official market approach Key objectives ■ ■ Bring relevant strategic investors up-to-speed Finalize business plan Source: ■ Finalize information memorandum Receive Indicative offers Receive Confirmatory offers Receive Binding offers Signing 27

Illustrative process set-up incl. relevant milestones 4 months from release of IM to signing Milestones Preparation Pre-marketing Month 3 Month 1 -2 ■ Develop investment case and equity story ■ Prepare / update business plan ■ Prepare pre-marketing and sale materials ■ Prepare data room ■ Financial factbook Month 4 -5 ■ Formal marketing /distribute Teaser ■ Management presentations ■ Execution of NDA ■ Optional: Informed management meetings (“fire side chats”) ■ Distribute Info Memo / process letter Distribute Factbook (if applicable) ■ Select parties to receive pre-marketing document ■ ■ ■ Pre-marketing with selected investors Prepare management presentation ■ Finalize draft SPA ■ Data room access ■ Site visits ■ Expert sessions ■ SPA drafts / markups Month 6 Draft NDA and process letter ■ Develop buyers list ■ End game Due diligence ■ Binding, fully financed offers submitted ■ Final price negotiations ■ Signing Official market approach Key objectives ■ ■ Bring relevant strategic investors up-to-speed Finalize business plan Source: ■ Finalize information memorandum Receive Indicative offers Receive Confirmatory offers Receive Binding offers Signing 27

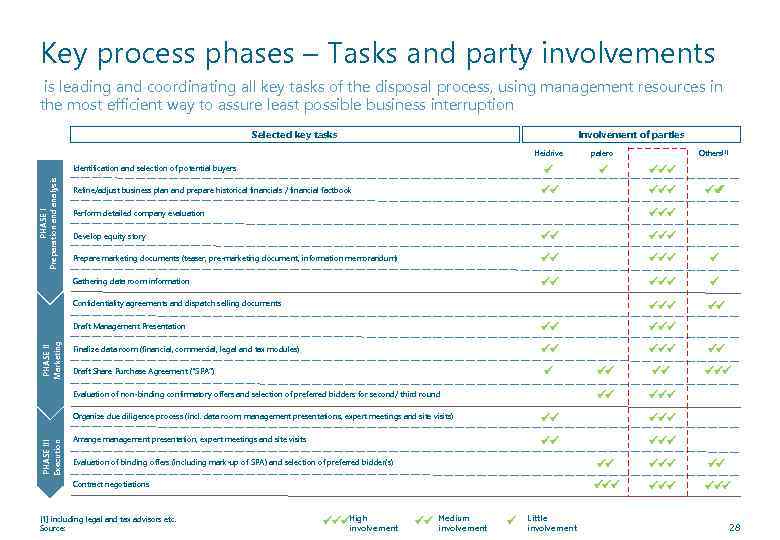

Key process phases – Tasks and party involvements is leading and coordinating all key tasks of the disposal process, using management resources in the most efficient way to assure least possible business interruption Selected key tasks Involvement of parties Heidrive ü PHASE I Preparation and analysis Identification and selection of potential buyers Refine/adjust business plan and prepare historical financials / financial factbook palero ü üü Others[1] üüü Perform detailed company evaluation üü ü üüü Develop equity story üü üüü Prepare marketing documents (teaser, pre-marketing document, information memorandum) üü ü Gathering data room information üü ü üüü üü Confidentiality agreements and dispatch selling documents PHASE II Marketing Draft Management Presentation üü üüü Finalize data room (financial, commercial, legal and tax modules) üü üüü ü Draft Share Purchase Agreement (“SPA”) Evaluation of non-binding confirmatory offers and selection of preferred bidders for second/ third round PHASE III Execution Organize due diligence process (incl. data room, management presentations, expert meetings and site visits) üü üüü Arrange management presentation, expert meetings and site visits üü üüü Evaluation of binding offers (including mark-up of SPA) and selection of preferred bidder(s) üü [1] including legal and tax advisors etc. Source: üüüHigh involvement üü Medium involvement ü Little involvement üü üüü Contract negotiations üüü üüü 28

Key process phases – Tasks and party involvements is leading and coordinating all key tasks of the disposal process, using management resources in the most efficient way to assure least possible business interruption Selected key tasks Involvement of parties Heidrive ü PHASE I Preparation and analysis Identification and selection of potential buyers Refine/adjust business plan and prepare historical financials / financial factbook palero ü üü Others[1] üüü Perform detailed company evaluation üü ü üüü Develop equity story üü üüü Prepare marketing documents (teaser, pre-marketing document, information memorandum) üü ü Gathering data room information üü ü üüü üü Confidentiality agreements and dispatch selling documents PHASE II Marketing Draft Management Presentation üü üüü Finalize data room (financial, commercial, legal and tax modules) üü üüü ü Draft Share Purchase Agreement (“SPA”) Evaluation of non-binding confirmatory offers and selection of preferred bidders for second/ third round PHASE III Execution Organize due diligence process (incl. data room, management presentations, expert meetings and site visits) üü üüü Arrange management presentation, expert meetings and site visits üü üüü Evaluation of binding offers (including mark-up of SPA) and selection of preferred bidder(s) üü [1] including legal and tax advisors etc. Source: üüüHigh involvement üü Medium involvement ü Little involvement üü üüü Contract negotiations üüü üüü 28

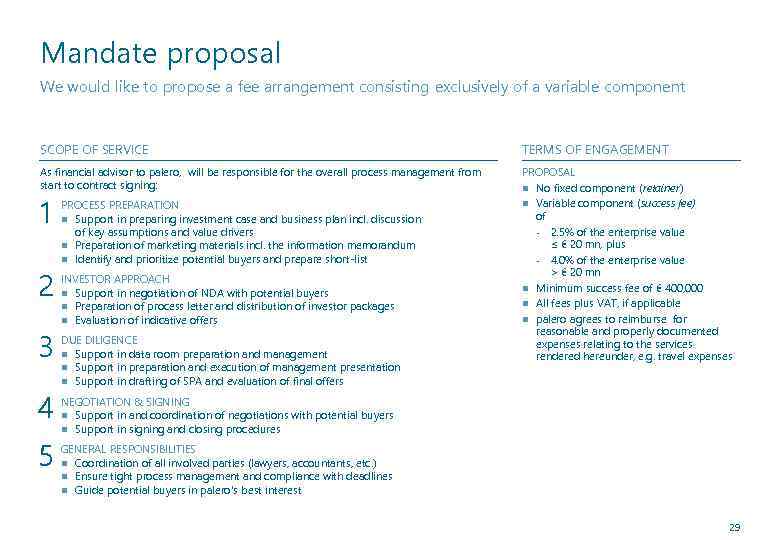

Mandate proposal We would like to propose a fee arrangement consisting exclusively of a variable component SCOPE OF SERVICE TERMS OF ENGAGEMENT As financial advisor to palero, will be responsible for the overall process management from start to contract signing: PROPOSAL No fixed component (retainer) Variable component (success fee) of - 2. 5% of the enterprise value ≤ € 20 mn, plus - 4. 0% of the enterprise value > € 20 mn Minimum success fee of € 400, 000 All fees plus VAT, if applicable palero agrees to reimburse for reasonable and properly documented expenses relating to the services rendered hereunder, e. g. travel expenses 1 2 3 4 5 PROCESS PREPARATION Support in preparing investment case and business plan incl. discussion of key assumptions and value drivers Preparation of marketing materials incl. the information memorandum Identify and prioritize potential buyers and prepare short-list INVESTOR APPROACH Support in negotiation of NDA with potential buyers Preparation of process letter and distribution of investor packages Evaluation of indicative offers DUE DILIGENCE Support in data room preparation and management Support in preparation and execution of management presentation Support in drafting of SPA and evaluation of final offers NEGOTIATION & SIGNING Support in and coordination of negotiations with potential buyers Support in signing and closing procedures GENERAL RESPONSIBILITIES Coordination of all involved parties (lawyers, accountants, etc. ) Ensure tight process management and compliance with deadlines Guide potential buyers in palero’s best interest 29

Mandate proposal We would like to propose a fee arrangement consisting exclusively of a variable component SCOPE OF SERVICE TERMS OF ENGAGEMENT As financial advisor to palero, will be responsible for the overall process management from start to contract signing: PROPOSAL No fixed component (retainer) Variable component (success fee) of - 2. 5% of the enterprise value ≤ € 20 mn, plus - 4. 0% of the enterprise value > € 20 mn Minimum success fee of € 400, 000 All fees plus VAT, if applicable palero agrees to reimburse for reasonable and properly documented expenses relating to the services rendered hereunder, e. g. travel expenses 1 2 3 4 5 PROCESS PREPARATION Support in preparing investment case and business plan incl. discussion of key assumptions and value drivers Preparation of marketing materials incl. the information memorandum Identify and prioritize potential buyers and prepare short-list INVESTOR APPROACH Support in negotiation of NDA with potential buyers Preparation of process letter and distribution of investor packages Evaluation of indicative offers DUE DILIGENCE Support in data room preparation and management Support in preparation and execution of management presentation Support in drafting of SPA and evaluation of final offers NEGOTIATION & SIGNING Support in and coordination of negotiations with potential buyers Support in signing and closing procedures GENERAL RESPONSIBILITIES Coordination of all involved parties (lawyers, accountants, etc. ) Ensure tight process management and compliance with deadlines Guide potential buyers in palero’s best interest 29

Agenda 1 2 3 4 5 6 Introduction Investment case and positioning Preliminary valuation considerations and M&A market dynamics Potential buyers universe Process considerations Appendix 30

Agenda 1 2 3 4 5 6 Introduction Investment case and positioning Preliminary valuation considerations and M&A market dynamics Potential buyers universe Process considerations Appendix 30

Agenda 6 Appendix - Comparable companies analysis - Recent M&A transactions - Potential buyer profiles 31

Agenda 6 Appendix - Comparable companies analysis - Recent M&A transactions - Potential buyer profiles 31

![Comparable companies analysis [1] Note: As of March 16, 2015 [1] Excluded from valuation Comparable companies analysis [1] Note: As of March 16, 2015 [1] Excluded from valuation](https://present5.com/presentation/92062072_416917740/image-32.jpg) Comparable companies analysis [1] Note: As of March 16, 2015 [1] Excluded from valuation Source: Fact. Set, analysis 32

Comparable companies analysis [1] Note: As of March 16, 2015 [1] Excluded from valuation Source: Fact. Set, analysis 32

Agenda 6 Appendix - Comparable companies analysis - Recent M&A transactions - Potential buyer profiles 33

Agenda 6 Appendix - Comparable companies analysis - Recent M&A transactions - Potential buyer profiles 33

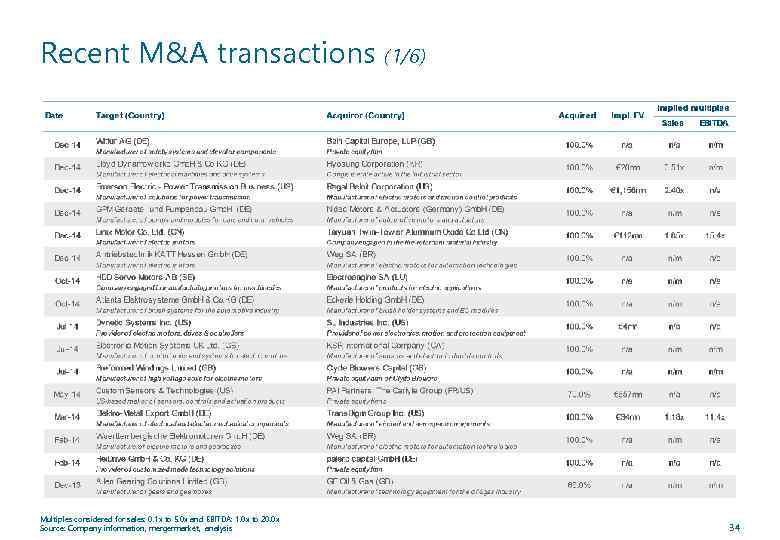

Recent M&A transactions (1/6) Multiples considered for sales: 0. 1 x to 5. 0 x and EBITDA: 1. 0 x to 20. 0 x Source: Company information, mergermarket, analysis 34

Recent M&A transactions (1/6) Multiples considered for sales: 0. 1 x to 5. 0 x and EBITDA: 1. 0 x to 20. 0 x Source: Company information, mergermarket, analysis 34

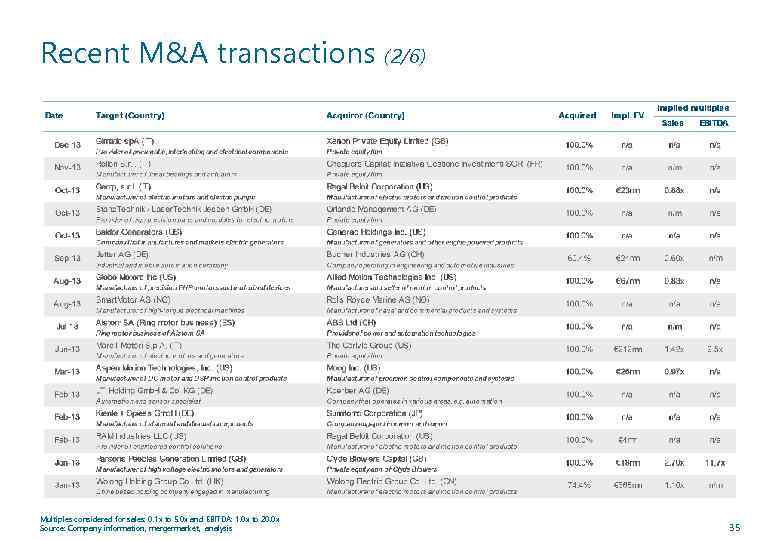

Recent M&A transactions (2/6) Multiples considered for sales: 0. 1 x to 5. 0 x and EBITDA: 1. 0 x to 20. 0 x Source: Company information, mergermarket, analysis 35

Recent M&A transactions (2/6) Multiples considered for sales: 0. 1 x to 5. 0 x and EBITDA: 1. 0 x to 20. 0 x Source: Company information, mergermarket, analysis 35

Recent M&A transactions (3/6) Multiples considered for sales: 0. 1 x to 5. 0 x and EBITDA: 1. 0 x to 20. 0 x Source: Company information, mergermarket, analysis 36

Recent M&A transactions (3/6) Multiples considered for sales: 0. 1 x to 5. 0 x and EBITDA: 1. 0 x to 20. 0 x Source: Company information, mergermarket, analysis 36

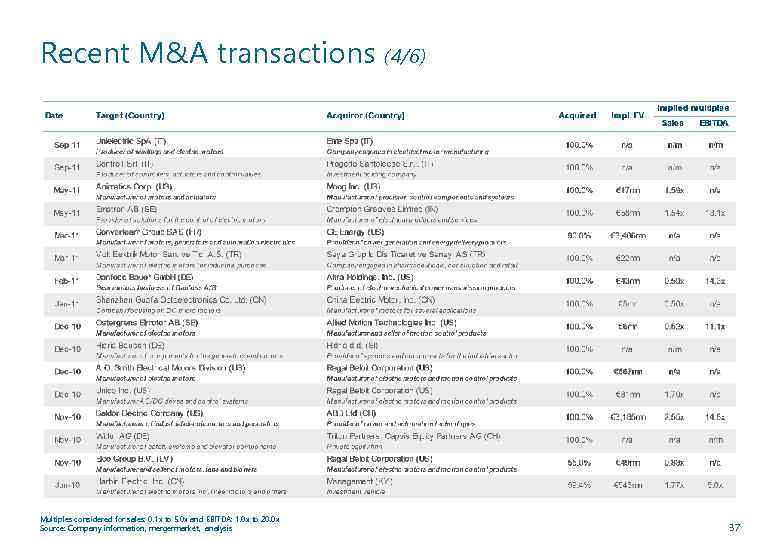

Recent M&A transactions (4/6) Multiples considered for sales: 0. 1 x to 5. 0 x and EBITDA: 1. 0 x to 20. 0 x Source: Company information, mergermarket, analysis 37

Recent M&A transactions (4/6) Multiples considered for sales: 0. 1 x to 5. 0 x and EBITDA: 1. 0 x to 20. 0 x Source: Company information, mergermarket, analysis 37

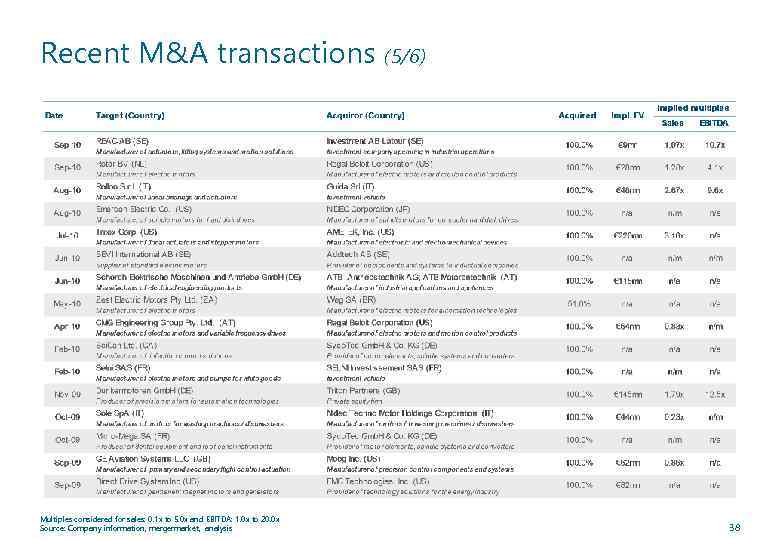

Recent M&A transactions (5/6) Multiples considered for sales: 0. 1 x to 5. 0 x and EBITDA: 1. 0 x to 20. 0 x Source: Company information, mergermarket, analysis 38

Recent M&A transactions (5/6) Multiples considered for sales: 0. 1 x to 5. 0 x and EBITDA: 1. 0 x to 20. 0 x Source: Company information, mergermarket, analysis 38

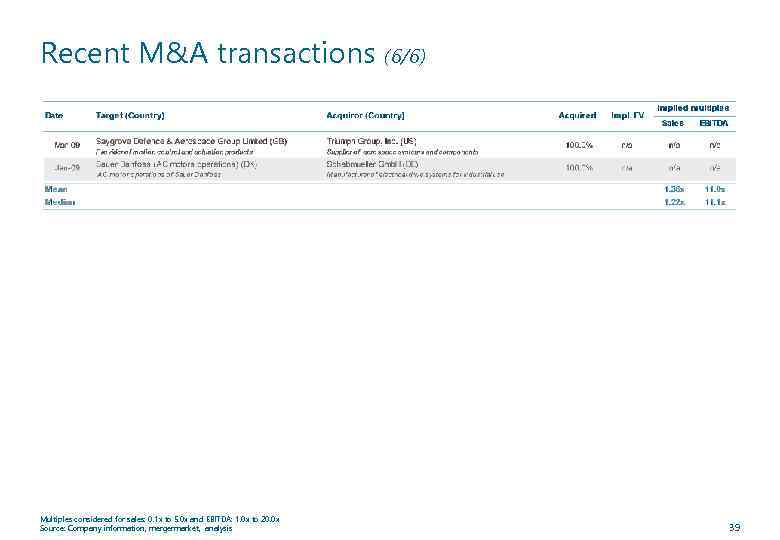

Recent M&A transactions (6/6) Multiples considered for sales: 0. 1 x to 5. 0 x and EBITDA: 1. 0 x to 20. 0 x Source: Company information, mergermarket, analysis 39

Recent M&A transactions (6/6) Multiples considered for sales: 0. 1 x to 5. 0 x and EBITDA: 1. 0 x to 20. 0 x Source: Company information, mergermarket, analysis 39

Agenda 6 Appendix - Comparable companies analysis - Recent M&A transactions - Potential buyer profiles 40

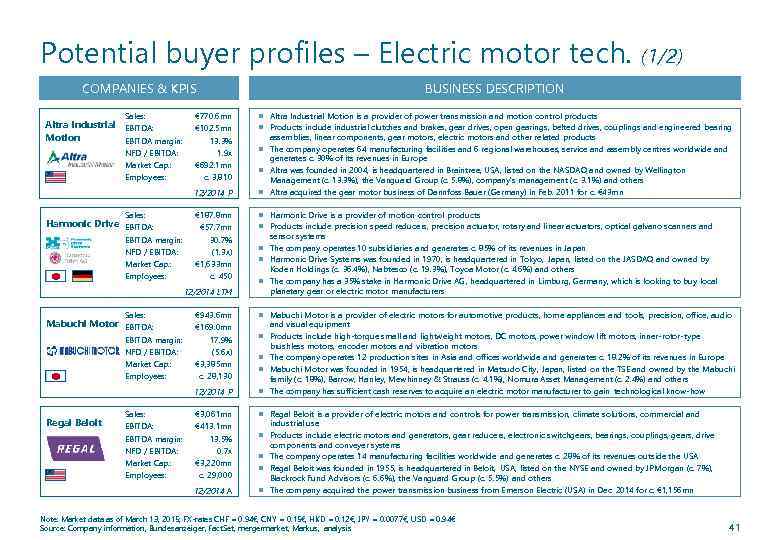

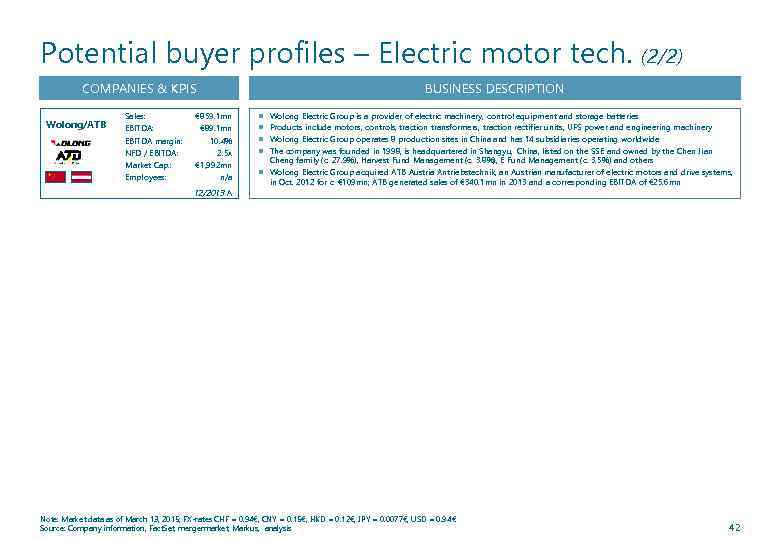

Agenda 6 Appendix - Comparable companies analysis - Recent M&A transactions - Potential buyer profiles 40