b69eff01a755521ac96632f5951efbf4.ppt

- Количество слайдов: 62

Discounted Cash Flow Analysis (Time Value of Money( n Future value n Present value n Rates of return

Discounted Cash Flow Analysis (Time Value of Money( n Future value n Present value n Rates of return

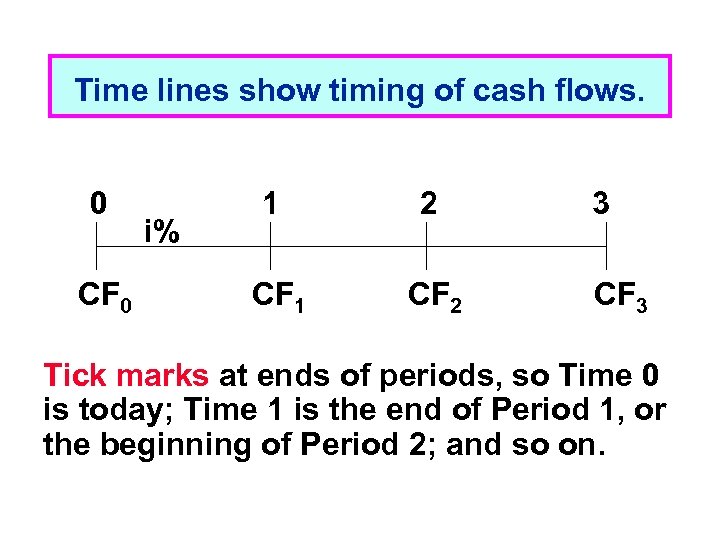

Time lines show timing of cash flows. 0 CF 0 i% 1 2 CF 1 CF 2 3 CF 3 Tick marks at ends of periods, so Time 0 is today; Time 1 is the end of Period 1, or the beginning of Period 2; and so on.

Time lines show timing of cash flows. 0 CF 0 i% 1 2 CF 1 CF 2 3 CF 3 Tick marks at ends of periods, so Time 0 is today; Time 1 is the end of Period 1, or the beginning of Period 2; and so on.

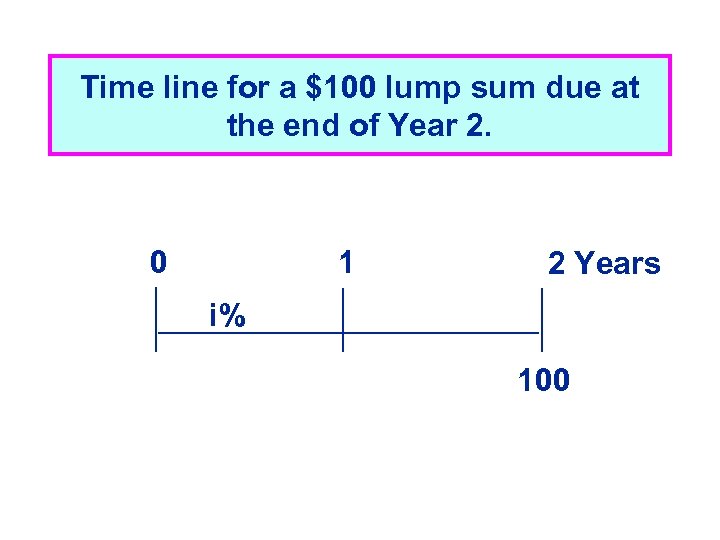

Time line for a $100 lump sum due at the end of Year 2. 0 1 2 Years i% 100

Time line for a $100 lump sum due at the end of Year 2. 0 1 2 Years i% 100

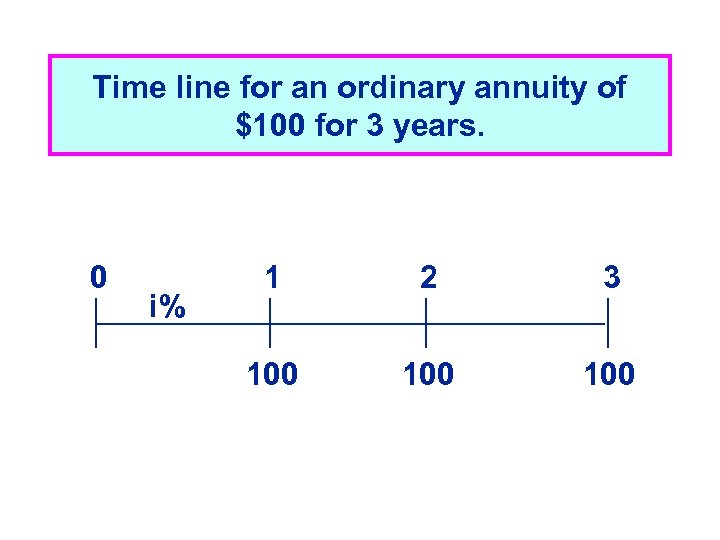

Time line for an ordinary annuity of $100 for 3 years. 0 i% 1 2 3 100 100

Time line for an ordinary annuity of $100 for 3 years. 0 i% 1 2 3 100 100

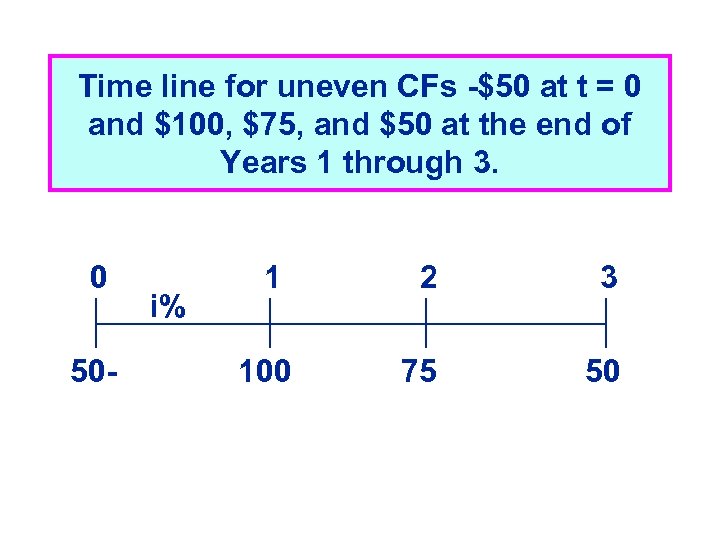

Time line for uneven CFs -$50 at t = 0 and $100, $75, and $50 at the end of Years 1 through 3. 0 50 - i% 1 2 3 100 75 50

Time line for uneven CFs -$50 at t = 0 and $100, $75, and $50 at the end of Years 1 through 3. 0 50 - i% 1 2 3 100 75 50

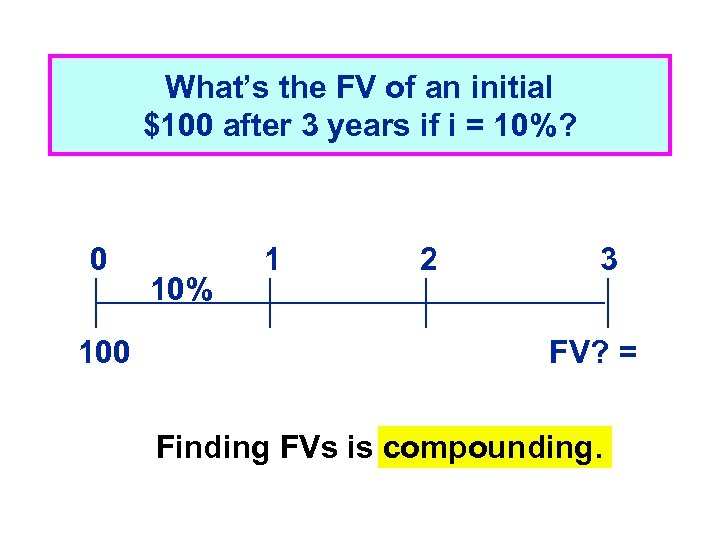

What’s the FV of an initial $100 after 3 years if i = 10%? 0 10% 1 2 3 FV? = Finding FVs is compounding.

What’s the FV of an initial $100 after 3 years if i = 10%? 0 10% 1 2 3 FV? = Finding FVs is compounding.

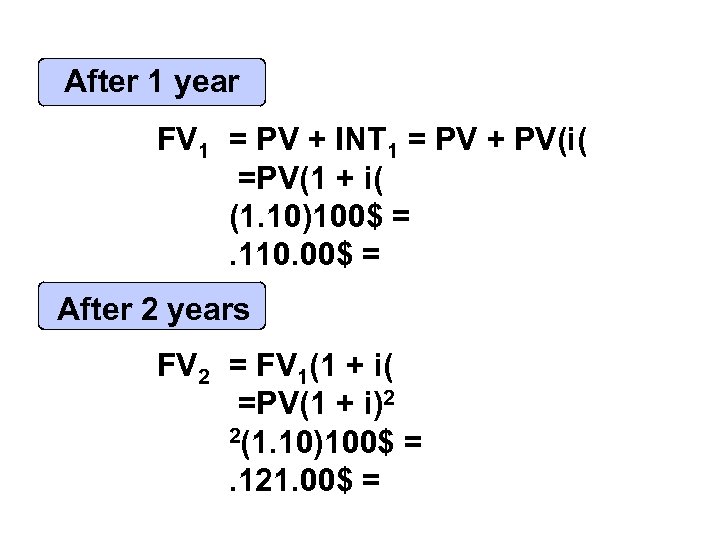

After 1 year FV 1 = PV + INT 1 = PV + PV(i( =PV(1 + i( (1. 10)100$ =. 110. 00$ = After 2 years FV 2 = FV 1(1 + i( =PV(1 + i)2 2(1. 10)100$ =. 121. 00$ =

After 1 year FV 1 = PV + INT 1 = PV + PV(i( =PV(1 + i( (1. 10)100$ =. 110. 00$ = After 2 years FV 2 = FV 1(1 + i( =PV(1 + i)2 2(1. 10)100$ =. 121. 00$ =

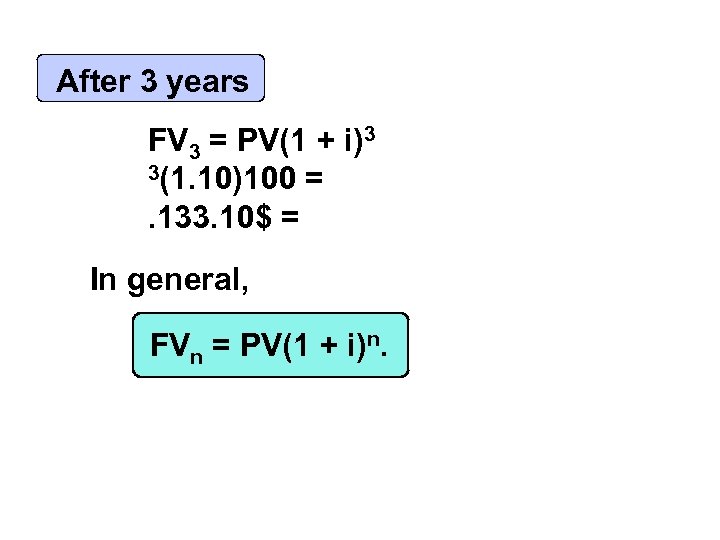

After 3 years FV 3 = PV(1 + i)3 3(1. 10)100 =. 133. 10$ = In general, FVn = PV(1 + i)n.

After 3 years FV 3 = PV(1 + i)3 3(1. 10)100 =. 133. 10$ = In general, FVn = PV(1 + i)n.

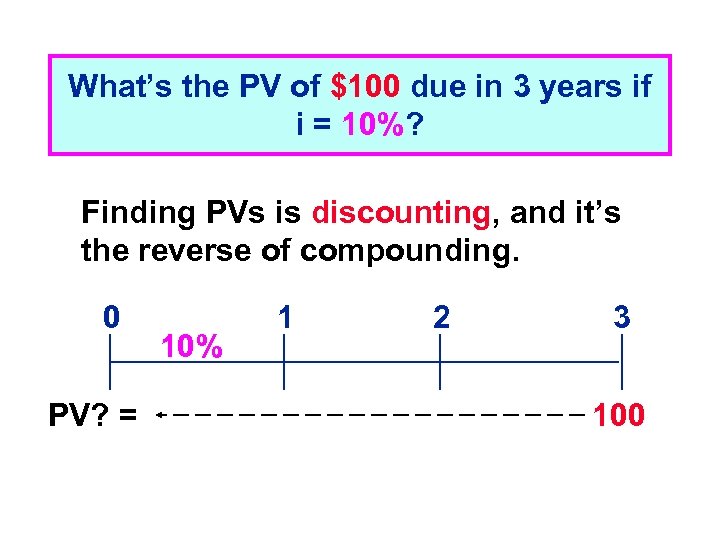

What’s the PV of $100 due in 3 years if i = 10%? Finding PVs is discounting, and it’s the reverse of compounding. 0 PV? = 10% 1 2 3 100

What’s the PV of $100 due in 3 years if i = 10%? Finding PVs is discounting, and it’s the reverse of compounding. 0 PV? = 10% 1 2 3 100

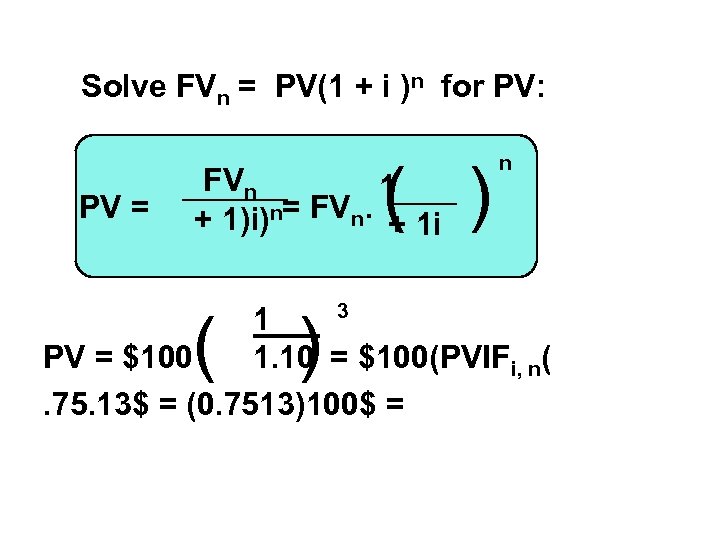

Solve FVn = PV(1 + i )n for PV: PV = ( ) FVn 1 + 1)i)n= FVn. + 1 i n 3 1 PV = $100 1. 10 = $100(PVIFi, n(. 75. 13$ = (0. 7513)100$ = ( )

Solve FVn = PV(1 + i )n for PV: PV = ( ) FVn 1 + 1)i)n= FVn. + 1 i n 3 1 PV = $100 1. 10 = $100(PVIFi, n(. 75. 13$ = (0. 7513)100$ = ( )

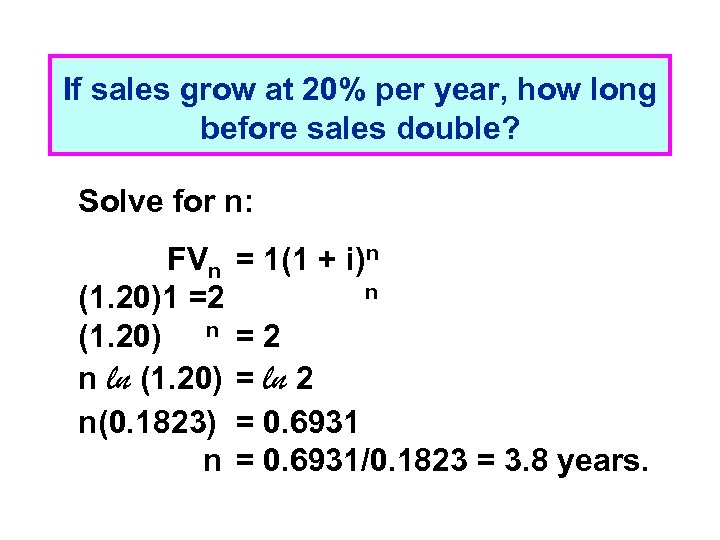

If sales grow at 20% per year, how long before sales double? Solve for n: FVn (1. 20)1 =2 (1. 20) n n ln (1. 20) n(0. 1823) n = 1(1 + i)n n =2 = ln 2 = 0. 6931/0. 1823 = 3. 8 years.

If sales grow at 20% per year, how long before sales double? Solve for n: FVn (1. 20)1 =2 (1. 20) n n ln (1. 20) n(0. 1823) n = 1(1 + i)n n =2 = ln 2 = 0. 6931/0. 1823 = 3. 8 years.

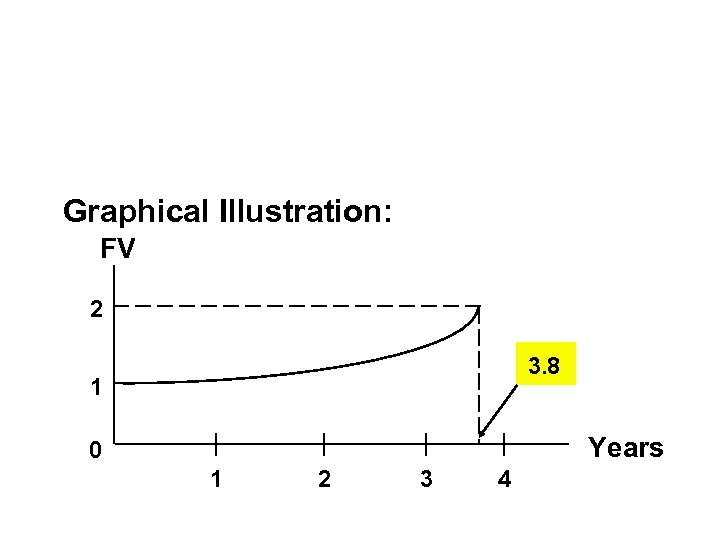

Graphical Illustration: FV 2 3. 8 1 Years 0 1 2 3 4

Graphical Illustration: FV 2 3. 8 1 Years 0 1 2 3 4

ordinary annuity and annuity due n An ordinary or deferred annuity consists of a series of equal payments made at the end of each period. n An annuity due is an annuity for which the cash flows occur at the beginning of each period. Annuity due value=ordinary due value x (1+r(

ordinary annuity and annuity due n An ordinary or deferred annuity consists of a series of equal payments made at the end of each period. n An annuity due is an annuity for which the cash flows occur at the beginning of each period. Annuity due value=ordinary due value x (1+r(

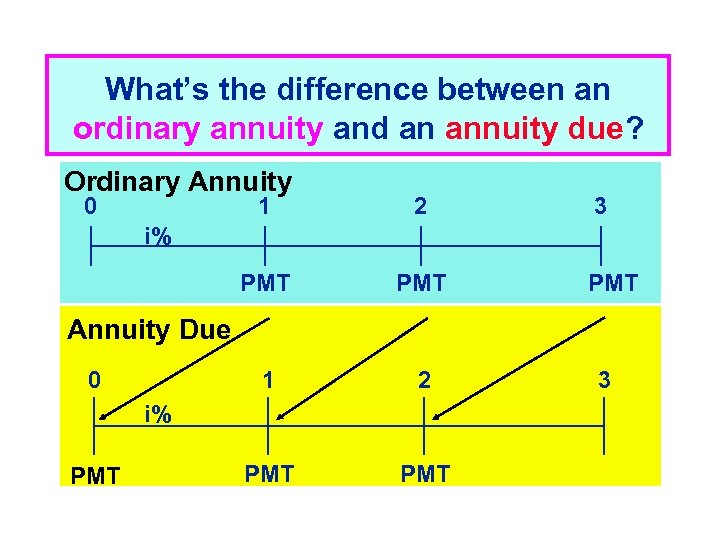

What’s the difference between an ordinary annuity and an annuity due? Ordinary Annuity 0 1 2 PMT PMT 3 i% PMT Annuity Due 0 i% PMT 3

What’s the difference between an ordinary annuity and an annuity due? Ordinary Annuity 0 1 2 PMT PMT 3 i% PMT Annuity Due 0 i% PMT 3

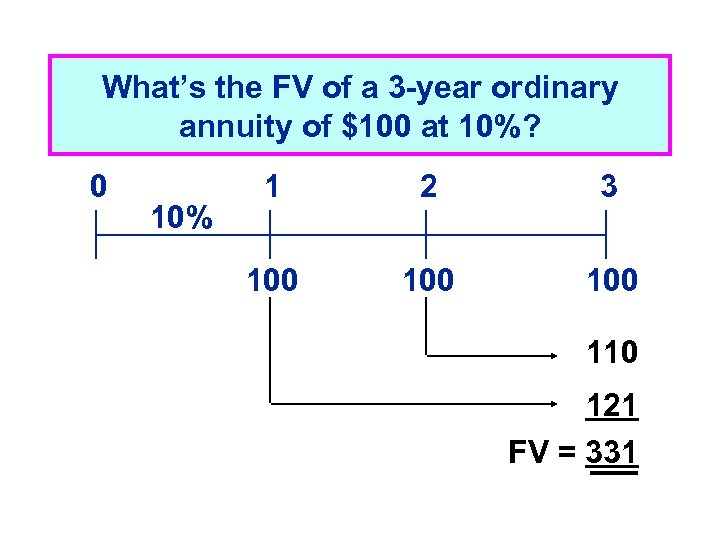

What’s the FV of a 3 -year ordinary annuity of $100 at 10%? 0 10% 1 2 3 100 100 110 121 FV = 331

What’s the FV of a 3 -year ordinary annuity of $100 at 10%? 0 10% 1 2 3 100 100 110 121 FV = 331

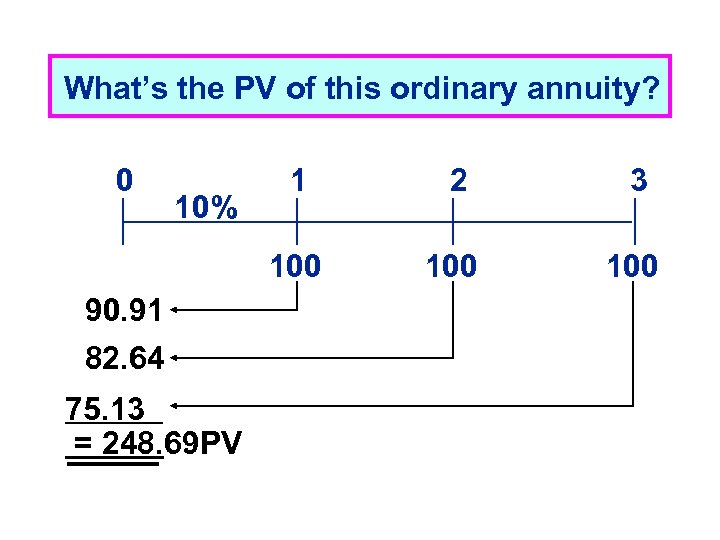

What’s the PV of this ordinary annuity? 0 90. 91 82. 64 75. 13 = 248. 69 PV 2 3 100 10% 1 100

What’s the PV of this ordinary annuity? 0 90. 91 82. 64 75. 13 = 248. 69 PV 2 3 100 10% 1 100

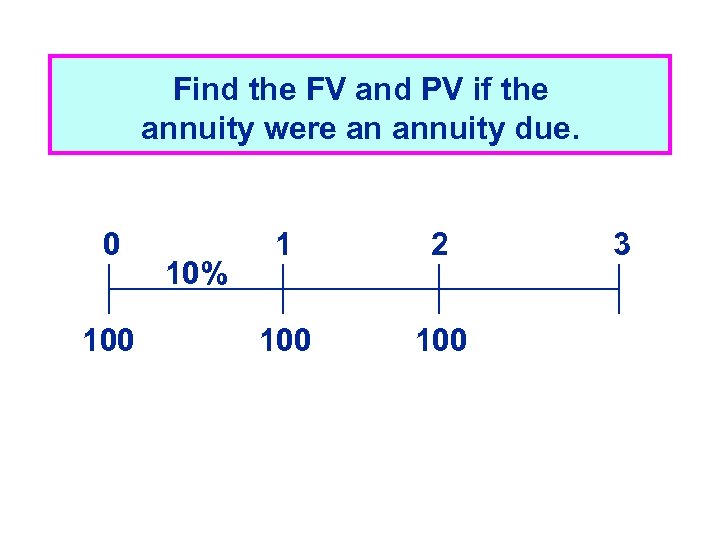

Find the FV and PV if the annuity were an annuity due. 0 10% 1 2 100 3

Find the FV and PV if the annuity were an annuity due. 0 10% 1 2 100 3

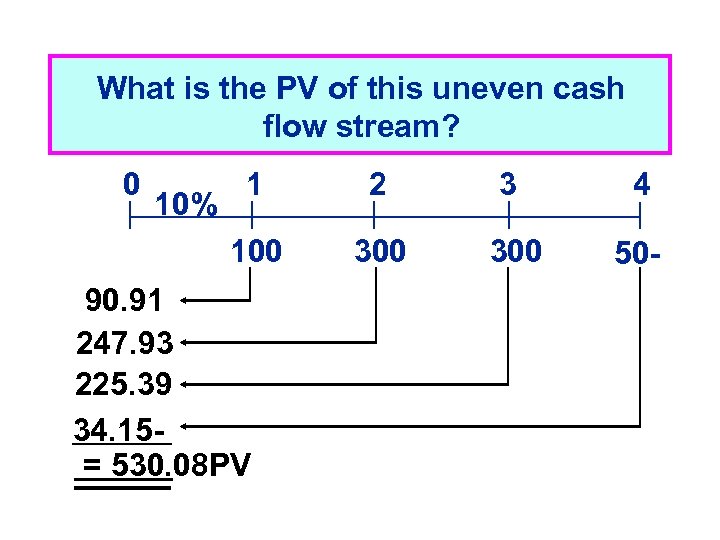

What is the PV of this uneven cash flow stream? 0 2 3 4 100 10% 1 300 50 - 90. 91 247. 93 225. 39 34. 15= 530. 08 PV

What is the PV of this uneven cash flow stream? 0 2 3 4 100 10% 1 300 50 - 90. 91 247. 93 225. 39 34. 15= 530. 08 PV

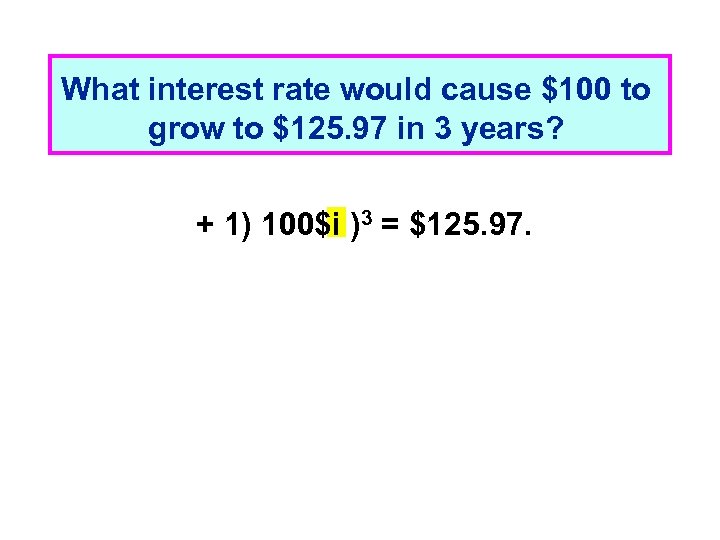

What interest rate would cause $100 to grow to $125. 97 in 3 years? + 1) 100$i )3 = $125. 97.

What interest rate would cause $100 to grow to $125. 97 in 3 years? + 1) 100$i )3 = $125. 97.

Will the FV of a lump sum be larger or smaller if we compound more often, holding the stated i% constant? Why? LARGER! If compounding is more frequent than once a year--for example, semiannually, quarterly, or daily--interest is earned on interest more often.

Will the FV of a lump sum be larger or smaller if we compound more often, holding the stated i% constant? Why? LARGER! If compounding is more frequent than once a year--for example, semiannually, quarterly, or daily--interest is earned on interest more often.

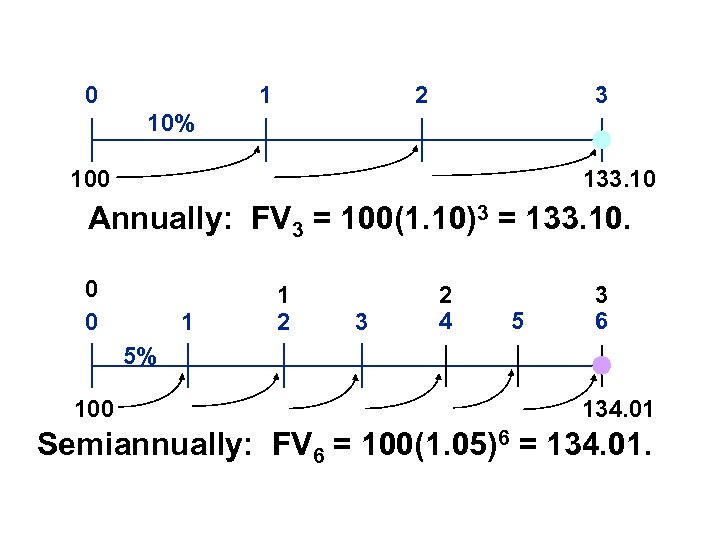

0 1 2 3 10% 100 133. 10 Annually: FV 3 = 100(1. 10)3 = 133. 10. 0 0 1 1 2 3 2 4 5 3 6 5% 100 134. 01 Semiannually: FV 6 = 100(1. 05)6 = 134. 01.

0 1 2 3 10% 100 133. 10 Annually: FV 3 = 100(1. 10)3 = 133. 10. 0 0 1 1 2 3 2 4 5 3 6 5% 100 134. 01 Semiannually: FV 6 = 100(1. 05)6 = 134. 01.

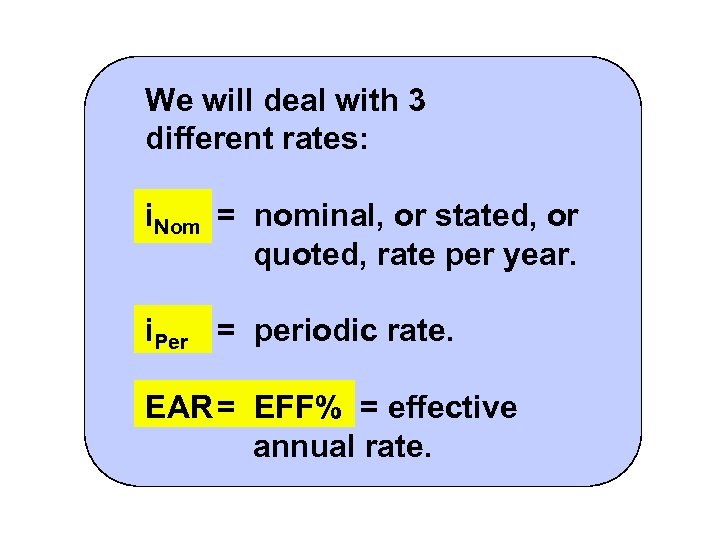

We will deal with 3 different rates: i. Nom = nominal, or stated, or quoted, rate per year. i. Per = periodic rate. EAR = EFF% = effective annual rate.

We will deal with 3 different rates: i. Nom = nominal, or stated, or quoted, rate per year. i. Per = periodic rate. EAR = EFF% = effective annual rate.

n i. Nom is stated in contracts. Periods per year (m) must also be given. n Examples: 8%, Quarterly interest 8%, Daily interest

n i. Nom is stated in contracts. Periods per year (m) must also be given. n Examples: 8%, Quarterly interest 8%, Daily interest

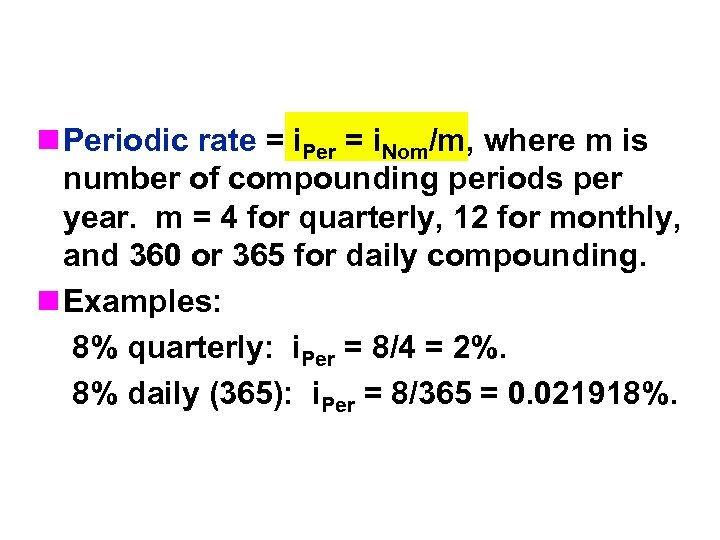

n Periodic rate = i. Per = i. Nom/m, where m is number of compounding periods per year. m = 4 for quarterly, 12 for monthly, and 360 or 365 for daily compounding. n Examples: 8% quarterly: i. Per = 8/4 = 2%. 8% daily (365): i. Per = 8/365 = 0. 021918%.

n Periodic rate = i. Per = i. Nom/m, where m is number of compounding periods per year. m = 4 for quarterly, 12 for monthly, and 360 or 365 for daily compounding. n Examples: 8% quarterly: i. Per = 8/4 = 2%. 8% daily (365): i. Per = 8/365 = 0. 021918%.

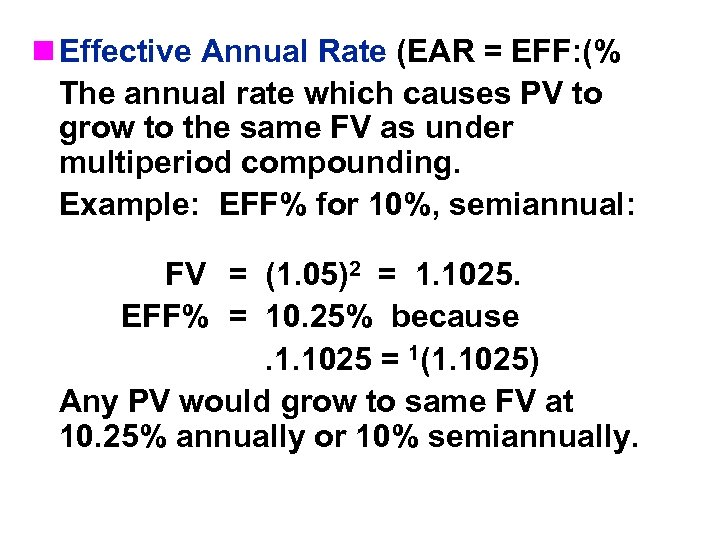

n Effective Annual Rate (EAR = EFF: (% The annual rate which causes PV to grow to the same FV as under multiperiod compounding. Example: EFF% for 10%, semiannual: FV = (1. 05)2 = 1. 1025. EFF% = 10. 25% because. 1. 1025 = 1(1. 1025) Any PV would grow to same FV at 10. 25% annually or 10% semiannually.

n Effective Annual Rate (EAR = EFF: (% The annual rate which causes PV to grow to the same FV as under multiperiod compounding. Example: EFF% for 10%, semiannual: FV = (1. 05)2 = 1. 1025. EFF% = 10. 25% because. 1. 1025 = 1(1. 1025) Any PV would grow to same FV at 10. 25% annually or 10% semiannually.

n An investment with monthly compounding is different from one with quarterly compounding. Must put on EFF% basis to compare rates of return. n Banks say “interest paid daily. ” Same as compounded daily.

n An investment with monthly compounding is different from one with quarterly compounding. Must put on EFF% basis to compare rates of return. n Banks say “interest paid daily. ” Same as compounded daily.

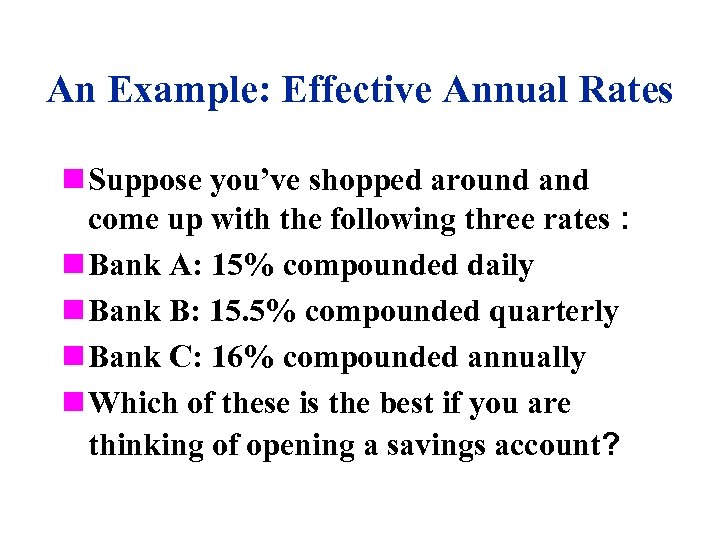

An Example: Effective Annual Rates n Suppose you’ve shopped around and come up with the following three rates : n Bank A: 15% compounded daily n Bank B: 15. 5% compounded quarterly n Bank C: 16% compounded annually n Which of these is the best if you are thinking of opening a savings account?

An Example: Effective Annual Rates n Suppose you’ve shopped around and come up with the following three rates : n Bank A: 15% compounded daily n Bank B: 15. 5% compounded quarterly n Bank C: 16% compounded annually n Which of these is the best if you are thinking of opening a savings account?

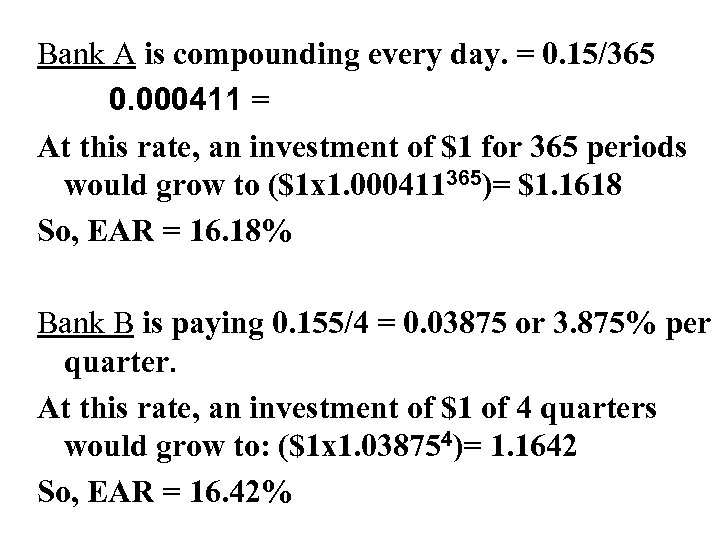

Bank A is compounding every day. = 0. 15/365 0. 000411 = At this rate, an investment of $1 for 365 periods would grow to ($1 x 1. 000411365)= $1. 1618 So, EAR = 16. 18% Bank B is paying 0. 155/4 = 0. 03875 or 3. 875% per quarter. At this rate, an investment of $1 of 4 quarters would grow to: ($1 x 1. 038754)= 1. 1642 So, EAR = 16. 42%

Bank A is compounding every day. = 0. 15/365 0. 000411 = At this rate, an investment of $1 for 365 periods would grow to ($1 x 1. 000411365)= $1. 1618 So, EAR = 16. 18% Bank B is paying 0. 155/4 = 0. 03875 or 3. 875% per quarter. At this rate, an investment of $1 of 4 quarters would grow to: ($1 x 1. 038754)= 1. 1642 So, EAR = 16. 42%

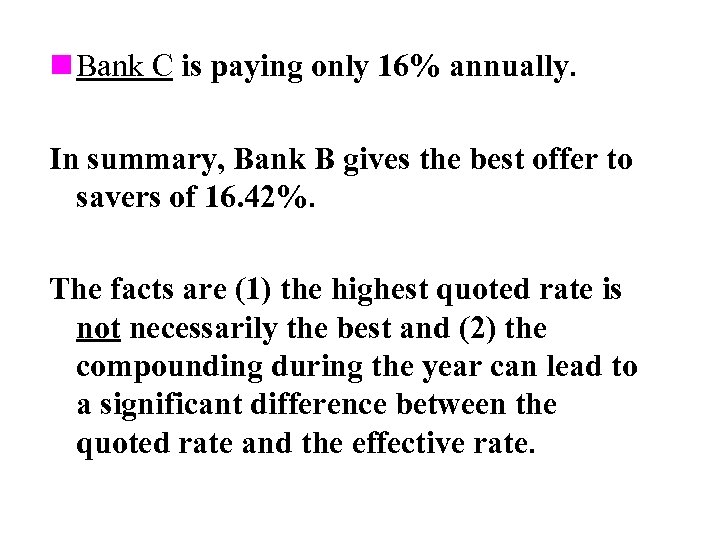

n Bank C is paying only 16% annually. In summary, Bank B gives the best offer to savers of 16. 42%. The facts are (1) the highest quoted rate is not necessarily the best and (2) the compounding during the year can lead to a significant difference between the quoted rate and the effective rate.

n Bank C is paying only 16% annually. In summary, Bank B gives the best offer to savers of 16. 42%. The facts are (1) the highest quoted rate is not necessarily the best and (2) the compounding during the year can lead to a significant difference between the quoted rate and the effective rate.

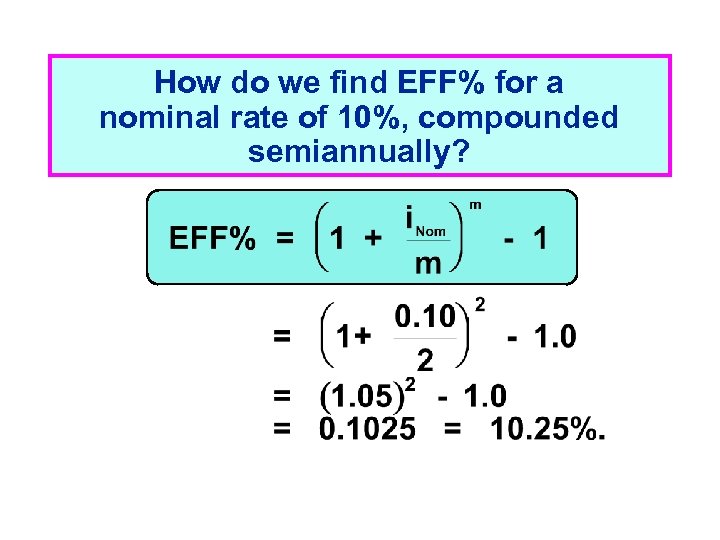

How do we find EFF% for a nominal rate of 10%, compounded semiannually?

How do we find EFF% for a nominal rate of 10%, compounded semiannually?

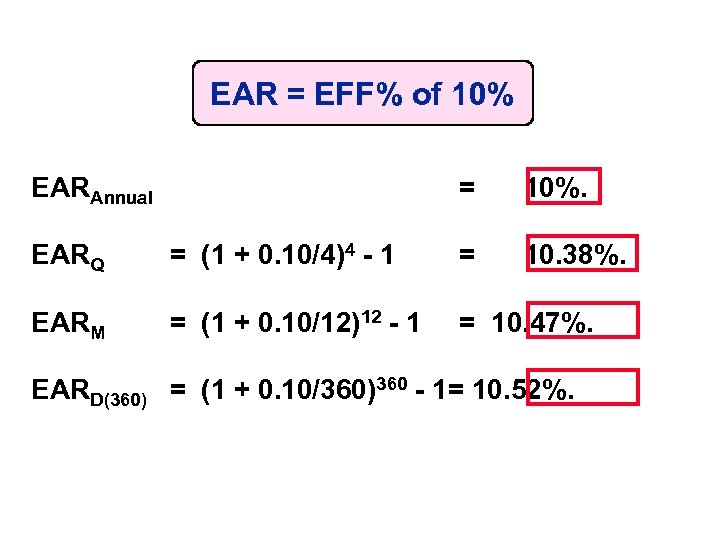

EAR = EFF% of 10% EARAnnual = 10%. 10. 38%. EARQ = (1 + 0. 10/4)4 - 1 = EARM = (1 + 0. 10/12)12 - 1 = 10. 47%. EARD(360) = (1 + 0. 10/360)360 - 1= 10. 52%.

EAR = EFF% of 10% EARAnnual = 10%. 10. 38%. EARQ = (1 + 0. 10/4)4 - 1 = EARM = (1 + 0. 10/12)12 - 1 = 10. 47%. EARD(360) = (1 + 0. 10/360)360 - 1= 10. 52%.

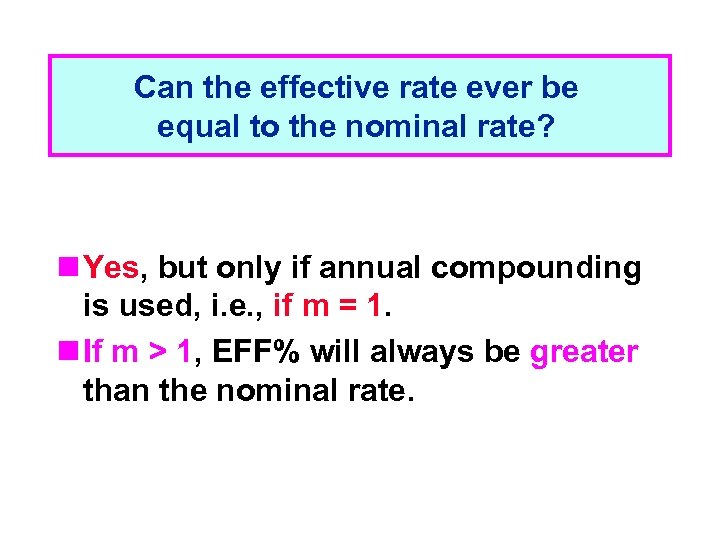

Can the effective rate ever be equal to the nominal rate? n Yes, but only if annual compounding is used, i. e. , if m = 1. n If m > 1, EFF% will always be greater than the nominal rate.

Can the effective rate ever be equal to the nominal rate? n Yes, but only if annual compounding is used, i. e. , if m = 1. n If m > 1, EFF% will always be greater than the nominal rate.

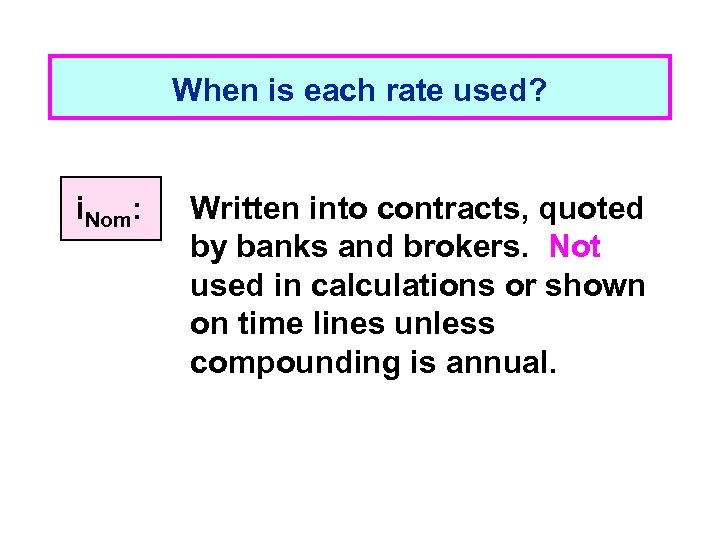

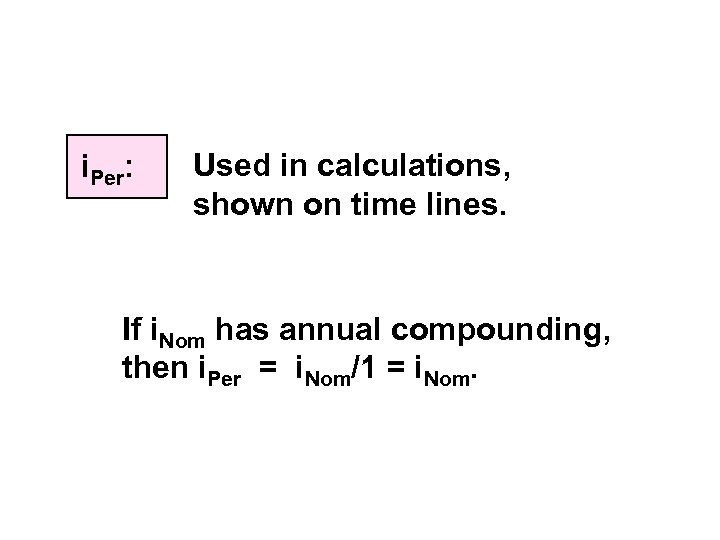

When is each rate used? i. Nom: Written into contracts, quoted by banks and brokers. Not used in calculations or shown on time lines unless compounding is annual.

When is each rate used? i. Nom: Written into contracts, quoted by banks and brokers. Not used in calculations or shown on time lines unless compounding is annual.

i. Per: Used in calculations, shown on time lines. If i. Nom has annual compounding, then i. Per = i. Nom/1 = i. Nom.

i. Per: Used in calculations, shown on time lines. If i. Nom has annual compounding, then i. Per = i. Nom/1 = i. Nom.

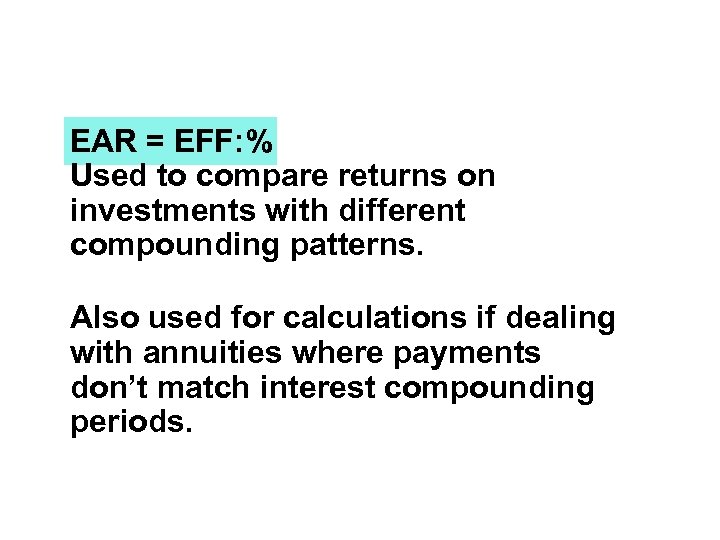

EAR = EFF: % Used to compare returns on investments with different compounding patterns. Also used for calculations if dealing with annuities where payments don’t match interest compounding periods.

EAR = EFF: % Used to compare returns on investments with different compounding patterns. Also used for calculations if dealing with annuities where payments don’t match interest compounding periods.

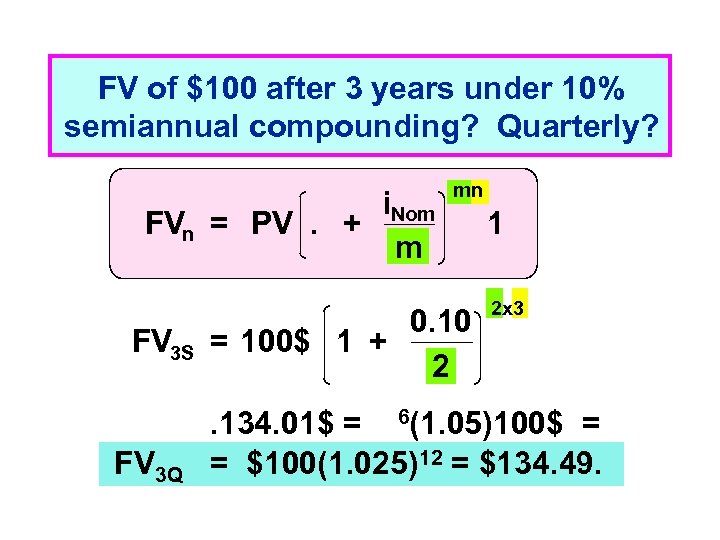

FV of $100 after 3 years under 10% semiannual compounding? Quarterly? i. Nom FVn = PV. + m FV 3 S FV 3 Q mn 0. 10 = 100$ 1 + 2 1 2 x 3 . 134. 01$ = 6(1. 05)100$ = = $100(1. 025)12 = $134. 49.

FV of $100 after 3 years under 10% semiannual compounding? Quarterly? i. Nom FVn = PV. + m FV 3 S FV 3 Q mn 0. 10 = 100$ 1 + 2 1 2 x 3 . 134. 01$ = 6(1. 05)100$ = = $100(1. 025)12 = $134. 49.

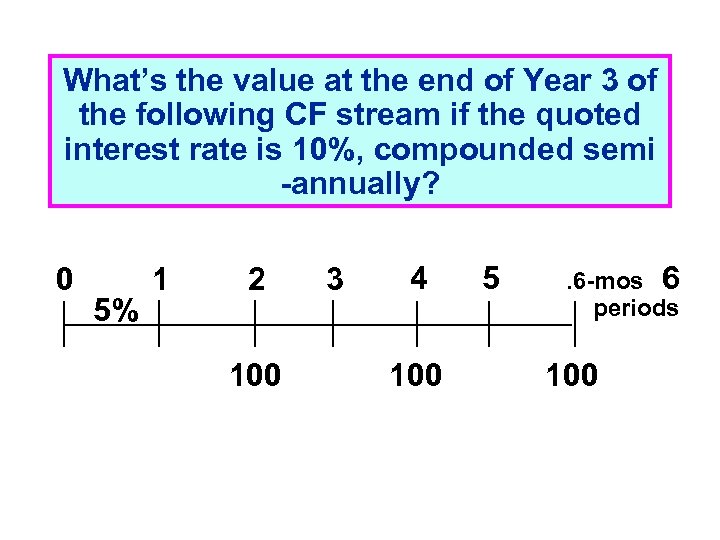

What’s the value at the end of Year 3 of the following CF stream if the quoted interest rate is 10%, compounded semi -annually? 0 5% 1 2 100 3 4 100 5 . 6 -mos 6 periods 100

What’s the value at the end of Year 3 of the following CF stream if the quoted interest rate is 10%, compounded semi -annually? 0 5% 1 2 100 3 4 100 5 . 6 -mos 6 periods 100

n Payments occur annually, but compounding occurs each 6 months. n So we can’t use normal annuity valuation techniques.

n Payments occur annually, but compounding occurs each 6 months. n So we can’t use normal annuity valuation techniques.

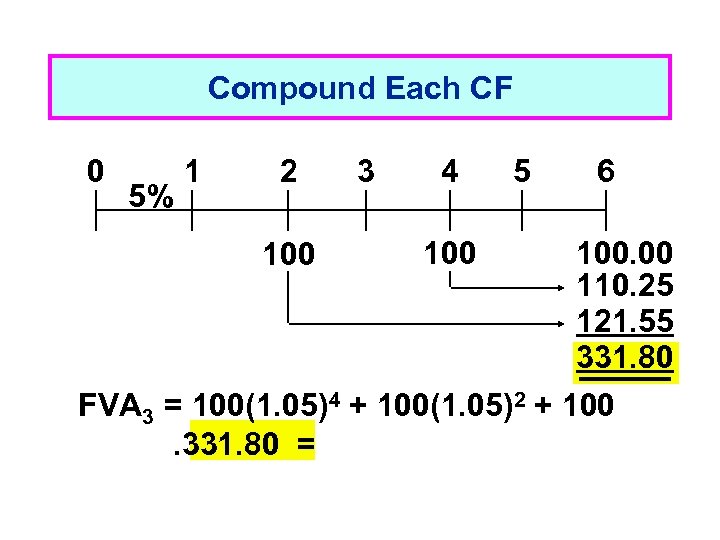

Compound Each CF 0 5% 1 2 3 4 6 100. 00 110. 25 121. 55 331. 80 FVA 3 = 100(1. 05)4 + 100(1. 05)2 + 100. 331. 80 = 100 5

Compound Each CF 0 5% 1 2 3 4 6 100. 00 110. 25 121. 55 331. 80 FVA 3 = 100(1. 05)4 + 100(1. 05)2 + 100. 331. 80 = 100 5

b. The cash flow stream is an annual annuity whose EFF% = 10. 25%.

b. The cash flow stream is an annual annuity whose EFF% = 10. 25%.

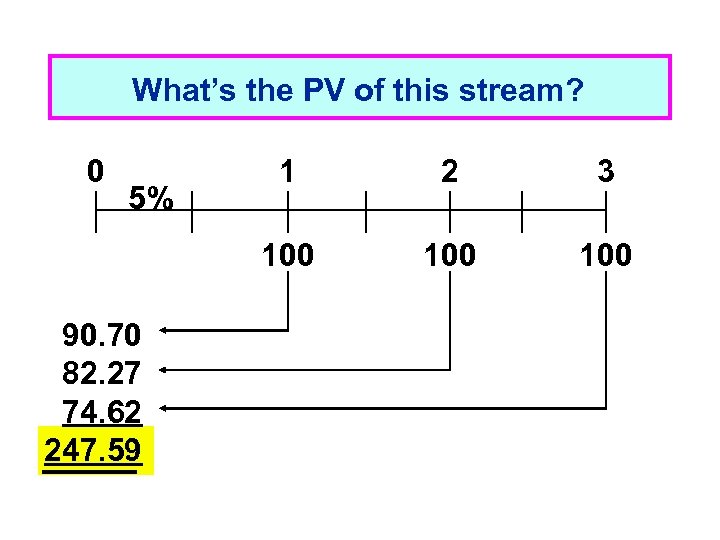

What’s the PV of this stream? 0 90. 70 82. 27 74. 62 247. 59 2 3 100 5% 1 100

What’s the PV of this stream? 0 90. 70 82. 27 74. 62 247. 59 2 3 100 5% 1 100

Amortization Construct an amortization schedule for a $1, 000, 10% annual rate loan with 3 equal payments.

Amortization Construct an amortization schedule for a $1, 000, 10% annual rate loan with 3 equal payments.

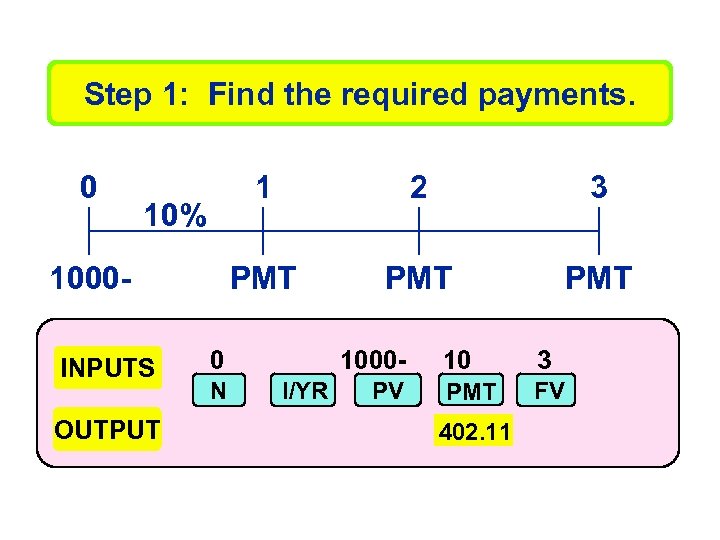

Step 1: Find the required payments. 0 1 1000 INPUTS OUTPUT 3 PMT 10% 2 PMT 0 N 1000 I/YR PV 10 3 PMT FV 402. 11

Step 1: Find the required payments. 0 1 1000 INPUTS OUTPUT 3 PMT 10% 2 PMT 0 N 1000 I/YR PV 10 3 PMT FV 402. 11

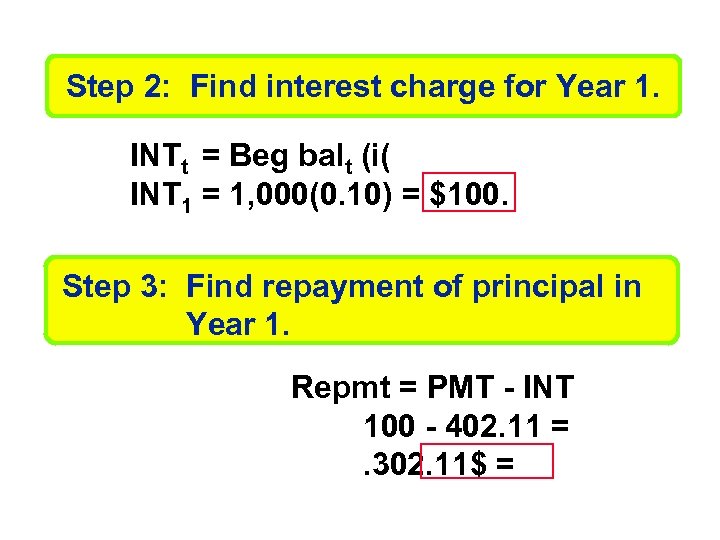

Step 2: Find interest charge for Year 1. INTt = Beg balt (i( INT 1 = 1, 000(0. 10) = $100. Step 3: Find repayment of principal in Year 1. Repmt = PMT - INT 100 - 402. 11 =. 302. 11$ =

Step 2: Find interest charge for Year 1. INTt = Beg balt (i( INT 1 = 1, 000(0. 10) = $100. Step 3: Find repayment of principal in Year 1. Repmt = PMT - INT 100 - 402. 11 =. 302. 11$ =

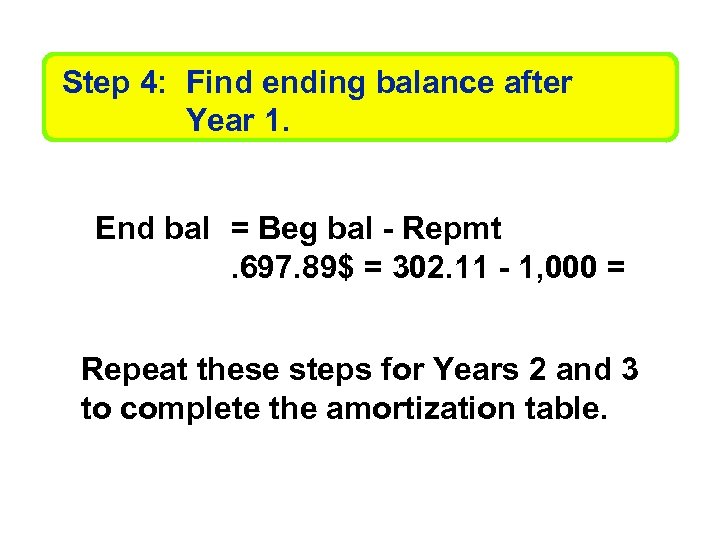

Step 4: Find ending balance after Year 1. End bal = Beg bal - Repmt. 697. 89$ = 302. 11 - 1, 000 = Repeat these steps for Years 2 and 3 to complete the amortization table.

Step 4: Find ending balance after Year 1. End bal = Beg bal - Repmt. 697. 89$ = 302. 11 - 1, 000 = Repeat these steps for Years 2 and 3 to complete the amortization table.

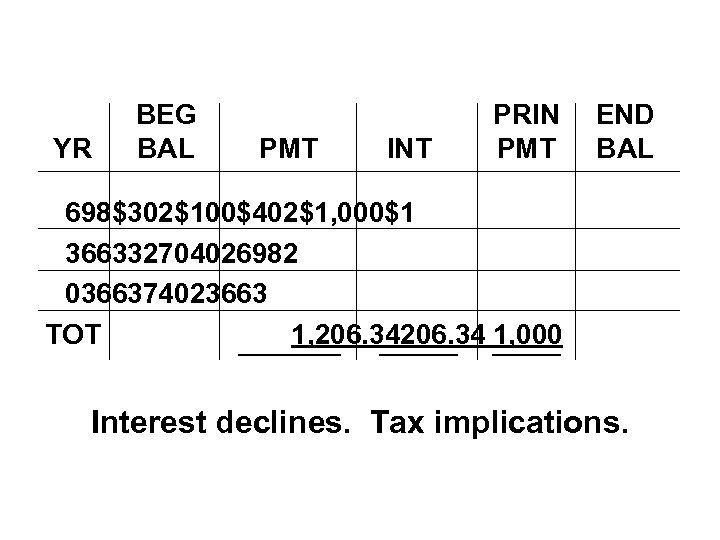

YR BEG BAL PMT INT PRIN PMT END BAL 698$302$100$402$1, 000$1 366332704026982 0366374023663 TOT 1, 206. 34 1, 000 Interest declines. Tax implications.

YR BEG BAL PMT INT PRIN PMT END BAL 698$302$100$402$1, 000$1 366332704026982 0366374023663 TOT 1, 206. 34 1, 000 Interest declines. Tax implications.

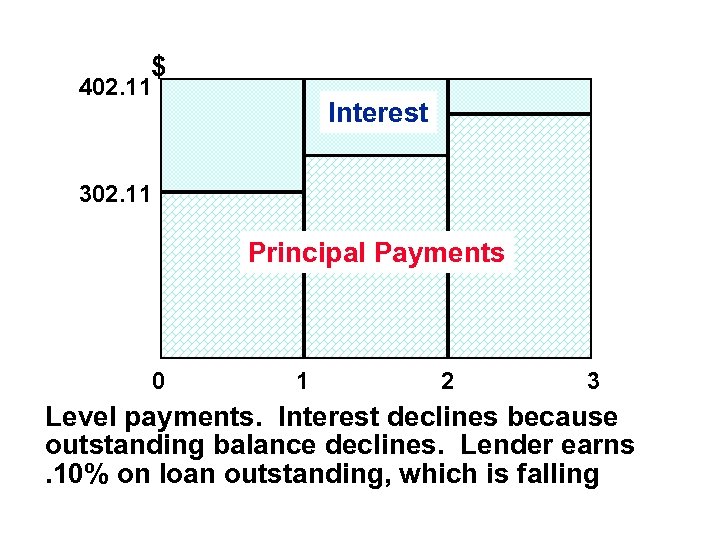

$ 402. 11 Interest 302. 11 Principal Payments 0 1 2 3 Level payments. Interest declines because outstanding balance declines. Lender earns. 10% on loan outstanding, which is falling

$ 402. 11 Interest 302. 11 Principal Payments 0 1 2 3 Level payments. Interest declines because outstanding balance declines. Lender earns. 10% on loan outstanding, which is falling

n Amortization tables are widely used--for home mortgages, auto loans, business loans, retirement plans, etc. They are very important! n Financial calculators (and spreadsheets) are great for setting up amortization tables.

n Amortization tables are widely used--for home mortgages, auto loans, business loans, retirement plans, etc. They are very important! n Financial calculators (and spreadsheets) are great for setting up amortization tables.

On January 1 you deposit $100 in an account that pays a nominal interest rate of 10%, with daily compounding (365 days. ( How much will you have on October 1, or after 9 months (273 days)? (Days given(.

On January 1 you deposit $100 in an account that pays a nominal interest rate of 10%, with daily compounding (365 days. ( How much will you have on October 1, or after 9 months (273 days)? (Days given(.

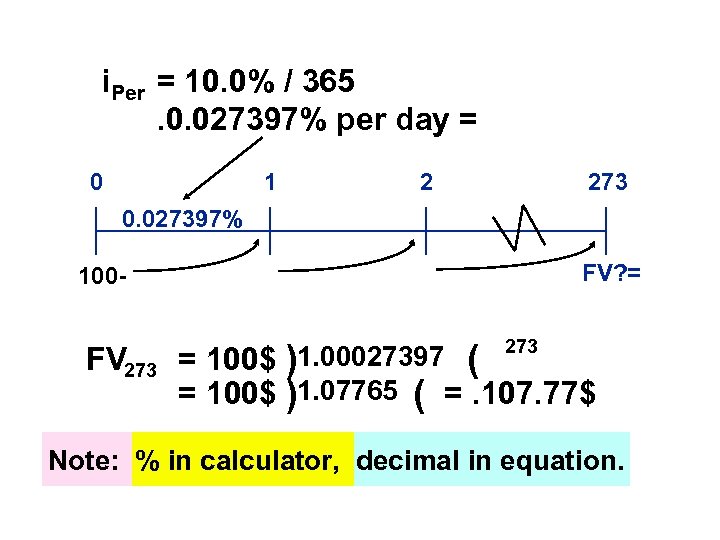

i. Per = 10. 0% / 365. 0. 027397% per day = 0 1 2 273 0. 027397% 100 - FV 273 FV? = 1. 00027397 ( 273 = 100$ )1. 07765 ( =. 107. 77$ Note: % in calculator, decimal in equation.

i. Per = 10. 0% / 365. 0. 027397% per day = 0 1 2 273 0. 027397% 100 - FV 273 FV? = 1. 00027397 ( 273 = 100$ )1. 07765 ( =. 107. 77$ Note: % in calculator, decimal in equation.

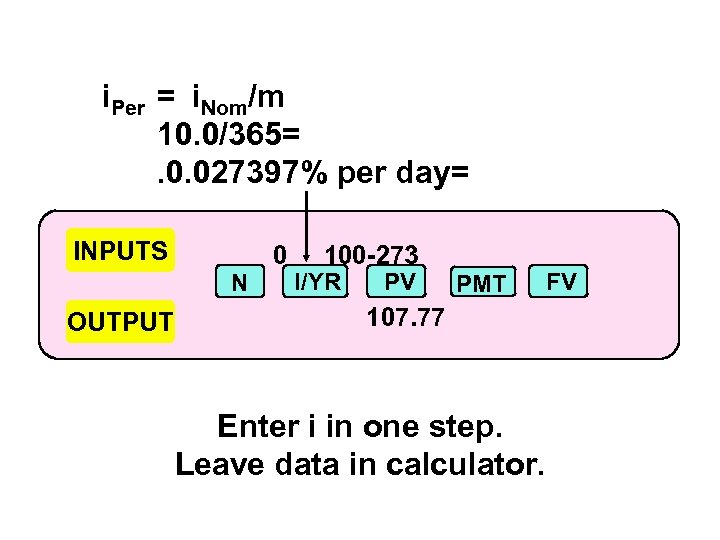

i. Per = i. Nom/m 10. 0/365=. 0. 027397% per day= INPUTS N OUTPUT 0 100 -273 I/YR PV PMT 107. 77 Enter i in one step. Leave data in calculator. FV

i. Per = i. Nom/m 10. 0/365=. 0. 027397% per day= INPUTS N OUTPUT 0 100 -273 I/YR PV PMT 107. 77 Enter i in one step. Leave data in calculator. FV

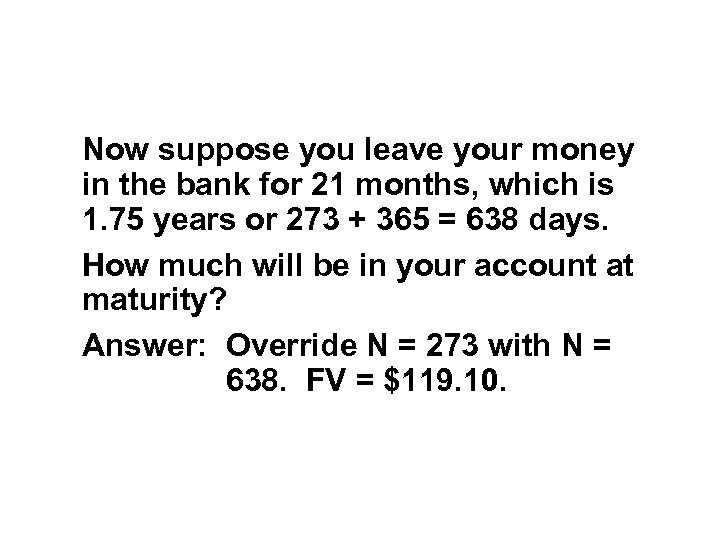

Now suppose you leave your money in the bank for 21 months, which is 1. 75 years or 273 + 365 = 638 days. How much will be in your account at maturity? Answer: Override N = 273 with N = 638. FV = $119. 10.

Now suppose you leave your money in the bank for 21 months, which is 1. 75 years or 273 + 365 = 638 days. How much will be in your account at maturity? Answer: Override N = 273 with N = 638. FV = $119. 10.

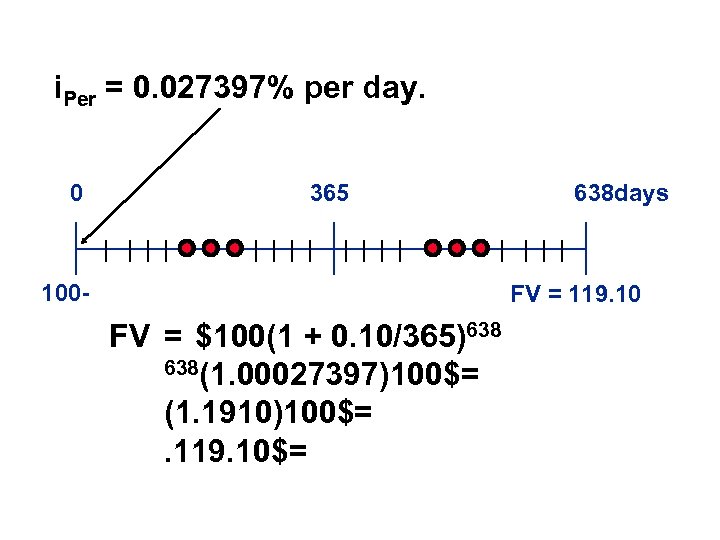

i. Per = 0. 027397% per day. 0 365 100 - 638 days FV = 119. 10 FV = $100(1 + 0. 10/365)638 638(1. 00027397)100$= (1. 1910)100$=. 119. 10$=

i. Per = 0. 027397% per day. 0 365 100 - 638 days FV = 119. 10 FV = $100(1 + 0. 10/365)638 638(1. 00027397)100$= (1. 1910)100$=. 119. 10$=

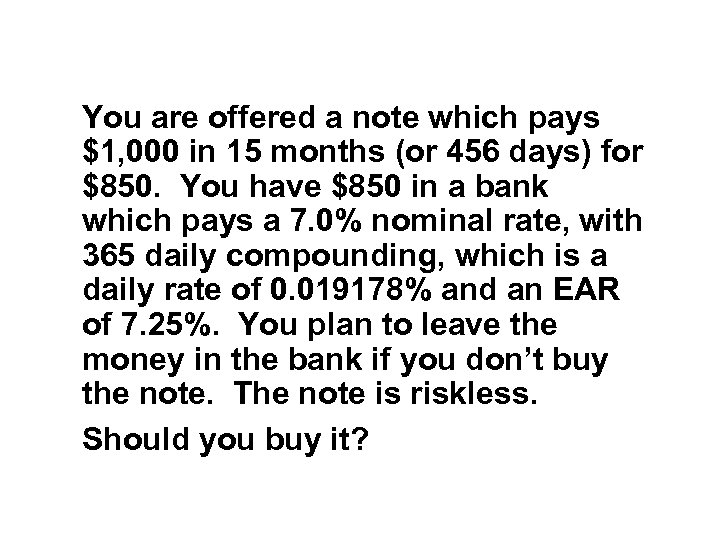

You are offered a note which pays $1, 000 in 15 months (or 456 days) for $850. You have $850 in a bank which pays a 7. 0% nominal rate, with 365 daily compounding, which is a daily rate of 0. 019178% and an EAR of 7. 25%. You plan to leave the money in the bank if you don’t buy the note. The note is riskless. Should you buy it?

You are offered a note which pays $1, 000 in 15 months (or 456 days) for $850. You have $850 in a bank which pays a 7. 0% nominal rate, with 365 daily compounding, which is a daily rate of 0. 019178% and an EAR of 7. 25%. You plan to leave the money in the bank if you don’t buy the note. The note is riskless. Should you buy it?

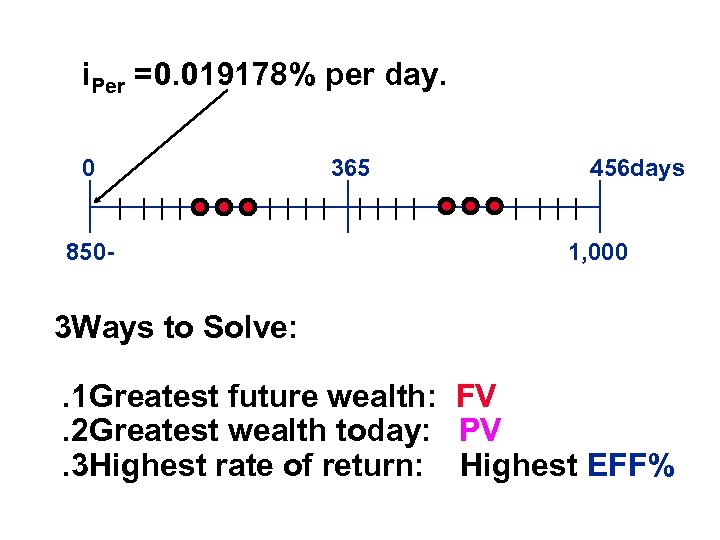

i. Per =0. 019178% per day. 0 850 - 365 456 days 1, 000 3 Ways to Solve: . 1 Greatest future wealth: FV. 2 Greatest wealth today: PV. 3 Highest rate of return: Highest EFF%

i. Per =0. 019178% per day. 0 850 - 365 456 days 1, 000 3 Ways to Solve: . 1 Greatest future wealth: FV. 2 Greatest wealth today: PV. 3 Highest rate of return: Highest EFF%

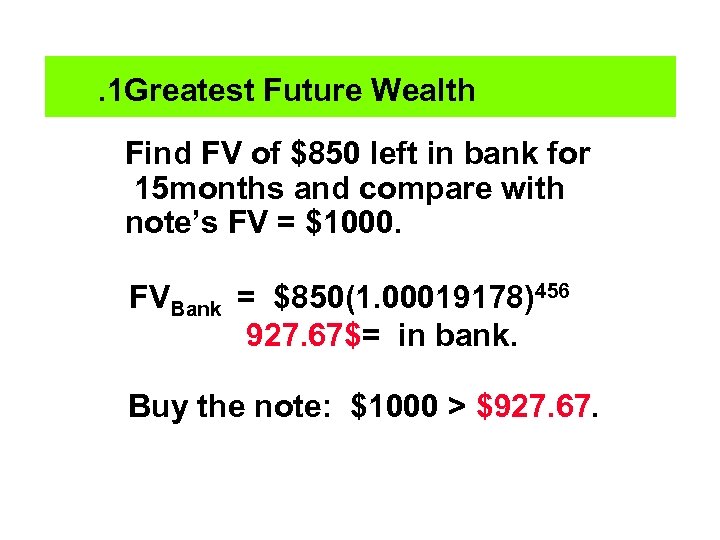

. 1 Greatest Future Wealth Find FV of $850 left in bank for 15 months and compare with note’s FV = $1000. FVBank = $850(1. 00019178)456 927. 67$= in bank. Buy the note: $1000 > $927. 67.

. 1 Greatest Future Wealth Find FV of $850 left in bank for 15 months and compare with note’s FV = $1000. FVBank = $850(1. 00019178)456 927. 67$= in bank. Buy the note: $1000 > $927. 67.

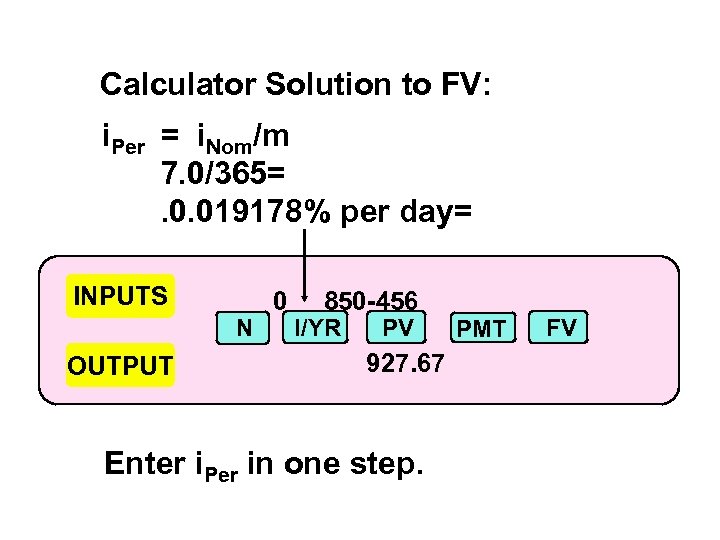

Calculator Solution to FV: i. Per = i. Nom/m 7. 0/365=. 0. 019178% per day= INPUTS N OUTPUT 0 850 -456 I/YR PV 927. 67 Enter i. Per in one step. PMT FV

Calculator Solution to FV: i. Per = i. Nom/m 7. 0/365=. 0. 019178% per day= INPUTS N OUTPUT 0 850 -456 I/YR PV 927. 67 Enter i. Per in one step. PMT FV

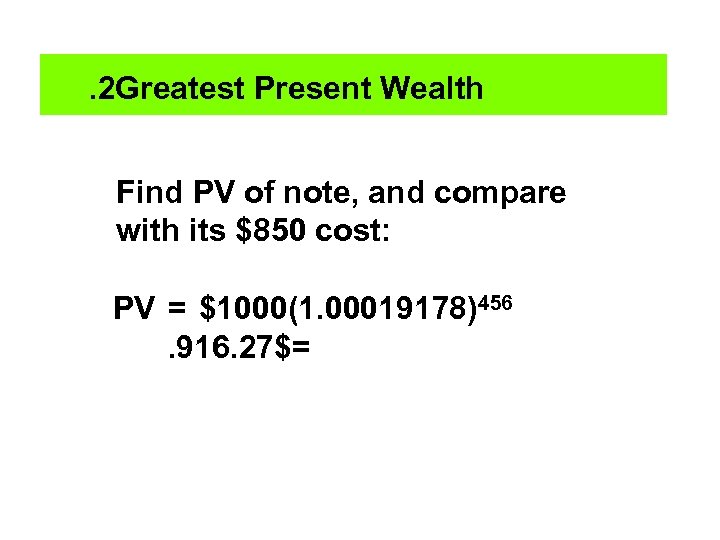

. 2 Greatest Present Wealth Find PV of note, and compare with its $850 cost: PV = $1000(1. 00019178)456. 916. 27$=

. 2 Greatest Present Wealth Find PV of note, and compare with its $850 cost: PV = $1000(1. 00019178)456. 916. 27$=

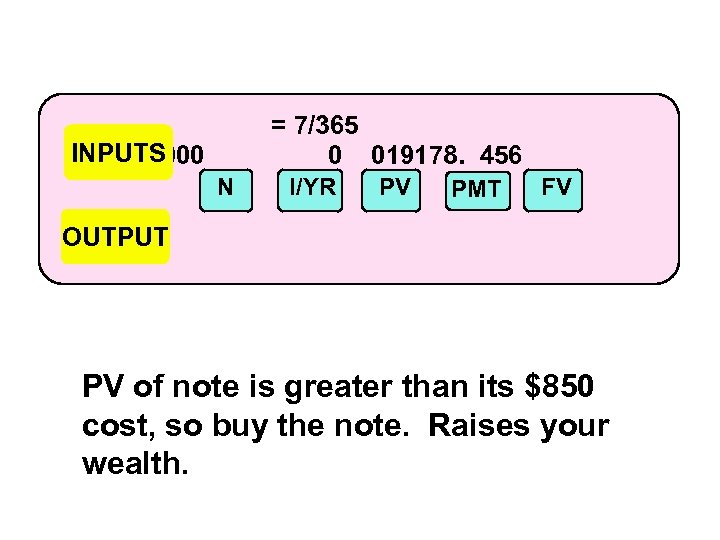

= 7/365 0 019178. 456 INPUTS 1000 N I/YR PV PMT FV 916. 27 OUTPUT PV of note is greater than its $850 cost, so buy the note. Raises your wealth.

= 7/365 0 019178. 456 INPUTS 1000 N I/YR PV PMT FV 916. 27 OUTPUT PV of note is greater than its $850 cost, so buy the note. Raises your wealth.

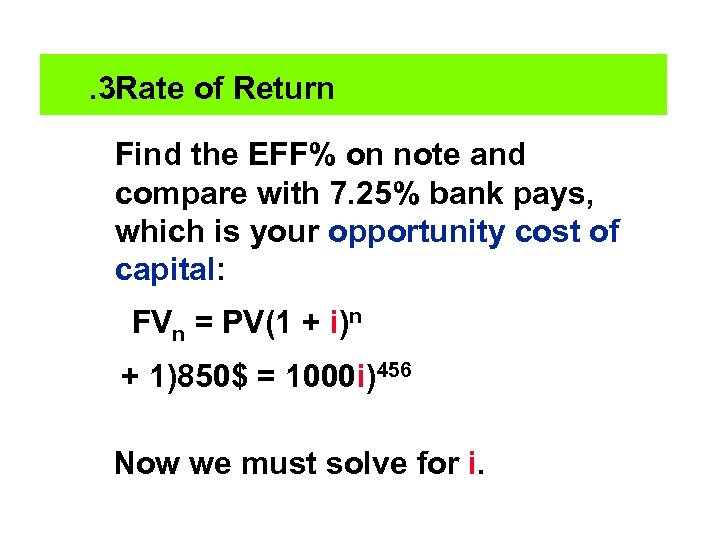

. 3 Rate of Return Find the EFF% on note and compare with 7. 25% bank pays, which is your opportunity cost of capital: FVn = PV(1 + i)n + 1)850$ = 1000 i)456 Now we must solve for i.

. 3 Rate of Return Find the EFF% on note and compare with 7. 25% bank pays, which is your opportunity cost of capital: FVn = PV(1 + i)n + 1)850$ = 1000 i)456 Now we must solve for i.

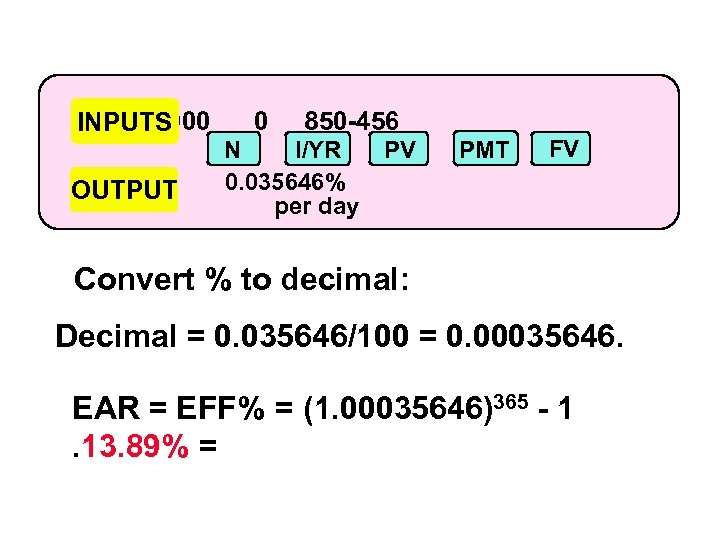

1000 INPUTS OUTPUT 0 850 -456 N I/YR 0. 035646% per day PV PMT FV Convert % to decimal: Decimal = 0. 035646/100 = 0. 00035646. EAR = EFF% = (1. 00035646)365 - 1. 13. 89% =

1000 INPUTS OUTPUT 0 850 -456 N I/YR 0. 035646% per day PV PMT FV Convert % to decimal: Decimal = 0. 035646/100 = 0. 00035646. EAR = EFF% = (1. 00035646)365 - 1. 13. 89% =

Using interest conversion: P/YR = 365 NOM% = 0. 035646(365) = 13. 01 EFF% = 13. 89 Since 13. 89% > 7. 25% opportunity cost, buy the note.

Using interest conversion: P/YR = 365 NOM% = 0. 035646(365) = 13. 01 EFF% = 13. 89 Since 13. 89% > 7. 25% opportunity cost, buy the note.