f420745b27cc5d34ac0422b429311b6d.ppt

- Количество слайдов: 40

DISCLAIMER This call will contain statements about the Company's future results call. These statements constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any forward-looking statements represent only the Company's views as of today, December 15, 2006, and are based on current expectations in light of the current economic environment. While we may choose to update forward-looking statements in the future, we specifically disclaim any duty to do so; therefore, these forward-looking statements should not be relied upon as representing the Company's views as of any later date. Forward-looking statements and projections are inherently subject to significant economic, competitive and other uncertainties and contingencies which are beyond the control of Net 1. We caution you that such statements are not guarantees of future performance. Actual results may differ materially from those expressed or implied in the forward-looking statements. Page 1

MISSION STATEMENT “To provide a secure, universal and affordable transacting system for all, utilizing existing infrastructures, that will enable the majority of people unqualified access to previously inaccessible goods and services, resulting in the upliftment of their lifestyles, whilst opening up new, low risk and profitable markets for the suppliers concerned. ” Page 2

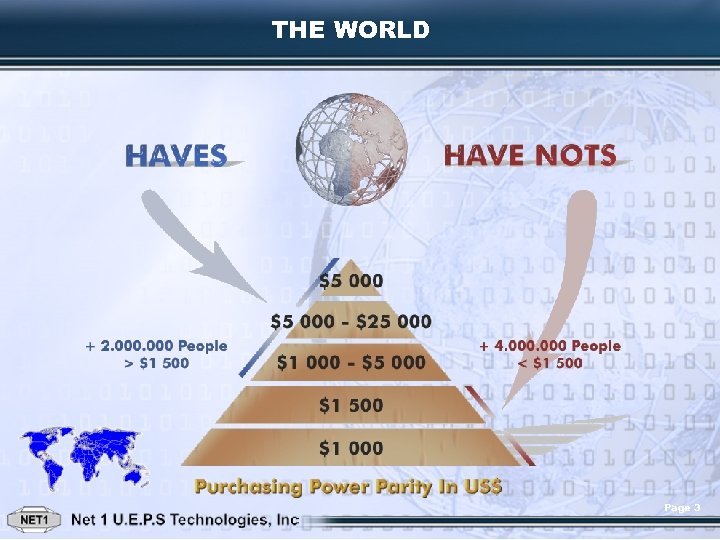

THE WORLD Page 3

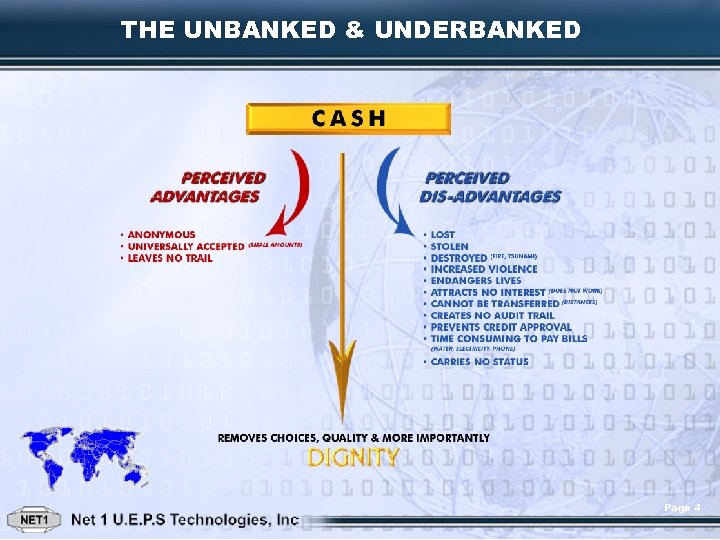

THE UNBANKED & UNDERBANKED Page 4

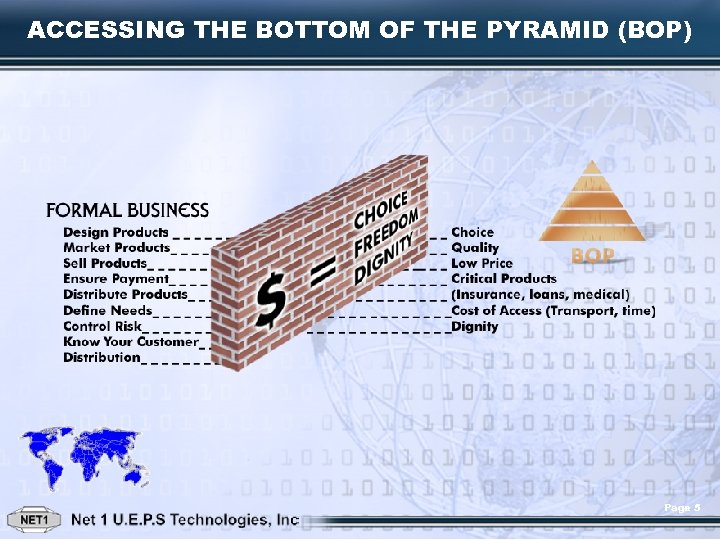

ACCESSING THE BOTTOM OF THE PYRAMID (BOP) Page 5

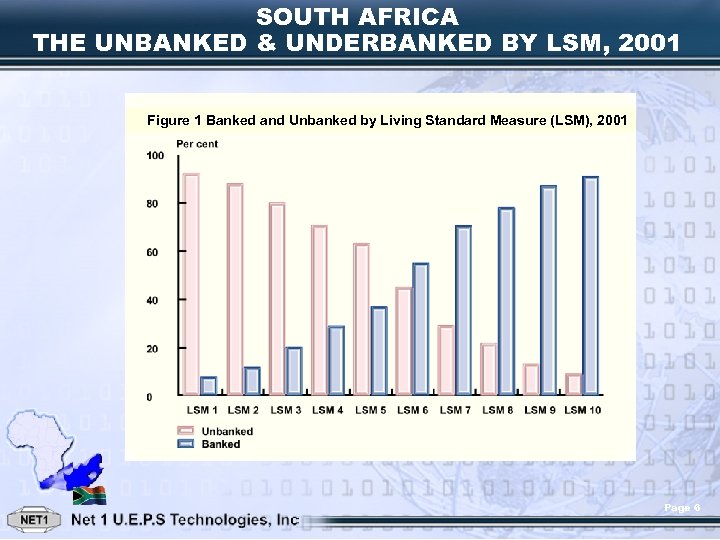

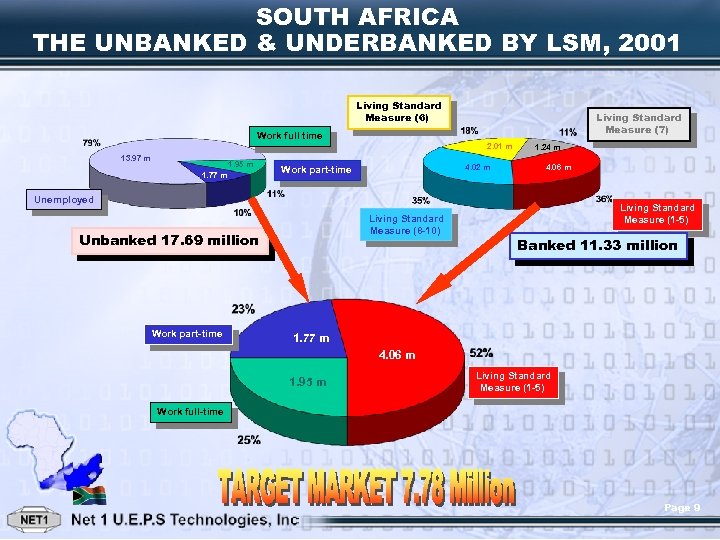

SOUTH AFRICA THE UNBANKED & UNDERBANKED BY LSM, 2001 Figure 1 Banked and Unbanked by Living Standard Measure (LSM), 2001 Page 6

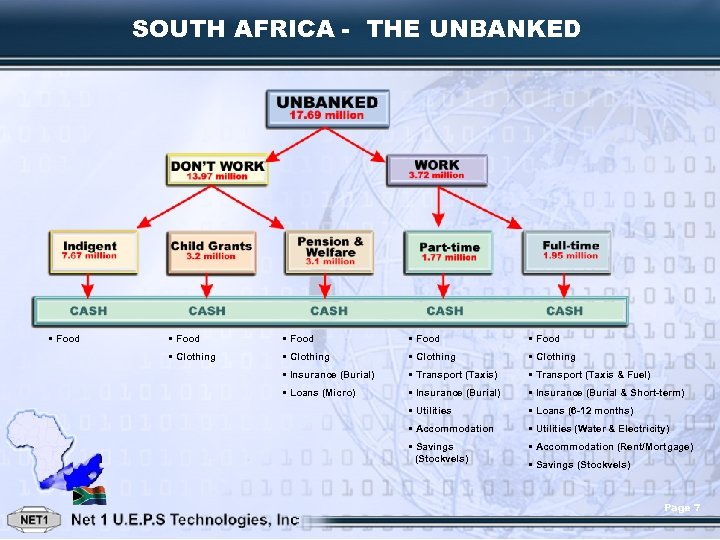

SOUTH AFRICA - THE UNBANKED • Food • Food • Clothing • Insurance (Burial) • Transport (Taxis & Fuel) • Loans (Micro) • Insurance (Burial & Short-term) • Utilities • Loans (6 -12 months) • Accommodation • Utilities (Water & Electricity) • Savings (Stockvels) • Accommodation (Rent/Mortgage) • Savings (Stockvels) Page 7

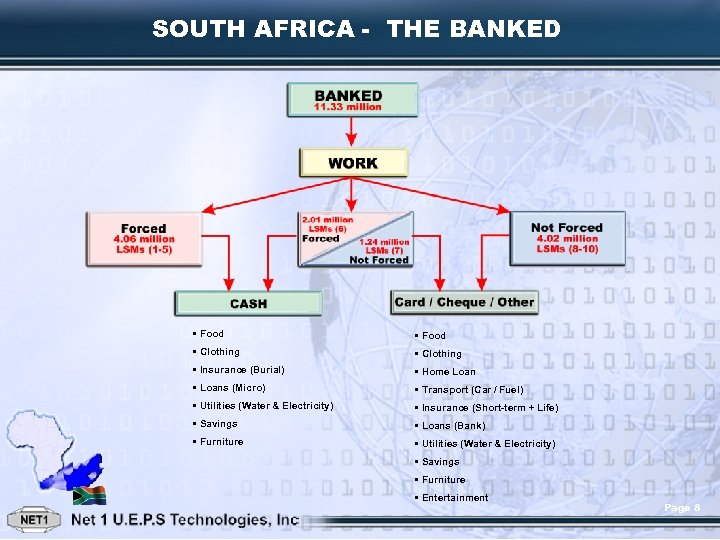

SOUTH AFRICA - THE BANKED • Food • Clothing • Insurance (Burial) • Home Loan • Loans (Micro) • Transport (Car / Fuel) • Utilities (Water & Electricity) • Insurance (Short-term + Life) • Savings • Loans (Bank) • Furniture • Utilities (Water & Electricity) • Savings • Furniture • Entertainment Page 8

SOUTH AFRICA THE UNBANKED & UNDERBANKED BY LSM, 2001 Living Standard Measure (6) Living Standard Measure (7) Work full time 2. 01 m 13. 97 m 1. 95 m 1. 77 m 4. 02 m Work part-time 1. 24 m 4. 06 m Unemployed Living Standard Measure (8 -10) Unbanked 17. 69 million Work part-time Living Standard Measure (1 -5) Banked 11. 33 million 1. 77 m 4. 06 m 1. 95 m Living Standard Measure (1 -5) Work full-time Page 9

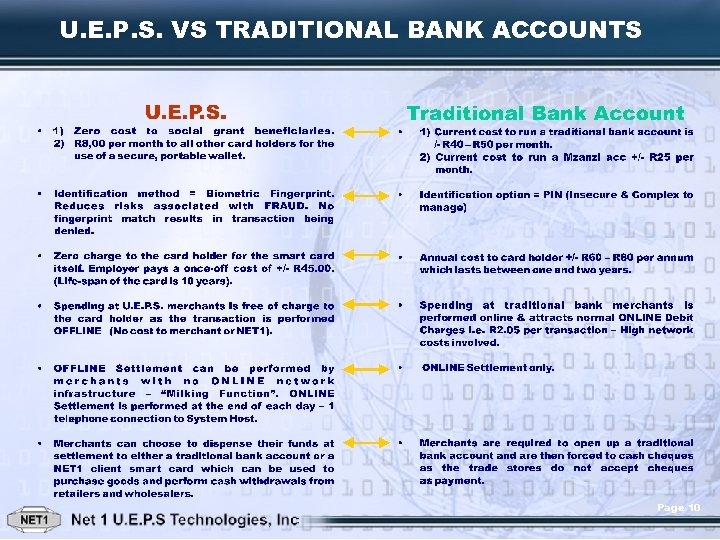

U. E. P. S. VS TRADITIONAL BANK ACCOUNTS Page 10

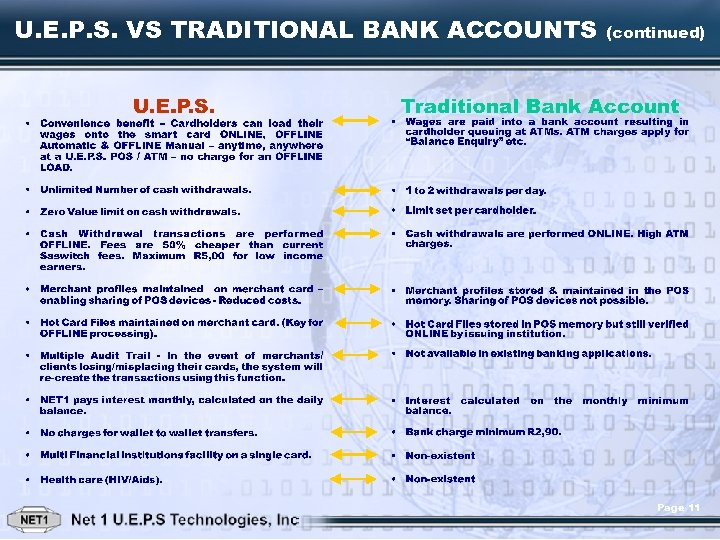

U. E. P. S. VS TRADITIONAL BANK ACCOUNTS (continued) Page 11

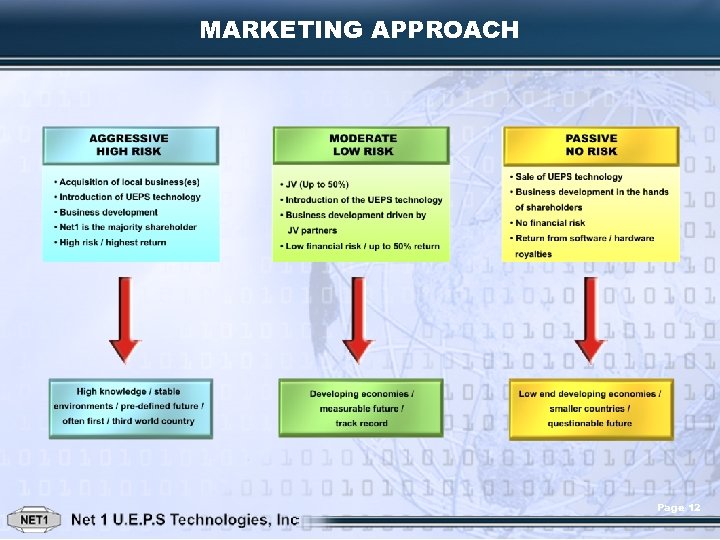

MARKETING APPROACH Page 12

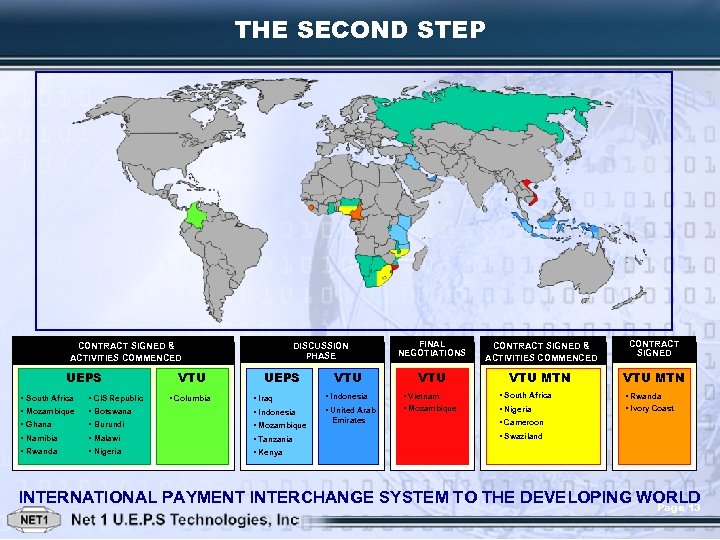

THE SECOND STEP UEPS • South Africa • CIS Republic VTU • Columbia FINAL NEGOTIATIONS CONTRACT SIGNED & ACTIVITIES COMMENCED CONTRACT SIGNED VTU VTU MTN • Indonesia • Vietnam • Mozambique DISCUSSION PHASE CONTRACT SIGNED & ACTIVITIES COMMENCED UEPS • Iraq • Mozambique • Botswana • Indonesia • Ghana • Burundi • Mozambique • Namibia • Malawi • Tanzania • Rwanda • Nigeria • United Arab • South Africa • Nigeria • Rwanda • Ivory Coast • Kenya Emirates • Cameroon • Swaziland INTERNATIONAL PAYMENT INTERCHANGE SYSTEM TO THE DEVELOPING WORLD Page 13

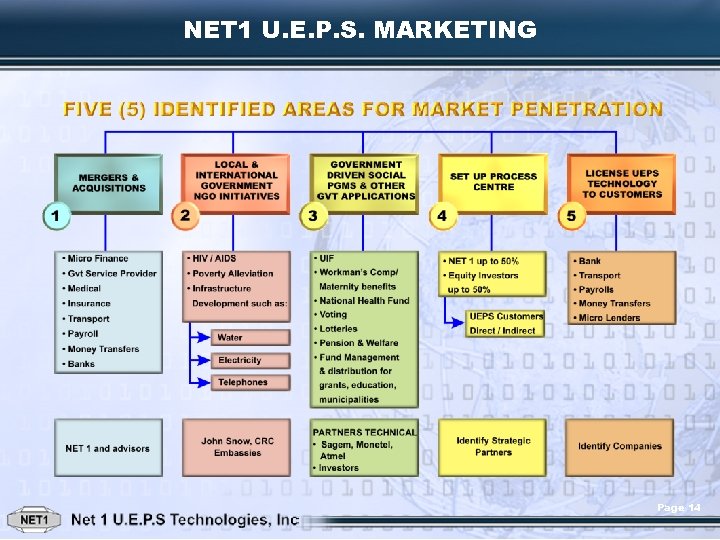

NET 1 U. E. P. S. MARKETING Page 14

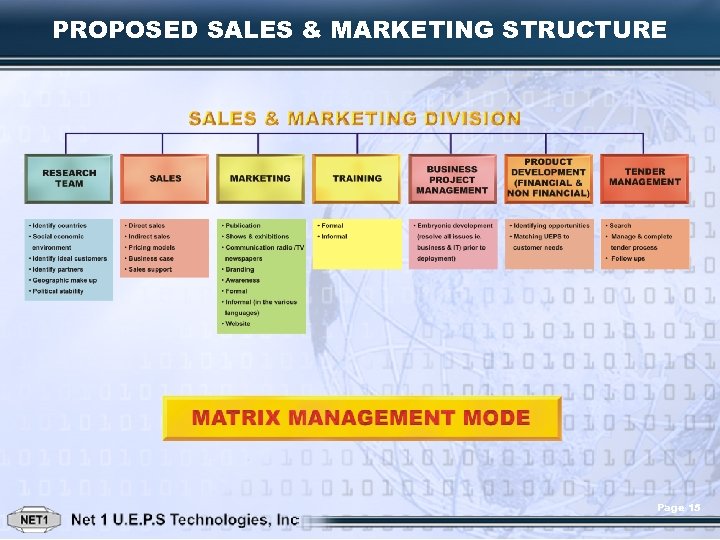

PROPOSED SALES & MARKETING STRUCTURE Page 15

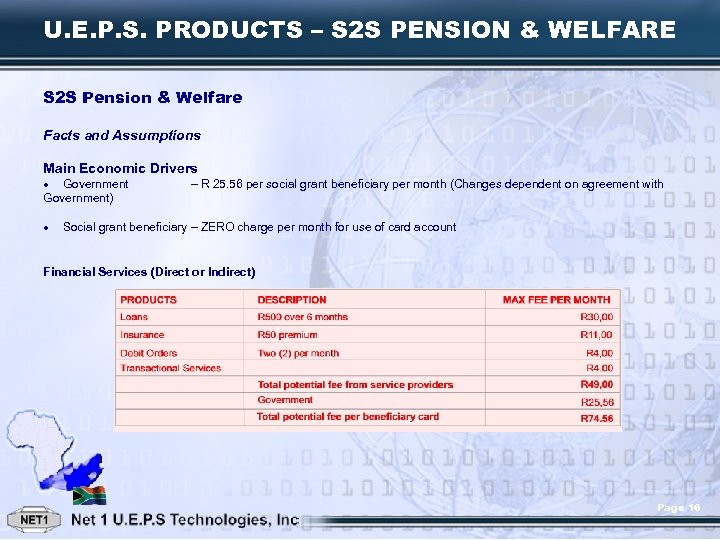

U. E. P. S. PRODUCTS – S 2 S PENSION & WELFARE S 2 S Pension & Welfare Facts and Assumptions Main Economic Drivers · Government – R 25. 56 per social grant beneficiary per month (Changes dependent on agreement with Government) · Social grant beneficiary – ZERO charge per month for use of card account Financial Services (Direct or Indirect) Page 16

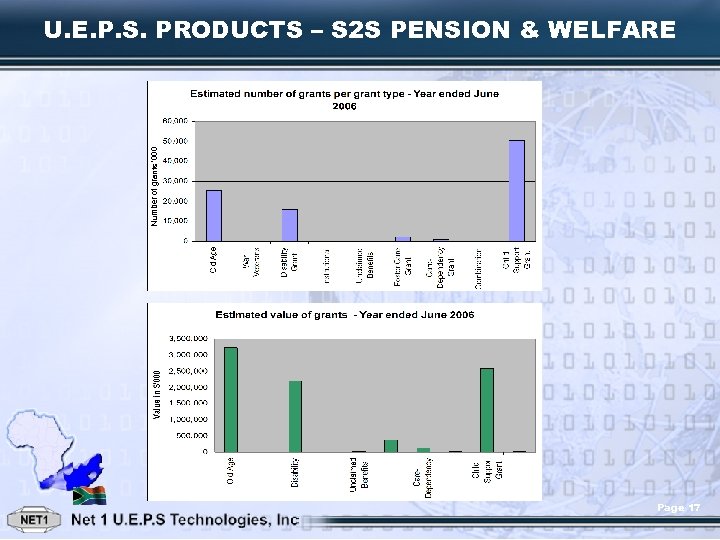

Number of grants ‘ 000 U. E. P. S. PRODUCTS – S 2 S PENSION & WELFARE Page 17

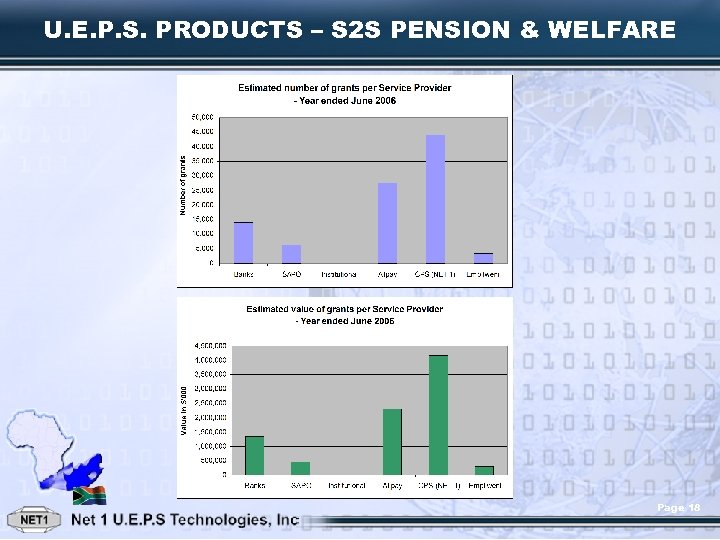

U. E. P. S. PRODUCTS – S 2 S PENSION & WELFARE Page 18

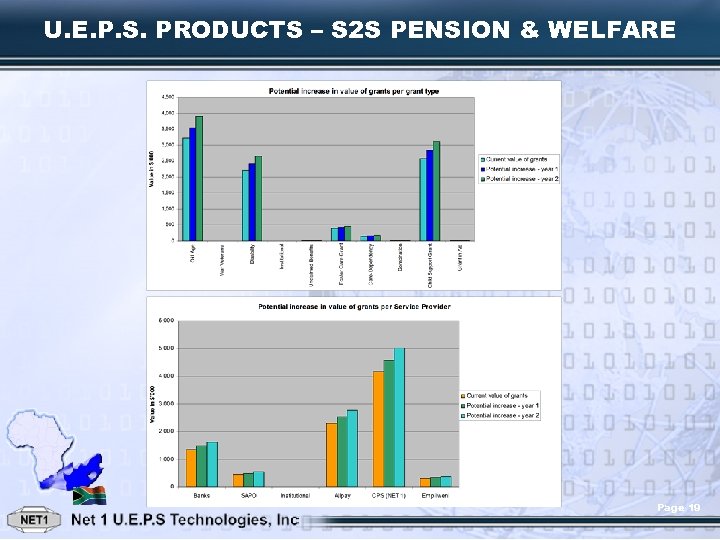

U. E. P. S. PRODUCTS – S 2 S PENSION & WELFARE Page 19

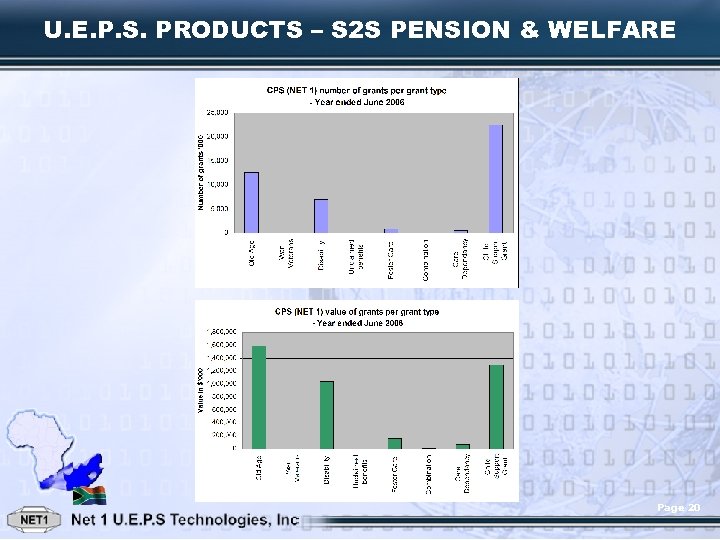

U. E. P. S. PRODUCTS – S 2 S PENSION & WELFARE Page 20

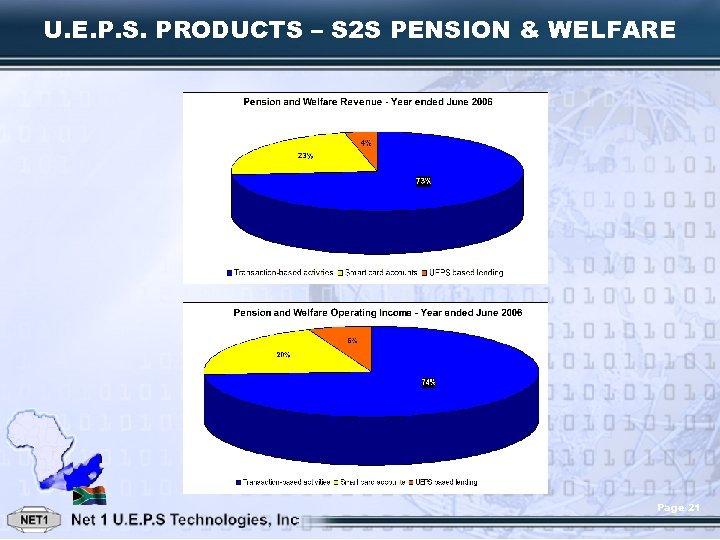

U. E. P. S. PRODUCTS – S 2 S PENSION & WELFARE Page 21

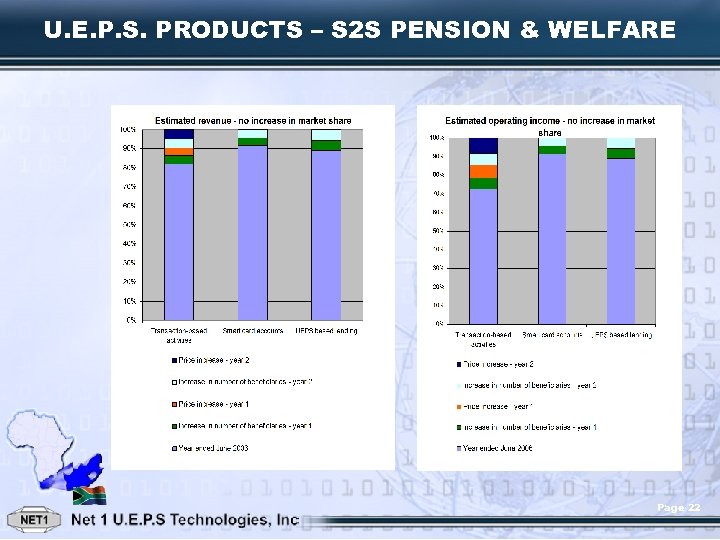

U. E. P. S. PRODUCTS – S 2 S PENSION & WELFARE Page 22

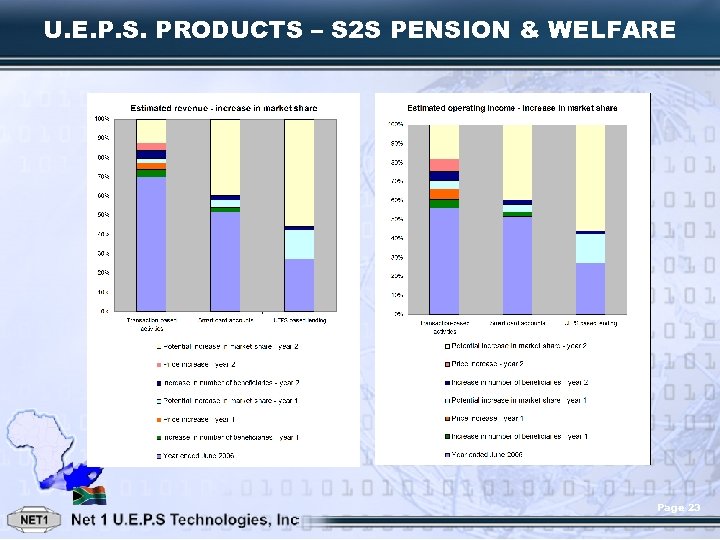

U. E. P. S. PRODUCTS – S 2 S PENSION & WELFARE Page 23

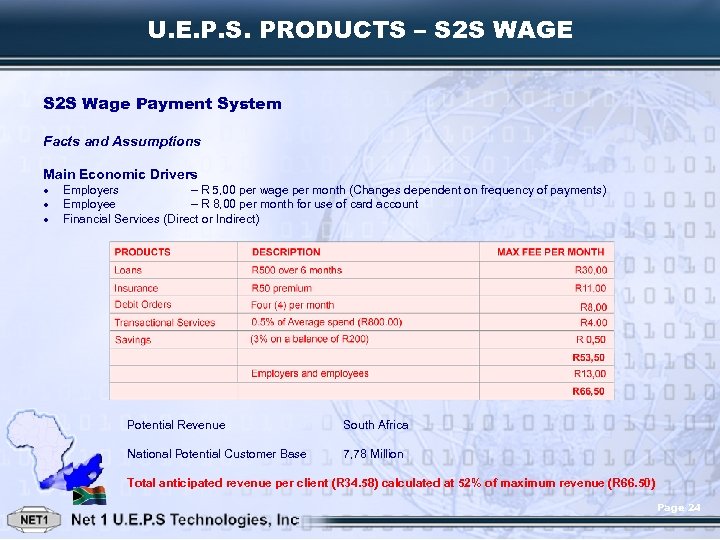

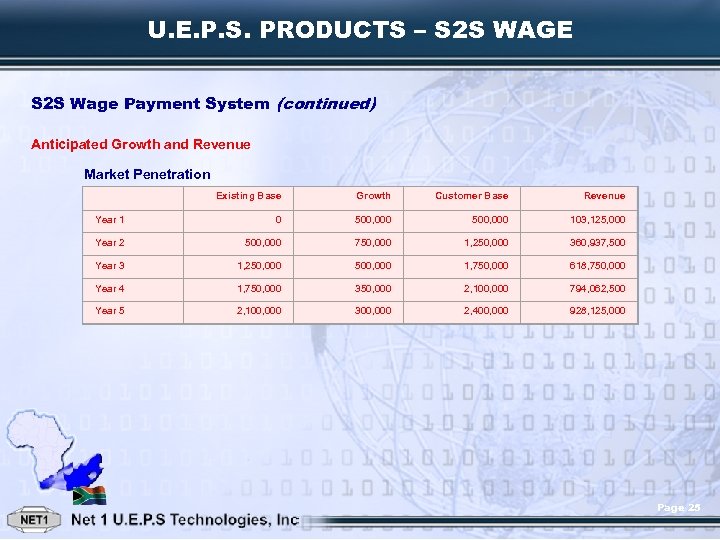

U. E. P. S. PRODUCTS – S 2 S WAGE S 2 S Wage Payment System Facts and Assumptions Main Economic Drivers · Employers – R 5, 00 per wage per month (Changes dependent on frequency of payments) · Employee – R 8, 00 per month for use of card account · Financial Services (Direct or Indirect) Potential Revenue South Africa National Potential Customer Base 7, 78 Million Total anticipated revenue per client (R 34. 58) calculated at 52% of maximum revenue (R 66. 50) Page 24

U. E. P. S. PRODUCTS – S 2 S WAGE S 2 S Wage Payment System (continued) Anticipated Growth and Revenue Market Penetration Existing Base Growth Customer Base Revenue Year 1 0 500, 000 103, 125, 000 Year 2 500, 000 750, 000 1, 250, 000 360, 937, 500 Year 3 1, 250, 000 500, 000 1, 750, 000 618, 750, 000 Year 4 1, 750, 000 350, 000 2, 100, 000 794, 062, 500 Year 5 2, 100, 000 300, 000 2, 400, 000 928, 125, 000 Page 25

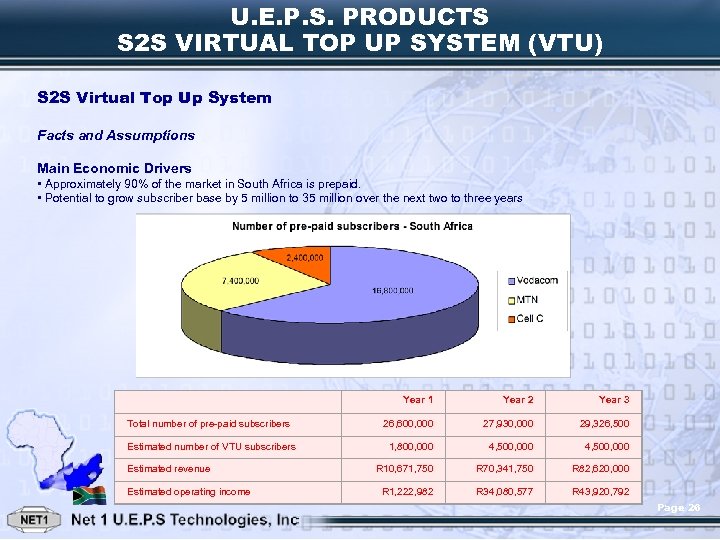

U. E. P. S. PRODUCTS S 2 S VIRTUAL TOP UP SYSTEM (VTU) S 2 S Virtual Top Up System Facts and Assumptions Main Economic Drivers • Approximately 90% of the market in South Africa is prepaid. • Potential to grow subscriber base by 5 million to 35 million over the next two to three years Year 1 Year 2 Year 3 Total number of pre-paid subscribers 26, 600, 000 27, 930, 000 29, 326, 500 Estimated number of VTU subscribers 1, 800, 000 4, 500, 000 R 10, 671, 750 R 70, 341, 750 R 82, 620, 000 R 1, 222, 982 R 34, 080, 577 R 43, 920, 792 Estimated revenue Estimated operating income Page 26

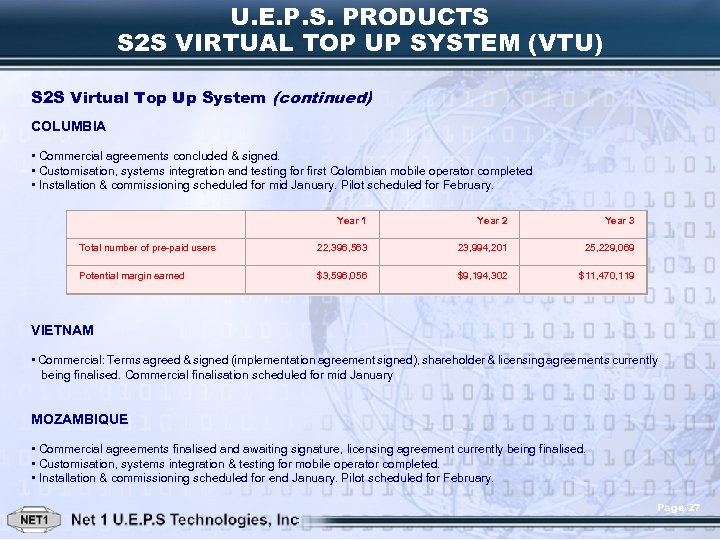

U. E. P. S. PRODUCTS S 2 S VIRTUAL TOP UP SYSTEM (VTU) S 2 S Virtual Top Up System (continued) COLUMBIA • Commercial agreements concluded & signed. • Customisation, systems integration and testing for first Colombian mobile operator completed • Installation & commissioning scheduled for mid January. Pilot scheduled for February. Year 1 Year 2 Year 3 Total number of pre-paid users 22, 396, 563 23, 994, 201 25, 229, 069 Potential margin earned $3, 596, 056 $9, 194, 302 $11, 470, 119 VIETNAM • Commercial: Terms agreed & signed (implementation agreement signed), shareholder & licensing agreements currently being finalised. Commercial finalisation scheduled for mid January MOZAMBIQUE • Commercial agreements finalised and awaiting signature, licensing agreement currently being finalised. • Customisation, systems integration & testing for mobile operator completed. • Installation & commissioning scheduled for end January. Pilot scheduled for February. Page 27

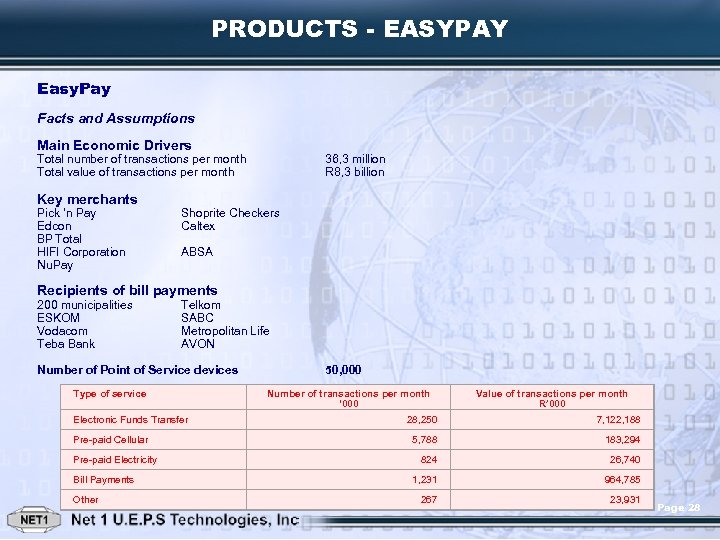

PRODUCTS - EASYPAY Easy. Pay Facts and Assumptions Main Economic Drivers Total number of transactions per month Total value of transactions per month Key merchants Pick ‘n Pay Edcon BP Total HIFI Corporation Nu. Pay 36, 3 million R 8, 3 billion Shoprite Checkers Caltex ABSA Recipients of bill payments 200 municipalities Telkom ESKOM SABC Vodacom Metropolitan Life Teba Bank AVON Number of Point of Service devices Type of service Electronic Funds Transfer Pre-paid Cellular Pre-paid Electricity Bill Payments Other 50, 000 Number of transactions per month ‘ 000 Value of transactions per month R’ 000 28, 250 7, 122, 188 5, 788 183, 294 824 26, 740 1, 231 964, 785 267 23, 931 Page 28

U. E. P. S. PRODUCTS – S 2 S INSURANCE SYSTEM S 2 S Insurance System Facts and Assumptions Main Economic Drivers • Insurance Underwriter/Broker – Transaction Processing Fee of R 1, 50 per insurance policy per month (External Insurance Merchant) – Collection Fee of R 2, 00 per debit order instruction per month Potential Revenue National Potential Customer Base South Africa 7, 78 Million Page 29

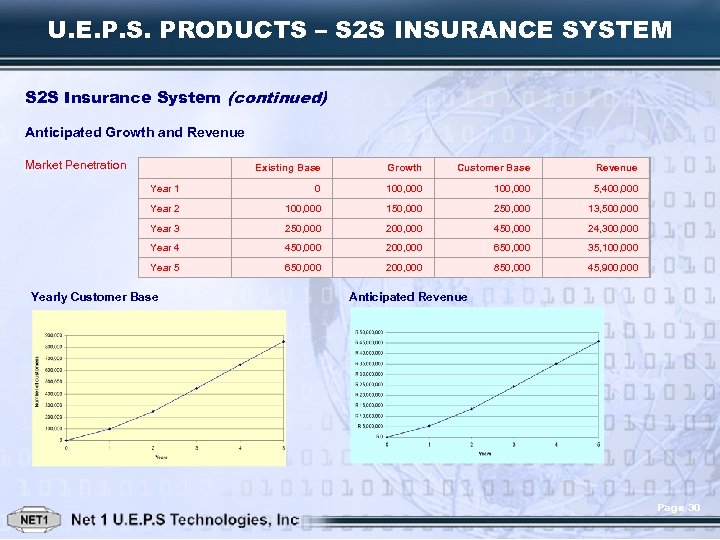

U. E. P. S. PRODUCTS – S 2 S INSURANCE SYSTEM S 2 S Insurance System (continued) Anticipated Growth and Revenue Market Penetration Existing Base Growth Customer Base Revenue Year 1 0 100, 000 5, 400, 000 Year 2 100, 000 150, 000 250, 000 13, 500, 000 Year 3 250, 000 200, 000 450, 000 24, 300, 000 Year 4 450, 000 200, 000 650, 000 35, 100, 000 Year 5 650, 000 200, 000 850, 000 45, 900, 000 Yearly Customer Base Anticipated Revenue Page 30

CURRENT U. E. P. S. BUSINESS OPPORTUNITIES NAMIBIA NEW APPROVALS 1) 27 th Oct 2006 – Approval From Bank of Namibia approving NAMPOST smart card as a payment instrument in Namibia. 2) SLA signed with PAYZONE – Pre-paid ESC and airtime Pilot rollout in December 2006 Thereafter national rollout – anticipated electricity sales of 210, 000 transactions per month – Windhoek area Tenders submitted for rural areas – awaiting outcome. GROWTH IN EXISTING PROJECT Nampost – Total cards issued 146, 000 MERCHANT ACQUIRING ROLL OUT 128 Merchants Registered Page 31

CURRENT U. E. P. S. BUSINESS OPPORTUNITIES BOTSWANA APPROVALS 1) 17 th May 2006 – Approval from Bank Of Botswana to perform clearing and settlement via Bank Gaborone. 2) SLA signed between Government & our Union Partners LITS PAYZONE 12 th Dec 2006 Final changes to be made in SLA between Smart. Switch and LITS – product wages & loan deductions +- 28, 000 cards Marketing Launch Date – November ON TARGET System ‘Live’ Date – End Jan 2007 POTENTIAL CUSTOMERS Botswana Building Society & Botswana Savings Bank +- 400, 000 accounts (old passbooks) BANKING Botswana Post Office – BANKING Botswana Life – INSURANCE DEDUCTIONS +- 180, 000 deductions per month Debswana – WAGES & DEDUCTIONS +- 20, 000 employees BOPMAS & PULA Medical Aid – Medical Solution (Member Identification, Premium Checks, Authorisation of Benefits & Claim Payment Distribution +- 120, 000 members + 60, 000 dependants BOMaid Medical Aid - +- 30, 000 members MERCHANT ACQUIRING & EMPLOYEES Marketing and awareness has commenced with retailers & employers in Botswana. Page 32

CURRENT U. E. P. S. BUSINESS OPPORTUNITIES NIGERIA 1) Final stages with the Central Bank of Nigeria for Smart. Switch to operate the scheme in Nigeria. Clearing & settlement will be managed via Diamond Bank 2) Negotiations to participate as a customer of the Switch with : • Ecobank • Uba • Skye • Oceanic • First Inland • Unity bank • First Bank 3) Marketing launch commenced in December 2006 Slight delay with materials - premises should be completed January 2007 – builders break over festive season 4) Diamond bank Phase 1 Teller training commences 8 th Jan 2007 ‘Live’ to customers - end January 2007 LAUNCHING: • Banking • Wholesale to retail distribution • Cash advances • Loyalty scheme • Personal loans • Money transfers • 3 rd party bill payments Page 33

CURRENT U. E. P. S. BUSINESS OPPORTUNITIES NIGERIA (continued) Phase 2 Student card Pension contribution & distribution Transportation TENDERS Nigerian Government Multi-Purpose Card Smart. Switch is one of six companies shortlisted out of 38 international companies The other entities shortlisted are: 1) CHAMS Consortium 2) SONDA S. A. / Interswitch 3) One. Secure. Card Consortium 4) Inter Security Systems 5) IRIS Smart Card Technology Limited Comprising : • National Identity Authentication/Verification • Government Financial Payments For Services • Affordable Banking • Consumer Credit Rating System Anticipated Card Volumes 65 million over 5 years Page 34

CURRENT U. E. P. S. BUSINESS OPPORTUNITIES IRAQ 1) Finalising numbers for Business Model with partners FUBI LLC 2) Presentations and negotiations in place with potential equity partners • Al Rafideen Bank • Al Rashid Bank • Post Office • Government Pension Department INITIAL PRODUCTS Banking Retail Government wages in respect of Iraqi military, coalition forces. (anticipated volumes +- 2 million) Government pension payments (anticipated volumes 1. 5 million) GHANA TENDERS • Ghana national switch & smart card payment system • Smart. Switch is one of six companies shortlisted out of 42 International companies • The other entities shortlisted are: Hightech Payments Systems Societe Maghrebine de Monetique (S 2 M) Gemalto N. V. Sungard Systems Access Pte Limited Corenett Limited • Submission of bid document due 12 th January 2007 • Ownership of the National Switch involving the Central Bank, all the banks in Ghana and the selected technology partner Page 35

CURRENT U. E. P. S. BUSINESS OPPORTUNITIES INDONESIA STATUS – IN ADVANCED DISCUSSIONS Partners Identified : ALITA (Infocom Network Solution) BRI (Indonesian People Bank) Telkomsel Finnet – 40% owned by Central Bank Business model in final stages Request for pilot system – to be negotiated during December 2006 MOZAMBIQUE STATUS – IN ADVANCED DISCUSSIONS Partners identified : DIGI Technologies CHUMA Bank Equity financing in advanced stages Marketing campaign & presentations to be held in Mozambique +- 14 th/15 th Jan 2007 across all market sectors Including Central Bank Page 36

CURRENT U. E. P. S. BUSINESS OPPORTUNITIES TANZANIA STATUS 1) Tanzania Postal Bank - Awaiting board decision (in current discussions with Government) anticipated card volumes +-500, 000 2) Advanced stages with Reserve Bank of Tanzania 3) Advanced stages with PRIDE Tanzania to acquire UEPS transactions via their NCR ATMs and bank branches 4) In discussion with De Beers and Government on artisanal Mining Project PRODUCTS • Banking • Cash advances • Money transfers • Retail • Loans • Bill payments • Wages • Mining KENYA STATUS 1) Advanced Stages with KUSSCO & SACCO Members. Service Level Agreement being prepared – 3000 branches and +- 2 million members 2) In negotiation with Postal Bank Kenya – decision to be taken in January 2007 PRODUCTS • Banking • Cash advances • Money transfers • Retail • Loans • Lill payments • Wages Page 37

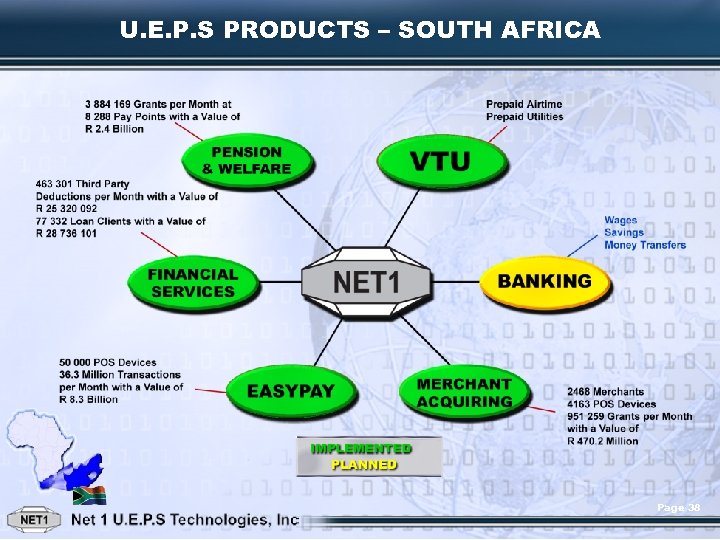

U. E. P. S PRODUCTS – SOUTH AFRICA Page 38

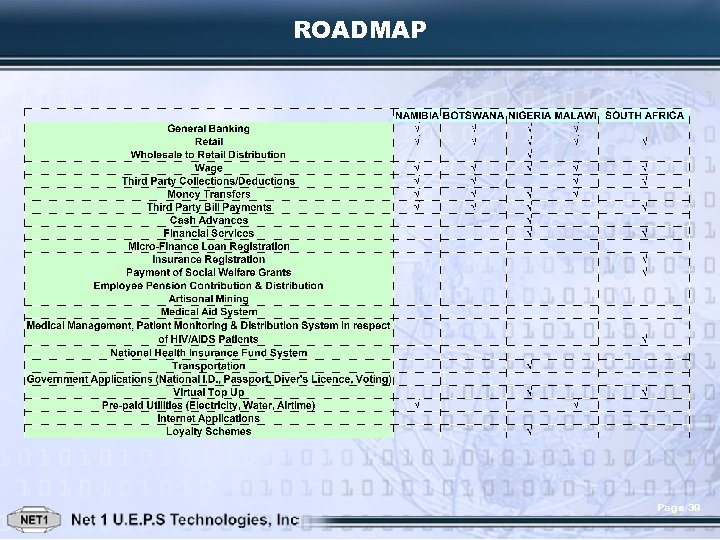

ROADMAP Page 39

f420745b27cc5d34ac0422b429311b6d.ppt