365868381af0d4c8052bf50004606385.ppt

- Количество слайдов: 65

Disclaimer The information in this presentation does not constitute an offer to sell or an invitation to buy shares in George Wimpey Plc or any other invitation or inducement to engage in investment activities. Past performance cannot be relied upon as a guide to future performance 2

Disclaimer The information in this presentation does not constitute an offer to sell or an invitation to buy shares in George Wimpey Plc or any other invitation or inducement to engage in investment activities. Past performance cannot be relied upon as a guide to future performance 2

George Wimpey Plc Interim Results for the 26 weeks to 3 July 2005 Tuesday 6 September 2005

George Wimpey Plc Interim Results for the 26 weeks to 3 July 2005 Tuesday 6 September 2005

Welcome John Robinson Chairman

Welcome John Robinson Chairman

Agenda H 1 Financial Review Andrew Carr-Locke UK Business Review Pete Redfern US Business Review Peter Johnson Strategy and Outlook Peter Johnson 5

Agenda H 1 Financial Review Andrew Carr-Locke UK Business Review Pete Redfern US Business Review Peter Johnson Strategy and Outlook Peter Johnson 5

H 1 2005 financial review Andrew Carr-Locke Group Finance Director

H 1 2005 financial review Andrew Carr-Locke Group Finance Director

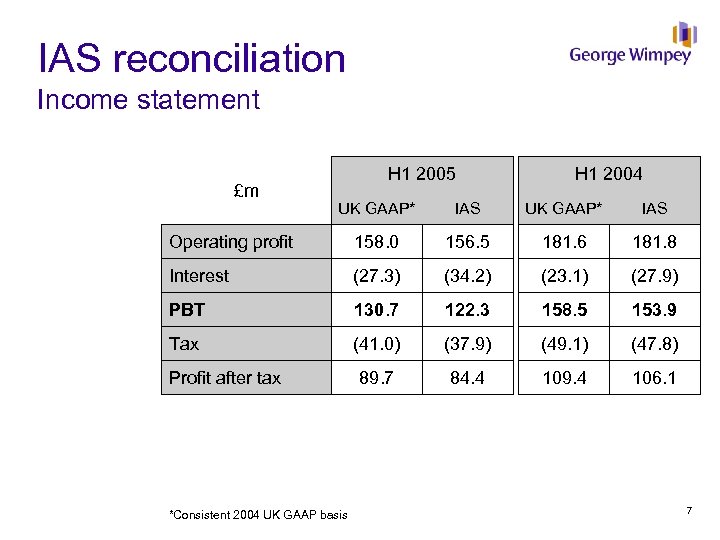

IAS reconciliation Income statement £m H 1 2005 H 1 2004 UK GAAP* IAS Operating profit 158. 0 156. 5 181. 6 181. 8 Interest (27. 3) (34. 2) (23. 1) (27. 9) PBT 130. 7 122. 3 158. 5 153. 9 Tax (41. 0) (37. 9) (49. 1) (47. 8) 89. 7 84. 4 109. 4 106. 1 Profit after tax *Consistent 2004 UK GAAP basis 7

IAS reconciliation Income statement £m H 1 2005 H 1 2004 UK GAAP* IAS Operating profit 158. 0 156. 5 181. 6 181. 8 Interest (27. 3) (34. 2) (23. 1) (27. 9) PBT 130. 7 122. 3 158. 5 153. 9 Tax (41. 0) (37. 9) (49. 1) (47. 8) 89. 7 84. 4 109. 4 106. 1 Profit after tax *Consistent 2004 UK GAAP basis 7

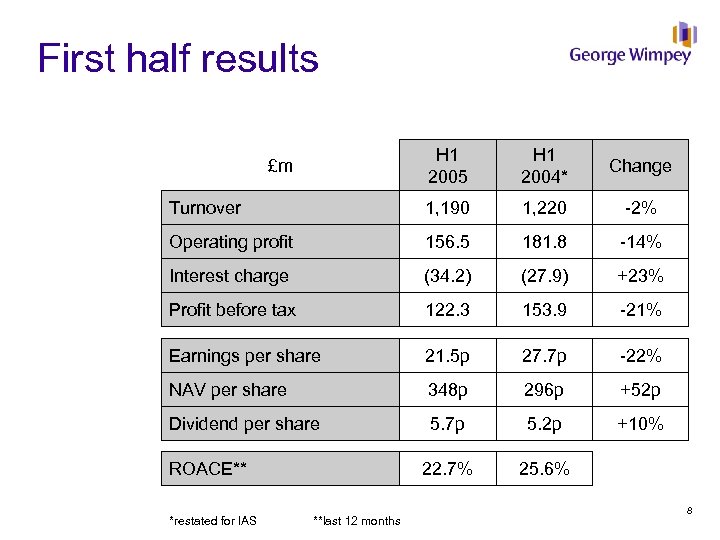

First half results H 1 2005 H 1 2004* Change Turnover 1, 190 1, 220 -2% Operating profit 156. 5 181. 8 -14% Interest charge (34. 2) (27. 9) +23% Profit before tax 122. 3 153. 9 -21% Earnings per share 21. 5 p 27. 7 p -22% NAV per share 348 p 296 p +52 p Dividend per share 5. 7 p 5. 2 p +10% 22. 7% 25. 6% £m ROACE** *restated for IAS **last 12 months 8

First half results H 1 2005 H 1 2004* Change Turnover 1, 190 1, 220 -2% Operating profit 156. 5 181. 8 -14% Interest charge (34. 2) (27. 9) +23% Profit before tax 122. 3 153. 9 -21% Earnings per share 21. 5 p 27. 7 p -22% NAV per share 348 p 296 p +52 p Dividend per share 5. 7 p 5. 2 p +10% 22. 7% 25. 6% £m ROACE** *restated for IAS **last 12 months 8

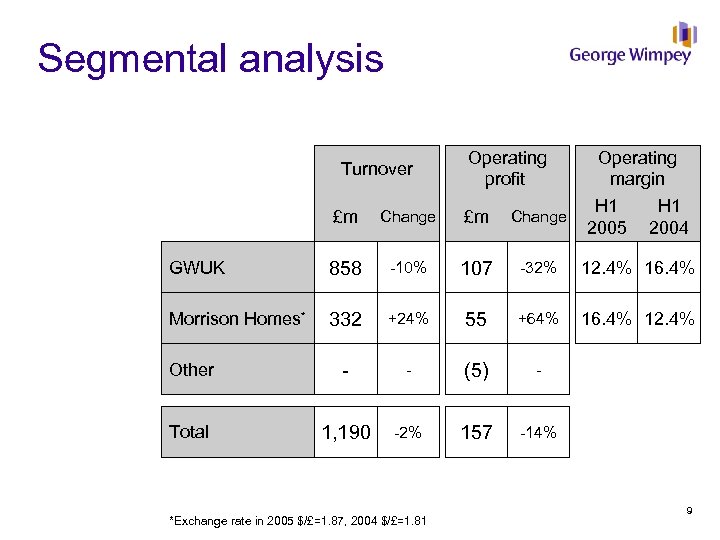

Segmental analysis Turnover Operating profit Operating margin H 1 2005 2004 £m Change GWUK 858 -10% 107 -32% 12. 4% 16. 4% Morrison Homes* 332 +24% 55 +64% 16. 4% 12. 4% Other - - (5) - Total 1, 190 -2% 157 -14% *Exchange rate in 2005 $/£=1. 87, 2004 $/£=1. 81 9

Segmental analysis Turnover Operating profit Operating margin H 1 2005 2004 £m Change GWUK 858 -10% 107 -32% 12. 4% 16. 4% Morrison Homes* 332 +24% 55 +64% 16. 4% 12. 4% Other - - (5) - Total 1, 190 -2% 157 -14% *Exchange rate in 2005 $/£=1. 87, 2004 $/£=1. 81 9

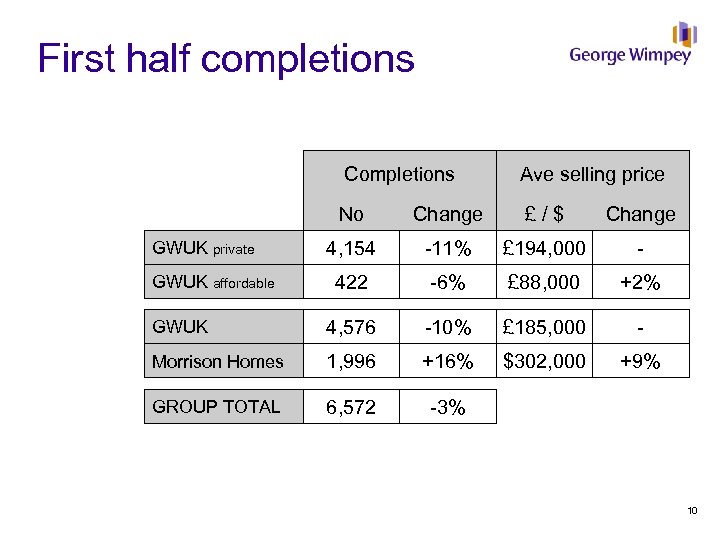

First half completions Completions Ave selling price No Change £ / $ Change 4, 154 -11% £ 194, 000 - 422 -6% £ 88, 000 +2% GWUK 4, 576 -10% £ 185, 000 - Morrison Homes 1, 996 +16% $302, 000 +9% GROUP TOTAL 6, 572 -3% GWUK private GWUK affordable 10

First half completions Completions Ave selling price No Change £ / $ Change 4, 154 -11% £ 194, 000 - 422 -6% £ 88, 000 +2% GWUK 4, 576 -10% £ 185, 000 - Morrison Homes 1, 996 +16% $302, 000 +9% GROUP TOTAL 6, 572 -3% GWUK private GWUK affordable 10

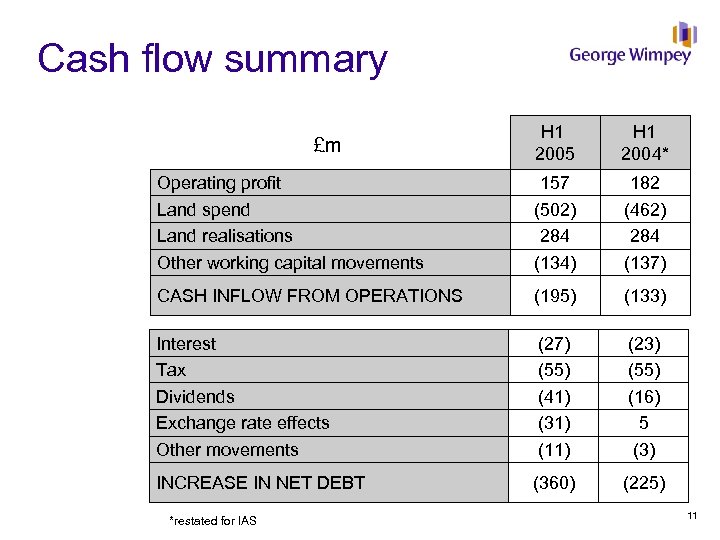

Cash flow summary H 1 2005 H 1 2004* Operating profit Land spend Land realisations Other working capital movements 157 (502) 284 (134) 182 (462) 284 (137) CASH INFLOW FROM OPERATIONS (195) (133) Interest Tax Dividends Exchange rate effects Other movements (27) (55) (41) (31) (11) (23) (55) (16) 5 (3) INCREASE IN NET DEBT (360) (225) £m *restated for IAS 11

Cash flow summary H 1 2005 H 1 2004* Operating profit Land spend Land realisations Other working capital movements 157 (502) 284 (134) 182 (462) 284 (137) CASH INFLOW FROM OPERATIONS (195) (133) Interest Tax Dividends Exchange rate effects Other movements (27) (55) (41) (31) (11) (23) (55) (16) 5 (3) INCREASE IN NET DEBT (360) (225) £m *restated for IAS 11

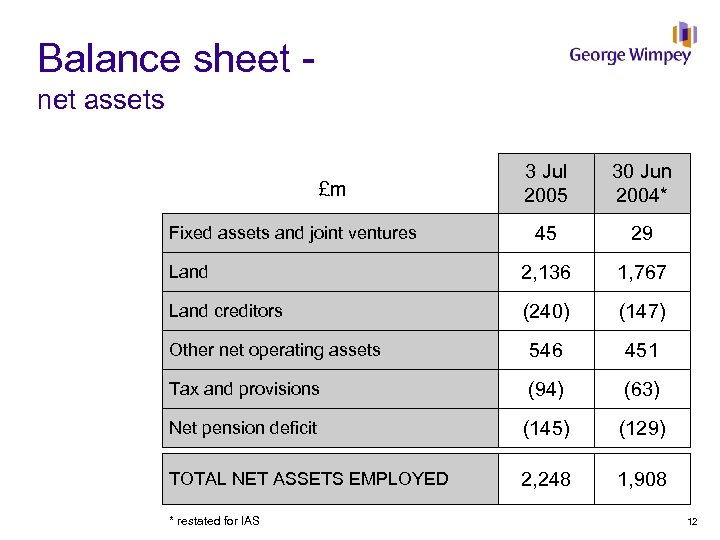

Balance sheet - net assets 3 Jul 2005 30 Jun 2004* 45 29 Land 2, 136 1, 767 Land creditors (240) (147) Other net operating assets 546 451 Tax and provisions (94) (63) Net pension deficit (145) (129) TOTAL NET ASSETS EMPLOYED 2, 248 1, 908 £m Fixed assets and joint ventures * restated for IAS 12

Balance sheet - net assets 3 Jul 2005 30 Jun 2004* 45 29 Land 2, 136 1, 767 Land creditors (240) (147) Other net operating assets 546 451 Tax and provisions (94) (63) Net pension deficit (145) (129) TOTAL NET ASSETS EMPLOYED 2, 248 1, 908 £m Fixed assets and joint ventures * restated for IAS 12

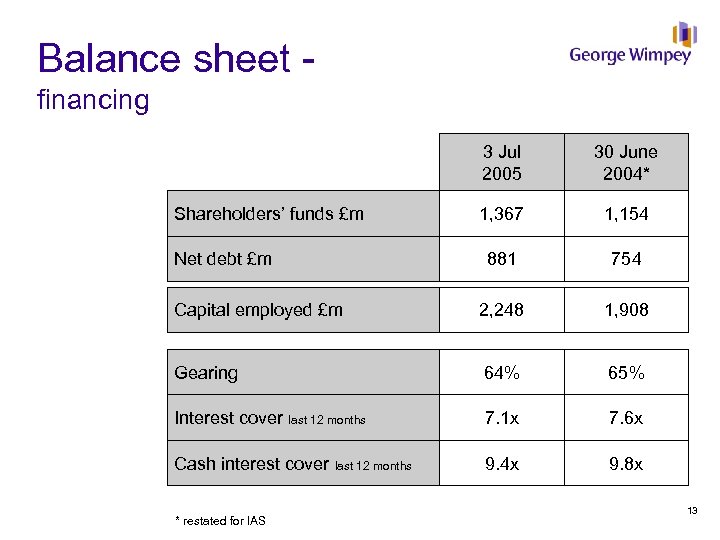

Balance sheet financing 3 Jul 2005 30 June 2004* 1, 367 1, 154 881 754 Capital employed £m 2, 248 1, 908 Gearing 64% 65% Interest cover last 12 months 7. 1 x 7. 6 x Cash interest cover last 12 months 9. 4 x 9. 8 x Shareholders’ funds £m Net debt £m * restated for IAS 13

Balance sheet financing 3 Jul 2005 30 June 2004* 1, 367 1, 154 881 754 Capital employed £m 2, 248 1, 908 Gearing 64% 65% Interest cover last 12 months 7. 1 x 7. 6 x Cash interest cover last 12 months 9. 4 x 9. 8 x Shareholders’ funds £m Net debt £m * restated for IAS 13

Financial summary Results now published under IAS Challenging market conditions in the UK §GWUK margins down 4. 0 pp, volumes down 10% Continued strength in the US §Morrison margins up 4. 0 pp, volumes up 16% Group PBT down 21% at £ 122 m Gearing in line with prior year at 64% ROCE at 22. 7% remains healthily above cost of capital Half year dividend increased by 10% to 5. 7 p 14

Financial summary Results now published under IAS Challenging market conditions in the UK §GWUK margins down 4. 0 pp, volumes down 10% Continued strength in the US §Morrison margins up 4. 0 pp, volumes up 16% Group PBT down 21% at £ 122 m Gearing in line with prior year at 64% ROCE at 22. 7% remains healthily above cost of capital Half year dividend increased by 10% to 5. 7 p 14

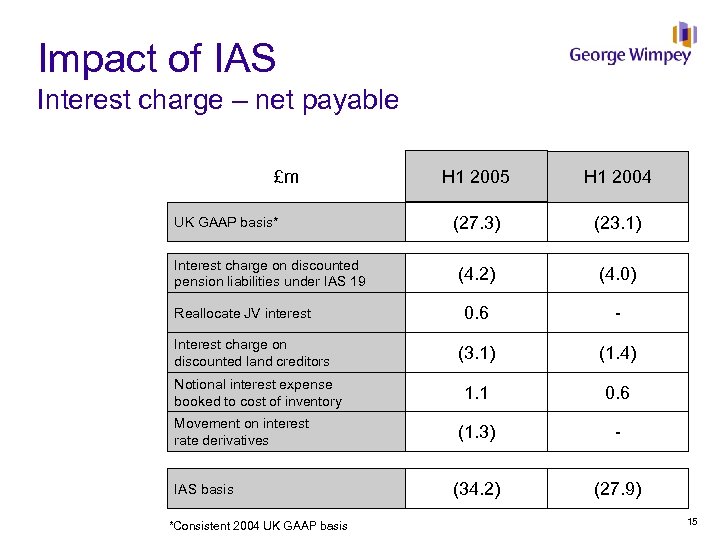

Impact of IAS Interest charge – net payable £m UK GAAP basis* Interest charge on discounted pension liabilities under IAS 19 Reallocate JV interest Interest charge on discounted land creditors Notional interest expense booked to cost of inventory Movement on interest rate derivatives IAS basis *Consistent 2004 UK GAAP basis H 1 2005 H 1 2004 (27. 3) (23. 1) (4. 2) (4. 0) 0. 6 - (3. 1) (1. 4) 1. 1 0. 6 (1. 3) - (34. 2) (27. 9) 15

Impact of IAS Interest charge – net payable £m UK GAAP basis* Interest charge on discounted pension liabilities under IAS 19 Reallocate JV interest Interest charge on discounted land creditors Notional interest expense booked to cost of inventory Movement on interest rate derivatives IAS basis *Consistent 2004 UK GAAP basis H 1 2005 H 1 2004 (27. 3) (23. 1) (4. 2) (4. 0) 0. 6 - (3. 1) (1. 4) 1. 1 0. 6 (1. 3) - (34. 2) (27. 9) 15

Financial summary Results now published under IAS Challenging market conditions in the UK §GWUK margins down 4. 0 pp, volumes down 10% Continued strength in the US §Morrison margins up 4. 0 pp, volumes up 16% Group PBT down 21% at £ 122 m Gearing in line with prior year at 64% ROCE at 22. 7% remains healthily above cost of capital Half year dividend increased by 10% to 5. 7 p 16

Financial summary Results now published under IAS Challenging market conditions in the UK §GWUK margins down 4. 0 pp, volumes down 10% Continued strength in the US §Morrison margins up 4. 0 pp, volumes up 16% Group PBT down 21% at £ 122 m Gearing in line with prior year at 64% ROCE at 22. 7% remains healthily above cost of capital Half year dividend increased by 10% to 5. 7 p 16

UK business review Pete Redfern Chief Executive, GWUK

UK business review Pete Redfern Chief Executive, GWUK

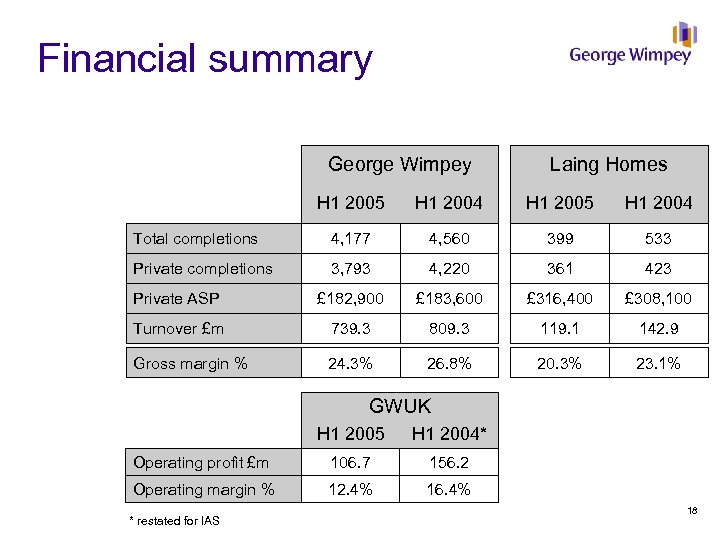

Financial summary George Wimpey Laing Homes H 1 2005 H 1 2004 Total completions 4, 177 4, 560 399 533 Private completions 3, 793 4, 220 361 423 Private ASP £ 182, 900 £ 183, 600 £ 316, 400 £ 308, 100 Turnover £m 739. 3 809. 3 119. 1 142. 9 Gross margin % 24. 3% 26. 8% 20. 3% 23. 1% GWUK H 1 2005 H 1 2004* Operating profit £m 106. 7 156. 2 Operating margin % 12. 4% 16. 4% * restated for IAS 18

Financial summary George Wimpey Laing Homes H 1 2005 H 1 2004 Total completions 4, 177 4, 560 399 533 Private completions 3, 793 4, 220 361 423 Private ASP £ 182, 900 £ 183, 600 £ 316, 400 £ 308, 100 Turnover £m 739. 3 809. 3 119. 1 142. 9 Gross margin % 24. 3% 26. 8% 20. 3% 23. 1% GWUK H 1 2005 H 1 2004* Operating profit £m 106. 7 156. 2 Operating margin % 12. 4% 16. 4% * restated for IAS 18

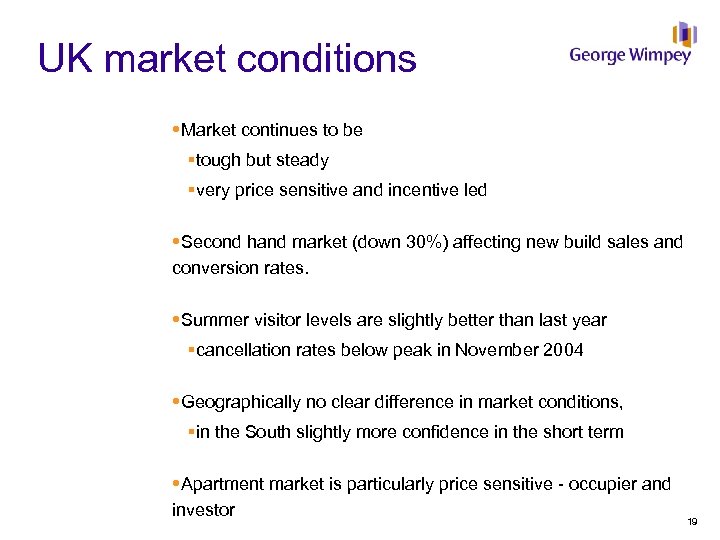

UK market conditions Market continues to be §tough but steady §very price sensitive and incentive led Second hand market (down 30%) affecting new build sales and conversion rates. Summer visitor levels are slightly better than last year §cancellation rates below peak in November 2004 Geographically no clear difference in market conditions, §in the South slightly more confidence in the short term Apartment market is particularly price sensitive - occupier and investor 19

UK market conditions Market continues to be §tough but steady §very price sensitive and incentive led Second hand market (down 30%) affecting new build sales and conversion rates. Summer visitor levels are slightly better than last year §cancellation rates below peak in November 2004 Geographically no clear difference in market conditions, §in the South slightly more confidence in the short term Apartment market is particularly price sensitive - occupier and investor 19

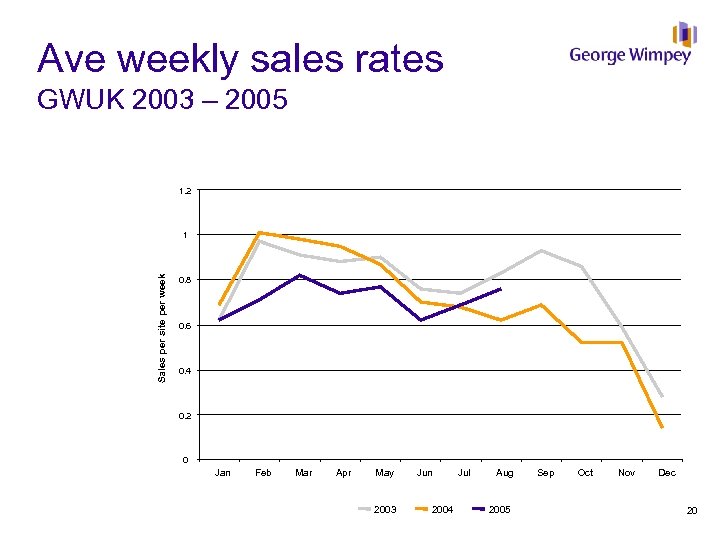

Ave weekly sales rates GWUK 2003 – 2005 1. 2 Sales per site per week 1 0. 8 0. 6 0. 4 0. 2 0 Jan Feb Mar Apr May 2003 Jun 2004 Jul Aug 2005 Sep Oct Nov Dec 20

Ave weekly sales rates GWUK 2003 – 2005 1. 2 Sales per site per week 1 0. 8 0. 6 0. 4 0. 2 0 Jan Feb Mar Apr May 2003 Jun 2004 Jul Aug 2005 Sep Oct Nov Dec 20

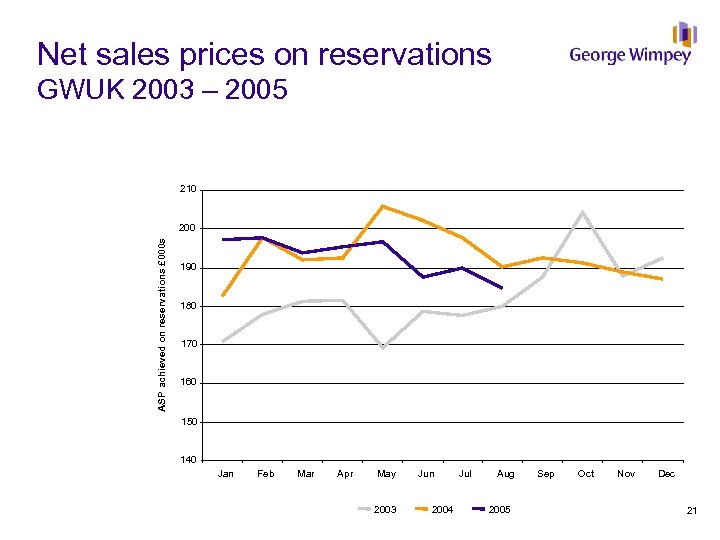

Net sales prices on reservations GWUK 2003 – 2005 210 ASP achieved on reservations £ 000 s 200 190 180 170 160 150 140 Jan Feb Mar Apr May 2003 Jun 2004 Jul Aug 2005 Sep Oct Nov Dec 21

Net sales prices on reservations GWUK 2003 – 2005 210 ASP achieved on reservations £ 000 s 200 190 180 170 160 150 140 Jan Feb Mar Apr May 2003 Jun 2004 Jul Aug 2005 Sep Oct Nov Dec 21

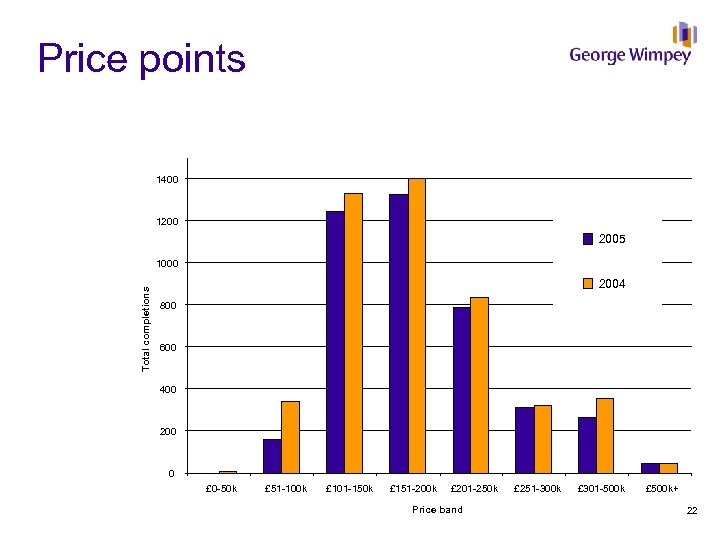

Price points 1400 1200 2005 Total completions 1000 2004 800 600 400 200 0 £ 0 -50 k £ 51 -100 k £ 101 -150 k £ 151 -200 k £ 201 -250 k Price band £ 251 -300 k £ 301 -500 k £ 500 k+ 22

Price points 1400 1200 2005 Total completions 1000 2004 800 600 400 200 0 £ 0 -50 k £ 51 -100 k £ 101 -150 k £ 151 -200 k £ 201 -250 k Price band £ 251 -300 k £ 301 -500 k £ 500 k+ 22

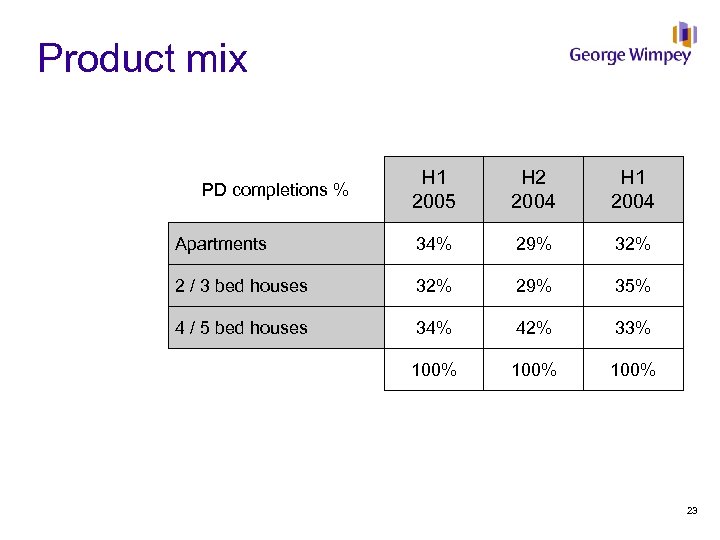

Product mix H 1 2005 H 2 2004 H 1 2004 Apartments 34% 29% 32% 2 / 3 bed houses 32% 29% 35% 4 / 5 bed houses 34% 42% 33% 100% PD completions % 23

Product mix H 1 2005 H 2 2004 H 1 2004 Apartments 34% 29% 32% 2 / 3 bed houses 32% 29% 35% 4 / 5 bed houses 34% 42% 33% 100% PD completions % 23

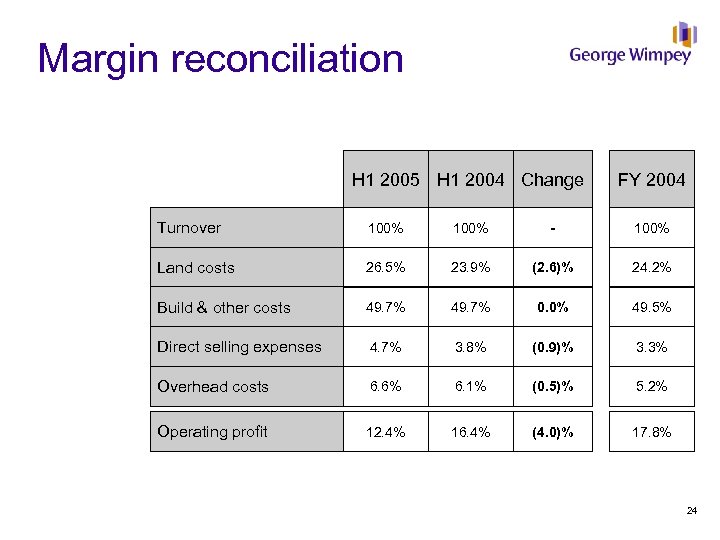

Margin reconciliation H 1 2005 H 1 2004 Change FY 2004 Turnover 100% - 100% Land costs 26. 5% 23. 9% (2. 6)% 24. 2% Build & other costs 49. 7% 0. 0% 49. 5% Direct selling expenses 4. 7% 3. 8% (0. 9)% 3. 3% Overhead costs 6. 6% 6. 1% (0. 5)% 5. 2% Operating profit 12. 4% 16. 4% (4. 0)% 17. 8% 24

Margin reconciliation H 1 2005 H 1 2004 Change FY 2004 Turnover 100% - 100% Land costs 26. 5% 23. 9% (2. 6)% 24. 2% Build & other costs 49. 7% 0. 0% 49. 5% Direct selling expenses 4. 7% 3. 8% (0. 9)% 3. 3% Overhead costs 6. 6% 6. 1% (0. 5)% 5. 2% Operating profit 12. 4% 16. 4% (4. 0)% 17. 8% 24

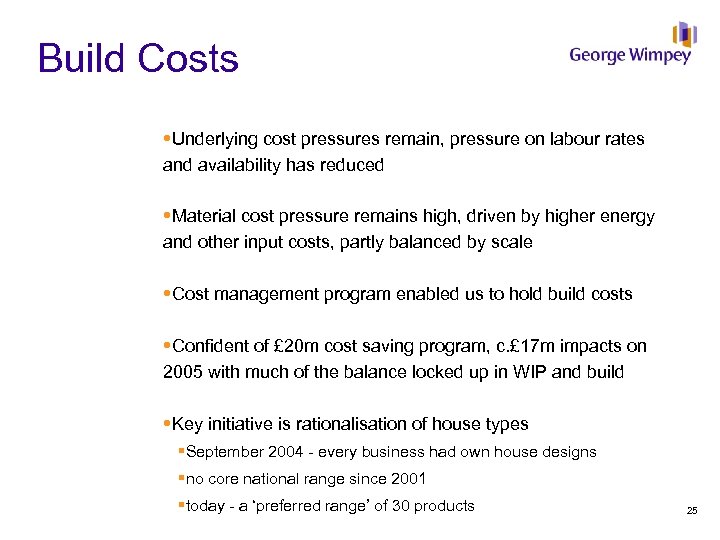

Build Costs Underlying cost pressures remain, pressure on labour rates and availability has reduced Material cost pressure remains high, driven by higher energy and other input costs, partly balanced by scale Cost management program enabled us to hold build costs Confident of £ 20 m cost saving program, c. £ 17 m impacts on 2005 with much of the balance locked up in WIP and build Key initiative is rationalisation of house types §September 2004 - every business had own house designs §no core national range since 2001 §today - a ‘preferred range’ of 30 products 25

Build Costs Underlying cost pressures remain, pressure on labour rates and availability has reduced Material cost pressure remains high, driven by higher energy and other input costs, partly balanced by scale Cost management program enabled us to hold build costs Confident of £ 20 m cost saving program, c. £ 17 m impacts on 2005 with much of the balance locked up in WIP and build Key initiative is rationalisation of house types §September 2004 - every business had own house designs §no core national range since 2001 §today - a ‘preferred range’ of 30 products 25

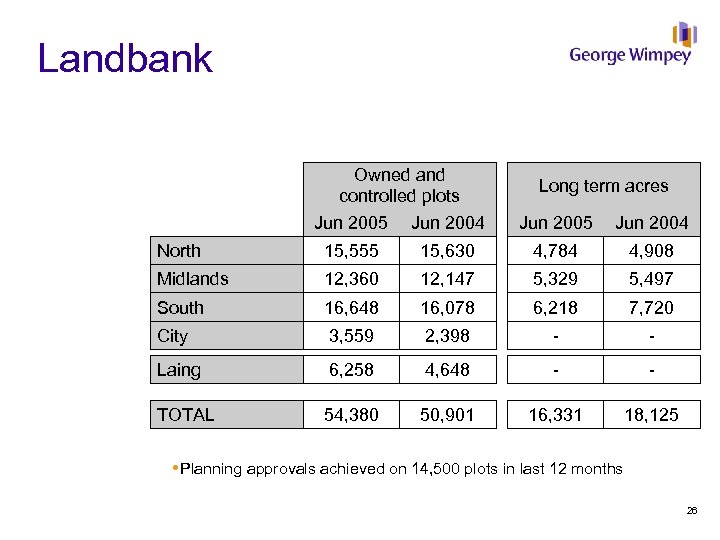

Landbank Owned and controlled plots Jun 2005 Jun 2004 Long term acres Jun 2005 Jun 2004 North 15, 555 15, 630 4, 784 4, 908 Midlands 12, 360 12, 147 5, 329 5, 497 South 16, 648 16, 078 6, 218 7, 720 City 3, 559 2, 398 - - Laing 6, 258 4, 648 - - TOTAL 54, 380 50, 901 16, 331 18, 125 Planning approvals achieved on 14, 500 plots in last 12 months 26

Landbank Owned and controlled plots Jun 2005 Jun 2004 Long term acres Jun 2005 Jun 2004 North 15, 555 15, 630 4, 784 4, 908 Midlands 12, 360 12, 147 5, 329 5, 497 South 16, 648 16, 078 6, 218 7, 720 City 3, 559 2, 398 - - Laing 6, 258 4, 648 - - TOTAL 54, 380 50, 901 16, 331 18, 125 Planning approvals achieved on 14, 500 plots in last 12 months 26

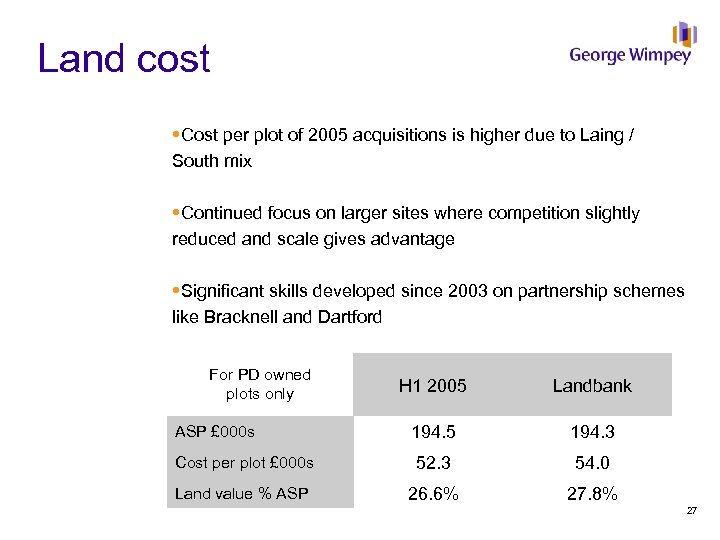

Land cost Cost per plot of 2005 acquisitions is higher due to Laing / South mix Continued focus on larger sites where competition slightly reduced and scale gives advantage Significant skills developed since 2003 on partnership schemes like Bracknell and Dartford For PD owned plots only H 1 2005 Landbank 194. 5 194. 3 Cost per plot £ 000 s 52. 3 54. 0 Land value % ASP 26. 6% 27. 8% ASP £ 000 s 27

Land cost Cost per plot of 2005 acquisitions is higher due to Laing / South mix Continued focus on larger sites where competition slightly reduced and scale gives advantage Significant skills developed since 2003 on partnership schemes like Bracknell and Dartford For PD owned plots only H 1 2005 Landbank 194. 5 194. 3 Cost per plot £ 000 s 52. 3 54. 0 Land value % ASP 26. 6% 27. 8% ASP £ 000 s 27

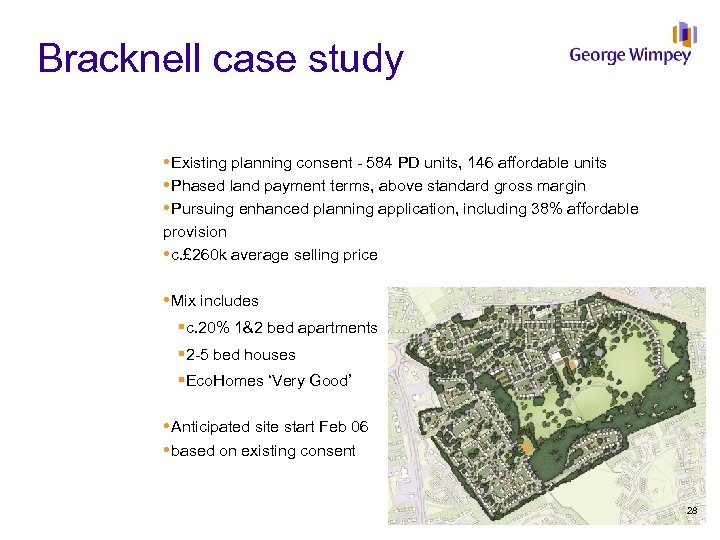

Bracknell case study Existing planning consent - 584 PD units, 146 affordable units Phased land payment terms, above standard gross margin Pursuing enhanced planning application, including 38% affordable provision c. £ 260 k average selling price Mix includes §c. 20% 1&2 bed apartments § 2 -5 bed houses §Eco. Homes ‘Very Good’ Anticipated site start Feb 06 based on existing consent 28

Bracknell case study Existing planning consent - 584 PD units, 146 affordable units Phased land payment terms, above standard gross margin Pursuing enhanced planning application, including 38% affordable provision c. £ 260 k average selling price Mix includes §c. 20% 1&2 bed apartments § 2 -5 bed houses §Eco. Homes ‘Very Good’ Anticipated site start Feb 06 based on existing consent 28

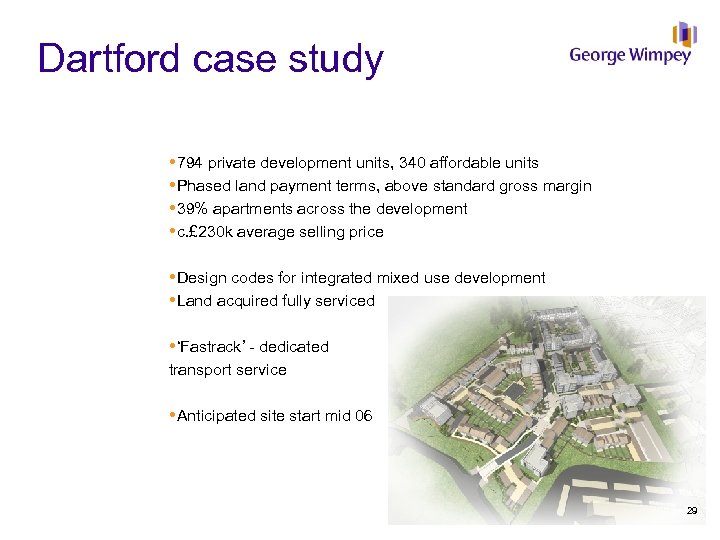

Dartford case study 794 private development units, 340 affordable units Phased land payment terms, above standard gross margin 39% apartments across the development c. £ 230 k average selling price Design codes for integrated mixed use development Land acquired fully serviced ‘Fastrack’ - dedicated transport service Anticipated site start mid 06 29

Dartford case study 794 private development units, 340 affordable units Phased land payment terms, above standard gross margin 39% apartments across the development c. £ 230 k average selling price Design codes for integrated mixed use development Land acquired fully serviced ‘Fastrack’ - dedicated transport service Anticipated site start mid 06 29

Summary Challenging first half §market tough, use of incentives essential §order book at 90% of expected full year volumes, margins below first half §build cost pressures significant but balanced by savings Outlook for H 2 §early to call autumn market §balance between customer demand supply availability is critical factor §cost pressures remain but mitigated by savings §operating margins improved by volume weighting 30

Summary Challenging first half §market tough, use of incentives essential §order book at 90% of expected full year volumes, margins below first half §build cost pressures significant but balanced by savings Outlook for H 2 §early to call autumn market §balance between customer demand supply availability is critical factor §cost pressures remain but mitigated by savings §operating margins improved by volume weighting 30

US business review Peter Johnson Group Chief Executive

US business review Peter Johnson Group Chief Executive

US housing market continued healthy economic data… Employment § 240, 000+ new jobs in July, 169, 000 in August §unemployment at four-year low Consumer confidence §up to 105. 6 in August (vs. 106. 2 max 2004 and 2005) 30 -year mortgage rates § 5. 71% - still near record lows 32

US housing market continued healthy economic data… Employment § 240, 000+ new jobs in July, 169, 000 in August §unemployment at four-year low Consumer confidence §up to 105. 6 in August (vs. 106. 2 max 2004 and 2005) 30 -year mortgage rates § 5. 71% - still near record lows 32

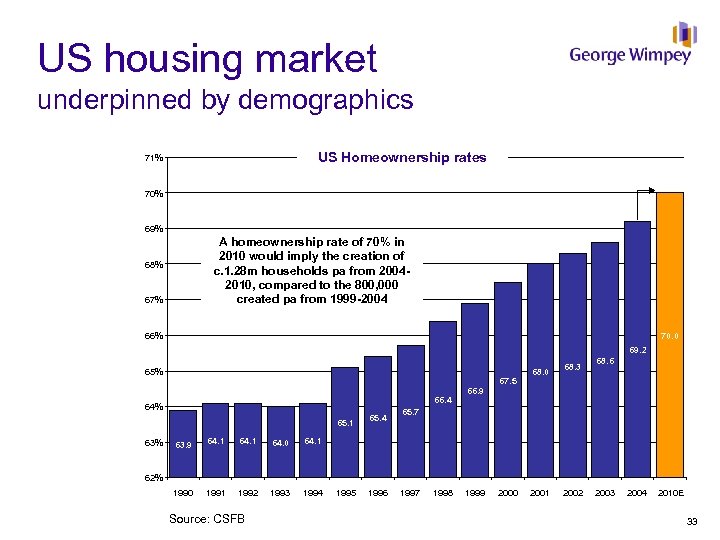

US housing market underpinned by demographics US Homeownership rates 71% 70% 69% A homeownership rate of 70% in 2010 would imply the creation of c. 1. 28 m households pa from 20042010, compared to the 800, 000 created pa from 1999 -2004 68% 67% 66% 70. 0 69. 2 65% 67. 5 66. 4 64% 65. 1 63% 63. 9 64. 1 64. 0 1991 1992 1993 1994 68. 3 66. 9 65. 7 64. 1 1990 65. 4 68. 0 68. 6 62% Source: CSFB 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2010 E 33

US housing market underpinned by demographics US Homeownership rates 71% 70% 69% A homeownership rate of 70% in 2010 would imply the creation of c. 1. 28 m households pa from 20042010, compared to the 800, 000 created pa from 1999 -2004 68% 67% 66% 70. 0 69. 2 65% 67. 5 66. 4 64% 65. 1 63% 63. 9 64. 1 64. 0 1991 1992 1993 1994 68. 3 66. 9 65. 7 64. 1 1990 65. 4 68. 0 68. 6 62% Source: CSFB 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2010 E 33

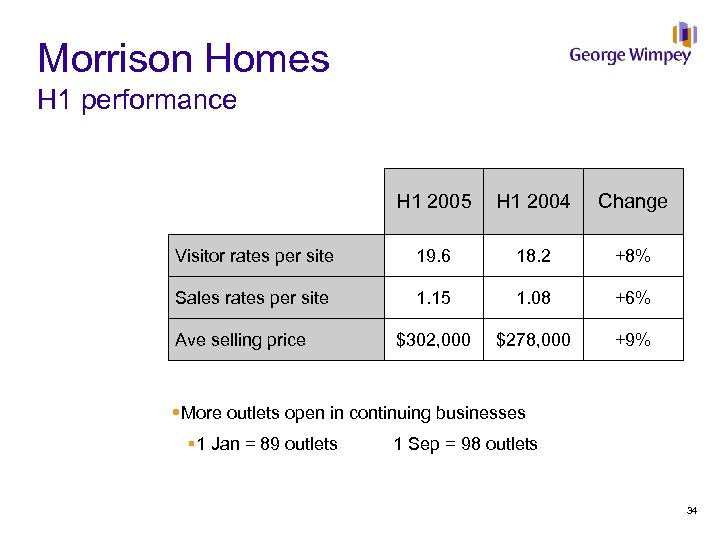

Morrison Homes H 1 performance H 1 2005 H 1 2004 Change Visitor rates per site 19. 6 18. 2 +8% Sales rates per site 1. 15 1. 08 +6% $302, 000 $278, 000 +9% Ave selling price More outlets open in continuing businesses § 1 Jan = 89 outlets 1 Sep = 98 outlets 34

Morrison Homes H 1 performance H 1 2005 H 1 2004 Change Visitor rates per site 19. 6 18. 2 +8% Sales rates per site 1. 15 1. 08 +6% $302, 000 $278, 000 +9% Ave selling price More outlets open in continuing businesses § 1 Jan = 89 outlets 1 Sep = 98 outlets 34

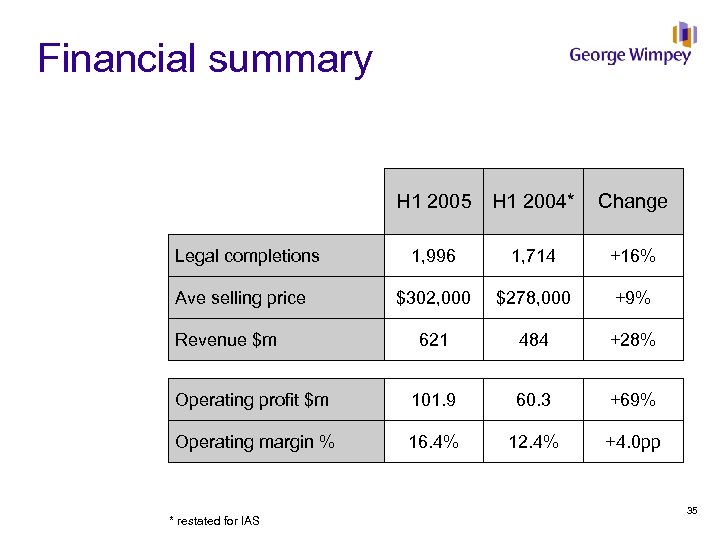

Financial summary H 1 2005 H 1 2004* Change 1, 996 1, 714 +16% $302, 000 $278, 000 +9% 621 484 +28% Operating profit $m 101. 9 60. 3 +69% Operating margin % 16. 4% 12. 4% +4. 0 pp Legal completions Ave selling price Revenue $m * restated for IAS 35

Financial summary H 1 2005 H 1 2004* Change 1, 996 1, 714 +16% $302, 000 $278, 000 +9% 621 484 +28% Operating profit $m 101. 9 60. 3 +69% Operating margin % 16. 4% 12. 4% +4. 0 pp Legal completions Ave selling price Revenue $m * restated for IAS 35

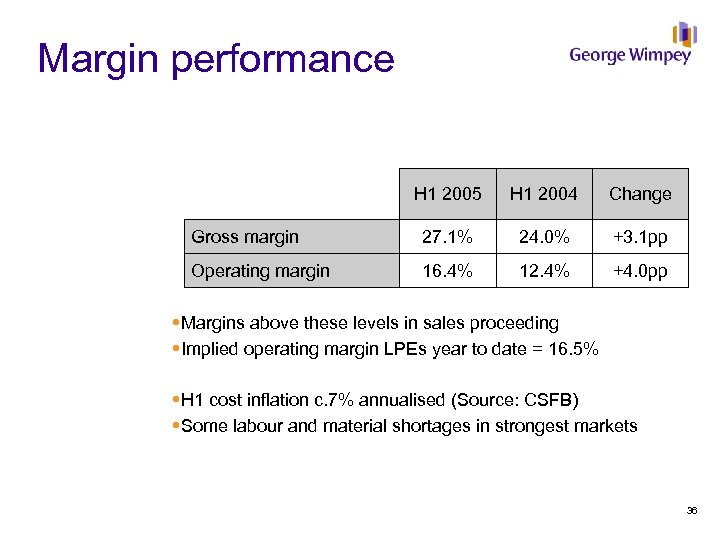

Margin performance H 1 2005 H 1 2004 Change Gross margin 27. 1% 24. 0% +3. 1 pp Operating margin 16. 4% 12. 4% +4. 0 pp Margins above these levels in sales proceeding Implied operating margin LPEs year to date = 16. 5% H 1 cost inflation c. 7% annualised (Source: CSFB) Some labour and material shortages in strongest markets 36

Margin performance H 1 2005 H 1 2004 Change Gross margin 27. 1% 24. 0% +3. 1 pp Operating margin 16. 4% 12. 4% +4. 0 pp Margins above these levels in sales proceeding Implied operating margin LPEs year to date = 16. 5% H 1 cost inflation c. 7% annualised (Source: CSFB) Some labour and material shortages in strongest markets 36

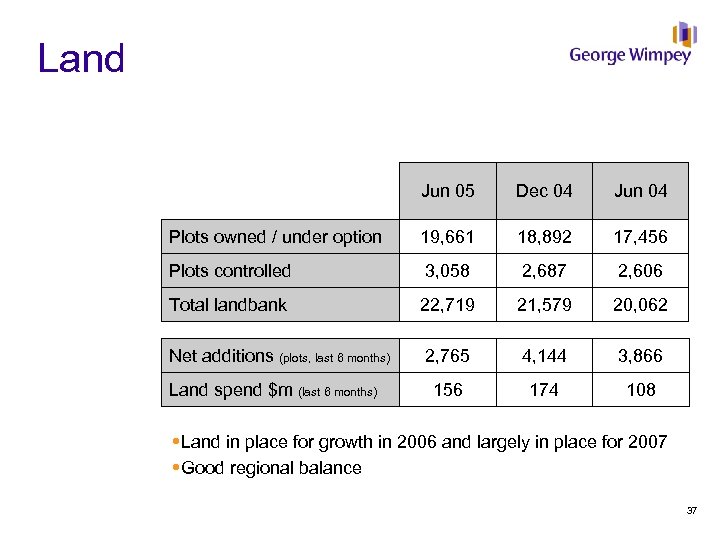

Land Jun 05 Dec 04 Jun 04 Plots owned / under option 19, 661 18, 892 17, 456 Plots controlled 3, 058 2, 687 2, 606 Total landbank 22, 719 21, 579 20, 062 Net additions (plots, last 6 months) 2, 765 4, 144 3, 866 156 174 108 Land spend $m (last 6 months) Land in place for growth in 2006 and largely in place for 2007 Good regional balance 37

Land Jun 05 Dec 04 Jun 04 Plots owned / under option 19, 661 18, 892 17, 456 Plots controlled 3, 058 2, 687 2, 606 Total landbank 22, 719 21, 579 20, 062 Net additions (plots, last 6 months) 2, 765 4, 144 3, 866 156 174 108 Land spend $m (last 6 months) Land in place for growth in 2006 and largely in place for 2007 Good regional balance 37

Progress on strategy: four platforms for growth Focus on growing markets §major beneficiaries of underlying trends Establish satellites in neighbouring markets §land in place to support 2006 growth in Reno, Ft Myers and Daytona Beach Product development §continued success of townhome product Performance improvement in Texas and exit from Atlanta §Texas completions + sales proceeding up 53% in H 1 §Atlanta exit largely complete 38

Progress on strategy: four platforms for growth Focus on growing markets §major beneficiaries of underlying trends Establish satellites in neighbouring markets §land in place to support 2006 growth in Reno, Ft Myers and Daytona Beach Product development §continued success of townhome product Performance improvement in Texas and exit from Atlanta §Texas completions + sales proceeding up 53% in H 1 §Atlanta exit largely complete 38

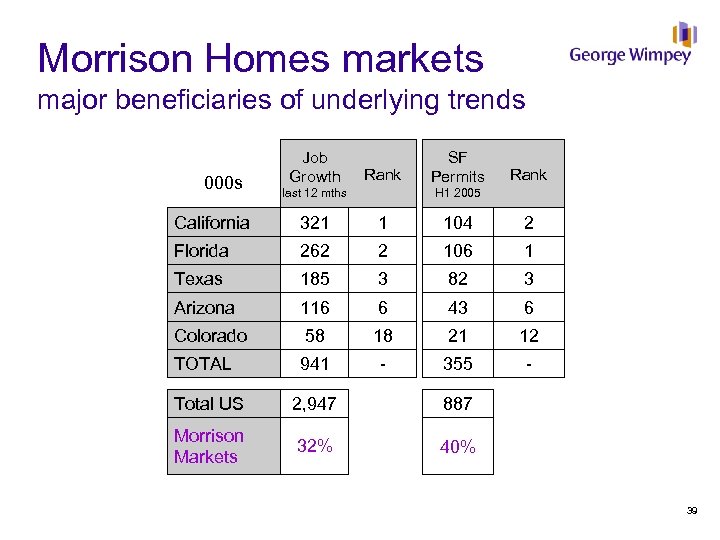

Morrison Homes markets major beneficiaries of underlying trends 000 s Job Growth Rank last 12 mths SF Permits Rank H 1 2005 California 321 1 104 2 Florida 262 2 106 1 Texas 185 3 82 3 Arizona 116 6 43 6 Colorado 58 18 21 12 TOTAL 941 - 355 - Total US 2, 947 887 Morrison Markets 32% 40% 39

Morrison Homes markets major beneficiaries of underlying trends 000 s Job Growth Rank last 12 mths SF Permits Rank H 1 2005 California 321 1 104 2 Florida 262 2 106 1 Texas 185 3 82 3 Arizona 116 6 43 6 Colorado 58 18 21 12 TOTAL 941 - 355 - Total US 2, 947 887 Morrison Markets 32% 40% 39

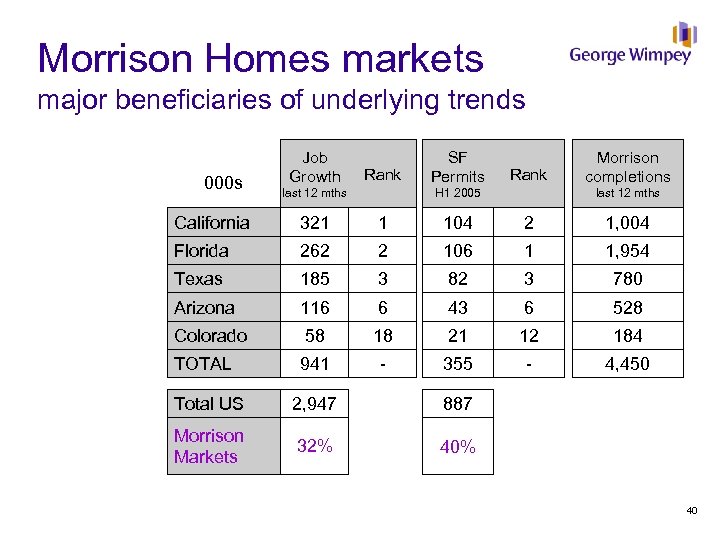

Morrison Homes markets major beneficiaries of underlying trends 000 s Job Growth Rank last 12 mths SF Permits Rank Morrison completions last 12 mths H 1 2005 California 321 1 104 2 1, 004 Florida 262 2 106 1 1, 954 Texas 185 3 82 3 780 Arizona 116 6 43 6 528 Colorado 58 18 21 12 184 TOTAL 941 - 355 - 4, 450 Total US 2, 947 887 Morrison Markets 32% 40

Morrison Homes markets major beneficiaries of underlying trends 000 s Job Growth Rank last 12 mths SF Permits Rank Morrison completions last 12 mths H 1 2005 California 321 1 104 2 1, 004 Florida 262 2 106 1 1, 954 Texas 185 3 82 3 780 Arizona 116 6 43 6 528 Colorado 58 18 21 12 184 TOTAL 941 - 355 - 4, 450 Total US 2, 947 887 Morrison Markets 32% 40

Progress on strategy: four platforms for growth Focus on growing markets §major beneficiaries of underlying trends Establish satellites in neighbouring markets §land in place to support 2006 growth in Reno, Ft Myers and Daytona Beach Product development §continued success of townhome product Performance improvement in Texas and exit from Atlanta §Texas completions + sales proceeding up 53% in H 1 §Atlanta exit largely complete 41

Progress on strategy: four platforms for growth Focus on growing markets §major beneficiaries of underlying trends Establish satellites in neighbouring markets §land in place to support 2006 growth in Reno, Ft Myers and Daytona Beach Product development §continued success of townhome product Performance improvement in Texas and exit from Atlanta §Texas completions + sales proceeding up 53% in H 1 §Atlanta exit largely complete 41

Summary Excellent first half performance §visitor levels, sales rates, selling prices all up Strongly placed for second half § 94% sold or completed for 2005 §order book margins and prices above first half §volumes may be held back by materials shortages Well-positioned for continued growth §land already in place to support continuing volume growth in 2006 and largely in place for 2007 42

Summary Excellent first half performance §visitor levels, sales rates, selling prices all up Strongly placed for second half § 94% sold or completed for 2005 §order book margins and prices above first half §volumes may be held back by materials shortages Well-positioned for continued growth §land already in place to support continuing volume growth in 2006 and largely in place for 2007 42

Strategy and outlook Peter Johnson Group Chief Executive

Strategy and outlook Peter Johnson Group Chief Executive

Strategy Market background UK §underpinned by continuing supply shortfall §price growth likely to be limited §opportunities at lower price points US §underpinned by demographics and economy §remains strong with wide regional variations §will come off peak but remain at historically high levels 44

Strategy Market background UK §underpinned by continuing supply shortfall §price growth likely to be limited §opportunities at lower price points US §underpinned by demographics and economy §remains strong with wide regional variations §will come off peak but remain at historically high levels 44

Strategy UK - focus remains on volume growth plans in place to deliver through §expanding existing regions §new Laing regions §new George Wimpey satellites Government initiatives offer potential for new business implementation depends on market and land prices US - sustained volume growth “four platforms” growth plan in place land detailed business plans in place to support growth these plans could deliver 10, 000 unit business within 5 years 45

Strategy UK - focus remains on volume growth plans in place to deliver through §expanding existing regions §new Laing regions §new George Wimpey satellites Government initiatives offer potential for new business implementation depends on market and land prices US - sustained volume growth “four platforms” growth plan in place land detailed business plans in place to support growth these plans could deliver 10, 000 unit business within 5 years 45

Outlook UK current sales rates ahead of same period 2004 premature to draw conclusions on autumn market if sales rates sustained, full year total volumes similar to 2004 by 1 September 90% completed or in order book margins in order book below first half actuals US visitor and sales rates remaining strong full year volumes still expected to be up c. 10% small volume risk from materials and labour shortages by 1 September 94% completed or in order book margins and prices in order book above first half actuals 46

Outlook UK current sales rates ahead of same period 2004 premature to draw conclusions on autumn market if sales rates sustained, full year total volumes similar to 2004 by 1 September 90% completed or in order book margins in order book below first half actuals US visitor and sales rates remaining strong full year volumes still expected to be up c. 10% small volume risk from materials and labour shortages by 1 September 94% completed or in order book margins and prices in order book above first half actuals 46

George Wimpey Plc Interim Results for the 26 weeks to 3 July 2005 APPENDIX

George Wimpey Plc Interim Results for the 26 weeks to 3 July 2005 APPENDIX

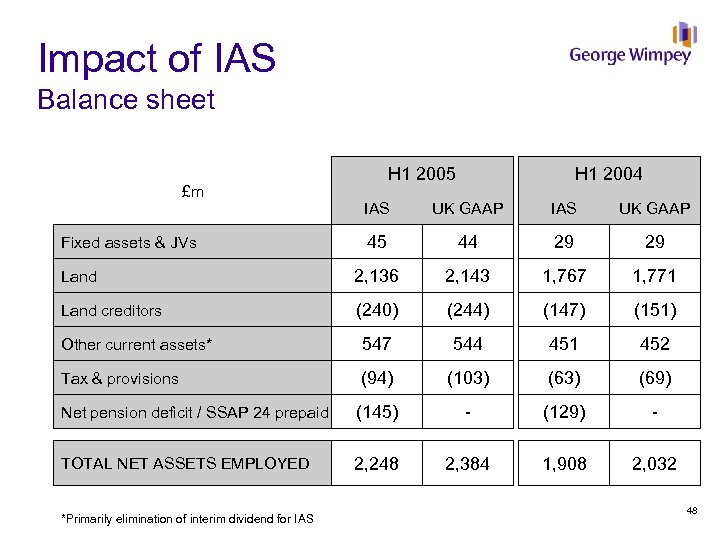

Impact of IAS Balance sheet £m H 1 2005 H 1 2004 IAS UK GAAP 45 44 29 29 Land 2, 136 2, 143 1, 767 1, 771 Land creditors (240) (244) (147) (151) Other current assets* 547 544 451 452 Tax & provisions (94) (103) (69) Net pension deficit / SSAP 24 prepaid (145) - (129) - TOTAL NET ASSETS EMPLOYED 2, 248 2, 384 1, 908 2, 032 Fixed assets & JVs *Primarily elimination of interim dividend for IAS 48

Impact of IAS Balance sheet £m H 1 2005 H 1 2004 IAS UK GAAP 45 44 29 29 Land 2, 136 2, 143 1, 767 1, 771 Land creditors (240) (244) (147) (151) Other current assets* 547 544 451 452 Tax & provisions (94) (103) (69) Net pension deficit / SSAP 24 prepaid (145) - (129) - TOTAL NET ASSETS EMPLOYED 2, 248 2, 384 1, 908 2, 032 Fixed assets & JVs *Primarily elimination of interim dividend for IAS 48

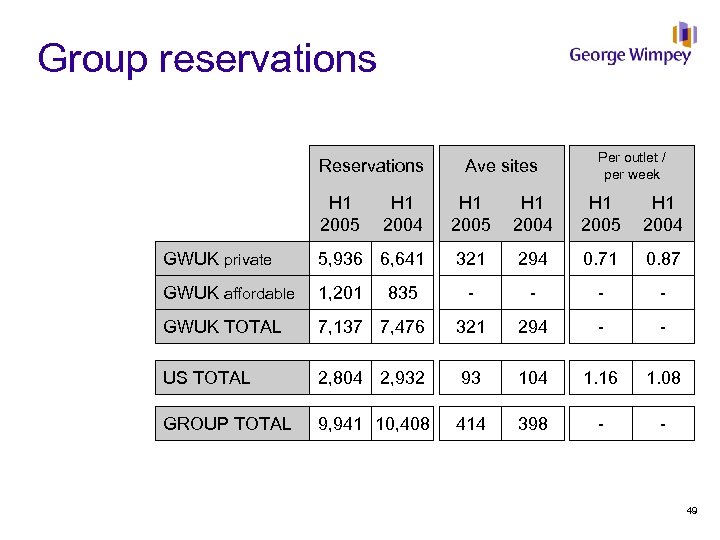

Group reservations Reservations H 1 2005 Ave sites Per outlet / per week H 1 2004 H 1 2005 H 1 2004 GWUK private 5, 936 6, 641 321 294 0. 71 0. 87 GWUK affordable 1, 201 - - GWUK TOTAL 7, 137 7, 476 321 294 - - US TOTAL 2, 804 2, 932 93 104 1. 16 1. 08 GROUP TOTAL 9, 941 10, 408 414 398 - - 835 49

Group reservations Reservations H 1 2005 Ave sites Per outlet / per week H 1 2004 H 1 2005 H 1 2004 GWUK private 5, 936 6, 641 321 294 0. 71 0. 87 GWUK affordable 1, 201 - - GWUK TOTAL 7, 137 7, 476 321 294 - - US TOTAL 2, 804 2, 932 93 104 1. 16 1. 08 GROUP TOTAL 9, 941 10, 408 414 398 - - 835 49

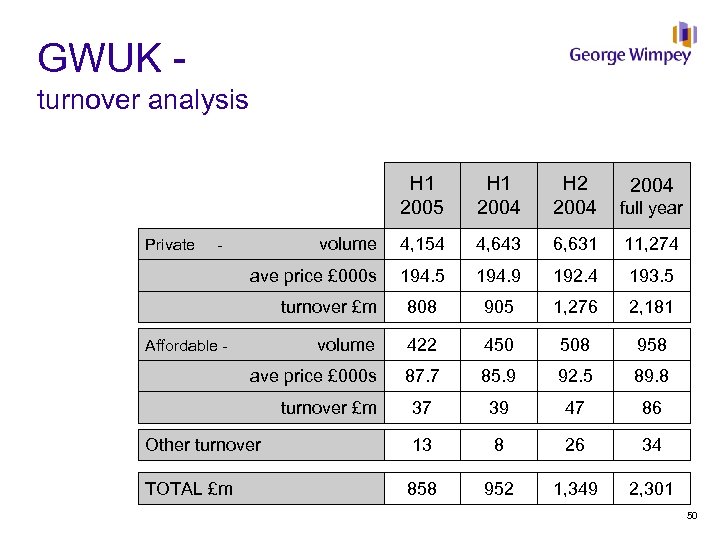

GWUK turnover analysis H 1 2005 H 1 2004 H 2 2004 full year volume 4, 154 4, 643 6, 631 11, 274 ave price £ 000 s 194. 5 194. 9 192. 4 193. 5 turnover £m 808 905 1, 276 2, 181 Affordable - volume 422 450 508 958 ave price £ 000 s 87. 7 85. 9 92. 5 89. 8 37 39 47 86 Other turnover 13 8 26 34 TOTAL £m 858 952 1, 349 2, 301 Private - turnover £m 2004 50

GWUK turnover analysis H 1 2005 H 1 2004 H 2 2004 full year volume 4, 154 4, 643 6, 631 11, 274 ave price £ 000 s 194. 5 194. 9 192. 4 193. 5 turnover £m 808 905 1, 276 2, 181 Affordable - volume 422 450 508 958 ave price £ 000 s 87. 7 85. 9 92. 5 89. 8 37 39 47 86 Other turnover 13 8 26 34 TOTAL £m 858 952 1, 349 2, 301 Private - turnover £m 2004 50

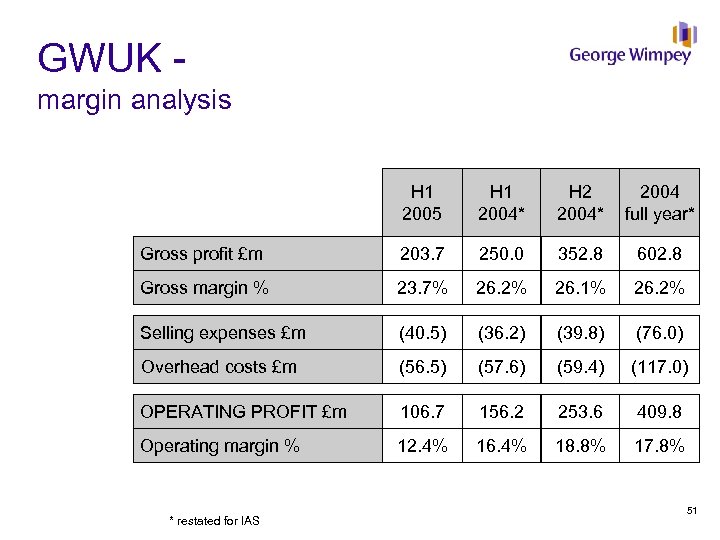

GWUK - margin analysis H 1 2005 H 1 2004* H 2 2004* 2004 full year* Gross profit £m 203. 7 250. 0 352. 8 602. 8 Gross margin % 23. 7% 26. 2% 26. 1% 26. 2% Selling expenses £m (40. 5) (36. 2) (39. 8) (76. 0) Overhead costs £m (56. 5) (57. 6) (59. 4) (117. 0) OPERATING PROFIT £m 106. 7 156. 2 253. 6 409. 8 Operating margin % 12. 4% 16. 4% 18. 8% 17. 8% * restated for IAS 51

GWUK - margin analysis H 1 2005 H 1 2004* H 2 2004* 2004 full year* Gross profit £m 203. 7 250. 0 352. 8 602. 8 Gross margin % 23. 7% 26. 2% 26. 1% 26. 2% Selling expenses £m (40. 5) (36. 2) (39. 8) (76. 0) Overhead costs £m (56. 5) (57. 6) (59. 4) (117. 0) OPERATING PROFIT £m 106. 7 156. 2 253. 6 409. 8 Operating margin % 12. 4% 16. 4% 18. 8% 17. 8% * restated for IAS 51

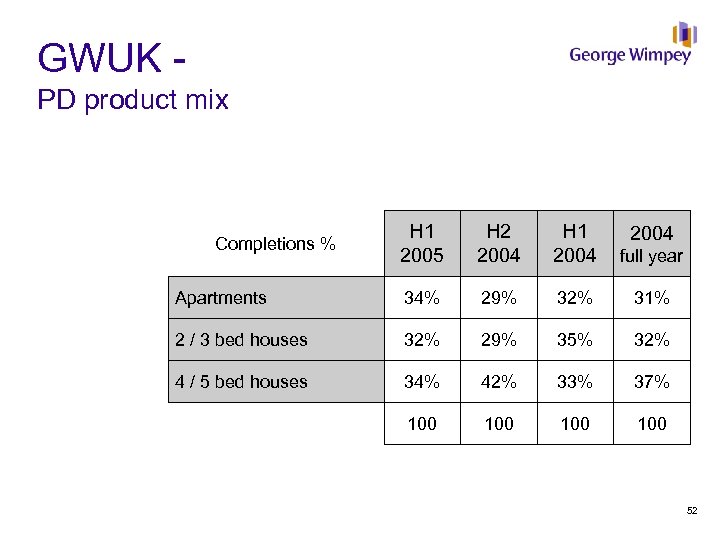

GWUK PD product mix H 1 2005 H 2 2004 H 1 2004 full year Apartments 34% 29% 32% 31% 2 / 3 bed houses 32% 29% 35% 32% 4 / 5 bed houses 34% 42% 33% 37% 100 100 Completions % 2004 52

GWUK PD product mix H 1 2005 H 2 2004 H 1 2004 full year Apartments 34% 29% 32% 31% 2 / 3 bed houses 32% 29% 35% 32% 4 / 5 bed houses 34% 42% 33% 37% 100 100 Completions % 2004 52

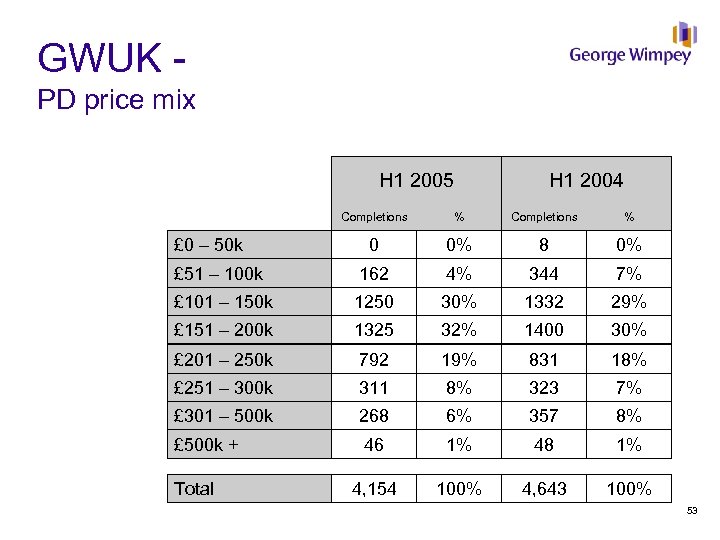

GWUK PD price mix H 1 2005 H 1 2004 Completions % 0 0% 8 0% £ 51 – 100 k 162 4% 344 7% £ 101 – 150 k 1250 30% 1332 29% £ 151 – 200 k 1325 32% 1400 30% £ 201 – 250 k 792 19% 831 18% £ 251 – 300 k 311 8% 323 7% £ 301 – 500 k 268 6% 357 8% £ 500 k + 46 1% 48 1% 4, 154 100% 4, 643 100% £ 0 – 50 k Total 53

GWUK PD price mix H 1 2005 H 1 2004 Completions % 0 0% 8 0% £ 51 – 100 k 162 4% 344 7% £ 101 – 150 k 1250 30% 1332 29% £ 151 – 200 k 1325 32% 1400 30% £ 201 – 250 k 792 19% 831 18% £ 251 – 300 k 311 8% 323 7% £ 301 – 500 k 268 6% 357 8% £ 500 k + 46 1% 48 1% 4, 154 100% 4, 643 100% £ 0 – 50 k Total 53

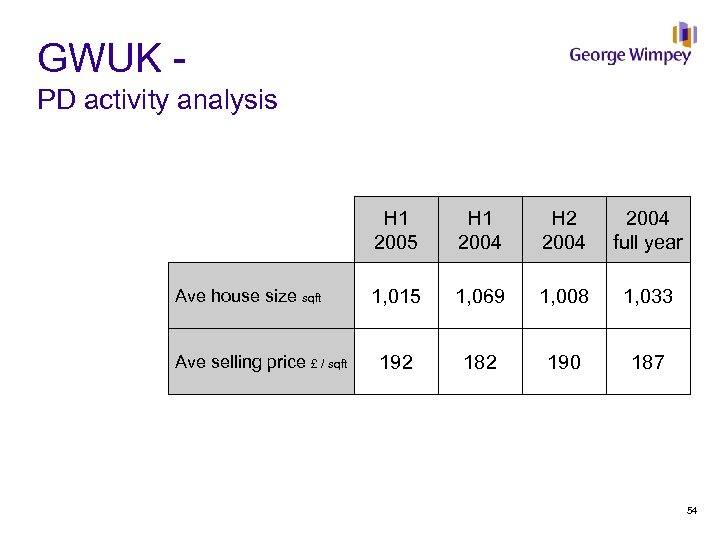

GWUK PD activity analysis H 1 2005 Ave house size sqft Ave selling price £ / sqft H 1 2004 H 2 2004 full year 1, 015 1, 069 1, 008 1, 033 192 182 190 187 54

GWUK PD activity analysis H 1 2005 Ave house size sqft Ave selling price £ / sqft H 1 2004 H 2 2004 full year 1, 015 1, 069 1, 008 1, 033 192 182 190 187 54

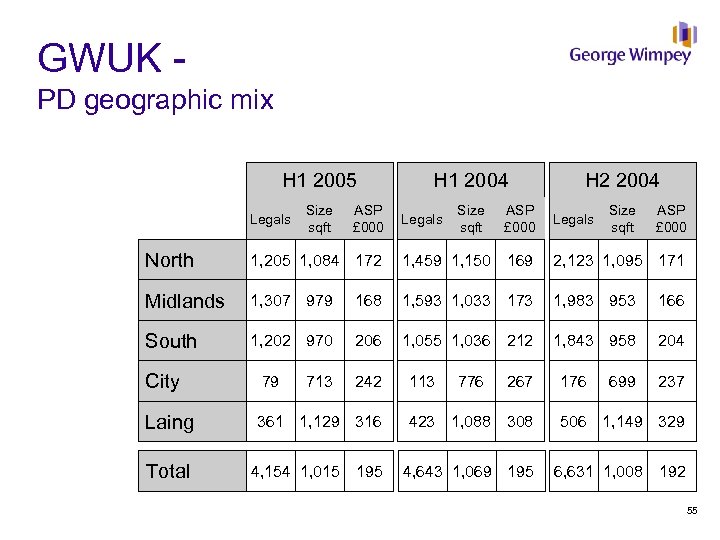

GWUK PD geographic mix H 1 2005 Legals Size sqft ASP £ 000 H 1 2004 Legals Size sqft ASP £ 000 H 2 2004 Legals Size sqft ASP £ 000 North 1, 205 1, 084 172 1, 459 1, 150 169 2, 123 1, 095 171 Midlands 1, 307 979 168 1, 593 1, 033 173 1, 983 953 166 South 1, 202 970 206 1, 055 1, 036 212 1, 843 958 204 City 79 Laing 361 1, 129 316 423 1, 088 308 506 1, 149 329 Total 4, 154 1, 015 195 4, 643 1, 069 195 6, 631 1, 008 192 713 242 113 776 267 176 699 237 55

GWUK PD geographic mix H 1 2005 Legals Size sqft ASP £ 000 H 1 2004 Legals Size sqft ASP £ 000 H 2 2004 Legals Size sqft ASP £ 000 North 1, 205 1, 084 172 1, 459 1, 150 169 2, 123 1, 095 171 Midlands 1, 307 979 168 1, 593 1, 033 173 1, 983 953 166 South 1, 202 970 206 1, 055 1, 036 212 1, 843 958 204 City 79 Laing 361 1, 129 316 423 1, 088 308 506 1, 149 329 Total 4, 154 1, 015 195 4, 643 1, 069 195 6, 631 1, 008 192 713 242 113 776 267 176 699 237 55

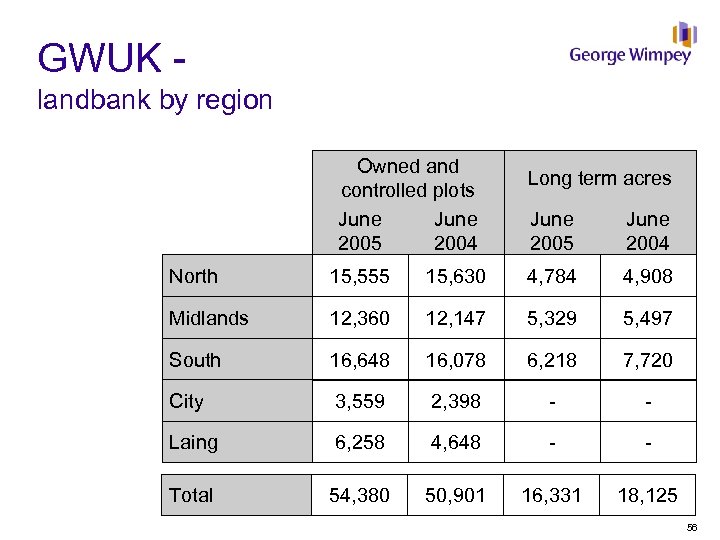

GWUK landbank by region Owned and controlled plots June 2005 2004 Long term acres June 2005 June 2004 North 15, 555 15, 630 4, 784 4, 908 Midlands 12, 360 12, 147 5, 329 5, 497 South 16, 648 16, 078 6, 218 7, 720 City 3, 559 2, 398 - - Laing 6, 258 4, 648 - - Total 54, 380 50, 901 16, 331 18, 125 56

GWUK landbank by region Owned and controlled plots June 2005 2004 Long term acres June 2005 June 2004 North 15, 555 15, 630 4, 784 4, 908 Midlands 12, 360 12, 147 5, 329 5, 497 South 16, 648 16, 078 6, 218 7, 720 City 3, 559 2, 398 - - Laing 6, 258 4, 648 - - Total 54, 380 50, 901 16, 331 18, 125 56

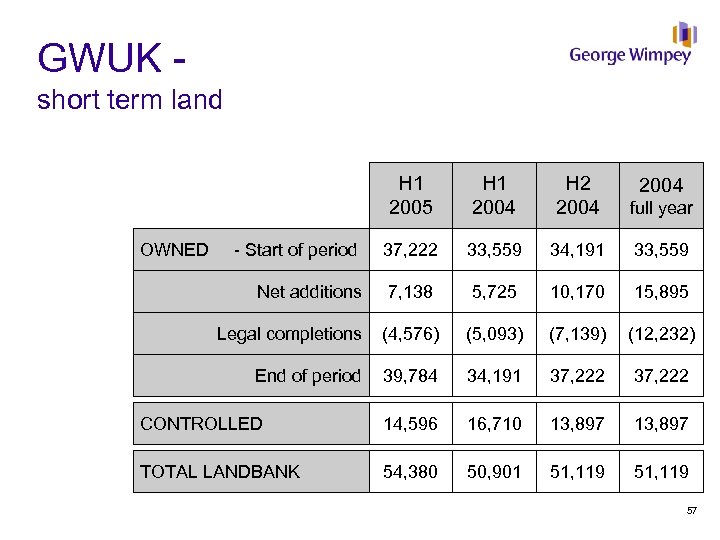

GWUK short term land H 1 2005 H 1 2004 H 2 2004 full year OWNED - Start of period 37, 222 33, 559 34, 191 33, 559 Net additions 7, 138 5, 725 10, 170 15, 895 Legal completions (4, 576) (5, 093) (7, 139) (12, 232) End of period 39, 784 34, 191 37, 222 CONTROLLED 14, 596 16, 710 13, 897 TOTAL LANDBANK 54, 380 50, 901 51, 119 2004 57

GWUK short term land H 1 2005 H 1 2004 H 2 2004 full year OWNED - Start of period 37, 222 33, 559 34, 191 33, 559 Net additions 7, 138 5, 725 10, 170 15, 895 Legal completions (4, 576) (5, 093) (7, 139) (12, 232) End of period 39, 784 34, 191 37, 222 CONTROLLED 14, 596 16, 710 13, 897 TOTAL LANDBANK 54, 380 50, 901 51, 119 2004 57

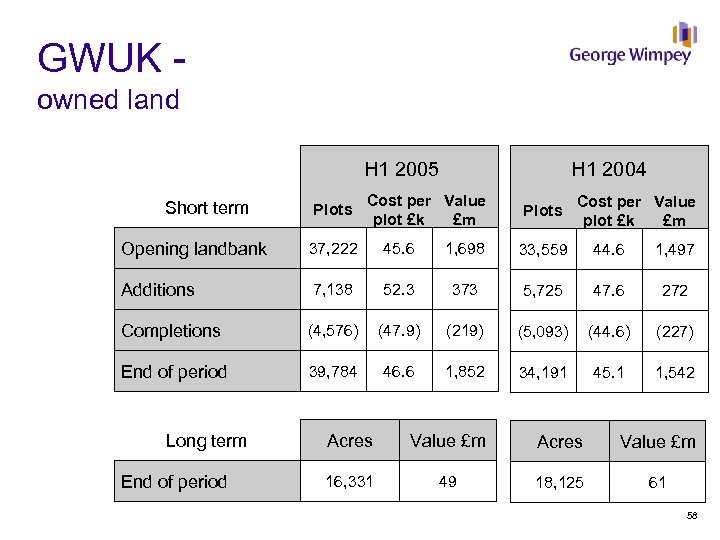

GWUK owned land H 1 2005 Short term Plots H 1 2004 Cost per Value plot £k £m Plots Cost per Value plot £k £m Opening landbank 37, 222 45. 6 1, 698 33, 559 44. 6 1, 497 Additions 7, 138 52. 3 373 5, 725 47. 6 272 Completions (4, 576) (47. 9) (219) (5, 093) (44. 6) (227) End of period 39, 784 46. 6 1, 852 34, 191 45. 1 1, 542 Long term End of period Acres Value £m 16, 331 49 18, 125 61 58

GWUK owned land H 1 2005 Short term Plots H 1 2004 Cost per Value plot £k £m Plots Cost per Value plot £k £m Opening landbank 37, 222 45. 6 1, 698 33, 559 44. 6 1, 497 Additions 7, 138 52. 3 373 5, 725 47. 6 272 Completions (4, 576) (47. 9) (219) (5, 093) (44. 6) (227) End of period 39, 784 46. 6 1, 852 34, 191 45. 1 1, 542 Long term End of period Acres Value £m 16, 331 49 18, 125 61 58

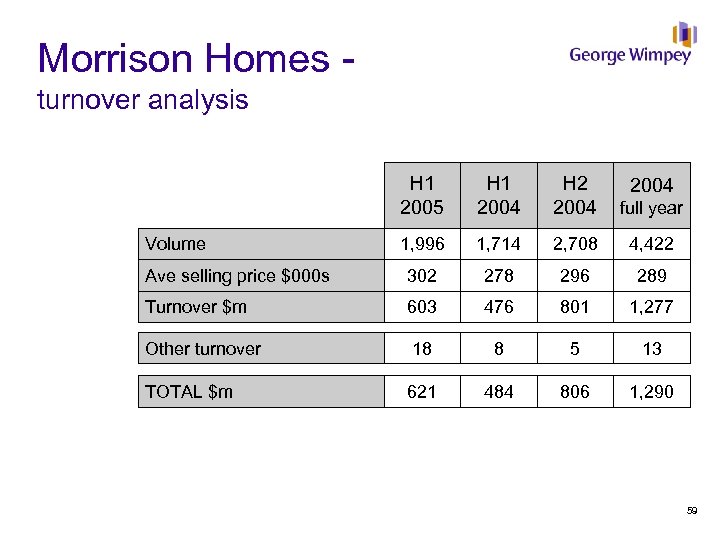

Morrison Homes turnover analysis H 1 2005 H 1 2004 H 2 2004 full year 1, 996 1, 714 2, 708 4, 422 Ave selling price $000 s 302 278 296 289 Turnover $m 603 476 801 1, 277 Other turnover 18 8 5 13 TOTAL $m 621 484 806 1, 290 Volume 2004 59

Morrison Homes turnover analysis H 1 2005 H 1 2004 H 2 2004 full year 1, 996 1, 714 2, 708 4, 422 Ave selling price $000 s 302 278 296 289 Turnover $m 603 476 801 1, 277 Other turnover 18 8 5 13 TOTAL $m 621 484 806 1, 290 Volume 2004 59

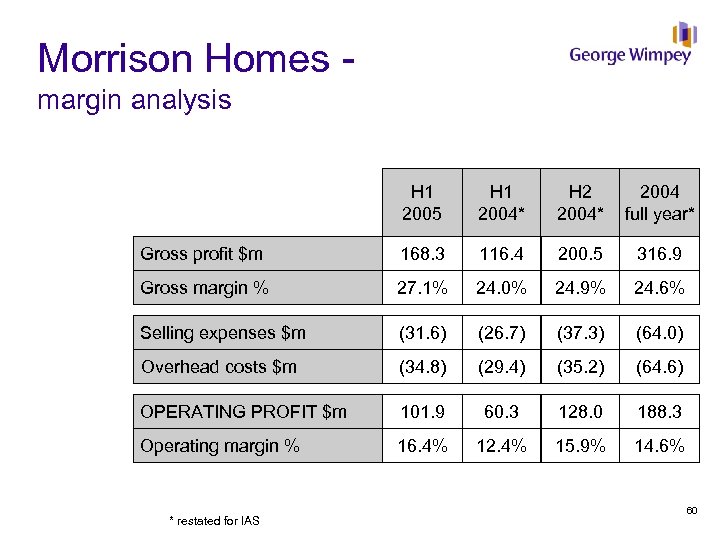

Morrison Homes - margin analysis H 1 2005 H 1 2004* H 2 2004* 2004 full year* Gross profit $m 168. 3 116. 4 200. 5 316. 9 Gross margin % 27. 1% 24. 0% 24. 9% 24. 6% Selling expenses $m (31. 6) (26. 7) (37. 3) (64. 0) Overhead costs $m (34. 8) (29. 4) (35. 2) (64. 6) OPERATING PROFIT $m 101. 9 60. 3 128. 0 188. 3 Operating margin % 16. 4% 12. 4% 15. 9% 14. 6% * restated for IAS 60

Morrison Homes - margin analysis H 1 2005 H 1 2004* H 2 2004* 2004 full year* Gross profit $m 168. 3 116. 4 200. 5 316. 9 Gross margin % 27. 1% 24. 0% 24. 9% 24. 6% Selling expenses $m (31. 6) (26. 7) (37. 3) (64. 0) Overhead costs $m (34. 8) (29. 4) (35. 2) (64. 6) OPERATING PROFIT $m 101. 9 60. 3 128. 0 188. 3 Operating margin % 16. 4% 12. 4% 15. 9% 14. 6% * restated for IAS 60

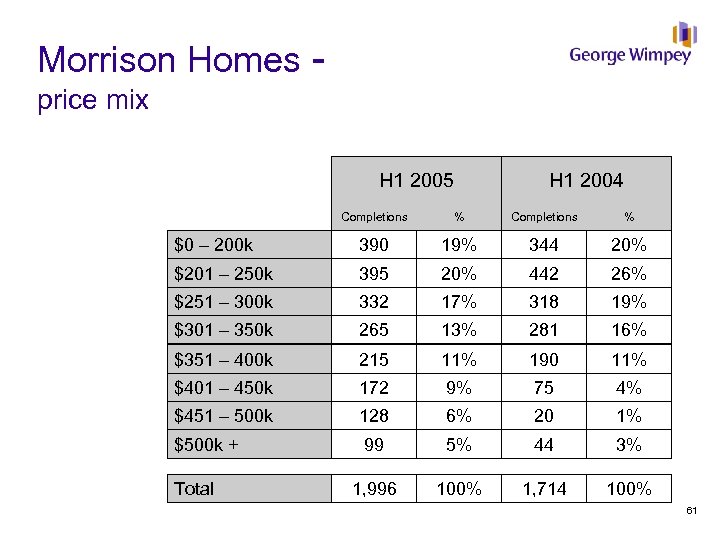

Morrison Homes price mix H 1 2005 H 1 2004 Completions % $0 – 200 k 390 19% 344 20% $201 – 250 k 395 20% 442 26% $251 – 300 k 332 17% 318 19% $301 – 350 k 265 13% 281 16% $351 – 400 k 215 11% 190 11% $401 – 450 k 172 9% 75 4% $451 – 500 k 128 6% 20 1% $500 k + 99 5% 44 3% 1, 996 100% 1, 714 100% Total 61

Morrison Homes price mix H 1 2005 H 1 2004 Completions % $0 – 200 k 390 19% 344 20% $201 – 250 k 395 20% 442 26% $251 – 300 k 332 17% 318 19% $301 – 350 k 265 13% 281 16% $351 – 400 k 215 11% 190 11% $401 – 450 k 172 9% 75 4% $451 – 500 k 128 6% 20 1% $500 k + 99 5% 44 3% 1, 996 100% 1, 714 100% Total 61

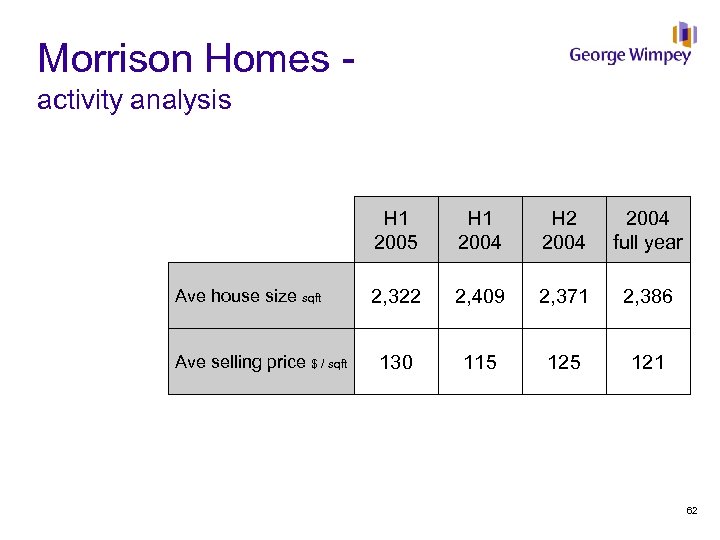

Morrison Homes activity analysis H 1 2005 Ave house size sqft Ave selling price $ / sqft H 1 2004 H 2 2004 full year 2, 322 2, 409 2, 371 2, 386 130 115 121 62

Morrison Homes activity analysis H 1 2005 Ave house size sqft Ave selling price $ / sqft H 1 2004 H 2 2004 full year 2, 322 2, 409 2, 371 2, 386 130 115 121 62

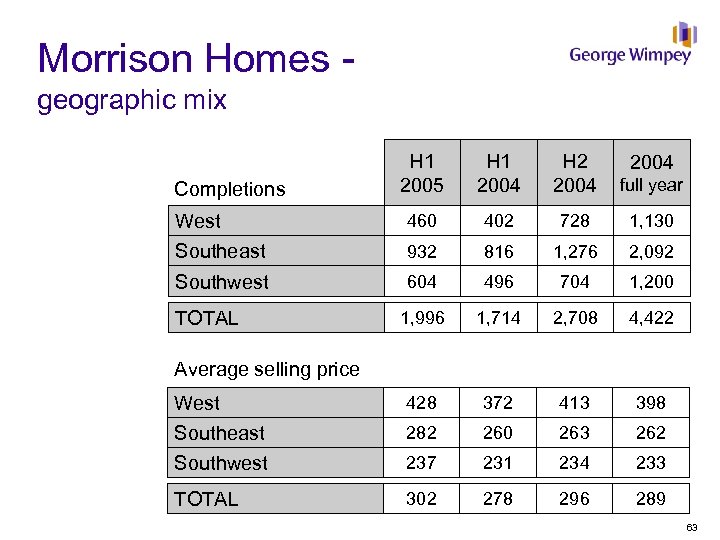

Morrison Homes geographic mix H 1 2005 H 1 2004 H 2 2004 full year West 460 402 728 1, 130 Southeast 932 816 1, 276 2, 092 Southwest 604 496 704 1, 200 1, 996 1, 714 2, 708 4, 422 West 428 372 413 398 Southeast 282 260 263 262 Southwest 237 231 234 233 TOTAL 302 278 296 289 Completions TOTAL 2004 Average selling price 63

Morrison Homes geographic mix H 1 2005 H 1 2004 H 2 2004 full year West 460 402 728 1, 130 Southeast 932 816 1, 276 2, 092 Southwest 604 496 704 1, 200 1, 996 1, 714 2, 708 4, 422 West 428 372 413 398 Southeast 282 260 263 262 Southwest 237 231 234 233 TOTAL 302 278 296 289 Completions TOTAL 2004 Average selling price 63

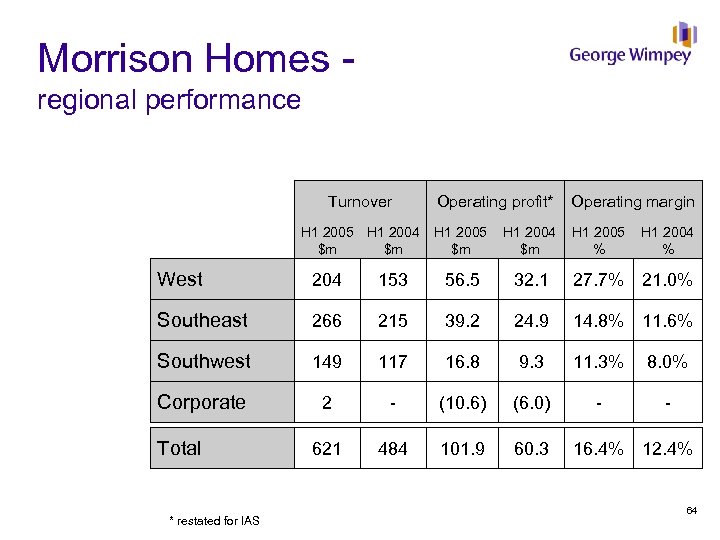

Morrison Homes - regional performance Turnover H 1 2005 H 1 2004 $m $m Operating profit* Operating margin H 1 2005 $m H 1 2004 $m H 1 2005 % H 1 2004 % West 204 153 56. 5 32. 1 27. 7% 21. 0% Southeast 266 215 39. 2 24. 9 14. 8% 11. 6% Southwest 149 117 16. 8 9. 3 11. 3% 8. 0% Corporate 2 - (10. 6) (6. 0) - - 621 484 101. 9 60. 3 Total * restated for IAS 16. 4% 12. 4% 64

Morrison Homes - regional performance Turnover H 1 2005 H 1 2004 $m $m Operating profit* Operating margin H 1 2005 $m H 1 2004 $m H 1 2005 % H 1 2004 % West 204 153 56. 5 32. 1 27. 7% 21. 0% Southeast 266 215 39. 2 24. 9 14. 8% 11. 6% Southwest 149 117 16. 8 9. 3 11. 3% 8. 0% Corporate 2 - (10. 6) (6. 0) - - 621 484 101. 9 60. 3 Total * restated for IAS 16. 4% 12. 4% 64

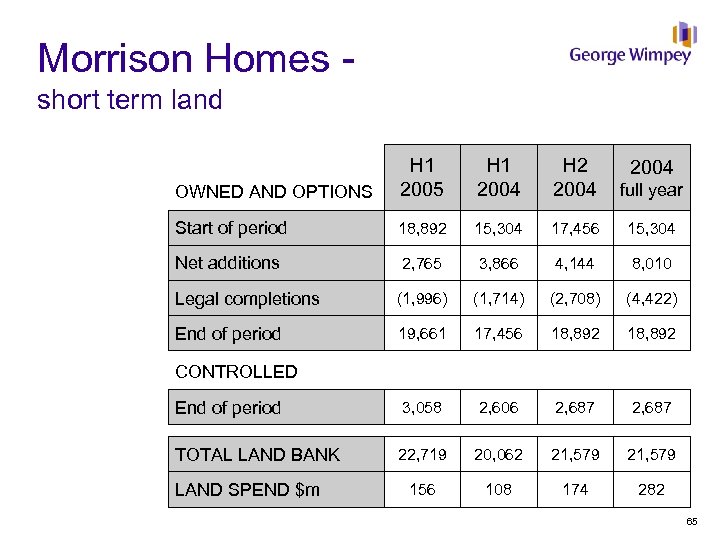

Morrison Homes - short term land OWNED AND OPTIONS H 1 2005 H 1 2004 H 2 2004 full year Start of period 18, 892 15, 304 17, 456 15, 304 Net additions 2, 765 3, 866 4, 144 8, 010 Legal completions (1, 996) (1, 714) (2, 708) (4, 422) End of period 19, 661 17, 456 18, 892 End of period 3, 058 2, 606 2, 687 TOTAL LAND BANK 22, 719 20, 062 21, 579 156 108 174 282 2004 CONTROLLED LAND SPEND $m 65

Morrison Homes - short term land OWNED AND OPTIONS H 1 2005 H 1 2004 H 2 2004 full year Start of period 18, 892 15, 304 17, 456 15, 304 Net additions 2, 765 3, 866 4, 144 8, 010 Legal completions (1, 996) (1, 714) (2, 708) (4, 422) End of period 19, 661 17, 456 18, 892 End of period 3, 058 2, 606 2, 687 TOTAL LAND BANK 22, 719 20, 062 21, 579 156 108 174 282 2004 CONTROLLED LAND SPEND $m 65