2841d4eb306f7b79d47f0c0983534b79.ppt

- Количество слайдов: 77

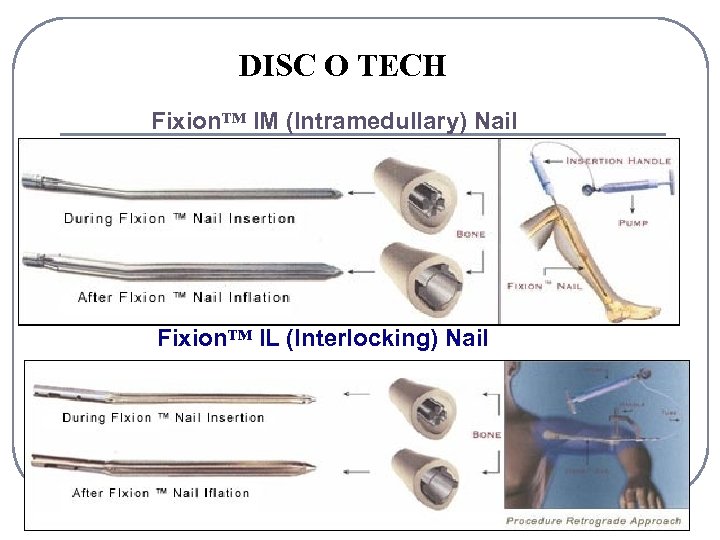

DISC O TECH Fixion™ IM (Intramedullary) Nail Fixion™ IL (Interlocking) Nail 1

DISC O TECH Fixion™ IM (Intramedullary) Nail Fixion™ IL (Interlocking) Nail 1

DISC O TECH THE B-TWIN EXPANDABLE SPINAL SYSTEM B-Twin Reduced Configuration (5 mm diameter) Post-Operative (after B-Twin Expanded expansion) Configuration (up to 15 mm diameter) Anterior-Posterior View 2

DISC O TECH THE B-TWIN EXPANDABLE SPINAL SYSTEM B-Twin Reduced Configuration (5 mm diameter) Post-Operative (after B-Twin Expanded expansion) Configuration (up to 15 mm diameter) Anterior-Posterior View 2

Kyphon Wins Patent Dispute against Disc-O-Tech; Disc-OTech to Stop Selling Kyphoplasty Products in U. S. Market; Court Broadly Construes Fundamental Kyphoplasty Patents. Business Wire | June 23, 2005 | Copyright SUNNYVALE, Calif. -- Kyphon Inc. (Nasdaq: KYPH), a leader in minimally invasive spinal products and solutions, announced today that in its patent litigation against Disc-O-Tech Medical Technologies, Ltd. and Disc Orthopaedic Technologies, Inc. ("Disc -O-Tech"), the U. S. District Court for the District of Delaware has entered a permanent injunction, effective July 22, 2005, barring Disc-O-Tech from further importing or selling its SKy Bone Expander product in the U. S. or otherwise infringing Kyphon's 4, 969, 888, 5, 108, 404 and 6, 235, 043 kyphoplasty patents. This concludes the patent dispute in Kyphon's favor without the possibility of further trial or appeal. Importantly, the court …

Kyphon Wins Patent Dispute against Disc-O-Tech; Disc-OTech to Stop Selling Kyphoplasty Products in U. S. Market; Court Broadly Construes Fundamental Kyphoplasty Patents. Business Wire | June 23, 2005 | Copyright SUNNYVALE, Calif. -- Kyphon Inc. (Nasdaq: KYPH), a leader in minimally invasive spinal products and solutions, announced today that in its patent litigation against Disc-O-Tech Medical Technologies, Ltd. and Disc Orthopaedic Technologies, Inc. ("Disc -O-Tech"), the U. S. District Court for the District of Delaware has entered a permanent injunction, effective July 22, 2005, barring Disc-O-Tech from further importing or selling its SKy Bone Expander product in the U. S. or otherwise infringing Kyphon's 4, 969, 888, 5, 108, 404 and 6, 235, 043 kyphoplasty patents. This concludes the patent dispute in Kyphon's favor without the possibility of further trial or appeal. Importantly, the court …

![Disco-Tech sells spine products for $220 m [p. 16] 12/21/2006 21: 07 http: //www. Disco-Tech sells spine products for $220 m [p. 16] 12/21/2006 21: 07 http: //www.](https://present5.com/presentation/2841d4eb306f7b79d47f0c0983534b79/image-4.jpg) Disco-Tech sells spine products for $220 m [p. 16] 12/21/2006 21: 07 http: //www. jpost. com/Home/Article. aspx? id=45533 Privately owned Israeli start-up company Disc-O-Tech Medical Technologies has agreed to sell its spinerelated product assets and intellectual property rights to California-based Kyphon Inc. for $220 million .

Disco-Tech sells spine products for $220 m [p. 16] 12/21/2006 21: 07 http: //www. jpost. com/Home/Article. aspx? id=45533 Privately owned Israeli start-up company Disc-O-Tech Medical Technologies has agreed to sell its spinerelated product assets and intellectual property rights to California-based Kyphon Inc. for $220 million .

http: //www. ynetnews. com/articles/0, 7340, L-3343290, 00. html American company Kyphon buys Israeli start-up Disc-o. Tech Medical from Herzliya at a sum of USD 240 million Eli Shimoni Published: 12. 22. 06, 14: 24 / Israel Business Disc-o-Tech was founded in 1998 by Oren Globerman and Dr. Motty Biar. The investors in the company are Louis Pell who have a record of , and Prof. Shlomo Ben-Haim successful "exits" in the area of life sciences The two were involved in purchases of companies which totaled USD 1 billion including the selling of Biosense to Johnson & Johnson in 1997 for USD 400 million in shares, selling of Instant to Medtronic in 1996, selling of Heart Technolgy to Boston Scientific in 1995, and the selling of X-Technologies to Guidenet.

http: //www. ynetnews. com/articles/0, 7340, L-3343290, 00. html American company Kyphon buys Israeli start-up Disc-o. Tech Medical from Herzliya at a sum of USD 240 million Eli Shimoni Published: 12. 22. 06, 14: 24 / Israel Business Disc-o-Tech was founded in 1998 by Oren Globerman and Dr. Motty Biar. The investors in the company are Louis Pell who have a record of , and Prof. Shlomo Ben-Haim successful "exits" in the area of life sciences The two were involved in purchases of companies which totaled USD 1 billion including the selling of Biosense to Johnson & Johnson in 1997 for USD 400 million in shares, selling of Instant to Medtronic in 1996, selling of Heart Technolgy to Boston Scientific in 1995, and the selling of X-Technologies to Guidenet.

Disc-O-Tech parent bought by Medtronic Disc-o-tech is still owed $120 million by its parent Kyphon, although the change in ownership is unlikely to affect this. 1 August 07 19: 11, Gali Weinreb http: //www. globes. co. il/serveen/globes/docview. asp? did=1000238936 Earlier this week US medical device giant Medtronic Inc. (NYSE: MDT) acquired Kyphon Inc. (Nasdaq: KYPH), which specializes in devices for treating spinal disorders, for $3. 9 billion. This comes after Kyphon recently made two major deals of its own. It acquired St. Francis Medical Technologies Inc. , as well as the spine-related product assets and associated intellectual property rights of Disc. O-Tech Medical Technologies, Ltd. .

Disc-O-Tech parent bought by Medtronic Disc-o-tech is still owed $120 million by its parent Kyphon, although the change in ownership is unlikely to affect this. 1 August 07 19: 11, Gali Weinreb http: //www. globes. co. il/serveen/globes/docview. asp? did=1000238936 Earlier this week US medical device giant Medtronic Inc. (NYSE: MDT) acquired Kyphon Inc. (Nasdaq: KYPH), which specializes in devices for treating spinal disorders, for $3. 9 billion. This comes after Kyphon recently made two major deals of its own. It acquired St. Francis Medical Technologies Inc. , as well as the spine-related product assets and associated intellectual property rights of Disc. O-Tech Medical Technologies, Ltd. .

Medtronic has activity in non-invasive spinal procedures, and says it is interested in Kyphon principally because of its expertise in this field. Disc-O-Tech's treatments also come under the same category, so they could well find their way on to the market, under the new owners. Medtronic previously acquired another company owned by Pell and Ben Haim - In. Stent Ltd. - for $220 million. Disc-O-Tech has additional devices for hip and thigh surgery, which it will retain ownership of following the completion of the deal. Published by Globes [online], Israel business news www. globes. co. il - on August 1, 2007 © Copyright of Globes Publisher Itonut (1983) Ltd. 2007

Medtronic has activity in non-invasive spinal procedures, and says it is interested in Kyphon principally because of its expertise in this field. Disc-O-Tech's treatments also come under the same category, so they could well find their way on to the market, under the new owners. Medtronic previously acquired another company owned by Pell and Ben Haim - In. Stent Ltd. - for $220 million. Disc-O-Tech has additional devices for hip and thigh surgery, which it will retain ownership of following the completion of the deal. Published by Globes [online], Israel business news www. globes. co. il - on August 1, 2007 © Copyright of Globes Publisher Itonut (1983) Ltd. 2007

About the Spinal and Biologics Business at Medtronic The Spinal and Biologics business is based in Memphis, Tenn. It is the global leader in today's spine market and is committed to advancing the treatment of spinal conditions. The Spinal and Biologics business works with worldrenowned surgeons, researchers and innovative partners to offer state-of-the-art products and technologies for neurological, orthopedic, dental and spinal conditions

About the Spinal and Biologics Business at Medtronic The Spinal and Biologics business is based in Memphis, Tenn. It is the global leader in today's spine market and is committed to advancing the treatment of spinal conditions. The Spinal and Biologics business works with worldrenowned surgeons, researchers and innovative partners to offer state-of-the-art products and technologies for neurological, orthopedic, dental and spinal conditions

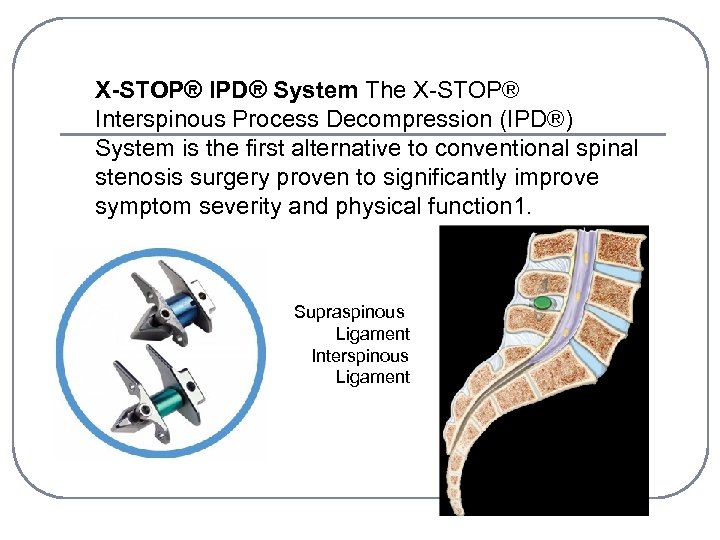

X-STOP® IPD® System The X-STOP® Interspinous Process Decompression (IPD®) System is the first alternative to conventional spinal stenosis surgery proven to significantly improve symptom severity and physical function 1. Supraspinous Ligament Interspinous Ligament

X-STOP® IPD® System The X-STOP® Interspinous Process Decompression (IPD®) System is the first alternative to conventional spinal stenosis surgery proven to significantly improve symptom severity and physical function 1. Supraspinous Ligament Interspinous Ligament

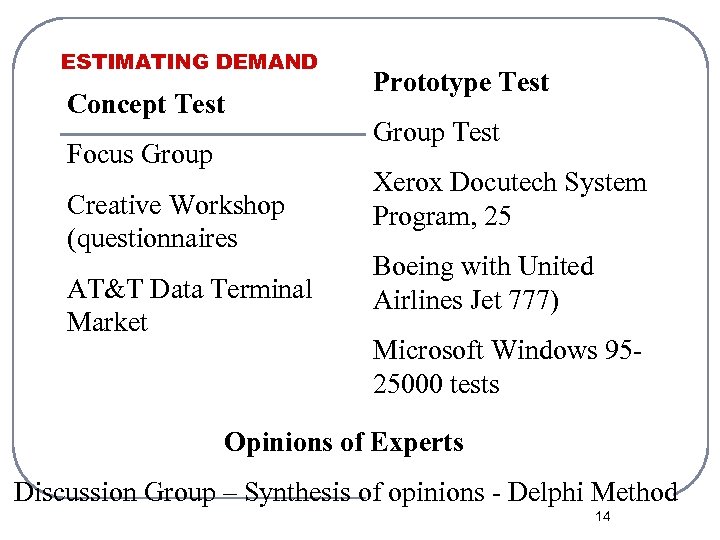

נחשפה הטכנולוגיה שפיתחה RF-Dynamics של בן חיים 6 בינואר 0102 מאת: Bio. Search הדפסת מאמר תגובות חברת , RF-Dynamics מקבוצת החברות שמנהל היזם הסדרתי פרופ' שלמה בן חיים, מפתחת תנור המבוסס על גלי רדיו, בטכנולוגיה המשמשת גם להפשרת רקמות שהוקפאו או איברים להשתלה. גלי הרדיו מסוגלים לחממם פריט מזון מסוים באופן אחיד, ממוקד ובעשירית מהזמן הנדרש לחימום במיקרוגל ביתי רגיל. כך פורסם ב"כלכליסט". יישום הטכנולוגיה לחימום מזון מאפשר חימום סלקטיבי של פריטים שונים בצלחת אחת, בטמפרטורות שונות. עד עתה נשמר הפיתוח בסוד. בבקשת הפטנט שהגישו בספטמבר האחרון שלמה בן חיים, מנכ"ל החברה ערן בן שמואל ומספר עובדים בחברה, נכתב בין היתר: "המכשיר יכול להפשיר באופן סלקטיבי רק חלק מהפריט, למשל חלק מפרוסת בשר. את שאר הפרוסה אפשר באותו זמן לקרר באמצעות אלמנט של הקפאה".

נחשפה הטכנולוגיה שפיתחה RF-Dynamics של בן חיים 6 בינואר 0102 מאת: Bio. Search הדפסת מאמר תגובות חברת , RF-Dynamics מקבוצת החברות שמנהל היזם הסדרתי פרופ' שלמה בן חיים, מפתחת תנור המבוסס על גלי רדיו, בטכנולוגיה המשמשת גם להפשרת רקמות שהוקפאו או איברים להשתלה. גלי הרדיו מסוגלים לחממם פריט מזון מסוים באופן אחיד, ממוקד ובעשירית מהזמן הנדרש לחימום במיקרוגל ביתי רגיל. כך פורסם ב"כלכליסט". יישום הטכנולוגיה לחימום מזון מאפשר חימום סלקטיבי של פריטים שונים בצלחת אחת, בטמפרטורות שונות. עד עתה נשמר הפיתוח בסוד. בבקשת הפטנט שהגישו בספטמבר האחרון שלמה בן חיים, מנכ"ל החברה ערן בן שמואל ומספר עובדים בחברה, נכתב בין היתר: "המכשיר יכול להפשיר באופן סלקטיבי רק חלק מהפריט, למשל חלק מפרוסת בשר. את שאר הפרוסה אפשר באותו זמן לקרר באמצעות אלמנט של הקפאה".

התנור אמור להתחרות בתנור המיקרוגל הביתי, המחמם את הפריטים שמוכנסים בו באופן לא אחיד, ומשתמש באנרגיה רבה. ככל הידוע, למשרדי RF-Dynamics הגיעו נציגיהן של חברות ציוד בישול ומוצרי מטבח עולמיות, כדי לבחון אפשרות לרכוש את הטכנולוגיה. לאחרונה ביקר בה בחשאי גם נשיא המדינה שמעון פרס. פרופ' בן חיים הוביל בשנים האחרונות כמה אקזיטים, בהם של החברות ביוסנס ודיסק־או־טק, בסכום כולל של כמיליארד דולר. יחד עם לואיס פל, שותפו הוותיק לעסקים, הוא מנהלה של חברת האחזקות מדינווסט, המשקיעה בחברות סטארט־אפ רבות בתחום הציוד הרפואי. ב- RF-Dynamics הושקעו עד כה מספר מיליוני דולרים על ידי בן חיים, מדינווסט ופל. החברה ממוקמת בכפר סבא ומעסיקה כ־ 05 עובדים.

התנור אמור להתחרות בתנור המיקרוגל הביתי, המחמם את הפריטים שמוכנסים בו באופן לא אחיד, ומשתמש באנרגיה רבה. ככל הידוע, למשרדי RF-Dynamics הגיעו נציגיהן של חברות ציוד בישול ומוצרי מטבח עולמיות, כדי לבחון אפשרות לרכוש את הטכנולוגיה. לאחרונה ביקר בה בחשאי גם נשיא המדינה שמעון פרס. פרופ' בן חיים הוביל בשנים האחרונות כמה אקזיטים, בהם של החברות ביוסנס ודיסק־או־טק, בסכום כולל של כמיליארד דולר. יחד עם לואיס פל, שותפו הוותיק לעסקים, הוא מנהלה של חברת האחזקות מדינווסט, המשקיעה בחברות סטארט־אפ רבות בתחום הציוד הרפואי. ב- RF-Dynamics הושקעו עד כה מספר מיליוני דולרים על ידי בן חיים, מדינווסט ופל. החברה ממוקמת בכפר סבא ומעסיקה כ־ 05 עובדים.

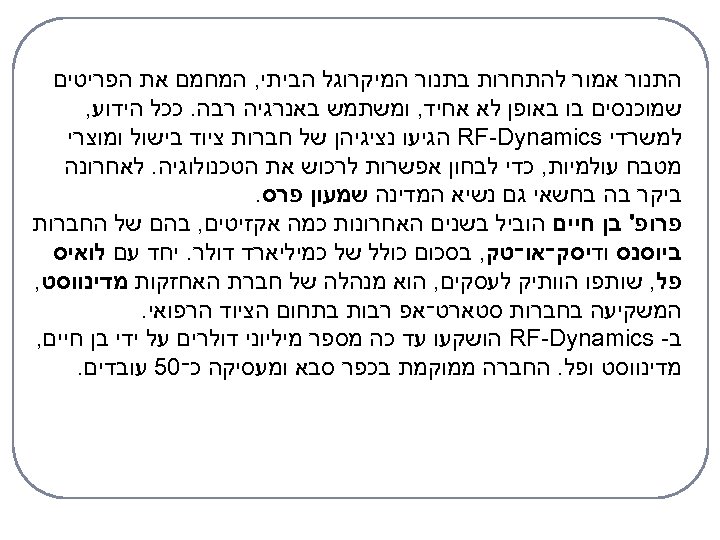

מושגי יסוד בשיווק צרכים רצונות דרישות רעיון, מוצר, שרות שוק תחום עסקי החלפה- יחסים תועלת-סיפוק 21

מושגי יסוד בשיווק צרכים רצונות דרישות רעיון, מוצר, שרות שוק תחום עסקי החלפה- יחסים תועלת-סיפוק 21

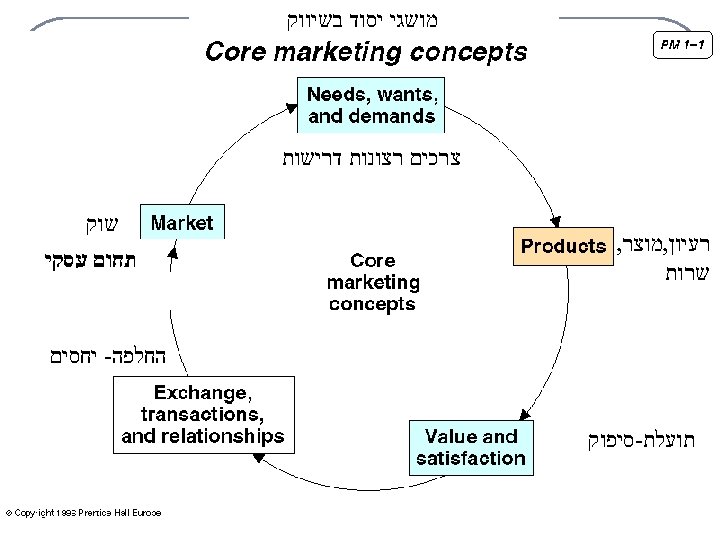

TIME OF ADOPTION OF INNOVATION (Roberts) TECHNOLOGY ADOPTION LIFE CYCLE Innovators Early Majority Late Majority Laggards Adopters 2. 5% 13. 5% 34% Visionary Pragmatist 34% 16% Conservative 13

TIME OF ADOPTION OF INNOVATION (Roberts) TECHNOLOGY ADOPTION LIFE CYCLE Innovators Early Majority Late Majority Laggards Adopters 2. 5% 13. 5% 34% Visionary Pragmatist 34% 16% Conservative 13

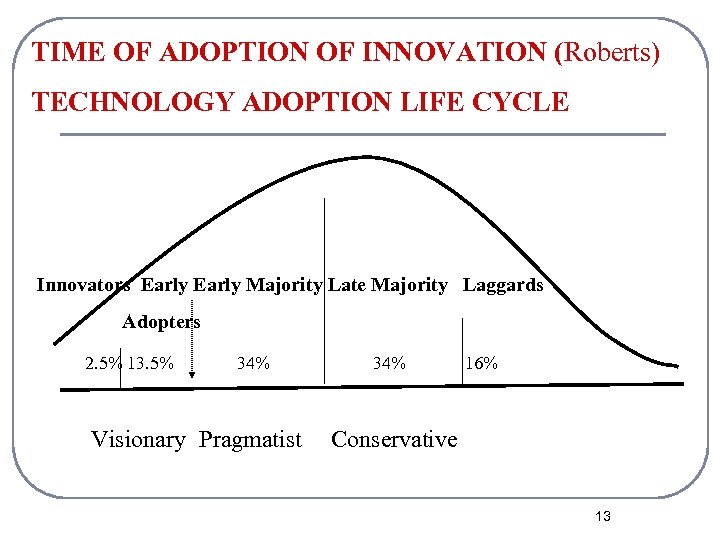

ESTIMATING DEMAND Concept Test Focus Group Creative Workshop (questionnaires AT&T Data Terminal Market Prototype Test Group Test Xerox Docutech System Program, 25 Boeing with United Airlines Jet 777) Microsoft Windows 9525000 tests Opinions of Experts Discussion Group – Synthesis of opinions - Delphi Method 14

ESTIMATING DEMAND Concept Test Focus Group Creative Workshop (questionnaires AT&T Data Terminal Market Prototype Test Group Test Xerox Docutech System Program, 25 Boeing with United Airlines Jet 777) Microsoft Windows 9525000 tests Opinions of Experts Discussion Group – Synthesis of opinions - Delphi Method 14

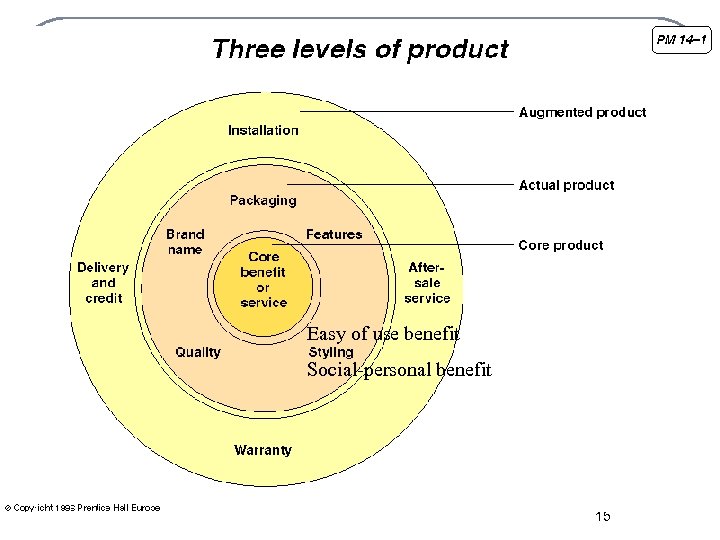

Easy of use benefit Social-personal benefit 15

Easy of use benefit Social-personal benefit 15

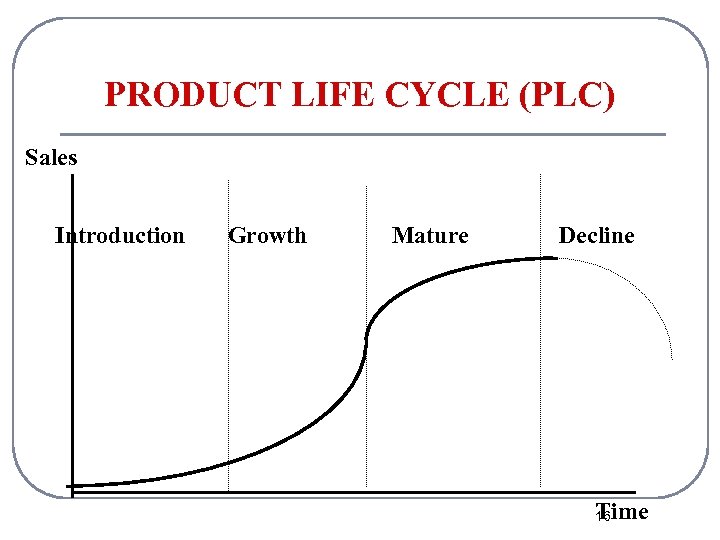

PRODUCT LIFE CYCLE (PLC) Sales Introduction Growth Mature Decline Time 16

PRODUCT LIFE CYCLE (PLC) Sales Introduction Growth Mature Decline Time 16

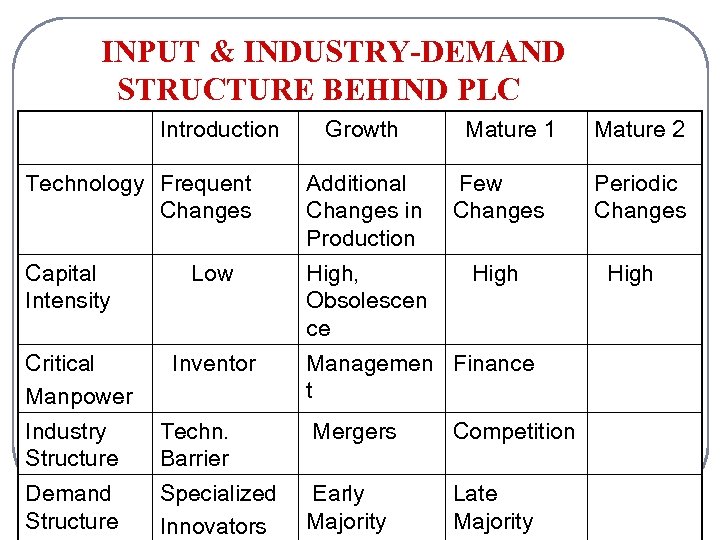

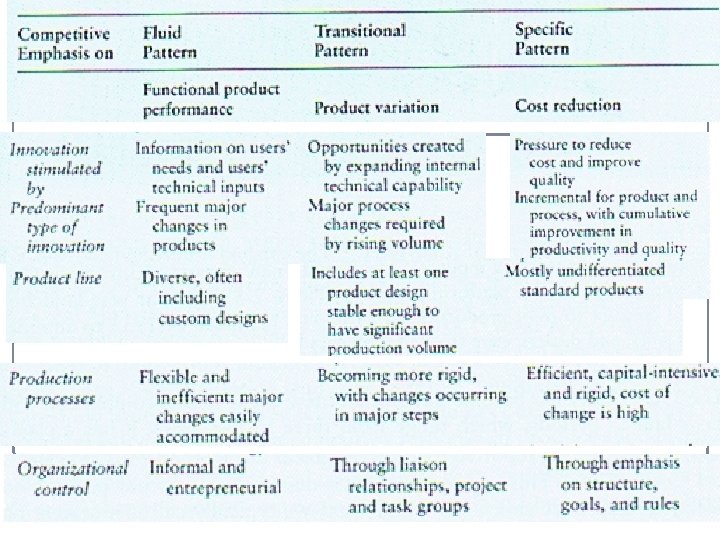

INPUT & INDUSTRY-DEMAND STRUCTURE BEHIND PLC Introduction Growth Mature 1 Mature 2 Technology Frequent Changes Additional Changes in Production Few Changes Periodic Changes Capital Intensity Low High, Obsolescen ce High Critical Manpower Inventor Managemen Finance t Industry Structure Techn. Barrier Mergers Competition Demand Structure Specialized Innovators Early Majority Late Majority 17

INPUT & INDUSTRY-DEMAND STRUCTURE BEHIND PLC Introduction Growth Mature 1 Mature 2 Technology Frequent Changes Additional Changes in Production Few Changes Periodic Changes Capital Intensity Low High, Obsolescen ce High Critical Manpower Inventor Managemen Finance t Industry Structure Techn. Barrier Mergers Competition Demand Structure Specialized Innovators Early Majority Late Majority 17

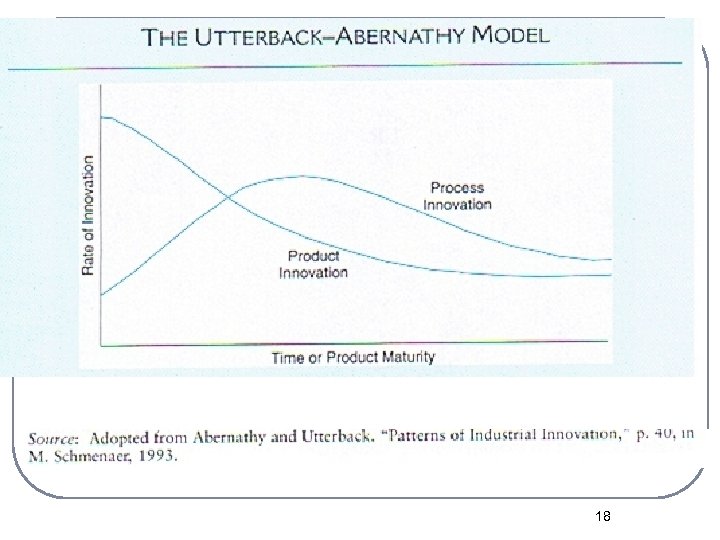

18

18

19

19

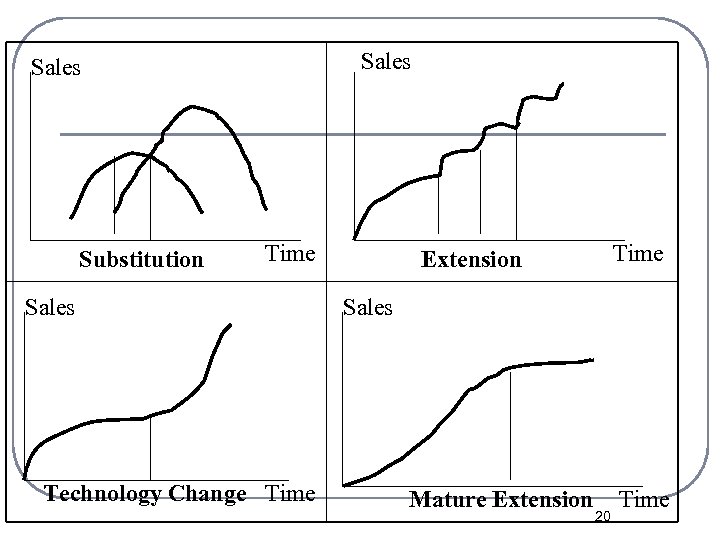

Sales Substitution Time Sales Technology Change Time Extension Sales Mature Extension 20 Time

Sales Substitution Time Sales Technology Change Time Extension Sales Mature Extension 20 Time

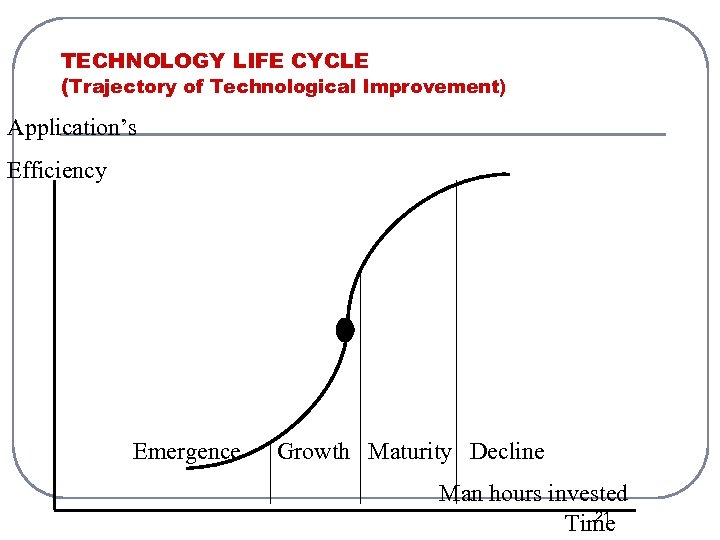

TECHNOLOGY LIFE CYCLE (Trajectory of Technological Improvement) Application’s Efficiency Emergence Growth Maturity Decline Man hours invested 21 Time

TECHNOLOGY LIFE CYCLE (Trajectory of Technological Improvement) Application’s Efficiency Emergence Growth Maturity Decline Man hours invested 21 Time

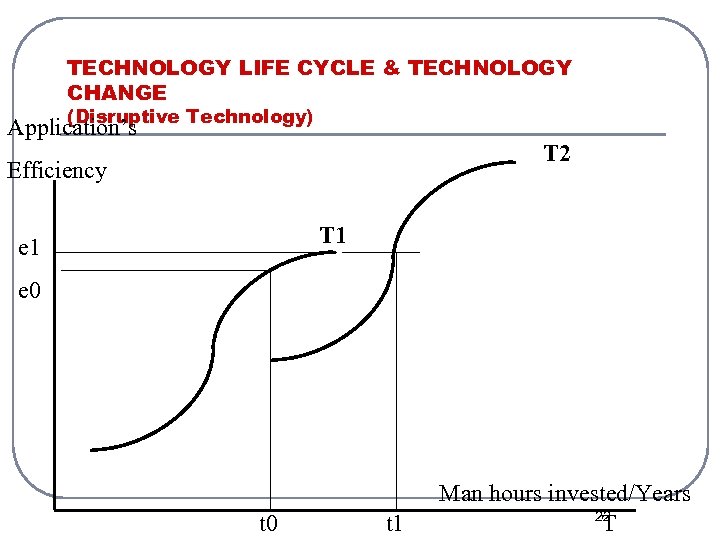

TECHNOLOGY LIFE CYCLE & TECHNOLOGY CHANGE (Disruptive Technology) Application’s T 2 Efficiency T 1 e 0 t 1 Man hours invested/Years 22 T

TECHNOLOGY LIFE CYCLE & TECHNOLOGY CHANGE (Disruptive Technology) Application’s T 2 Efficiency T 1 e 0 t 1 Man hours invested/Years 22 T

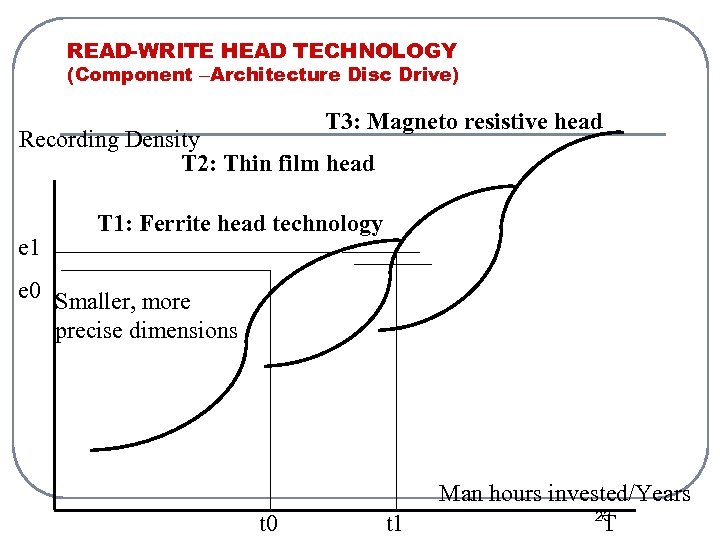

READ-WRITE HEAD TECHNOLOGY (Component –Architecture Disc Drive) T 3: Magneto resistive head Recording Density T 2: Thin film head e 1 T 1: Ferrite head technology e 0 Smaller, more precise dimensions t 0 t 1 Man hours invested/Years 23 T

READ-WRITE HEAD TECHNOLOGY (Component –Architecture Disc Drive) T 3: Magneto resistive head Recording Density T 2: Thin film head e 1 T 1: Ferrite head technology e 0 Smaller, more precise dimensions t 0 t 1 Man hours invested/Years 23 T

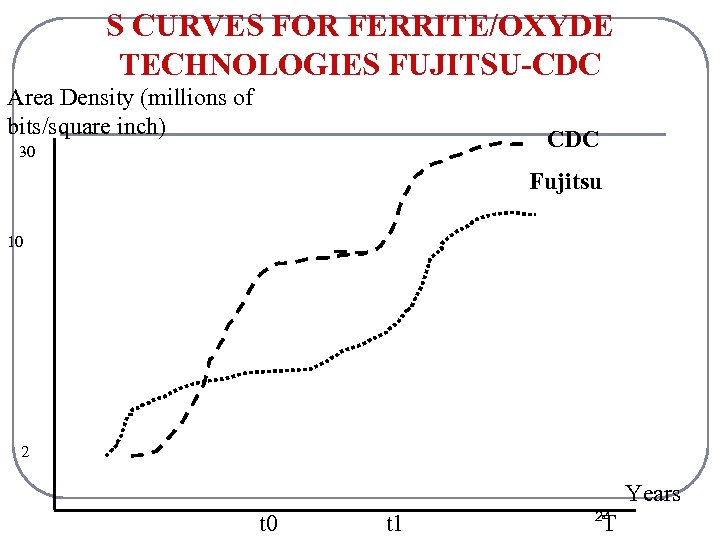

S CURVES FOR FERRITE/OXYDE TECHNOLOGIES FUJITSU-CDC Area Density (millions of bits/square inch) CDC 30 Fujitsu 10 2 Years t 0 t 1 24 T

S CURVES FOR FERRITE/OXYDE TECHNOLOGIES FUJITSU-CDC Area Density (millions of bits/square inch) CDC 30 Fujitsu 10 2 Years t 0 t 1 24 T

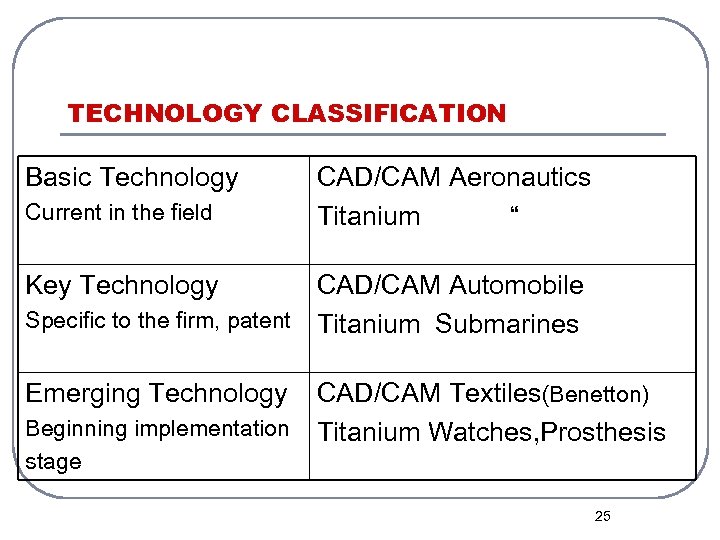

TECHNOLOGY CLASSIFICATION Basic Technology Current in the field CAD/CAM Aeronautics Titanium “ Key Technology CAD/CAM Automobile Specific to the firm, patent Titanium Submarines Emerging Technology CAD/CAM Textiles(Benetton) Beginning implementation Titanium Watches, Prosthesis stage 25

TECHNOLOGY CLASSIFICATION Basic Technology Current in the field CAD/CAM Aeronautics Titanium “ Key Technology CAD/CAM Automobile Specific to the firm, patent Titanium Submarines Emerging Technology CAD/CAM Textiles(Benetton) Beginning implementation Titanium Watches, Prosthesis stage 25

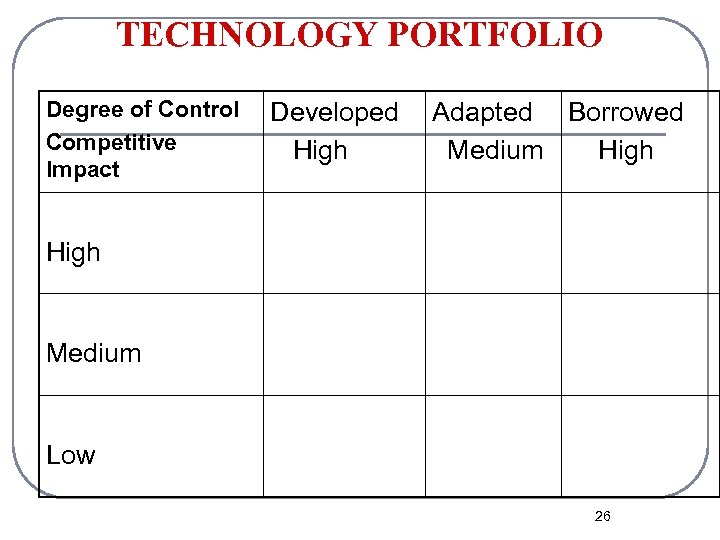

TECHNOLOGY PORTFOLIO Degree of Control Competitive Impact Developed High Adapted Borrowed Medium High Medium Low 26

TECHNOLOGY PORTFOLIO Degree of Control Competitive Impact Developed High Adapted Borrowed Medium High Medium Low 26

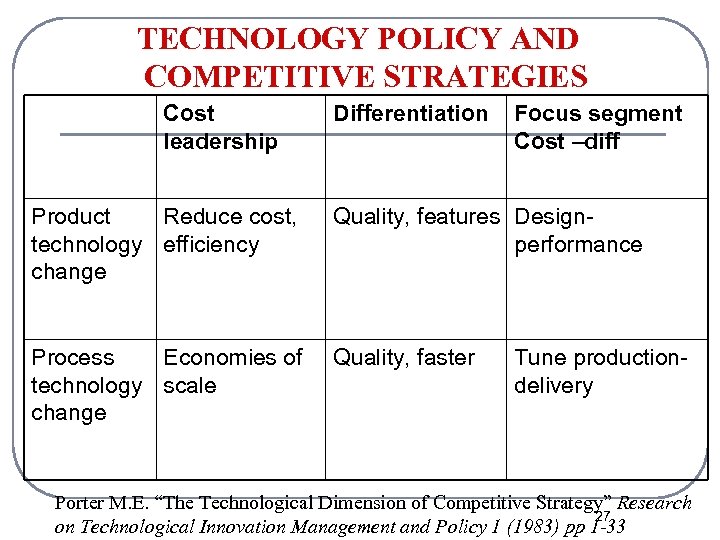

TECHNOLOGY POLICY AND COMPETITIVE STRATEGIES Cost leadership Differentiation Focus segment Cost –diff Product Reduce cost, technology efficiency change Quality, features Designperformance Process Economies of technology scale change Quality, faster Tune productiondelivery Porter M. E. “The Technological Dimension of Competitive Strategy” Research 27 on Technological Innovation Management and Policy 1 (1983) pp 1 -33

TECHNOLOGY POLICY AND COMPETITIVE STRATEGIES Cost leadership Differentiation Focus segment Cost –diff Product Reduce cost, technology efficiency change Quality, features Designperformance Process Economies of technology scale change Quality, faster Tune productiondelivery Porter M. E. “The Technological Dimension of Competitive Strategy” Research 27 on Technological Innovation Management and Policy 1 (1983) pp 1 -33

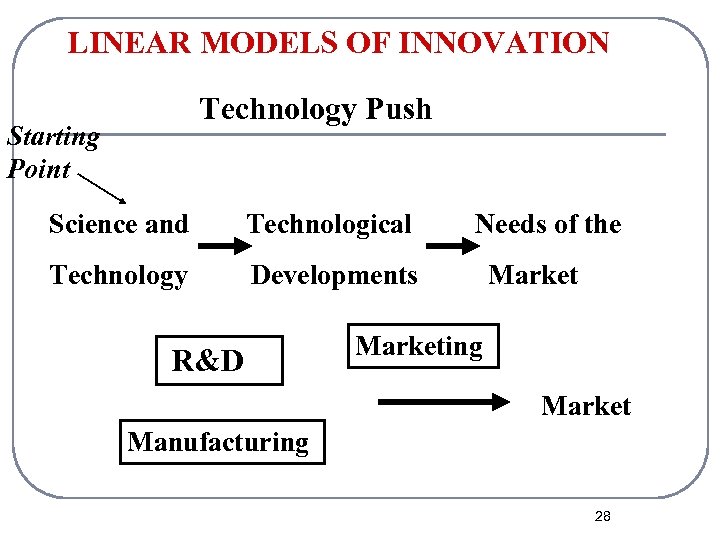

LINEAR MODELS OF INNOVATION Technology Push Starting Point Science and Technological Technology Developments R&D Needs of the Marketing Market Manufacturing 28

LINEAR MODELS OF INNOVATION Technology Push Starting Point Science and Technological Technology Developments R&D Needs of the Marketing Market Manufacturing 28

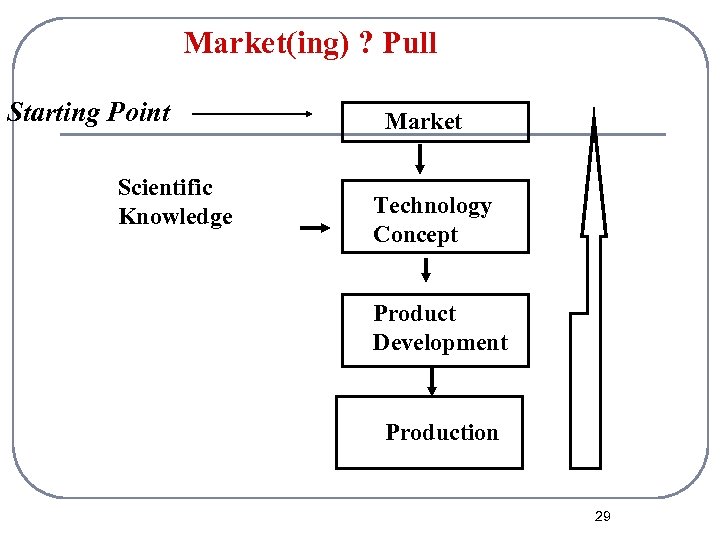

Market(ing) ? Pull Starting Point Scientific Knowledge Market Technology Concept Product Development Production 29

Market(ing) ? Pull Starting Point Scientific Knowledge Market Technology Concept Product Development Production 29

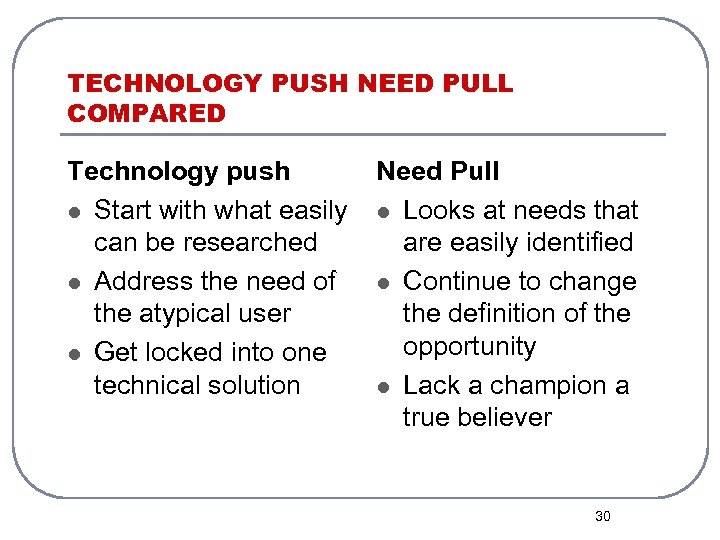

TECHNOLOGY PUSH NEED PULL COMPARED Technology push Need Pull l Start with what easily l Looks at needs that can be researched are easily identified l Address the need of l Continue to change the atypical user the definition of the opportunity l Get locked into one technical solution l Lack a champion a true believer 30

TECHNOLOGY PUSH NEED PULL COMPARED Technology push Need Pull l Start with what easily l Looks at needs that can be researched are easily identified l Address the need of l Continue to change the atypical user the definition of the opportunity l Get locked into one technical solution l Lack a champion a true believer 30

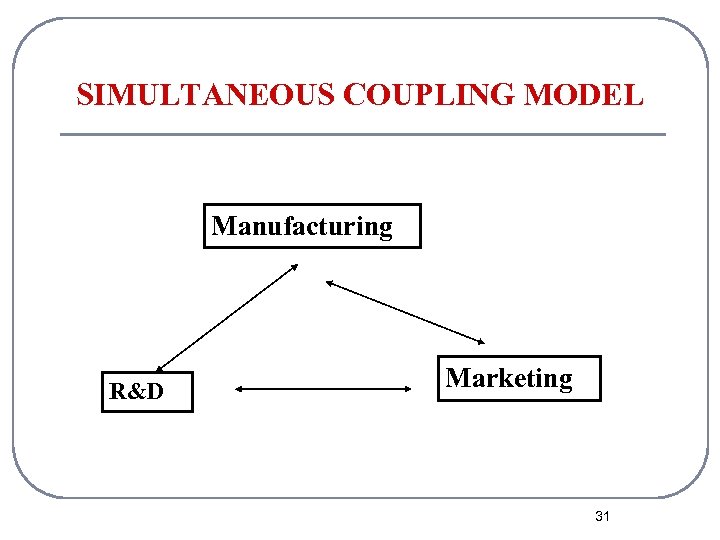

SIMULTANEOUS COUPLING MODEL Manufacturing R&D Marketing 31

SIMULTANEOUS COUPLING MODEL Manufacturing R&D Marketing 31

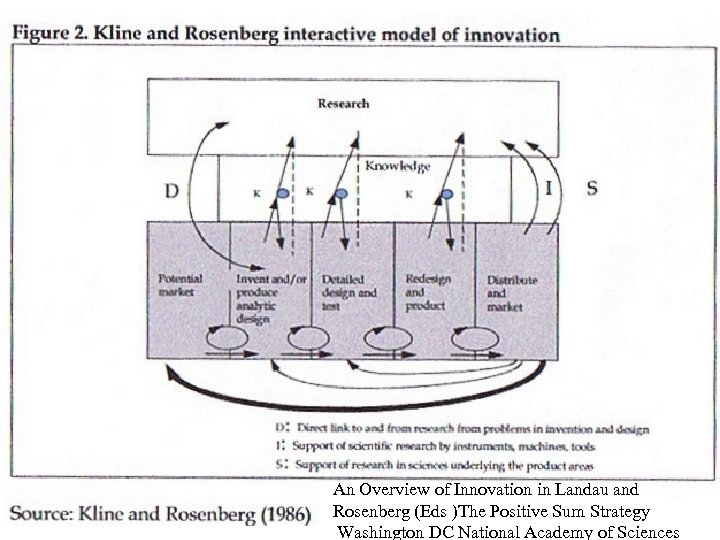

An Overview of Innovation in Landau and Rosenberg (Eds )The Positive Sum Strategy 32 Washington DC National Academy of Sciences

An Overview of Innovation in Landau and Rosenberg (Eds )The Positive Sum Strategy 32 Washington DC National Academy of Sciences

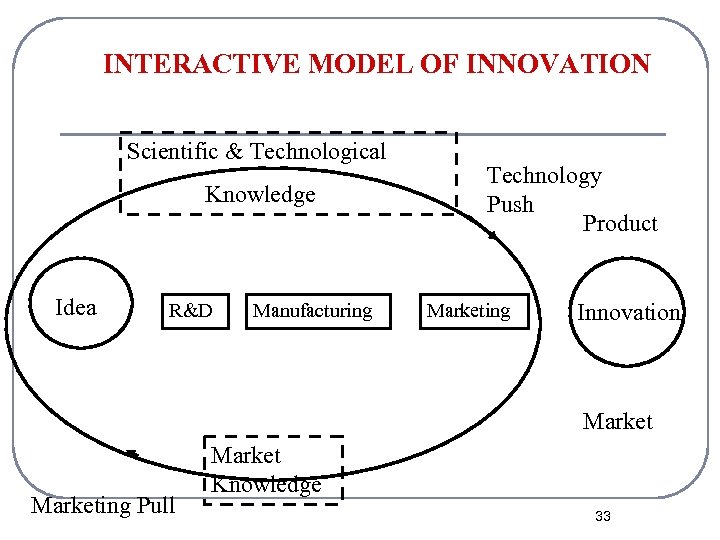

INTERACTIVE MODEL OF INNOVATION Scientific & Technological Knowledge Idea R&D Manufacturing Technology Push Product Marketing Innovation Marketing Pull Market Knowledge 33

INTERACTIVE MODEL OF INNOVATION Scientific & Technological Knowledge Idea R&D Manufacturing Technology Push Product Marketing Innovation Marketing Pull Market Knowledge 33

NETWORK MODEL Freeman C. (1992) Network of Innovators, a synthesis of research issues in Freeman C, The Economics of Hope London Pinter 93 -120 34

NETWORK MODEL Freeman C. (1992) Network of Innovators, a synthesis of research issues in Freeman C, The Economics of Hope London Pinter 93 -120 34

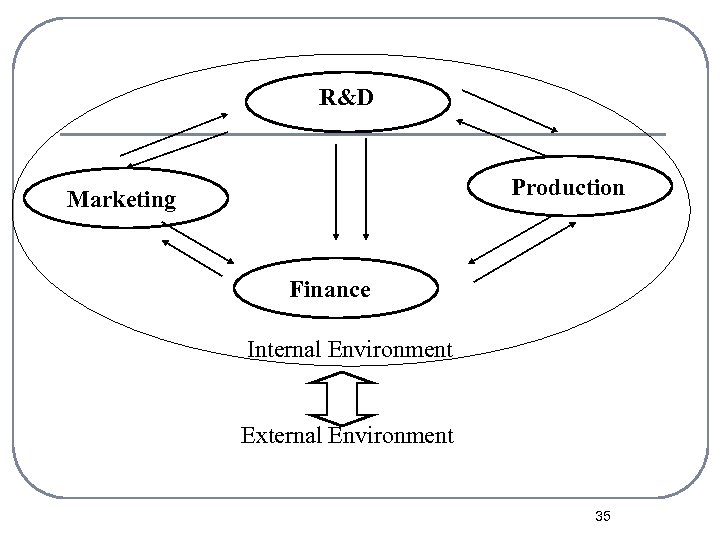

R&D Production Marketing Finance Internal Environment External Environment 35

R&D Production Marketing Finance Internal Environment External Environment 35

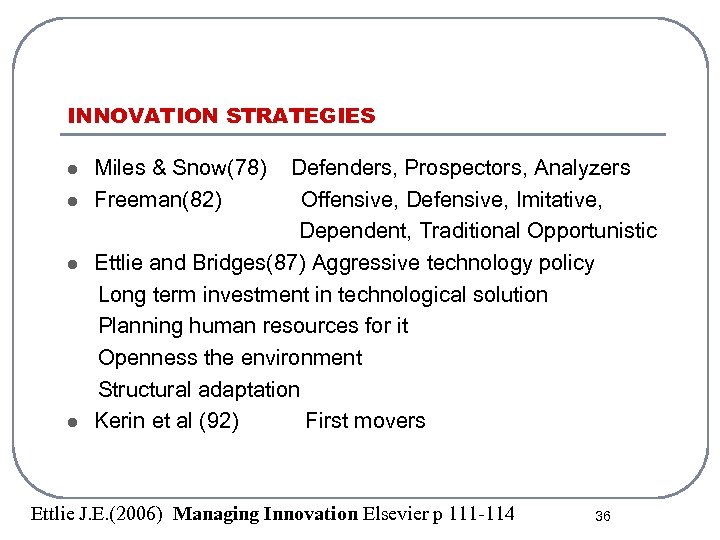

INNOVATION STRATEGIES Miles & Snow(78) Defenders, Prospectors, Analyzers l Freeman(82) Offensive, Defensive, Imitative, Dependent, Traditional Opportunistic l Ettlie and Bridges(87) Aggressive technology policy Long term investment in technological solution Planning human resources for it Openness the environment Structural adaptation l Kerin et al (92) First movers l Ettlie J. E. (2006) Managing Innovation Elsevier p 111 -114 36

INNOVATION STRATEGIES Miles & Snow(78) Defenders, Prospectors, Analyzers l Freeman(82) Offensive, Defensive, Imitative, Dependent, Traditional Opportunistic l Ettlie and Bridges(87) Aggressive technology policy Long term investment in technological solution Planning human resources for it Openness the environment Structural adaptation l Kerin et al (92) First movers l Ettlie J. E. (2006) Managing Innovation Elsevier p 111 -114 36

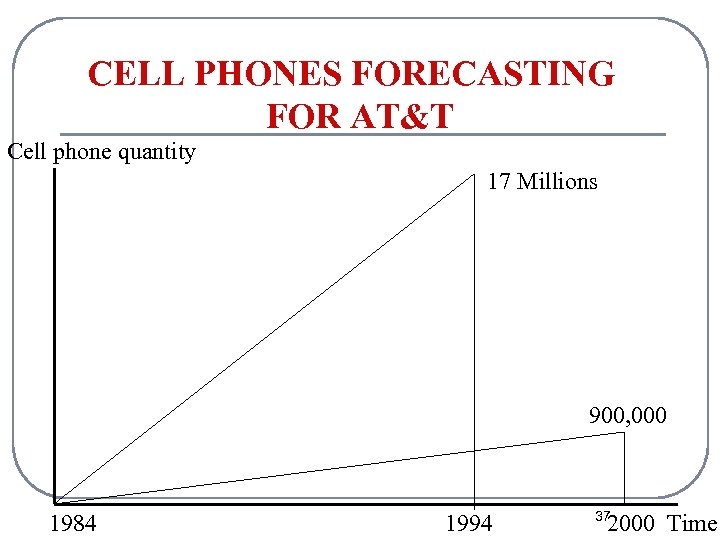

CELL PHONES FORECASTING FOR AT&T Cell phone quantity 17 Millions 900, 000 1984 1994 37 2000 Time

CELL PHONES FORECASTING FOR AT&T Cell phone quantity 17 Millions 900, 000 1984 1994 37 2000 Time

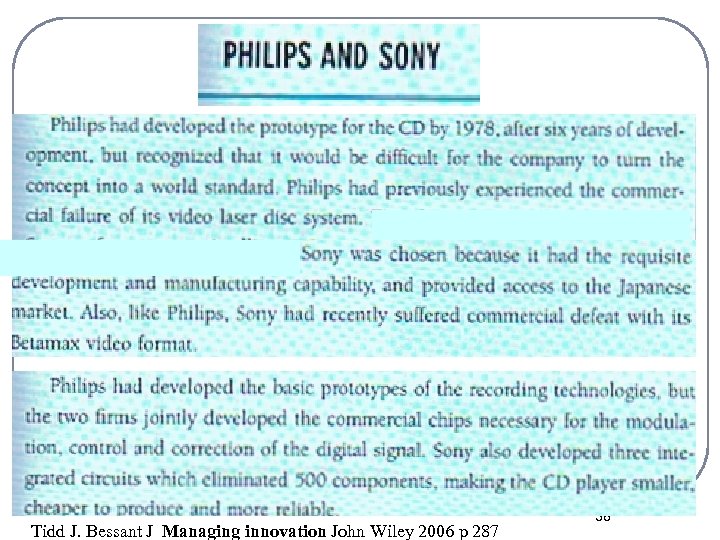

Tidd J. Bessant J Managing innovation John Wiley 2006 p 287 38

Tidd J. Bessant J Managing innovation John Wiley 2006 p 287 38

39

39

FROM MAINSTREAM MARKET TO MARKET/TECHNOLOGY INNOVATION AND BACK l l Requested speed and total capacity to 812 disc drive : Control Data 3. 5 inch Disc Drive: Conner and Quantum 5. 25 inch : Seagate, Tandon, Miniscribe 8 -12 inch using 5. 25 and 3. 5 inch architecture 40

FROM MAINSTREAM MARKET TO MARKET/TECHNOLOGY INNOVATION AND BACK l l Requested speed and total capacity to 812 disc drive : Control Data 3. 5 inch Disc Drive: Conner and Quantum 5. 25 inch : Seagate, Tandon, Miniscribe 8 -12 inch using 5. 25 and 3. 5 inch architecture 40

R&D GENERATIONS 1 st Generation : • Unbounded search for scientific breakthrough • Leap from current to new knowledge • Breakthrough inventions 2 nd Generation • Applicability • Project management • Fusion innovations 41

R&D GENERATIONS 1 st Generation : • Unbounded search for scientific breakthrough • Leap from current to new knowledge • Breakthrough inventions 2 nd Generation • Applicability • Project management • Fusion innovations 41

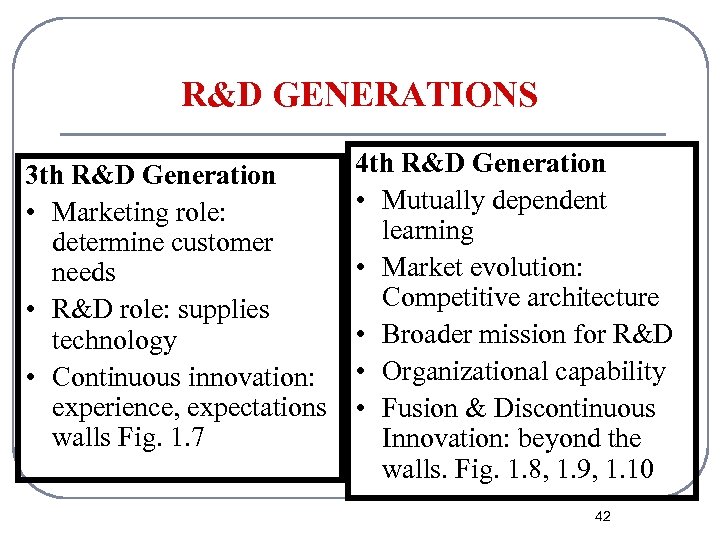

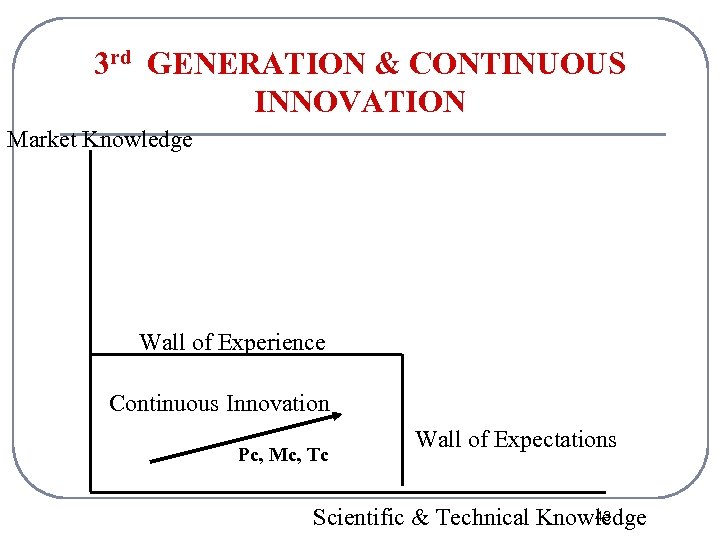

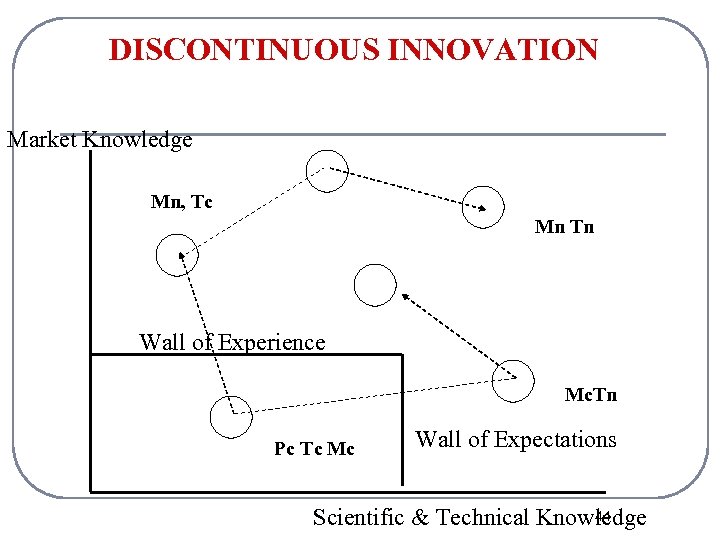

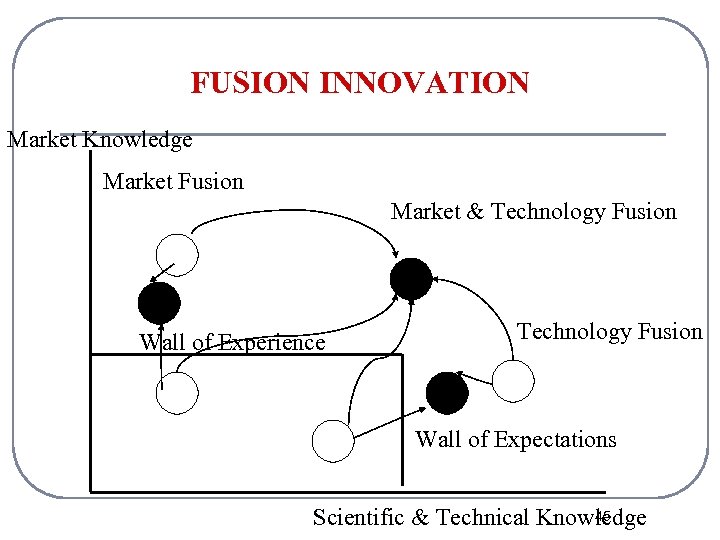

R&D GENERATIONS 3 th R&D Generation • Marketing role: determine customer needs • R&D role: supplies technology • Continuous innovation: experience, expectations walls Fig. 1. 7 4 th R&D Generation • Mutually dependent learning • Market evolution: Competitive architecture • Broader mission for R&D • Organizational capability • Fusion & Discontinuous Innovation: beyond the walls. Fig. 1. 8, 1. 9, 1. 10 42

R&D GENERATIONS 3 th R&D Generation • Marketing role: determine customer needs • R&D role: supplies technology • Continuous innovation: experience, expectations walls Fig. 1. 7 4 th R&D Generation • Mutually dependent learning • Market evolution: Competitive architecture • Broader mission for R&D • Organizational capability • Fusion & Discontinuous Innovation: beyond the walls. Fig. 1. 8, 1. 9, 1. 10 42

3 rd GENERATION & CONTINUOUS INNOVATION Market Knowledge Wall of Experience Continuous Innovation Pc, Mc, Tc Wall of Expectations 43 Scientific & Technical Knowledge

3 rd GENERATION & CONTINUOUS INNOVATION Market Knowledge Wall of Experience Continuous Innovation Pc, Mc, Tc Wall of Expectations 43 Scientific & Technical Knowledge

DISCONTINUOUS INNOVATION Market Knowledge Mn, Tc Mn Tn Wall of Experience Mc. Tn Pc Tc Mc Wall of Expectations 44 Scientific & Technical Knowledge

DISCONTINUOUS INNOVATION Market Knowledge Mn, Tc Mn Tn Wall of Experience Mc. Tn Pc Tc Mc Wall of Expectations 44 Scientific & Technical Knowledge

FUSION INNOVATION Market Knowledge Market Fusion Market & Technology Fusion Wall of Experience Technology Fusion Wall of Expectations 45 Scientific & Technical Knowledge

FUSION INNOVATION Market Knowledge Market Fusion Market & Technology Fusion Wall of Experience Technology Fusion Wall of Expectations 45 Scientific & Technical Knowledge

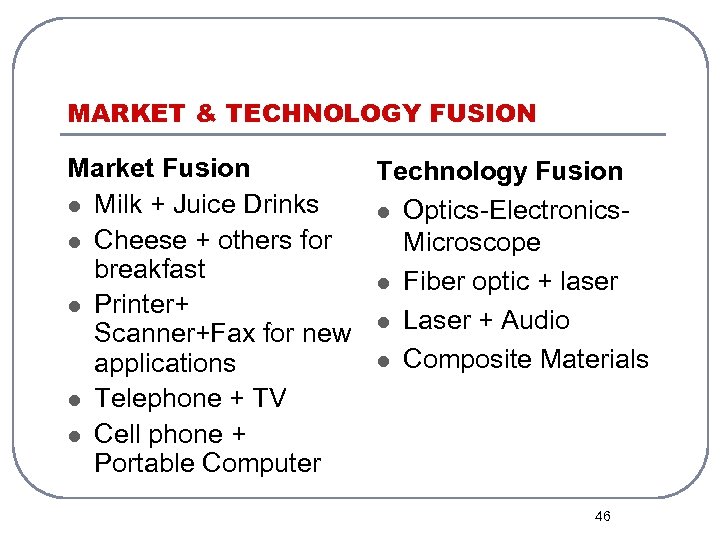

MARKET & TECHNOLOGY FUSION Market Fusion Technology Fusion l Milk + Juice Drinks l Optics-Electronicsl Cheese + others for Microscope breakfast l Fiber optic + laser l Printer+ l Laser + Audio Scanner+Fax for new l Composite Materials applications l Telephone + TV l Cell phone + Portable Computer 46

MARKET & TECHNOLOGY FUSION Market Fusion Technology Fusion l Milk + Juice Drinks l Optics-Electronicsl Cheese + others for Microscope breakfast l Fiber optic + laser l Printer+ l Laser + Audio Scanner+Fax for new l Composite Materials applications l Telephone + TV l Cell phone + Portable Computer 46

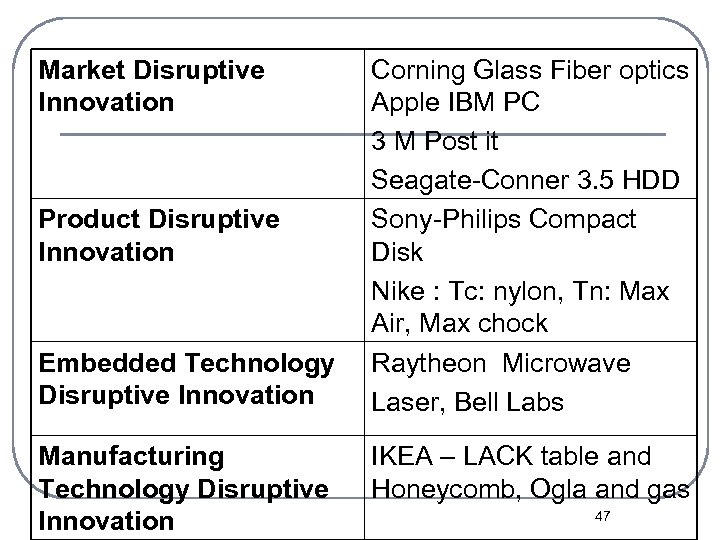

Market Disruptive Innovation Product Disruptive Innovation Embedded Technology Disruptive Innovation Manufacturing Technology Disruptive Innovation Corning Glass Fiber optics Apple IBM PC 3 M Post it Seagate-Conner 3. 5 HDD Sony-Philips Compact Disk Nike : Tc: nylon, Tn: Max Air, Max chock Raytheon Microwave Laser, Bell Labs IKEA – LACK table and Honeycomb, Ogla and gas 47

Market Disruptive Innovation Product Disruptive Innovation Embedded Technology Disruptive Innovation Manufacturing Technology Disruptive Innovation Corning Glass Fiber optics Apple IBM PC 3 M Post it Seagate-Conner 3. 5 HDD Sony-Philips Compact Disk Nike : Tc: nylon, Tn: Max Air, Max chock Raytheon Microwave Laser, Bell Labs IKEA – LACK table and Honeycomb, Ogla and gas 47

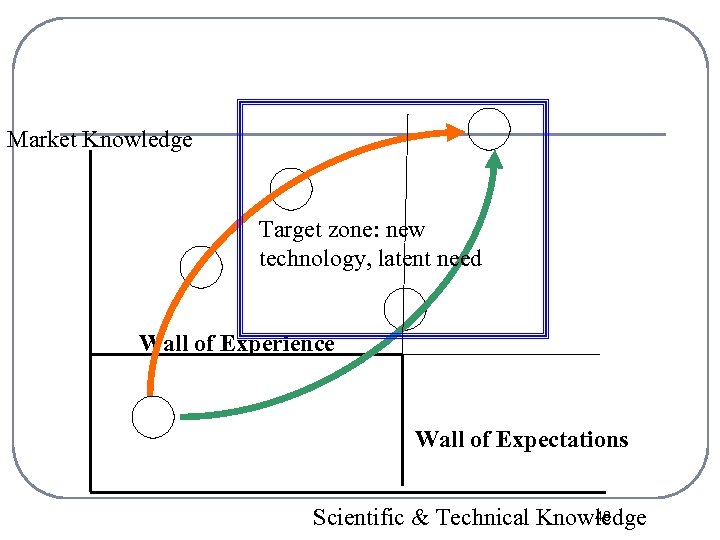

Market Knowledge Target zone: new technology, latent need Wall of Experience Wall of Expectations 48 Scientific & Technical Knowledge

Market Knowledge Target zone: new technology, latent need Wall of Experience Wall of Expectations 48 Scientific & Technical Knowledge

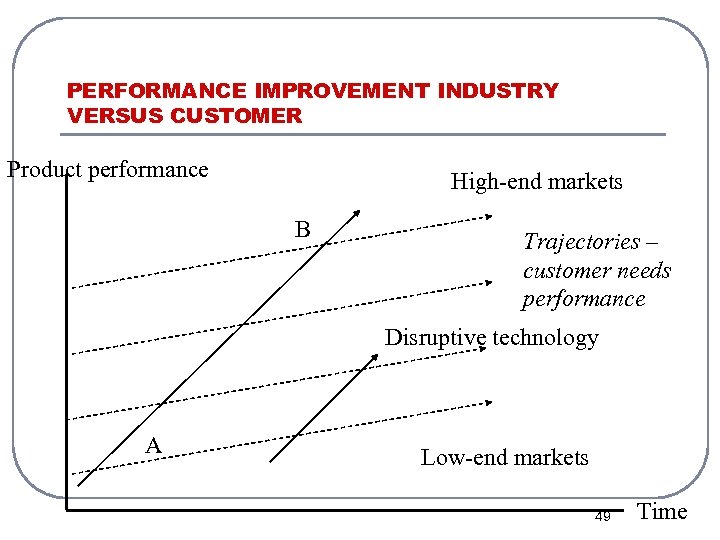

PERFORMANCE IMPROVEMENT INDUSTRY VERSUS CUSTOMER Product performance High-end markets B Trajectories – customer needs performance Disruptive technology A Low-end markets 49 Time

PERFORMANCE IMPROVEMENT INDUSTRY VERSUS CUSTOMER Product performance High-end markets B Trajectories – customer needs performance Disruptive technology A Low-end markets 49 Time

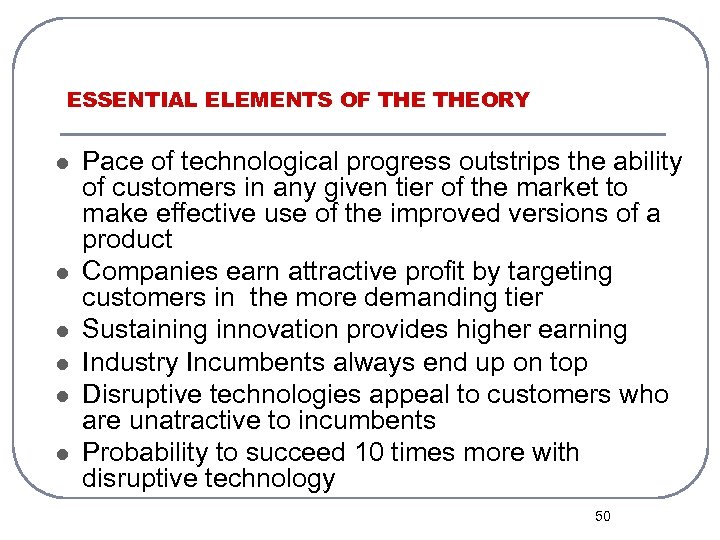

ESSENTIAL ELEMENTS OF THEORY l l l Pace of technological progress outstrips the ability of customers in any given tier of the market to make effective use of the improved versions of a product Companies earn attractive profit by targeting customers in the more demanding tier Sustaining innovation provides higher earning Industry Incumbents always end up on top Disruptive technologies appeal to customers who are unatractive to incumbents Probability to succeed 10 times more with disruptive technology 50

ESSENTIAL ELEMENTS OF THEORY l l l Pace of technological progress outstrips the ability of customers in any given tier of the market to make effective use of the improved versions of a product Companies earn attractive profit by targeting customers in the more demanding tier Sustaining innovation provides higher earning Industry Incumbents always end up on top Disruptive technologies appeal to customers who are unatractive to incumbents Probability to succeed 10 times more with disruptive technology 50

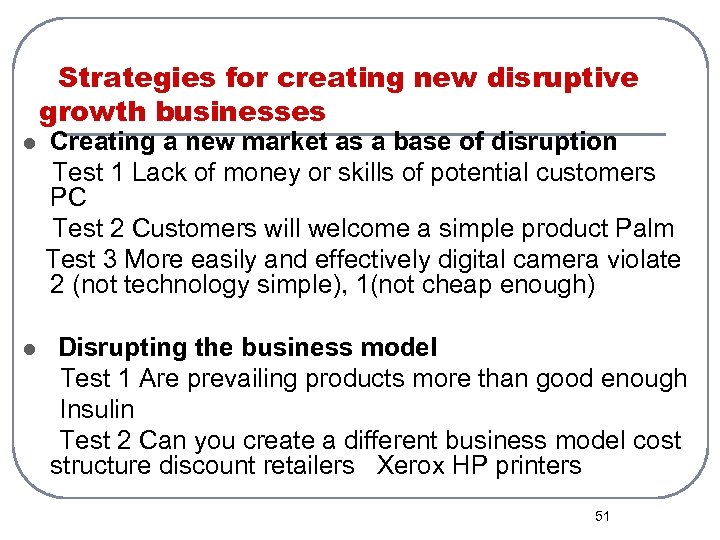

Strategies for creating new disruptive growth businesses Creating a new market as a base of disruption Test 1 Lack of money or skills of potential customers PC Test 2 Customers will welcome a simple product Palm Test 3 More easily and effectively digital camera violate 2 (not technology simple), 1(not cheap enough) l Disrupting the business model Test 1 Are prevailing products more than good enough Insulin Test 2 Can you create a different business model cost structure discount retailers Xerox HP printers l 51

Strategies for creating new disruptive growth businesses Creating a new market as a base of disruption Test 1 Lack of money or skills of potential customers PC Test 2 Customers will welcome a simple product Palm Test 3 More easily and effectively digital camera violate 2 (not technology simple), 1(not cheap enough) l Disrupting the business model Test 1 Are prevailing products more than good enough Insulin Test 2 Can you create a different business model cost structure discount retailers Xerox HP printers l 51

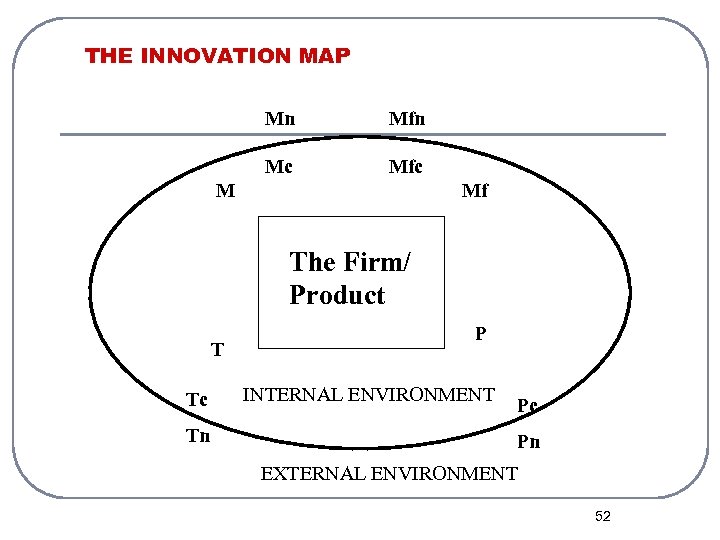

THE INNOVATION MAP Mn Mfn Mc Mfc M Mf The Firm/ Product T Tc Tn P INTERNAL ENVIRONMENT Pc Pn EXTERNAL ENVIRONMENT 52

THE INNOVATION MAP Mn Mfn Mc Mfc M Mf The Firm/ Product T Tc Tn P INTERNAL ENVIRONMENT Pc Pn EXTERNAL ENVIRONMENT 52

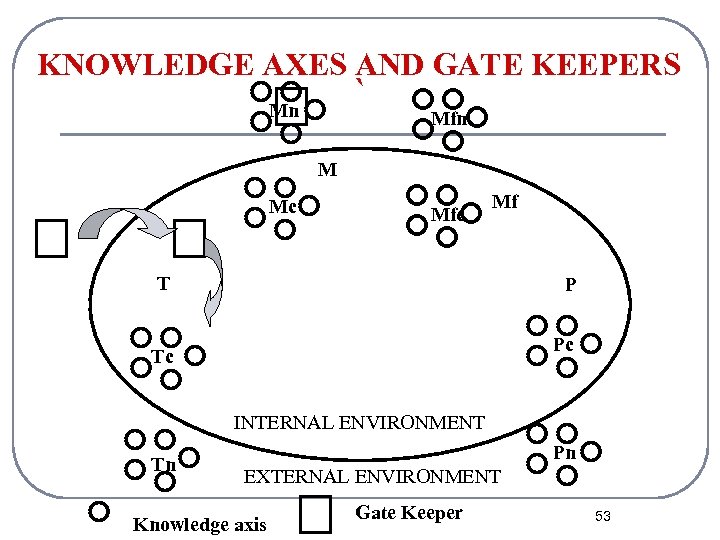

KNOWLEDGE AXES AND GATE KEEPERS ` Mn Mfn M Mc Mf T P Pc Tc INTERNAL ENVIRONMENT Tn Pn EXTERNAL ENVIRONMENT Knowledge axis Gate Keeper 53

KNOWLEDGE AXES AND GATE KEEPERS ` Mn Mfn M Mc Mf T P Pc Tc INTERNAL ENVIRONMENT Tn Pn EXTERNAL ENVIRONMENT Knowledge axis Gate Keeper 53

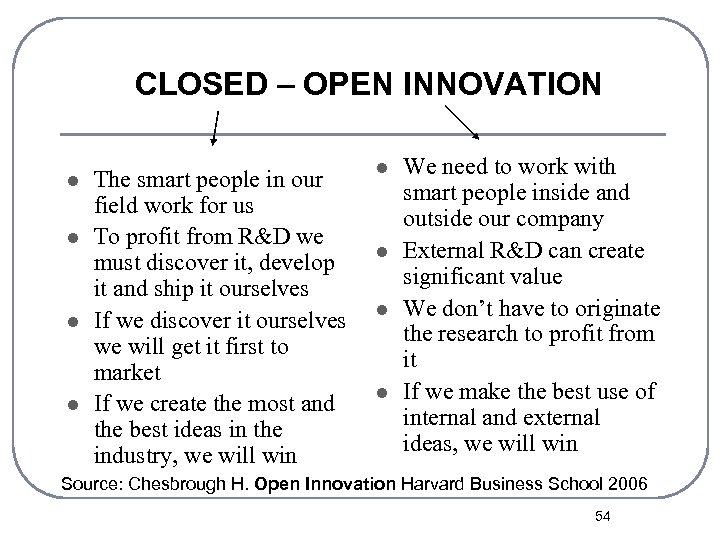

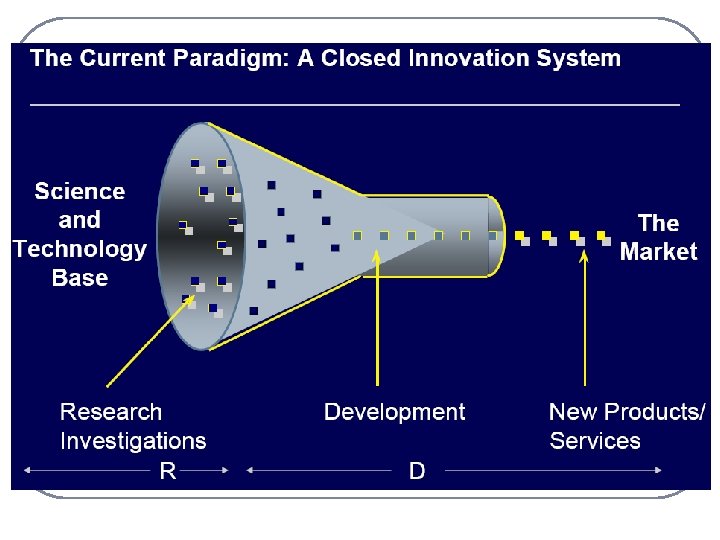

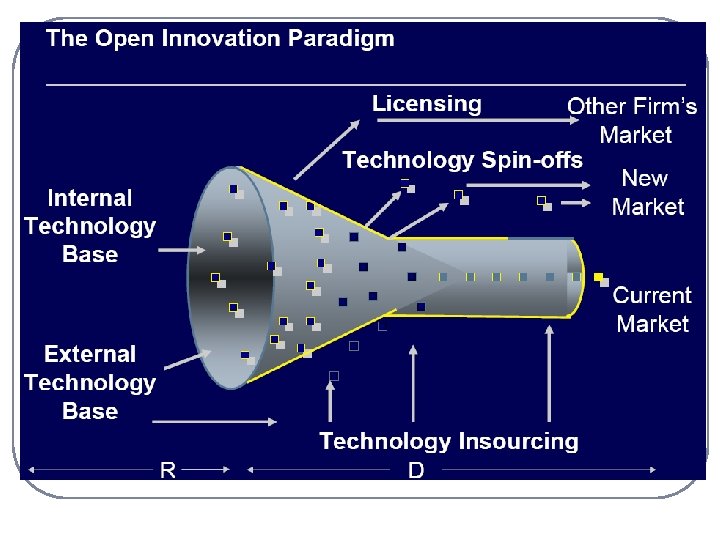

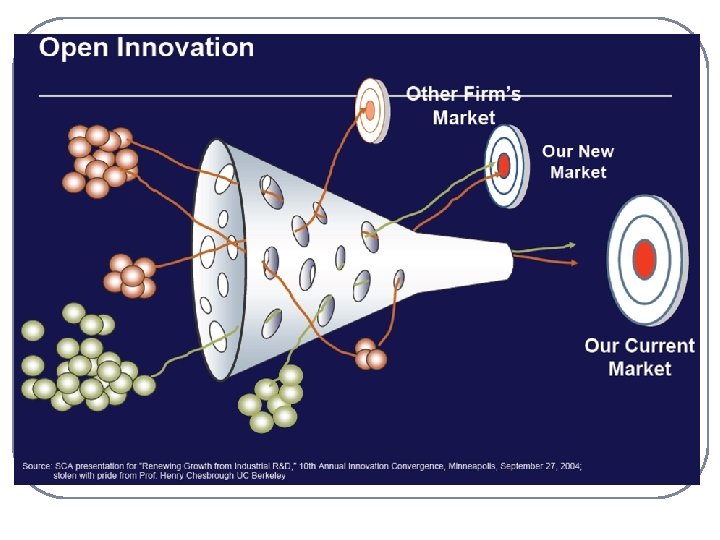

CLOSED – OPEN INNOVATION l l The smart people in our field work for us To profit from R&D we must discover it, develop it and ship it ourselves If we discover it ourselves we will get it first to market If we create the most and the best ideas in the industry, we will win l l We need to work with smart people inside and outside our company External R&D can create significant value We don’t have to originate the research to profit from it If we make the best use of internal and external ideas, we will win Source: Chesbrough H. Open Innovation Harvard Business School 2006 54

CLOSED – OPEN INNOVATION l l The smart people in our field work for us To profit from R&D we must discover it, develop it and ship it ourselves If we discover it ourselves we will get it first to market If we create the most and the best ideas in the industry, we will win l l We need to work with smart people inside and outside our company External R&D can create significant value We don’t have to originate the research to profit from it If we make the best use of internal and external ideas, we will win Source: Chesbrough H. Open Innovation Harvard Business School 2006 54

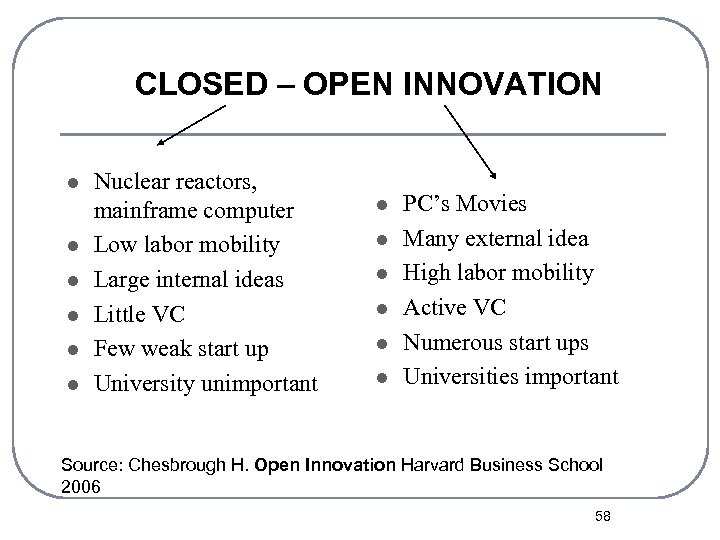

CLOSED – OPEN INNOVATION l l l Nuclear reactors, mainframe computer Low labor mobility Large internal ideas Little VC Few weak start up University unimportant l l l PC’s Movies Many external idea High labor mobility Active VC Numerous start ups Universities important Source: Chesbrough H. Open Innovation Harvard Business School 2006 58

CLOSED – OPEN INNOVATION l l l Nuclear reactors, mainframe computer Low labor mobility Large internal ideas Little VC Few weak start up University unimportant l l l PC’s Movies Many external idea High labor mobility Active VC Numerous start ups Universities important Source: Chesbrough H. Open Innovation Harvard Business School 2006 58

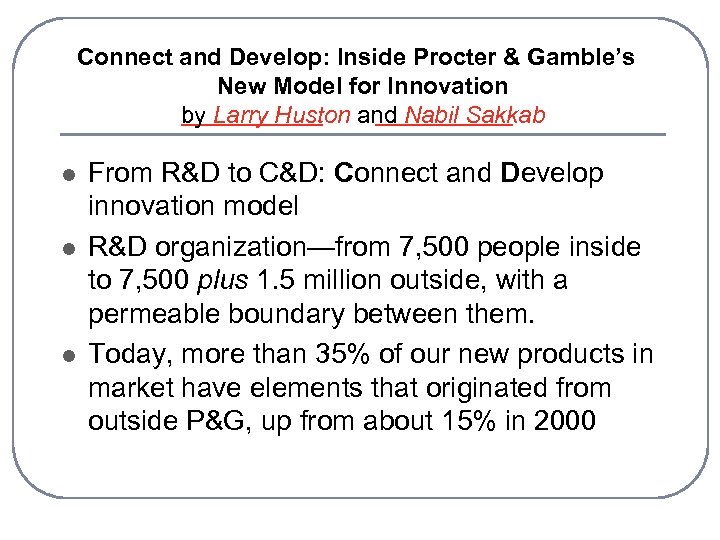

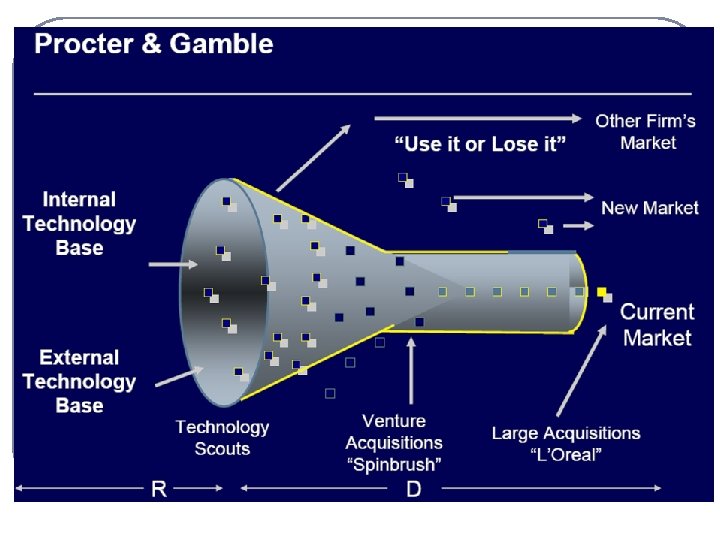

Connect and Develop: Inside Procter & Gamble’s New Model for Innovation by Larry Huston and Nabil Sakkab l l l From R&D to C&D: Connect and Develop innovation model R&D organization—from 7, 500 people inside to 7, 500 plus 1. 5 million outside, with a permeable boundary between them. Today, more than 35% of our new products in market have elements that originated from outside P&G, up from about 15% in 2000

Connect and Develop: Inside Procter & Gamble’s New Model for Innovation by Larry Huston and Nabil Sakkab l l l From R&D to C&D: Connect and Develop innovation model R&D organization—from 7, 500 people inside to 7, 500 plus 1. 5 million outside, with a permeable boundary between them. Today, more than 35% of our new products in market have elements that originated from outside P&G, up from about 15% in 2000

Connect and Develop: Inside Procter & Gamble’s New Model for Innovation by Larry Huston and Nabil Sakkab l l 45% of the initiatives in our product development portfolio have key elements that were discovered externally Five years after the company’s stock collapse in 2000, we have doubled our share price and have a portfolio of 22 billion-dollar brands

Connect and Develop: Inside Procter & Gamble’s New Model for Innovation by Larry Huston and Nabil Sakkab l l 45% of the initiatives in our product development portfolio have key elements that were discovered externally Five years after the company’s stock collapse in 2000, we have doubled our share price and have a portfolio of 22 billion-dollar brands

Connect and Develop: Inside Procter & Gamble’s New Model for Innovation by Larry Huston and Nabil Sakkab l l l Top ten consumer needs list for each business and one for the company overall Adjacencies: new products or concepts that can help us take advantage of existing brand equity. Baby care Technology game boards. Which technologies do we want to acquire to help us better compete with rivals? ” and “Of those that we already own, which do we want to license, sell, or codevelop further? ”

Connect and Develop: Inside Procter & Gamble’s New Model for Innovation by Larry Huston and Nabil Sakkab l l l Top ten consumer needs list for each business and one for the company overall Adjacencies: new products or concepts that can help us take advantage of existing brand equity. Baby care Technology game boards. Which technologies do we want to acquire to help us better compete with rivals? ” and “Of those that we already own, which do we want to license, sell, or codevelop further? ”

Connect and Develop: Inside Procter & Gamble’s New Model for Innovation by Larry Huston and Nabil Sakkab How to Network Proprietary networks : 70 technology entrepreneurs based around the world Top 15 suppliers have an estimated combined R&D staff of 50, 000. “cocreation, ”. Open networks Nine. Sigma: science and technology problems Inno. Centive: narrowly defined scientific problems. Your. Encore: 800 retired scientists and engineer Yet 2. com: intellectual property exchange l

Connect and Develop: Inside Procter & Gamble’s New Model for Innovation by Larry Huston and Nabil Sakkab How to Network Proprietary networks : 70 technology entrepreneurs based around the world Top 15 suppliers have an estimated combined R&D staff of 50, 000. “cocreation, ”. Open networks Nine. Sigma: science and technology problems Inno. Centive: narrowly defined scientific problems. Your. Encore: 800 retired scientists and engineer Yet 2. com: intellectual property exchange l

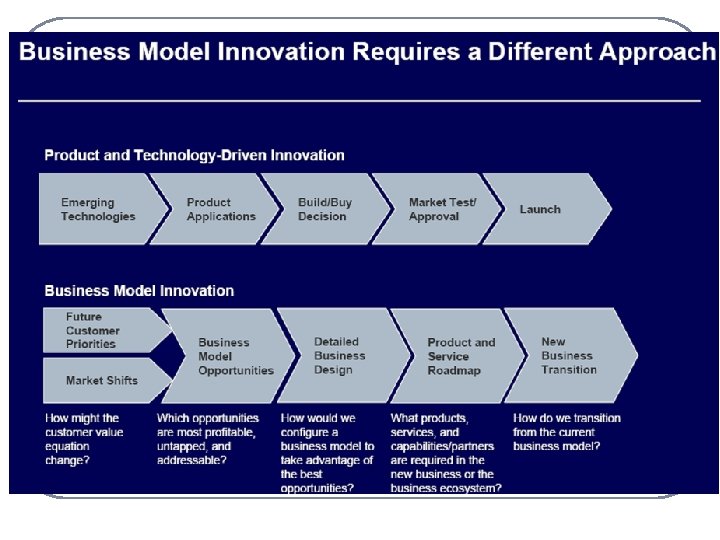

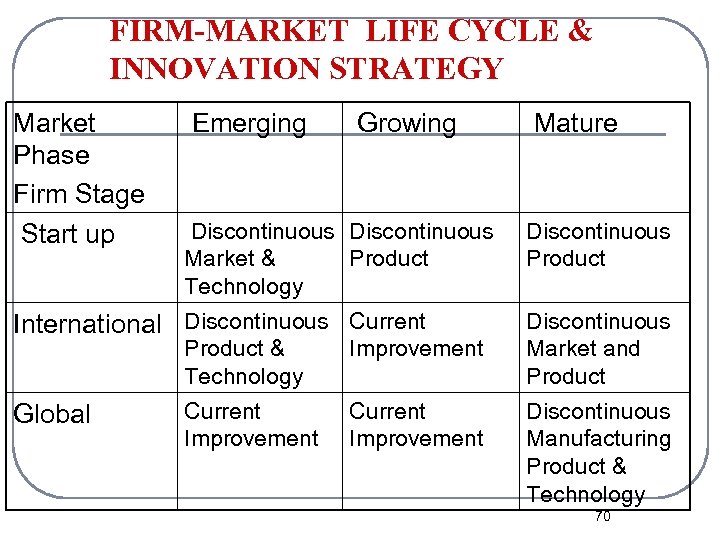

FIRM-MARKET LIFE CYCLE & INNOVATION STRATEGY Market Phase Firm Stage Start up Emerging Growing Discontinuous Market & Product Technology International Discontinuous Current Product & Technology Global Improvement Current Improvement Mature Discontinuous Product Discontinuous Market and Product Discontinuous Manufacturing Product & Technology 70

FIRM-MARKET LIFE CYCLE & INNOVATION STRATEGY Market Phase Firm Stage Start up Emerging Growing Discontinuous Market & Product Technology International Discontinuous Current Product & Technology Global Improvement Current Improvement Mature Discontinuous Product Discontinuous Market and Product Discontinuous Manufacturing Product & Technology 70

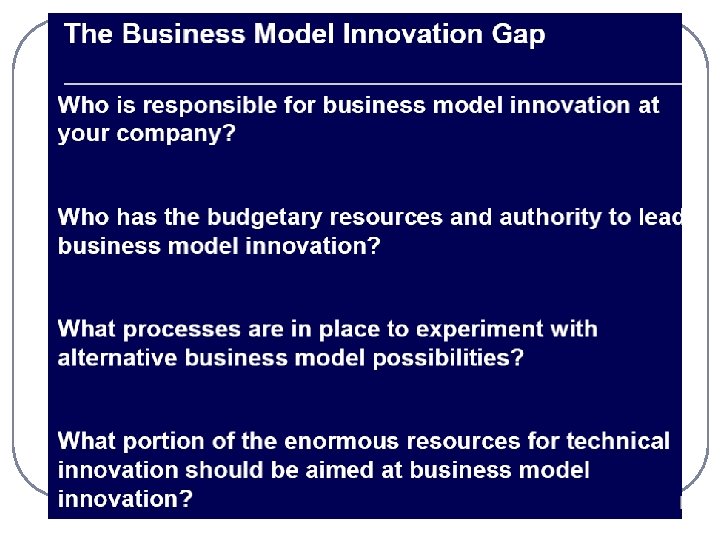

FIRM-MARKET LIFE CYCLE & INNOVATION STRATEGY Market Phase Firm Stage Start up Emerging Growing Mature Functionality Convenience Functionality Reliability Convenience Functionality International Reliability Global Reliability 71

FIRM-MARKET LIFE CYCLE & INNOVATION STRATEGY Market Phase Firm Stage Start up Emerging Growing Mature Functionality Convenience Functionality Reliability Convenience Functionality International Reliability Global Reliability 71

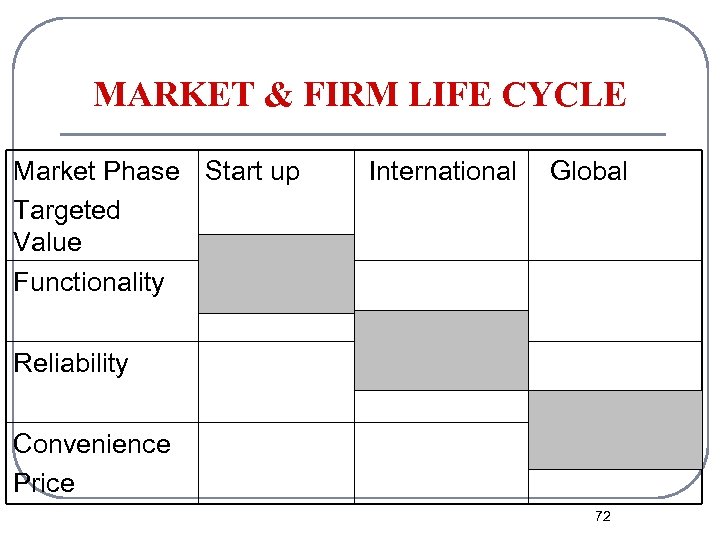

MARKET & FIRM LIFE CYCLE Market Phase Start up Targeted Value Functionality International Global Reliability Convenience Price 72

MARKET & FIRM LIFE CYCLE Market Phase Start up Targeted Value Functionality International Global Reliability Convenience Price 72

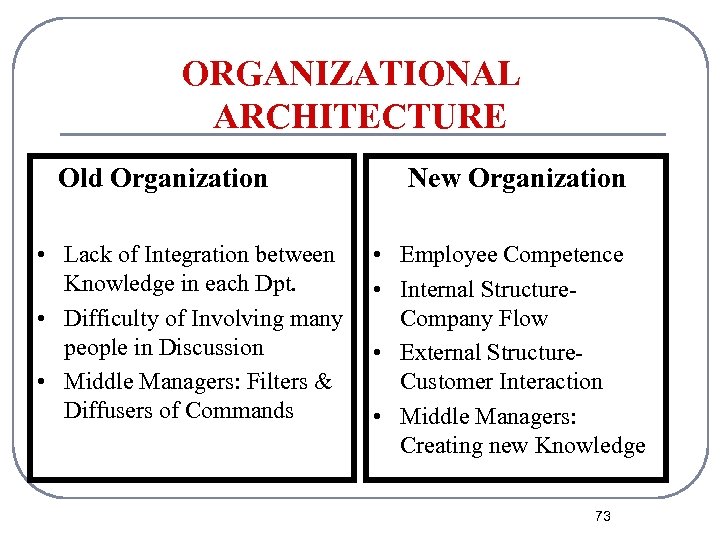

ORGANIZATIONAL ARCHITECTURE Old Organization • Lack of Integration between Knowledge in each Dpt. • Difficulty of Involving many people in Discussion • Middle Managers: Filters & Diffusers of Commands New Organization • Employee Competence • Internal Structure. Company Flow • External Structure. Customer Interaction • Middle Managers: Creating new Knowledge 73

ORGANIZATIONAL ARCHITECTURE Old Organization • Lack of Integration between Knowledge in each Dpt. • Difficulty of Involving many people in Discussion • Middle Managers: Filters & Diffusers of Commands New Organization • Employee Competence • Internal Structure. Company Flow • External Structure. Customer Interaction • Middle Managers: Creating new Knowledge 73

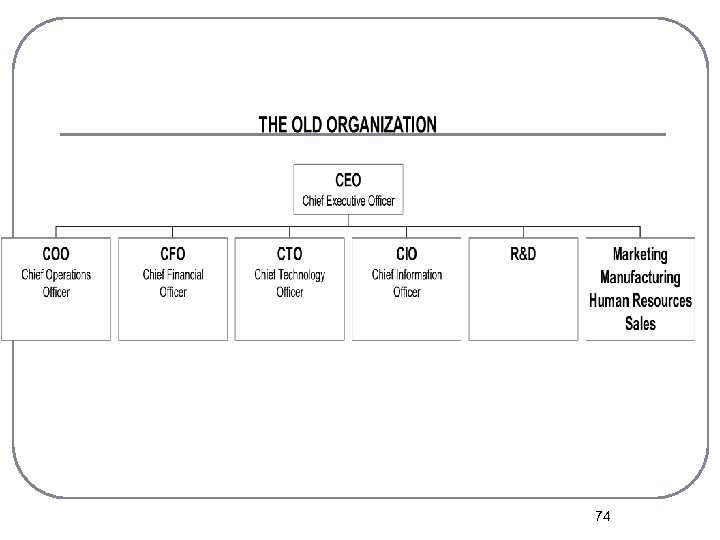

74

74

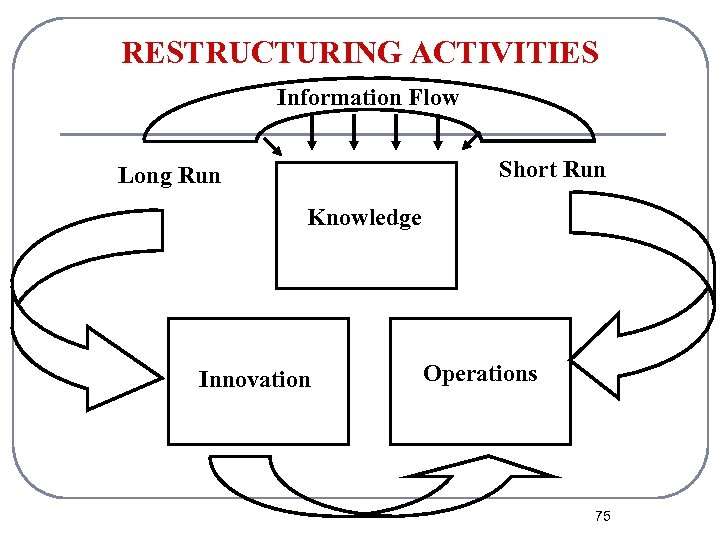

RESTRUCTURING ACTIVITIES Information Flow Short Run Long Run Knowledge Innovation Operations 75

RESTRUCTURING ACTIVITIES Information Flow Short Run Long Run Knowledge Innovation Operations 75

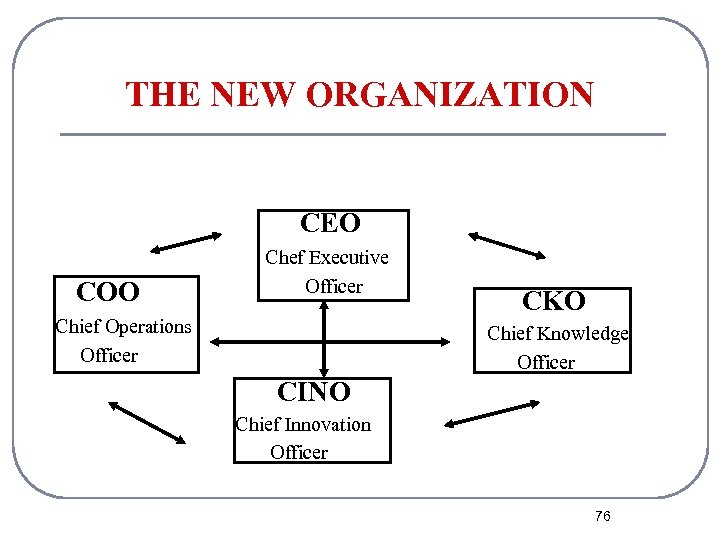

THE NEW ORGANIZATION CEO COO Chef Executive Officer Chief Operations Officer CKO Chief Knowledge Officer CINO Chief Innovation Officer 76

THE NEW ORGANIZATION CEO COO Chef Executive Officer Chief Operations Officer CKO Chief Knowledge Officer CINO Chief Innovation Officer 76

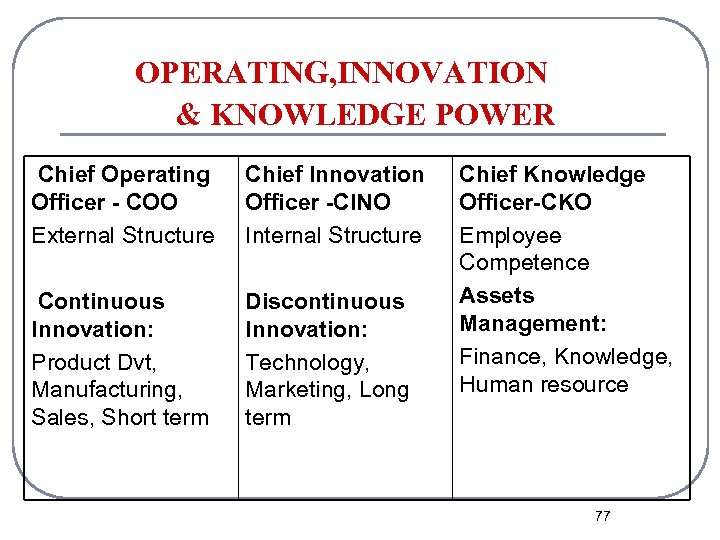

OPERATING, INNOVATION & KNOWLEDGE POWER Chief Operating Officer - COO External Structure Chief Innovation Officer -CINO Internal Structure Continuous Innovation: Product Dvt, Manufacturing, Sales, Short term Discontinuous Innovation: Technology, Marketing, Long term Chief Knowledge Officer-CKO Employee Competence Assets Management: Finance, Knowledge, Human resource 77

OPERATING, INNOVATION & KNOWLEDGE POWER Chief Operating Officer - COO External Structure Chief Innovation Officer -CINO Internal Structure Continuous Innovation: Product Dvt, Manufacturing, Sales, Short term Discontinuous Innovation: Technology, Marketing, Long term Chief Knowledge Officer-CKO Employee Competence Assets Management: Finance, Knowledge, Human resource 77