4bd718be7ad6a43252ea560bba37bf62.ppt

- Количество слайдов: 32

Disability Income : Helping You Build Financial Freedom L 05068 U 1 R(exp 0606)(FL)MLIC-LD ©UFS

What We’re Going to Cover Today • Why do your clients need DI? • How do you benefit from selling disability insurance? • Who makes up the individual DI market? • What disability products does Met. Life offer? • What are the limitations of group LTD plans? • How is the Multi. Life program beneficial to you and your clients? 2

Why DI? Why Sell Disability Income Insurance? 3

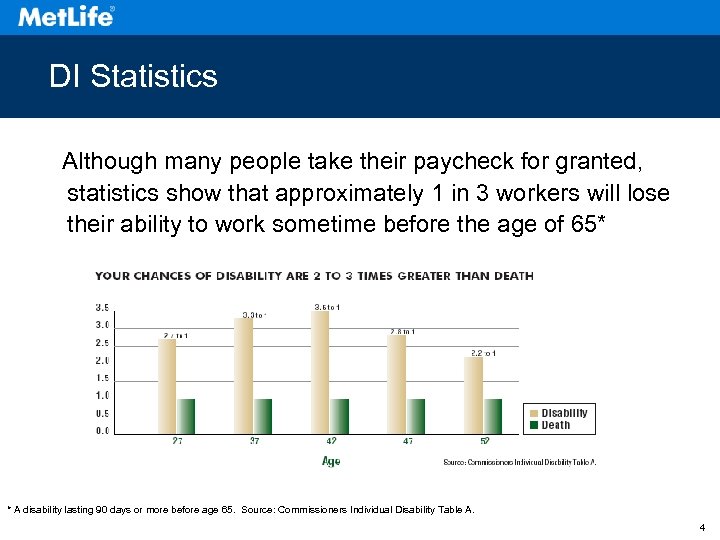

DI Statistics Although many people take their paycheck for granted, statistics show that approximately 1 in 3 workers will lose their ability to work sometime before the age of 65* * A disability lasting 90 days or more before age 65. Source: Commissioners Individual Disability Table A. 4

Other Financial Means How Would Your Clients Replace Their Lost Income? Savings Social Security One year of disability can wipe out 10 years of savings. 1 To qualify, your client’s disability must be expected to last at least 12 months or end in death, in addition to other requirements. 2 Borrow Other Income What bank would lend them money if they were disabled and unemployed? Could they maintain their standard of living without placing additional strain on themselves and their family? The Life Underwriter Training Council. “Fundamentals of Financial Services Course. ” Volume 6, 1997 edition. engage in any occupation. 1 2 You also must be unable to 5

Competitive Advantages What’s In It For You? • The ability to offer a valuable benefit to your client’s protection portfolio • Competitive rates and a broad range of availability to most occupations • Strong compensation potential • Local support and expertise from a Met. Life IDI Sales Representative 6

Met. Life’s Advantages Strength of Met. Life • More than 80 years in the DI industry with 130, 000 DI policyholders and annual premium exceeding $131 million. 1 • Customer service for all DI policyholders and claimants via toll free number, allowing direct access to a policy administrative or claim representative. • The Met. Life claim system provides prompt and on-time payment of claims including electronic funds transfer of benefit payments into a claimant’s checking or savings account. 1 2000 LIMRA International Report 7

Disability Income The Individual Sale 8

DI Eligibility The Individual DI Market • Ages 18 to 59 • Earns over $18, 000 annually • Has a history of good health • Works at least 30 hours per week • Does not have excessive unearned income or net worth 9

A Sample of DI Products What we have to offer. . . 10

OMNI Advantage* Base Contract • Non-cancelable and guaranteed renewable to age 65 • Total disability benefit • Presumptive disability provision with elimination period waiver • No mental/nervous disorder limitation • No relation to earnings provision • No mandatory rehabilitation * Not available in CA, VT or OR 11

OMNI Essential* Base Contract • Guaranteed renewable to age 65, or five policy years if later • Total disability benefit • Presumptive disability provision with elimination period waiver • Mental/nervous disorder limitation • No relation to earnings provision • No mandatory rehabilitation * Not available in CA, VT or OR 12

Salary Saver Base Contract* • Non-cancelable, guaranteed renewable to age 65 • Total disability benefit • Presumptive disability provision with elimination period waiver • Mental/nervous disorder limitation • Benefit flexibility * For California Only 13

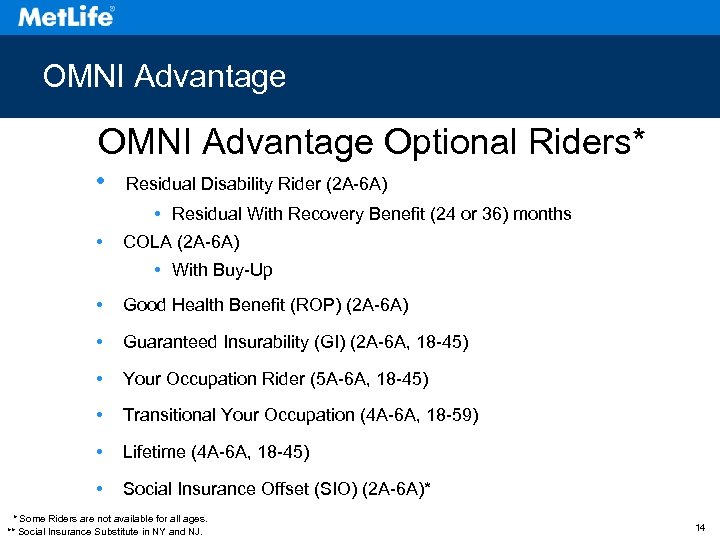

OMNI Advantage Optional Riders* • Residual Disability Rider (2 A-6 A) • Residual With Recovery Benefit (24 or 36) months • COLA (2 A-6 A) • With Buy-Up • Good Health Benefit (ROP) (2 A-6 A) • Guaranteed Insurability (GI) (2 A-6 A, 18 -45) • Your Occupation Rider (5 A-6 A, 18 -45) • Transitional Your Occupation (4 A-6 A, 18 -59) • Lifetime (4 A-6 A, 18 -45) • Social Insurance Offset (SIO) (2 A-6 A)* * Some Riders are not available for all ages. ** Social Insurance Substitute in NY and NJ. 14

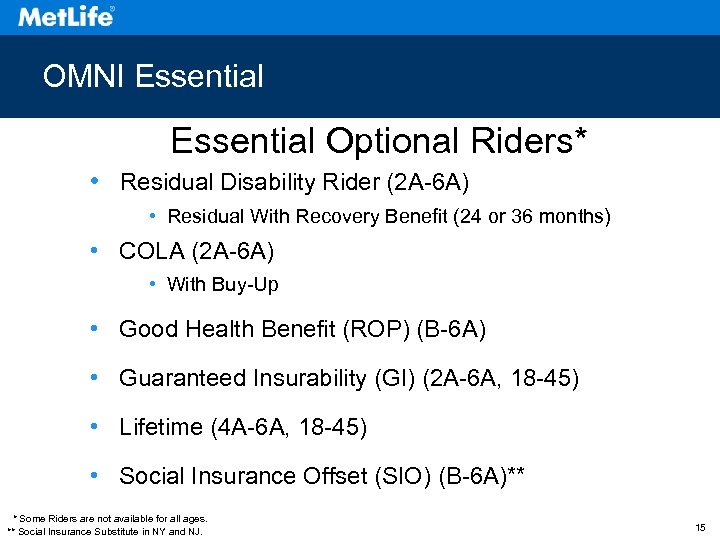

OMNI Essential Optional Riders* • Residual Disability Rider (2 A-6 A) • Residual With Recovery Benefit (24 or 36 months) • COLA (2 A-6 A) • With Buy-Up • Good Health Benefit (ROP) (B-6 A) • Guaranteed Insurability (GI) (2 A-6 A, 18 -45) • Lifetime (4 A-6 A, 18 -45) • Social Insurance Offset (SIO) (B-6 A)** * Some Riders are not available for all ages. ** Social Insurance Substitute in NY and NJ. 15

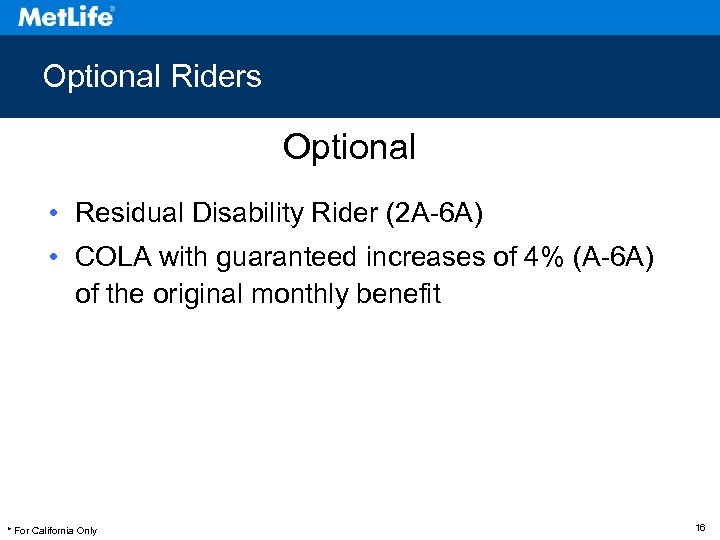

Optional Riders Salary Saver Optional Riders* • Residual Disability Rider (2 A-6 A) • COLA with guaranteed increases of 4% (A-6 A) of the original monthly benefit * For California Only 16

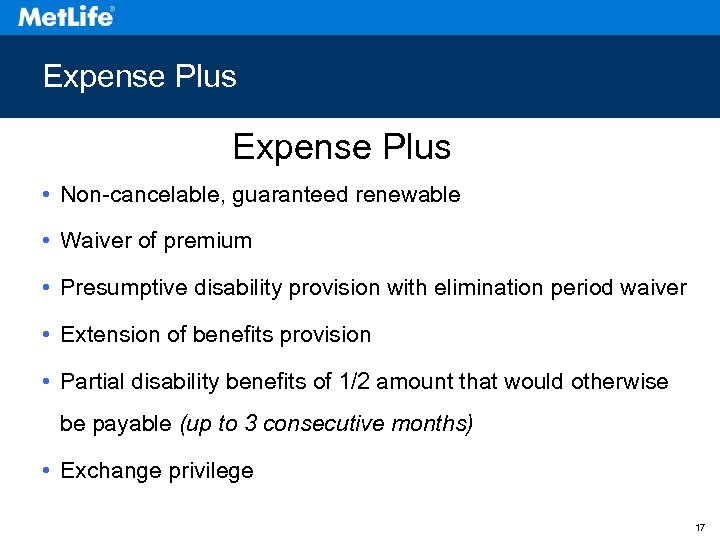

Expense Plus • Non-cancelable, guaranteed renewable • Waiver of premium • Presumptive disability provision with elimination period waiver • Extension of benefits provision • Partial disability benefits of 1/2 amount that would otherwise be payable (up to 3 consecutive months) • Exchange privilege 17

Multi. Life The Multi. Life Sale* *Multi. Life discounts available in most states 18

Why Multi. Life? What’s In It For You? • Daytime selling at the workplace • Opportunity for multiple sales • Potential for cross selling • Few competitors in the marketplace • Higher compensation 19

Multi. Life Opportunities • Occ classes 2 A-6 A • Most White & Gray Collar Industries • W-2 employees only • OMNI Essential & OMNI Select policies only • Level of discount based on case specifics • Two Multi. Life options. . . 20

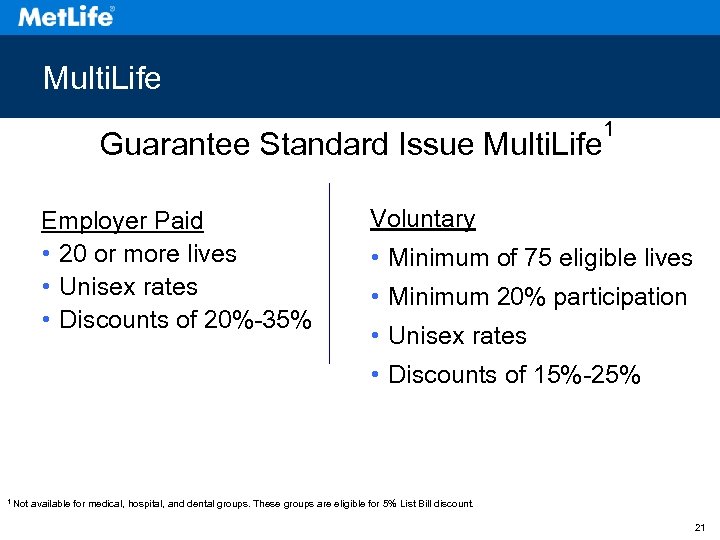

Multi. Life Opportunities Guarantee Standard Issue Multi. Life Employer Paid • 20 or more lives • Unisex rates • Discounts of 20%-35% 1 Voluntary • Minimum of 75 eligible lives • Minimum 20% participation • Unisex rates • Discounts of 15%-25% 1 Not available for medical, hospital, and dental groups. These groups are eligible for 5% List Bill discount. 21

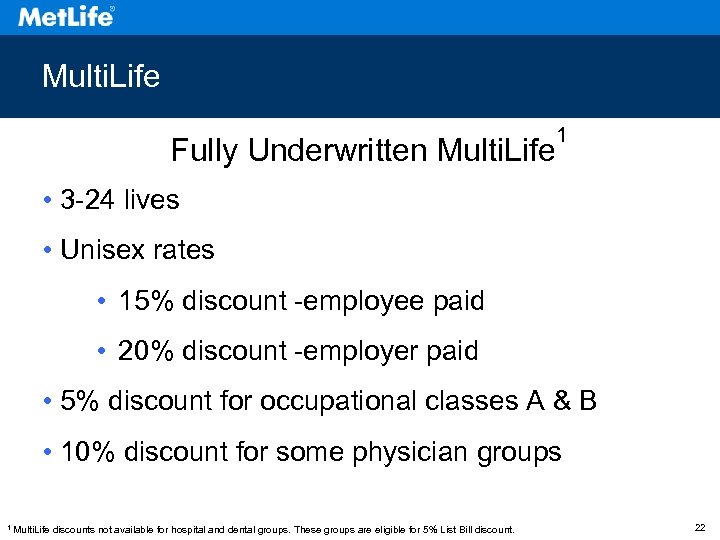

Multi. Life Fully Underwritten Multi. Life 1 • 3 -24 lives • Unisex rates • 15% discount -employee paid • 20% discount -employer paid • 5% discount for occupational classes A & B • 10% discount for some physician groups 1 Multi. Life discounts not available for hospital and dental groups. These groups are eligible for 5% List Bill discount. 22

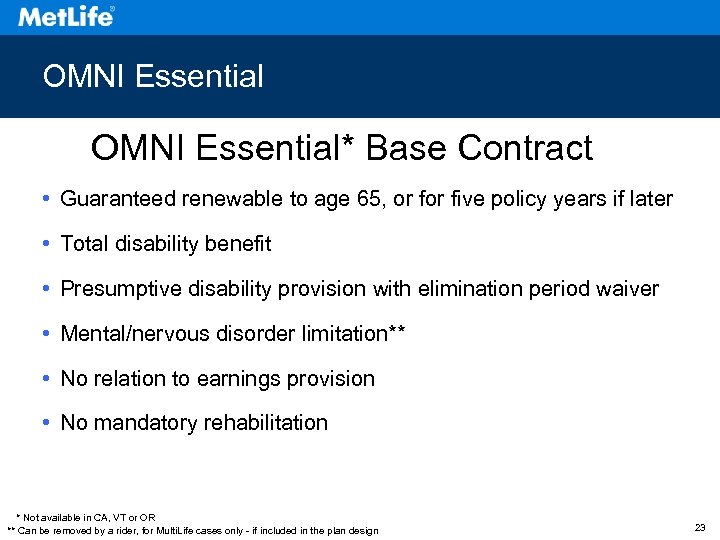

OMNI Essential* Base Contract • Guaranteed renewable to age 65, or five policy years if later • Total disability benefit • Presumptive disability provision with elimination period waiver • Mental/nervous disorder limitation** • No relation to earnings provision • No mandatory rehabilitation * Not available in CA, VT or OR ** Can be removed by a rider, for Multi. Life cases only - if included in the plan design 23

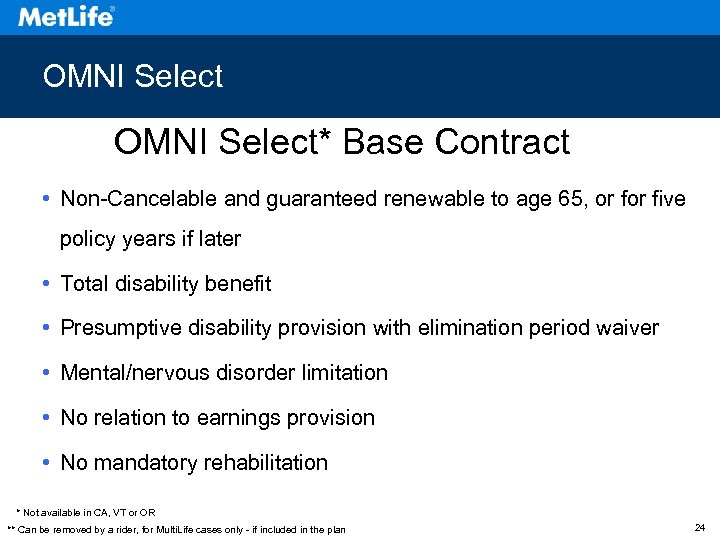

OMNI Select* Base Contract • Non-Cancelable and guaranteed renewable to age 65, or five policy years if later • Total disability benefit • Presumptive disability provision with elimination period waiver • Mental/nervous disorder limitation • No relation to earnings provision • No mandatory rehabilitation * Not available in CA, VT or OR ** Can be removed by a rider, for Multi. Life cases only - if included in the plan design 24

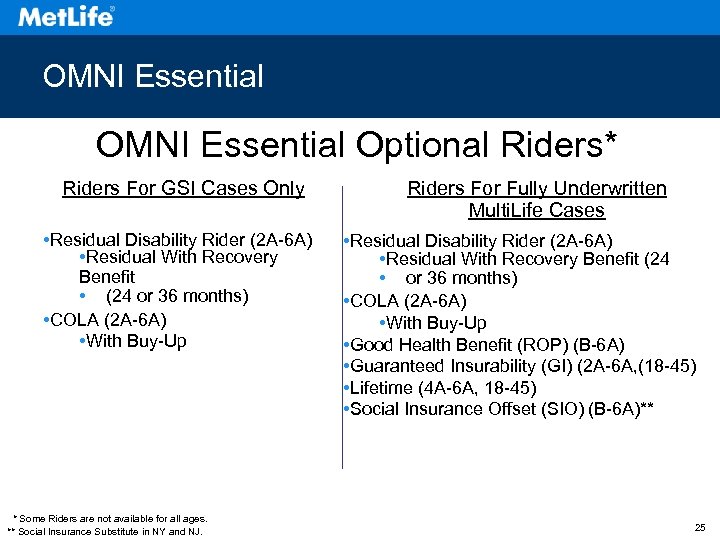

OMNI Essential Optional Riders* Riders For GSI Cases Only • Residual Disability Rider (2 A-6 A) • Residual With Recovery Benefit • (24 or 36 months) • COLA (2 A-6 A) • With Buy-Up * Some Riders are not available for all ages. ** Social Insurance Substitute in NY and NJ. Riders For Fully Underwritten Multi. Life Cases • Residual Disability Rider (2 A-6 A) • Residual With Recovery Benefit (24 • or 36 months) • COLA (2 A-6 A) • With Buy-Up • Good Health Benefit (ROP) (B-6 A) • Guaranteed Insurability (GI) (2 A-6 A, (18 -45) • Lifetime (4 A-6 A, 18 -45) • Social Insurance Offset (SIO) (B-6 A)** 25

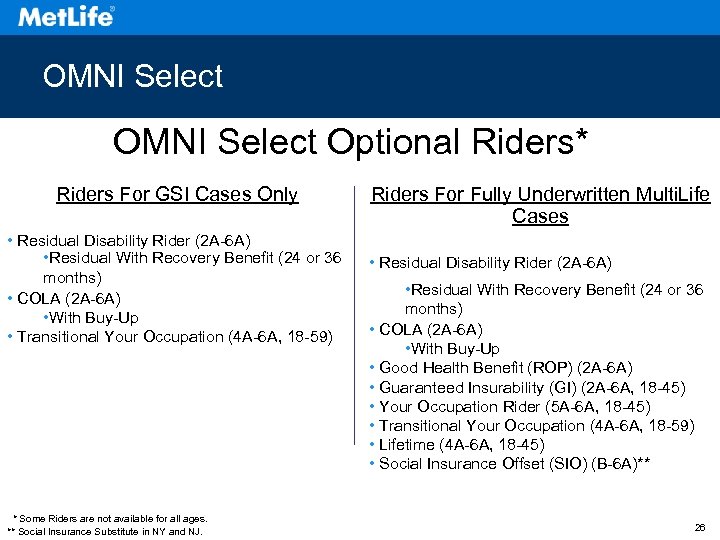

OMNI Select Optional Riders* Riders For GSI Cases Only • Residual Disability Rider (2 A-6 A) • Residual With Recovery Benefit (24 or 36 months) • COLA (2 A-6 A) • With Buy-Up • Transitional Your Occupation (4 A-6 A, 18 -59) * Some Riders are not available for all ages. ** Social Insurance Substitute in NY and NJ. Riders For Fully Underwritten Multi. Life Cases • Residual Disability Rider (2 A-6 A) • Residual With Recovery Benefit (24 or 36 months) • COLA (2 A-6 A) • With Buy-Up • Good Health Benefit (ROP) (2 A-6 A) • Guaranteed Insurability (GI) (2 A-6 A, 18 -45) • Your Occupation Rider (5 A-6 A, 18 -45) • Transitional Your Occupation (4 A-6 A, 18 -59) • Lifetime (4 A-6 A, 18 -45) • Social Insurance Offset (SIO) (B-6 A)** 26

Group Versus Individual Limitations of Group Long-term Disability (LTD) Plans • Group LTD benefits are generally taxable if the employer is paying the premiums. • Most Group LTD plans do not cover bonus or incentive compensation. • There is often a cap placed on the maximum monthly benefit. • Group LTD benefits are usually offset by social security. • A Mental/nervous disorder limitation is often included. Group LTD often results in “discrimination” against key employees - only a small % of income is replaced during a disability. 27

Why DI Why Employers Should Consider Making A DI Product Available A DI Policy Available • The 4 R’s of Human Resources: Recruit, Retain, Reward, Retire • Strong contract with guaranteed rates to age 65 • Protect bonus/variable income • Help prevent reverse discrimination against high income employees • Discounted premiums and portability • Can be offered at no cost or as an added benefit 28

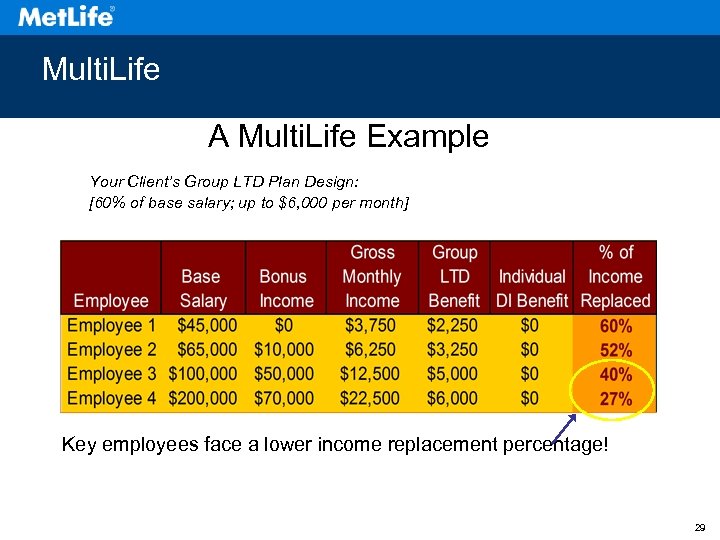

Multi. Life A Consider This. . . Multi. Life Example Your Client’s Group LTD Plan Design: [60% of base salary; up to $6, 000 per month] Key employees face a lower income replacement percentage! 29

![Multi. Life The Solution… [Policy Name] A Multi. Life Example This comprehensive program provides Multi. Life The Solution… [Policy Name] A Multi. Life Example This comprehensive program provides](https://present5.com/presentation/4bd718be7ad6a43252ea560bba37bf62/image-30.jpg)

Multi. Life The Solution… [Policy Name] A Multi. Life Example This comprehensive program provides additional coverage for all eligible employees and helps reduce “discrimination” against highly compensated employees. With [Policy Name], the percentage of income replaced for Employees 3 and 4 is considerably higher! 30

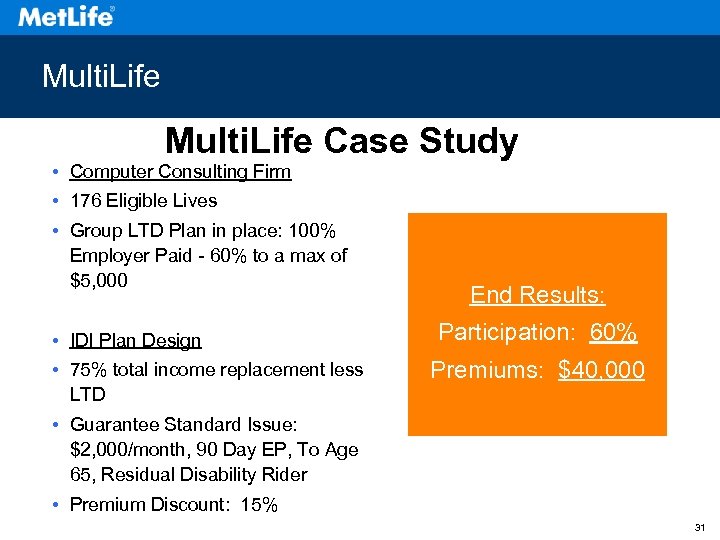

Multi. Life Case Study • Computer Consulting Firm • 176 Eligible Lives • Group LTD Plan in place: 100% Employer Paid - 60% to a max of $5, 000 • IDI Plan Design • 75% total income replacement less LTD End Results: Participation: 60% Premiums: $40, 000 • Guarantee Standard Issue: $2, 000/month, 90 Day EP, To Age 65, Residual Disability Rider • Premium Discount: 15% 31

Contact Your SBC DI Rep How Your SBC DI Rep Can Help • Your local SBC DI Rep can provide you with all of your DI solutions such as: • Market Segmentation • Client Prospecting • Illustration Assistance • Competition Information 32

4bd718be7ad6a43252ea560bba37bf62.ppt