edea225f0196afb0589c44ea18f85d31.ppt

- Количество слайдов: 30

Dimension 4: Treat Clients Responsibly The Universal Standards Implementation Series Today’s speakers: Roshaneh Zafar, Managing Director, Kashf Foundation Yamini Annadanam, Independent Consultant March 19, 2015

Agenda • Review of Dimension 4 of the Universal Standards for SPM • Presentation by Roshaneh Zafar, Kashf Foundation • Discussion with Participants • Wrap up

There are 19 standards, organized into six dimensions. Today we will discuss dimension 4.

Dimension 4 of the Universal Standards • Title: Treat Clients Responsibly • Rationale: Institutions that seek to bring benefits to their clients must ensure that they “do no harm” • Standards: This dimension has 5 standards and 21 Essential Practices.

Dimension 4: 5 Standards • 4 A. Prevention of Over-indebtedness • 4 B. Transparency • 4 C. Fair and Respectful Treatment of Clients • 4 D. Privacy of Client Data • 4 E. Mechanisms for Complaint Resolution

Dimension 4: Treat Clients Responsibly Standard 4 A. Prevention of Over Indebtedness Essential Practices • The institution conducts appropriate client repayment capacity analysis before disbursing a loan. (CP standard 2. 1) • The institution uses credit bureau and competitor data, when feasible in the local context. (CP standard 2. 3) • Senior management and the board are aware of and concerned about the risk of over indebtedness. (Client Protection standard 2. 4) • The institution’s internal audit department monitors that policies to prevent over indebtedness are applied. (Client Protection standard 2. 5). • The institution avoids dangerous commercial practices. (Client Protection standard 2. 6)

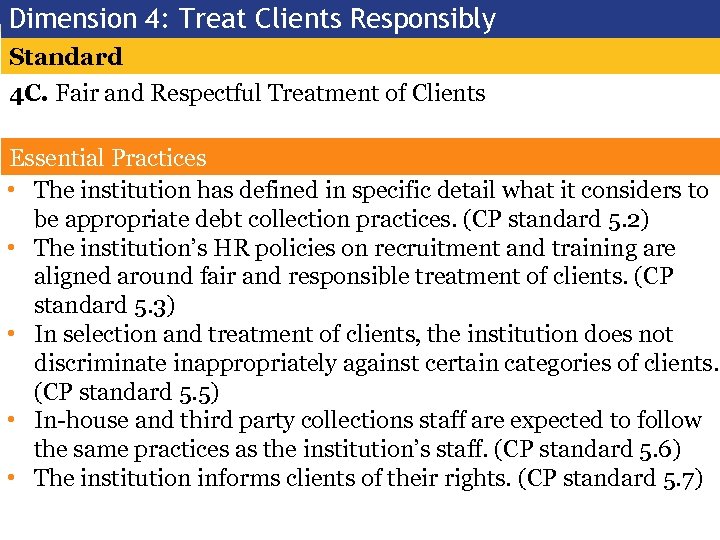

Dimension 4: Treat Clients Responsibly Standard 4 C. Fair and Respectful Treatment of Clients Essential Practices • The institution has defined in specific detail what it considers to be appropriate debt collection practices. (CP standard 5. 2) • The institution’s HR policies on recruitment and training are aligned around fair and responsible treatment of clients. (CP standard 5. 3) • In selection and treatment of clients, the institution does not discriminate inappropriately against certain categories of clients. (CP standard 5. 5) • In house and third party collections staff are expected to follow the same practices as the institution’s staff. (CP standard 5. 6) • The institution informs clients of their rights. (CP standard 5. 7)

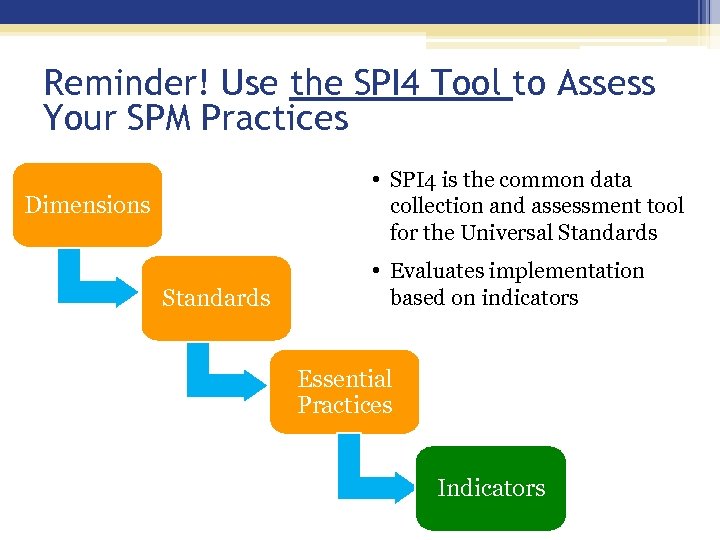

Reminder! Use the SPI 4 Tool to Assess Your SPM Practices • SPI 4 is the common data collection and assessment tool for the Universal Standards Dimensions Standards • Evaluates implementation based on indicators Essential Practices Indicators

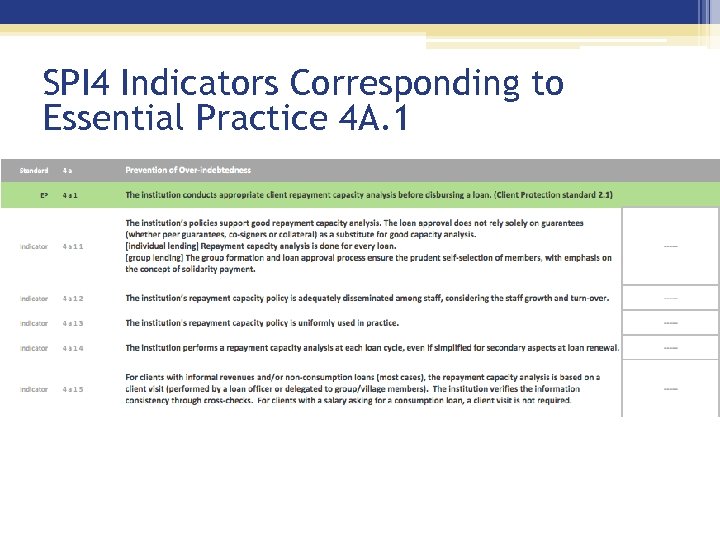

SPI 4 Indicators Corresponding to Essential Practice 4 A. 1

Agenda • Review of Dimension 4 of the Universal Standards for SPM • Presentation by Roshaneh Zafar, Kash Foundation • Discussion with Participants • Wrap up

Meet your Speakers! Name: Roshaneh Zafar Title: Managing Director Organization: Kashf Foundation Email: roshaneh. zafar@kashf. org Name: Yamini Annadanam Title: Independent Consultant Email: yamini. avk@gmail. com

Introduction to Kashf Foundation • Pakistan’s premier microfinance institution that has been working with low income households, especially women since 1996 • Offers a range of services including microcredit, life insurance, health insurance, financial education, gender justice trainings, and interactive theatre performances to raise awareness on social issues • Since its inception: ▫ cumulatively disbursed over 2. 5 million loans amounting to over USD 360 million ▫ trained over 900, 000 women on financial literacy, and trained over 70, 000 participants on gender justice Kashf has the experience of successfully introducing numerous pro poor women friendly interventions that aim to transform their lives.

• Kashf Foundation has been awarded with client protection certification by Smart Campaign for meeting excellent standards of customer care

What mechanisms have you put in place for prevention of overindebtedness? • Clients’ repayment capacity is assessed with calculations of their Net Disposable Income • Client’s credit history and current loans are mapped through Microfinance Credit Information Bureau (MFCIB) • Cap for clients with other loans

What triggered having in place rigorous mechanisms for prevention of overindebtedness? • The idea of responsible finance: We wanted to create good credit behavior by factoring in clients’ financial capacity • As competition increased, these clients became a target of all other MFIs too, so it became even more important to protect them from over indebtedness

How does the board and management monitor the over-indebtedness policies? • MFCIB embedded in the system • Compliance monitors the loan post disbursement • If a branch does not comply with this policy, they become ineligible to be the policy champions • Risk Management Committee

How did you go about creating that culture / discipline at the strategic level? • Created ownership of management for responsible finance • Staff training to bring a mindset change • Staff training for process change • Capacity building of clients • Mapping Social performance • Non financial incentives for staff 5 star ranking • Development of Consumer Protection Code

Kashf has a consumer protection code. Can you please explain about that? What does it entail? The code of conduct is built on three main principles: • Truth-in-lending • Abusive or inappropriate lending and debt collection practices • Customer Satisfaction Kashf Foundation Principles of Consumer Protection: • Quality of Service • Transparent, Fair and Affordable Pricing • Protection from Unethical Debt Collection Practices • Privacy of Customer Information • Ethical Conduct of Staff • Client Feedback Mechanisms

How do you ensure that the staff are aligned with the organization's values on treating clients with respect? • Client retention is monitored • Staff is trained on the Client Protection Code after hiring • Staff’s contract contains clause on agreement with Client Protection Code • Part of accountability matrix of staff Field staff and Compliance are responsible for implementation of client protection

How do you inform the clients of their rights on customer service, client protection? • Clients are given messages by the staff on client protection prior to disbursement • Pictorial Information for clients on Passbook • Complaint box placed in branches • Toll Free Number for client complaint cell

What were the costs involved in implementing such an initiative? • Marketing brochure cost • Introduction of complaint cell • Resource dedicated to monitor compliance + Internal Audit

What are the benefits of these initiatives for Kashf Foundation? • Client Satisfaction • Giving respect to client adds to Kashf’s recognition among them • Adds to Kashf’s reputation

How have these practices benefitted your clients? • Clients are better educated about the policies • Their grievances are addressed through the feedback mechanism

What advice do you have for other practitioners who want to practice 4 A and 4 C? • Cashflow based lending • Creating a mechanism to understand client’s credit history

Agenda • Review of Dimension 4 of the Universal Standards for SPM • Presentation by Roshaneh Zafar, Kash Foundation • Discussion with Participants • Wrap up

Agenda • Review of Dimension 4 of the Universal Standards for SPM • Presentation by Roshaneh Zafar, Kash Foundation • Discussion with Participants • Wrap up

Take Action: Use the Implementation Guide! • Download the guide here: http: //sptf. info/spmstandards/universal standards

Take Action: Consult the Resource Center! • Visit the resource center here: http: //sptf. info/resources/resource center

Where to find more information: • The Universal Standards of SPM Manual: http: //sptf. info/spmstandards/universal standards • The SPI 4 social audit tool: spi 4. squarespace. com http: //cerise • The presentation and recording from today’s session: http: //www. sptf. info/online trainings/universal standards implementation • The SPTF Resource Center: http: //www. sptf. info/resources/resource center • The SPM Implementation Guide: http: //sptf. info/spmstandards/universal standards

Thank you for your participation! Please join us next week on 26 th March 2015 for a discussion about how to improve practice in: Dimension 3, Design Products, Services, Delivery Channels and Mechanisms That Meet Clients’ Needs

edea225f0196afb0589c44ea18f85d31.ppt