e6b1832e7309620ce371389f5da610b0.ppt

- Количество слайдов: 22

Digital Transformations A Research Programme at London Business School Funded by the Leverhulme Trust Session on the Industry Level Impact of ICT Michael G. Jacobides, Principal Investigator Page 1

Reminder: Digital Transformation of Firm and Industry Boundaries Where we started from: Motivating questions on enduring puzzles § Were the prophecies of the world being “blown to bits”, mediated by ICT, correct? § How exactly does ICT affect firm and industry boundaries? § Why are some sectors or countries impacted from ICT, leading to new structures and / or higher performance, and others not? § What are the competitive ramifications of breaking up the value chain? How does ICT affect the strategic landscape? 2

Reminder: Digital Transformation of Firm and Industry Boundaries What we did, I: Study sectors as they evolve, keeping a cool head § Analysis of sectors dis-integrating, refining the role of ICT: – Mortgage Banking in the US as a tell-tale § Analysis of sectors that failed to disintegrate, despite early hype – Re-insurance: A failed transformation and millions wasted § Analysis of sectors that re-integrated and the role of ICT – Construction’s technologically enabled face § Comparative analysis of sectors in different countries – International contrasts on “how things work” and global convergence 3

Reminder: Digital Transformation of Firm and Industry Boundaries What we did, II: From the sector, to the firm, to the practice § How do firms change and set their boundaries? What’s ICT’s role? – Textile manufacturing and the process of “opening to the market” § How do firms choose how to use ICT to affect their boundaries? – Ongoing field work from manufacturing § What makes coordination across geographic and firm boundaries? – How ICT is used in outsourcing or off-shoring: Going micro § Integrating findings from the practice to the firm to the industry… – …and some modelling (and evidence) to track competitive implications 4

Reminder: Digital Transformation of Firm and Industry Boundaries What was our evidence, what were our methods… § Emphasis on qualitative analysis – With some econometrics and formal analysis or simulation – Multiple sectors, multiple countries; focused on most interesting cases § Ensuring we capture the phenomenon, not glorify ICT – Re-phrasing the question in terms of industry and firm evolution – Keeping an open mind as for “what we’re studying anyway” § Substantial interest in developing new theory – …as well as debunking received wisdom not fit for purpose 5

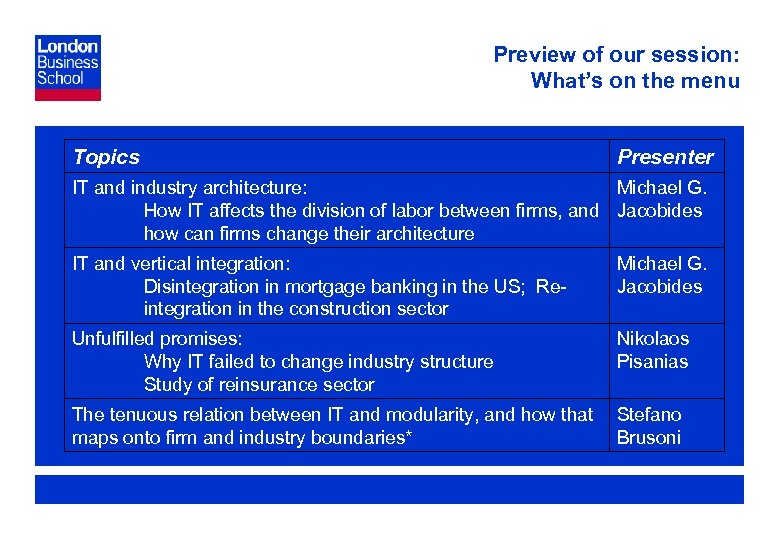

Preview of our session: What’s on the menu Topics Presenter IT and industry architecture: Michael G. How IT affects the division of labor between firms, and Jacobides how can firms change their architecture IT and vertical integration: Disintegration in mortgage banking in the US; Reintegration in the construction sector Michael G. Jacobides Unfulfilled promises: Why IT failed to change industry structure Study of reinsurance sector Nikolaos Pisanias The tenuous relation between IT and modularity, and how that Stefano maps onto firm and industry boundaries* Brusoni 6

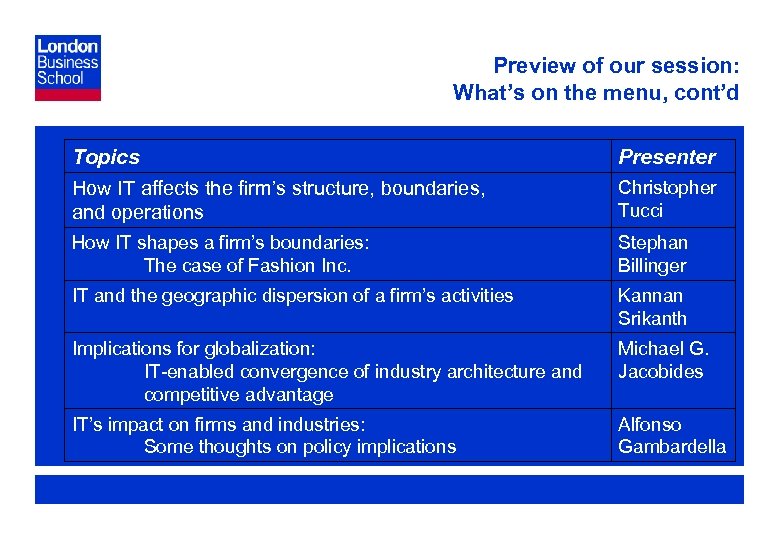

Preview of our session: What’s on the menu, cont’d Topics How IT affects the firm’s structure, boundaries, and operations Presenter How IT shapes a firm’s boundaries: The case of Fashion Inc. Stephan Billinger IT and the geographic dispersion of a firm’s activities Kannan Srikanth Implications for globalization: IT-enabled convergence of industry architecture and competitive advantage Michael G. Jacobides IT’s impact on firms and industries: Some thoughts on policy implications Alfonso Gambardella Christopher Tucci 7

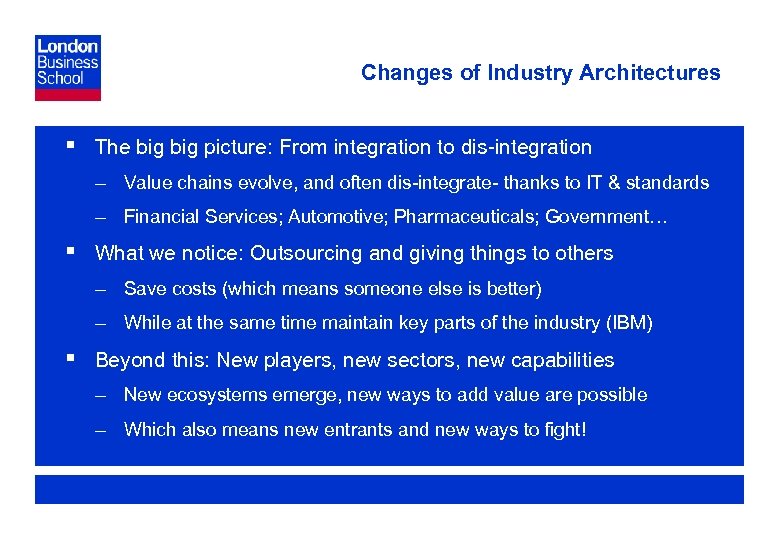

Changes of Industry Architectures § The big picture: From integration to dis-integration – Value chains evolve, and often dis-integrate- thanks to IT & standards – Financial Services; Automotive; Pharmaceuticals; Government… § What we notice: Outsourcing and giving things to others – Save costs (which means someone else is better) – While at the same time maintain key parts of the industry (IBM) § Beyond this: New players, new sectors, new capabilities – New ecosystems emerge, new ways to add value are possible – Which also means new entrants and new ways to fight! 8

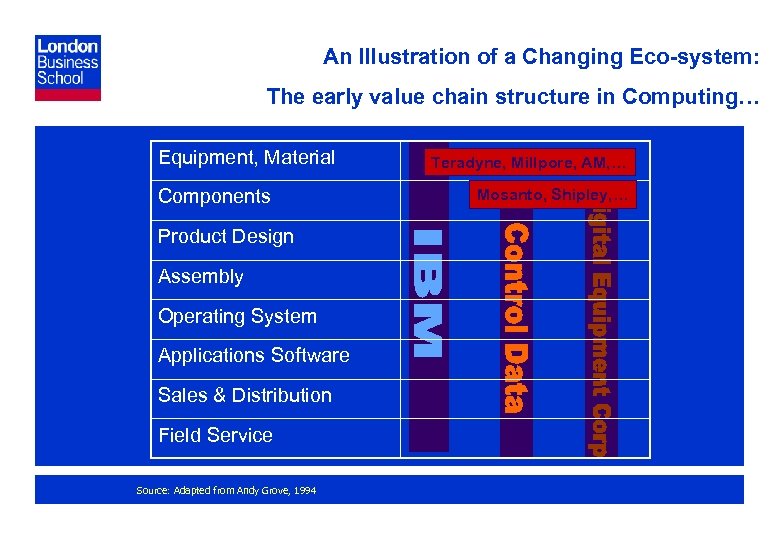

An Illustration of a Changing Eco-system: The early value chain structure in Computing… Equipment, Material Components Teradyne, Millpore, AM, … Mosanto, Shipley, … Product Design Assembly Operating System Applications Software Sales & Distribution Field Service Source: Adapted from Andy Grove, 1994 9

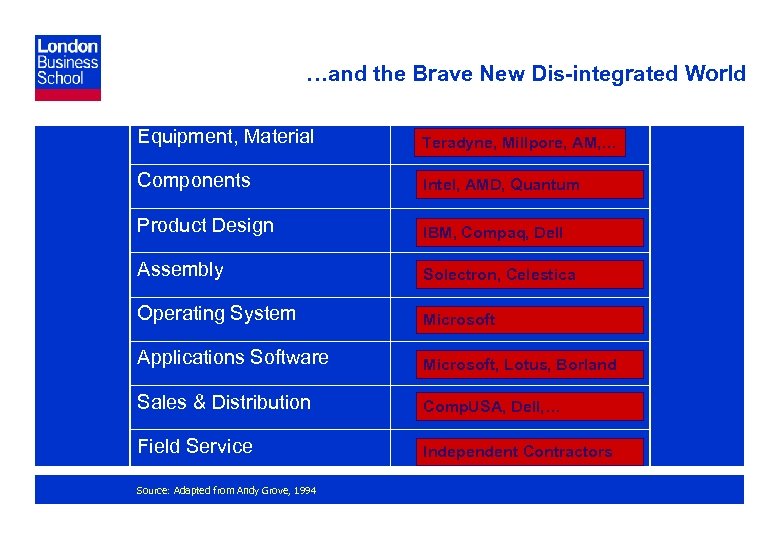

…and the Brave New Dis-integrated World Equipment, Material Teradyne, Millpore, AM, … Components Intel, AMD, Quantum Product Design IBM, Compaq, Dell Assembly Solectron, Celestica Operating System Microsoft Applications Software Microsoft, Lotus, Borland Sales & Distribution Comp. USA, Dell, … Field Service Independent Contractors Source: Adapted from Andy Grove, 1994 10

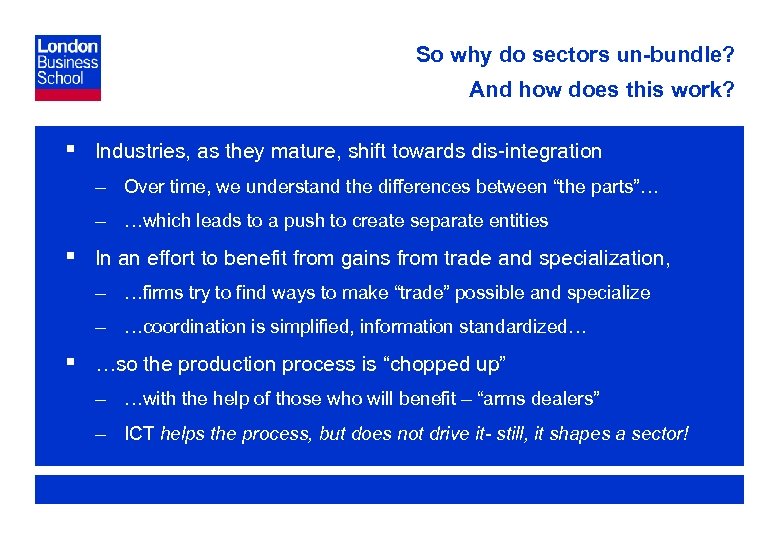

So why do sectors un-bundle? And how does this work? § Industries, as they mature, shift towards dis-integration – Over time, we understand the differences between “the parts”… – …which leads to a push to create separate entities § In an effort to benefit from gains from trade and specialization, – …firms try to find ways to make “trade” possible and specialize – …coordination is simplified, information standardized… § …so the production process is “chopped up” – …with the help of those who will benefit – “arms dealers” – ICT helps the process, but does not drive it- still, it shapes a sector! 11

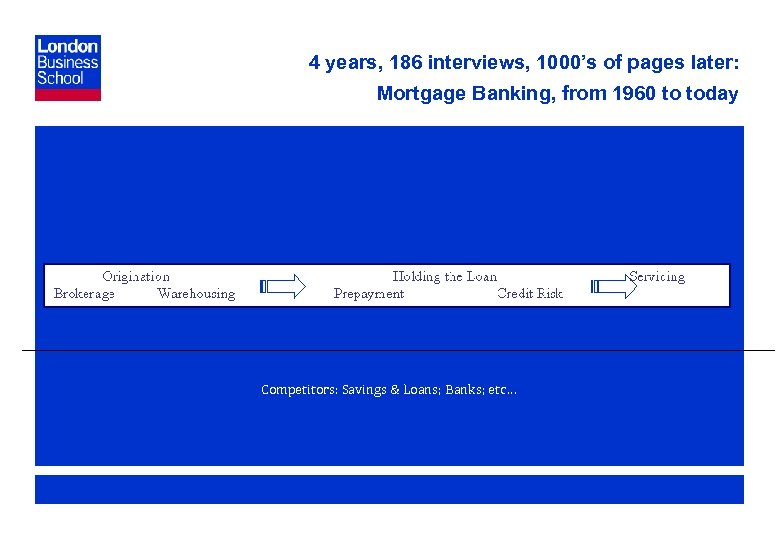

4 years, 186 interviews, 1000’s of pages later: Mortgage Banking, from 1960 to today Competitors: Savings & Loans; Banks; etc… 12

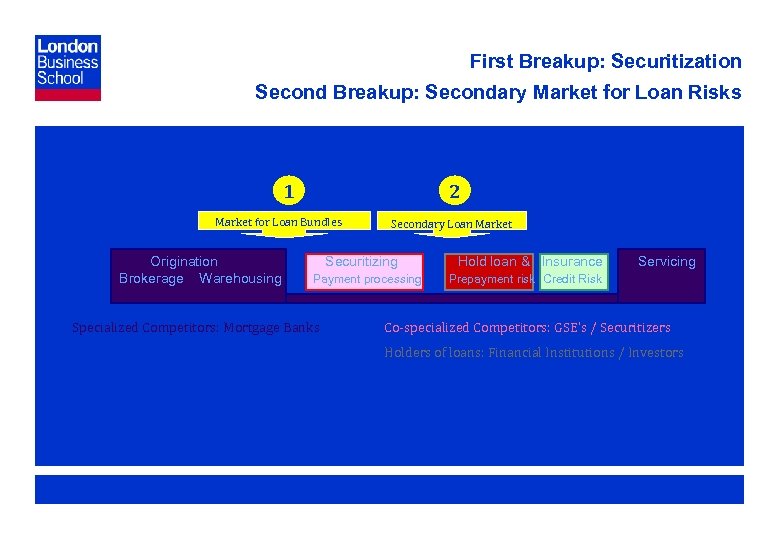

First Breakup: Securitization Second Breakup: Secondary Market for Loan Risks 1 2 Market for Loan Bundles Origination Brokerage Warehousing Secondary Loan Market Securitizing Payment processing Specialized Competitors: Mortgage Banks Hold loan & Insurance Servicing Prepayment risk Credit Risk Co-specialized Competitors: GSE’s / Securitizers Holders of loans: Financial Institutions / Investors Insurance for default: Private Mortgage Insurers 13

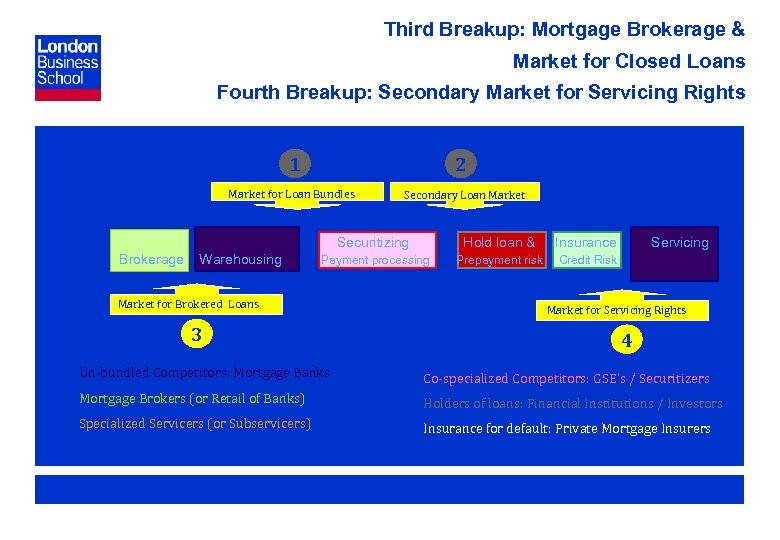

Third Breakup: Mortgage Brokerage & Market for Closed Loans Fourth Breakup: Secondary Market for Servicing Rights 1 2 Market for Loan Bundles Brokerage Warehousing Secondary Loan Market Securitizing Hold loan & Insurance Payment processing Prepayment risk Credit Risk Market for Brokered Loans 3 Servicing Market for Servicing Rights 4 Un-bundled Competitors: Mortgage Banks Co-specialized Competitors: GSE’s / Securitizers Mortgage Brokers (or Retail of Banks) Holders of loans: Financial Institutions / Investors Specialized Servicers (or Subservicers) Insurance for default: Private Mortgage Insurers 14

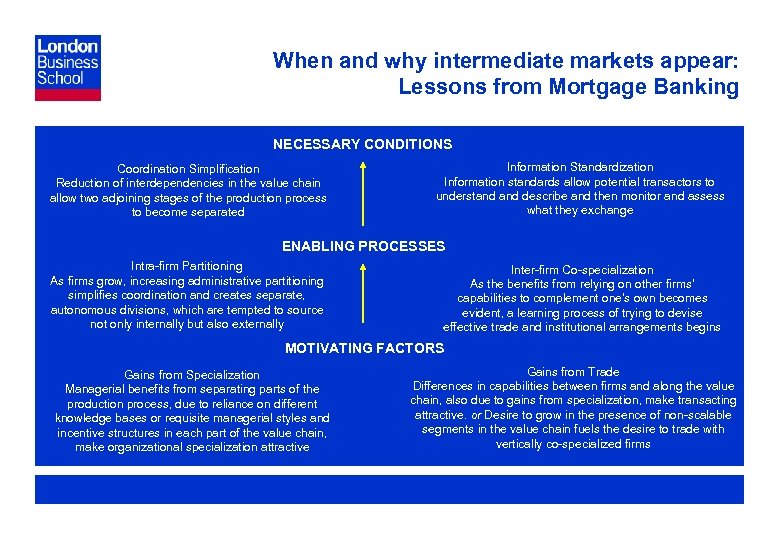

When and why intermediate markets appear: Lessons from Mortgage Banking NECESSARY CONDITIONS Coordination Simplification Reduction of interdependencies in the value chain allow two adjoining stages of the production process to become separated Information Standardization Information standards allow potential transactors to understand describe and then monitor and assess what they exchange ENABLING PROCESSES Intra-firm Partitioning As firms grow, increasing administrative partitioning simplifies coordination and creates separate, autonomous divisions, which are tempted to source not only internally but also externally Inter-firm Co-specialization As the benefits from relying on other firms’ capabilities to complement one's own becomes evident, a learning process of trying to devise effective trade and institutional arrangements begins MOTIVATING FACTORS Gains from Specialization Managerial benefits from separating parts of the production process, due to reliance on different knowledge bases or requisite managerial styles and incentive structures in each part of the value chain, make organizational specialization attractive Gains from Trade Differences in capabilities between firms and along the value chain, also due to gains from specialization, make transacting attractive. or Desire to grow in the presence of non-scalable segments in the value chain fuels the desire to trade with vertically co-specialized firms 15

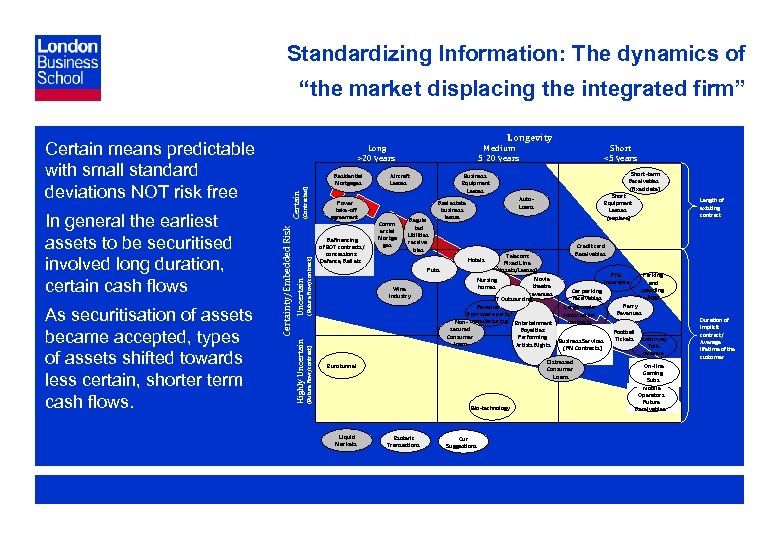

Standardizing Information: The dynamics of “the market displacing the integrated firm” § Certain means predictable became accepted, types of assets shifted towards less certain, shorter term cash flows. Certain (Contracted) (Future flow/contract) Uncertain § As securitisation of assets (Future flow/contract) assets to be securitised involved long duration, certain cash flows Certainty/Embedded Risk § In general the earliest Highly Uncertain with small standard deviations NOT risk free Longevity Long >20 years Residential Mortgages Power take -off agreement Refinancing of BOT contracts/ concessions: Defence, Rail etc Medium 5 -20 years Aircraft Leases Comm ercial Mortga ges Regula ted Utilities receiva bles Auto Loans Short Equipment Leases (copiers) Credit card Receivables Telecom: Fixed Line (Assets/Leases) PNC Parking Movie Nursing Insurance and theatre homes speeding Car parking revenues fines receivables IT Outsourcing Ferry Large -scale Revenues from spare parts construction Non - manufacturing Entertainment contracts secured Royalties: Football Consumer Performing Tickets Motorway Business Services loans Artists Rights Tolls (FM Contracts) revenue Distressed On -line Consumer Gaming Loans Subs Mobile Operators Future Bio -technology Receivables Length of existing contract Hotels Pubs Wine Industry Eurotunnel Liquid Markets Short -term Receivables (fixed date) Business Equipment Leases Real estate business leases Short <5 years Esoteric Transactions Duration of implicit contract/ Average lifetime of the customer Our Suggestions 16

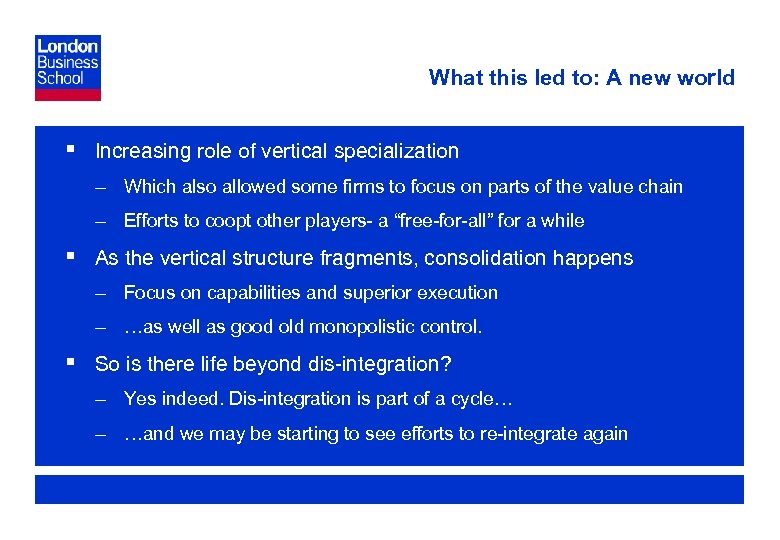

What this led to: A new world § Increasing role of vertical specialization – Which also allowed some firms to focus on parts of the value chain – Efforts to coopt other players- a “free-for-all” for a while § As the vertical structure fragments, consolidation happens – Focus on capabilities and superior execution – …as well as good old monopolistic control. § So is there life beyond dis-integration? – Yes indeed. Dis-integration is part of a cycle… – …and we may be starting to see efforts to re-integrate again 17

From dis-integration to re-integration: The Bits Bite Back § In construction, a nice, and very strict specialized system arose – With architects, engineers, quality surveyors, contractors etc – In each European country, a different way to divide labour § But after a while, the system started rattling and shaking – Architects increasingly artsy; quantity surveyors accountant-y; etc – So the opportunities (including ICT) were not fully taken advantage of § Plus, when there’s no room for growth, expect war! – ICT led to the need to re-organize, and led to a new “topography” – Re-integrated services now the rule. Try to “be the bottleneck”… 18

So the world shifts between integration and disintegration. Who gives a damn? § Well, those who do end up being more profitable… – Either because they are the new entrants or those who adapt… – …and change their business model accordingly § Changes in scope change the nature of your competitors… – From tactical warfare to guerrilla fighting: think Iraq – Redefining your enemies and friends, revisiting your strategies § When sectors change, capabilities, assets, strategies do to… – Figuring out what you need to have and what is valuable – Reconfiguring your strategies, playing a new game 19

Revisiting the role of ICT in changing industry architectures § ICT is an important factor facilitating the process of dis-integration – Esp. when ICT is bundled with information / coordination standards – But ICT is also important by introducing new capability bases § But it can also lead to re-integration / architectural change – Changes in the rules of “how the game is played” – Which also affects who has an “architectural advantage” § ICT thus shapes competitive dynamics, redefining sectors – But ICT alone will not change a sector- it’s an enabler! 20

Measuring success: What this line of research led to… § Publications in the top Journals of the field – AMJ and SMJ on how and why mortgage banking disintegrated (07/05, 11/05) – Org studies (12/05) on textile re-integration – SMJ on coevolution of technology, capabilities and scope (05/05) – Org Sci on textiles and “opening up” the value chain (03/06) – MDE/JIBS on global differences / similarities in sectors (09/06) – ICC on theoretical a-ha’s on “sector architecture” and design (02/06) § And there’s more in the works – revisions, and working papers – Org Sci on the way ICT catalyzes capabilities to drive scope; RP on benefiting from innovation and industry architectures… WP’s on ICT and “vertical architectures”; Why ICT failed to fill its promises; How ICT is used in offshoring; ICT & coordination across geographies / firms 21

Measuring success: And how this was disseminated / shared § Interactions and presentations to academics – 6 symposia in the Academy of Management, 2001 -6; Professional Development Workshops (Ao. M), 2005 & 2006 – Presentations to the Strategic Management Society (2003, 2005), Schumpeter Society (2004, 2006), DRUID (2005, 2006), a. o. – Presentations at invited seminars at Wharton, Stanford, Harvard, MIT, CMU, LSE, Bocconi, IESE, etc. – Conference and mini-conferences at LBS, 2003 -2006 § Managerial Impact: Sharing and co-producing knowledge – Presentations or addresses to Winterthur, Zurich Financial Services, Barclays, IBM, EDS, BT, Pirelli, EADS, etc. – Presentations / keynotes in events organized by Pw. C, BBA, MBAA, EDS, in the US, the UK, Italy, Greece… 22

e6b1832e7309620ce371389f5da610b0.ppt