e373601c1fc3249381afa3d27d5ddb91.ppt

- Количество слайдов: 45

Digital Services & Distribution Budget Presentation Fiscal Year 2008 February 2007

Agenda 1. Executive Summary 2. Digital Distribution 3. Mobile 4. Distribution Services / Grouper 5. Consolidated P&L [DRAFT] 2

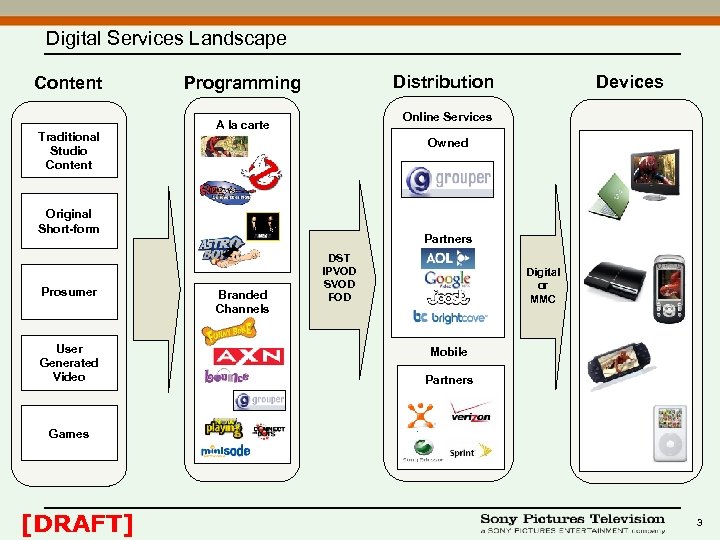

Digital Services Landscape Content Traditional Studio Content Distribution Programming Online Services A la carte Owned Original Short-form Prosumer User Generated Video Devices Partners Branded Channels DST IPVOD SVOD FOD Digital or MMC Mobile Partners Games [DRAFT] 3

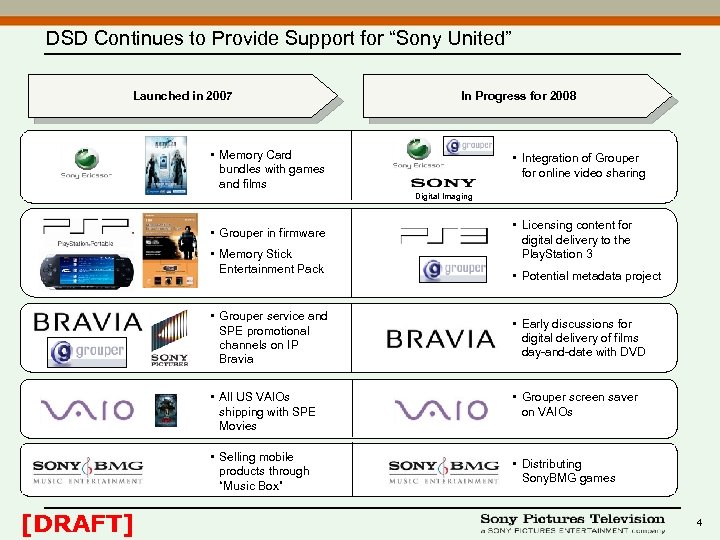

DSD Continues to Provide Support for “Sony United” Launched in 2007 In Progress for 2008 • Memory Card bundles with games and films • Integration of Grouper for online video sharing Digital Imaging • Grouper in firmware • Memory Stick Entertainment Pack • Grouper service and SPE promotional channels on IP Bravia • All US VAIOs shipping with SPE Movies • Selling mobile products through “Music Box” [DRAFT] • Licensing content for digital delivery to the Play. Station 3 • Potential metadata project • Early discussions for digital delivery of films day-and-date with DVD • Grouper screen saver on VAIOs • Distributing Sony. BMG games 4

Competition is Increasing as Demand for Digital Distribution Grows • Content owners are distributing a wider range of content digitally, exploring new business models, and generating incremental revenue – Studios and networks are distributing download-to-own television and film through i. Tunes – Networks are launching branded online channels and streaming full-length episodes on an ad-supported basis • Mobile distribution is becoming more mainstream and relevant to consumers – Increased adoption of 3 G handsets – Carriers seeking video content to attract and retain customers • Competition is increasing for quality UGV content and online audience – Google’s acquisition of You. Tube raised the bar for critical mass of audience – Shift to revenue sharing models increased competition for the best videos [DRAFT] 5

Success in FY 07 Established Foundation for Growth • Key accomplishments in FY 07 –Launched multiple new business models for digital distribution –Launched mobile video –Significantly expanded distribution partnerships across internet services, mobile carriers, and hardware partnerships –Acquired and integrated Grouper; grew unique users by 40% –Created and launched first branded cross-platform channels • Focus areas to drive continued growth in FY 08 –Add 21 distribution partners in 2008 –Grow distribution revenue 140% from $16. 5 MM in FY 07 to $39. 7 MM in FY 08; with a contribution of $27. 8 MM –Broaden digital content offering, including acquired and produced content –Increase number of branded digital channels and expand distribution –Re-launch “Grouper 3. 0” with differentiated content and service offer –Continue to grow Grouper user base and begin monetizing audience [DRAFT] 6

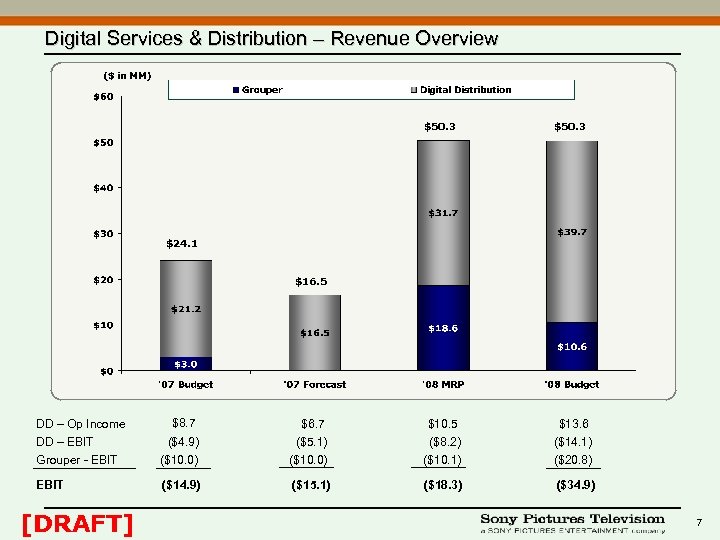

Digital Services & Distribution – Revenue Overview $50. 3 $10. 5 ($8. 2) ($10. 1) $13. 6 ($14. 1) ($20. 8) ($18. 3) ($34. 9) $24. 1 $16. 5 DD – Op Income $8. 7 DD – EBIT Grouper - EBIT ($4. 9) ($10. 0) $6. 7 ($5. 1) ($10. 0) EBIT ($14. 9) ($15. 1) [DRAFT] 7

Agenda 1. Executive Summary 2. Digital Distribution 3. Mobile 4. Distribution Services / Grouper 5. Consolidated P&L [DRAFT] 8

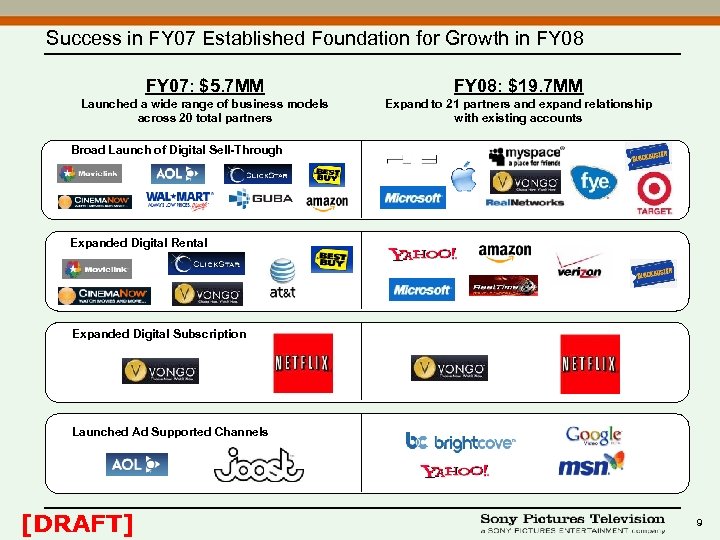

Success in FY 07 Established Foundation for Growth in FY 08 FY 07: $5. 7 MM FY 08: $19. 7 MM Launched a wide range of business models across 20 total partners Expand to 21 partners and expand relationship with existing accounts Broad Launch of Digital Sell-Through Expanded Digital Rental Expanded Digital Subscription Launched Ad Supported Channels [DRAFT] 9

Key FY 07 Successes • Established and launched new business models – Launched download-to-own business – Launched cross-platform digital channels • Expanded distribution relationships – Deals with Amazon, Wal-Mart, Movielink, Cinema. NOW, AOL, Clickstar, GUBA, AT&T, Best Buy, and Net. Flix • Supported cross-Sony digital entertainment initiatives – Launched first secure digital content program for the PSP – Content bundling relationships with VAIO and Sony Ericsson • Established end-to-end operational processes with SPHE, SPT, WPF and Digi. Pol to operate these emerging digital businesses [DRAFT] 10

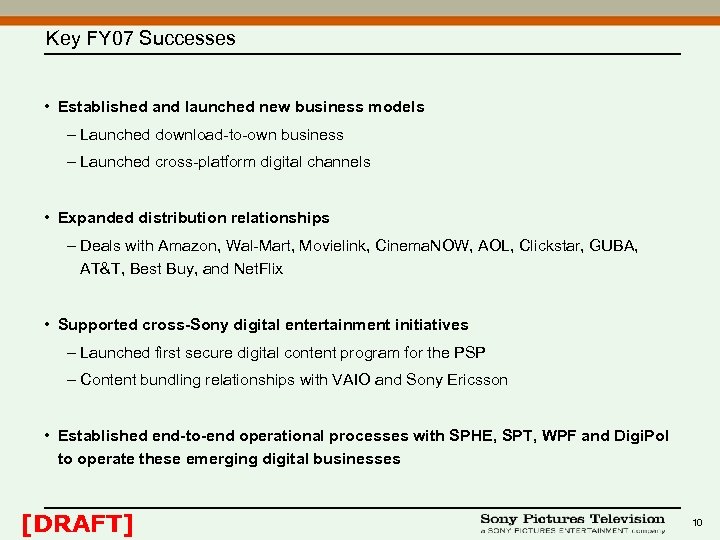

FY 07 Demonstrated Demand for a Wide Range of Studio Product Top 10 DST Titles • Made 305 feature film titles available in the marketplace to date (most of any studio) 1. The Da Vinci Code 2. Click 3. Talladega Nights • Business to-date is largely new release driven, but there is demonstrated demand for “long tail” product 4. Underworld Evolution 5. Ultraviolet 6. RV 7. Silent Hill • All titles in the program have been purchased by end consumers [DRAFT] 8. The Covenant 9. Monster House 10. Memoirs of a Geisha 11

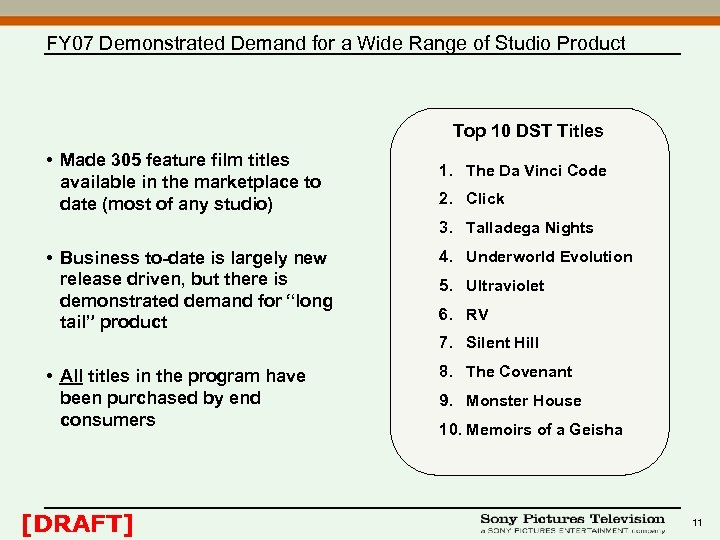

FY 08 Digital Sell-Through / IP-VOD Strategy • Aggressively build on the existing distribution network – Strike partnerships across the complete spectrum of traditional and on-line player – Expand partners to include: Starz, Apple, Microsoft, Best Buy, Transworld, Target – Significant opportunity for incremental revenue in an Apple deal • Expand the overall content offering – Broaden selection of film and TV product – Introduce the most compelling short-form/original content into the offering – Plan to launch DST of TV product by end of year • Continue to lead market in innovating digital product offerings and usage models • Continue to operate an industry leading digital organization – End-to-end asset delivery and digital operations – Create innovative marketing and promotional programs • Grow the business from $5. 7 MM in FY 07 to $18. 1 MM in FY 08 [DRAFT] 12

FY 08 Digital Channel Strategy • Continue to expand SPE’s digital channel offering, including – Comedy (Funnybone) - Who’s The Boss, News. Radio – Action (AXN) - SWAT, Charlie’s Angels – Kids (Bounce) - Jackie Chan, Animated MIB, – International Programming (World Channel) – Anime (Animax) - Samurai X – Movies on Demand (Now Playing/Hollywood Hits) – Minisodes – Grouper “Off the Hook” • Introduce additional film and television properties complemented by a blend of original programming and interactive features • Establish relationships with 3 rd party content holders to improve channel offerings – Nelvana for Bounce (e. g. , Rescue Heroes, Rolie Polie Olie, Babar) – Ban Dai for Animax (e. g. , Gundam) • Aggressively expand channel distribution to high-traffic destinations across platforms [DRAFT] 13

![IP Distribution – Revenue Overview $19. 7 $14. 0 $5. 0 [DRAFT] $5. 7 IP Distribution – Revenue Overview $19. 7 $14. 0 $5. 0 [DRAFT] $5. 7](https://present5.com/presentation/e373601c1fc3249381afa3d27d5ddb91/image-14.jpg)

IP Distribution – Revenue Overview $19. 7 $14. 0 $5. 0 [DRAFT] $5. 7 14

![IP Distribution – Summary P&L [DRAFT] 15 IP Distribution – Summary P&L [DRAFT] 15](https://present5.com/presentation/e373601c1fc3249381afa3d27d5ddb91/image-15.jpg)

IP Distribution – Summary P&L [DRAFT] 15

Agenda 1. Executive Summary 2. Digital Distribution 3. Mobile 4. Distribution Services / Grouper 5. Consolidated P&L [DRAFT] 16

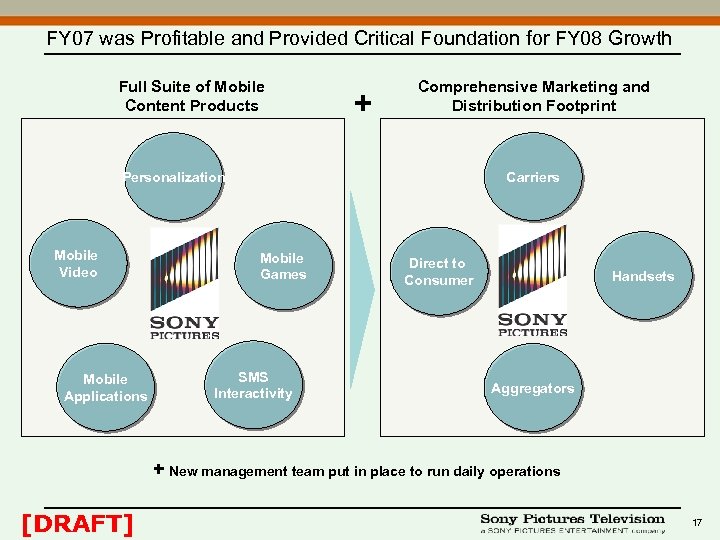

FY 07 was Profitable and Provided Critical Foundation for FY 08 Growth Full Suite of Mobile Content Products + Comprehensive Marketing and Distribution Footprint Personalization Mobile Video Mobile Applications Carriers Mobile Games SMS Interactivity Direct to Consumer Handsets Aggregators + New management team put in place to run daily operations [DRAFT] 17

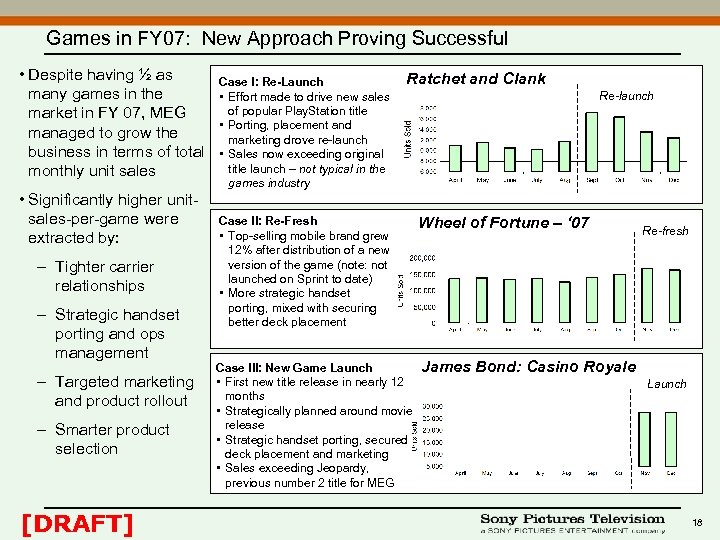

Games in FY 07: New Approach Proving Successful • Despite having ½ as many games in the market in FY 07, MEG managed to grow the business in terms of total monthly unit sales • Significantly higher unitsales-per-game were extracted by: – Tighter carrier relationships – Strategic handset porting and ops management – Targeted marketing and product rollout – Smarter product selection [DRAFT] Case I: Re-Launch • Effort made to drive new sales of popular Play. Station title • Porting, placement and marketing drove re-launch • Sales now exceeding original title launch – not typical in the games industry Ratchet and Clank Re-launch Case II: Re-Fresh • Top-selling mobile brand grew 12% after distribution of a new version of the game (note: not launched on Sprint to date) • More strategic handset porting, mixed with securing better deck placement Wheel of Fortune – ‘ 07 Case III: New Game Launch • First new title release in nearly 12 months • Strategically planned around movie release • Strategic handset porting, secured deck placement and marketing • Sales exceeding Jeopardy, previous number 2 title for MEG James Bond: Casino Royale Re-fresh Launch 18

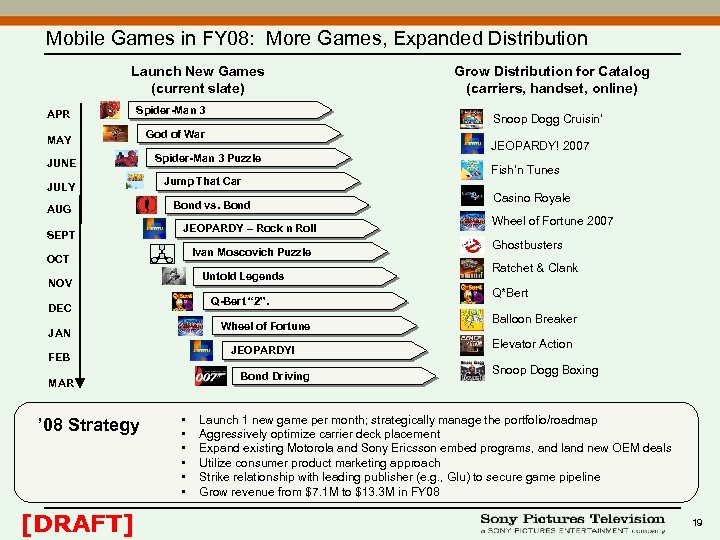

Mobile Games in FY 08: More Games, Expanded Distribution Launch New Games (current slate) APR Spider-Man 3 MAY JUNE JULY AUG SEPT Spider-Man 3 Puzzle Jump That Car Bond vs. Bond JEOPARDY – Rock n Roll Ivan Moscovich Puzzle Untold Legends NOV Q-Bert “ 2”. DEC Wheel of Fortune JAN JEOPARDY! FEB Bond Driving MAR ’ 08 Strategy [DRAFT] Snoop Dogg Cruisin’ God of War OCT • • • Grow Distribution for Catalog (carriers, handset, online) JEOPARDY! 2007 Fish’n Tunes Casino Royale Wheel of Fortune 2007 Ghostbusters Ratchet & Clank Q*Bert Balloon Breaker Elevator Action Snoop Dogg Boxing Launch 1 new game per month; strategically manage the portfolio/roadmap Aggressively optimize carrier deck placement Expand existing Motorola and Sony Ericsson embed programs, and land new OEM deals Utilize consumer product marketing approach Strike relationship with leading publisher (e. g. , Glu) to secure game pipeline Grow revenue from $7. 1 M to $13. 3 M in FY 08 19

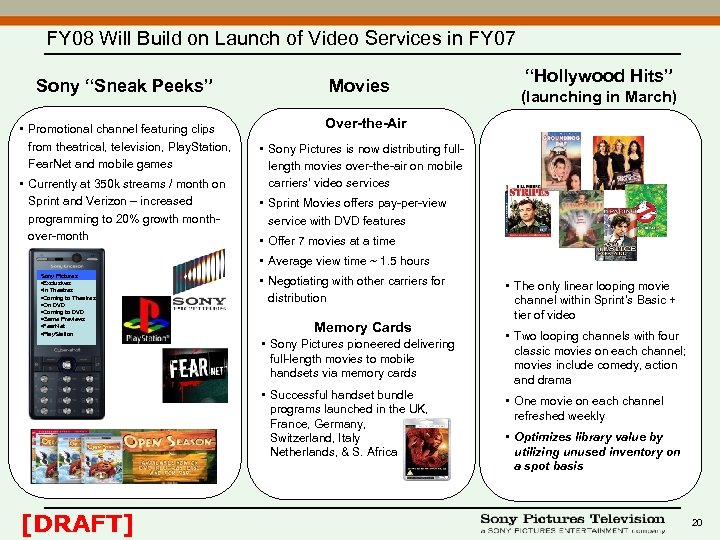

FY 08 Will Build on Launch of Video Services in FY 07 Sony “Sneak Peeks” • Promotional channel featuring clips from theatrical, television, Play. Station, Fear. Net and mobile games • Currently at 350 k streams / month on Sprint and Verizon – increased programming to 20% growth monthover-month Movies “Hollywood Hits” (launching in March) Over-the-Air • Sony Pictures is now distributing fulllength movies over-the-air on mobile carriers’ video services • Sprint Movies offers pay-per-view service with DVD features • Offer 7 movies at a time • Average view time ~ 1. 5 hours Sony Pictures • Exclusives • In Theatres • Coming to Theatres • On DVD • Coming to DVD • Game Previews • Fear. Net • Play. Station • Negotiating with other carriers for distribution Memory Cards • Sony Pictures pioneered delivering full-length movies to mobile handsets via memory cards • Successful handset bundle programs launched in the UK, France, Germany, Switzerland, Italy Netherlands, & S. Africa [DRAFT] • The only linear looping movie channel within Sprint’s Basic + tier of video • Two looping channels with four classic movies on each channel; movies include comedy, action and drama • One movie on each channel refreshed weekly • Optimizes library value by utilizing unused inventory on a spot basis 20

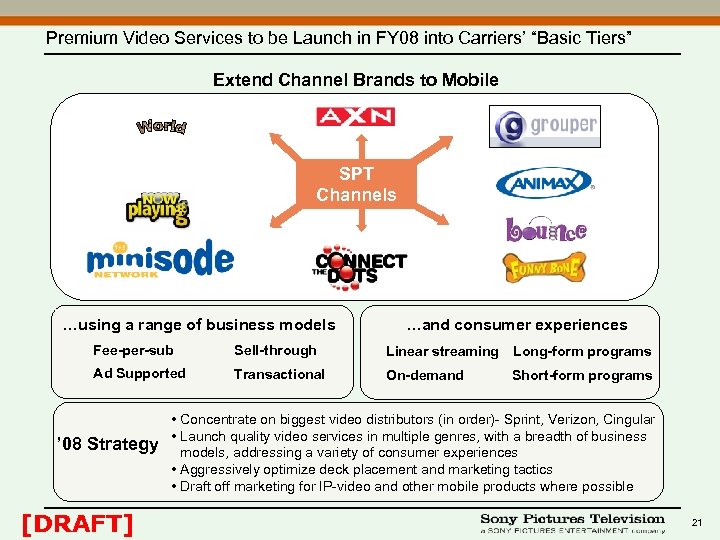

Premium Video Services to be Launch in FY 08 into Carriers’ “Basic Tiers” Extend Channel Brands to Mobile SPT Channels …using a range of business models …and consumer experiences Fee-per-sub Sell-through Linear streaming Long-form programs Ad Supported Transactional On-demand Short-form programs ’ 08 Strategy [DRAFT] • Concentrate on biggest video distributors (in order)- Sprint, Verizon, Cingular • Launch quality video services in multiple genres, with a breadth of business models, addressing a variety of consumer experiences • Aggressively optimize deck placement and marketing tactics • Draft off marketing for IP-video and other mobile products where possible 21

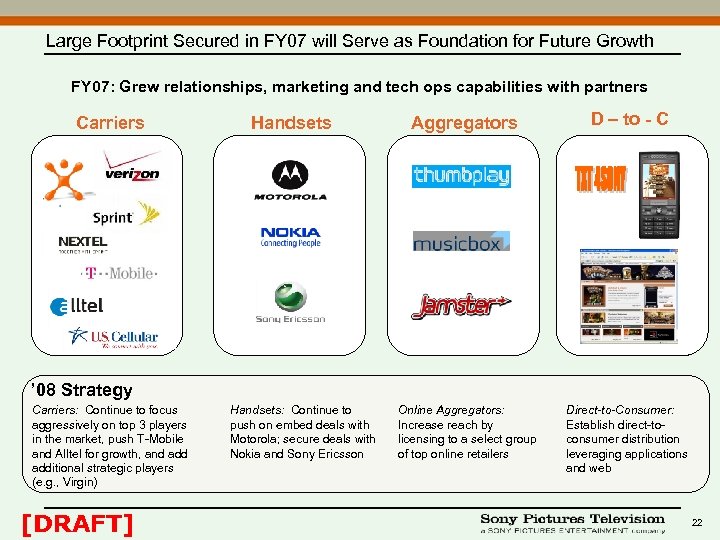

Large Footprint Secured in FY 07 will Serve as Foundation for Future Growth FY 07: Grew relationships, marketing and tech ops capabilities with partners Carriers Handsets Aggregators D – to - C Online Aggregators: Increase reach by licensing to a select group of top online retailers Direct-to-Consumer: Establish direct-toconsumer distribution leveraging applications and web ’ 08 Strategy Carriers: Continue to focus aggressively on top 3 players in the market, push T-Mobile and Alltel for growth, and additional strategic players (e. g. , Virgin) [DRAFT] Handsets: Continue to push on embed deals with Motorola; secure deals with Nokia and Sony Ericsson 22

![Mobile Distribution – Revenue Overview $20. 0 $17. 7 $16. 2 $10. 7 [DRAFT] Mobile Distribution – Revenue Overview $20. 0 $17. 7 $16. 2 $10. 7 [DRAFT]](https://present5.com/presentation/e373601c1fc3249381afa3d27d5ddb91/image-23.jpg)

Mobile Distribution – Revenue Overview $20. 0 $17. 7 $16. 2 $10. 7 [DRAFT] 23

![Mobile Distribution – Summary P&L [DRAFT] 24 Mobile Distribution – Summary P&L [DRAFT] 24](https://present5.com/presentation/e373601c1fc3249381afa3d27d5ddb91/image-24.jpg)

Mobile Distribution – Summary P&L [DRAFT] 24

![Digital Distribution – Consolidated P&L TO BE UPDATED [DRAFT] 25 Digital Distribution – Consolidated P&L TO BE UPDATED [DRAFT] 25](https://present5.com/presentation/e373601c1fc3249381afa3d27d5ddb91/image-25.jpg)

Digital Distribution – Consolidated P&L TO BE UPDATED [DRAFT] 25

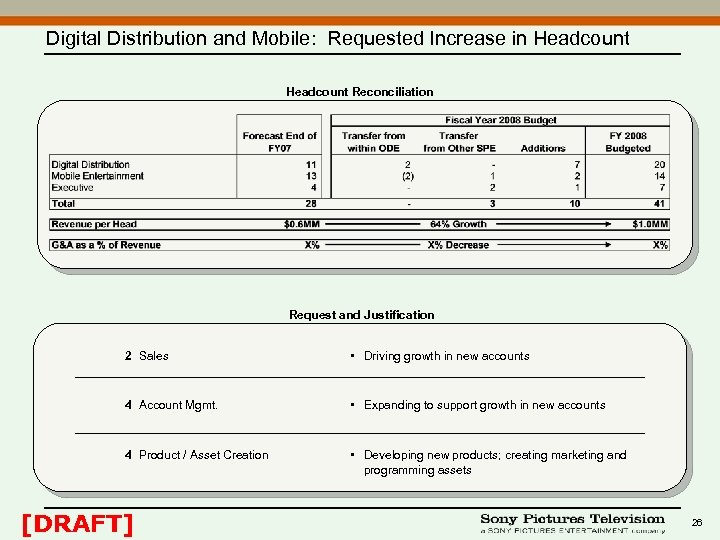

Digital Distribution and Mobile: Requested Increase in Headcount Reconciliation Request and Justification 2 Sales • Driving growth in new accounts 4 Account Mgmt. • Expanding to support growth in new accounts 4 Product / Asset Creation • Developing new products; creating marketing and programming assets [DRAFT] 26

Agenda 1. Executive Summary 2. Digital Distribution 3. Mobile 4. Distribution Services / Grouper 5. Consolidated P&L [DRAFT] 27

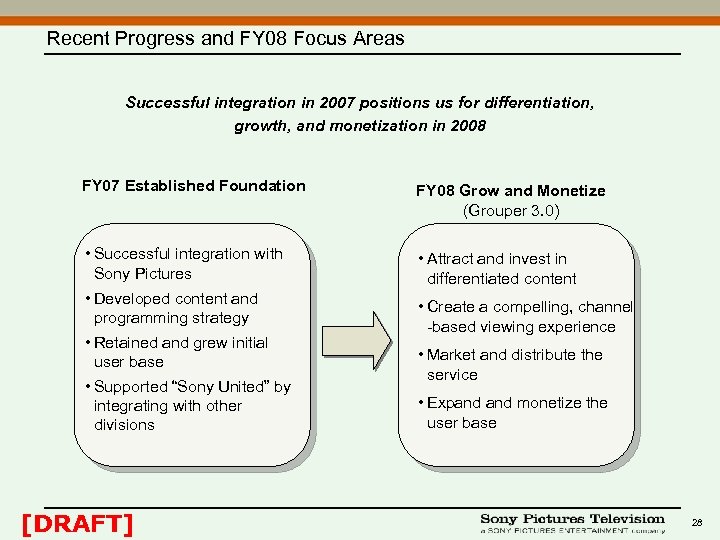

Recent Progress and FY 08 Focus Areas Successful integration in 2007 positions us for differentiation, growth, and monetization in 2008 FY 07 Established Foundation FY 08 Grow and Monetize (Grouper 3. 0) • Successful integration with Sony Pictures • Attract and invest in differentiated content • Developed content and programming strategy • Retained and grew initial user base • Supported “Sony United” by integrating with other divisions [DRAFT] • Create a compelling, channel -based viewing experience • Market and distribute the service • Expand monetize the user base 28

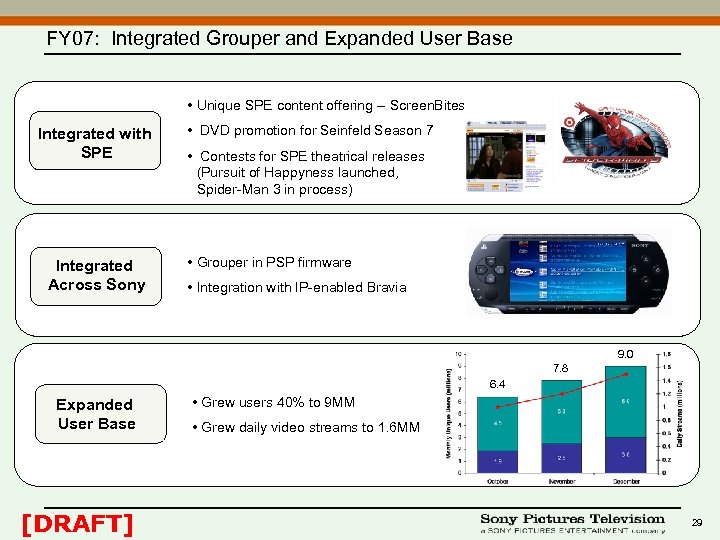

FY 07: Integrated Grouper and Expanded User Base • Unique SPE content offering -- Screen. Bites Integrated with SPE Integrated Across Sony • DVD promotion for Seinfeld Season 7 • Contests for SPE theatrical releases (Pursuit of Happyness launched, Spider-Man 3 in process) • Grouper in PSP firmware • Integration with IP-enabled Bravia 9. 0 7. 8 6. 4 Expanded User Base [DRAFT] • Grew users 40% to 9 MM • Grew daily video streams to 1. 6 MM 29

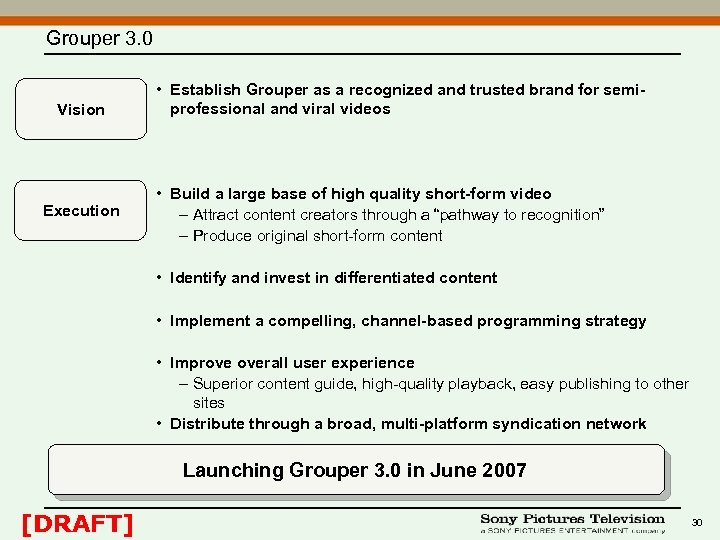

Grouper 3. 0 Vision Execution • Establish Grouper as a recognized and trusted brand for semiprofessional and viral videos • Build a large base of high quality short-form video – Attract content creators through a “pathway to recognition” – Produce original short-form content • Identify and invest in differentiated content • Implement a compelling, channel-based programming strategy • Improve overall user experience – Superior content guide, high-quality playback, easy publishing to other sites • Distribute through a broad, multi-platform syndication network Launching Grouper 3. 0 in June 2007 [DRAFT] 30

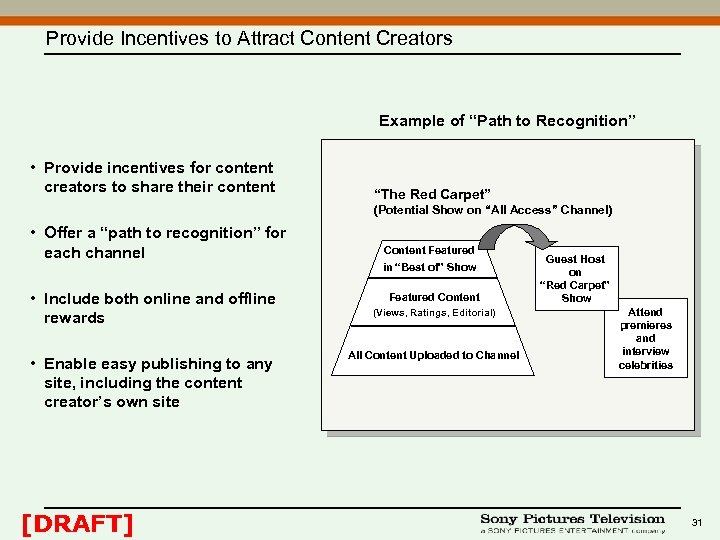

Provide Incentives to Attract Content Creators Example of “Path to Recognition” • Provide incentives for content creators to share their content “The Red Carpet” (Potential Show on “All Access” Channel) • Offer a “path to recognition” for each channel • Include both online and offline rewards • Enable easy publishing to any site, including the content creator’s own site [DRAFT] Content Featured in “Best of” Show Featured Content (Views, Ratings, Editorial) All Content Uploaded to Channel Guest Host on “Red Carpet” Show Attend premieres and interview celebrities 31

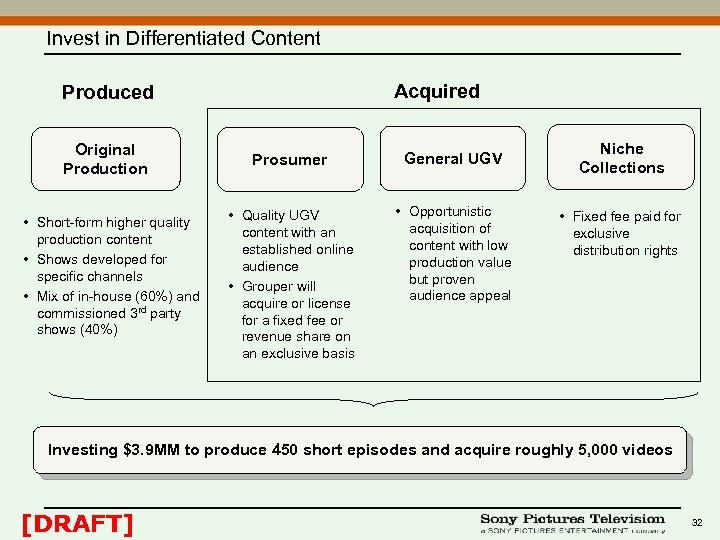

Invest in Differentiated Content Acquired Produced Original Production • Short-form higher quality production content • Shows developed for specific channels • Mix of in-house (60%) and commissioned 3 rd party shows (40%) Prosumer General UGV • Quality UGV content with an established online audience • Grouper will acquire or license for a fixed fee or revenue share on an exclusive basis • Opportunistic acquisition of content with low production value but proven audience appeal Niche Collections • Fixed fee paid for exclusive distribution rights Investing $3. 9 MM to produce 450 short episodes and acquire roughly 5, 000 videos [DRAFT] 32

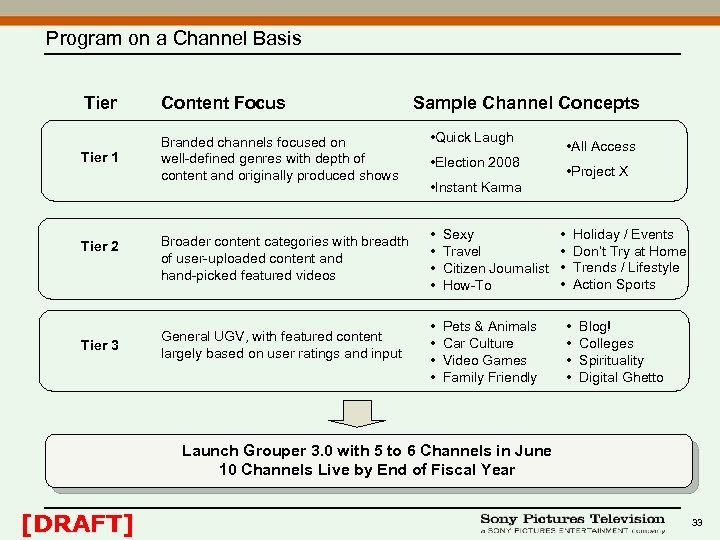

Program on a Channel Basis Tier Content Focus Tier 1 Branded channels focused on well-defined genres with depth of content and originally produced shows Tier 2 Tier 3 Sample Channel Concepts • Quick Laugh • All Access • Election 2008 • Project X • Instant Karma Broader content categories with breadth of user-uploaded content and hand-picked featured videos • • Sexy Travel Citizen Journalist How-To General UGV, with featured content largely based on user ratings and input • • Pets & Animals Car Culture Video Games Family Friendly • • Holiday / Events Don’t Try at Home Trends / Lifestyle Action Sports • • Blog! Colleges Spirituality Digital Ghetto Launch Grouper 3. 0 with 5 to 6 Channels in June 10 Channels Live by End of Fiscal Year [DRAFT] 33

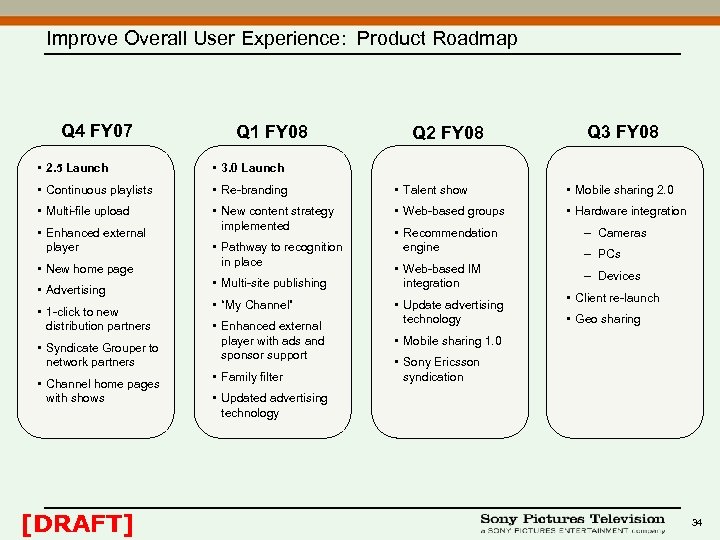

Improve Overall User Experience: Product Roadmap Q 4 FY 07 Q 1 FY 08 Q 2 FY 08 Q 3 FY 08 • 2. 5 Launch • 3. 0 Launch • Continuous playlists • Re-branding • Talent show • Mobile sharing 2. 0 • Multi-file upload • New content strategy implemented • Web-based groups • Hardware integration • Enhanced external player • New home page • Advertising • 1 -click to new distribution partners • Syndicate Grouper to network partners • Channel home pages with shows [DRAFT] • Pathway to recognition in place • Multi-site publishing • “My Channel” • Enhanced external player with ads and sponsor support • Family filter • Recommendation engine • Web-based IM integration • Update advertising technology – Cameras – PCs – Devices • Client re-launch • Geo sharing • Mobile sharing 1. 0 • Sony Ericsson syndication • Updated advertising technology 34

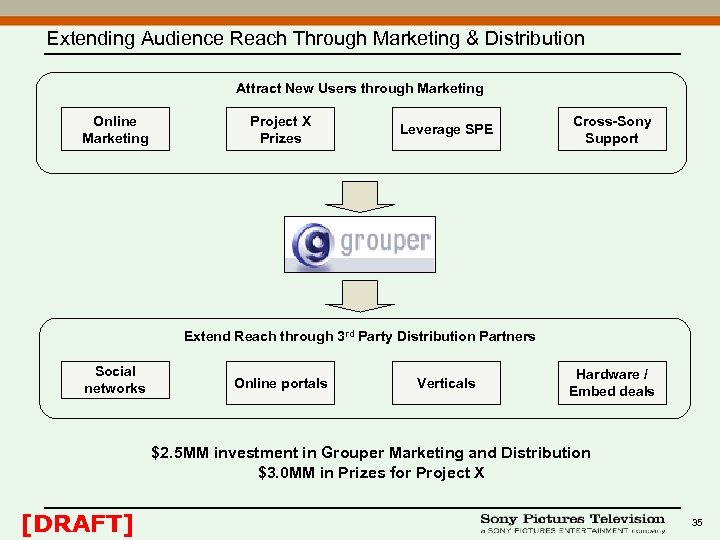

Extending Audience Reach Through Marketing & Distribution Attract New Users through Marketing Online Marketing Project X Prizes Leverage SPE Cross-Sony Support Extend Reach through 3 rd Party Distribution Partners Social networks Online portals Verticals Hardware / Embed deals $2. 5 MM investment in Grouper Marketing and Distribution $3. 0 MM in Prizes for Project X [DRAFT] 35

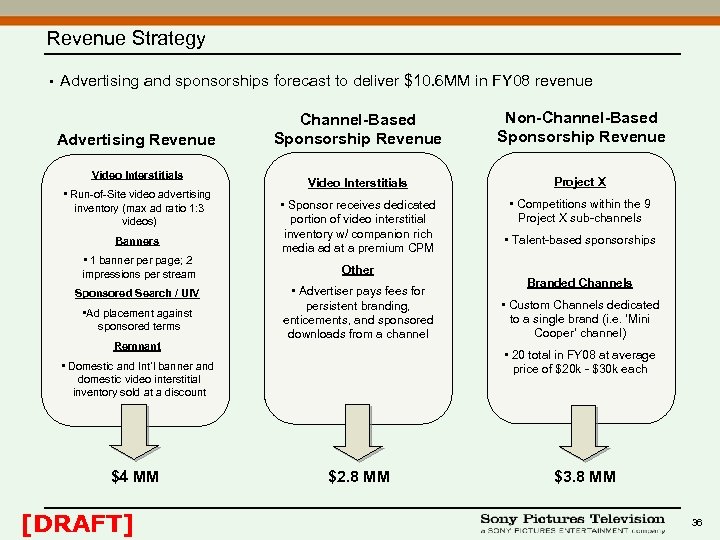

Revenue Strategy • Advertising and sponsorships forecast to deliver $10. 6 MM in FY 08 revenue Advertising Revenue Video Interstitials • Run-of-Site video advertising inventory (max ad ratio 1: 3 videos) Banners • 1 banner page; 2 impressions per stream Sponsored Search / UIV • Ad placement against sponsored terms Remnant Channel-Based Sponsorship Revenue Non-Channel-Based Sponsorship Revenue Video Interstitials Project X • Sponsor receives dedicated portion of video interstitial inventory w/ companion rich media ad at a premium CPM • Competitions within the 9 Project X sub-channels Other • Advertiser pays fees for persistent branding, enticements, and sponsored downloads from a channel [DRAFT] Branded Channels • Custom Channels dedicated to a single brand (i. e. ‘Mini Cooper’ channel) • 20 total in FY 08 at average price of $20 k - $30 k each • Domestic and Int’l banner and domestic video interstitial inventory sold at a discount $4 MM • Talent-based sponsorships $2. 8 MM $3. 8 MM 36

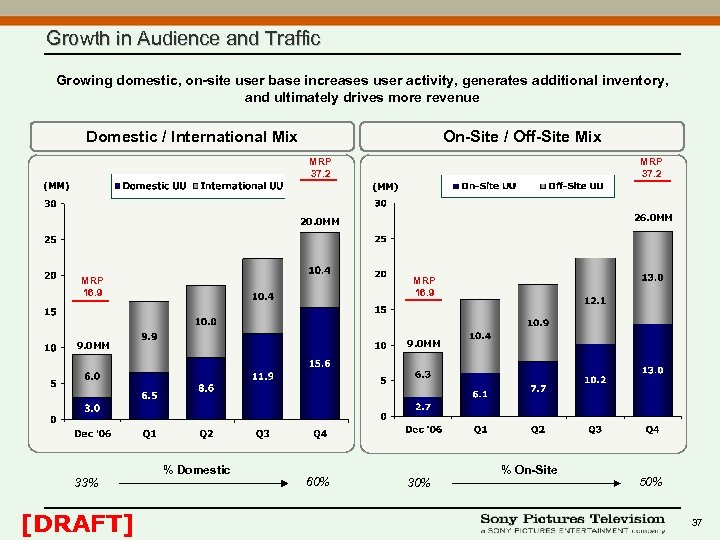

Growth in Audience and Traffic Growing domestic, on-site user base increases user activity, generates additional inventory, and ultimately drives more revenue Domestic / International Mix On-Site / Off-Site Mix MRP 37. 2 20. 0 MM 26. 0 MM MRP 16. 9 9. 0 MM 33% [DRAFT] % Domestic 60% 30% % On-Site 50% 37

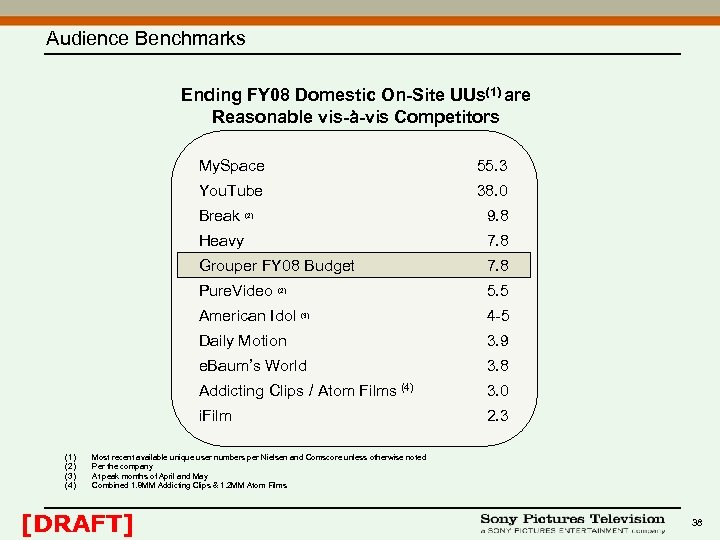

Audience Benchmarks Ending FY 08 Domestic On-Site UUs(1) are Reasonable vis-à-vis Competitors My. Space 55. 3 You. Tube 38. 0 Break (2) Heavy 7. 8 Grouper FY 08 Budget 7. 8 Pure. Video (2) 5. 5 American Idol (3) 4 -5 Daily Motion 3. 9 e. Baum’s World 3. 8 Addicting Clips / Atom Films (4) 3. 0 i. Film (1) (2) (3) (4) 9. 8 2. 3 Most recent available unique user numbers per Nielsen and Comscore unless otherwise noted Per the company At peak months of April and May Combined 1. 8 MM Addicting Clips & 1. 2 MM Atom Films [DRAFT] 38

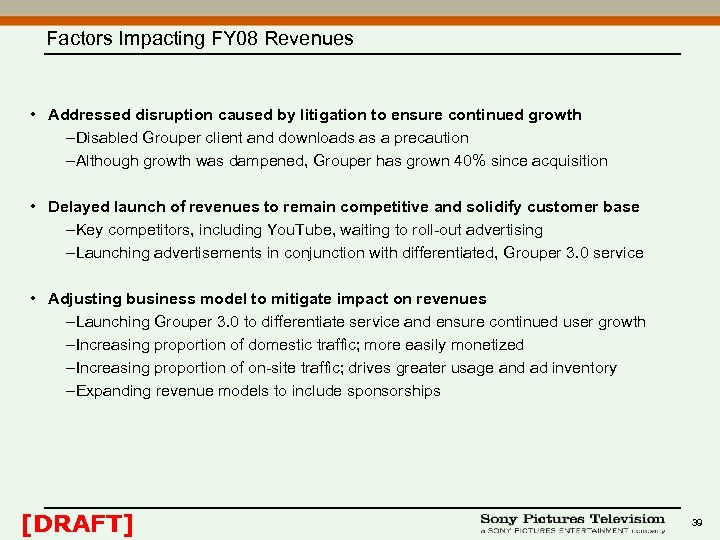

Factors Impacting FY 08 Revenues • Addressed disruption caused by litigation to ensure continued growth –Disabled Grouper client and downloads as a precaution –Although growth was dampened, Grouper has grown 40% since acquisition • Delayed launch of revenues to remain competitive and solidify customer base –Key competitors, including You. Tube, waiting to roll-out advertising –Launching advertisements in conjunction with differentiated, Grouper 3. 0 service • Adjusting business model to mitigate impact on revenues –Launching Grouper 3. 0 to differentiate service and ensure continued user growth –Increasing proportion of domestic traffic; more easily monetized –Increasing proportion of on-site traffic; drives greater usage and ad inventory –Expanding revenue models to include sponsorships [DRAFT] 39

![Grouper – Revenue Overview $18. 6 $10. 6 $3. 0 $. 03 [DRAFT] 40 Grouper – Revenue Overview $18. 6 $10. 6 $3. 0 $. 03 [DRAFT] 40](https://present5.com/presentation/e373601c1fc3249381afa3d27d5ddb91/image-40.jpg)

Grouper – Revenue Overview $18. 6 $10. 6 $3. 0 $. 03 [DRAFT] 40

![Grouper – Summary P&L [DRAFT] 41 Grouper – Summary P&L [DRAFT] 41](https://present5.com/presentation/e373601c1fc3249381afa3d27d5ddb91/image-41.jpg)

Grouper – Summary P&L [DRAFT] 41

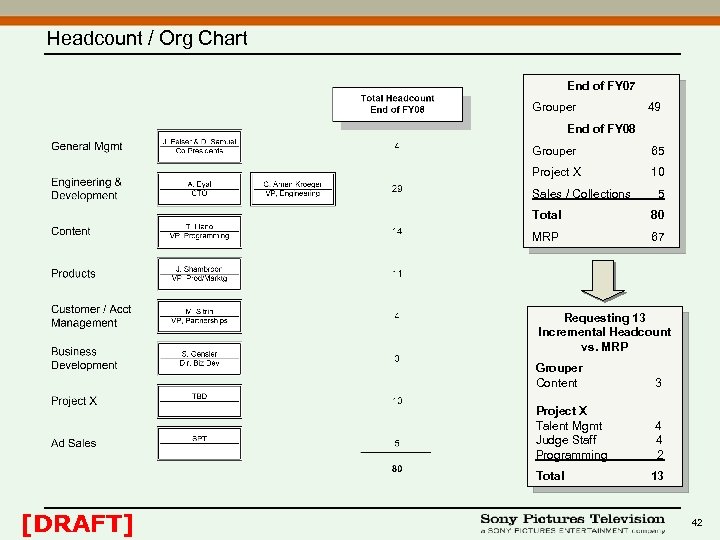

Headcount / Org Chart End of FY 07 Grouper 49 End of FY 08 Grouper 65 Project X 10 Sales / Collections 5 Total 80 MRP 67 Requesting 13 Incremental Headcount vs. MRP Grouper Content 3 Project X Talent Mgmt Judge Staff Programming 4 4 2 Total [DRAFT] 13 42

Agenda 1. Executive Summary 2. Digital Distribution 3. Mobile 4. Distribution Services / Grouper 5. Consolidated P&L [DRAFT] 43

![Digital Services & Distribution – Consolidated P&L TO BE UPDATED [DRAFT] 44 Digital Services & Distribution – Consolidated P&L TO BE UPDATED [DRAFT] 44](https://present5.com/presentation/e373601c1fc3249381afa3d27d5ddb91/image-44.jpg)

Digital Services & Distribution – Consolidated P&L TO BE UPDATED [DRAFT] 44

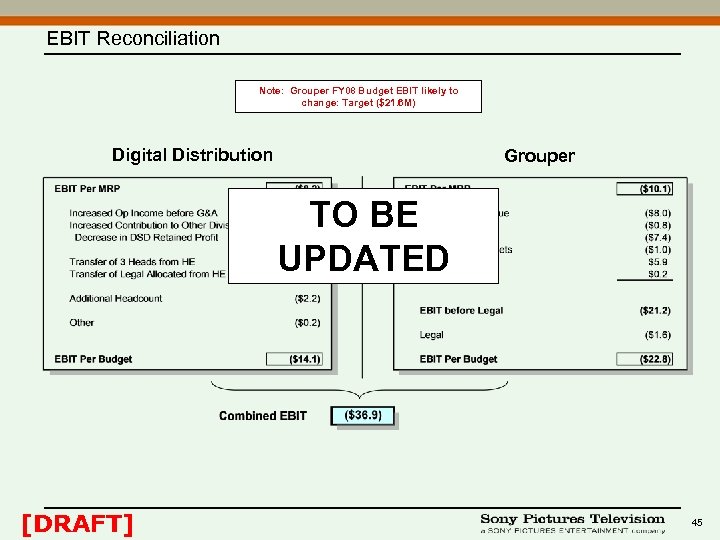

EBIT Reconciliation Note: Grouper FY 08 Budget EBIT likely to change: Target ($21. 6 M) Digital Distribution Grouper TO BE UPDATED [DRAFT] 45

e373601c1fc3249381afa3d27d5ddb91.ppt