e1677690dc3437fd1ba41b606038a57a.ppt

- Количество слайдов: 24

DIFX Market Model Presentation for AMEDA 20 th April, 2006 by Nasser Al Shaali, COO – DIFX & Muffadal Kagalwala, Head - DIFX CSD & Registry 1

DIFX Market Model Presentation for AMEDA 20 th April, 2006 by Nasser Al Shaali, COO – DIFX & Muffadal Kagalwala, Head - DIFX CSD & Registry 1

Topics covered in this presentation: § Introduction to DIFC and DIFX § DIFX Membership § DIFX Trading § DIFX Clearing and Risk Management § DIFX Central Securities Depository § DIFX Registry § DIFX Systems 2

Topics covered in this presentation: § Introduction to DIFC and DIFX § DIFX Membership § DIFX Trading § DIFX Clearing and Risk Management § DIFX Central Securities Depository § DIFX Registry § DIFX Systems 2

Introduction to the DIFC and DIFX § Dubai International Financial Exchange (DIFX) is a company incorporated under Dubai International Financial Centre (DIFC), a financial free zone situated in the heart of Dubai. § Financial activities in DIFC are governed to the international standards by an independent regulator, the Dubai Financial Services Authority (DFSA) § DIFX is the main gateway of opportunities in the GCC as well as Middle East & Africa. It bridges the gap between Western Europe and far east. 3

Introduction to the DIFC and DIFX § Dubai International Financial Exchange (DIFX) is a company incorporated under Dubai International Financial Centre (DIFC), a financial free zone situated in the heart of Dubai. § Financial activities in DIFC are governed to the international standards by an independent regulator, the Dubai Financial Services Authority (DFSA) § DIFX is the main gateway of opportunities in the GCC as well as Middle East & Africa. It bridges the gap between Western Europe and far east. 3

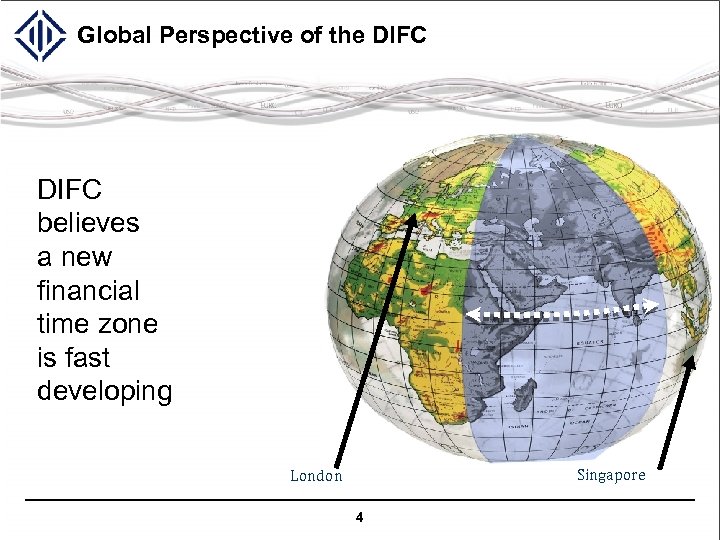

Global Perspective of the DIFC believes a new financial time zone is fast developing Singapore London 4

Global Perspective of the DIFC believes a new financial time zone is fast developing Singapore London 4

DIFX : Diverse and Complementary § The DIFX complements regional and international stock exchanges § The Exchange is attracting Issuers and Members from across the globe on a level playing field 5

DIFX : Diverse and Complementary § The DIFX complements regional and international stock exchanges § The Exchange is attracting Issuers and Members from across the globe on a level playing field 5

Products at DIFX § IPOs § Secondary Listings and Offerings § Bonds § Islamic Products § Funds, Indices & Structured Products § Warrants § Futures & Options 6

Products at DIFX § IPOs § Secondary Listings and Offerings § Bonds § Islamic Products § Funds, Indices & Structured Products § Warrants § Futures & Options 6

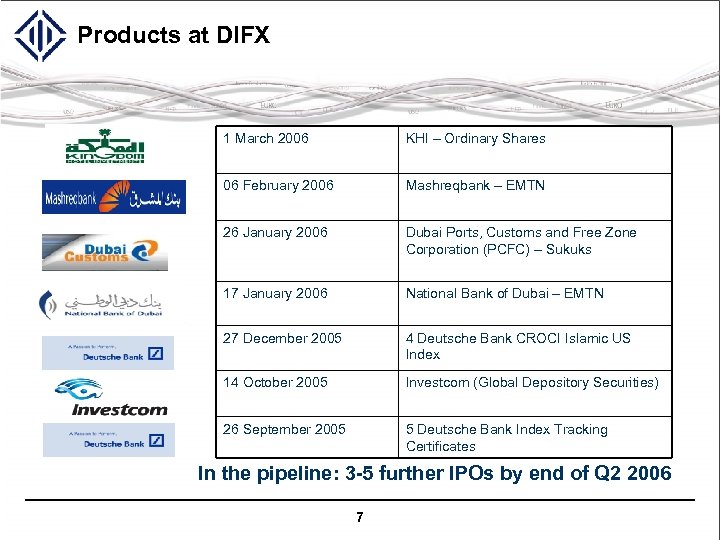

Products at DIFX 1 March 2006 KHI – Ordinary Shares 06 February 2006 Mashreqbank – EMTN 26 January 2006 Dubai Ports, Customs and Free Zone Corporation (PCFC) – Sukuks 17 January 2006 National Bank of Dubai – EMTN 27 December 2005 4 Deutsche Bank CROCI Islamic US Index 14 October 2005 Investcom (Global Depository Securities) 26 September 2005 5 Deutsche Bank Index Tracking Certificates In the pipeline: 3 -5 further IPOs by end of Q 2 2006 7

Products at DIFX 1 March 2006 KHI – Ordinary Shares 06 February 2006 Mashreqbank – EMTN 26 January 2006 Dubai Ports, Customs and Free Zone Corporation (PCFC) – Sukuks 17 January 2006 National Bank of Dubai – EMTN 27 December 2005 4 Deutsche Bank CROCI Islamic US Index 14 October 2005 Investcom (Global Depository Securities) 26 September 2005 5 Deutsche Bank Index Tracking Certificates In the pipeline: 3 -5 further IPOs by end of Q 2 2006 7

Membership at DIFX § DIFX membership offers 3 types of Membership to its participants: § Non Clearing Member : (NCM) i. e. Trading Only § Individual Clearing Member : (ICM) i. e. Trading & Own Clearing § General Clearing Member : (GCM) i. e. 3 rd Party Clearing Only § DIFX CSD offers a Custodian role to international and regional banks. § DIFX CSD also allows HNWI and corporate investors to open direct accounts. 8

Membership at DIFX § DIFX membership offers 3 types of Membership to its participants: § Non Clearing Member : (NCM) i. e. Trading Only § Individual Clearing Member : (ICM) i. e. Trading & Own Clearing § General Clearing Member : (GCM) i. e. 3 rd Party Clearing Only § DIFX CSD offers a Custodian role to international and regional banks. § DIFX CSD also allows HNWI and corporate investors to open direct accounts. 8

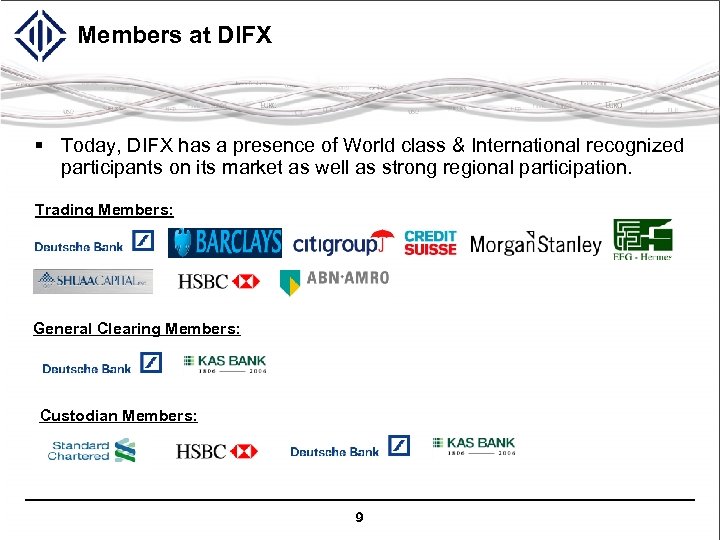

Members at DIFX § Today, DIFX has a presence of World class & International recognized participants on its market as well as strong regional participation. Trading Members: General Clearing Members: Custodian Members: 9

Members at DIFX § Today, DIFX has a presence of World class & International recognized participants on its market as well as strong regional participation. Trading Members: General Clearing Members: Custodian Members: 9

DIFX Trading § The DIFX Trading platform is a “Hybrid” trading system. § The DIFX Trading system is based on the latest version of AEMS, NSC trading platform. § DIFX trading is an anonymous and order-driven market which also allows for Market Makers to make markets in the products listed. § DIFX offers GL Win Terminals to members for access DIFX § GL also has an internet application which has the same features. § DIFX offers a technical connectivity (API) for users & dealing room equipment providers who wish to develop their own interface. Access to the API is available from Dubai or Paris. § The timing of the trading sessions are from 11. 45 am to 04. 45 pm § The exchange operates from Monday to Friday. 10

DIFX Trading § The DIFX Trading platform is a “Hybrid” trading system. § The DIFX Trading system is based on the latest version of AEMS, NSC trading platform. § DIFX trading is an anonymous and order-driven market which also allows for Market Makers to make markets in the products listed. § DIFX offers GL Win Terminals to members for access DIFX § GL also has an internet application which has the same features. § DIFX offers a technical connectivity (API) for users & dealing room equipment providers who wish to develop their own interface. Access to the API is available from Dubai or Paris. § The timing of the trading sessions are from 11. 45 am to 04. 45 pm § The exchange operates from Monday to Friday. 10

DIFX Clearing § DIFX offers the Central Counter Party (CCP) for its Clearing Members § Trade novation facility – DIFX becomes buyer to every seller and seller to every buyers. § Eliminates the bilateral counter party risks. § CCP allows the multilateral netting and reduction of settlement volumes. § One delivery obligation per security per date per member. § One cash obligations per currency per date per member. § DIFX has outsourced all its banking activities to a Clearing Bank and the Clearing Bank coordinates with Member’s Settlement Banks for the funds transfers. 11

DIFX Clearing § DIFX offers the Central Counter Party (CCP) for its Clearing Members § Trade novation facility – DIFX becomes buyer to every seller and seller to every buyers. § Eliminates the bilateral counter party risks. § CCP allows the multilateral netting and reduction of settlement volumes. § One delivery obligation per security per date per member. § One cash obligations per currency per date per member. § DIFX has outsourced all its banking activities to a Clearing Bank and the Clearing Bank coordinates with Member’s Settlement Banks for the funds transfers. 11

DIFX Risk Management § DIFX takes on certain risks in its capacity of Central Counter Party (CCP) for all the On Exchange trades. The risks are: § Counter Party Risks § Replacement costs Risks § These risks are addressed by DIFX Risk Management Policies § Defining Membership criteria with certain capital adequacy requirements § Margins from DIFX Members § Adequate Clearing Fund 12

DIFX Risk Management § DIFX takes on certain risks in its capacity of Central Counter Party (CCP) for all the On Exchange trades. The risks are: § Counter Party Risks § Replacement costs Risks § These risks are addressed by DIFX Risk Management Policies § Defining Membership criteria with certain capital adequacy requirements § Margins from DIFX Members § Adequate Clearing Fund 12

Margins at DIFX – Initial Margin & MTM § Initial Margin § DIFX uses the VAR methodology, based on each night Closing Price. § Initial Margins are therefore expressed as a percentage of the closing price. § Variation Margin – Mark to Market Margins (MTM) § DIFX does not give the notional credits to members – credit variation margin cannot be used to offset margin obligations § Margins are accepted in Cash, Securities, CD and Bank Guarantee 13

Margins at DIFX – Initial Margin & MTM § Initial Margin § DIFX uses the VAR methodology, based on each night Closing Price. § Initial Margins are therefore expressed as a percentage of the closing price. § Variation Margin – Mark to Market Margins (MTM) § DIFX does not give the notional credits to members – credit variation margin cannot be used to offset margin obligations § Margins are accepted in Cash, Securities, CD and Bank Guarantee 13

DIFX Central Securities Depository (CSD) § DIFX owns & operates a Central Securities Depository (CSD). § Also, The DIFX owns a bare trustee company called ‘DIFX Guardian Limited’ DIFX Guardian is hold the legal title or beneficial title (where applicable) for the DIFX CSD. § The CSD holds DIFX listed securities in a 100% electronically dematerialized form. 14

DIFX Central Securities Depository (CSD) § DIFX owns & operates a Central Securities Depository (CSD). § Also, The DIFX owns a bare trustee company called ‘DIFX Guardian Limited’ DIFX Guardian is hold the legal title or beneficial title (where applicable) for the DIFX CSD. § The CSD holds DIFX listed securities in a 100% electronically dematerialized form. 14

DIFX CSD Services § Custody of securities § Settlement Services for DIFX Clearing Members § Securities transfer between accounts (Push Transfers) § Securities transfer with DVP / RVP and DFP /RFP § DIFX facilitates transfer of securities between CSD accounts and Registry accounts § The CSD handles all corporate action processing & IPO processing. 15

DIFX CSD Services § Custody of securities § Settlement Services for DIFX Clearing Members § Securities transfer between accounts (Push Transfers) § Securities transfer with DVP / RVP and DFP /RFP § DIFX facilitates transfer of securities between CSD accounts and Registry accounts § The CSD handles all corporate action processing & IPO processing. 15

DIFX CSD Accounts Structure § Custodian can hold securities for their clients under their account at the CSD. The custodian account type are Omnibus without details and OWN accounts. § Trading Members will operate accounts at the CSD for Settlement purposes. The account type is normal accounts. § The Clearing Member will operate accounts at the CSD for Settlement, and other purposes. The account types are SSP and normal accounts. § HNWI and Corporate Investors operate accounts at the CSD for Custody purposes. The account type is normal accounts. 16

DIFX CSD Accounts Structure § Custodian can hold securities for their clients under their account at the CSD. The custodian account type are Omnibus without details and OWN accounts. § Trading Members will operate accounts at the CSD for Settlement purposes. The account type is normal accounts. § The Clearing Member will operate accounts at the CSD for Settlement, and other purposes. The account types are SSP and normal accounts. § HNWI and Corporate Investors operate accounts at the CSD for Custody purposes. The account type is normal accounts. 16

DIFX Settlement § DIFX follows a continuous T + 3 rolling Settlement cycle. § Securities settlement takes place on the DIFX CSD and Cash settlement takes place through the DIFX Clearing Bank § DIFX has nominated Standard Chartered as its Clearing Bank. § All Clearing Members are required to have a Securities Settlement Pool account (SSP) for settlement purposes and a Settlement Bank account for Cash. § Presently, All securities traded are denominated, cleared & settled in US Dollars. §Settlement activity is not performed on US Fed Reserve holidays. 17

DIFX Settlement § DIFX follows a continuous T + 3 rolling Settlement cycle. § Securities settlement takes place on the DIFX CSD and Cash settlement takes place through the DIFX Clearing Bank § DIFX has nominated Standard Chartered as its Clearing Bank. § All Clearing Members are required to have a Securities Settlement Pool account (SSP) for settlement purposes and a Settlement Bank account for Cash. § Presently, All securities traded are denominated, cleared & settled in US Dollars. §Settlement activity is not performed on US Fed Reserve holidays. 17

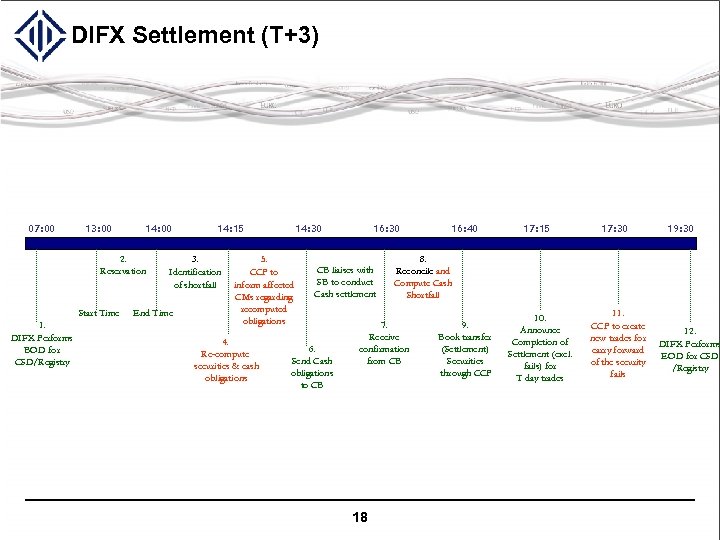

DIFX Settlement (T+3) 07: 00 13: 00 14: 00 2. Reservation Start Time 1. DIFX Performs BOD for CSD/Registry 14: 15 3. Identification of shortfall End Time 14: 30 5. CCP to inform affected CMs regarding recomputed obligations 4. Re-compute securities & cash obligations 16: 30 CB liaises with SB to conduct Cash settlement 6. Send Cash obligations to CB 17: 15 17: 30 19: 30 8. Reconcile and Compute Cash Shortfall 7. Receive confirmation from CB 18 16: 40 9. Book transfer (Settlement) Securities through CCP 10. Announce Completion of Settlement (excl. fails) for T day trades 11. CCP to create new trades for carry forward of the security fails 12. DIFX Performs EOD for CSD /Registry

DIFX Settlement (T+3) 07: 00 13: 00 14: 00 2. Reservation Start Time 1. DIFX Performs BOD for CSD/Registry 14: 15 3. Identification of shortfall End Time 14: 30 5. CCP to inform affected CMs regarding recomputed obligations 4. Re-compute securities & cash obligations 16: 30 CB liaises with SB to conduct Cash settlement 6. Send Cash obligations to CB 17: 15 17: 30 19: 30 8. Reconcile and Compute Cash Shortfall 7. Receive confirmation from CB 18 16: 40 9. Book transfer (Settlement) Securities through CCP 10. Announce Completion of Settlement (excl. fails) for T day trades 11. CCP to create new trades for carry forward of the security fails 12. DIFX Performs EOD for CSD /Registry

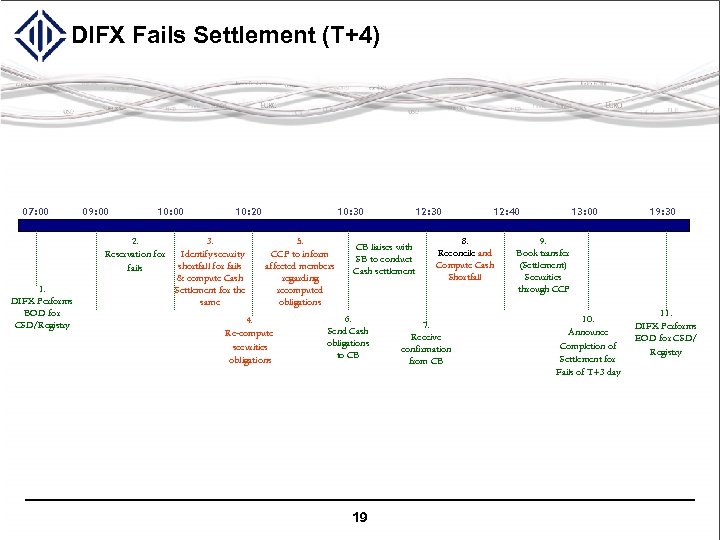

DIFX Fails Settlement (T+4) 07: 00 09: 00 10: 00 2. Reservation for fails 1. DIFX Performs BOD for CSD/Registry 10: 20 3. Identify security shortfall for fails & compute Cash Settlement for the same 10: 30 5. CCP to inform affected members regarding recomputed obligations 4. Re-compute securities obligations 12: 30 CB liaises with SB to conduct Cash settlement 6. Send Cash obligations to CB 19 12: 40 8. Reconcile and Compute Cash Shortfall 7. Receive confirmation from CB 13: 00 19: 30 9. Book transfer (Settlement) Securities through CCP 10. Announce Completion of Settlement for Fails of T+3 day 11. DIFX Performs EOD for CSD/ Registry

DIFX Fails Settlement (T+4) 07: 00 09: 00 10: 00 2. Reservation for fails 1. DIFX Performs BOD for CSD/Registry 10: 20 3. Identify security shortfall for fails & compute Cash Settlement for the same 10: 30 5. CCP to inform affected members regarding recomputed obligations 4. Re-compute securities obligations 12: 30 CB liaises with SB to conduct Cash settlement 6. Send Cash obligations to CB 19 12: 40 8. Reconcile and Compute Cash Shortfall 7. Receive confirmation from CB 13: 00 19: 30 9. Book transfer (Settlement) Securities through CCP 10. Announce Completion of Settlement for Fails of T+3 day 11. DIFX Performs EOD for CSD/ Registry

Future programs of DIFX CSD § DIFX envisages in future to have links with other International CSD (ICSD) which will enable DIFX account holders to move securities from one market to another markets. § The DIFX also plans to tie-up with regional CSD’s to allow investors to hold DIFX securities in their existing accounts § § § DIFX CSD also plans to offer other value added services: Pledge of securities. Securities Lending & Borrowing of securities (SLB). SMS alerts, WAP / IVR based services. e. C connect & e. C access facilities. Online risk management profile. 20

Future programs of DIFX CSD § DIFX envisages in future to have links with other International CSD (ICSD) which will enable DIFX account holders to move securities from one market to another markets. § The DIFX also plans to tie-up with regional CSD’s to allow investors to hold DIFX securities in their existing accounts § § § DIFX CSD also plans to offer other value added services: Pledge of securities. Securities Lending & Borrowing of securities (SLB). SMS alerts, WAP / IVR based services. e. C connect & e. C access facilities. Online risk management profile. 20

DIFX Registry § Holds the Shareholder Register of Legal Title for the Issuer. § Company Registrar functions. § Corporate Actions Processing. § IPO processing for the Issuers & Lead Managers. 21

DIFX Registry § Holds the Shareholder Register of Legal Title for the Issuer. § Company Registrar functions. § Corporate Actions Processing. § IPO processing for the Issuers & Lead Managers. 21

DIFX Clearing, CSD and Registry System (e. Clear. Settle) § The DIFX uses its e. Clear. Settle system for Clearing, Settlement, CSD and Registry activities. § The DIFX e. Clear. Settle systems has been developed by Tata Consultancy Services (TCS Ltd) India. § It’s a Highly secured web based application system. § It is an end to end integrated systems capable of performing Clearing, Settlement, CSD, Risks Management & Registry Functions. § It is SWIFT compliant for all internationally accepted messages. § User friendly reports (PDF) on the pre specified email address. § On-line query of all accounts & securities balances held. § Participants can participate & instruct in all corporate action – mandatory & voluntary. 22

DIFX Clearing, CSD and Registry System (e. Clear. Settle) § The DIFX uses its e. Clear. Settle system for Clearing, Settlement, CSD and Registry activities. § The DIFX e. Clear. Settle systems has been developed by Tata Consultancy Services (TCS Ltd) India. § It’s a Highly secured web based application system. § It is an end to end integrated systems capable of performing Clearing, Settlement, CSD, Risks Management & Registry Functions. § It is SWIFT compliant for all internationally accepted messages. § User friendly reports (PDF) on the pre specified email address. § On-line query of all accounts & securities balances held. § Participants can participate & instruct in all corporate action – mandatory & voluntary. 22

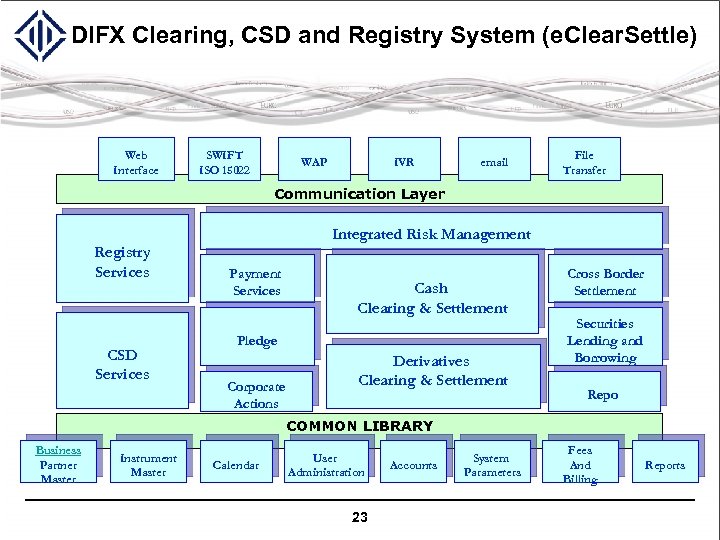

DIFX Clearing, CSD and Registry System (e. Clear. Settle) Web Interface SWIFT ISO 15022 WAP IVR email File Transfer Communication Layer Integrated Risk Management Registry Services CSD Services Payment Services Cash Clearing & Settlement Pledge Corporate Actions Derivatives Clearing & Settlement Cross Border Settlement Securities Lending and Borrowing Repo COMMON LIBRARY Business Partner Master Instrument Master Calendar User Administration 23 Accounts System Parameters Fees And Billing Reports

DIFX Clearing, CSD and Registry System (e. Clear. Settle) Web Interface SWIFT ISO 15022 WAP IVR email File Transfer Communication Layer Integrated Risk Management Registry Services CSD Services Payment Services Cash Clearing & Settlement Pledge Corporate Actions Derivatives Clearing & Settlement Cross Border Settlement Securities Lending and Borrowing Repo COMMON LIBRARY Business Partner Master Instrument Master Calendar User Administration 23 Accounts System Parameters Fees And Billing Reports

Thank You 24

Thank You 24