cc4cd9b86b6587b53f0118f45691b23d.ppt

- Количество слайдов: 17

Differences between Fee Structure of Mobile Money Technologies and Traditional Banking Systems, Social Psychological Determinants and Service Uptake: A Case Study of Uganda Bruno L. YAWE & Tinah NASSALI College of Business and Management Sciences Makerere University, Kampala, UGANDA December 07 th 2011 1

Presentation Plan • Research Procedures Completed to date • Preliminary Findings • Reflections on the Research Process [What has Worked, Successes, Pitfalls, Setbacks] • New Questions that the Research to date has Posed • Research Procedures still to be Conducted • Next Steps 2

Research Procedures Completed to date • Some interviews with officials from Bank of Uganda and the Uganda Communications Commission (UCC); • Questionnaires • Participating in public dialogues like: The operator-consumer dialogue on quality of service by UCC 3

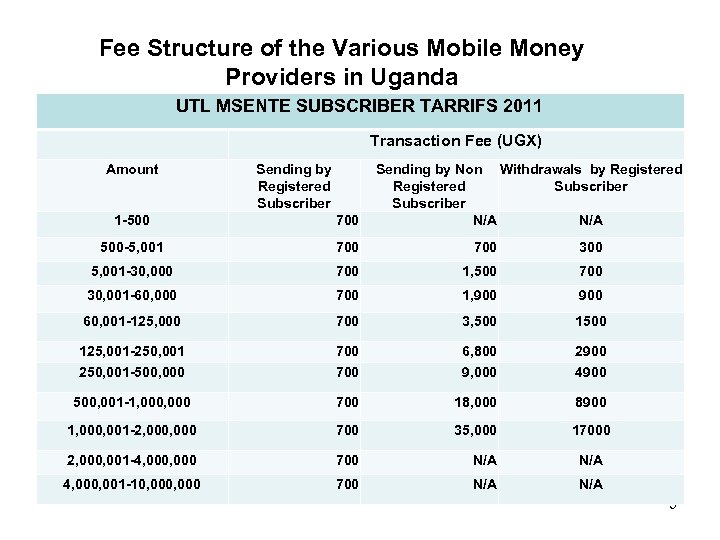

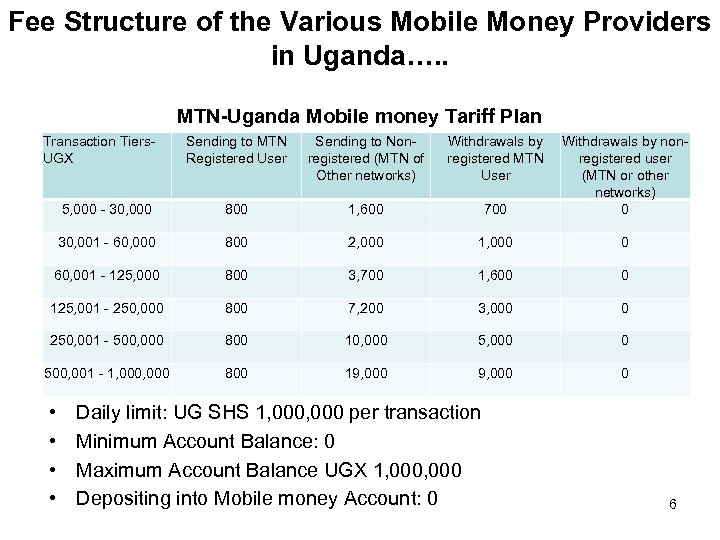

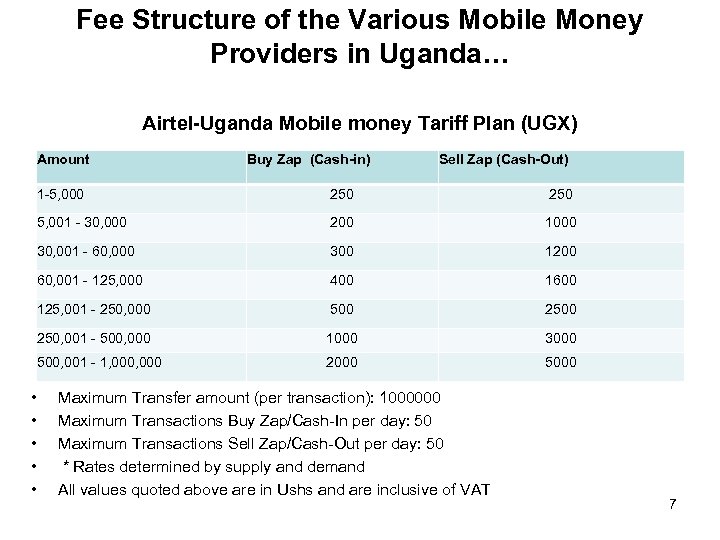

Preliminary Findings • (a) Fee Structure of the Various Mobile Money Providers in Uganda • (b) Relate the Fees Structure of the various Mobile Money Providers to Service Uptake • (c) Examine the Social and Psychological Determinants of Mobile Money Technology Use and Adoption in Uganda 4

Fee Structure of the Various Mobile Money Providers in Uganda UTL MSENTE SUBSCRIBER TARRIFS 2011 Amount Transaction Fee (UGX) Sending by Registered Subscriber Sending by Non Withdrawals by Registered Subscriber N/A 1 -500 700 500 -5, 001 700 300 5, 001 -30, 000 700 1, 500 700 30, 001 -60, 000 700 1, 900 60, 001 -125, 000 700 3, 500 125, 001 -250, 001 700 6, 800 2900 250, 001 -500, 000 700 9, 000 4900 500, 001 -1, 000 700 18, 000 8900 1, 000, 001 -2, 000 700 35, 000 17000 2, 000, 001 -4, 000 700 N/A 4, 000, 001 -10, 000 700 N/A 5

Fee Structure of the Various Mobile Money Providers in Uganda…. . MTN-Uganda Mobile money Tariff Plan Transaction Tiers. UGX Sending to MTN Registered User Sending to Nonregistered (MTN of Other networks) Withdrawals by registered MTN User 5, 000 - 30, 000 800 1, 600 700 Withdrawals by nonregistered user (MTN or other networks) 0 30, 001 - 60, 000 800 2, 000 1, 000 0 60, 001 - 125, 000 800 3, 700 1, 600 0 125, 001 - 250, 000 800 7, 200 3, 000 0 250, 001 - 500, 000 800 10, 000 5, 000 0 500, 001 - 1, 000 800 19, 000 0 • • Daily limit: UG SHS 1, 000 per transaction Minimum Account Balance: 0 Maximum Account Balance UGX 1, 000 Depositing into Mobile money Account: 0 6

Fee Structure of the Various Mobile Money Providers in Uganda… Airtel-Uganda Mobile money Tariff Plan (UGX) Amount Buy Zap (Cash-in) Sell Zap (Cash-Out) 1 -5, 000 250 5, 001 - 30, 000 200 1000 30, 001 - 60, 000 300 1200 60, 001 - 125, 000 400 1600 125, 001 - 250, 000 500 250, 001 - 500, 000 1000 3000 500, 001 - 1, 000 2000 5000 • • • Maximum Transfer amount (per transaction): 1000000 Maximum Transactions Buy Zap/Cash-In per day: 50 Maximum Transactions Sell Zap/Cash-Out per day: 50 * Rates determined by supply and demand All values quoted above are in Ushs and are inclusive of VAT 7

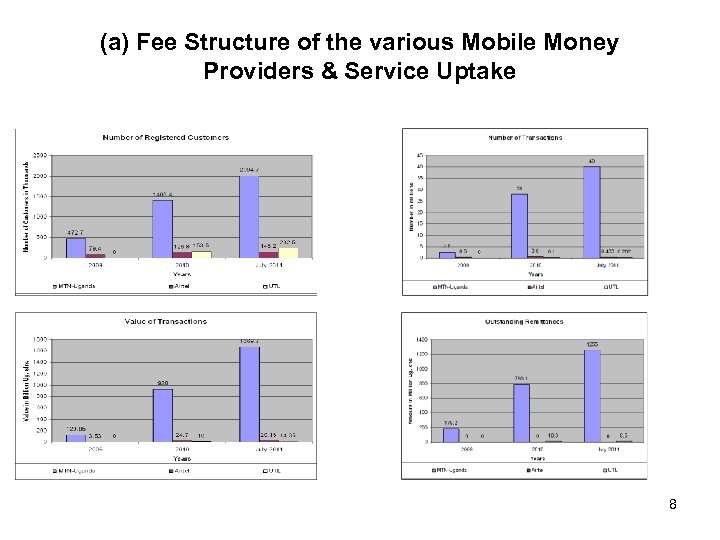

(a) Fee Structure of the various Mobile Money Providers & Service Uptake 8

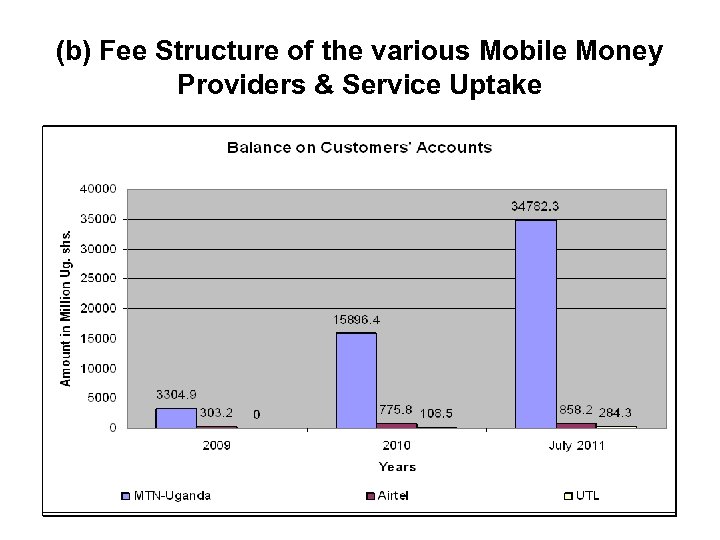

(b) Fee Structure of the various Mobile Money Providers & Service Uptake 9

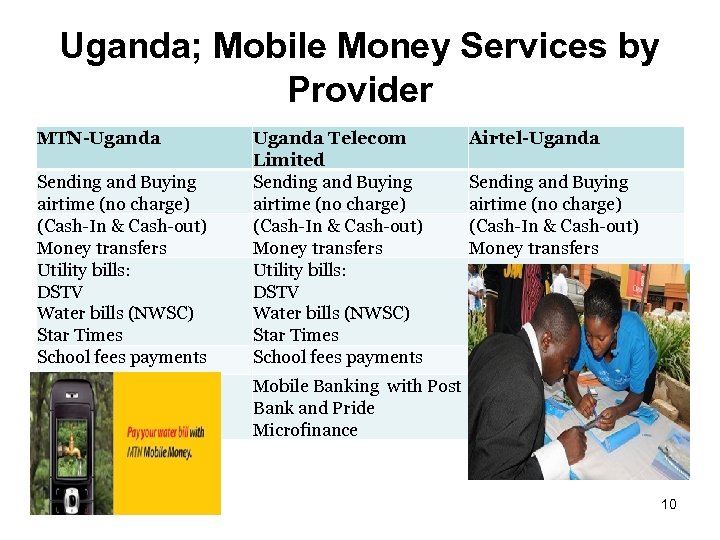

Uganda; Mobile Money Services by Provider MTN-Uganda Sending and Buying airtime (no charge) (Cash-In & Cash-out) Money transfers Utility bills: DSTV Water bills (NWSC) Star Times School fees payments Uganda Telecom Limited Sending and Buying airtime (no charge) (Cash-In & Cash-out) Money transfers Utility bills: DSTV Water bills (NWSC) Star Times School fees payments Airtel-Uganda Sending and Buying airtime (no charge) (Cash-In & Cash-out) Money transfers Mobile Banking with Post Bank and Pride Microfinance 10

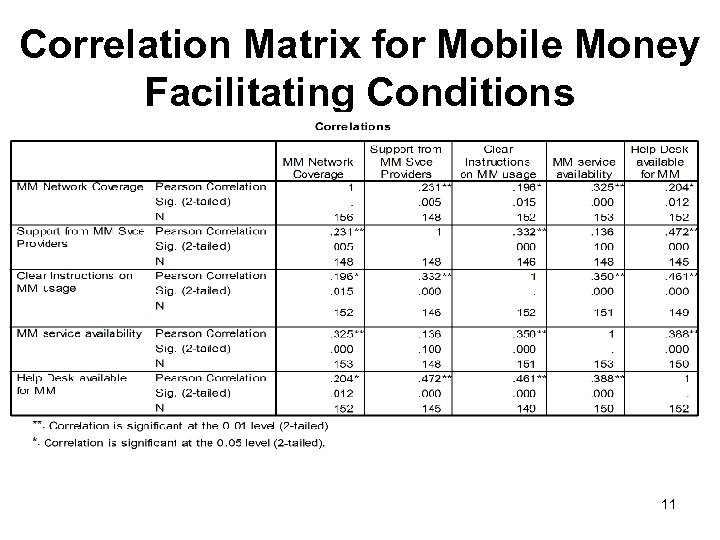

Correlation Matrix for Mobile Money Facilitating Conditions 11

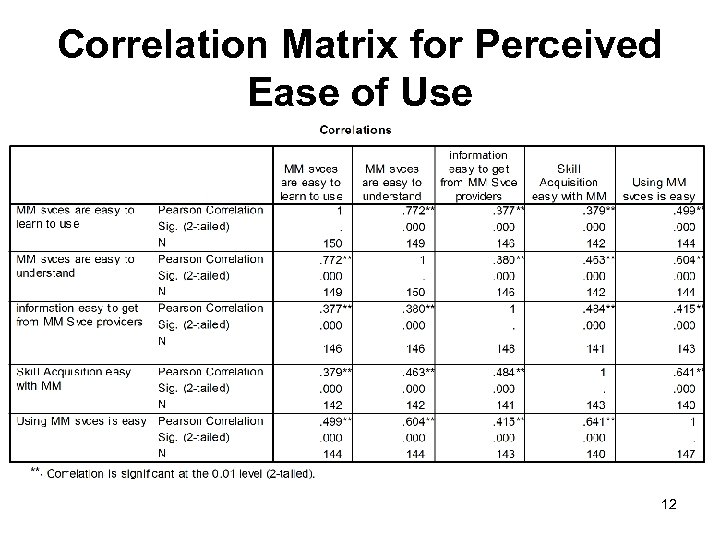

Correlation Matrix for Perceived Ease of Use 12

Facilitating Conditions and Perceived Ease of Use • The quality of MM services is dependent on amongst others the quality of mobile services and the agent-specific attributes [e. g. liquidity of agents, MM service-mix provided, security]. We delve into this on slide 14. • Further research should investigate the rationale for consumers subscribing to all MM providers; risk exposure associated with this; 13

Operator-Consumer Dialogue on Quality of Service § § Accessibility to M. M services Network coverage (no. of branches) Liquidity availability for clients at all times Possibility of inter-network transactions at reduced cost § Security of clients’ money ensured by providers § Perceived Ease of Use of M. M services (flexibility & convenience) § Perceived Usefulness of M. M services (reduced time costs) 14

Reflections on the Research Process What has Worked/Successes • Secondary data sources (from Bank of Uganda); • Questionnaire; • Focused-Group Discussions (operator-consumer dialogue); Pitfalls • Tariff plans not easily comparable across providers; • Service uptake information from Bank of Uganda is too aggregated and providers cannot easily release it; Next Steps • Complete remaining research procedures; • Prepare a manuscript for submission to a journal 15

New Questions that the Research to date has Posed • Who is the regulator of mobile money services? Providers; The Central Bank, Uganda Communications Commission? • Who set the tariff plans being implemented by agents? • If a client sends money and it does not get received where does one seek redress? BOU, UCC, National Information Technology Authority – Uganda (NITA-U) or providers? • The tariff plans differ depending upon the provider. What are the implications of this? 16

Mobile Money in Rural areas Thank You! 17

cc4cd9b86b6587b53f0118f45691b23d.ppt