32f7a70b477ccd40e46bcf58d98c4be1.ppt

- Количество слайдов: 26

Developments in Indian Life Insurance Industry 23 rd May 2011, Hyderabad 1

Developments in Indian Life Insurance Industry 23 rd May 2011, Hyderabad 1

Agenda Key Indicators of Indian Life Insurance Industry Inclusive Growth of Life Insurance Sector Investment by Life Insurance Companies Expenses of Life Insurance Companies Protection of Policyholders Interest Issues Related to DTC 2

Agenda Key Indicators of Indian Life Insurance Industry Inclusive Growth of Life Insurance Sector Investment by Life Insurance Companies Expenses of Life Insurance Companies Protection of Policyholders Interest Issues Related to DTC 2

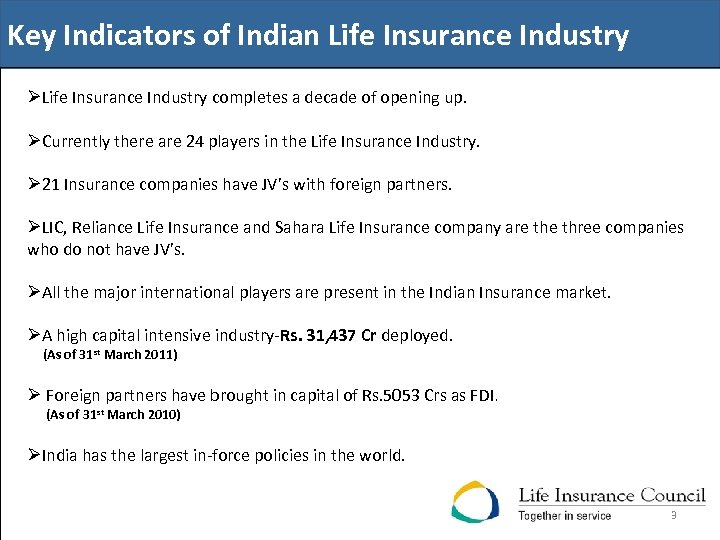

Key Indicators of Indian Life Insurance Industry ØLife Insurance Industry completes a decade of opening up. ØCurrently there are 24 players in the Life Insurance Industry. Ø 21 Insurance companies have JV’s with foreign partners. ØLIC, Reliance Life Insurance and Sahara Life Insurance company are three companies who do not have JV’s. ØAll the major international players are present in the Indian Insurance market. ØA high capital intensive industry-Rs. 31, 437 Cr deployed. (As of 31 st March 2011) Ø Foreign partners have brought in capital of Rs. 5053 Crs as FDI. (As of 31 st March 2010) ØIndia has the largest in-force policies in the world. 3

Key Indicators of Indian Life Insurance Industry ØLife Insurance Industry completes a decade of opening up. ØCurrently there are 24 players in the Life Insurance Industry. Ø 21 Insurance companies have JV’s with foreign partners. ØLIC, Reliance Life Insurance and Sahara Life Insurance company are three companies who do not have JV’s. ØAll the major international players are present in the Indian Insurance market. ØA high capital intensive industry-Rs. 31, 437 Cr deployed. (As of 31 st March 2011) Ø Foreign partners have brought in capital of Rs. 5053 Crs as FDI. (As of 31 st March 2010) ØIndia has the largest in-force policies in the world. 3

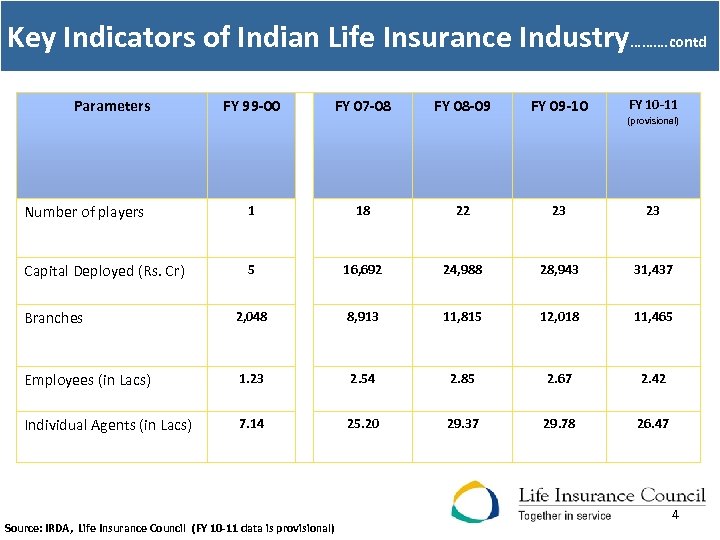

Key Indicators of Indian Life Insurance Industry………. contd Parameters FY 99 -00 FY 07 -08 FY 08 -09 FY 09 -10 Number of players 1 18 22 23 23 Capital Deployed (Rs. Cr) 5 16, 692 24, 988 28, 943 31, 437 Branches 2, 048 8, 913 11, 815 12, 018 11, 465 Employees (in Lacs) 1. 23 2. 54 2. 85 2. 67 2. 42 Individual Agents (in Lacs) 7. 14 25. 20 29. 37 29. 78 26. 47 Source: IRDA, Life Insurance Council (FY 10 -11 data is provisional) FY 10 -11 (provisional) 4

Key Indicators of Indian Life Insurance Industry………. contd Parameters FY 99 -00 FY 07 -08 FY 08 -09 FY 09 -10 Number of players 1 18 22 23 23 Capital Deployed (Rs. Cr) 5 16, 692 24, 988 28, 943 31, 437 Branches 2, 048 8, 913 11, 815 12, 018 11, 465 Employees (in Lacs) 1. 23 2. 54 2. 85 2. 67 2. 42 Individual Agents (in Lacs) 7. 14 25. 20 29. 37 29. 78 26. 47 Source: IRDA, Life Insurance Council (FY 10 -11 data is provisional) FY 10 -11 (provisional) 4

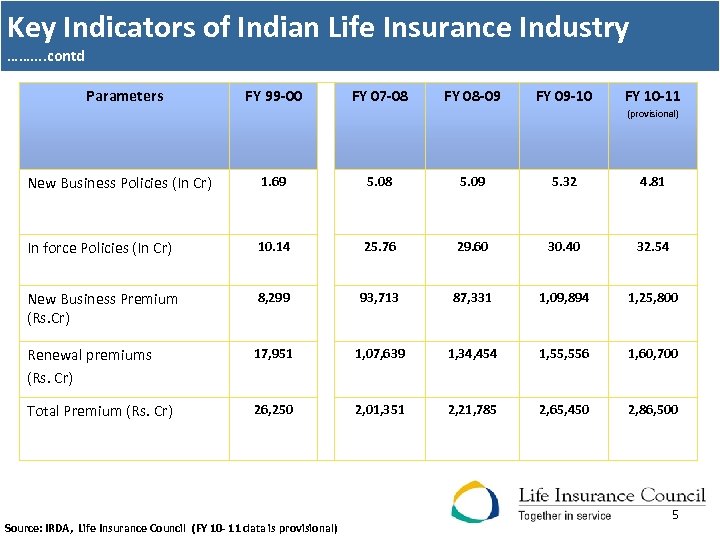

Key Indicators of Indian Life Insurance Industry ……. . contd Parameters FY 99 -00 FY 07 -08 FY 08 -09 FY 09 -10 FY 10 -11 (provisional) New Business Policies (In Cr) 1. 69 5. 08 5. 09 5. 32 4. 81 In force Policies (In Cr) 10. 14 25. 76 29. 60 30. 40 32. 54 New Business Premium (Rs. Cr) 8, 299 93, 713 87, 331 1, 09, 894 1, 25, 800 Renewal premiums (Rs. Cr) 17, 951 1, 07, 639 1, 34, 454 1, 556 1, 60, 700 Total Premium (Rs. Cr) 26, 250 2, 01, 351 2, 21, 785 2, 65, 450 2, 86, 500 Source: IRDA, Life Insurance Council (FY 10 - 11 data is provisional) 5

Key Indicators of Indian Life Insurance Industry ……. . contd Parameters FY 99 -00 FY 07 -08 FY 08 -09 FY 09 -10 FY 10 -11 (provisional) New Business Policies (In Cr) 1. 69 5. 08 5. 09 5. 32 4. 81 In force Policies (In Cr) 10. 14 25. 76 29. 60 30. 40 32. 54 New Business Premium (Rs. Cr) 8, 299 93, 713 87, 331 1, 09, 894 1, 25, 800 Renewal premiums (Rs. Cr) 17, 951 1, 07, 639 1, 34, 454 1, 556 1, 60, 700 Total Premium (Rs. Cr) 26, 250 2, 01, 351 2, 21, 785 2, 65, 450 2, 86, 500 Source: IRDA, Life Insurance Council (FY 10 - 11 data is provisional) 5

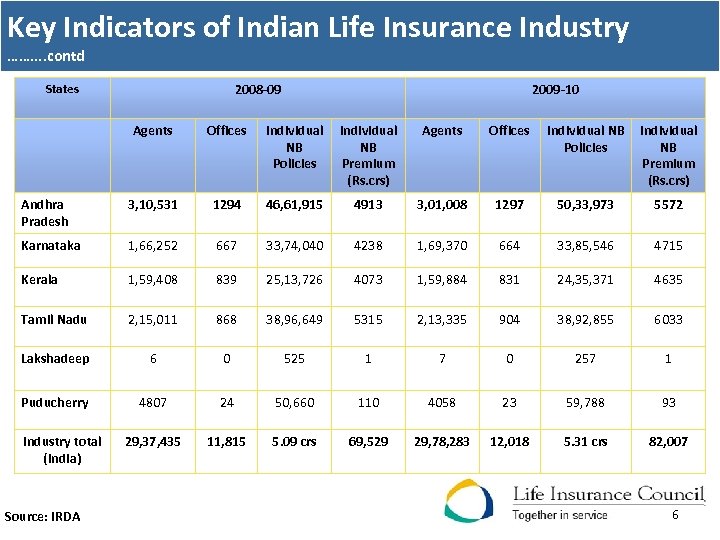

Key Indicators of Indian Life Insurance Industry ……. . contd 2008 -09 States 2009 -10 Agents Offices Individual NB Policies Individual NB Premium (Rs. crs) Andhra Pradesh 3, 10, 531 1294 46, 61, 915 4913 3, 01, 008 1297 50, 33, 973 5572 Karnataka 1, 66, 252 667 33, 74, 040 4238 1, 69, 370 664 33, 85, 546 4715 Kerala 1, 59, 408 839 25, 13, 726 4073 1, 59, 884 831 24, 35, 371 4635 Tamil Nadu 2, 15, 011 868 38, 96, 649 5315 2, 13, 335 904 38, 92, 855 6033 Lakshadeep 6 0 525 1 7 0 257 1 Puducherry 4807 24 50, 660 110 4058 23 59, 788 93 29, 37, 435 11, 815 5. 09 crs 69, 529 29, 78, 283 12, 018 5. 31 crs 82, 007 Industry total (India) Source: IRDA 6

Key Indicators of Indian Life Insurance Industry ……. . contd 2008 -09 States 2009 -10 Agents Offices Individual NB Policies Individual NB Premium (Rs. crs) Andhra Pradesh 3, 10, 531 1294 46, 61, 915 4913 3, 01, 008 1297 50, 33, 973 5572 Karnataka 1, 66, 252 667 33, 74, 040 4238 1, 69, 370 664 33, 85, 546 4715 Kerala 1, 59, 408 839 25, 13, 726 4073 1, 59, 884 831 24, 35, 371 4635 Tamil Nadu 2, 15, 011 868 38, 96, 649 5315 2, 13, 335 904 38, 92, 855 6033 Lakshadeep 6 0 525 1 7 0 257 1 Puducherry 4807 24 50, 660 110 4058 23 59, 788 93 29, 37, 435 11, 815 5. 09 crs 69, 529 29, 78, 283 12, 018 5. 31 crs 82, 007 Industry total (India) Source: IRDA 6

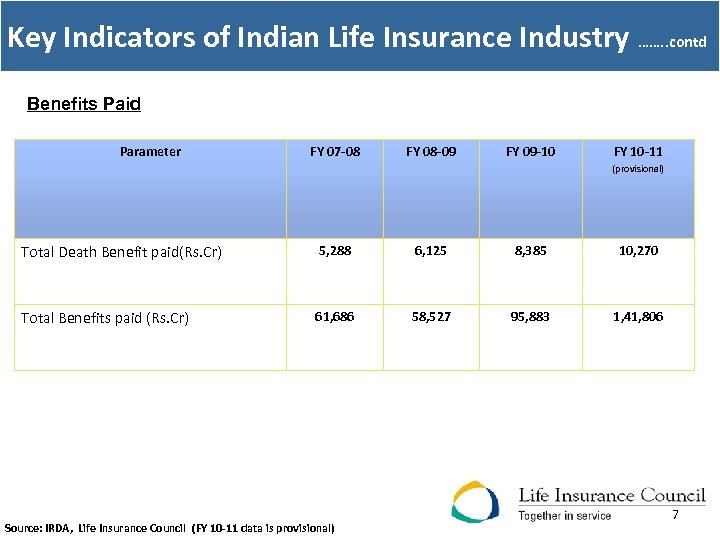

Key Indicators of Indian Life Insurance Industry ……. . contd Benefits Paid Parameter FY 07 -08 FY 08 -09 FY 09 -10 FY 10 -11 (provisional) Total Death Benefit paid(Rs. Cr) 5, 288 6, 125 8, 385 10, 270 Total Benefits paid (Rs. Cr) 61, 686 58, 527 95, 883 1, 41, 806 Source: IRDA, Life Insurance Council (FY 10 -11 data is provisional) 7

Key Indicators of Indian Life Insurance Industry ……. . contd Benefits Paid Parameter FY 07 -08 FY 08 -09 FY 09 -10 FY 10 -11 (provisional) Total Death Benefit paid(Rs. Cr) 5, 288 6, 125 8, 385 10, 270 Total Benefits paid (Rs. Cr) 61, 686 58, 527 95, 883 1, 41, 806 Source: IRDA, Life Insurance Council (FY 10 -11 data is provisional) 7

Agenda Inclusive Growth of Life Insurance Sector 8

Agenda Inclusive Growth of Life Insurance Sector 8

Inclusive growth of Life Insurance Sector Ø Companies are statutorily required to do rural business and cover lives from social sector rural, un-organized and socially underprivileged from there first year of operation. Ø Companies have to mandatorily sell – 18% of new policies in rural areas. – Cover 25, 000 lives in social sector every year. Ø 2. 8 Crore rural policies were sold by companies in last two years. (1. 55 Crore policies in 2007 -08 and 1. 26 Crore policies in 2008 -09) Ø 3. 36 Crore life's covered in social sector in last two years. (1. 43 Crore in 2007 -08 and 1. 93 Crore in 2008 -09) Ø 72% of the total 11, 465 branches of insurance companies are in semi-urban or rural areas (33% in rural areas). Ø No such obligations for Mutual Funds. Source: IRDA, Life Insurance Council 9

Inclusive growth of Life Insurance Sector Ø Companies are statutorily required to do rural business and cover lives from social sector rural, un-organized and socially underprivileged from there first year of operation. Ø Companies have to mandatorily sell – 18% of new policies in rural areas. – Cover 25, 000 lives in social sector every year. Ø 2. 8 Crore rural policies were sold by companies in last two years. (1. 55 Crore policies in 2007 -08 and 1. 26 Crore policies in 2008 -09) Ø 3. 36 Crore life's covered in social sector in last two years. (1. 43 Crore in 2007 -08 and 1. 93 Crore in 2008 -09) Ø 72% of the total 11, 465 branches of insurance companies are in semi-urban or rural areas (33% in rural areas). Ø No such obligations for Mutual Funds. Source: IRDA, Life Insurance Council 9

Agenda Investment by Life Insurance Companies 10

Agenda Investment by Life Insurance Companies 10

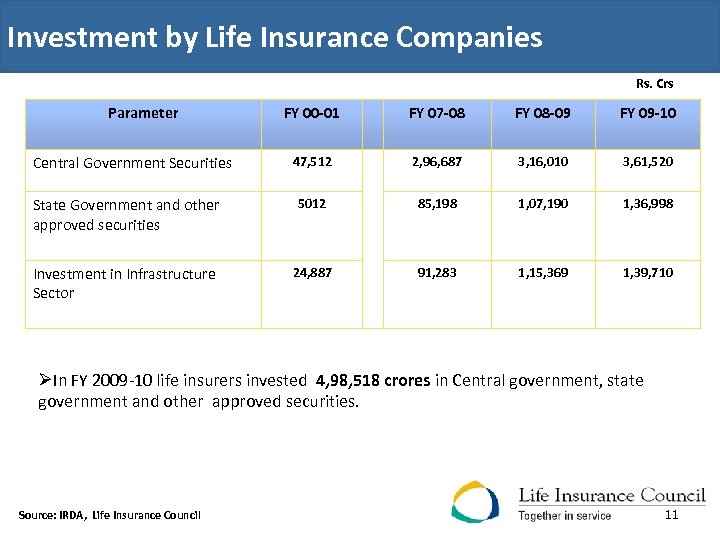

Investment by Life Insurance Companies Rs. Crs Parameter FY 00 -01 FY 07 -08 FY 08 -09 FY 09 -10 47, 512 2, 96, 687 3, 16, 010 3, 61, 520 State Government and other approved securities 5012 85, 198 1, 07, 190 1, 36, 998 Investment in Infrastructure Sector 24, 887 91, 283 1, 15, 369 1, 39, 710 Central Government Securities ØIn FY 2009 -10 life insurers invested 4, 98, 518 crores in Central government, state government and other approved securities. Source: IRDA, Life Insurance Council 11

Investment by Life Insurance Companies Rs. Crs Parameter FY 00 -01 FY 07 -08 FY 08 -09 FY 09 -10 47, 512 2, 96, 687 3, 16, 010 3, 61, 520 State Government and other approved securities 5012 85, 198 1, 07, 190 1, 36, 998 Investment in Infrastructure Sector 24, 887 91, 283 1, 15, 369 1, 39, 710 Central Government Securities ØIn FY 2009 -10 life insurers invested 4, 98, 518 crores in Central government, state government and other approved securities. Source: IRDA, Life Insurance Council 11

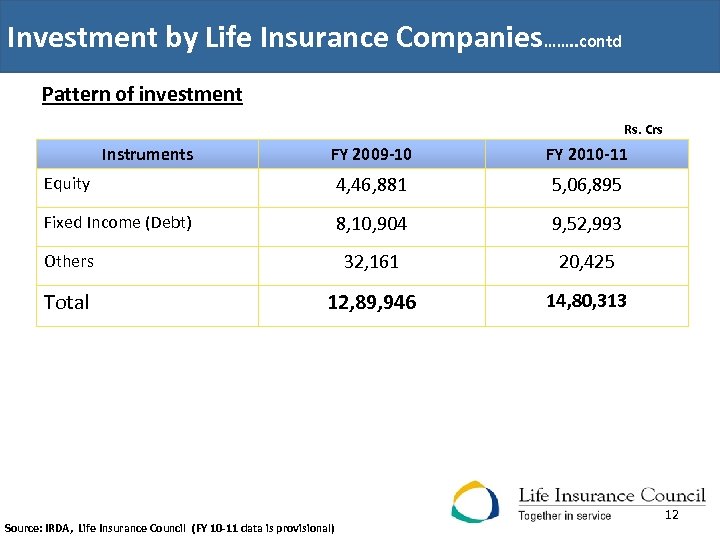

Investment by Life Insurance Companies……. . contd Pattern of investment Rs. Crs Instruments FY 2009 -10 FY 2010 -11 Equity 4, 46, 881 5, 06, 895 Fixed Income (Debt) 8, 10, 904 9, 52, 993 Others 32, 161 20, 425 Total 12, 89, 946 14, 80, 313 Source: IRDA, Life Insurance Council (FY 10 -11 data is provisional) 12

Investment by Life Insurance Companies……. . contd Pattern of investment Rs. Crs Instruments FY 2009 -10 FY 2010 -11 Equity 4, 46, 881 5, 06, 895 Fixed Income (Debt) 8, 10, 904 9, 52, 993 Others 32, 161 20, 425 Total 12, 89, 946 14, 80, 313 Source: IRDA, Life Insurance Council (FY 10 -11 data is provisional) 12

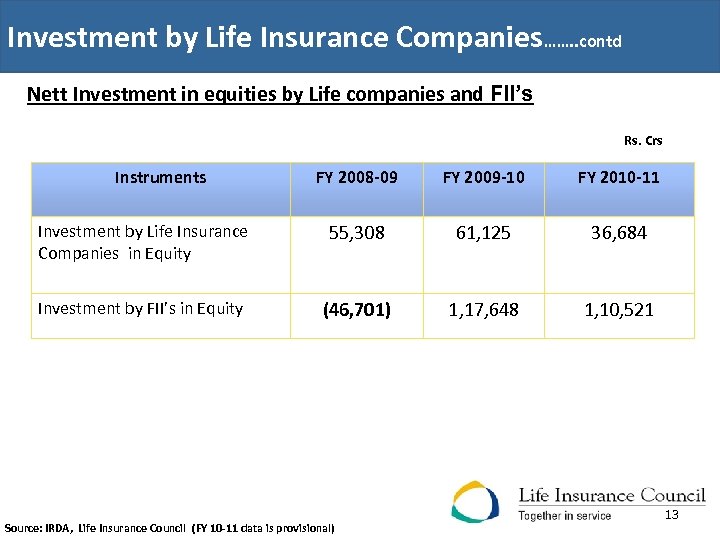

Investment by Life Insurance Companies……. . contd Nett Investment in equities by Life companies and FII’s Rs. Crs Instruments FY 2008 -09 FY 2009 -10 FY 2010 -11 Investment by Life Insurance Companies in Equity 55, 308 61, 125 36, 684 Investment by FII’s in Equity (46, 701) 1, 17, 648 1, 10, 521 Source: IRDA, Life Insurance Council (FY 10 -11 data is provisional) 13

Investment by Life Insurance Companies……. . contd Nett Investment in equities by Life companies and FII’s Rs. Crs Instruments FY 2008 -09 FY 2009 -10 FY 2010 -11 Investment by Life Insurance Companies in Equity 55, 308 61, 125 36, 684 Investment by FII’s in Equity (46, 701) 1, 17, 648 1, 10, 521 Source: IRDA, Life Insurance Council (FY 10 -11 data is provisional) 13

Agenda Expenses of Life Insurance Companies 14

Agenda Expenses of Life Insurance Companies 14

Expenses of Life Insurance Companies Ø Insurance is a long term contract with average tenure of 15 years. Ø Comparatively high start-up cost to be related to a long tenure. Ø Under Section 40 B of Insurance Act 1938, there is a capping on expenses of management. - Exemption is granted to companies in first 5 years of operation. - Any non-compliance later is viewed adversely by IRDA. Ø Maximum Commission payable to agents under various product heads is prescribed in the Insurance Act (section 40 A). Ø Longer the term of the policy, lower is the premium and therefore percent commission is higher. For shorter term policies the percent commission is lower as premium is higher. This ensures that the absolute commission is reasonable. Ø In last five years (i. e. from FY 06 -07 to FY 10 -11) more than Rs. 2, 18, 000 crores of premium was collected at a commission of less than 2. 0% Source: IRDA, Life Insurance Council (FY 10 -11 data is provisional) 15

Expenses of Life Insurance Companies Ø Insurance is a long term contract with average tenure of 15 years. Ø Comparatively high start-up cost to be related to a long tenure. Ø Under Section 40 B of Insurance Act 1938, there is a capping on expenses of management. - Exemption is granted to companies in first 5 years of operation. - Any non-compliance later is viewed adversely by IRDA. Ø Maximum Commission payable to agents under various product heads is prescribed in the Insurance Act (section 40 A). Ø Longer the term of the policy, lower is the premium and therefore percent commission is higher. For shorter term policies the percent commission is lower as premium is higher. This ensures that the absolute commission is reasonable. Ø In last five years (i. e. from FY 06 -07 to FY 10 -11) more than Rs. 2, 18, 000 crores of premium was collected at a commission of less than 2. 0% Source: IRDA, Life Insurance Council (FY 10 -11 data is provisional) 15

Agenda Protection of Policyholders Interest 16

Agenda Protection of Policyholders Interest 16

Protection of Policy holders interest Prevention of Mis-selling ØAll advertisements are to be filed with the regulator & must satisfy fairness criteria. ØIt is mandatory to explicitly give information on the definitions of all the applicable charges, method of appropriation of these charges and the quantum of all the charges during the entire term of the policy. ØAll ULIP sales illustration should highlight the rate of return calculated at 6% and 10% to enable comparison across various products. The illustration is to be signed by the policyholders. ØIt is compulsory to mention on top each ULIP policy document “In this policy, the investment risk in investment portfolio is borne by policy holder. ØDisclosure of Commission to the prospect. ØUnder regulation 6(1)Policy holders are given a 15 day free-look period from the date of receipt of policy document, where in the policy holder can review the terms and condition of the policy and opt to return the policy and claim refund 17

Protection of Policy holders interest Prevention of Mis-selling ØAll advertisements are to be filed with the regulator & must satisfy fairness criteria. ØIt is mandatory to explicitly give information on the definitions of all the applicable charges, method of appropriation of these charges and the quantum of all the charges during the entire term of the policy. ØAll ULIP sales illustration should highlight the rate of return calculated at 6% and 10% to enable comparison across various products. The illustration is to be signed by the policyholders. ØIt is compulsory to mention on top each ULIP policy document “In this policy, the investment risk in investment portfolio is borne by policy holder. ØDisclosure of Commission to the prospect. ØUnder regulation 6(1)Policy holders are given a 15 day free-look period from the date of receipt of policy document, where in the policy holder can review the terms and condition of the policy and opt to return the policy and claim refund 17

Protection of Policy holders interest…………. Contd Fair return to policy-holders ØU/s 17 d of Insurance Act 1938, there is a overall capping on expenses of management. Ø Post 01 st September 2010 the reduction in nett yield for all ULIP policies with term of: 10 years or more More than 15 years - not more than 300 bps at maturity. - not more than 225 bps at maturity. This will cap the expenses under each products offered by life companies. ØLock in period increased to 5 years ØEven spread of charges during the lock in period ØCap on surrender charges / discontinuance. Annual charges are also capped for various maturities. Ø Interest is paid even on discontinuance fund which is on par with saving bank account. ØGuarantee of return at maturity for ULIP Pension / Annuity Plans (4. 5%) 18

Protection of Policy holders interest…………. Contd Fair return to policy-holders ØU/s 17 d of Insurance Act 1938, there is a overall capping on expenses of management. Ø Post 01 st September 2010 the reduction in nett yield for all ULIP policies with term of: 10 years or more More than 15 years - not more than 300 bps at maturity. - not more than 225 bps at maturity. This will cap the expenses under each products offered by life companies. ØLock in period increased to 5 years ØEven spread of charges during the lock in period ØCap on surrender charges / discontinuance. Annual charges are also capped for various maturities. Ø Interest is paid even on discontinuance fund which is on par with saving bank account. ØGuarantee of return at maturity for ULIP Pension / Annuity Plans (4. 5%) 18

Protection of Policy holders interest…………. Contd Grievance Redressal Ø Policy document should clearly mention inter-alia the grievance redressal mechanism, name and address of grievance officer, ombudsman to whom complaint can be registered. ØIRDA has set up an Integrated Grievances Redressal system where the complaint is escalated to higher authorities. Ø There are 12 ombudsman Centre's in India which provides resolution to policy-holders at nominal cost. ØThe companies cannot challenge the decision of the ombudsman. 19

Protection of Policy holders interest…………. Contd Grievance Redressal Ø Policy document should clearly mention inter-alia the grievance redressal mechanism, name and address of grievance officer, ombudsman to whom complaint can be registered. ØIRDA has set up an Integrated Grievances Redressal system where the complaint is escalated to higher authorities. Ø There are 12 ombudsman Centre's in India which provides resolution to policy-holders at nominal cost. ØThe companies cannot challenge the decision of the ombudsman. 19

Protection of Policy holders interest…………. Contd Insurance a “unique product” ØOffers savings and protection in a tax efficient way. . ØMinimum life insurance cover should be 110% of Single Premium for age at entry of 45 years and above and 125 % for age at entry below 45 years. ØCustomizable solution, where the customer can choose his Ø Ø Protection level Investment horizon Additional Benefits (Riders) Option to allocate assets as per need 20

Protection of Policy holders interest…………. Contd Insurance a “unique product” ØOffers savings and protection in a tax efficient way. . ØMinimum life insurance cover should be 110% of Single Premium for age at entry of 45 years and above and 125 % for age at entry below 45 years. ØCustomizable solution, where the customer can choose his Ø Ø Protection level Investment horizon Additional Benefits (Riders) Option to allocate assets as per need 20

Protection of Policy holders interest……………. Contd Transparency and Corporate Governance Public Disclosures Ø Companies are required to disclose detailed financial & statistical information on quarterly /half yearly and yearly basis on their website. Ø Companies are required to publish audited half yearly and annual financial statement in newspapers along with critical ratios. Corporate Governance Ø Companies are required to follow Corporate Governance guidelines which are followed by all listed companies in India. 21

Protection of Policy holders interest……………. Contd Transparency and Corporate Governance Public Disclosures Ø Companies are required to disclose detailed financial & statistical information on quarterly /half yearly and yearly basis on their website. Ø Companies are required to publish audited half yearly and annual financial statement in newspapers along with critical ratios. Corporate Governance Ø Companies are required to follow Corporate Governance guidelines which are followed by all listed companies in India. 21

Agenda Issues related to DTC 22

Agenda Issues related to DTC 22

Issues related to DTC Eligibility Criteria of Premium < 5% of Sum Assured ØInsurance premium will qualify for deductions only if premium paid for any of the years is <5% of sum assured. ØIt will deny benefits to large number of policy holders since typically for age, 30 minimum term will be around 21 or 22 years and for age 40 and above term will be 25 to 26 years. ØIt will lead to inequity as for same term and sum assured, tax exemption would be available to say a 30 years old person but not to 40 years old person because of higher term assurance content. Ø It will deny benefits to large number of people with irregular income like persons working in agriculture sector who prefer single premium policies. ØIRDA has stipulated term cover should be 10 times regular annual premium(125% of single premium) for persons upto age 45 and 7 times (110% of single premium) for others OR alternatively IRDA has suggested tax exemption to all policies with minimum term of 10 years. ØTax Authorities should follow the same principle to ensure long term savings only qualify for tax exemptions Source: Life Insurance Council 23

Issues related to DTC Eligibility Criteria of Premium < 5% of Sum Assured ØInsurance premium will qualify for deductions only if premium paid for any of the years is <5% of sum assured. ØIt will deny benefits to large number of policy holders since typically for age, 30 minimum term will be around 21 or 22 years and for age 40 and above term will be 25 to 26 years. ØIt will lead to inequity as for same term and sum assured, tax exemption would be available to say a 30 years old person but not to 40 years old person because of higher term assurance content. Ø It will deny benefits to large number of people with irregular income like persons working in agriculture sector who prefer single premium policies. ØIRDA has stipulated term cover should be 10 times regular annual premium(125% of single premium) for persons upto age 45 and 7 times (110% of single premium) for others OR alternatively IRDA has suggested tax exemption to all policies with minimum term of 10 years. ØTax Authorities should follow the same principle to ensure long term savings only qualify for tax exemptions Source: Life Insurance Council 23

Issues related to DTC …………. Contd Increase in deduction limit for life insurance and health insurance ØUnder DTC 2010, the aggregate deduction for life cover and health cover is restricted to a sum of Rs. 50, 000 and that to, along with tuition fees. ØAfter payment of health insurance premium and claiming deduction for tuition fees, hardly any amount is left for claiming deduction on payment of life insurance premium. ØThe aggregate deduction limit of upto Rs. 50, 000 specified for life insurance, health insurance and tuition fees payment needs to be revised to provide for deduction of Rs. 100, 000 only for life insurance. ØDeduction limit for health insurance should be separately provided at Rs. 50, 000. Current scenario The current tax regime provides for an aggregate deduction of upto Rs. 100, 000 in respect of premiums paid under a life insurance policy along with other specified investments made. In addition, separate deduction is available to a policyholder upto maximum sum of Rs. 20, 000 towards premiums paid for health cover. Source: Life Insurance Council 24

Issues related to DTC …………. Contd Increase in deduction limit for life insurance and health insurance ØUnder DTC 2010, the aggregate deduction for life cover and health cover is restricted to a sum of Rs. 50, 000 and that to, along with tuition fees. ØAfter payment of health insurance premium and claiming deduction for tuition fees, hardly any amount is left for claiming deduction on payment of life insurance premium. ØThe aggregate deduction limit of upto Rs. 50, 000 specified for life insurance, health insurance and tuition fees payment needs to be revised to provide for deduction of Rs. 100, 000 only for life insurance. ØDeduction limit for health insurance should be separately provided at Rs. 50, 000. Current scenario The current tax regime provides for an aggregate deduction of upto Rs. 100, 000 in respect of premiums paid under a life insurance policy along with other specified investments made. In addition, separate deduction is available to a policyholder upto maximum sum of Rs. 20, 000 towards premiums paid for health cover. Source: Life Insurance Council 24

Issues related to DTC …………. Contd Pensions/annuity policies of life insurance companies ØDeduction should be allowed for an IRDA approved pension fund / annuity plan of a life insurance company under clause 73 of DTC 2010 within the recommended limit of Rs. 120, 000. ØExemption be provided for the amount received from a pension fund / annuity plan upon death by specifically including it in clause 46 of the Sixth schedule. ØSpecific exemption should be provided for commuted amount of pension received, other than under any scheme of an employer by including the same under clause 40 of the Sixth Schedule. ØPension amount received and used to buy an annuity policy from a life insurance company should not taxable in the year of such receipt. ØAnnuity received by the policyholder from a life insurance company should not be taxable. Source: Life Insurance Council 25

Issues related to DTC …………. Contd Pensions/annuity policies of life insurance companies ØDeduction should be allowed for an IRDA approved pension fund / annuity plan of a life insurance company under clause 73 of DTC 2010 within the recommended limit of Rs. 120, 000. ØExemption be provided for the amount received from a pension fund / annuity plan upon death by specifically including it in clause 46 of the Sixth schedule. ØSpecific exemption should be provided for commuted amount of pension received, other than under any scheme of an employer by including the same under clause 40 of the Sixth Schedule. ØPension amount received and used to buy an annuity policy from a life insurance company should not taxable in the year of such receipt. ØAnnuity received by the policyholder from a life insurance company should not be taxable. Source: Life Insurance Council 25

Thank You 26

Thank You 26