Developing A New Crediting Method Jeff Hanschmann

Developing A New Crediting Method Jeff Hanschmann

Why Develop a New Crediting Method? • Feedback and planned enhancements • Options for customers • Simplicity • Innovation 2

Why Develop a New Crediting Method? • Feedback and planned enhancements • Options for customers • Simplicity • Innovation 2

Common Crediting Methods • Annual Point-to-Point • Difference between ending and beginning annual values • Buy a call, sell a call. • Monthly Average* • Difference between average and beginning annual value • Geometric Asian option • Monthly Sum • Sum of monthly returns • Monthly cap (1%) 3

Common Crediting Methods • Annual Point-to-Point • Difference between ending and beginning annual values • Buy a call, sell a call. • Monthly Average* • Difference between average and beginning annual value • Geometric Asian option • Monthly Sum • Sum of monthly returns • Monthly cap (1%) 3

Other Crediting Methods • Rainbow Method* • Weighted average of best performing indices • ING, American General • Trigger Method* • Brand new to life insurance industry (Why hasn’t any company come out with it before? ) • Common in FIA industry 4

Other Crediting Methods • Rainbow Method* • Weighted average of best performing indices • ING, American General • Trigger Method* • Brand new to life insurance industry (Why hasn’t any company come out with it before? ) • Common in FIA industry 4

Rainbow and Asian Option • Index Correlation risk (for blended indexes) • Cholesky Decomposition • In a loose, metaphorical sense, as the matrix analogue of taking the square root of a number • The Cholesky decomposition is commonly used in the Monte Carlo method for simulating systems with multiple correlated variables: The covariance matrix is decomposed, to give the lower-triangular L. Applying this to a vector of uncorrelated samples, u, produces a sample vector Lu with the covariance properties of the system being modeled. • Excel Sheets** 5

Rainbow and Asian Option • Index Correlation risk (for blended indexes) • Cholesky Decomposition • In a loose, metaphorical sense, as the matrix analogue of taking the square root of a number • The Cholesky decomposition is commonly used in the Monte Carlo method for simulating systems with multiple correlated variables: The covariance matrix is decomposed, to give the lower-triangular L. Applying this to a vector of uncorrelated samples, u, produces a sample vector Lu with the covariance properties of the system being modeled. • Excel Sheets** 5

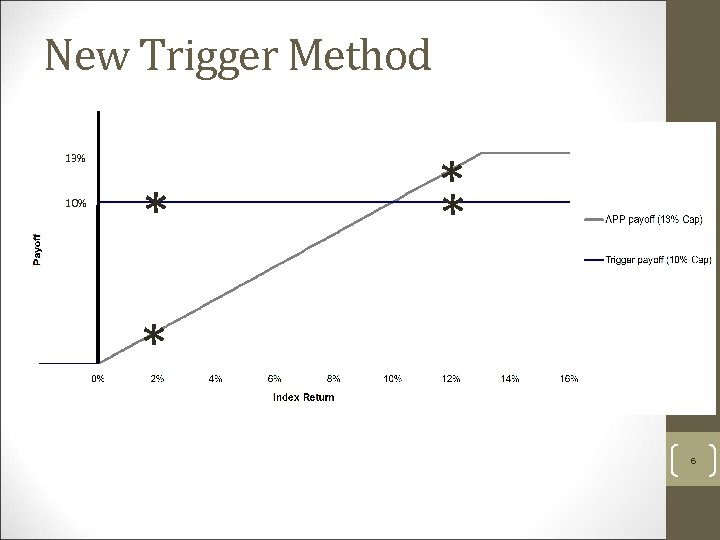

New Trigger Method 13% 10% * * 6

New Trigger Method 13% 10% * * 6

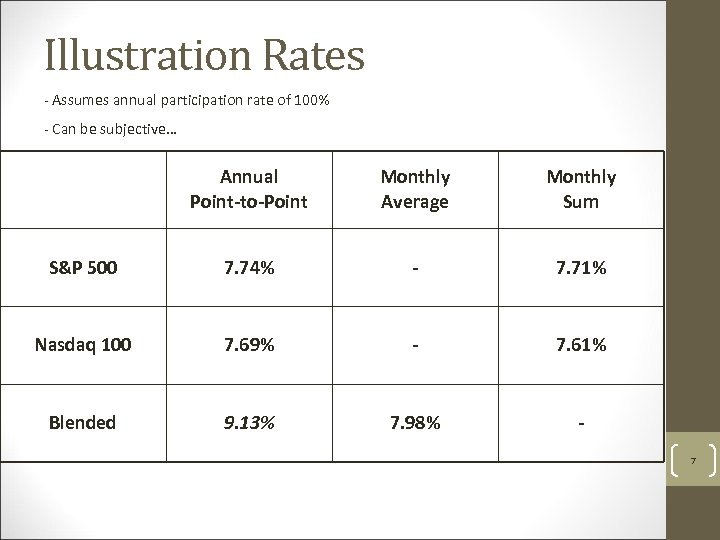

Illustration Rates - Assumes annual participation rate of 100% - Can be subjective… Annual Point-to-Point Monthly Average Monthly Sum S&P 500 7. 74% - 7. 71% Nasdaq 100 7. 69% - 7. 61% Blended 9. 13% 7. 98% 7

Illustration Rates - Assumes annual participation rate of 100% - Can be subjective… Annual Point-to-Point Monthly Average Monthly Sum S&P 500 7. 74% - 7. 71% Nasdaq 100 7. 69% - 7. 61% Blended 9. 13% 7. 98% 7

Illustrations • What initial cap are we able to provide? • Why do we need to blend current and long term if we statically hedge? • Avoid fluctuating caps! • Estimate bank “mark-up” 8

Illustrations • What initial cap are we able to provide? • Why do we need to blend current and long term if we statically hedge? • Avoid fluctuating caps! • Estimate bank “mark-up” 8

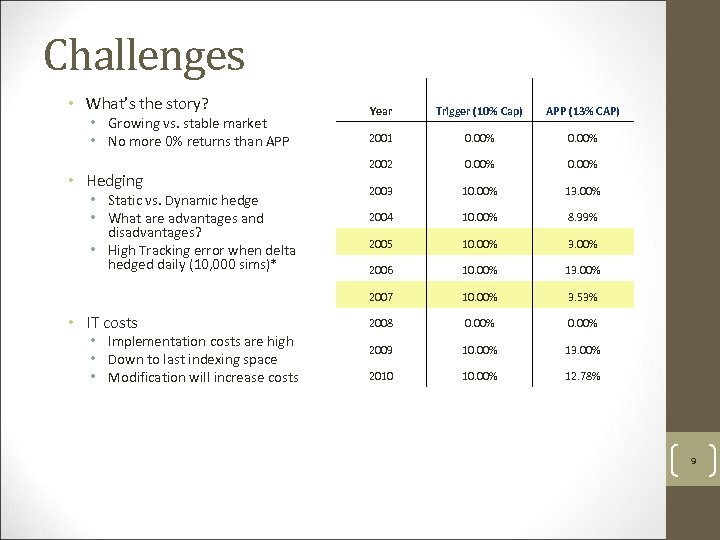

Challenges • What’s the story? • Hedging • Static vs. Dynamic hedge • What are advantages and disadvantages? • High Tracking error when delta hedged daily (10, 000 sims)* • IT costs • Implementation costs are high • Down to last indexing space • Modification will increase costs Year Trigger (10% Cap) APP (13% CAP) 2001 0. 00% 2002 0. 00% 2003 10. 00% 13. 00% 2004 10. 00% 8. 99% 2005 10. 00% 3. 00% 2006 10. 00% 13. 00% 2007 • Growing vs. stable market • No more 0% returns than APP 10. 00% 3. 53% 2008 0. 00% 2009 10. 00% 13. 00% 2010 10. 00% 12. 78% 9

Challenges • What’s the story? • Hedging • Static vs. Dynamic hedge • What are advantages and disadvantages? • High Tracking error when delta hedged daily (10, 000 sims)* • IT costs • Implementation costs are high • Down to last indexing space • Modification will increase costs Year Trigger (10% Cap) APP (13% CAP) 2001 0. 00% 2002 0. 00% 2003 10. 00% 13. 00% 2004 10. 00% 8. 99% 2005 10. 00% 3. 00% 2006 10. 00% 13. 00% 2007 • Growing vs. stable market • No more 0% returns than APP 10. 00% 3. 53% 2008 0. 00% 2009 10. 00% 13. 00% 2010 10. 00% 12. 78% 9

Implementation Process • Product Development partners with… • Concepts (June 2011) • MMPI (Market Research) • Design • CRM (Assumptions and risk evaluation) • Hedging and AIM • Requirements • Marketing (Marketing plan) • IT (Product validation plan) • Implementation (Jan. 2012) • • Operations Suitability Distribution (Training) Filing 10

Implementation Process • Product Development partners with… • Concepts (June 2011) • MMPI (Market Research) • Design • CRM (Assumptions and risk evaluation) • Hedging and AIM • Requirements • Marketing (Marketing plan) • IT (Product validation plan) • Implementation (Jan. 2012) • • Operations Suitability Distribution (Training) Filing 10

Q/A • Thank you!

Q/A • Thank you!