8786d02e79424a0daeaf7638c598a274.ppt

- Количество слайдов: 24

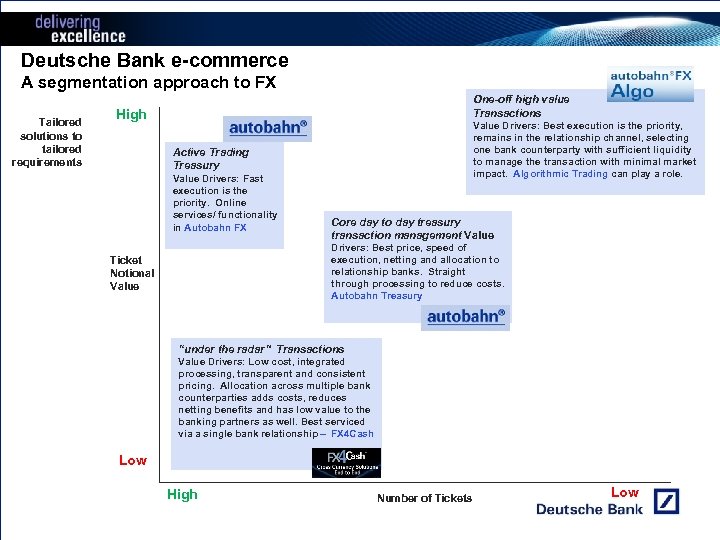

Deutsche Bank e-commerce A segmentation approach to FX Tailored solutions to tailored requirements One-off high value Transactions High Value Drivers: Best execution is the priority, remains in the relationship channel, selecting one bank counterparty with sufficient liquidity to manage the transaction with minimal market impact. Algorithmic Trading can play a role. Active Trading Treasury Value Drivers: Fast execution is the priority. Online services/ functionality in Autobahn FX Core day to day treasury transaction management Value Drivers: Best price, speed of execution, netting and allocation to relationship banks. Straight through processing to reduce costs. Autobahn Treasury Ticket Notional Value “under the radar” Transactions Value Drivers: Low cost, integrated processing, transparent and consistent pricing. Allocation across multiple bank counterparties adds costs, reduces netting benefits and has low value to the banking partners as well. Best serviced via a single bank relationship – FX 4 Cash Low High Number of Tickets Low

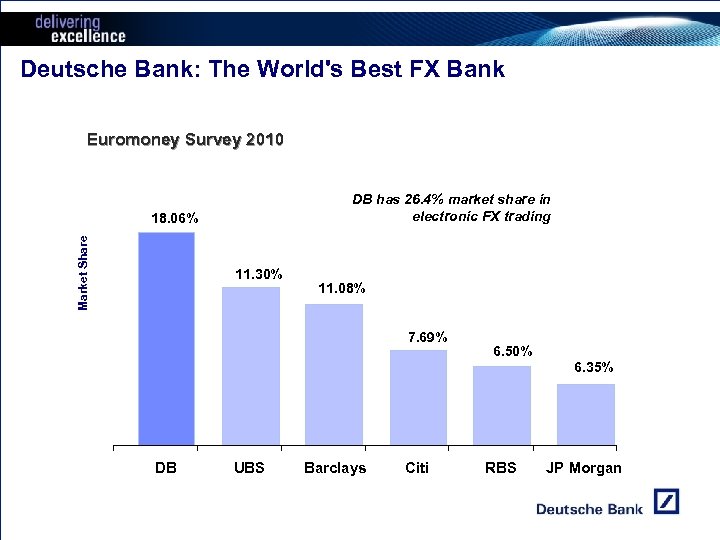

Deutsche Bank: The World's Best FX Bank Euromoney Survey 2010 DB has 26. 4% market share in electronic FX trading Market Share 18. 06% 11. 30% 11. 08% 7. 69% DB UBS Barclays Citi 6. 50% RBS 6. 35% JP Morgan

The challenges keep on coming • Liquidity management • Centralisation • Volatility in markers and in forecasts • Counterparty risk / credit risk • Optimisation of cash – pooling and effectively managing cash Ø Globalisation - operating a 24 hour treasury centre, operational risk Ø Benchmarking a treasury’s performance Ø Reducing per ticket cost of execution Ø Maximising netting across the group of companies/exposures Ø Accounting concerns - IAS 39, GAAP, FASB Ø Technology – opening more doors Ø European Payments Directive initiatives Ø Legal issues as more currencies join the EURO

What is FX 4 Cash? n A cross-currency payment solution – Enable you to make and receive payments in 125 currencies without having to maintain foreign currency accounts n A streamlined process – Allow you to handle small value, repetitive cross-border payments efficiently and cost-effectively n A strong value proposition – Combine Deutsche Bank’s leading Foreign Exchange (FX) offerings and payment capabilities n Receivables – Convert incoming FX payments into the base currency of your choice – Credit to your account at DB or with another bank n Active Client Funding – Use FX 4 Cash, without having accounts in DB – Client sends funding directly from their acc in another bank to DB LDN

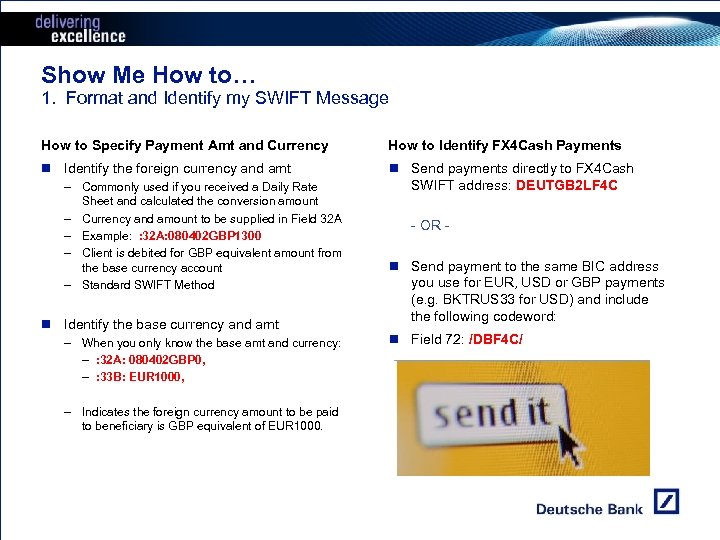

Show Me How to… 1. Format and Identify my SWIFT Message How to Specify Payment Amt and Currency How to Identify FX 4 Cash Payments n Identify the foreign currency and amt n Send payments directly to FX 4 Cash SWIFT address: DEUTGB 2 LF 4 C – Commonly used if you received a Daily Rate Sheet and calculated the conversion amount – Currency and amount to be supplied in Field 32 A – Example: : 32 A: 080402 GBP 1300 – Client is debited for GBP equivalent amount from the base currency account – Standard SWIFT Method n Identify the base currency and amt – When you only know the base amt and currency: – : 32 A: 080402 GBP 0, – : 33 B: EUR 1000, – Indicates the foreign currency amount to be paid to beneficiary is GBP equivalent of EUR 1000. - OR - n Send payment to the same BIC address you use for EUR, USD or GBP payments (e. g. BKTRUS 33 for USD) and include the following codeword: n Field 72: /DBF 4 C/

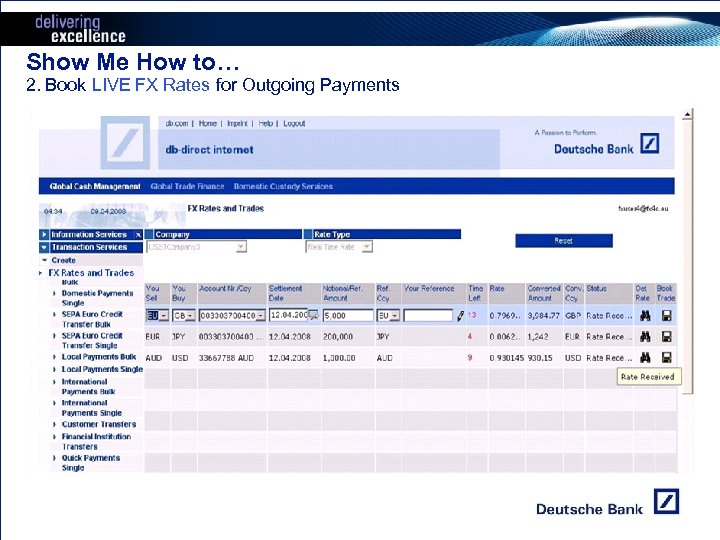

Show Me How to… 2. Book LIVE FX Rates for Outgoing Payments

FX 4 Cash supports the following 125 disbursement currencies ALL DZD AOA ARS AMD AUD BSD BHD BDT BBD BYR BZD BOB BAM BWP BRL GBP BGN BIF KHR CAD CVE XOF XAF CLP CNY COP CDF CRC HRK CZK DKK DJF DOP XCD EGP ERN EEK ETB EUR FJD GMD Albanian Lek Algerian Dinar Angola Kwanza Argentine Peso Armenian Dram Australian Dollar Bahamian Dollar Bahrain Dinar Bangladesh Taka Barbadian Dollar Belarusian Ruble Belize Dollar Boliviano Bosnia Herzegovina Marka Botswana Pula Brazilian Real British Pound Bulgarian Lev Burundian Franc Cambodian Riel Canadian Dollar Cape Verdean Escudo Central African States CFA Franc BCEAO Central African States CFA Franc BEAC Chilean Peso Chinese Yuan Columbian Peso Congolese Franc Costa Rican Colon Croatian Kuna Czech Republic Koruna Danish Krone Djiboutian Franc Dominican Peso Eastern Caribbean Dollar Egyptian Pound Eritrean Nakfa Estonian Kroon Ethiopia Birr Euro Fijian Dollar Gambian Dalasi GEL GHS GTQ GNF GYD HTG HNL HKD HUF ISK INR IDR IQD ILS JMD JPY KZT KES KRW KWD LVL LBP LSL LRD LTL MKD MGA MWK MYR MRO MUR MXN MNT MAD MZN NAD NPR ANG NZD NIO NGN Georgian Lari Ghanaian Cedi Guatemalan Quetzal Guinean Franc Guyanese Dollar Haitian Gourde Honduran Lempira Hong Kong Dollar Hungarian Forint Icelandic Krona Indian Rupee Indonesian Rupiah Iraqi Dinar Israeli Shekel Jamaican Dollar Japanese Yen Kazakhstan Tenge Kenyan Shilling Korean Won Kuwaiti Dinar Latvian Lats Lebanese Pound Lesotho Loti Liberian Dollar Lithuanian Litas Macedonian Dinar Malagasy Ariary Malawi Kwacha Malaysia Ringgit Mauritanian Ouguiya Mauritius Rupee Mexican Peso Mongolia Tugrik Moroccan Dirham Mozambique Metical Namibian Dollar Nepalese Rupee Netherlands Antillean Guilder New Zealand Dollar Nicaragua Cordoba Nigerian Naira NOK OMR PKR PGK PYG PEN PHP PLN QAR RON RUB RWF STD SAR RSD SLL SGD SBD ZAR LKR SRD SZL SEK CHF XPF TWD TZS THB TOP TTD TND TRY UGX AED USD UYU VUV VEF VND WST ZMK Norwegian Krone Omani Rial Pakistan Rupee Papua New Guinea Kina Paraguay Guarani Peruvian Nuevo Sol Philippine Peso Polish Zloty Qatari Rial Romanian Leu Russia Rouble Rwandan Franc Sao Tome & Principe Dobra Saudi Arabian Riyal Serbian Dinar Sierra Leone Singapore Dollar Solomon Islands Dollar South African Rand Sri Lanka Rupee Surinamese Dollar Swaziland Lilangeni Swedish Krona Swiss Franc Tahitian Franc Taiwanese Dollar Tanzanian Shilling Thai Bhat Tonga Pa’anga Trinidad & Tobago Dollar Tunisian Dinar Turkish New Lira Ugandan Shilling United Arab Emirates Dirham United States Dollar Uruguayan New Peso Vanuatu Venezuelan Bolivar Fuerte Vietnamese Dong West Samoa Tala Zambia Kwacha

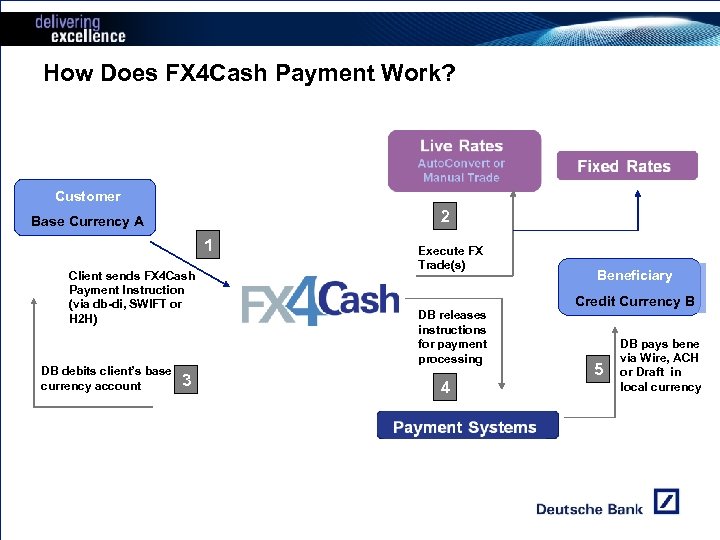

How Does FX 4 Cash Payment Work? Customer 2 Base Currency A 1 Client sends FX 4 Cash Payment Instruction (via db-di, SWIFT or H 2 H) DB debits client’s base currency account 3 Execute FX Trade(s) DB releases instructions for payment processing 4 Beneficiary Credit Currency B 5 DB pays bene via Wire, ACH or Draft in local currency

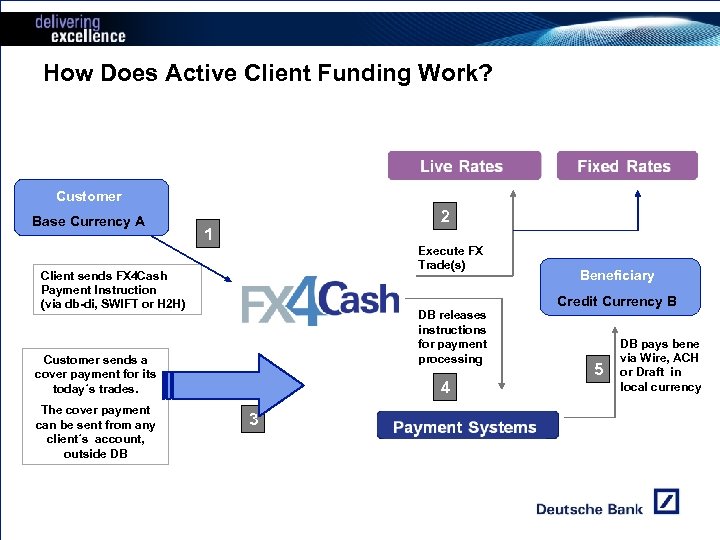

How Does Active Client Funding Work? Customer Base Currency A 2 1 Execute FX Trade(s) Client sends FX 4 Cash Payment Instruction (via db-di, SWIFT or H 2 H) DB releases instructions for payment processing Customer sends a cover payment for its today´s trades. The cover payment can be sent from any client´s account, outside DB 4 3 Beneficiary Credit Currency B 5 DB pays bene via Wire, ACH or Draft in local currency

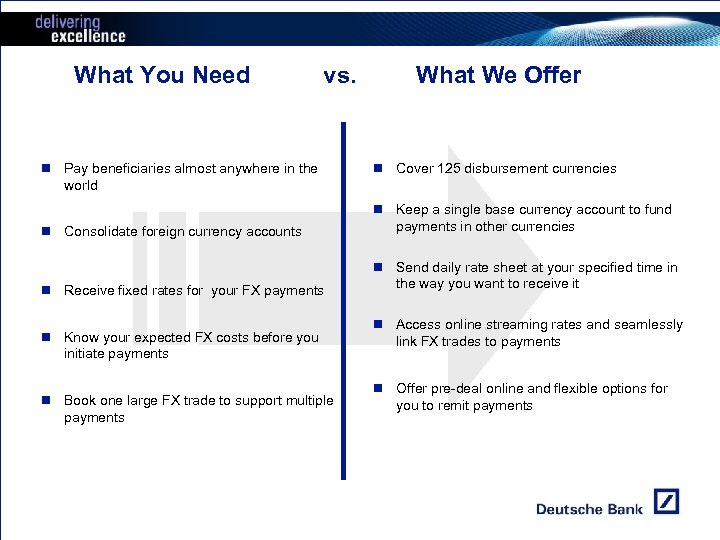

What You Need vs. Customer Needs n Pay beneficiaries almost anywhere in the world What We Offer db. FX 4 Cash Solutions n Cover 125 disbursement currencies n Consolidate foreign currency accounts n Keep a single base currency account to fund payments in other currencies n Receive fixed rates for your FX payments n Send daily rate sheet at your specified time in the way you want to receive it n Know your expected FX costs before you initiate payments n Book one large FX trade to support multiple payments n Access online streaming rates and seamlessly link FX trades to payments n Offer pre-deal online and flexible options for you to remit payments

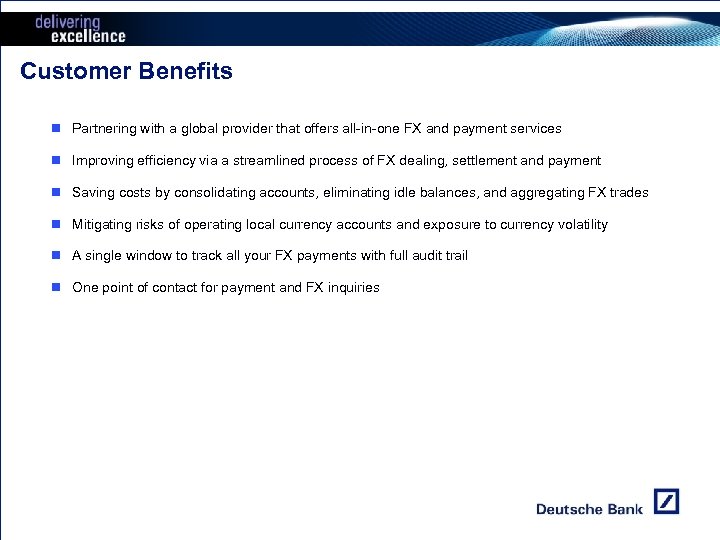

Customer Benefits n Partnering with a global provider that offers all-in-one FX and payment services n Improving efficiency via a streamlined process of FX dealing, settlement and payment n Saving costs by consolidating accounts, eliminating idle balances, and aggregating FX trades n Mitigating risks of operating local currency accounts and exposure to currency volatility n A single window to track all your FX payments with full audit trail n One point of contact for payment and FX inquiries

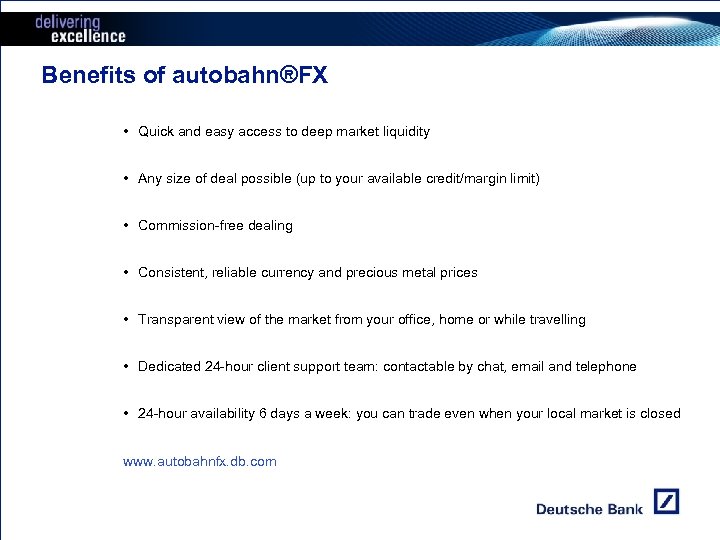

Benefits of autobahn®FX • Quick and easy access to deep market liquidity • Any size of deal possible (up to your available credit/margin limit) • Commission-free dealing • Consistent, reliable currency and precious metal prices • Transparent view of the market from your office, home or while travelling • Dedicated 24 -hour client support team: contactable by chat, email and telephone • 24 -hour availability 6 days a week: you can trade even when your local market is closed www. autobahnfx. db. com

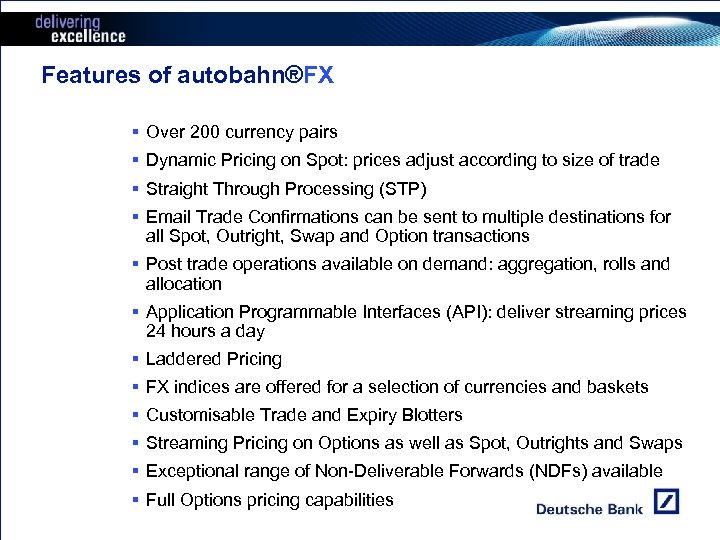

Features of autobahn®FX § Over 200 currency pairs § Dynamic Pricing on Spot: prices adjust according to size of trade § Straight Through Processing (STP) § Email Trade Confirmations can be sent to multiple destinations for all Spot, Outright, Swap and Option transactions § Post trade operations available on demand: aggregation, rolls and allocation § Application Programmable Interfaces (API): deliver streaming prices 24 hours a day § Laddered Pricing § FX indices are offered for a selection of currencies and baskets § Customisable Trade and Expiry Blotters § Streaming Pricing on Options as well as Spot, Outrights and Swaps § Exceptional range of Non-Deliverable Forwards (NDFs) available § Full Options pricing capabilities

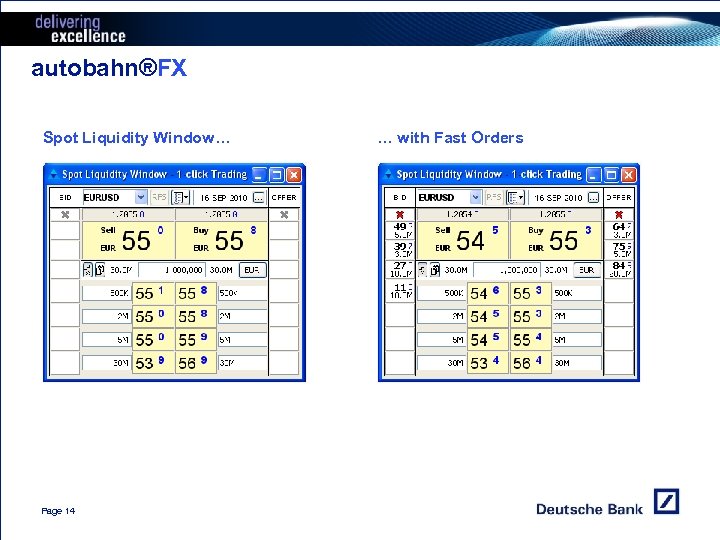

autobahn®FX Spot Liquidity Window… Page 14 … with Fast Orders

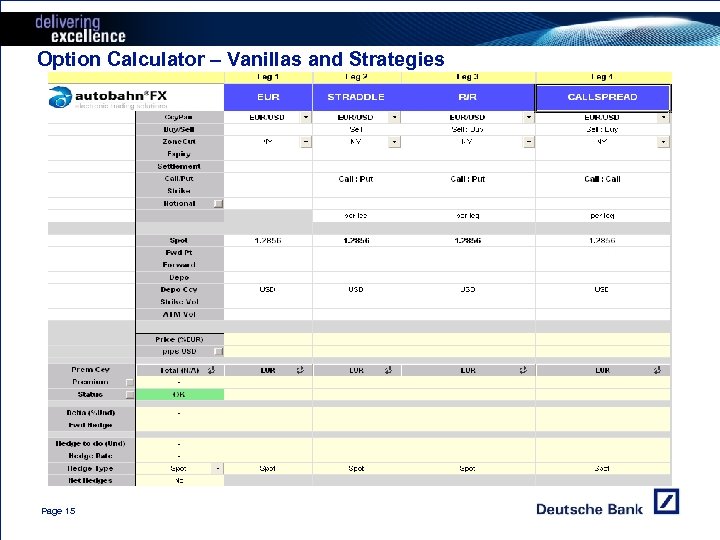

Option Calculator – Vanillas and Strategies Page 15

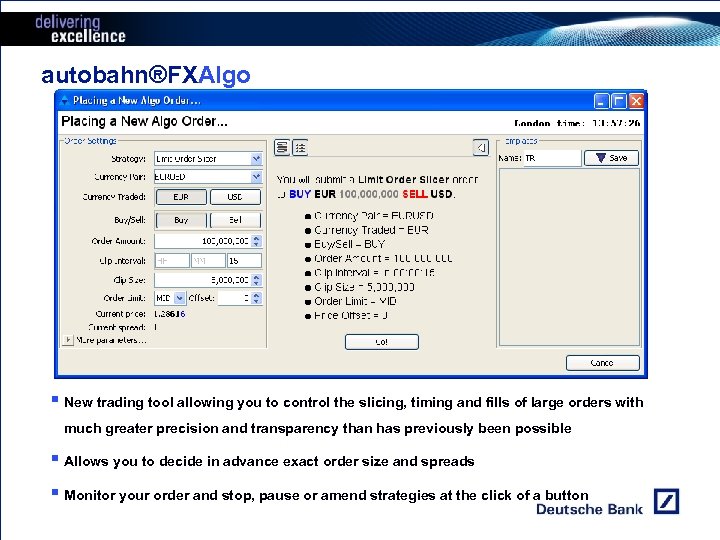

autobahn®FXAlgo § New trading tool allowing you to control the slicing, timing and fills of large orders with much greater precision and transparency than has previously been possible § Allows you to decide in advance exact order size and spreads § Monitor your order and stop, pause or amend strategies at the click of a button

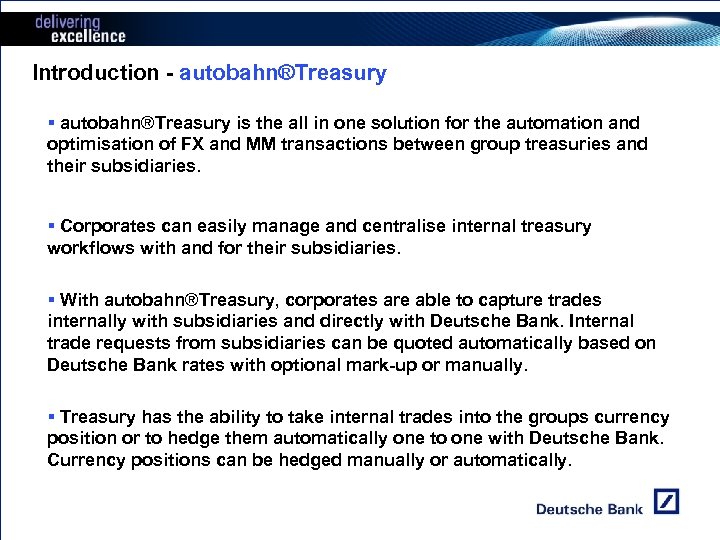

Introduction - autobahn®Treasury § autobahn®Treasury is the all in one solution for the automation and optimisation of FX and MM transactions between group treasuries and their subsidiaries. § Corporates can easily manage and centralise internal treasury workflows with and for their subsidiaries. § With autobahn®Treasury, corporates are able to capture trades internally with subsidiaries and directly with Deutsche Bank. Internal trade requests from subsidiaries can be quoted automatically based on Deutsche Bank rates with optional mark-up or manually. § Treasury has the ability to take internal trades into the groups currency position or to hedge them automatically one to one with Deutsche Bank. Currency positions can be hedged manually or automatically.

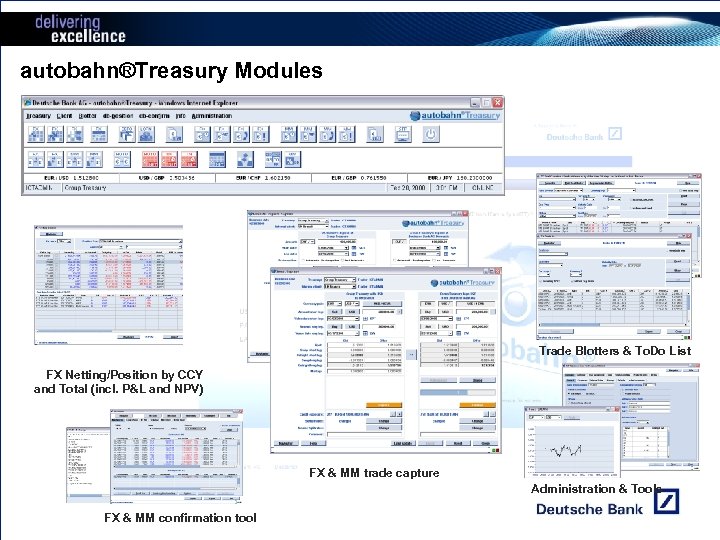

autobahn®Treasury Modules Trade Blotters & To. Do List FX Netting/Position by CCY and Total (incl. P&L and NPV) FX & MM trade capture Administration & Tools FX & MM confirmation tool

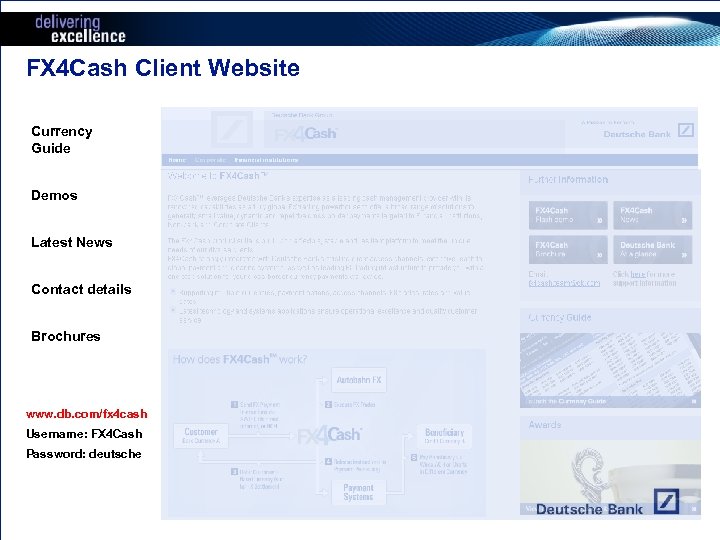

FX 4 Cash Client Website Currency Guide Demos Latest News Contact details Brochures www. db. com/fx 4 cash Username: FX 4 Cash Password: deutsche

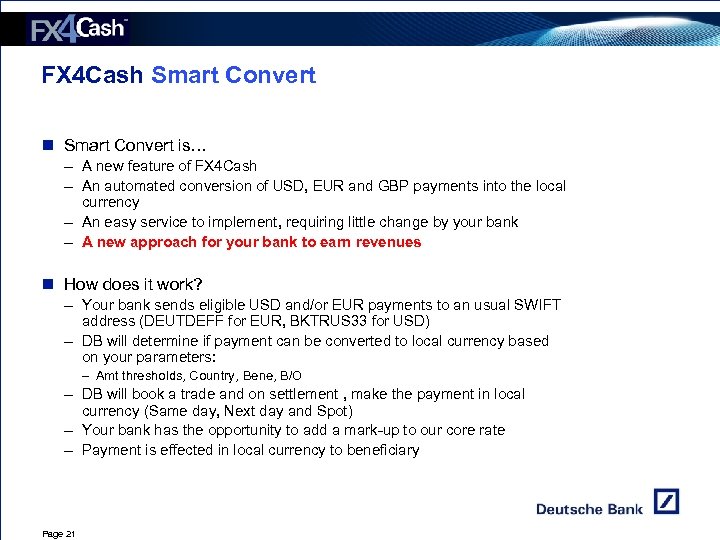

FX 4 Cash Smart Convert n Smart Convert is… – A new feature of FX 4 Cash – An automated conversion of USD, EUR and GBP payments into the local currency – An easy service to implement, requiring little change by your bank – A new approach for your bank to earn revenues n How does it work? – Your bank sends eligible USD and/or EUR payments to an usual SWIFT address (DEUTDEFF for EUR, BKTRUS 33 for USD) – DB will determine if payment can be converted to local currency based on your parameters: – Amt thresholds, Country, Bene, B/O – DB will book a trade and on settlement , make the payment in local currency (Same day, Next day and Spot) – Your bank has the opportunity to add a mark-up to our core rate – Payment is effected in local currency to beneficiary Page 21

The Details: Flow and Override Controls Flow Controls n Available currencies – Set-up for each client – If BBK field (57) is a valid country (5 th and 6 th characters), Smart Convert will convert to respective currency n Amount thresholds – Ability to set minimum and maximum thresholds – Minimum should not be less than USD/EUR 500 – Maximum should generally not be greater than USD/EUR 500 k n Other Inclusion options: – Any field in payment message – For example, the client may want to set-up Swiss Franc for only two beneficiary banks Override Controls n Payment Details – – Beneficiary By Order Party Beneficiary Bank Reference n Wildcards available n Other Overrides – Intercompany transfers (Field 23=INTC) Page 22

The Details: Managing Reconverts n Reconverts – Reconverts occur when we receive a complaint from the bene or our client about the conversion and we are requested to pay in the original currency – Once funds are returned, FX 4 Cash Investigations will reconvert the paid funds to the original currency using the rates for that day – The payment is then re-effected in full amount to the beneficiary in the original currency – Your bank has the option of automatically setting the beneficiary on an override pattern or you can review individually – When the conversion to the original currency occurs, there may be a gain or loss from the conversion. – We will ensure special arrangements with your bank to manage this gain or loss. Page 23

Questions and Answers – Smart Convert n Q: Is there a legal agreement needed? n A: Yes, a slim 3 page agreement is required n Q: Why do we limit the currencies to 39? n A: We limit the currencies to those provided by DB London where we do not face restrictions in the payment or in their returns n Q: How do we manage returns or complaints? n A: Once we receive a return, we will re-effect the full original currency amount. The potential gain or loss can be borne by the customer or the sales manager n Q: How do I get implemented? n A: The same implementation process used for FX 4 Cash is used for Smart Convert. Once the setup form is completed, a client kick off meeting will be scheduled. Page 24 n Q: Can our bank use standard FX 4 Cash as well as Smart Convert? n A: Yes. However, we currently cannot differentiate the markup or client margin between the two services unless the client opens a separate account n Q: What are the special formatting requirements? n A: There are none.

8786d02e79424a0daeaf7638c598a274.ppt