60a3b22b4aeefe5f6611b7486f8d4eba.ppt

- Количество слайдов: 7

Determining a Reasonable Period for Amortization of a Non-Conforming Use Presentation to the Albuquerque City Council Philip T. Ganderton Professor and Chair, Dept. of Economics, UNM November 21, 2005

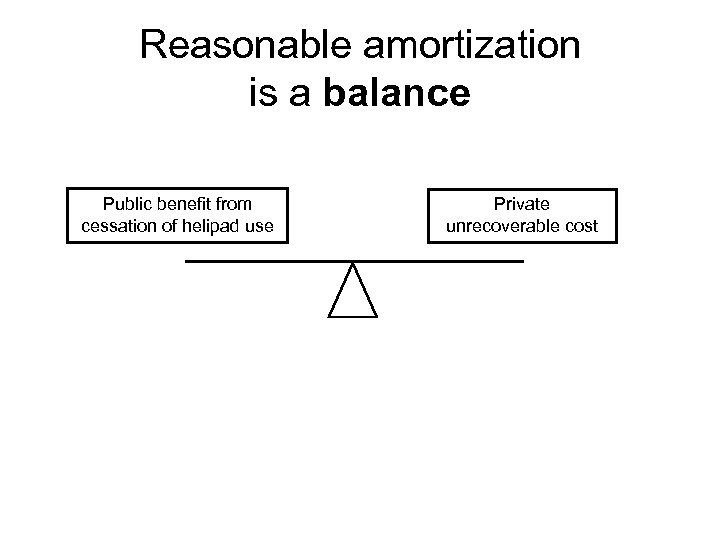

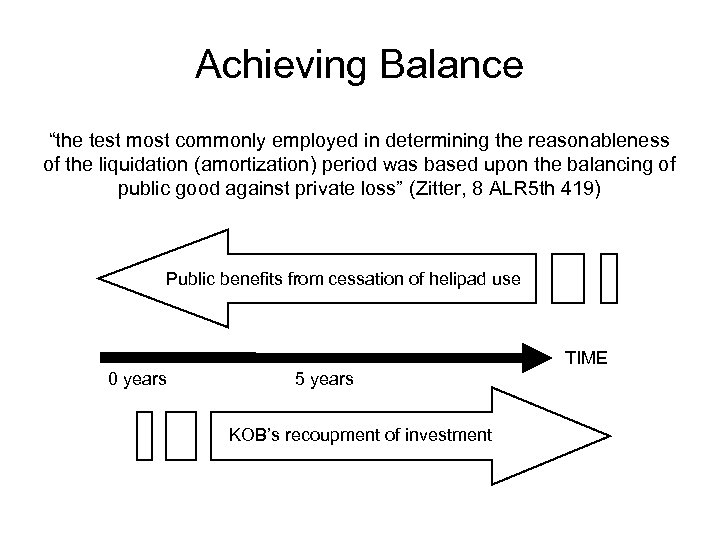

Reasonable amortization is a balance Public benefit from cessation of helipad use Private unrecoverable cost

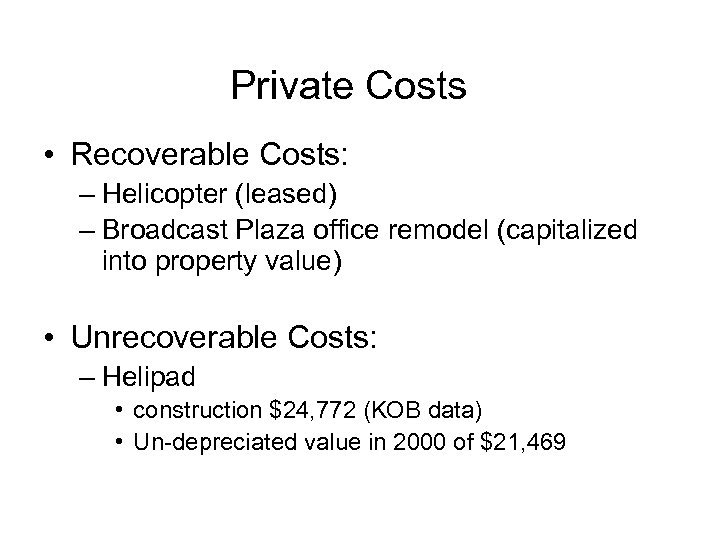

Private Costs • Recoverable Costs: – Helicopter (leased) – Broadcast Plaza office remodel (capitalized into property value) • Unrecoverable Costs: – Helipad • construction $24, 772 (KOB data) • Un-depreciated value in 2000 of $21, 469

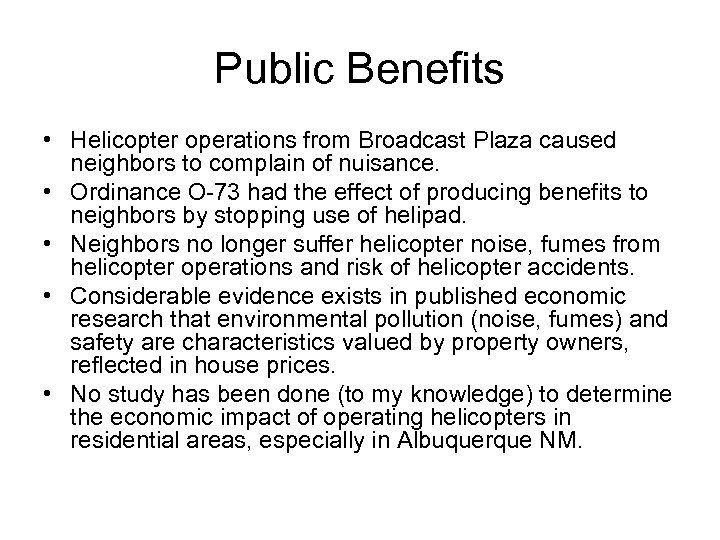

Public Benefits • Helicopter operations from Broadcast Plaza caused neighbors to complain of nuisance. • Ordinance O-73 had the effect of producing benefits to neighbors by stopping use of helipad. • Neighbors no longer suffer helicopter noise, fumes from helicopter operations and risk of helicopter accidents. • Considerable evidence exists in published economic research that environmental pollution (noise, fumes) and safety are characteristics valued by property owners, reflected in house prices. • No study has been done (to my knowledge) to determine the economic impact of operating helicopters in residential areas, especially in Albuquerque NM.

Achieving Balance “the test most commonly employed in determining the reasonableness of the liquidation (amortization) period was based upon the balancing of public good against private loss” (Zitter, 8 ALR 5 th 419) Public benefits from cessation of helipad use TIME 0 years 5 years KOB’s recoupment of investment

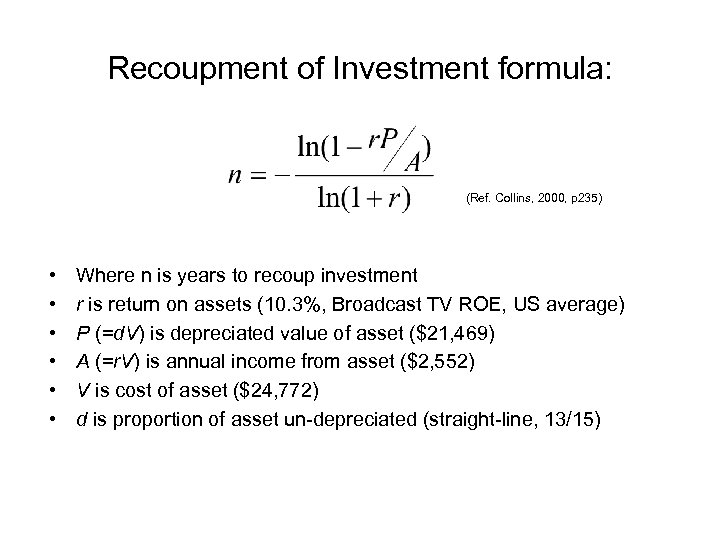

Recoupment of Investment formula: (Ref. Collins, 2000, p 235) • • • Where n is years to recoup investment r is return on assets (10. 3%, Broadcast TV ROE, US average) P (=d. V) is depreciated value of asset ($21, 469) A (=r. V) is annual income from asset ($2, 552) V is cost of asset ($24, 772) d is proportion of asset un-depreciated (straight-line, 13/15)

References • References: – Collins, M. “Methods of Determining Amortization Periods for Non-Conforming Uses” Washington University Journal of Law and Policy, Vol. 3: 2000, 215 -240. – Varadarajan, D. “Billboards and Big Utilities: Borrowing Land-Use Concepts to Regulate Non. Conforming Sources Under the Clean Air Act” Yale Law Journal, Vol. 112: 2003, 2553 -2589. – Owens, D. W. “Amortization: An Old Land-Use Controversy Heats Up” University of North Carolina School of Government, 2001. – Zitter, J. M. “Validity of Provisions for Amortization of Nonconforming Uses” 8 ALR 5 th 391.

60a3b22b4aeefe5f6611b7486f8d4eba.ppt