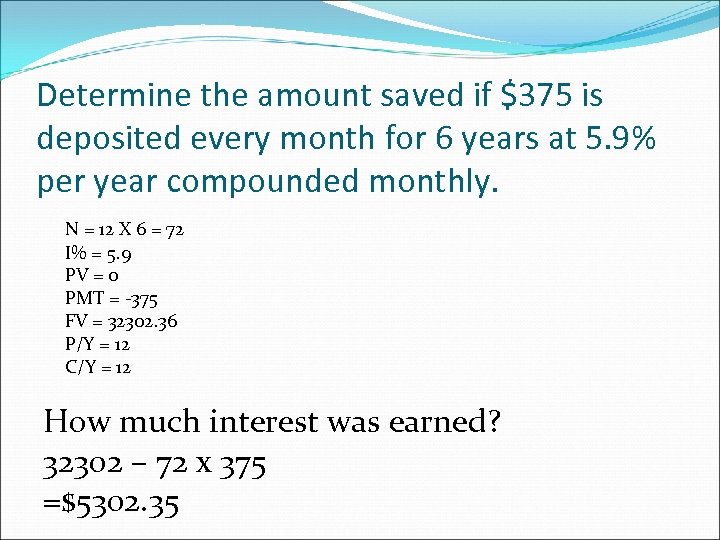

Determine the amount saved if $375 is deposited every month for 6 years at 5. 9% per year compounded monthly. N = 12 X 6 = 72 I% = 5. 9 PV = 0 PMT = -375 FV = 32302. 36 P/Y = 12 C/Y = 12 How much interest was earned? 32302 – 72 x 375 =$5302. 35

Determine the amount saved if $375 is deposited every month for 6 years at 5. 9% per year compounded monthly. N = 12 X 6 = 72 I% = 5. 9 PV = 0 PMT = -375 FV = 32302. 36 P/Y = 12 C/Y = 12 How much interest was earned? 32302 – 72 x 375 =$5302. 35

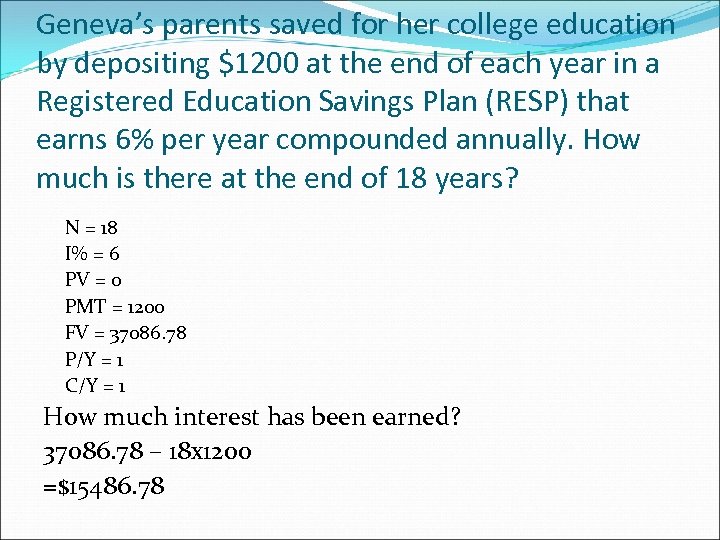

Geneva’s parents saved for her college education by depositing $1200 at the end of each year in a Registered Education Savings Plan (RESP) that earns 6% per year compounded annually. How much is there at the end of 18 years? N = 18 I% = 6 PV = 0 PMT = 1200 FV = 37086. 78 P/Y = 1 C/Y = 1 How much interest has been earned? 37086. 78 – 18 x 1200 =$15486. 78

Geneva’s parents saved for her college education by depositing $1200 at the end of each year in a Registered Education Savings Plan (RESP) that earns 6% per year compounded annually. How much is there at the end of 18 years? N = 18 I% = 6 PV = 0 PMT = 1200 FV = 37086. 78 P/Y = 1 C/Y = 1 How much interest has been earned? 37086. 78 – 18 x 1200 =$15486. 78

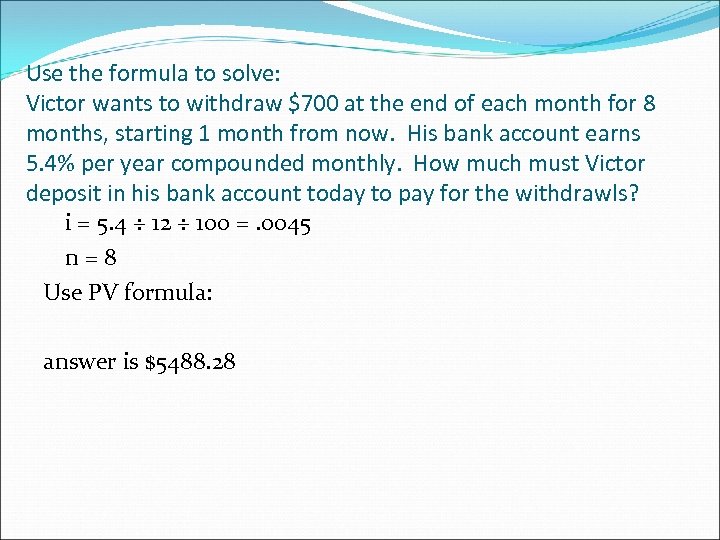

Use the formula to solve: Victor wants to withdraw $700 at the end of each month for 8 months, starting 1 month from now. His bank account earns 5. 4% per year compounded monthly. How much must Victor deposit in his bank account today to pay for the withdrawls? i = 5. 4 ÷ 12 ÷ 100 =. 0045 n=8 Use PV formula: answer is $5488. 28

Use the formula to solve: Victor wants to withdraw $700 at the end of each month for 8 months, starting 1 month from now. His bank account earns 5. 4% per year compounded monthly. How much must Victor deposit in his bank account today to pay for the withdrawls? i = 5. 4 ÷ 12 ÷ 100 =. 0045 n=8 Use PV formula: answer is $5488. 28

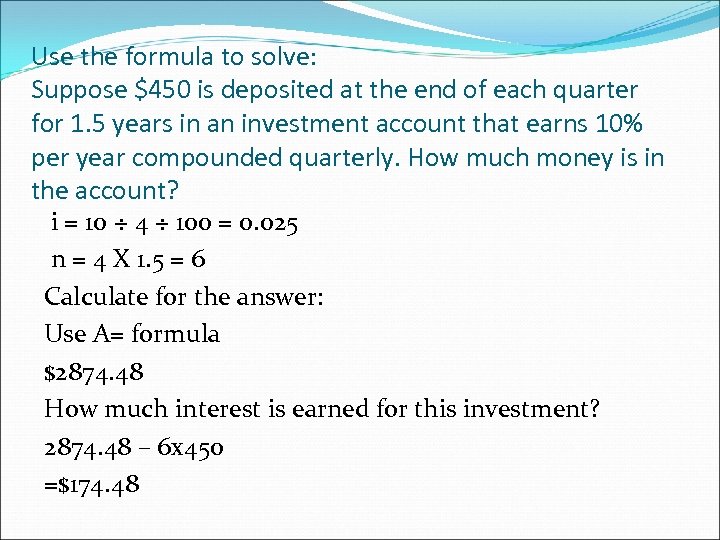

Use the formula to solve: Suppose $450 is deposited at the end of each quarter for 1. 5 years in an investment account that earns 10% per year compounded quarterly. How much money is in the account? i = 10 ÷ 4 ÷ 100 = 0. 025 n = 4 X 1. 5 = 6 Calculate for the answer: Use A= formula $2874. 48 How much interest is earned for this investment? 2874. 48 – 6 x 450 =$174. 48

Use the formula to solve: Suppose $450 is deposited at the end of each quarter for 1. 5 years in an investment account that earns 10% per year compounded quarterly. How much money is in the account? i = 10 ÷ 4 ÷ 100 = 0. 025 n = 4 X 1. 5 = 6 Calculate for the answer: Use A= formula $2874. 48 How much interest is earned for this investment? 2874. 48 – 6 x 450 =$174. 48

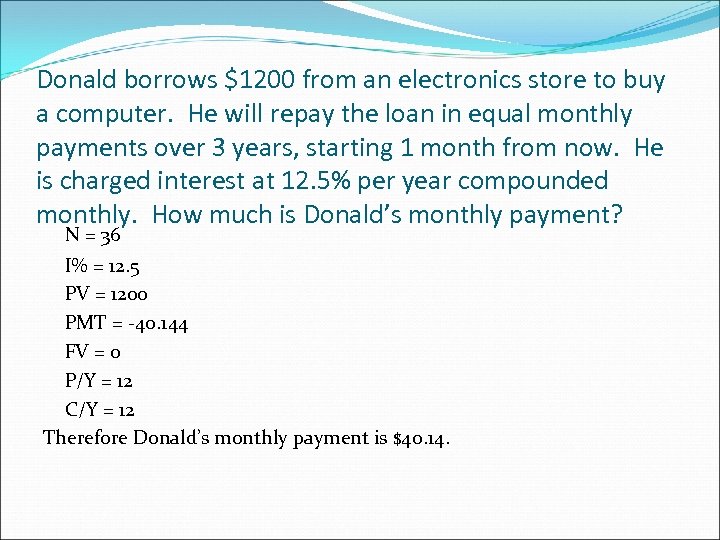

Donald borrows $1200 from an electronics store to buy a computer. He will repay the loan in equal monthly payments over 3 years, starting 1 month from now. He is charged interest at 12. 5% per year compounded monthly. How much is Donald’s monthly payment? N = 36 I% = 12. 5 PV = 1200 PMT = -40. 144 FV = 0 P/Y = 12 C/Y = 12 Therefore Donald’s monthly payment is $40. 14.

Donald borrows $1200 from an electronics store to buy a computer. He will repay the loan in equal monthly payments over 3 years, starting 1 month from now. He is charged interest at 12. 5% per year compounded monthly. How much is Donald’s monthly payment? N = 36 I% = 12. 5 PV = 1200 PMT = -40. 144 FV = 0 P/Y = 12 C/Y = 12 Therefore Donald’s monthly payment is $40. 14.

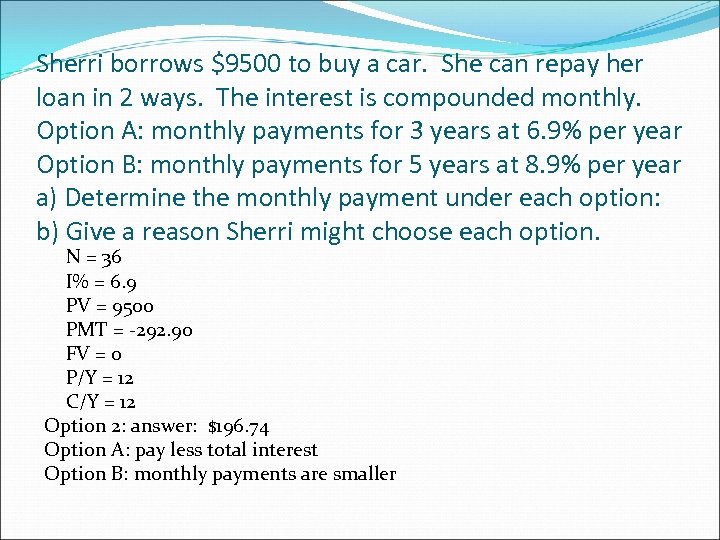

Sherri borrows $9500 to buy a car. She can repay her loan in 2 ways. The interest is compounded monthly. Option A: monthly payments for 3 years at 6. 9% per year Option B: monthly payments for 5 years at 8. 9% per year a) Determine the monthly payment under each option: b) Give a reason Sherri might choose each option. N = 36 I% = 6. 9 PV = 9500 PMT = -292. 90 FV = 0 P/Y = 12 C/Y = 12 Option 2: answer: $196. 74 Option A: pay less total interest Option B: monthly payments are smaller

Sherri borrows $9500 to buy a car. She can repay her loan in 2 ways. The interest is compounded monthly. Option A: monthly payments for 3 years at 6. 9% per year Option B: monthly payments for 5 years at 8. 9% per year a) Determine the monthly payment under each option: b) Give a reason Sherri might choose each option. N = 36 I% = 6. 9 PV = 9500 PMT = -292. 90 FV = 0 P/Y = 12 C/Y = 12 Option 2: answer: $196. 74 Option A: pay less total interest Option B: monthly payments are smaller

What is an RRSP? What is an RESP? Why would you save using them?

What is an RRSP? What is an RESP? Why would you save using them?

Jane and Jim buy a house for $170 000 and put a 20% down payment on the house. How much is their mortgage for? . 20 X 170 000 = $34 000 down payment Mortgage: 170 000 – 34 000 = 136 000 Calculate their monthly payments if they have a mortgage rate of 5% compounded semi-annually for a 5 year term and it is amortized over 25 years. N = 25 X 12 = 300 I% = 5 PV = 136000 PMT = -790. 98 FV = 0 P/Y = 12 C/Y =2 Therefore: Jim and Jane’s regular monthly payment would be $790. 98

Jane and Jim buy a house for $170 000 and put a 20% down payment on the house. How much is their mortgage for? . 20 X 170 000 = $34 000 down payment Mortgage: 170 000 – 34 000 = 136 000 Calculate their monthly payments if they have a mortgage rate of 5% compounded semi-annually for a 5 year term and it is amortized over 25 years. N = 25 X 12 = 300 I% = 5 PV = 136000 PMT = -790. 98 FV = 0 P/Y = 12 C/Y =2 Therefore: Jim and Jane’s regular monthly payment would be $790. 98