e692dc13b84d902fba489db2e77cf1dc.ppt

- Количество слайдов: 17

Deter, Detect, Defend: The FTC’s Program on Identity Theft

Deter, Detect, Defend: The FTC’s Program on Identity Theft

What is Identity Theft? u When someone else uses your personally identifying information without your knowledge or permission to § § § Obtain Credit Cards Get Wireless or phone products, services Get Loans and Mortgages Obtain Employment Avoid Criminal Penalties Commit Other Frauds or Crimes

What is Identity Theft? u When someone else uses your personally identifying information without your knowledge or permission to § § § Obtain Credit Cards Get Wireless or phone products, services Get Loans and Mortgages Obtain Employment Avoid Criminal Penalties Commit Other Frauds or Crimes

What Kind of Information Does an Identity Thief Need? u Identity § § § thieves use: Social Security Number Name and Address Date of Birth Mother’s Maiden Name Driver’s License Credit Card, Bank and other Account Numbers

What Kind of Information Does an Identity Thief Need? u Identity § § § thieves use: Social Security Number Name and Address Date of Birth Mother’s Maiden Name Driver’s License Credit Card, Bank and other Account Numbers

Consequences of Identity Theft u Identity thief seldom pays bills for debts incurred under your name u You may not discover for months or years u You are saddled with bad credit report u Due to bad credit report, you may be denied or charged higher rates for new credit, loans, mortgages, utility service, or employment u If criminal record created in your name, you may fail background checks for employment, firearms, etc. , may even spend time in jail

Consequences of Identity Theft u Identity thief seldom pays bills for debts incurred under your name u You may not discover for months or years u You are saddled with bad credit report u Due to bad credit report, you may be denied or charged higher rates for new credit, loans, mortgages, utility service, or employment u If criminal record created in your name, you may fail background checks for employment, firearms, etc. , may even spend time in jail

Students Are a Vulnerable Group u. Developing financial identity u. Targeted age category by ID thieves

Students Are a Vulnerable Group u. Developing financial identity u. Targeted age category by ID thieves

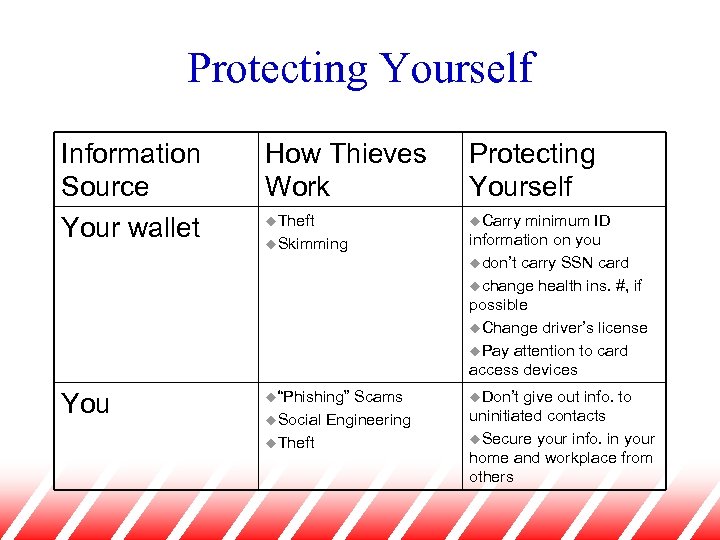

Protecting Yourself Information Source Your wallet How Thieves Work Protecting Yourself u. Theft u. Carry You u“Phishing” u. Skimming Scams u. Social Engineering u. Theft minimum ID information on you udon’t carry SSN card uchange health ins. #, if possible u. Change driver’s license u. Pay attention to card access devices u. Don’t give out info. to uninitiated contacts u. Secure your info. in your home and workplace from others

Protecting Yourself Information Source Your wallet How Thieves Work Protecting Yourself u. Theft u. Carry You u“Phishing” u. Skimming Scams u. Social Engineering u. Theft minimum ID information on you udon’t carry SSN card uchange health ins. #, if possible u. Change driver’s license u. Pay attention to card access devices u. Don’t give out info. to uninitiated contacts u. Secure your info. in your home and workplace from others

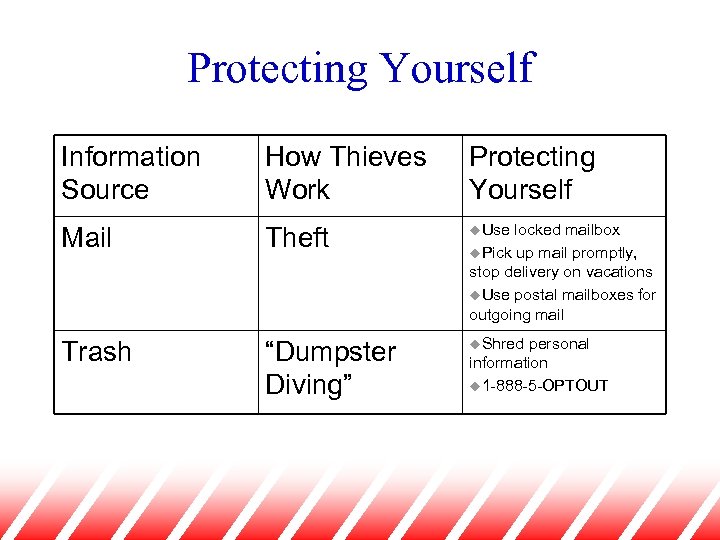

Protecting Yourself Information Source How Thieves Work Protecting Yourself Mail Theft u. Use Trash “Dumpster Diving” u. Shred locked mailbox u. Pick up mail promptly, stop delivery on vacations u. Use postal mailboxes for outgoing mail personal information u 1 -888 -5 -OPTOUT

Protecting Yourself Information Source How Thieves Work Protecting Yourself Mail Theft u. Use Trash “Dumpster Diving” u. Shred locked mailbox u. Pick up mail promptly, stop delivery on vacations u. Use postal mailboxes for outgoing mail personal information u 1 -888 -5 -OPTOUT

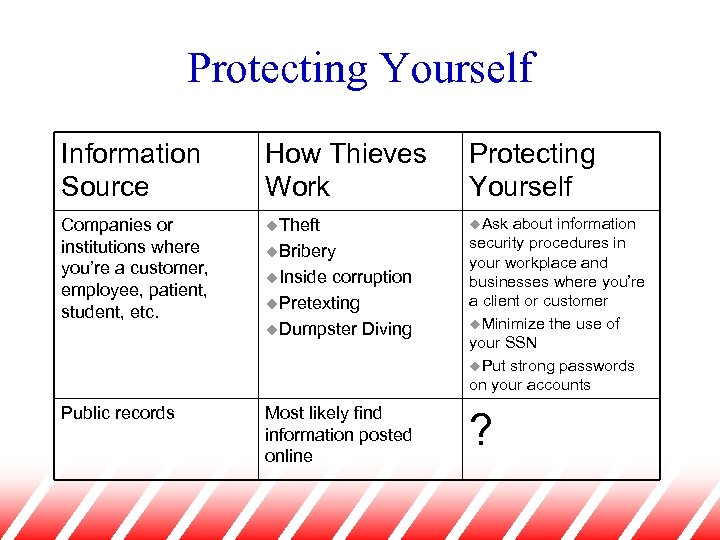

Protecting Yourself Information Source How Thieves Work Protecting Yourself Companies or institutions where you’re a customer, employee, patient, student, etc. u. Theft u. Ask corruption u. Pretexting u. Dumpster Diving about information security procedures in your workplace and businesses where you’re a client or customer u. Minimize the use of your SSN u. Put strong passwords on your accounts Public records Most likely find information posted online ? u. Bribery u. Inside

Protecting Yourself Information Source How Thieves Work Protecting Yourself Companies or institutions where you’re a customer, employee, patient, student, etc. u. Theft u. Ask corruption u. Pretexting u. Dumpster Diving about information security procedures in your workplace and businesses where you’re a client or customer u. Minimize the use of your SSN u. Put strong passwords on your accounts Public records Most likely find information posted online ? u. Bribery u. Inside

Personal Computer Security § Keep your anti-virus and anti-spyware software updated § Use a firewall § Set up security protocols properly if file sharing or using Wi-fi § Use a delete program to wipe your hard drive before getting rid of your old computer § Visit http: //onguardonline. gov for more tips.

Personal Computer Security § Keep your anti-virus and anti-spyware software updated § Use a firewall § Set up security protocols properly if file sharing or using Wi-fi § Use a delete program to wipe your hard drive before getting rid of your old computer § Visit http: //onguardonline. gov for more tips.

Know what to do if your information gets lost or stolen u SSNs – place a fraud alert, check credit reports u Existing accounts – close and open new ones, place strong passwords u Driver’s license, etc. – contact issuing agency

Know what to do if your information gets lost or stolen u SSNs – place a fraud alert, check credit reports u Existing accounts – close and open new ones, place strong passwords u Driver’s license, etc. – contact issuing agency

How Can You Tell if You’re a Victim? u u u Check credit reports – www. Annual. Credit. Report. com or 1 -877 -322 -8228 Monitor financial accounts Failure to receive bills or other mail signaling theft or an address change by the identity thief Receiving credit cards for which you did not apply Denial of credit, or offer of poor credit terms such as high interest rate, for no apparent reason Receiving calls or letters from debt collectors or businesses about merchandise or services you did not buy

How Can You Tell if You’re a Victim? u u u Check credit reports – www. Annual. Credit. Report. com or 1 -877 -322 -8228 Monitor financial accounts Failure to receive bills or other mail signaling theft or an address change by the identity thief Receiving credit cards for which you did not apply Denial of credit, or offer of poor credit terms such as high interest rate, for no apparent reason Receiving calls or letters from debt collectors or businesses about merchandise or services you did not buy

What Should Victims Do? u Immediately: § Call fraud lines of CRAs and get fraud alerts placed on credit reports; review your free credit report for inaccuracies § Close affected accounts: Contact creditors’ fraud departments, ask if they accept IDT Affidavit, if not, ask for their fraud forms § File a complaint with FTC, take complaint to police § Report to local police, get copy of report

What Should Victims Do? u Immediately: § Call fraud lines of CRAs and get fraud alerts placed on credit reports; review your free credit report for inaccuracies § Close affected accounts: Contact creditors’ fraud departments, ask if they accept IDT Affidavit, if not, ask for their fraud forms § File a complaint with FTC, take complaint to police § Report to local police, get copy of report

Protections for Victims u Know § § your legal rights Fair Credit Reporting Act Fair Debt Collection Practices Act The Truth in Lending Act The Electronic Fund Transfer Act u Contact state or federal agencies if you need additional help with specific problems

Protections for Victims u Know § § your legal rights Fair Credit Reporting Act Fair Debt Collection Practices Act The Truth in Lending Act The Electronic Fund Transfer Act u Contact state or federal agencies if you need additional help with specific problems

Credit Report Clean-Up If Victim Provides CRAs with Identity Theft Report: u CRAs will block the inaccurate information on victim’s credit report resulting from identity theft u When victim’s credit report is sent out, it will be correct

Credit Report Clean-Up If Victim Provides CRAs with Identity Theft Report: u CRAs will block the inaccurate information on victim’s credit report resulting from identity theft u When victim’s credit report is sent out, it will be correct

Filing a Complaint with the FTC File online at www. ftc. gov/idtheft or by calling 1 -877 -IDTHEFT § Get helpful information § Use complaint to get an identity theft report from the police § Report law violations by companies § Helps law enforcement § Informs FTC of problem trends

Filing a Complaint with the FTC File online at www. ftc. gov/idtheft or by calling 1 -877 -IDTHEFT § Get helpful information § Use complaint to get an identity theft report from the police § Report law violations by companies § Helps law enforcement § Informs FTC of problem trends

Resources u www. ftc. gov/idtheft u http: //onguardonline. gov u 1 -877 -ID THEFT (438 -4338) u Deter, Detect, Defend: Avoid ID Theft and Take Charge: Fighting Back Against ID Theft u ID Theft Affidavit

Resources u www. ftc. gov/idtheft u http: //onguardonline. gov u 1 -877 -ID THEFT (438 -4338) u Deter, Detect, Defend: Avoid ID Theft and Take Charge: Fighting Back Against ID Theft u ID Theft Affidavit