e2135f03e68bdd1c08c49375c6e88b1a.ppt

- Количество слайдов: 30

Desktop Printing Supplies: The Global Market & South Africa Steve Bambridge Lyra Research October 10, 2003

Agenda • Desktop Printer and Printing Markets – What is driving the OEMs? – What does this mean for supplies? • Inkjet Cartridge Market • Laser Cartridge Market • South Africa 2

Worldwide Printer Market 3

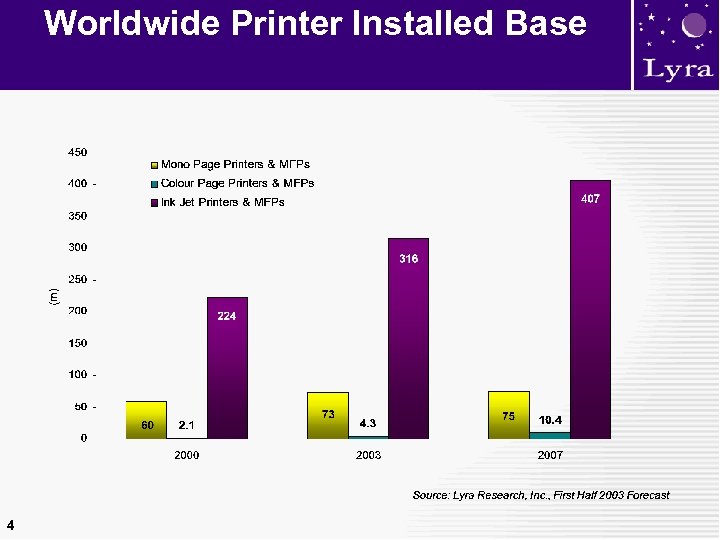

Worldwide Printer Installed Base 4

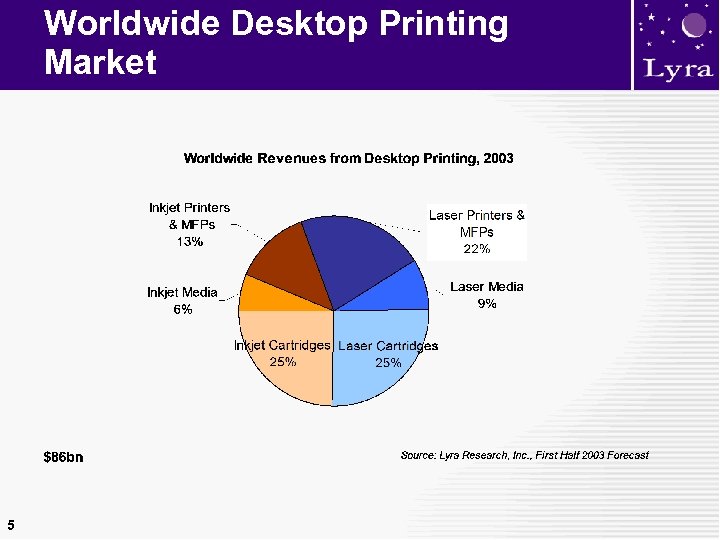

Worldwide Desktop Printing Market 5

Worldwide Revenue Trends 6

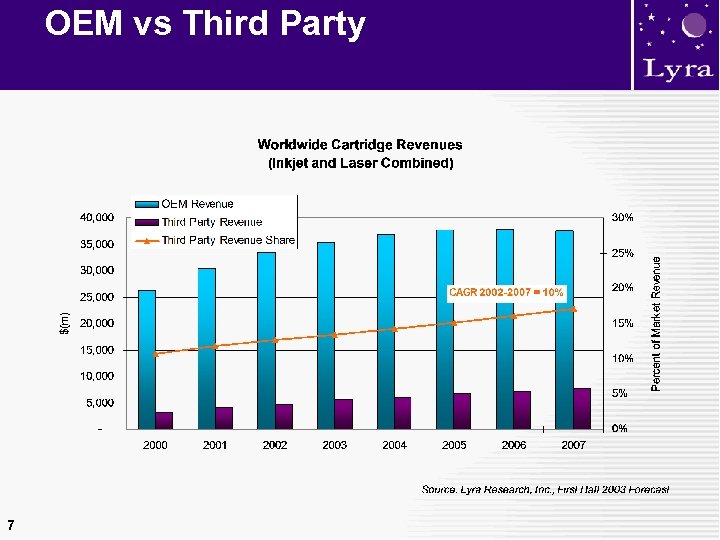

OEM vs Third Party 7

What‘s So Important about Supplies? Printer market is mature and supplies are now the main source of revenue growth and margin • Critical to OEMs – The ‘razors & blades’ business model is coming under threat – Revenue growth is slowing and may cease for some • Growth area for the channel • Fuelling third party industry 8

Ink Jet Cartridges 9

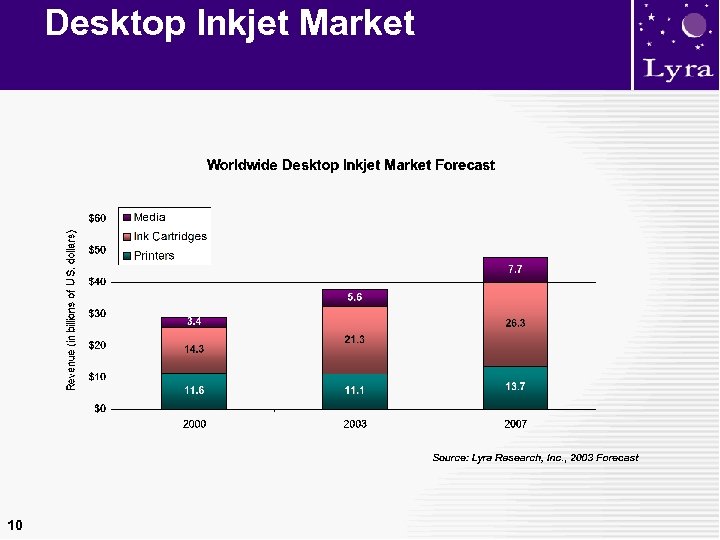

Desktop Inkjet Market 10

Ink Jet Cartridge Market 11 1 billion cartridges ÷ 365 days/year = 2. 7 million cartridges/day!

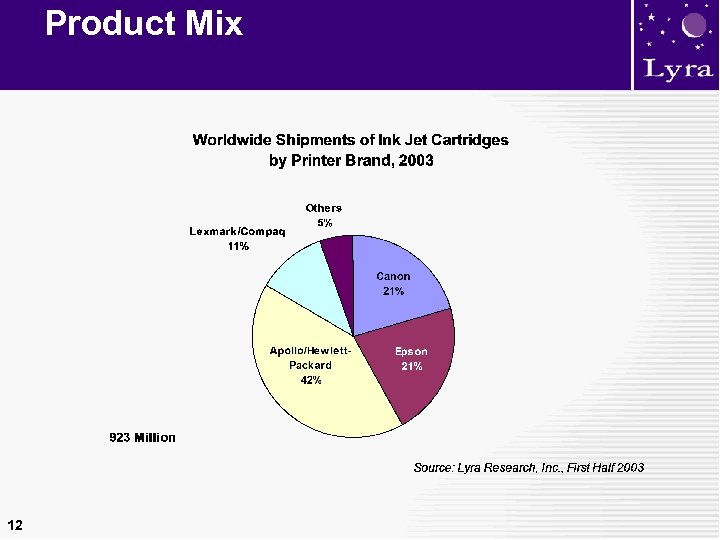

Product Mix 12

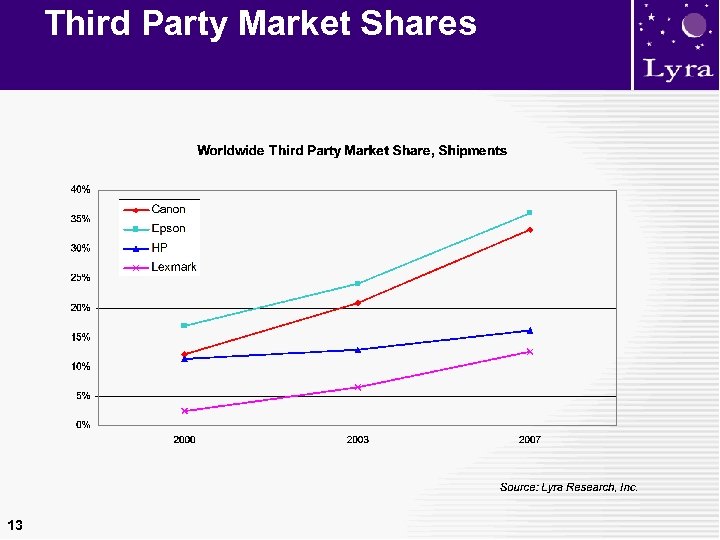

Third Party Market Shares 13

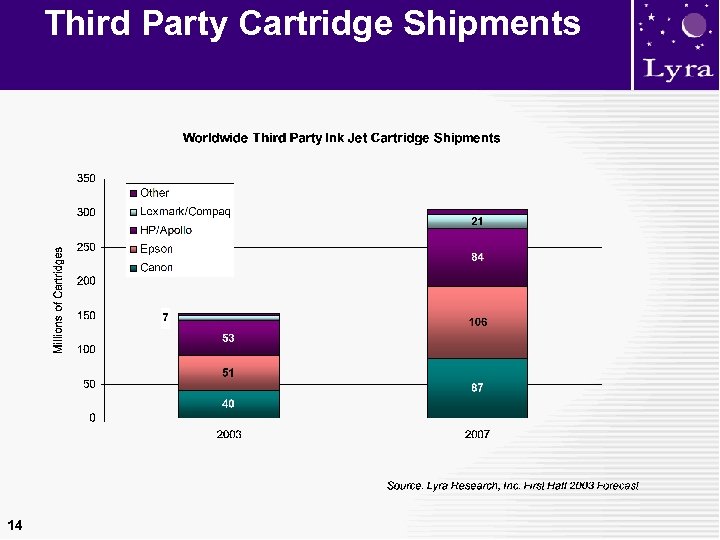

Third Party Cartridge Shipments 14

OEM Strategies • Frequent launch of new cartridges (especially Epson) • Use of inhibiting technology – Patent protection on integrated cartridges – Canon Think. Tank. TM, Epson smart chips – Litigate where possible (e. g. HP vs Multi. Union, Canon vs Pelikan) • Lower cartridge pricing – Single color ink tanks (especially Canon) – Reduced ink volume (HP 56/57/58) • Performance guarantees – Matched ink/media for long photo print life • Leverage Brand Channel Strengths • Cartridge reclaim schemes (HP) 15

Laser Cartridges 16

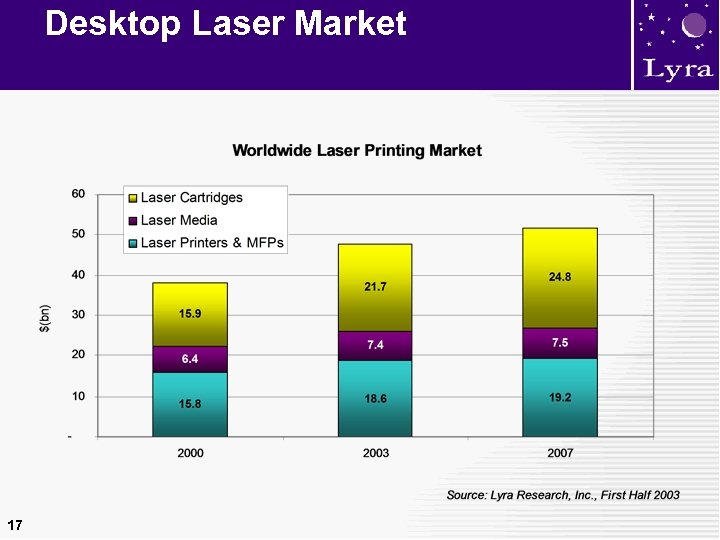

Desktop Laser Market 17

Mono Cartridge Market 18 Shipments will decline as mix shifts towards larger capacity cartridges

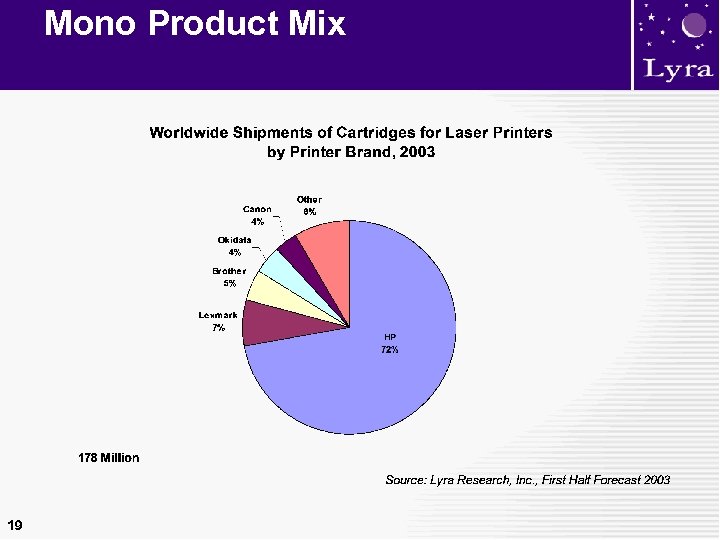

Mono Product Mix 19

Colour Laser Cartridge Market 20

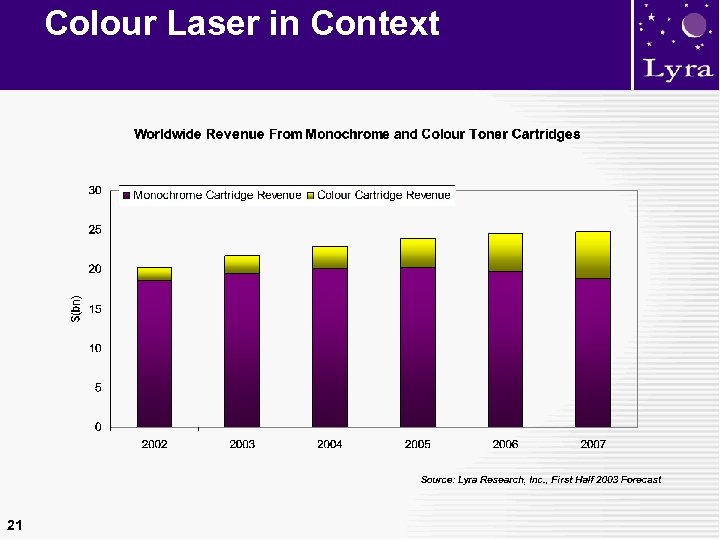

Colour Laser in Context 21

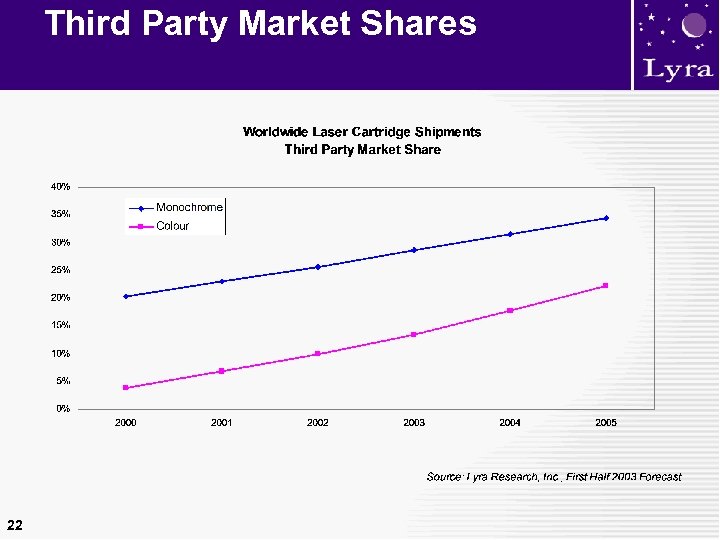

Third Party Market Shares 22

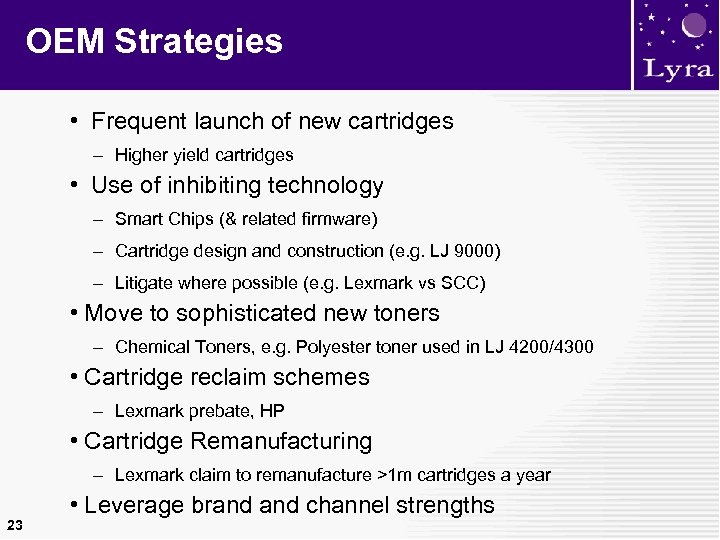

OEM Strategies • Frequent launch of new cartridges – Higher yield cartridges • Use of inhibiting technology – Smart Chips (& related firmware) – Cartridge design and construction (e. g. LJ 9000) – Litigate where possible (e. g. Lexmark vs SCC) • Move to sophisticated new toners – Chemical Toners, e. g. Polyester toner used in LJ 4200/4300 • Cartridge reclaim schemes – Lexmark prebate, HP • Cartridge Remanufacturing – Lexmark claim to remanufacture >1 m cartridges a year 23 • Leverage brand channel strengths

Some Key Messages • The ink jet and laser cartridge markets remain critically important to OEMs as a source of revenue growth and margin – Growth for some is threatened in part by success of third party industry – OEMs will continue to seek ways of slowing down third parties • The OEMs will increasingly focus on the colour laser market – Be ready for rapid growth of the cartridge market – Potential opportunity for third parties to take ownership of the mono cartridge market • Be ready for rapid growth in the Lexmark ink jet cartridge market • The South African third party market growth should exceed worldwide growth rates over the next few years 24

South Africa 25

Desktop Printing Market South Africa What little information is available suggests…… • Laser printing market is relatively well developed – Driven by business activity – PC use normal in business environments – OEM growth has fallen below 10% per annum • Inkjet printing market is under developed – Low level of household PC ownership – Low level of spending on consumer electronics (e. g. digital cameras) – OEM growth remains between 15 and 20% per annum 26

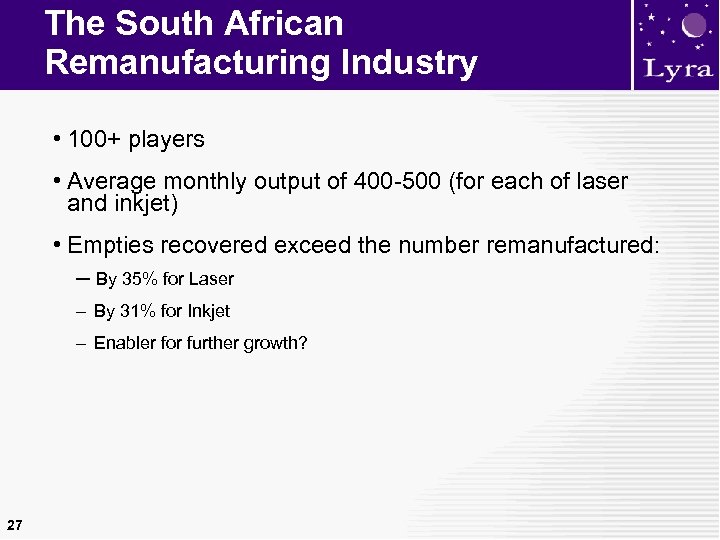

The South African Remanufacturing Industry • 100+ players • Average monthly output of 400 -500 (for each of laser and inkjet) • Empties recovered exceed the number remanufactured: – By 35% for Laser – By 31% for Inkjet – Enabler for further growth? 27

Ink Jet Cartridge Market 28

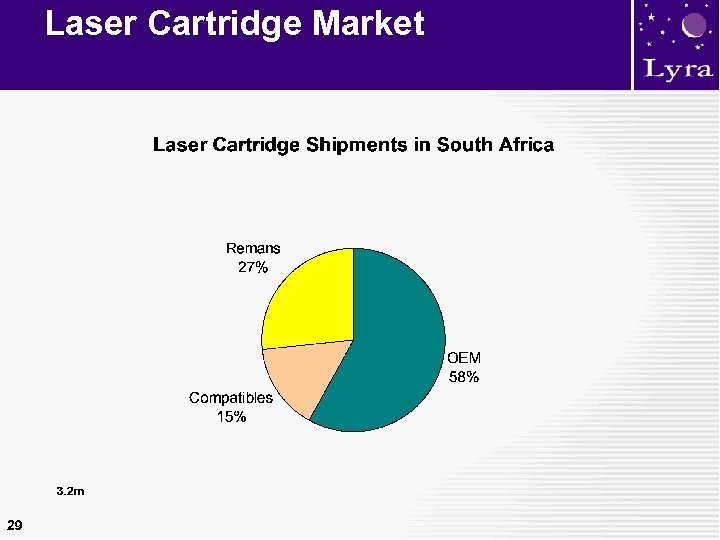

Laser Cartridge Market 29

Which Means…. The available data suggests……. . • Third party ink jet cartridges have much higher market share in South Africa than in Europe and the USA – Compatibles account for well over 50% of ink tanks shipped, vs <30% in USA and Europe – Remans account for over 20% of integrated cartridges shipped, vs <15% in USA and Europe • Third party laser cartridges also have significantly higher market share in South Africa than in Europe and the USA • Is this correct? • How do the OEMs feel about this, and what are they doing? 30

e2135f03e68bdd1c08c49375c6e88b1a.ppt