4623071a487d5d2fd1396d6f2934f01c.ppt

- Количество слайдов: 21

DESIGNING EFFICIENT ORGANIZATIONS FOR MICROFINANCE OPERATIONS: The Experience of Green Bank of Caraga GREEN BANK OF CARAGA, INC. TREES Loan Program

DESIGNING EFFICIENT ORGANIZATIONS FOR MICROFINANCE OPERATIONS: The Experience of Green Bank of Caraga GREEN BANK OF CARAGA, INC. TREES Loan Program

OBJECTIVES Share with other participating bank’s the following: v GBC’s experiences in Organizing & Managing its microfinance operations v The Approach used by the bank in expanding its MF operations v The Organization & Management before and after the expansion of its MF operations

OBJECTIVES Share with other participating bank’s the following: v GBC’s experiences in Organizing & Managing its microfinance operations v The Approach used by the bank in expanding its MF operations v The Organization & Management before and after the expansion of its MF operations

AGENDA v Organization & Management Structure at the start-up phase of its MF Operations v When & How GBC expanded its MF Operations v Changes in the Organization & Management v Lessons Learned

AGENDA v Organization & Management Structure at the start-up phase of its MF Operations v When & How GBC expanded its MF Operations v Changes in the Organization & Management v Lessons Learned

BEFORE GBC STARTED ITS MF OPERATIONS v There was no proper accountability of loan accounts v Good MIS was not in place v Collection was very lax v Restructuring of past due loans was rampant

BEFORE GBC STARTED ITS MF OPERATIONS v There was no proper accountability of loan accounts v Good MIS was not in place v Collection was very lax v Restructuring of past due loans was rampant

BEFORE GBC STARTED ITS MF OPERATIONS v Regular loans were mostly collateralized v Loan amount was based on value of collateral v Cash flow was not analyzed v Credit & Background Investigation was very insufficient v Some branches had very high past due ratio

BEFORE GBC STARTED ITS MF OPERATIONS v Regular loans were mostly collateralized v Loan amount was based on value of collateral v Cash flow was not analyzed v Credit & Background Investigation was very insufficient v Some branches had very high past due ratio

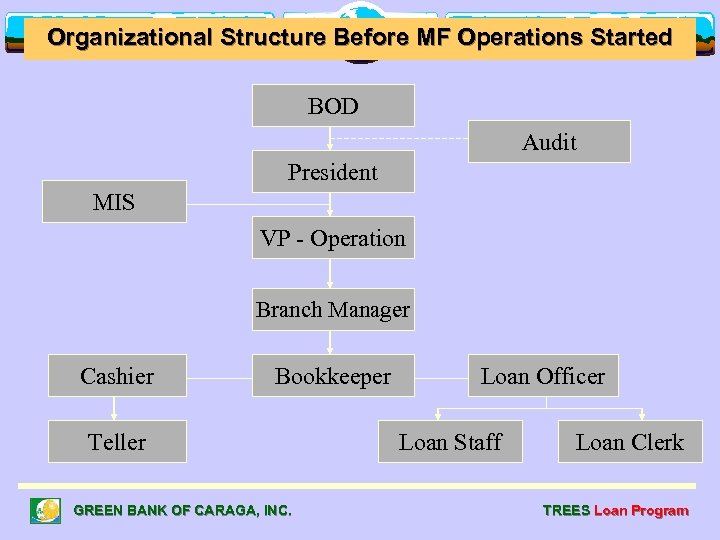

Organizational Structure Before MF Operations Started BOD Audit President MIS VP - Operation Branch Manager Cashier Bookkeeper Teller GREEN BANK OF CARAGA, INC. Loan Officer Loan Staff Loan Clerk TREES Loan Program

Organizational Structure Before MF Operations Started BOD Audit President MIS VP - Operation Branch Manager Cashier Bookkeeper Teller GREEN BANK OF CARAGA, INC. Loan Officer Loan Staff Loan Clerk TREES Loan Program

START OF GBC’s MF OPERATIONS v Signed up with MABS in February 2000 v TREES product pilot-tested in Bayugan branch v Initially hired 5 MF Account Officers and one fulltime MF Supervisor v In the pilot branch, the MFU reported directly to the Branch Manager v Proper accountability of loan accounts was implemented

START OF GBC’s MF OPERATIONS v Signed up with MABS in February 2000 v TREES product pilot-tested in Bayugan branch v Initially hired 5 MF Account Officers and one fulltime MF Supervisor v In the pilot branch, the MFU reported directly to the Branch Manager v Proper accountability of loan accounts was implemented

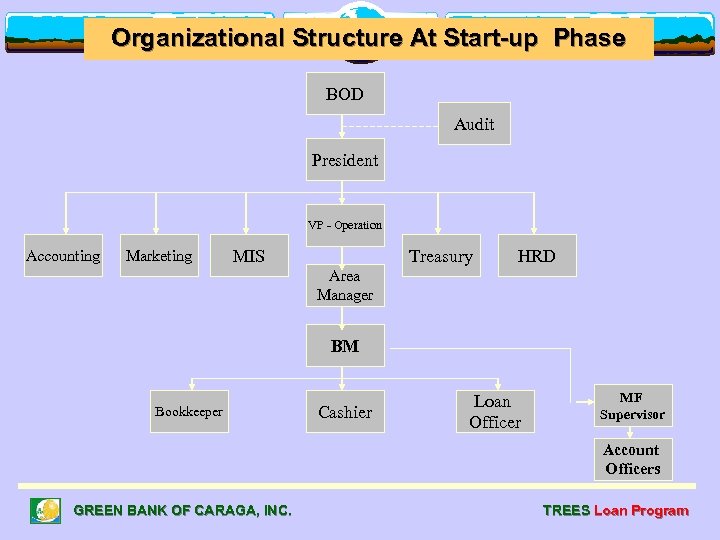

Organizational Structure At Start-up Phase BOD Audit President VP - Operation Accounting Marketing MIS Treasury HRD Area Manager BM Bookkeeper Cashier Loan Officer MF Supervisor Account Officers GREEN BANK OF CARAGA, INC. TREES Loan Program

Organizational Structure At Start-up Phase BOD Audit President VP - Operation Accounting Marketing MIS Treasury HRD Area Manager BM Bookkeeper Cashier Loan Officer MF Supervisor Account Officers GREEN BANK OF CARAGA, INC. TREES Loan Program

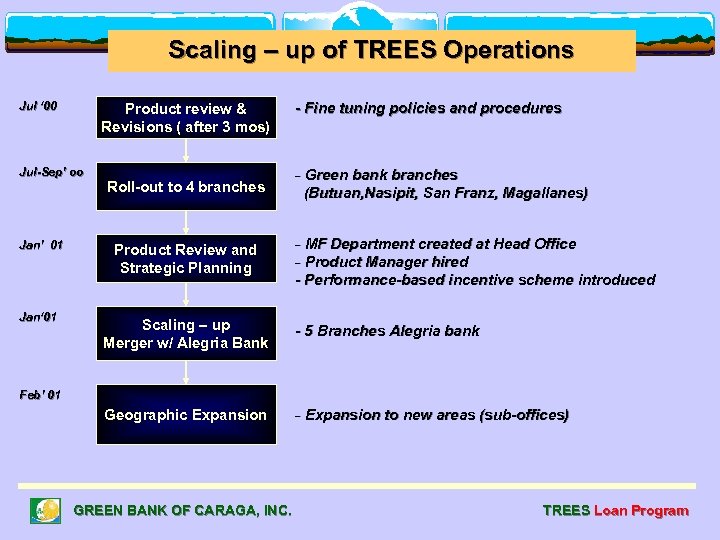

Scaling – up of TREES Operations Jul ‘ 00 Product review & Revisions ( after 3 mos) Jul-Sep’ oo Roll-out to 4 branches - Fine tuning policies and procedures - Green bank branches (Butuan, Nasipit, San Franz, Magallanes) - MF Department created at Head Office - Product Manager hired - Performance-based incentive scheme introduced Jan’ 01 Product Review and Strategic Planning Jan‘ 01 Scaling – up Merger w/ Alegria Bank - 5 Branches Alegria bank Geographic Expansion - Expansion to new areas (sub-offices) Feb’ 01 GREEN BANK OF CARAGA, INC. TREES Loan Program

Scaling – up of TREES Operations Jul ‘ 00 Product review & Revisions ( after 3 mos) Jul-Sep’ oo Roll-out to 4 branches - Fine tuning policies and procedures - Green bank branches (Butuan, Nasipit, San Franz, Magallanes) - MF Department created at Head Office - Product Manager hired - Performance-based incentive scheme introduced Jan’ 01 Product Review and Strategic Planning Jan‘ 01 Scaling – up Merger w/ Alegria Bank - 5 Branches Alegria bank Geographic Expansion - Expansion to new areas (sub-offices) Feb’ 01 GREEN BANK OF CARAGA, INC. TREES Loan Program

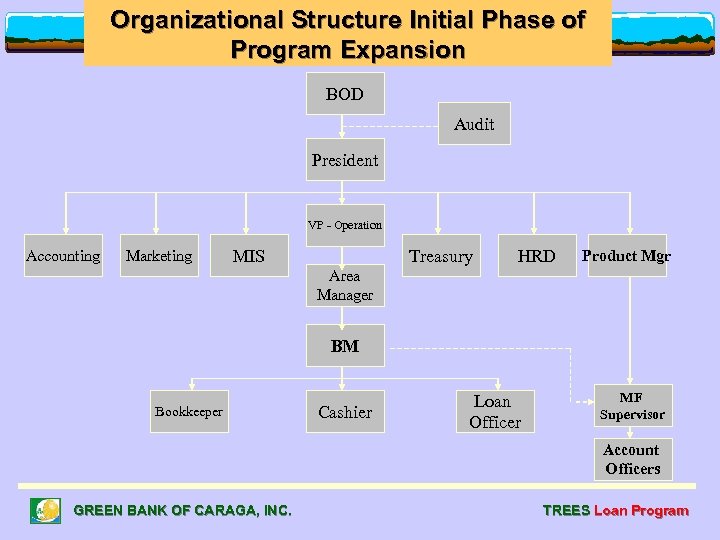

Organizational Structure Initial Phase of Program Expansion BOD Audit President VP - Operation Accounting Marketing MIS Treasury HRD Product Mgr Area Manager BM Bookkeeper Cashier Loan Officer MF Supervisor Account Officers GREEN BANK OF CARAGA, INC. TREES Loan Program

Organizational Structure Initial Phase of Program Expansion BOD Audit President VP - Operation Accounting Marketing MIS Treasury HRD Product Mgr Area Manager BM Bookkeeper Cashier Loan Officer MF Supervisor Account Officers GREEN BANK OF CARAGA, INC. TREES Loan Program

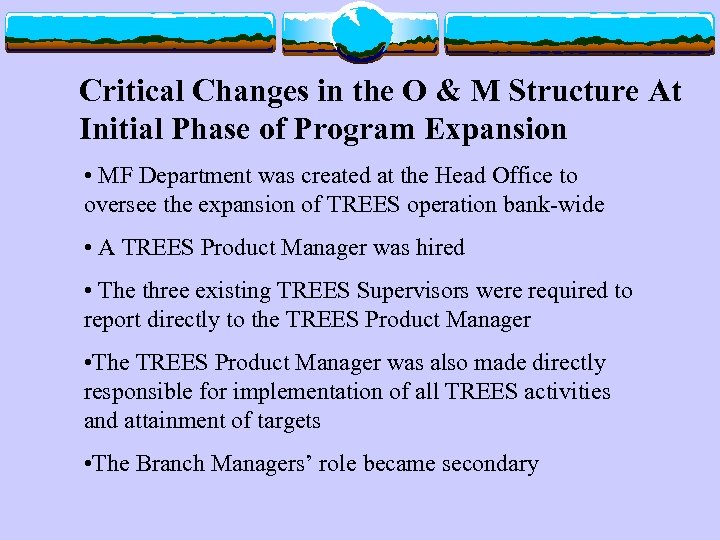

Critical Changes in the O & M Structure At Initial Phase of Program Expansion • MF Department was created at the Head Office to oversee the expansion of TREES operation bank-wide • A TREES Product Manager was hired • The three existing TREES Supervisors were required to report directly to the TREES Product Manager • The TREES Product Manager was also made directly responsible for implementation of all TREES activities and attainment of targets • The Branch Managers’ role became secondary

Critical Changes in the O & M Structure At Initial Phase of Program Expansion • MF Department was created at the Head Office to oversee the expansion of TREES operation bank-wide • A TREES Product Manager was hired • The three existing TREES Supervisors were required to report directly to the TREES Product Manager • The TREES Product Manager was also made directly responsible for implementation of all TREES activities and attainment of targets • The Branch Managers’ role became secondary

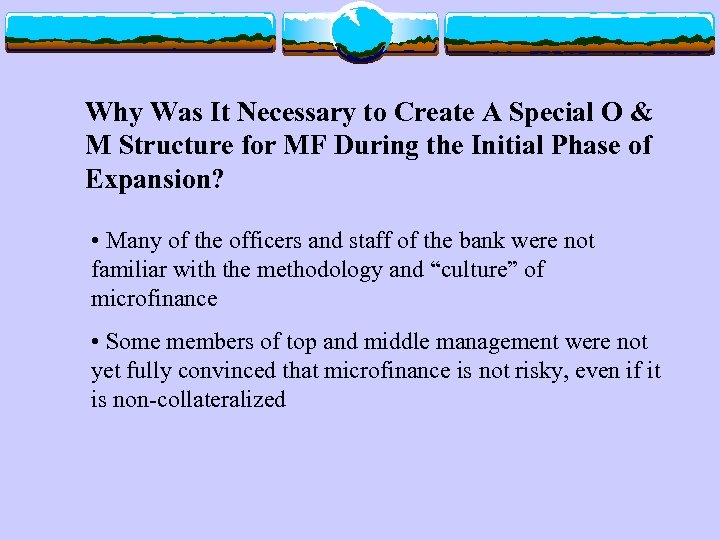

Why Was It Necessary to Create A Special O & M Structure for MF During the Initial Phase of Expansion? • Many of the officers and staff of the bank were not familiar with the methodology and “culture” of microfinance • Some members of top and middle management were not yet fully convinced that microfinance is not risky, even if it is non-collateralized

Why Was It Necessary to Create A Special O & M Structure for MF During the Initial Phase of Expansion? • Many of the officers and staff of the bank were not familiar with the methodology and “culture” of microfinance • Some members of top and middle management were not yet fully convinced that microfinance is not risky, even if it is non-collateralized

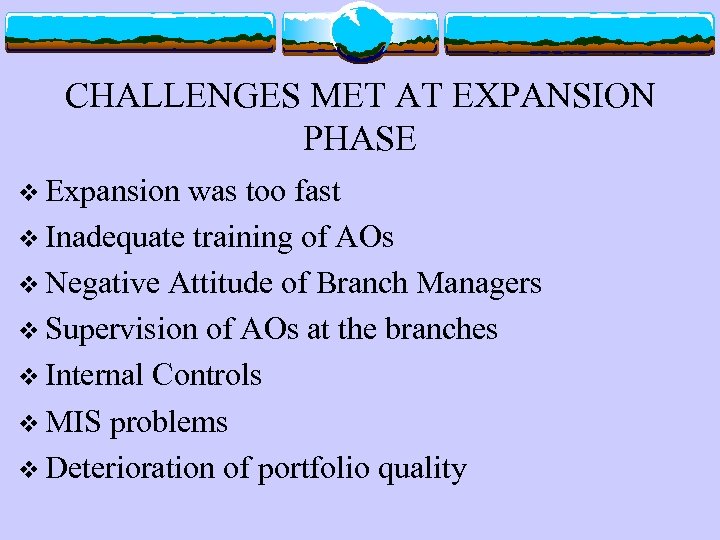

CHALLENGES MET AT EXPANSION PHASE v Expansion was too fast v Inadequate training of AOs v Negative Attitude of Branch Managers v Supervision of AOs at the branches v Internal Controls v MIS problems v Deterioration of portfolio quality

CHALLENGES MET AT EXPANSION PHASE v Expansion was too fast v Inadequate training of AOs v Negative Attitude of Branch Managers v Supervision of AOs at the branches v Internal Controls v MIS problems v Deterioration of portfolio quality

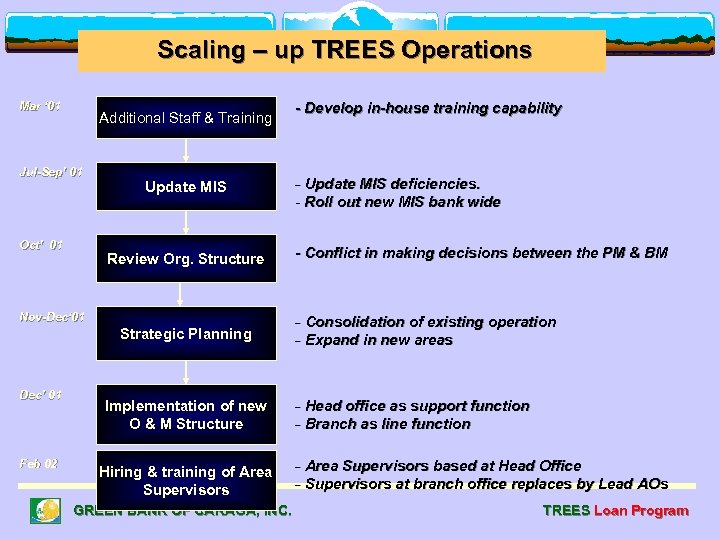

Scaling – up TREES Operations Mar ‘ 01 Additional Staff & Training Jul-Sep’ 01 Oct’ 01 Update MIS Review Org. Structure Nov-Dec‘ 01 Strategic Planning Dec’ 01 Feb 02 Implementation of new O & M Structure Hiring & training of Area Supervisors GREEN BANK OF CARAGA, INC. - Develop in-house training capability - Update MIS deficiencies. - Roll out new MIS bank wide - Conflict in making decisions between the PM & BM - Consolidation of existing operation - Expand in new areas - Head office as support function - Branch as line function - Area Supervisors based at Head Office - Supervisors at branch office replaces by Lead AOs TREES Loan Program

Scaling – up TREES Operations Mar ‘ 01 Additional Staff & Training Jul-Sep’ 01 Oct’ 01 Update MIS Review Org. Structure Nov-Dec‘ 01 Strategic Planning Dec’ 01 Feb 02 Implementation of new O & M Structure Hiring & training of Area Supervisors GREEN BANK OF CARAGA, INC. - Develop in-house training capability - Update MIS deficiencies. - Roll out new MIS bank wide - Conflict in making decisions between the PM & BM - Consolidation of existing operation - Expand in new areas - Head office as support function - Branch as line function - Area Supervisors based at Head Office - Supervisors at branch office replaces by Lead AOs TREES Loan Program

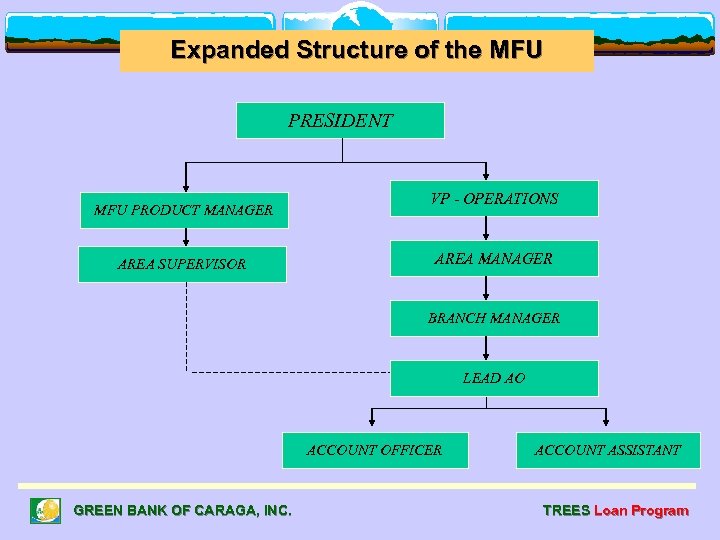

Expanded Structure of the MFU PRESIDENT MFU PRODUCT MANAGER AREA SUPERVISOR VP - OPERATIONS AREA MANAGER BRANCH MANAGER LEAD AO ACCOUNT OFFICER GREEN BANK OF CARAGA, INC. ACCOUNT ASSISTANT TREES Loan Program

Expanded Structure of the MFU PRESIDENT MFU PRODUCT MANAGER AREA SUPERVISOR VP - OPERATIONS AREA MANAGER BRANCH MANAGER LEAD AO ACCOUNT OFFICER GREEN BANK OF CARAGA, INC. ACCOUNT ASSISTANT TREES Loan Program

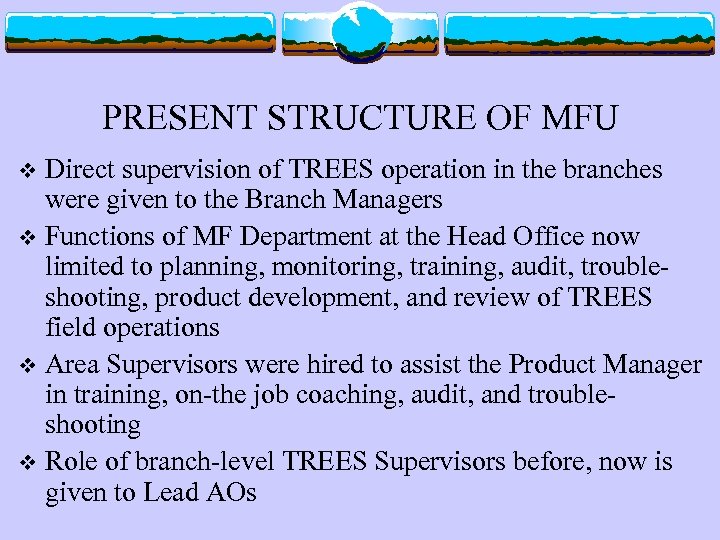

PRESENT STRUCTURE OF MFU Direct supervision of TREES operation in the branches were given to the Branch Managers v Functions of MF Department at the Head Office now limited to planning, monitoring, training, audit, troubleshooting, product development, and review of TREES field operations v Area Supervisors were hired to assist the Product Manager in training, on-the job coaching, audit, and troubleshooting v Role of branch-level TREES Supervisors before, now is given to Lead AOs v

PRESENT STRUCTURE OF MFU Direct supervision of TREES operation in the branches were given to the Branch Managers v Functions of MF Department at the Head Office now limited to planning, monitoring, training, audit, troubleshooting, product development, and review of TREES field operations v Area Supervisors were hired to assist the Product Manager in training, on-the job coaching, audit, and troubleshooting v Role of branch-level TREES Supervisors before, now is given to Lead AOs v

LEVELS OF SUPERVISION v Product Manager directly reports to the President v Area Supervisors report to the Product Manager v Lead AOs are under the Branch Managers, but are also supervised by the Area Supervisors on matters related to the TREES implementation v Implementation of TREES product at the branches is directly supervised by the Branch Managers

LEVELS OF SUPERVISION v Product Manager directly reports to the President v Area Supervisors report to the Product Manager v Lead AOs are under the Branch Managers, but are also supervised by the Area Supervisors on matters related to the TREES implementation v Implementation of TREES product at the branches is directly supervised by the Branch Managers

WHY WERE THESE CHANGES NECESSARY? v v v Because of rapid expansion, the MF Department at Head Office had difficulty supervising field operations on day-to-day basis Branch Managers are the best persons to supervise the AOs on a day -to-day basis When Branch Managers are made responsible for the TREES targets in their own branch, they become more committed in supervising field operations Branch Managers, however, cannot devote full-time to supervising TREES operations, so that Lead AOs are necessary Area Supervisors are needed to help the Lead AOs deal with their more difficult tasks (PAR), and to ensure no short-cut in procedures

WHY WERE THESE CHANGES NECESSARY? v v v Because of rapid expansion, the MF Department at Head Office had difficulty supervising field operations on day-to-day basis Branch Managers are the best persons to supervise the AOs on a day -to-day basis When Branch Managers are made responsible for the TREES targets in their own branch, they become more committed in supervising field operations Branch Managers, however, cannot devote full-time to supervising TREES operations, so that Lead AOs are necessary Area Supervisors are needed to help the Lead AOs deal with their more difficult tasks (PAR), and to ensure no short-cut in procedures

Effects of Changing the Banks’ O & M Structure • Decentralization of authority • More focused supervision • Better implementation of policies & procedures • More committed middle management • Improved loan portfolio quality • Cost effective • Standardization of Policies and Procedures • Clearer flow of communication GREEN BANK OF CARAGA, INC. TREES Loan Program

Effects of Changing the Banks’ O & M Structure • Decentralization of authority • More focused supervision • Better implementation of policies & procedures • More committed middle management • Improved loan portfolio quality • Cost effective • Standardization of Policies and Procedures • Clearer flow of communication GREEN BANK OF CARAGA, INC. TREES Loan Program

Lessons Learned v Some resistance within the organization can be expected when introducing a new product and culture v At the start, it may be necessary to create a special unit to implement these new product and culture v However, there will be problems within the organization if the new product and culture are not integrated in the mainstream operation v Changing the attitude of the organization towards the new product and culture can take time. The best way is to show them that it works. GREEN BANK OF CARAGA, INC. TREES Loan Program

Lessons Learned v Some resistance within the organization can be expected when introducing a new product and culture v At the start, it may be necessary to create a special unit to implement these new product and culture v However, there will be problems within the organization if the new product and culture are not integrated in the mainstream operation v Changing the attitude of the organization towards the new product and culture can take time. The best way is to show them that it works. GREEN BANK OF CARAGA, INC. TREES Loan Program

Lessons Learned v People are more committed and supportive to implement the new product and culture if they are given direct responsibility for the product’s success v Decentralization of authority can improve efficiency in service delivery v. Staff should be rewarded well to sustain their motivation and productivity v. Proper training and close supervision of Account Officers are critical in sustaining good portfolio quality v. All employees of the bank should be made aware of the benefits of the new product to get their full commitment and support

Lessons Learned v People are more committed and supportive to implement the new product and culture if they are given direct responsibility for the product’s success v Decentralization of authority can improve efficiency in service delivery v. Staff should be rewarded well to sustain their motivation and productivity v. Proper training and close supervision of Account Officers are critical in sustaining good portfolio quality v. All employees of the bank should be made aware of the benefits of the new product to get their full commitment and support