915e6ce3b76679789ec7aa24c6f4afe3.ppt

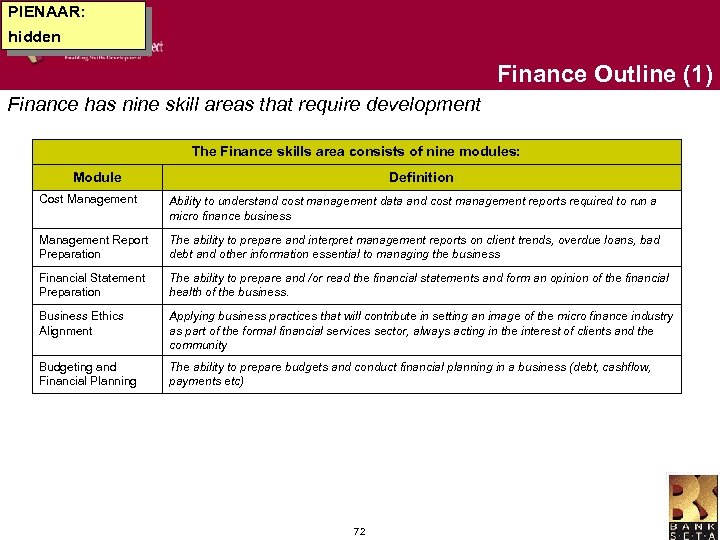

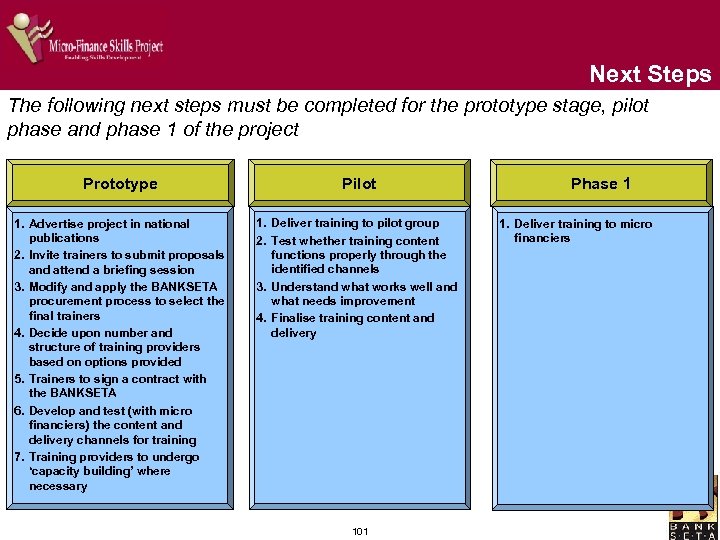

- Количество слайдов: 114

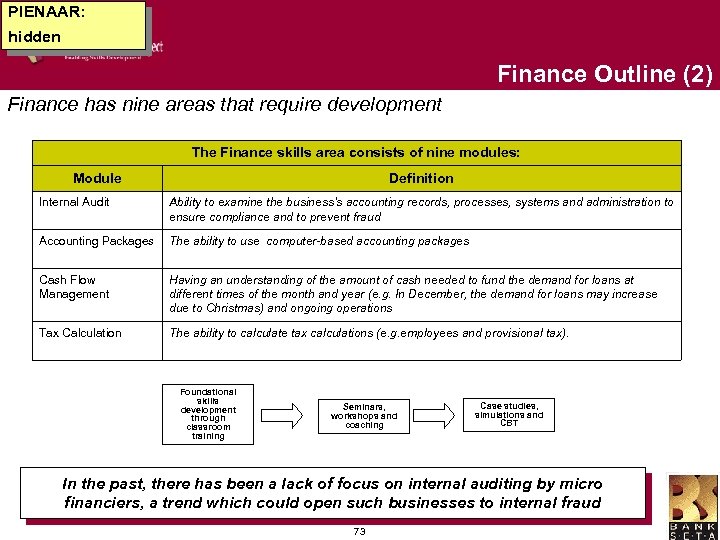

DESIGN PHASE EXECUTIVE SUMMARY MAY 2002 Design Phase Executive Summary 9 May 2002

DESIGN PHASE EXECUTIVE SUMMARY MAY 2002 Design Phase Executive Summary 9 May 2002

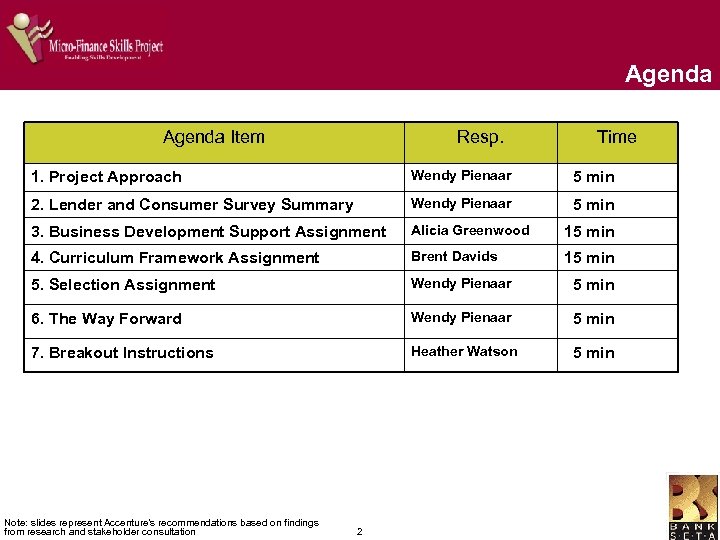

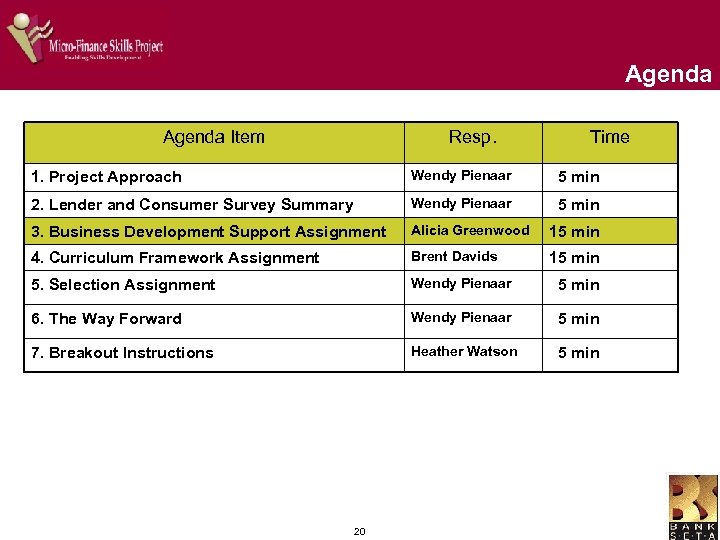

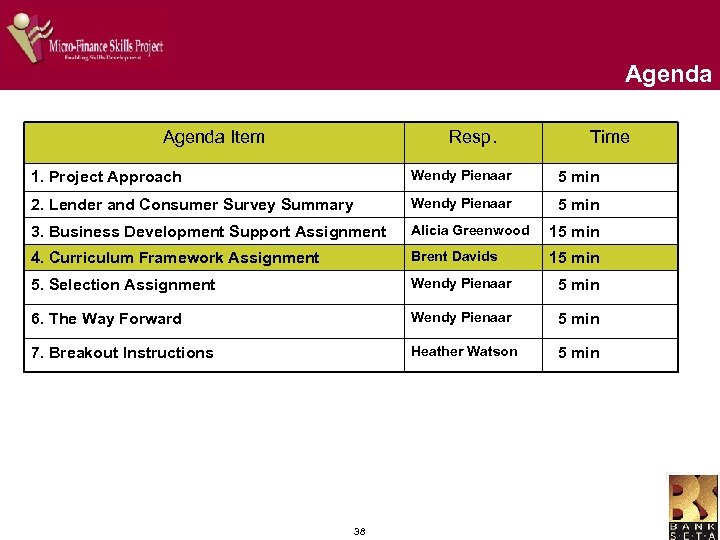

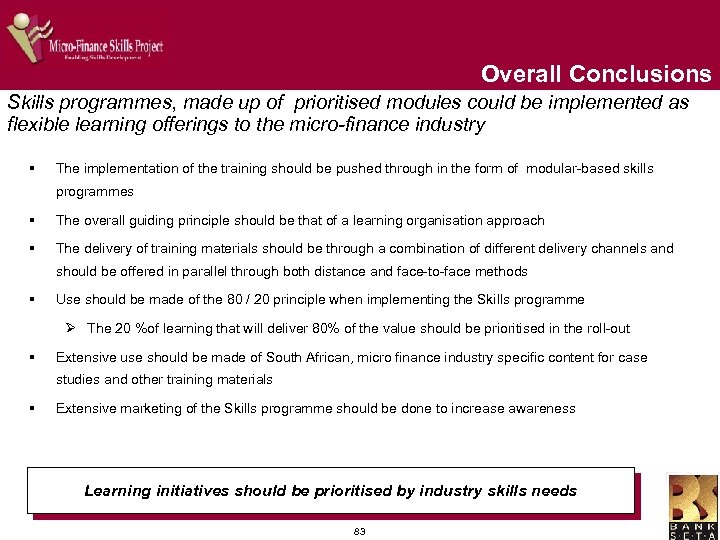

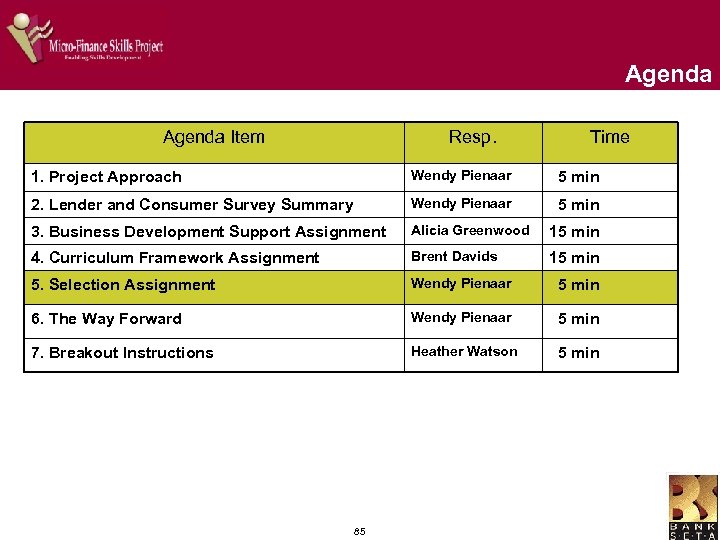

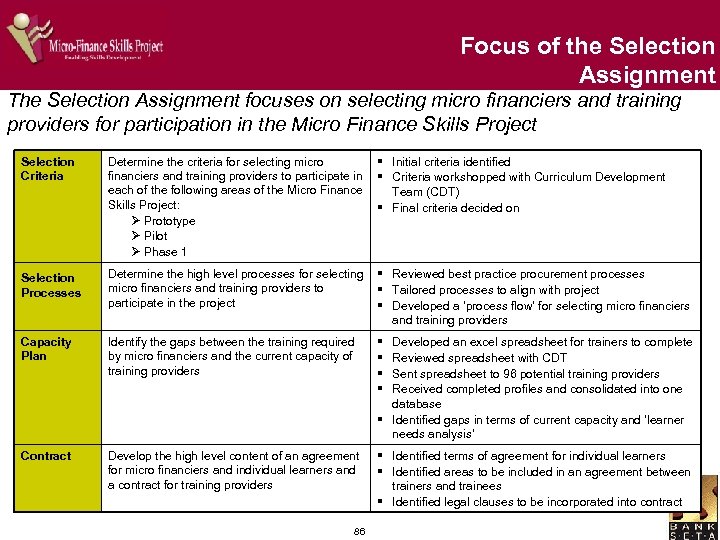

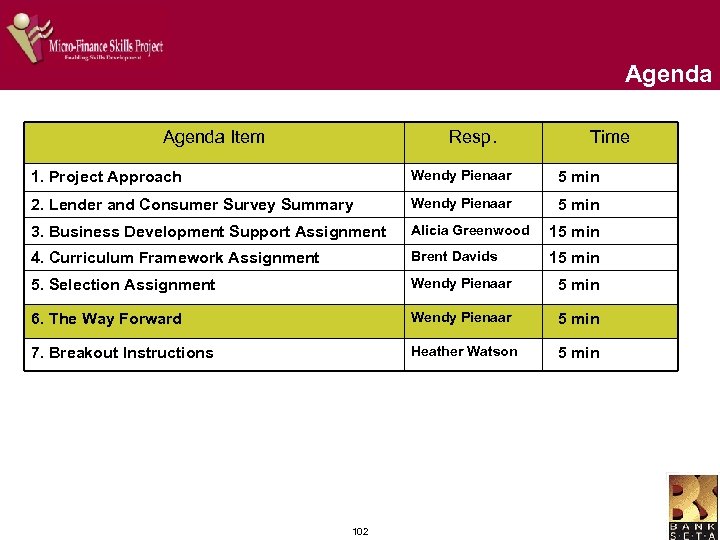

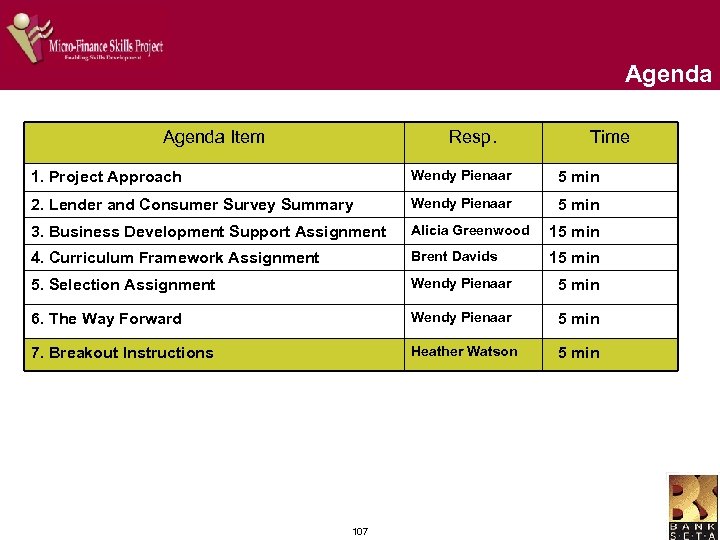

Agenda Item Resp. Time 1. Project Approach Wendy Pienaar 5 min 2. Lender and Consumer Survey Summary Wendy Pienaar 5 min 3. Business Development Support Assignment Alicia Greenwood 15 min 4. Curriculum Framework Assignment Brent Davids 15 min 5. Selection Assignment Wendy Pienaar 5 min 6. The Way Forward Wendy Pienaar 5 min 7. Breakout Instructions Heather Watson 5 min Note: slides represent Accenture's recommendations based on findings from research and stakeholder consultation 2

Agenda Item Resp. Time 1. Project Approach Wendy Pienaar 5 min 2. Lender and Consumer Survey Summary Wendy Pienaar 5 min 3. Business Development Support Assignment Alicia Greenwood 15 min 4. Curriculum Framework Assignment Brent Davids 15 min 5. Selection Assignment Wendy Pienaar 5 min 6. The Way Forward Wendy Pienaar 5 min 7. Breakout Instructions Heather Watson 5 min Note: slides represent Accenture's recommendations based on findings from research and stakeholder consultation 2

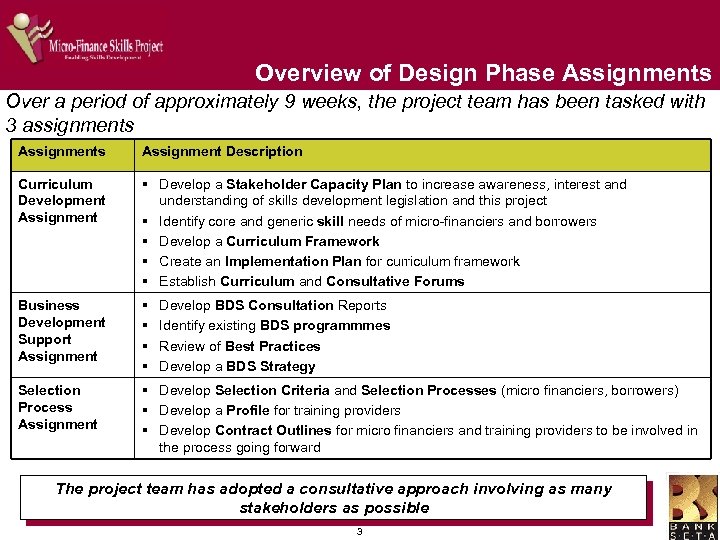

Overview of Design Phase Assignments Over a period of approximately 9 weeks, the project team has been tasked with 3 assignments Assignment Description Curriculum Development Assignment § Develop a Stakeholder Capacity Plan to increase awareness, interest and understanding of skills development legislation and this project § Identify core and generic skill needs of micro-financiers and borrowers § Develop a Curriculum Framework § Create an Implementation Plan for curriculum framework § Establish Curriculum and Consultative Forums Business Development Support Assignment § § Selection Process Assignment § Develop Selection Criteria and Selection Processes (micro financiers, borrowers) § Develop a Profile for training providers § Develop Contract Outlines for micro financiers and training providers to be involved in the process going forward Develop BDS Consultation Reports Identify existing BDS programmmes Review of Best Practices Develop a BDS Strategy The project team has adopted a consultative approach involving as many stakeholders as possible 3

Overview of Design Phase Assignments Over a period of approximately 9 weeks, the project team has been tasked with 3 assignments Assignment Description Curriculum Development Assignment § Develop a Stakeholder Capacity Plan to increase awareness, interest and understanding of skills development legislation and this project § Identify core and generic skill needs of micro-financiers and borrowers § Develop a Curriculum Framework § Create an Implementation Plan for curriculum framework § Establish Curriculum and Consultative Forums Business Development Support Assignment § § Selection Process Assignment § Develop Selection Criteria and Selection Processes (micro financiers, borrowers) § Develop a Profile for training providers § Develop Contract Outlines for micro financiers and training providers to be involved in the process going forward Develop BDS Consultation Reports Identify existing BDS programmmes Review of Best Practices Develop a BDS Strategy The project team has adopted a consultative approach involving as many stakeholders as possible 3

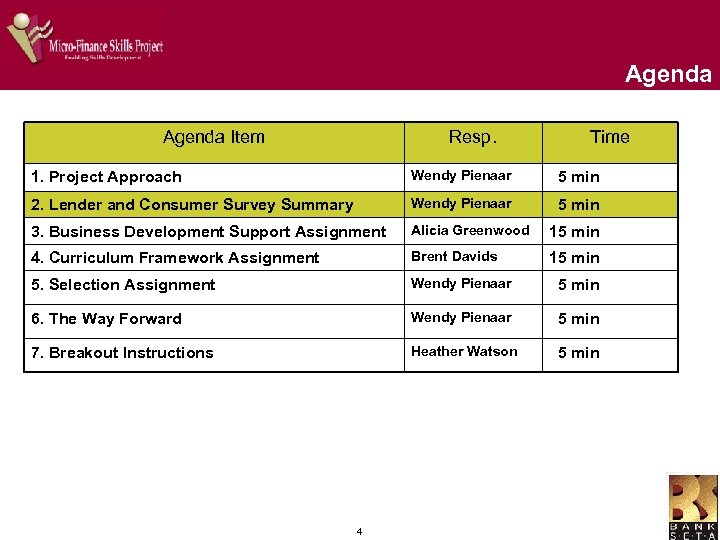

Agenda Item Resp. Time 1. Project Approach Wendy Pienaar 5 min 2. Lender and Consumer Survey Summary Wendy Pienaar 5 min 3. Business Development Support Assignment Alicia Greenwood 15 min 4. Curriculum Framework Assignment Brent Davids 15 min 5. Selection Assignment Wendy Pienaar 5 min 6. The Way Forward Wendy Pienaar 5 min 7. Breakout Instructions Heather Watson 5 min 4

Agenda Item Resp. Time 1. Project Approach Wendy Pienaar 5 min 2. Lender and Consumer Survey Summary Wendy Pienaar 5 min 3. Business Development Support Assignment Alicia Greenwood 15 min 4. Curriculum Framework Assignment Brent Davids 15 min 5. Selection Assignment Wendy Pienaar 5 min 6. The Way Forward Wendy Pienaar 5 min 7. Breakout Instructions Heather Watson 5 min 4

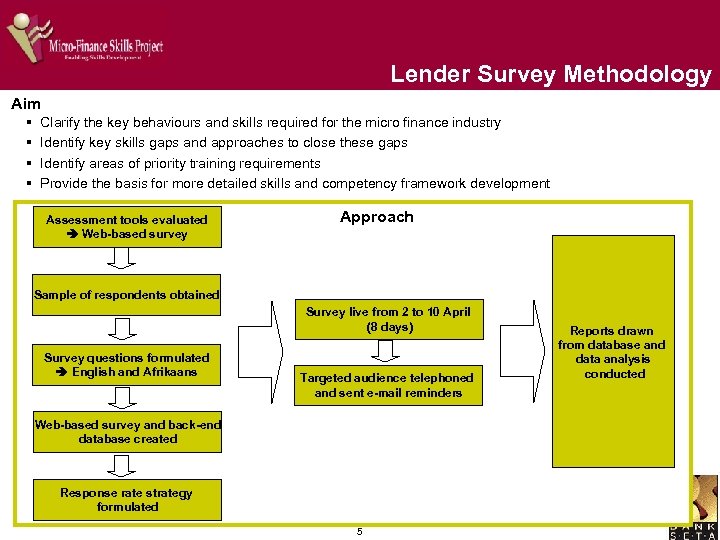

Lender Survey Methodology Aim § § Clarify the key behaviours and skills required for the micro finance industry Identify key skills gaps and approaches to close these gaps Identify areas of priority training requirements Provide the basis for more detailed skills and competency framework development Assessment tools evaluated Web-based survey Approach Sample of respondents obtained Survey live from 2 to 10 April (8 days) Survey questions formulated English and Afrikaans Targeted audience telephoned and sent e-mail reminders Web-based survey and back-end database created Response rate strategy formulated 5 Reports drawn from database and data analysis conducted

Lender Survey Methodology Aim § § Clarify the key behaviours and skills required for the micro finance industry Identify key skills gaps and approaches to close these gaps Identify areas of priority training requirements Provide the basis for more detailed skills and competency framework development Assessment tools evaluated Web-based survey Approach Sample of respondents obtained Survey live from 2 to 10 April (8 days) Survey questions formulated English and Afrikaans Targeted audience telephoned and sent e-mail reminders Web-based survey and back-end database created Response rate strategy formulated 5 Reports drawn from database and data analysis conducted

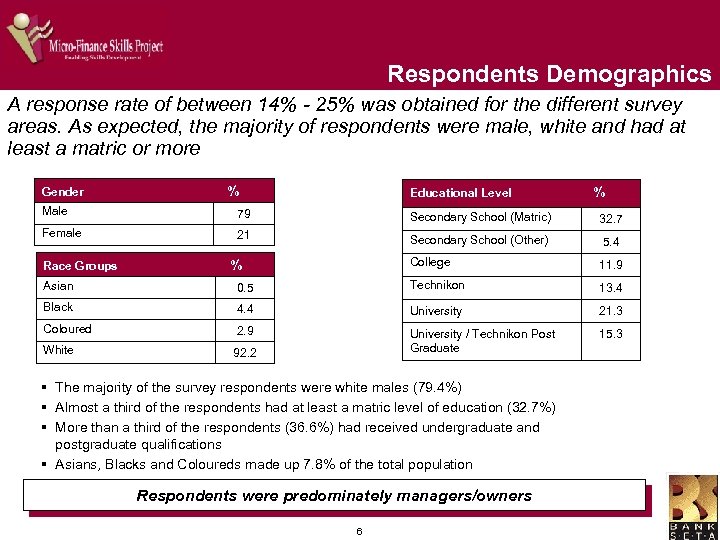

Respondents Demographics A response rate of between 14% - 25% was obtained for the different survey areas. As expected, the majority of respondents were male, white and had at least a matric or more Gender % Educational Level % Male 79 Secondary School (Matric) 32. 7 Female 21 Secondary School (Other) 5. 4 College 11. 9 Race Groups % Asian 0. 5 Technikon 13. 4 Black 4. 4 University 21. 3 Coloured 2. 9 15. 3 White 92. 2 University / Technikon Post Graduate § The majority of the survey respondents were white males (79. 4%) § Almost a third of the respondents had at least a matric level of education (32. 7%) § More than a third of the respondents (36. 6%) had received undergraduate and postgraduate qualifications § Asians, Blacks and Coloureds made up 7. 8% of the total population Respondents were predominately managers/owners 6

Respondents Demographics A response rate of between 14% - 25% was obtained for the different survey areas. As expected, the majority of respondents were male, white and had at least a matric or more Gender % Educational Level % Male 79 Secondary School (Matric) 32. 7 Female 21 Secondary School (Other) 5. 4 College 11. 9 Race Groups % Asian 0. 5 Technikon 13. 4 Black 4. 4 University 21. 3 Coloured 2. 9 15. 3 White 92. 2 University / Technikon Post Graduate § The majority of the survey respondents were white males (79. 4%) § Almost a third of the respondents had at least a matric level of education (32. 7%) § More than a third of the respondents (36. 6%) had received undergraduate and postgraduate qualifications § Asians, Blacks and Coloureds made up 7. 8% of the total population Respondents were predominately managers/owners 6

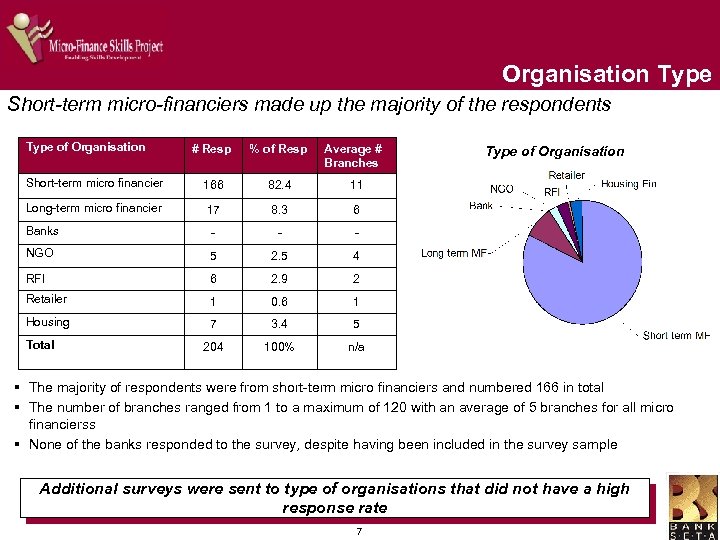

Organisation Type Short-term micro-financiers made up the majority of the respondents Type of Organisation # Resp % of Resp Short-term micro financier 166 82. 4 11 Long-term micro financier 17 8. 3 6 Banks - - - NGO 5 2. 5 4 RFI 6 2. 9 2 Retailer 1 0. 6 1 Housing 7 3. 4 5 204 100% n/a Total Average # Branches Type of Organisation § The majority of respondents were from short-term micro financiers and numbered 166 in total § The number of branches ranged from 1 to a maximum of 120 with an average of 5 branches for all micro financierss § None of the banks responded to the survey, despite having been included in the survey sample Additional surveys were sent to type of organisations that did not have a high response rate 7

Organisation Type Short-term micro-financiers made up the majority of the respondents Type of Organisation # Resp % of Resp Short-term micro financier 166 82. 4 11 Long-term micro financier 17 8. 3 6 Banks - - - NGO 5 2. 5 4 RFI 6 2. 9 2 Retailer 1 0. 6 1 Housing 7 3. 4 5 204 100% n/a Total Average # Branches Type of Organisation § The majority of respondents were from short-term micro financiers and numbered 166 in total § The number of branches ranged from 1 to a maximum of 120 with an average of 5 branches for all micro financierss § None of the banks responded to the survey, despite having been included in the survey sample Additional surveys were sent to type of organisations that did not have a high response rate 7

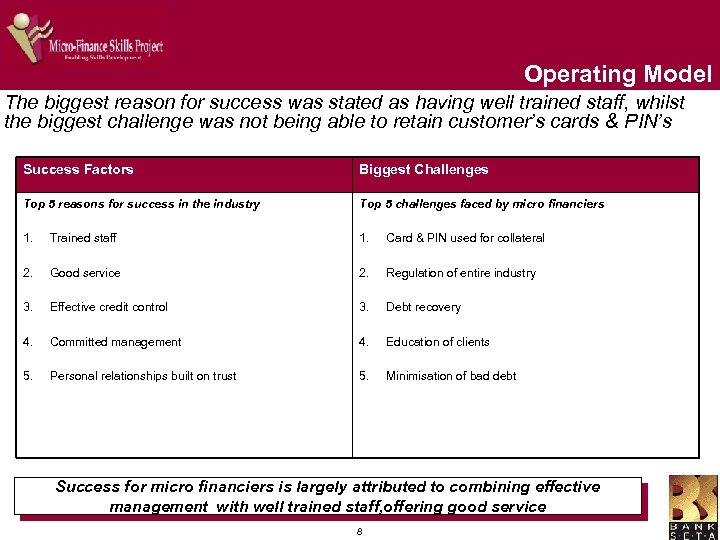

Operating Model The biggest reason for success was stated as having well trained staff, whilst the biggest challenge was not being able to retain customer’s cards & PIN’s Success Factors Biggest Challenges Top 5 reasons for success in the industry 1. Trained staff Top 5 challenges faced by micro financiers 1. Card & PIN used for collateral 2. Good service 2. Regulation of entire industry 3. Effective credit control 3. Debt recovery 4. Committed management 4. Education of clients 5. Personal relationships built on trust 5. Minimisation of bad debt Success for micro financiers is largely attributed to combining effective management with well trained staff, offering good service 8

Operating Model The biggest reason for success was stated as having well trained staff, whilst the biggest challenge was not being able to retain customer’s cards & PIN’s Success Factors Biggest Challenges Top 5 reasons for success in the industry 1. Trained staff Top 5 challenges faced by micro financiers 1. Card & PIN used for collateral 2. Good service 2. Regulation of entire industry 3. Effective credit control 3. Debt recovery 4. Committed management 4. Education of clients 5. Personal relationships built on trust 5. Minimisation of bad debt Success for micro financiers is largely attributed to combining effective management with well trained staff, offering good service 8

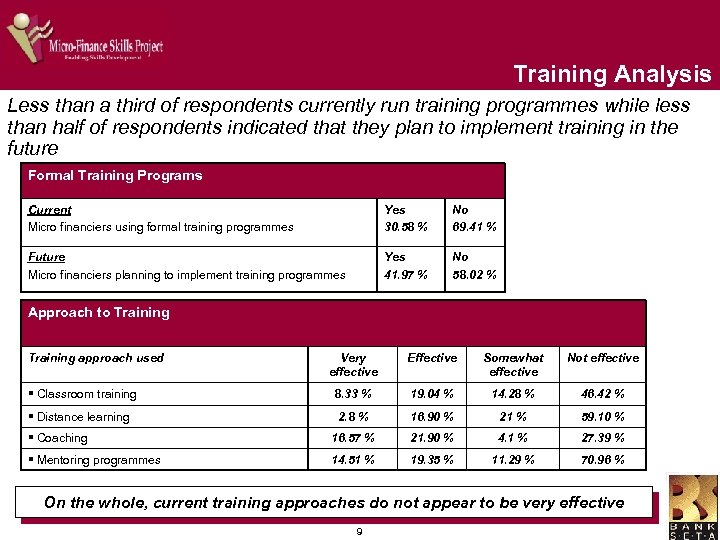

Training Analysis Less than a third of respondents currently run training programmes while less than half of respondents indicated that they plan to implement training in the future Formal Training Programs Current Micro financiers using formal training programmes Yes 30. 58 % No 69. 41 % Future Micro financiers planning to implement training programmes Yes 41. 97 % No 58. 02 % Approach to Training approach used Very effective Effective Somewhat effective Not effective § Classroom training 8. 33 % 19. 04 % 14. 28 % 46. 42 % § Distance learning 2. 8 % 16. 90 % 21 % 59. 10 % § Coaching 16. 57 % 21. 90 % 4. 1 % 27. 39 % § Mentoring programmes 14. 51 % 19. 35 % 11. 29 % 70. 96 % On the whole, current training approaches do not appear to be very effective 9

Training Analysis Less than a third of respondents currently run training programmes while less than half of respondents indicated that they plan to implement training in the future Formal Training Programs Current Micro financiers using formal training programmes Yes 30. 58 % No 69. 41 % Future Micro financiers planning to implement training programmes Yes 41. 97 % No 58. 02 % Approach to Training approach used Very effective Effective Somewhat effective Not effective § Classroom training 8. 33 % 19. 04 % 14. 28 % 46. 42 % § Distance learning 2. 8 % 16. 90 % 21 % 59. 10 % § Coaching 16. 57 % 21. 90 % 4. 1 % 27. 39 % § Mentoring programmes 14. 51 % 19. 35 % 11. 29 % 70. 96 % On the whole, current training approaches do not appear to be very effective 9

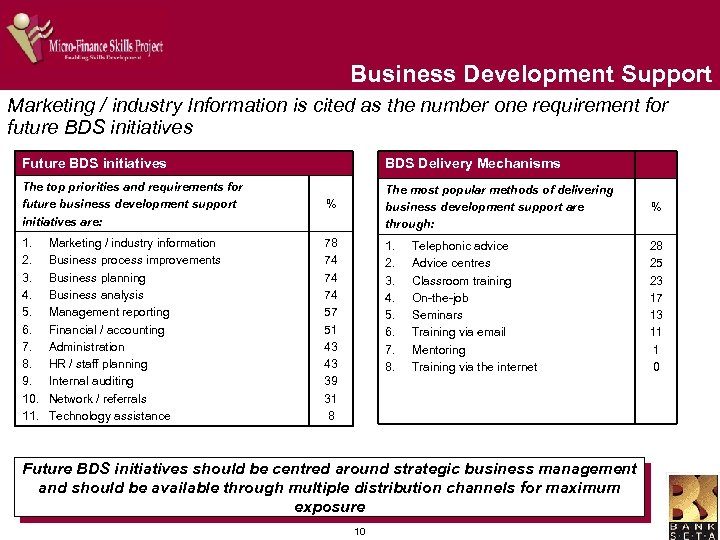

Business Development Support Marketing / industry Information is cited as the number one requirement for future BDS initiatives Future BDS initiatives BDS Delivery Mechanisms The top priorities and requirements for future business development support initiatives are: % The most popular methods of delivering business development support are through: % 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 78 74 74 74 57 51 43 43 39 31 8 1. 2. 3. 4. 5. 6. 7. 8. 28 25 23 17 13 11 1 0 Marketing / industry information Business process improvements Business planning Business analysis Management reporting Financial / accounting Administration HR / staff planning Internal auditing Network / referrals Technology assistance Telephonic advice Advice centres Classroom training On-the-job Seminars Training via email Mentoring Training via the internet Future BDS initiatives should be centred around strategic business management and should be available through multiple distribution channels for maximum exposure 10

Business Development Support Marketing / industry Information is cited as the number one requirement for future BDS initiatives Future BDS initiatives BDS Delivery Mechanisms The top priorities and requirements for future business development support initiatives are: % The most popular methods of delivering business development support are through: % 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 78 74 74 74 57 51 43 43 39 31 8 1. 2. 3. 4. 5. 6. 7. 8. 28 25 23 17 13 11 1 0 Marketing / industry information Business process improvements Business planning Business analysis Management reporting Financial / accounting Administration HR / staff planning Internal auditing Network / referrals Technology assistance Telephonic advice Advice centres Classroom training On-the-job Seminars Training via email Mentoring Training via the internet Future BDS initiatives should be centred around strategic business management and should be available through multiple distribution channels for maximum exposure 10

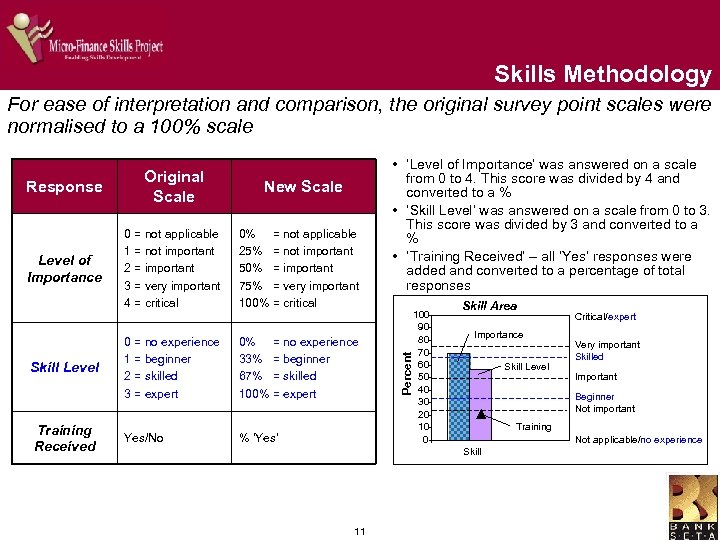

Skills Methodology For ease of interpretation and comparison, the original survey point scales were normalised to a 100% scale Level of Importance 0 = not applicable 1 = not important 2 = important 3 = very important 4 = critical Skill Level Training Received New Scale 0% = not applicable 25% = not important 50% = important 75% = very important 100% = critical 0 = no experience 1 = beginner 2 = skilled 3 = expert 0% = no experience 33% = beginner 67% = skilled 100% = expert Yes/No % ‘Yes’ • ‘Level of Importance’ was answered on a scale from 0 to 4. This score was divided by 4 and converted to a % • ‘Skill Level’ was answered on a scale from 0 to 3. This score was divided by 3 and converted to a % • ‘Training Received’ – all ‘Yes’ responses were added and converted to a percentage of total responses Percent Response Original Scale 100 90 80 70 60 50 40 30 20 10 0 Skill Area Importance Skill Level Very important Skilled Important Beginner Not important Training Not applicable/no experience Skill 11 Critical/expert

Skills Methodology For ease of interpretation and comparison, the original survey point scales were normalised to a 100% scale Level of Importance 0 = not applicable 1 = not important 2 = important 3 = very important 4 = critical Skill Level Training Received New Scale 0% = not applicable 25% = not important 50% = important 75% = very important 100% = critical 0 = no experience 1 = beginner 2 = skilled 3 = expert 0% = no experience 33% = beginner 67% = skilled 100% = expert Yes/No % ‘Yes’ • ‘Level of Importance’ was answered on a scale from 0 to 4. This score was divided by 4 and converted to a % • ‘Skill Level’ was answered on a scale from 0 to 3. This score was divided by 3 and converted to a % • ‘Training Received’ – all ‘Yes’ responses were added and converted to a percentage of total responses Percent Response Original Scale 100 90 80 70 60 50 40 30 20 10 0 Skill Area Importance Skill Level Very important Skilled Important Beginner Not important Training Not applicable/no experience Skill 11 Critical/expert

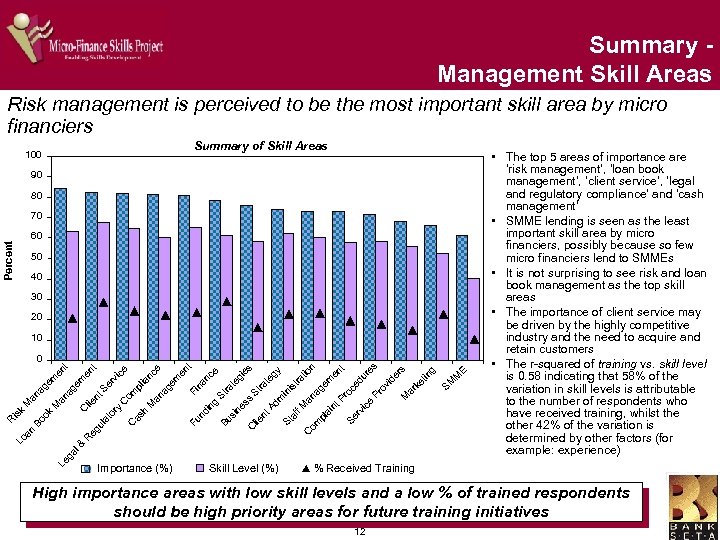

Summary Management Skill Areas Risk management is perceived to be the most important skill area by micro financiers Summary of Skill Areas 100 90 80 70 Percent 60 50 40 30 20 10 te gy dm in St is af tra f M tio C an n om ag pl em ai nt en P t ro Se ce rv du ic re e s Pr ov id er s M ar ke tin g SM M E lie C Bu si nt A ne ss S tra te gi e e ra St g in nd Fu h as s t na nc en Fi e ge m ia M an a om pl C at o eg ul Le ga l & R C C ry lie nt S er vi nc ce t m en ag e an M oo k an B Lo R is k M an ag em en t 0 Importance (%) Skill Level (%) • The top 5 areas of importance are ‘risk management’, ‘loan book management’, ‘client service’, ‘legal and regulatory compliance’ and ‘cash management’ • SMME lending is seen as the least important skill area by micro financiers, possibly because so few micro financiers lend to SMMEs • It is not surprising to see risk and loan book management as the top skill areas • The importance of client service may be driven by the highly competitive industry and the need to acquire and retain customers • The r-squared of training vs. skill level is 0. 58 indicating that 58% of the variation in skill levels is attributable to the number of respondents who have received training, whilst the other 42% of the variation is determined by other factors (for example: experience) % Received Training High importance areas with low skill levels and a low % of trained respondents should be high priority areas for future training initiatives 12

Summary Management Skill Areas Risk management is perceived to be the most important skill area by micro financiers Summary of Skill Areas 100 90 80 70 Percent 60 50 40 30 20 10 te gy dm in St is af tra f M tio C an n om ag pl em ai nt en P t ro Se ce rv du ic re e s Pr ov id er s M ar ke tin g SM M E lie C Bu si nt A ne ss S tra te gi e e ra St g in nd Fu h as s t na nc en Fi e ge m ia M an a om pl C at o eg ul Le ga l & R C C ry lie nt S er vi nc ce t m en ag e an M oo k an B Lo R is k M an ag em en t 0 Importance (%) Skill Level (%) • The top 5 areas of importance are ‘risk management’, ‘loan book management’, ‘client service’, ‘legal and regulatory compliance’ and ‘cash management’ • SMME lending is seen as the least important skill area by micro financiers, possibly because so few micro financiers lend to SMMEs • It is not surprising to see risk and loan book management as the top skill areas • The importance of client service may be driven by the highly competitive industry and the need to acquire and retain customers • The r-squared of training vs. skill level is 0. 58 indicating that 58% of the variation in skill levels is attributable to the number of respondents who have received training, whilst the other 42% of the variation is determined by other factors (for example: experience) % Received Training High importance areas with low skill levels and a low % of trained respondents should be high priority areas for future training initiatives 12

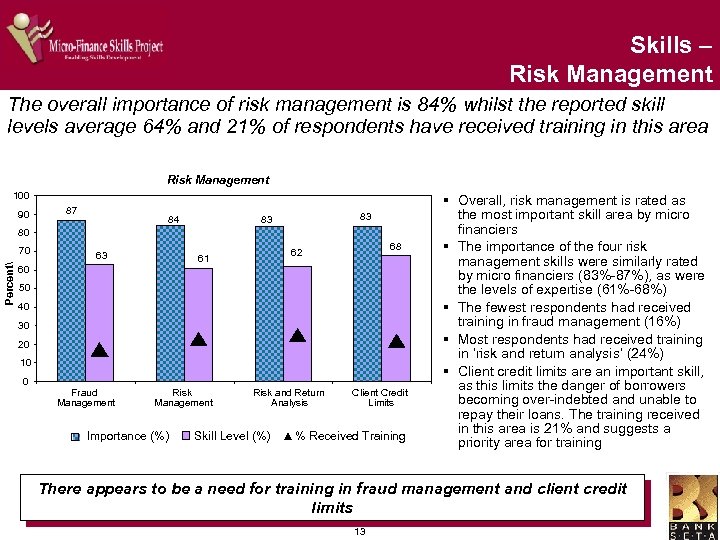

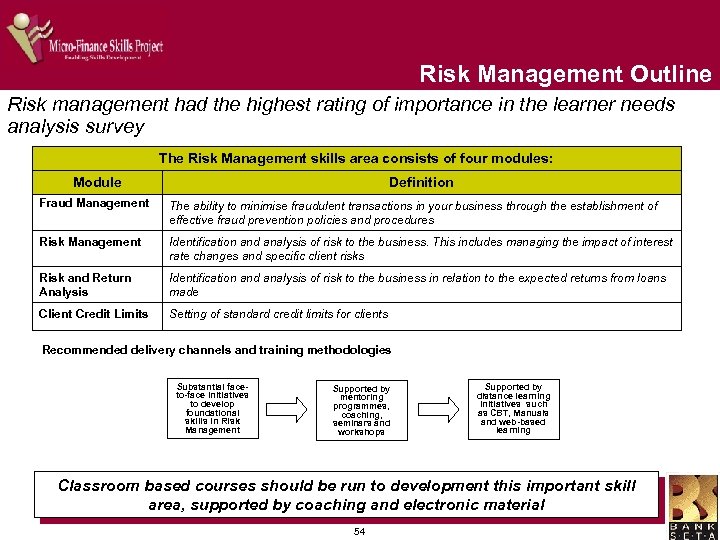

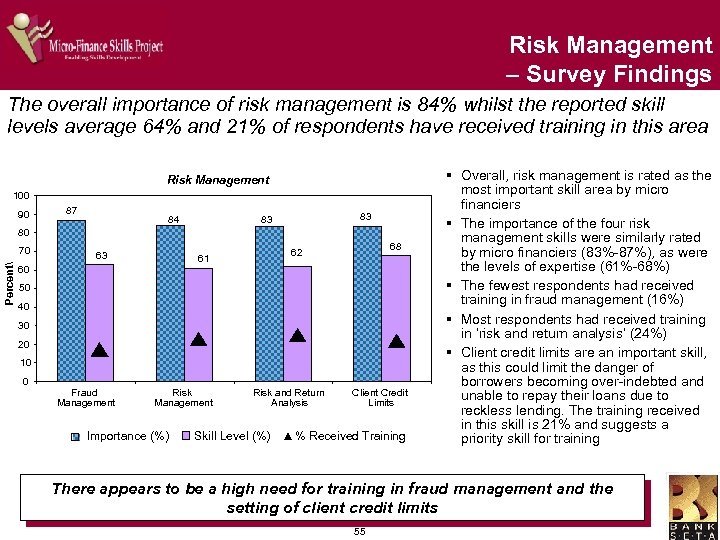

Skills – Risk Management The overall importance of risk management is 84% whilst the reported skill levels average 64% and 21% of respondents have received training in this area Risk Management 100 90 87 84 83 83 80 Percent 70 63 68 62 61 60 50 40 30 20 10 0 Fraud Management Risk Management Importance (%) Risk and Return Analysis Skill Level (%) Client Credit Limits % Received Training § Overall, risk management is rated as the most important skill area by micro financiers § The importance of the four risk management skills were similarly rated by micro financiers (83%-87%), as were the levels of expertise (61%-68%) § The fewest respondents had received training in fraud management (16%) § Most respondents had received training in ‘risk and return analysis’ (24%) § Client credit limits are an important skill, as this limits the danger of borrowers becoming over-indebted and unable to repay their loans. The training received in this area is 21% and suggests a priority area for training There appears to be a need for training in fraud management and client credit limits 13

Skills – Risk Management The overall importance of risk management is 84% whilst the reported skill levels average 64% and 21% of respondents have received training in this area Risk Management 100 90 87 84 83 83 80 Percent 70 63 68 62 61 60 50 40 30 20 10 0 Fraud Management Risk Management Importance (%) Risk and Return Analysis Skill Level (%) Client Credit Limits % Received Training § Overall, risk management is rated as the most important skill area by micro financiers § The importance of the four risk management skills were similarly rated by micro financiers (83%-87%), as were the levels of expertise (61%-68%) § The fewest respondents had received training in fraud management (16%) § Most respondents had received training in ‘risk and return analysis’ (24%) § Client credit limits are an important skill, as this limits the danger of borrowers becoming over-indebted and unable to repay their loans. The training received in this area is 21% and suggests a priority area for training There appears to be a need for training in fraud management and client credit limits 13

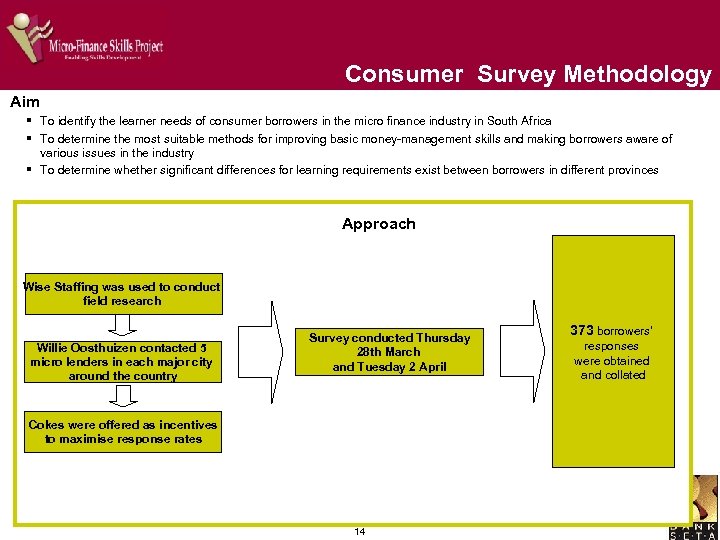

Consumer Survey Methodology Aim § To identify the learner needs of consumer borrowers in the micro finance industry in South Africa § To determine the most suitable methods for improving basic money-management skills and making borrowers aware of various issues in the industry § To determine whether significant differences for learning requirements exist between borrowers in different provinces Approach Wise Staffing was used to conduct field research Willie Oosthuizen contacted 5 micro lenders in each major city around the country Survey conducted Thursday 28 th March and Tuesday 2 April Cokes were offered as incentives to maximise response rates 14 373 borrowers’ responses were obtained and collated

Consumer Survey Methodology Aim § To identify the learner needs of consumer borrowers in the micro finance industry in South Africa § To determine the most suitable methods for improving basic money-management skills and making borrowers aware of various issues in the industry § To determine whether significant differences for learning requirements exist between borrowers in different provinces Approach Wise Staffing was used to conduct field research Willie Oosthuizen contacted 5 micro lenders in each major city around the country Survey conducted Thursday 28 th March and Tuesday 2 April Cokes were offered as incentives to maximise response rates 14 373 borrowers’ responses were obtained and collated

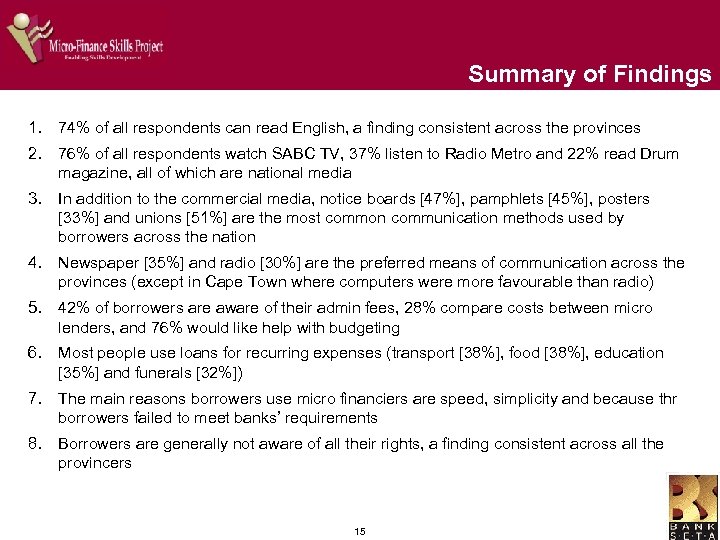

Summary of Findings 1. 74% of all respondents can read English, a finding consistent across the provinces 2. 76% of all respondents watch SABC TV, 37% listen to Radio Metro and 22% read Drum magazine, all of which are national media 3. In addition to the commercial media, notice boards [47%], pamphlets [45%], posters [33%] and unions [51%] are the most common communication methods used by borrowers across the nation 4. Newspaper [35%] and radio [30%] are the preferred means of communication across the provinces (except in Cape Town where computers were more favourable than radio) 5. 42% of borrowers are aware of their admin fees, 28% compare costs between micro lenders, and 76% would like help with budgeting 6. Most people use loans for recurring expenses (transport [38%], food [38%], education [35%] and funerals [32%]) 7. The main reasons borrowers use micro financiers are speed, simplicity and because thr borrowers failed to meet banks’ requirements 8. Borrowers are generally not aware of all their rights, a finding consistent across all the provincers 15

Summary of Findings 1. 74% of all respondents can read English, a finding consistent across the provinces 2. 76% of all respondents watch SABC TV, 37% listen to Radio Metro and 22% read Drum magazine, all of which are national media 3. In addition to the commercial media, notice boards [47%], pamphlets [45%], posters [33%] and unions [51%] are the most common communication methods used by borrowers across the nation 4. Newspaper [35%] and radio [30%] are the preferred means of communication across the provinces (except in Cape Town where computers were more favourable than radio) 5. 42% of borrowers are aware of their admin fees, 28% compare costs between micro lenders, and 76% would like help with budgeting 6. Most people use loans for recurring expenses (transport [38%], food [38%], education [35%] and funerals [32%]) 7. The main reasons borrowers use micro financiers are speed, simplicity and because thr borrowers failed to meet banks’ requirements 8. Borrowers are generally not aware of all their rights, a finding consistent across all the provincers 15

![Communication Method Newspaper [35%] and radio [30%] are the preferred means of communication across Communication Method Newspaper [35%] and radio [30%] are the preferred means of communication across](https://present5.com/presentation/915e6ce3b76679789ec7aa24c6f4afe3/image-16.jpg) Communication Method Newspaper [35%] and radio [30%] are the preferred means of communication across the provinces (except in Cape Town where computers were more favourable than radio) Cape Town Joburg Bloem Durban PE Sample Size (n) 145 109 58 40 21 Newspaper 52% 37% 12% 15% 5% Radio 4% 67% 12% 48% 33% Computer 23% - - Television 6% 1% - 28% - Pamphlets - - 14% 3% Commercial Communication Media Preference – Total Sample - Language Computer TV Pamphlets Newspaper Radio • Although many respondents watch TV (at least 76%) it is not a preferred communication method ØThis could be due to respondents watching at irregular intervals, or perhaps not owning their own televisions and only watching at work • The response rate in Bloemfontein was low for all media possibly because respondents did not understand the questions • Pamphlets do not appear to be an effective means of communicating with borrowers ØThis finding may be due to people not knowing where to get pamphlets from, or the irregularity in the distribution of information pamphlets The Sowetan and the Argus would reach a large percentage of the population and is a practical means of delivery (newspapers are cheap and can be kept). Radio Metro would also reach a large audience, although listening times have not been tested 16

Communication Method Newspaper [35%] and radio [30%] are the preferred means of communication across the provinces (except in Cape Town where computers were more favourable than radio) Cape Town Joburg Bloem Durban PE Sample Size (n) 145 109 58 40 21 Newspaper 52% 37% 12% 15% 5% Radio 4% 67% 12% 48% 33% Computer 23% - - Television 6% 1% - 28% - Pamphlets - - 14% 3% Commercial Communication Media Preference – Total Sample - Language Computer TV Pamphlets Newspaper Radio • Although many respondents watch TV (at least 76%) it is not a preferred communication method ØThis could be due to respondents watching at irregular intervals, or perhaps not owning their own televisions and only watching at work • The response rate in Bloemfontein was low for all media possibly because respondents did not understand the questions • Pamphlets do not appear to be an effective means of communicating with borrowers ØThis finding may be due to people not knowing where to get pamphlets from, or the irregularity in the distribution of information pamphlets The Sowetan and the Argus would reach a large percentage of the population and is a practical means of delivery (newspapers are cheap and can be kept). Radio Metro would also reach a large audience, although listening times have not been tested 16

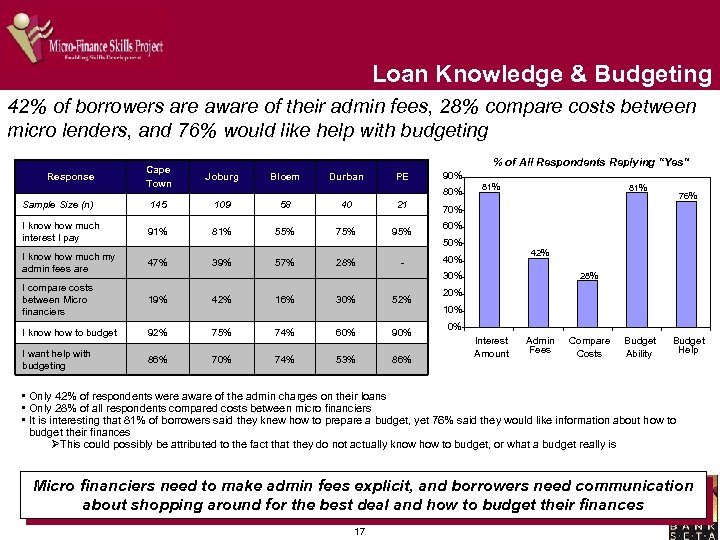

Loan Knowledge & Budgeting 42% of borrowers are aware of their admin fees, 28% compare costs between micro lenders, and 76% would like help with budgeting % of All Respondents Replying “Yes” Cape Town Joburg Sample Size (n) 145 109 58 40 21 I know how much interest I pay 91% 81% 55% 75% 95% I know how much my admin fees are 47% 39% 57% 28% - I compare costs between Micro financiers 19% 42% 16% 30% 52% I know how to budget 92% 75% 74% 60% 90% I want help with budgeting 86% 70% 74% 53% 86% Response Bloem Durban PE 90% 81% 81% 76% 70% 60% 50% 42% 40% 30% 28% 20% 10% 0% Interest Amount Admin Fees Compare Costs Budget Ability Budget Help • Only 42% of respondents were aware of the admin charges on their loans • Only 28% of all respondents compared costs between micro financiers • It is interesting that 81% of borrowers said they knew how to prepare a budget, yet 76% said they would like information about how to budget their finances ØThis could possibly be attributed to the fact that they do not actually know how to budget, or what a budget really is Micro financiers need to make admin fees explicit, and borrowers need communication about shopping around for the best deal and how to budget their finances 17

Loan Knowledge & Budgeting 42% of borrowers are aware of their admin fees, 28% compare costs between micro lenders, and 76% would like help with budgeting % of All Respondents Replying “Yes” Cape Town Joburg Sample Size (n) 145 109 58 40 21 I know how much interest I pay 91% 81% 55% 75% 95% I know how much my admin fees are 47% 39% 57% 28% - I compare costs between Micro financiers 19% 42% 16% 30% 52% I know how to budget 92% 75% 74% 60% 90% I want help with budgeting 86% 70% 74% 53% 86% Response Bloem Durban PE 90% 81% 81% 76% 70% 60% 50% 42% 40% 30% 28% 20% 10% 0% Interest Amount Admin Fees Compare Costs Budget Ability Budget Help • Only 42% of respondents were aware of the admin charges on their loans • Only 28% of all respondents compared costs between micro financiers • It is interesting that 81% of borrowers said they knew how to prepare a budget, yet 76% said they would like information about how to budget their finances ØThis could possibly be attributed to the fact that they do not actually know how to budget, or what a budget really is Micro financiers need to make admin fees explicit, and borrowers need communication about shopping around for the best deal and how to budget their finances 17

![Loan Usage Most borrowers use loans for recurring expenses (transport & food [38%], education Loan Usage Most borrowers use loans for recurring expenses (transport & food [38%], education](https://present5.com/presentation/915e6ce3b76679789ec7aa24c6f4afe3/image-18.jpg) Loan Usage Most borrowers use loans for recurring expenses (transport & food [38%], education [35%] and funerals [32%]) Why do you use a Micro financier and not a bank? Total Sample Size (n) 373 It is easier than using a bank 35% It takes less time to approve a loan than at a bank 20% I do not meet the requirements for a bank loan 17% I don’t know how bank loans work 4% I am blacklisted and can’t get a loan at the bank Recreation & Sport Agriculture Business Use Transport Pay off other loans 4% It is cheaper [interest] than the banks Loan Use - Total Sample 2% Home Extensions Medical Expenses Food Clothing Furniture Education Funerals • Most respondents felt that micro financiers are quicker and easier than banks Ø Many borrowers said they need money in a hurry, therefore micro financiers are the lenders of choice for them § Only 17% of borrowers used micro financiers because they didn’t qualify for a bank loan – most respondents therefore prefer micro financiers for reasons of convenience • These findings showed no significant differences across the provinces Borrowers need communication on how to calculate their recurring monthly expenses and to save enough money each month in order to avoid the debt spiral. Borrowers also need information on how bank loans work and what is required to obtain a bank loan 18

Loan Usage Most borrowers use loans for recurring expenses (transport & food [38%], education [35%] and funerals [32%]) Why do you use a Micro financier and not a bank? Total Sample Size (n) 373 It is easier than using a bank 35% It takes less time to approve a loan than at a bank 20% I do not meet the requirements for a bank loan 17% I don’t know how bank loans work 4% I am blacklisted and can’t get a loan at the bank Recreation & Sport Agriculture Business Use Transport Pay off other loans 4% It is cheaper [interest] than the banks Loan Use - Total Sample 2% Home Extensions Medical Expenses Food Clothing Furniture Education Funerals • Most respondents felt that micro financiers are quicker and easier than banks Ø Many borrowers said they need money in a hurry, therefore micro financiers are the lenders of choice for them § Only 17% of borrowers used micro financiers because they didn’t qualify for a bank loan – most respondents therefore prefer micro financiers for reasons of convenience • These findings showed no significant differences across the provinces Borrowers need communication on how to calculate their recurring monthly expenses and to save enough money each month in order to avoid the debt spiral. Borrowers also need information on how bank loans work and what is required to obtain a bank loan 18

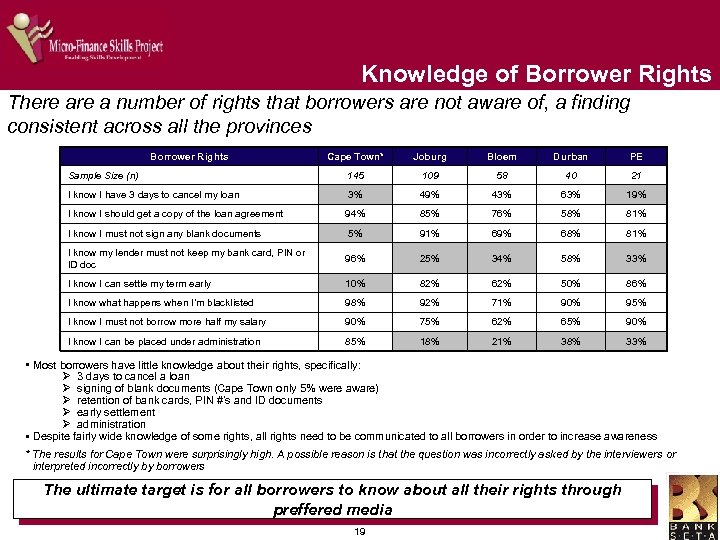

Knowledge of Borrower Rights There a number of rights that borrowers are not aware of, a finding consistent across all the provinces Borrower Rights Cape Town* Joburg Bloem Durban PE Sample Size (n) 145 109 58 40 21 I know I have 3 days to cancel my loan 3% 49% 43% 63% 19% I know I should get a copy of the loan agreement 94% 85% 76% 58% 81% I know I must not sign any blank documents 5% 91% 69% 68% 81% I know my lender must not keep my bank card, PIN or ID doc 96% 25% 34% 58% 33% I know I can settle my term early 10% 82% 62% 50% 86% I know what happens when I’m blacklisted 98% 92% 71% 90% 95% I know I must not borrow more half my salary 90% 75% 62% 65% 90% I know I can be placed under administration 85% 18% 21% 38% 33% • Most borrowers have little knowledge about their rights, specifically: Ø 3 days to cancel a loan Ø signing of blank documents (Cape Town only 5% were aware) Ø retention of bank cards, PIN #’s and ID documents Ø early settlement Ø administration § Despite fairly wide knowledge of some rights, all rights need to be communicated to all borrowers in order to increase awareness * The results for Cape Town were surprisingly high. A possible reason is that the question was incorrectly asked by the interviewers or interpreted incorrectly by borrowers The ultimate target is for all borrowers to know about all their rights through preffered media 19

Knowledge of Borrower Rights There a number of rights that borrowers are not aware of, a finding consistent across all the provinces Borrower Rights Cape Town* Joburg Bloem Durban PE Sample Size (n) 145 109 58 40 21 I know I have 3 days to cancel my loan 3% 49% 43% 63% 19% I know I should get a copy of the loan agreement 94% 85% 76% 58% 81% I know I must not sign any blank documents 5% 91% 69% 68% 81% I know my lender must not keep my bank card, PIN or ID doc 96% 25% 34% 58% 33% I know I can settle my term early 10% 82% 62% 50% 86% I know what happens when I’m blacklisted 98% 92% 71% 90% 95% I know I must not borrow more half my salary 90% 75% 62% 65% 90% I know I can be placed under administration 85% 18% 21% 38% 33% • Most borrowers have little knowledge about their rights, specifically: Ø 3 days to cancel a loan Ø signing of blank documents (Cape Town only 5% were aware) Ø retention of bank cards, PIN #’s and ID documents Ø early settlement Ø administration § Despite fairly wide knowledge of some rights, all rights need to be communicated to all borrowers in order to increase awareness * The results for Cape Town were surprisingly high. A possible reason is that the question was incorrectly asked by the interviewers or interpreted incorrectly by borrowers The ultimate target is for all borrowers to know about all their rights through preffered media 19

Agenda Item Resp. Time 1. Project Approach Wendy Pienaar 5 min 2. Lender and Consumer Survey Summary Wendy Pienaar 5 min 3. Business Development Support Assignment Alicia Greenwood 15 min 4. Curriculum Framework Assignment Brent Davids 15 min 5. Selection Assignment Wendy Pienaar 5 min 6. The Way Forward Wendy Pienaar 5 min 7. Breakout Instructions Heather Watson 5 min 20

Agenda Item Resp. Time 1. Project Approach Wendy Pienaar 5 min 2. Lender and Consumer Survey Summary Wendy Pienaar 5 min 3. Business Development Support Assignment Alicia Greenwood 15 min 4. Curriculum Framework Assignment Brent Davids 15 min 5. Selection Assignment Wendy Pienaar 5 min 6. The Way Forward Wendy Pienaar 5 min 7. Breakout Instructions Heather Watson 5 min 20

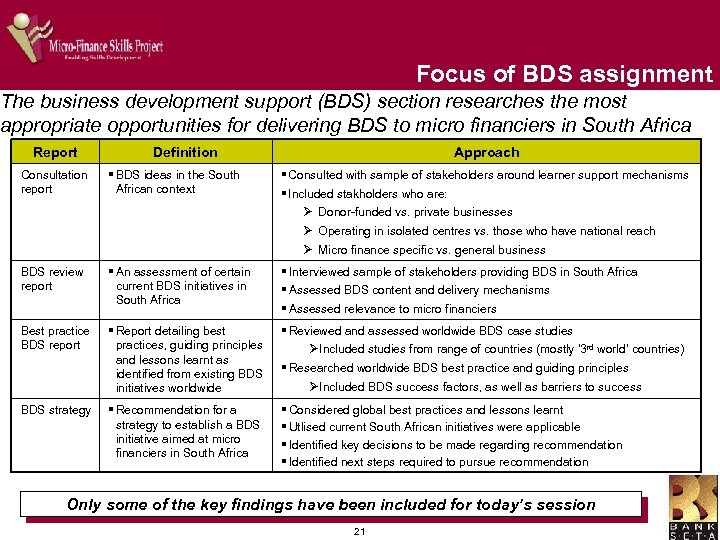

Focus of BDS assignment The business development support (BDS) section researches the most appropriate opportunities for delivering BDS to micro financiers in South Africa Report Definition Approach Consultation report § BDS ideas in the South African context § Consulted with sample of stakeholders around learner support mechanisms § Included stakholders who are: Ø Donor-funded vs. private businesses Ø Operating in isolated centres vs. those who have national reach Ø Micro finance specific vs. general business BDS review report § An assessment of certain current BDS initiatives in South Africa § Interviewed sample of stakeholders providing BDS in South Africa § Assessed BDS content and delivery mechanisms § Assessed relevance to micro financiers Best practice BDS report § Report detailing best practices, guiding principles and lessons learnt as identified from existing BDS initiatives worldwide § Reviewed and assessed worldwide BDS case studies ØIncluded studies from range of countries (mostly ‘ 3 rd world’ countries) § Researched worldwide BDS best practice and guiding principles ØIncluded BDS success factors, as well as barriers to success BDS strategy § Recommendation for a strategy to establish a BDS initiative aimed at micro financiers in South Africa § Considered global best practices and lessons learnt § Utlised current South African initiatives were applicable § Identified key decisions to be made regarding recommendation § Identified next steps required to pursue recommendation Only some of the key findings have been included for today’s session 21

Focus of BDS assignment The business development support (BDS) section researches the most appropriate opportunities for delivering BDS to micro financiers in South Africa Report Definition Approach Consultation report § BDS ideas in the South African context § Consulted with sample of stakeholders around learner support mechanisms § Included stakholders who are: Ø Donor-funded vs. private businesses Ø Operating in isolated centres vs. those who have national reach Ø Micro finance specific vs. general business BDS review report § An assessment of certain current BDS initiatives in South Africa § Interviewed sample of stakeholders providing BDS in South Africa § Assessed BDS content and delivery mechanisms § Assessed relevance to micro financiers Best practice BDS report § Report detailing best practices, guiding principles and lessons learnt as identified from existing BDS initiatives worldwide § Reviewed and assessed worldwide BDS case studies ØIncluded studies from range of countries (mostly ‘ 3 rd world’ countries) § Researched worldwide BDS best practice and guiding principles ØIncluded BDS success factors, as well as barriers to success BDS strategy § Recommendation for a strategy to establish a BDS initiative aimed at micro financiers in South Africa § Considered global best practices and lessons learnt § Utlised current South African initiatives were applicable § Identified key decisions to be made regarding recommendation § Identified next steps required to pursue recommendation Only some of the key findings have been included for today’s session 21

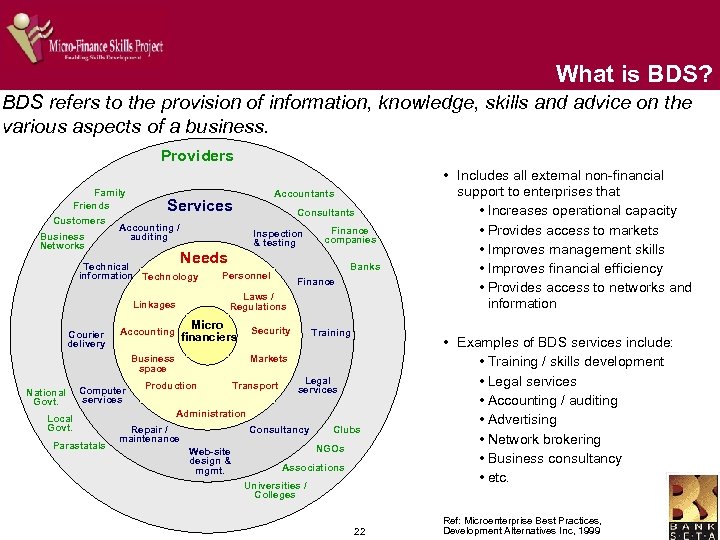

What is BDS? BDS refers to the provision of information, knowledge, skills and advice on the various aspects of a business. Providers Family Friends Customers Accounting / Business auditing Networks Accountants Services Inspection & testing Needs Technical information Technology Micro financiers Accounting Computer services Local Govt. Parastatals Banks Personnel Finance Security Training Markets Business space National Govt. Finance companies Laws / Regulations Linkages Courier delivery Consultants Production Transport Legal services Administration Consultancy Repair / maintenance Web-site design & mgmt. Clubs NGOs Associations Universities / Colleges 22 • Includes all external non-financial support to enterprises that • Increases operational capacity • Provides access to markets • Improves management skills • Improves financial efficiency • Provides access to networks and information • Examples of BDS services include: • Training / skills development • Legal services • Accounting / auditing • Advertising • Network brokering • Business consultancy • etc. Ref: Microenterprise Best Practices, Development Alternatives Inc, 1999

What is BDS? BDS refers to the provision of information, knowledge, skills and advice on the various aspects of a business. Providers Family Friends Customers Accounting / Business auditing Networks Accountants Services Inspection & testing Needs Technical information Technology Micro financiers Accounting Computer services Local Govt. Parastatals Banks Personnel Finance Security Training Markets Business space National Govt. Finance companies Laws / Regulations Linkages Courier delivery Consultants Production Transport Legal services Administration Consultancy Repair / maintenance Web-site design & mgmt. Clubs NGOs Associations Universities / Colleges 22 • Includes all external non-financial support to enterprises that • Increases operational capacity • Provides access to markets • Improves management skills • Improves financial efficiency • Provides access to networks and information • Examples of BDS services include: • Training / skills development • Legal services • Accounting / auditing • Advertising • Network brokering • Business consultancy • etc. Ref: Microenterprise Best Practices, Development Alternatives Inc, 1999

BDS Success Criteria Best practice research indicates that successful BDS initiatives understand the markets they serve and provide demand-driven services 1. BDS services must be demand-driven Ø Ensures a greater, more positive impact, and encourages clients to pay for the services they value 2. BDS services must be provided to the right clientele Ø The main objective of a BDS is to facilitate growth, profitability and competitiveness of SMMEs. The BDS must therefore be provided to SMMEs who exhibit good entrepreneurial characteristics and can make good use of the services 3. The SMME community must have a strong sense of ownership in the BDS Ø The best business providers generally work in the environment, resulting in commitment and strong ownership 4. The BDS centre must achieve maximum outreach Ø Maximum impact can be achieved by strengthening private sector service providers, creating better networks between service providers, and promoting informal systems of learning 5. The BDS centre and its service providers must achieve financial sustainability Ø The institutional and financial sustainability must be achieved by controlling costs to maintain competitive and to increase profits 23

BDS Success Criteria Best practice research indicates that successful BDS initiatives understand the markets they serve and provide demand-driven services 1. BDS services must be demand-driven Ø Ensures a greater, more positive impact, and encourages clients to pay for the services they value 2. BDS services must be provided to the right clientele Ø The main objective of a BDS is to facilitate growth, profitability and competitiveness of SMMEs. The BDS must therefore be provided to SMMEs who exhibit good entrepreneurial characteristics and can make good use of the services 3. The SMME community must have a strong sense of ownership in the BDS Ø The best business providers generally work in the environment, resulting in commitment and strong ownership 4. The BDS centre must achieve maximum outreach Ø Maximum impact can be achieved by strengthening private sector service providers, creating better networks between service providers, and promoting informal systems of learning 5. The BDS centre and its service providers must achieve financial sustainability Ø The institutional and financial sustainability must be achieved by controlling costs to maintain competitive and to increase profits 23

Barriers to BDS Success Provision of BDS can be complicated and some international initiatives have not been successful § Not charging for services often results in poor commitment from the users Ø There must be a balance between free and paid-for services § Relying solely on private market finance can be detrimental Ø Businesses may be reluctant to incur the costs of setting up BDS initiatives, as their competitors may be just as likely to benefit Ø Provides a rationale for donor support justified on a cost-benefit basis, rather than on the return on investment that individual businesses usually make § Support services are often too generalised Ø Often supply-driven and delivered in a top-down fashion, rather than from a SMME demand perspective Ø Training should be business-oriented, and not viewed as an extension of the basic general educational system § Support services are sometimes not accessible by the target users Ø Must be delivered via a suitable, convenient medium 24

Barriers to BDS Success Provision of BDS can be complicated and some international initiatives have not been successful § Not charging for services often results in poor commitment from the users Ø There must be a balance between free and paid-for services § Relying solely on private market finance can be detrimental Ø Businesses may be reluctant to incur the costs of setting up BDS initiatives, as their competitors may be just as likely to benefit Ø Provides a rationale for donor support justified on a cost-benefit basis, rather than on the return on investment that individual businesses usually make § Support services are often too generalised Ø Often supply-driven and delivered in a top-down fashion, rather than from a SMME demand perspective Ø Training should be business-oriented, and not viewed as an extension of the basic general educational system § Support services are sometimes not accessible by the target users Ø Must be delivered via a suitable, convenient medium 24

Overview of BDS Initiatives An assessment of a sample set of SA BDS initiatives illustrated that excellent progress has been made in supporting SMMEs § There are many BDS initiatives targeting SMMEs in general Ø Ø Ø § Strengths: Ø Ø § Different delivery mechanisms are used Different levels of information are provided Different levels of support are provided In some cases, shared services are provided Both donor-funded and self-sustainable models are used Large volumes of general business information are available A large amount of support is available A large network of service providers is in place across the country A web-based BDS initiative is being successfully run Lessons learnt: Ø Ø Ø Require sector-specific expertise and support Face-to-face approach is very successful Charging for services results in more buy-in and commitment from users Closer interaction with affiliates required Limited resources for industry research Poor client satisfaction / client impact assessment processes 25

Overview of BDS Initiatives An assessment of a sample set of SA BDS initiatives illustrated that excellent progress has been made in supporting SMMEs § There are many BDS initiatives targeting SMMEs in general Ø Ø Ø § Strengths: Ø Ø § Different delivery mechanisms are used Different levels of information are provided Different levels of support are provided In some cases, shared services are provided Both donor-funded and self-sustainable models are used Large volumes of general business information are available A large amount of support is available A large network of service providers is in place across the country A web-based BDS initiative is being successfully run Lessons learnt: Ø Ø Ø Require sector-specific expertise and support Face-to-face approach is very successful Charging for services results in more buy-in and commitment from users Closer interaction with affiliates required Limited resources for industry research Poor client satisfaction / client impact assessment processes 25

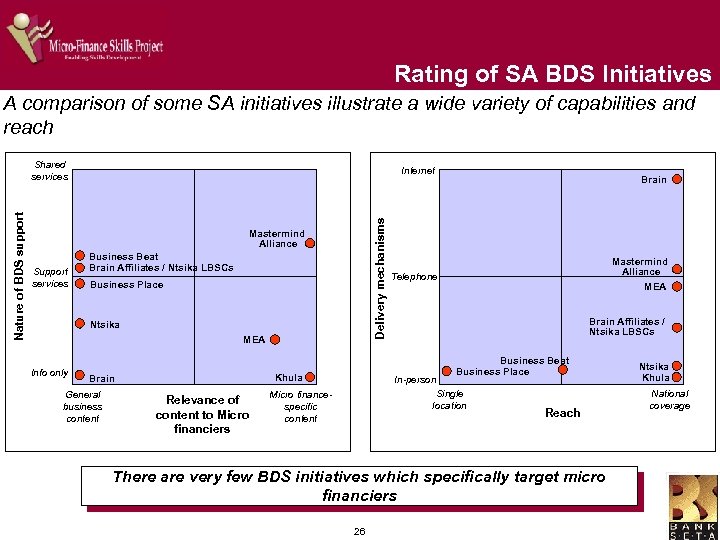

Rating of SA BDS Initiatives A comparison of some SA initiatives illustrate a wide variety of capabilities and reach Internet Delivery mechanisms Nature of BDS support Shared services Mastermind Alliance Support services Business Beat Brain Affiliates / Ntsika LBSCs Business Place Ntsika MEA Info only General business content Relevance of content to Micro financiers Mastermind Alliance Telephone MEA Brain Affiliates / Ntsika LBSCs Business Beat Business Place Khula Brain In-person Single location Micro financespecific content Reach There are very few BDS initiatives which specifically target micro financiers 26 Ntsika Khula National coverage

Rating of SA BDS Initiatives A comparison of some SA initiatives illustrate a wide variety of capabilities and reach Internet Delivery mechanisms Nature of BDS support Shared services Mastermind Alliance Support services Business Beat Brain Affiliates / Ntsika LBSCs Business Place Ntsika MEA Info only General business content Relevance of content to Micro financiers Mastermind Alliance Telephone MEA Brain Affiliates / Ntsika LBSCs Business Beat Business Place Khula Brain In-person Single location Micro financespecific content Reach There are very few BDS initiatives which specifically target micro financiers 26 Ntsika Khula National coverage

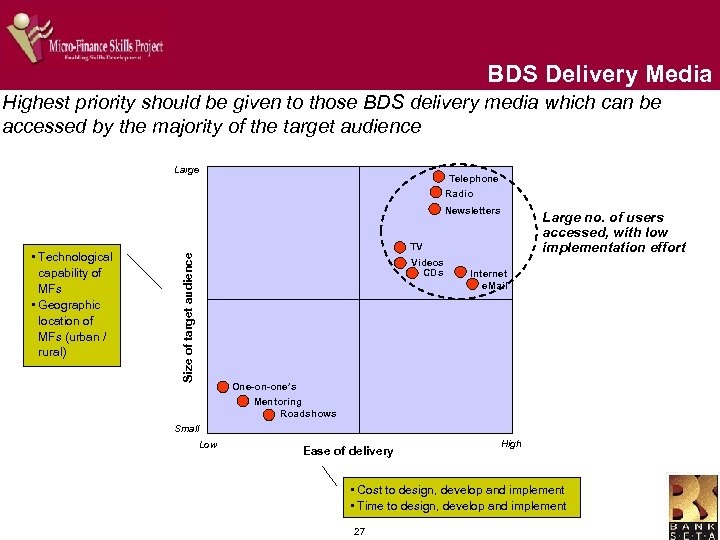

BDS Delivery Media Highest priority should be given to those BDS delivery media which can be accessed by the majority of the target audience Large Telephone Radio Newsletters TV Size of target audience • Technological capability of MFs • Geographic location of MFs (urban / rural) Videos CDs Large no. of users accessed, with low implementation effort Internet e. Mail One-on-one’s Mentoring Roadshows Small Low Ease of delivery High • Cost to design, develop and implement • Time to design, develop and implement 27

BDS Delivery Media Highest priority should be given to those BDS delivery media which can be accessed by the majority of the target audience Large Telephone Radio Newsletters TV Size of target audience • Technological capability of MFs • Geographic location of MFs (urban / rural) Videos CDs Large no. of users accessed, with low implementation effort Internet e. Mail One-on-one’s Mentoring Roadshows Small Low Ease of delivery High • Cost to design, develop and implement • Time to design, develop and implement 27

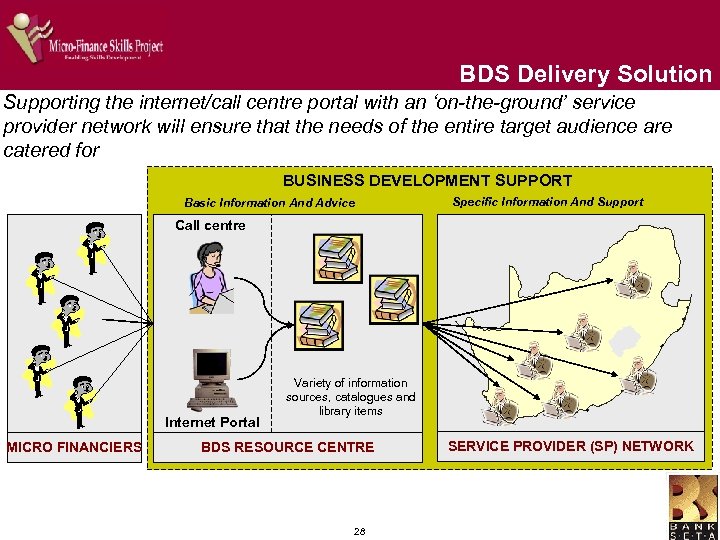

BDS Delivery Solution Supporting the internet/call centre portal with an ‘on-the-ground’ service provider network will ensure that the needs of the entire target audience are catered for BUSINESS DEVELOPMENT SUPPORT Basic Information And Advice Specific Information And Support Call centre Internet Portal MICRO FINANCIERS Variety of information sources, catalogues and library items BDS RESOURCE CENTRE 28 SERVICE PROVIDER (SP) NETWORK

BDS Delivery Solution Supporting the internet/call centre portal with an ‘on-the-ground’ service provider network will ensure that the needs of the entire target audience are catered for BUSINESS DEVELOPMENT SUPPORT Basic Information And Advice Specific Information And Support Call centre Internet Portal MICRO FINANCIERS Variety of information sources, catalogues and library items BDS RESOURCE CENTRE 28 SERVICE PROVIDER (SP) NETWORK

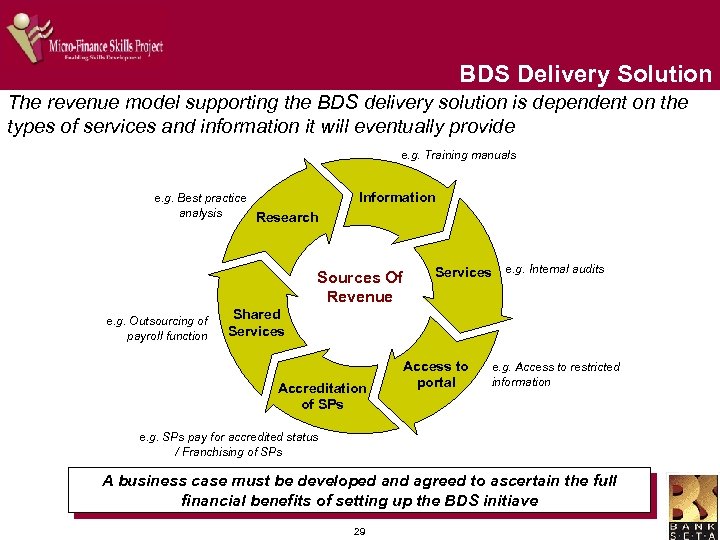

BDS Delivery Solution The revenue model supporting the BDS delivery solution is dependent on the types of services and information it will eventually provide e. g. Training manuals e. g. Best practice analysis Research Information Sources Of Revenue e. g. Outsourcing of payroll function Services e. g. Internal audits Shared Services Accreditation of SPs Access to portal e. g. Access to restricted information e. g. SPs pay for accredited status / Franchising of SPs A business case must be developed and agreed to ascertain the full financial benefits of setting up the BDS initiave 29

BDS Delivery Solution The revenue model supporting the BDS delivery solution is dependent on the types of services and information it will eventually provide e. g. Training manuals e. g. Best practice analysis Research Information Sources Of Revenue e. g. Outsourcing of payroll function Services e. g. Internal audits Shared Services Accreditation of SPs Access to portal e. g. Access to restricted information e. g. SPs pay for accredited status / Franchising of SPs A business case must be developed and agreed to ascertain the full financial benefits of setting up the BDS initiave 29

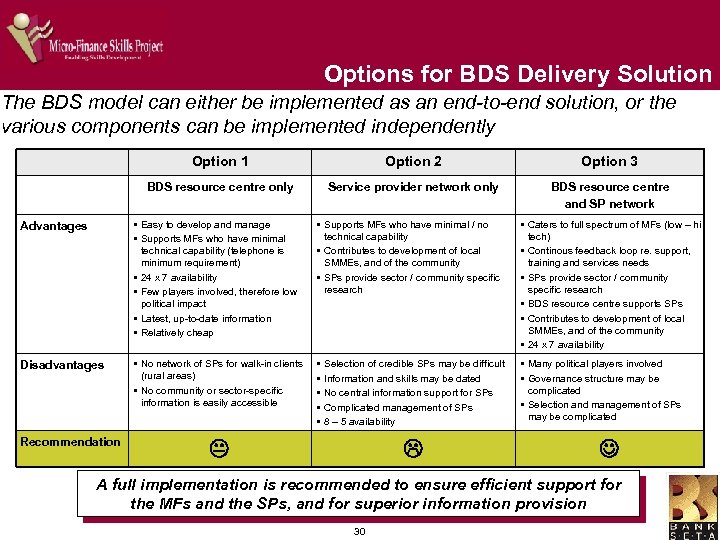

Options for BDS Delivery Solution The BDS model can either be implemented as an end-to-end solution, or the various components can be implemented independently Option 1 Option 2 Option 3 BDS resource centre only Service provider network only BDS resource centre and SP network Advantages § Easy to develop and manage § Supports MFs who have minimal technical capability (telephone is minimum requirement) § 24 x 7 availability § Few players involved, therefore low political impact § Latest, up-to-date information § Relatively cheap § Supports MFs who have minimal / no technical capability § Contributes to development of local SMMEs, and of the community § SPs provide sector / community specific research § Caters to full spectrum of MFs (low – hi tech) § Continous feedback loop re. support, training and services needs § SPs provide sector / community specific research § BDS resource centre supports SPs § Contributes to development of local SMMEs, and of the community § 24 x 7 availability Disadvantages § No network of SPs for walk-in clients (rural areas) § No community or sector-specific information is easily accessible § § § Many political players involved § Governance structure may be complicated § Selection and management of SPs may be complicated Recommendation Selection of credible SPs may be difficult Information and skills may be dated No central information support for SPs Complicated management of SPs 8 – 5 availability A full implementation is recommended to ensure efficient support for the MFs and the SPs, and for superior information provision 30

Options for BDS Delivery Solution The BDS model can either be implemented as an end-to-end solution, or the various components can be implemented independently Option 1 Option 2 Option 3 BDS resource centre only Service provider network only BDS resource centre and SP network Advantages § Easy to develop and manage § Supports MFs who have minimal technical capability (telephone is minimum requirement) § 24 x 7 availability § Few players involved, therefore low political impact § Latest, up-to-date information § Relatively cheap § Supports MFs who have minimal / no technical capability § Contributes to development of local SMMEs, and of the community § SPs provide sector / community specific research § Caters to full spectrum of MFs (low – hi tech) § Continous feedback loop re. support, training and services needs § SPs provide sector / community specific research § BDS resource centre supports SPs § Contributes to development of local SMMEs, and of the community § 24 x 7 availability Disadvantages § No network of SPs for walk-in clients (rural areas) § No community or sector-specific information is easily accessible § § § Many political players involved § Governance structure may be complicated § Selection and management of SPs may be complicated Recommendation Selection of credible SPs may be difficult Information and skills may be dated No central information support for SPs Complicated management of SPs 8 – 5 availability A full implementation is recommended to ensure efficient support for the MFs and the SPs, and for superior information provision 30

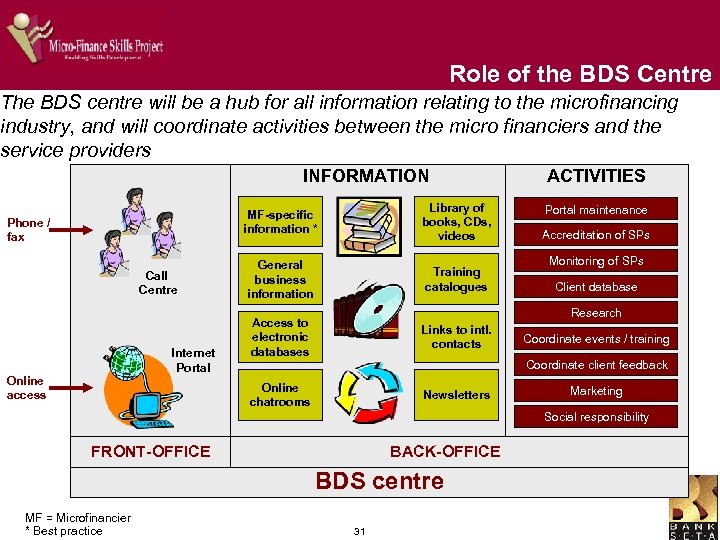

Role of the BDS Centre The BDS centre will be a hub for all information relating to the microfinancing industry, and will coordinate activities between the micro financiers and the service providers INFORMATION MF-specific information * Phone / fax Call Centre Library of books, CDs, videos General business information Training catalogues Online access Portal maintenance Accreditation of SPs Monitoring of SPs Client database Research Access to electronic databases Links to intl. contacts Online chatrooms Internet Portal ACTIVITIES Newsletters Coordinate events / training Coordinate client feedback Marketing Social responsibility FRONT-OFFICE BACK-OFFICE BDS centre MF = Microfinancier * Best practice 31

Role of the BDS Centre The BDS centre will be a hub for all information relating to the microfinancing industry, and will coordinate activities between the micro financiers and the service providers INFORMATION MF-specific information * Phone / fax Call Centre Library of books, CDs, videos General business information Training catalogues Online access Portal maintenance Accreditation of SPs Monitoring of SPs Client database Research Access to electronic databases Links to intl. contacts Online chatrooms Internet Portal ACTIVITIES Newsletters Coordinate events / training Coordinate client feedback Marketing Social responsibility FRONT-OFFICE BACK-OFFICE BDS centre MF = Microfinancier * Best practice 31

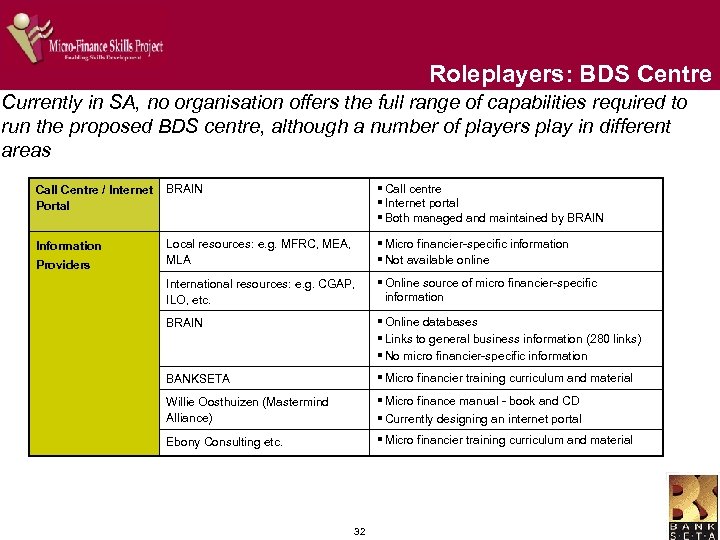

Roleplayers: BDS Centre Currently in SA, no organisation offers the full range of capabilities required to run the proposed BDS centre, although a number of players play in different areas Call Centre / Internet Portal BRAIN § Call centre § Internet portal § Both managed and maintained by BRAIN Information Local resources: e. g. MFRC, MEA, MLA § Micro financier-specific information § Not available online International resources: e. g. CGAP, ILO, etc. § Online source of micro financier-specific information BRAIN § Online databases § Links to general business information (280 links) § No micro financier-specific information BANKSETA § Micro financier training curriculum and material Willie Oosthuizen (Mastermind Alliance) § Micro finance manual - book and CD § Currently designing an internet portal Ebony Consulting etc. § Micro financier training curriculum and material Providers 32

Roleplayers: BDS Centre Currently in SA, no organisation offers the full range of capabilities required to run the proposed BDS centre, although a number of players play in different areas Call Centre / Internet Portal BRAIN § Call centre § Internet portal § Both managed and maintained by BRAIN Information Local resources: e. g. MFRC, MEA, MLA § Micro financier-specific information § Not available online International resources: e. g. CGAP, ILO, etc. § Online source of micro financier-specific information BRAIN § Online databases § Links to general business information (280 links) § No micro financier-specific information BANKSETA § Micro financier training curriculum and material Willie Oosthuizen (Mastermind Alliance) § Micro finance manual - book and CD § Currently designing an internet portal Ebony Consulting etc. § Micro financier training curriculum and material Providers 32

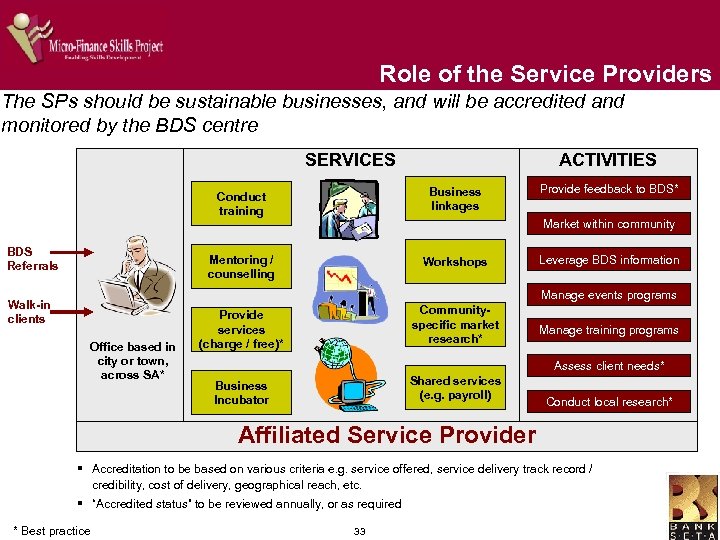

Role of the Service Providers The SPs should be sustainable businesses, and will be accredited and monitored by the BDS centre SERVICES ACTIVITIES Conduct training Mentoring / counselling BDS Referrals Business linkages Workshops Provide feedback to BDS* Market within community Leverage BDS information Manage events programs Walk-in clients Office based in city or town, across SA* Communityspecific market research* Provide services (charge / free)* Manage training programs Assess client needs* Shared services (e. g. payroll) Business Incubator Conduct local research* Affiliated Service Provider § Accreditation to be based on various criteria e. g. service offered, service delivery track record / credibility, cost of delivery, geographical reach, etc. § “Accredited status” to be reviewed annually, or as required * Best practice 33

Role of the Service Providers The SPs should be sustainable businesses, and will be accredited and monitored by the BDS centre SERVICES ACTIVITIES Conduct training Mentoring / counselling BDS Referrals Business linkages Workshops Provide feedback to BDS* Market within community Leverage BDS information Manage events programs Walk-in clients Office based in city or town, across SA* Communityspecific market research* Provide services (charge / free)* Manage training programs Assess client needs* Shared services (e. g. payroll) Business Incubator Conduct local research* Affiliated Service Provider § Accreditation to be based on various criteria e. g. service offered, service delivery track record / credibility, cost of delivery, geographical reach, etc. § “Accredited status” to be reviewed annually, or as required * Best practice 33

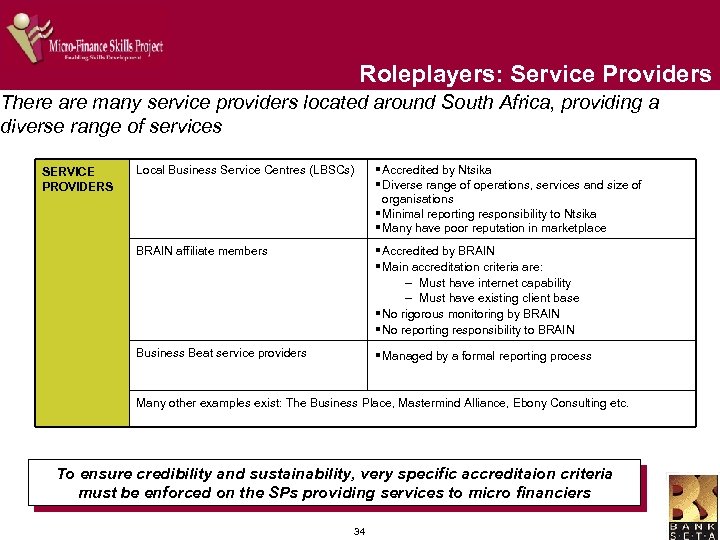

Roleplayers: Service Providers There are many service providers located around South Africa, providing a diverse range of services Local Business Service Centres (LBSCs) § Accredited by Ntsika § Diverse range of operations, services and size of organisations § Minimal reporting responsibility to Ntsika § Many have poor reputation in marketplace BRAIN affiliate members § Accredited by BRAIN § Main accreditation criteria are: – Must have internet capability – Must have existing client base § No rigorous monitoring by BRAIN § No reporting responsibility to BRAIN Business Beat service providers SERVICE PROVIDERS § Managed by a formal reporting process Many other examples exist: The Business Place, Mastermind Alliance, Ebony Consulting etc. To ensure credibility and sustainability, very specific accreditaion criteria must be enforced on the SPs providing services to micro financiers 34

Roleplayers: Service Providers There are many service providers located around South Africa, providing a diverse range of services Local Business Service Centres (LBSCs) § Accredited by Ntsika § Diverse range of operations, services and size of organisations § Minimal reporting responsibility to Ntsika § Many have poor reputation in marketplace BRAIN affiliate members § Accredited by BRAIN § Main accreditation criteria are: – Must have internet capability – Must have existing client base § No rigorous monitoring by BRAIN § No reporting responsibility to BRAIN Business Beat service providers SERVICE PROVIDERS § Managed by a formal reporting process Many other examples exist: The Business Place, Mastermind Alliance, Ebony Consulting etc. To ensure credibility and sustainability, very specific accreditaion criteria must be enforced on the SPs providing services to micro financiers 34

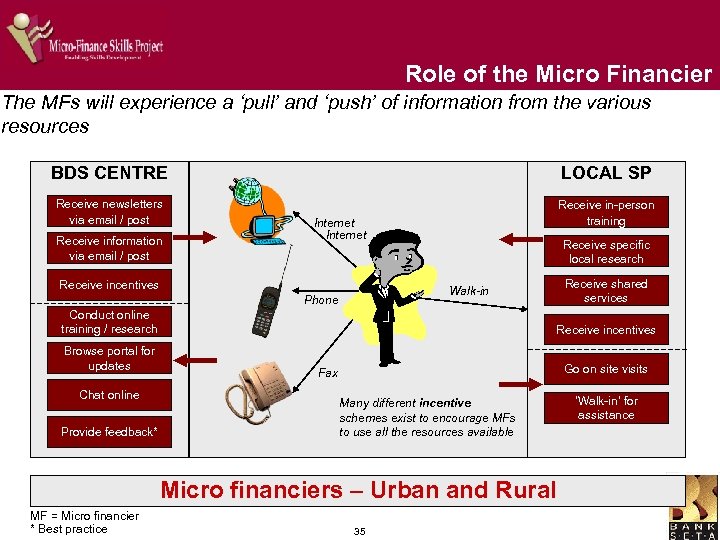

Role of the Micro Financier The MFs will experience a ‘pull’ and ‘push’ of information from the various resources BDS CENTRE LOCAL SP Receive newsletters via email / post Receive in-person training Receive information via email / post Internet Receive incentives Receive specific local research Phone Conduct online training / research Browse portal for updates Chat online Provide feedback* Receive shared services Walk-in Receive incentives Go on site visits Fax Many different incentive schemes exist to encourage MFs to use all the resources available Micro financiers – Urban and Rural MF = Micro financier * Best practice 35 ‘Walk-in’ for assistance

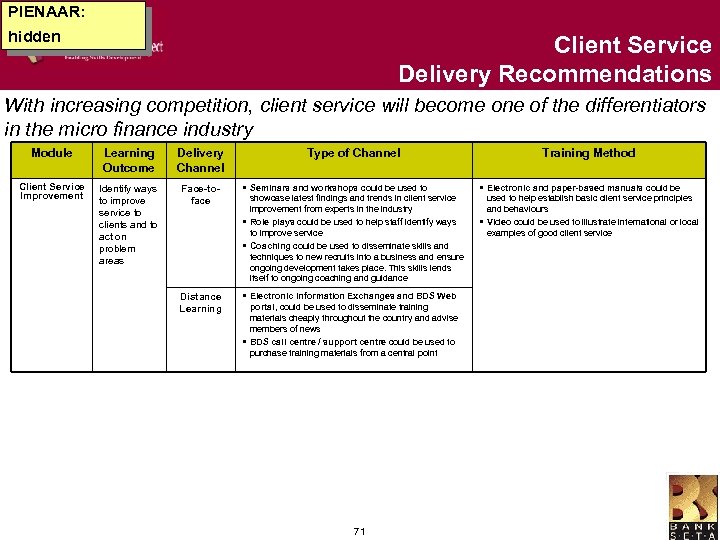

Role of the Micro Financier The MFs will experience a ‘pull’ and ‘push’ of information from the various resources BDS CENTRE LOCAL SP Receive newsletters via email / post Receive in-person training Receive information via email / post Internet Receive incentives Receive specific local research Phone Conduct online training / research Browse portal for updates Chat online Provide feedback* Receive shared services Walk-in Receive incentives Go on site visits Fax Many different incentive schemes exist to encourage MFs to use all the resources available Micro financiers – Urban and Rural MF = Micro financier * Best practice 35 ‘Walk-in’ for assistance

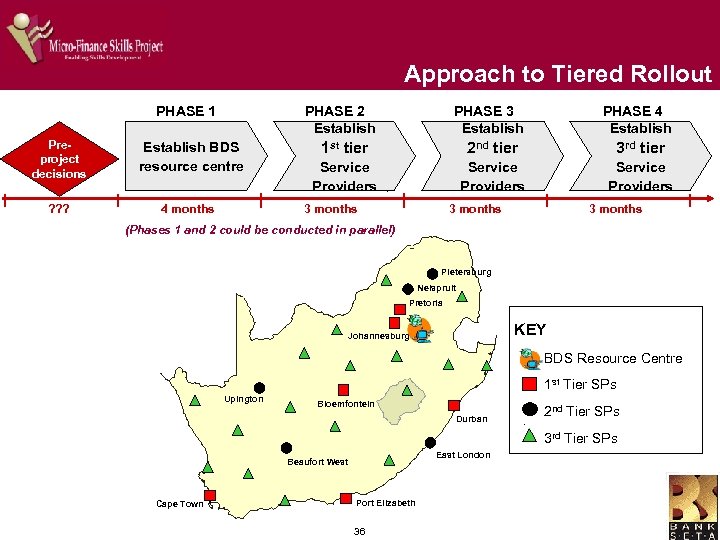

Approach to Tiered Rollout PHASE 1 PHASE 2 Establish Preproject decisions Establish BDS resource centre ? ? ? 4 months PHASE 3 Establish PHASE 4 Establish 1 st tier 2 nd tier 3 rd tier Service Providers 3 months (Phases 1 and 2 could be conducted in parallel) Pietersburg Nelspruit Pretoria KEY Johannesburg BDS Resource Centre 1 st Tier SPs Upington Bloemfontein Durban 2 nd Tier SPs 3 rd Tier SPs East London Beaufort West Cape Town Port Elizabeth 36

Approach to Tiered Rollout PHASE 1 PHASE 2 Establish Preproject decisions Establish BDS resource centre ? ? ? 4 months PHASE 3 Establish PHASE 4 Establish 1 st tier 2 nd tier 3 rd tier Service Providers 3 months (Phases 1 and 2 could be conducted in parallel) Pietersburg Nelspruit Pretoria KEY Johannesburg BDS Resource Centre 1 st Tier SPs Upington Bloemfontein Durban 2 nd Tier SPs 3 rd Tier SPs East London Beaufort West Cape Town Port Elizabeth 36

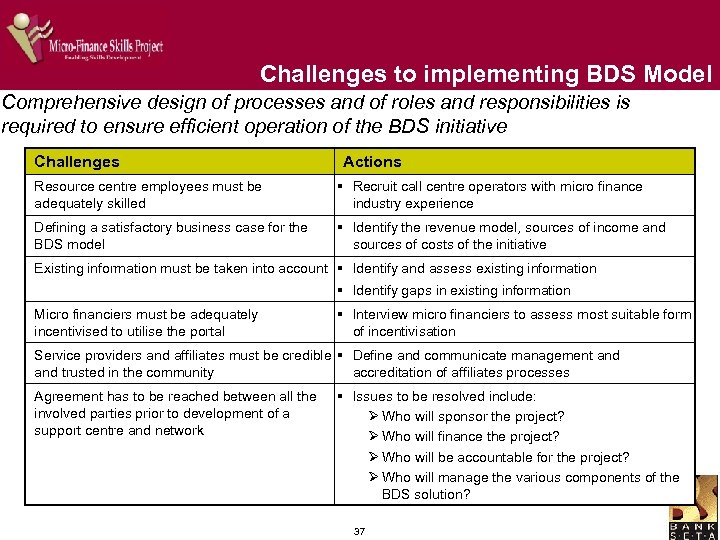

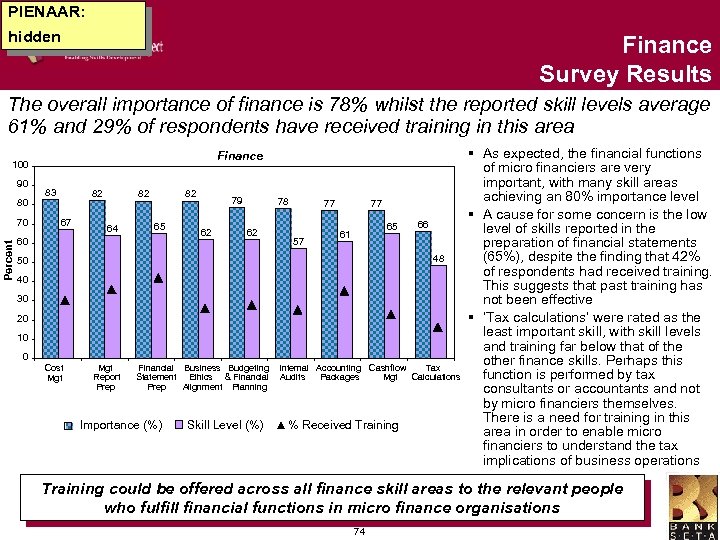

Challenges to implementing BDS Model Comprehensive design of processes and of roles and responsibilities is required to ensure efficient operation of the BDS initiative Challenges Actions Resource centre employees must be adequately skilled § Recruit call centre operators with micro finance industry experience Defining a satisfactory business case for the BDS model § Identify the revenue model, sources of income and sources of costs of the initiative Existing information must be taken into account § Identify and assess existing information § Identify gaps in existing information Micro financiers must be adequately incentivised to utilise the portal § Interview micro financiers to assess most suitable form of incentivisation Service providers and affiliates must be credible § Define and communicate management and accreditation of affiliates processes and trusted in the community Agreement has to be reached between all the involved parties prior to development of a support centre and network § Issues to be resolved include: Ø Who will sponsor the project? Ø Who will finance the project? Ø Who will be accountable for the project? Ø Who will manage the various components of the BDS solution? 37

Challenges to implementing BDS Model Comprehensive design of processes and of roles and responsibilities is required to ensure efficient operation of the BDS initiative Challenges Actions Resource centre employees must be adequately skilled § Recruit call centre operators with micro finance industry experience Defining a satisfactory business case for the BDS model § Identify the revenue model, sources of income and sources of costs of the initiative Existing information must be taken into account § Identify and assess existing information § Identify gaps in existing information Micro financiers must be adequately incentivised to utilise the portal § Interview micro financiers to assess most suitable form of incentivisation Service providers and affiliates must be credible § Define and communicate management and accreditation of affiliates processes and trusted in the community Agreement has to be reached between all the involved parties prior to development of a support centre and network § Issues to be resolved include: Ø Who will sponsor the project? Ø Who will finance the project? Ø Who will be accountable for the project? Ø Who will manage the various components of the BDS solution? 37

Agenda Item Resp. Time 1. Project Approach Wendy Pienaar 5 min 2. Lender and Consumer Survey Summary Wendy Pienaar 5 min 3. Business Development Support Assignment Alicia Greenwood 15 min 4. Curriculum Framework Assignment Brent Davids 15 min 5. Selection Assignment Wendy Pienaar 5 min 6. The Way Forward Wendy Pienaar 5 min 7. Breakout Instructions Heather Watson 5 min 38

Agenda Item Resp. Time 1. Project Approach Wendy Pienaar 5 min 2. Lender and Consumer Survey Summary Wendy Pienaar 5 min 3. Business Development Support Assignment Alicia Greenwood 15 min 4. Curriculum Framework Assignment Brent Davids 15 min 5. Selection Assignment Wendy Pienaar 5 min 6. The Way Forward Wendy Pienaar 5 min 7. Breakout Instructions Heather Watson 5 min 38

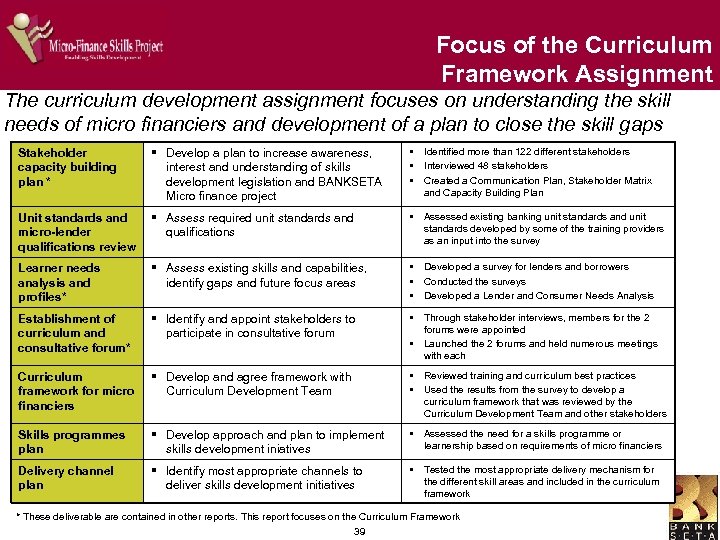

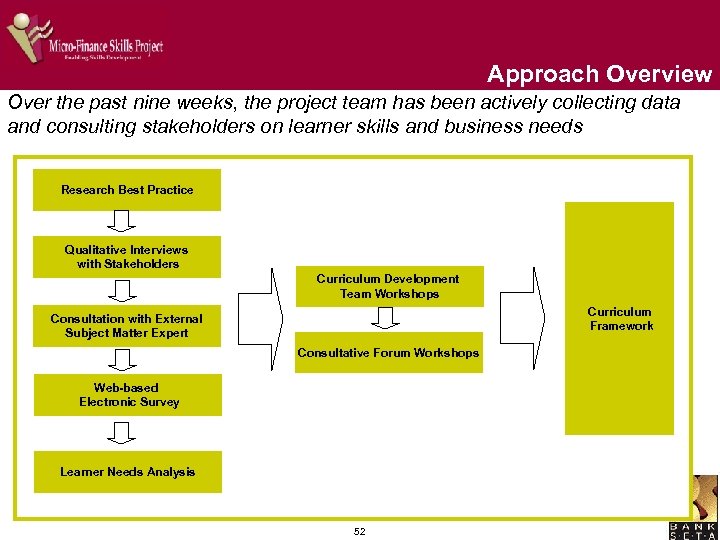

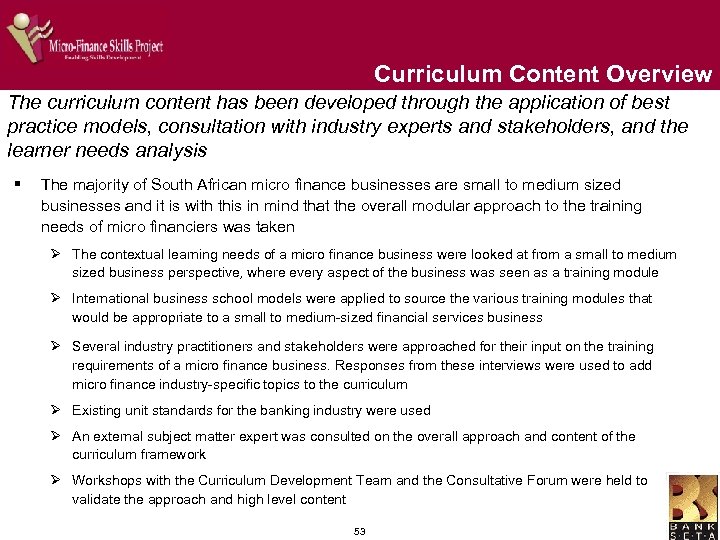

Focus of the Curriculum Framework Assignment The curriculum development assignment focuses on understanding the skill needs of micro financiers and development of a plan to close the skill gaps Stakeholder capacity building plan * § Develop a plan to increase awareness, interest and understanding of skills development legislation and BANKSETA Micro finance project § Identified more than 122 different stakeholders § Interviewed 48 stakeholders § Created a Communication Plan, Stakeholder Matrix and Capacity Building Plan Unit standards and micro-lender qualifications review § Assess required unit standards and qualifications § Assessed existing banking unit standards and unit standards developed by some of the training providers as an input into the survey Learner needs analysis and profiles* § Assess existing skills and capabilities, identify gaps and future focus areas § Developed a survey for lenders and borrowers § Conducted the surveys § Developed a Lender and Consumer Needs Analysis Establishment of curriculum and consultative forum* § Identify and appoint stakeholders to participate in consultative forum § Through stakeholder interviews, members for the 2 forums were appointed § Launched the 2 forums and held numerous meetings with each Curriculum framework for micro financiers § Develop and agree framework with Curriculum Development Team § Reviewed training and curriculum best practices § Used the results from the survey to develop a curriculum framework that was reviewed by the Curriculum Development Team and other stakeholders Skills programmes plan § Develop approach and plan to implement skills development iniatives § Assessed the need for a skills programme or learnership based on requirements of micro financiers Delivery channel plan § Identify most appropriate channels to deliver skills development initiatives § Tested the most appropriate delivery mechanism for the different skill areas and included in the curriculum framework * These deliverable are contained in other reports. This report focuses on the Curriculum Framework 39

Focus of the Curriculum Framework Assignment The curriculum development assignment focuses on understanding the skill needs of micro financiers and development of a plan to close the skill gaps Stakeholder capacity building plan * § Develop a plan to increase awareness, interest and understanding of skills development legislation and BANKSETA Micro finance project § Identified more than 122 different stakeholders § Interviewed 48 stakeholders § Created a Communication Plan, Stakeholder Matrix and Capacity Building Plan Unit standards and micro-lender qualifications review § Assess required unit standards and qualifications § Assessed existing banking unit standards and unit standards developed by some of the training providers as an input into the survey Learner needs analysis and profiles* § Assess existing skills and capabilities, identify gaps and future focus areas § Developed a survey for lenders and borrowers § Conducted the surveys § Developed a Lender and Consumer Needs Analysis Establishment of curriculum and consultative forum* § Identify and appoint stakeholders to participate in consultative forum § Through stakeholder interviews, members for the 2 forums were appointed § Launched the 2 forums and held numerous meetings with each Curriculum framework for micro financiers § Develop and agree framework with Curriculum Development Team § Reviewed training and curriculum best practices § Used the results from the survey to develop a curriculum framework that was reviewed by the Curriculum Development Team and other stakeholders Skills programmes plan § Develop approach and plan to implement skills development iniatives § Assessed the need for a skills programme or learnership based on requirements of micro financiers Delivery channel plan § Identify most appropriate channels to deliver skills development initiatives § Tested the most appropriate delivery mechanism for the different skill areas and included in the curriculum framework * These deliverable are contained in other reports. This report focuses on the Curriculum Framework 39

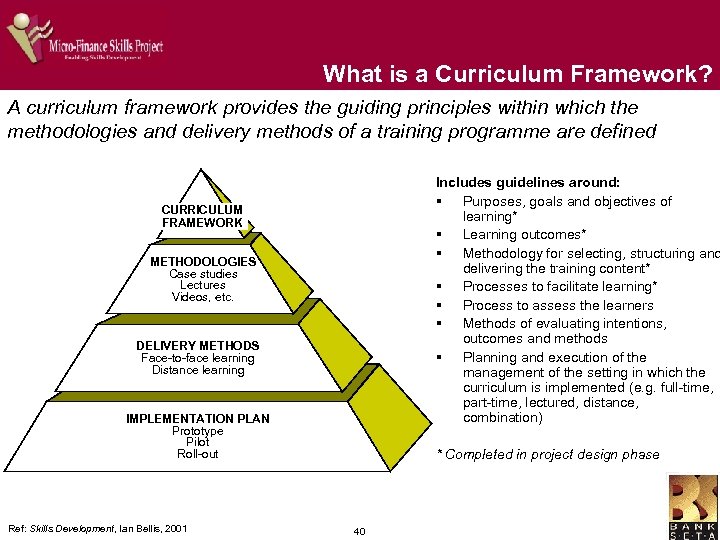

What is a Curriculum Framework? A curriculum framework provides the guiding principles within which the methodologies and delivery methods of a training programme are defined Includes guidelines around: § Purposes, goals and objectives of learning* § Learning outcomes* § Methodology for selecting, structuring and delivering the training content* § Processes to facilitate learning* § Process to assess the learners § Methods of evaluating intentions, outcomes and methods § Planning and execution of the management of the setting in which the curriculum is implemented (e. g. full-time, part-time, lectured, distance, combination) CURRICULUM FRAMEWORK METHODOLOGIES Case studies Lectures Videos, etc. DELIVERY METHODS Face-to-face learning Distance learning IMPLEMENTATION PLAN Prototype Pilot Roll-out Ref: Skills Development, Ian Bellis, 2001 * Completed in project design phase 40

What is a Curriculum Framework? A curriculum framework provides the guiding principles within which the methodologies and delivery methods of a training programme are defined Includes guidelines around: § Purposes, goals and objectives of learning* § Learning outcomes* § Methodology for selecting, structuring and delivering the training content* § Processes to facilitate learning* § Process to assess the learners § Methods of evaluating intentions, outcomes and methods § Planning and execution of the management of the setting in which the curriculum is implemented (e. g. full-time, part-time, lectured, distance, combination) CURRICULUM FRAMEWORK METHODOLOGIES Case studies Lectures Videos, etc. DELIVERY METHODS Face-to-face learning Distance learning IMPLEMENTATION PLAN Prototype Pilot Roll-out Ref: Skills Development, Ian Bellis, 2001 * Completed in project design phase 40

Curriculum Framework Success Factors Best practice suggests that the fostering of a “learning organisation” culture will aid in the successful delivery of training initiatives • Curricula must have a clearly defined vision, mission and goals • Training should be modular and outcomes based • Training content must be relevant to the trainee, and be based on trainee needs • Training standards, systems and models must be clearly defined • Curricula should offer a choice of training content and delivery mechanisms • Training must be prioritised, addressing the most pressing needs first • Training should be delivered at a convenient time, and in a convenient manner • Registering for training should be easy for the trainee • Feedback must be obtained from trainees to continuously improve programs • Skills-based learning and people interfacing skills should ideally be facilitated through a face-toface delivery channel to cater for questions and problem-solving A curriculum framework should be flexible enough to incorporate a number of different means for developing and delivering training Ref: Training from Scratch, Nancy Kuhn, 41

Curriculum Framework Success Factors Best practice suggests that the fostering of a “learning organisation” culture will aid in the successful delivery of training initiatives • Curricula must have a clearly defined vision, mission and goals • Training should be modular and outcomes based • Training content must be relevant to the trainee, and be based on trainee needs • Training standards, systems and models must be clearly defined • Curricula should offer a choice of training content and delivery mechanisms • Training must be prioritised, addressing the most pressing needs first • Training should be delivered at a convenient time, and in a convenient manner • Registering for training should be easy for the trainee • Feedback must be obtained from trainees to continuously improve programs • Skills-based learning and people interfacing skills should ideally be facilitated through a face-toface delivery channel to cater for questions and problem-solving A curriculum framework should be flexible enough to incorporate a number of different means for developing and delivering training Ref: Training from Scratch, Nancy Kuhn, 41

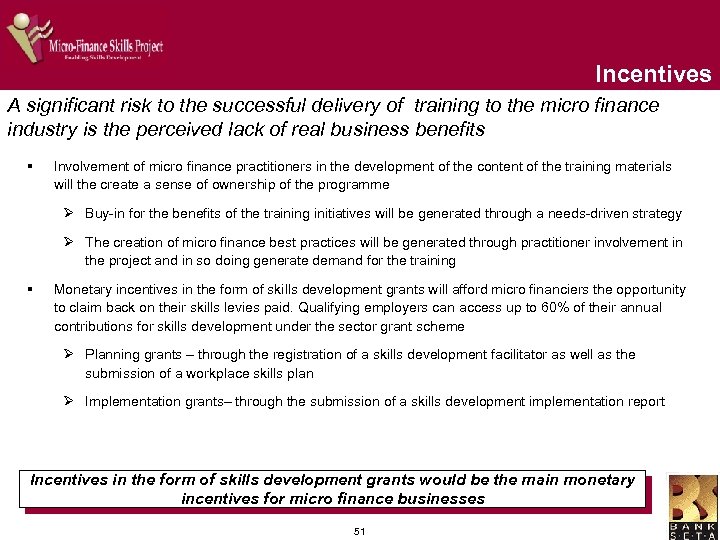

Curriculum Framework Barriers to Success Significant barriers to success exist, which may significantly undermine the successful adoption of the curriculum by the micro finance industry • Lack of a cohesive approach to the deployment and delivery of training and development initiatives • Lack of ownership and buy-in for training and development • Lack of incentives to take advantage of the learning initiatives and to generate demand for training • Often supply-driven and delivered in a top-down fashion, rather than from the target audience needs • Training should be business-oriented, and not viewed as an extension of the basic general educational system • Training services are not always accessible to the target audience • Must be delivered via a suitable, convenient medium • Geographic dispersion must be taken into account when planning the delivery of curriculum content 42

Curriculum Framework Barriers to Success Significant barriers to success exist, which may significantly undermine the successful adoption of the curriculum by the micro finance industry • Lack of a cohesive approach to the deployment and delivery of training and development initiatives • Lack of ownership and buy-in for training and development • Lack of incentives to take advantage of the learning initiatives and to generate demand for training • Often supply-driven and delivered in a top-down fashion, rather than from the target audience needs • Training should be business-oriented, and not viewed as an extension of the basic general educational system • Training services are not always accessible to the target audience • Must be delivered via a suitable, convenient medium • Geographic dispersion must be taken into account when planning the delivery of curriculum content 42

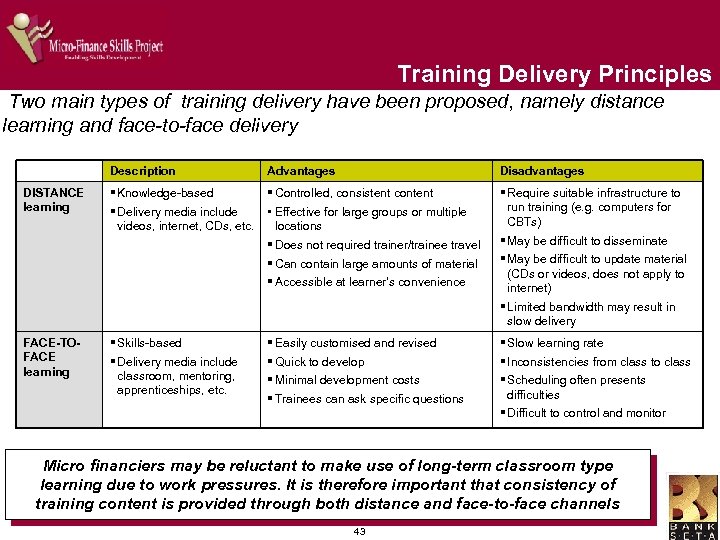

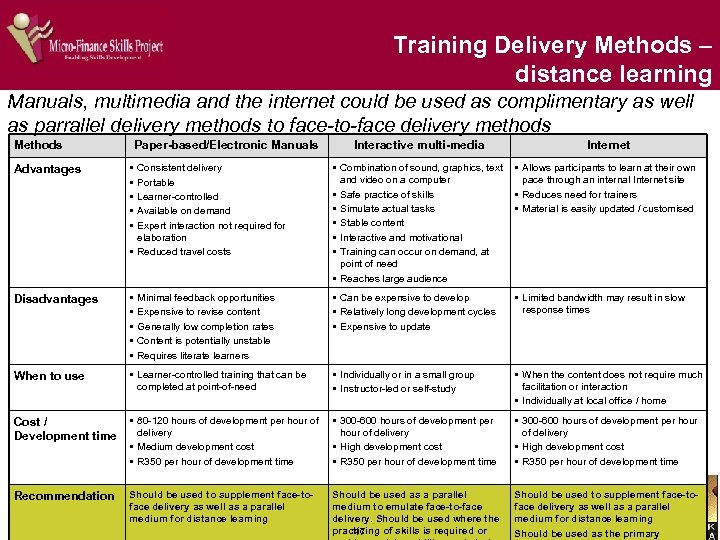

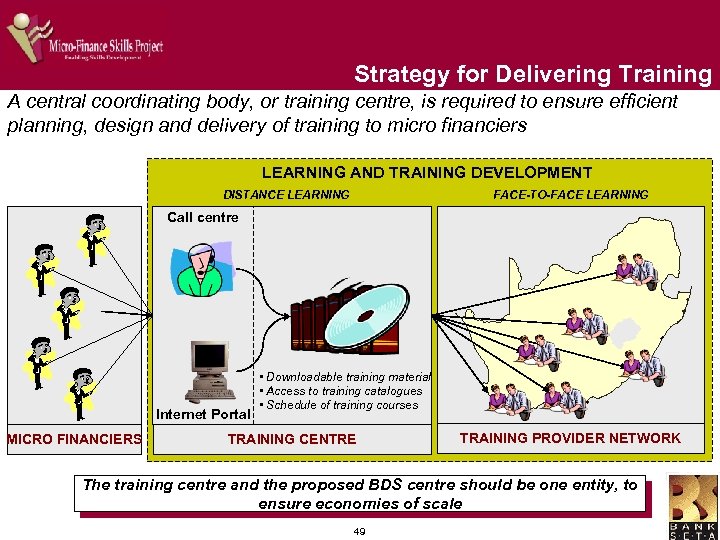

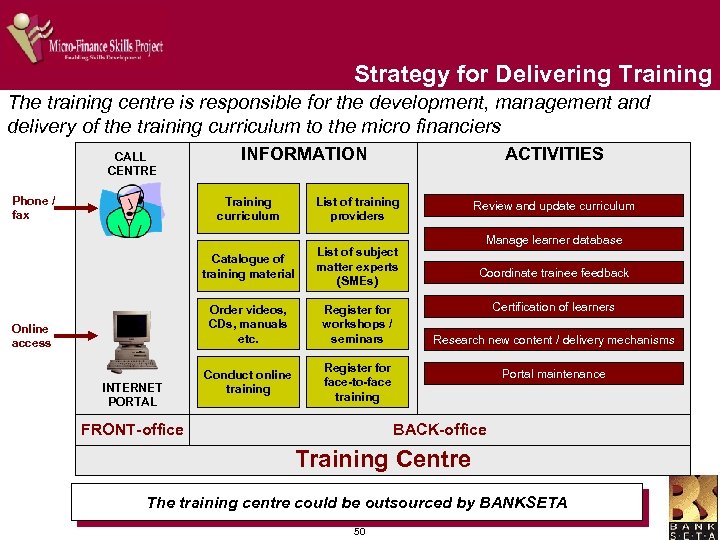

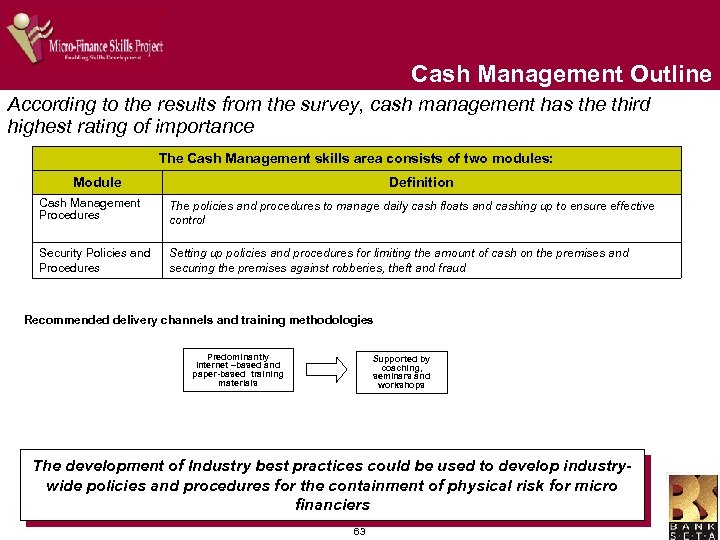

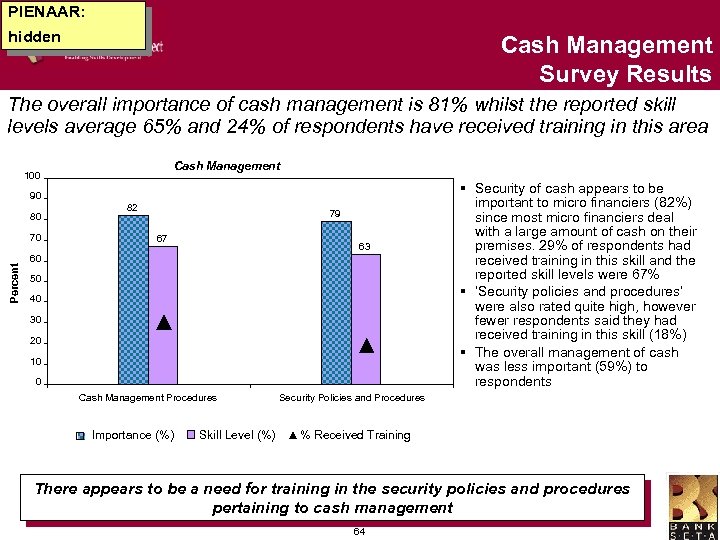

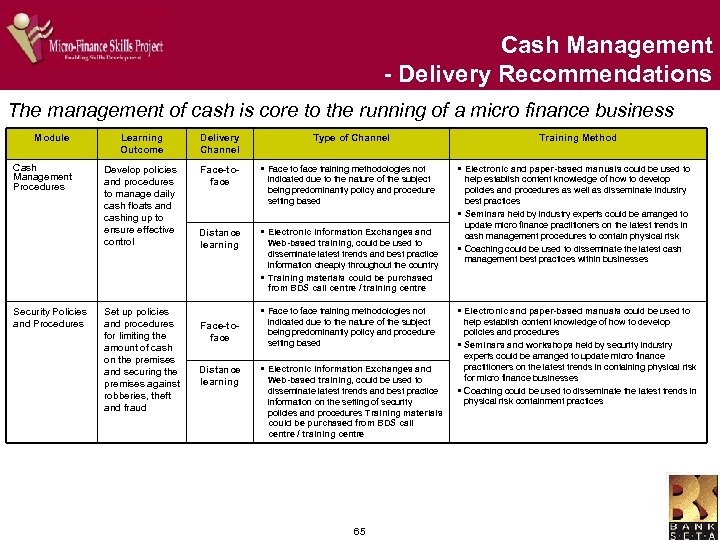

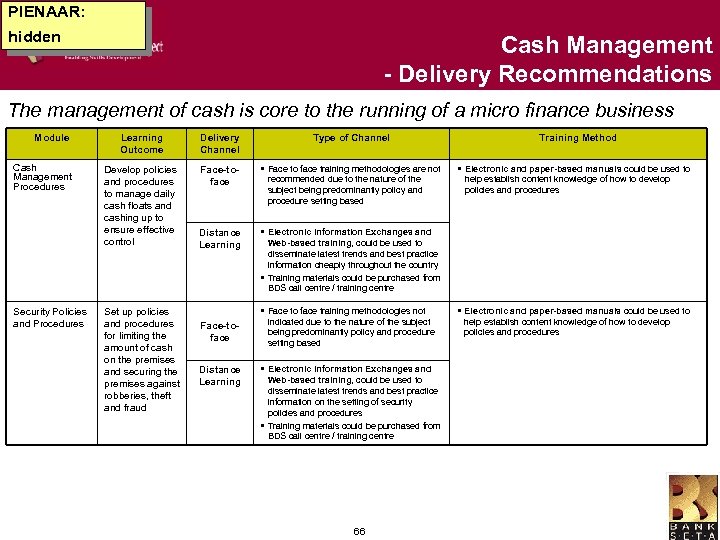

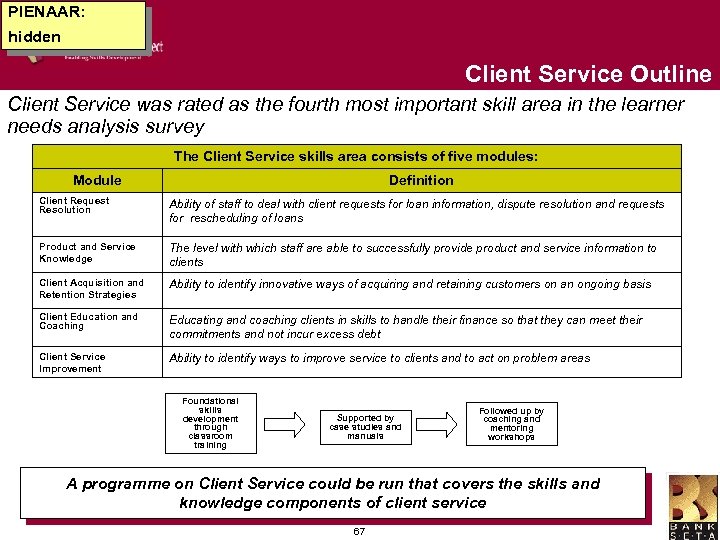

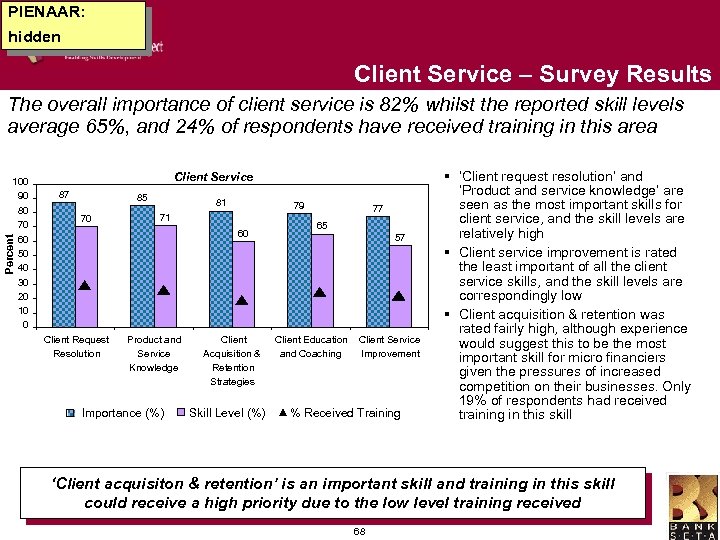

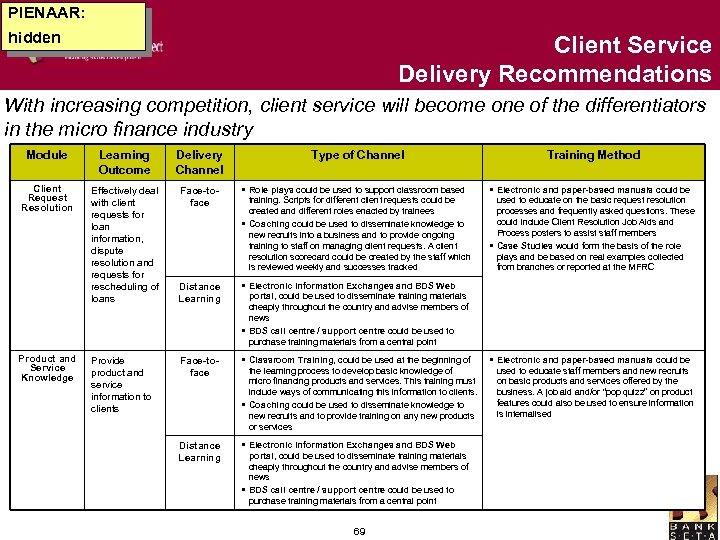

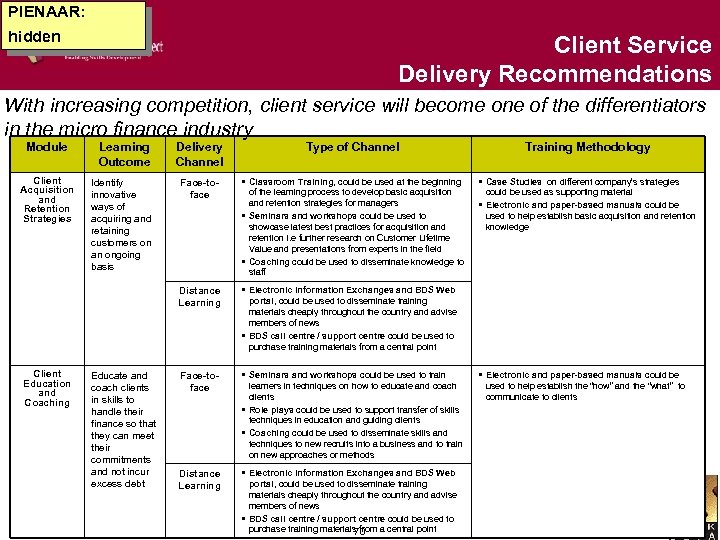

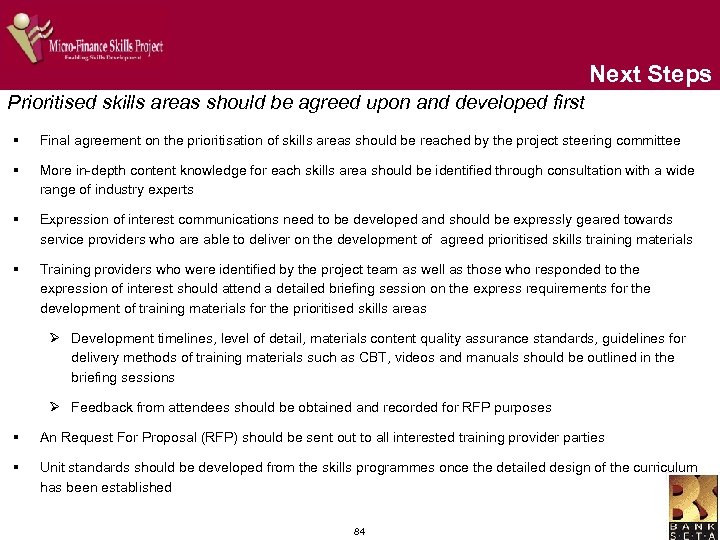

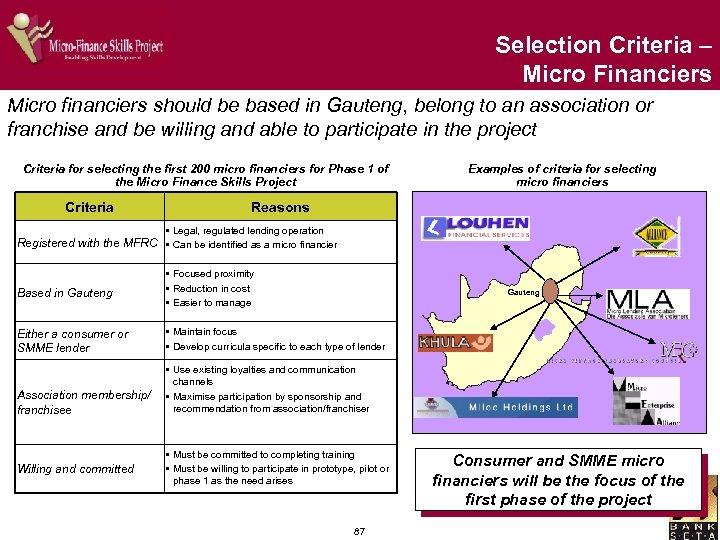

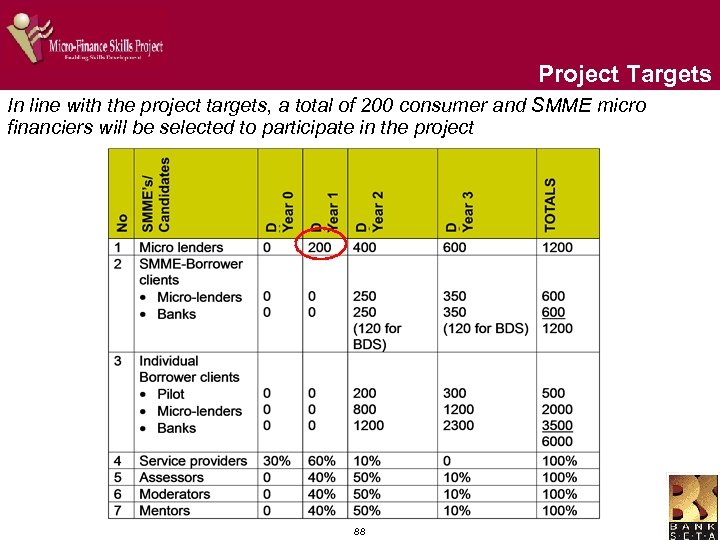

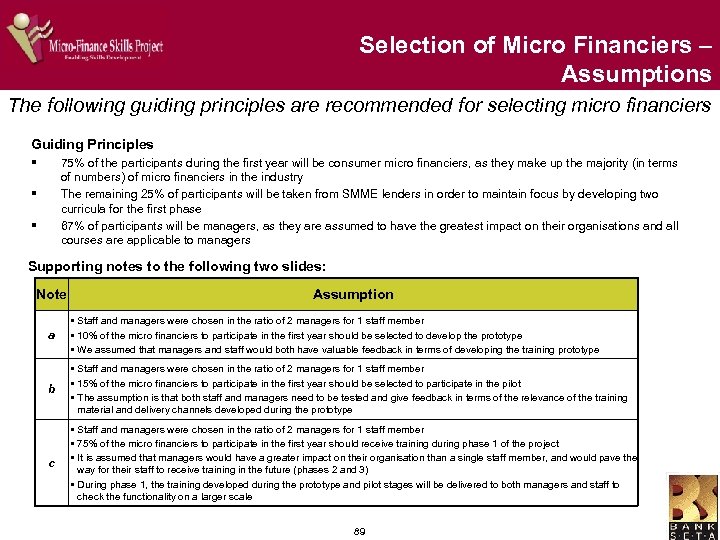

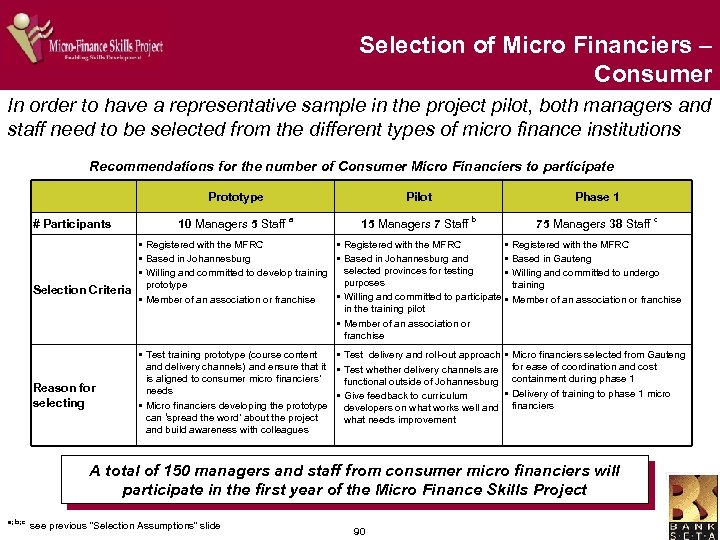

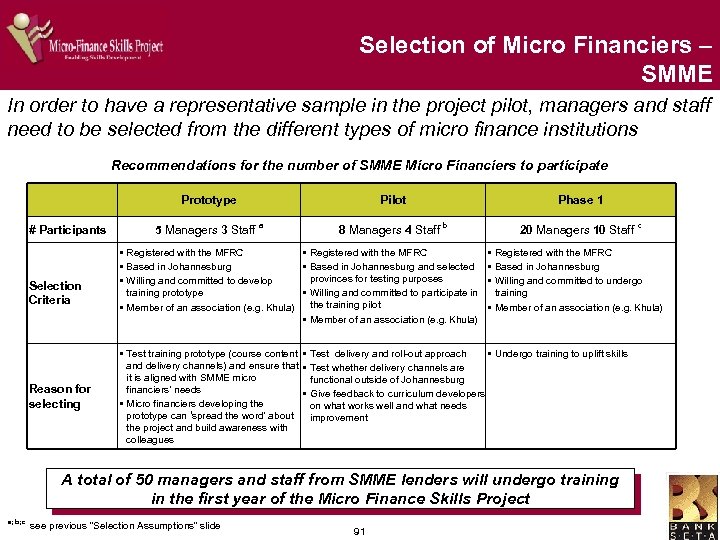

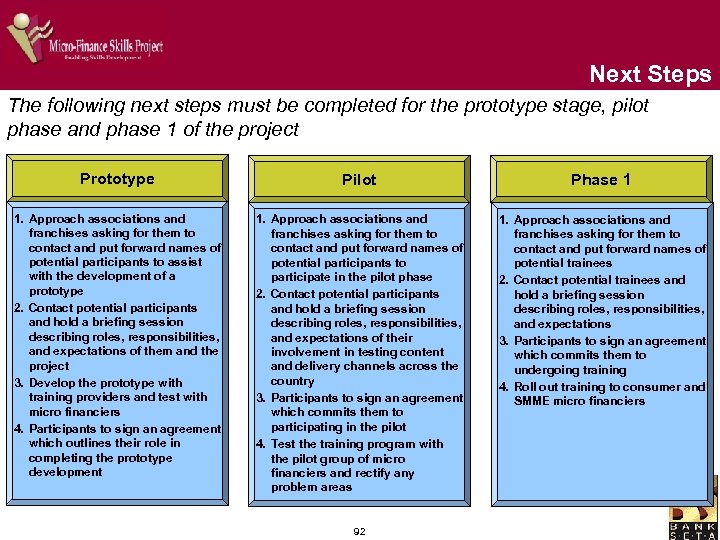

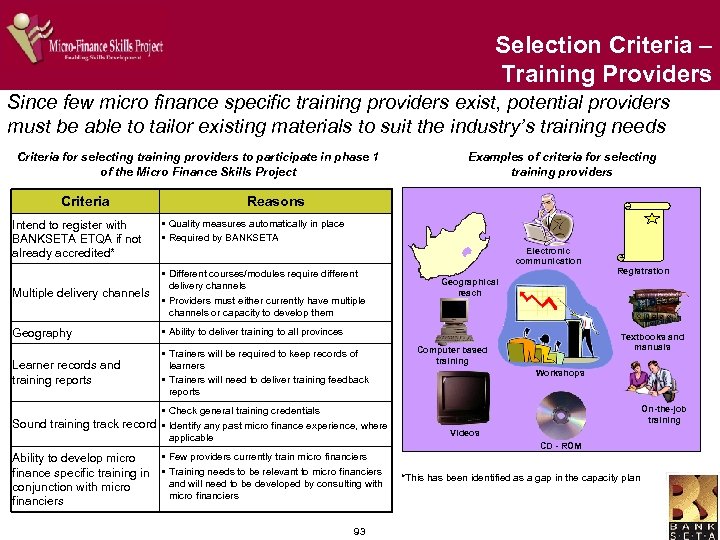

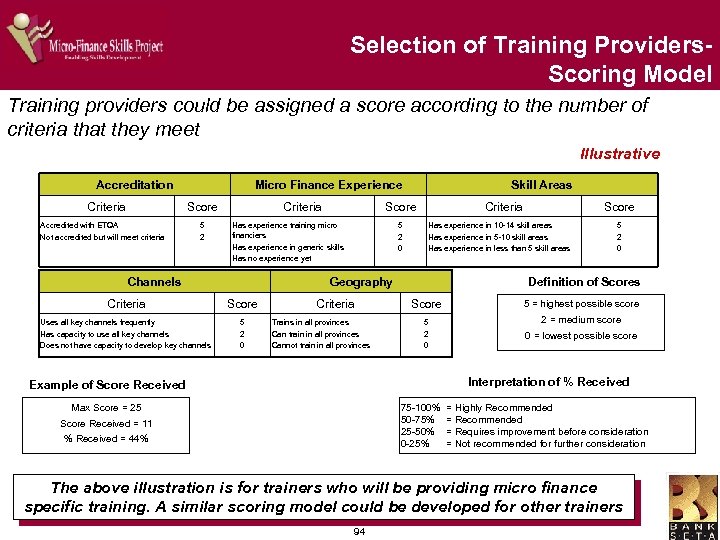

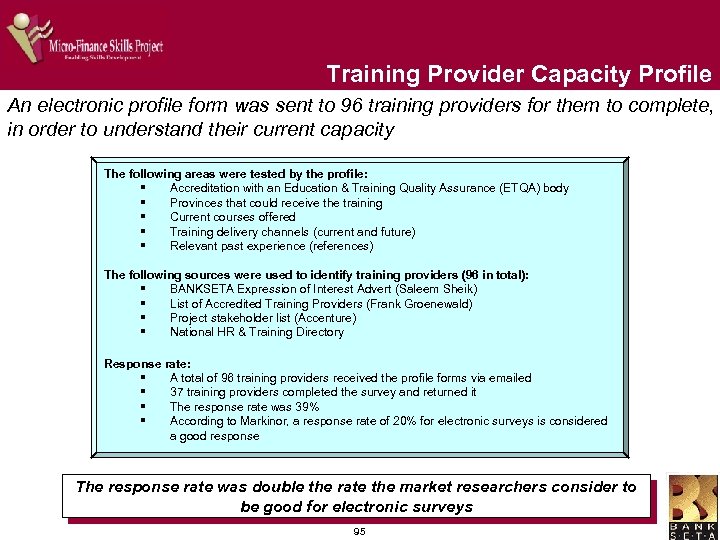

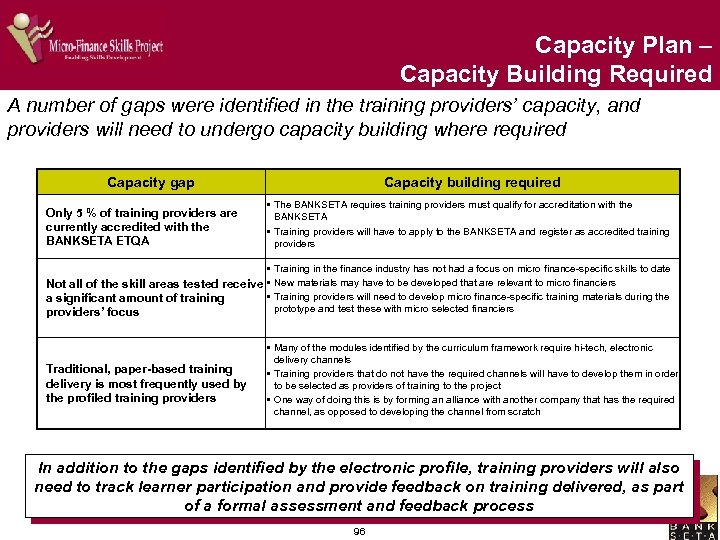

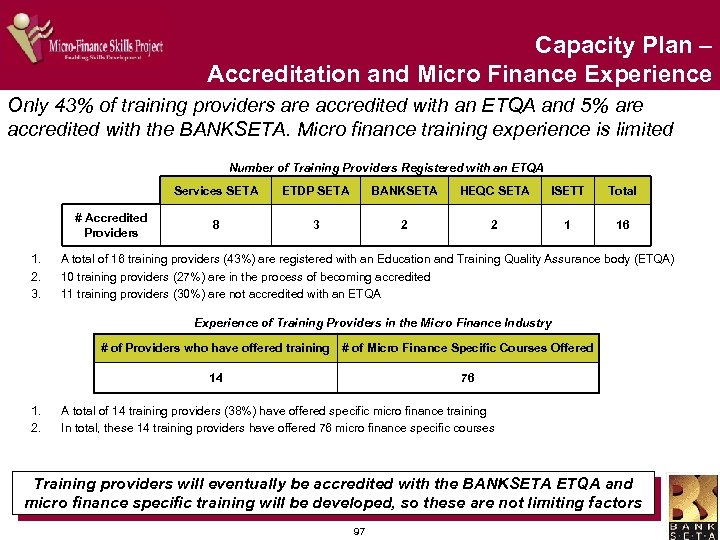

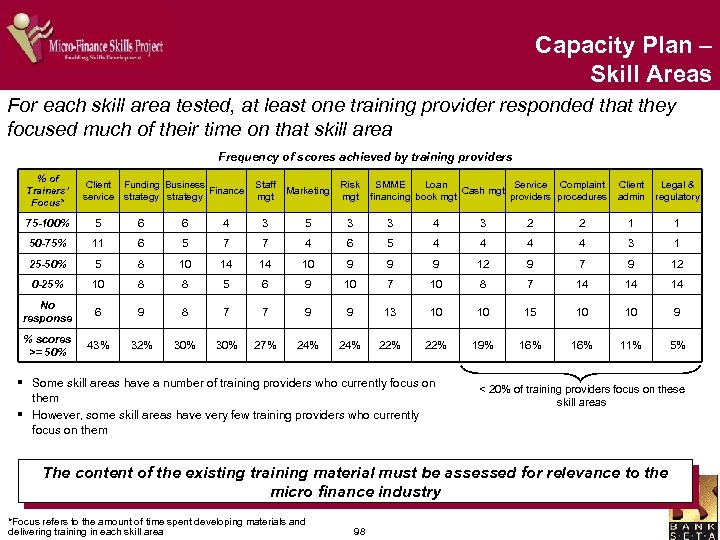

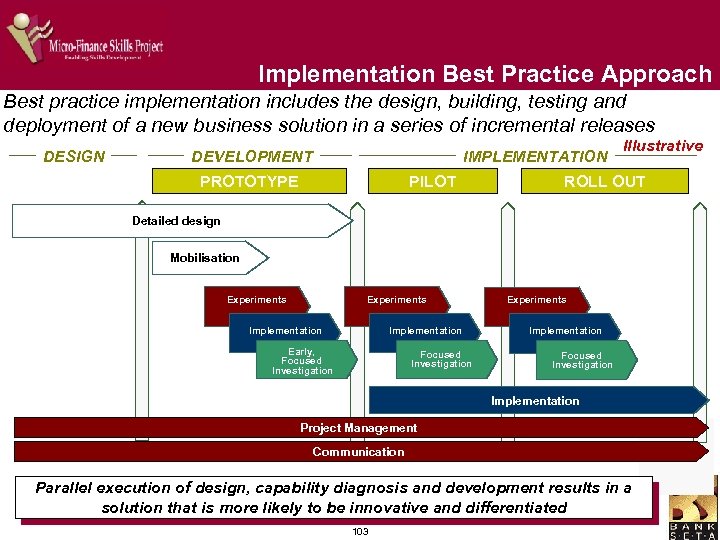

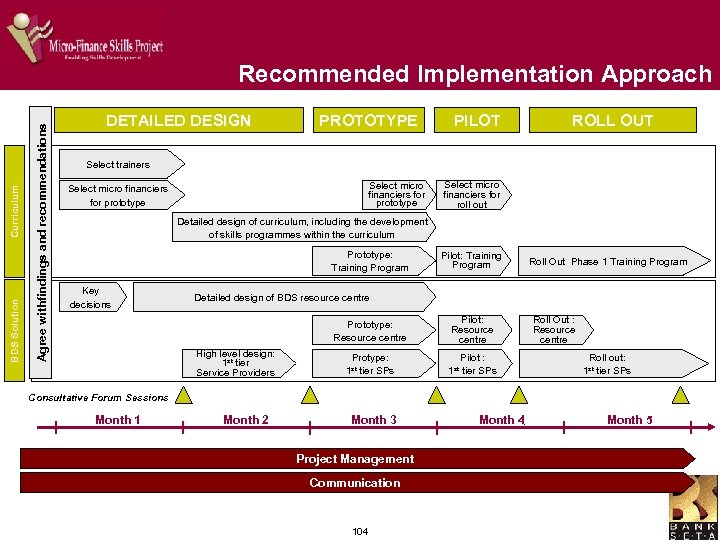

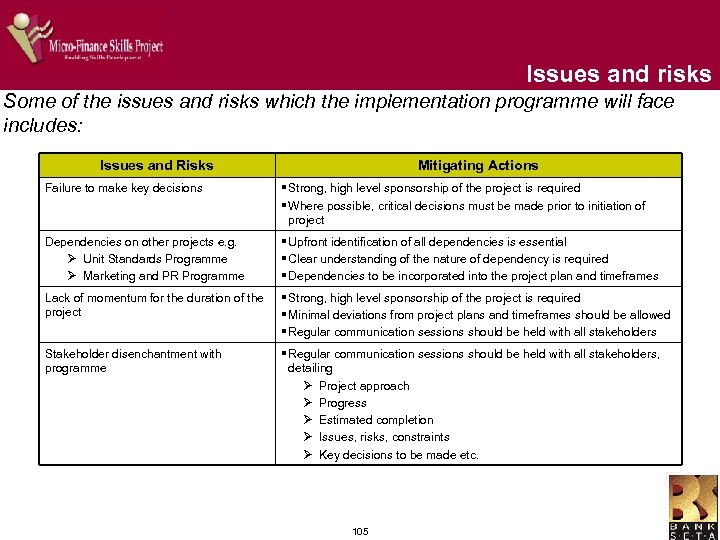

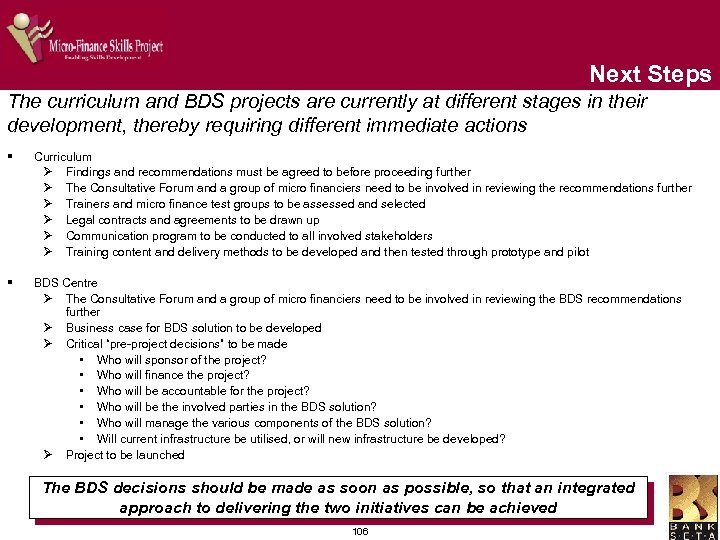

Training Delivery Principles Two main types of training delivery have been proposed, namely distance learning and face-to-face delivery Description Advantages Disadvantages DISTANCE learning § Knowledge-based § Delivery media include videos, internet, CDs, etc. § Controlled, consistent content • Effective for large groups or multiple locations § Does not required trainer/trainee travel § Can contain large amounts of material § Accessible at learner’s convenience § Require suitable infrastructure to run training (e. g. computers for CBTs) § May be difficult to disseminate § May be difficult to update material (CDs or videos, does not apply to internet) § Limited bandwidth may result in slow delivery FACE-TOFACE learning § Skills-based § Delivery media include classroom, mentoring, apprenticeships, etc. § Easily customised and revised § Quick to develop § Minimal development costs § Trainees can ask specific questions § Slow learning rate § Inconsistencies from class to class § Scheduling often presents difficulties § Difficult to control and monitor Micro financiers may be reluctant to make use of long-term classroom type learning due to work pressures. It is therefore important that consistency of training content is provided through both distance and face-to-face channels 43