7c0875793848c1599de0430bfda79009.ppt

- Количество слайдов: 92

Describing Demand Supply: Elasticities Chapter 6 © 2003 Mc. Graw-Hill Ryerson Limited

6 -2 The Concept of Elasticity u Elasticity is a measure of the responsiveness of one variable to a change in another. u The most commonly used elasticity concept is price elasticity of demand. © 2003 Mc. Graw-Hill Ryerson Limited.

6 -3 Price Elasticity u The price elasticity of demand is the percentage change in quantity demanded divided by the percentage change in price. © 2003 Mc. Graw-Hill Ryerson Limited.

6 -4 Things to Note About Elasticity u Price elasticity of demand is always negative because price and quantity demanded are inversely related—when price rises, quantity demanded falls, and vice versa. © 2003 Mc. Graw-Hill Ryerson Limited.

6 -5 Things to Note About Elasticity u Economists have developed a convention and talk about price elasticity of demand as an absolute value of the number. u Thus, price elasticity of demand is reported as if it were positive. © 2003 Mc. Graw-Hill Ryerson Limited.

6 -6 Classifying Demand as Elastic or Inelastic u It is helpful to classify demand by relative responsiveness as elastic or inelastic. © 2003 Mc. Graw-Hill Ryerson Limited.

6 -7 Elastic Demand u For elastic points on curves, the percentage change in quantity is greater than the percentage change in price, in absolute value. D > 1 © 2003 Mc. Graw-Hill Ryerson Limited.

6 -8 Elastic Demand u Common sense tells us that an elastic demand means that quantity changes by a greater percentage than the percentage change in price, in absolute value. © 2003 Mc. Graw-Hill Ryerson Limited.

6 -9 Inelastic Demand u For inelastic points on curves, the percentage change in quantity is less than the percentage change in price, in absolute value. D < 1 © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 10 Inelastic Demand u Common sense tells us that an inelastic demand means that the percent change in quantity is less than the percentage change in price, in absolute value. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 11 Elasticity Is Independent of Units u Elasticity is calculated as a ratio of percentages. u Percentages allow us to have a measure of responsiveness that is independent of units. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 12 Elasticity Is Independent of Units u Having a measure of responsiveness that is independent of units makes comparisons of responsiveness of different goods easier. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 13 Calculating Elasticities u To determine elasticity, divide the percentage change in quantity by the percentage change in price. © 2003 Mc. Graw-Hill Ryerson Limited.

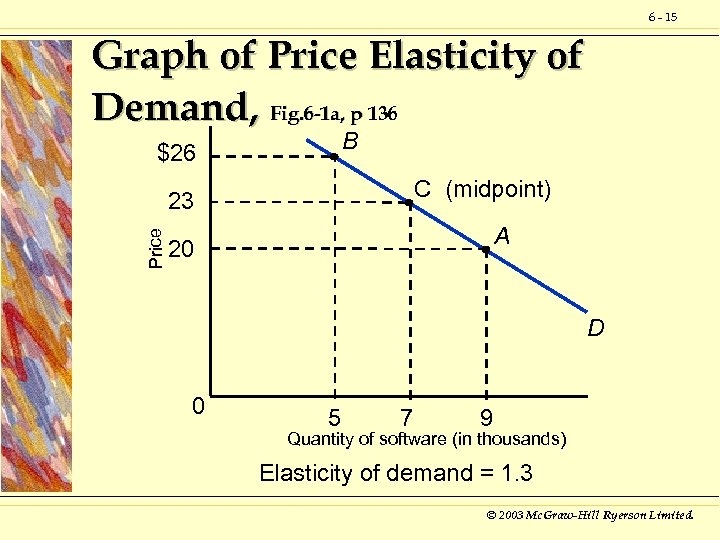

6 - 14 The Mid-point Formula u Using the mid-point formula, the average of the two end points are used when calculating percentage change. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 15 Graph of Price Elasticity of Demand, Fig. 6 -1 a, p 136 B $26 C (midpoint) Price 23 A 20 D 0 5 7 9 Quantity of software (in thousands) Elasticity of demand = 1. 3 © 2003 Mc. Graw-Hill Ryerson Limited.

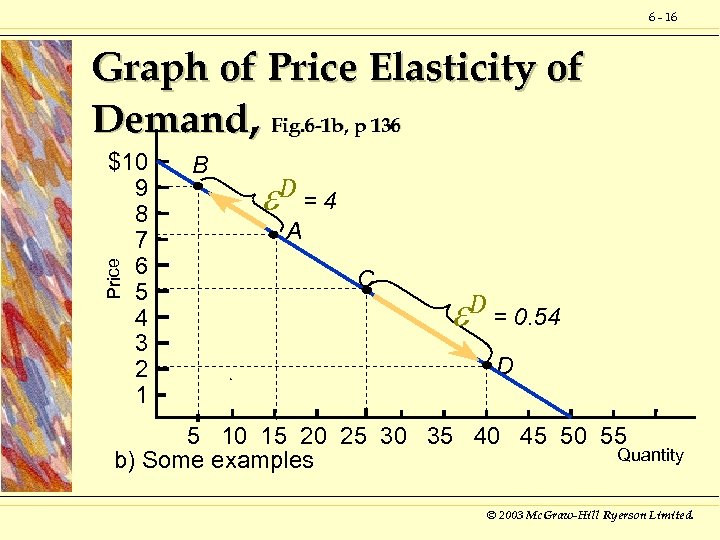

6 - 16 Graph of Price Elasticity of Demand, Fig. 6 -1 b, p 136 Price $10 9 8 7 6 5 4 3 2 1 B D = 4 A C D = 0. 54 D 5 10 15 20 25 30 35 40 45 50 55 Quantity b) Some examples © 2003 Mc. Graw-Hill Ryerson Limited.

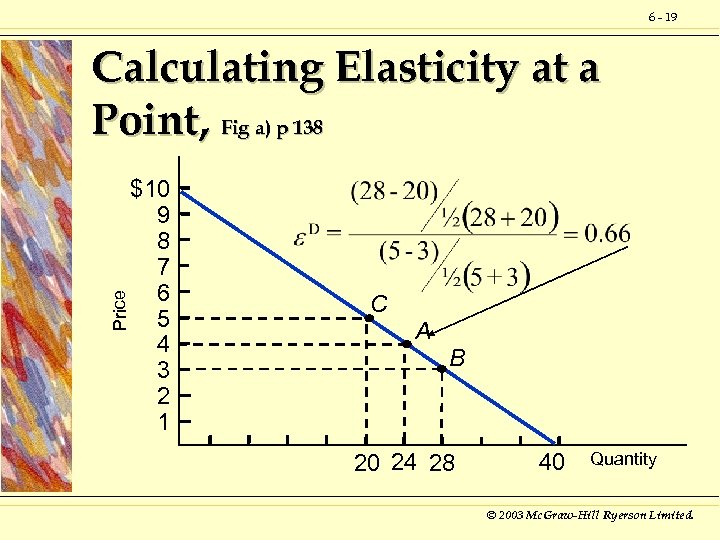

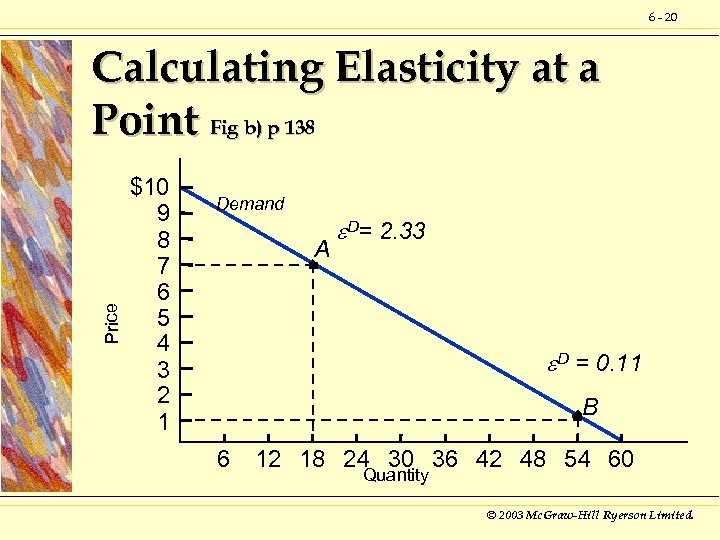

6 - 17 Calculating Elasticity at a Point u Let us now turn to a method of calculating the elasticity at a specific point, rather than over a range. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 18 Calculating Elasticity at a Point u To calculate elasticity at a point, determine a range around that point and calculate the elasticity using the midpoint formula. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 19 Price Calculating Elasticity at a Point, Fig a) p 138 $10 9 8 7 6 5 4 3 2 1 C A B 20 24 28 40 Quantity © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 20 Price Calculating Elasticity at a Point Fig b) p 138 $10 9 8 7 6 5 4 3 2 1 Demand A D= 2. 33 D = 0. 11 B 6 12 18 24 30 36 42 48 54 60 Quantity © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 21 Elasticity and Demand Curves u Two important points to consider: Elasticity is related to (but is not the same as) slope. l Elasticity changes along a straight-line demand curve. l © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 22 Elasticity Is Not the Same as Slope u The relationship between elasticity and slope means that the steeper the curve, the less elastic is demand. u There are two limiting examples of this. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 23 Elasticity Is Not the Same as Slope u When the curve is horizontal, it is perfectly elastic. u Perfectly elastic demand is a horizontal line in which quantity changes enormously in response to any change in price ( D = ). © 2003 Mc. Graw-Hill Ryerson Limited.

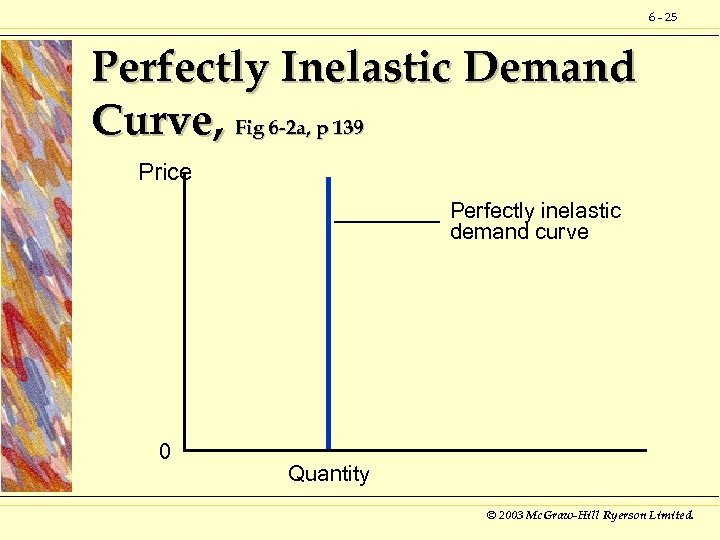

6 - 24 Elasticity Is Not the Same as Slope u When the curve is vertical, we call the demand perfectly inelastic. u Perfectly inelastic demand is a vertical line in which quantity does not change at all in response to a change in price ( D = 0). © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 25 Perfectly Inelastic Demand Curve, Fig 6 -2 a, p 139 Price Perfectly inelastic demand curve 0 Quantity © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 26 Perfectly Elastic Demand Curve Fig 6 -2 b, p 139 Price Perfectly elastic demand curve 0 Quantity © 2003 Mc. Graw-Hill Ryerson Limited.

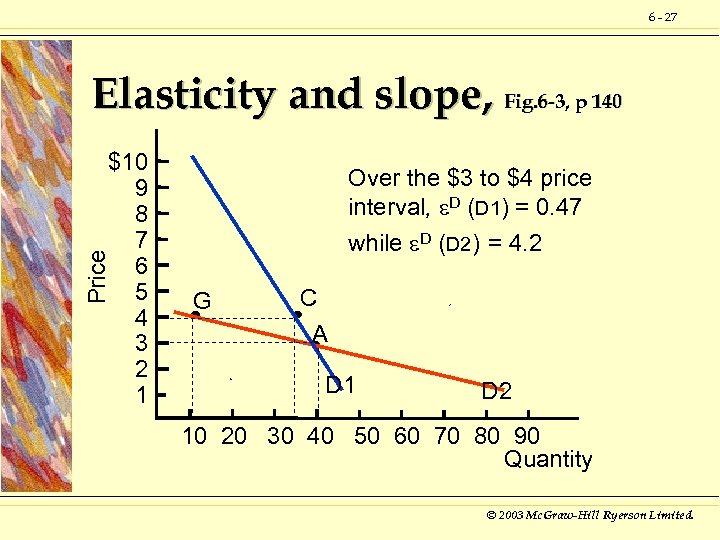

6 - 27 Elasticity and slope, Fig. 6 -3, p 140 Price $10 9 8 7 6 5 4 3 2 1 Over the $3 to $4 price interval, D (D 1) = 0. 47 while D (D 2) = 4. 2 G C A D 1 D 2 10 20 30 40 50 60 70 80 90 Quantity © 2003 Mc. Graw-Hill Ryerson Limited.

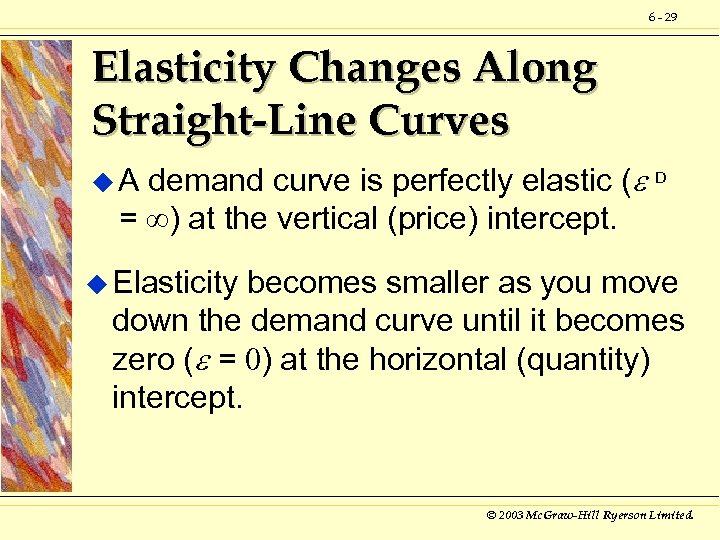

6 - 28 Elasticity Changes Along Straight-Line Curves u Elasticity is not the same as slope. u Elasticity changes along the straight line supply and demand curves—slope does not. © 2003 Mc. Graw-Hill Ryerson Limited.

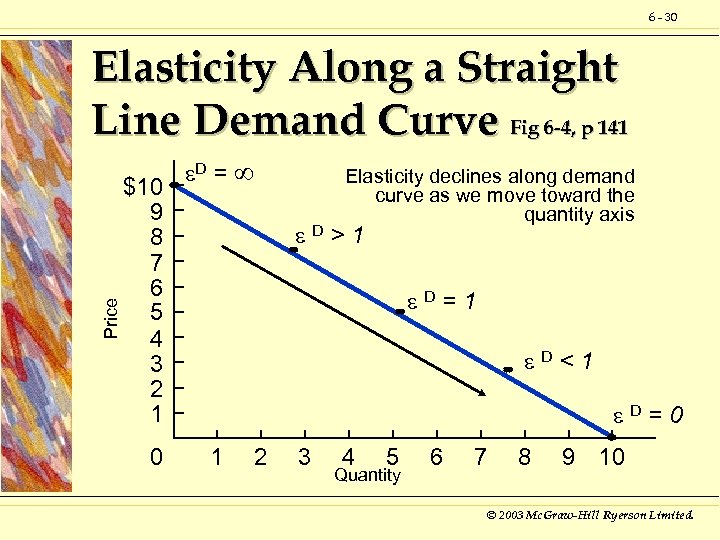

6 - 29 Elasticity Changes Along Straight-Line Curves demand curve is perfectly elastic ( D = ) at the vertical (price) intercept. u. A u Elasticity becomes smaller as you move down the demand curve until it becomes zero ( = 0) at the horizontal (quantity) intercept. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 30 Price Elasticity Along a Straight Line Demand Curve Fig 6 -4, p 141 $10 9 8 7 6 5 4 3 2 1 0 D = Elasticity declines along demand curve as we move toward the quantity axis D>1 D=1 D<1 D=0 1 2 3 4 5 Quantity 6 7 8 9 10 © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 31 Interpreting elasticities u We know by the law of demand that consumers buy less as price rises u Price elasticity of demand tells us if whether consumers reduce their purchases by a lot (elastic demand) or a little (inelastic demand). © 2003 Mc. Graw-Hill Ryerson Limited.

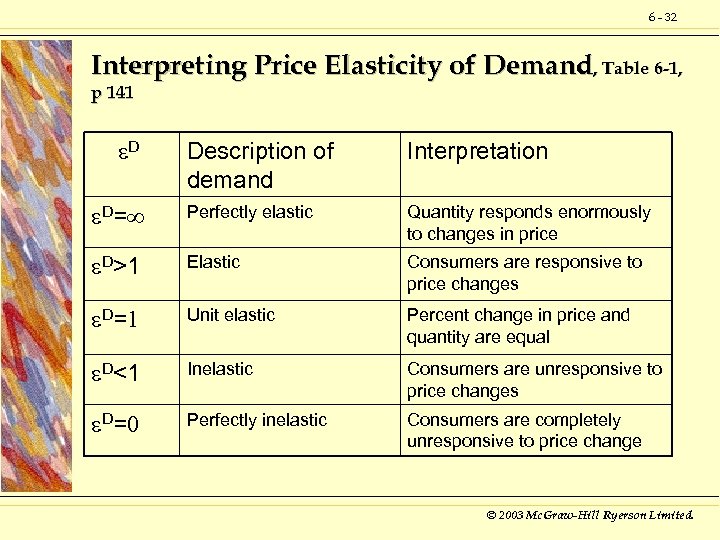

6 - 32 Interpreting Price Elasticity of Demand, Table 6 -1, p 141 D Description of demand Interpretation D= Perfectly elastic Quantity responds enormously to changes in price D>1 Elastic Consumers are responsive to price changes D=1 Unit elastic Percent change in price and quantity are equal D<1 Inelastic Consumers are unresponsive to price changes D=0 Perfectly inelastic Consumers are completely unresponsive to price change © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 33 Substitution and Price Elasticity of Demand u As a general rule, the more substitutes a good has, the more elastic is its demand. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 34 Substitution and Price Elasticity of Demand u How many substitutes a good has is affected by many factors: Time to Adjust l Luxuries versus Necessities l Narrow or Broad Definition l Budget Proportion l © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 35 Time to Adjust u The larger the time interval considered, or the longer the run, the more elastic is the good’s demand curve. There are more substitutes in the long run than in the short run. l The long run provides more options for change. l © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 36 Luxuries versus Necessities u The less a good is a necessity, the more elastic its demand curve. u Necessities tend to have fewer substitutes than do luxuries, so their demand is less elastic. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 37 Narrow or Broad Definition u As the definition of a good becomes more specific, demand becomes more elastic. l If the good is broadly defined—for example, transportation—there are not many substitutes and demand will be inelastic. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 38 Narrow or Broad Definition u As the definition of a good becomes more specific, demand becomes more elastic. l If the definition of a good is narrowed—to travel by bus, for example—there are more substitutes. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 39 Budget Proportion u Demand for goods that represent a large proportion of one's budget are more elastic than demand for goods that represent a small proportion of one's budget. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 40 Budget Proportion u Most people shop around for the lowest price on expensive items – the demand elasticity is large for those goods. u It is not worth spending the time looking for substitutes for goods which do not take much out of one’s income. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 41 Empirical Estimates of Elasticities u The following table provides short- and long-term estimates of elasticities for a number of goods. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 42 Empirical Estimates of Elasticities, Table 6 -2, p 143 © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 43 Price Elasticity of Demand Total Revenue u Total revenue is the total amount of money a firm receives from selling its product. u Revenue equals total quantity sold multiplied by the price of good. u Knowing the elasticity of demand is useful to firms because from it they can tell what happens to total revenue when they raise or lower their prices. © 2003 Mc. Graw-Hill Ryerson Limited.

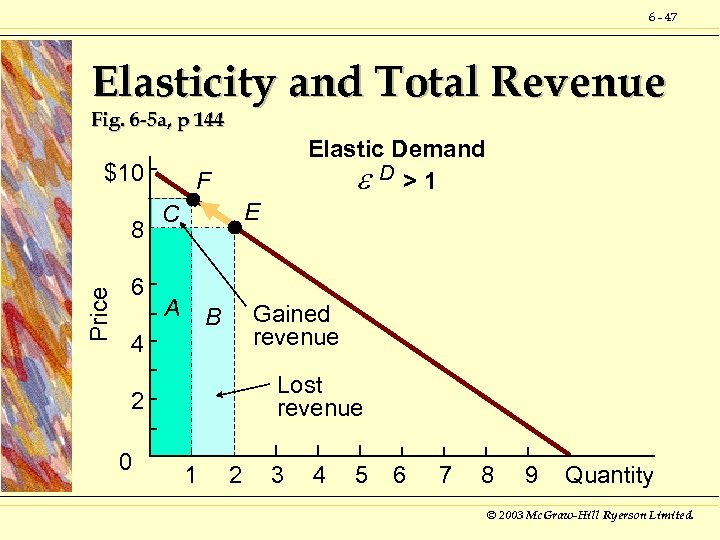

6 - 44 Price Elasticity of Demand Total Revenue demand is elastic ( D > 1), a rise in price lowers total revenue. u Price and total revenue move in opposite directions. u If © 2003 Mc. Graw-Hill Ryerson Limited.

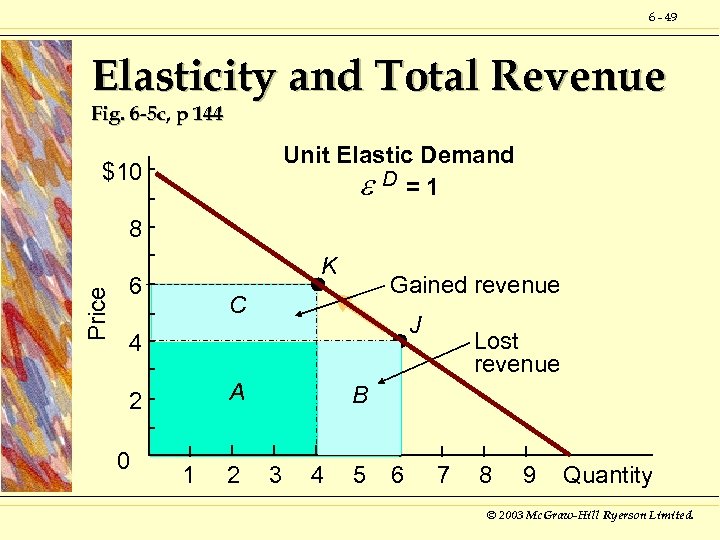

6 - 45 Price Elasticity of Demand Total Revenue demand is unit elastic ( D = 1), a rise in price leaves total revenue unchanged. u If © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 46 Price Elasticity of Demand Total Revenue demand is inelastic ( D < 1), a rise in price increases total revenue. u Price and total revenue move in the same direction. u If © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 47 Elasticity and Total Revenue Fig. 6 -5 a, p 144 $10 Price 8 6 Elastic Demand D >1 F E C A Gained revenue B 4 Lost revenue 2 0 1 2 3 4 5 6 7 8 9 Quantity © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 48 Elasticity and Total Revenue Fig. 6 -5 b, p 144 Inelastic Demand D <1 $10 Price 8 6 4 Gained revenue H 2 0 G C A 1 2 Lost revenue B 3 4 5 6 7 8 9 Quantity © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 49 Elasticity and Total Revenue Fig. 6 -5 c, p 144 Unit Elastic Demand D =1 $10 Price 8 K 6 Gained revenue C J 4 A 2 0 1 2 Lost revenue B 3 4 5 6 7 8 9 Quantity © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 50 Total Revenue Along a Demand Curve u Demand is elastic at prices above the middle point where demand is unit elastic – a rise in price in that range lowers total revenue. u Demand is inelastic at prices below the middle point where demand is unit elastic – a rise in price in that range increases total revenue. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 51 How Total Revenue Changes Along a Demand Curve Fig. 6 -6, p 145 P TR Elastic range D >1 D =1 Inelastic range D <1 0 (a) Q 0 0 Quantity (b) Q 0 Quantity © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 52 Elasticity of Individual and Market Demand u Market demand elasticity is influenced both by: How many people reduce their quantity to zero when price increases. l How much an existing consumer marginally changes his or her quantity demanded. l © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 53 Elasticity of Individual and Market Demand u Price discrimination occurs when a firm separates the people with less elastic demand from those with more elastic demand. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 54 Elasticity of Individual and Market Demand u Firms that price discriminate can charge more to the individuals with inelastic demand less to individuals with elastic demand. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 55 Elasticity of Individual and Market Demand u Examples of price discrimination include: Airlines’ Saturday stay-over specials. l Selling new cars at a discount. l The almost-continual-sale phenomenon. l © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 56 Other Elasticities of Demand u Two other demand elasticities are important in describing consumer behaviour: Income elasticity of demand. l Cross-price elasticity of demand. l © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 57 Income Elasticity of Demand u Income elasticity of demand is defined as the percentage change in demand divided by the percentage change in income. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 58 Income Elasticity of Demand u Income elasticity of demand tells us how demand responds to changes in income. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 59 Income Elasticity of Demand u An increase in income generally increases one’s consumption of almost all goods, although the increase may be greater for some goods than for others. © 2003 Mc. Graw-Hill Ryerson Limited.

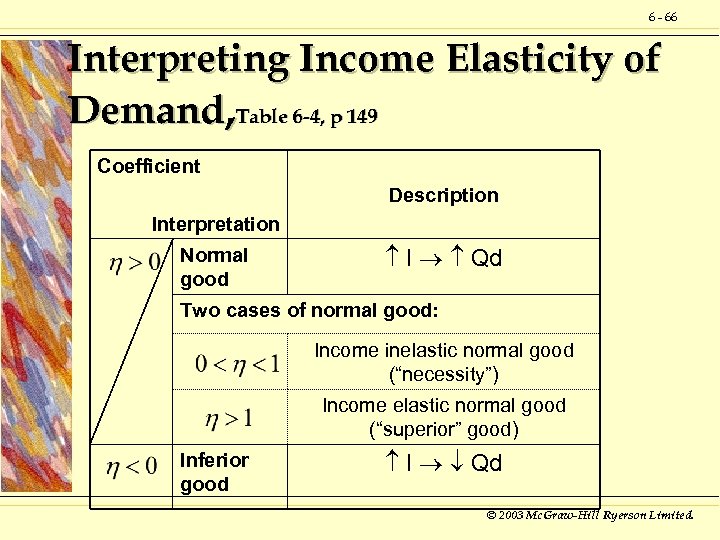

6 - 60 Income Elasticity of Demand u Normal goods are those goods whose consumption increases with an increase in income. u They have income elasticities greater than zero (positive). © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 61 Income Elasticity of Demand u Normal goods are usually divided into two categories: luxuries and l necessities. l © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 62 Income Elasticity of Demand u Luxuries are goods that have an income elasticity greater than 1. u Their percentage increase in quantity demanded is greater than the percentage increase in income. u They are an “income elastic normal good”. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 63 Income Elasticity of Demand u Shoes are a necessity—a good that has an income elasticity less than 1, but still positive (shoes are an “income inelastic normal good”). u The consumption of a necessity rises by a smaller proportion than the rise in income. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 64 Income Elasticity of Demand u Inferior goods are those whose consumption decreases when income increases. u Inferior goods have income elasticities less than zero (negative). u Generic (store-brand) cereals are one example of inferior goods. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 65 Income Elasticities of Selected Goods, Table 6 -3, p 148 © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 66 Interpreting Income Elasticity of Demand, Table 6 -4, p 149 Coefficient Description Interpretation Normal good I Qd Two cases of normal good: Income inelastic normal good (“necessity”) Income elastic normal good (“superior” good) Inferior good I Qd © 2003 Mc. Graw-Hill Ryerson Limited.

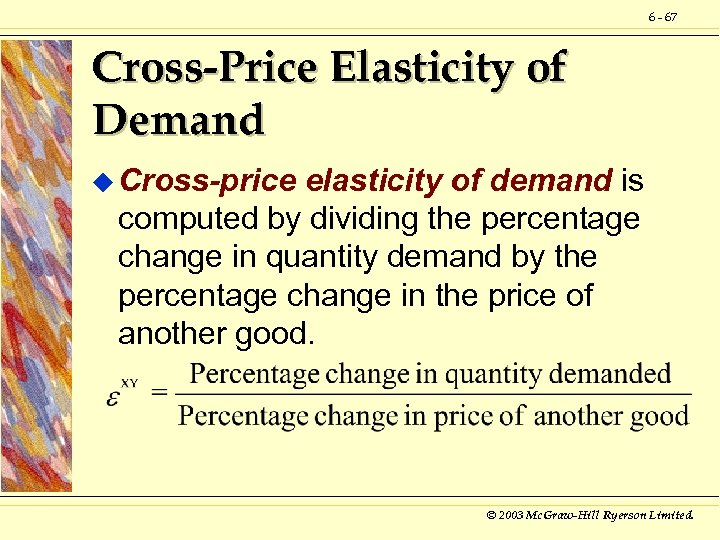

6 - 67 Cross-Price Elasticity of Demand u Cross-price elasticity of demand is computed by dividing the percentage change in quantity demand by the percentage change in the price of another good. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 68 Cross-Price Elasticity of Demand u Cross-price elasticity of demand tells us the responsiveness of demand to changes in prices of other goods. u Cross-price elasticity measures both how and how strongly consumers respond to changes in the price of related products. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 69 Cross-Price Elasticity of Demand u Depending on how consumers respond to changes in the price of related products, goods can be classified as Substitutes or l Complements l © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 70 Complements and Substitutes u Substitutes are goods that can be used in place of one another. u When the price of a good goes up, the demand for the substitute good also goes up. u Cross-price elasticity of substitutes is positive © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 71 Complements and Substitutes u Complements are goods that are used in conjunction with other goods. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 72 Complements and Substitutes u. A rise in the price of a good will decrease the demand for its complement, and a fall in the price of a good will increase the demand for its complement. u The cross-price elasticity of complements is negative. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 73 Interpretation of Cross-Price Elasticity Table 6 -5, p 150 Coefficient Interpretation Ratio XY > 0 Substitute Goods PY QX XY < 0 Complementary Goods PY QX XY = 0 Unrelated Goods QX=0 P Y © 2003 Mc. Graw-Hill Ryerson Limited.

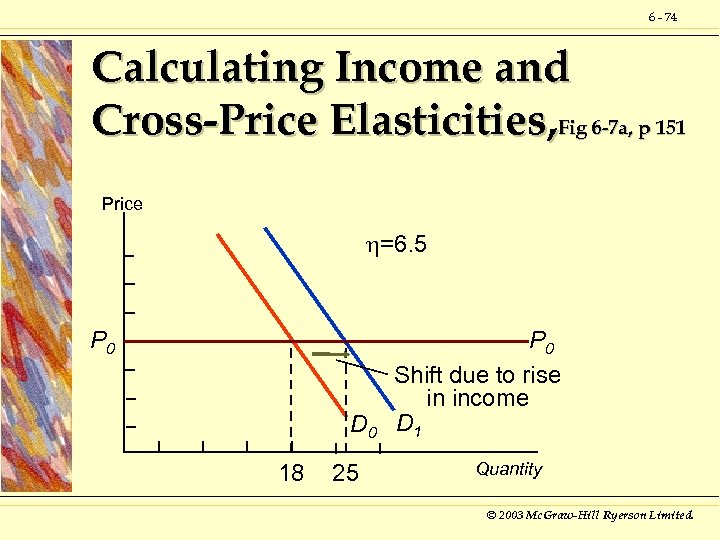

6 - 74 Calculating Income and Cross-Price Elasticities, Fig 6 -7 a, p 151 Price =6. 5 P 0 D 0 18 25 P 0 Shift due to rise in income D 1 Quantity © 2003 Mc. Graw-Hill Ryerson Limited.

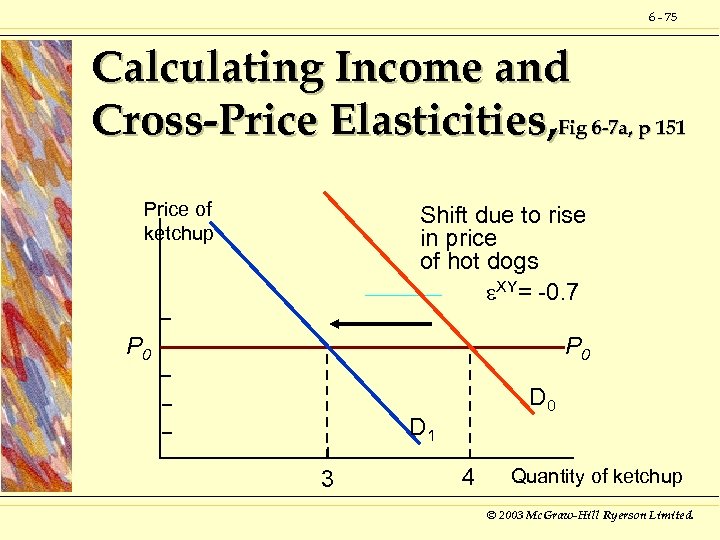

6 - 75 Calculating Income and Cross-Price Elasticities, Fig 6 -7 a, p 151 Price of ketchup Shift due to rise in price of hot dogs XY= -0. 7 P 0 D 0 D 1 3 4 Quantity of ketchup © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 76 Price Elasticity of Supply u Measures the responsiveness of firms to a change in the price of their product. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 77 Price Elasticity of Supply u The price elasticity of supply is calculated as the percent change in quantity supplied over the percent change in price. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 78 Inelastic Supply u Common sense tells us that an inelastic supply means that the percent change in quantity is less than the percentage change in price. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 79 Elastic Supply u An elastic supply means that quantity supplied changes by a larger percent than the percent change in price. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 80 Substitution and Supply u The longer the time period considered, the more elastic the supply. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 81 Substitution and Supply u The reasoning is the same as for demand. l In the long run there are more alternatives so it is easier (less costly) for suppliers to change and produce other goods. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 82 Substitution and Supply u Economists distinguish three time periods relevant to supply: The instantaneous period. l The short run. l The long run. l © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 83 Substitution and Supply u In the instantaneous period, quantity supplied is fixed so supply is perfectly inelastic. u This supply is sometimes called the momentary supply. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 84 Substitution and Supply u In the short run, some substitution is possible, so the short-run supply curve is somewhat elastic. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 85 Substitution and Supply u In the long run, significant substitution is possible; the supply curve becomes very elastic. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 86 Substitution and Supply u An additional factor to consider in determining elasticity of supply: l One must take into account how easy or how difficult it is to produce more of the same good. The easier it is to produce additional units, the more elastic the supply. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 87 Empirical Estimates of Elasticities u There are fewer empirical measurements of elasticity of supply than there are of demand elasticities. © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 88 Effects of Shifts in Supply on Price and Quantity u An example of the importance of elasticities of demand supply can be illustrated by the example of the world market for oil © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 89 Effects of Shifts in Supply on Price and Quantity u If oil supply decreases, the world prices will rise sharply if the demand for oil is inelastic u Oil prices will not be affected a lot if demand is elastic © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 90 Effects of Shifts in Supply on Price and Quantity, Fig 6 -8 a, p 154 Inelastic Supply and Inelastic Demand Price S 1 Demand S 0 P 1 P 0 Q 1 Q 0 Quantity © 2003 Mc. Graw-Hill Ryerson Limited.

6 - 91 Effects of Shifts in Supply on Price and Quantity, Fig 6 -8 b, p 154 Inelastic Supply and Elastic Demand S 1 Price S 0 Demand P 1 P 0 Q 1 Q 0 Quantity © 2003 Mc. Graw-Hill Ryerson Limited.

Describing Supply and Demand: Elasticities End of Chapter 6 © 2003 Mc. Graw-Hill Ryerson Limited

7c0875793848c1599de0430bfda79009.ppt